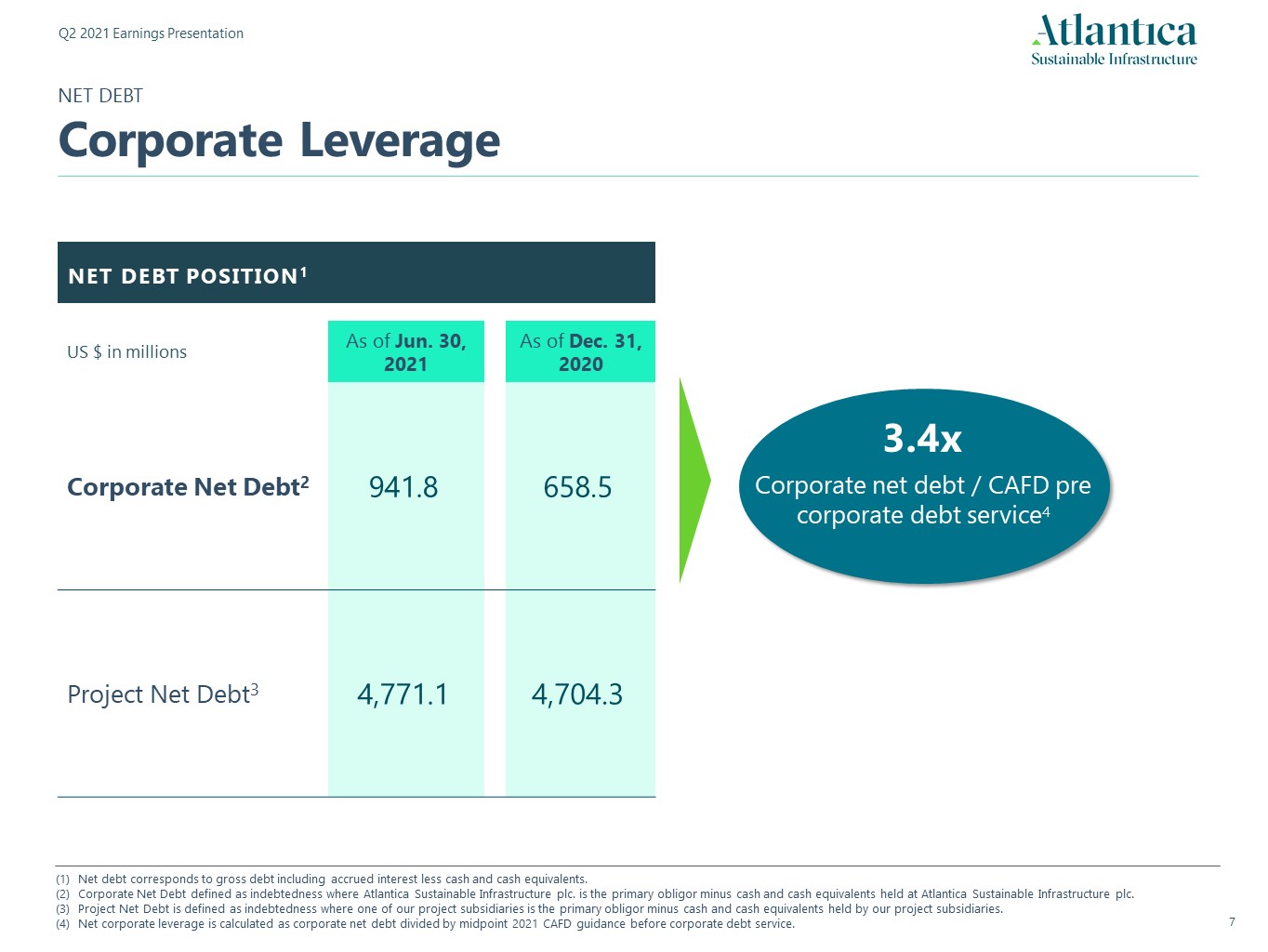

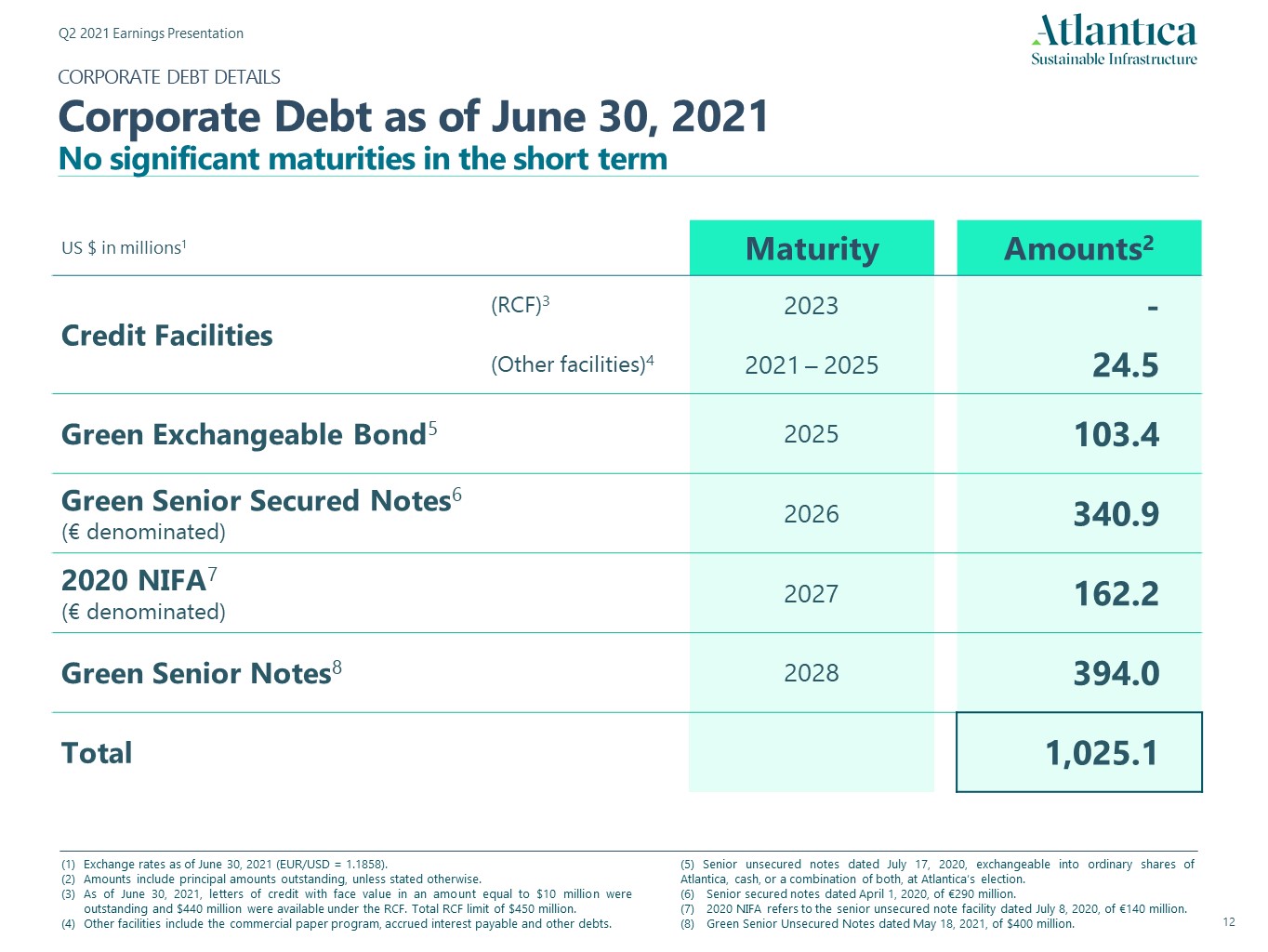

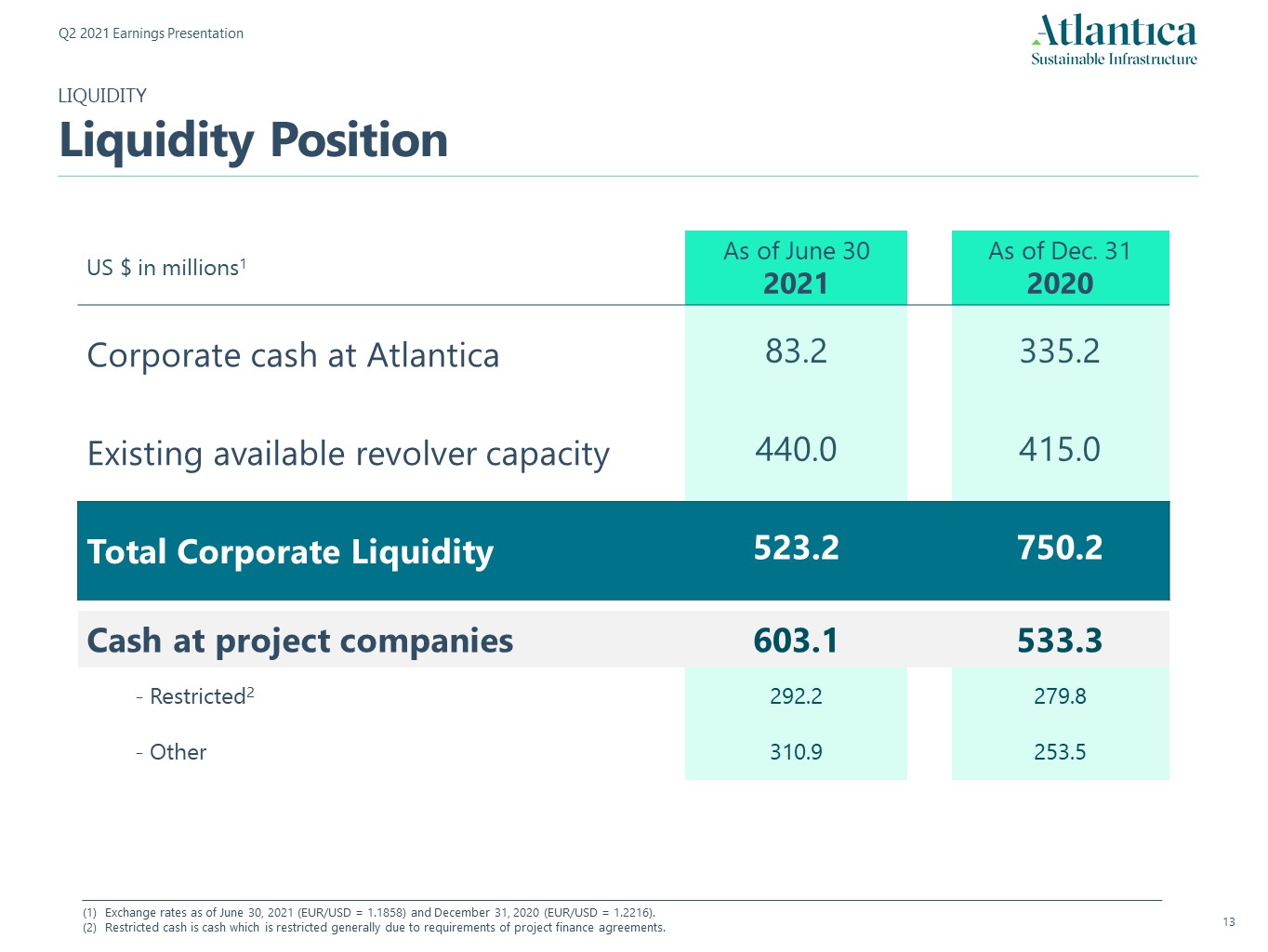

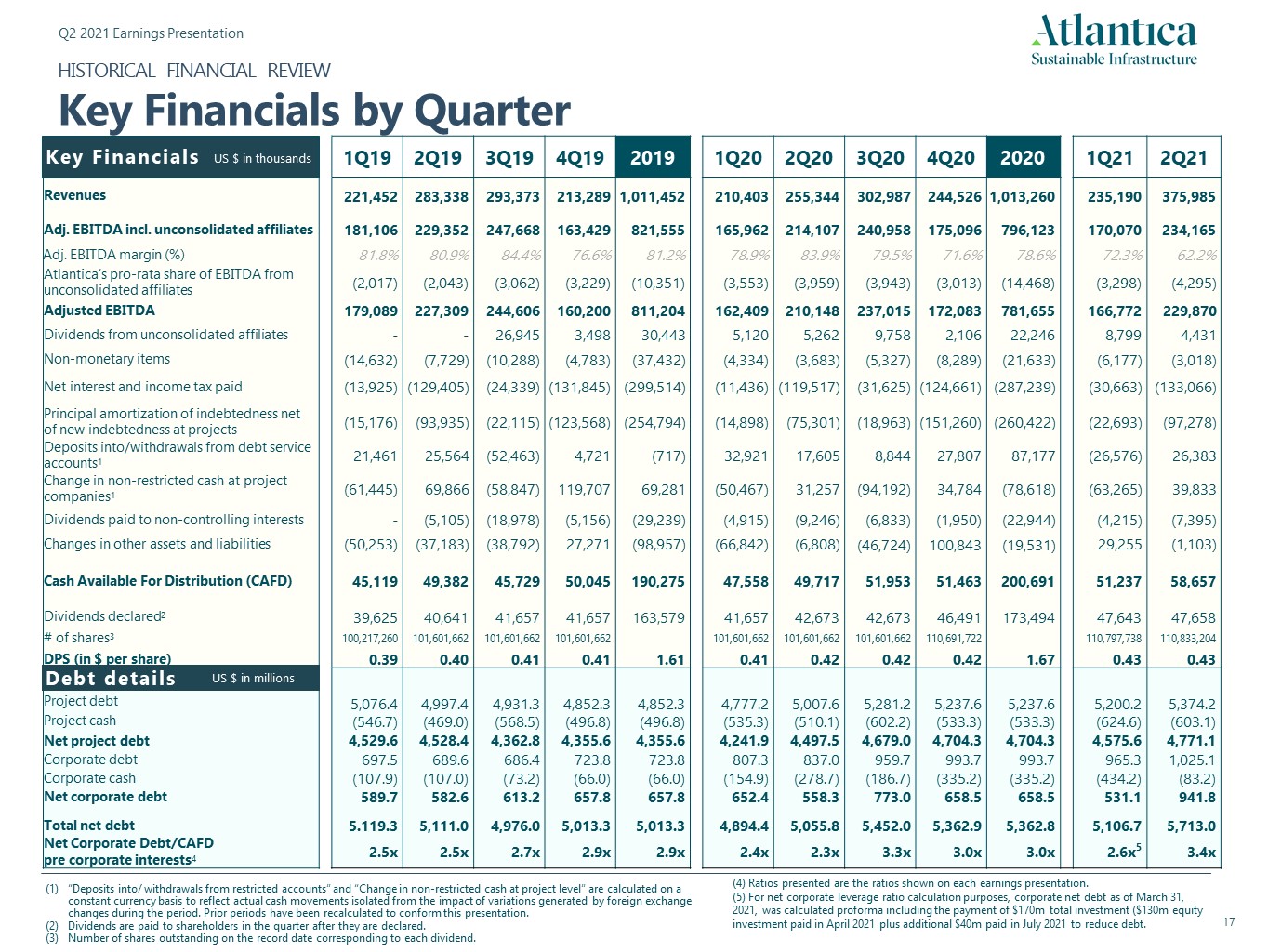

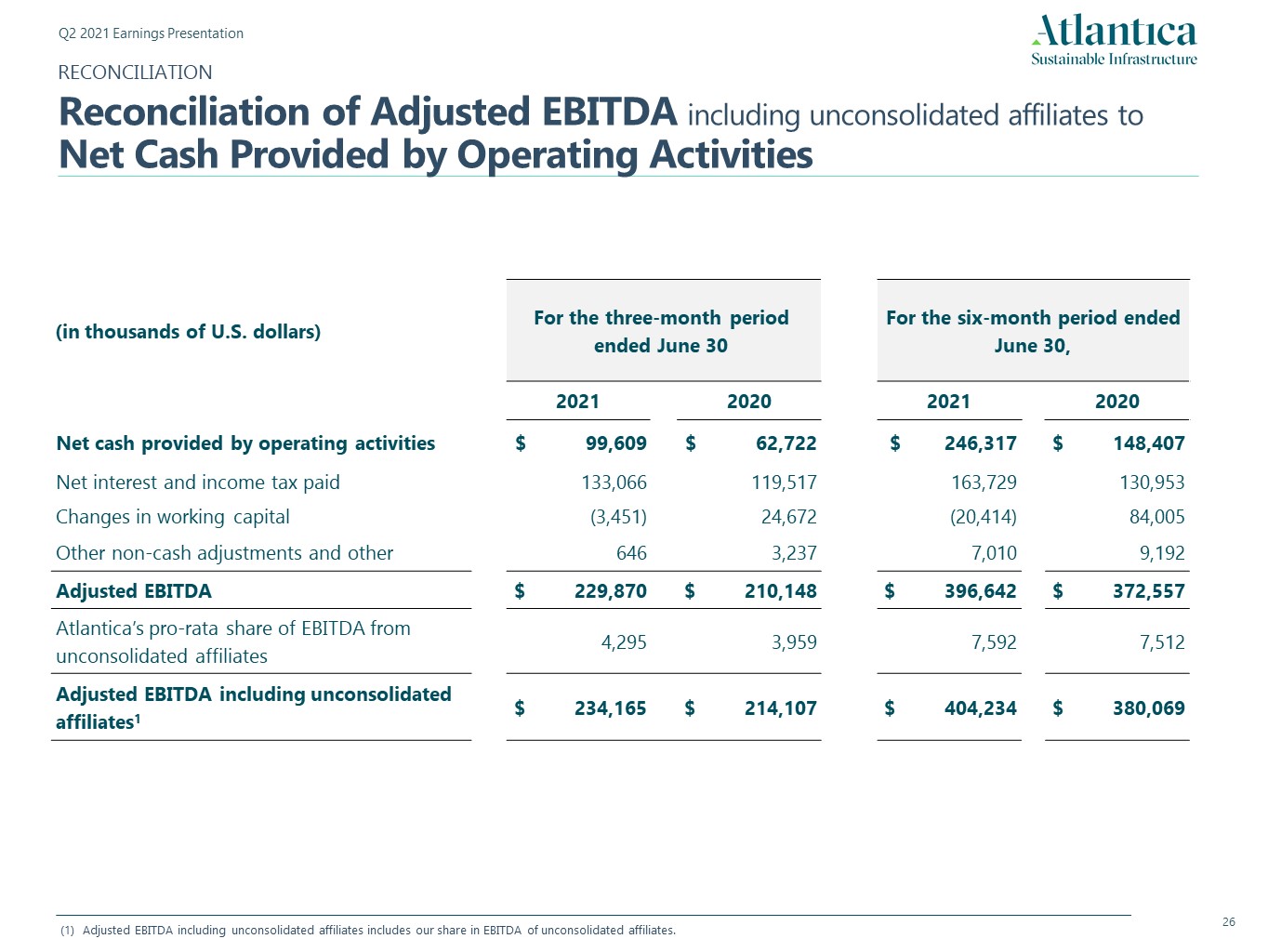

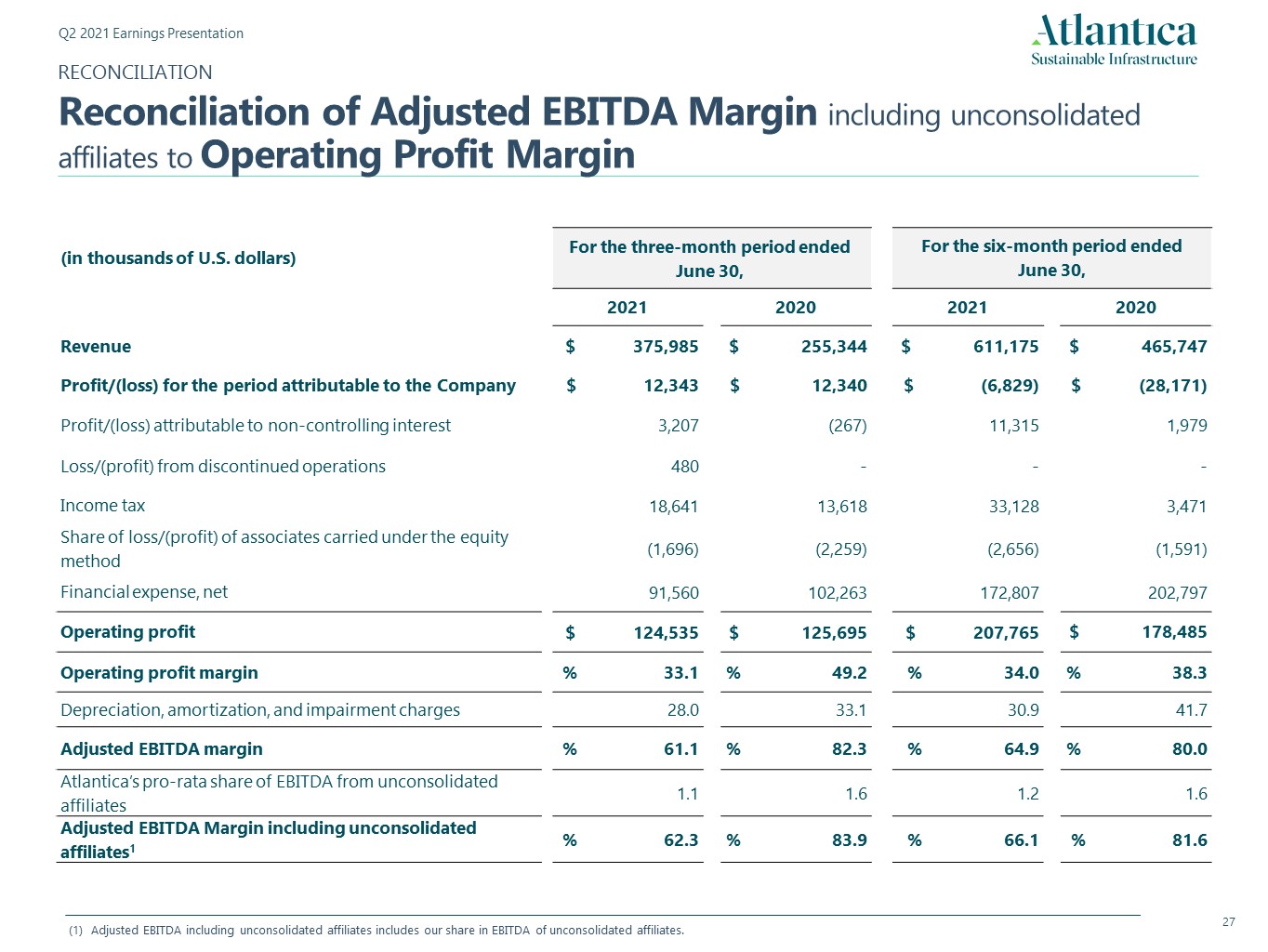

1Q19 2Q19 3Q19 4Q19 2019 1Q20 2Q20 3Q20 4Q20 2020 1Q21 2Q21 Revenues 221,452 283,338 293,373 213,289 1,011,452 210,403 255,344 302,987 244,526 1,013,260 235,190 375,985 Adj. EBITDA incl. unconsolidated affiliates 181,106 229,352 247,668 163,429 821,555 165,962 214,107 240,958 175,096 796,123 170,070 234,165 Adj. EBITDA margin (%) 81.8% 80.9% 84.4% 76.6% 81.2% 78.9% 