UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

x Preliminary Proxy Statement.

o Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

o Definitive Proxy Statement.

o Definitive Additional Materials.

o Soliciting Material Pursuant to § 240.14a-12.

FundX Investment Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4)Date Filed:

FUNDX INVESTMENT GROUP, LLC

FundX Upgrader Fund – FUNDX

FundX Flexible Income Fund – INCMX

FundX Conservative Upgrader Fund – RELAX

FundX Aggressive Upgrader Fund – HOTFX

FundX Sustainable Impact Fund - SRIFX

each a series of

FUNDX INVESTMENT TRUST

c/o U.S. Bank Global Fund Services

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

[PHONE NUMBER]

[MAIL DATE]

Dear Fund Shareholder:

FundX Investment Group, LLC (“FundX”) is the investment advisor to the FundX Upgrader Fund ("Upgrader Fund"), FundX Flexible Income Fund ("Flexible Income Fund"), FundX Conservative Upgrader Fund ("Conservative Upgrader Fund"), FundX Aggressive Upgrader Fund ("Aggressive Upgrader Fund"), and FundX Sustainable Impact Fund ("Sustainable Impact Fund," and together with Upgrader Fund, Flexible Income Fund, Conservative Upgrader Fund, and Aggressive Upgrader Fund, the "Funds," and separately, each a "Fund"). Pursuant to a proposed transaction between One Capital Management, LLC ("OCM)" and FundX, OCM intends to acquire a controlling interest in FundX (the "Transaction").

In light of the change of control of FundX pursuant to the Transaction, the Transaction will cause an assignment of the investment advisory agreement between FundX Investment Trust (the "Trust"), on behalf of the Funds, and FundX under the Investment Company Act of 1940 (the “1940 Act”). This assignment will terminate the agreement in accordance with its terms as required by Section 15 of the 1940 Act.

If the shareholders of the Trust, or the shareholders of any Fund, fail to approve the new investment advisory agreement ("Proposed Agreement"), the parties will not consummate the Transaction and OCM will not acquire any equity in FundX. On June 23, 2021, the Board approved the Proposed Agreement between the Trust, on behalf of the Funds, and OCM. The Trust is seeking shareholder approval of the Proposed Agreement. There are no material differences between the Proposed Agreement and the current investment advisory agreement, nor are there any material differences in FundX’s obligations under the Proposed Agreement.

Enclosed is a Notice of Special Meeting of Shareholders of the Funds to be held on [SHAREHOLDER MEETING DATE] (the “Meeting”) together with a proxy statement and proxy card

relating to the proposals to consider and approve the Proposed Agreement.

If you are a shareholder of record of the Funds as of the close of business on June 30, 2021, you are entitled to vote at the Meeting and at any postponement or adjournment thereof. While you are, of course, welcome to join us at the Meeting, most shareholders will cast their votes by filling out and signing the enclosed proxy card. The Board of Trustees of the Funds has recommended approval of the Proposed Agreement for the Funds, and encourages you to vote “FOR” Proposal 1. If you have any questions regarding the issues to be voted on, please do not hesitate to call [PHONE NUMBER].

Your vote is important, no matter how many shares you own. Even if you plan to attend the Meeting, to help ensure that your vote is represented, please either complete, date, sign and return the enclosed proxy card by mailing it in the enclosed postage-paid envelope or follow the instructions under “Frequently Asked Questions” to vote by phone or internet. You may revoke your proxy at any time before it is actually voted by providing written notice of your revocation to the undersigned, by submitting a subsequent proxy or by voting in person at the Meeting.

In light of the ongoing situation with COVID-19 (coronavirus), shareholders are urged to vote by internet, telephone, or mail. Shareholders are advised to monitor federal, state and local orders and recommendations in connection with COVID-19. Please know that we are monitoring the situation and may determine to institute alternative arrangements such as postponing the Meeting or providing access to the Meeting via remote communication.

Thank you for taking the time to consider these important proposals and for your continuing investment in the Fund.

Sincerely,

Jeff Smith

President, FundX Investment Trust

Important information to help you understand and vote on the proposals

Please read the full text of the proxy statement. Below is a brief overview of the proposals to be voted upon. Your vote is important.

Q: What is this document and why did you send it to me?

A: This document is a proxy statement. We are sending this document to you for your use in deciding whether to approve the proposed investment advisory agreement (the “Proposed Agreement”) with One Capital Management LLC ("OCM" or the “Advisor”) (“Proposals” or when referring to a single Fund, "Proposal"). Approval of the Proposed Agreement enables the Advisor to act as the investment advisor for the FundX Upgrader Fund ("Upgrader Fund"), FundX Flexible Income Fund ("Flexible Income Fund"), FundX Conservative Upgrader Fund ("Conservative Upgrader Fund"), FundX Aggressive Upgrader Fund ("Aggressive Upgrader Fund"), and FundX Sustainable Impact Fund ("Sustainable Impact Fund," and together with Upgrader Fund, Flexible Income Fund, Conservative Upgrader Fund, and Aggressive Upgrader Fund, the "Funds," and separately, each a "Fund"). This document includes the Notice of Special Meeting of Shareholders, a proxy statement, and a proxy card.

Q: What is a proxy?

A: A proxy is a person who votes the shares of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing Jeff Smith and William McDonnell, each of whom are officers of the Trust, as your proxies, and you are giving them permission to vote your mutual fund shares at the special meeting. The appointed proxies will vote your mutual fund shares as you instruct, unless you submit your proxy without instructions. In this case, they will vote FOR the proposals. With respect to any other proposals to be voted upon, they will vote in accordance with the recommendation of the Board or, in the absence of such a recommendation, in their discretion. If you do not submit your proxy, they will not vote your mutual fund shares. This is why it is important for you to return the proxy card to us as soon as possible whether or not you plan on attending the meeting.

Q: What am I being asked to vote on?

A: You are being asked to approve the Proposed Agreement between the Advisor and the Trust on behalf of the Funds.

The Proposals relate to a “change in control” of the equity ownership of the current investment advisor, FundX Investment Group, LLC ("Current Advisor"). Pursuant to a proposed transaction with OCM, OCM intends to purchase a majority ownership of the Current Advisor (the “Transaction”). There will be no change in the day-to-day management of the Funds' investment portfolios as a result of the Transaction. Additionally, the incumbent leadership of the Current Advisor will not change as a result of the Transaction.

In light of the change of control of the Current Advisor pursuant to the Transaction, the Transaction will cause an assignment of the investment advisory agreement between the Trust, on behalf of the Funds, and the Current Advisor under the Investment Company Act of 1940 (the “1940 Act”). This assignment will terminate the existing investment advisory agreement in accordance with their terms as required by Section 15 of the 1940 Act.

The Proposals are seeking shareholder approval of the Proposed agreement. There are no material differences between the Proposed Agreement and the existing investment advisory agreement, nor are there any material differences in the investment advisor’s obligations under the new agreement.

Q: How will my approval of any of the Proposals affect the management and operation of my Fund?

A: The persons responsible for managing each Fund’s assets are not expected to change as a result of or in connection with the Transaction. Each Fund's portfolio management team will continue to be primarily responsible for the day-to-day management of each Fund’s portfolio.

Q: How will my approval of any of the Proposals affect the expenses of my Fund?

A: The investment advisory fee paid by each Fund to the Advisor will not increase if the Proposed Agreement with the Advisor is approved. In addition, the Advisor has agreed to maintain each Fund's current expense cap for a two-year period after the date of the Transaction.

Q: What are the primary reasons for the Board’s approval of the Advisor to continue as the investment advisor of my Fund?

A: The Board weighed a number of factors in reaching its decision to approve the Advisor to continue as the investment advisor for the Funds, including the history, reputation, qualifications and resources of the Advisor and the fact that each Fund's current portfolio managers would continue to provide the portfolio management services to the Funds. The Board also considered that if the Proposed Agreement is approved, the Fund’s investment advisory fee would not increase and total expenses for each Fund would not increase.

Q: Are there any differences between the existing investment advisory agreement and the Proposed Agreement?

A: No. There are no material differences between the existing investment advisory agreement and the Proposed Agreement other than the effective date.

Q: Does the Fund’s Board of Trustees recommend that I approve any of the Proposals?

A: Yes. The Board has unanimously approved the Proposals to approve the Proposed Agreement with the Advisor on behalf of the Funds, and recommends that you also vote to approve your respective Proposals.

