As filed with the Securities and Exchange Commission on May 23, 2014

Registration No. 333-194935

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORMS-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DS Services Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2086 | | 20-5752672 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

DS Services of America, Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 2086 | | 20-5743877 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

*ADDITIONAL REGISTRANT LISTED ON SCHEDULE A HERETO

5660 New Northside Drive

Atlanta, GA 30328

(770) 933-1400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ryan K. Owens

Senior Vice President, Chief Legal Officer and Secretary

DS Services of America, Inc.

5660 New Northside Drive

Atlanta, GA 30328

(770) 933-1400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Monica K. Thurmond, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

212-373-3000

Approximate date of commencement of proposed sale to public:As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is apost-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of each class of securities to be registered | | Amount

to be

registered | | Proposed

maximum

offering price

per share | | Proposed

maximum

aggregate offering price(1) | | Amount of registration fee(2) |

10.000% Second-Priority Senior Secured Notes due 2021 | | $350,000,000 | | 100% | | $350,000,000 | | $45,080(3) |

Guarantees of Second-Priority Senior Secured Notes due 2021 | | N/A | | N/A | | N/A | | N/A(4) |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) of the Securities Act of 1933. |

| (2) | The registration fee has been calculated pursuant to Rule 457(f) under the Securities Act of 1933, as amended. |

| (3) | The Registrants previously paid this amount in connection with the initial filing of this Registration Statement on March 31, 2014. |

| (4) | No additional consideration is being received for the guarantees, and, therefore no additional fee is required. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SCHEDULE A

| | | | | | | | | | | | |

Name | | State or Other

Jurisdiction of

Incorporation or

Organization | | | Primary Standard

Industrial

Classification

Code Number | | | I.R.S.

Employer

Identification

Number | |

Crystal Springs of Alabama Holdings, LLC | | | Delaware | | | | 2086 | | | | N/A | |

The address of the additional registrant is c/o DS Services of America, Inc., 5660 New Northside Drive, Atlanta, GA 30328.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED May 23, 2014

PRELIMINARY PROSPECTUS

DS Services of America, Inc.

Exchange Offer for $350,000,000

10.000% Second-Priority Senior Secured Notes due 2021 and Related Guarantees

The Notes and the Guarantees

| • | | We are offering to exchange $350,000,000 of our outstanding 10.000% Second-Priority Senior Secured Notes due 2021 and certain related guarantees, which were issued on August 30, 2013 in a private offering and which we refer to collectively as the “initial notes,” for a like aggregate amount of our registered 10.000% Second-Priority Senior Secured Notes due 2021 and certain related guarantees, which we refer to collectively as the “exchange notes”. The exchange notes will be issued under an indenture dated as of August 30, 2013, which we refer to as the “indenture”. We refer to the initial notes and the exchange notes collectively as the “notes.” |

| • | | The exchange notes will mature on September 1, 2021. We will pay interest on the exchange notes semi-annually on March 1 and September 1 of each year, at a rate of 10.000% per annum, to holders of record on the February 15 or August 15 immediately preceding the interest payment date. |

| • | | The exchange notes will be fully and unconditionally guaranteed by DS Services Holdings, Inc. (“Holdings” and formerly known as DS Waters Enterprises, Inc.) and by each of our wholly-owned material domestic restricted subsidiaries that guarantees our senior secured term loan facility (the “Term Loan Facility”), which we refer to collectively as the “guarantors.” |

| • | | The exchange notes and related guarantees will be secured by (i) second-priority security interests in the collateral that secures the obligations of DS Services of America, Inc. (the “Issuer”) and the guarantors under the Term Loan Facility on a first-priority basis (the “Non-ABL Priority Collateral”), which will also secure the Issuer’s asset-based revolving credit facility (the “ABL Facility”) on a third-priority basis, and (ii) third-priority security interests in the collateral that secures the obligations of the Issuer and the guarantors under the ABL Facility on a first-priority basis (consisting primarily of inventory, accounts receivable and related assets and certain real property) (the “ABL Priority Collateral”), which will also secure the Term Loan Facility on a second-priority basis, in each case subject to permitted liens and exceptions as described in this prospectus. See “Description of Notes.” |

| • | | The exchange notes and related guarantees will rank (i) equally in right of payment with all existing and future senior indebtedness of the Issuer and the guarantors, (ii) senior in right of payment to all future subordinated indebtedness of the Issuer and the guarantors, (iii) effectively senior to all existing and future unsecured indebtedness of the Issuer and the guarantors, to the extent of the value of the collateral securing the notes, (iv) effectively junior to all existing and future indebtedness of the Issuer and the guarantors that is secured by the collateral on a senior-priority basis, to the extent of the value of such collateral, (v) effectively senior to all existing and future indebtedness of the Issuer and the guarantors that is secured by the collateral on a junior-priority basis, to the extent of the value of such collateral, and (vi) structurally subordinated to all obligations of each of the Issuer’s subsidiaries that is not a guarantor of the notes. See “Description of Notes—Ranking.” |

Terms of the Exchange Offer

| • | | The exchange offer will expire at 5:00 p.m., New York City time, on , 2014, unless we extend it. |

| • | | If all the conditions to this exchange offer are satisfied, we will exchange all of our initial notes that are validly tendered and not withdrawn for the exchange notes. |

| • | | You may withdraw your tender of initial notes at any time before the expiration of this exchange offer. |

| • | | The exchange notes that we will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights. |

| • | | The exchange notes that we will issue you in exchange for your initial notes are new securities with no established market for trading. |

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups (“JOBS”) Act and are therefore eligible to take advantage of certain reduced reporting requirements that are otherwise applicable to other public companies.

Before participating in this exchange offer, please refer to the section in this prospectus entitled “Risk Factors” commencing on page 29.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have not applied, and do not intend to apply, for listing or quotation of the notes on any national securities exchange or automated quotation system.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for initial notes where such initial notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is , 2014.

TABLE OF CONTENTS

We have not authorized anyone to give you any information or to make any representations about us or the transactions we discuss in this prospectus other than those contained in this prospectus. If you are given any information or representations about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law. The delivery of this prospectus does not, under any circumstances, mean that there has not been a change in our affairs since the date of this prospectus. Subject to our obligation to amend or supplement this prospectus as required by law and the rules and regulations of the SEC, the information contained in this prospectus is correct only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of these securities.

Until , 2014 (90 days after the date of this prospectus), all dealers effecting transactions in the exchange notes, whether or not participating in the exchange offer, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Each prospective purchaser of the exchange notes must comply with all applicable laws and regulations in force in any jurisdiction in which it purchases, offers or sells the notes or possesses or distributes this prospectus and must obtain any consent, approval or permission required by it for the purchase, offer or sale by it of the additional exchange notes under the laws and regulations in force in any jurisdiction to which it is subject or in which it makes such purchases, offers or sales, and we shall not have any responsibility therefor.

i

USE OFNON-GAAP FINANCIAL INFORMATION

We have provided EBITDA and Adjusted EBITDA in this prospectus because we believe they provide investors with additional information to measure our performance and evaluate our ability to service our indebtedness. We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about certain materialnon-cash items and about certain other adjustments that we do not expect to continue at the same level in the future as well as other items. Further, we believe Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance and understanding certain significant items.

