UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER: 811-22949

| | |

| |

EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | | Calamos Dynamic Convertible and Income Fund |

| |

ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | | 2020 Calamos Court, Naperville,

Illinois 60563-2787 |

| |

NAME AND ADDRESS OF AGENT FOR SERVICE: | | John P. Calamos, Sr., President

Calamos Advisors LLC 2020 Calamos Court Naperville, Illinois 60563-2787 |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2015

DATE OF REPORTING PERIOD: November 1, 2014 through April 30, 2015

Item 1. Report to Shareholders

Experience and Foresight

About Calamos Investments

For over 35 years, we have helped investors like you manage and build wealth to meet their long-term individual objectives by working to capitalize on the opportunities of the evolving global marketplace. We launched our first mutual fund in 1985 and our first closed-end fund in 2002. Today, we manage six closed-end funds. These include income-oriented total return offerings, which seek current income, with increased emphasis on capital gains potential, and enhanced fixed income offerings, which pursue high current income from income and capital gains. Calamos Dynamic Convertible and Income Fund (CCD) falls into income-oriented total return category. Please see page 5 for a more detailed overview of our closed-end offerings.

We are dedicated to helping our clients build and protect wealth. We understand when you entrust us with your assets, you also entrust us with your achievements, goals and aspirations. We believe we best honor this trust by making investment decisions guided by integrity, by discipline, and by our conscientious research.

We believe an active, risk-conscious approach is essential for wealth creation. In the 1970s, we pioneered strategies that seek to participate in equity market upside and mitigate some of the potential risks of equity market volatility. Our investment process seeks to manage risk at multiple levels and draws upon our experience investing through multiple market cycles.

We have a global perspective. We believe globalization offers tremendous opportunities for countries and companies all over the world. In our view, this creates significant opportunities for investors. In our U.S., global and international portfolios, we are seeking to capitalize on the potential growth of the global economy.

We believe there are opportunities in all markets. Our history traces back to the 1970s, a period of significant volatility and economic concerns. We have invested through multiple market cycles, each with its own challenges. Out of this experience comes our belief that the flipside of volatility is opportunity.

Letter to Shareholders

JOHN P. CALAMOS, SR.

CEO and Global Co-CIO

Dear Fellow Shareholder:

Welcome to your first semiannual report for the period March 27, 2015 to April 30, 2015 for the Calamos Dynamic Convertible and Income Fund (CCD). The Fund began trading on March 27, 2015 at an initial public offering price of $25.00 per share, with an initial capital raise of more than $500 million. The offering sought to raise capital to invest in current opportunities in both the convertible and fixed income markets, while taking advantage of favorable borrowing costs to further enhance income. The Fund’s objective is to provide total return through a combination of capital appreciation and current income.

In this report, you will find commentary from the management team, as well as a listing of portfolio holdings, financial statements and highlights, and detailed information about the Fund’s performance and positioning. I invite you to review not only the commentary for this Fund, but also to discuss with your financial advisor if there are other Calamos funds that could be suitable for your asset allocation.

Calamos Dynamic Convertible and Income Fund is a total return fund. To help generate income and attempt to achieve a more favorable reward/risk profile, the Fund’s investment team also has the flexibility to sell options on the underlying equities of the convertible holdings.

We utilize dynamic asset allocation to pursue high current income with a less rate-sensitive approach while also maintaining a focus on capital gains. We believe the flexibility to invest in high yield corporate bonds and convertible securities is an important differentiator, especially given the speculation surrounding the Federal Reserve’s potential decision to raise interest rates.

Distributions

On May 4, 2015, the Calamos Dynamic Convertible and Income Fund declared a series of three distributions of $0.1670 per share for each of the months of June, July and August 2015. On an annualized basis this distribution reflects a distribution rate of 8.02% based upon an IPO price of $25.00 per share.* We believe this rate is very

| * | Based on our current estimates, we anticipate that $0.1670 of the distribution payable 06/15/15 would be paid from ordinary income or capital gains, and that approximately $0.000 would represent a return of capital. Estimates of the character of the distributions payable 07/15/15 and 08/14/15 respectively are subject to greater uncertainty due to the amount of time between declaration and payment date, and are therefore not included. Estimates are calculated on a tax basis rather than on a generally accepted accounting principles (GAAP) basis, but should not be used for tax reporting purposes. Distributions are subject to re-characterization for tax purposes after the end of the fiscal year. This information is not legal or tax advice. Consult a professional regarding your specific legal or tax matters. Under the Fund’s level rate distribution policy, distributions paid to common shareholders may include net investment income, net realized short-term capital gains and return of capital. When the net investment income and net realized short-term capital gains are not sufficient, a portion of the level rate distribution will be a return of capital. In addition, a limited number of distributions per calendar year may include net realized long-term capital gains. Distribution rate may vary. |

| | | | | | |

| | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 1 | |

Letter to Shareholders

competitive, given the low interest rates in many segments of the bond market. In our view, the Fund’s distributions illustrate the benefits of a multi-asset class approach and flexible allocation strategy.

We understand that many closed-end fund investors seek steady, predictable distributions instead of distributions that fluctuate. Therefore, this Fund has a level rate distribution policy. As part of this policy, we aim to keep distributions consistent from month to month, and at a level that we believe can be sustained over the long term. In setting the Fund’s distribution rate, the investment management team and the Fund’s Board of Trustees consider the interest rate, market and economic environment. We also factor in our assessment of individual securities and asset classes. (For additional information on our level rate distribution policy, please see “The Calamos Closed-End Funds: An Overview” on page 5 and “Level Rate Distribution Policy” on page 31.)

Market Review

Convertible securities, which combine attributes of stocks and fixed income securities, captured a substantial measure of the stock market’s gains. U.S. convertibles advanced 3.64%, as measured by the BofA Merrill Lynch All U.S. Convertibles ex-Mandatory Index. In the high yield bond market, the Credit Suisse High Yield Index advanced 1.33%.

These gains were earned despite headwinds related to energy prices, unrest in Ukraine, political wrangling in the euro zone, global growth rates, and the potential impact of a strengthening dollar. In the U.S., unemployment continued to fall, the Federal Reserve maintained accommodative monetary policy, and corporate profits remained healthy. Outside the U.S., positive economic surprises in Europe and Japan boosted investor sentiment. Markets responded favorably to the European Central Bank’s decision to move forward with quantitative easing as well as to Japan’s concerted and coordinated efforts to promote economic recovery.

Our Use of Leverage**

We have the flexibility to utilize leverage in this Fund. Over the long term, we believe that the judicious use of leverage provides us with opportunities to enhance total return and support the Fund’s distribution rate. Leverage strategies typically entail borrowing at short-term interest rates and investing the proceeds at higher rates of return. During the reporting period, we believed the prudent use of leverage would be advantageous given the economic environment, specifically the low borrowing costs we were able to secure. Overall, we expect the use of leverage to contribute favorably to the returns of the Fund, as the performance of the Fund’s holdings are anticipated to exceed the cost of borrowing.

| | | | |

| 2 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | |

| ** | Leverage creates risks that may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares, and fluctuations in the variable rates of the leverage financing. The Fund has a non-fundamental policy that it will not issue preferred shares, borrow money, or issue debt securities with an aggregate liquidation preference and aggregate principal amount exceeding 38% of the Fund’s managed assets as measured immediately after the issuance of any preferred shares or debt. Prior to May 22, 2015, this leverage limitation was measured according to the Fund’s total assets. |

Letter to Shareholders

Consistent with our focus on risk management, we have employed techniques to hedge against a rise in interest rates in our other closed-end funds. We have used interest rate swaps to manage the borrowing costs associated with the Fund’s use of leverage. Interest rate swaps allow us to “lock down” an interest rate we believe to be attractive. Although rates are at historically low levels across much of the fixed income market, history has taught us that rates can rise quickly, in some cases, in a matter of months. We believe the Fund’s use of interest rate swaps can be beneficial because it may provide a degree of protection should a rise in rates occur. We currently do not employ such in this Fund. However, we will continue to assess the costs versus benefits of employing swaps as part of our overall leverage strategy.

Outlook

Our team is optimistic about the global markets. Although the U.S. economy grew slowly during the first quarter of the year—due in large measure to unseasonably cold weather and turmoil in the energy sector—we believe the U.S. can resume its steady expansion for the remainder of 2015, as energy prices stabilize, inflation remains contained, and the Federal Reserve maintains its accommodative stance. We also expect the global economy to expand in 2015, benefiting from ranging factors including central bank policy in the euro zone, Japan, and select emerging markets.

While we see opportunities among convertibles and high yield securities, we are concerned about the potential risks associated with oversized allocations to traditional fixed-income securities, as history has shown that interest rates can rise quickly. We believe investors should work proactively with their financial advisors to ensure appropriate diversification, which may include convertibles strategies and liquid alternative strategies.