Q: Who is paying for this proxy mailing and for the other solicitation costs associated with this shareholder meeting?

A: The expenses in connection with preparing the proxy statement and its enclosures and all solicitations will be paid by the Current Advisor and the Advisor.

Q: Who is eligible to vote?

A: Shareholders of record of the Fund as of the close of business on June 30, 2021 (the “Record Date”) are entitled to be present and to vote at the Meeting or any adjournment thereof. Shareholders of record of a Fund at the close of business on the Record Date will be entitled to cast one vote for each

full share and a fractional vote for each fractional share they hold on the Proposals presented at the Meeting.

Q: What vote is required?

A: Approval of the Proposed Agreement requires the vote of the “majority of the outstanding voting securities,” which is defined under the 1940 Act as the lesser of: (1) 67% or more of the voting securities of each Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting shares entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding shares of each Fund entitled to vote thereon.

Q: How do I vote my shares?

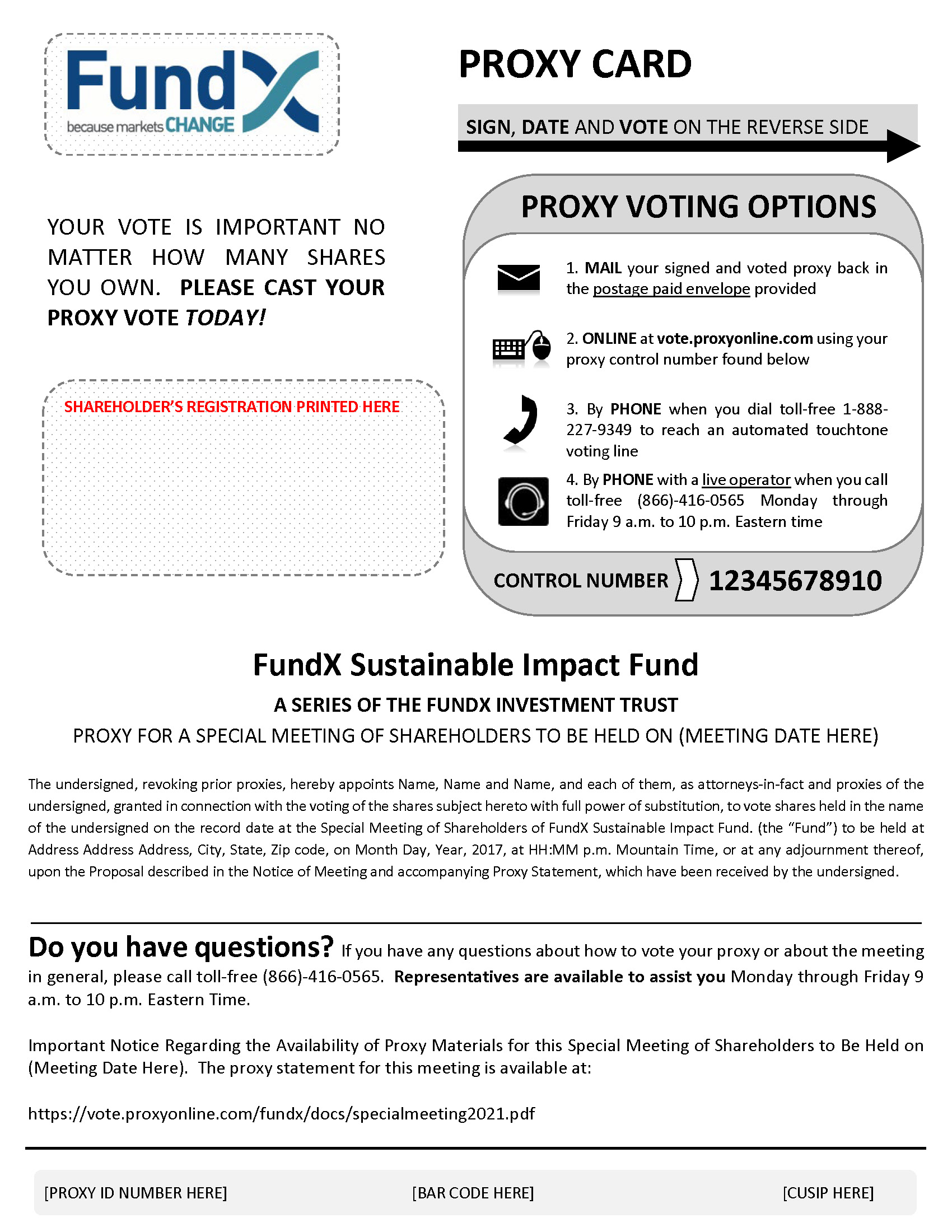

A: For your convenience, you may vote your shares in the following four ways:

By Mail: You may vote your shares by completing, dating, signing and returning your proxy card by mailing it in the enclosed postage-paid envelope.

By Telephone: You may vote your shares by telephone. To do so, please have your proxy card available, call the toll-free number on the proxy card and follow the simple instructions.

Online: You may vote your shares using the internet. To do so, please have your proxy card available and go to the website shown on the proxy card. Follow the simple instructions found on the website.

In Person: You may vote your shares in person at the Meeting if you attend.

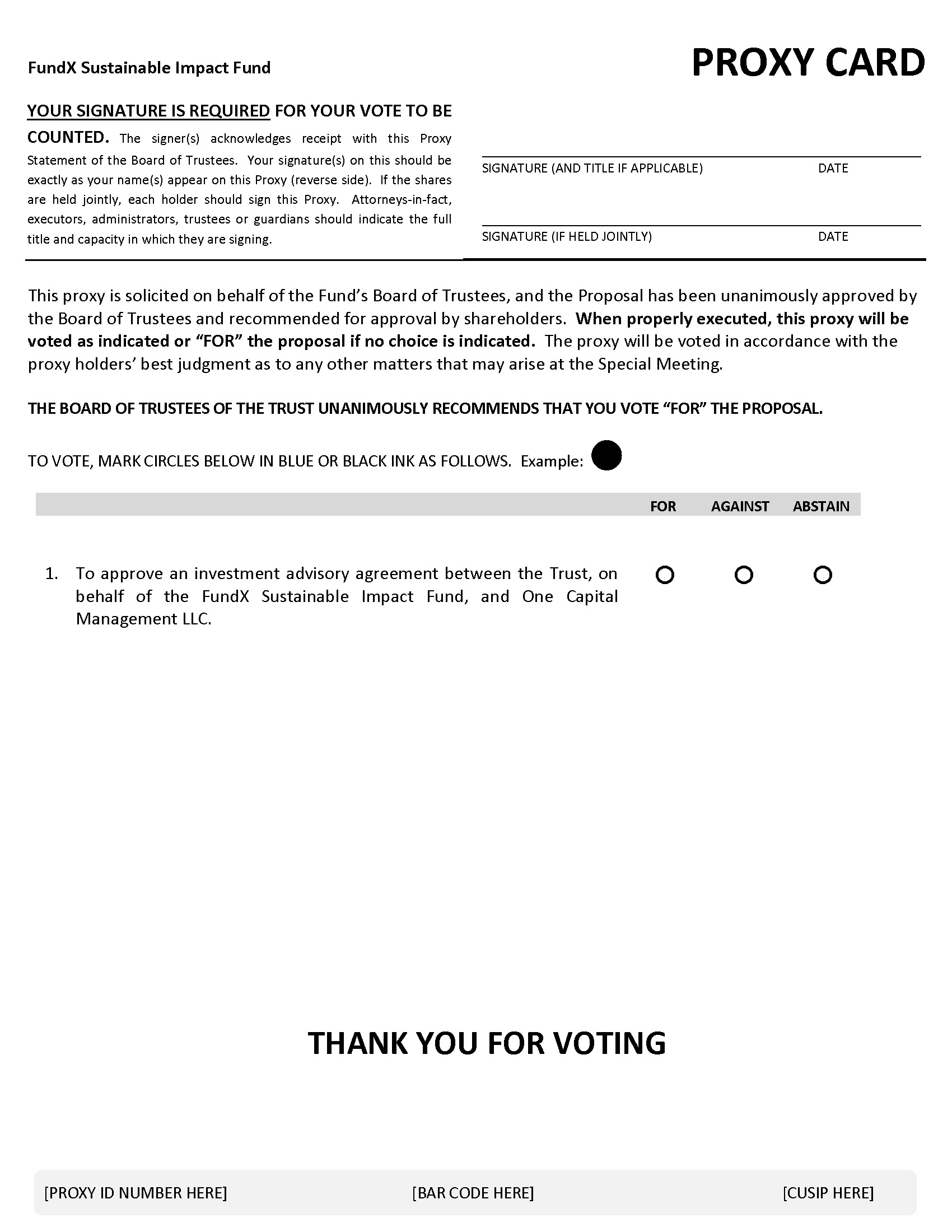

If you simply sign and date the proxy card, but do not indicate a specific vote for a Proposal, your shares will be voted FOR the Proposals and to grant discretionary authority to the persons named in the card as to any other matters that properly come before the Meeting.