EBITDA and Adjusted EBITDA are not measurements of operating performance computed in accordance with United States Generally Accepted Accounting Principles (“GAAP”), and our use of the term Adjusted EBITDA varies from others in our industry. EBITDA and Adjusted EBITDA are presented in this prospectus as supplemental measures that are not required by, or presented in accordance with, GAAP. EBITDA and Adjusted EBITDA should not be considered as alternatives for net income or any other performance measures derived in accordance with GAAP or as measures of liquidity. EBITDA and Adjusted EBITDA have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. For example, EBITDA:

| | • | | excludes certain tax payments that may represent a reduction in cash available to us; |

| | • | | does not reflect any cash capital expenditure requirements for the assets being depreciated and amortized that may have to be replaced in the future; |

| | • | | does not reflect changes in, or cash requirements for, our working capital needs; and |

| | • | | does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness. |

In addition, Adjusted EBITDA:

| | • | | does not include certainone-time or other expenditures, including, among other things, refinancing costs and costs required to realize certain operating synergies; |

| | • | | includes the EBITDA of acquired entities for certain periods prior to the date on which we made such acquisitions, as well as costs associated with business lines we have exited prior to the date on which we made such exit; |

| | • | | does not includenon-cash expenses incurred in connection with our stock options; |

| | • | | does not include management fees payable to our Sponsor; and |

| | • | | does not reflect the impact of earnings or charges resulting from matters that we may consider not to be indicative of our ongoing operations. |

In addition, certain adjustments used in calculating Adjusted EBITDA are based on estimates and assumptions of management and do not purport to reflect actual historical results. Because of these limitations, we rely primarily on our GAAP results and use EBITDA and Adjusted EBITDA only supplementally. In addition, you should be aware when evaluating EBITDA and Adjusted EBITDA that in the future we may incur expenses similar to those excluded when calculating these measures. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual ornon-recurring items. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures computed by other companies, because all companies do not calculated Adjusted EBITDA in the same fashion.

ii

MARKET AND INDUSTRY DATA

We include statements regarding factors that have impacted our industry and competitive position. Such statements regarding our industry and market share or position are statements of belief and are based on market share and industry data and forecasts that we have obtained from industry publications and surveys, as well as internal company sources. We believe that each of the third-party sources, as well as the market share, market position and other industry information included herein, is reliable. However, our industry data presented herein and our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the caption “Risk Factors” in this prospectus. We are responsible for the disclosure contained in this prospectus and we believe that the third-party market and industry data and our internal data and estimates are true and accurate.

For the purposes of determining market share and industry data contained in this prospectus, as well as the number of customers served in each of our lines of service, we count each individual dispenser, brewer and filtration unit as a single “customer.” Customers that own their own water dispenser (rather than rent a dispenser from us) are counted per delivery location. Customer counts do not account for customers with units across more than one line of service (for example, a customer with a dispenser and a brewer is included in both the home and office delivery bottled water and the office coffee services count). All customer counts exclude customers of our retail segment.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-4 to register the exchange notes. Upon the effectiveness of this registration statement on Form S-4, we will become subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will be required to file reports and other information with the SEC. This prospectus, which forms part of the registration statement, does not contain all of the information included in that registration statement. For further information about us and the exchange notes offered in this prospectus, you should refer to the registration statement and its exhibits. You may read and copy any document we file with the SEC at the SEC’s Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549. Copies of these reports, proxy statements and information that we file with the SEC may be obtained at prescribed rates from the Public Reference Section of the Commission at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. In addition, the SEC maintains a web site that contains reports, proxy statements and other information regarding registrants, such as us, that file electronically with the Commission. The address of this web site is http://www.sec.gov.

Anyone who receives a copy of this prospectus may obtain a copy of the indenture without charge by writing to DS Services of America, Inc., 5660 New Northside Drive, Atlanta, GA 30328.

iii

PROSPECTUS SUMMARY

This summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in the notes. You should carefully read the entire prospectus, including the information presented under “Risk Factors” and “Unaudited Pro Forma Condensed Consolidated Financial Data” and the historical financial statements and related notes presented elsewhere in this prospectus.

The term “initial notes” refers to the 10.000% Second-Priority Senior Secured Notes due 2021 and certain related guarantees that were issued on August 30, 2013 in a private offering, and the term “exchange notes” refers to the 10.000% Second-Priority Senior Secured Notes due 2021 and certain related guarantees offered by this prospectus. The term “notes” refers to the initial notes and the exchange notes, collectively.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “Issuer” or “DS Services of America” refer to DS Services of America, Inc., formerly known as DS Waters of America, Inc. References in this prospectus to “Holdings” refer to DS Services Holdings, Inc., formerly known as DS Waters Enterprises, Inc., which is a guarantor of the notes. Unless otherwise indicated or the context otherwise requires, references in this prospectus to “we,” “us,” “our” and the “Company” refer to Holdings and each of its consolidated subsidiaries, including DS Services of America, the capital stock of which is Holdings’ onlydirectly-held asset. References in this prospectus to the “Sponsor” or “Crestview Partners” refer to the entity described under “—Our Sponsor” and its affiliates. Unless otherwise indicated or the context otherwise requires, references to “pro forma” information give pro forma effect to the Transactions (as defined below under “—The Transactions”) as if they had occurred on December 29, 2012 for income statement purposes. Our fiscal year and fiscal quarters end on the Friday nearest the calendar year and calendar quarter end, as applicable, unless such Friday falls after such calendar period end, in which case the fiscal year end is the calendar year end and the fiscal quarter end is the final Friday in such quarter and calendar quarter end, respectively.

Emerging Growth Company Status

An “emerging growth company” is defined in the JOBS Act as an issuer with total annual gross revenue of less than $1.0 billion during its most recently completed fiscal year. As an emerging growth company, we are eligible to take advantage of certain reduced reporting requirements that are otherwise generally applicable to public companies including, but not limited to, the following:

| | • | | we may present, and discuss, only two years of audited financial statements; |

| | • | | we are exempt from the requirement to obtain an auditor’s attestation and report on management’s assessment of the effectiveness of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley Act”); |

| | • | | we are not required to disclose obligations regarding executive compensation in our periodic reports and proxy statements; |

| | • | | we are exempt from the requirement to hold a non-binding advisory vote on executive compensation and the requirement to obtain stockholder approval of any golden parachute arrangements; and |

| | • | | we are not required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (“PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (auditor discussion and analysis). |

1

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to ‘‘opt out’’ of such extended transition period and, as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We will remain an “emerging growth company” until the earliest of: (i) the last day of the fiscal year during which we had total annual gross revenue of $1.0 billion or more; (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the previous three year period, issued more than $1.0 billion in non-convertible debt; or (iv) the date on which we are deemed a “large accelerated issuer” as defined under the federal securities laws.

