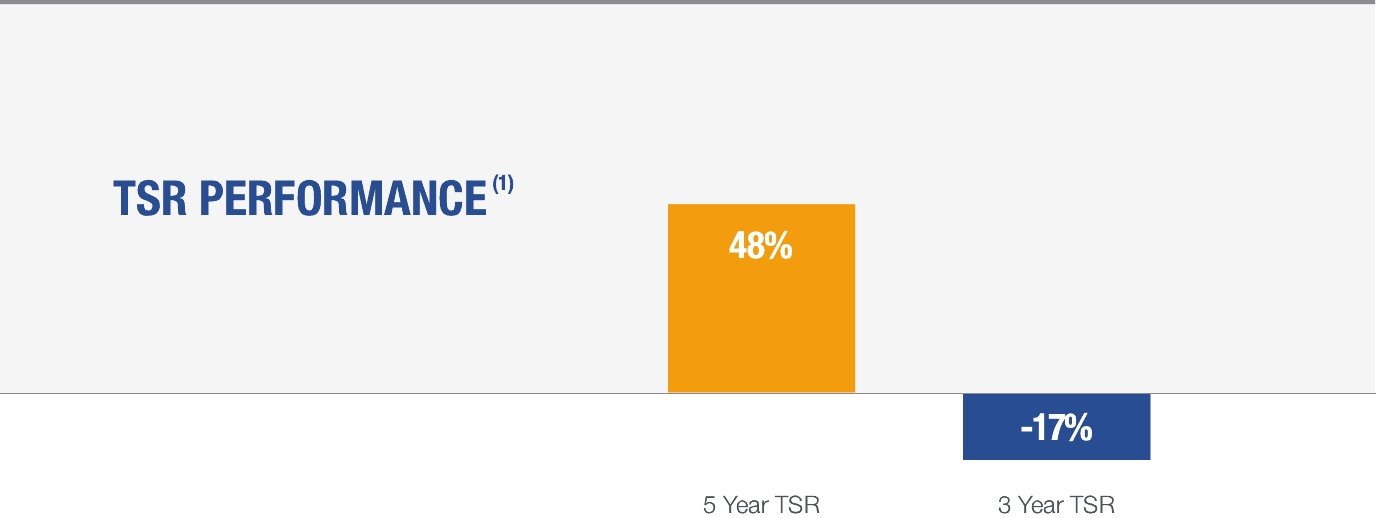

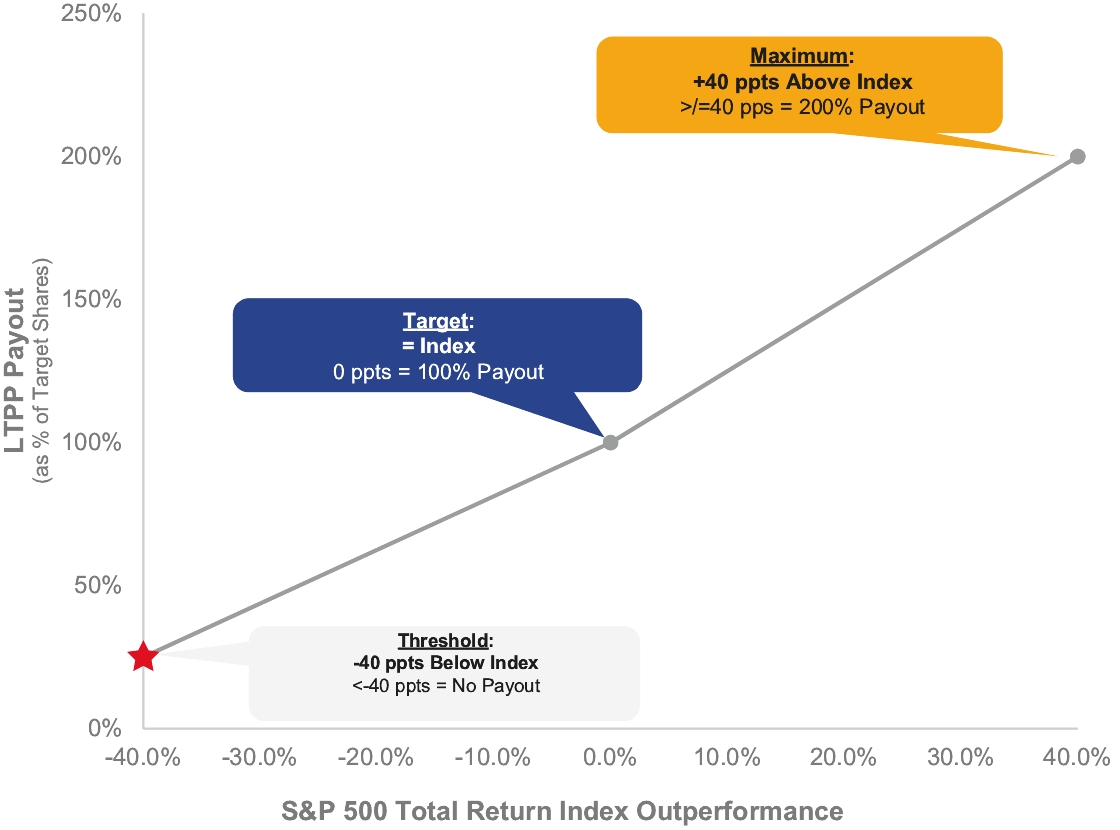

Peer Group for the Long-Term Incentive Program

The Compensation and Human Capital Committee believes that a larger peer group is more appropriate for evaluating TSR performance under Keysight’s LTP Program, as a larger peer group provides a broader index for comparison and better alignment with stockholder investment choices. For the Fiscal Year 2024 – Fiscal Year 2026 performance period, the Compensation and Human Capital Committee selected the S&P 500 Total Return Index for determining and evaluating our relative TSR performance. This index has a strong correlation with Keysight’s stock price, and the Compensation and Human Capital Committee views the S&P 500 as a possible investment alternative to Keysight. The S&P 500 constituent list is maintained by the S&P Index Committee, which is available at standardandpoors.com/indices/main/en/us. Any change in the expanded peer group is solely due to Standard & Poor’s criteria for inclusion in the index.

POLICIES FOR COMPENSATION RISK MITIGATION

RECOUPMENT POLICY

Our Executive Compensation Recoupment Policy (the “Recoupment Policy”) and our Compensation Recovery Policy (the “Recovery Policy,” together the “Clawback Policies”) apply to all executive officers who are subject to Section 16 of the Exchange Act.

The Recoupment Policy applies to grants which were made and vested between October 31, 2014 and October 1, 2023. Under the Recoupment Policy, in the event of (A) a material restatement of financial results (wherein results were incorrect at the time published due to mistake, fraud or other misconduct), or (B) fraud or misconduct by an executive officer, the Compensation and Human Capital Committee will, in the case of a restatement, review all short-term and long-term incentive compensation awards that were paid or awarded to the executive officer, in whole or in part, during the restatement period. In the case of fraud or misconduct, the Compensation and Human Capital Committee will consider actions to remedy the fraud or misconduct, prevent its recurrence, and impose discipline on the wrongdoers, in each case, as it deems appropriate. These actions may include, without limitation and to the extent permitted by