September 2024 Decoding Biology To Radically Improve Lives

This presentation of Recursion Pharmaceuticals, Inc. (“Recursion,” “we,” “us,” or “our”) and any accompanying discussion contain statements that are not historical facts may be considered forward-looking statements under federal securities laws and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” or words of similar meaning and include, but are not limited to, statements regarding bringing better medicines to patients more rapidly and more cost efficiently; the occurrence or realization of near-or medium-term potential milestones; current and future preclinical and clinical studies, including timelines for enrollment in studies, data readouts, and progression toward IND-enabling studies; Recursion’s anticipated meeting with the FDA; Recursion’s plans to present SYCAMORE trial data at a medical conference and submit the data for publication; the clinical relevance of the SYCAMORE trial data and obtaining additional confirmatory data; promising trends in REC-994 efficacy endpoints; advancing potential transformational therapies for CCM and beyond; subsequent REC-994 studies and their results and advancing Recursion’s REC-994 program further; the size of the potential CCM patient population;outcomes and benefits from licenses, partnerships and collaborations, including option exercises by partners and the amount and timing of potential milestone payments; the initiation, timing, progress, results, and cost of our research and development programs; advancements of our Recursion OS, including augmentation of our dataset and movement toward autonomous discovery; outcomes and benefits expected from the Tempus and Helix relationships, including our building of large-scale causal AI models; outcomes and benefits expected from the Large Language Model-Orchestrated Workflow Engine (LOWE); the potential for additional partnerships and making data and tools available to third parties; expected supercomputer capabilities; our ability to identify viable new drug candidates for clinical development and the accelerating rate at which we expect to identify such candidates including our ability to leverage the datasets acquired through the license agreement into increased machine learning capabilities and accelerate clinical trial enrollment; the potential size of the market opportunity for our drug candidates; outcomes and benefits expected from the Enamine partnership, including the generating and co-branding of new chemical libraries; and many others. Such statements also include statements regarding the proposed business combination of Recursion and Exscientia plc (“Exscientia”) and the outlook for Recursion’sor Exscientia’s future business and financial performance, including the combined company’s first-in-class and best-in-class opportunities; potential for annual peak sales from successful programs of over $1 billion each; potential milestone payments of the combined company of approximately $200 million over the next 2 years from current partnerships; potential for more than $20 billion in total milestone payments for the combined company from partners before royalties; percentage of the pro forma company to be received by Exscientia shareholders; ability to reduce pro forma spend of the combined company; revenue, business synergies, and reduced pro forma spend from the combination resulting in cash runway extending into 2027; completion of the business combination in 2025; and many others. Such forward-looking statements are based on the current beliefs of Recursion’s and Exscientia’s respective management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including: the occurrence of any event, change or other circumstances that could give rise to the termination of the transaction agreement; the inability to obtainRecursion’s stockholder approval or Exscientia’s shareholder approval or the failure to satisfy other conditions to completion of the proposed combination, including receipt of the required regulatory approvals and obtaining the sanction of the High Court of Justice of England and Wales to the Scheme of Arrangement, on a timely basis or at all; risks that the proposed combination disrupts each company’s current plans and operations; the diversion of the attention of the respective management teams of Recursion and Exscientia from their respective ongoing business operations; the ability of either Recursion,Exscientia or the combined company to retain key personnel; the ability to realize the benefits of the proposed combination, including cost synergies; the ability to successfully integrate Exscientia's business with Recursion’sbusiness or to integrate the businesses within the anticipated timeframe; the outcome of any legal proceedings that may be instituted againstRecursion,Exscientia or others following announcement of the proposed combination; the amount of the costs, fees, expenses and charges related to the proposed combination; the effect of economic, market or business conditions, including competition, regulatory approvals and commercializing drug candidates, or changes in such conditions, have onRecursion’s,Exscientia’s and the combined company’s operations, revenue, cash flow, operating expenses, employee hiring and retention, relationships with business partners, the development or launch of technology enabled drug discovery, and commercializing drug candidates; the risks of conductingRecursion’s and Exscientia’s businesses internationally; the impact of potential inflation, volatility in foreign currency exchange rates and supply chain disruptions; the ability to maintain technology-enabled drug discovery in the biopharma industry; and risks relating to the market value ofRecursion’scommon stock to be issued in the proposed transaction. Other important factors and information are contained in Recursion’s most recent Annual Report on Form 10-K and Exscientia’s most recent Annual Report on Form 20-F, including the risks summarized in the section entitled “Risk Factors,” Recursion’s Quarterly Reports on Form 10-Q for the quarterly periods ended March 31 and June 30, 2024 and Exscientia’s filing on Form 6-K filed May 21, 2024, and each company’s other filings with the U.S. Securities and Exchange Commission (the “SEC”), which can be accessed at https://ir.recursion.com in the case of Recursion, http://investors.exscientia.ai in the case of Exscientia, or www.sec.gov. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. Neither Recursion nor Exscientia undertakes any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. 2 Important Information

Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the company’s own internal estimates and research. While the company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the company believes its own internal research is reliable, such research has not been verified by any independent source. Information contained in, or that can be accessed through our website is not a part of and is not incorporated into this presentation. Cross-trial or cross-candidate comparisons against other clinical trials and other drug candidates are not based on head-to-head studies and are presented for informational purposes; comparisons are based on publicly available information for other clinical trials and other drug candidates. Any non-Recursion logos or trademarks included herein are the property of the owners thereof and are used for reference purposes only. Additional Information and Where to Find It This communication relates to the proposed business combination of Recursion and Exscientia that will become the subject of a joint proxy statement to be filed by Recursion and Exscientia with the SEC. The joint proxy statement will provide full details of the proposed combination and the attendant benefits and risks. This communication is not a substitute for the joint proxy statement or any other document that Recursion or Exscientia may file with the SEC or send to their respective security holders in connection with the proposed transaction. Security holders are urged to read the definitive joint proxy statement and all other relevant documents filed with the SEC or sent to Recursion’s stockholders or Exscientia’s shareholders as they become available because they will contain important information about the proposed transaction. All documents, when filed, will be available free of charge at the SEC’s website (www.sec.gov). You may also obtain these documents by contacting Recursion’s Investor Relations department at investor@recursion.com; or by contacting Exscientia’s Investor Relations department at investors@exscientia.ai. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Participants in the Solicitation Recursion,Exscientia and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies in connection with the proposed business combination. Information aboutRecursion’sdirectors and executive officers is available in Recursion’s proxy statement dated April 23, 2024 for its 2024 Annual Meeting of Stockholders. Information about Exscientia’s directors and executive officers is available in Exscientia’s Annual Report on Form 20-F dated March 21, 2024. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement and all other relevant materials to be filed with the SEC regarding the proposed combination when they become available. Investors should read the joint proxy statement carefully when it becomes available before making any voting or investment decisions. 3 Important Information (continued)

Phase 2 CCM Clinical Trial Update and Potential Milestones 4

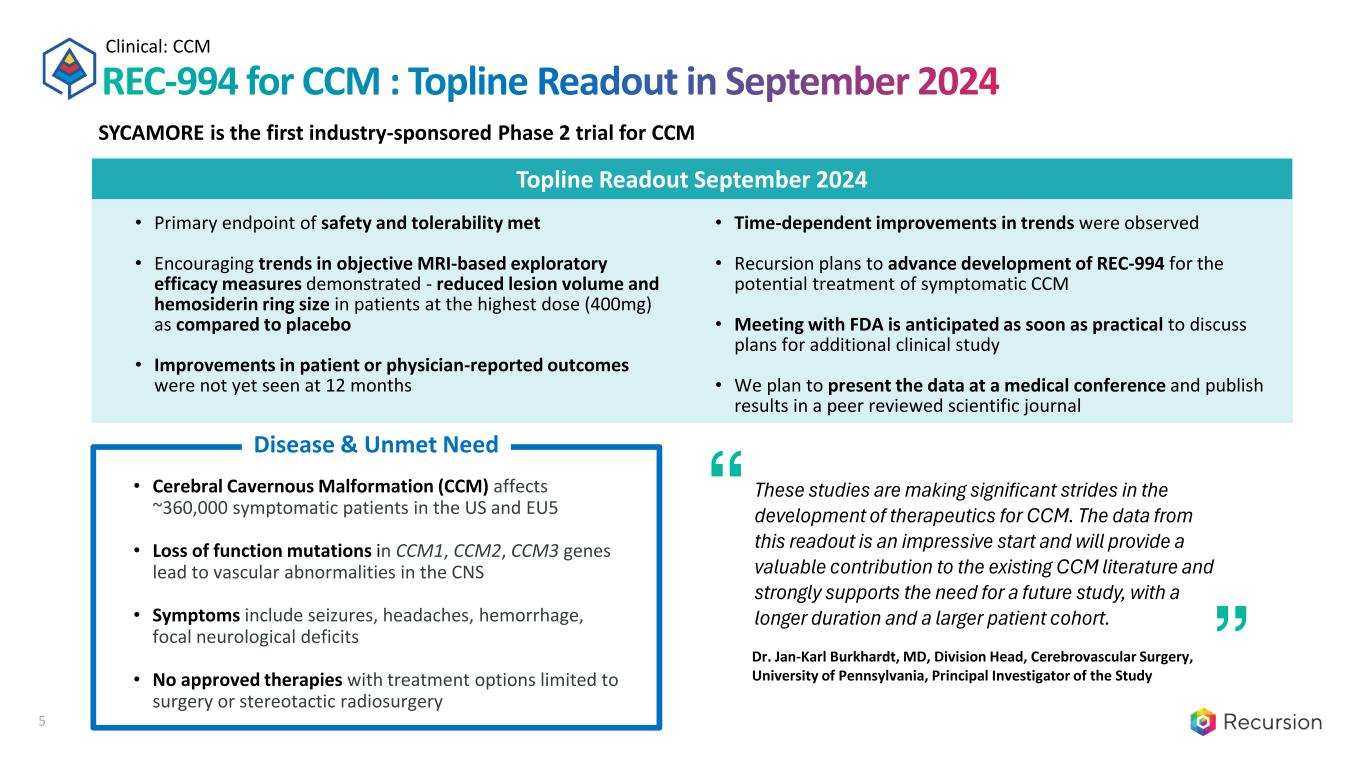

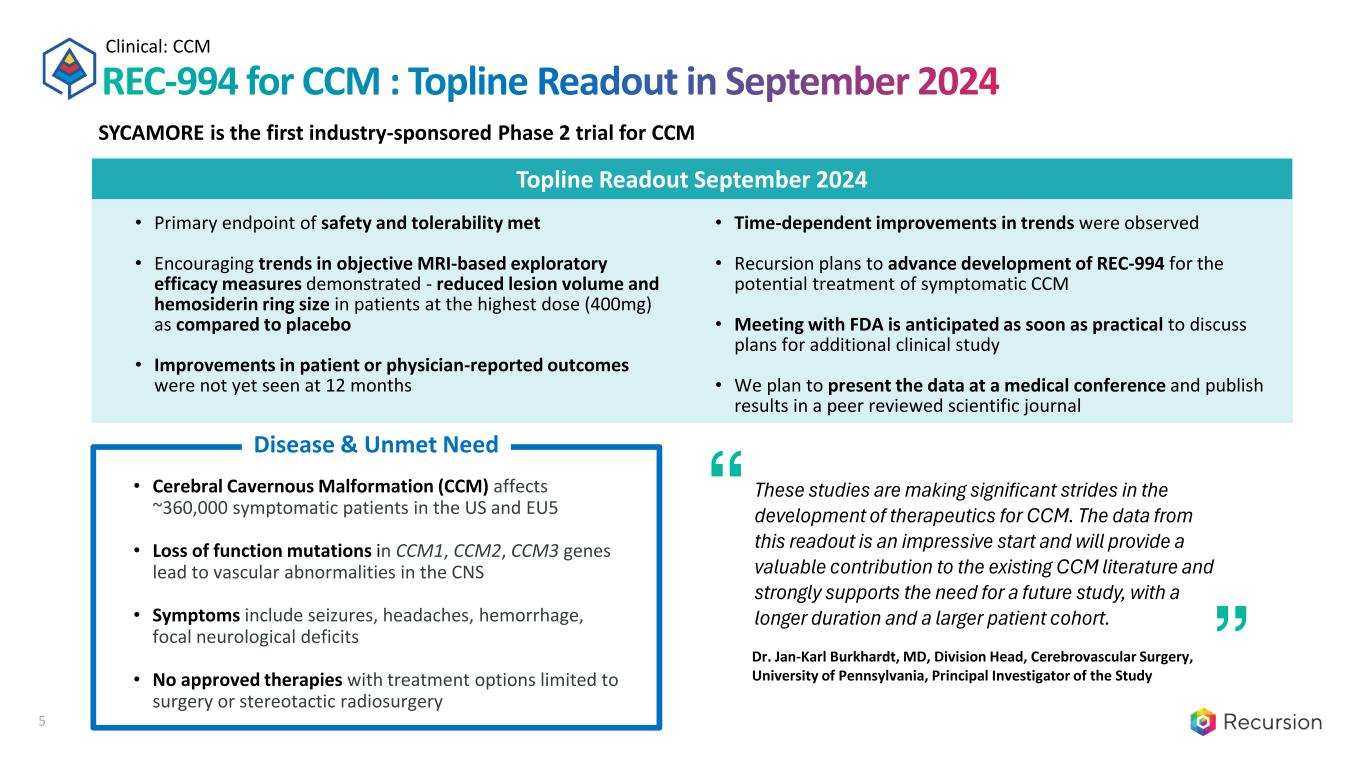

SYCAMORE is the first industry-sponsored Phase 2 trial for CCM Topline Readout September 2024 • Primary endpoint of safety and tolerability met • Encouraging trends in objective MRI-based exploratory efficacy measures demonstrated - reduced lesion volume and hemosiderin ring size in patients at the highest dose (400mg) as compared to placebo • Improvements in patient or physician-reported outcomes were not yet seen at 12 months REC-994 for CCM : Topline Readout in September 2024 Clinical: CCM 5 • Cerebral Cavernous Malformation (CCM) affects ~360,000 symptomatic patients in the US and EU5 • Loss of function mutations in CCM1, CCM2, CCM3 genes lead to vascular abnormalities in the CNS • Symptoms include seizures, headaches, hemorrhage, focal neurological deficits • No approved therapies with treatment options limited to surgery or stereotactic radiosurgery Disease & Unmet Need • Time-dependent improvements in trends were observed • Recursion plans to advance development of REC-994 for the potential treatment of symptomatic CCM • Meeting with FDA is anticipated as soon as practical to discuss plans for additional clinical study • We plan to present the data at a medical conference and publish results in a peer reviewed scientific journal These studies are making significant strides in the development of therapeutics for CCM. The data from this readout is an impressive start and will provide a valuable contribution to the existing CCM literature and strongly supports the need for a future study, with a longer duration and a larger patient cohort. Dr. Jan-Karl Burkhardt, MD, Division Head, Cerebrovascular Surgery, University of Pennsylvania, Principal Investigator of the Study

Pipeline • CCM: Ph2 in Sep 2024 primary endpoint of safety met, encouraging trends seen in exploratory efficacy • NF2: Ph2 safety & preliminary efficacy expected in Q4 2024 • FAP: Ph2 safety & preliminary efficacy expected in H1 2025 • AXIN1 or APC Mutant Cancers: Ph2 safety & preliminary efficacy expected in H1 2025 • C. difficile Infection: Ph2 initiation expected in Q4 2024 with preliminary readout expected by end of 2025 • Advanced HR-Proficient Cancers, Target RBM39: IND submission expected in Q3 2024. Ph1/2 initiation expected in Q4 2024 with Ph1 dose-escalation readout by end of 2025 • Target Epsilon (novel target in fibrotic diseases): IND submission expected in early 2025 with Ph1 healthy volunteer readout by end of 2025 • Dozens of internal & partner programs in early stages with first LLM & causal model driven programs entering pipeline Milestones: 7 Clinical Readouts from Recursion Expected in ~18 Months 6

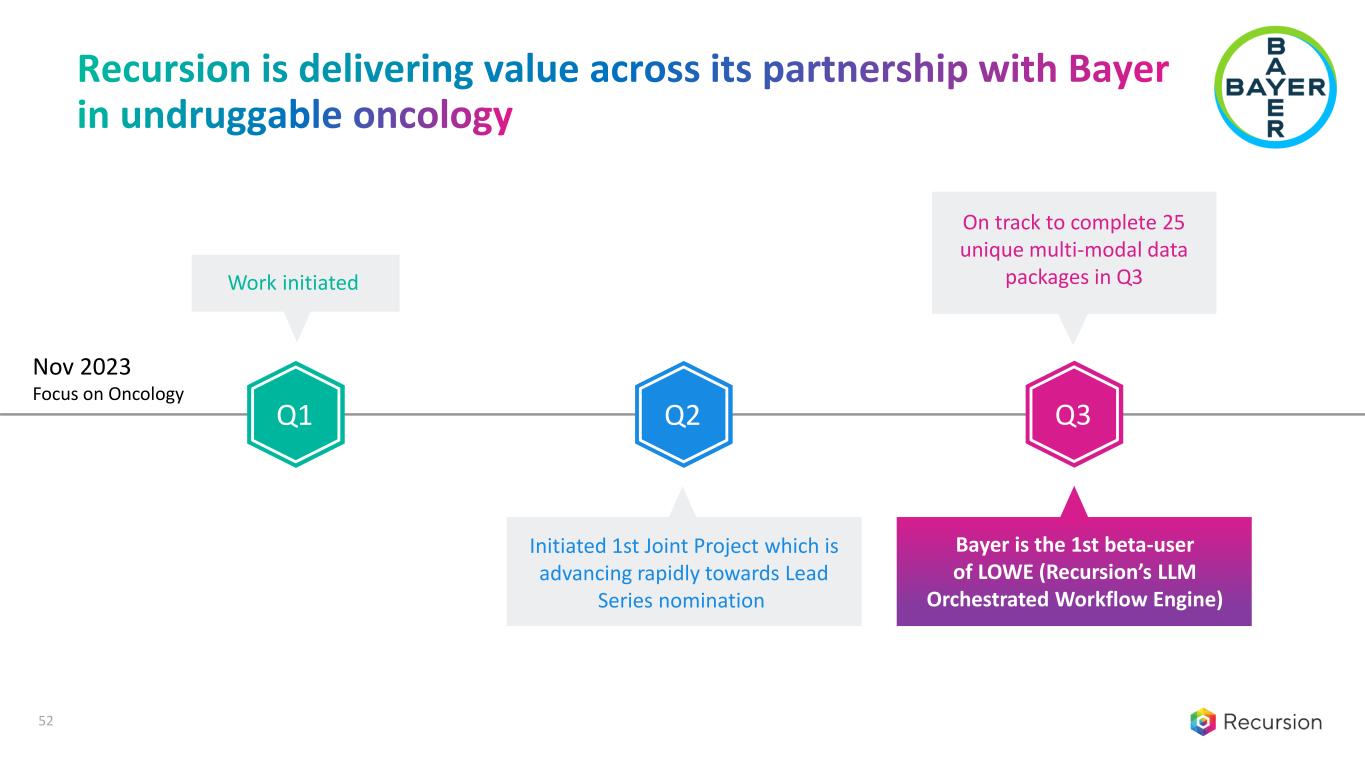

Partnerships • Roche & Genentech: validation program option exercised for 1st validated hit series in oncology, 1st neuroscience phenomap optioned for $30M (part of a structure that could exceed a total of $500M across multiple maps), potential for near-term program and additional map options • Bayer: delivered multiple oncology data packages, on track to complete 25 unique data packages in Q3 2024, advancing 1st joint project towards lead series nomination, agreed to be 1st beta-user of LOWE for drug discovery and development, potential near-term program options • Tempus & Helix: building large-scale causal AI models to generate target hypotheses across cancer and other disease areas, exploring novel NSCLC targets • Potential for additional partnership(s) in large, intractable areas of biology Platform • Built our 1st genome-scale transcriptomics KO map, moving towards multiomics foundation models • Active learning and exploration of proteomics, organoids, spheroids, & automated synthesis • Potential to make some data and tools available to biopharma and commercial users • OS moving towards autonomous discovery Strong Financial Position ~$474M in cash Q2 2024 Cash refers to cash and cash equivalents at the end of Q2 2024 Milestones: Recursion Partnerships and Platform 7

Recursion and Exscientia Combination 8

Combination of Many Complementary Factors • Pipeline: Diverse portfolio of clinical and near-clinical programs with ~10 clinical readouts over the next ~18 months • Partnerships: Diverse portfolio of transformational partnerships with potential for over $200 million in milestone payments over the next 2 years • Platform: Full-stack technology-enabled small molecule discovery platform • Business: ~$850 million in combined cash (end of Q2 2024), estimated annual synergies of ~$100 million or more and runway into 2027 • People: Shared vision to leverage technology & talent to discover and develop high quality medicines efficiently and at scale Recursion enters agreement with Exscientia to bring better medicines to patients more rapidly and more cost efficiently 9

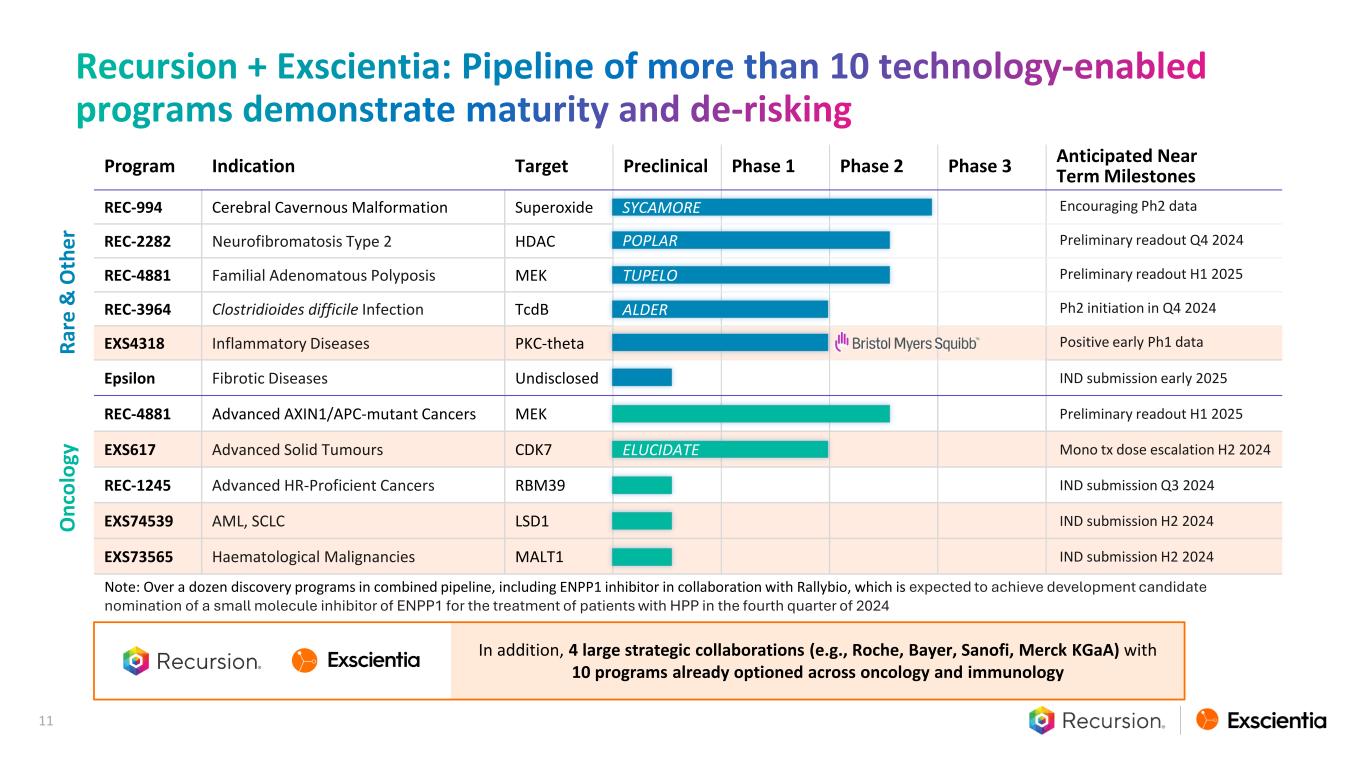

• Diverse Portfolio of clinical or near-clinical programs • ~10 clinical readouts over the next ~18 months • Complementary therapeutic pipelines with no competitive overlap • Most of these programs, if successful, could have annual peak sales opportunities >$1 billion each • Strategic Focus • Recursion: first-in-disease drug candidates in oncology, rare disease, infectious disease • Exscientia: best-in-class drug candidates in oncology, inflammation, immunology • Many additional research and discovery programs for both companies Recursion + Exscientia: Pipeline 10 ~10 clinical readouts in the next 18 months Combining first-in-class and best- in-class opportunities

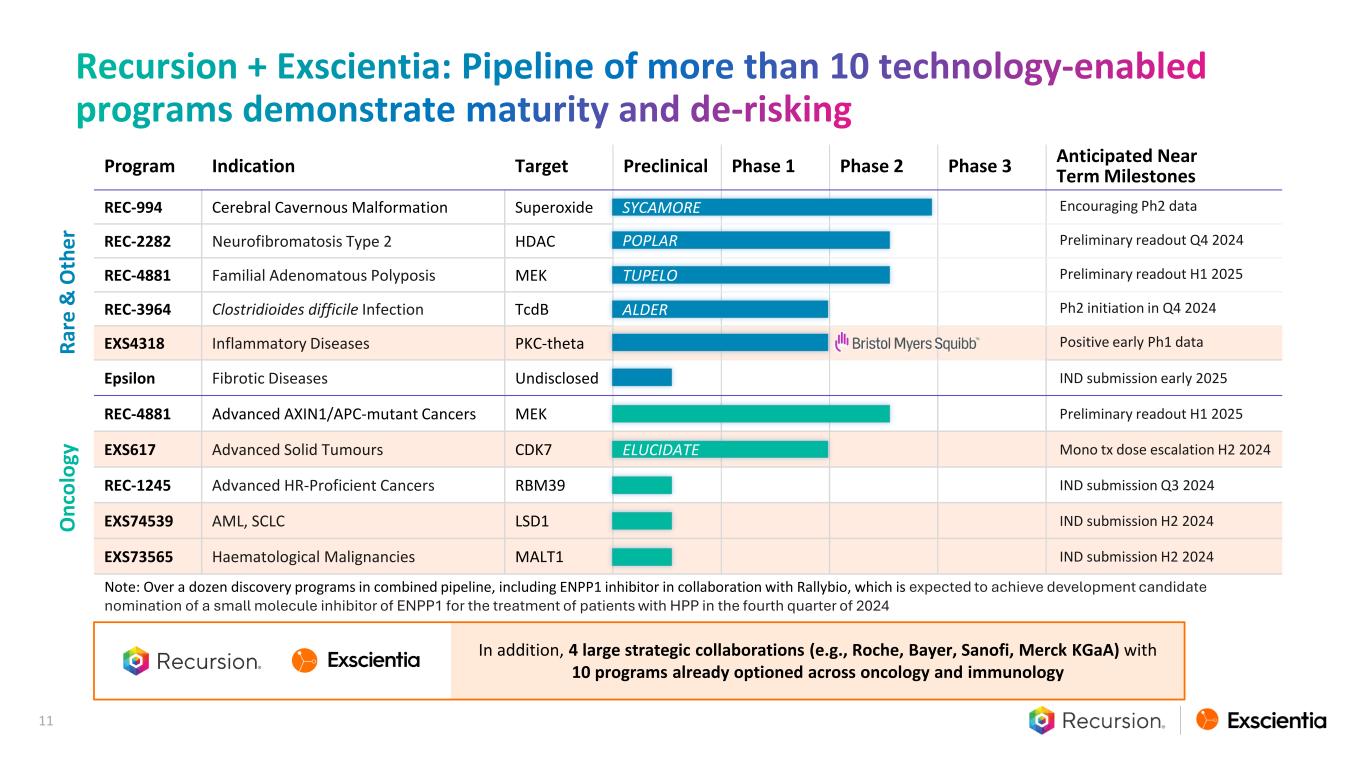

In addition, 4 large strategic collaborations (e.g., Roche, Bayer, Sanofi, Merck KGaA) with 10 programs already optioned across oncology and immunology Note: Over a dozen discovery programs in combined pipeline, including ENPP1 inhibitor in collaboration with Rallybio, which is expected to achieve development candidate nomination of a small molecule inhibitor of ENPP1 for the treatment of patients with HPP in the fourth quarter of 2024 Program Indication Target Preclinical Phase 1 Phase 2 Phase 3 Anticipated Near Term Milestones REC-994 Cerebral Cavernous Malformation Superoxide Encouraging Ph2 data REC-2282 Neurofibromatosis Type 2 HDAC Preliminary readout Q4 2024 REC-4881 Familial Adenomatous Polyposis MEK Preliminary readout H1 2025 REC-3964 Clostridioides difficile Infection TcdB Ph2 initiation in Q4 2024 EXS4318 Inflammatory Diseases PKC-theta Positive early Ph1 data Epsilon Fibrotic Diseases Undisclosed IND submission early 2025 REC-4881 Advanced AXIN1/APC-mutant Cancers MEK Preliminary readout H1 2025 EXS617 Advanced Solid Tumours CDK7 Mono tx dose escalation H2 2024 REC-1245 Advanced HR-Proficient Cancers RBM39 IND submission Q3 2024 EXS74539 AML, SCLC LSD1 IND submission H2 2024 EXS73565 Haematological Malignancies MALT1 IND submission H2 2024 R ar e & O th e r SYCAMORE POPLAR ALDER TUPELO O n co lo gy ELUCIDATE 11 Recursion + Exscientia: Pipeline of more than 10 technology-enabled programs demonstrate maturity and de-risking

• Diverse Portfolio of transformational partnerships with leading large pharma companies • 10 programs already optioned across oncology and immunology • Combined company expects potential additional milestone payments of ~$200 million over the next 2 years from current partnerships • Potential for >$20 billion in total combined revenue before royalties from partners • Transformational Large Pharma Partnerships • Recursion: Roche-Genentech (neuroscience, single GI-oncology indication), Bayer (oncology) • Exscientia: Sanofi (oncology, immunology), Merck KGaA (oncology, immunology) Trademarks are the property of their respective owners and used for informational purposes only. Recursion Partners Exscientia Partners 12 Recursion + Exscientia: Partnerships

• Core Strengths • Recursion: scaled biology exploration and translational capabilities primarily focused on first-in- disease opportunities • Exscientia: precision chemistry design and small molecule automated synthesis primarily focused on best-in-class opportunities • Assembles a full-stack platform spanning • Patient-centric target discovery • Hit discovery and lead optimization • Automated chemical synthesis • Predictive ADMET and translation • Biomarker selection • Clinical development 13 Recursion + Exscientia: Platform

14 Complementary capabilities through combination with Exscientia labelled in orange. Overview of areas where Exscientia’s capabilities can immediately integrate and complement the Recursion OS upon close

Platform Strength Scaled exploration and mapping of biological relationships Precision chemistry design and molecular synthesis Internal Pipeline First-in-class products in oncology, rare disease, infectious disease Best-in-class products in oncology, inflammation, immunology Large Pharma Partnerships Roche-Genentech (neuro, single GI-onc indication), Bayer (oncology) Sanofi (oncology, immunology), Merck KGaA (onc, immunology) Cash (End of Q2 2024) ~$475 million ~$370 million* Locations Salt Lake City, London, Toronto, Montreal, San Francisco Bay Area Oxford, Boston, Vienna, Dundee, Miami Employees >500 >350 15 Recursion + Exscientia: Summary of complementary factors This preliminary financial data for Exscientia has been prepared by and is the responsibility of Exscientia, and it has not been reviewed or audited by the company’s independent auditor. Exscientia’s actual results may differ from these preliminary financial results.