Our Company

We are a leading national provider ofdirect-to-consumer beverage services within the home and office delivery (“HOD”) bottled water, office coffee service (“OCS”) and filtration services markets. We offer a comprehensive portfolio of beverage products, includingthree- andfive-gallon returnable bottled water, coffee, brewed tea, water dispensers, coffee and tea brewers and filtration equipment, as well as other ancillary products and services. We deliver these products to approximately 1.5 million customers through our national network of 212 sales and distribution facilities, approximately 3,350 on road vehicles and approximately 2,100 routes. We believe we operate the broadest distribution network in our industry, which enables us to reach approximately 90% of U.S. households and efficiently service offices, as well as national and regional customers.

We are one of the two leading providers in the $1.5 billion U.S. HOD bottled water industry, with more than a 30% market share based on net revenues for fiscal year 2013. We believe that we have the strongest position within the HOD bottled water market based on the population base we service, our nationwide distribution capabilities and the size of our sales force in this market. Our HOD bottled water network covers 42 of the 50 largest cities in the United States, and in 38 of these 42 cities we believe we hold the largest or second largest market share. As of December 27, 2013, our HOD customer base was approximately 57% commercial and 43% residential.

We believe we are the third largest provider in the OCS market and the second largest provider in the filtration services market, based on our market share as determined by revenue generated in the fiscal year ended December 27, 2013. Our OCS and filtration services networks extend to all of the 50 largest U.S. cities. We primarily service commercial customers and currently have limited overlap among our HOD bottled water, OCS and filtration services customers.

For the fiscal three months ended March 28, 2014 and the fiscal year ended December 27, 2013, we generated approximately $230.5 million and $925.6 million in net revenue, respectively. See “—Summary Historical Consolidated Financial and Other Data,” “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

2

Our Products and Services

We operate through two reportable segments: Beverage Services (“Beverage Services”) and Retail Services (“Retail Services”). Beverage Services consist of sales and rental income from our HOD bottled water, brewed beverage services and filtration services. We sell bottled water, brewed coffee andbeverage-related equipment, plus water filtration system products and services to residential and commercial customers. Beverage Services products are delivered through our national network of distribution facilities, vehicles and routes. Retail Services consist of sales of ournon-returnable branded and private label one- and two- and ahalf-gallonhigh-density polyethylene (“HDPE”) bottles, as well as branded polyethylene terephthalate (“PET”) bottles, to major retailers. Retail Services products are distributed in all 50 states and are typically delivered to our retail customers’ distribution centers by common carrier transportation.

Beverage Services

HOD Bottled Water Services

We are one of the two leading national providers in the HOD bottled water industry, with more than a 30% market share based on net revenue and approximately 1.3 million customers. We operate in 42 of the 50 largest cities in the United States, and in 38 of these 42 cities we believe our brands hold the largest or second largest market share. Our leadership position is built on a portfolio of strong regional brands, many of which have existed for over 50 years. Our Alhambra®, Belmont Springs®, Deep Rock®, Hinckley Springs® and Mount Olympus® brands have existed for over 100 years. Many of our target customers are loyal to their local brands, which positions us well against smaller,lesser-known competitors.

We deliver a broad range of bottled water products directly to customers, including water packaged inthree- andfive-gallon returnable bottles,one- and two- and ahalf-gallon HDPE bottles andmulti-pack andsingle-serve 500 ml, one-liter and 24 ounce PET bottles. We provide deliveries to approximately 63% of our customers once every two weeks or less, which we believe is more frequent than most of our competitors, many of which work onthree- orfour-week delivery schedules. We complete over 145,000 transactions a day and believe our frequent and reliable service is a key competitive advantage.

A majority of our HOD bottled water customers, both residential and commercial, rent water dispensers from us. These units dispense hot and cold water, offer top or bottom load features for ourthree- andfive-gallon returnable bottles and are available in black, white or stainless steel models. Customers can pay separately for water dispenser rentals and water services or opt for an integrated “Budget Plan.” Under the Budget Plan, customers typically select a regular delivery of between three to eight water bottles every28-day period, along with the use of a water dispenser, for one fixed price. About 17% of our bottled water customers are on a Budget Plan. The regular payment cycle, combined with customer retention rates of over 80%, create a stable stream of recurring revenue.

Our water dispensers are purchased primarily from two different suppliers in China. In addition to our current suppliers, we believe there are a number of alternative suppliers that could satisfy our demand for water dispensers at any given time. We regularly evaluate our needs and the capacities of our suppliers and may switch suppliers for pricing, quality or other reasons. We maintain an inventory of approximately 40,000 water dispensers to ensure that an adequate supply is readily available for our customers. In 2012, we made a meaningful investment to upgrade to newer models and expand our overall inventory levels to meet growing customer demand.

We bottle our water products at 28 combined production and distribution facilities, as well as at 19 additionalproduction-only facilities operated bythird-party suppliers with whom we have strategic supply relationships. The vertical integration of our production and distribution facilities enables us to reduce costs, improve efficiency and reduce turnaround times. We also distribute our HOD products from an additional

3

184 branch distribution facilities. Our HOD products and services are available in 45 states in the United States and, in areas we do not service, we have distribution agreements with other HOD water distribution companies that allow us to provide comprehensive service to our national HOD bottled water customers.

Our scale and established delivery infrastructure enable us to generate attractive economics while offering competitive prices to our customers. The initial cost to acquire an average HOD bottled water customer, including sale commissions and the cost of a new water dispenser, is recovered in approximately 14 to 16 months. The average tenure of our customers is currently four years, which results in a high return on our upfront investment. Upon termination of service, water dispensers are picked up, cleaned, sanitized andre-issued to other customers at a relatively low cost. Given that the average life of a water dispenser is estimated to be seven to ten years and we refurbish existing dispensers tore-issue to new customers, our actual payback period is often less than 14 to 16 months.

In November 2013, we entered into a strategic alliance agreement with Primo Water Corporation (“Primo”) pursuant to which Primo assumed management of our three- and five-gallon retail exchange customers and we became the primary bottler and distribution partner in the United States for Primo’s products. We believe that this strategic alliance will allow us to gain increased bottling and distribution volume as we leverage our existing distribution capabilities to service Primo’s significant retail exchange customer base.

HOD bottled water services (including bottled water, the rental of water dispensers, energy surcharges and financing charges) represented approximately $151.7 million and $617.7 million of our net revenue for the fiscal three months ended March 28, 2014 and the fiscal year ended December 27, 2013, respectively including revenues from deposits onfive-gallon bottles which have been forfeited during this period. Revenues related to deposits on HOD bottled water services are calculated quarterly for customer forfeitures.

Brewed Beverage Services

We currently offer delivery of coffee, tea, brewers, cups and other breakroom products to approximately 105,000 commercial customers across the country. In 2012, we significantly increased our presence in this market through our acquisition of The Standard Companies, Inc. (“Standard Coffee”) and its approximately 82,000 customers. As a result of the acquisition, we believe we are now the third largest provider in the approximately $4.3 billion U.S. OCS industry.

