VECTRUS SECOND QUARTER 2018 RESULTS CHUCK PROW PRESIDENT AND CHIEF EXECUTIVE OFFICER MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER AUGUST 7, 2018

SAFE HARBOR STATEMENT SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 (THE "ACT"): CERTAIN MATERIAL PRESENTED HEREIN INCLUDES FORWARD-LOOKING STATEMENTS INTENDED TO QUALIFY FOR THE SAFE HARBOR FROM LIABILITY ESTABLISHED BY THE ACT. THESE FORWARD-LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, STATEMENTS IN 2018 GUIDANCE ABOUT OUR REVENUE, OPERATING MARGIN, NET INCOME, EPS AND NET CASH PROVIDED BY OPERATING ACTIVITIES FOR 2018 AND OTHER ASSUMPTIONS CONTAINED THEREIN FOR PURPOSES OF SUCH GUIDANCE, OTHER STATEMENTS ABOUT REVENUE AND DAYS SALES OUTSTANDING (DSO), OUR CREDIT FACILITY, DEBT PAYMENTS, EXPENSE SAVINGS, CONTRACT OPPORTUNITIES, BIDS AND AWARDS, COLLECTIONS, BUSINESS STRATEGY, OUTLOOK, OBJECTIVES, PLANS, INTENTIONS OR GOALS, AND ANY DISCUSSION OF FUTURE OPERATING OR FINANCIAL PERFORMANCE. WHENEVER USED, WORDS SUCH AS "MAY," "WILL," "LIKELY," "ANTICIPATE," "ESTIMATE," "EXPECT," "PROJECT," "INTEND," "PLAN," "BELIEVE," "TARGET," "COULD," "POTENTIAL,” “ARE CONSIDERING,” "CONTINUE," “GOAL” OR SIMILAR TERMINOLOGY ARE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE RESULTS CONTEMPLATED BY THE FORWARD- LOOKING STATEMENTS, OUR HISTORICAL EXPERIENCE AND OUR PRESENT EXPECTATIONS OR PROJECTIONS. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO: OUR DEPENDENCE ON A FEW LARGE CONTRACTS FOR A SIGNIFICANT PORTION OF OUR REVENUE; COMPETITION IN OUR INDUSTRY; OUR DEPENDENCE ON THE U.S. GOVERNMENT AND THE IMPORTANCE OF OUR MAINTAINING A GOOD RELATIONSHIP WITH THE U.S. GOVERNMENT; OUR ABILITY TO SUBMIT PROPOSALS FOR AND/OR WIN POTENTIAL OPPORTUNITIES IN OUR PIPELINE; OUR ABILITY TO RETAIN AND RENEW OUR EXISTING CONTRACTS; PROTESTS OF NEW AWARDS; ANY ACQUISITIONS, INVESTMENTS OR JOINT VENTURES, INCLUDING THE INTEGRATION OF SENTEL CORPORATION INTO OUR BUSINESS; OUR INTERNATIONAL OPERATIONS, INCLUDING THE ECONOMIC, POLITICAL AND SOCIAL CONDITIONS IN THE COUNTRIES IN WHICH WE CONDUCT OUR BUSINESSES; CHANGES IN U.S. GOVERNMENT MILITARY OPERATIONS, INCLUDING ITS OPERATIONS