Whether you vote in person, by mail, by telephone or by internet, you may revoke your proxy at any time before it is exercised by giving the Trust’s Secretary written notice of your revocation, by submitting a subsequent proxy (the subsequent proxy may be submitted by mail, telephone or internet) or by voting in person at the Meeting. Your attendance at the Meeting does not automatically revoke your proxy.

In light of the ongoing situation with COVID-19 (coronavirus), shareholders are urged to vote by internet, telephone, or mail. Shareholders are advised to monitor federal, state and local orders and recommendations in connection with COVID-19. Please know that we are

monitoring the situation and may determine to institute alternative arrangements such as postponing the Meeting or providing access to the Meeting via remote communication.

Q: How can a quorum be established?

A: Under the Trust’s Bylaws, a quorum is constituted by the presence in person or by proxy of 33 percent of the outstanding shares of each Fund entitled to vote at the Meeting. Proxies returned for shares that represent broker non-votes, and shares whose proxies reflect an abstention on the Proposals, are all counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists.

Q: What will happen if there are not enough votes to approve the any or all of the Proposals?

A: It is important that we receive your signed proxy card to ensure that there is a quorum for the Meeting. If we do not receive your vote as the date of the Meeting approaches, you may be contacted to remind you to vote your shares and help you return your proxy. In the event a quorum is present at the Meeting but sufficient votes to approve any or all of the Proposals are not received, the persons named as proxies may propose one or more postponements or adjournments of the Meeting to permit further solicitation of proxies, provided they determine that such an adjournment and additional solicitation is reasonable and in the interest of shareholders based on a consideration of all relevant factors, including the nature of the Proposals, the percentage of votes then cast, the percentage of negative votes then cast, the nature of the proposed solicitation activities, and the nature of the reasons for such further solicitation.

Q: If I vote by mail, how do I sign the proxy card?

A: Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.”

Please complete, sign and return the enclosed proxy card in the enclosed envelope. You may proxy vote by internet or telephone in accordance with the instructions set forth on the enclosed proxy card. No postage is required if mailed in the United States.

FUNDX INVESTMENT GROUP, LLC

FundX Upgrader Fund – FUNDX

FundX Flexible Income Fund – INCMX

FundX Conservative Upgrader Fund – RELAX

FundX Aggressive Upgrader Fund – HOTFX

FundX Sustainable Impact Fund - SRIFX

each a series of

FUNDX INVESTMENT TRUST

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD [SHAREHOLDER MEETING DATE]

A special meeting of shareholders (the “Meeting”) of the FundX Upgrader Fund ("Upgrader Fund"), FundX Flexible Income Fund ("Flexible Income Fund"), FundX Conservative Upgrader Fund ("Conservative Upgrader Fund"), FundX Aggressive Upgrader Fund ("Aggressive Upgrader Fund"), and FundX Sustainable Impact Fund ("Sustainable Impact Fund," and together with Upgrader Fund, Flexible Income Fund, Conservative Upgrader Fund, and Aggressive Upgrader Fund, the "Funds," and separately, each a "Fund"), each a series of FundX Investment Trust (the “Trust”), will be held on [SHAREHOLDER MEETING DATE], at [MEETING TIME], at the offices of [MEETING LOCATION]. At the Meeting, shareholders of the Fund will be asked to consider and act upon the following proposals:

Proposal 1 - To approve an investment advisory agreement between the Trust, on behalf of the FundX Upgrader Fund, and One Capital Management LLC.

Proposal 2 - To approve an investment advisory agreement between the Trust, on behalf of the FundX Flexible Income Fund, and One Capital Management LLC.

Proposal 3 - To approve an investment advisory agreement between the Trust, on behalf of the FundX Conservative Upgrader Fund, and One Capital Management LLC.

Proposal 4 - To approve an investment advisory agreement between the Trust, on behalf of the FundX Aggressive Upgrader Fund, and One Capital Management LLC.

Proposal 5 - To approve an investment advisory agreement between the Trust, on behalf of the FundX Sustainable Impact Fund, and One Capital Management LLC.

Shareholders may also be asked to transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS UPON WHICH YOU ARE BEING ASKED TO VOTE.

The Trust’s Board of Trustees has fixed the close of business on June 30, 2021 as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Meeting and any adjournments thereof.

Please read the accompanying proxy statement. Regardless of whether you plan to attend the Meeting, please complete, sign and return promptly the enclosed proxy card so that a quorum will be present and a maximum number of shares may be voted for a Fund. In the alternative, please call the toll-free number on your proxy card to vote by telephone or go to the web site shown on your proxy card to vote over the internet.

By Order of the Board of Trustees

Jeff Smith

President, FundX Investment Trust

[MAIL DATE]

Your vote is important - please vote your shares promptly.

In light of the ongoing situation with COVID-19, shareholders are urged to vote by internet, telephone, or mail. Shareholders are advised to monitor federal, state and local orders and recommendations in connection with COVID-19. Telephone and internet voting instructions can be found on the enclosed proxy card or indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

FUNDX INVESTMENT GROUP, LLC

FundX Upgrader Fund – FUNDX

FundX Flexible Income Fund – INCMX

FundX Conservative Upgrader Fund – RELAX

FundX Aggressive Upgrader Fund – HOTFX

FundX Sustainable Impact Fund - SRIFX

each a series of

FUNDX INVESTMENT TRUST

PROXY STATEMENT

[PROXY DATE]

This Proxy Statement is being furnished to the shareholders of the FundX Upgrader Fund ("Upgrader Fund"), FundX Flexible Income Fund ("Flexible Income Fund"), FundX Conservative Upgrader Fund ("Conservative Upgrader Fund"), FundX Aggressive Upgrader Fund ("Aggressive Upgrader Fund"), and FundX Sustainable Impact Fund ("Sustainable Impact Fund," and together with Upgrader Fund, Flexible Income Fund, Conservative Upgrader Fund, and Aggressive Upgrader Fund, the "Funds," and separately, each a "Fund"), each a series of FundX Investment Trust (the “Trust”), an open-end management investment company, on behalf of the Trust’s Board of Trustees (the “Board”) in connection with the Funds' solicitation of shareholders’ proxies for use at a special meeting of shareholders of the Funds (the “Meeting”) to be held on [SHAREHOLDER MEETING DATE], at [MEETING TIME], at the offices of [MEETING LOCATION], for the purposes set forth below and in the accompanying Notice of Special Meeting of Shareholders.

Shareholders of record at the close of business on the record date, established as June 30, 2021 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting. The approximate mailing date of this Proxy Statement to shareholders is[MAIL DATE]. The Meeting will be held for the following purpose:

Proposal 1 To approve an investment advisory agreement between the Trust, on behalf of the FundX Upgrader Fund, and One Capital Management LLC.

Proposal 2 To approve an investment advisory agreement between the Trust, on behalf of the FundX Flexible Income Fund, and One Capital Management LLC.

Proposal 3 To approve an investment advisory agreement between the Trust, on behalf of the FundX Conservative Upgrader Fund, and One Capital Management LLC.

Proposal 4 To approve an investment advisory agreement between the Trust, on behalf of the FundX Aggressive Upgrader Fund, and One Capital Management LLC.

Proposal 5 To approve an investment advisory agreement between the Trust, on behalf of the FundX Sustainable Impact Fund, and One Capital Management LLC.

THE PROPOSALS

APPROVAL OF INVESTMENT ADVISORY AGREEMENT BETWEEN THE TRUST AND

ONE CAPITAL MANAGEMENT LLC.

Background. The proposals relate to a proposed change in control of the equity ownership of FundX Investment Group, LLC (the “Current Advisor”). Pursuant to a transaction with One Capital Management LLC ("OCM" or the "Advisor"). The Transaction is contingent upon shareholders of the funds approving and clients of the Current Advisor's separately managed accounts consenting to, jointly and separately, a new investment advisory agreement and/or separate account agreement, as applicable. Upon completion of the Transaction there will be no change in the day-to-day management of the Funds' investment portfolios as a result of the Transaction. Additionally, the incumbent leadership of the Current Advisor will not change as a result of the Transaction.