Our OCS customer base is comprised primarily ofsmall-to-medium sized businesses, which fits with our strategy to continually leverage our superior distribution capabilities, high route density andwell-established national footprint. We believe larger providers do not have the operating model to service these smaller enterprises profitably giving us a strong competitive position in this target market. While the majority of our brewed beverage revenue is generated from office coffee customers, we also generate revenue from the sale of brewed tea to large national quick service restaurants, including Sonic, America’sDrive-In® and Pizza Hut®.

We arewell-positioned to capitalize on the growth of the overall OCS industry, as well as the faster growth areas within OCS such assingle-cup products.Single-cup services involve a home or small office brewing system that uses a preportioned “pack,” such as a Green Mountain CoffeeK-Cup® or Mars Drinks’ Alterra® Fresh Packs, to brew one cup of coffee or a similar beverage. In comparison, traditional brewing systems generally utilize a larger user-selected portion size to brew a bigger batch of coffee or similar beverage. In addition to our traditional coffee and brewer products, we offer a full range ofsingle-cup coffee products which includes Mars Drinks’ Alterra® brands and Green Mountain Coffee products, as well as our own line ofsingle-serve coffee products marketed under our Javarama® brand.

Single-cup brewer placements have increased steadily over the last several years and now comprise approximately 20% of the overall market, and a higher proportion for small to medium sized businesses. We

4

expect to benefit disproportionately from this growth given our focus on smaller businesses and our geographic advantage in servicing these customers. We also anticipate growth from increased penetration within our existing OCS customer base, most of which were offered a very limitedsingle-cup selection under Standard Coffee and now have access to our comprehensivesingle-cup products and services. We estimate that the associated revenue generated from asingle-cup customer is more than double that of a comparable customer that brews several cups of coffee in one batch at a single time, which we refer to as a traditional batch brewing customer, since the cost of a single-cup portion pack is significantly higher than the cost of a comparable portion of product sold in a batch. In addition,single-cup brewer purchases for homes have increased, which provides us with an opportunity to expand our addressable market beyond the traditional office customer to our residential customers.

We currently have little overlap between our OCS and HOD commercial bottled water customers, with only approximately 5% of our approximately 575,000 commercial bottled water customer delivery locations using our office coffee services. Since many of our commercial HOD customers also purchase office coffee service from other providers, we believe significant growth potential exists tocross-sell our OCS products to our existing HOD bottled water customer base. Having now completed the operational integration of the Standard Coffee acquisition, we have focused our sales force resources on thiscross-selling opportunity and are beginning to see the success of these efforts. In addition, we plan to introduce a new combination brewer and water dispenser in the third quarter of 2014, which we expect will further support thecross-selling of our HOD bottled water and coffee products and favorably position us in the growingsingle-cup services market.

Our brewers are purchased from several suppliers. Oursingle-cup brewers are purchased directly from Green Mountain Coffee and Mars Drinks to support their respective products. Batch brewers to support our Standard Coffee® and Javarama® brands are purchased from a supplier in St. Louis and another supplier in China. Similar to our water dispensers, we regularly evaluate our needs and the capacities of our suppliers and may switch suppliers for pricing, quality or other reasons. We maintain an inventory of approximately 20,000 brewers to ensure that an adequate supply is readily available for our OCS customers. During 2012 and 2013, we began to make the necessary investments to support our growth insingle-cup products.

Brewed beverage services (including coffee, tea, brewer rentals and the sale of cups and other breakroom products) represented approximately $40.4 million and $161.5 million of our net revenue for the fiscal three months ended March 28, 2014 and the fiscal year ended December 27, 2013, respectively. See “—Summary Historical Consolidated Financial and Other Data,” “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Filtration Services

We market and sellon-premise water filtration systems, either on a standalone basis or in conjunction with our brewed beverage offerings, and currently have approximately 67,000, primarily commercial, customers. In 2012, we significantly increased our presence in this market through our acquisition of Relyant Equipment Services, a division of Standard Coffee included with the acquisition, and, as a result, we believe we are now the second largest provider in this market.

Water filtration systems are connected to an existing water supply to reduce impurities and other contaminants found in municipal tap water. Water is filtered before it is dispensed from the tap and can then be used for drinking or brewing coffee or tea. We charge our customers on a regular cycle to cover both the rental and routine maintenance. We generate additional revenue if we are required to perform any other work on filtration equipment outside of our standard maintenance. We also provide these services on an outsourced basis to customers of large national retailers in the office supply business.

Our strong presence in filtration services has allowed us to access new customers and provide a more comprehensive water offering. We believe our filtration services are a complement to our HOD bottled water

5

services and are not typically a substitute for such services. For example, historically, less than 1% of our annual HOD bottled water customer terminations have been related to filtration. As a result, we expect to grow our HOD bottled water and filtration services customer bases independently. Filtration provides us with another product that leverages our national distribution network and enables us to pursue additionalcross-selling opportunities with our brewed beverage customer base.

Filtration services represented approximately $6.0 million and $22.7 million of our net revenue for the fiscal three months ended March 28, 2014 and the fiscal year ended December 27, 2013, respectively. See “—Summary Historical Consolidated Financial and Other Data,” “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Retail Services

As part of Retail Services, we sell water innon-returnable branded and private label one- and two- and ahalf-gallon HDPE bottles, as well as branded 500 ml, one-liter and 24-ounce PET bottles, to major retailers such as Walmart, Safeway and Kroger. Our products are distributed to retailers in all 50 states. In addition, we recently began partnering with large national retailers to provide private label products which we are able to supplycost-effectively by utilizing the excess capacity in our production facilities. Our ability to work with our corporate customers to provide new products contributes to the long relationships we enjoy with our key clients.

Retail Services represented approximately $32.4 million and $123.7 million of our net revenue for the fiscal three months ended March 28, 2014 and the fiscal year ended December 27, 2013, respectively, including volume sold to several accounts from which we intentionally exited. See “—Summary Historical Consolidated Financial and Other Data,” “Selected Historical Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our Industry

U.S. Bottled Water Industry

The U.S. bottled water industry is comprised of bottled water delivered directly to consumers and bottled water sold in retail locations. For the 2013 calendar year, the U.S. bottled water industry reached close to $12.3 billion in total revenue and approximately 10.1 billion gallons in total volume, according to Beverage Marketing Corp. Retail bottled water sold at retail store locations, which includes the sale of sparkling bottled water, represented approximately 8.1 billion gallons and $10.5 billion in revenue of the overall bottled water market in 2013, or approximately 80% and 85%, respectively. HOD bottled water represented approximately 12% of the total bottled water market in the United States by volume and 13% by revenue in 2013, or 1.2 billion gallons and $1.5 billion, respectively.

We are one of two leading national providers in the HOD bottled water market with more than a 30% market share. Apart from ourselves and Nestlé, which has a similar size market share, the remaining HOD bottled water market is extremely fragmented and comprised of over 3,000 small andmedium-sized HOD bottled water providers.