16 Transaction details of Recursion-Exscientia combination Stock Consideration Pro-Forma Ownership Cash Position Management and Board Timing and Approvals • Stock for stock transaction • Exscientia shareholders will receive 0.7729 shares of Recursion Class A common stock for each Exscientia ordinary share, subject to rounding for fractional shares • Recursion shareholders will own ~74% of the combined company • Exscientia shareholders will own ~26% of the combined company • ~$850 million in combined cash at the end of Q2, 2024 • Expect pro-forma combined financial plans to extend runway into 2027 • Estimated annual synergies of ~$100 million or more • Recursion will be the Go-Forward Entity • Recursion Co-Founder & CEO Chris Gibson will be CEO of combined company • Exscientia Interim CEO David Hallett will join as Chief Scientific Officer • Two Exscientia Board Members will join the Recursion Board • Expect this transaction to close by early 2025 • Subject to approval of both companies’ shareholders and closing conditions Pro-forma ownership is based on the number of shares outstanding today

Exscientia: ‘617 precision designed to have best-in-class properties Precision designed to maximize therapeutic index allowing for optimized combinations and potentially better efficacy • Selectivity, reversibility & efflux design properties limit potential toxicities to widen therapeutic index • CDK7 regulates both cell cycle and transcription • Cell cycle inhibitors are a validated mechanism of action: CDK4/6 inhibitors generated $11 billion in sales in 2023 • Opportunity in multiple tumor types • Ongoing ELUCIDATE Phase I/II trial in patients with advanced solid tumors and potential best in class* • Ahead of monotherapy dose escalation clinical trial data • Full rights acquired for ‘617 – CDK7 inhibitor • Across these six tumor types, there are 75k newly diagnosed patients in the US per year • CDK4/6 relapsed breast cancer is the first indication being considered for combination dose expansion – expected to start in 2H24/1H25 CDK7 Sales data from Evaluate Pharma *Tumor types: head and neck cancer, colorectal cancer, pancreatic cancer, non-small cell lung cancer (NSCLC), HR+/HER2- breast cancer and ovarian cancer Maximize upside potential of precision- designed GTAEXS617 with purchase of full rights from GT Apeiron: • Upfront $10m in cash + $10m in Exscientia equity + single digit royalties • Potential best-in-class molecule in Phase 1/2 studies • Ahead of monotherapy dose escalation clinical trial data

Recursion Value Proposition and OS 18

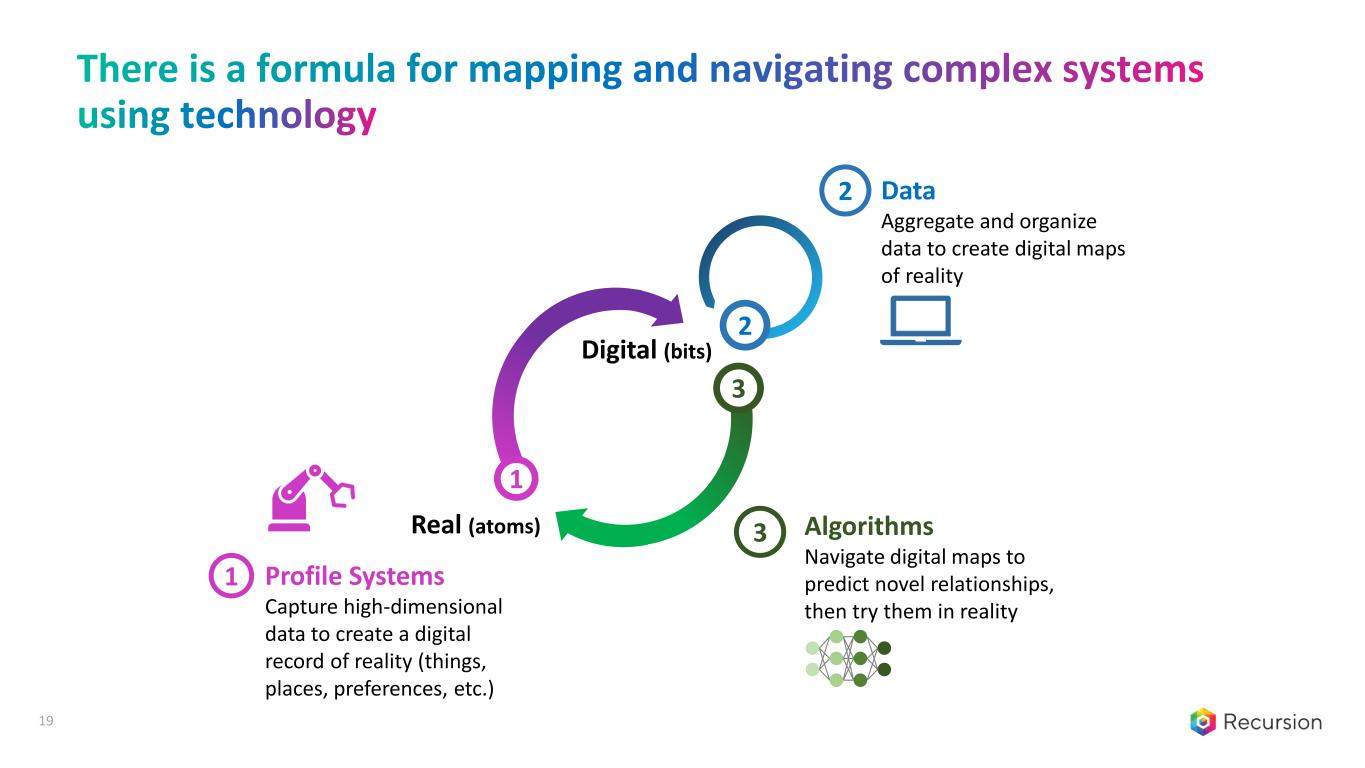

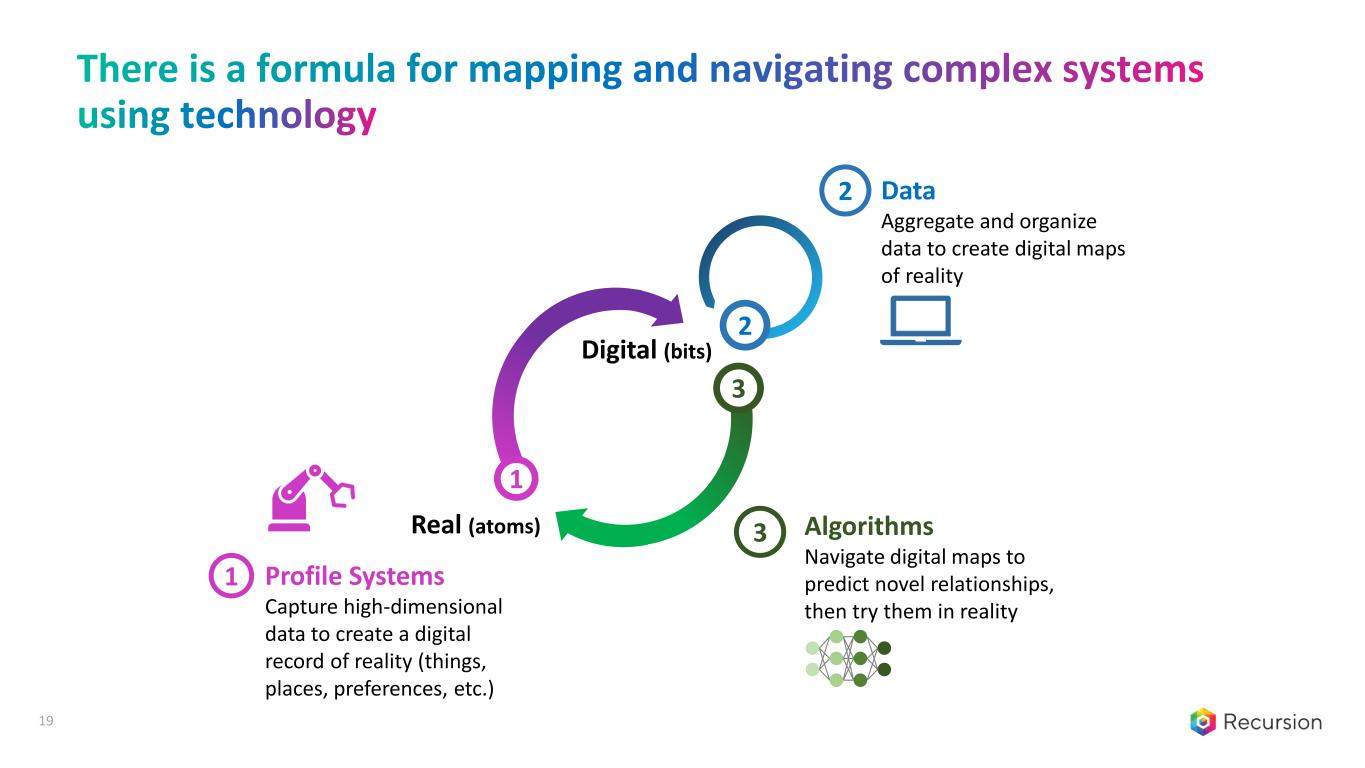

There is a formula for mapping and navigating complex systems using technology Digital (bits) Data Aggregate and organize data to create digital maps of reality 2 2 Real (atoms) 1 Profile Systems Capture high-dimensional data to create a digital record of reality (things, places, preferences, etc.) 1 Algorithms Navigate digital maps to predict novel relationships, then try them in reality 3 3 19

Data roadblocks make mapping and navigating biology difficult Reproducibility Crisis Multiple studies have shown that the vast majority of published academic literature cannot be recapitulated Analog Standard The fax machine is alive and well in medicine, while in biopharma, study results from CROs are still often reported as PDFs or scanned printouts Siloed Data in Pharma Biopharma has 100s of petabytes of scientific data stored on a project-by- project basis without the meta-data or annotation needed to relate it to other projects or questions in biology ! ! ! ! ! ! ! ! ! ! Trademarks are the property of their respective owners and used for informational purposes only. Baker, M. Irreproducible biology research costs put at $28 billion per year. Nature (2015). https://doi.org/10.1038/nature.2015.17711 20

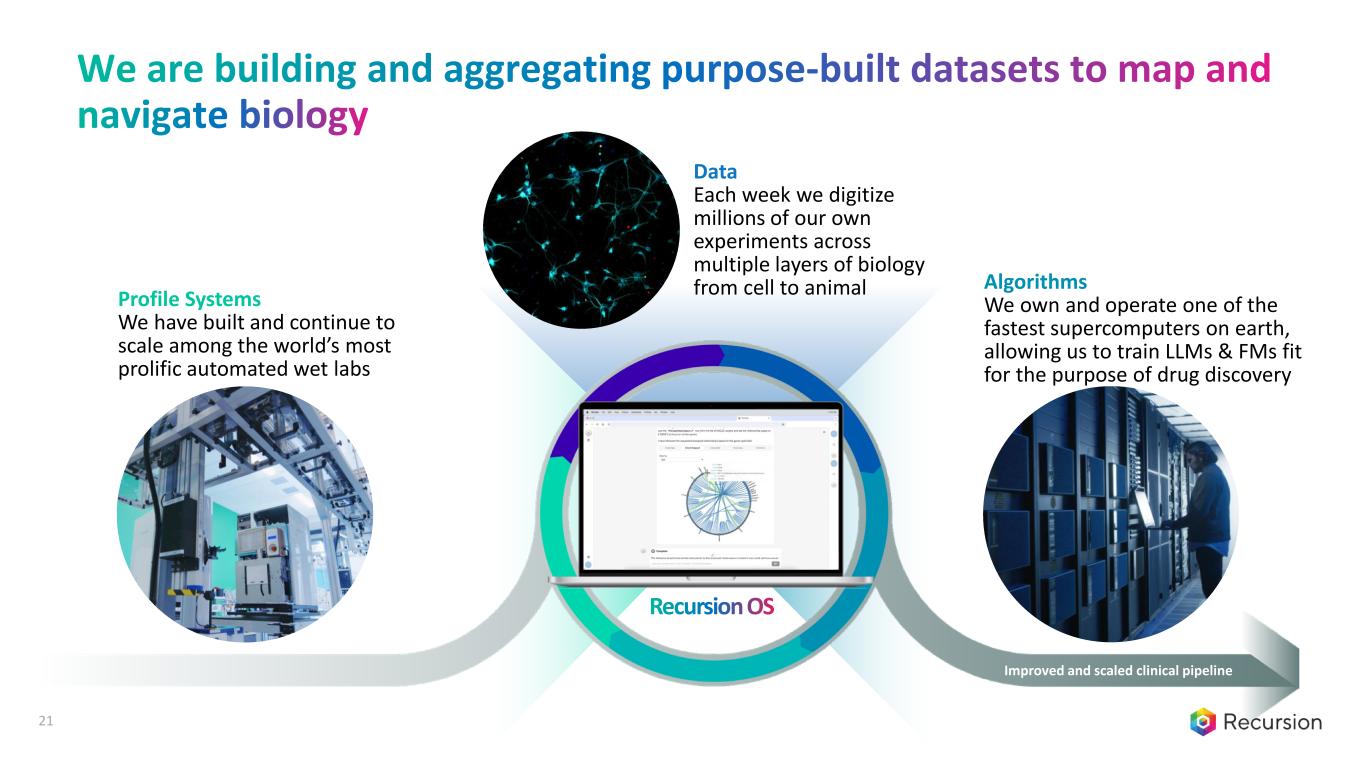

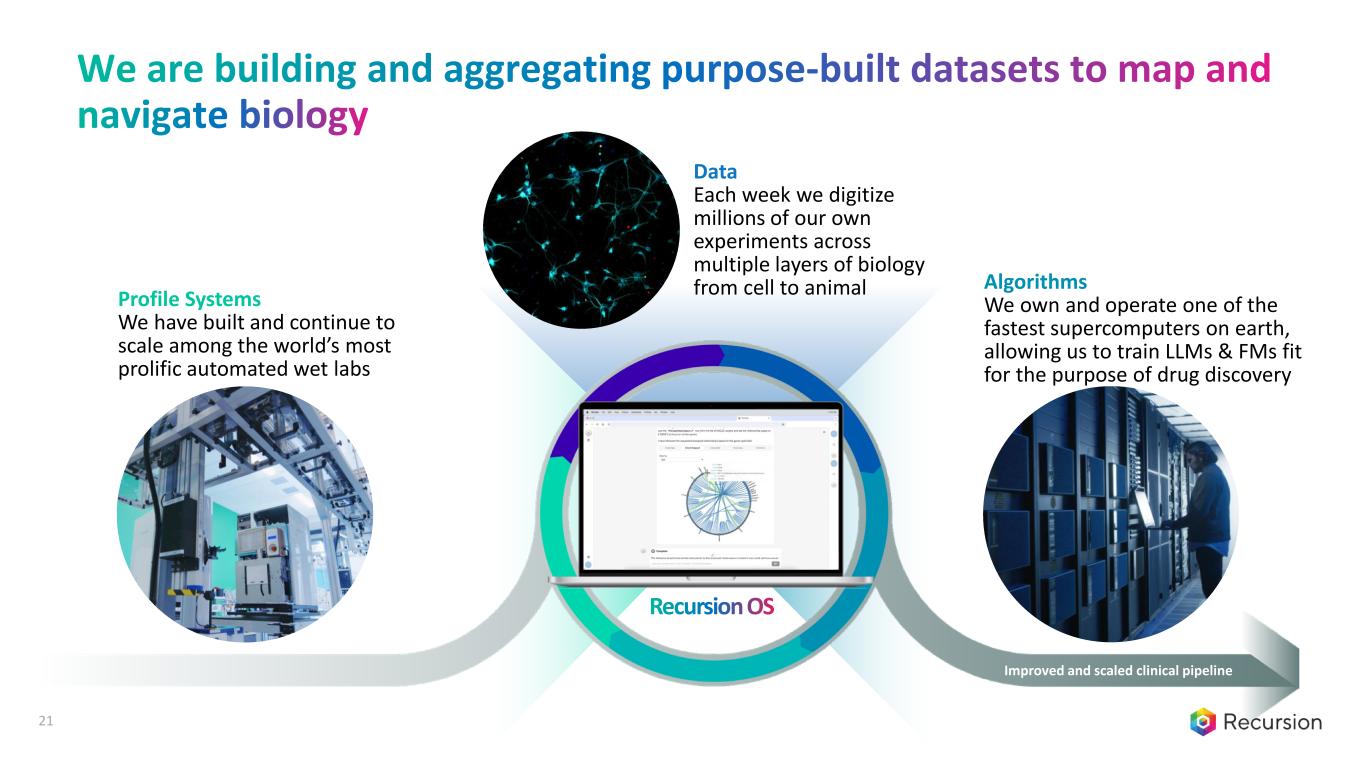

Algorithms We own and operate one of the fastest supercomputers on earth, allowing us to train LLMs & FMs fit for the purpose of drug discovery Profile Systems We have built and continue to scale among the world’s most prolific automated wet labs Data Each week we digitize millions of our own experiments across multiple layers of biology from cell to animal Improved and scaled clinical pipeline We are building and aggregating purpose-built datasets to map and navigate biology Recursion OS 21

