| | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM 10-Q

(Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2024 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-40323

RECURSION PHARMACEUTICALS, INC. (Exact name of registrant as specified in its charter)

Delaware 46-4099738 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

41 S Rio Grande Street Salt Lake City, UT 84101 (Address of principal executive offices) (Zip code) (385) 269 - 0203 (Registrant’s telephone number, including area code) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.00001 | RXRX | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. |

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Non-accelerated filer | ☐ |

| Accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 31, 2024, there were 273,940,019 and 7,168,575 of the registrant’s Class A and B common stock outstanding, respectively. |

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 6. | | |

| | |

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” about us and our industry within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements contained in this report may include without limitation those regarding:

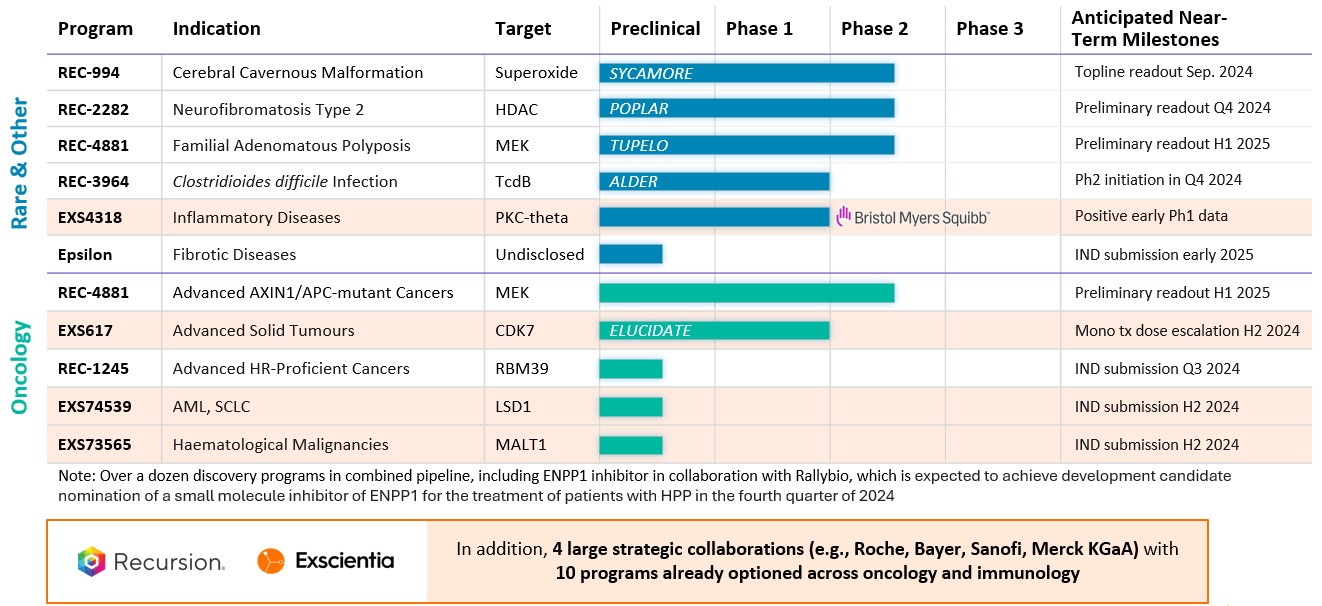

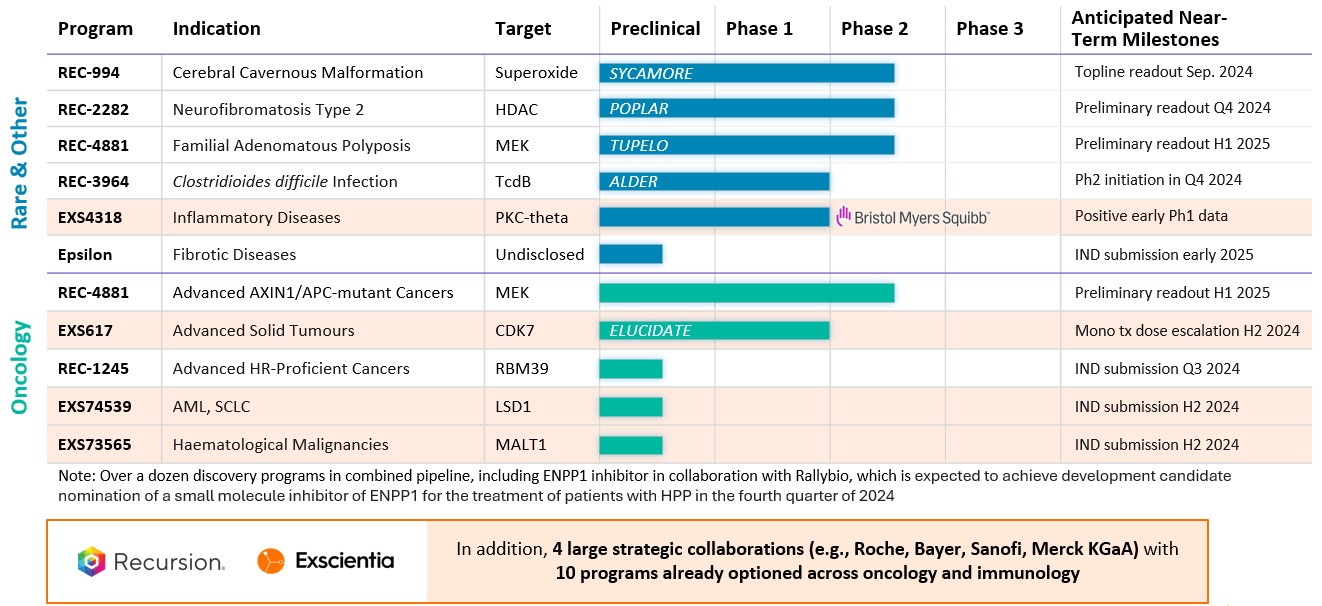

•our research and development programs;

•the initiation, timing, progress, results, and cost of our current and future preclinical and clinical studies, including statements regarding the design of, and the timing of initiation and completion of, studies and related preparatory work, as well as the period during which the results of the studies will become available;

•the ability of our clinical trials to demonstrate the safety and efficacy of our drug candidates, and other positive results;

•the ability and willingness of our collaborators to continue research and development activities relating to our development candidates and investigational medicines;

•future agreements with third parties in connection with the commercialization of our investigational medicines and any other approved product;

•the timing, scope, or likelihood of regulatory filings and approvals, including the timing of Investigational New Drug applications and final approval by the U.S. Food and Drug Administration, or FDA, of our current drug candidates and any other future drug candidates, as well as our ability to maintain any such approvals;

•the timing, scope, or likelihood of foreign regulatory filings and approvals, including our ability to maintain any such approvals;

•the size of the potential market opportunity for our drug candidates, including our estimates of the number of patients who suffer from the diseases we are targeting and potential annual sales;

•our ability to identify viable new drug candidates for clinical development and the rate at which we expect to identify such candidates, whether through an inferential approach or otherwise;

•our expectation that the assets that will drive the most value for us are those that we will identify in the future using our datasets and tools;

•our ability to develop and advance our current drug candidates and programs into, and successfully complete, clinical studies;

•our ability to reduce the time or cost or increase the likelihood of success of our research and development relative to the traditional drug discovery paradigm;

•our ability to improve, and the rate of improvement in, our infrastructure, datasets, biology, technology tools and drug discovery platform, and our ability to realize benefits from such improvements;

•our expectations related to the performance and benefits of our BioHive supercomputer, including our planned expansion of the BioHive supercomputer capabilities;

•our ability to realize a return on our investment of resources and cash in our drug discovery collaborations;

•our ability to integrate acquired businesses with our existing programs and platform and realize a return on acquired assets;

•our ability to leverage datasets acquired through licenses with third parties, including with Tempus, into increased machine learning capabilities, novel genetic associations and mechanisms, innovative therapeutics, or other beneficial outcomes;

