VECTRUS FOURTH QUARTER 2016 RESULTS CHUCK PROW PRESIDENT AND CHIEF EXECUTIVE OFFICER MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER MARCH 1, 2017

SAFE HARBOR STATEMENT Page 2 SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 (THE "ACT"): CERTAIN MATERIAL PRESENTED HEREIN INCLUDES FORWARD-LOOKING STATEMENTS INTENDED TO QUALIFY FOR THE SAFE HARBOR FROM LIABILITY ESTABLISHED BY THE ACT. THESE FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS IN 2017 GUIDANCE, ABOUT OUR REVENUE, OPERATING MARGIN, NET INCOME, EPS AND NET CASH PROVIDED BY OPERATING ACTIVITIES FOR 2017 AND OTHER ASSUMPTIONS CONTAINED THEREIN FOR PURPOSES OF SUCH GUIDANCE, DEBT PAYMENTS, EXPENSE SAVINGS, CONTRACT OPPORTUNITIES, BIDS AND AWARDS, COLLECTIONS, BUSINESS STRATEGY, OUTLOOK, OBJECTIVES, PLANS, INTENTIONS OR GOALS, AND ANY DISCUSSION OF FUTURE OPERATING OR FINANCIAL PERFORMANCE. WHENEVER USED, WORDS SUCH AS "MAY," "WILL," "LIKELY," "ANTICIPATE," "ESTIMATE," "EXPECT," "PROJECT," "INTEND," "PLAN," "BELIEVE," "TARGET," "COULD," "POTENTIAL,“ “ARE CONSIDERING,” "CONTINUE," OR SIMILAR TERMINOLOGY ARE FORWARD- LOOKING STATEMENTS. THESE STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE RESULTS CONTEMPLATED BY THE FORWARD-LOOKING STATEMENTS, OUR HISTORICAL EXPERIENCE AND OUR PRESENT EXPECTATIONS OR PROJECTIONS. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO: OUR DEPENDENCE ON A FEW LARGE CONTRACTS FOR A SIGNIFICANT PORTION OF OUR REVENUE; COMPETITION IN OUR INDUSTRY; OUR ABILITY TO SUBMIT PROPOSALS FOR AND/OR WIN POTENTIAL OPPORTUNITIES IN OUR PIPELINE; OUR ABILITY TO RETAIN AND RENEW OUR EXISTING CONTRACTS; PROTESTS OF NEW AWARDS; OUR INTERNATIONAL OPERATIONS, INCLUDING THE ECONOMIC, POLITICAL AND SOCIAL CONDITIONS IN THE COUNTRIES IN WHICH WE CONDUCT OUR BUSINESSES; CHANGES IN U.S. GOVERNMENT MILITARY OPERATIONS, INCLUDING ITS OPERATIONS IN AFGHANISTAN; CHANGES IN, OR DELAYS IN THE COMPLETION OF, U.S. OR INTERNATIONAL GOVERNMENT BUDGETS; GOVERNMENT REGULATIONS AND COMPLIANCE