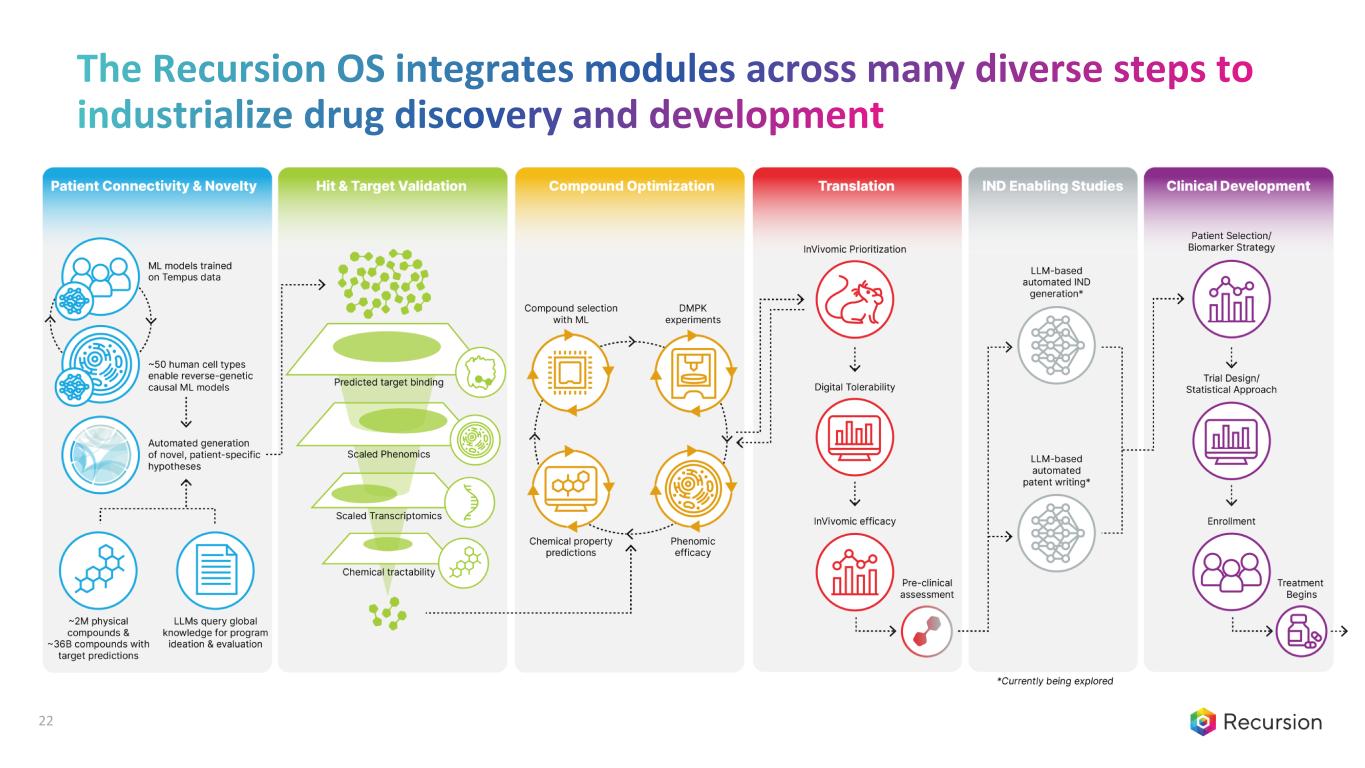

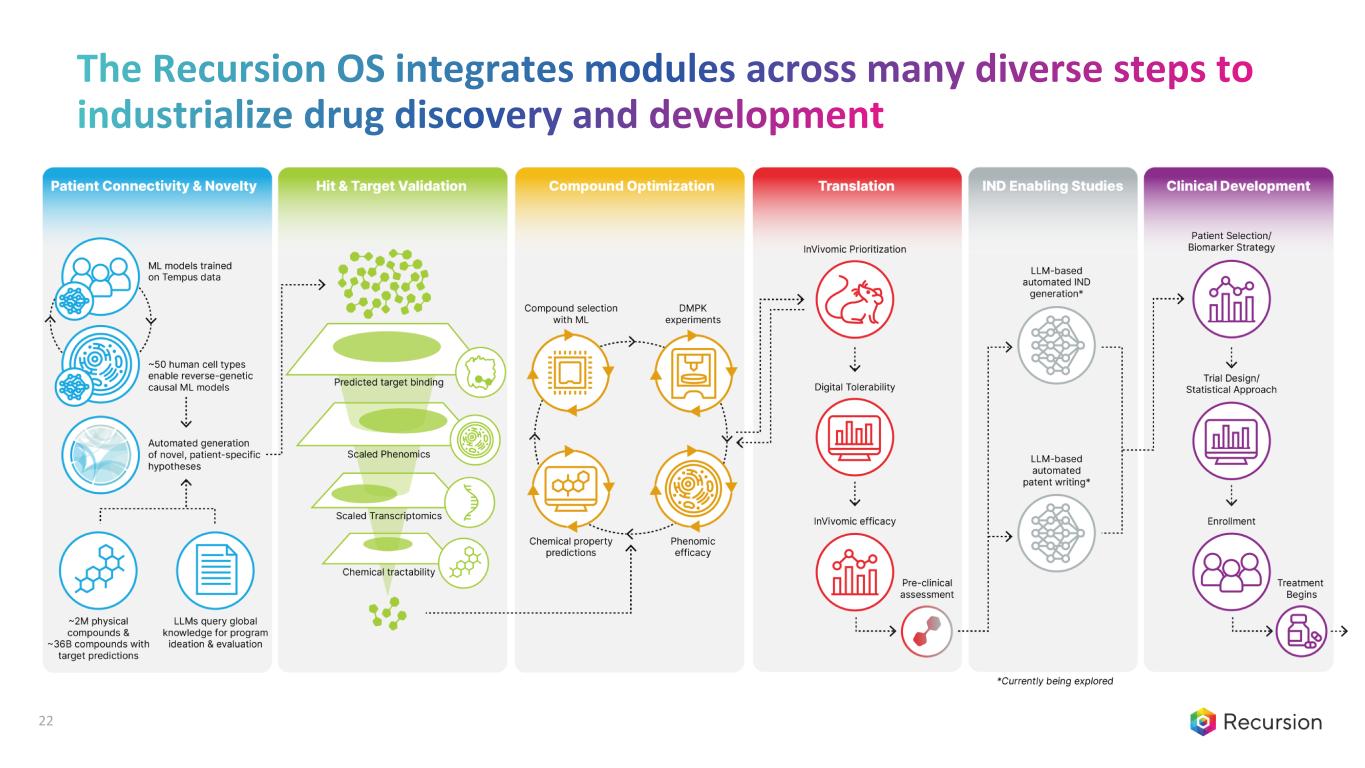

22 The Recursion OS integrates modules across many diverse steps to industrialize drug discovery and development

23 We connect data layers to build multiomic digital maps of biology

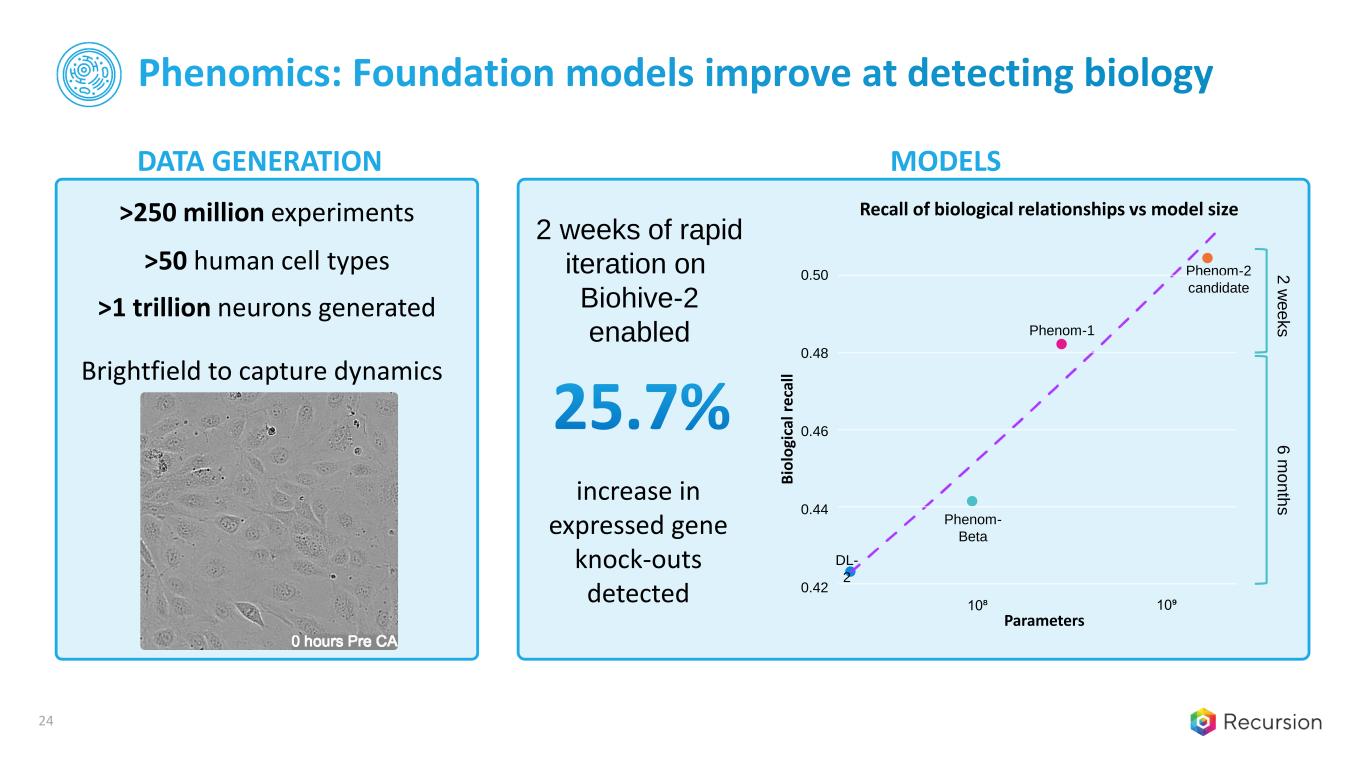

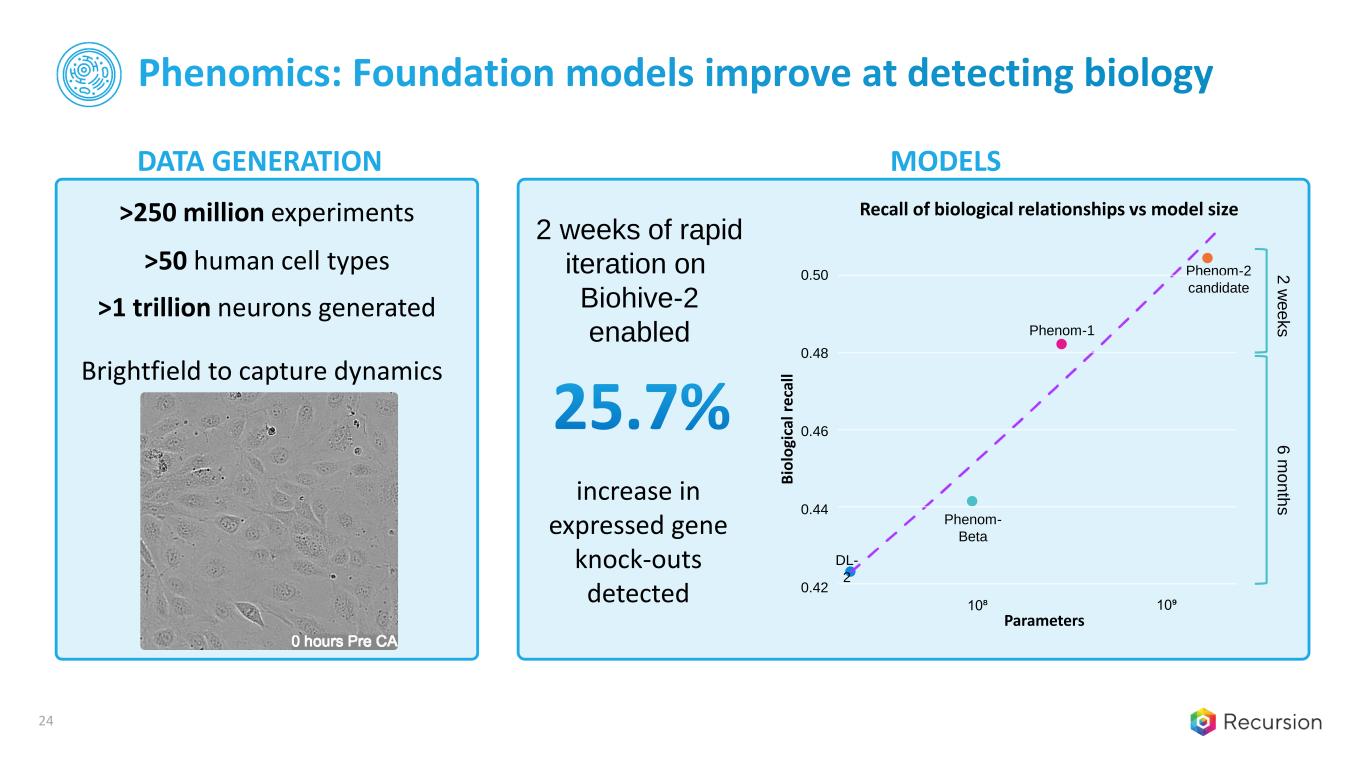

Phenomics: Foundation models improve at detecting biology Brightfield to capture dynamics DATA GENERATION MODELS 25.7% increase in expressed gene knock-outs detected >250 million experiments >50 human cell types >1 trillion neurons generated 2 w e e k s Parameters B io lo gi ca l r ec al l Recall of biological relationships vs model size 0.48 0.50 0.46 0.44 0.42 10⁸ 10⁹ DL- 2 Phenom- Beta Phenom-1 Phenom-2 candidate 6 m o n th s 2 weeks of rapid iteration on Biohive-2 enabled 24

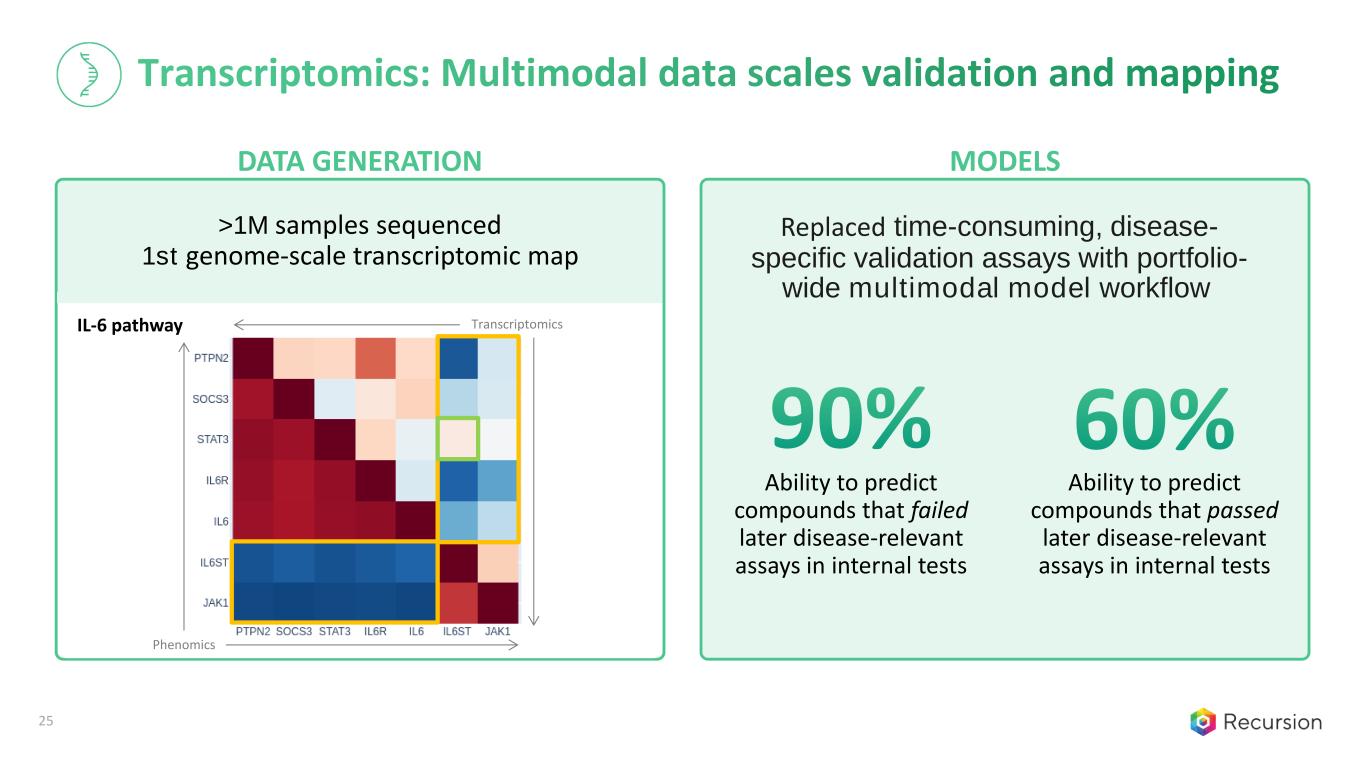

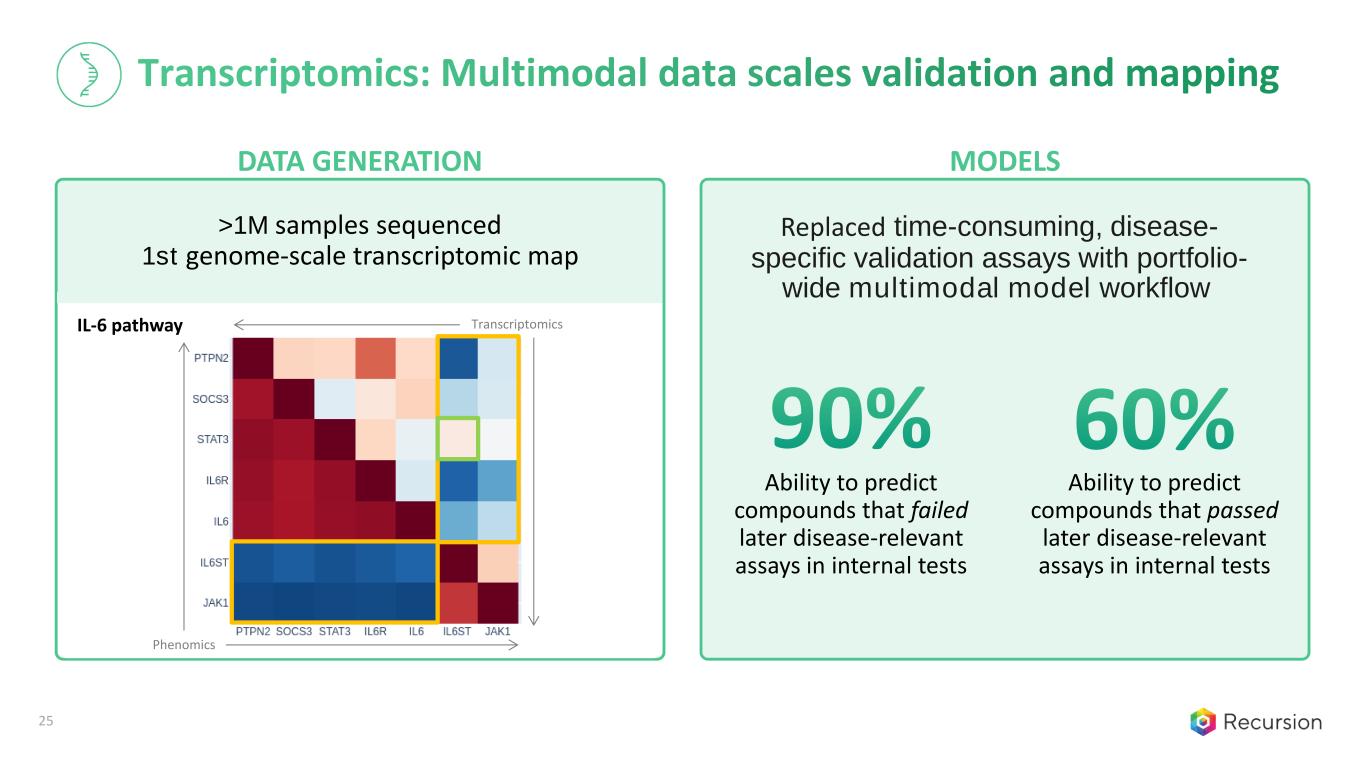

Transcriptomics: Multimodal data scales validation and mapping >1M samples sequenced 1st genome-scale transcriptomic map DATA GENERATION MODELS 90% Ability to predict compounds that failed later disease-relevant assays in internal tests 60% Ability to predict compounds that passed later disease-relevant assays in internal tests Replaced time-consuming, disease- specific validation assays with portfolio- wide multimodal model workflow IL-6 pathway Transcriptomics Phenomics 25

1.25 1.00 0.75 0.50 0.25 0.00 -0.25 10⁶ 10⁷ 10⁸ 10⁹ Generalized performance over all 22 TDC ADMET datasets Number of parameters N o rm a liz e d p e rf o rm a n c e DATA GENERATION MODELS ADME: Data and scale lead to State of the Art models Estimated 90x throughput over manual approach >750 compounds per week Our single generalizable model improves with multimodal data and model size External best model 2024 Average of all TDC models 26

DATA GENERATION MODELS InVivomics accelerates decision-making in late discovery • Machine learning enables scale by extracting signals from video and temperature sensors • Applied across breadth of Recursion portfolio • Designed to select the right molecule at the right dose before entering efficacy studies >1,000 digital mouse cages 150 digital rat cages in 2024 Social housing increases relevance 27

DATA GENERATION MODELS Patient Data: Path to uncover novel disease drivers with Maps >20 PB of real-world multi-modal oncology data Hundreds of thousands of unique de-identified patient records across diverse therapeutic areas Combining Recursion maps of biology with patient clinical data unlocks causal modeling to find novel targets 28

Screen — Hit ID — Validated Lead — Advanced Candidate — Development Candidate — Industry Recursion Failing faster and earlier to › › spend less › C o st t o IN D ( $ M ) › and go faster 100 80 60 51 80% 75% 85% 100 55 18 55% 32% 62% 7 37% St ag e Ti m e t o V al id at ed L e ad ( m o ) 4 Industry Recursion We believe that, compared to industry averages, our approach enables us to: (i) identify low-viability programs earlier in the research cycle, (i) spend less per program and (iii) rapidly advance program to a validated lead candidate. All industry data has been adapted from Paul, et al. Nature Reviews Drug Discovery. (2010) 9, 203–214. The cost to IND has been inflation- adjusted using the US Consumer Price Index (CPI) through 2023. The Recursion data shown for the transition stages and time to validated lead is the average of all Recursion programs since late 2017 through 2023. The Recursion data shown for cost to IND pertains to the actual and projected costs for a novel chemical entity to reach IND. The Recursion OS maps and navigates biology to shift drug discovery from bespoke science to scaled engineering 0 5 10 15 20 25 30 Industry Recursion 0 5 10 15 20 25 30 35 Industry Recursion 29

Recursion’s Approach High potential, unexplored Low potential, thoroughly explored Low potential, unexplored High potential, thoroughly explored Our unique approach creates novel opportunities 30

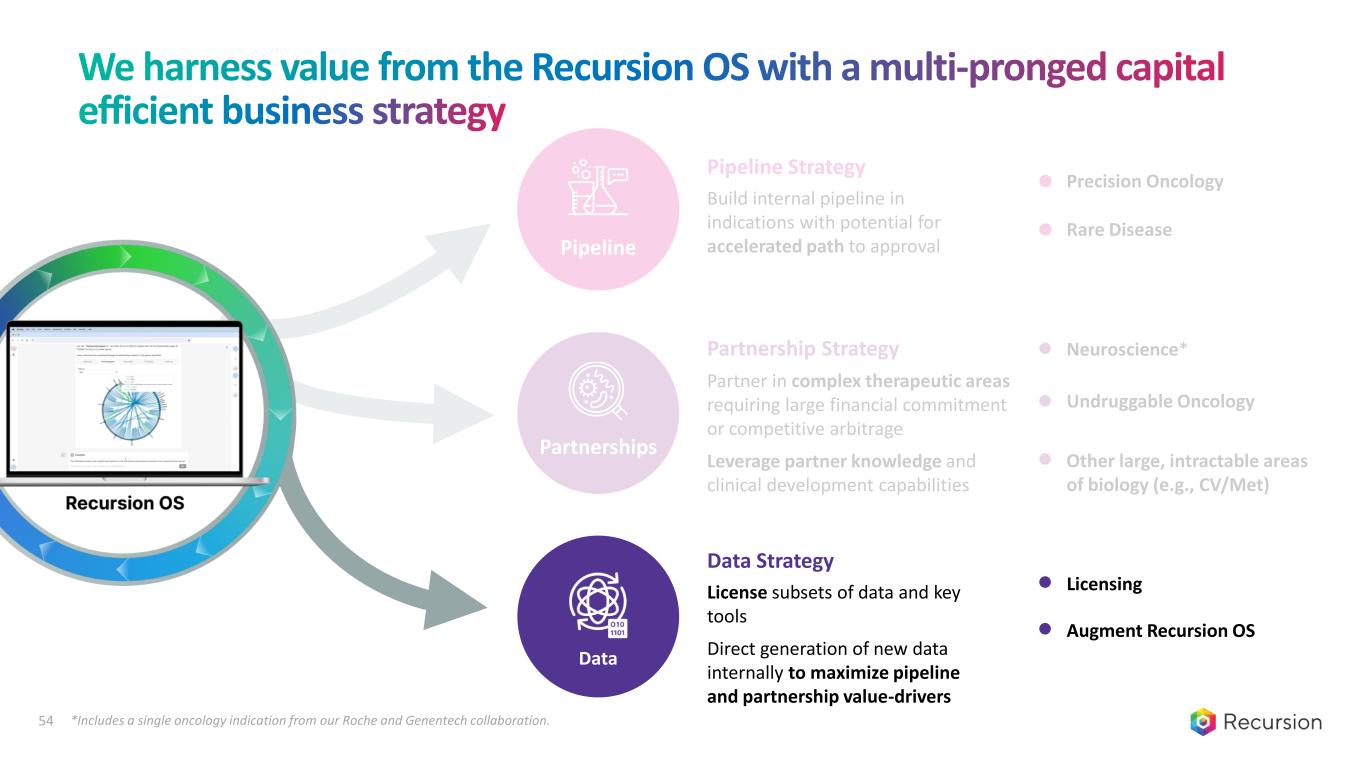

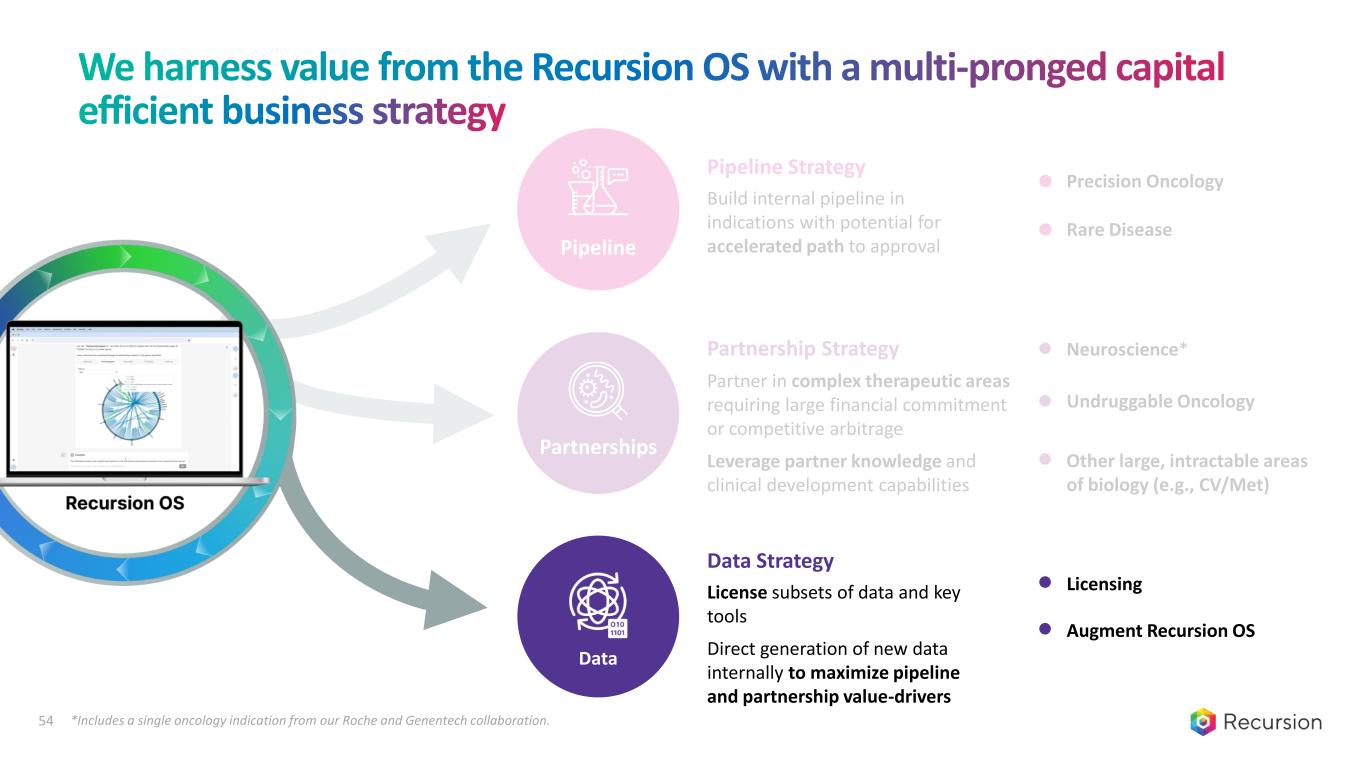

We harness value from the Recursion OS with a multi-pronged capital efficient business strategy Pipeline Build internal pipeline in indications with potential for accelerated path to approval Pipeline Strategy Precision Oncology Rare Disease Partnerships Data Partnership Strategy Partner in complex therapeutic areas requiring large financial commitment or competitive arbitrage Leverage partner knowledge and clinical development capabilities License subsets of data and key tools Direct generation of new data internally to maximize pipeline and partnership value-drivers Data Strategy Undruggable Oncology Other large, intractable areas of biology (e.g., CV/Met) Neuroscience* Licensing Augment Recursion OS *Includes a single oncology indication from our Roche and Genentech collaboration.31

Value Creation – Pipeline 32

Build internal pipeline in indications with potential for accelerated path to approval Pipeline Strategy Precision Oncology Rare Disease Pipeline Partnerships Data *Includes a single oncology indication from our Roche and Genentech collaboration. We harness value from the Recursion OS with a multi-pronged capital efficient business strategy 33

34 More than a dozen discovery and research programs in oncology or with our partners – first program optioned by Roche-Genentech in GI-oncology All populations defined above are US and EU5 incidence unless otherwise noted. EU5 is defined as France, Germany, Italy, Spain, and UK. (1) Prevalence for hereditary and sporadic symptomatic population. (2) Annual US and EU5 incidence for all NF2-driven meningiomas. (3) Prevalence for adult and pediatric population. (4) Our program has the potential to address several indications. (5) We have not finalized a target product profile for a specific indication. (6) Incidence for US only. (7) 2L+ drug-treatable population. (8) 2L+ drug-treatable population comprising ovarian, prostate, breast, and pancreatic cancers. Program Indication Target Patient Population Preclinical Phase 1 Phase 2 Phase 3 Anticipated Near-Term Milestones REC-994 Cerebral Cavernous Malformation Superoxide ~ 360K1 Encouraging Ph2 data, meeting with FDA is anticipated REC-2282 Neurofibromatosis Type 2 HDAC ~ 33K2 Preliminary data readout in Q4 2024 REC-4881 Familial Adenomatous Polyposis MEK ~ 50K3 Preliminary data readout in H1 2025 REC-3964 Clostridioides difficile Infection TcdB ~730K Ph2 initiation in Q4 2024 Epsilon Fibrotic Diseases Undisclosed ~ 50K4,5,6 IND submission in early 2025 REC-4881 Advanced AXIN1/APC-mutant Cancers MEK ~ 104K7 Preliminary data readout in H1 2025 REC-1245 Advanced HR-Proficient Cancers RBM39 ~ 220K8 IND submission in Q3 2024, Ph 1/2 initiation in Q4 2024 Our pipeline reflects the scale and breadth of our approach R ar e & O th e r O n co lo gy LILAC SYCAMORE POPLAR ALDER TUPELO

PATHOPHYSIOLOGY & REASON TO BELIEVE PREVALENCE & STANDARD OF CARE CAUSE KEY ELEMENTS Symptomatic US + EU5, >1 million patients worldwide live with these lesions today LOF mutations in genes CCM1, CCM2 & CCM3, key for maintaining the structural integrity of the vasculature due to unknown mechanisms Efficacy signal in Recursion OS as well as functional validation via scavenging of massive superoxide accumulation in cellular models; reduction in lesion number with chronic administration in mice • Targeting sporadic and familial symptomatic CCM patients with CCM1, CCM2, and CCM3 mutations • Superoxide scavenger, small molecule • Encouraging Phase 2 data, meeting with FDA is anticipated as soon as practical • US & EU Orphan Drug Designation ~360,000 Vascular malformations of the CNS leading to focal neurological deficits, hemorrhage and other symptoms No approved therapy • Most patients receive no treatment or only symptomatic therapy • Surgical resection or stereotactic radiosurgery not always feasible because of location and is not curative >5x larger US patient population than other rare diseases like Cystic Fibrosis (>31k patients) Clinical: CCM SYCAMORE Clinical Trial : REC-994 for CCM Phase 2 Vascular malformations (cavernomas) Julia – living with CCM 35

Outcome Measures Enrollment Criteria • MRI-confirmed CCM lesion(s) • Familial or sporadic • Symptoms directly related to CCM • Primary: Safety and tolerability • Secondary: Efficacy • Exploratory: Biomarkers Trial Update 400mg 200mg Placebo Visits: Days 1 & 2 Months 1, 3, 6, 9 & 12 Enroll ~60 Extension Study 12 Months Treatment Period Screening & Randomization 1:1:1 Treatment Follow-up Topline Data Delivered September 2024 Source : The Symptomatic Cerebral Cavernous Malformation Trial of REC-994 (SYCAMORE) Clinical: CCM SYCAMORE Clinical Trial: REC-994 for CCM Phase 2 36 80% of participants elected to join the extension study Meeting with FDA is anticipated as soon as practical to discuss plans for additional clinical study

PATHOPHYSIOLOGY & REASON TO BELIEVE PREVALENCE & STANDARD OF CARE CAUSE KEY ELEMENTS LOF mutations in NF2 tumor suppressor gene, leading to deficiencies in the tumor suppressor protein merlin Efficacy signal in Recursion OS, cellular, and animal models; suppression of aberrant ERK, AKT, and S6 pathway activation in a Phase 1 PD Study in NF2 patient tumors ~33,000 Inherited rare CNS tumor syndrome leading to loss of hearing and mobility, other focal neurologic deficits Clinical: NF2 POPLAR Trial: REC-2282 for NF2 Part A Fully Enrolled No approved therapy • Surgery/RT is standard of care (when feasible) • Location may make complete resection untenable, leading to hearing loss, facial paralysis, poor balance and visual difficulty • Stasis or shrinkage of tumor could improve prognosis Treatable US + EU • Targeting familial & sporadic NF2 meningioma patients • CNS penetrant HDAC inhibitor • Oral dosing • Part A (adult cohort) fully enrolled • Preliminary readout expected Q4 2024 • Fast-track and US & EU Orphan Drug Designation Ricki – living with NF2 Intracranial meningiomas 37