While we see a good deal of opportunity, this is an environment where active management, rigorous research and keen awareness of risk will be important drivers of success. We anticipate market volatility will persist as investors respond to the activities of central banks (particularly those of the Federal Reserve), as well as geopolitical uncertainties. We are confident that our disciplined, tested, and fundamentally driven approach will serve the Fund well.

In closing, I invite you to visit us at www.calamos.com. We’re continually updating our site with thought leadership, blogs and commentary designed to help you and your financial advisor decide which opportunities are most appropriate for you.

On behalf of all of us at Calamos Investments, I thank you for your trust. We are honored you have chosen us to help you pursue your investment goals.

Sincerely,

John P. Calamos, Sr.

CEO and Global Co-CIO,

Calamos Advisors LLC

| | | | | | |

| | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 3 | |

Letter to Shareholders

Before investing, carefully consider a Fund’s investment objectives, risks, charges and expenses. Please see the prospectus containing this and other information or call 800.582.6959. Please read the prospectus carefully. Performance data represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

The BofA Merrill Lynch All U.S. Convertibles Index is representative of the U.S. convertible market. The BofA Merrill Lynch All U.S. Convertibles Index ex Mandatory Index represents the U.S. convertible securities market excluding mandatory convertibles. The Credit Suisse High Yield Index is considered generally representative of the U.S. market for high yield bonds. Source: Lipper

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index. Investments in overseas markets pose special risks, including currency fluctuation and political risks. These risks are generally intensified for investments in emerging markets. Countries, regions, and sectors mentioned are presented to illustrate countries, regions, and sectors in which a fund may invest. Fund holdings are subject to change daily. The Fund is actively managed. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. There are certain risks involved with investing in convertible securities in addition to market risk, such as call risk, dividend risk, liquidity risk and default risk, that should be carefully considered prior to investing. This information is being provided for informational purposes only and should not be considered investment advice or an offer to buy or sell any security in the portfolio.

| | | | |

| 4 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | |

The Calamos Closed-End Funds: An Overview

In our closed-end funds, we draw upon decades of investment experience, including a long history of opportunistically blending asset classes in an attempt to capture upside potential while seeking to manage downside risk. We launched our first closed-end fund in 2002.

Closed-end funds are long-term investments. Most focus on providing monthly distributions, but there are important differences among individual closed-end funds. Calamos closed-end funds can be grouped into multiple categories that seek to produce income while offering exposure to various asset classes and sectors.

| | |

Portfolios Positioned to Pursue High Current Income from Income and Capital Gains | | Portfolios Positioned to Seek Current Income, with Increased Emphasis on Capital Gains Potential |

| |

| OBJECTIVE: U.S. ENHANCED FIXED INCOME | | OBJECTIVE: GLOBAL TOTAL RETURN |

Calamos Convertible Opportunities and Income Fund (Ticker: CHI) Invests in high yield and convertible securities, primarily in U.S. markets | | Calamos Global Total Return Fund (Ticker: CGO) Invests in equities and higher-yielding convertible securities and corporate bonds, in both U.S. and non-U.S. markets |

| |

| | | OBJECTIVE: U.S. TOTAL RETURN |

Calamos Convertible and High Income Fund (Ticker: CHY) Invests in high yield and convertible securities, primarily in U.S. markets | | Calamos Strategic Total Return Fund (Ticker: CSQ) Invests in equities and higher-yielding convertible securities and corporate bonds, primarily in U.S. markets |

| |

| OBJECTIVE: GLOBAL ENHANCED FIXED INCOME | | |

Calamos Global Dynamic Income Fund (Ticker: CHW) Invests in global fixed income securities, alternative investments and equities | | Calamos Dynamic Convertible and Income Fund (Ticker: CCD) Invests in convertibles and other fixed income securities |

Our Level Rate Distribution Policy

Closed-end fund investors often look for a steady stream of income. Recognizing this, Calamos closed-end funds have a level rate distribution policy in which we aim to keep monthly income consistent through the disbursement of net investment income, net realized short-term capital gains and, if necessary, return of capital. We set distributions at levels that we believe are sustainable for the long term. Our team is focused on delivering an attractive monthly distribution, while maintaining a long-term focus on risk management. The level of the funds’ distributions can be greatly influenced by market conditions, including the interest rate environment. The funds’ distributions will depend on the individual performance of positions the funds hold, our view of the benefits of retaining leverage, fund tax considerations, and maintaining regulatory requirements.

For more information about any of these funds, we encourage you to contact your financial advisor or Calamos Investments at 800.582.6959 (Monday through Friday from 8:00 a.m. to 6:00 p.m., Central Time). You can also visit us at www.calamos.com.

For more information on our level rate distribution policy, please see page 31.

| | | | | | |

| | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 5 | |

Investment Team Discussion

| | | | | | |

TOTAL RETURN* AS OF 04/30/15 | |

Common Shares – Inception 3/27/15 | |

| | | | | Since

Inception** | |

On Market Price | | | | | 1.88% | |

On NAV | | | | | -0.44% | |

* Total return measures net investment income and net realized gain or loss from Fund investments, and change in net unrealized appreciation or depreciation, assuming reinvestment of income and net realized gains distributions. ** Cumulative since inception. | |

| | | | |

SECTOR WEIGHTINGS | |

Information Technology | | | 22.2 | % |

Health Care | | | 19.9 | |

Financials | | | 13.9 | |

Consumer Discretionary | | | 13.3 | |

Industrials | | | 6.2 | |

Energy | | | 5.0 | |

Utilities | | | 4.1 | |

Telecommunication Services | | | 3.8 | |

Consumer Staples | | | 2.0 | |

Materials | | | 1.2 | |

Sector Weightings are based on managed assets and may vary over time. Sector Weightings exclude any government/sovereign bonds or options on broad market indexes the Fund may hold.

DYNAMIC CONVERTIBLE AND

INCOME FUND (CCD)

Investment Team Discussion

Could you please describe the Fund’s IPO and how the new Fund can be used in an asset allocation?

A pioneer in convertible securities investing since the 1970s, Calamos completed the initial public offering for the Calamos Dynamic Convertible and Income Fund (CCD) on March 27, 2015. The IPO raised more than $500 million at that time and managed assets, which include leverage, totaled $738 million as of April 30, 2015. The IPO was the first such closed-end fund convertible offering since 2007.

The Fund is designed to offer total return through a combination of capital appreciation and current income by investing primarily in a portfolio of convertible and income producing securities, including high yield bonds. To help generate income and attempt to achieve a more favorable reward/risk profile, the Fund has the flexibility to opportunistically write options on a portion of the portfolio’s securities.

Like all six Calamos closed-end funds, the Fund seeks to provide a steady stream of distributions paid out monthly and invests in multiple asset classes that can provide a strong basis to maintain competitive distribution levels, while offering meaningful participation in the equity markets through investments in convertible securities. In addition, in an effort to achieve income and manage risk, we selectively sell call options on certain underlying equities of convertibles that we own in the portfolio.

We invest in a diversified portfolio of convertible securities and high-yield securities. The allocation to each asset class is dynamic and reflects our view of the economic landscape as well as the potential of individual securities. By combining these asset classes, we believe that the Fund is well positioned to generate capital gains as well as income. We think this broader range of security types also provides increased opportunities to manage the risk and reward characteristics of the portfolio over full market cycles.

How did the Fund perform over the reporting period?

Since inception on March 27, 2015 through April 30, 2015, the Fund returned -0.44% on a net asset value (NAV) basis and 1.88% on a market price basis. Bear in mind, the Fund was in the early investing stage during its first month, and had a large position of cash at that time.

At the end of the reporting period, the Fund’s shares traded at a 7.15% premium to net asset value.

CCD DAILY NAV AND MARKET PRICE

| | | | |

| 6 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | |

Investment Team Discussion

How do NAV and market price return differ?

Closed-end funds trade on exchanges, where the price of shares may be driven by factors other than the value of the underlying securities. The price of a share in the market is called market value. Market price may be influenced by factors unrelated to the performance of the Fund’s holdings, such as general market sentiment or future expectation. A fund’s NAV return measures the actual return of the individual securities in the portfolio, less fund expenses. It also measures how a manager was able to capitalize on market opportunities. Because we believe closed-end funds are best utilized as a long-term holding within asset allocations, we believe that NAV return is the better measure of a fund’s performance. However, when managing the Fund, we strongly consider actions and policies that we believe will optimize its overall price performance and returns based on market value.

Please discuss the Fund’s distributions during the period.

We employ a level rate distribution policy within this Fund with the goal of providing shareholders with a consistent distribution stream. In May, we declared a monthly distribution of $0.1670 per share for each month of June, July and August 2015. Based on the declared distributions, the Fund’s current annualized distribution rate is 8.02% on the initial public offering price of $25.