THEREWITH, INCLUDING CHANGES TO THE DEPARTMENT OF DEFENSE PROCUREMENT PROCESS; CHANGES IN TECHNOLOGY; INTELLECTUAL PROPERTY MATTERS; GOVERNMENTAL INVESTIGATIONS, REVIEWS, AUDITS AND COST ADJUSTMENTS; CONTINGENCIES RELATED TO ACTUAL OR ALLEGED ENVIRONMENTAL CONTAMINATION, CLAIMS AND CONCERNS; OUR SUCCESS IN EXPANDING OUR GEOGRAPHIC FOOTPRINT OR BROADENING OUR CUSTOMER BASE, MARKETS AND CAPABILITIES; OUR ABILITY TO REALIZE THE FULL AMOUNTS REFLECTED IN OUR BACKLOG; OUR MAINTAINING OUR GOOD RELATIONSHIP WITH THE U.S. GOVERNMENT; IMPAIRMENT OF GOODWILL; OUR PERFORMANCE OF OUR CONTRACTS AND OUR ABILITY TO CONTROL COSTS; OUR LEVEL OF INDEBTEDNESS; OUR COMPLIANCE WITH THE TERMS OF OUR CREDIT AGREEMENT; SUBCONTRACTOR AND EMPLOYEE PERFORMANCE AND CONDUCT; OUR TEAMING ARRANGEMENTS WITH OTHER CONTRACTORS; ECONOMIC AND CAPITAL MARKETS CONDITIONS; ANY FUTURE ACQUISITIONS, INVESTMENTS OR JOINT VENTURES; OUR ABILITY TO RETAIN AND RECRUIT QUALIFIED PERSONNEL; OUR MAINTENANCE OF SAFE WORK SITES AND EQUIPMENT; OUR COMPLIANCE WITH APPLICABLE ENVIRONMENTAL, HEALTH AND SAFETY REGULATIONS; OUR ABILITY TO MAINTAIN REQUIRED SECURITY CLEARANCES; ANY DISPUTES WITH LABOR UNIONS; COSTS OF OUTCOME OF ANY LEGAL PROCEEDINGS; SECURITY BREACHES AND OTHER DISRUPTIONS TO OUR INFORMATION TECHNOLOGY AND OPERATIONS; CHANGES IN OUR TAX PROVISIONS OR EXPOSURE TO ADDITIONAL INCOME TAX LIABILITIES; CHANGES IN U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES; ACCOUNTING ESTIMATES MADE IN CONNECTION WITH OUR CONTRACTS; OUR EXPOSURE TO INTEREST RATE RISK; OUR COMPLIANCE WITH PUBLIC COMPANY ACCOUNTING AND FINANCIAL REPORTING REQUIREMENTS; TIMING OF PAYMENTS BY THE U.S. GOVERNMENT; RISKS AND UNCERTAINTIES RELATING TO THE SPIN-OFF FROM OUR FORMER PARENT; AND OTHER FACTORS SET FORTH IN PART I, ITEM 1A, – “RISK FACTORS,” AND ELSEWHERE IN OUR 2016 ANNUAL REPORT ON FORM 10-K AND DESCRIBED FROM TIME TO TIME IN OUR FUTURE REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD- LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW.