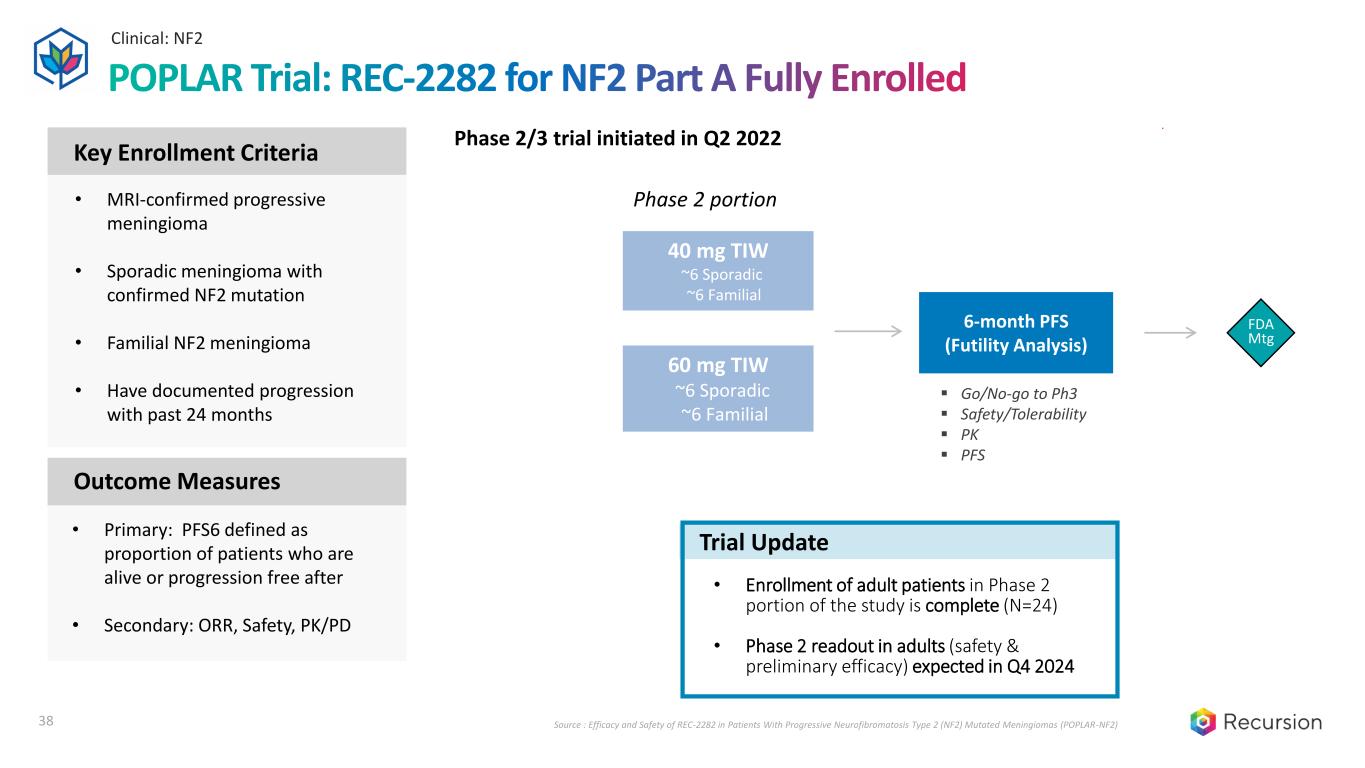

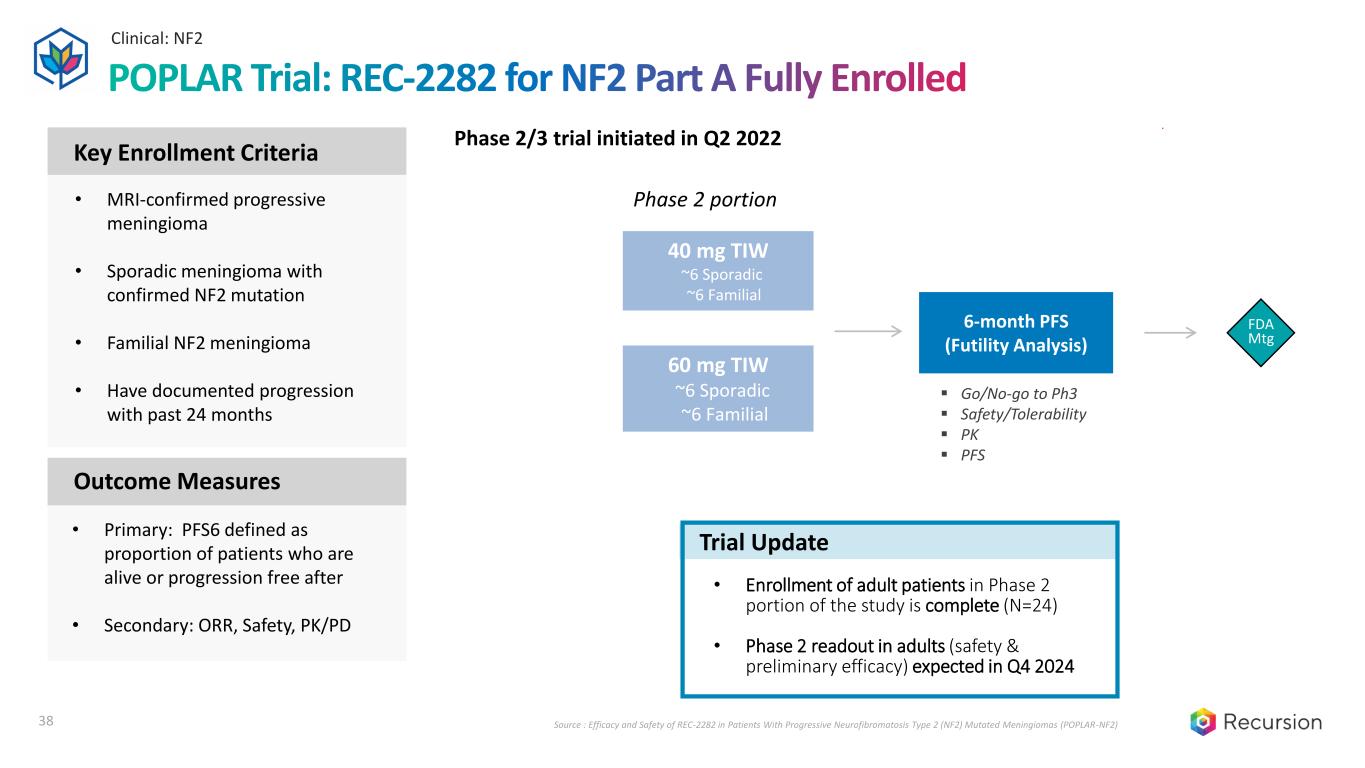

Clinical: NF2 POPLAR Trial: REC-2282 for NF2 Part A Fully Enrolled Phase 2/3 trial initiated in Q2 2022 Outcome Measures Key Enrollment Criteria • MRI-confirmed progressive meningioma • Sporadic meningioma with confirmed NF2 mutation • Familial NF2 meningioma • Have documented progression with past 24 months • Primary: PFS6 defined as proportion of patients who are alive or progression free after • Secondary: ORR, Safety, PK/PD Source : Efficacy and Safety of REC-2282 in Patients With Progressive Neurofibromatosis Type 2 (NF2) Mutated Meningiomas (POPLAR-NF2) Phase 2 portion FDA Mtg 6-month PFS (Futility Analysis) ▪ Go/No-go to Ph3 ▪ Safety/Tolerability ▪ PK ▪ PFS 40 mg TIW ~6 Sporadic ~6 Familial 60 mg TIW ~6 Sporadic ~6 Familial Trial Update • Enrollment of adult patients in Phase 2 portion of the study is complete (N=24) • Phase 2 readout in adults (safety & preliminary efficacy) expected in Q4 2024 38

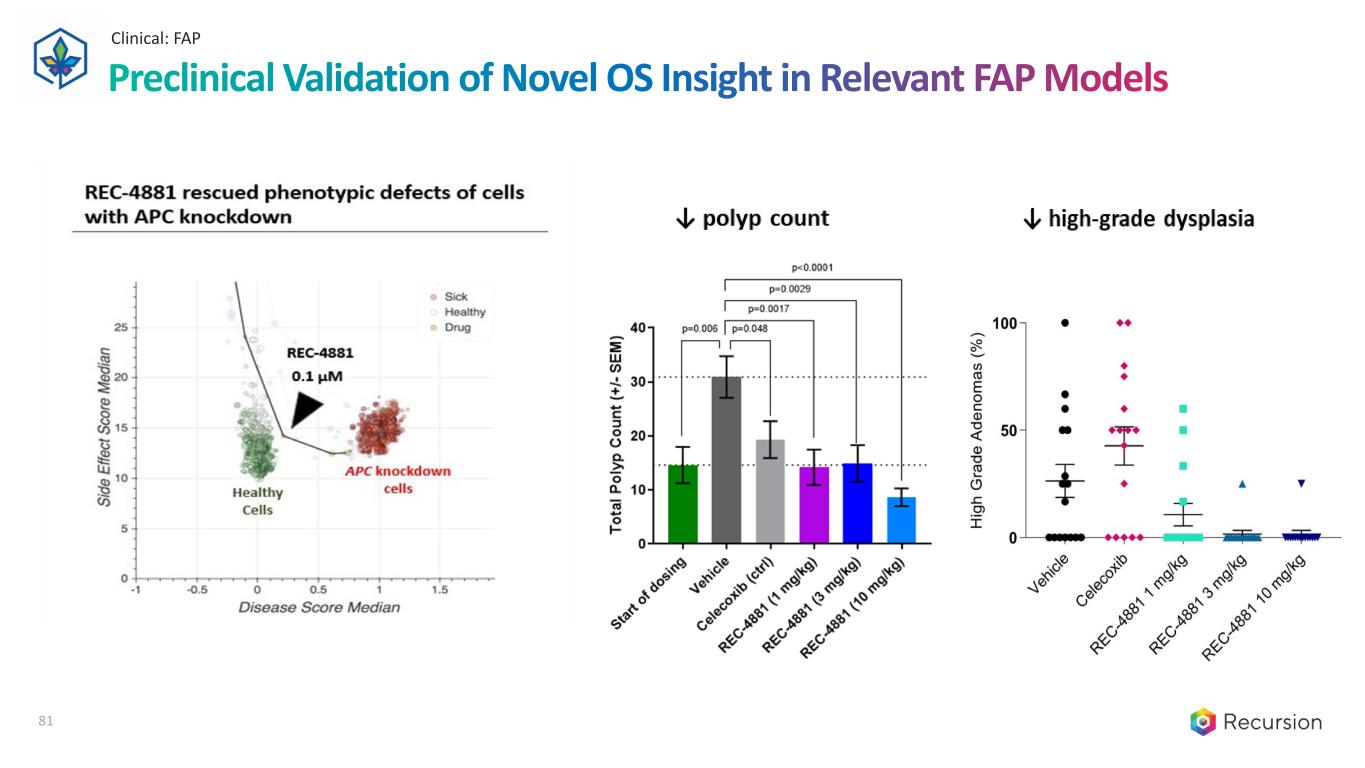

Clinical: FAP TUPELO Clinical Trial : REC-4881 for FAP Phase 2 Underway Polyps Found in Colon and Upper GI Tract PATHOPHYSIOLOGY & REASON TO BELIEVE PREVALENCE & STANDARD OF CARE CAUSE KEY ELEMENTS Inactivating mutations in the tumor suppressor gene APC • Targeting classical FAP patients (with APC mutation) • MEK inhibitor, small molecule • Oral dosing • Preliminary readout expected H1 2025 • Fast-Track and US & EU Orphan Drug Designation Polyps throughout the GI tract with extremely high risk of malignant transformation Efficacy signal in the Recursion OS showed specific MEK 1/2 inhibitors had an effect in context of APC LOF. Subsequent APCmin mouse model showed potent reduction in polyps and dysplastic adenomas No approved therapy • Colectomy during adolescence (with or without removal of rectum) is standard of care • Post-colectomy, patients still at significant risk of polyps progressing to GI cancer • Significant decrease in quality-of-life post-colectomy (continued endoscopies, surgical intervention) Diagnosed US + EU~50,000 39

Clinical: FAP TUPELO Clinical Trial : REC-4881 for FAP Phase 2 Underway Source : Evaluate REC-4881 in Patients With FAP (TUPELO) Part 2 Enrollment Commenced Outcome Measures Key Enrollment Criteria • Confirmed APC mutation • ≥ 55 years old • Post-colectomy/proctocolectomy • No cancer present • Polyps in either duodenum (including ampulla of vater) or rectum/pouch • Primary: • Safety & Tolerability • Change from baseline in polyp burden at 12 weeks • RP2D • Secondary: • PK/PD Part 2 Dose Expansion at RP2D • Futility Assessment • Go/No-Go Single agent REC-4881 Dose Escalation • Safety • Tolerability • PK/PD Screening & Treatment 4 mg QD (n ≤ 6) 8 mg QD (n ≤ 6) 12 mg QD (n ≤ 6) Recommended Phase 2 Dose Phase 2 initiated preliminary readout expected by H1 2025 Trial Update 40

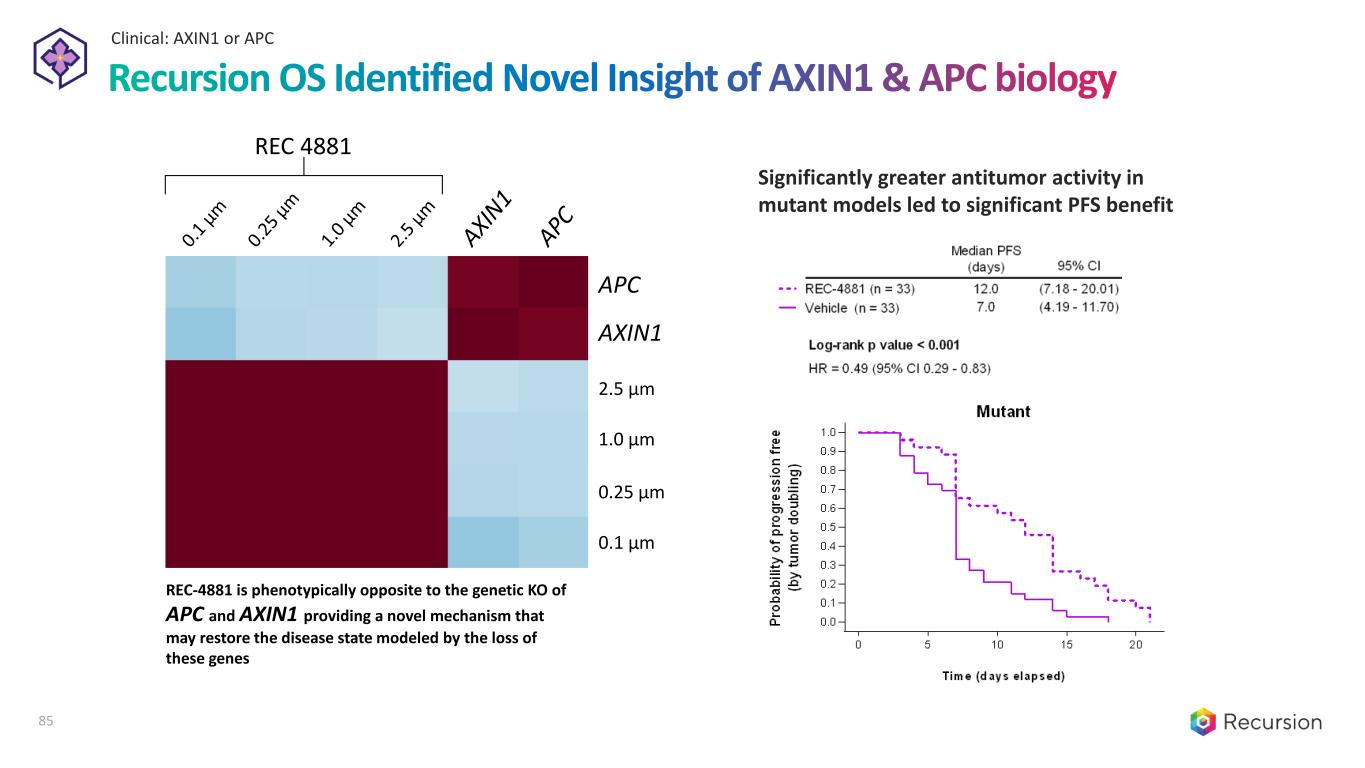

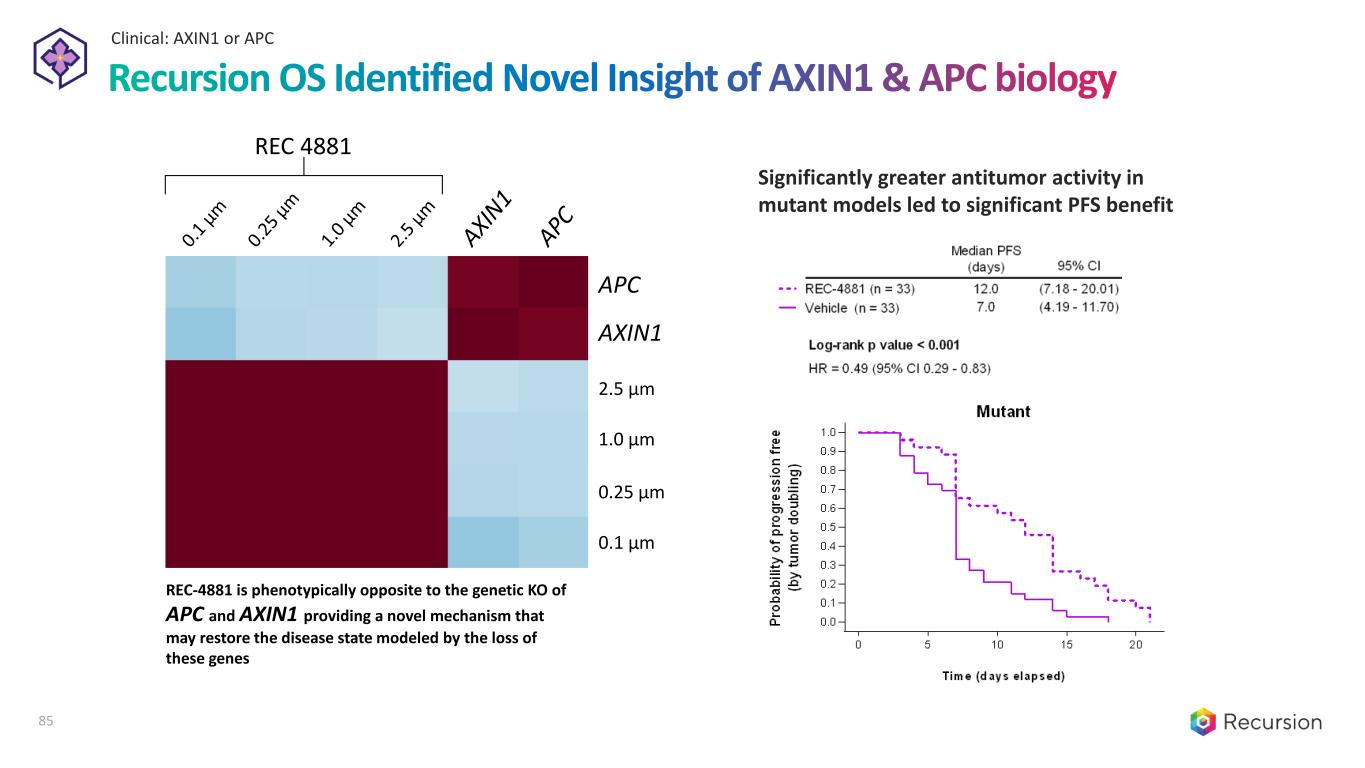

Clinical: AXIN1 or APC LILAC Clinical Trial: REC-4881 for AXIN1 or APC mutant cancers PATHOPHYSIOLOGY & REASON TO BELIEVE PREVALENCE & STANDARD OF CARE CAUSE KEY ELEMENTS LOF mutations in AXIN1 or APC tumor suppressor genes Treatable US + EU~104,000 Substantial need for developing therapeutics for patients harboring mutations in AXIN1 or APC, as these mutations are considered undruggable To our knowledge, REC-4881 is the only industry sponsored small molecule therapeutic designed to enroll solid tumor patients harboring mutations in AXIN1 or APC • Targeting AXIN1 or APC mutant cancers • MEK inhibitor, small molecule • Oral dosing • Enrollment ongoing • Phase 2 initial readout expected H1 2025 Alterations in the WNT pathway are found in a wide variety of tumors and confer poor prognosis and resistance to standard of care Efficacy signal in the Recursion OS and favorable results in PDX models harboring AXIN1 or APC mutations vs wild-type leading to a significant PFS benefit only in mutant models AXIN1/APC regulate WNT signaling 41

Clinical: AXIN1 or APC LILAC Clinical Trial: REC-4881 for AXIN1 or APC mutant cancers FPI achieved Q1 2024 Outcome Measures Enrollment Criteria • Unresectable, locally advanced, or metastatic cancers • ≥ 55 years old • AXIN1 or APC mutation confirmed by NGS (tissue or blood) • CRC patients must be RAS / RAF wildtype • No MEK inhibitor treatment within 2 months of initial dose • ≥ 1 prior line of therapy • ECOG PS 0-1 • Primary • Safety/tolerability • ORR (RECIST 1.1) • Secondary • PK • Additional efficacy parameters Source : A Study of REC-4881 in Participants With Cancers Which Have an AXIN1 or APC Mutation Screening & Treatment Safety Assessment 12 mg REC-4881 QD R P 2 D AXIN1 (n=10) APC (n=10) Futility Assessment AXIN1 (n=10) APC (n=10) Once 10 pts enrolled in each cohort with ≥ 1 scan post-baseline Futility Assessment Part 1 Part 2 • Utilizing genomics & RWD data for patient/site matching • Phase 2 initial readout expected H1 2025 Trial Update 42

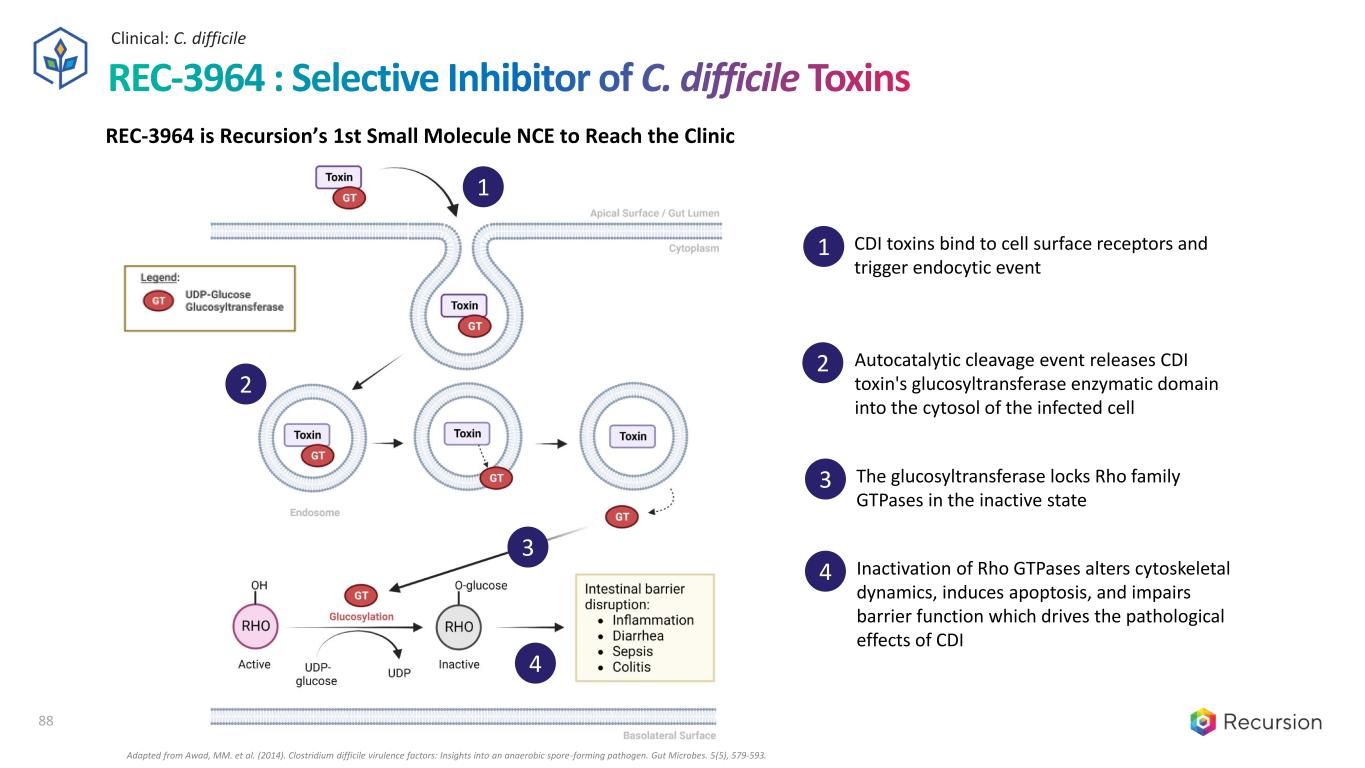

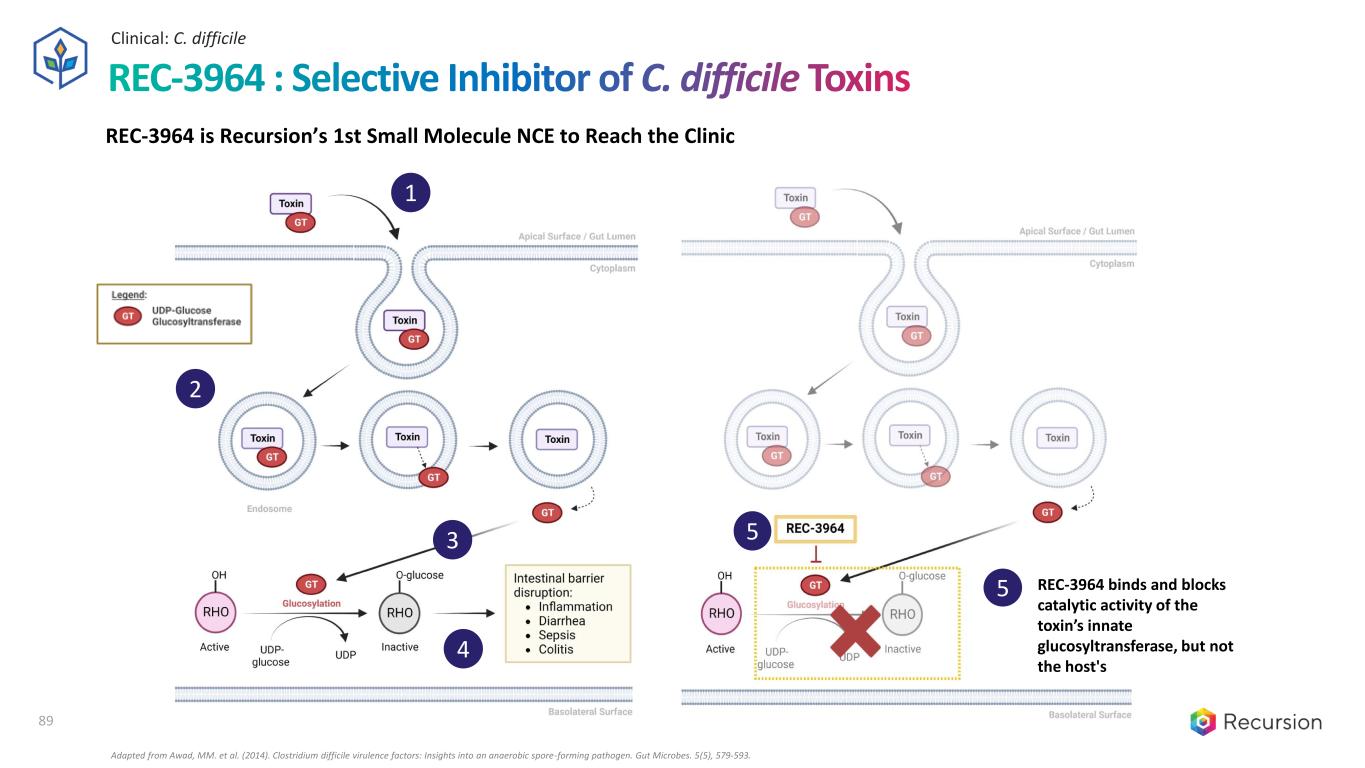

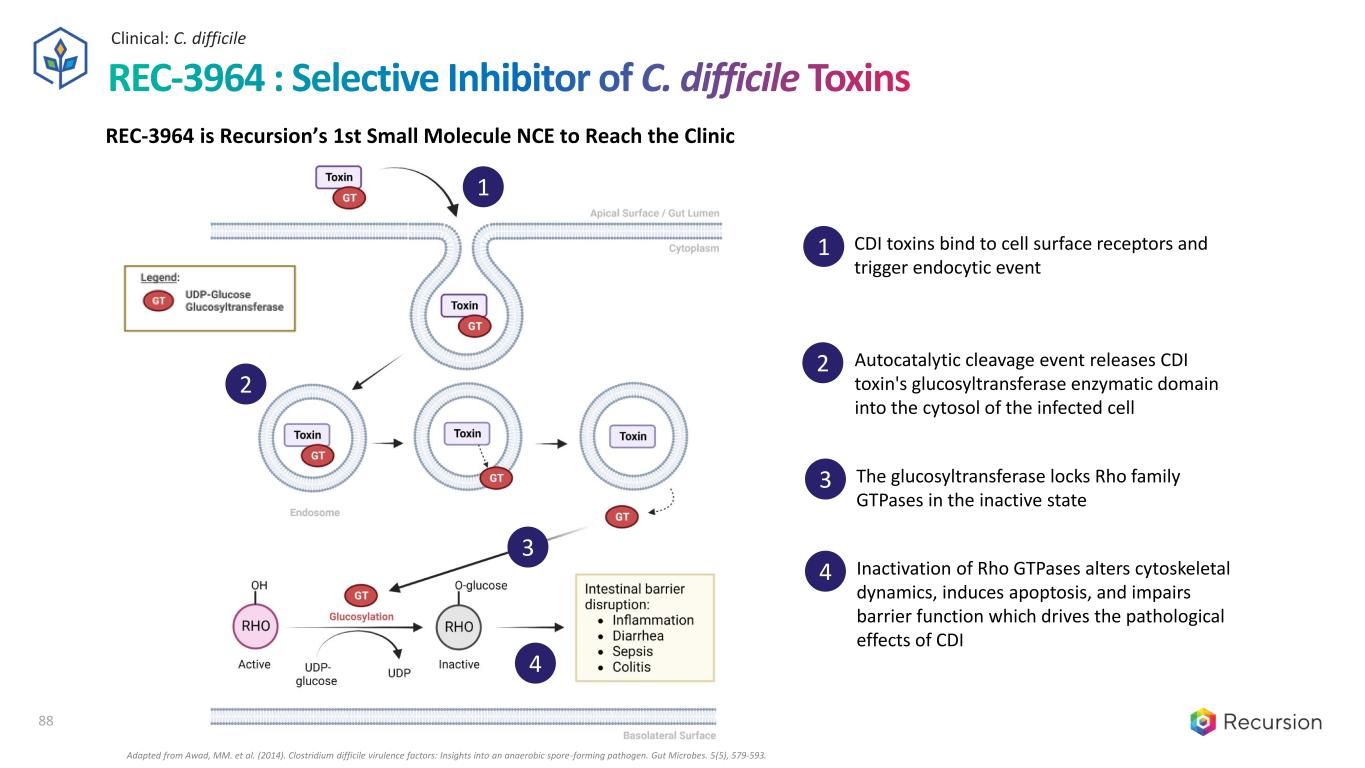

Clinical: C. difficile ALDER Clinical Trial: REC-3964 for C. Difficile PATHOPHYSIOLOGY & REASON TO BELIEVE ~730,000 Diagnosed US + EU5 patients • Severity of infection varies and can range from mild to severe, requiring colectomy • >29,000 patients die in the US each year from CDI • Cost burden of up to $4.8bn annually TREATMENT PARADIGM • Standard of care for 1st occurrence: Antibiotics alone • Recurrence (20-30% of patients) treated with antibiotics ± adjunct therapy (bezlotoxumab IV or fecal transplant) • REC3964 inhibits the C. difficile toxins and is a non-antibiotic therapy • Selective Inhibitor of C. difficile Toxins • Recursion's 1st Small Molecule NCE to Reach the Clinic • Binds and blocks catalytic activity of the toxin's innate glucosyltransferase, but not the host’s PATHOPHYSIOLOGY & REASON TO BELIEVE PREVALENCE & STANDARD OF CARE 43

