UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

| | | | | | | | | | | | | | |

Commission File Number | | Exact name of registrant as specified in its charter, address of principal executive offices and registrant's telephone number | | IRS Employer Identification Number |

| 1-36518 | | XPLR INFRASTRUCTURE, LP | | 30-0818558 |

700 Universe Boulevard

Juno Beach, Florida 33408

(561) 694-4000

State or other jurisdiction of incorporation or organization: Delaware

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of exchange

on which registered |

| Common units | | XIFR | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

Large Accelerated Filer þ Accelerated Filer ☐ Non-Accelerated Filer ☐ Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Exchange Act of 1934. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No þ

Aggregate market value of the voting and non-voting common equity of XPLR Infrastructure, LP held by non-affiliates at June 28, 2024 (based on the closing market price on the Composite Tape on June 28, 2024) was $2,513,554,430.

Number of XPLR Infrastructure, LP common units outstanding at January 31, 2025: 93,534,176

DOCUMENTS INCORPORATED BY REFERENCE

__________________________________

Portions of XPLR Infrastructure, LP's Proxy Statement for the 2025 Annual Meeting of Unitholders are incorporated by reference in Part III hereof.

DEFINITIONS

Acronyms and defined terms used in the text include the following:

| | | | | |

| Term | Meaning |

| ASA | administrative services agreement |

| |

| BLM | U.S. Bureau of Land Management |

| CITC | convertible investment tax credit |

| |

| Code | U.S. Internal Revenue Code of 1986, as amended |

| CSCS agreement | amended and restated cash sweep and credit support agreement |

| |

| |

| |

| FERC | U.S. Federal Energy Regulatory Commission |

| |

| |

| |

| |

| |

| |

| IDR fee | certain payments from XPLR OpCo to NEE Management as a component of the MSA which are based on the achievement by XPLR OpCo of certain target quarterly distribution levels to its unitholders |

| |

| IPP | independent power producer |

| ITC | investment tax credit |

| limited partner interest in XPLR OpCo | limited partner interest in XPLR OpCo's common units |

| |

| |

| management sub-contract | management services subcontract between NEE Management and NEER |

| Management's Discussion | Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations |

| |

| |

| |

| MSA | Fifth Amended and Restated Management Services Agreement among XPLR, NEE Management, XPLR OpCo and XPLR OpCo GP |

| MW | megawatt(s) |

| MWh | megawatt-hour(s) |

| |

| |

| |

| NEE | NextEra Energy, Inc. |

| |

| NEECH | NextEra Energy Capital Holdings, Inc. |

| NEE Equity | NextEra Energy Equity Partners, LP |

| NEE Management | NextEra Energy Management Partners, LP |

| NEER | NextEra Energy Resources, LLC |

| |

| |

| |

| |

| |

| |

| |

| NERC | North American Electric Reliability Corporation |

| |

| |

| |

| Note __ | Note __ to consolidated financial statements |

| NYSE | New York Stock Exchange |

| O&M | operations and maintenance |

| |

| |

| |

| |

| PPA | power purchase agreement

|

| |

| PTC | production tax credit |

| |

| renewable energy tax credits | production tax credits and investment tax credits collectively |

| |

| ROFR | right of first refusal |

| RPS | renewable portfolio standards |

| SEC | U.S. Securities and Exchange Commission |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| the board | the board of directors of XPLR |

| U.S. | United States of America |

| XPLR | XPLR Infrastructure, LP, formerly known as NextEra Energy Partners, LP |

| XPLR GP | XPLR Infrastructure Partners GP, Inc., formerly known as NextEra Energy Partners GP, Inc. |

| XPLR OpCo | XPLR Infrastructure Operating Partners, LP, formerly known as NextEra Energy Operating Partners, LP |

| XPLR OpCo GP | XPLR Infrastructure Operating Partners GP, LLC, formerly known as NextEra Energy Operating Partners GP, LLC |

| XPLR OpCo ROFR assets | all assets owned or hereafter acquired by XPLR OpCo or its subsidiaries |

| |

| |

| |

| |

Each of XPLR and XPLR OpCo has subsidiaries and affiliates with names that may include XPLR Infrastructure and similar references. For convenience and simplicity, in this report, the terms XPLR and XPLR OpCo are sometimes used as abbreviated references to specific subsidiaries, affiliates or groups of subsidiaries or affiliates. The precise meaning depends on the context. Discussions of XPLR's ownership of subsidiaries and projects refers to its controlling interest in the general partner of XPLR OpCo and XPLR's indirect interest in and control over the subsidiaries of XPLR OpCo. See Note 1 for a description of the noncontrolling interest in XPLR OpCo. References to XPLR's projects generally include XPLR's consolidated subsidiaries and the projects in which XPLR has equity method investments. References to XPLR's pipeline investment refers to its equity method investment in contracted natural gas assets.

NEE, NEECH and NEER each has subsidiaries and affiliates with names that may include NextEra Energy, NextEra Energy Resources, NextEra and similar references. For convenience and simplicity, in this report the terms NEE, NEECH and NEER are sometimes used as abbreviated references to specific subsidiaries, affiliates or groups of subsidiaries or affiliates. The precise meaning depends on the context.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements within the meaning of the federal securities laws. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions, strategies, future events or performance (often, but not always, through the use of words or phrases such as may result, are expected to, will continue, anticipate, believe, will, could, should, would, estimated, may, plan, potential, future, projection, goals, target, outlook, predict and intend or words of similar meaning) are not statements of historical facts and may be forward looking. Forward-looking statements involve estimates, assumptions and uncertainties. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, important factors included in Part I, Item 1A. Risk Factors (in addition to any assumptions and other factors referred to specifically in connection with such forward-looking statements) that could have a significant impact on XPLR's operations and financial results, and could cause XPLR's actual results to differ materially from those contained or implied in forward-looking statements made by or on behalf of XPLR in this Form 10-K, in presentations, on its website, in response to questions or otherwise.

Any forward-looking statement speaks only as of the date on which such statement is made, and XPLR undertakes no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law. New factors emerge from time to time and it is not possible for management to predict all of such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement.