IN AFGHANISTAN; CHANGES IN, OR DELAYS IN THE COMPLETION OF, U.S. OR INTERNATIONAL GOVERNMENT BUDGETS; GOVERNMENT REGULATIONS AND COMPLIANCE THEREWITH, INCLUDING CHANGES TO THE DEPARTMENT OF DEFENSE PROCUREMENT PROCESS; CHANGES IN TECHNOLOGY; INTELLECTUAL PROPERTY MATTERS; GOVERNMENTAL INVESTIGATIONS, REVIEWS, AUDITS AND COST ADJUSTMENTS; CONTINGENCIES RELATED TO ACTUAL OR ALLEGED ENVIRONMENTAL CONTAMINATION, CLAIMS AND CONCERNS; OUR SUCCESS IN EXPANDING OUR GEOGRAPHIC FOOTPRINT OR BROADENING OUR CUSTOMER BASE, MARKETS AND CAPABILITIES; OUR ABILITY TO REALIZE THE FULL AMOUNTS REFLECTED IN OUR BACKLOG; IMPAIRMENT OF GOODWILL; OUR PERFORMANCE OF OUR CONTRACTS AND OUR ABILITY TO CONTROL COSTS; OUR LEVEL OF INDEBTEDNESS; OUR COMPLIANCE WITH THE TERMS OF OUR CREDIT AGREEMENT; SUBCONTRACTOR AND EMPLOYEE PERFORMANCE AND CONDUCT; OUR TEAMING ARRANGEMENTS WITH OTHER CONTRACTORS; ECONOMIC AND CAPITAL MARKETS CONDITIONS; OUR ABILITY TO RETAIN AND RECRUIT QUALIFIED PERSONNEL; OUR MAINTENANCE OF SAFE WORK SITES AND EQUIPMENT; OUR COMPLIANCE WITH APPLICABLE ENVIRONMENTAL, HEALTH AND SAFETY REGULATIONS; OUR ABILITY TO MAINTAIN REQUIRED SECURITY CLEARANCES; ANY DISPUTES WITH LABOR UNIONS; COSTS OF OUTCOME OF ANY LEGAL PROCEEDINGS; SECURITY BREACHES AND OTHER DISRUPTIONS TO OUR INFORMATION TECHNOLOGY AND OPERATIONS; CHANGES IN OUR TAX PROVISIONS INCLUDING UNDER THE TAX CUTS AND JOBS ACT, OR EXPOSURE TO ADDITIONAL INCOME TAX LIABILITIES; CHANGES IN U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES; INCLUDING CHANGES RELATED TO ACCOUNTING STANDARDS CODIFICATION TOPIC 606, REVENUE FROM CONTRACTS WITH CUSTOMERS (ASC 606); ACCOUNTING ESTIMATES MADE IN CONNECTION WITH OUR CONTRACTS; OUR EXPOSURE TO INTEREST RATE RISK; OUR COMPLIANCE WITH PUBLIC COMPANY ACCOUNTING AND FINANCIAL REPORTING REQUIREMENTS; TIMING OF PAYMENTS BY THE U.S. GOVERNMENT; RISKS AND UNCERTAINTIES RELATING TO THE SPIN-OFF FROM OUR FORMER PARENT; AND OTHER FACTORS SET FORTH IN PART I, ITEM 1A, – “RISK FACTORS,” AND ELSEWHERE IN OUR 2017 ANNUAL REPORT ON FORM 10-K AND DESCRIBED FROM TIME TO TIME IN OUR FUTURE REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW. Page 2