Currently, the Current Advisor provides investment advisory services to the Funds and managed portfolio assets pursuant to an investment advisory agreement with the Trust (the “Current Agreement”). The Current Agreement was last approved by the Board, including a majority of the Independent Trustees (as defined below), at its meeting held on June 23, 2021, and was last approved by a vote of shareholders on July 30, 2014.

In light of the proposed change of control of the Current Advisor pursuant to the Transaction, the Transaction will result in an assignment of the Current Agreement under the Investment Company Act of 1940 (the “1940 Act”). This assignment will terminate the Current Agreement in accordance with its terms as required by Section 15 of the 1940 Act. In anticipation of this assignment and termination, on June 23, 2021, the Board approved a new investment advisory agreement between the Trust, on behalf of the Funds, and the Advisor (the “Proposed Agreement”) and is seeking shareholder approval of the Proposed Agreement.

In order for the Advisor to serve as investment advisor to the Funds, shareholders of each Fund must approve the Proposed Agreement. If approved, the Proposed Agreement will be effective upon the close of the Transaction, which is expected shortly after the Shareholder Meeting.. There are no differences in the Advisor’s obligations under the Current Agreement and the Proposed Agreement.

Summary of the Current Agreement and Proposed Agreement. The Proposed Agreement is substantially identical to the Current Agreement, except for the dates of execution and effectiveness. A copy of the Proposed Agreement is attached to this Proxy Statement as Exhibit A. The following description of the Proposed Agreement is only a summary. You should refer to Exhibit A for the terms of the Proposed Agreement, and the description set forth below of the Proposed Agreement is qualified in its entirety by reference to Exhibit A.

Description of Advisory Agreement. The Current Advisor has served as investment advisor to the Funds since each Fund's inception. If approved by shareholders at the Meeting and upon completion of the Transaction, the Advisor will provide the same services pursuant to the terms of the Proposed Agreement. The Proposed Agreement will remain in effect for a period of two (2) years, unless sooner terminated. After the initial two-year period, continuation of the Proposed Agreement from year-to-year is subject to annual approval by the Board, including at least a majority of the Independent Trustees. Both the Current Agreement and the Proposed Agreement may be terminated by the Board or a vote of a majority (as that term is defined in the 1940 Act) of the shareholders of the Fund upon not more than 60 days’ notice, or by the Advisor upon 60 days’ notice.

Advisory Services. Like the Current Agreement, the Proposed Agreement states that, subject to the supervision and direction of the Board of Trustees, the Advisor will supervise and manage the investment portfolio of each Fund and direct the purchase and sale of investment securities in the day to day management of each Fund.

Management Fees. Like the Current Agreement, the Proposed Agreement provides that each Fund will pay the Advisor a fee at an annual rate based on the Fund’s average daily net assets. Each Fund's advisory fee is described in the table below:

| | | | | |

| Annual Advisory Fee |

| FundX Upgrader Fund | 1.00% on assets up to $500 million, 0.90% on assets between $500 million and $750 million, 0.80% on assets between $750 million and $1 billion, and 0.70% on assets over $1 billion. |

| FundX Flexible Income Fund | 0.70% |

| FundX Conservative Upgrader Fund | 1.00% on assets up to $500 million, 0.90% on assets between $500 million and $750 million, 0.80% on assets between $750 million and $1 billion, and 0.70% on assets over $1 billion. |

| FundX Aggressive Upgrader Fund | 1.00% on assets up to $500 million, 0.90% on assets between $500 million and $750 million, 0.80% on assets between $750 million and $1 billion, and 0.70% on assets over $1 billion. |

| FundX Sustainable Impact Fund | 1.00% on assets up to $500 million, 0.90% on assets between $500 million and $750 million, 0.80% on assets between $750 million and $1 billion, and 0.70% on assets over $1 billion. |

For the fiscal years ended September 30, the Funds paid the following fees to the Current Advisor:

| | | | | | | | | | | |

| Upgrader Fund |

| 2020 | 2019 | 2018 |

| Fees Accrued | $2,017,733 | $2,100,331 | $2,269,958 |

| Fees (Waived)/Recouped | $0 | $0 | $0 |

| Net Advisory Fee Paid | $2,017,733 | $2,100,331 | $2,269,958 |

| | | | | | | | | | | |

| Flexible Income Fund |

| 2020 | 2019 | 2018 |

| Fees Accrued | $645,214 | $651,143 | $697,555 |

| Fees (Waived) | $(17,938) | $(12,491) | $0 |

| Fees Recouped | $4,367 | $0 | $7,220 |

| Net Advisory Fee Paid | $631,643 | $638,652 | $704,775 |

| | | | | | | | | | | |

| Conservative Upgrader Fund |

| 2020 | 2019 | 2018 |

| Fees Accrued | $862,385 | $627,914 | $581,692 |

| Fees (Waived) | ($174) | $0 | $0 |

| Fees Recouped | $19,220 | $3,737 | $2,876 |

| Net Advisory Fee Paid | $881,431 | $631,651 | $584,568 |

| | | | | | | | | | | |

| Aggressive Upgrader Fund |

| 2020 | 2019 | 2018 |

| Fees Accrued | $338,183 | $373,465 | $437,046 |

| Fees (Waived)/Recouped | $(42,876) | $(33,362) | $(29,675) |

| Net Advisory Fee Paid | $295,307 | $340,103 | $407,371 |

| | | | | | | | | | | |

| Sustainable Impact Fund |

| 2020 | 2019 | 2018 |

| Fees Accrued | $196,312 | $185,968 | $152,284 |

| Fees (Waived)/Recouped | $(34,315) | $(29,665) | $(30,358) |

| Net Advisory Fee Paid | $161,997 | $156,303 | $121,926 |

Brokerage Policies. Like the Current Agreement, the Proposed Agreement authorizes the Advisor to select the brokers or dealers that will execute the purchases and sales of securities of the Funds and direct the Advisor to use its best efforts to obtain the most favorable price. The Advisor may cause a Fund to pay a broker a commission in excess of that which another broker might have charged for effecting the same transaction, if the Advisor determines in good faith that such amount of commission is reasonable in relation to the value of brokerage and research services provided by the executing broker-dealer viewed in terms of either that particular transaction or his overall responsibilities with respect to the accounts as to which he exercises investment discretion.

Payment of Expenses. Like the Current Agreement, the Proposed Agreement provides that the Advisor will pay all of the costs and expenses incurred by it in connection with its advisory services provided for a Fund. The Advisor will not be required to pay the costs and expenses associated with purchasing securities, commodities and other investments for a Fund (including brokerage commissions and other transaction or custodial charges).

Other Provisions. Like the Current Agreement, the Proposed Agreement provides that in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of obligations or duties under the agreement on the part of the Advisor, the Advisor shall not be subject to liability to a Fund or to any shareholder of a Fund for any act or omission in the course of, or connected with, rendering services under the agreement, or for any losses that may be sustained in the purchase, holding or sale of any security. Additionally, the Current Agreement and Proposed Agreement provide that the federal securities laws impose liabilities under certain circumstances on persons who act in good faith, and therefore nothing in the agreement should in any way constitute a waiver or limitation of any rights that a Fund’s shareholders may have under any federal securities laws.

Executive Officers and Directors of the Current Advisor. Information regarding the current principal executive officers and directors of the Current Advisor is set forth below. The address of the Current Advisor is 101 Montgomery Street, Suite 2400, San Francisco, California 94104. The name and principal occupation of the principal executive officer and each director of the Current Advisor are listed below.

| | | | | | | | |

| Name | | Principal Occupation |

| Janet Brown | | President and Portfolio Manager |

| Jeffrey Smith | | Managing Partner |

| Marty DeVault | | Principal and Portfolio Manager |

| Sean McKeon | | CCO and Portfolio Manager |

Considerations of the Board of Trustees. At a Special Board Meeting held on June 23, 2021, the Board considered and approved both the Current Agreement as well as the Proposed Agreement. The Board noted that its earlier approval of the Current Agreement was necessary to maintain continuity of services to the Funds during the proxy period. At its meeting, the Board received information about the Transaction and its potential impact on the Funds, as well as the terms of the Proposed Agreement. The Board received and reviewed extensive information and documentation from both the Current Advisor and the Advisor relating to the Transaction and other relevant matters. Factors relating to continuity of investment personnel of the Current Advisor with the Advisor, historical performance of the Current Advisor, and the resources of the Advisor, were considered. The Board reviewed detailed information about the Transaction, the structure, operations, organization, personnel, and financial capabilities of OCM and the financial terms of the Transaction. The Board reviewed and discussed the structure of the Transaction with representatives of both the Current Advisor and the Advisor. Additionally, information and analysis previously provided by the Current Advisor over the course of their service to the Funds was considered in evaluating the Proposed Agreement. The Board considered such information carefully in conjunction with the other detailed information it received from the Current Advisor in the process of conducting its annual consideration and approval of the continuance of the Current Agreement. In preparation for the Meeting, the Board was provided with, and the Board reviewed and considered, extensive information regarding the Funds and the Current Advisor, detailing the services provided by the Current Advisor to each of the Funds under the Current Agreement. The Board in particular noted and considered that there are no material differences between the terms of the Proposed Agreement and the terms of the Current Agreement.

In its deliberations, the Board did not identify any single factor or piece of information as all important, controlling, or determinative of its decision to approve the Proposed Agreement, rather the Board based its determination on the total mix of information available to it, and each Trustee may have attributed different weights to the various factors and information.

•In considering the nature, extent, and quality of the services to be provided by the Advisor, the Board considered information it believed necessary to assess the stability and viability of the Advisor subsequent to the Transaction and to assess the ongoing nature and quality of services to be provided to the Funds following the Transaction. The Board reviewed details of the anticipated equity structure of the Advisor as a result of the Transaction generally and with respect to the identity and business of the entities and individuals that were expected to become employees of the Advisor as a result of the Transaction, including the financial resources of those entities and their ability to assist in growing the Advisor’s business and/or in servicing the Funds. In this regard, the Board considered information about how the Advisor’s management and operations would be structured following the Transaction, including in particular how the Transaction might affect the Advisor’s performance or delivery of services under the Proposed Agreement. The Board considered information addressing the projected benefits to the Advisor expected to result from the Transaction and information describing how the Transaction may be expected to affect the Advisor’s business, including key personnel.

In addition, the Board took note of its comprehensive review of the Current Advisor, both at earlier meetings and this meeting, in connection with the annual approval of the Current Agreement. The Board considered the Advisor’s specific responsibilities in all aspects of the day-to-day management of the Funds, as well as the qualifications, experience and responsibilities of the portfolio managers and other key personnel involved in the day-to-day activities of the Funds. The Board reviewed the services that the

Advisor would provide to the Funds, noting to what degree those services would extend beyond portfolio management. The Trustees also considered the structure of the compliance procedures of the Advisor, including information regarding its compliance program, chief compliance officer, and compliance record and its disaster recovery/business continuity plan. The Board also considered the existing relationship between the Current Advisor and the Trust as well as the Board’s knowledge of the Current Advisor’s operations and noted that during the course of the prior year it had met with the Current Advisor to discuss various operational topics, including compliance and investment management processes and methodologies. The Board concluded that the Current Advisor, and by extension as a result of the Transaction, the Advisor, may be reasonably expected to have sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures to perform their duties under the Proposed Agreement, and that, in the Board’s view, the nature, overall quality, and extent of the management services to be provided to the Funds may be expected to continue to be satisfactory.

Based on its review, within the context of its full deliberations, the Board concluded that the Advisor following the Transaction may be reasonably expected to continue to provide the same type and quality of services to the Funds, in particular noting the following:

•In assessing the quality of the portfolio management and other services to be delivered by the Advisor, the Board reviewed the performance of the Funds on both an absolute basis and in comparison, to their peer groups and relevant benchmark indices. The Board considered that the Funds had performed in-line relative to their peer groups medians/averages for the one-year and three-year periods as of March 31, 2021.

•Noting that the fees under the Proposed Agreement are the same as the fees under the Current Agreement, the Board considered its comprehensive review of the cost of the Current Advisor’s services, and the structure and level of advisory fees payable by the Funds, including a comparison of those fees to fees charged by a peer group of funds. The Board also reviewed comprehensive comparative fee information prepared by Broadridge.

•In considering economies of scale the Trustees considered the Current Advisor’s assertion that, based on the asset size of the Funds, economies of scale had not yet been achieved. The Board also considered the Advisor’s commitment to maintain its cap on each Fund's expenses for a two-year period after the date of the Transaction. The Trustees further concluded that they would have the opportunity to periodically reexamine whether economies of scale have been achieved.

•The Board took note of its comprehensive review of the profitability of the Current Advisor in its capacity managing the Funds. The Board considered the assumptions and representations as to the Advisor’s financial condition, profitability and operations following the Transaction. In assessing the Advisor’s profitability, the Trustees reviewed the Advisor’s financial information that was provided and considered both the direct and indirect benefits that may be expected to accrue to the Advisor from managing the Funds. The Trustees concluded that the Advisor’s profits from managing the Fund would not be excessive and after a review of the relevant financial information provided, concluded that the Advisor appeared to have adequate capitalization and may reasonably be expected to maintain adequate profit levels to support the Funds.

Other Legal Requirements under the 1940 Act. When a change in control of an investment advisor occurs, Section 15(f) of the 1940 Act provides a non-exclusive safe harbor for the investment

advisor or any of its affiliated persons to receive any amount or benefit in connection with the change in control as long as two conditions are satisfied. The first condition specifies that, during the three-year period immediately following consummation of the transaction, at least 75% of the Fund’s Board must be Independent Trustees. Currently, the Board meets this 75% requirement and intends to continue to do so for the required three-year period.

The second condition specifies that no “unfair burden” may be imposed on the investment company as a result of the transaction relating to the change of control, or any express or implied terms, conditions or understandings. The term “unfair burden,” as defined in the 1940 Act, includes any arrangement during the two-year period after the change in control whereby the investment advisor (or predecessor or successor advisor), or any interested person of any such advisor, receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from, or on behalf of the investment company (other than fees for bona fide principal underwriting services). The Advisor has agreed to use its best efforts to ensure that the transaction will not cause the imposition of an unfair burden, as that term is defined in Section 15(f) of the 1940 Act, on the Funds. In addition, the Advisor has agreed to maintain each Fund’s current expense cap for a two‑year period after the date of the Transaction.

For the reasons set forth above, the Board unanimously recommends that shareholders of each Fund vote “FOR” the respective proposals to approve the Proposed Agreement between the Trust, on behalf of the Funds, and FundX Investment Group, LLC.

GENERAL INFORMATION

Required Vote. Approval of each of the Proposals requires the affirmative vote of a “majority of the outstanding voting securities” of each Fund. Under the 1940 Act, a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the shares of the Fund present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding shares are present at the Meeting or represented by proxy, or (b) more than 50% of the outstanding shares. If the Proposed Agreement is approved by all Funds' shareholders, they are expected to become effective on at the close of the Transaction, currently expected shortly after the Shareholder Meeting on [SHAREHOLDER MEETING DATE]. If the shareholders of any Fund do not approve their respective Proposal, the Advisor and OCM will not consummate the Transaction and the Current Agreement will continue to be effective.

Record Date/Shareholders Entitled to Vote. Each Fund is a series, or portfolio, of the Trust, a Delaware statutory trust and registered investment company under the 1940 Act. The record holders of outstanding shares of each Fund are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Meeting with respect to a Fund to which they own shares as of the Record Date. Shareholders of a Fund at the close of business on June 30, 2021 will be entitled to be present and vote at the Meeting. As of the Record Date, each Fund had the following shares outstanding and entitled to vote, along with the following net assets:

| | | | | | | | |

| Outstanding Shares | Net Assets |

| FundX Upgrader Fund | | |

| FundX Flexible Income Fund | | |

| FundX Conservative Upgrader Fund | | |

| FundX Aggressive Upgrader Fund | | |

| FundX Sustainable Impact Fund | | |

Voting Proxies. You should read the entire proxy statement before voting. If you have any questions regarding the proxy statement or special , please call [PROXY PHONE NUMBER]. If you sign and return the accompanying proxy card, you may revoke it by giving written notice of such revocation to the Secretary of the Trust prior to the Meeting or by delivering a subsequently dated proxy card or by attending and voting at the Meeting in person. Proxies voted by telephone or internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number listed in the enclosed proxy card. All properly executed proxy cards received prior to the Meeting will be voted at the Meeting in accordance with the instructions marked thereon. Proxy cards received prior to the Meeting on which no vote is indicated will be voted “for” each proposal. Proxies may vote at their discretion with respect to other matters not now known to the Board that may be presented to the Meeting. Shareholders who execute proxy cards may revoke them at any time before they are voted, either by writing to the Secretary of the Trust at the Fund’s address noted above, delivering a duly executed proxy card bearing a later date or in person at the time of the Meeting. If not so revoked, the shares represented by the proxy card will be voted at the Meeting, and any adjournments thereof, as instructed. Attendance by a shareholder at the Meeting does not, in itself, revoke a proxy.