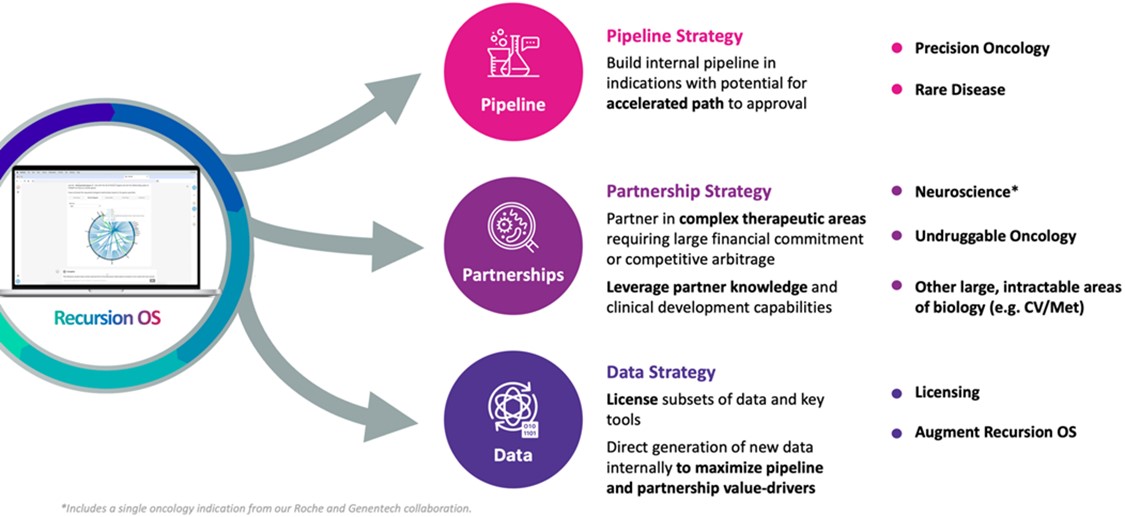

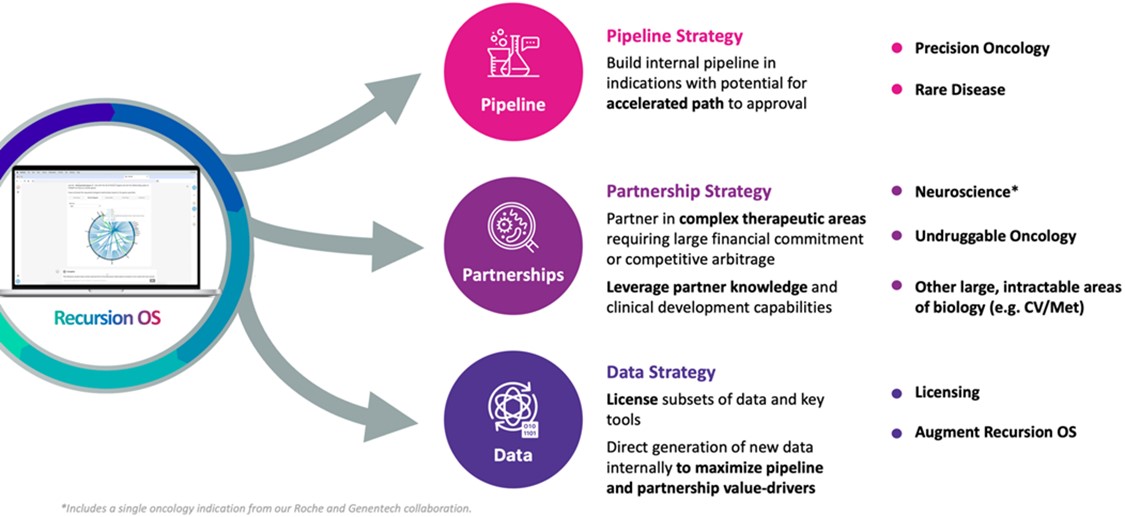

•our ability to derive value from our Recursion OS by licensing subsets of data and key tools;

•the ability to construct and apply more and increasingly sophisticated foundation models and large language models across biology, chemistry and translation and to use these models to drive new, better programs into clinical development both in our own pipeline and with our current and future partners at scale;

•our ability to scale like a technology company, including scaling our Recursion OS, and to add more programs to our pipeline each year;

•our ability to successfully compete in a highly competitive market;

•our manufacturing, commercialization and marketing capabilities and strategies;

•our plans relating to commercializing our drug candidates, if approved, including the geographic areas of focus and sales strategy;

•our expectations regarding the approval and use of our drug candidates in combination with other drugs;

•the rate and degree of market acceptance and clinical utility of our current drug candidates, if approved, and other drug candidates we may develop;

•our competitive position and the success of competing approaches that are or may become available;

•our estimates of the number of patients that we will enroll in our clinical trials and the timing of their enrollment;

•the beneficial characteristics, safety, efficacy and therapeutic effects of our drug candidates;

•our plans for further development of our drug candidates, including additional indications we may pursue;

•our ability to adequately protect and enforce our intellectual property and proprietary technology, including the scope of protection we are able to establish and maintain for intellectual property rights covering our current drug candidates and other drug candidates we may develop, receipt of patent protection, the extensions of existing patent terms where available, the validity of intellectual property rights held by third parties, the protection of our trade secrets, and our ability not to infringe, misappropriate or otherwise violate any third-party intellectual property rights;

•the impact of any intellectual property disputes and our ability to defend against claims of infringement, misappropriation, or other violations of intellectual property rights;

•our ability to keep pace with new technological developments;

•our ability to utilize third-party open source software and cloud-based infrastructure, on which we are dependent;

•the adequacy of our insurance policies and the scope of their coverage;

•the potential impact of a pandemic, epidemic, or outbreak of an infectious disease, such as COVID-19, or natural disaster, global political instability or warfare, and the effect of such outbreak or natural disaster, global political instability or warfare on our business and financial results;

•our ability to maintain our technical operations infrastructure to avoid errors, delays, or cybersecurity breaches;

•our continued reliance on third parties to conduct additional clinical trials of our drug candidates, and for the manufacture of our drug candidates for preclinical studies and clinical trials;

•our ability to obtain and negotiate favorable terms of, any collaboration, licensing, or other arrangements that may be necessary or desirable to research, develop, manufacture, or commercialize our platform and drug candidates;

•the pricing and reimbursement of our current drug candidates and other drug candidates we may develop, if approved;

•our estimates regarding expenses, future revenue, capital requirements and need for additional financing;

•our financial performance;

•the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements;

•our ability to raise substantial additional funding;

•the impact of current and future laws and regulations, and our ability to comply with all regulations that we are, or may become, subject to;

•the need to hire additional personnel and our ability to attract and retain such personnel;

•the impact of any current or future litigation, which may arise during the ordinary course of business and be costly to defend;

•the need to raise additional capital may cause dilution to our stockholders, restrict our operations, require us to relinquish rights to our technologies or drug candidates, and divert management’s attention from our core business;

•our anticipated use of our existing resources and the net proceeds from our initial public offering; and

•other risks and uncertainties, including those listed in the section titled “Risk Factors.”

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate, and financial trends that we believe may affect our business, financial condition, results of operations and prospects. These forward-looking statements are not guarantees of future performance or development. These statements speak only as of the date of this report and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we undertake no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report. While we believe such information forms a reasonable basis for such statements, the information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon them.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

Recursion Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets (unaudited)

(in thousands, except share and per share amounts) | | | | | | | | |

| | June 30, | December 31, |

| | 2024 | 2023 |

| Assets | | |

| Current assets | | |

| Cash and cash equivalents | $ | 474,341 | | $ | 391,565 | |

| Restricted cash | 1,783 | | 3,231 | |

| Other receivables | 2,526 | | 3,094 | |

| Other current assets | 43,725 | | 40,247 | |

| Total current assets | 522,375 | | 438,137 | |

| | |

| Restricted cash, non-current | 6,629 | | 6,629 | |

| Property and equipment, net | 83,633 | | 86,510 | |

| Operating lease right-of-use assets | 44,088 | | 33,663 | |

| Financing lease right-of-use assets | 28,562 | | — | |

| Intangible assets, net | 38,210 | | 36,443 | |

| Goodwill | 52,056 | | 52,056 | |

| Other assets, non-current | 308 | | 261 | |

| Total assets | $ | 775,861 | | $ | 653,699 | |

| | |

| Liabilities and stockholders’ equity | | |

| Current liabilities | | |

| Accounts payable | $ | 3,762 | | $ | 3,953 | |

| Accrued expenses and other liabilities | 33,401 | | 46,635 | |

| Unearned revenue | 32,204 | | 36,426 | |

| Notes payable and financing lease liabilities | 8,109 | | 41 | |

| Operating lease liabilities | 8,607 | | 6,116 | |

| Total current liabilities | 86,083 | | 93,171 | |

| | |

| Unearned revenue, non-current | 29,169 | | 51,238 | |

| Notes payable and financing lease liabilities, non-current | 22,921 | | 1,101 | |

| Operating lease liabilities, non-current | 50,239 | | 43,414 | |

| Deferred tax liabilities | — | | 1,339 | |

| Other liabilities, non-current | 3,000 | | — | |

| Total liabilities | 191,412 | | 190,263 | |

| | |

| Commitments and contingencies (Note 7) | | |

| | |

| Stockholders’ equity | | |

| Common stock, $0.00001 par value; 2,000,000,000 shares (Class A 1,989,032,117 and Class B 10,967,883) authorized as of June 30, 2024 and December 31, 2023; 280,968,276 shares (Class A 273,606,541, Class B 7,268,575 and Exchangeable 93,160) and 234,270,384 shares (Class A 226,264,764, Class B 7,544,871 and Exchangeable 460,749) issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 3 | | 2 | |

| Additional paid-in capital | 1,740,981 | | 1,431,056 | |

| Accumulated deficit | (1,156,535) | | (967,622) | |

| Total stockholders’ equity | 584,449 | | 463,436 | |

| | |

| Total liabilities and stockholders’ equity | $ | 775,861 | | $ | 653,699 | |

See the accompanying notes to these condensed consolidated financial statements.