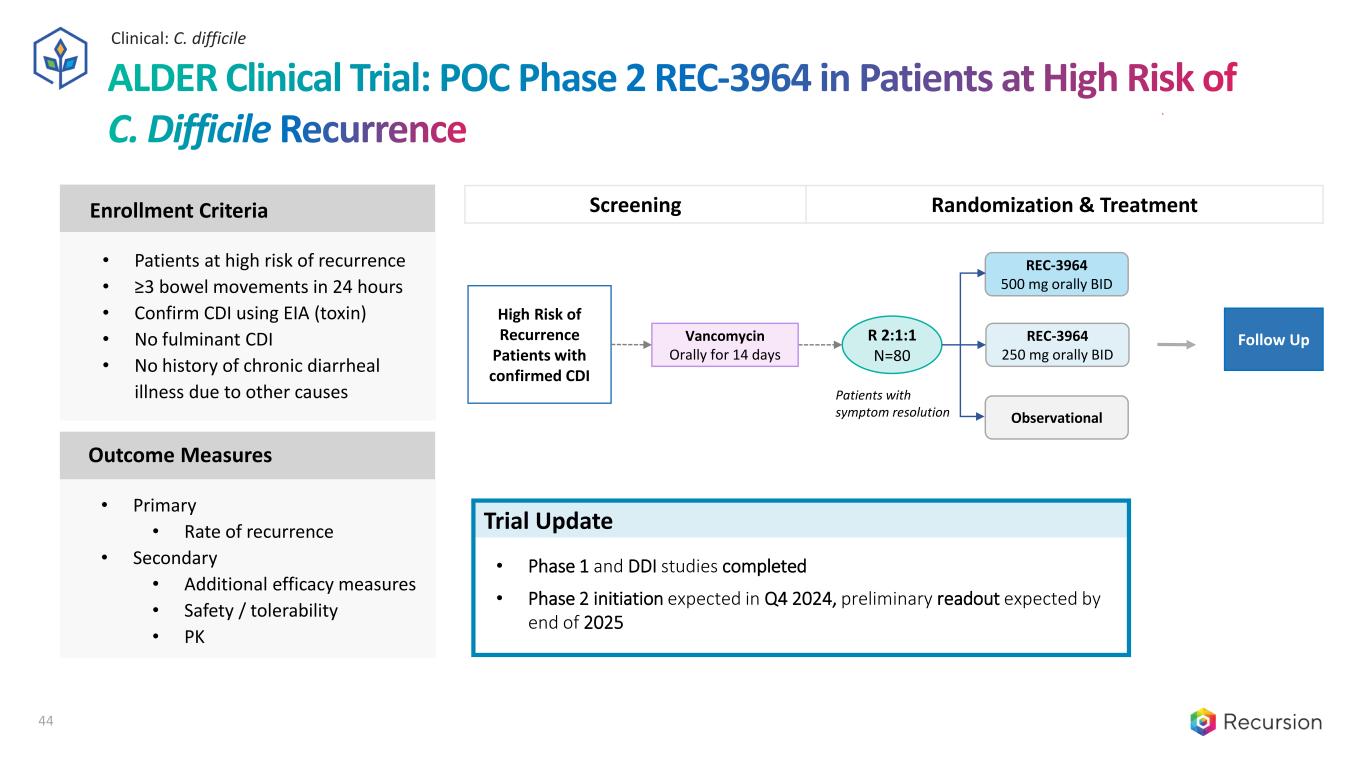

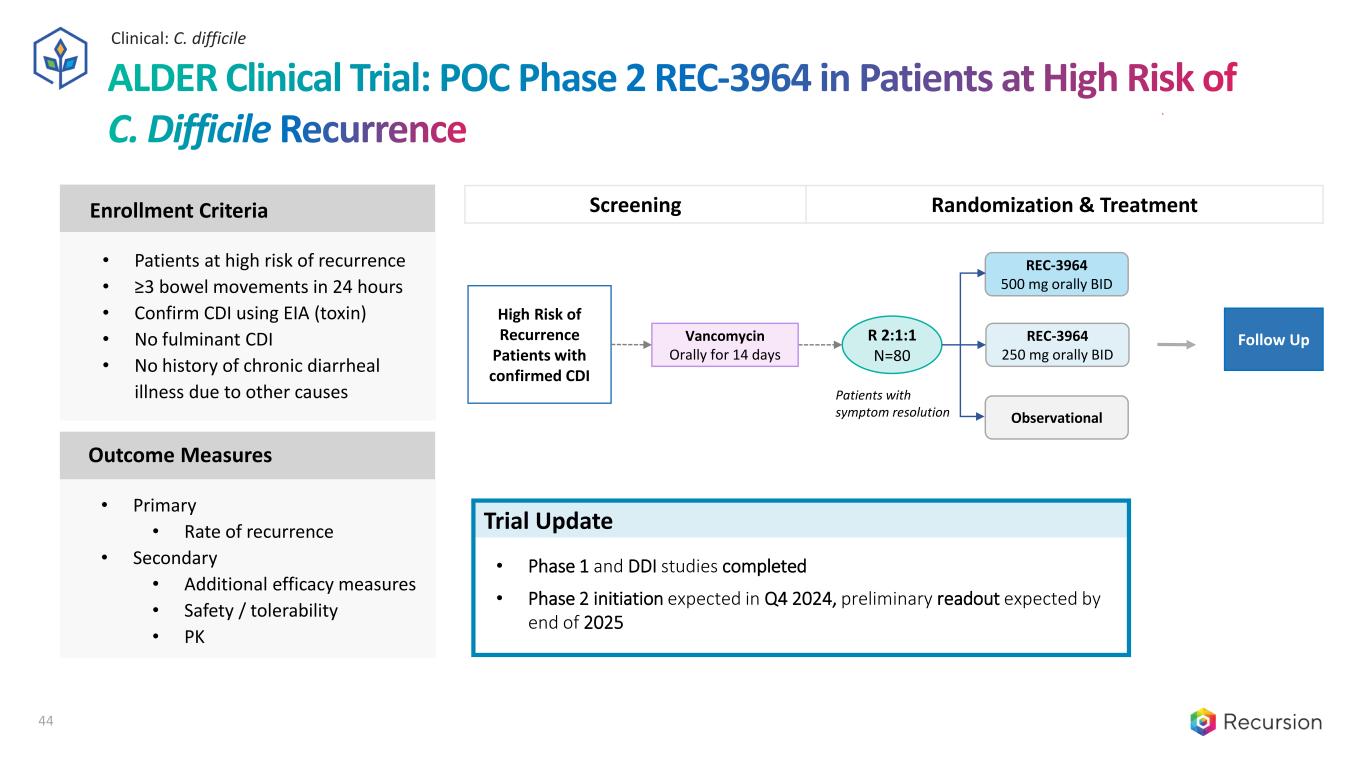

ALDER Clinical Trial: POC Phase 2 REC-3964 in Patients at High Risk of C. Difficile Recurrence Trial Update Clinical: C. difficile Screening Randomization & Treatment • Phase 1 and DDI studies completed • Phase 2 initiation expected in Q4 2024, preliminary readout expected by end of 2025 REC-3964 250 mg orally BID REC-3964 500 mg orally BID Observational R 2:1:1 N=80 High Risk of Recurrence Patients with confirmed CDI Vancomycin Orally for 14 days Follow Up Patients with symptom resolution Outcome Measures • Patients at high risk of recurrence • ≥3 bowel movements in 24 hours • Confirm CDI using EIA (toxin) • No fulminant CDI • No history of chronic diarrheal illness due to other causes • Primary • Rate of recurrence • Secondary • Additional efficacy measures • Safety / tolerability • PK Enrollment Criteria 44

Similar Opposite BRCA-proficient ovarian cancer PDX Identify tumor-targeted precision therapeutic NCE with novel MOA capable of potentially treating HR-proficient cancers Inhibition of target RBM39 (previously referred to as Target γ) may mimic the inhibition of CDK12 while mitigating toxicity related to CDK13 inhibition A Recursion-generated NCE showed single agent efficacy that is enhanced in combination with Niraparib in a BRCA-proficient PDX model IND submission in Q3 2024 with Phase 1/2 dose finding / confirmation study expected to initiate in Q4 2024 GOAL INSIGHT FROM OS FURTHER CONFIDENCE NEXT STEPS Vehicle Niraparib REC-204 100 mpk REC-204 100 mpk + Niraparib OV0273 (PDX) in-vivo efficacy Survival data Note: in the OV0273 PDX model, mice were treated with a representative lead molecule REC-1170204 (100 mg/kg, BID, PO) ± Niraparib (40 mg/kg, QD, PO) for 28 days. Single agent REC-1170204 or in combination with Niraparib resulted in a statistically significant response vs either Niraparib or vehicle arms. In addition, there was a statistically significant improvement in survival > 30 days post final dose. *p<0.05, ** p<0.01, **** p<0.0001 CDK12 RBM39 2.5 µM 1.0 µM 0.25 µM 0.1 µM CDK13 REC-1170204 Preclinical: REC-1245 REC-1245: RBM39 Inhibition for Advanced HR-Proficient Cancers 45

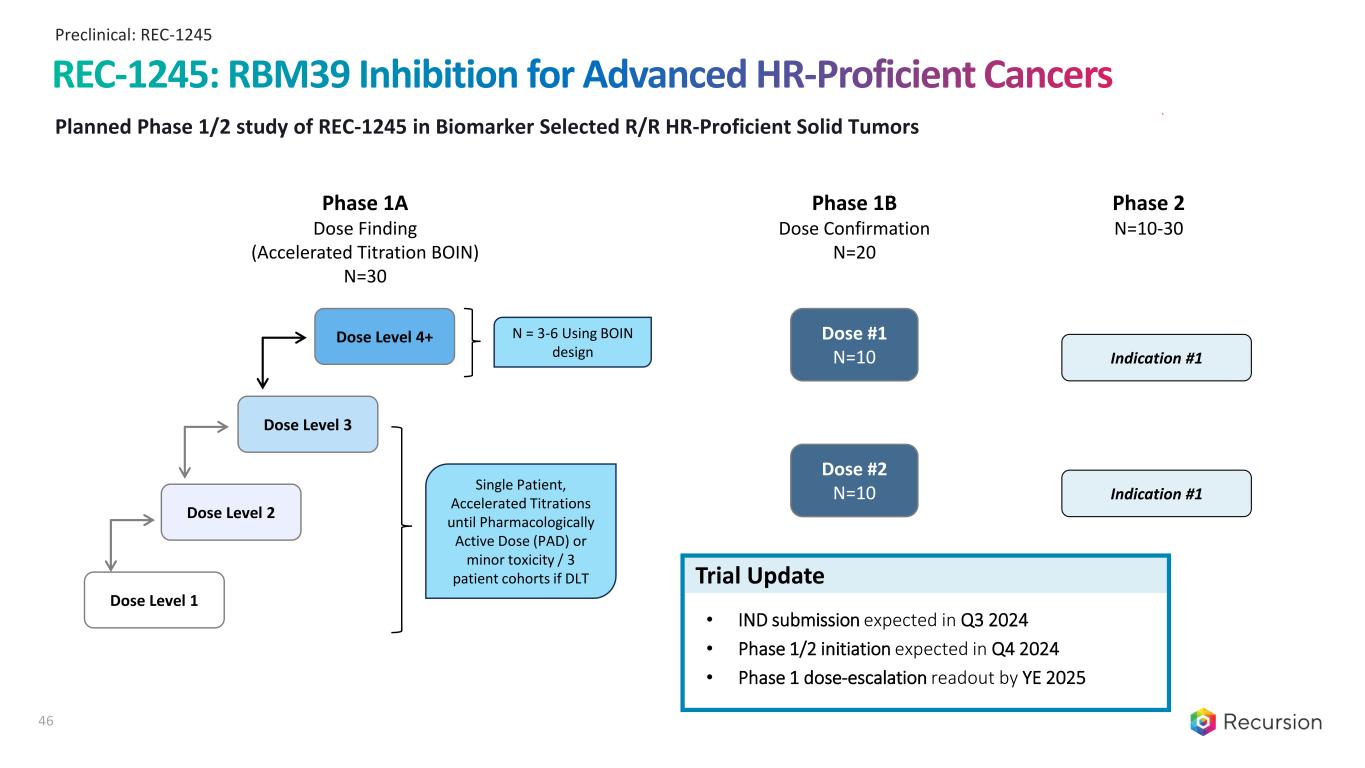

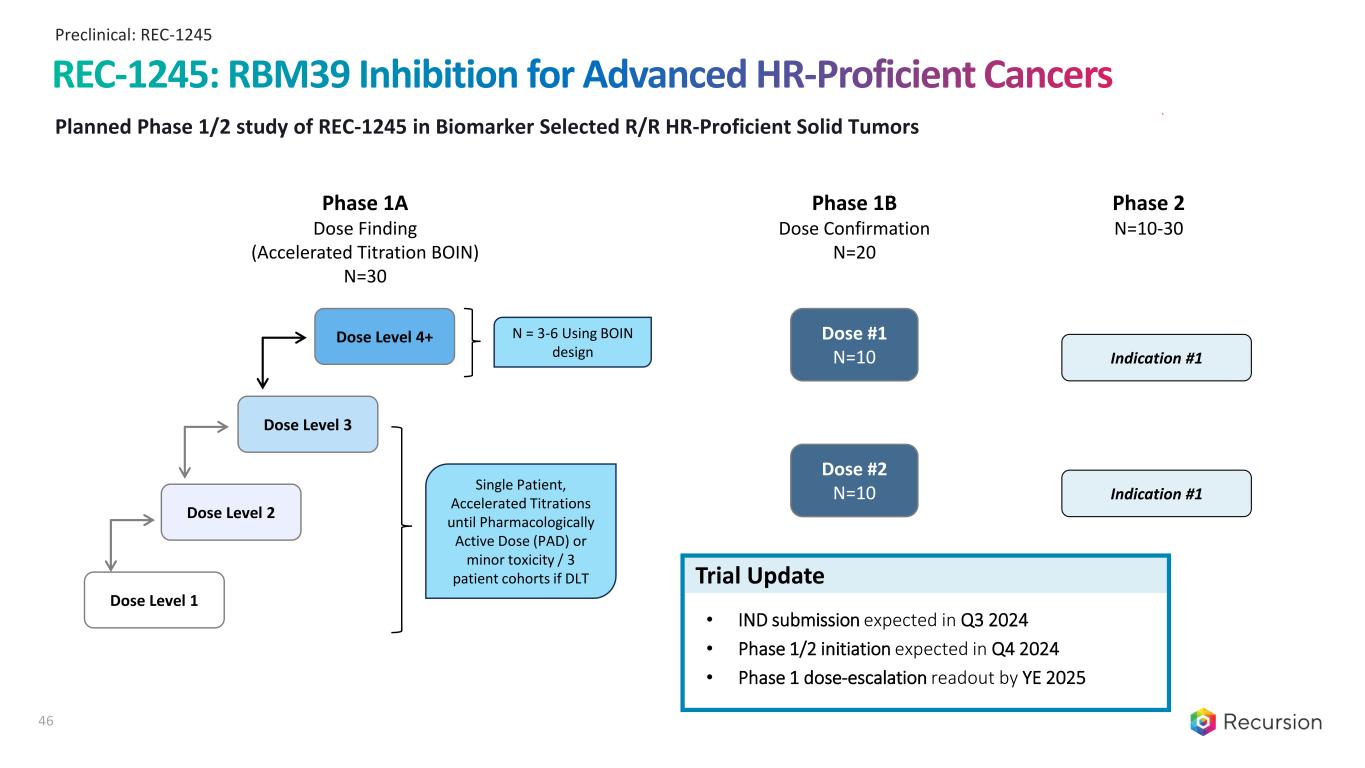

Trial Update Phase 1A Dose Finding (Accelerated Titration BOIN) N=30 Dose Level 1 Dose Level 2 Dose Level 3 Dose Level 4+ Single Patient, Accelerated Titrations until Pharmacologically Active Dose (PAD) or minor toxicity / 3 patient cohorts if DLT N = 3-6 Using BOIN design Phase 1B Dose Confirmation N=20 Dose #2 N=10 Dose #1 N=10 Indication #1 Phase 2 N=10-30 Indication #1 • IND submission expected in Q3 2024 • Phase 1/2 initiation expected in Q4 2024 • Phase 1 dose-escalation readout by YE 2025 Planned Phase 1/2 study of REC-1245 in Biomarker Selected R/R HR-Proficient Solid Tumors Preclinical: REC-1245 REC-1245: RBM39 Inhibition for Advanced HR-Proficient Cancers 46

Healthy StateDiseased State Reversal of Fibrocyte Differentiation Assay Identify a therapeutic NCE with a novel MOA capable of reversing disease- related fibrotic processes Recursion-generated hits show concentration-dependent rescue in a disease relevant human PBMC assay and phenomimic genetic KO of Target Epsilon Compelling activity demonstrated in a gold standard animal model of a fibrotic disease with significant unmet need IND submission expected in early 2025 with Phase 1 healthy volunteer readout by YE 2025 GOAL INSIGHT FROM OS FURTHER CONFIDENCE NEXT STEPS + Pentraxin-2 • Differentiation of human PBMCs into fibrocytes can be reversed by Pentraxin-2, a tissue repair protein, to mimic a healthy state • Phenotypic features of healthy state can be replicated by small molecule rescue REC-1169575 demonstrated concentration dependent rescue in the human fibrocyte phenotypic assay 11 REC-1169575 mimicked CRISPR-KO of Epsilon at low doses and validated in a target Epsilon engagement assay 2 0.25 µM 0.1 µM Epsilon 2 Similar Opposite REC-1169575 significantly reduced collagen in a gold standard animal model of fibrotic disease 33 1. Disease Score of 1.0 reflects “disease state” while disease score of 0.0 reflects “healthy state.” 2. Target Epsilon NanoBRET assay. 3. REC-1169575 administered 50 mg/kg BID PO. Differences between groups analyzed using Kruskal-Wallis test (*p< 0.05). Preclinical: Undisclosed Indication in Fibrosis Target Epsilon: Novel Approach for Fibrotic Diseases 47

Value Creation – Partnerships 48

Partnership Strategy Partner in complex therapeutic areas requiring large financial commitment or competitive arbitrage Leverage partner knowledge and clinical development capabilities Undruggable Oncology Other large, intractable areas of biology (e.g., CV/Met) Neuroscience* Pipeline Partnerships Data *Includes a single oncology indication from our Roche and Genentech collaboration. We harness value from the Recursion OS with a multi-pronged capital efficient business strategy 49

Undruggable oncology targets • $30M upfront and $50M equity investment • Increased per program milestones which may be up to $1.5B in aggregate for up to 7 oncology programs • Mid single-digit royalties on net sales • Recursion owns all algorithmic improvements • First beta-user of LOWE Neuroscience and a single oncology indication • $150M upfront and up to or exceeding $500M in research milestones and data usage options • In addition, up to or exceeding $300M in possible program milestones for up to 40 programs • One program and one map already optioned • Mid to high single-digit tiered royalties on net sales Computation and ML/AI • $50M equity investment • Partnership on advanced computation (e.g., foundation model development) • Priority access to compute hardware or DGXCloud Resources • Phenom-Beta, a phenomics-based foundation model from Recursion, now available on NVIDIA’s BioNeMo platform Real-world data access • Preferential access to >20 PBs of real-world, multi-modal oncology data, including DNA & RNA sequencing and clinical outcome data for >100,000 patients • Ability to train causal AI models with utility in target discovery, biomarker development & patient selection • Opportunity to accelerate clinical trial enrollment through broad clinical network Therapeutic discovery Platform, Technology and Data Announced Dec 2021 Announced Nov 2023 Announced July 2023 Announced Sep 2020 Significant Update Announced Nov 2023 Announced Dec 2023 Cheminformatics and chemical synthesis • Utilizes Recursion’s predicted protein-ligand interactions for ~36B compounds from Enamine’s REAL Library • Aim to generate enriched screening libraries & co-brand customer offerings Announced May 2024 • Access to hundreds of thousands of de-identified records, including Helix’s Exome+(R) genomics & longitudinal health data, to train causal AI models and design biomarker & patient stratification strategies across broad disease areas Exciting scientific collaborations span biopharma, tech & data Trademarks are the property of their respective owners and used for informational purposes only.50

Fee Structure Validated Approach Milestone Payment Building Technologies Additional Maps $30 million is part of a fee structure that could exceed a total of $500 million across multiple maps, not inclusive of program milestones Validates Recursion’s scientific approach to mapping biology as well as Recursion’s ability to deliver on success-based data options Augmenting this map with chemical perturbations, completion and acceptance could trigger a larger second milestone payment Built cell manufacturing technologies and produced >1 trillion hiPSC derived neuronal cells to create this initial map Building additional maps in other neural cell contexts that will further investigate genome scale genetic and diverse chemical perturbations for this decade-long collaboration Roche-Genentech optioned industry-first neuroscience phenomap from Recursion for $30 Million 51

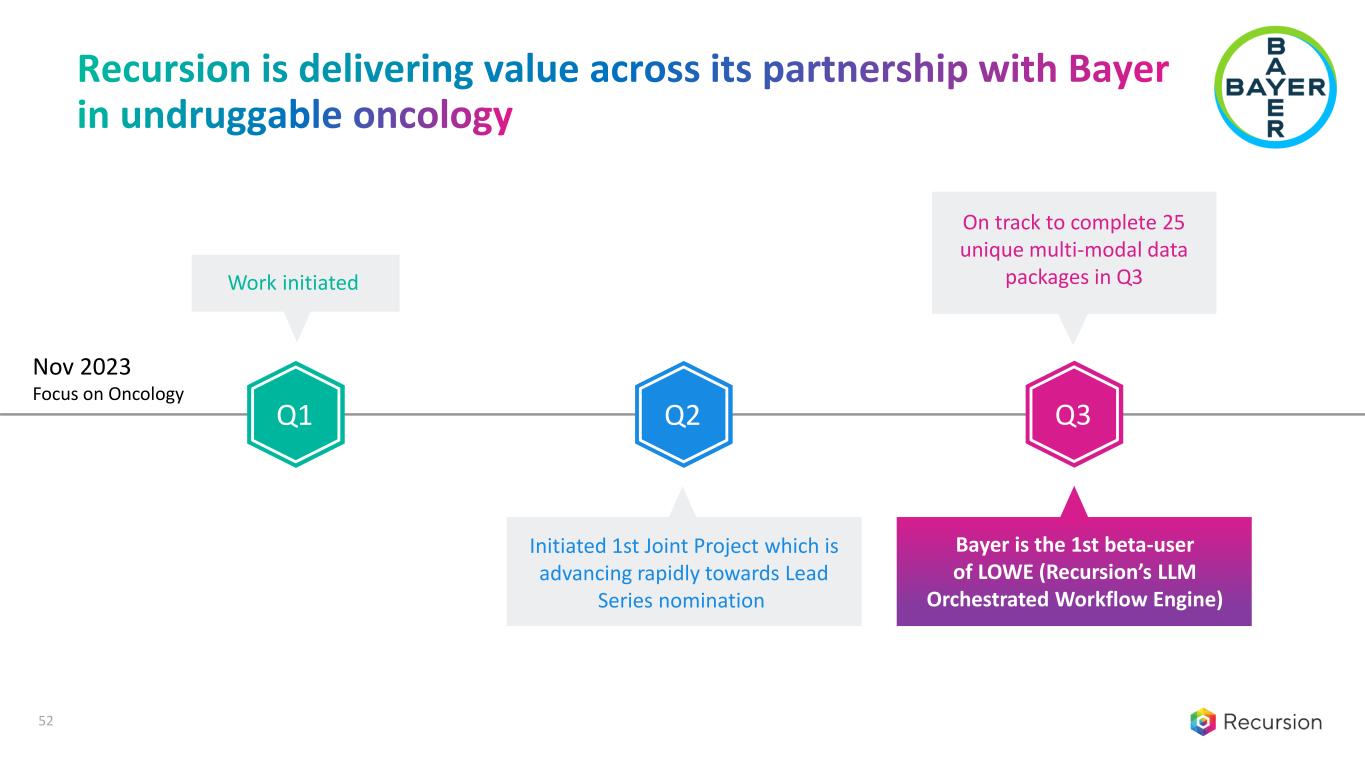

Work initiated Initiated 1st Joint Project which is advancing rapidly towards Lead Series nomination On track to complete 25 unique multi-modal data packages in Q3 Nov 2023 Focus on Oncology Q2 Bayer is the 1st beta-user of LOWE (Recursion’s LLM Orchestrated Workflow Engine) Recursion is delivering value across its partnership with Bayer in undruggable oncology Q1 Q3 52

Value Creation – Data Strategy 53

Pipeline Partnerships License subsets of data and key tools Direct generation of new data internally to maximize pipeline and partnership value-drivers Data Strategy Licensing Augment Recursion OS Data We harness value from the Recursion OS with a multi-pronged capital efficient business strategy *Includes a single oncology indication from our Roche and Genentech collaboration.54

The Recursion OS is a palette of evolving sophisticated modules 55

[ DEMO ] 56 LOWE puts the Recursion OS at your fingertips via natural language without any coding expertise required

[ DEMO ] LOWE puts the Recursion OS at your fingertips via natural language without any coding expertise required 57

The Recursion OS is now more than a collection of point solutions accessible to expert users …it is increasingly integrated and accessible via a Discovery User Interface that can be used by any of our scientists from the comfort of their laptop… 58