We believe that both the Fund’s distribution rate and level remained attractive and competitive, as low interest rates limited yield opportunities in much of the marketplace. For example, as of April 30, 2015, the dividend yield of the S&P 500 Index stocks averaged 1.99%. Yields also remained low within the U.S. government bond market, with the 10-year U.S. Treasury and the 30-year U.S. Treasury yielding 2.03% and 2.74%, respectively. Our yield was even higher than more speculative measures including the Credit Suisse High Yield Index and the BofA Merrill Lynch All U.S. Convertibles Index, which offered yields on April 30, 2015, of 7.07% and 2.79%, respectively.

What factors influenced performance over the reporting period?

Performance was hindered by a large cash position throughout the month as initial investments were being made. As of the end of the period, cash constituted 8.6% of the Fund’s assets.

From an economic sector perspective, the Fund benefitted from its security selection in and underweight to health care, mainly with respect to biotechnology, pharmaceuticals and health care facilities. In addition, the Fund was helped by its selection within consumer discretionary, specifically apparel, accessories and luxury goods.

Although our holdings in energy and materials generated positive absolute returns, they lagged their sector peers. Namely, our underweight and selection in oil and gas exploration and production (energy), and selection in and underweight to the diversified metals and mining (materials), inhibited the Fund’s performance.

How is the Fund positioned?

We continue to increase our position in convertible securities, which we believe will provide income and benefit from a rising equity market. We should note that our bullish position in the equity and convertible markets was not deterred by market volatility near period end. Minor corrections are not uncommon in a bull market. In addition, we continue to favor growth-oriented equities.

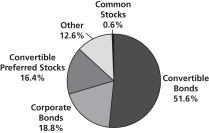

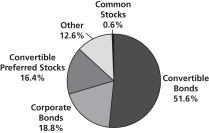

ASSET ALLOCATION AS OF 04/30/15

Fund asset allocations are based on total investments and may vary over time.

| | | | | | |

| | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 7 | |

Investment Team Discussion

We hold our highest allocations in the BB credit tier and believe this exposure will offer investors a better risk/return dynamic while continuing to provide regular income. Our credit process tends to guide us away from the most speculative corporate securities in the high-yield market. We currently view the lowest credit tiers of the market as less attractive based on their pricing and our outlook for a slower-growth global economy, and less than 3% of the Fund’s holdings are in the lowest credit tier (CCC credit rating and below). We view the mid-grade credit space as particularly well-priced, offering both attractive levels of income with less exposure to potential inflation and higher interest rates.

From a sector perspective, our heaviest exposures are to information technology, health care, consumer discretionary and financials. We believe that these sectors will outperform in the economic recovery cycle.

Leverage totaled 28% of managed assets at the end of the period, which we believe is a moderate amount. We borrow through floating rate bank debt and, given low borrowing rates, we expect this to be beneficial to the performance of the Fund.

Through dynamic asset allocation we are able to optimize the total return of the Fund by adjusting our exposure to take advantage of market opportunities within various sectors and asset classes. For example, our exposure to fixed income securities allows us to maintain a competitive distribution. However, given the weighting of the asset classes represented in the portfolio and the overall low duration of the Fund, we should be well positioned in a rising-interest-rate environment.

What are your closing thoughts for Fund shareholders?

We believe that the Dynamic Convertible and Income Fund’s introduction into the market came at an opportune time. We expect markets to remain volatile, creating an environment where convertibles, especially those that are actively managed, can be beneficial as an asset allocation. In this respect, we believe returns are best viewed over a full market cycle. As we maintain a cautious view of the U.S. economy, we believe that convertibles can provide a compelling investment opportunity to participate in the equity market in a more risk-managed way.

| | | | |

| 8 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | |

Schedule of Investments April 30, 2015 (Unaudited)

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | CORPORATE BONDS (26.8%) | |

| | | | | | Consumer Discretionary (5.9%) | | | | |

| | 7,120,000 | | | | | DISH DBS Corp.m

6.750%, 06/01/21 | | $ | 7,573,900 | |

| | 5,852,000 | | | | | FCA US, LLCm

8.250%, 06/15/21 | | | 6,466,460 | |

| | 2,438,000 | | | | | Golden Nugget Escrow, Inc.*

8.500%, 12/01/21 | | | 2,572,090 | |

| | 5,889,000 | | | | | Goodyear Tire & Rubber Companym

8.750%, 08/15/20 | | | 7,110,967 | |

| | 4,877,000 | | | | | MGM Resorts International

6.750%, 10/01/20 | | | 5,254,968 | |

| | 1,951,000 | | | | | Neiman Marcus Group Ltd., LLC*^

8.000%, 10/15/21 | | | 2,094,886 | |

| | | | | | | | | | |

| | | | | | | | | 31,073,271 | |

| | | | | | | | | | |

| | | | | | Consumer Staples (1.0%) | | | | |

| | 4,779,000 | | | | | Smithfield Foods, Inc.m

6.625%, 08/15/22 | | | 5,155,346 | |

| | | | | | | | | | |

| | | | | | Energy (1.4%) | | | | |

| | 7,315,000 | | | | | SESI, LLCm

6.375%, 05/01/19 | | | 7,496,997 | |

| | | | | | | | | | |

| | | | | | Financials (2.0%) | | | | |

| | 3,830,000 | | | | | Ally Financial, Inc.

6.250%, 12/01/17 | | | 4,112,463 | |

| | 5,852,000 | | | | | International Lease Finance Corp.m^

8.750%, 03/15/17 | | | 6,510,350 | |

| | | | | | | | | | |

| | | | | | | | | 10,622,813 | |

| | | | | | | | | | |

| | | | | | Health Care (4.1%) | | | | |

| | 5,755,000 | | | | | Endo International, PLC*

7.250%, 01/15/22 | | | 6,154,253 | |

| | 7,315,000 | | | | | Tenet Healthcare Corp.

6.750%, 02/01/20 | | | 7,731,041 | |

| | 7,120,000 | | | | | VPII Escrow Corp.m*

7.500%, 07/15/21 | | | 7,743,000 | |

| | | | | | | | | | |

| | | | | | | | | 21,628,294 | |

| | | | | | | | | | |

| | | | | | Industrials (3.4%) | | | | |

| | 4,877,000 | | | | | Icahn Enterprises, LP

6.000%, 08/01/20 | | | 5,148,283 | |

| | 2,536,000 | | | | | Michael Baker International, LLCm*

8.250%, 10/15/18 | | | 2,496,375 | |

| | 4,877,000 | | | | | United Continental Holdings, Inc.

6.375%, 06/01/18 | | | 5,215,342 | |

| | 4,487,000 | | | | | United Rentals North America, Inc.m

7.625%, 04/15/22 | | | 4,963,744 | |

| | | | | | | | | | |

| | | | | | | | | 17,823,744 | |

| | | | | | | | | | |

| | | | | | Information Technology (1.9%) | | | | |

| | 2,124,000 | | | | | Alliance Data Systems Corp.*

6.375%, 04/01/20 | | | 2,220,918 | |

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | 6,438,000 | | | | | First Data Corp.m

12.625%, 01/15/21 | | $ | 7,604,888 | |

| | | | | | | | | | |

| | | | | | | | | 9,825,806 | |

| | | | | | | | | | |

| | | | | | Materials (0.9%) | | | | |

| | 4,877,000 | | | | | Trinseo Materials Operating, SCA*†

6.750%, 05/01/22 | | | 4,956,251 | |

| | | | | | | | | | |

| | | | | | Telecommunication Services (3.8%) | | | | |

| | 4,682,000 | | | | | Frontier Communications Corp.m

8.500%, 04/15/20 | | | 5,202,873 | |

| | 8,193,000 | | | | | Intelsat, SA^

7.750%, 06/01/21 | | | 7,537,560 | |

| | 7,706,000 | | | | | Sprint Corp.m

7.625%, 02/15/25 | | | 7,600,042 | |

| | | | | | | | | | |

| | | | | | | | | 20,340,475 | |

| | | | | | | | | | |

| | | | | | Utilities (2.4%) | | | | |

| | 5,852,000 | | | | | Calpine Corp.m*

7.875%, 01/15/23 | | | 6,484,747 | |

| | 5,852,000 | | | | | NRG Energy, Inc.m

7.875%, 05/15/21 | | | 6,276,270 | |

| | | | | | | | | | |

| | | | | | | | | 12,761,017 | |

| | | | | | | | | | |

| | | | | | TOTAL CORPORATE BONDS

(Cost $142,080,891) | | | 141,684,014 | |

| | | | | | | | | | |

| | CONVERTIBLE BONDS (74.0%) | | | | |

| | | | | | Consumer Discretionary (11.1%) | | | | |

| | 4,400,000 | | | | | Jarden Corp.m~

1.125%, 03/15/34 | | | 5,093,484 | |

| | 2,830,000 | | | | | Lennar Corp.m*

3.250%, 11/15/21 | | | 5,597,471 | |

| | 5,600,000 | | | | | Liberty Interactive, LLC (Time Warner Cable, Inc., Time Warner, Inc.)m¤

0.750%, 03/30/43 | | | 8,110,592 | |

| | 4,200,000 | | | | | Liberty Media Corp.m

1.375%, 10/15/23 | | | 4,203,654 | |

| | | | | | Priceline Group, Inc. | | | | |

| | 6,370,000 | | | | | 0.350%, 06/15/20m^ | | | 7,514,402 | |

| | 3,800,000 | | | | | 0.900%, 09/15/21* | | | 3,778,492 | |

| | 2,400,000 | | | | | 1.000%, 03/15/18m | | | 3,361,932 | |

| | 2,500,000 | | | | | Restoration Hardware Holdings, Inc.m*

0.000%, 06/15/19 | | | 2,499,050 | |

| | 3,000,000 | | | | | Standard Pacific Corp.~

1.250%, 08/01/32 | | | 3,501,870 | |

| | 11,650,000 | | | | | Tesla Motors, Inc.m^~

1.250%, 03/01/21 | | | 10,782,483 | |

| | 1,800,000 | | | | | Toll Brothers Finance Corp.