With consumers searching for healthier beverage options, per capita annual consumption of bottled water in the United States has increased from less than 2.0 gallons in 1976 to anall-time high of 30.8 gallons in 2012. Beverage Marketing Corp. projects that per capita annual consumption will increase at a 4.7% compound annual growth rate (“CAGR”) over the next five years, reaching 37.2 gallons in 2017. We believe that growth in the HOD bottled water market will continue due to a number of positive industry trends, including:

| | • | | Health and Wellness Considerations: Health considerations have led consumers to increasingly select bottled water over artificially flavored or carbonated beverages, as well as to drink greater |

6

| | quantities of water generally. In addition, regulation has heightened consumer awareness of the potentially harmful impact ofhigh-calorie juices and sodas and has provided further support for bottled water as a safe,calorie-free and affordable alternative. |

| | • | | Deteriorating Tap Water Quality: Many consumers purchase bottled water because of concerns with the quality and safety of municipal tap water due to the aging of the municipal water supply infrastructure. |

| | • | | Convenience: Direct,regularly-scheduled delivery of bottled water andpick-up of empty bottles provides consumers with a convenient and reliable method of obtaininghigh-quality drinking water. In addition, for an aging population, home delivery removes the need to transport heavy product from retail locations to residences. |

| | • | | Increasing Environmental Consciousness: Low recycling rates forsingle-serve PET bottles and concerns related to the potential harmful environmental effects of PET waste should benefit our HOD bottled water business. Ourthree- andfive-gallon returnable bottles reduce PET waste and typically can be reused 40 to 50 times and recycled at the end of their useful life when they are returned to us, providing an environmentally friendly alternative tosingle-serve PET bottles. |

| | • | | Ease of Use: Water dispensers are simple to use, can immediately provide temperature controlled water and are aspace-saving alternative to other means of storing bottled water. In addition, it can easily provide access tohigh-quality bottled water in locations that have experienced water supply contamination, are under construction, or otherwise are not serviced by the municipal water supply. |

Following declines due to the economic downturn, the HOD bottled water industry experienced eight consecutive quarters of volume growth through the fourth quarter of 2012 and continued growth through the third quarter of 2013. As evidence of this, we grew our water dispenser rental customer base by over 2%year-over-year in 2013 (based on average monthly water dispenser balances), a similar rate to our growth year-over-year in 2012, which was our highest rate of growth in the last decade. We expect to see continued growth in the HOD bottled water industry based on a number of macroeconomic factors, including:

| | • | | Recovery in the Economy: U.S. GDP and economic growth have historically been highly correlated to HOD bottled water growth. |

| | • | | Recovery in Employment Levels: Beverage Marketing Corp. states that nearly 50% of all HOD bottled water in the United States is consumed in commercial locations. Employment is a key driver of the industry, as more employees generally leads to higher consumption per office. |

| | • | | Increase in Housing Starts: As new homeowners initiate HOD service, new residential customer growth increases. |

In addition to the growth of the overall HOD bottled water industry, we also expect to see further industry consolidation. We estimate that over 3,000 companies operate in the highly fragmented HOD bottled water market in the U.S. Consolidation in the industry has been primarily driven by the following factors:

| | • | | smaller companies typically have less route density and less sophisticated technology which results in lower margins relative to larger competitors; |

| | • | | few companies have the financing or capital required for growth; |

| | • | | many of the smaller, independent companies are family owned with no succession plans in place; and |

| | • | | the cost to comply with more stringent water quality standards is a disadvantage tolow-volume producers. |

Historically, we have capitalized on these industry dynamics by acquiring smaller providers with strategic or geographic overlap. As a result of the significant synergies we can realize from consolidating operations,

7

acquisitions have typically represented a lower total acquisition cost per new customer of $133 per new customer as compared to $163 for customers acquired organically. In addition, acquired customers have typically exhibited 28% higher retention rates than that of organically-acquired customers. We have consummated 40 acquisitions related to HOD bottled water services since 2007.

Office Coffee Service Industry

The U.S. OCS industry is defined as coffee, tea and related products sold primarily to locations where such beverages are provided as an amenity to employees, guests and customers. Total revenue for the twelve months ended June 30, 2013 in the OCS market was $4.3 billion according toAutomatic Merchandiser. The industry is highly fragmented and composed primarily of small “mom and pop” operators, and we believe the top five providers collectively account for only approximately 20% of the total market based on revenue. We believe the key providers in the OCS market, including us, are Canteen, Aramark, First Choice and Royal Cup.

Similar to the HOD bottled water industry, OCS industry performance tracks national employment trends. After five consecutive years of growth, the industry experienced two years of declines during the economic crisis, from its high of $4.1 billion in 2007/2008 to $3.7 billion in 2009/2010. However, as employment has rebounded, the office coffee segment has improved considerably, growing 5.4% during the twelve months ended June 30, 2011, 4.8% during the twelve months ended June 30, 2012 and 5.1% during the twelve months ended June 30, 2013, according toAutomatic Merchandiser.We believe this favorable trend will continue during 2014. The key drivers of growth have been (i) innovation insingle-cup brewing, (ii) “premiumization” with consumers choosing to drink higher quality coffee and (iii) increased consumption in the“away-from-home” channel.

Within OCS, the growth insingle-cup brewers in the United States has accelerated significantly since 2011 and these brewers currently account for approximately 20% of the current market and a higher percentage of new office coffee brewer installations nationwide.Single-serve coffee has begun to penetrate the residential market as well as customers increasingly choose to purchasesingle-cup brewers for convenience, ease of use and taste.

We believe we arewell-positioned to consolidate the fragmented OCS market due to our existing distribution infrastructure which allows us to efficiently and profitably complete acquisitions. In addition, we expect our organic growth to outpace the industry given our ability to cross-sell OCS into our existing HOD bottled water commercial customer base and to capture a share of the growth insingle-cup services among residential customers.

Filtration Services

The filtration services industry that we participate in includes countertop coolers,under-the-sink filtration systems andstand-alone water filtration coolers, and excludes other filtering systems such as Brita filters,water-softening or whole house systems. Filtration, along with the filtered water industry as a whole, has benefited from an increasing national awareness of health, wellness and the benefits of hydration. Additionally, filtration appeals to the growing environmental consciousness among consumers about the potential harmful effects of PET waste. This market is highly fragmented and we believe that the leading providers, including, us, Nestlé, Culligan, Aramark and Quench, collectively hold less than 25% of the total market.

The filtration services industry has historically seen less consolidation and acquisition activity than the HOD or OCS markets, in part due to higher capital requirements for equipment. Filtration systems cost approximately double that of an HOD bottled water dispenser, thus the investment required to acquire new customers is significantly higher. Smaller regional operators have not had the financial capacity nor the access to capital to rapidly grow customers or acquire competitors.