PART I

Item 1. Business

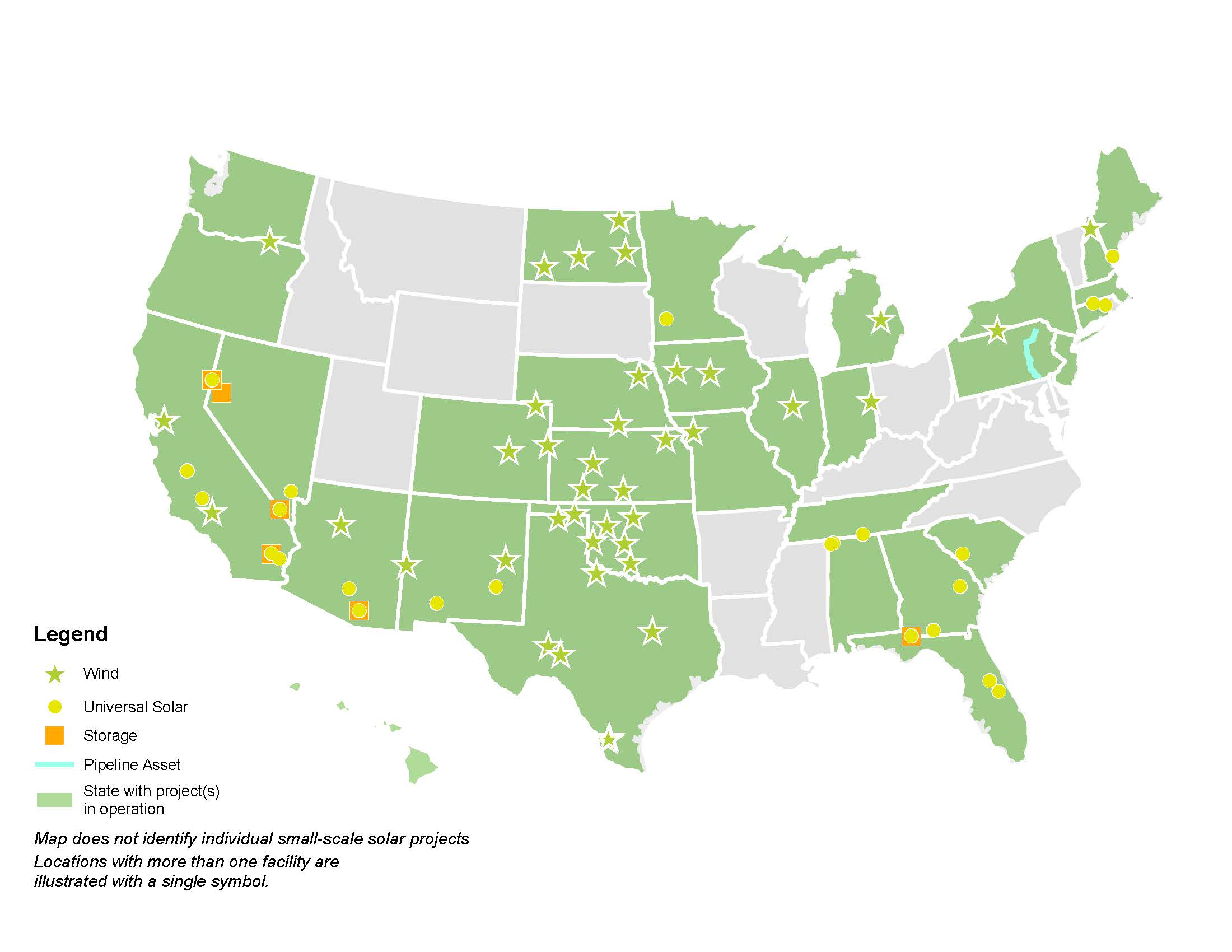

XPLR, through its ownership in XPLR OpCo, has a partial ownership interest in a clean energy infrastructure portfolio in the U.S. with approximately 10 gigawatts of net generating capacity in 31 states as of December 31, 2024 and is one of the largest generators of energy from the wind and sun in the U.S. based on 2024 MWh produced on a net generation basis. XPLR's portfolio is diversified across generation technologies including wind, solar and battery storage projects and an investment in natural gas pipeline assets.

In January 2025, XPLR announced a strategic repositioning, including suspension of the distribution to its common unitholders, intended to allow XPLR to use its retained operating cash flow and balance sheet capacity to make investments that it believes will enhance the long-term value of its portfolio. XPLR's capital allocation priorities include investments to improve and expand XPLR's existing portfolio and the pursuit of investment opportunities in areas adjacent to its existing clean energy assets that are expected to benefit from U.S. power sector growth.

XPLR believes anticipated long-term growth in U.S. electricity demand will create opportunities for XPLR to invest in its existing portfolio, including through additional investments in renewable energy repowering projects and co-located battery storage and through renewing or extending existing PPAs. XPLR also plans to pursue investment opportunities in areas adjacent to its existing clean energy projects, with a focus on assets that are expected to provide incremental cash flows and opportunities for growth. XPLR believes its cash flow profile, geographic, technological and resource diversity, operational excellence, contractual relationships with NEE and disciplined approach to capital allocation provide XPLR with a competitive advantage and enable XPLR to execute its business plan.

OWNERSHIP STRUCTURE AND PORTFOLIO

XPLR is a limited partnership. At December 31, 2024, XPLR owned a controlling, non-economic general partner interest and an approximately 48.6% limited partner interest in XPLR OpCo. Through XPLR OpCo, XPLR has a partial ownership interest in a portfolio of contracted clean energy assets consisting of wind, solar and solar-plus-storage projects and a stand-alone battery storage project, as well as contracted natural gas pipeline assets (pipeline investment).

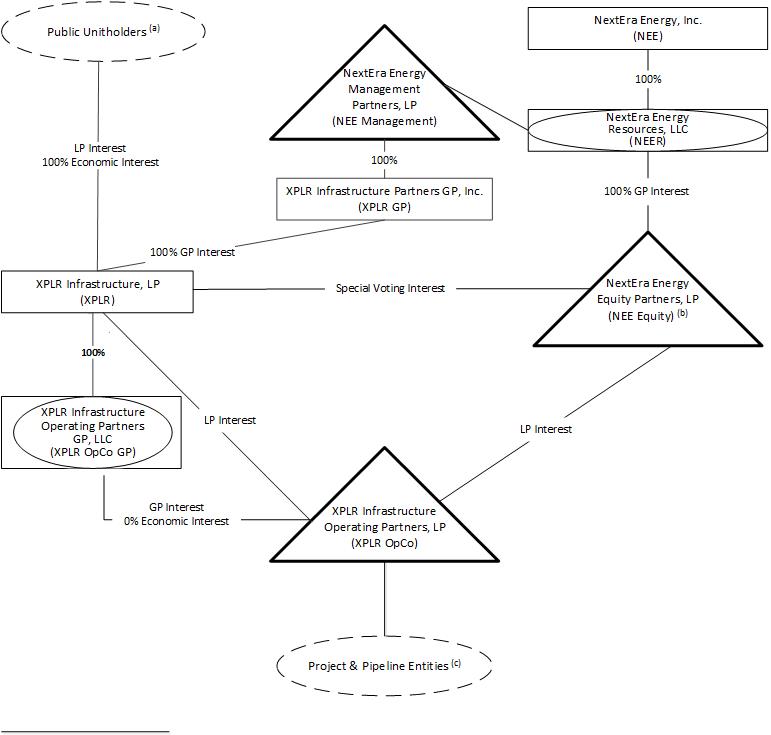

The following diagram depicts XPLR's simplified ownership structure:

(a) At December 31, 2024, NEE owns 2,377,882 XPLR common units.

(b) At December 31, 2024, NEE Equity owns approximately 51.4% of XPLR OpCo's common units representing limited partnership interests,

100% of XPLR OpCo's Class B partnership interests and 100% of XPLR OpCo's Class P units. NEE Equity may tender its XPLR OpCo common units and in exchange receive XPLR common units on a one-for-one basis, or the value of such common units in cash, subject to the terms of an exchange agreement.

(c) At December 31, 2024, certain project entities and the pipeline investment are subject to noncontrolling interests. See Note 2 – Noncontrolling Interests.

Clean energy projects – At December 31, 2024, XPLR owned interests in a portfolio of contracted clean energy projects located in 31 states as summarized below:

| | | | | | | | | | | | | | |

| Technology | | Net MW(a) | | Contract Expiration |

| Wind | | 8,054 | | 2025 – 2051 |

| Solar | | 1,790 | | 2035 – 2051 |

| Battery Storage | | 274 | | 2037 – 2051 |

| | 10,118 | (b)(c) | |

____________________

(a) MWs reflect XPLR OpCo's net ownership in the clean energy project capacity based on respective ownership interests. XPLR OpCo has indirect equity method investments in projects with a net generating capacity of approximately 862 MW with ownership interests ranging from 33.3% to 50%. Additionally, XPLR OpCo has indirect controlling ownership interests ranging from 49% to 67% in projects with a net generation capacity of approximately 2,087 MW and battery storage capacity of 244 MW. See Note 2 – Investments in Unconsolidated Entities and – Noncontrolling Interests.