Recursion Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss (unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Revenue | | | | | |

| Operating revenue | $ | 14,404 | | $ | 11,016 | | | $ | 27,895 | | $ | 23,150 | |

| Grant revenue | 13 | | 1 | | | 316 | | 1 | |

| Total revenue | 14,417 | | 11,017 | | | 28,211 | | 23,151 | |

| | | | | |

| Operating costs and expenses | | | | | |

| Cost of revenue | 9,199 | | 9,382 | | | 20,365 | | 21,829 | |

| Research and development | 73,928 | | 55,060 | | | 141,488 | | 101,737 | |

| General and administrative | 31,833 | | 28,290 | | | 63,241 | | 51,165 | |

| Total operating costs and expenses | 114,960 | | 92,732 | | | 225,094 | | 174,731 | |

| | | | | |

| Loss from operations | (100,543) | | (81,715) | | | (196,883) | | (151,580) | |

| Other income, net | 2,480 | | 4,989 | | | 6,668 | | 9,527 | |

| Loss before income tax benefit | (98,063) | | (76,726) | | | (190,215) | | (142,053) | |

| Income tax benefit | 523 | | — | | | 1,302 | | — | |

| Net loss and comprehensive loss | $ | (97,540) | | $ | (76,726) | | | $ | (188,913) | | $ | (142,053) | |

| | | | | |

| Per share data | | | | | |

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.40) | | $ | (0.38) | | | $ | (0.79) | | $ | (0.71) | |

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 242,196,409 | | 201,415,475 | | | 239,107,879 | | 198,957,804 | |

See the accompanying notes to these condensed consolidated financial statements.

Recursion Pharmaceuticals, Inc.

Condensed Consolidated Statements of Stockholders’ Equity (unaudited)

(in thousands, except share amounts)

| | | | | | | | | | | | | | | | | |

| Common Stock | Additional Paid-in-Capital | Accumulated Deficit | Stockholders’ Equity |

| (Class A, B and Exchangeable) |

| Shares | Amount |

| Balance as of March 31, 2024 | 237,508,682 | | $ | 2 | | $ | 1,460,144 | | $ | (1,058,995) | | $ | 401,151 | |

| Net loss | — | | — | | — | | (97,540) | | (97,540) | |

| Stock option exercises and other | 2,820,506 | | — | | 2,767 | | — | | 2,767 | |

| Stock-based compensation | — | | — | | 16,524 | | — | | 16,524 | |

| Common stock sales issuances, net of issuance costs | 40,639,088 | | 1 | | 261,546 | | — | | 261,547 | |

| Balance as of June 30, 2024 | 280,968,276 | | $ | 3 | | $ | 1,740,981 | | $ | (1,156,535) | | $ | 584,449 | |

| | | | | | | | | | | | | | | | | |

| Common Stock | Additional Paid-in-Capital | Accumulated Deficit | Stockholders’ Equity |

| (Class A, B and Exchangeable) |

| Shares | Amount |

| Balance as of December 31, 2023 | 234,270,384 | | $ | 2 | | $ | 1,431,056 | | $ | (967,622) | | $ | 463,436 | |

| Net loss | — | | — | | — | | (188,913) | | (188,913) | |

| Stock option exercises and other | 5,137,589 | | — | | 4,855 | | — | | 4,855 | |

| Stock-based compensation | — | | — | | 32,651 | | — | | 32,651 | |

| Common stock sales issuances, net of issuance costs | 41,560,303 | | 1 | | 272,419 | | — | | 272,420 | |

| Balance as of June 30, 2024 | 280,968,276 | | $ | 3 | | $ | 1,740,981 | | $ | (1,156,535) | | $ | 584,449 | |

See the accompanying notes to these condensed consolidated financial statements.

Recursion Pharmaceuticals, Inc.

Condensed Consolidated Statements of Stockholders’ Equity (unaudited)

(in thousands, except share amounts)

| | | | | | | | | | | | | | | | | |

| Common Stock | Additional Paid-in-Capital | Accumulated Deficit | Stockholders’ Equity |

| (Class A, B and Exchangeable) |

| Shares | Amount |

| Balance as of March 31, 2023 | 192,230,854 | | $ | 2 | | $ | 1,135,056 | | $ | (704,883) | | $ | 430,175 | |

| Net loss | — | | — | | — | | (76,726) | | (76,726) | |

| | | | | |

| Stock option exercises and other | 2,394,131 | | — | | 4,912 | | — | | 4,912 | |

| Stock-based compensation | — | | — | | 11,811 | | — | | 11,811 | |

| Common stock sales issuances, net of issuance costs | 12,112,347 | | — | | 98,791 | | — | | 98,791 | |

| Balance as of June 30, 2023 | 206,737,332 | | $ | 2 | | $ | 1,250,570 | | $ | (781,609) | | $ | 468,963 | |

| | | | | | | | | | | | | | | | | |

| Common Stock | Additional Paid-in-Capital | Accumulated Deficit | Stockholders’ Equity |

| (Class A, B and Exchangeable) |

| Shares | Amount |

| Balance as of December 31, 2022 | 191,022,864 | | $ | 2 | | $ | 1,125,360 | | $ | (639,556) | | $ | 485,806 | |

| Net loss | — | | — | | — | | (142,053) | | (142,053) | |

| | | | | |

| Stock option exercises and other | 3,602,121 | | — | | 5,794 | | — | | 5,794 | |

| Stock-based compensation | — | | — | | 20,625 | | — | | 20,625 | |

| Common stock sales issuances, net of issuance costs | 12,112,347 | | — | | 98,791 | | — | | 98,791 | |

| Balance as of June 30, 2023 | 206,737,332 | | $ | 2 | | $ | 1,250,570 | | $ | (781,609) | | $ | 468,963 | |

See the accompanying notes to these condensed consolidated financial statements.

Recursion Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows (unaudited)

(in thousands) | | | | | | | | |

| Six months ended June 30, |

| | 2024 | 2023 |

| Cash flows from operating activities | | |

| Net loss | $ | (188,913) | | $ | (142,053) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | |

| Depreciation and amortization | 16,345 | | 9,271 | |

| Stock-based compensation | 32,651 | | 20,625 | |

| Asset impairment | 108 | | 1,169 | |

| Lease expense | 5,575 | | 3,991 | |

| Other, net | (3,570) | | 739 | |

| Changes in operating assets and liabilities: | | |

| Other receivables and assets | (304) | | (1,131) | |

| Unearned revenue | (26,291) | | (23,200) | |

| Accounts payable | (174) | | (2,856) | |

| Accrued development expense | (2,178) | | 1,747 | |

| Accrued expenses and other current liabilities | (11,350) | | (3,643) | |

| Operating lease liabilities | (6,418) | | (5,442) | |

| Net cash used in operating activities | (184,519) | | (140,783) | |

| | |

| Cash flows from investing activities | | |

| Net cash and restricted cash acquired in the acquisition of a business | — | | 1,915 | |

| Purchases of property and equipment | (7,835) | | (9,143) | |

| Purchase of an intangible asset | (3,000) | | (165) | |

| Net cash used in investing activities | (10,835) | | (7,393) | |

| | |

| Cash flows from financing activities | | |

| Proceeds from issuance of common shares, net of issuance costs | 272,419 | | — | |

| Proceeds from equity incentive plans | 4,652 | | 5,757 | |

| Repayment of long-term debt | (52) | | (48) | |

| Net cash provided by financing activities | 277,019 | | 5,709 | |

| | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (337) | | 179 | |

| | |

| Net change in cash, cash equivalents and restricted cash | 81,328 | | (142,288) | |

| Cash, cash equivalents and restricted cash, beginning of period | 401,425 | | 559,112 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 482,753 | | $ | 416,824 | |

| | |

| Supplemental schedule of non-cash investing and financing activities | | |

| Issuance of shares for the acquisitions of businesses | $ | — | | $ | 98,791 | |

| Accrued property and equipment | 549 | | 6 | |

| Financed equipment purchase | — | | 1,214 | |

| Purchase of an intangible asset | 6,000 | | — | |

See the accompanying notes to these condensed consolidated financial statements.