Culture and Team 59

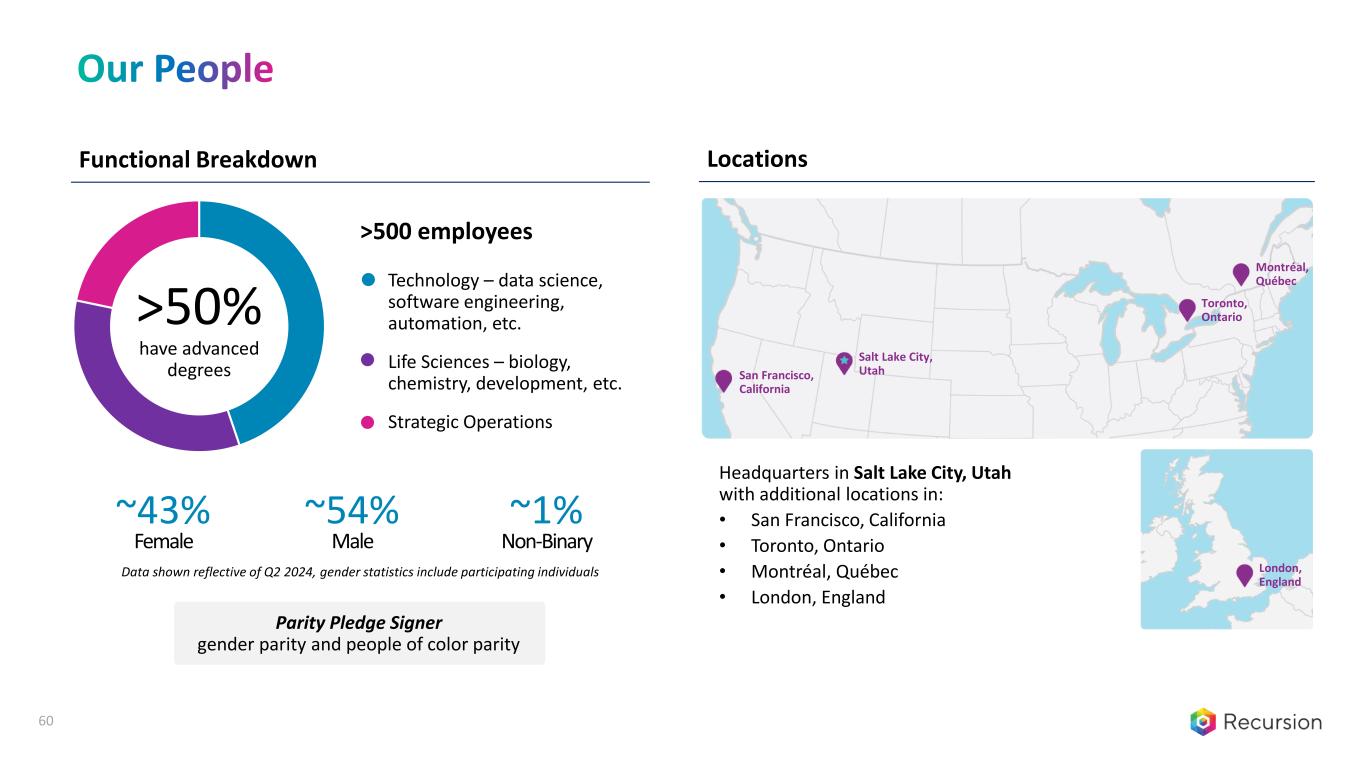

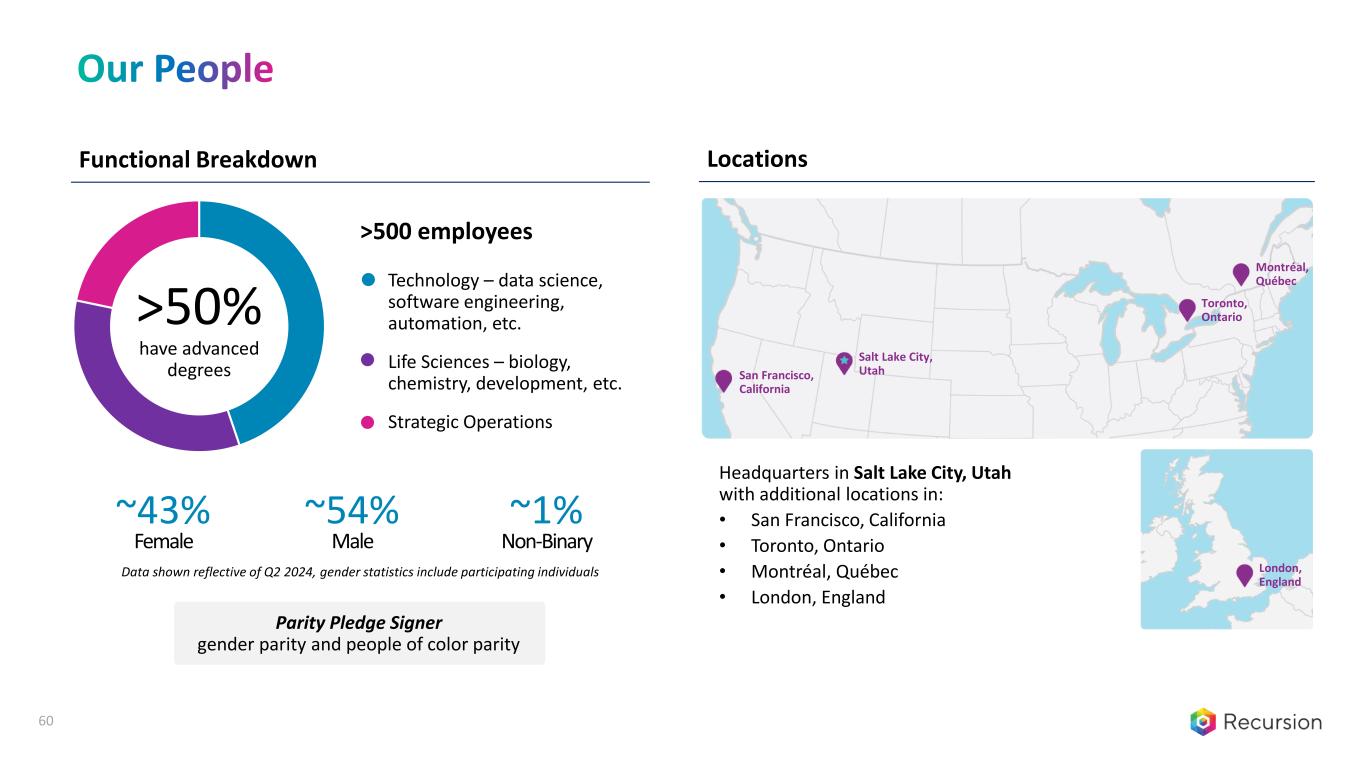

~43% Female Male ~54% ~1% Non-Binary Parity Pledge Signer gender parity and people of color parity Data shown reflective of Q2 2024, gender statistics include participating individuals have advanced degrees >50% Technology – data science, software engineering, automation, etc. Life Sciences – biology, chemistry, development, etc. Strategic Operations >500 employees Functional Breakdown Locations San Francisco, California Salt Lake City, Utah Toronto, Ontario Montréal, Québec London, England Headquarters in Salt Lake City, Utah with additional locations in: • San Francisco, California • Toronto, Ontario • Montréal, Québec • London, England 60 Our People

David Mauro, MD PHD Chief Medical Officer Board of Directors Dean Li, MD PHD Co-Founder of RXRX, President of Merck Research Labs Rob Hershberg, MD PHD Co-Founder, CEO, & Chair of HilleVax, Former EVP, CSO, & CBO of Celgene Blake Borgeson, PHD Co-Founder of RXRX Terry-Ann Burrell, MBA CFO & Treasurer of Beam Therapeutics Zavain Dar Co-Founder & Partner of Dimension Najat Khan, PHD Chief R&D Officer & Chief Commercial Officer Chris Gibson, PHD Co-Founder & CEO Tina Larson President & COO Executive Team Ben Mabey Chief Technology Officer Kristen Rushton, MBA Chief Business Ops Officer Michael Secora, PHD Chief Financial Officer Nathan Hatfield, JD MBA Chief Legal Officer Laura Schaevitz, PHD SVP & Head of Research Trademarks are the property of their respective owners and used for informational purposes only. Matt Kinn, MBA SVP Business Development Zachary Bogue, JD Co-Founder & Partner of Data Collective Najat Khan, PHD Chief R&D Officer & Chief Commercial Officer Our leadership brings together experience & innovation to advance TechBio 61 Chris Gibson, PHD Co-Founder & CEO

Additional Information about Scientific Approach 62

This is a whole-genome arrayed CRISPR knock-out Map generated in primary human endothelial cells Every gene is represented in a pairwise way (each is present in columns and rows) Dark Red indicates phenotypic similarity according to our neural networks while Dark Blue indicates phenotypic anti- similarity (which in our experience often suggests negative regulation) We can add the phenotypes of hundreds of thousands of small molecules at multiple doses and query and interact with these maps using a web application Thousands of examples of known biology and chemistry Genome-scale mapping All Human Genes with Significant Effects in this Cellular Context → A ll H u m an G en es w it h S ig n if ic an t Ef fe ct s in t h is C el lu la r C o n te xt → 63

One such example – the JAK / STAT pathway clustered by strength of interaction, including both similar genes (red) and opposite genes (blue) Can wade into areas of novel biology and chemistry… JAK1 TNKS1BP1 PPP1R9B PHF13 SOCS3 PRKCH MEGF8 ASB7 SLC39A1 DOCK9 ZMYM3 FAM49B STK24 YWHAB IL6ST IL6R STAT3 IL6 JA K 1 IL 6 ST A T3 IL 6 R IL 6 ST YW H A B ST K 2 4 FA M 4 9 B ZM YM 3 TN K S1 B P 1 P P P 1 R 9 B P H F1 3 SO C S3 P R K C H M EG F8 A SB 7 SL C 3 9 A 1 D O C K 9 64

65 Active Learning to Increase Knowledge Per Experiment

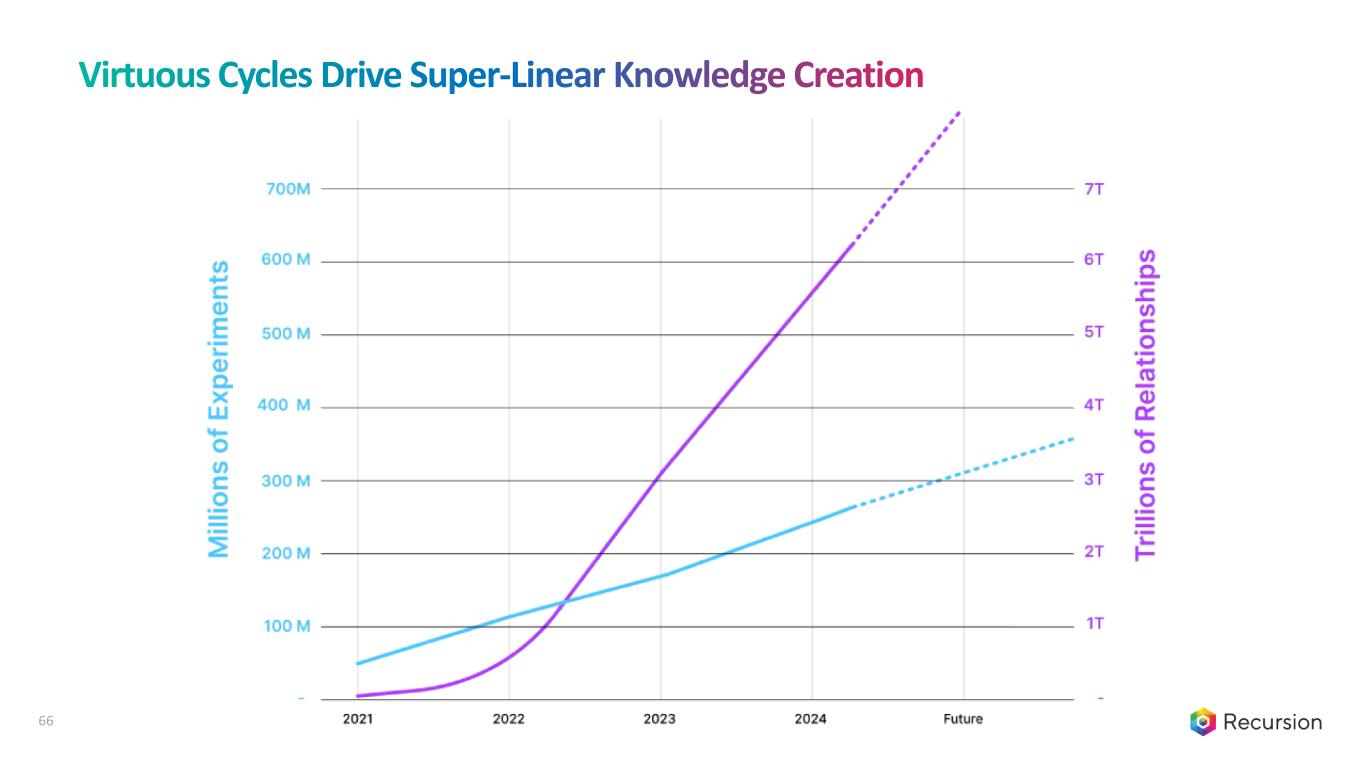

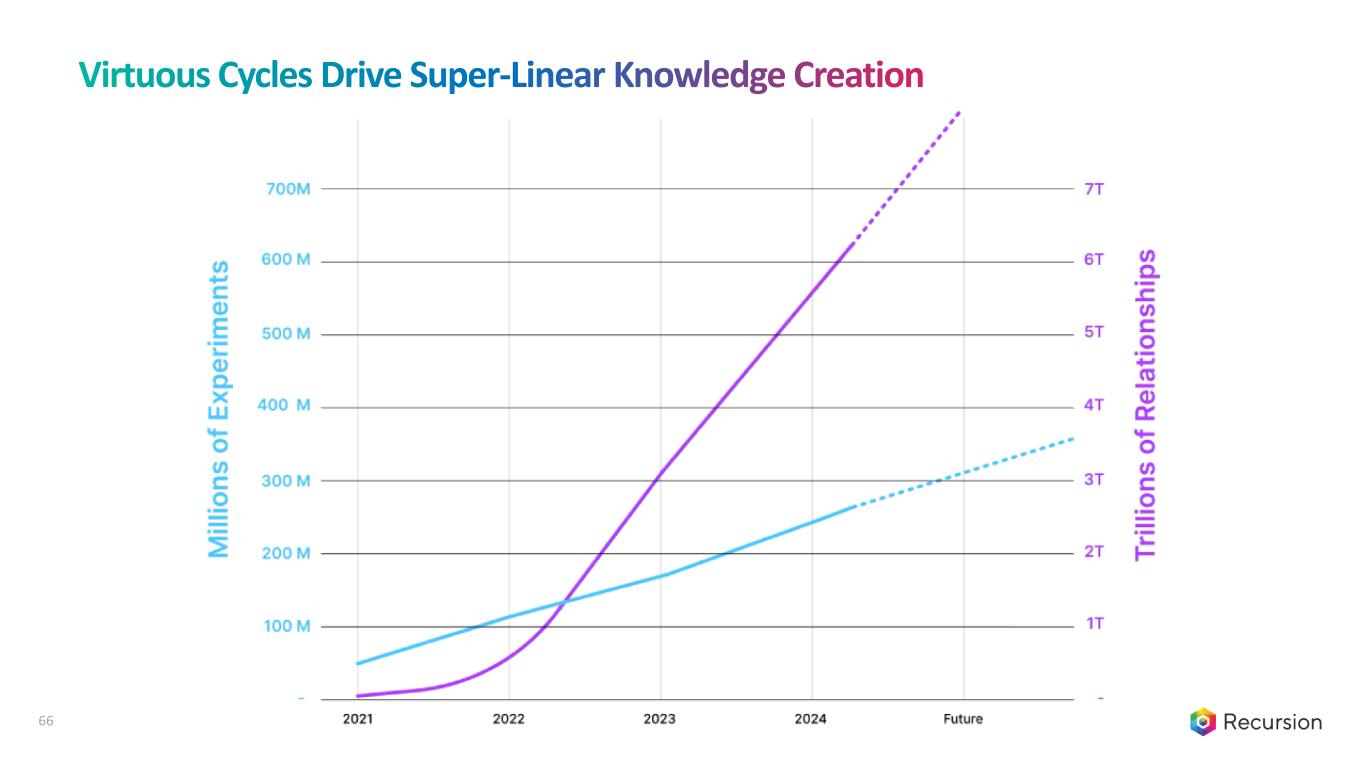

66 Virtuous Cycles Drive Super-Linear Knowledge Creation

Additional Information about Pipeline Programs 67

Clinical: CCM REC-994 for CCM • First therapeutic candidate advanced to an industry-sponsored Phase 2 trial (SYCAMORE) for CCM • Partnered with leading KOLs at University of Rochester to develop a CCM PRO instrument for clinical trials • Putative MOA decreases ROS and oxidative stress to rescue pathogenetic endothelial dysfunction Program Overview Clinical Updates • Phase 2 primary endpoint of safety met with similar AE profile seen across placebo and REC-994 arms • MRI-based trends towards reduced lesion volume and hemosiderin ring size in patients on 400mg vs placebo • 80% of participants who completed 12 months of treatment entered LTE portion Near-term Catalysts • Planning to present data at a medical conference and publish results in a peer reviewed scientific journal • Meeting with the FDA is anticipated as soon as practical to discuss plans for an additional clinical study Commercial Opportunity • ~360,000 symptomatic CCM patients living in US and EU5 with no pharmacological agents approved • Favorable competitive landscape with REC-994 estimated to be 2+ years ahead in development IP & Exclusivity • ODD in US and EU provides 7 and 10 years, respectively, of market exclusivity following approval • Method of use patents provide protection until 2035 (excluding extensions), additional protections being sought First-in-disease potential in CCM with an orally bioavailable small molecule superoxide scavenger 68

69 Non-oncology Orphan Indication Product U.S. + EU5 Prevalence Cerebral cavernous malformation (CCM) REC-994 (Recursion) >1,800,000 (Symptomatic: ~360,000) Idiopathic pulmonary fibrosis (IPF) Esbriet (pirfenidone) >160,000 Cystic fibrosis (CF) VX-669/ VX-445 + Tezacaftor + Ivacaftor - Vertex >55,000 Spinal muscular atrophy (SMA) SPINRAZA (nusinersen) >65,000 Sources: Angioma Alliance ; Flemming KD, et al . Population-Based Prevalence of Cerebral Cavernous Malformations in Older Adults: Mayo Clinic Study of Aging. JAMA Neurol. 2017 Jul 1;74(7):801-805. doi: 10.1001/jamaneurol.2017.0439. PMID: 28492932; PMCID: PMC5647645 ; Spiegler S, et al Cerebral Cavernous Malformations: An Update on Prevalence, Molecular Genetic Analyses, and Genetic Counselling. Mol Syndromol. 2018 Feb;9(2):60-69. doi: 10.1159/000486292. Epub 2018 Jan 25. PMID: 29593473; PMCID: PMC5836221; Maher T, et al Global incidence and prevalence of idiopathic pulmonary fibrosis. Respir Res. 2021 Jul 7;22(197). Doi: 10.1186/s12931-021-01791-z. PMID: 34233665. DRG 2022 Solutions, Report: Epidemiology, Cystic Fibrosis. CDC: SMA Clinical: CCM Disease Overview : CCM is an Under-Appreciated Orphan Disease 69

siCTRL siCCM2 siCCM2 + Simvastatin siCCM2 + Cholecalciferol siCCM2 + REC-994 Using an early version of our Recursion OS in an academic setting, we identified about 39 molecules out of 2,100 screened that according to a machine learning classifier rescued a complex unbiased phenotype associated with CCM2 loss of function. Through a set of follow-on confirmatory assays of increasing complexity, REC-994 stood out as one of two compounds we tested in a 5-month chronic CCM animal model where both compounds demonstrated significant benefit. Clinical: CCM CCM – Applied prototyping of the Recursion OS 70 Gibson, et al. Strategy for identifying repurposed drugs for the treatment of cerebral cavernous malformation. Circulation, 2015

Clinical: CCM Source: Data above from Gibson, et al. Strategy for identifying repurposed drugs for the treatment of cerebral cavernous malformation. Circulation, 2015 or Recursion internal data (Ccm1 mouse model) • REC-994 stabilizes the integrity of vasculature against challenges to permeability • Altered vascular permeability is a clinically relevant feature of CCM lesions Reduces lesion number & size in Ccm1 and Ccm2 LOF mouse models1 Rescues acetylcholine-induced vasodilation defect2 Lesion size (mm2) Ccm1 LOF Model ecKO + REC-994 WT ecKO % V as o d ila ti o n Acetylcholine [Log M] Lesion size (mm2) Ccm2 LOF Model * * * Rescues dermal permeability defect in CCM2 mice3 DMSO control REC-994 Ccm2 WT Ccm2 ecKO D e rm al P e rm e ab ili ty (A b so rp ti o n , A U ) * Preclinical Studies: REC-994 reduces lesion burden and ameliorates vascular defects in genetic mouse models of CCM 71

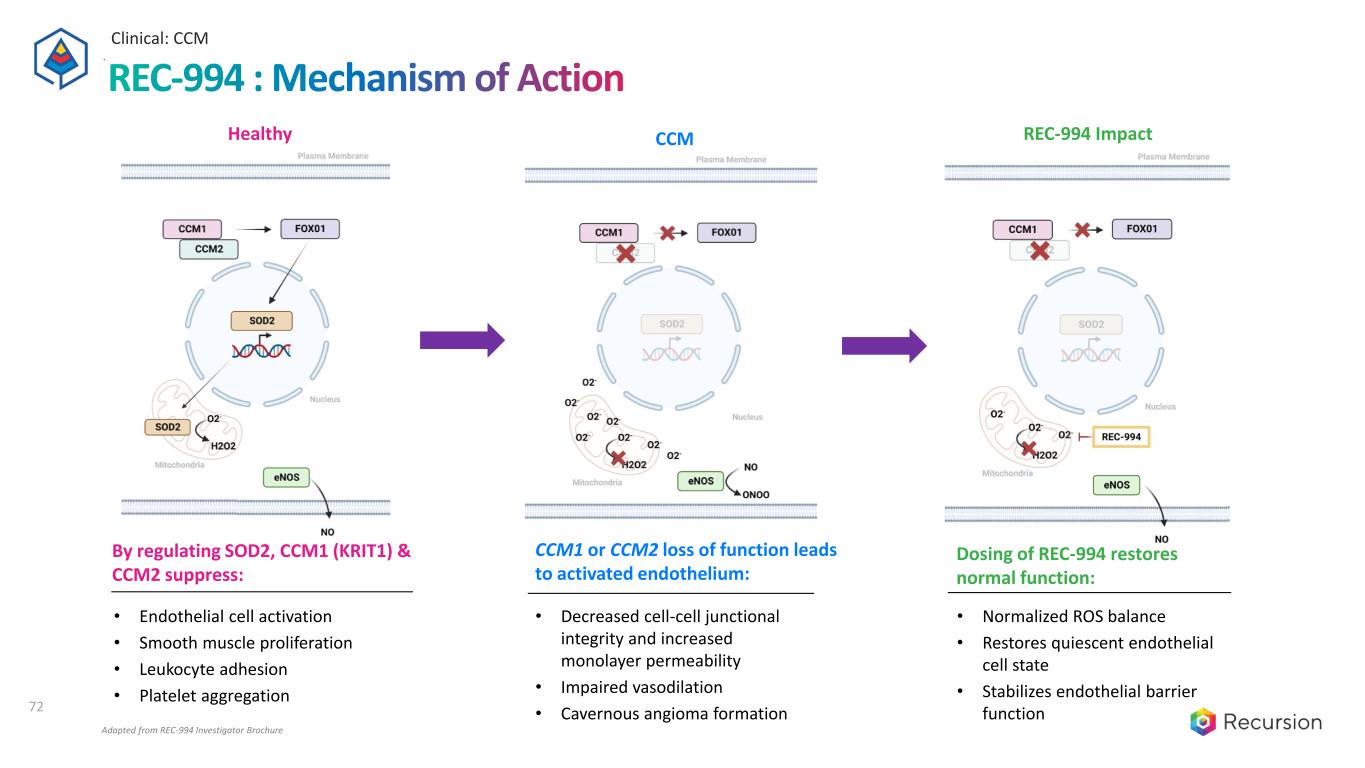

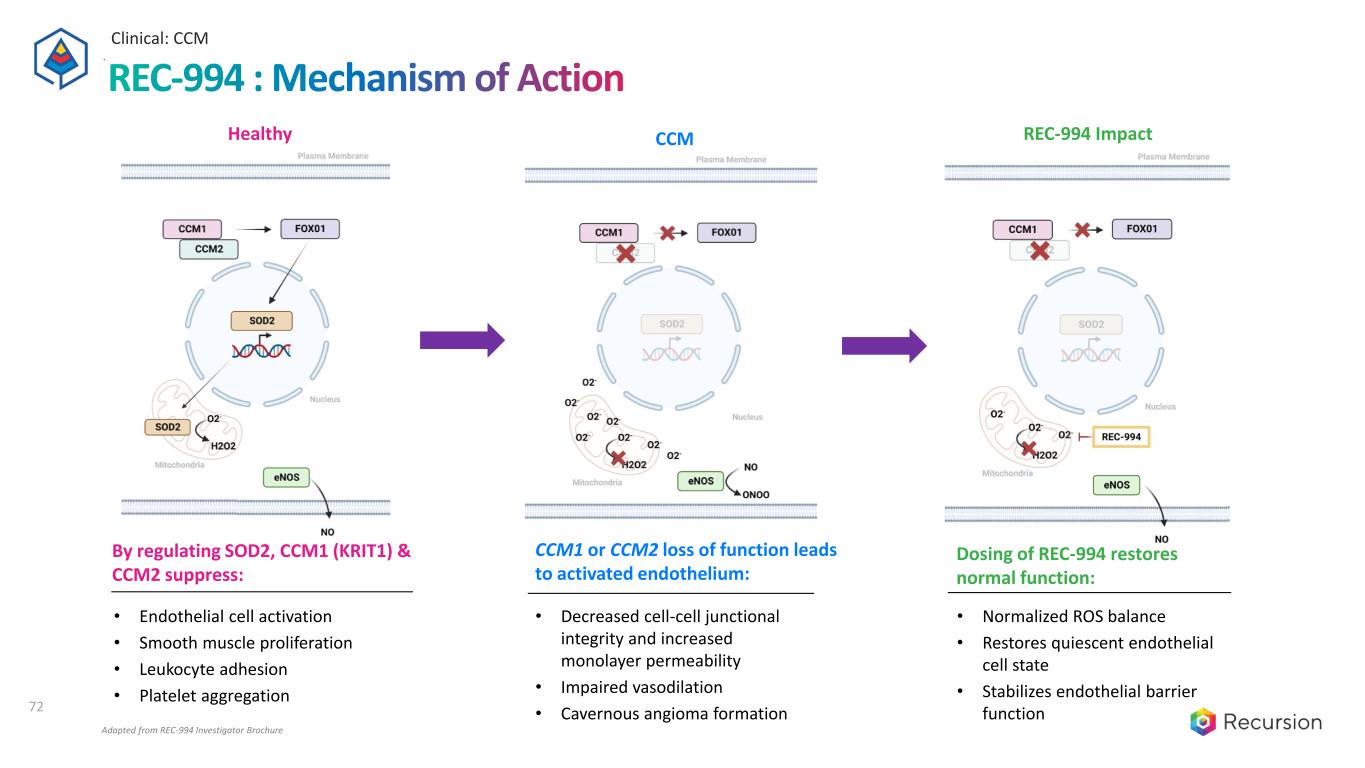

Healthy REC-994 ImpactCCM • Endothelial cell activation • Smooth muscle proliferation • Leukocyte adhesion • Platelet aggregation By regulating SOD2, CCM1 (KRIT1) & CCM2 suppress: CCM1 or CCM2 loss of function leads to activated endothelium: • Decreased cell-cell junctional integrity and increased monolayer permeability • Impaired vasodilation • Cavernous angioma formation Dosing of REC-994 restores normal function: • Normalized ROS balance • Restores quiescent endothelial cell state • Stabilizes endothelial barrier function Adapted from REC-994 Investigator Brochure Clinical: CCM REC-994 : Mechanism of Action 72