FULL-YEAR 2016 HIGHLIGHTS Page 3 • Full-Year 2016 Results o Revenue of $1,190.5 million o Operating margin of 3.6% o Diluted EPS of $2.16 o Net cash provided by operating activities of $36.6 million o Paid down $29 million of debt; $15 million voluntary • Awarded and successfully phased in a $21 million dollar installation services task order in support of the U.S. Air Force at Al Udeid Air Base in Qatar • Awarded a position on the U.S. Navy’s Global Contingency Services Multiple Award Contract II (GCS MAC II) • Successful ELVIS contract win extends our ~20-year support of the program

BUSINESS UPDATE Page 4 • Contract Updates o K-BOSSS o APS-5 Kuwait/Qatar o Maxwell BOS • Thule Base Maintenance Contract Update • New Business o Approx. $1.5 billion of proposals submitted and pending potential award1, 100% for new business; almost $6 billion in potential new business opportunities identified over the next 12 months. Award decisions expected on roughly $1 billion of bids in the next six to nine months. • Favorable Financial Liquidity • Vectrus Improvement Project (VIP) Update • Strategy Update (1) Indefinite Delivery Indefinite Quantity (IDIQ) contracts carry no value in the pipeline of potential proposals to be submitted until a specific task order is identified.

VECTRUS STRATEGY UPDATE Page 5 Vectrus will drive growth through strategic imperatives aligned to our three core strategies. ENHANCE PROGRAM EXECUTION AND EXPAND THE BASE EXPAND SERVICE OFFERING AND OPTIMIZE BUSINESS MODEL INFUSE TECHNOLOGY INTO CURRENT FACILITIES & LOGISTICS SERVICES (F&LS) BUSINESS Expand Portfolio Add More Value Enhance Foundation Vectrus will be an innovator and leader in the convergence of our clients' physical and digital infrastructure and supply chains Benefit: Strengthened methods and approaches, resulting in the delivery of higher value, high impact services to our clients, while growing in, and around, our base Benefit: Integrated solutions that improve efficiency, reduce downtime, and drive cost savings for clients while delivering higher margins to Vectrus Benefit: Stronger competitive position when going to market that drives revenue and margin growth EXPAND IT CAPABILITIES TO BECOME A FULL LIFECYCLE PROVIDER Benefit: Mature portfolio of capabilities available to sell across current and future client set

Q4 AND FULL-YEAR 2016 FINANCIAL RESULTS Page 6 (1) Non-GAAP financial measure. See appendix for reconciliation. There were no adjustments to 2016 financial results. (In millions, except Operating Margin and Diluted Earnings Per Share) Q4 2016 Q4 2015 vs 2015 2016 2015 vs. 2015 Revenue 288.2$ 311.2$ (23.0)$ 1,190.5$ 1,180.7$ 9.8$ Operating Income 8.6$ 11.3$ (2.7)$ 42.8$ 40.0$ 2.8$ Adjusted Operating Income 1 43.4$ (0.6)$ Operating Margin 3.0 % 3.6 % (0.6)% 3.6 % 3.4 % 0.2 % Adjusted Operating Margin 1 3.7 % (0.1)% Diluted Earnings Per Share 0.40$ 0.55$ (0.15)$ 2.16$ 2.86$ (0.70)$ Adjusted Diluted Earnings Per Share 1 2.23$ (0.07)$ Net Cash Provided by Operating Activities 36.6$ 18.9$ 17.7$ Three Months Ended December 31, Year Ended December 31,

$140.0 $137.4 $114.0 $85.0 12.0 15.0 2.6 11.4 14.0 $75 $85 $95 $105 $115 $125 $135 $145 9/30/14 Debt Balance 2014 12/31/14 Debt Balance 2015 2015 12/31/15 Debt Balance 2016 2016 12/31/16 Debt Balance Voluntary Payments Mandatory Payments DEBT PROFILE Page 7 ($M) Total Debt Payment History: Mandatory $28M Voluntary $27M Total $55M

BACKLOG(1)(2) Page 8 (2) (1) Total backlog represents firm orders and potential options on multi-year contracts, excluding potential orders under IDIQ contracts. (2) Q4 2016 total backlog includes the Thule Base Maintenance Contract. • Total backlog $2,356 million as of December 31, 2016 o Funded backlog $665 million o Unfunded backlog $1,691 million $0.7 $1.0 $1.0 $0.8 $0.7 $1.7 $1.5 $1.3 $1.3 $1.7 $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Funded Unfunded $2.4 $2.3 $2.1 $2.4 $2.5 ($B)

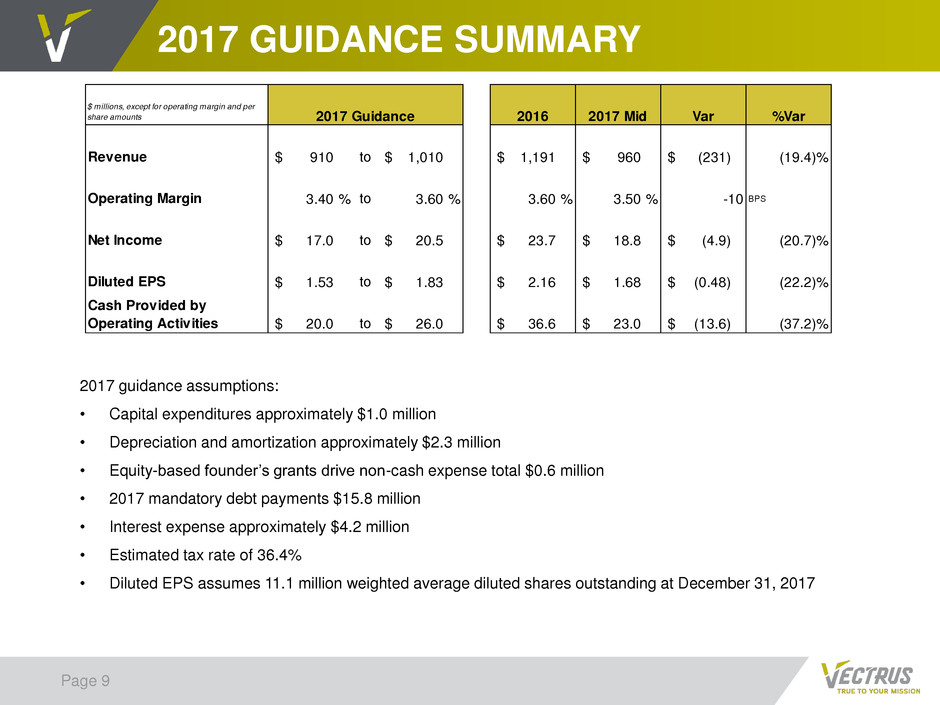

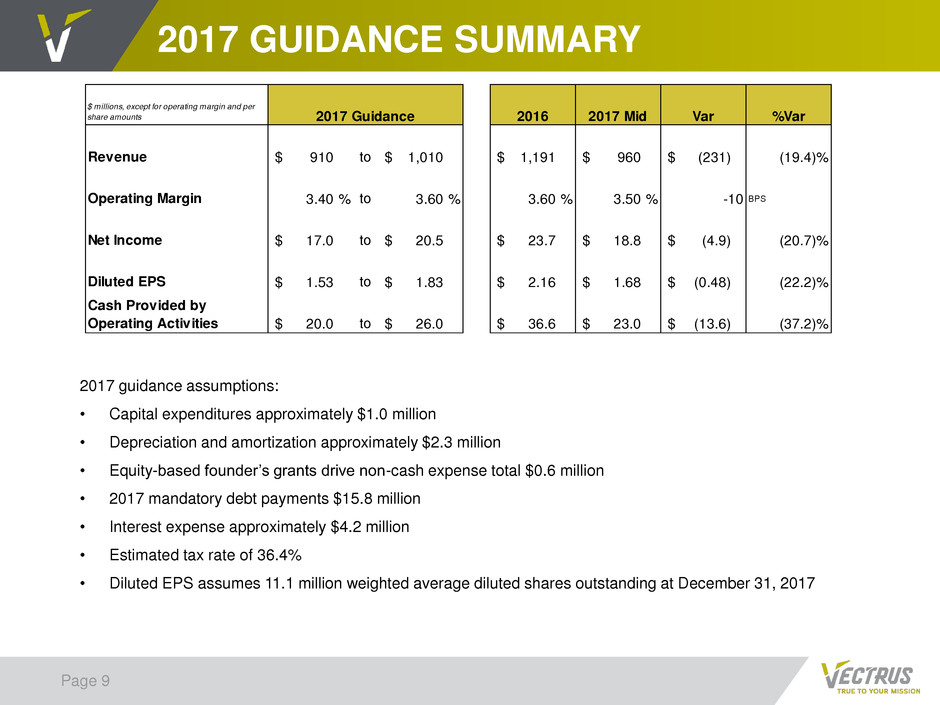

2017 GUIDANCE SUMMARY Page 9 2017 guidance assumptions: • Capital expenditures approximately $1.0 million • Depreciation and amortization approximately $2.3 million • Equity-based founder’s grants drive non-cash expense total $0.6 million • 2017 mandatory debt payments $15.8 million • Interest expense approximately $4.2 million • Estimated tax rate of 36.4% • Diluted EPS assumes 11.1 million weighted average diluted shares outstanding at December 31, 2017 $ millions, except for operating margin and per share amounts 2016 2017 Mid Var %Var Revenue 910$ to 1,010$ 1,191$ 960$ (231)$ (19.4)% Operating Margin 3.40 % to 3.60 % 3.60 % 3.50 % -10 BPS Net Income 17.0$ to 20.5$ 23.7$ 18.8$ (4.9)$ (20.7)% Diluted EPS 1.53$ to 1.83$ 2.16$ 1.68$ (0.48)$ (22.2)% Cash Provided by Operating Activities 20.0$ to 26.0$ 36.6$ 23.0$ (13.6)$ (37.2)% 2017 Guidance

CHUCK PROW PRESIDENT AND CHIEF EXECUTIVE OFFICER MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER VECTRUS FOURTH QUARTER 2016 RESULTS

APPENDIX

RECONCILIATION OF NON-GAAP MEASURES Page 12 The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. In addition, we consider adjusted operating income, adjusted operating margin, adjusted net income, and adjusted diluted earnings per share to be useful to management and investors in evaluating our operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. Adjusted operating income, adjusted operating margin, adjusted net income, and adjusted diluted earnings per share, however, are not measures of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for operating income, net income, diluted earnings per share, or net cash provided by operating activities as determined in accordance with GAAP. Reconciliations of these items are provided below. “Adjusted operating income” is defined as operating income, adjusted to exclude items that may include, but are not limited to, other income; significant charges or credits that impact current results but are not related to our ongoing operations and unusual and infrequent non-operating items and non-operating tax settlements or