Recursion Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 1. Description of the Business

Recursion is a clinical stage TechBio company decoding biology to industrialize drug discovery. The Recursion Operating System (OS), a platform built across diverse technologies, enables the Company to map and navigate trillions of biological and chemical relationships within the Recursion Data Universe, one of the world’s largest proprietary biological and chemical datasets. The Company integrates physical and digital components as iterative loops of atoms and bits scaling wet lab biology and chemistry data organized into virtuous cycles with computational tools to rapidly translate in silico hypotheses into validated insights and novel chemistry.

As of June 30, 2024, the Company had an accumulated deficit of $1.2 billion. The Company expects to incur substantial operating losses in future periods and will require additional capital to advance its drug candidates. The Company does not expect to generate significant revenue until the Company successfully completes significant drug development milestones with its subsidiaries or in collaboration with third parties, which the Company expects will take a number of years. In order to commercialize its drug candidates, the Company or its partners need to complete clinical development and comply with comprehensive regulatory requirements. The Company is subject to a number of risks and uncertainties similar to those of other companies of the same size within the biotechnology industry, such as the uncertainty of clinical trial outcomes, uncertainty of additional funding and a history of operating losses.

The Company has funded its operations to date primarily through the issuance of Class A common stock (see Note 8, “Common Stock” for additional details). Additionally, the Company has received payments from its strategic partnerships (see Note 9, “Collaborative Development Contracts” for additional details). Recursion will likely be required to raise additional capital. As of June 30, 2024, the Company did not have any unconditional outstanding commitments for additional funding. If the Company is unable to access additional funds when needed, it may not be able to continue the development of its products or the Company could be required to delay, scale back or abandon some or all of its development programs and other operations. The Company’s ability to access capital when needed is not assured and, if not achieved on a timely basis, could materially harm its business, financial condition and results of operations.

Recursion believes that the Company’s existing cash and cash equivalents will be sufficient to fund the Company’s operating expenses and capital expenditures for at least the next 12 months.

Note 2. Basis of Presentation

Basis of Presentation

The unaudited interim condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (SEC). Accordingly, certain information and footnote disclosures normally included in annual financial statements prepared in accordance with generally accepted accounting principles in the United States (U.S. GAAP) have been condensed or omitted. These unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and notes for the year ended December 31, 2023.

It is management’s opinion that these condensed consolidated financial statements include all normal and recurring adjustments necessary for a fair statement of the financial position, results of operations and cash flows for the periods presented. Revenue and net loss for any interim period are not necessarily indicative of future or annual results.

Recent Accounting Pronouncements

In March 2024, the SEC issued rule 33-11275, The Enhancement and Standardization of Climate-Related Disclosures for Investors. The new rule requires Recursion to provide certain disclosures in the footnotes to the financial statements of climate-related information. These disclosures include the impact of severe weather and other natural conditions on the Company’s consolidated balance sheet and statement of operations, to the extent they are material. Recursion will also need to disclose a rollforward of the beginning and ending balances of its

carbon offsets and renewable energy credits or certificates (RECs), if they are a material component of meeting the Company’s climate-related targets and goals. Additionally, the Company will need to disclose whether and, if so, how severe weather events and other natural conditions and disclosed climate-related targets or transition plans materially affected estimates and assumptions in the financial statements.

The final rule’s effective dates, if adopted, will be phased in depending on the disclosure requirement starting the annual period ending December 31, 2025. In April 2024, the SEC voluntarily stayed implementation of the new climate-related disclosure requirements pending judicial review. The Company is currently evaluating the impact this rule will have on its consolidated financial statements and related disclosures.

In December 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2023-9, Income Taxes (Topic 740). The new standard updates disclosure requirements for Accounting Standards Codification (ASC) 740 primarily by requiring additional information in the income tax rate reconciliation and additional disclosures about income taxes paid. This standard will be effective for Recursion starting the annual period ending December 31, 2025. Early adoption is permitted for annual financial statements that have not yet been issued. The amendments can be applied on a prospective or retrospective basis. The adoption of this standard will not impact Recursion’s consolidated balance sheet and statement of operations.

In November 2023, the FASB issued ASU No. 2023-7, Segment Reporting (Topic 280). The standard requires new disclosures related to ASC 280 including: disclosing significant segment expenses by category; requiring all the ASC 280 disclosures for companies with a single reportable segment and; requiring ASC 280 disclosures for interim financial statements. Recursion must apply the amendments retrospectively to each prior reporting period presented. This standard will be effective for Recursion starting the annual period ending December 31, 2024. Early adoption is permitted. The adoption of this standard will not impact Recursion’s consolidated balance sheet and statement of operations.

Note 3. Supplemental Financial Information

Tempus agreement

In November 2023, Recursion entered into a five-year agreement with Tempus Labs, Inc. (Tempus) to purchase access to their records of patient-centric multimodal oncology data and use rights for therapeutic development purposes. This data will be used to improve the training of Recursion’s artificial intelligence and machine learning models and is expected to accelerate Recursion’s drug discovery process. Recursion is making annual payments, ranging between $22.0 million and $42.0 million, up to $160.0 million in aggregate, to Tempus in cash or equity at the Company’s option. The equity value is determined by using the seven-trading day period dollar volume-weighted average price (VWAP) for Recursion Class A common stock ending on the day immediately preceding the date that is five business days prior to the payment date.

Recursion is expensing the record purchases based on a contractually agreed price as “Research and Development” expenses in the Condensed Consolidated Statements of Operations as the records are downloaded. To the extent that the Recursion payments to Tempus are greater than or less than the records purchased amount, Recursion records the applicable amount to “Other Current Assets” or “Accrued Expenses and Other Liabilities” on the Condensed Consolidated Balance Sheet, respectively. As of June 30, 2024, Recursion had recorded $13.1 million within “Other Current Assets” on the Consolidated Balance Sheet related to the Tempus agreement.

Property and Equipment, net

| | | | | | | | |

| June 30, | December 31, |

| (in thousands) | 2024 | 2023 |

| Lab equipment | $ | 61,138 | | $ | 60,096 | |

| Leasehold improvements | 46,776 | | 45,929 | |

| Office equipment | 25,370 | | 22,126 | |

| Construction in progress | 2,796 | | 3,231 | |

| Property and equipment, gross | 136,080 | | 131,382 | |

| Less: Accumulated depreciation | (52,447) | | (44,872) | |

| Property and equipment, net | $ | 83,633 | | $ | 86,510 | |

Depreciation expense on property and equipment was $4.1 million and $8.1 million during the three and six months ended June 30, 2024, respectively, and $4.0 million and $7.5 million during the three and six months ended June 30, 2023, respectively. The Company recorded an insignificant impairment and an impairment of $1.2 million during the six months ended June 30, 2024 and 2023, respectively, related to construction projects for leasehold improvements as the Company no longer intended to use them. The impairments were recorded in “General and Administrative” in the Condensed Consolidated Statements of Operations.

Accrued Expenses and Other Liabilities

| | | | | | | | |

| June 30, | December 31, |

| (in thousands) | 2024 | 2023 |

| Accrued compensation | $ | 13,119 | | $ | 22,888 | |

| Accrued development expenses | 3,899 | | 6,077 | |

| Accrued early discovery expenses | 3,730 | | 2,570 | |

| Accrued construction | — | | 2,439 | |

| Accrued data | 3,000 | | — | |

| Materials received not invoiced | 1,920 | | 2,432 | |

| Accrued other expenses | 7,733 | | 10,229 | |

| Accrued expense and other liabilities | $ | 33,401 | | $ | 46,635 | |

Interest Income, net

| | | | | | | | | | | | | | | | | |

| Three months ended

June 30, | | Six months ended

June 30, |

| (in thousands) | 2024 | 2023 | | 2024 | 2023 |

| Interest income | $ | 3,266 | | $ | 4,957 | | | $ | 7,313 | | $ | 9,617 | |

| Interest expense | (394) | | (26) | | | (414) | | (45) | |

| Interest income, net | $ | 2,872 | | $ | 4,931 | | | $ | 6,899 | | $ | 9,572 | |

For the three and six months ended June 30, 2024 and 2023, interest income primarily related to earnings on cash and cash equivalents in money market funds. Interest expense primarily related to the Company’s supercomputer financing lease. Interest income, net was included in “Other income, net” on the Condensed Consolidated Statements of Operations.

Note 4. Acquisitions

Valence Discovery Inc.

On May 16, 2023, Recursion acquired all of the outstanding equity interests in Valence Discovery Inc. (Valence), a privately-held machine learning (ML) / artificial intelligence (AI) digital chemistry company. The integration of Valence’s AI-based chemistry engine into Recursion’s operating system will allow Recursion to expand its technology-enabled drug discovery process. This will accelerate Recursion’s digital chemistry capabilities and its drug discovery process.