REC-994 Phase 1 Studies - well-tolerated with no dose-dependent adverse events in SAD and MAD MAD Study Placebo 50 mg 200 mg 400 mg 800 mg Total Number of TEAEs Total Subjects with ≥ one TEAE 5 4 0 0 10 3 4 3 15 4 Severity Mild Moderate Severe 3 1 0 0 0 0 3 0 0 3 0 0 3 1 0 Relationship to Study Drug None Unlikely Possibly Likely Definitely 3 1 0 0 0 0 0 0 0 0 0 1 0 2 0 2 1 0 0 0 1 2 0 1 0 Total Number of SAEs Total Subject with ≥ one TEAE Discontinued Study Drug Due to AE 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Source: REC-994 for the Treatment of Symptomatic Cerebral Cavernous Malformation (CCM) Phase 1 SAD and MAD Study Results. Oral Presentation at Alliance to Cure Scientific Meeting. 2022 Nov 17 Clinical: CCM Further Confidence : Clinical Studies Indicate Favorable Safety Profile 73

Program Overview First-in-disease opportunity in NF2 with HDAC inhibitor Clinical Updates Near-term Catalysts Commercial Opportunity IP & Exclusivity • Orally bioavailable small molecule inhibitor of class I and class IIB HDACs in Phase 2/3 (POPLAR) trial • Unique MOA that disrupts PP1-HDAC interface, attenuating pathophysiologic p-AKT without affecting total AKT • Fast Track Designation in NF2 mutant meningioma granted by FDA in 2021 • Part A (Phase 2) fully enrolled with 24 adult participants • Early Phase 1 study demonstrated mPFS of 9.1 months in patients with CNS tumors, including 5 NF2 patients • Therapeutic concentrations of REC-2282 achieved in plasma and CNS tumors in early Phase 1 studies • Phase 2 readout in adults (safety and preliminary efficacy) expected Q4 2024 • ~ 33,000 NF2-associated meningioma patients in US and EU5 eligible for treatment with no approved therapies • Potential to expand into additional NF2 mutant populations including mesothelioma, MPNST and EHE • ODD in US and EU provides 7 and 10 years, respectively, of market exclusivity following approval • Composition of matter patent provides protection until 2030 (excluding extensions) Clinical: NF2 REC-2282 for Neurofibromatosis Type 2 (NF2) 74

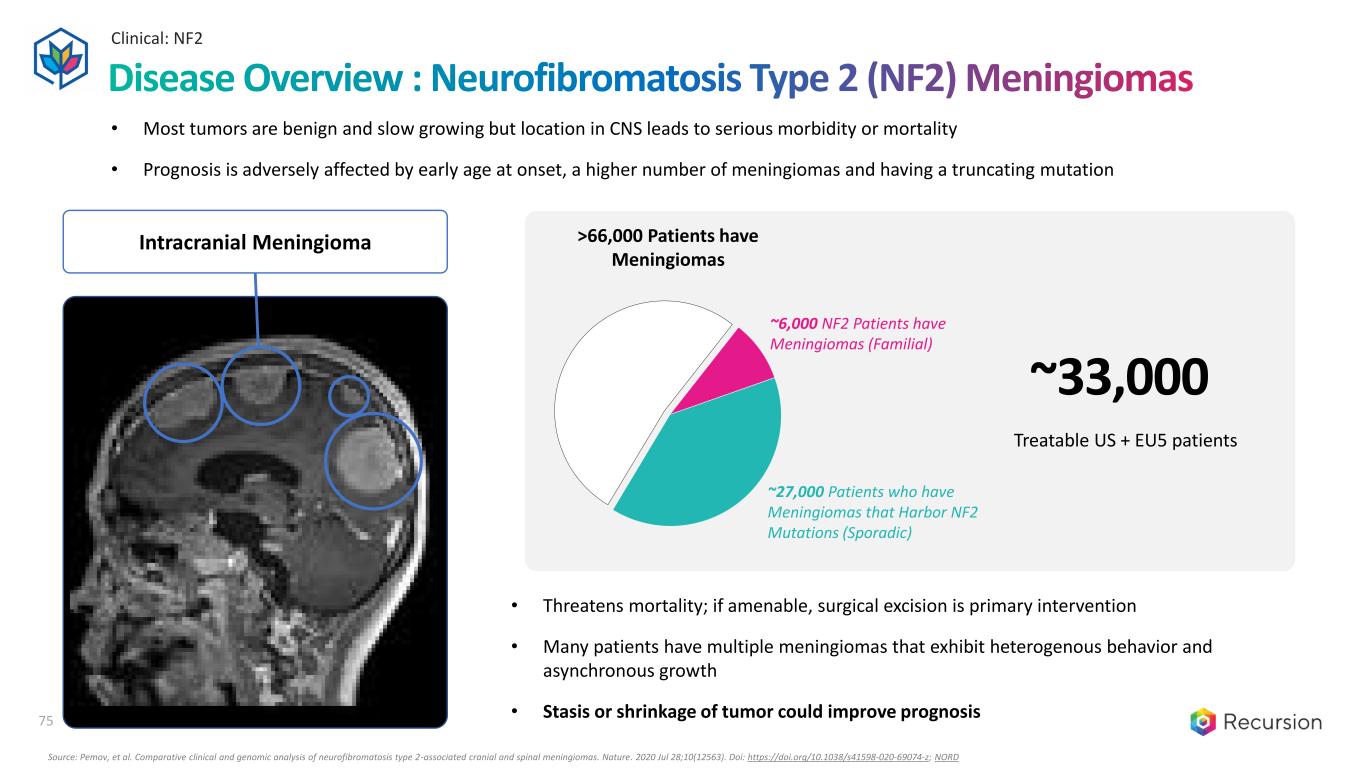

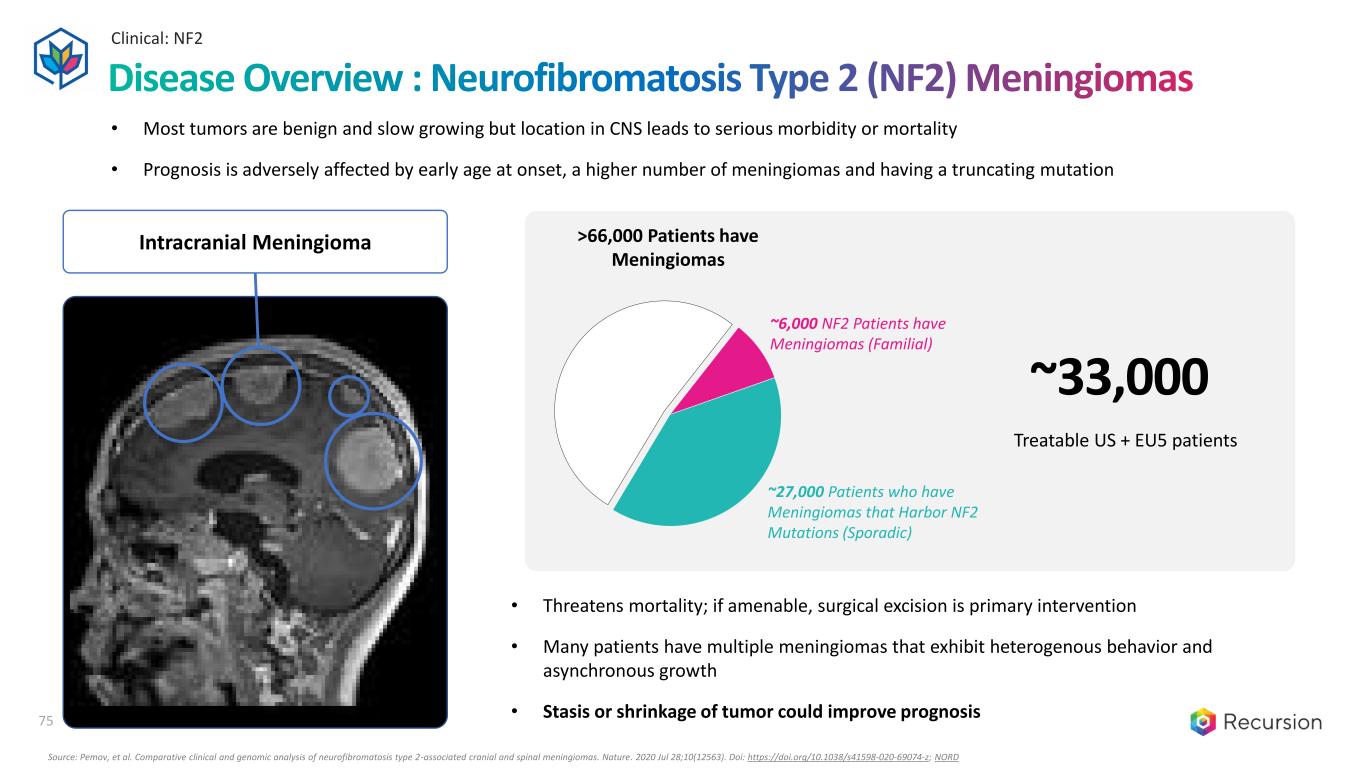

75 • Threatens mortality; if amenable, surgical excision is primary intervention • Many patients have multiple meningiomas that exhibit heterogenous behavior and asynchronous growth • Stasis or shrinkage of tumor could improve prognosis ~27,000 Patients who have Meningiomas that Harbor NF2 Mutations (Sporadic) ~6,000 NF2 Patients have Meningiomas (Familial) >66,000 Patients have Meningiomas Treatable US + EU5 patients ~33,000 Intracranial Meningioma Source: Pemov, et al. Comparative clinical and genomic analysis of neurofibromatosis type 2-associated cranial and spinal meningiomas. Nature. 2020 Jul 28;10(12563). Doi: https://doi.org/10.1038/s41598-020-69074-z; NORD Clinical: NF2 Disease Overview : Neurofibromatosis Type 2 (NF2) Meningiomas 75 • Most tumors are benign and slow growing but location in CNS leads to serious morbidity or mortality • Prognosis is adversely affected by early age at onset, a higher number of meningiomas and having a truncating mutation

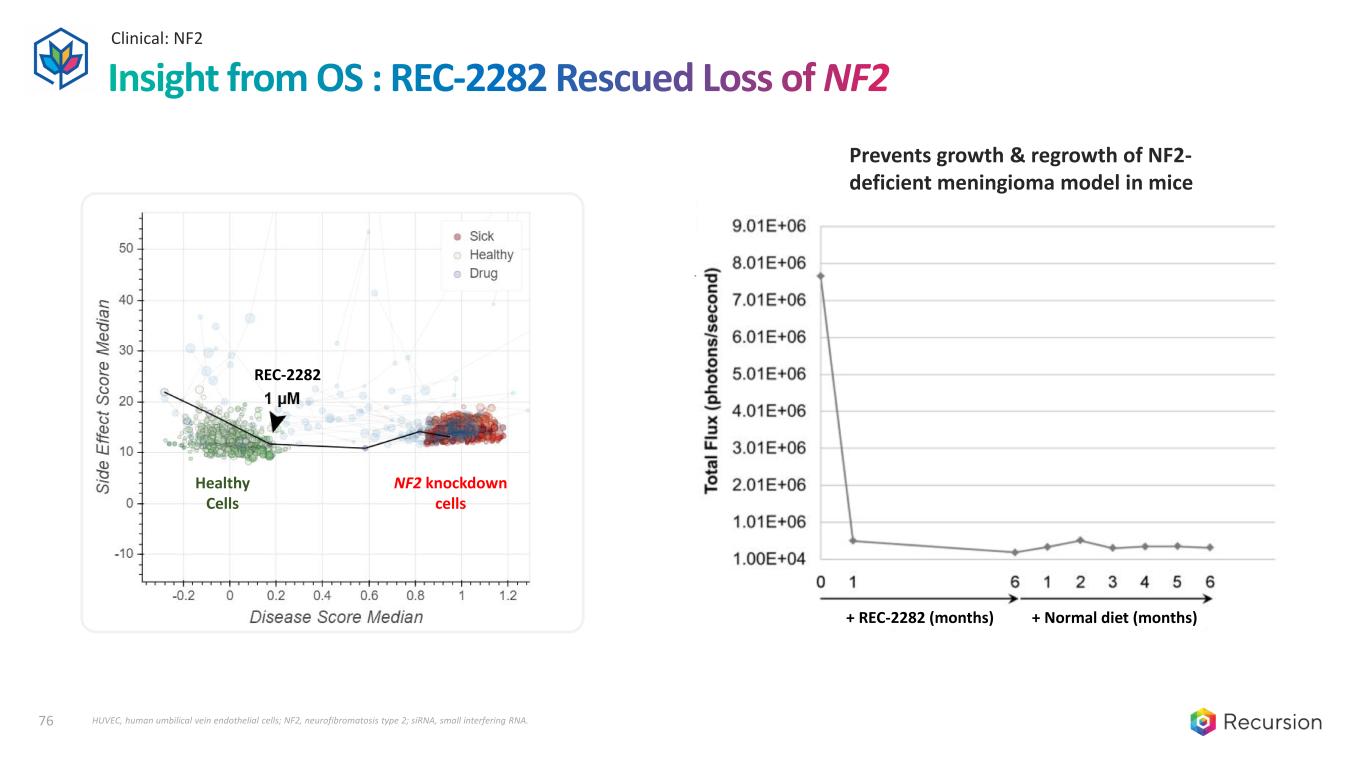

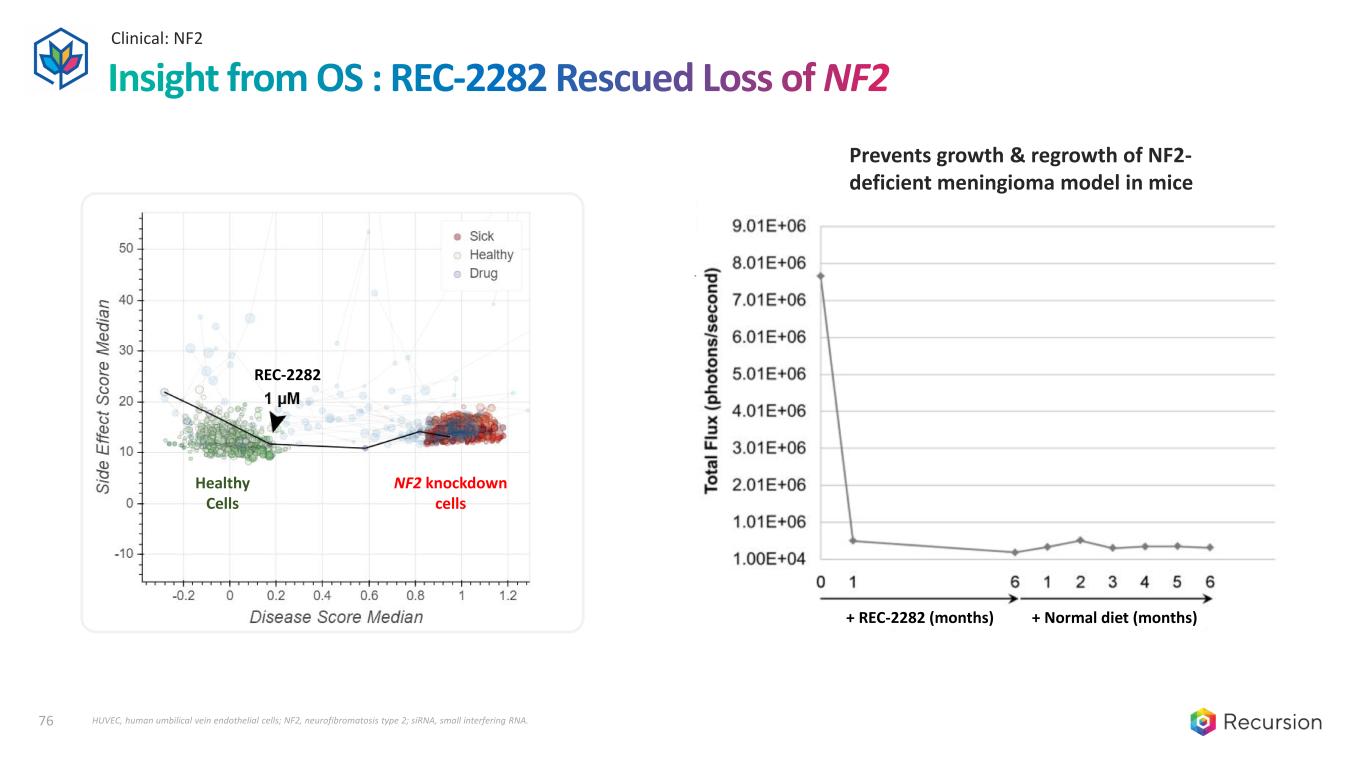

76 Clinical: NF2 NF2 knockdown cells Healthy Cells REC-2282 HUVEC, human umbilical vein endothelial cells; NF2, neurofibromatosis type 2; siRNA, small interfering RNA. Prevents growth & regrowth of NF2- deficient meningioma model in mice + REC-2282 (months) + Normal diet (months) Insight from OS : REC-2282 Rescued Loss of NF2 76

77 AKT, protein kinase B; eIF4F, eukaryotic initiation factor 4F; HDAC, histone deacetylase; mTor, mammalian target of rapamycin; mTORC1; mammalian target of rapamycin complex 1; NF2, neurofibromatosis type 2; PI3K, phosphoinositide 3-kinase; PP1, protein phosphate 1; Ras, reticular activating system. NF2 encodes for the protein Merlin and negatively regulates mTOR signaling 1 2 3 Loss of Merlin leads to increased signaling in the PI3K/AKT/mTOR pathway Oncogenic mTOR signaling arrested with HDAC inhibitors Cell proliferation and survival Normal cell proliferation and survival Cell proliferation and survival Constitutive activation is independent of extracellular factors and does not respond to biochemical signals that would normally regulate activity 1 2 3 2 3 Clinical: NF2 REC-2282 : Mechanism of Action 77 Orally Bioavailable, CNS-penetrating, Small Molecule HDAC Inhibitor

78 1 Sborov DW, et al. A phase 1 trial of the HDAC inhibitor AR-42 in patients with multiple myeloma and T- and B-cell lymphomas. Leuk Lymphoma. 2017 Oct;58(10):2310-2318. 2 Collier KA, et al. A phase 1 trial of the histone deacetylase inhibitor AR-42 in patients with neurofibromatosis type 2-associated tumors and advanced solid malignancies. Cancer Chemother Pharmacol. 2021 May;87(5):599-611. 3 Prescribing Information of Vorinostat/Belinostat/Romidepsin respectively Clinical: NF2 REC-2282 Appears Well Suited for NF2 vs Other HDAC Inhibitors 78 REC-2282 Would be First-In-Disease HDAC Inhibitor for Treatment of NF2 Meningiomas

First-in-disease opportunity in FAP with a MEK 1/2 inhibitor • Orally bioavailable, small molecule non-ATP competitive allosteric inhibitor of MEK 1/2 in Phase 1b/2 (TUPELO) • REC-4881 appears more active versus approved MEK inhibitors in disease relevant preclinical models • Fast Track Designation in FAP granted by FDA in 2022 • Part 1 completed with 4 mg QD generally well-tolerated and safety profile consistent with other MEK inhibitors • Early PD data indicates 4 mg is pharmacologically active – Part 2 protocol updated to dose escalation / expansion • Efficacy will evaluate change in polyp burden relative to baseline at 12 weeks • FPI for Part 2 achieved in Q2 2024 • Phase 2 initial readout (safety, preliminary efficacy, pharmacokinetics) anticipated H1 2025 • ~ 50,000 FAP patients in US and EU5 eligible for treatment with no approved therapies • Opportunity to treat moderate-to-severe population to potentially delay or prevent surgical intervention • ODD in US and EU provides 7 and 10 years, respectively, of market exclusivity following approval • No known barriers to market access Program Overview Clinical Updates Near-term Catalysts Commercial Opportunity IP & Exclusivity Clinical: FAP REC-4881 for Familial Adenomatous Polyposis (FAP) 79

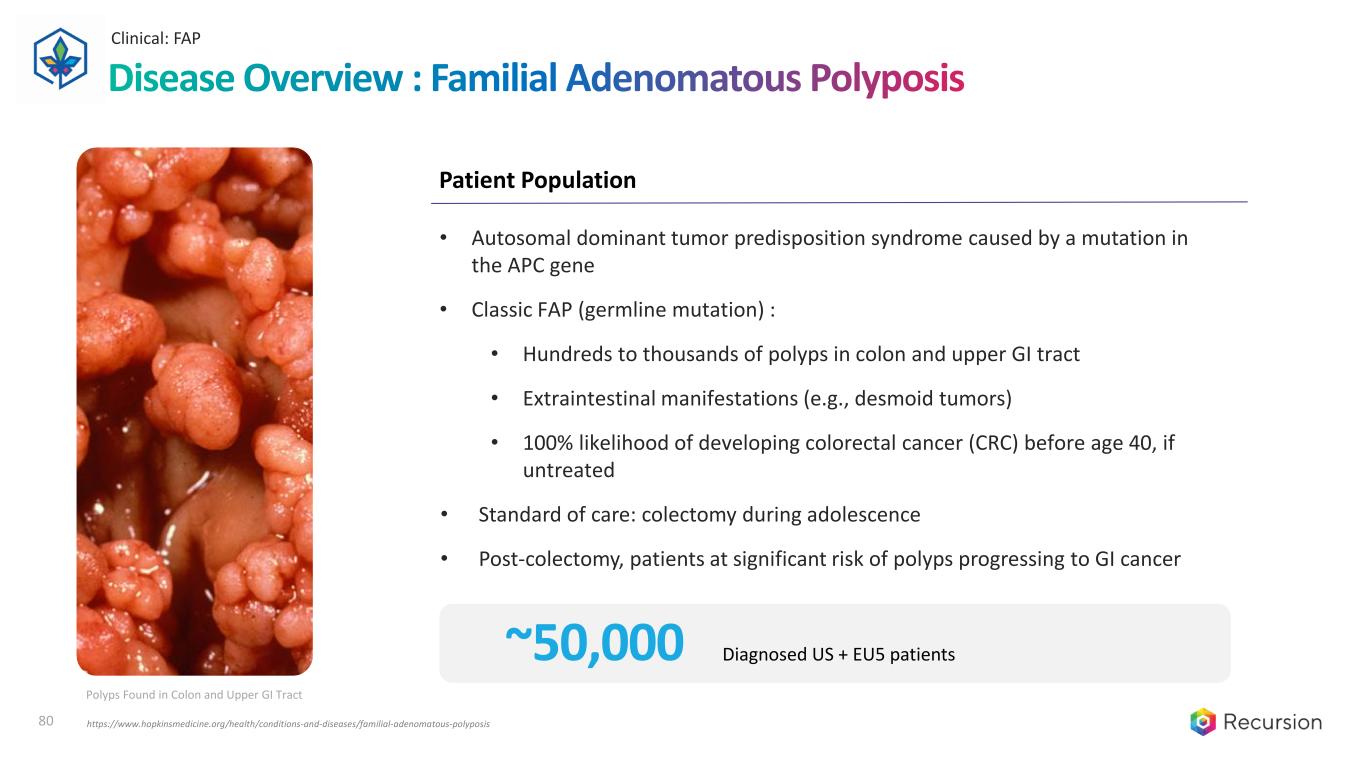

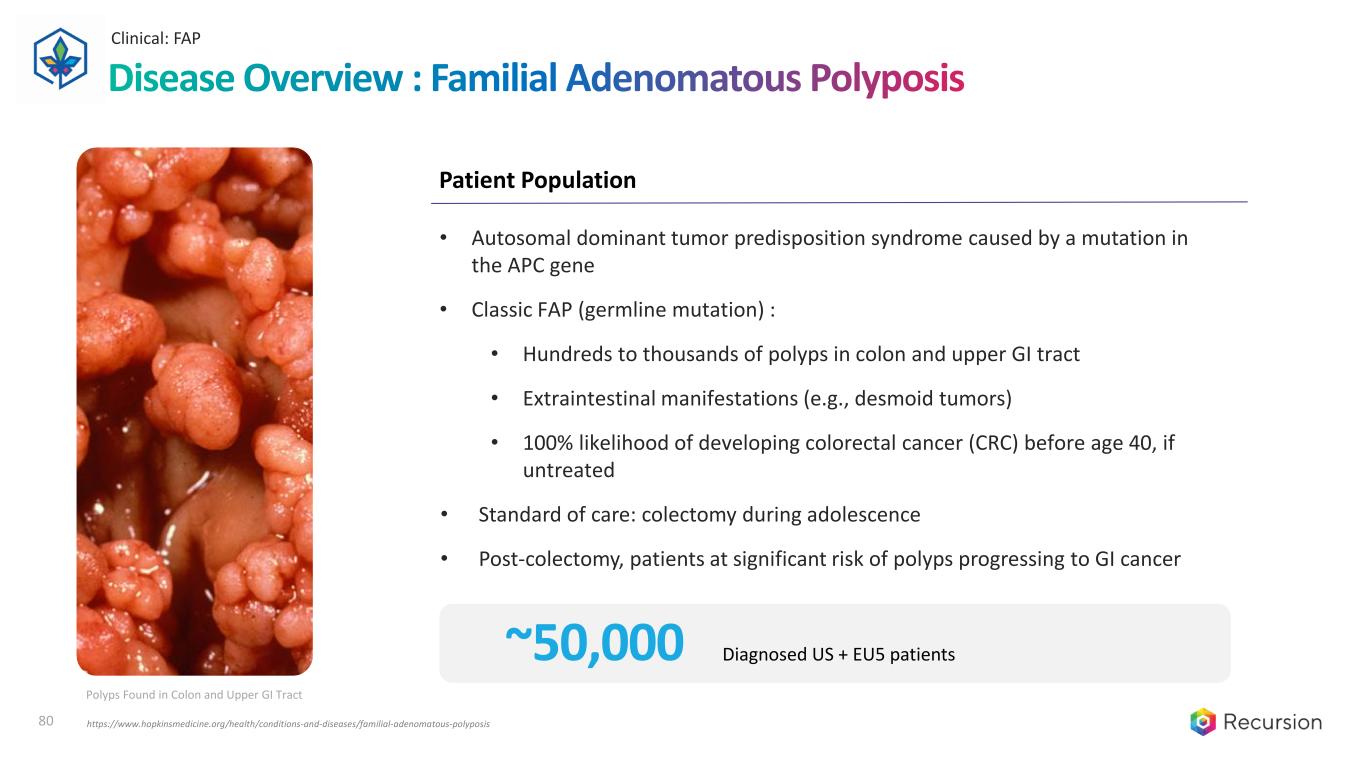

80 Patient Population ~50,000 Diagnosed US + EU5 patients • Autosomal dominant tumor predisposition syndrome caused by a mutation in the APC gene • Classic FAP (germline mutation) : • Hundreds to thousands of polyps in colon and upper GI tract • Extraintestinal manifestations (e.g., desmoid tumors) • 100% likelihood of developing colorectal cancer (CRC) before age 40, if untreated • Standard of care: colectomy during adolescence • Post-colectomy, patients at significant risk of polyps progressing to GI cancer Polyps Found in Colon and Upper GI Tract https://www.hopkinsmedicine.org/health/conditions-and-diseases/familial-adenomatous-polyposis Clinical: FAP Disease Overview : Familial Adenomatous Polyposis 80

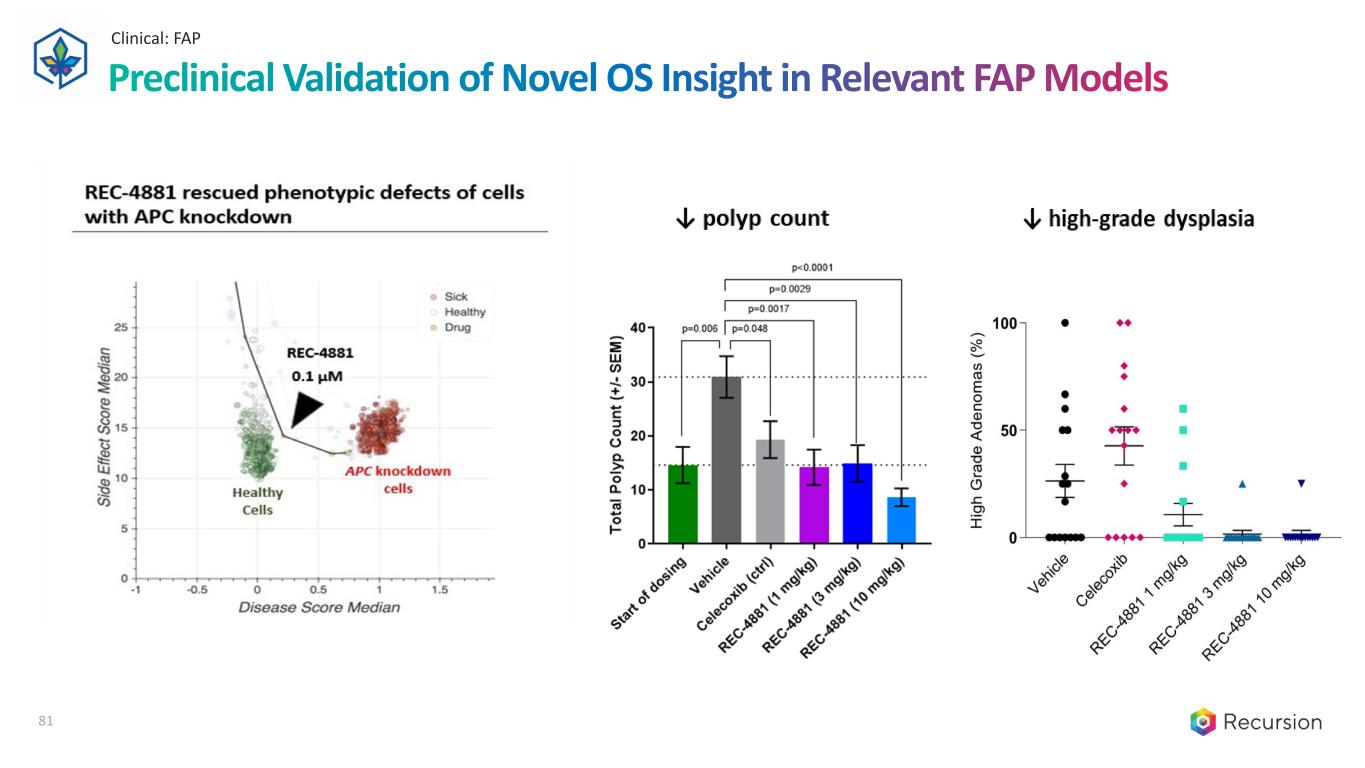

Clinical: FAP Preclinical Validation of Novel OS Insight in Relevant FAP Models 81