If sufficient votes are not received by the date of the Meeting, a person named as proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. The persons named as proxies will vote all proxies in favor of adjournment that voted in favor of each proposal (or abstained) and vote against adjournment all proxies that voted against each proposal.

Quorum Required. Each Fund must have a quorum of shares represented at the Meeting, in person or by proxy, in order to take action on any matter relating to that Fund. Under the Trust’s Bylaws, a quorum is constituted by the presence in person or by proxy of 33 percent of the outstanding shares of a Fund entitled to vote at the Meeting.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter.

If a quorum is not present at the Meeting, or a quorum is present at the Meeting but sufficient votes to approve a proposal for a Fund are not received, the Secretary of the Meeting or the holders of a majority of the shares of a Fund present at the Meeting in person or by proxy may adjourn the Meeting to permit further solicitation of proxies.

Method and Cost of Proxy Solicitation. Proxies will be solicited by the Trust primarily by mail. The solicitation may also include telephone, facsimile, electronic or oral communications by certain officers or employees of the Funds or the Advisor who will not be paid for these services. The Current Adviser and Advisor will pay the costs of the Meeting and the expenses incurred in connection with the solicitation of proxies, including those expenses incurred by the Current Adviser and Advisor. The Trust may also request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Funds held of record by such persons. The Advisor may reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of the Funds.

Other Service Providers. The Fund’s distributor and principal underwriter is Quasar Distributors, LLC, 111 East Kilbourn Avenue, Suite 1250, Milwaukee, Wisconsin, 53202. The Fund’s administrator, transfer agent and dividend disbursing agent is U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, WI 53202.

Share Ownership. To the knowledge of the Trust’s management, as of the close of business on June 30, 2021, none of the officers or Trustees of the Trust held any beneficial ownership of the Fund’s outstanding shares. To the knowledge of the Trust’s management, as of June 30, 2021, the following shareholders were considered to be either a control person or principal shareholder of the Fund:

Upgrader Fund | | | | | | | | |

| Name and Address | % Ownership | Type of Ownership |

Charles Schwab Co.

Reinvest Account

211 Main St.

San Francisco, CA 94105-1905

| | Record |

National Financial Services, LLC

For the Exclusive Benefit of Our Customers

Attn. Mutual Funds Department

499 Washington Blvd. Floor 5

Jersey City, NJ 07310-20110

| | Record |

TD Ameritrade Inc.

For the Exclusive Benefit of our Clients

P.O. Box 2226

Omaha, NE 68103-2226

| | Record |

Flexible Income Fund | | | | | | | | |

| Name and Address | % Ownership | Type of Ownership |

Charles Schwab Co. Reinvest Account 211 Main St. San Francisco, CA 94105-1905

| | Record |

National Financial Services, LLC

For the Exclusive Benefit of Our Customers

Attn. Mutual Funds Department

499 Washington Blvd. Floor 5

Jersey City, NJ 07310-20110

| | Record |

Conservative Upgrader Fund | | | | | | | | |

| Name and Address | % Ownership | Type of Ownership |

Charles Schwab Co.

Reinvest Account

211 Main St.

San Francisco, CA 94105-1905

| | Record |

National Financial Services, LLC

For the Exclusive Benefit of Our Customers

Attn. Mutual Funds Department

499 Washington Blvd. Floor 5

Jersey City, NJ 07310-20110

| | Record |

TD Ameritrade Inc.

For the Exclusive Benefit of our Clients

P.O. Box 2226

Omaha, NE 68103-2226

| | Record |

Aggressive Upgrader Fund | | | | | | | | |

| Name and Address | % Ownership | Type of Ownership |

Charles Schwab Co.

Reinvest Account

211 Main St.

San Francisco, CA 94105-1905

| | Record |

National Financial Services, LLC For the Exclusive Benefit of Our Customers Attn. Mutual Funds Department 499 Washington Blvd. Floor 5 Jersey City, NJ 07310-20110

| | Record |

TD Ameritrade Inc.

For the Exclusive Benefit of our Clients

P.O. Box 2226

Omaha, NE 68103-2226

| | Record |

Sustainable Impact Fund | | | | | | | | |

| Name and Address | % Ownership | Type of Ownership |

Charles Schwab Co. Reinvest Account 211 Main St. San Francisco, CA 94105-1905

| | Record |

National Financial Services, LLC

For the Exclusive Benefit of Our Customers

Attn. Mutual Funds Department

499 Washington Blvd. Floor 5

Jersey City, NJ 07310-20110

| | Record |

As of June 30, 2021, the Trustees and officers of the Trust as a group beneficially owned less than 1% of the outstanding shares of any class of the Fund.

Reports to Shareholders. Copies of the Fund’s most recent annual and semi-annual reports may be requested without charge by writing to the [Name of Fund] , c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI, 53201-0701 or by calling, toll-free, 1-866-455-FUND [3863].

Other Matters to Come Before the Meeting. The Trust’s management does not know of any matters to be presented at the Meeting other than those described in this Proxy Statement. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Shareholder Proposals. The Trust and the Funds are generally not required to hold annual meetings of shareholders and the Trust generally does not hold a meeting of shareholders in any year unless certain specified shareholder actions such as election of trustees or approval of a new advisory agreement are required to be taken under the 1940 Act. By observing this policy, the Trust seeks to avoid the expenses customarily incurred in the preparation of proxy material and the holding of shareholder meetings.

A shareholder desiring to submit a proposal intended to be presented at any meeting of shareholders of the Trust hereafter called, whether pursuant to Rule 14a-8 under the Securities Exchange

Act of 1934 or otherwise, should send the proposal to the Secretary of the Trust, c/o FundX Investment Trust, P.O. Box 701, Milwaukee, WI 53201-0701 within a reasonable time before the solicitation of the proxies for such meeting. Shareholders who wish to recommend a nominee for election to the Board may do so by submitting the appropriate information about the candidate to the Trust’s Secretary. The mere submission of a proposal by a shareholder does not guarantee that such proposal will be included in the Proxy Statement because certain rules under the federal securities laws must be complied with before inclusion of the proposal is required. Also, the submission does not mean that the proposal will be presented at the meeting. For a shareholder proposal to be considered at a shareholder meeting, it must be a proper matter for consideration at the Meeting.

Householding. If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of the Proxy Statement, please call [PROXY PHONE NUMBER]. If you currently receive multiple copies of Proxy Statements or shareholder reports and would like to request to receive a single copy of documents in the future, please call 1-866-455-FUND [3863] or write to [Name of Fund], PO Box 701, Milwaukee, WI 53201-0701.

FUNDX INVESTMENT TRUST

INVESTMENT ADVISORY AGREEMENT

THIS INVESTMENT ADVISORY AGREEMENT (the “Agreement”) is made as of the ___ day of _____, 2021, by and between FundX Investment Trust, a Delaware statutory trust (the “Trust”), on behalf of the series of the Trust listed on Schedule A, which may be amended from time to time (the “Funds”), and One Capital Management LLC (the “Advisor”).

WITNESSETH:

WHEREAS, the Trust is an open-end management investment company, registered as such under the Investment Company Act of 1940 (the “Investment Company Act”); and

WHEREAS, the Funds are each a series of the Trust having separate assets and liabilities; and

WHEREAS, the Advisor is registered as an investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”) and is engaged in the business of supplying investment advice as an independent contractor; and

WHEREAS, the Trust desires to retain the Advisor to render advice and services to the Funds pursuant to the terms and provisions of this Agreement, and the Advisor desires to furnish said advice and services; and

WHEREAS, the Funds’ former investment adviser, FundX Investment Group, was acquired by the Advisor and the investment advisory agreement between the Trust and FundX Investment Group terminated upon the close of the acquisition; and

WHEREAS, shareholders of the Funds have approved this Agreement pursuant to the requirements of the Investment Company Act;

NOW, THEREFORE, in consideration of the covenants and the mutual promises hereinafter set forth, the parties to this Agreement, intending to be legally bound hereby, mutually agree as follows:

1. APPOINTMENT OF ADVISOR. The Trust hereby employs the Advisor and the Advisor hereby accepts such employment, to render investment advice and related services with respect to the assets of the Funds for the period and on the terms set forth in this Agreement, subject to the supervision and direction of the Trust’s Board of Trustees (the “Board of Trustees”).