The acquisition of Valence was accounted for as a business combination using the acquisition method of accounting. The aggregate upfront consideration for the acquisition of Valence consisted of 2.2 million shares of Recursion Class A common stock, 4.4 million shares of a subsidiary of Recursion, exchangeable for shares of Recursion’s Class A common stock, 792 thousand shares issuable upon exercise of stock options held by Valence equity award holders and deferred liabilities for additional consideration.

The following table summarizes total consideration:

| | | | | |

| (in thousands) | |

| Fair value of Recursion Class A common stock | $ | 11,096 | |

| Fair value of Exchangeable stock | 22,473 | |

| Fair value of equity awards issued to Valance equity award holders | 1,933 | |

| Deferred liabilities for additional consideration | 396 | |

| Total consideration | $ | 35,898 | |

The following table summarizes the fair value of assets acquired and liabilities assumed as of the acquisition date:

| | | | | |

| (in thousands) | |

| Cash | $ | 4,235 | |

| Other receivables | 536 | |

| Intangible asset - technology | 15,000 | |

| Accounts payable and accrued liabilities | (872) | |

| Deferred income taxes | (3,265) | |

| Total identifiable net assets | 15,634 | |

| Goodwill | 20,264 | |

| Total assets acquired and liabilities assumed | $ | 35,898 | |

The intangible asset is related to Valence’s ML and AI digital chemistry platform. The estimated fair value of the intangible asset was determined using a cost approach. This valuation technique provides the fair value of an asset based on estimates of the total costs to develop the technology. Significant inputs used to determine the total cost includes the length of time required and service hours performed by Company employees. The technology intangible asset is being amortized on a straight-line basis over its four-year useful life.

Goodwill was calculated as the excess of the consideration transferred over the net assets recognized. The goodwill recognized represents the assembled workforce and expected synergies, including the ability to: (i) leverage Valence’s digital chemistry platform across Recursion’s business; (ii) leverage Valence’s ML and AI capabilities; (iii) integrate Recursion’s data and operating system into Valence’s platform; and (iv) accelerate Recursion’s pipeline. Goodwill was also impacted by the establishment of a deferred tax liability for the acquired identifiable intangible assets which have no tax basis. The goodwill is not deductible for tax purposes.

Recursion’s condensed consolidated statement of operations during the six months ended June 30, 2024 included immaterial net revenue and a $5.9 million operating loss associated with Valence’s operations. The Company has finalized the amounts recognized disclosed in the above tables.

Cyclica Inc.

On May 25, 2023, Recursion acquired all of the outstanding equity interests in Cyclica Inc. (Cyclica), a privately-held Company that has built a digital chemistry software suite which enables mechanism of action deconvolution and generative chemistry suggestions based on desired targets. Cyclica’s platform is expected to enhance the optimization of Recursion’s compounds for efficacy while minimizing liabilities through generative machine learning approaches.

The acquisition of Cyclica was accounted for as a business combination using the acquisition method of accounting. The aggregate upfront consideration for the acquisition of Cyclica consisted of 5.8 million shares of Recursion Class A common stock, cash payments, 1.0 million shares issuable upon exercise of stock options held by Cyclica equity award holders and deferred liabilities for additional consideration. Approximately 172 thousand of the aforementioned shares of Class A common stock consideration had not yet been issued as of June 30, 2024.

The following table summarizes total consideration:

| | | | | |

| (in thousands) | |

| Fair value of Recursion Class A common stock | $ | 49,915 | |

| Cash | 6,505 | |

| Fair value of equity awards issued to Cyclica equity award holders | 3,852 | |

| Deferred liabilities for additional consideration | 344 | |

| Total consideration | $ | 60,617 | |

The following table summarizes the fair value of assets acquired and liabilities assumed as of the acquisition date:

| | | | | |

| (in thousands) | |

| Cash | $ | 2,429 | |

| Restricted cash | 1,685 | |

| Other receivables | 741 | |

| Investments | 1,000 | |

| Other current assets | 385 | |

| Intangible assets - technology | 28,000 | |

| Accounts payable and accrued liabilities | (579) | |

| Unearned revenue | (1,754) | |

| Deferred income taxes | (2,075) | |

| Other liabilities, current | (66) | |

| Other liabilities, non-current | (139) | |

| Total identifiable net assets | 29,627 | |

| Goodwill | 30,990 | |

| Total assets acquired and liabilities assumed | $ | 60,617 | |

The intangible assets are related to Cyclica’s digital chemistry platforms. The estimated fair value of the intangible assets were determined using a cost approach. This valuation technique provides the fair value of an asset based on estimates of the total costs to develop the technology. Significant inputs used to determine the total cost includes the length of time required and service hours performed by Company employees. The technology intangible assets are being amortized on a straight-line basis over their three-year useful lives.

Goodwill was calculated as the excess of the consideration transferred over the net assets recognized. The goodwill recognized represents the assembled workforce and expected synergies, including the ability to: (i) leverage Cyclica’s digital chemistry platform across Recursion’s business; (ii) leverage Cyclica’s ML and AI capabilities; (iii)

integrate Recursion’s data and operating system into Cyclica’s platform; and (iv) accelerate Recursion’s pipeline. Goodwill was also impacted by the establishment of a deferred tax liability for the acquired identifiable intangible assets. The goodwill is not deductible for tax purposes.

Recursion’s condensed consolidated statement of operations during the six months ended June 30, 2024 included immaterial net revenue and a $7.4 million operating loss associated with Cyclica’s operations. The Company has finalized the amounts recognized disclosed in the above tables.

Pro forma financial information

The following table presents the unaudited pro forma combined results of operations of Recursion, Valence and Cyclica as if the acquisitions had occurred on January 1, 2022:

| | | | | | | | |

| (in thousands) | Three months ended June 30, 2023 | Six Months Ended June 30, 2023 |

| Net revenue | $ | 11,258 | | $ | 23,437 | |

| Net loss | (79,586) | | (153,037) | |

The unaudited pro forma financial information was prepared using the acquisition method of accounting and was based on the historical financial information of Recursion, Valence and Cyclica. In order to reflect the occurrence of the acquisitions on January 1, 2022 as required, the unaudited pro forma financial information includes adjustments to reflect the incremental amortization expense to be incurred based on the fair values of the identifiable intangible assets acquired and the additional stock compensation expense associated with the issuance of equity compensation related to the acquisitions. The unaudited pro forma financial information is not necessarily indicative of what the consolidated results of operations would have been had the acquisitions been completed on January 1, 2022. In addition, the unaudited pro forma financial information is not a projection of the future results of operations of the combined company nor does it reflect the expected realization of any cost savings or synergies associated with the acquisitions.

Note 5. Leases

The Company has entered into various long-term real estate operating leases primarily related to office, research and development and operating activities and a long-term equipment financing lease related to the supercomputer for research and development activities. The Company’s leases have remaining terms from under 1 year to 8 years and some of those leases include options that provide Recursion with the ability to extend the lease term, generally for five years. The options are included in the lease term when it is reasonably certain that the option will be exercised.

For the six months ended June 30, 2024 and 2023, Recursion entered into lease modifications resulting in a decrease to the right-of-use asset and lease liability of $3.1 million and an increase to the right-of-use asset and lease liability of $3.4 million, respectively. The modifications had no impact to the Condensed Consolidated Statements of Operations.

In May 2024, the Company entered into a financing lease agreement for the supercomputer equipment (the “Supercomputer Lease”). The right of use began May 2024 when control of the asset was obtained and the lease term is 3 years with two additional renewal options for a one-year or two-year period. Total fixed payments are expected to be approximately $34.0 million.

In February 2024, the Company entered into an operating lease agreement related to the supercomputer for the exclusive use of physical space in a data center of approximately 1,851 square feet (the “Data Center Lease”). The right of use began in April 2024 and lease term is 5 years with a five-year renewal option. The lease includes provisions for escalating rent payments. Total fixed lease payments are expected to be approximately $13.0 million with additional variable expenses, including utilities and tax expenses.

In January 2024, the Company entered into an operating lease agreement for office space in London, England with approximately 6,792 square feet (the “London Lease”). The right of use began January 2024 when control of the

asset was obtained. The London Lease term is 5 years with a five-year renewal option. The London Lease includes provisions for escalating rent payments. Total fixed payments are expected to be approximately $7.9 million, additionally there will be variable expenses including building service charges related to the lease.

The components of the lease cost were:

| | | | | | | | | | | | | | |

| Three months ended June 30, | Six months ended June 30, 2024 |

| (in thousands) | 2024 | 2023 | 2024 | 2023 |

| Operating lease cost | $ | 3,109 | | $ | 2,020 | | $ | 5,582 | | $ | 4,018 | |

| Finance lease cost: | | | | |

| Amortization of leased assets | 985 | | — | | 985 | | — | |

| Interest on lease liabilities | 376 | | — | | 376 | | — | |

| Variable lease cost | 697 | | 499 | | 1,235 | | 1,157 | |

| Short-term lease cost | 42 | | 41 | | 82 | | 41 | |

| Total lease cost | $ | 5,209 | | $ | 2,560 | | $ | 8,260 | | $ | 5,216 | |

Supplemental balance sheet information related to leases were:

| | | | | | | | |

| (in thousands) | June 30, 2024 | December 31, 2023 |

| Assets | | |

| Operating lease right-of-use assets | $ | 44,088 | $ | 33,663 |

| Financing lease right-of-use assets | 28,562 | — |

| Total lease right-of-use assets | $ | 72,649 | $ | 33,663 |

| | |

| Liabilities | | |

| Current liabilities | | |

| Notes payable and financing lease liabilities | $ | 8,045 | $ | — |

| Operating lease liabilities | 8,607 | 6,116 |

| Total current lease liabilities | 16,652 | 6,116 |

| Non-current liabilities | | |

| Notes payable and financing lease liabilities, non-current | 21,878 | — |

| Operating lease liabilities, non-current | 50,239 | 43,414 |

| Total non-current lease liabilities | 72,117 | 43,414 |

| Total lease liabilities | $ | 88,769 | $ | 49,530 |

Supplemental cash flow information related to leases were:

| | | | | | | | |

| Six months ended June 30, |

| (in thousands) | 2024 | 2023 |

| Cash paid for amount included in the measurement of lease liabilities: | | |

| Operating cash flows from operating leases | $ | 6,579 | | $ | 5,442 | |

| Operating cash flows from financing leases | — | | — | |

| Financing cash flows from financing leases | — | | — | |

| | |

| Right-of-use assets additions and modifications: | | |

| Operating leases | $ | 13,738 | | $ | 4,160 | |

| Financing leases | 29,547 | | — | |

Lease term and discount rates as of June 30, 2024 were:

| | | | | |

| (in thousands) | June 30, 2024 |

| Operating leases | |

| Weighted-average remaining lease term (years) | 5.9 |

| Weighted-average discount rate | 7.8 | % |

| Finance leases | |

| Weighted-average remaining lease term (years) | 3.0 |

| Weighted-average discount rate | 7.6 | % |

Maturities of lease liabilities as of June 30, 2024 were:

| | | | | | | | |

| (in thousands) | Operating leases | Finance leases |

| Remainder of 2024 | $ | 6,535 | | $ | 5,024 | |

| 2025 | 13,251 | | 10,048 | |

| 2026 | 13,499 | | 10,048 | |

| 2027 | 13,938 | | 8,882 | |

| 2028 | 11,174 | | — | |

| Thereafter | 17,607 | | — | |

| Total lease payments | 76,004 | | 34,002 | |

| Less amounts representing interest or imputed interest | (17,158) | | (4,079) | |

| Present value of lease liabilities | $ | 58,846 | | $ | 29,923 | |

Note 6. Goodwill and Intangible Assets

Goodwill

There were no changes to the carrying amount of goodwill during the three and six months ended June 30, 2024. There were additions of $51.3 million to the carrying amount of goodwill related to the acquisition of Cyclica and Valence during the three and six months ended June 30, 2023. No goodwill impairment was recorded during the three and six months ended June 30, 2024 and 2023.

Intangible Assets, Net

The following table summarizes intangible assets:

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (in thousands) | Gross carrying amount | Accumulated Amortization | Net carrying amount | | Gross carrying amount | Accumulated Amortization | Net carrying amount |

| Definite-lived technology intangible assets | $ | 44,076 | | $ | (15,440) | | $ | 28,636 | | | $ | 44,076 | | $ | (8,882) | | $ | 35,194 | |

| Definite-lived licensed intangible assets | 9,350 | | (762) | | 8,588 | | | 350 | | (87) | | 263 | |

| Indefinite-lived intangible assets | 986 | | — | | 986 | | | 986 | | — | | 986 | |

| Intangible assets, net | $ | 54,412 | | $ | (16,202) | | $ | 38,210 | | | $ | 45,412 | | $ | (8,969) | | $ | 36,443 | |

Amortization expense was $3.9 million and $7.2 million during the three and six months ended June 30, 2024, respectively. Amortization expense was $1.6 million and $1.7 million during the three and six months ended June 30, 2023, respectively. Amortization expense was included in “Research and Development” in the Condensed Consolidated Statements of Operations. No indefinite-lived intangible asset impairment charges were recorded during the three and six months ended June 30, 2024 and 2023.

For the six months ended June 30, 2024, the Company entered into a 3-year licensing agreement with Helix for access to their patient data and use rights for therapeutics development purposes. This data will be used to improve the training of Recursion’s artificial intelligence and machine learning models and is expected to accelerate Recursion’s drug discovery process. Recursion is making annual payments of $3.0 million for a total of $9.0 million, which was recorded in “Intangible Assets, net” on the Condensed Consolidated Balance Sheet and included as a licensed intangible asset in the above table. Recursion made the first payment during the six months ended June 30, 2024 and recorded the two remaining $3.0 million payments in “Accrued Expenses and Other Liabilities” and “Accrued Other, Non-current” on the Condensed Consolidated Balance Sheet, respectively. The licensed intangible asset is being amortized on a straight-line basis over its three-year useful life.

Note 7. Commitments and Contingencies

Contract Obligations

In the normal course of business, the Company enters into contracts with clinical research organizations, drug manufacturers and other vendors for preclinical and clinical research studies, research and development supplies and other services and products for operating purposes. These contracts generally provide for termination on notice and are cancellable contracts.

Indemnification

The Company has agreed to indemnify its officers and directors for certain events or occurrences, while the officer or director is or was serving at the Company’s request in such capacity. The Company purchases directors and officers liability insurance coverage that provides for reimbursement to the Company for covered obligations and this is intended to limit the Company’s exposure and enable it to recover a portion of any amounts it pays under its indemnification obligations. The Company had no liabilities recorded for these agreements as of June 30, 2024 and December 31, 2023, as no amounts were probable.

Employee Agreements

The Company has signed employment agreements with certain key employees pursuant to which, if their employment is terminated following a change of control of the Company, the employees are entitled to receive certain benefits, including accelerated vesting of equity incentives.

Legal Matters

The Company may, from time to time, be involved in various legal proceedings arising in the normal course of business. An unfavorable resolution of any such matter could materially affect the Company’s future financial position, results of operations or cash flows.

In February 2021, the Company entered into a lease agreement for laboratory and office space (the Industry Lease) with Industry Office SLC, LLC (the landlord). In March 2023, the Company sent a letter to the landlord detailing numerous construction delays and irregularities, deficiencies and deviations from applicable structural drawings and/or non-conforming conditions with applicable building codes. On June 23, 2023, the landlord filed a lawsuit against the Company (Industry Office SLC, LLC v. Recursion Pharmaceuticals, Inc., Case No. 230904627) in the Third District Court for Salt Lake County, State of Utah (the Court), alleging anticipatory repudiation and breach of contract. The Plaintiff seeks monetary damages and attorney’s fees. As of June 30, 2024, the Company had no liability recorded for these events as an unfavorable outcome was not probable.

In connection with the Industry Lease, in September 2023, the Company filed claims in the Court against the landlord alleging, among other things, breach of contract and fraudulent misrepresentation (the Counterclaims). In October 2023, the landlord filed an answer and denied the Company’s allegations asserted in the Counterclaims. The Company and the landlord are currently engaged in discovery. The Company is unable to estimate the possible amount or range of amounts associated with the Counterclaims.

Pledged Assets

As of June 30, 2024, assets pledged as collateral against finance leases totaled $27.0 million. Assets pledged as collateral are Lab Equipment reported in “Property and Equipment, net” on the Condensed Consolidated Balance Sheet. As of June 30, 2024, the liabilities associated with collateral pledged were solely comprised of a finance lease and had a carrying value of $29.9 million. The collateral pledged under the lease agreement may only be operated by the Company within the continental United States and must maintain a good title. The assets cannot be sold, disposed of or repledged by the Company.

Note 8. Common Stock

Each share of Class A common stock entitles the holder to one vote per share and each share of Class B common stock entitles the holder to 10 votes per share on all matters submitted to a vote of the Company’s stockholders. Common stockholders are entitled to receive dividends, as may be declared by the Company’s Board of Directors. As of June 30, 2024 and December 31, 2023, no dividends had been declared.

Public Offering of Common Stock

On June 28, 2024, the Company closed its public offering of Class A common stock and issued 35.4 million shares at a price of $6.50 per share for net proceeds of approximately $216.4 million, after deducting transaction costs of $13.6 million. In connection with the public offering of Class A common stock, the Company entered into an underwriting agreement for the offering and sale of 30.8 million shares. The Company also granted the Underwriters a 30-day option from the date of the underwriting agreement to purchase up to an additional 4.6 million shares of Class A Common Stock, which was exercised in full. The public offering was made pursuant to the Company's effective registration statement on Form S-3 (File No. 333-264845) and a related prospectus supplement and accompanying prospectus dated June 26, 2024.