0.500%, 09/15/32 | | | 1,851,372 | |

| | 1,600,000 | | | EUR | | Volkswagen International Finance, NV 5.500%, 11/09/15 | | | 2,389,452 | |

| | | | | | | | | | |

| | | | | | | | | 58,684,254 | |

| | | | | | | | | | |

| | | | | | |

| See accompanying Notes to Schedule of Investments | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 9 | |

Schedule of Investments April 30, 2015 (Unaudited)

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | | | | | | | | | |

| | | | | | Energy (3.0%) | | | | |

| | 4,200,000 | | | | | Chesapeake Energy Corp.

2.500%, 05/15/37 | | $ | 4,068,750 | |

| | 9,735,000 | | | | | Whiting Petroleum Corp.m*~

1.250%, 04/01/20 | | | 11,604,363 | |

| | | | | | | | | | |

| | | | | | | | | 15,673,113 | |

| | | | | | | | | | |

| | | | | | Financials (6.3%) | | | | |

| | 2,000,000 | | | | | AmTrust Financial Services, Inc.

2.750%, 12/15/44 | | | 1,860,000 | |

| | | | | | Ares Capital Corp. | | | | |

| | 6,100,000 | | | | | 5.750%, 02/01/16m | | | 6,292,272 | |

| | 4,250,000 | | | | | 4.375%, 01/15/19^ | | | 4,463,605 | |

| | 1,500,000 | | | | | Blackstone Mortgage Trust, Inc.

5.250%, 12/01/18 | | | 1,643,693 | |

| | 2,000,000 | | | | | Colony Capital, Inc.

3.875%, 01/15/21 | | | 2,179,460 | |

| | 2,200,000 | | | | | Jefferies Group, Inc.

3.875%, 11/01/29 | | | 2,247,861 | |

| | 3,480,000 | | | | | MGIC Investment Corp.m

2.000%, 04/01/20 | | | 5,472,526 | |

| | 5,800,000 | | | | | Starwood Property Trust, Inc.m~

4.550%, 03/01/18 | | | 6,312,575 | |

| | 2,700,000 | | | | | Starwood Waypoint Residential Trustµ*

3.000%, 07/01/19 | | | 2,615,355 | |

| | | | | | | | | | |

| | | | | | | | | 33,087,347 | |

| | | | | | | | | | |

| | | | | | Health Care (19.8%) | | | | |

| | 2,600,000 | | | | | Acorda Therapeutics, Inc.m

1.750%, 06/15/21 | | | 2,533,193 | |

| | 1,400,000 | | | | | Anacor Pharmaceuticals, Inc.m*

2.000%, 10/15/21 | | | 2,520,294 | |

| | 5,800,000 | | | | | Anthem, Inc.m

2.750%, 10/15/42 | | | 11,715,623 | |

| | 3,400,000 | | | | | BioMarin Pharmaceutical, Inc.m

1.500%, 10/15/20 | | | 4,777,935 | |

| | 2,400,000 | | | | | Cepheidm

1.250%, 02/01/21 | | | 2,670,924 | |

| | 4,150,000 | | | | | Depomed, Inc.m

2.500%, 09/01/21 | | | 5,708,823 | |

| | 2,165,000 | | | | | Emergent Biosolutions, Inc.^

2.875%, 01/15/21 | | | 2,564,919 | |

| | 1,300,000 | | | | | Gilead Sciences, Inc.m

1.625%, 05/01/16 | | | 5,739,571 | |

| | 6,000,000 | | | | | HealthSouth Corp.m

2.000%, 12/01/43 | | | 7,671,870 | |

| | 5,350,000 | | | | | Hologic, Inc.m~‡

2.000%, 12/15/37 | | | 8,048,219 | |

| | 3,400,000 | | | | | Horizon Pharma Investment, Ltd.m*

2.500%, 03/15/22 | | | 4,225,503 | |

| | 3,300,000 | | | | | Illumina, Inc.m

0.250%, 03/15/16 | | | 7,273,282 | |

| | 3,100,000 | | | | | Incyte Corp.m

1.250%, 11/15/20 | | | 6,015,674 | |

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | 2,300,000 | | | | | Integra LifeSciences Holdings Corp.

1.625%, 12/15/16 | | $ | 2,594,124 | |

| | 4,500,000 | | | | | Isis Pharmaceuticals, Inc.m*

1.000%, 11/15/21 | | | 4,888,598 | |

| | 4,500,000 | | | | | Jazz Pharmaceuticals, PLCm*^

1.875%, 08/15/21 | | | 5,392,373 | |

| | 2,400,000 | | | | | Medidata Solutions, Inc.m

1.000%, 08/01/18 | | | 2,813,688 | |

| | 4,100,000 | | | | | Molina Healthcare, Inc.m

1.625%, 08/15/44 | | | 4,865,798 | |

| | 1,490,000 | | | | | Mylan, Inc.m

3.750%, 09/15/15 | | | 8,066,487 | |

| | 862,000 | | | | | NuVasive, Inc.

2.750%, 07/01/17 | | | 1,062,260 | |

| | 3,150,000 | | | | | Wright Medical Group, Inc.*^

2.000%, 02/15/20 | | | 3,293,845 | |

| | | | | | | | | | |

| | | | | | | | | 104,443,003 | |

| | | | | | | | | | |

| | | | | | Industrials (2.6%) | | | | |

| | 2,500,000 | | | | | Air Lease Corp.m

3.875%, 12/01/18 | | | 3,669,863 | |

| | 3,000,000 | | | | | Echo Global Logistics, Inc.

2.500%, 05/01/20 | | | 3,075,000 | |

| | 1,750,000 | | | | | Greenbrier Companies, Inc.m

3.500%, 04/01/18 | | | 2,684,421 | |

| | 3,500,000 | | | | | Trinity Industries, Inc.m

3.875%, 06/01/36 | | | 4,546,780 | |

| | | | | | | | | | |

| | | | | | | | | 13,976,064 | |

| | | | | | | | | | |

| | | | | | Information Technology (30.5%) | | | | |

| | 4,385,000 | | | | | AOL, Inc.m*

0.750%, 09/01/19 | | | 4,435,493 | |

| | 5,935,000 | | | | | Citrix Systems, Inc.m*^

0.500%, 04/15/19 | | | 6,343,328 | |

| | 3,500,000 | | | | | Euronet Worldwide, Inc.m*

1.500%, 10/01/44 | | | 3,824,503 | |

| | 2,550,000 | | | | | Finisar Corp.