2. DUTIES OF ADVISOR.

(a) GENERAL DUTIES. The Advisor shall act as investment adviser to the Funds and shall supervise investments of the Funds on behalf of the Funds in accordance with the investment objectives, policies and restrictions of the Funds as set forth in the Funds’ and Trust’s governing documents, including, without limitation, the Trust’s Agreement and Declaration of Trust and By-Laws; the Funds’ prospectus, statement of additional information and undertakings; and such other limitations, policies and procedures as the Trustees may impose from time to time in writing to the Advisor (collectively, the “Investment Policies”). In providing such services, the Advisor shall at all times adhere to the provisions and restrictions contained in

the federal securities laws, applicable state securities laws, the Internal Revenue Code of 1986, the Uniform Commercial Code and other applicable law.

Without limiting the generality of the foregoing, the Advisor shall: (i) furnish the Funds with advice and recommendations with respect to the investment of the Funds’ assets and the purchase and sale of portfolio securities for the Funds, including the taking of such steps as may be necessary to implement such advice and recommendations (i.e., placing the orders); (ii) manage and oversee the investments of the Funds, subject to the ultimate supervision and direction of the Trust’s Board of Trustees; (iii) vote proxies for the Funds, file ownership reports under Section 13 of the Securities Exchange Act of 1934 (the “1934 Act”) for the Funds, and take other actions on behalf of the Funds; (iv) maintain the books and records required to be maintained by the Funds except to the extent arrangements have been made for such books and records to be maintained by the administrator or another agent of the Funds; (v) furnish reports, statements and other data on securities, economic conditions and other matters related to the investment of the Funds’ assets which the Funds’ administrator or distributor or the officers of the Trust may reasonably request; and (vi) render to the Trust’s Board of Trustees such periodic and special reports with respect to the Funds’ investment activities as the Board may reasonably request, including at least one in-person appearance annually before the Board of Trustees.

(b) BROKERAGE. The Advisor shall be responsible for decisions to buy and sell securities for the Funds, for broker-dealer selection, and for negotiation of brokerage commission rates, provided that the Advisor shall not direct orders to an affiliated person of the Advisor without general prior authorization to use such affiliated broker or dealer from the Trust’s Board of Trustees. The Advisor’s primary consideration in effecting a securities transaction will be execution at the most favorable price. In selecting a broker-dealer to execute each particular transaction, the Advisor may take the following into consideration: the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of the Funds on a continuing basis. The price to the Funds in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the portfolio execution services offered.

Subject to such policies as the Board of Trustees of the Trust may determine and consistent with Section 28(e) of the 1934 Act, the Advisor shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement or otherwise solely by reason of its having caused the Funds to pay a broker or dealer that provides (directly or indirectly) brokerage or research services to the Advisor an amount of commission for effecting a portfolio transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if the Advisor determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the Advisor’s overall responsibilities with respect to the Trust. Subject to the same policies and legal provisions, the Advisor is further authorized to allocate the orders placed by it on behalf of the Funds to such brokers or dealers who also provide research or statistical material, or other services, to the Trust, the Advisor, or any affiliate of either. Such allocation shall be in such amounts and proportions as the Advisor shall determine, and the Advisor shall report on such allocations regularly to the Trust, indicating the broker-dealers to whom such allocations have been made and the basis therefor.

On occasions when the Advisor deems the purchase or sale of a security to be in the best interest of the Fund as well as of other clients, the Advisor, to the extent permitted by applicable laws and regulations, may aggregate the securities to be so purchased or sold in order to obtain the most favorable price or lower brokerage commissions and the most efficient execution. In such event, allocation of the securities so purchased or sold, as well as the expenses incurred in the transaction, will be made by the Advisor in the manner it considers to be the most equitable and consistent with its fiduciary obligations to the Funds and to such other clients.

3. REPRESENTATIONS OF THE ADVISOR.

(a) The Advisor shall use its best judgment and efforts in rendering the advice and services to the Funds as contemplated by this Agreement.

(b) The Advisor shall maintain all licenses and registrations necessary to perform its duties hereunder in good order.

(c) The Advisor shall conduct its operations at all times in conformance with the Advisers Act, the Investment Company Act, and any other applicable state and/or self-regulatory organization regulations.

(d) The Advisor shall maintain errors and omissions insurance in an amount at least equal to that disclosed to the Board of Trustees in connection with their approval of this Agreement.

4. INDEPENDENT CONTRACTOR. The Advisor shall, for all purposes herein, be deemed to be an independent contractor, and shall, unless otherwise expressly provided and authorized to do so, have no authority to act for or represent the Trust or the Funds in any way, or in any way be deemed an agent for the Trust or for the Funds. It is expressly understood and agreed that the services to be rendered by the Advisor to the Funds under the provisions of this Agreement are not to be deemed exclusive, and the Advisor shall be free to render similar or different services to others so long as its ability to render the services provided for in this Agreement shall not be impaired thereby.

5. ADVISOR’S PERSONNEL. The Advisor shall, at its own expense, maintain such staff and employ or retain such personnel and consult with such other persons as it shall from time to time determine to be necessary to the performance of its obligations under this Agreement. Without limiting the generality of the foregoing, the staff and personnel of the Advisor shall be deemed to include persons employed or retained by the Advisor to furnish statistical information, research, and other factual information, advice regarding economic factors and trends, information with respect to technical and scientific developments, and such other information, advice and assistance as the Advisor or the Trust’s Board of Trustees may desire and reasonably request and any compliance staff and personnel required by the Advisor.

6. EXPENSES.

(a) With respect to the operation of the Funds, the Advisor shall be responsible for (i) providing the personnel, office space and equipment reasonably necessary for the operation of the Funds; (ii) the expenses of printing and distributing extra copies of the Funds’ prospectus, statement of additional information, and sales and advertising materials (but not the legal, auditing or accounting fees attendant thereto) to prospective investors (but not to existing shareholders) to the extent such expenses are not covered by any applicable plan adopted pursuant to Rule 12b-1 under the Investment Company Act (each, a “12b-1 Plan”); (iii) the costs of any special Board of Trustees meetings or shareholder meetings convened for the primary benefit of the Advisor; and (iv) any costs of liquidating or reorganizing the Funds (unless such cost is otherwise allocated by the Board of Trustees). If the Advisor has agreed to limit the operating expenses of the Funds, the Advisor also shall be responsible on a monthly basis for any operating expenses that exceed the agreed upon expense limit.

(b) The Funds are responsible for and have assumed the obligation for payment of all of their expenses, other than as stated in Subparagraph 6(a) above, including but not limited to: organizational expenses, fees and expenses incurred in connection with the issuance, registration and transfer of its shares; brokerage and commission expenses; all expenses of transfer, receipt, safekeeping, servicing and accounting for the cash, securities and other property of the Trust for the benefit of the Funds including all fees and

expenses of their custodian, shareholder services agent and accounting services agent; interest charges on any borrowings; costs and expenses of pricing and calculating its daily net asset value and of maintaining its books of account required under the Investment Company Act; taxes, if any; a pro rata portion of expenditures in connection with meetings of the Funds’ shareholders and the Board of Trustees that are properly payable by the Funds; salaries and expenses of officers of the Trust, including without limitation the Trust’s Chief Compliance Officer, and fees and expenses of members of the Board of Trustees or members of any advisory board or committee who are not members of, affiliated with or interested persons of the Advisor; insurance premiums on property or personnel of the Fund which inure to its benefit, including liability and fidelity bond insurance; the cost of preparing and printing reports, proxy statements, prospectuses and statements of additional information of the Fund or other communications for distribution to existing shareholders which are covered by any 12b-1 Plan; legal, auditing and accounting fees; all or any portion of trade association dues or educational program expenses determined appropriate by the Board of Trustees; fees and expenses (including legal fees) of registering and maintaining registration of its shares for sale under applicable securities laws; all expenses of maintaining and servicing shareholder accounts, including all charges for transfer, shareholder recordkeeping, dividend disbursing, redemption, and other agents for the benefit of the Funds, if any; and all other charges and costs of its operation plus any extraordinary and non-recurring expenses, except as herein otherwise prescribed.