8

Our Competitive Strengths

Market Leader in theDirect-to-Consumer Beverage Services Industry

We believe we are the market leader in thedirect-to-consumer beverage services industry based on our market share and geographic reach as compared to our competitors, achieved through a comprehensive product and service portfolio and leading market positions across our three lines of business. We believe we hold one of the two largest positions in HOD bottled water services, the third largest position in OCS and the second largest position in filtration services based on revenue generated during the fiscal year ended December 27, 2013. We operate in most major markets in the United States, and in 38 of the 42 largest cities we believe we hold either the largest or second largest market share. These leadership positions are built on a portfolio of strong regional brands in HOD bottled water, including Alhambra®, Belmont Springs®, Deep Rock®, Hinckley Springs® and Mount Olympus® with recognized heritages of over 100 years, and our dedication to superior customer service. In addition, as a result of the Standard Coffee acquisition, we are better equipped to serve the needs of our customers as the onlydirect-to-consumer beverage services provider with a comprehensive offering of HOD bottled water, brewed beverages and filtration products and services.

Established National Distribution Network Creates Significant Competitive Advantages

We believe we have the largest national network in our industry with customers located in most major metropolitan markets and numerous smaller local markets. To support our customers and expand our business, we have built a distribution footprint that provides us access to approximately 90% of U.S. households. Today, we serve approximately 1.5 million customers utilizing 184 branch distribution facilities, an additional 28 combined production and distribution facilities, approximately 3,350 on road vehicles and approximately 2,100 routes. Our retail products are also sold to retailers in all 50 states. We have developed extensive capabilities to serve the needs of our customers, whethermulti-location national accounts or individual households, across multiple products and in nearly every region of the United States. We focus our efforts in markets withabove-average customer density which allows us to take advantage of our established infrastructure to drive economies of scale and generate high incremental returns. We believe our size affords us greater purchasing power, further enhancing our strong margins.

High Barriers to Entry in theDirect-to-Consumer Beverage Services Market

Thedirect-to-consumer beverage services industry requires a significant investment in assets and infrastructure, which represents a large barrier to entry for any new entrant or smaller industry participants. In addition, we believe that customers choose beverage services providers based on brand recognition and service reputation, which we have successfully created over our long operating history. Lastly, our broad geographic coverage would be difficult to replicate and provides us with an advantage over our regional competitors who are unable to service national customer accounts.

Positive Industry Dynamics

We believe our industry will continue to benefit from favorable macroeconomic and industry trends. In an improving economy, we typically benefit from higher pricing, increased consumption and new customers. Due to our operationally leveraged model, revenue can be added with low incremental costs driving strong performance. A growing economy also generally leads to improved customer retention and longer average tenure. We have experienced consistent organic revenue and customer growth since early 2012 and expect these trends to accelerate as the economy and employment levels continue to recover. In addition, we anticipate ongoing growth in bottled water as a category due to health considerations and growing concerns over municipal tap water quality and the aging of the municipal water supply infrastructure. Further, greater environmental consciousness should favor returnablethree- andfive-gallon bottles, which typically can be reused 40 to 50 times and recycled at the end of their useful life when they are returned to us, making them more environmentally friendly than retail PET bottles.

9

Sophisticated, Proprietary Technology DrivesCost-Efficient Routing

The scale of our business and high transaction volume require a dedicated focus on logistics and operational efficiency. Our ongoing investment in proprietary technology has been and will continue to be a key differentiator against our competitors. Each of our Route Service Representatives (each, an “RSR”) is equipped with a handheld device used to record transactions for each customer delivery point. These handheld devices include GPS tracking capabilities which, through our proprietary Route Operations Manager (“ROM”) Dashboard Map technology, enable us to monitor the daily activity and transactional details by customer, by day, and by RSR. This technology has increased our RSR productivity and lowered our delivery costs. We have, on average, reduced drive time by 10 to 30 minutes per route per day and reduced the distance between 5 to 20 miles per route per day. Importantly, our ability to collect and analyze transactional details across multiple variables allows us to identify trends or problems quickly. We believe that our proprietary technology provides us a significant competitive advantage as we are better able to manage our business leading to improved profitability and high quality and reliable customer service.

Attractive Financial Model

In addition to our market leadership positions and expansive national footprint, we have an attractive financial model characterized by diversified revenue streams, high operating leverage and predictable capital expenditures. We offer a broad range of products and services across HOD bottled water, OCS and filtration services to approximately 1.5 million customers. Our route density and manufacturing and distribution capabilities enable us to add new volume and customers onto our existing routes at relatively low additional cost. Additionally, we have high visibility into our annual maintenance capital expenditures, which are primarily related to maintaining our fleet of trucks, dispensers and brewers. Our required capital expenditures for growth are directly related to our new customer additions and are expected to generate high returns given the typical customer payback period of approximately 14 to 16 months and four year average tenure. As we increase retention rates, these economics are further enhanced as the ongoing cost to service a customer is low.

Diversified Customer Base withLong-Standing Relationships

For the fiscal year ended December 27, 2013, no single customer or retailer accounted for more than 2.3% of total revenue. Our national footprint, widespread customer base and diversified product offering shield us from dependence on a single customer, industry or geographic region. Nonetheless, we have historically enjoyed high retention rates andlong-standing relationships across our business. We have consistently increased our annual customer retention rate from 75.0% in 2009 to 81.0% for 2013 and we expect our customer retention rates to increase further in the future. As of December 27, 2013, the average tenure of our customers was four years. We also have long relationships with our key corporate clients. We believe the loyalty of our customers is evidence of our high quality service and proven ability to continuously evolve and grow our business to meet their ongoing needs.

Experienced Management Team with Proven Track Record

We have a proven, experienced management team that has been instrumental in establishing and expanding our leadership position in the bottled water, office coffee and filtration industries. Our senior management team has been together since 2005 and is led by our Chief Executive Officer, Thomas J. Harrington, who has 28 years of beverage industry experience. Since that time, management has enhanced our sales and marketing efforts, continued to promote a strong customer service culture and developed a proprietary logistics management platform. In addition, our team has successfully integrated 43 acquisitions related to Beverage Services since 2007.

10

Our Business Strategy

Leverage Existing Distribution Network and Expand Customer Base

We will continue to capitalize on our existing distribution network and strong brand recognition. Our network currently extends to most major markets in the United States, reaching approximately 90% of the country’s households. We believe no other competitor has comparable national scale ordirect-to-consumer market reach. We are continually increasing customer and route density in our existing markets, which enables us to grow quickly and cost effectively. Our coverage provides us a significant advantage in competing for national commercial customers, a key component of our distribution strategy and a growing focus of our marketing efforts. We have also reconfigured our sales and marketing organization to support our customer expansion efforts in our faster growth channels such as Costco. In addition, as our model is highly scalable, we will seek to leverage our established infrastructure by adding adjacent products onto our existing routes.