0.500%, 12/15/33 | | | 2,581,046 | |

| | | | | | Intel Corp. | | | | |

| | 5,000,000 | | | | | 3.250%, 08/01/39m | | | 8,158,925 | |

| | 2,600,000 | | | | | 3.482%, 12/15/35 | | | 3,278,743 | |

| | 7,600,000 | | | | | LinkedIn Corp.*~

0.500%, 11/01/19 | | | 8,436,304 | |

| | 2,100,000 | | | | | Mentor Graphics Corp.m

4.000%, 04/01/31 | | | 2,627,510 | |

| | 5,500,000 | | | | | Microchip Technology, Inc.m*~

1.625%, 02/15/25 | | | 5,623,228 | |

| | 3,850,000 | | | | | Micron Technology, Inc.m~

3.125%, 05/01/32 | | | 11,169,966 | |

| | 3,500,000 | | | | | Novellus Systems, Inc.m

2.625%, 05/15/41 | | | 7,699,912 | |

| | 8,915,000 | | | | | NVIDIA Corp.m~

1.000%, 12/01/18 | | | 10,883,521 | |

| | 3,725,000 | | | | | NXP Semiconductors, NV*~

1.000%, 12/01/19 | | | 4,359,256 | |

| | | | |

| 10 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | See accompanying Notes to Schedule of Investments |

Schedule of Investments April 30, 2015 (Unaudited)

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | 3,100,000 | | | | | ON Semiconductor Corp.~

2.625%, 12/15/26 | | $ | 3,867,746 | |

| | 1,800,000 | | | | | Palo Alto Networks, Inc.m*

0.000%, 07/01/19 | | | 2,580,156 | |

| | 3,200,000 | | | | | Red Hat, Inc.m*

0.250%, 10/01/19 | | | 3,919,632 | |

| | 2,750,000 | | | | | Rovi Corp.µ*

0.500%, 03/01/20 | | | 2,672,244 | |

| | 9,100,000 | | | | | Salesforce.com, Inc.m

0.250%, 04/01/18 | | | 11,383,645 | |

| | 7,500,000 | | | | | SanDisk Corp.m~

0.500%, 10/15/20 | | | 7,762,612 | |

| | 4,300,000 | | | | | ServiceNow, Inc.m

0.000%, 11/01/18 | | | 5,169,632 | |

| | 9,600,000 | | | | | SunEdison, Inc.m*^

0.250%, 01/15/20 | | | 10,778,688 | |

| | 4,075,000 | | | | | SunPower Corp.m

0.750%, 06/01/18 | | | 5,796,341 | |

| | 4,500,000 | | | | | Synchronoss Technologies, Inc.m

0.750%, 08/15/19 | | | 5,213,700 | |

| | 2,000,000 | | | | | Take-Two Interactive Software, Inc.m

1.000%, 07/01/18 | | | 2,506,950 | |

| | 10,075,000 | | | | | Twitter, Inc.m*~

1.000%, 09/15/21 | | | 9,162,910 | |

| | 2,250,000 | | | | | Verint Systems, Inc.m

1.500%, 06/01/21 | | | 2,629,485 | |

| | 2,100,000 | | | | | Workday, Inc.

1.500%, 07/15/20 | | | 2,758,245 | |

| | 5,300,000 | | | | | Yahoo!, Inc.m~

0.000%, 12/01/18 | | | 5,640,446 | |

| | | | | | | | | | |

| | | | | | | | | 161,264,167 | |

| | | | | | | | | | |

| | | | | | Materials (0.7%) | | | | |

| | 3,200,000 | | | | | RTI International Metals, Inc.m

1.625%, 10/15/19 | | | 3,800,688 | |

| | | | | | | | | | |

| | | | | | TOTAL CONVERTIBLE BONDS

(Cost $391,917,128) | | | 390,928,636 | |

| | | | | | | | | | |

| | SYNTHETIC CONVERTIBLE SECURITIES (0.8%) | |

| | Corporate Bonds (0.7%) | |

| | | | | | Consumer Discretionary (0.2%) | | | | |

| | 180,000 | | | | | DISH DBS Corp.m

6.750%, 06/01/21 | | | 191,475 | |

| | 148,000 | | | | | FCA US, LLCm

8.250%, 06/15/21 | | | 163,540 | |

| | 62,000 | | | | | Golden Nugget Escrow, Inc.*

8.500%, 12/01/21 | | | 65,410 | |

| | 149,000 | | | | | Goodyear Tire & Rubber Companyµ

8.750%, 08/15/20 | | | 179,917 | |

| | 123,000 | | | | | MGM Resorts International

6.750%, 10/01/20 | | | 132,533 | |

| | 49,000 | | | | | Neiman Marcus Group Ltd., LLC*^

8.000%, 10/15/21 | | | 52,614 | |

| | | | | | | | | | |

| | | | | | | | | 785,489 | |

| | | | | | | | | | |

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | | | | | | | | | |

| | | | | | Consumer Staples (0.0%) | | | | |

| | 121,000 | | | | | Smithfield Foods, Inc.m

6.625%, 08/15/22 | | $ | 130,529 | |

| | | | | | | | | | |

| | | | | | Energy (0.0%) | | | | |

| | 185,000 | | | | | SESI, LLCm

6.375%, 05/01/19 | | | 189,603 | |

| | | | | | | | | | |

| | | | | | Financials (0.1%) | | | | |

| | 97,000 | | | | | Ally Financial, Inc.

6.250%, 12/01/17 | | | 104,154 | |

| | 148,000 | | | | | International Lease Finance Corp.m^

8.750%, 03/15/17 | | | 164,650 | |

| | | | | | | | | | |

| | | | | | | | | 268,804 | |

| | | | | | | | | | |

| | | | | | Health Care (0.1%) | | | | |

| | 145,000 | | | | | Endo International, PLC*

7.250%, 01/15/22 | | | 155,059 | |

| | 185,000 | | | | | Tenet Healthcare Corp.

6.750%, 02/01/20 | | | 195,522 | |

| | 180,000 | | | | | VPII Escrow Corp.m*

7.500%, 07/15/21 | | | 195,750 | |

| | | | | | | | | | |

| | | | | | | | | 546,331 | |

| | | | | | | | | | |

| | | | | | Industrials (0.1%) | | | | |

| | 123,000 | | | | | Icahn Enterprises, LP

6.000%, 08/01/20 | | | 129,842 | |

| | 64,000 | | | | | Michael Baker International, LLCm*

8.250%, 10/15/18 | | | 63,000 | |

| | 123,000 | | | | | United Continental Holdings, Inc.

6.375%, 06/01/18 | | | 131,533 | |

| | 113,000 | | | | | United Rentals North America, Inc.m

7.625%, 04/15/22 | | | 125,006 | |

| | | | | | | | | | |

| | | | | | | | | 449,381 | |

| | | | | | | | | | |

| | | | | | Information Technology (0.0%) | |

| | 54,000 | | | | | Alliance Data Systems Corp.*

6.375%, 04/01/20 | | | 56,464 | |

| | 162,000 | | | | | First Data Corp.m

12.625%, 01/15/21 | | | 191,362 | |

| | | | | | | | | | |

| | | | | | | | | 247,826 | |

| | | | | | | | | | |

| | | | | | Materials (0.0%) | | | | |

| | 123,000 | | | | | Trinseo Materials Operating, SCA*†

6.750%, 05/01/22 | | | 124,999 | |

| | | | | | | | | | |

| | | | | | Telecommunication Services (0.1%) | |

| | 118,000 | | | | | Frontier Communications Corp.m

8.500%, 04/15/20 | | | 131,128 | |

| | 207,000 | | | | | Intelsat, SA^

7.750%, 06/01/21 | | | 190,440 | |

| | 194,000 | | | | | Sprint Corp.m

7.625%, 02/15/25 | | | 191,332 | |

| | | | | | | | | | |

| | | | | | | | | 512,900 | |

| | | | | | | | | | |

| | | | | | |

| See accompanying Notes to Schedule of Investments | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 11 | |

Schedule of Investments April 30, 2015 (Unaudited)

| | | | | | | | | | |

PRINCIPAL

AMOUNT | | | | | | | VALUE | |

| | | | | | | | | | |

| | | | | | Utilities (0.1%) | | | | |

| | 148,000 | | | | | Calpine Corp.m*

7.875%, 01/15/23 | | $ | 164,003 | |

| | 148,000 | | | | | NRG Energy, Inc.m

7.875%, 05/15/21 | | | 158,730 | |

| | | | | | | | | | |

| | | | | | | | | 322,733 | |

| | | | | | | | | | |

| | | | | | TOTAL CORPORATE BONDS | | | 3,578,595 | |

| | | | | | | | | | |

| | | | | | | | | | |

NUMBER OF

CONTRACTS | | | | | | | VALUE | |

| | Purchased Options (0.1%) # | | | | |

| | | | | | Health Care (0.0%) | | | | |

| | 50 | | | | | Biogen, Inc.

Call, 01/15/16, Strike $425.00 | | | 129,000 | |

| | | | | | | | | | |

| | | | | | Information Technology (0.1%) | |

| | 2,000 | | | | | Xilinx, Inc.