adjustments, such as separation costs incurred to become a stand-alone public company and tax indemnifications in connection with the spin-off. “Adjusted operating margin” is defined as adjusted operating income divided by revenue. "Adjusted net income" is defined as net income, adjusted to exclude items that may include, but are not limited to, other income; significant charges or credits that impact current results but are not related to our ongoing operations and unusual and infrequent non-operating items and non-operating tax settlements or adjustments, such as separation costs incurred to become a stand-alone public company and net settlement of uncertain tax positions. "Adjusted diluted earnings per share" is defined as adjusted net income divided by the weighted average diluted common shares outstanding.

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Page 13 (In thousands) Adjusted Operating Income (Non-GAAP Measure) 2016 2015 2016 2015 Revenue 288,160$ 311,194$ 1,190,519 1,180,684 Operating income 8,555$ 11,291$ 42,826$ 39,962$ Separation costs 1 (pretax) — — — 177 Tax indemnifications 2 — — — 3,300 Adjusted operating income 8,555$ 11,291$ 42,826$ 43,439$ Operating margin 3.0 % 3.6 % 3.6 % 3.4 % Adjusted operating margin 3.0 % 3.6 % 3.6 % 3.7 % (In thousands, except for share and per share data) Adjusted Net Income and Adjusted Diluted Earnings Per Share (Non-GAAP Measure) 2016 2015 2016 2015 Net income 4,409$ 5,960$ 23,655$ 30,973$ Separation costs 1 (pretax) — — — 177 Tax impact of adjustments — (20) — (13) Net settlement of uncertain tax positions 2 — — — (6,949) Adjusted net income 4,409$ 5,940$ 23,655$ 24,188$ GAAP EPS - diluted $0.40 $0.55 $2.16 $2.86 Adjusted EPS - diluted $0.40 $0.55 $2.16 $2.23 Weighted average common shares outstanding - diluted 10,988 10,869 10,974 10,825 Three Months Ended December 31, Year Ended December 31, 1 Costs incurred to become a stand-alone public company. 2 Tax indemnifications in connection with the spin-off from our former parent (see "Tax Indemnifications" in Note 3 to the financial statements in our 2016 Annual Report on Form 10-K). Three Months Ended December 31, Year Ended December 31,