ExpandCross-Selling of Product Offerings

Our acquisition of Standard Coffee diversified our beverage services offerings and strengthened our ability to meet the needs of our customers across products. We believe thiscross-sell potential represents a significant untapped opportunity as most of our commercial customers enjoy both services. We have approximately 575,000 commercial bottled water customer delivery locations, of which only approximately 5%, or 30,000 customers, also receive our office coffee services. Similarly, we believe we cancross-sell our HOD bottled water products to our approximately 60,000 OCS customer delivery locations that do not currently buy bottled water from us. Our delivery trucks and RSRs can service both water and coffee customers, and therefore we can provide coffee services to virtually all our commercial customers at little incremental cost and generate higher profitability per route. Filtration systems also present a compellingcross-sell opportunity that we intend to explore with our brewed beverage offerings.

Grow Strategic Customer Relationships

In late 2011, we developed a strategic relationship with Costco to market HOD bottled water services to Costco’s over 21 million members. The program has been highly successful in winning new customers and continues to gain considerable momentum. As a result of our success in generating higher quality customers at lower acquisition costs through Costco, we have shifted more resources to this channel and reduced our overall cost per new customer acquisition. The strategic relationship with Costco has provided us with a powerful marketing tool for attracting new customers as compared to traditional advertising ordoor-to-door sales. We have found that when presented with the features and benefits of bottled water service throughin-store manned displays, consumers adopt the service at significantly higher rates. We believe the Costco relationship has enabled us to significantly expand our marketing reach and effectiveness and we are pursuing similar strategic relationships with other large retailers. We expect these relationships will become a meaningful source of customer growth going forward.

Selectively Pursue Opportunistic Acquisitions

Since 2007, we have successfully completed 43 acquisitions related to Beverage Services at an average purchase multiple of less than 3x EBITDA (post synergies, assuming our cost model was applied to revenues associated with acquired entity in each transaction for that period), capitalizing on attractive opportunities in both new and existing markets to grow our business and customer base. We have a proven ability to identify and execute transactions, realizing significant synergies shortly after acquisition. We are able to integrate businesses with minimal disruption to our operations, often completing the full migration onto our routing and billing system over the course of a weekend. The acquisition of Standard Coffee provides a clear illustration of our ability to execute larger deals and quickly enhance profitability by eliminating route and facilities overlap,

11

and reducing corporate overhead and operating costs. As a standalone company, Standard Coffee generated $1.0 million of net income and approximately $7.5 million of annual Adjusted EBITDA (approximately 6% EBITDA margin) for the year ended December 31, 2011. Through our integration efforts, we realized substantial synergies, which helped contribute to an increase of $25.4 million in Adjusted EBITDA for the fiscal year ended December 28, 2012 as compared to the fiscal year ended December 30, 2011. We have a strong acquisition pipeline across HOD bottled water, OCS and filtration services markets and will continue to enhance our growth through a disciplined acquisition strategy.

Continue to Focus on Margin Improvement

We believe that our high service quality is a key competitive advantage. We provide reliable deliveries and train our customer service representatives to promptly answer incoming telephone calls and respond to customer inquiries. We strive to answer the majority of customer calls within 20 seconds. We closely track call center and customer service metrics to continually improve our service levels, the success of which is reflected in our high retention rates and customer tenure. We implemented several initiatives aimed at further improving customer retention, including the redesign of our self-service website to improve our customers’ ability to place orders, schedule deliveries and pay bills. We have also enhanced customer communications through our email platform which initiates communications and reminders at predetermined intervals. As the costs associated with keeping existing customers are lower than the cost of acquiring new customers, we believe our efforts will improve our future profitability.

Continue to Drive Margin Improvement

We believe we have the most efficient cost structure within the HOD bottled water and OCS markets. Our national footprint and high route density creates scale benefits and reduces our distribution costs. We will continue to invest in proprietary logistics technology to drive further productivity gains across our platform. We also regularly review our cost structure for opportunities that can enhance our operational efficiency and improve financial performance. As an example, we recently changed the formulation of our energy surcharge, strengthening our ability to pass through increases inpetroleum-based product costs to our customers and mitigate our risks to fluctuations in such prices. We have also reduced customer acquisition costs by redirecting our resources to more effective, lower cost sales channels.

Recent Developments

The Transactions

Pursuant to the Agreement and Plan of Merger, dated as of July 23, 2013 (the “Merger Agreement”), by and among Crestview DSW Investors, L.P., a Delaware limited partnership (“Crestview Parent”), Crestview DSW Merger Sub, Inc., a Delaware corporation (“Acquisition Sub”), DSW Group, Inc. (now known as DSS Group, Inc.), a Delaware corporation (“DSS Group”), and DSW Group Holdings, LLC, a Delaware limited liability company (“Seller”), on August 30, 2013, Acquisition Sub was merged with and into DSS Group, with DSS Group as the surviving corporation (the “Merger”). The merger consideration paid by Crestview Parent in the Merger was approximately $887.5 million (the “Merger Consideration”).

In connection with the Merger, the Sponsor, certain members of management and DSS Group’s board of directors and certain otherco-investors directly or indirectly contributed approximately $260.7 million in cash in the form of common equity to DSS Group, which amounts were used to fund a portion of the Merger Consideration and to pay fees and expenses in connection with the Transactions.

12

On the closing date of the offering of the initial notes, and immediately after the issuance of the initial notes, Crestview DS Merger Sub II, Inc. (“MergerSub”), a direct, wholly-owned subsidiary of Acquisition Sub and the initial issuer of the initial notes, merged with and into DS Waters of America, Inc. (now known as DS Services of America, Inc.), with DS Waters of America, Inc. (now known as DS Services of America, Inc.) as the surviving corporation. We refer to this merger as the “Issuer Merger.”

Concurrently with the closing of the offering of the initial notes, the Issuer entered into a new $320.0 million senior secured term loan facility, which we refer to as the “Term Loan Facility,” and a new $75.0 million senior securedasset- based revolving credit facility, which we refer to as the “ABL Facility.” See “Description of Other Indebtedness.”

Throughout this prospectus, we collectively refer to the Merger, the equity contribution, the Issuer Merger, the consummation of the offering of the initial notes and the entry into both the Term Loan Facility and the ABL Facility as the “Transactions.”

The PCS Merger

Effective December 28, 2013, PolyCycle Solutions, LLC, a Delaware limited liability company and former wholly-owned subsidiary of the Issuer (“PCS”), was merged with and into the Issuer with the Issuer as the surviving corporation.

Corporate Name Changes

On March 1, 2014, the Issuer changed its name from DS Waters of America, Inc. to DS Services of America, Inc., Holdings changed its name from DS Waters Enterprises, Inc. to DS Services Holdings, Inc., and DSS Group changed its name from DSW Group, Inc. to DSS Group, Inc.