At-The-Market Offering

In August 2023, the Company entered into an Open Market Sales Agreement (the “Sales Agreement”) with Jefferies LLC (the “Sales Agent”), to provide for the offering, issuance and sale of up to an aggregate amount of $300.0 million of its Class A common stock from time to time in “at-the-market” (ATM) offerings. As of June 30, 2024, an amount of $161.6 million remained available for future sales under the Sales Agreement. For the six months ended June 30, 2024, the Company has sold 5.9 million shares and received net proceeds of $56.0 million under the agreement. Recursion is not required to sell additional shares under the Sales Agreement. The Company will pay the Sales Agent a commission of up to 3% of the aggregate gross proceeds received from all sales of Class A common stock. The Sales Agreement continues until the earlier of selling all shares available under the Sales

Agreement or terminated by written notice from either of the parties. The ATM Offering is being made under a prospectus supplement dated August 8, 2023, and related prospectus filed with the Securities and Exchange Commission pursuant to our automatically effective shelf registration statement on Form S-3ASR (Registration No. 333-264845).

NVIDIA Private Placement

In July 2023, Recursion entered into a Stock Purchase Agreement for a private placement with NVIDIA Corporation (2023 Private Placement), pursuant to which the Company sold an aggregate of 7.7 million shares of the Company’s Class A common stock at a price of $6.49 per share for net proceeds of approximately $49.9 million.

Valence Acquisition Exchangeable Shares

In May 2023, in connection with the acquisition of Valence, the Company entered into an agreement to issue up to 5.9 million shares of Class A common stock (the “Exchangeable Shares”), that may be issued upon exchange, retraction or redemption of exchangeable shares of a subsidiary of Recursion. Each exchangeable share of the subsidiary of Recursion entitles the holder to exchange those shares on a one-for-one basis for Recursion’s Class A common stock. The shares are entitled to receive dividends economically equivalent to dividends declared by Recursion, are non-voting and are subject to customary adjustments for stock splits or other reorganizations. In addition, the Company may require all outstanding exchangeable shares to be exchanged into an equal number of Class A common stock upon the occurrence of certain events and at any time following the seventh anniversary of the closing of the Valence acquisition. The exchangeable shares are substantially the economic equivalent of the Class A shares and classified as common stock within the Company’s stockholders’ equity. The Company’s calculation of weighted-average shares outstanding includes the exchangeable shares. As of June 30, 2024, 4.8 million Exchangeable shares have been redeemed for Class A shares.

Registration Rights Agreements

Tempus agreement

In November 2023, in connection with the Tempus Agreement, the Company agreed to prepare and file a registration statement (or a prospectus supplement to an effective registration statement on Form S-3ASR that will become automatically effective upon filing with the SEC pursuant to Rule 462(e)) with the SEC, for resale of the shares of Class A common stock issued or issuable under the Tempus Agreement. A prospectus supplement to a registration statement (File No. 333-264845) was subsequently filed in December 2023 to register shares issued to Tempus for the initial license fee under the Tempus Agreement for resale.

After registration of any shares issued to Tempus under the Tempus Agreement, the Company has agreed to use commercially reasonable efforts to keep such registration statement effective until such date that all shares issued to Tempus covered by such registration statement have been sold or are able to be publicly sold by relying on Rule 144 of the Securities Act without registration.

NVIDIA Private Placement

In July 2023, in connection with the 2023 Private Placement with NVIDIA, the Company entered into a Registration Rights Agreement providing for the registration for resale of the shares of Class A common stock issued in such transaction. A prospectus supplement to a registration statement (File No. 333-264845) was subsequently filed in August 2023 to register the resale of the shares of Class A common stock issued to NVIDIA. The Company has agreed to use commercially reasonable efforts to keep the registration statement continuously effective until such date that all registrable securities under the agreement have been sold. In the event the holders cannot sell their shares due to certain circumstances causing the registration statement to be ineffective, the Company must pay each holder of shares outstanding on the date and each month thereafter 1% of the aggregate purchase price with the maximum payable amount of 5% of the aggregate purchase price. As of June 30, 2024, there was no accrued liability related to this agreement, as it was not probable that a payment would be required.

Acquisitions

In May 2023, in connection with the acquisition of Valence, the Company entered into a Registration Agreement providing for the registration for resale of the shares of Class A common stock and Exchange Shares issued or issuable in such transaction. A registration statement on Form S-3ASR (File No. 333-272281) was filed to register

the shares for resale by the holders. The registration statement must remain effective for a period of not less than three years.

In May 2023, in connection with the acquisition of Cyclica, the Company entered into a Registration Agreement providing for the registration for resale of the shares of Class A common stock issued in such transaction. A prospectus supplement to a registration statement (File No. 333-264845) was subsequently filed in June 2023 to register the shares for resale by the holders. The registration agreement must be continuously effective until the earlier of the date that all shares have been sold thereunder or are able to be publicly sold by relying on Rule 144 of the Securities Act without registration.

2022 Private Placement

In October 2022, in connection with the 2022 Private Placement, the Company entered into a Registration Rights Agreement providing for the registration for resale of the shares of Class A common stock issued in such transaction. A prospectus supplement to a registration statement (File No. 333-264845) was subsequently filed in October 2022 to register the resale of the shares of Class A common stock by the Purchasers. The agreement must remain effective until registrable securities covered by the agreement have been publicly sold by the holders or all shares cease to be registrable securities. In the event the holders cannot sell their shares due to certain circumstances causing the agreement to be ineffective, the Company must pay each holder of shares outstanding on the date and each month thereafter 1.0% of the aggregate purchase price paid by the holder without limit until the agreement is cured. As of June 30, 2024, there was no accrued liability related to this agreement, as it was not probable that a payment would be required.

Class A and B Common Shares Authorization

In April 2021, the Company’s Board of Directors authorized two classes of common stock, Class A and Class B. The rights of the holders of Class A and B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to 10 votes per share and is convertible at any time into one share of Class A common stock.

All Class B common stock is held by Christopher Gibson, Ph.D., the Company’s Chief Executive Officer (CEO), or his affiliates. As of June 30, 2024, Dr. Gibson and his affiliates held outstanding shares of Class B common stock representing approximately 21% of the voting power of the Company’s outstanding shares. This voting power may increase over time as Dr. Gibson vests in and exercises equity awards outstanding. If all the exchangeable equity awards held by Dr. Gibson had been fully vested, exercised and exchanged for shares of Class B common stock as of June 30, 2024, Dr. Gibson and his affiliates would hold approximately 22% of the voting power of the Company’s outstanding shares. As a result, Dr. Gibson will be able to significantly influence any action requiring the approval of Recursion stockholders, including the election of the Board of Directors; the adoption of amendments to the Company’s certificate of incorporation and bylaws; and the approval of any merger, consolidation, sale of all or substantially all of the Company’s assets, or other major corporate transaction.

Note 9. Collaborative Development Contracts

Roche and Genentech

Description

In December 2021, Recursion entered into a collaboration and license agreement with Roche and Genentech (collectively referred to as Roche). Recursion is constructing, using the Company’s imaging technology and proprietary machine-learning algorithms, unique maps of the inferred relationships amongst perturbation phenotypes in a given cellular context with the goal to discover and develop therapeutic small molecule programs in a gastrointestinal cancer indication and in key areas of neuroscience. Roche and Recursion will collaborate to select certain novel inferences with respect to small molecules or targets generated from the Phenomaps for further validation and optimization as collaboration programs. Roche and Recursion may also combine sequencing datasets from Roche with Recursion’s Phenomaps and collaborate to generate new algorithms to produce multi-modal maps from which additional collaboration programs may be initiated. For every collaboration program that successfully identifies potential therapeutic small molecules or validates a target, Roche will have an option to obtain an exclusive license to develop and commercialize such potential therapeutic small molecules or to exploit such target in the applicable exclusive field.

Pricing

In January 2022, Recursion received a $150.0 million non-refundable upfront payment from the Company’s collaboration with Roche. Recursion is eligible for additional milestone payments based on performance progress of the collaboration. Each of the Phenomaps requested by Roche and created by Recursion may be subject to either an initiation fee, acceptance fee or both. Such fees could exceed $250.0 million for 16 accepted Phenomaps. In addition, for a period of time after Roche’s acceptance of certain Phenomaps, Roche will have the option to obtain, subject to payment of an exercise fee, rights to use outside the collaboration the raw images generated in the course of creating those Phenomaps. If Roche exercises its external use option for all 12 eligible Phenomaps, Roche’s associated exercise fee payments to Recursion could exceed $250.0 million. Under the collaboration, Roche may initiate up to 40 programs, each of which, if successfully developed and commercialized, could yield more than $300.0 million in development, commercialization and net revenue milestones for Recursion, as well as tiered royalties on net revenue.