BUSINESS UPDATE • Solid Q2’18 results with revenue increasing 24% year-over-year o Vectrus base business grew 12% year-over-year with the remainder coming from SENTEL o Experienced growth in Middle East, Europe, and U.S. programs • Won over $125 million of new business in Q2’18 o Awarded $84 million Air Force Contract for base maintenance support services at Sheppard Air Force Base Vectrus has won $450 million worth of contracts with the Air Education Training Command over the past 18 months o Awarded $43 million Army Contract for Installation Maintenance Services at U.S. Army Garrison Stuttgart Further positions Vectrus as a leading provider of facilities support services in Germany and builds on our almost 40 years of experience operating in the country • New business pipeline remains favorable o Approx. $1.4 billion of proposals submitted and pending potential award o $8 billion in potential new business opportunities identified over the next 12 months • Well positioned for LOGCAP V o Received highest possible performance ratings on the Kuwait-Base Operations and Security Support Services (K-BOSSS) contract Page 3

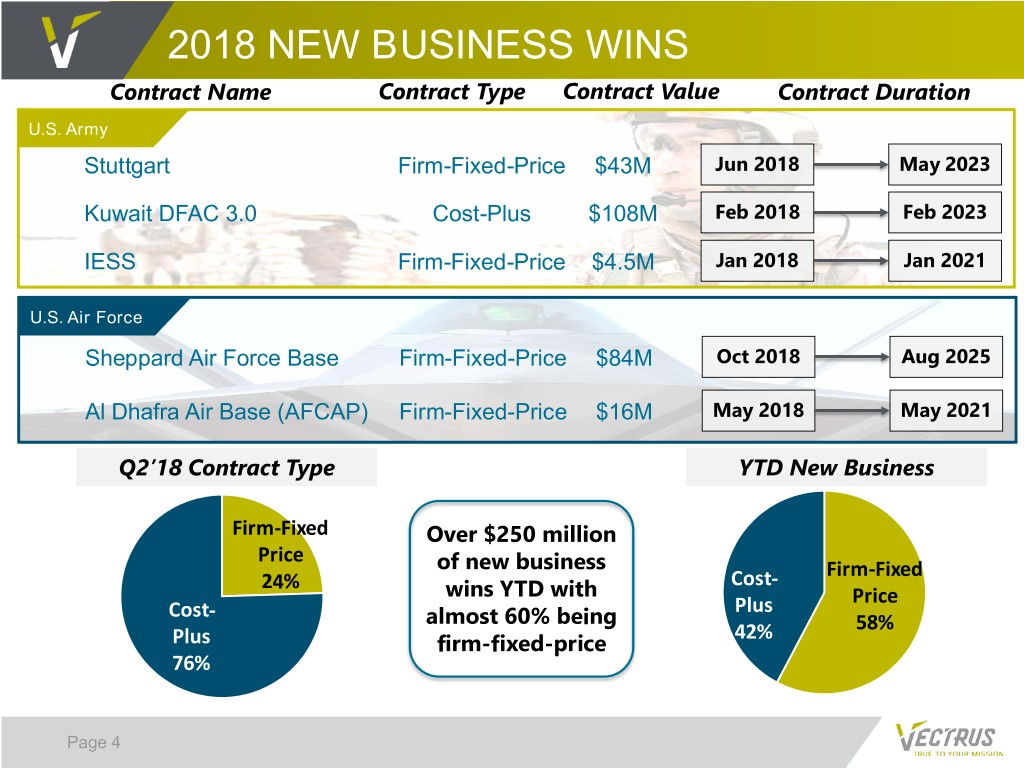

2018 NEW BUSINESS WINS Contract Name Contract Type Contract Value Contract Duration U.S. Army Stuttgart Firm-Fixed-Price $43M Jun 2018 May 2023 Kuwait DFAC 3.0 Cost-Plus $108M Feb 2018 Feb 2023 IESS Firm-Fixed-Price $4.5M Jan 2018 Jan 2021 U.S. Air Force Sheppard Air Force Base Firm-Fixed-Price $84M Oct 2018 Aug 2025 Al Dhafra Air Base (AFCAP) Firm-Fixed-Price $16M May 2018 May 2021 Q2’18 Contract Type YTD New Business Firm-Fixed Over $250 million Price of new business Cost- Firm-Fixed 24% wins YTD with Plus Price Cost- almost 60% being 42% 58% Plus firm-fixed-price 76% Page 4

Q2 OPERATIONAL HIGHLIGHTS • Solid financial results o Revenue $321.1 million o Operating margin 4.0% o Diluted earnings per share $0.81 o Days sales outstanding (DSO): 60 • Backlog increased 17% year-over-year to $3.3 billion • SENTEL integration on schedule and below budget • Total leverage ratio of 1.44x o Total debt $77 million o Cash $41 million • Enterprise Vectrus regionalization initiative is fully operational Page 5

Q2 2018 FINANCIAL RESULTS Second Quarter 2018 Q2 Q2 (In millions, except Operating Margin and Diluted Earnings Per Share) 2018 2017 vs. 2017 Revenue $ 321.1 $ 259.3 $ 61.8 Operating income $ 13.0 $ 9.2 $ 3.8 Operating margin 4.0 % 3.5 % 0.5 % EBITDA $ 13.8 $ 9.6 $ 4.2 EBITDA margin 4.3 % 3.7 % 0.6 % Net income $ 9.2 $ 5.5 $ 3.7 Diluted earnings per share $ 0.81 $ 0.49 $ 0.32 Year-to-date Second Quarter 2018 Q2 Q2 (In millions, except Operating Margin and Diluted Earnings Per Share) 2018 2017 vs. 2017 Revenue $ 641.6 $ 549.4 $ 92.3 Operating income $ 21.7 $ 20.9 $ 0.8 Operating margin 3.4 % 3.8 % (0.4)% EBITDA $ 23.3 $ 21.6 $ 1.6 EBITDA margin 3.6 % 3.9 % (0.3)% Net income $ 15.3 $ 12.1 $ 3.2 Diluted earnings per share $ 1.35 $ 1.09 $ 0.26 Net cash provided by operating activities $ 4.2 $ 5.7 $ (1.6) Page 6