83.9% 79.5% 71.6% 78.6% 72.3% 62.2% Atlantica’s pro-rata share of EBITDA from unconsolidated affiliates (2,017) (2,043) (3,062) (3,229) (10,351) (3,553) (3,959) (3,943) (3,013) (14,468) (3,298) (4,295) Adjusted EBITDA 179,089 227,309 244,606 160,200 811,204 162,409 210,148 237,015 172,083 781,655 166,772 229,870 Dividends from unconsolidated affiliates ��- - 26,945 3,498 30,443 5,120 5,262 9,758 2,106 22,246 8,799 4,431 Non-monetary items (14,632) (7,729) (10,288) (4,783) (37,432) (4,334) (3,683) (5,327) (8,289) (21,633) (6,177) (3,018) Net interest and income tax paid (13,925) (129,405) (24,339) (131,845) (299,514) (11,436) (119,517) (31,625) (124,661) (287,239) (30,663) (133,066) Principal amortization of indebtedness net of new indebtedness at projects (15,176) (93,935) (22,115) (123,568) (254,794) (14,898) (75,301) (18,963) (151,260) (260,422) (22,693) (97,278) Deposits into/withdrawals from debt service accounts1 21,461 25,564 (52,463) 4,721 (717) 32,921 17,605 8,844 27,807 87,177 (26,576) 26,383 Change in non-restricted cash at project companies1 (61,445) 69,866 (58,847) 119,707 69,281 (50,467) 31,257 (94,192) 34,784 (78,618) (63,265) 39,833 Dividends paid to non-controlling interests - (5,105) (18,978) (5,156) (29,239) (4,915) (9,246) (6,833) (1,950) (22,944) (4,215) (7,395) Changes in other assets and liabilities (50,253) (37,183) (38,792) 27,271 (98,957) (66,842) (6,808) (46,724) 100,843 (19,531) 29,255 (1,103) Cash Available For Distribution (CAFD) 45,119 49,382 45,729 50,045 190,275 47,558 49,717 51,953 51,463 200,691 51,237 58,657 Dividends declared2 39,625 40,641 41,657 41,657 163,579 41,657 42,673 42,673 46,491 173,494 47,643 47,658 # of shares3 100,217,260 101,601,662 101,601,662 101,601,662 101,601,662 101,601,662 101,601,662 110,691,722 110,797,738 110,833,204 DPS (in $ per share) 0.39 0.40 0.41 0.41 1.61 0.41 0.42 0.42 0.42 1.67 0.43 0.43 Project debt 5,076.4 4,997.4 4,931.3 4,852.3 4,852.3 4,777.2 5,007.6 5,281.2 5,237.6 5,237.6 5,200.2 5,374.2 Project cash Project cash (546.7) (469.0) (568.5) (496.8) (496.8) (535.3) (510.1) (602.2) (533.3) (533.3) (624.6) (603.1) Net project debt 4,529.6 4,528.4 4,362.8 4,355.6 4,355.6 4,241.9 4,497.5 4,679.0 4,704.3 4,704.3 4,575.6 4,771.1 Corporate debt 697.5 689.6 686.4 723.8 723.8 807.3 837.0 959.7 993.7 993.7 965.3 1,025.1 Corporate cash (107.9) (107.0) (73.2) (66.0) (66.0) (154.9) (278.7) (186.7) (335.2) (335.2) (434.2) (83.2) Net corporate debt 589.7 582.6 613.2 657.8 657.8 652.4 558.3 773.0 658.5 658.5 531.1 941.8 Total net debt 5.119.3 5,111.0 4,976.0 5,013.3 5,013.3 4,894.4 5,055.8 5,452.0 5,362.9 5,362.8 5,106.7 5,713.0 Net Corporate Debt/CAFD pre corporate interests4 2.5x 2.5x 2.7x 2.9x 2.9x 2.4x 2.3x 3.3x 3.0x 3.0x 2.6x5 3.4x HISTORICAL FINANCIAL REVIEWKey Financials by Quarter Debt details Key Financials US $ in thousands “Deposits into/ withdrawals from restricted accounts” and “Change in non-restricted cash at project level” are calculated on a constant currency basis to reflect actual cash movements isolated from the impact of variations generated by foreign exchange changes during the period. Prior periods have been recalculated to conform this presentation.Dividends are paid to shareholders in the quarter after they are declared. Number of shares outstanding on the record date corresponding to each dividend. US $ in millions (4) Ratios presented are the ratios shown on each earnings presentation.(5) For net corporate leverage ratio calculation purposes, corporate net debt as of March 31, 2021, was calculated proforma including the payment of $170m total investment ($130m equity investment paid in April 2021 plus additional $40m paid in July 2021 to reduce debt.