(c) The Advisor may voluntarily or contractually absorb certain Fund expenses.

(d) To the extent the Advisor incurs any costs by assuming expenses which are an obligation of the Funds as set forth herein, the Funds shall promptly reimburse the Advisor for such costs and expenses, except to the extent the Advisor has otherwise agreed to bear such expenses. To the extent the services for which the Funds are obligated to pay are performed by the Advisor, the Advisor shall be entitled to recover from such Funds to the extent of the Advisor’s actual costs for providing such services. In determining the Advisor’s actual costs, the Advisor may take into account an allocated portion of the salaries and overhead of personnel performing such services.

(e) The Advisor may not pay fees in addition to any Funds distribution or servicing fees to financial intermediaries, including without limitation banks, broker-dealers, financial advisors, or pension administrators, for sub-administration, sub-transfer agency or any other shareholder servicing or distribution services associated with shareholders whose shares are held in omnibus or other group accounts, except with the prior authorization of the Trust’s Board of Trustees. Where such arrangements are authorized by the Trust’s Board of Trustees, the Advisor shall report regularly to the Trust on the amounts paid and the relevant financial institutions.

7. INVESTMENT ADVISORY AND MANAGEMENT FEE.

(a) The Funds shall pay to the Advisor, and the Advisor agrees to accept, as full compensation for all services furnished or provided to such Funds pursuant to this Agreement, an annual management fee at the rate set forth in Schedule A to this Agreement.

(b) The management fee shall be accrued daily by the Funds and paid to the Advisor on the first business day of the succeeding month.

(c) The initial fee under this Agreement shall be payable on the first business day of the first month following the effective date of this Agreement and shall be prorated as set forth below. If this Agreement is terminated prior to the end of any month, the fee to the Advisor shall be prorated for the portion of any month in which this Agreement is in effect which is not a complete month according to the proportion which the number of calendar days in the month during which the Agreement is in effect bears to the number of calendar days in the month, and shall be payable within ten (10) days after the date of termination.

(d) The fee payable to the Advisor under this Agreement will be reduced to the extent of any receivable owed by the Advisor to the Funds and as required under any expense limitation applicable to the Funds.

(e) The Advisor voluntarily may reduce any portion of the compensation or reimbursement of expenses due to it pursuant to this Agreement and may agree to make payments to limit the expenses which are the responsibility of the Funds under this Agreement. Any such reduction or payment shall be applicable only to such specific reduction or payment and shall not constitute an agreement to reduce any future compensation or reimbursement due to the Advisor hereunder or to continue future payments. Any such reduction will be agreed to prior to accrual of the related expense or fee and will be estimated daily and reconciled and paid on a monthly basis.

(f) Any such reductions made by the Advisor in its fees or payment of expenses which are the Funds’ obligation are subject to reimbursement by the Funds to the Advisor, if so requested by the Advisor, within the following 36 months if the aggregate amount actually paid by the Funds toward the operating expenses for such period (taking into account the reimbursement) does not exceed the applicable limitation on Fund expenses. Under the expense limitation agreement, the Advisor may recoup reimbursements made of the Funds over the following 36 months. Any such reimbursement is also contingent upon Board of Trustees review and approval at time the reimbursement is made. Such reimbursement may not be paid prior to the Funds’ payment of current ordinary operating expenses.

(g) The Advisor may agree not to require payment of any portion of the compensation or reimbursement of expenses otherwise due to it pursuant to this Agreement. Any such agreement shall be applicable only with respect to the specific items covered thereby and shall not constitute an agreement not to require payment of any future compensation or reimbursement due to the Advisor hereunder.

8. NO SHORTING; NO BORROWING. The Advisor agrees that neither it nor any of its officers or employees shall take any short position in the shares of the Funds. This prohibition shall not prevent the purchase of such shares by any of the officers or employees of the Advisor or any trust, pension, profit-sharing or other benefit plan for such persons or affiliates thereof, at a price not less than the net asset value thereof at the time of purchase, as allowed pursuant to rules promulgated under the Investment Company Act. The Advisor agrees that neither it nor any of its officers or employees shall borrow from the Funds or pledge or use the Funds’ assets in connection with any borrowing not directly for the Funds’ benefit. For this purpose, failure to pay any amount due and payable to the Funds for a period of more than thirty (30) days shall constitute a borrowing.

9. CONFLICTS WITH TRUST’S GOVERNING DOCUMENTS AND APPLICABLE LAWS. Nothing herein contained shall be deemed to require the Trust or the Funds to take any action contrary to the Trust’s Agreement and Declaration of Trust, By-Laws, or any applicable statute or regulation, or to relieve or deprive the Board of Trustees of its responsibility for and control of the conduct of the affairs of the Trust and Funds. In this connection, the Advisor acknowledges that the Trustees retain ultimate plenary authority over the Funds and may take any and all actions necessary and reasonable to protect the interests of shareholders.

10. REPORTS AND ACCESS. The Advisor agrees to supply such information to the Funds’ administrator and to permit such compliance inspections by the Funds’ administrator as shall be reasonably necessary to permit the administrator to satisfy its obligations and respond to the reasonable requests of the Board of Trustees.

11. ADVISOR’S LIABILITIES AND INDEMNIFICATION.

(a) The Advisor shall have responsibility for the accuracy and completeness (and liability for the lack thereof) of the statements in the Funds’ offering materials (including the prospectus, the statement of additional information, advertising and sales materials), except for information supplied by the administrator or the Trust or another third party for inclusion therein.

(b) The Advisor shall be liable to the Funds for any loss (including brokerage charges) incurred by the Funds as a result of any improper investment made by the Advisor in contradiction of the Investment Policies.

(c) In the absence of willful misfeasance, bad faith, negligence, or reckless disregard of the obligations or duties hereunder on the part of the Advisor, the Advisor shall not be subject to liability to the Trust or the Funds or to any shareholder of the Funds for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security by the Funds. Notwithstanding the foregoing, federal securities laws and certain state laws impose liabilities under certain circumstances on persons who have acted in good faith, and therefore nothing herein shall in any way constitute a waiver or limitation of any rights which the Trust, the Funds or any shareholder of the Funds may have under any federal securities law or state law.

(d) Each party to this Agreement shall indemnify and hold harmless the other party and the shareholders, directors, officers and employees of the other party (any such person, an “Indemnified Party”) against any loss, liability, claim, damage or expense (including the reasonable cost of investigating and defending any alleged loss, liability, claim, damage or expenses and reasonable counsel fees incurred in connection therewith) arising out of the Indemnifying Party’s performance or non-performance of any duties under this Agreement; provided, however, that nothing herein shall be deemed to protect any Indemnified Party against any liability to which such Indemnified Party would otherwise be subject by reason of willful misfeasance, bad faith or negligence in the performance of duties hereunder or by reason of reckless disregard of obligations and duties under this Agreement.

(e) No provision of this Agreement shall be construed to protect any Trustee or officer of the Trust, or officer of the Advisor, from liability in violation of Sections 17(h) and (i) of the Investment Company Act.

12. NON-EXCLUSIVITY; TRADING FOR ADVISOR’S OWN ACCOUNT. The Trust’s employment of the Advisor is not an exclusive arrangement. The Trust may from time to time employ other individuals or entities to furnish it with the services provided for herein. Likewise, the Advisor may act as investment adviser for any other person, and shall not in any way be limited or restricted from buying, selling or trading any securities for its or their own accounts or the accounts of others for whom it or they may be acting; provided, however, that the Advisor expressly represents that it will undertake no activities which will adversely affect the performance of its obligations to the Funds under this Agreement; and provided further that the Advisor will adhere to a code of ethics governing employee trading and trading for proprietary accounts that conforms to the requirements of the Investment Company Act and the Advisers Act and has been approved by the Board of Trustees.

13. TERM.

With respect to a Fund, this Agreement shall become effective on the date of execution of this Agreement or, if later, at the time the Fund commences operations pursuant to an effective amendment to the Trust’s Registration Statement under the Securities Act of 1933, as amended, and shall remain in effect for a period of two (2) years, unless sooner terminated as hereinafter provided. This Agreement shall continue in effect thereafter, with respect to a Fund, for additional periods not exceeding one year so long as such