(b) Third-party investors own noncontrolling Class B membership interests in the XPLR subsidiaries that own interests in projects with net generating capacity of approximately 5,560 MW and battery storage capacity of 120 MW. Third-party investors own differential membership interests in projects with net generating capacity of approximately 6,295 MW and battery storage capacity of 274 MW. See Note 2 – Noncontrolling Interests, Note 11 and Note 14 – Class B Noncontrolling Interests. Projects with net generating capacity of approximately 2,208 MW are encumbered by liens against their assets securing various financings.

(c) At December 31, 2024, XPLR OpCo owns an approximately 50% non-economic ownership interest in three NEER solar projects with a total generating capacity of 277 MW and battery storage capacity of 230 MW. All equity in earnings of these non-economic ownership interests is allocated to net loss (income) attributable to noncontrolling interests. See Note 2 – Investments in Unconsolidated Entities.

During 2024, XPLR OpCo generated approximately 27.0 million MWh and 4.0 million MWh from wind and solar generating facilities, respectively, and discharged 0.2 million MWh from its battery storage projects. During 2023, XPLR OpCo generated approximately 25.8 million MWh and 3.8 million MWh from wind and solar generating facilities, respectively, and discharged 0.2 million MWh from its battery storage projects.

Pipeline investment – At December 31, 2024, through its ownership interest in Meade Pipeline Co, LLC (Meade), XPLR has an indirect equity method investment in the Central Penn Line (CPL), natural gas pipeline assets in Pennsylvania with 191 miles of pipeline with 30 inch and 42 inch diameter pipes which is fully contracted with contract expirations between 2033 and 2041. XPLR's net ownership interest represents an approximately 39% aggregate ownership interest in the CPL and net capacity of 0.73 billion cubic feet per day. XPLR is evaluating options relating to the expected sale of its ownership interest in Meade in the second half of 2025. See Note 7 – Nonrecurring Fair Value Measurements.

In December 2023, XPLR sold its interests in a portfolio of seven natural gas pipelines assets in Texas (Texas pipelines). See Note 4.

The following map shows XPLR's ownership interests in clean energy projects in operation, excluding its non-economic ownership interests, and XPLR's pipeline investment.

Each of the clean energy projects sells the majority of its output and related renewable energy attributes pursuant to long-term, fixed price PPAs to various counterparties. The pipeline assets in which XPLR is invested primarily operate under long-term firm transportation contracts under which counterparties pay for a fixed amount of capacity that is reserved by the counterparties and also generate revenues based on the volume of natural gas transported on the pipeline. In 2024, XPLR derived approximately 15% and 15% of its consolidated revenues from its contracts with Pacific Gas and Electric Company and Southern California Edison Company, respectively. See Item 1A for a discussion of risks related to XPLR's counterparties.

XPLR, XPLR OpCo and XPLR OpCo GP are parties to the MSA with an indirect wholly owned subsidiary of NEE, under which operational, management and administrative services are provided to XPLR under the direction of the board, including managing XPLR’s day-to-day affairs and providing individuals to act as XPLR’s executive officers, in addition to those services that are provided under O&M agreements and ASAs between NEER subsidiaries and XPLR subsidiaries. XPLR OpCo pays NEE a management fee pursuant to the terms of the MSA. See Note 15 – Management Services Agreement.

XPLR and XPLR OpCo are parties to a ROFR agreement with NEER granting NEER and its subsidiaries (other than XPLR OpCo and its subsidiaries) a right of first refusal on any proposed sale of any XPLR OpCo ROFR assets. Pursuant to the terms of the ROFR agreement, prior to engaging in any negotiation regarding any sale of a XPLR OpCo ROFR asset, XPLR OpCo must first negotiate with NEER to attempt to reach an agreement on a sale of such asset to NEER or any of its subsidiaries. This negotiation with NEER and its subsidiaries could occur over two separate 30-day periods, by the end of which, if NEER and XPLR OpCo have not reached an agreement, XPLR OpCo will have the right to sell such asset to a third party.

INDUSTRY OVERVIEW

Energy Industry

U.S. electric power demand is expected to undergo long-term secular growth due in part to data centers, onshoring of manufacturing and electrification of industry, which XPLR expects will increase demand for clean energy. The expected need for electric power will require utilities and other wholesale end users to look to new electricity generation across a wide range of energy generating options including renewable and other clean energy sources, such as battery storage, natural gas-fired generation and other adjacent and complementary infrastructure. XPLR believes this will create a variety of opportunities at its existing portfolio as well as other adjacent investment opportunities.

Policy Incentives

U.S. federal, state and local governments have established various incentives to support the development of clean energy projects. These incentives include accelerated tax depreciation, PTCs, ITCs, cash grants, tax abatements and RPS programs. Pursuant to the U.S. federal Modified Accelerated Cost Recovery System (MACRS), wind and solar generation facilities are depreciated for tax purposes over a five-year period even though the useful life of such facilities is generally much longer than five years.

Owners of wind and solar facilities are eligible to claim an income tax credit (the PTC, or an ITC in lieu of the PTC) upon initially achieving commercial operation. Wind and solar generation facilities are eligible for 100% PTC or 30% ITC if such facilities start construction before the later of 2034 or the end of the calendar year following the year in which greenhouse gas emissions from U.S. electric generation are reduced by 75% from 2022 levels. The PTC is determined based on the amount of electricity produced by the facility during the first ten years of commercial operation. A facility must also meet certain labor requirements to qualify for the 100% PTC or 30% ITC rate or construction must have started on the facility before January 29, 2023. In addition, the PTC is increased by 10% and the ITC rate is increased by 10 percentage points for facilities that satisfy certain tax credit enhancement requirements. Retrofitted wind and solar generation facilities may qualify for a PTC or an ITC if the cost basis of the new investment is at least 80% of the retrofitted facility’s total fair value.

In addition, the 30% ITC applies to energy storage projects placed in service after 2022 (previously, such projects qualified only if they were connected to and charged by a renewable generation facility that claimed the ITC). Energy storage projects are eligible for a 10 percentage point increase in the ITC rate if the facilities satisfy certain tax credit enhancement requirements.

For taxable years beginning after 2022, clean energy tax credits generated during the year can be transferred to an unrelated purchaser for cash, providing an additional path, along with sales of differential membership interests, for developers to monetize the value of the clean energy tax credits.

RPS, currently in place in certain states, require electricity providers in the state to meet a certain percentage of their retail sales with energy from renewable sources. Additionally, other states in the U.S. have set renewable energy goals to reduce greenhouse gas emissions from historic levels. XPLR believes that these standards and goals will create incremental demand for renewable energy in the future.

The foregoing incentives have the effect of making the development of renewable energy projects more competitive. A loss of, or reduction in, the foregoing incentives could decrease the attractiveness of renewable energy projects to developers.

Regulation

XPLR's projects, including projects under development, and the pipeline assets underlying its pipeline investment are subject to regulation by a number of U.S. federal, state and other organizations, including, but not limited to, the following:

•the FERC, which oversees the acquisition and disposition of generation, transmission and other facilities, transmission of electricity and natural gas in interstate commerce and wholesale purchases and sales of electric energy, among other things;

•the NERC, which, through its regional entities, establishes and enforces mandatory reliability standards, subject to approval by the FERC, to ensure the reliability of the U.S. electric transmission and generation system and to prevent major system blackouts;

•the Environmental Protection Agency (EPA), which has the responsibility to maintain and enforce national standards under a variety of environmental laws, while also working with industries and all levels of government, including U.S. federal and state governments, in a wide variety of voluntary pollution prevention programs and energy conservation efforts;

•various agencies in Pennsylvania, which oversee environmental and general welfare laws related to the pipeline assets in which XPLR is invested; and

•the Pipeline and Hazardous Materials Safety Administration, which, among other things, oversees the safety of natural gas pipelines.