governing law, requiring reimbursement of compensation, causing the cancellation of outstanding PSUs, RSUs, stock options, and other equity incentive awards, limiting future awards or compensation, and requiring the disgorgement of profits realized from the sale of shares of our common stock to the extent such profit was, in part or in whole, the result of the fraud or misconduct.

On November 15, 2023, in compliance with Rule 10D-1 of the Exchange Act, the Compensation and Human Capital Committee adopted the Recovery Policy, effective October 2, 2023. The Recovery Policy applies to performance-based incentive compensation received on or after October 2, 2023, and provides for the mandatory recovery from current and former executive officers of erroneously awarded incentive compensation in the event of an accounting restatement of the Company’s financial statements regardless of fault or misconduct. The Compensation and Human Capital Committee also has discretion, under the Recovery Policy, to seek recovery from current and former executive officers of erroneously awarded incentive compensation in the event of a financial misstatement that does not result in a restatement of financial results.

HEDGING AND INSIDER TRADING POLICY

Our Insider Trading Policy expressly bars hedging transactions such as purchasing or writing derivative securities, including puts and calls, and entering into short sales or short positions, with respect to Keysight securities by our executive officers, directors, and other employees. Under our Insider Trading Policy, we prohibit our general managers, executives, executive officers and the members of our Board from pledging our equity securities as collateral for loans, and we prohibit our executive officers, directors and all employees from purchasing or selling our securities while in possession of material, non-public information, or otherwise using such information for their personal benefit and we maintain a quarterly black-out window where applicable individuals may not trade.

Our executive officers and members of our Board are permitted to enter into trading plans that are intended to comply with the requirements of Exchange Act Rule 10b5-1 so they may make predetermined trades of Keysight stock or exercise stock options.