Call, 01/15/16, Strike $45.00 | | | 502,000 | |

| | | | | | | | | | |

| | | | | | TOTAL PURCHASED OPTIONS | | | 631,000 | |

| | | | | | | | | | |

| | | | | | TOTAL SYNTHETIC CONVERTIBLE SECURITIES

(Cost $4,426,711) | | | 4,209,595 | |

| | | | | | | | | | |

| | | | | | | | | | |

NUMBER OF

SHARES | | | | | | | VALUE | |

| | CONVERTIBLE PREFERRED STOCKS (26.3%) | |

| | | | | | Consumer Discretionary (1.4%) | |

| | 57,000 | | | | | Fiat Chrysler Automobiles, NV

7.875% | | | 7,329,373 | |

| | | | | | | | | | |

| | | | | | Consumer Staples (1.8%) | | | | |

| | 39,000 | | | | | Post Holdings, Inc.m

5.250% | | | 3,724,500 | |

| | 110,000 | | | | | Tyson Foods, Inc.m

4.750% | | | 5,410,900 | |

| | | | | | | | | | |

| | | | | | | | | 9,135,400 | |

| | | | | | | | | | |

| | | | | | Energy (2.6%) | | | | |

| | 9,110 | | | | | Chesapeake Energy Corp.m

5.750% | | | 7,980,360 | |

| | 96,825 | | | | | Southwestern Energy Company^

6.250% | | | 5,743,659 | |

| | | | | | | | | | |

| | | | | | | | | 13,724,019 | |

| | | | | | | | | | |

| | | | | | Financials (9.6%) | | | | |

| | 104,000 | | | | | Affiliated Managers Group, Inc.m

5.150% | | | 6,402,500 | |

| | 70,700 | | | | | American Tower Corp.m

5.250% | | | 7,330,176 | |

| | 8,175 | | | | | Bank of America Corp.m

7.250% | | | 9,474,825 | |

| | 36,000 | | | | | Crown Castle International Corp.m

4.500% | | | 3,769,200 | |

| | | | | | | | | | |

NUMBER OF

SHARES | | | | | | | VALUE | |

| | 76,025 | | | | | Health Care REIT, Inc.m

6.500% | | $ | 4,846,594 | |

| | 11,155 | | | | | Wells Fargo & Companym

7.500% | | | 13,595,156 | |

| | 97,000 | | | | | Weyerhaeuser Companym

6.375% | | | 5,178,830 | |

| | | | | | | | | | |

| | | | | | | | | 50,597,281 | |

| | | | | | | | | | |

| | | | | | Health Care (3.8%) | | | | |

| | 16,050 | | | | | Actavis, PLCm

5.500% | | | 16,060,593 | |

| | 32,000 | | | | | Amsurg Corp.m

5.250% | | | 4,032,320 | |

| | | | | | | | | | |

| | | | | | | | | 20,092,913 | |

| | | | | | | | | | |

| | | | | | Industrials (2.5%) | | | | |

| | 54,600 | | | | | Stanley Black & Decker, Inc.^

0.000% | | | 6,380,556 | |

| | 118,500 | | | | | United Technologies Corp.m

0.000% | | | 6,970,170 | |

| | | | | | | | | | |

| | | | | | | | | 13,350,726 | |

| | | | | | | | | | |

| | | | | | Telecommunication Services (1.4%) | | | | |

| | 119,200 | | | | | T-Mobile USA, Inc.m

5.500% | | | 7,432,120 | |

| | | | | | | | | | |

| | | | | | Utilities (3.2%) | | | | |

| | 97,000 | | | | | Dominion Resources, Inc.m

6.375% | | | 4,816,050 | |

| | 59,000 | | | | | Exelon Corp.m

6.500% | | | 2,906,930 | |

| | 164,000 | | | | | NextEra Energy, Inc.m^

5.799% | | | 9,329,960 | |

| | | | | | | | | | |

| | | | | | | | | 17,052,940 | |

| | | | | | | | | | |

| | | | | | TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost $140,513,408) | | | 138,714,772 | |

| | | | | | | | | | |

| | SHORT TERM INVESTMENT (18.4%) | |

| | 97,037,335 | | | | | Fidelity Prime Money Market Fund - Institutional Class (Cost $97,037,335) | | | 97,037,335 | |

| | | | | | | | | | |

| TOTAL INVESTMENTS (146.3%)

(Cost $775,975,473) | | | 772,574,352 | |

| | | | | | | | | | |

| | LIABILITIES, LESS OTHER ASSETS (-46.3%) | | | (244,657,024 | ) |

| | | | | | | | | | |

| |

| | NET ASSETS (100.0%) | | $ | 527,917,328 | |

| | | | | | | | | | |

| | | | | | | | | | |

NUMBER OF

CONTRACTS | | | | | | | VALUE | |

| | WRITTEN OPTIONS (-0.2%) # | | | | |

| | | | | | Consumer Discretionary (0.0%) | | | | |

| | 22 | | | | | Priceline Group, Inc.

Call, 05/15/15, Strike $1,220.00 | | | (101,640 | ) |

| | | | | | | | | | |

| | | | | | | | | (101,640 | ) |

| | | | | | | | | | |

| | | | |

| 12 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | See accompanying Notes to Schedule of Investments |

Schedule of Investments April 30, 2015 (Unaudited)

| | | | | | | | | | |

NUMBER OF

CONTRACTS | | | | | | | VALUE | |

| | | | | | | | | | |

| | | | | | Health Care (-0.1%) | | | | |

| | 534 | | | | | Gilead Sciences, Inc.

Call, 05/15/15, Strike $105.00 | | $ | (72,624 | ) |

| | 573 | | | | | Incyte Corp.

Call, 05/15/15, Strike $100.00 | | | (176,198 | ) |

| | 441 | | | | | Mylan, NV

Call, 05/15/15, Strike $65.00 | | | (357,210 | ) |

| | | | | | | | | | |

| | | | | | | | | (606,032 | ) |

| | | | | | | | | | |

| | | | | | Information Technology (-0.1%) | | | | |

| | 1,260 | | | | | Intel Corp.

Call, 05/15/15, Strike $33.00 | | | (36,540 | ) |

| | 752 | | | | | Lam Research Corp.

Call, 05/15/15, Strike $75.00 | | | (139,120 | ) |

| | 1,973 | | | | | Micron Technology, Inc.

Call, 05/15/15, Strike $30.00 | | | (24,662 | ) |

| | 180 | | | | | Palo Alto Networks, Inc.

Call, 05/15/15, Strike $155.00 | | | (22,050 | ) |

| | 425 | | | | | Salesforce.com, Inc.

Call, 05/22/15, Strike $80.00 | | | (78,625 | ) |

| | 1,192 | | | | | Sunpower Corp.

Call, 05/15/15, Strike $33.00 | | | (130,524 | ) |

| | | | | | | | | | |

| | | | | | | | | (431,521 | ) |

| | | | | | | | | | |

| | | | | | TOTAL WRITTEN OPTIONS

(Premium $840,350) | | | (1,139,193 | ) |

| | | | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS

| m | Security, or portion of security, is held in a segregated account as collateral for note payable aggregating a total value of $444,481,657. $0 of the collateral has been re-registered by one of the counterparties, BNP (see Note 8 - Borrowings). |

| * | Securities issued and sold pursuant to a Rule 144A transaction are excepted from the registration requirement of the Securities Act of 1933, as amended. These securities may only be sold to qualified institutional buyers (“QIBs”), such as the Fund. Any resale of these securities must generally be effected through a sale that is registered under the Act or otherwise exempted from such registration requirements. |

| ^ | Security, or portion of security, is on loan. |

| † | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| ~ | Security, or portion of security, is segregated as collateral for written options. The aggregate value of such securities is $34,374,712. |

| ¤ | Securities exchangeable or convertible into securities of one or more entities that are different than the issuer. Each entity is identified in the parenthetical. |

| ‡ | Variable rate or step bond security. The rate shown is the rate in effect at April 30, 2015. |

FOREIGN CURRENCY ABBREVIATION

| | |

| EUR | | European Monetary Unit |

Note: Value for securities denominated in foreign currencies is shown in U.S. dollars. The principal amount for such securities is shown in the respective foreign currency. The date on options represents the expiration date of the option contract. The option contract may be exercised at any date on or before the date shown.

| | | | | | |

| See accompanying Notes to Financial Statements | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 13 | |

Statement of Assets and Liabilities April 30, 2015 (Unaudited)

| | | | |

ASSETS | | | | |

Investments in securities, at value (cost $775,975,473) | | $ | 772,574,352 | |

Receivables: | | | | |

Accrued interest and dividends | | | 4,482,385 | |

Investments sold | | | 1,933,352 | |

Other assets | | | 3,607 | |

Total assets | | | 778,993,696 | |

LIABILITIES | | | | |

Options written, at value (premium $840,350) | | | 1,139,193 | |

Payables: | | | | |

Notes payable | | | 210,000,000 | |

Investments purchased | | | 38,281,111 | |

Affiliates: | | | | |

Investment advisory fees | | | 491,899 | |

Deferred compensation to trustees | | | 3,607 | |

Financial accounting fees | | | 6,010 | |

Trustees’ fees and officer compensation | | | 2,896 | |

Other accounts payable and accrued liabilities | | | 1,151,652 | |

Total liabilities | | | 251,076,368 | |

NET ASSETS | | $ | 527,917,328 | |

COMPOSITION OF NET ASSETS | | | | |

Common stock, no par value, unlimited shares authorized 22,205,247 shares issued and outstanding | | $ | 529,040,000 | |