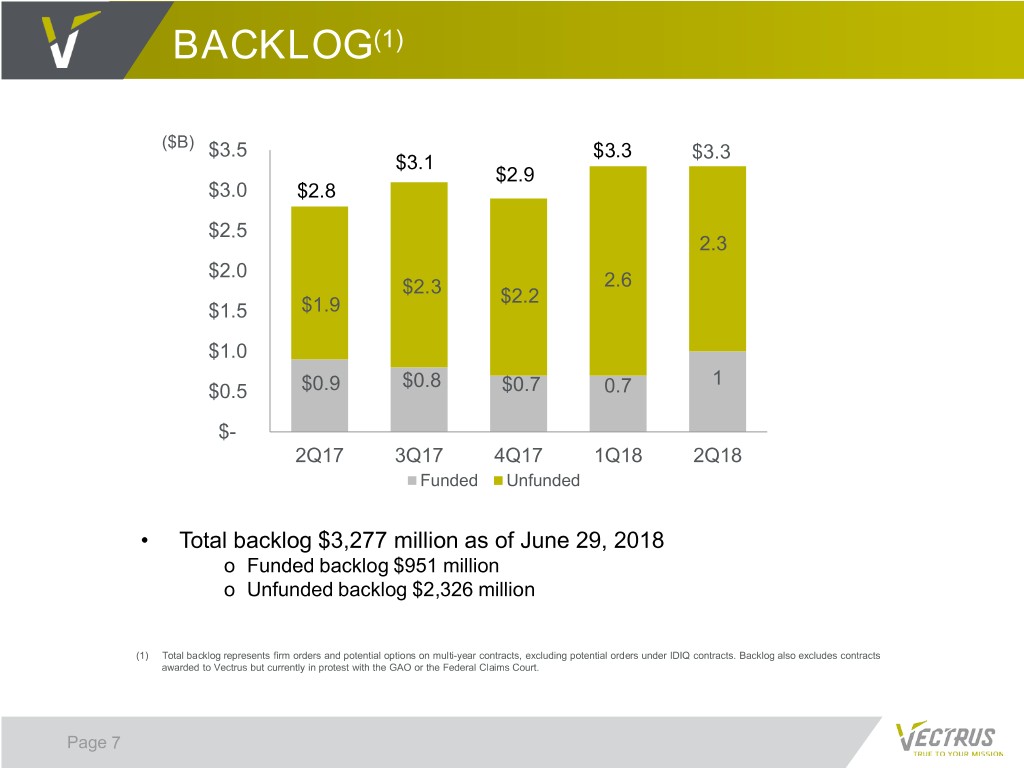

BACKLOG(1) ($B) $3.5 $3.3 $3.3 $3.1 $2.9 $3.0 $2.8 $2.5 2.3(2) $2.0 2.6 $2.3 $2.2 $1.5 $1.9 $1.0 $0.8 1 $0.5 $0.9 $0.7 0.7 $- 2Q17 3Q17 4Q17 1Q18 2Q18 Funded Unfunded • Total backlog $3,277 million as of June 29, 2018 o Funded backlog $951 million o Unfunded backlog $2,326 million (1) Total backlog represents firm orders and potential options on multi-year contracts, excluding potential orders under IDIQ contracts. Backlog also excludes contracts awarded to Vectrus but currently in protest with the GAO or the Federal Claims Court. Page 7