Accounting

This agreement represents a transaction with a customer and therefore is accounted for in accordance with ASC 606. Recursion has determined that it has three performance obligations, one related to gastrointestinal cancer and two in neuroscience. These performance obligations are for performing research and development services for Roche to identify targets and medicines. The performance obligations also include potential licenses related to the intellectual property. The Company concluded that licenses within the contract are not distinct from the research and development services as they are interrelated due to the fact that the research and development services significantly impact the potential licenses. Any additional services are considered customer options and will be considered as separate contracts for accounting purposes.

The Company has determined the transaction price to be $150.0 million, comprised of the upfront payment. Recursion will fully constrain the amounts of variable consideration to be received from potential milestones considering the stage of development and the risks associated with the remaining development required to achieve each milestone. Recursion will re-evaluate the transaction price each reporting period.

The transaction price was allocated to the performance obligations based on the estimated relative stand-alone selling price of each performance obligation as determined using an expected cost plus margin approach. The Company recognizes revenue over time based on costs incurred relative to total expected costs to perform the research and development services. Recursion determined that this method provides a faithful depiction of the transfer of control to the customer. This method of recognizing revenue requires the Company to make estimates of total costs to provide the services required under the performance obligations. Significant inputs used to determine the total costs included the length of time required, service hours performed by Company employees and materials costs. A significant change in these estimates could have a material effect on the timing and amount of revenue recognized in future periods. Recursion has estimated the completion of the performance obligations by 2026.

Additional Revenue Disclosures

Of the revenue recognized during the three and six months ended June 30, 2024, $11.3 million and $25.0 million was included in the unearned revenue balance as of December 31, 2023, respectively. Primarily all revenue recognized during the three and six months ended June 30, 2023 was included in the unearned revenue balance as of December 31, 2022. Revenue recognized was from upfront payments received at the inception of the related contracts, which decreased the initial unearned revenue recognized. As of June 30, 2024, the Company had $7.5 million of costs incurred to fulfill a contract on its Condensed Consolidated Balance Sheet within “Other Current Assets.”

Unearned revenue was classified as short-term and long-term on the Condensed Consolidated Balance Sheets based on the Company’s estimate of revenue that will be recognized during the next twelve months.

Note 10. Stock-Based Compensation

In April 2021, the Board of Directors and the stockholders of the Company adopted the 2021 Equity Incentive Plan (the 2021 Plan). The Company may grant stock options, restricted stock units (RSUs), stock appreciation rights, restricted stock awards and other forms of stock-based compensation. As of June 30, 2024, 14.1 million shares of Class A common stock were available for grant.

The following table presents the classification of stock-based compensation expense for employees and non-employees within the Condensed Consolidated Statements of Operations:

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (in thousands) | 2024 | 2023 | | 2024 | 2023 |

| Cost of revenue | $ | 680 | | $ | 1,415 | | | $ | 1,447 | | $ | 2,426 | |

| Research and development | 8,281 | | 4,329 | | | 15,947 | | 7,012 | |

| General and administrative | 6,997 | | 5,643 | | | 14,074 | | 10,221 | |

| Total | $ | 15,958 | | $ | 11,387 | | | $ | 31,468 | | $ | 19,659 | |

Stock Options

Stock options are primarily granted to executive leaders at the Company, generally vest over four years and expire no later than 10 years from the date of grant.

Stock option activity during the six months ended June 30, 2024 was as follows:

| | | | | | | | | | | | | | |

| (in thousands except share data and per share amounts) | Shares | Weighted-Average Exercise Price | Weighted-Average Remaining Contractual Life (in years) | Aggregate Intrinsic Value |

| Outstanding as of December 31, 2023 | 14,957,617 | | $ | 6.13 | | 7.0 | $ | 72,416 | |

| Granted | 2,689,067 | | 10.02 | | | |

| Cancelled | 377,538 | | 11.89 | | | |

| Exercised | 1,852,880 | | 2.71 | | | 15,114 | |

| Outstanding as of June 30, 2024 | 15,416,266 | | $ | 7.13 | | 7.1 | $ | 37,638 | |

| Exercisable as of June 30, 2024 | 9,505,438 | | $ | 5.87 | | 6.2 | $ | 34,178 | |

The fair value of options granted to employees is calculated on the grant date using the Black-Scholes option valuation model. The weighted-average grant-date fair values of stock options granted during the six months ended June 30, 2024 and 2023 were $6.35 and $5.55, respectively.

The following weighted-average assumptions were used to calculate the grant-date fair value of stock options:

| | | | | | | | |

| Six months ended June 30, |

| | 2024 | 2023 |

| Expected term (in years) | 6.2 | 5.8 |

| Expected volatility | 65 | % | 66 | % |

| Expected dividend yield | — | | — | |

| Risk-free interest rate | 4.3 | % | 3.6 | % |

As of June 30, 2024, $38.8 million of unrecognized compensation cost related to stock options is expected to be recognized as expense over approximately the next two years.

RSUs

Equity awards granted to employees primarily consist of RSUs and generally vest over four years. The weighted-average grant-date fair value of RSUs generally is determined based on the number of units granted and the quoted price of Recursion’s common stock on the date of grant.

The following table summarizes Recursion’s RSU activity during the six months ended June 30, 2024:

| | | | | | | | |

| Stock units | Weighted-average grant date fair value |

| Outstanding as of December 31, 2023 | 15,223,764 | | $ | 8.39 | |

| Granted | 7,380,219 | | 8.85 | |

| Vested | 2,276,563 | | 8.56 | |

| Forfeited | 915,080 | | 8.47 | |

| Outstanding as of June 30, 2024 | 19,412,340 | | $ | 8.54 | |

The fair market value of RSUs vested was $25.5 million during the six months ended June 30, 2024. As of June 30, 2024, $155.3 million of unrecognized compensation cost related to RSUs is expected to be recognized as expense over approximately the next three years.

Note 11. Income Taxes

The Company did not record any U.S. income tax expense during the three and six months ended June 30, 2024 and 2023. The Company has historically incurred operating losses and maintains a full valuation allowance against its U.S. net deferred tax assets. Foreign taxes were insignificant during the three and six months ended June 30, 2024 and 2023.

Net operating losses (NOLs) and tax credit carry-forwards are subject to review and possible adjustment by the Internal Revenue Service (“IRS”) and may become subject to annual limitation due to ownership changes that occur under Section 382 of the Internal Revenue Code, as amended and similar state provisions. These ownership changes may limit the amount of carryforwards that can be utilized annually to offset future taxable income. In general, an ownership change, as defined by Section 382, results from transactions increasing the ownership of certain shareholders or public groups in the stock of a corporation by more than 50% over a three-year period. As of June 30, 2024, the Company was not limited on its NOLs and tax credit carry-forwards. The Company will continue to monitor future ownership changes for potential Section 382 limitations.

Note 12. Net Loss Per Share

For the three and six months ended June 30, 2024 and 2023, Recursion calculated net loss per share of Class A, Class B and the Exchangeable common stock using the two-class method. Basic net loss per share is computed using the weighted-average number of shares outstanding during the period. Diluted net loss per share is computed using the weighted-average number of shares and the effect of potentially dilutive securities outstanding during the period. Potentially dilutive securities consist of stock options and other contingently issuable shares. For periods presented in which the Company reports a net loss, all potentially dilutive shares are anti-dilutive and as such are excluded from the calculation. For the three and six months ended June 30, 2024 and 2023, the Company reported a net loss and therefore basic and diluted loss per share were the same.

The rights, including the liquidation and dividend rights, of the holders of the Company’s Class A, Class B and the Exchangeable common stock are identical, except with respect to voting. As a result, the undistributed earnings for each period are allocated based on the contractual participation rights of the Class A, Class B and the Exchangeable common stock as if the earnings for the period had been distributed. As the liquidation and dividend rights are identical, the undistributed earnings are allocated on a proportionate basis and the resulting amount per share for Class A, Class B and the Exchangeable common stock was the same during the three and six months ended June 30, 2024 and 2023.

The following tables set forth the computation of basic and diluted net loss per share of Class A, Class B and Exchangeable common stock:

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (in thousands, except share amounts) | 2024 | 2023 | | 2024 | 2023 |

| Numerator: | | | | | |

| Net loss | $ | (97,540) | | $ | (76,726) | | | $ | (188,913) | | $ | (142,053) | |

| Denominator: | | | | | |

| Weighted average common shares outstanding | 242,196,409 | | 201,415,475 | | | 239,107,879 | | 198,957,804 | |