U.S. federal, state and local governments have established extensive approvals and permitting requirements for items such as disturbing wetlands, obtaining no hazard determinations from the Federal Aviation Administration, interacting with wildlife, making wholesale sales of electricity, and other clearances. These requirements may change from time to time. For example, a federal executive order was issued in January 2025 that calls for a pause in federal land leasing, permitting and approvals for wind development facilities pending completion of a review of the federal rules providing for leasing, permitting and approvals for wind projects. This or similar initiatives could limit XPLR's and its subsidiaries' ability, and the ability of third parties with which XPLR contracts, to obtain or renew necessary approvals, rights-of-way, permits, leases or loans for wind or other clean energy projects.

In addition, XPLR is also subject to environmental laws and regulations described in the Environmental Matters section below.

BUSINESS STRATEGY

XPLR's primary business objective is to deliver value to common unitholders which it plans to do over time by allocating the cash flows generated by its assets toward selected clean energy investments. These investments may include organic growth opportunities at existing assets, as well as selective acquisitions of ownership interests in clean energy projects or other investments. To achieve this objective, XPLR intends to execute the following business strategy:

•Invest cash generated by existing assets to enhance long-term value. Among other uses, XPLR and XPLR OpCo intend to use retained cash to repower renewable energy projects which would extend the life of their existing assets, enhance operations and provide attractive returns. XPLR also intends to use cash to exercise buyout rights relating to noncontrolling Class B members' interests under certain limited liability company agreements to which XPLR and certain of its subsidiaries is a party (see Note 2 – Noncontrolling Interests and Note 14 – Class B Noncontrolling Interests).

•Focus ancillary investments on areas where XPLR expects to generate attractive returns. XPLR continually evaluates investment opportunities in areas adjacent to its existing clean energy portfolio and their potential to generate attractive returns. Geographically, XPLR intends to focus its investments in the U.S., where it believes industry trends present significant investment opportunities, including acquisitions of clean energy assets in various regions and favorable locations where power demand growth is expected.

•Deliver long-term value to common unitholders through disciplined capital allocation. XPLR's capital allocation strategy seeks to enhance the long-term value of its portfolio on behalf of common unitholders. XPLR's capital allocation strategy will measure its investment opportunities for both organic growth and ancillary opportunities against returning capital to common unitholders over time.

•Maintain a sound capital structure and financial flexibility. Maintaining a sound capital structure is expected to allow XPLR capital allocation flexibility and support access to diverse sources of capital. XPLR and its subsidiaries have utilized various financing structures including limited-recourse project-level financings, the sale of differential membership interests and equity interests in certain subsidiaries, convertible preferred units, convertible senior unsecured notes and senior unsecured notes, as well as revolving credit facilities and term loans.

•Utilize NEER’s operational excellence to maintain the value of the projects in XPLR's portfolio. NEER provides O&M, administrative and management services to XPLR's projects pursuant to the MSA and other agreements. Through these agreements, XPLR benefits from the operational expertise that NEER currently provides across its entire portfolio. XPLR expects that these services will maximize the operational efficiencies of its portfolio.

COMPETITION

Wholesale power generation is a capital-intensive, commodity-driven business with numerous industry participants. While the majority of XPLR's existing projects are currently contracted, XPLR may compete in the future primarily on the bases of price and terms. XPLR also believes the clean attributes of XPLR's generation assets, among other strengths discussed below, are competitive advantages. Wholesale power generation is a regional business that is highly fragmented relative to many other commodity industries and diverse in terms of industry structure. As such, there is a wide variation in terms of the capabilities, resources, nature and identity of the companies XPLR competes with depending on the market. In wholesale and merchant markets, customers' needs are met through a variety of means, including long-term bilateral contracts, standardized bilateral products such as full requirements service and customized supply and risk management services.

In addition, when seeking to add new generation, XPLR competes with other companies to acquire projects. XPLR believes its primary competitors for opportunities in the U.S. are regulated utility holding companies, developers, IPPs, pension funds and private equity funds.

XPLR's pipeline investment faces competition with respect to retaining and obtaining firm transportation contracts and competes with other pipeline companies based on location, capacity, price and reliability.

XPLR believes that it is well-positioned to execute its strategy and deliver value to its common unitholders and customers over the long term based on the following competitive strengths:

Contracted projects with stable cash flows. The clean energy projects in XPLR's portfolio are contracted with a diverse group of customers under long-term PPAs that generally provide for fixed price payments over the contract term. The clean energy projects have a total weighted average remaining contract term of approximately 13 years at December 31, 2024 based on forecasted contributions to earnings. The expected stable cash flows generated by XPLR's portfolio of clean energy projects support access to diverse sources of financing and can be deployed towards investments as well as potential return of capital to common unitholders.

Geographic and resource diversification. XPLR's portfolio is geographically diverse across the U.S. In addition, XPLR's portfolio consists of wind and solar generation facilities, solar-plus-storage projects, a stand-alone battery storage project and an investment in pipeline assets. A diverse portfolio tends to reduce the magnitude of individual project or regional deviations from historical resource conditions, providing a more stable stream of cash flows over the long term than a non-diversified portfolio. In addition, XPLR believes the geographic diversity of its portfolio helps minimize the impact of adverse regulatory conditions in particular jurisdictions.

Organic growth opportunities at XPLR's existing assets. XPLR has organic reinvestment opportunities across its existing portfolio through renewable energy repowering that could provide additional value to customers and are expected to produce attractive returns for XPLR. XPLR expects the repowering projects that it pursues will allow XPLR to refresh and enhance the performance and extend the expected life of the wind turbine equipment as well as start a new 10 years of PTCs.

NEE management and operational expertise. XPLR believes it benefits from NEE’s experience, operational excellence and cost-efficient operations. Through the MSA and other agreements with NEE and its subsidiaries, XPLR's projects will receive the same benefits and expertise that NEE currently provides across its entire portfolio. XPLR also seeks to take advantage of incremental investment opportunities enabled by NEE's long-standing industry and customer relationships, knowledge and experience.

ENVIRONMENTAL MATTERS

XPLR is subject to environmental laws and regulations, including extensive U.S. federal, state and local environmental statutes, rules and regulations relating to, among others, air quality, water quality and usage, waste management, wildlife protection and historical resources, for the ongoing operations, siting and construction of its facilities. The environmental laws in the U.S., including, among others, the Endangered Species Act (ESA), the Migratory Bird Treaty Act, and the Bald and Golden Eagle Protection Act (BGEPA), provide for the protection of numerous species, including endangered species and/or their habitats, migratory birds, bats and eagles. Complying with these environmental laws and regulations could result in, among other things, changes in the design and operation of, and additional costs associated with, existing facilities and changes or delays in the location, design, construction and operation of any new facilities and failure to comply could result in fines, penalties, criminal sanctions or injunctions.

HUMAN CAPITAL

XPLR does not have any employees and relies solely on employees of affiliates of the manager under the MSA, including employees of NEE and NEER, to serve as officers of XPLR. See further discussion of the MSA and other payments to NEE in Note 15.

WEBSITE ACCESS TO SEC FILINGS

XPLR makes its SEC filings, including the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8‑K, and any amendments to those reports, available free of charge on XPLR's internet website, www.xplrinfrastructure.com, as soon as reasonably practicable after those documents are electronically filed with or furnished to the SEC. The information and materials available on XPLR's website (or any of its subsidiaries' or affiliates' websites) are not incorporated by reference into this Form 10-K.

Item 1A. Risk Factors

Limited partnerships and limited partnership interests are inherently different than corporations and shares of capital stock of a corporation, although many of the business risks to which XPLR is subject are similar to those that would be faced by a corporation engaged in similar businesses and XPLR has elected to be treated as a corporation for U.S. federal income tax purposes. If any of the following risks were to occur, and whether or not expressly stated with respect to any particular risk factor, XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan could be materially and adversely affected. In that case, the trading price of XPLR's common units could decline and investors could lose all or part of their investment in XPLR.

Performance Risks

XPLR's business and results of operations are affected by the performance of its renewable energy projects which could be impacted by wind and solar conditions and in certain circumstances by market prices for power.

The output from XPLR's wind projects can vary greatly as local wind speeds and other conditions vary. Similarly, the amount of energy that a solar project is able to produce depends on several factors, including the amount of solar energy that reaches its solar panels. Wind turbine or solar panel placement, interference from nearby wind projects or other structures and the effects of vegetation, snow, ice, land use and terrain also affect the amount of energy that XPLR's wind and solar projects generate. In certain circumstances, XPLR is exposed to the inherent power market price risk created by the differences in pricing between commodity selling and purchasing locations known as basis risk. The failure of some or all of XPLR's projects to perform according to XPLR's expectations as well as basis risk could have a material adverse effect on its business, financial condition, results of operations, liquidity and ability to execute its business plan.

Operation and maintenance of renewable energy projects, battery storage projects and other facilities and XPLR's pipeline investment involve significant risks that could result in unplanned power outages, reduced output or capacity, property damage, environmental pollution, personal injury or loss of life.

There are risks associated with the operation and maintenance of XPLR's renewable energy projects, battery storage projects and other facilities and XPLR's pipeline investment, including:

•risks associated with facility start-up operations, such as whether the facility will achieve projected operating performance on schedule and otherwise as planned;

•breakdown or failure, including, but not limited to, leaks, fires, explosions, mechanical problems or other major events, of, or damage to, turbines, blades, blade attachments, solar panels, mirrors, pipelines, batteries and other equipment, which could reduce a project’s energy output or a pipeline's ability to transport natural gas at expected levels or result in unplanned power outages, significant property damage, environmental pollution, personal injury or loss of life;

•catastrophic events, such as wildfires, earthquakes, hurricanes, severe weather, tornadoes, ice and hailstorms, extreme temperatures, icing events, floods, severe convective storms and droughts, other meteorological conditions, landslides and other similar events beyond XPLR's control, which could severely damage or destroy all or a part of a project, pipeline or interconnection and transmission facilities, reduce its energy output or capacity, or result in unplanned power outages, property damage, environmental pollution, personal injury or loss of life;

•technical performance below expected levels, including, but not limited to, the failure of wind turbines, solar panels, mirrors, batteries and other equipment to produce energy as expected due to incorrect measures of expected performance provided by equipment suppliers;

•interference from nearby wind projects or other structures;

•increases in the cost of operating the projects;

•operator, contractor or supplier error or failure to perform or to fulfill any warranty obligations;

•serial design, manufacturing or other defects, which may not be covered by warranties or performance guarantees;

•inability to anticipate or adapt to changes in the reliability of XPLR's or NEE's equipment, operating systems or facilities;

•extended events, including, but not limited to, force majeure under certain PPAs that may give rise to a termination right of the customer under such a PPA (renewable energy counterparty);

•failure to comply with permits and the inability to renew or replace permits that have expired or terminated;

•the inability to operate within limitations that may be imposed by current or future governmental permits;

•replacements for failed equipment, which may need to meet new interconnection standards or require system impact studies and compliance that may be difficult or expensive to achieve;

•land use, environmental or other regulatory requirements;

•risks associated with potential harm to wildlife;

•disputes with the BLM, other owners of land on which XPLR's projects are located or nearby landowners;

•changes in laws, regulations, policies and treaties;

•government or utility exercise of eminent domain power or similar events;

•existence of liens, encumbrances and other imperfections in title affecting real estate interests; and

•insufficient insurance, warranties or performance guarantees to cover any or all lost revenues or increased expenses from the foregoing.

These and other factors could require the shutdown of XPLR's renewable energy projects, battery storage projects or other facilities or its pipeline investment. For renewable energy projects, battery storage projects, other facilities or pipelines located near populated areas, including, but not limited to, residential areas, commercial business centers, industrial sites and other public gathering areas, or areas more prone to wildfires, the level of damage resulting from certain of these risks could be greater.

These factors could also reduce the useful lives of and degrade equipment, interconnection facilities and transmission facilities, and materially increase maintenance and other costs. Unanticipated costs associated with maintaining or repairing XPLR's projects and pipeline investment may reduce profitability. In addition, replacement and spare parts for solar panels, wind turbines, batteries and other key equipment may be difficult or costly to acquire or may be unavailable.

Such events or actions could significantly decrease or eliminate the revenues of a project or pipeline, significantly increase its operating costs, cause a default under XPLR's financing agreements or give rise to damages or penalties payable to a PPA or transportation agreement counterparty, another contractual counterparty, a governmental authority or other third parties or cause defaults under related contracts or permits. Any of these events could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR's business, financial condition, results of operations and prospects can be materially adversely affected by weather conditions and related impacts, including, but not limited to, the impact of severe weather.

Weather conditions directly influence the demand for electricity, natural gas and other fuels and affect the price of energy and energy-related commodities. In addition, severe weather and natural disasters, such as hurricanes, floods, tornadoes, droughts, extreme temperatures, icing events, wildfires, severe convective storms and earthquakes, can be destructive and cause power outages, personal injury and property damage, reduce revenue, affect the availability of fuel and water and require XPLR to incur additional costs to, for example, restore service and repair damaged facilities, obtain replacement power, access available financing sources, obtain insurance, pay for any associated injuries and damages and fund any associated legal matters and compliance penalties. Furthermore, XPLR's physical plants could be placed at greater risk of damage should changes in the global climate produce unusual variations in temperature and weather patterns, resulting in more intense, frequent and extreme weather events and abnormal levels of precipitation. A disruption or failure of electric generation, storage, transmission or distribution systems or natural gas production, transmission, storage or distribution systems in the event of a hurricane, tornado or other severe weather event, or otherwise, could prevent XPLR from operating its business in the normal course and could result in any of the adverse consequences described above. Additionally, the actions taken to address the potential for severe weather such as additional winterizing of critical equipment and infrastructure, modifying or alternating plant operations and expanding load shedding options could result in significant increases in costs. Any of the foregoing could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

Changes in weather can also affect the level of wind and solar resource available, and thus the production of electricity, at XPLR's power generating facilities. Because the levels of wind and solar resources are variable and difficult to predict, XPLR’s results of operations for individual wind and solar facilities specifically, and XPLR's results of operations generally, may vary significantly from period to period, depending on the level of available resources. To the extent that resources are not available at planned levels, the financial results from these facilities may be less than expected.

XPLR depends on certain of the renewable energy projects and the investment in pipeline assets in its portfolio for a substantial portion of its anticipated cash flows.

XPLR depends on certain of the renewable energy projects and the investment in pipeline assets in its portfolio for a substantial portion of its anticipated cash flows. Consequently, the impairment or loss of any one or more of those projects or the pipeline investment could materially and, depending on the relative size of the affected projects or the pipeline investment, disproportionately reduce XPLR’s cash flows and, as a result, could have a material adverse effect on XPLR's business, financial condition, results of operations and ability to execute its business plan.

Developing and investing in power and related infrastructure, including repowering of XPLR's existing renewable energy projects, requires up-front capital and other expenditures and could expose XPLR to project development risks, as well as financing expense.

XPLR expects to pursue repowering of its existing renewable energy projects and may pursue other development opportunities. Repowering and development of assets involve regulatory, environmental, construction, safety, political and legal uncertainties and may require the expenditure of significant amounts of capital. These projects may not be completed on schedule, at the budgeted cost or at all. There may be cost overruns and construction difficulties. In addition, XPLR may be required to pay liquidated damages to counterparties if a project does not achieve commercial operations before a specified date that the parties have agreed or may agree upon in advance. Any cost overruns XPLR experiences or liquidated damages XPLR pays could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan. In addition, XPLR may choose to finance all or a portion of the development costs of any repowering or development project through the sale of additional common units or securities convertible into, or settleable with, common units, which could result in dilution to XPLR’s unitholders, or through other financings which could result in additional expense. Any such financings could involve the issuance of securities or indebtedness that could be senior to the common units upon liquidation. The development and construction related to repowering projects and other development projects may occur over an extended period of time and XPLR may not receive increases in revenues until the projects are placed in service, or at all. Accordingly, XPLR's repowering and other development efforts may not result in additional long-term contracted revenue streams that increase, and could decrease, the amount of cash available to execute XPLR's business plan.

Threats of terrorism and catastrophic events that could result from geopolitical factors, terrorism, cyberattacks, or individuals and/or groups attempting to disrupt XPLR’s business, or the businesses of third parties, may materially adversely affect XPLR’s business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR is subject to the potentially adverse operating and financial effects of geopolitical factors, terrorist acts and threats, as well as cyberattacks and other disruptive activities of individuals or groups. There have been cyberattacks and other physical attacks within the energy industry on energy infrastructure such as substations, natural gas pipelines and related assets in the past and there may be such attacks in the future. In addition, the advancement of artificial intelligence has given rise to added vulnerabilities and potential entry points for cyberattacks. XPLR’s generation, transmission, storage and distribution facilities, information technology systems and other infrastructure facilities and systems could be direct targets of, or otherwise be materially adversely affected by, such activities.

Geopolitical factors, terrorist acts, cyberattacks or other similar events affecting XPLR’s or NEE's systems and facilities, or those of third parties on which XPLR relies, could harm XPLR’s business by, for example, limiting their ability to generate, purchase, store or transmit power, natural gas or other energy-related commodities, limiting their ability to bill customers and collect and process payments, and delaying their development and construction of new generation, distribution, storage or transmission facilities or capital improvements to existing facilities. These events, and governmental actions in response, could result in a material decrease in revenues, significant additional costs (for example, to repair assets, implement additional security requirements or maintain or acquire insurance), significant fines and penalties, and reputational damage, could materially adversely affect XPLR’s operations (for example, by contributing to disruption of supplies and markets for natural gas, oil and other fuels), and could impair XPLR’s ability to raise capital (for example, by contributing to financial instability and lower economic activity). In addition, the implementation of security guidelines and measures has resulted in and is expected to continue to result in increased costs. To the extent geopolitical factors, terrorist acts, cyberattacks or other similar events equate to a force majeure event under the XPLR's PPAs, the renewable energy counterparty may terminate such PPAs if such a force majeure event continues for a specified period. Such events or actions may materially adversely affect XPLR’s business, financial condition, results of operations, liquidity and ability to execute its business plan.

The ability of XPLR to obtain insurance and the terms of any available insurance coverage could be materially adversely affected by international, national, state or local events and company-specific events at XPLR or NEE, as well as the financial condition of insurers. XPLR's insurance coverage does not provide protection against all significant losses.

XPLR shares insurance coverage with NEE and its affiliates, for which XPLR reimburses NEE. NEE currently maintains liability insurance coverage for itself and its affiliates, including XPLR, which covers legal and contractual liabilities arising out of bodily injury, personal injury or property damage to third parties. NEE also maintains coverage for itself and its affiliates, including XPLR, for physical damage to assets and resulting business interruption,

including, but not limited to, damage caused by terrorist acts. However, such policies do not cover all potential losses and coverage is not always available in the insurance market on commercially reasonable terms. To the extent NEE or any of its affiliates experience covered losses under the insurance policies, the limit of XPLR's coverage for potential losses may be decreased. NEE may also reduce or eliminate such coverage at any time. XPLR may not be able to maintain or obtain insurance of the type and amount XPLR desires at reasonable rates and XPLR may elect to self-insure some of its wind and solar projects. The ability of NEE to obtain insurance and the terms of any available insurance coverage could be materially adversely affected by international, national, state or local events and company-specific events at XPLR or NEE, as well as the financial condition of insurers. If XPLR cannot or does not obtain insurance coverage, XPLR may be required to pay costs associated with adverse future events. A loss for which XPLR is not fully insured could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR relies on interconnection and transmission and other pipeline facilities of third parties to deliver energy from certain of its projects and to transport natural gas to and from its pipeline investment. If these facilities become unavailable, XPLR's projects and pipeline investment may not be able to operate or deliver energy or may become partially or fully unavailable to transport natural gas.

XPLR depends on interconnection and transmission facilities owned and operated by third parties to deliver energy from certain of its projects. In addition, some of the projects in XPLR's portfolio share essential facilities, including interconnection and transmission facilities, with projects that are owned by other affiliates of NEE. If the interconnection or transmission arrangement for a project is terminated, XPLR may not be able to replace it on similar terms to the existing arrangement, or at all, or XPLR may experience significant delays or costs in connection with such replacement. XPLR also depends upon third-party pipelines and other facilities that transport natural gas to and from its pipeline investment. Because XPLR does not own these third-party pipelines or facilities, their continuing operations are not within its control. The unavailability of interconnection, transmission, pipeline or shared facilities due to reasons such as geopolitical factors, cyber incidents, physical attacks, severe weather or a generation, storage or transmission facility outage, pipeline rupture, or sudden and significant increase or decrease in wind or solar generation could adversely affect the operation of XPLR's projects and pipeline investment and the revenues received, which could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR's business is subject to liabilities and operating restrictions arising from environmental, health and safety laws and regulations and other standards, compliance with which may require significant capital expenditures, increase XPLR’s cost of operations and affect or limit its business plans.

XPLR's projects and pipeline investment are subject to numerous domestic environmental, health and safety laws, regulations, guidelines, policies, directives and other requirements governing or relating to the protection of avian, bats and other wildlife mortality and habitat protection; the storage, handling, use and transportation of natural gas as well as other hazardous or toxic substances and other regulated substances, materials, and/or chemicals; air quality, water quality and usage, soil quality, releases of hazardous materials into the environment and the prevention of and responses to releases of hazardous materials into soil and groundwater; climate change and greenhouse gas emissions; waste management; U.S. federal, state or local land use, zoning, building and transportation laws and requirements; the presence or discovery of archaeological, religious or cultural resources at or near XPLR's projects or pipeline investment; and the protection of workers’ health and safety, among other things. If XPLR's projects or pipeline investment do not comply with such laws, regulations, environmental licenses, permits, inspections or other requirements, XPLR may be required to incur significant expenditures, pay penalties or fines, or curtail or cease operations of the affected projects or the pipeline investment, prevent or delay the development of power generation, storage and transmission or other development projects, limit the availability and use of some fuels required for the production of electricity and may also be subject to criminal sanctions or injunctions, such as restrictions on how it operates its facilities. XPLR's projects and pipeline investment also carry inherent environmental, health and safety risks, including, without limitation, the potential for related civil litigation, regulatory compliance actions, remediation orders, fines and other penalties. Proceedings related to any such litigation or actions could result in significant expenditures as well as the restriction or elimination of the ability to operate any affected project. For example, if XPLR fails to obtain eagle "take" permits under the BGEPA or incidental take permits under the ESA for certain of its wind facilities and eagles or listed species, like cave bats, perish in collisions with facility turbines, XPLR or its subsidiaries could face criminal prosecution under these laws.

Environmental, health and safety laws and regulations and other standards have generally become more stringent over time and this trend could continue. Significant capital and operating costs may be incurred at any time to keep XPLR's projects or pipeline investment in compliance with environmental, health and safety laws and regulations and other standards, including in response to any addition of species, such as additional bat species, to the endangered species list. If it is not economical to make those expenditures, or if XPLR's projects or pipeline investment violate any of these current or future laws and regulations, it may be necessary to retire the affected project or pipeline or restrict or modify its operations, including restrictions on how XPLR develops, sites and operates projects, which could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan could be materially adversely affected by new or revised laws, regulations or executive orders, as well as by regulatory action or inaction.

XPLR’s business could be materially adversely affected by a variety of legal activity, such as: 1) the adoption of new or revised laws, such as international trade laws, regulations and interpretations; 2) regulatory initiatives such as those seeking restructuring of the energy industry; 3) new or revised regulations such as those affecting emissions, water consumption, water discharges wetlands, gas and oil infrastructure operations, and environmental and other permitting requirements for energy infrastructure projects; 4) actions taken, or not taken, by government agencies as a result of executive orders, such as failing to issue, delaying the issuance of, or increasing the requirements necessary to obtain approvals, rights-of-way, permits, determinations, leases or loans related to wind or other clean energy projects; and 5) changes in the way government interprets or applies laws, regulations or orders. Changes in the nature of the regulation of XPLR’s business through this type or other types of legal activity could have a material adverse effect on XPLR’s business, financial condition, results of operations, liquidity and ability to execute its business plan. XPLR is unable to predict future legislative, regulatory or executive action or inaction, including through changed government interpretations or applications, although any such changes may increase costs, the challenges associated with developing and operating clean and other energy infrastructure projects, and competitive pressures on XPLR, which could have a material adverse effect on the XPLR’s business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR is subject to FERC rules related to transmission that are designed to facilitate competition in the wholesale market on practically a nationwide basis and that evolve over time. XPLR cannot predict the impact of changing FERC rules or policies of the RTOs and ISOs, such as rules governing generator interconnection procedures and transmission planning requirements and cost allocation methodologies, or the effect of changes in levels of wholesale supply and demand, which are typically driven by factors beyond XPLR's control. There can be no assurance that XPLR will be able to respond adequately or sufficiently quickly to such rules and developments, which may impact the ability, timeline and cost of interconnecting new or repowered energy projects to the transmission system and the availability of transmission system capacity to deliver energy products to market, or to any changes that reverse or restrict the competitive restructuring of the energy industry in those jurisdictions in which such restructuring has occurred. Any of these events could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR's projects, pipeline investment and PPA counterparties are subject to regulation by U.S. federal, state and local authorities. The wholesale sale of electric energy in the continental U.S., other than portions of Texas, is subject to the jurisdiction of the FERC and the ability of a project to charge the negotiated rates contained in its PPA is subject to that project’s maintenance of its general authorization from the FERC to sell electricity at market-based rates. The FERC may impose penalties or revoke a project's market-based rate authorization if it determines that the project entity can exercise market power in transmission or generation, creates barriers to entry, has engaged in abusive affiliate transactions or fails to meet compliance requirements associated with such rates. The negotiated rates entered into under PPAs could be changed by the FERC if it determines such change is in the public interest or just and reasonable, depending on the standard in the respective PPA. If the FERC decreases the prices paid to XPLR for energy delivered under any of its PPAs, XPLR’s revenues could be below its projections and its business, financial condition, results of operations, liquidity and ability to execute its business plan could be materially adversely affected.

XPLR's clean energy projects are subject to the mandatory reliability standards of the NERC. The NERC reliability standards are a series of requirements that relate to maintaining the reliability of the North American bulk electric system and cover a wide variety of topics, including, but not limited to, physical and cybersecurity of critical assets, information protocols, frequency response and voltage standards, testing, documentation and outage management. If XPLR fails to comply with these standards, XPLR could be subject to sanctions, including, but not limited to, substantial monetary penalties. Although the projects are not subject to state utility rate regulation because they sell energy exclusively on a wholesale basis, XPLR is subject to other state regulations that may affect XPLR's projects’ sale of energy and operations. Changes in state regulatory treatment are unpredictable and could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

The structure of the energy industry and regulation in the U.S. is currently, and may continue to be, subject to challenges and restructuring proposals. Additional regulatory approvals may be required due to changes in law or for other reasons. XPLR expects the laws and regulation applicable to its business and the energy industry, including laws and regulations generally supportive of clean energy project development, generally to be in a state of transition for the foreseeable future. Changes in the structure of the industry or in such laws and regulations could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR does not own all of the land on which the projects in its portfolio are located and its use and enjoyment of the property may be adversely affected to the extent that there are any lienholders or land rights holders that have rights that are superior to XPLR's rights or the BLM suspends its federal rights-of-way grants.

XPLR does not own all of the land on which the projects in its portfolio are located and they generally are, and its future projects may be, located on land occupied under long-term easements, leases and rights-of-way. The ownership interests in the land subject to these easements, leases and rights-of-way may be subject to mortgages securing loans or other liens and other easements, lease rights and rights-of-way of third parties that were created prior to XPLR's projects’ easements, leases and rights-of-way. As a result, some of XPLR's projects’ rights under such easements, leases or rights-of-way may be subject to the rights of these third parties. While XPLR performs title searches, obtains title insurance, records its interests in the real property records of the projects’ localities and enters into non-disturbance agreements to protect itself against these risks, such measures may be inadequate to protect against all risk that XPLR's rights to use the land on which its projects are or will be located and its projects’ rights to such easements, leases and rights-of-way could be lost or curtailed. Additionally, XPLR operations located on properties owned by others are subject to termination for violation of the terms and conditions of the various easements, leases or rights-of-way under which such operations are conducted.

Further, XPLR's activities conducted under federal rights-of-way grants are subject to “immediate temporary suspension” of unspecified duration, at any time, at the discretion of the BLM. A suspension of XPLR activities within a federal right-of-way may be issued by the BLM to protect public health or safety or the environment. An order to suspend XPLR activities may be issued by the BLM prior to an administrative proceeding and may require immediate compliance by XPLR. Any violation of such an order could result in the loss or curtailment of XPLR's rights to use any federal land on which its projects are or will be located.

Any such loss or curtailment of XPLR's rights to use the land on which its projects are or will be located as a result of any lienholders or leaseholders that have rights that are superior to XPLR's rights or the BLM’s suspension of its federal rights-of-way grants could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan. In certain instances, rights-of-way may be subordinate to the rights of government agencies, which could result in costs or interruptions to XPLR's service. Restrictions on XPLR's ability to use rights-of-way could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR is subject to risks associated with litigation or administrative proceedings, as well as negative publicity.

XPLR is subject to risks and costs associated with litigation and administrative proceedings, including without limitation, those that may contest the operation, development, construction or repowering of its projects. The existence of litigation as well as impacts of defending, or failing to prevail in, any such proceeding in which XPLR is involved or other future legal or administrative proceedings, regardless of the merits, may be material to XPLR and harm its reputation.

XPLR is subject to, and may also become subject to additional, claims based on alleged negative health effects related to acoustics, shadow flicker or other claims associated with wind turbines from individuals who live near XPLR's projects. Any such legal proceedings or disputes could materially increase the costs associated with XPLR's operations. In addition, XPLR may become subject to legal proceedings or claims contesting the operation, development, construction or repowering of XPLR's projects. Any such legal proceedings or disputes could materially delay XPLR's ability to complete construction or repowering of a project in a timely manner, or at all, or materially increase the costs associated with commencing or continuing a project’s commercial operations. Any settlement of claims or unfavorable outcomes or developments relating to these proceedings or disputes, such as judgments for monetary damages, penalties, injunctions or denial or revocation of permits, could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

From time to time, political and public sentiment may result in a significant amount of adverse press coverage and other adverse public statements affecting XPLR. Adverse press coverage and other adverse statements, whether or not driven by political or public sentiment, may also result in investigations by regulators, legislators and law enforcement officials or in legal claims. Responding to the negative publicity and any resulting investigations and lawsuits, regardless of the ultimate outcome of the proceeding, can divert the time and effort of senior management from XPLR's business.

Addressing any adverse publicity, governmental scrutiny or enforcement or other legal proceedings is time consuming and expensive and, regardless of the factual basis for the assertions being made, can have a negative impact on the reputation of XPLR. It may also have a negative impact on its ability to take timely advantage of various business and market opportunities. The direct and indirect effects of negative publicity, and the demands of responding to and addressing it, may have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

XPLR is subject to risks associated with its ownership interests in projects that undergo development or construction, including for repowering, and other capital improvements to its clean energy or other projects, which could result in its inability to complete development and construction at those projects on time or at all, and make those projects too expensive to complete or cause the return on an investment to be less than expected.

XPLR's ownership interests in clean energy or other projects that undergo development or construction, including for repowering, and other capital improvements are subject to risks. There may be delays or unexpected developments in completing any future construction projects, including through actions or inaction taken by federal agencies and departments as a result of executive orders such as the assessment and review required before issuing new or renewed approvals, rights-of-way, permits, leases or loans related to the development of energy projects. Such factors could cause the construction costs of these projects to exceed XPLR's expectations, result in substantial delays or prevent the project from commencing commercial operations. Further, XPLR could become obligated to make delay or termination payments or become obligated for other damages under contracts, could experience the loss, or reduction, of tax credits, bonus credits or tax incentives, the inability to transfer tax credits, or delayed or diminished returns, and could be required to write off all or a portion of its investment in the project. Various factors could contribute to these risks, including:

•delays in obtaining, or the inability to obtain, necessary permits, rights-of-way, easements, licenses and other approvals on schedule and within budget;

•delays and increased costs related to the interconnection of new projects to the transmission system;

•the inability to acquire or maintain land use and access rights;

•the failure to receive contracted third-party services;

•interruptions to dispatch at the projects;

•supply chain disruptions, including as a result of changes in international trade laws, regulations, agreements, treaties, taxes, tariffs, duties or policies of the U.S. or other countries in which XPLR's suppliers are located;

•geopolitical factors;

•work stoppages;

•disputes involving contractors, land owners, governmental entities, environmental groups, Native American and aboriginal groups, lessors, joint venture partners, suppliers and other third parties;

•weather interferences;

•unforeseen engineering, environmental and geological problems, including, but not limited to, discoveries of contamination, protected plant or animal species or habitat, archaeological or cultural resources or other environment-related factors;

•changes to laws, regulations or policies that promote and support clean energy and enhance the economic viability of owning clean energy projects;

•negative publicity;

•unanticipated cost overruns in excess of budgeted contingencies, including for escalating costs for materials and labor and regulatory compliance; and

•failure of contracting parties, including suppliers, to perform under contracts.

In addition, it is common for XPLR, one of its subsidiaries or an affiliated party under the MSA to have an agreement with a third party to complete construction of its projects, in which case XPLR is subject to the viability and performance of the third party. XPLR's inability to find a replacement contracting party, if the original contracting party has failed to perform, could result in the abandonment of the construction of a project, while XPLR could remain obligated under other agreements associated with the project, including, but not limited to, offtake power sales agreements.

Any of these risks could cause XPLR's cash flows from, and financial returns on, these investments to be lower than expected or otherwise delay or prevent the completion of such projects or distribution of cash to XPLR, or could cause XPLR to operate below expected capacity or availability levels, which could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

Contract Risks

XPLR relies on a limited number of customers and vendors and is exposed to credit and performance risk in that they may be unwilling or unable to fulfill their contractual obligations to XPLR or that they otherwise terminate their agreements with XPLR.

In most instances, XPLR sells the energy generated by each of its clean energy projects to a single PPA counterparty under a long-term PPA. Further, through XPLR's pipeline investment, natural gas is transported under long-term natural gas transportation agreements with a limited number of counterparties. XPLR's equity method investees also have contracts with a limited number of counterparties.

XPLR expects that its existing and future contracts will be the principal source of cash flows available to execute its business plan. Thus, the actions of even one customer may cause variability of XPLR’s revenue, financial results and cash flows that are difficult to predict. Similarly, significant portions of XPLR’s credit risk may be concentrated among a limited number of customers and the failure of even one of these key customers to fulfill its contractual obligations to XPLR could significantly impact XPLR's business and financial results.

XPLR utilizes a limited number of vendors for the supply of equipment, materials and other goods and services required for its business operations and for the construction and operation of, and for capital improvements to, its facilities.

Any or all of XPLR's customers and vendors may fail to fulfill their obligations under their contracts with XPLR, whether as a result of the occurrence of any of the factors listed below or otherwise.

•Specified events beyond XPLR's control or the control of a customer may temporarily or permanently excuse the customer from its obligation to accept and pay for delivery of energy generated by a project. Specified events beyond XPLR's control or the control of a vendor may temporarily or permanently excuse the vendor from its obligation to supply equipment, materials, fuel and other goods and services to XPLR. These events could include, among other things, a system emergency, transmission failure or curtailment, adverse weather conditions or labor disputes.

•Adverse conditions in the energy industry or the general economy such as inflation, as well as circumstances of individual customers and vendors, may adversely affect the ability of some customers and vendors to perform as required under their contracts with XPLR.

•Certain of XPLR’s customers have been impacted by wildfires and have been, or could be, subject to significant liability which have had, or could be expected to have, a significant impact on their financial condition.

•The ability of XPLR's customers and vendors to fulfill their contractual obligations to XPLR depends on their financial condition. XPLR is exposed to the credit risk of its customers over an extended period of time due to the long-term nature of XPLR's contracts with them. These customers could become subject to insolvency or liquidation proceedings or otherwise suffer a deterioration of their financial condition when they have not yet paid for services delivered, any of which could result in underpayment or nonpayment under such agreements.

•A default or failure by XPLR to satisfy minimum energy requirements or mechanical availability levels under XPLR's agreements could result in damage payments to the applicable customer or termination of the applicable agreement.

If XPLR's customers are unwilling or unable to fulfill their contractual obligations to XPLR, or if they otherwise terminate such contracts, XPLR may not be able to recover contractual payments due to XPLR. Since the number of customers that purchase wholesale bulk energy or require the transportation of natural gas is limited, XPLR or its pipeline investment may be unable to find a new customer on similar or otherwise acceptable terms or at all. In some cases, there currently is no economical alternative counterparty to the original customer. The loss of, or a reduction in sales to, any of XPLR's customers could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.

If any vendor or other counterparty fails to fulfill its contractual obligations, XPLR may need to make arrangements with other counterparties or vendors, which could result in material financial losses, higher costs, untimely completion of power generation or storage facilities and other projects, and/or a disruption of its operations. If a defaulting counterparty is in poor financial condition, XPLR may not be able to recover damages for any contract breach which could have a material adverse effect on XPLR's business, financial condition, results of operations, liquidity and ability to execute its business plan.