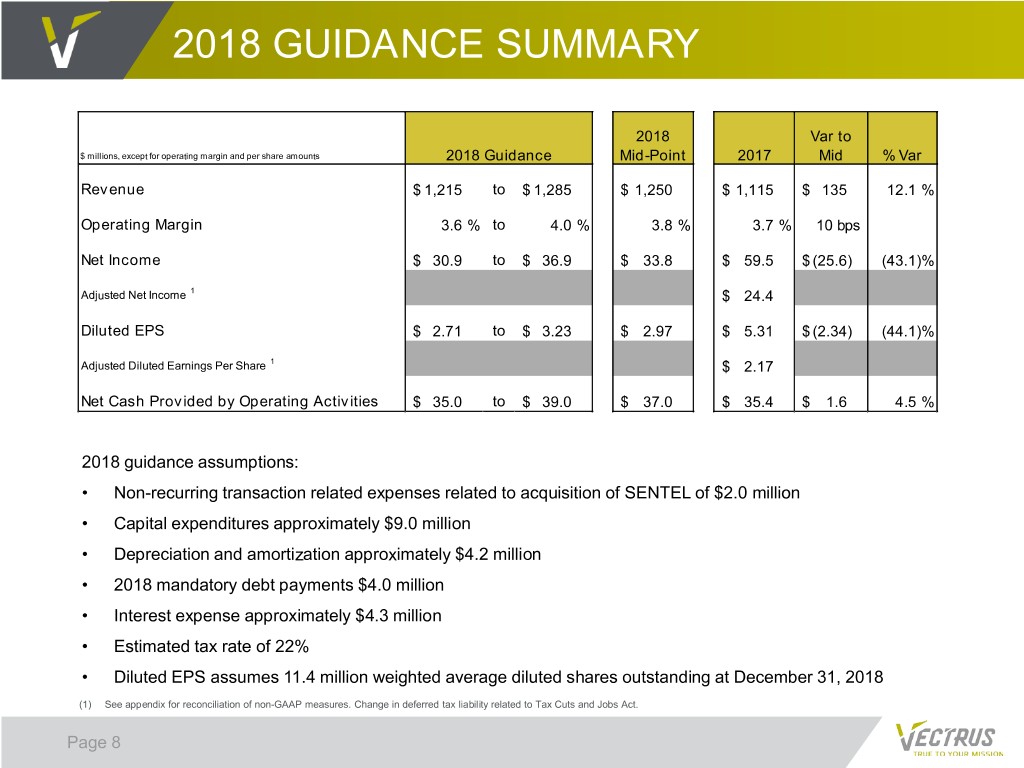

2018 GUIDANCE SUMMARY 2018 Var to $ millions, except for operating margin and per share amounts 2018 Guidance Mid-Point 2017 Mid % Var Revenue $ 1,215 to $ 1,285 $ 1,250 $ 1,115 $ 135 12.1 % Operating Margin 3.6 % to 4.0 % 3.8 % 3.7 % 10 bps Net Income $ 30.9 to $ 36.9 $ 33.8 $ 59.5 $ (25.6) (43.1)% Adjusted Net Income 1 $ 24.4 Diluted EPS $ 2.71 to $ 3.23 $ 2.97 $ 5.31 $ (2.34) (44.1)% Adjusted Diluted Earnings Per Share 1 $ 2.17 Net Cash Provided by Operating Activities $ 35.0 to $ 39.0 $ 37.0 $ 35.4 $ 1.6 4.5 % 2018 guidance assumptions: • Non-recurring transaction related expenses related to acquisition of SENTEL of $2.0 million • Capital expenditures approximately $9.0 million • Depreciation and amortization approximately $4.2 million • 2018 mandatory debt payments $4.0 million • Interest expense approximately $4.3 million • Estimated tax rate of 22% • Diluted EPS assumes 11.4 million weighted average diluted shares outstanding at December 31, 2018 (1) See appendix for reconciliation of non-GAAP measures. Change in deferred tax liability related to Tax Cuts and Jobs Act. Page 8

VECTRUS SECOND QUARTER 2018 RESULTS CHUCK PROW PRESIDENT AND CHIEF EXECUTIVE OFFICER MATT KLEIN SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

RECONCILIATION OF NON-GAAP MEASURES The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. In addition, we consider adjusted operating income, adjusted operating margin, EBITDA, EBITDA %, adjusted EBITDA, adjusted EBITDA %, adjusted net income and adjusted diluted earnings per share to be useful to management and investors in evaluating our operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. Adjusted operating income, adjusted operating margin, EBITDA, EBITDA %, adjusted EBITDA, adjusted EBITDA %, net income, adjusted net income and adjusted diluted earnings per share, however, are not measures of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for net income and diluted earnings per share as determined in accordance with GAAP. Reconciliations of these items are provided below. "Adjusted operating income" is defined as operating income, adjusted to exclude items that may include, but are not limited to, transaction and non-recurring integration costs that impact current results but are not related to our ongoing operations. "Adjusted operating margin" is defined as adjusted operating income divided by revenue. "EBITDA" is defined as operating income, adjusted to exclude depreciation and amortization. "EBITDA %" is defined as EBITDA divided by revenue. "Adjusted EBITDA" is defined as EBITDA adjusted to exclude items that may include, but are not limited to, transaction and non-recurring integration costs that impact current results but are not related to our ongoing operations. "Adjusted EBITDA %" is defined as adjusted EBITDA divided by revenue. "Adjusted net income" is defined as net income, adjusted to exclude items that may include, but are not limited to, other income; significant charges or credits that impact current results but are not related to our ongoing operations and unusual and infrequent non-operating items and non-operating tax settlements or adjustments, such as revaluation of our deferred tax liability as a result of the Tax Cuts and Jobs Act, and net settlement of uncertain tax positions. "Adjusted diluted earnings per share" is defined as adjusted net income divided by the weighted average diluted common shares outstanding. Page 10