Undistributed net investment income (loss) | | | 809,766 | |

Accumulated net realized gain (loss) on investments, foreign currency transactions and written options | | | 1,763,869 | |

Unrealized appreciation (depreciation) of investments, foreign currency translations and written options | | | (3,696,307 | ) |

NET ASSETS | | $ | 527,917,328 | |

Net asset value per common shares based upon 22,205,247 shares issued and outstanding | | $ | 23.77 | |

| | | | |

| 14 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | See accompanying Notes to Financial Statements |

Statement of Operations Period Ended April 30, 2015 (Unaudited)*

| | | | |

INVESTMENT INCOME | | | | |

Interest | | | $987,494 | |

Dividends | | | 437,917 | |

Total investment income | | | 1,425,411 | |

| |

EXPENSES | | | | |

Investment advisory fees | | | 506,393 | |

Interest expense and related fees | | | 47,064 | |

Offering costs and organizational fees | | | 25,000 | |

Financial accounting fees | | | 6,177 | |

Audit fees | | | 5,797 | |

Printing and mailing fees | | | 5,549 | |

Custodian fees | | | 5,345 | |

Accounting fees | | | 4,121 | |

Trustees’ fees and officer compensation | | | 3,193 | |

Legal fees | | | 2,046 | |

Transfer agent fees | | | 2,046 | |

Other | | | 2,914 | |

Total expenses | | | 615,645 | |

NET INVESTMENT INCOME (LOSS) | | | 809,766 | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) from: | | | | |

Investments | | | 1,375,132 | |

Foreign currency transactions | | | (2,618 | ) |

Written options | | | 391,355 | |

Change in net unrealized appreciation/(depreciation) on: | | | | |

Investments, excluding purchased options | | | (3,194,007 | ) |

Purchased options | | | (207,114 | ) |

Foreign currency translations | | | 3,657 | |

Written options | | | (298,843 | ) |

NET GAIN (LOSS) | | | (1,932,438 | ) |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (1,122,672 | ) |

| * | Dynamic Convertible and Income Fund commenced operations on March 27, 2015. |

| | | | | | |

| See accompanying Notes to Financial Statements | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 15 | |

Statements of Changes in Net Assets

| | | | |

| | | (UNAUDITED) PERIOD ENDED

APRIL 30, 2015* | |

| | | | |

OPERATIONS | | | | |

Net investment income (loss) | | $ | 809,766 | |

Net realized gain (loss) | | | 1,763,869 | |

Change in unrealized appreciation/(depreciation) | | | (3,696,307 | ) |

Net increase (decrease) in net assets applicable to shareholders resulting from operations | | | (1,122,672 | ) |

| |

CAPITAL STOCK TRANSACTIONS | | | | |

Proceeds from shares sold | | | 530,150,000 | |

Offering costs on shares | | | (1,110,000 | ) |

Net increase (decrease) in net assets from capital stock transactions | | | 529,040,000 | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 527,917,328 | |

| |

NET ASSETS | | | | |

Beginning of period | | $ | — | |

End of period | | | 527,917,328 | |

Undistributed net investment income (loss) | | $ | 809,766 | |

| * | Dynamic Convertible and Income Fund commenced operations on March 27, 2015. |

| | | | |

| 16 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | See accompanying Notes to Financial Statements |

Statement of Cash Flows Period Ended April 30, 2015 (Unaudited)*

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net increase/(decrease) in net assets from operations | | $ | (1,122,672 | ) |

Adjustments to reconcile net increase/(decrease) in net assets from operations to net cash provided by operating activities: | | | | |

Purchase of investment securities, including purchased options | | | (654,863,615 | ) |

Net purchases of short term investments | | | (97,037,335 | ) |

Proceeds paid on closing written options | | | (190,578 | ) |

Proceeds from disposition of investment securities, including purchased options | | | 13,910,416 | |

Premiums received from written options | | | 1,422,420 | |

Amortization and accretion of fixed-income securities | | | (262,185 | ) |

Net realized gains/losses from investments | | | (1,375,132 | ) |

Net realized gains/losses from written options | | | (391,355 | ) |

Change in unrealized appreciation or depreciation on investments, excluding purchased options | | | 3,194,007 | |

Change in unrealized appreciation or depreciation on purchased options | | | 207,114 | |

Change in unrealized appreciation or depreciation on written options | | | 298,843 | |

Net change in assets and liabilities: | | | | |

(Increase)/decrease in assets: | | | | |

Accrued interest and dividends receivable | | | (4,482,385 | ) |

Other assets | | | (3,607 | ) |

Increase/(decrease) in liabilities: | | | | |

Payables to affiliates | | | 504,412 | |

Other accounts payable and accrued liabilities | | | 1,151,652 | |

Net cash provided by/(used in) operating activities | | $ | (739,040,000 | ) |

| |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Proceeds from shares sold | | | 530,150,000 | |

Offering costs related to shares sold | | | (1,110,000 | ) |

Proceeds from note payable | | | 210,000,000 | |

Net cash provided by/(used in) financing activities | | $ | 739,040,000 | |

Net increase/(decrease) in cash | | $ | — | |

Cash at beginning of period | | $ | — | |

Cash at end of period | | $ | — | |

Supplemental disclosure | | | | |

Cash paid for interest and related fees | | $ | 47,064 | |

| * | Dynamic Convertible and Income Fund commenced operations on March 27, 2015. |

| | | | | | |

| See accompanying Notes to Financial Statements | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 17 | |

Notes to Financial Statements (Unaudited)

Note 1 – Organization and Significant Accounting Policies

Organization. Calamos Dynamic Convertible and Income Fund (the “Fund”) was organized as a Delaware statutory trust on March 11, 2014 and is registered under the Investment Company Act of 1940 (the “1940 Act”) as a diversified, closed-end management investment company. The Fund commenced operations on March 27, 2015.

The Fund’s investment strategy is to provide total return through a combination of capital appreciation and current income. Under normal circumstances, at least 80% of the Fund’s managed assets will be invested in convertible securities and income-producing securities, with at least 50% of the Fund’s managed assets invested in convertible securities (including synthetic convertible securities, which are single instruments, or multiple instruments held in concert, that are composed of two or more securities with investment characteristics that, when taken together, resemble those of traditional convertible securities). The Fund may invest up to 50% of its managed assets in securities of foreign issuers, with up to 15% of its managed assets in securities issued by foreign issuers in emerging markets. The Fund may invest up to 20% of its managed assets in high-yield non-convertible bonds (excluding such securities held to create synthetic convertible securities). “Managed assets” means the Fund’s total assets (including any assets attributable to any leverage that may be outstanding) minus total liabilities (other than debt representing financial leverage).

Fund Valuation. The valuation of the Fund’s investments is in accordance with policies and procedures adopted by and under the ultimate supervision of the board of trustees.

Fund securities that are traded on U.S. securities exchanges, except option securities, are valued at the official closing price, which is the last current reported sales price on its principal exchange at the time each Fund determines its net asset value (“NAV”). Securities traded in the over-the-counter market and quoted on The NASDAQ Stock Market are valued at the NASDAQ Official Closing Price, as determined by NASDAQ, or lacking a NASDAQ Official Closing Price, the last current reported sale price on NASDAQ at the time a Fund determines its NAV. When a last sale or closing price is not available, equity securities, other than option securities, that are traded on a U.S. securities exchange and other equity securities traded in the over-the-counter market are valued at the mean between the most recent bid and asked quotations on its principal exchange in accordance with guidelines adopted by the board of trustees. Each option security traded on a U.S. securities exchange is valued at the mid-point of the consolidated bid/ask quote for the option security, also in accordance with guidelines adopted by the board of trustees. Each over-the-counter option that is not traded through the Options Clearing Corporation is valued based on a quotation provided by the counterparty to such option under the ultimate supervision of the board of trustees.

Fixed income securities, certain convertible preferred securities, and non-exchange traded derivatives are normally valued by independent pricing services or by dealers or brokers who make markets in such securities. Valuations of such fixed income securities, certain convertible preferred securities, and non-exchange traded derivatives consider yield or price of equivalent securities of comparable quality, coupon rate, maturity, type of issue, trading characteristics and other market data and do not rely exclusively upon exchange or over-the-counter prices.

Trading on European and Far Eastern exchanges and over-the-counter markets is typically completed at various times before the close of business on each day on which the New York Stock Exchange (“NYSE”) is open. Each security trading on these exchanges or in over-the-counter markets may be valued utilizing a systematic fair valuation model provided by an independent pricing service approved by the board of trustees. The valuation of each security that meets certain criteria in relation to the valuation model is systematically adjusted to reflect the impact of movement in the U.S. market after the foreign markets close. Securities that do not meet the criteria, or that are principally traded in other foreign markets, are valued as of the last reported sale price at the time the Fund determines its NAV, or when reliable market prices or quotations are not readily available, at the mean between the most recent bid and asked quotations as of the close of the appropriate exchange or other designated time. Trading of foreign securities may not take place on every NYSE business day. In addition, trading may take place in various foreign markets on Saturdays or on other days when the NYSE is not open and on which the Fund’s NAV is not calculated.