82 Jeon, WJ, et al. (2018). Interaction between Wnt/β-catenin and RAS-ERK pathways and an anti-cancer strategy via degradations of β-catenin and RAS by targeting the Wnt/β-catenin pathway. npj Precision Oncology, 2(5). 3 3 REC-4881 inhibits MEK 1/2 and recovers the destabilization of RAS by the β-Catenin destruction complex, restoring the cell back to a Wnt-off like state 2 1 Disease State REC-4881 Impact Clinical: FAP MoA : REC-4881 Blocks Wnt Mutation Induced MAPK Signaling 82 Orally Bioavailable, Small Molecule MEK Inhibitor

Program Overview Clinical Updates Near-term Catalysts Commercial Opportunity IP & Exclusivity Clinical: AXIN1 or APC First-in-disease opportunity in AXIN1 or APC mutant cancers with a MEK 1/2 inhibitor • Orally bioavailable, small molecule non-ATP competitive allosteric inhibitor of MEK 1/2 in Phase 2 (LILAC) • First therapeutic candidate advanced to a Phase 2 signal finding study in AXIN1 or APC mutant cancers • Recursion’s first clinical trial in oncology and the first that used inferential search for hypothesis generation • Safety run-in of REC-4881 to identify RP2D prior to allocation • Protocol designed to assess activity in two independent cohorts of AXIN1 or APC mutant tumors • Efficacy will evaluate ORR as measured by RECIST 1.1 • FPI achieved in Q1 2024 • Phase 2 readout (safety, preliminary efficacy, and PK) anticipated H1 2025 • Diagnosed incidence of ~ 104,000 2L+ drug-treatable patients harboring AXIN1 or APC mutations in US and EU5 • AXIN1 and APC genes covered by commercially available NGS panels and liquid biopsy detection assays • Method of use patent pending with protection until 2043 (excluding extensions) • No known barriers to market access 83 REC-4881 for AXIN1 or APC Mutant Cancers

84 • AXIN1 and APC genes covered by commercially available NGS panels and liquid biopsy detection assays • FDA guidance supports utility of ctDNA as patient selection for the detection of alterations for eligibility criteria and as a stratification factor for trials enrolling marker-positive and marker-negative populations4 • Multiple tumor types will inform study design and patient selection Flexible Patient Selection Strategy and Study Design When present, AXIN1 or APC mutations may be actionable drivers across multiple solid tumors 1AXIN1 and APC alteration frequencies obtained from AACR Genie Portal. 2 Advanced population estimates using number of deaths per year in US and EU5 across tumors, extracted from ACS and ECIS. 3 CRC population restricted to RAS/RAF wildtype. 4 https://www.fda.gov/media/158072/download. ~104,000 2L+ drug-treatable AXIN1/APC-mutant cases each year (US & EU5)1,2 Colorectal3 42% Upper GI 18% SCCHN 15% Urological 13% Gynecological 7% Breast 4% Clinical: AXIN1 or APC Disease Overview : AXIN1 or APC Mutant Cancers 84

85 Clinical: AXIN1 or APC REC-4881 is phenotypically opposite to the genetic KO of APC and AXIN1 providing a novel mechanism that may restore the disease state modeled by the loss of these genes AXIN1 APC 2.5 µm 1.0 µm 0.25 µm 0.1 µm REC 4881 Significantly greater antitumor activity in mutant models led to significant PFS benefit Recursion OS Identified Novel Insight of AXIN1 & APC biology 85

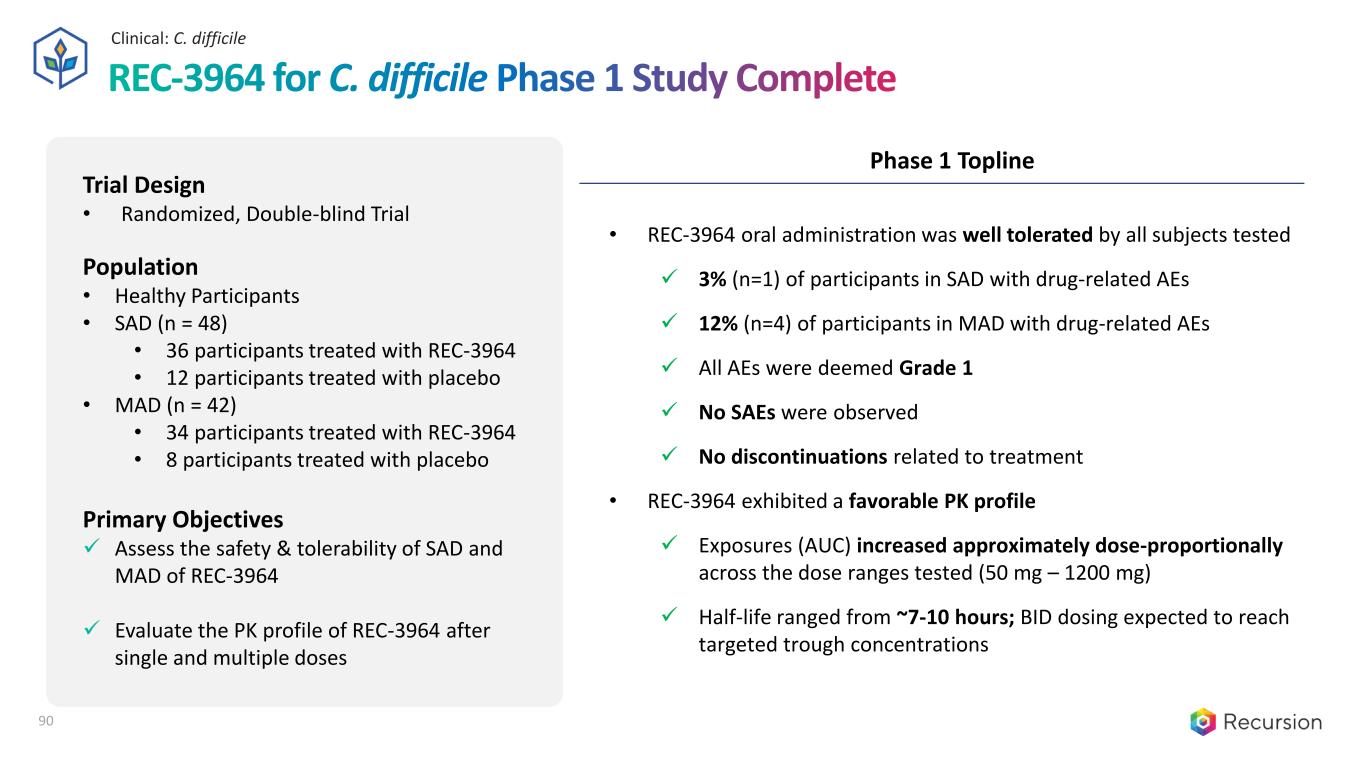

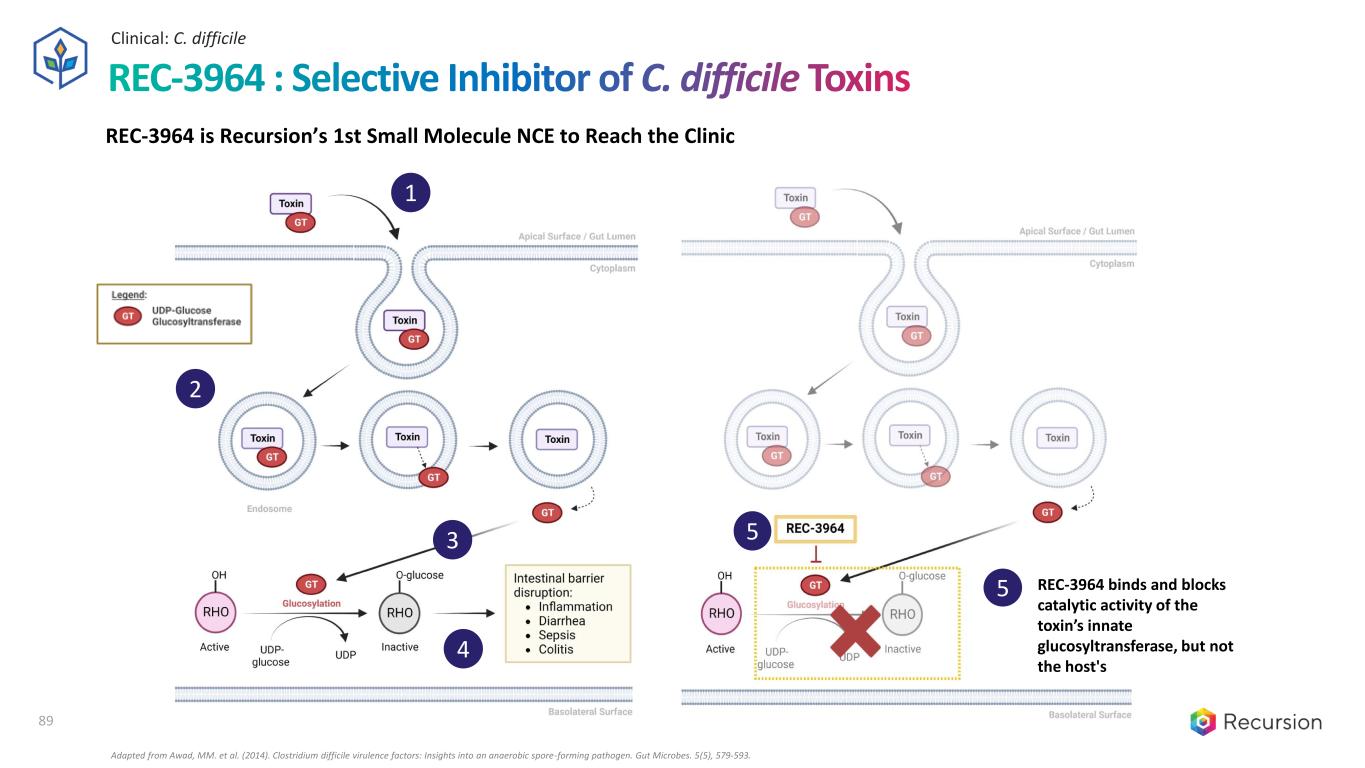

Program Overview Clinical Updates Near-term Catalysts Commercial Opportunity IP & Exclusivity Potential first-in-class small molecule for prevention of rCDI • Orally bioavailable, small molecule C. difficile toxin inhibitor and the first NCE developed by Recursion • Differentiated MOA selectively targets bacterial toxin while sparing the host to minimize adverse events • Robust preclinical activity demonstrating superiority vs bezlotoxumab in the gold standard hamster model • Favorable safety and tolerability profile in Phase 1 dose-escalation with no DLTs and no SAEs • Minimal adverse events seen in Phase 1, and all deemed Grade 1 • BID dosing provides therapeutic exposures expected to reach targeted trough concentrations • Phase 2 proof-of-concept study planned for initiation in Q4 2024 • Preliminary readout expected YE 2025 • > 100,000 high-risk rCDI patients in US and EU5 with limited treatment options to prevent recurrent disease • Ability to address populations not eligible for FMT or microbiome-based therapies due to comorbidities • Composition of matter patent allowed with protection until 2042 (excluding extensions) • No known barriers to market access REC-3964 for Prevention of recurrent C. difficile infection (rCDI) Clinical: C. difficile 86

Disease State Healthy Cells REC-3964 0.1 µM Clinical: C. difficile • REC-3964 potently inhibits toxin B with residual activity against toxin A, while bezlotoxumab is specific to toxin B. • Significant difference in probability of survival vs bezlotoxumab alone at the end of treatment (p<0.001, log-rank test) REC-3964 significantly extended survival over SOC Insight from OS: REC-3964 Rescued Cells Treated with C. difficile Toxins 87

Clinical: C. difficile CDI toxins bind to cell surface receptors and trigger endocytic event 1 Autocatalytic cleavage event releases CDI toxin's glucosyltransferase enzymatic domain into the cytosol of the infected cell 2 The glucosyltransferase locks Rho family GTPases in the inactive state 3 Inactivation of Rho GTPases alters cytoskeletal dynamics, induces apoptosis, and impairs barrier function which drives the pathological effects of CDI 4 3 1 2 4 Adapted from Awad, MM. et al. (2014). Clostridium difficile virulence factors: Insights into an anaerobic spore-forming pathogen. Gut Microbes. 5(5), 579-593. REC-3964 is Recursion’s 1st Small Molecule NCE to Reach the Clinic REC-3964 : Selective Inhibitor of C. difficile Toxins 88

Adapted from Awad, MM. et al. (2014). Clostridium difficile virulence factors: Insights into an anaerobic spore-forming pathogen. Gut Microbes. 5(5), 579-593. 3 1 2 4 Clinical: C. difficile REC-3964 : Selective Inhibitor of C. difficile Toxins 89 REC-3964 binds and blocks catalytic activity of the toxin’s innate glucosyltransferase, but not the host's 5 5 REC-3964 is Recursion’s 1st Small Molecule NCE to Reach the Clinic

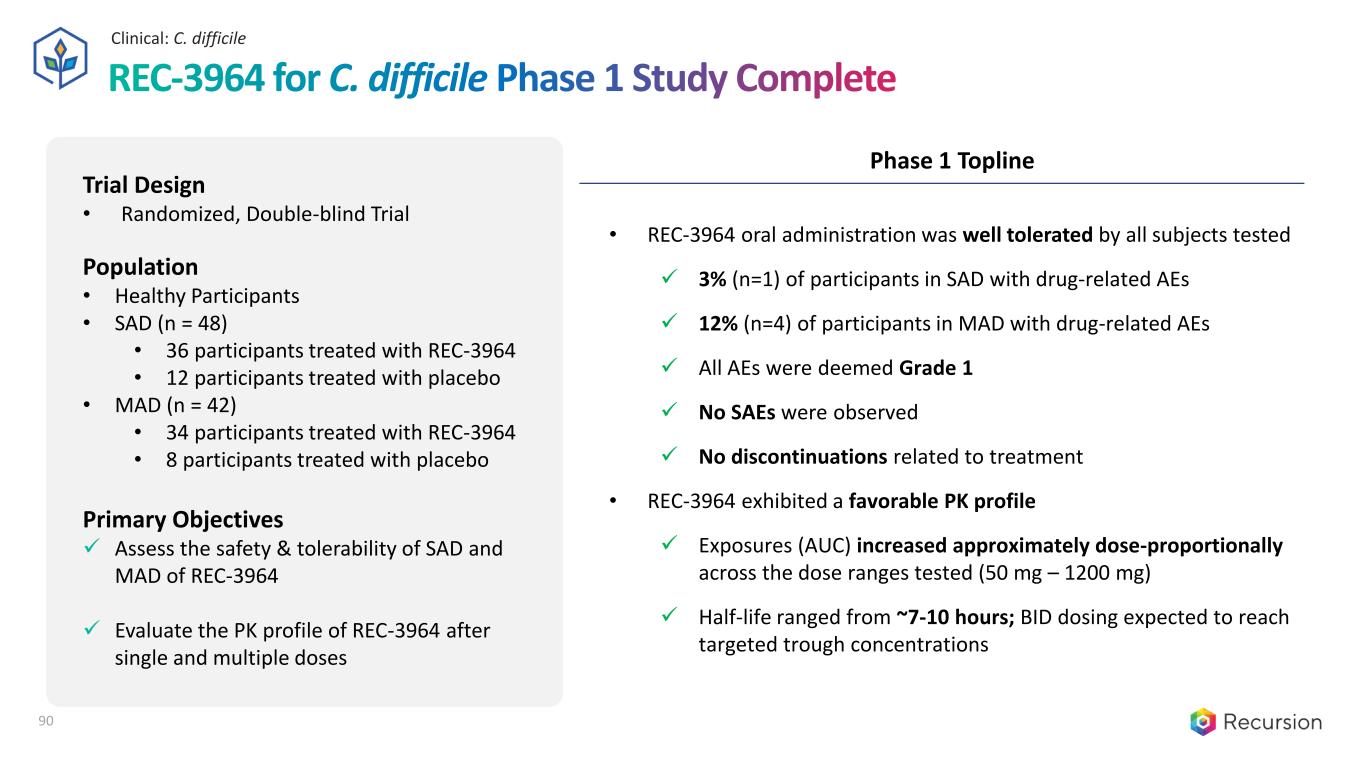

90 Trial Design • Randomized, Double-blind Trial Population • Healthy Participants • SAD (n = 48) • 36 participants treated with REC-3964 • 12 participants treated with placebo • MAD (n = 42) • 34 participants treated with REC-3964 • 8 participants treated with placebo Primary Objectives ✓ Assess the safety & tolerability of SAD and MAD of REC-3964 ✓ Evaluate the PK profile of REC-3964 after single and multiple doses Phase 1 Topline • REC-3964 oral administration was well tolerated by all subjects tested ✓ 3% (n=1) of participants in SAD with drug-related AEs ✓ 12% (n=4) of participants in MAD with drug-related AEs ✓ All AEs were deemed Grade 1 ✓ No SAEs were observed ✓ No discontinuations related to treatment • REC-3964 exhibited a favorable PK profile ✓ Exposures (AUC) increased approximately dose-proportionally across the dose ranges tested (50 mg – 1200 mg) ✓ Half-life ranged from ~7-10 hours; BID dosing expected to reach targeted trough concentrations Clinical: C. difficile REC-3964 for C. difficile Phase 1 Study Complete 90

MAD Study Placebo (N=8) n ( %) 100 mg (N=10) n ( %) 300 mg (N=8) n ( %) 500 mg (N=8) n ( %) 900 mg (N=8) n ( %) REC-3964 Overall (N=34) n ( %) MAD Overall (N=42) n ( %) Total Number of TEAEs 17 24 5 9 7 45 62 Total Participants with ≥ 1 TEAE 6 ( 75.0) 8 ( 80.0) 4 ( 50.0) 5 ( 62.5) 4 ( 50.0) 21 ( 61.8) 27 ( 64.3) Relationship to Study Drug Not Related 4 ( 50.0) 6 ( 60.0) 3 ( 37.5) 4 ( 50.0) 4 ( 50.0) 17 ( 50.0) 21 ( 50.0) Related 2 ( 25.0) 2 ( 20.0) 1 ( 12.5) 1 ( 12.5) 0 4 ( 11.8) 6 ( 14.3) Abdominal Distension 2 ( 25.0) 1 ( 10.0) 1 ( 12.5) 1 ( 12.5) 0 3 ( 8.8) 5 ( 11.9) Flatulence 0 1 ( 10.0) 0 0 0 1 ( 2.9) 1 ( 2.4) Severity Grade 1 6 ( 75.0) 8 ( 80.0) 4 ( 50.0) 5 ( 62.5) 4 ( 50.0) 21 ( 61.8) 27 ( 64.3) Grade 2 0 0 0 0 0 0 0 Grade ≥ 3 0 0 0 0 0 0 0 Total Number of SAEs 0 0 0 0 0 0 0 Discontinued Study Drug Due to AE 0 0 0 0 0 0 0 TEAEs = treatment emergent adverse events; Grade 1 = Mild, Grade 2 = Moderate, Grade 3 = Severe, Grade 4 = Life Threatening, Grade 5 = Fatal REC-3964 was well-tolerated with no treatment-related SAEs Clinical: C. difficile Further Confidence : Clinical Studies Confirming Safety 91

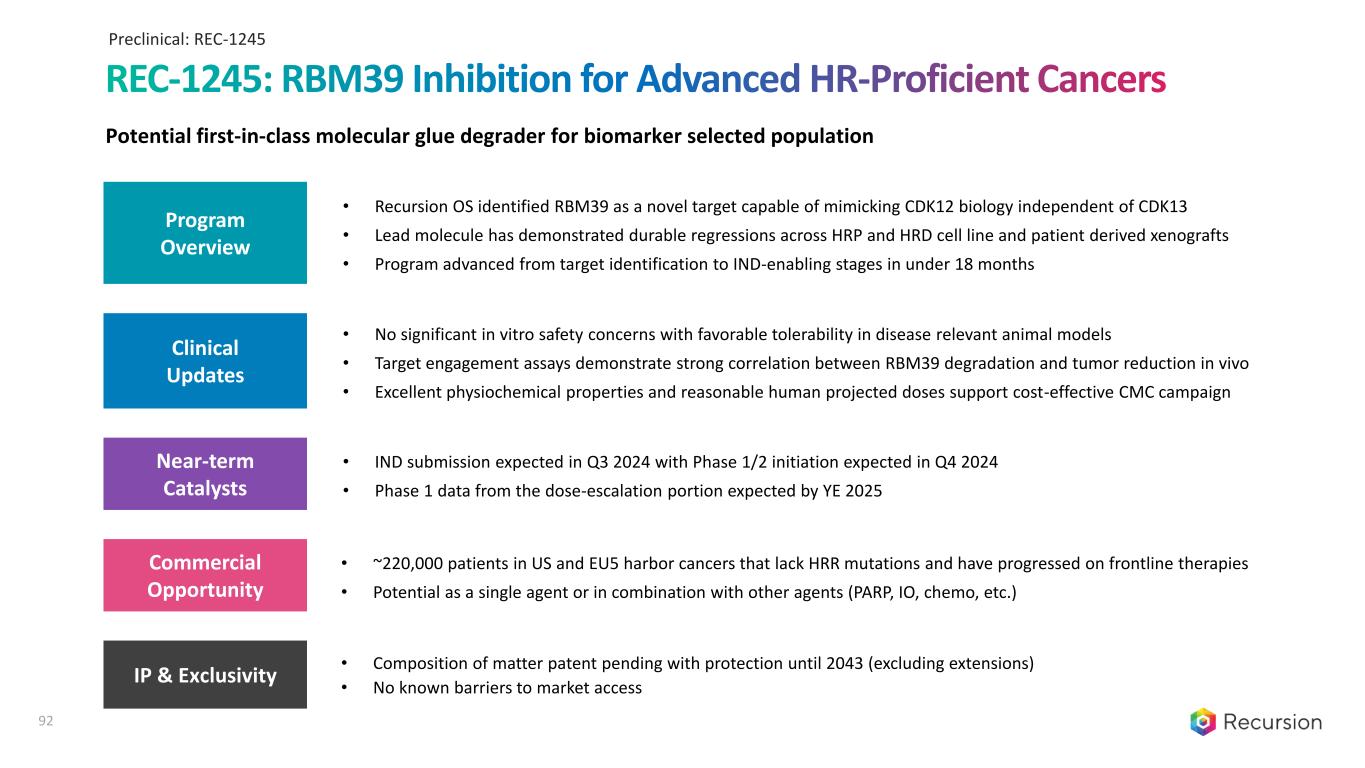

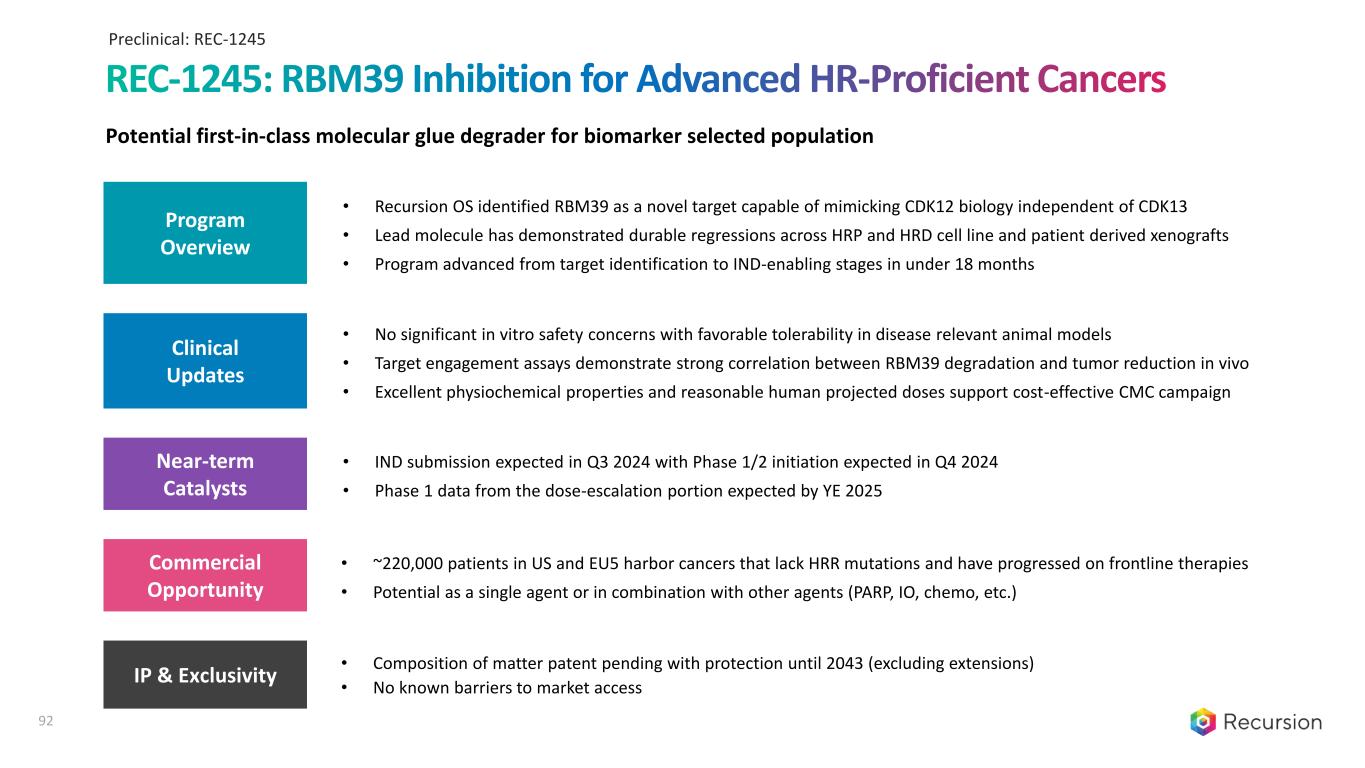

Program Overview Clinical Updates Near-term Catalysts Commercial Opportunity IP & Exclusivity Potential first-in-class molecular glue degrader for biomarker selected population • Recursion OS identified RBM39 as a novel target capable of mimicking CDK12 biology independent of CDK13 • Lead molecule has demonstrated durable regressions across HRP and HRD cell line and patient derived xenografts • Program advanced from target identification to IND-enabling stages in under 18 months • No significant in vitro safety concerns with favorable tolerability in disease relevant animal models • Target engagement assays demonstrate strong correlation between RBM39 degradation and tumor reduction in vivo • Excellent physiochemical properties and reasonable human projected doses support cost-effective CMC campaign • IND submission expected in Q3 2024 with Phase 1/2 initiation expected in Q4 2024 • Phase 1 data from the dose-escalation portion expected by YE 2025 • ~220,000 patients in US and EU5 harbor cancers that lack HRR mutations and have progressed on frontline therapies • Potential as a single agent or in combination with other agents (PARP, IO, chemo, etc.) • Composition of matter patent pending with protection until 2043 (excluding extensions) • No known barriers to market access Preclinical: REC-1245 REC-1245: RBM39 Inhibition for Advanced HR-Proficient Cancers 92