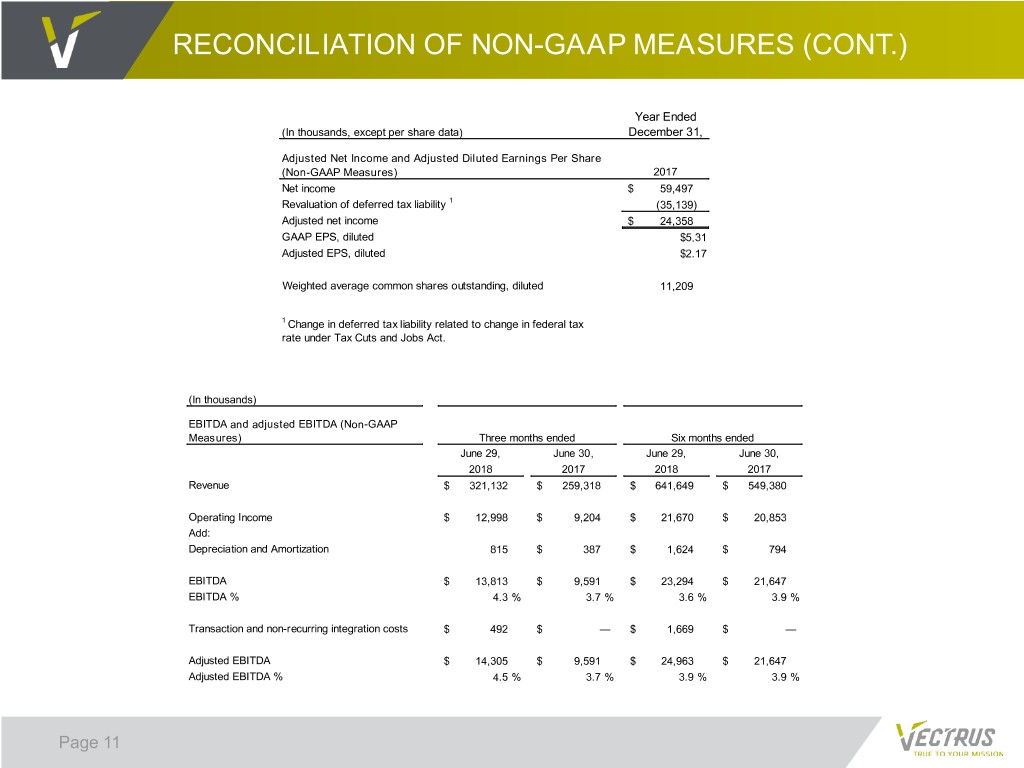

RECONCILIATION OF NON-GAAP MEASURES (CONT.) Year Ended (In thousands, except per share data) December 31, Adjusted Net Income and Adjusted Diluted Earnings Per Share (Non-GAAP Measures) 2017 Net income $ 59,497 Revaluation of deferred tax liability 1 (35,139) Adjusted net income $ 24,358 GAAP EPS, diluted $5.31 Adjusted EPS, diluted $2.17 Weighted average common shares outstanding, diluted 11,209 1 Change in deferred tax liability related to change in federal tax rate under Tax Cuts and Jobs Act. (In thousands) EBITDA and adjusted EBITDA (Non-GAAP Measures) Three months ended Six months ended June 29, June 30, June 29, June 30, 2018 2017 2018 2017 Revenue $ 321,132 $ 259,318 $ 641,649 $ 549,380 Operating Income $ 12,998 $ 9,204 $ 21,670 $ 20,853 Add: Depreciation and Amortization 815 $ 387 $ 1,624 $ 794 EBITDA $ 13,813 $ 9,591 $ 23,294 $ 21,647 EBITDA % 4.3 % 3.7 % 3.6 % 3.9 % Transaction and non-recurring integration costs $ 492 $ — $ 1,669 $ — Adjusted EBITDA $ 14,305 $ 9,591 $ 24,963 $ 21,647 Adjusted EBITDA % 4.5 % 3.7 % 3.9 % 3.9 % Page 11

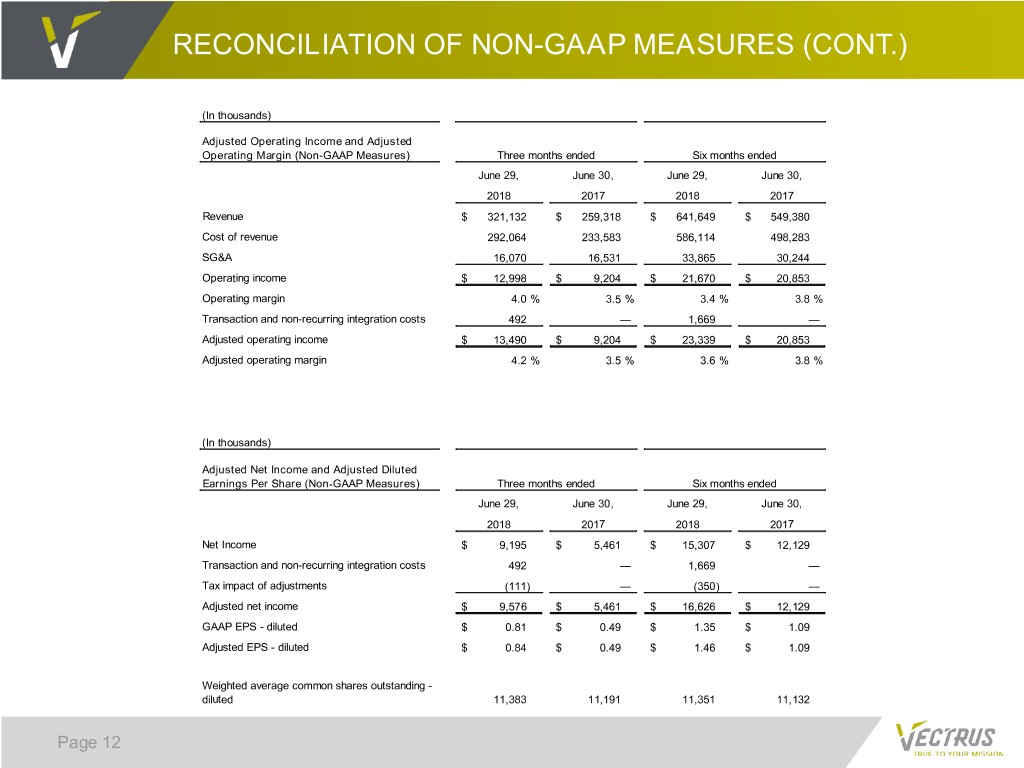

RECONCILIATION OF NON-GAAP MEASURES (CONT.) (In thousands) Adjusted Operating Income and Adjusted Operating Margin (Non-GAAP Measures) Three months ended Six months ended June 29, June 30, June 29, June 30, 2018 2017 2018 2017 Revenue $ 321,132 $ 259,318 $ 641,649 $ 549,380 Cost of revenue 292,064 233,583 586,114 498,283 SG&A 16,070 16,531 33,865 30,244 Operating income $ 12,998 $ 9,204 $ 21,670 $ 20,853 Operating margin 4.0 % 3.5 % 3.4 % 3.8 % Transaction and non-recurring integration costs 492 — 1,669 — Adjusted operating income $ 13,490 $ 9,204 $ 23,339 $ 20,853 Adjusted operating margin 4.2 % 3.5 % 3.6 % 3.8 % (In thousands) Adjusted Net Income and Adjusted Diluted Earnings Per Share (Non-GAAP Measures) Three months ended Six months ended June 29, June 30, June 29, June 30, 2018 2017 2018 2017 Net Income $ 9,195 $ 5,461 $ 15,307 $ 12,129 Transaction and non-recurring integration costs 492 — 1,669 — Tax impact of adjustments (111) — (350) — Adjusted net income $ 9,576 $ 5,461 $ 16,626 $ 12,129 GAAP EPS - diluted $ 0.81 $ 0.49 $ 1.35 $ 1.09 Adjusted EPS - diluted $ 0.84 $ 0.49 $ 1.46 $ 1.09 Weighted average common shares outstanding - diluted 11,383 11,191 11,351 11,132 Page 12