If the pricing committee determines that the valuation of a security in accordance with the methods described above is not reflective of a fair value for such security, the security is valued at a fair value by the pricing committee, under the ultimate supervision of the board of trustees, following the guidelines and/or procedures adopted by the board of trustees.

The Fund also may use fair value pricing, pursuant to guidelines adopted by the board of trustees and under the ultimate supervision of the board of trustees, if trading in the security is halted or if the value of a security it holds is materially affected by events occurring before the Fund’s pricing time but after the close of the primary market or exchange on which the security is listed. Those

| | | | |

| 18 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | |

Notes to Financial Statements (Unaudited)

procedures may utilize valuations furnished by pricing services approved by the board of trustees, which may be based on market transactions for comparable securities and various relationships between securities that are generally recognized by institutional traders, a computerized matrix system, or appraisals derived from information concerning the securities or similar securities received from recognized dealers in those securities.

When fair value pricing of securities is employed, the prices of securities used by a Fund to calculate its NAV may differ from market quotations or official closing prices. In light of the judgment involved in fair valuations, there can be no assurance that a fair value assigned to a particular security is accurate.

Investment Transactions. Investment transactions are recorded on a trade date basis as of April 30, 2015. Net realized gains and losses from investment transactions are reported on an identified cost basis. Interest income is recognized using the accrual method and includes accretion of original issue and market discount and amortization of premium. Dividend income is recognized on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information becomes available after the ex-dividend date.

Foreign Currency Translation. Values of investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using a rate quoted by a major bank or dealer in the particular currency market, as reported by a recognized quotation dissemination service.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency gains or losses arise from disposition of foreign currency, the difference in the foreign exchange rates between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the ex-date or accrual date and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes (due to the changes in the exchange rate) in the value of foreign currency and other assets and liabilities denominated in foreign currencies held at year end.

Allocation of Expenses Among Funds. Expenses directly attributable to the Fund are charged to the Fund; certain other common expenses of Calamos Advisors Trust, Calamos Investment Trust, Calamos ETF Trust, Calamos Convertible Opportunities and Income Fund, Calamos Convertible and High Income Fund, Calamos Strategic Total Return Fund, Calamos Global Total Return Fund, Calamos Global Dynamic Income Fund and Calamos Dynamic Convertible and Income Fund are allocated proportionately among each Fund to which the expenses relate in relation to the net assets of each Fund or on another reasonable basis.

Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates.

Income Taxes. No provision has been made for U.S. income taxes because the Fund’s policy is to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended, and distribute to shareholders substantially all of the Fund’s taxable income and net realized gains.

Dividends and distributions paid to shareholders are recorded on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. To the extent these “book/tax” differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment. These differences are primarily due to differing treatments for foreign currency transactions, contingent payment debt instruments and methods of amortizing and accreting for fixed income securities. The financial statements are not adjusted for temporary differences.

The Fund recognized no liability for uncertain tax positions. A reconciliation is not provided as the beginning and ending amounts of unrecognized benefits are zero, with no interim additions, reductions or settlements.

Indemnifications. Under the Fund’s organizational documents, the Fund is obligated to indemnify its officers and trustees against certain liabilities incurred by them by reason of having been an officer or trustee of the Fund. In addition, in the normal course of

| | | | | | |

| | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | | 19 | |

Notes to Financial Statements (Unaudited)

business, the Fund may enter into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund’s management expects the risk of material loss in connection to a potential claim to be remote.

Note 2 – Investment Adviser and Transactions With Affiliates Or Certain Other Parties

Pursuant to an investment advisory agreement with Calamos Advisors LLC (“Calamos Advisors”), the Fund pays an annual fee, payable monthly, equal to 1.00% based on the average weekly managed assets.

Pursuant to a financial accounting services agreement, during the period the Fund paid Calamos Advisors a fee for financial accounting services payable monthly at the annual rate of 0.0175% on the first $1 billion of combined assets, 0.0150% on the next $1 billion of combined assets and 0.0110% on combined assets above $2 billion (for purposes of this calculation “combined assets” means the sum of the total average daily net assets of Calamos Advisors Trust, Calamos Investment Trust, Calamos ETF Trust and the total average weekly managed assets of Calamos Convertible and High Income Fund, Calamos Strategic Total Return Fund, Calamos Convertible Opportunities and Income Fund, Calamos Global Total Return Fund, Calamos Global Dynamic Income Fund and Calamos Dynamic Convertible and Income Fund). Financial accounting services include, but are not limited to, the following: managing expenses and expense payment processing; monitoring the calculation of expense accrual amounts; calculating, tracking and reporting tax adjustments on all assets; and monitoring trustee deferred compensation plan accruals and valuations. The Fund pays its pro rata share of the financial accounting services fee payable to Calamos Advisors based on its relative portion of combined assets used in calculating the fee.

The Fund reimburses Calamos Advisors for a portion of compensation paid to the Fund’s Chief Compliance Officer. This compensation is reported as part of “Trustees’ fees and officer compensation” expense on the Statement of Operations.

A trustee and certain officers of the Fund are also officers and directors of Calamos Advisors. Such trustee and officers serve without direct compensation from the Fund.

The Fund has adopted a deferred compensation plan (the “Plan”). Under the Plan, a trustee who is not an “interested person” (as defined in the 1940 Act) and has elected to participate in the Plan (a “participating trustee”) may defer receipt of all or a portion of their compensation from the Trust. The deferred compensation payable to the participating trustee is credited to the trustee’s deferral account as of the business day such compensation would have been paid to the participating trustee. The value of amounts deferred for a participating trustee is determined by reference to the change in value of Class I shares of one or more funds of Calamos Investment Trust designated by the participant. The value of the account increases with contributions to the account or with increases in the value of the measuring shares, and the value of the account decreases with withdrawals from the account or with declines in the value of the measuring shares. Deferred compensation of $3,607 is included in “Other assets” on the Statement of Assets and Liabilities at April 30, 2015. The Fund’s obligation to make payments under the Plan is a general obligation of the Fund and is included in “Payable for deferred compensation to trustees” on the Statement of Assets and Liabilities at April 30, 2015.

Note 3 – Investments

The cost of purchases and proceeds from sale of long-term investments for the period ended April 30, 2015 were as follows:

| | | | |

| Cost of purchases | | $ | 693,144,726 | |

| Proceeds from sales | | | 15,843,768 | |

The following information is presented on a federal income tax basis as of April 30, 2015. Differences between the cost basis under U.S. generally accepted accounting principles and federal income tax purposes are primarily due to temporary differences.

The cost basis of investments for federal income tax purposes at April 30, 2015 was as follows:

| | | | |

| Cost basis of investments | | $ | 775,869,557 | |

| | | | |

| Gross unrealized appreciation | | | 6,010,707 | |

| Gross unrealized depreciation | | | (9,305,912 | ) |

| | | | |

| Net unrealized appreciation (depreciation) | | $ | (3,295,205 | ) |

| | | | |

| | | | |

| 20 | | CALAMOS DYNAMIC CONVERTIBLE AND INCOME FUND SEMIANNUAL REPORT | | |

Notes to Financial Statements (Unaudited)

Note 4 – Income Taxes

The Fund intends to make monthly distributions from its income available for distribution, which consists of the Fund’s dividends and interest income after payment of Fund expenses, and net realized gains on stock investments. At least annually, the Fund intends to distribute all or substantially all of its net realized capital gains, if any. Distributions are recorded on the ex-dividend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in-capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income. Distributions in any year may include a return of capital component.

The tax character of distributions for the period ended April 30, 2015 will be determined at the end of the Fund’s current fiscal year.

Note 5 – Common Shares

There are unlimited common shares of beneficial interest authorized and 22,205,247 shares outstanding at April 30, 2015. Calamos Advisors owned 5,247 of the outstanding shares at April 30, 2015. Transactions in common shares were as follows:

| | | | |

| | | PERIOD ENDED

APRIL 30, 2015* | |

| Beginning shares | | | 5,247 | |

| Shares issued through subscriptions | | | 22,200,000 | |

| | | | |

| Ending shares | | | 22,205,247 | |

| | | | |

| * | Fund commenced operations on March 27, 2015. |

Notice is hereby given in accordance with Section 23(c) of the 1940 Act that the Fund may from time to time purchase its shares of common stock in the open market.

The Fund also may offer and sell common shares from time to time at an offering price equal to or in excess of the net asset value per share of the Fund’s common shares at the time such common shares are initially sold.

Note 6 – Short Sales