13

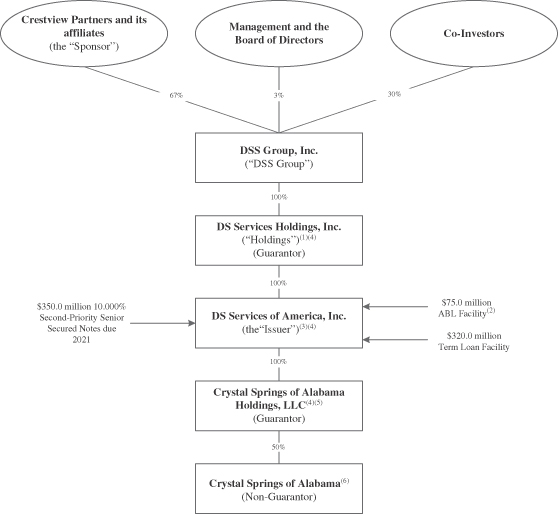

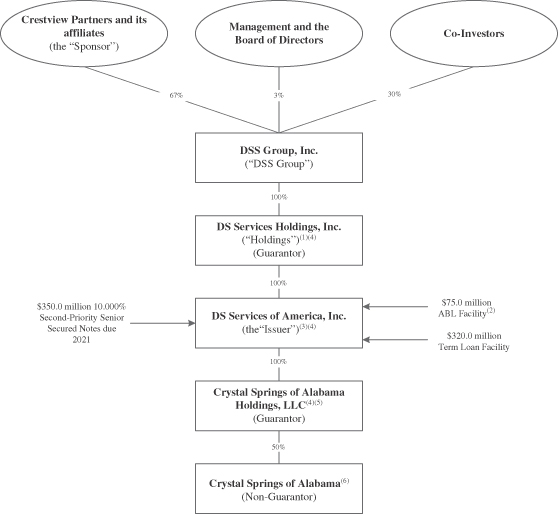

Corporate Structure

The diagram below sets forth a simplified version of our organizational structure and our principal indebtedness. This chart is provided for illustrative purposes only and does not represent all legal entities affiliated with, or all obligations of, the Issuer and its subsidiaries.

| (1) | Holdings guarantees the notes, the Term Loan Facility and the ABL Facility. Holdings has pledged all of the equity of the Issuer to secure the notes, the Term Loan Facility and the ABL Facility. |

| (2) | As of March 28, 2014, no amounts were drawn and outstanding under the ABL Facility, and approximately $45.8 million was available for borrowing and undrawn (after giving effect to approximately $29.2 million of outstanding letters of credit) under the ABL Facility. |

| (3) | DS Services of America, Inc. is the Issuer of the notes and the borrower under each of the Term Loan Facility and the ABL Facility. |

| (4) | The Issuer and the guarantors have pledged (i) theNon-ABL Priority Collateral to secure the Term Loan Facility on afirst-priority basis, the notes on asecond-priority basis and the ABL Facility on athird-priority basis and (ii) the ABL Priority Collateral to secure the ABL Facility on afirst-priority basis, the Term Loan |

14

| | Facility on asecond-priority basis and the notes on athird-priority basis, in each case subject to permitted liens and certain exceptions as described in this prospectus. See “Description of Notes.” |

| (5) | All wholly-owned material domestic restricted subsidiaries of the Issuer guarantee the notes, the Term Loan Facility and the ABL Facility. |

| (6) | Crystal Springs of Alabama, our joint venture in which we hold an indirect 50% interest, is not a guarantor of the notes. |

Our Sponsor

Founded in 2004, Crestview Partners, our Sponsor, is a private equity firm with a value orientation focused on the middle market. The firm’s partners have complementary experience and distinguished backgrounds in private equity, finance, operations and management. Crestview Partners has deep experience in its focus sectors—media, financial services, energy and healthcare.

Corporate Information

DS Services of America, Inc. is a Delaware corporation and was originally incorporated on September 20, 1985. DS Services Holdings, Inc. is a Delaware corporation and was originally incorporated on November 3, 2003. Crystal Springs of Alabama Holdings, LLC is a Delaware limited liability company originally formed on November 5, 2003. The principal executive offices of each of the registrants are located at 5660 New Northside Drive, Atlanta, Georgia, 30328 and the telephone number at that address is(770) 933-1400. We maintain a website on the Internet at www.water.com. The information on our website is not incorporated by reference into, and does not constitute a part of, this prospectus.

15

SUMMARY OF THE EXCHANGE OFFER

Exchange Offer | We are offering to exchange $350,000,000 aggregate principal amount of exchange notes and certain related guarantees for a like aggregate principal amount of our initial notes and certain related guarantees. In order to exchange your initial notes, you must properly tender them and we must accept your tender. We will exchange all outstanding initial notes that are validly tendered and not validly withdrawn. Initial notes may be exchanged only for a minimum principal denomination of $2,000 and in integral multiples of $1,000 in excess thereof. |

Expiration Date | This exchange offer will expire at 5:00 p.m., New York City time, on , 2014, unless we decide to extend it. |

Exchange Notes | The exchange notes will be substantially identical to the initial notes except that: |

| | • | | the exchange notes have been registered under the Securities Act and will be freely tradable by persons who are not affiliates of ours or subject to restrictions due to being broker-dealers; |

| | • | | the exchange notes are not entitled to the registration rights applicable to the initial notes under the registration rights agreement dated August 30, 2013 (the “Registration Rights Agreement”); and |

| | • | | our obligation to pay additional interest on the initial notes due to the failure to consummate the exchange offer by a prior date does not apply to the exchange notes. |

Conditions to the Exchange Offer | We will complete this exchange offer only if certain conditions, including the following, are met or waived: |

| | • | | there is no change in the laws and regulations which would impair our ability to proceed with this exchange offer; |

| | • | | there is no change in the current interpretation of the staff of the SEC permitting resales of the exchange notes; |

| | • | | there is no stop order issued by the SEC which would suspend the effectiveness of the registration statement which includes this prospectus or the qualification of the exchange notes under the Trust Indenture Act of 1939 (the “TIA”); |

| | • | | there is no litigation or threatened litigation which would impair the Issuer’s ability to proceed with this exchange offer; and |

| | • | | the Issuer obtains all the governmental approvals it deems necessary to complete this exchange offer. |

| | Please refer to the section in this prospectus entitled “The Exchange Offer—Conditions to the Exchange Offer.” |

16

Procedures for Tendering Initial Notes | To participate in this exchange offer, you must complete, sign and date the letter of transmittal or its facsimile and transmit it, together with your initial notes to be exchanged and all other documents required by the letter of transmittal, to Wilmington Trust, National Association, as exchange agent, at its address indicated under “The Exchange Offer—Exchange Agent.” In the alternative, you can tender your initial notes by book-entry delivery following the procedures described in this prospectus. For more information on tendering your notes, please refer to the section in this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes.” |

Special Procedures for Beneficial Owners | If you are a beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your initial notes in the exchange offer, you should contact the registered holder promptly and instruct that person to tender on your behalf. |

Guaranteed Delivery Procedures | If you wish to tender your initial notes and you cannot get the required documents to the exchange agent on time, you may tender your initial notes by using the guaranteed delivery procedures described under the section of this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes—Guaranteed Delivery Procedure.” |

Withdrawal Rights | You may withdraw the tender of your initial notes at any time before 5:00 p.m., New York City time, on the expiration date of the exchange offer. To withdraw, you must send a written or facsimile transmission notice of withdrawal to the exchange agent at its address indicated under “The Exchange Offer—Exchange Agent” before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |