We appreciate your continued involvement with Forefront Income Trust. Our shareholders are our priority, which is why at Forefront the investor always comes first. Your investment satisfaction means a great deal to us which is why we strive to invest in high yielding, risk mitigated opportunities.

Since inception, our shareholders have realized a positive return despite the volatile market environment. The Forefront Team has worked diligently to offer our investors a portfolio of non-correlated, risk mitigated, direct lending opportunities which we believe may provide our investors income and diversification from the equity market.

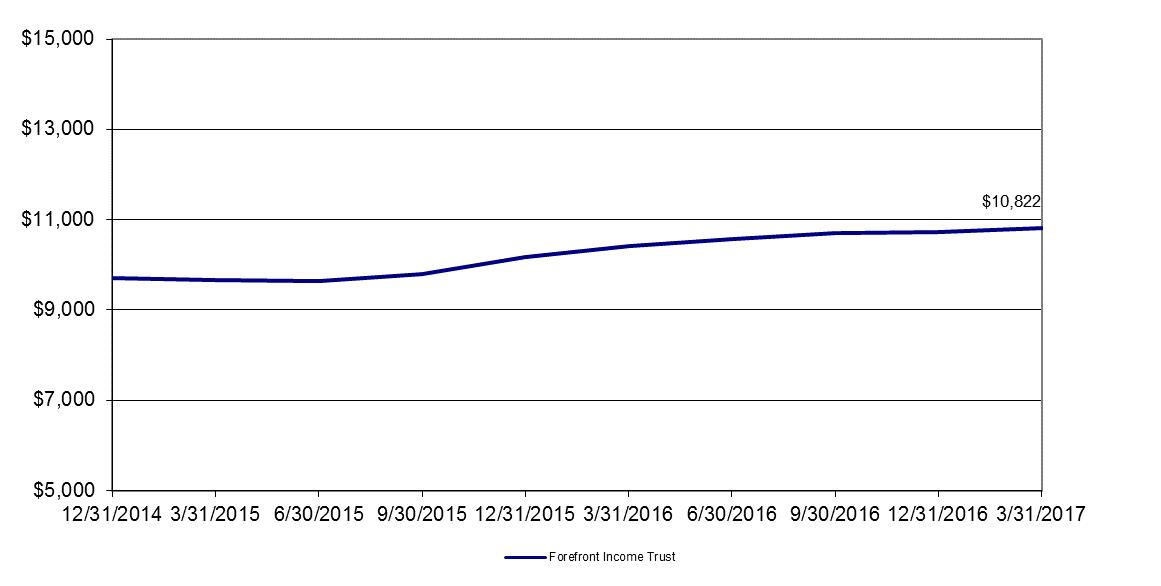

Below is a snapshot of the Fund’s performance compared to our benchmarks through March 31, 2017:

Fee waivers and expenses reimbursements have positively impacted Fund performance.

We continue to see attractive opportunities in the market place, and are confident that coupled with our structuring ability and the existing market, our portfolio will continue to pursue positive returns for our investors.

As always, we are available to answer individual questions because at Forefront Income Trust, the investor is the priority. Please do not hesitate to call a FIT representative at 1-888-484-4348 or send an email to info@forefrontcapitaladvisors.com. Please look at our symbol: BFITX for daily reporting of our NAV.

1. Organization and Significant Accounting Policies

The Forefront Income Trust (the “Trust”) is organized as a Delaware statutory trust organized on August 20, 2014 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, non-diversified, “interval” management investment company. The Trust follows accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codifications 946, Financial Services – Investment Companies. The Trust became effective on December 8, 2014 and commenced operations on December 31, 2014 upon the issuance of shares.

The Trust seeks to achieve its investment objective of current income by primarily investing in fixed income securities, such as unrated or below-investment-grade-rated (commonly referred to as “junk” or high yield risk) loans and debt instruments with maturities of generally not more than three years, as well as, to a lesser extent, dividend yielding preferred securities, all of which will represent what Forefront Capital Advisors, LLC (the “Advisor”) believes to be deep value opportunities, in that they will offer prospective returns that are high in proportion to their risks as assessed by the Advisor based on its fundamental analysis.

The following is a summary of significant accounting policies consistently followed by the Trust. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Trust’s fiscal year end is September 30.

Investment Valuation

The Trust’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the security is principally traded closes early or if trading of the particular security is halted during the day and does not resume prior to the Trust’s net asset value calculation) or which cannot be accurately valued using the Trust’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees, who consist of the Independent Trustees, the Chairman, and the Chief Executive Officer of the Advisor. A security’s “fair value” price may differ from the price next available for that security using the Trust’s normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Investments in underlying investment vehicles are valued, as a practical expedient, utilizing the net asset valuations provided by the underlying investment vehicles and/or their administrators, without adjustment, when the net asset valuations of the investments are calculated in a manner consistent with GAAP for investment companies. The Trust applies the practical expedient to its investments in underlying investment vehicles on an investment-by-investment basis, and consistently with the Trust’s entire position in a particular underlying investment vehicle, unless it is probable that the Trust will sell a portion of an investment at an amount different from the net asset valuation. If it is probable that the Trust will sell an investment in the underlying investment vehicle at an amount different from the net asset valuation or in other situations where the practical expedient is not available, the Trust considers other factors in addition to the net asset valuation, such as subscription and redemption rights, expected discounted cash flows, transactions in the secondary market, bids received from potential buyers, and overall market conditions in its determination of fair value.

Valuation of Securities For Which Independent Pricing Sources Are Not Available

The Trust may hold certain interests in loans and other fixed income securities, including senior loans, and will not have readily available market quotations or will not be priced by an independent pricing source or pricing model. Such loans and fixed income securities will be valued by the Advisor, Forefront Capital Advisors, LLC (the “Advisor”), according to the fair value process set forth in the Trust’s valuation policies and procedures. Loans and other securities held by the Trust which do not trade in any market, which are not priced by an independent pricing source or pricing model, or which are deemed to be illiquid will be valued at fair value by the Advisor under valuations policies and procedures established by and under the general supervision and responsibility of the Trust’s Board of Trustees.

(Continued)

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

The Advisor meets with the Board of Trustees on a quarterly basis, or more frequently as needed, to review and discuss the appropriateness of such fair values using more current information such as, recent security news, recent market transactions, updated corporate action information and/or other macro or security specific events. The Advisor is responsible for developing the Trust’s written valuation processes and procedures, conducting periodic reviews of the valuation policies, and evaluating the overall fairness and consistent application of the valuation policies as well as ensuring that the valuation methodologies for investments that are categorized within Level 3 of the fair value hierarchy are fair, consistent, and verifiable. Valuations determined by the Advisor are required to be supported by market data, third-party pricing sources, industry accepted third-party pricing models, counterparty prices, or other methods the Board of Trustees deem to be appropriate, including the use of internal proprietary pricing models. When determining the reliability of third party pricing information for investments owned by the Trust, the Board of Trustees, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

Also, when observable inputs become available, the Board of Trustees conducts back testing of the methodologies used to value Level 3 financial instruments to substantiate the unobservable inputs used to value those investments. Such back testing includes comparing Level 3 investment values to observable inputs such as exchange-traded prices, transaction prices, and/or vendor prices.

The fair value methodologies and processes set forth in the Trust’s valuation policies and procedures take into account applicable regulatory and accounting guidance, including the fair value measurement standards incorporated in Financial Accounting Standards Board (“FASB”) Topic 820, in addition to other factors, as defined below.

Fair Value Measurement

Various inputs are used in determining the value of the Trust's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities and identical securities in inactive markets, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Trust’s own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

(Continued)

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of March 31, 2017 for the Trust’s assets measured at fair value:

| Investments (a) | | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

| Assets | | | | | | | | | | | | |

| Senior Loans | | $ | 3,000,000 | | | $ | - | | | $ | - | | | $ | 3,000,000 | |

| Structured Notes | | | 6,600,000 | | | | - | | | | - | | | | 6,600,000 | |

| Warrants | | | - | | | | - | | | | - | | | | - | |

| Short-Term Investment | | | 833,797 | | | | 833,797 | | | | - | | | | - | |

| Total | | $ | 10,433,797 | | | $ | 833,797 | | | $ | - | | | $ | 9,600,000 | |

| (a) | The Trust had no significant transfers into or out of Level 1, 2, or 3 during the period ended March 31, 2017. The Trust held Level 3 securities during the period. The aggregate value of such securities is 91.56% of net assets, and they have been fair valued under procedures approved by the Trust’s Board of Trustees. It is the Trust’s policy to record transfers at the end of the reporting period. |

The table below presents a reconciliation of all Level 3 fair value measurements existing at March 31, 2017:

| | | Limited Liability Company Interest | | | Senior Loans | | | Structured Notes | | | Warrants | |

| Opening Balance | | $ | 2,500,000 | | | $ | 3,180,000 | | | $ | 4,675,000 | | | $ | - | |

| Purchases | | | - | | | | - | | | | 2,425,000 | | | | - | |

| Principal payments/sales | | | (2,806,936 | ) | | | - | | | | (500,000 | ) | | | - | |

| Accrued discounts (premiums) | | | - | | | | - | | | | - | | | | - | |

| Realized Gains | | | 306,936 | | | | - | | | | - | | | | - | |

| Unrealized Losses | | | - | | | | (180,000 | ) | | | - | | | | - | |

| Ending Balance | | $ | - | | | $ | 3,000,000 - | | | $ | 6,600,000 | | | $ | - | |

Valuation Techniques

Limited Liability Company Interest

The Trust’s investments in limited liability companies consist of direct equity interest investments. The transaction price, excluding transaction costs, is typically the Trust’s best estimate of fair value at inception. When evidence supports a change to the carrying value from the transaction price, adjustments are made to reflect expected exit values in the investment’s principal market under current market conditions. Ongoing reviews by management are based on an assessment of each underlying investment from the inception date through the most recent valuation date. These assessments typically incorporate valuation techniques that consider the evaluation of financing and sale transactions with third parties, an income approach reflecting a discounted cash flow analysis using an appropriate risk-adjusted discount rate, and a market approach that includes comparative analysis of acquisition multiples and pricing multiples generated by market participants. In certain instances, the Partnership may use multiple valuation methodologies for a particular investment and estimate its fair value based on a weighted average or a selected outcome within a range of multiple valuation results. Equity investments in private limited liability companies are generally included in Level 3 of the fair value hierarchy.

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

Senior Loans and Structured Notes

Investments in private operating companies also consist of senior loan investments and structured notes. The transaction price, excluding transaction costs, is typically the Trust’s best estimate of fair value at inception. When evidence supports a change to the carrying value from the transaction price, adjustments are made to reflect expected exit values in the investment’s principal market under current market conditions. Ongoing reviews by management are based on an assessment of each underlying investment from the inception date through the most recent valuation date. These assessments typically incorporate valuation techniques that consider trends in the performance and credit profile of each underlying investment, evaluation of arm’s length financing, an income approach based upon a discounted cash flow analysis and sales transactions with third parties. Inputs relied upon by debt investments using the income approach include an understanding of the underlying company’s compliance with debt covenants, the operating performance of the underlying company, trends in liquidity and financial leverage ratios of the underlying company from the point of the original investment to the stated valuation date, an assessment of the credit profile of the underlying company from the original investment to the stated valuation date, as well as an assessment of the underlying company’s business enterprise value, liquidation value and debt repayment capacity of each subject debt investment. In addition, inputs include an assessment of potential yield adjustments for each debt investment based upon trends in the credit profile of the underlying company and trends in the interest rate environment from the date of the original investment to the stated valuation date. Investments in senior loans and structured notes provided to private operating companies are generally included in Level 3 of the fair value hierarchy.

Short-Term Investment

Investments in the short term investment for the Blackrock Liquidity account was priced at the ending net asset value (NAV) provided by the service agent of the account. These securities will be categorized as Level 1 securities since they are valued at the closing price reported by an active market.

At March 31, 2017, investments in the Limited Liability Company Interest, the Senior Loans, and Structured Notes within Level 3 have been valued at fair value using unadjusted third party transaction prices as described above by the Advisor. No unobservable inputs internally developed by the Trust have been applied to these investments, thus tabular disclosure has been omitted. The Senior Loans and Structured Notes are collateralized by underlying assets and/or real estate property. As part of the Trust’s analysis for entering into these loans as well as for its fair value analysis, the Advisor will value the collateral using valuation techniques such as the discounted cash flow method, the direct capitalization method and the comparable sales method. The Trust’s remaining Level 3 investment in the Limited Partnership was valued using the unadjusted net asset value of investments in private investment vehicles. No unobservable inputs internally developed by the Trust have been applied to this investment thus tabular disclosure has also been omitted.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from investments will be recorded as soon as the Trust is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Generally, when interest and/or principal payments on a loan become past due, or if the Trust otherwise does not expect the borrower to be able to service its debt and other obligations, the Trust will place the loan on non-accrual status and will generally cease recognizing interest income on that loan for financial reporting purposes until all principal and interest have been brought current through payment or due to restructuring such that the interest income is deemed to be collectible. The Trust generally restores non-accrual loans to accrual status when past due principal and interest is paid and, in the Trust’s judgment, the payments are likely to remain current. As of March 31, 2017, the Trust had no non-accrual assets held in its portfolio. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

Expenses

The Trust bears expenses incurred specifically on its behalf as well as a portion of general Trust level expenses, which are allocated according to methods reviewed and approved annually by the Trustees. The expenses of the Trust are detailed below in Note 2.

Distributions

The Trust may declare and distribute dividends from net investment income (if any) quarterly. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are determined in accordance with income tax regulations and are recorded on ex-dividend date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Trust intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

| 2. | Transactions with Affiliates and Service Providers |

Advisor

The Trust will not pay the Advisor a fixed management fee. The Trust will pay the Advisor an Advisory Fee annually in arrears for the previous fiscal year after the close of such fiscal year and in the first quarter following the close of such fiscal year, subject to the Trust having achieved an increase in its Pre-Advisory Fee Net Investment Income for that previous fiscal year of 8.00% (in other words, subject to the Trust having achieved an 8.00% Pre-Advisory Fee net return (the “Hurdle”) for its shareholders for that previous fiscal year.) The Advisor will receive no compensation until after the Hurdle is passed. Thereafter, the Advisory Fee will be charged, and will be equal to (i) 80% of the portion, if any, of the Trust’s Pre-Advisory Fee Net Investment Income (as defined below) that exceeds the 8.00% Hurdle but is less than or equal to an 18.00% return, plus (ii) 20% of the portion, if any, of the Trust’s Pre-Advisory Fee Net Investment Income that exceeds an 18.00% return. For the purposes of calculating the Advisory Fee, “Pre-Advisory Fee Net Investment Income shall mean, with respect to any fiscal year, interest income, dividend income, and any other income, including (i) any fees such as commitments and origination fees received by the Trust; (ii) any structuring, diligence, consulting, and any other fees received by the Trust, or by the Advisor and accruing to the Trust, in connection with the Trust investment; and (iii) any income received from investments with a deferred interest feature (such as original interest discount, pay in kind interest, and zero coupon securities), less other expenses. Pre-Advisory Fee Net Investment Income does not include any realized or unrealized capital gains. For the purposes of calculating Pre-Advisory Fee Net Investment Income, neither the liquidation preference of any preferred shares issued by the Trust nor the aggregate amount of any borrowings for investment purposes will be deducted from the Trust’s total assets. Pre-Advisory Fee Net Investment Income includes accrued income that we have not yet received in cash, such as the amount of any market discount we may accrue on debt instruments we purchase below par value. Total Advisory fees paid to the Advisor during the period ended March 31, 2017 were $189,080.

The Advisor has entered into a contractual agreement (the “Expense Limitation Agreement”) with the Trust, under which it has agreed to waive or reduce its fees and to assume other expenses of the Trust, if necessary, in amounts that limit the Trust’s total operating expenses (exclusive of interest, taxes, brokerage commissions, borrowing costs, fees and expenses of other investment companies in which the Trust invests, and other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Trust’s business, and amounts, if any, payable under a Rule 12b-1 distribution plan) to not more than 1.75% of the average daily net assets of the Trust. The current term of the Expense Limitation Agreement remains in effect until December 31, 2017. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter.

(Continued)

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

The Advisor paid the initial organizational expenses of the Fund, which amounted to $37,500, and are subject to repayment by the Fund, provided the Fund is able to make such repayment without causing operating expenses to exceed the annual rate of 1.75% and provided that the fees and expenses which are subject of the repayment were incurred within three years of the repayment. As of the period ended March 31, 2017, the remaining amount for recoupment by the Advisor was $37,500. The Advisor reimbursed the Fund for $62,947 during the period.

Organizational and Deferred Offering Costs

The Fund’s organizational costs of $37,500, which were incurred prior to the commencement of operations through September 10, 2014, were reimbursed by the Advisor. The organizational costs consisted of legal fees incurred to establish and launch the Trust. The organizational costs are subject to repayment by the Fund until September 10, 2017 as noted above. The organizational costs are expensed as incurred.

The Fund’s offering costs consist of legal fees for preparing the initial prospectus and statement of additional information. These offering costs, which are subject to the Expense Limitation Agreement, are accounted for as deferred costs until the commencement of operations and, thereafter, amortized to expense over twelve months on a straight-line basis. For the period ended March 31, 2017, there were no remaining offering costs to be deferred in the Fund.

Administrator

For the period from October 1, 2016 through December 31, 2016, The Nottingham Company provided services as the Trust’s Administrator. During this period, the Trust paid $14,851 in fees.

The Trust pays a monthly fee to The Nottingham Company based upon the average daily net assets of the Trust and calculated at the annual rates as shown in the schedule below which is subject to a minimum of $2,500 per month. The Administrator also receives a fee to procure and pay the Trust’s custodian, additional compensation for fund accounting and recordkeeping services, and additional compensation for certain costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. A breakdown of these fees is provided below.

| Administration Fees* | Custody Fees* | Fund Accounting Fees (monthly) | Fund Accounting Fees | Blue Sky Administration Fees (annual) |

Average Net Assets | Annual Rate | Average Net Assets | Annual Rate |

| First $250 million | 0.070% | First $500 million | 0.010% | $2,500 | 0.01% | $150 per state |

| Next $250 million | 0.050% | Over $500 million | 0.0075% | | | |

| Next $500 million | 0.030% | | | | | |

| Over $1 billion | 0.020% | | | | | |

| | | * Minimum monthly fees of $2,500 and $417 for Administration and Custody, respectively. |

As of January 1, 2017, the Trust has engaged S&Z Fund Services, LLC as its Administrator (the “Administrator”). During this period, the Trust paid the Administrator $15,000 in fees.

Compliance Services

Wendy Espinoza, an officer of the Advisor, serves as the Trust’s Chief Compliance Officer.

Barge Consulting, LLC provides services as the Trust’s Compliance Consultant. Barge Consulting, LLC is entitled to receive customary fees from the Trust for their services pursuant to the Compliance Services agreement with the Trust. The Trust incurred $10,700 in fees for compliance consulting services.

(Continued)

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

Transfer Agent

S&Z Fund Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent’s fee arrangements with the Fund.

Distributor

Foreside (the “Distributor”) serves as the Fund’s principal underwriter and distributor. The Distributor receives $1,500 per month for services provided and expenses assumed.

Trustees

The Board of Trustees consists of two Independent Trustees, the Chairman, and the Chief Executive Officer of the Advisor. For the period from October 1, 2016 through March 31, 2017, the Trust incurred $5,000 in Trustee fees. Certain officers of the Trust are also officers of the Advisor.

| 3. | Shareholder Service Plan Fees |

The Trustees, including a majority of the Trustees who are not “interested persons” of the Trust as defined in the 1940 Act and who have no direct or indirect financial interest in such plan or in any agreement related to such plan, adopted a Shareholder Service Plan under which certain assets of the Trust may be used to compensate the Trust’s principal underwriter within meaning of the 1940 Act, and brokers, dealers, and other financial intermediaries for providing personal services to shareholders and/or the maintenance of shareholder accounts with respect to the Trust’s shares of beneficial interest. For the period ended March 31, 2017, $6,995 in fees were incurred by the Trust.

| 4. | Share Repurchase Program |

The Trust makes quarterly offers to repurchase its Shares pursuant to Rule 23c-3(b) under the 1940 Act. The Trust is authorized to repurchase between 5% and 25% of its Shares outstanding on the quarterly repurchase request deadline. However, no assurance can be given that shareholders will be able to sell all of their Shares tendered to the Trust pursuant to any particular repurchase offer or than any particular Shares tendered will be accepted in such a repurchase offer. Shares tendered for repurchase within 180 days from the date of the original issuance of the Shares will be subject to a repurchase fee of 2%. The Trust’s quarterly repurchase offers will end on the third Friday (or the preceding business day if such third Friday is not a business day) of each month in which a repurchase offer ends.

| 5. | Purchases and Sales of Investment Securities |

For the period ended March 31, 2017, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales and Maturities of Securities |

| $ 7,894,506 | $ 8,404,530 |

There were no long-term purchases or sales of U.S Government Obligations during the period ended March 31, 2017.

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

(Continued)

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

Management reviewed the Trust’s tax positions taken on federal income tax returns for the open tax period of September 30, 2016 and as of and during the period ended March 31, 2017, and concluded that the Trust does not have a liability for uncertain tax positions. The Trust recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Trust did not incur any interest or penalties. The Trust identifies its major tax jurisdictions as U.S. Federal and New York State where the Trust makes its significant investments. The Trust does not expect that its assessment regarding unrecognized tax positions will change over the next twelve months. There are no income tax returns currently under examination.

Distributions during the periods ended were characterized for tax purposes as follows:

| | | March 31, 2017 | | | September 30, 2016 | |

| Ordinary Income | | $ | 766,803 | | | $ | 525,996 | |

| Long-term capital gain | | | - | | | | - | |

At March 31, 2017, the tax-basis cost of investments and components of distributable earnings were as follows:

| Cost of Investments | | $ | 10,613,797 | |

| | | | | |

| Unrealized Appreciation | | | - | |

| Unrealized Depreciation | | | (180,000 | ) |

| Net Unrealized Appreciation | | $ | 10,433,797 | |

| 7. | Commitments and Contingencies |

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Trust, and others that provide for general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust. The Trust expects the risk of loss to be remote.

| 8. | Investments in Restricted Securities |

Restricted securities include securities that have not been registered under the Securities Act of 1933. The Trust may invest in restricted securities that are consistent with the Trust’s investment strategy. Investments in restricted securities are valued at fair value under procedures approved by the Trust’s Board of Trustees.

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

As of March 31, 2017, the Trust was invested in the following restricted securities:

| Security | Initial Purchase Date | Shares | Cost | Value | % of Net Assets |

| Banjo & Matilda, Inc. | 6/18/2015 | 500,000 | $500,000 | $500,000 | 4.39% |

| WBSH Met Tower, LLC | 6/30/2015 | 750,000 | $750,000 | $750,000 | 6.58% |

| Delta Energy Natchez, LLC | 10/14/2015 | 500,000 | $500,000 | $500,000 | 4.39% |

| Auto Funding Group, LLC | 10/20/2015 | 2,680,000 | $2,680,000 | $2,500,000 | 21.93% |

| WB Park Avenue, LLC | 10/30/2015 | 550,000 | $550,000 | $550,000 | 4.83% |

WB West 25th Street | 12/1/2015 | 550,000 | $550,000 | $550,000 | 4.83% |

| 1501 Sheepshead Bay Road Partners, LLC | 1/19/2016 | 250,000 | $250,000 | $250,000 | 2.19% |

| Blaichbridge Driggs, LLC | 3/11/2016 | 525,000 | $525,000 | $525,000 | 4.61% |

| 2020 Eastchester Road, LLC | 4/19/2016 | 550,000 | $550,000 | $550,000 | 4.83% |

| 700 Atlantic Equities, LLC | 5/2/2016 | 500,000 | $500,000 | $500,000 | 4.39% |

| 35 Tech Partners, LLC | 12/22/2016 | 500,000 | $500,000 | $500,000 | 4.39% |

| 4765 Carpenter Avenue, LLC | 12/22/2016 | 400,000 | $400,000 | $400,000 | 3.51% |

| Banjo & Matilda, Inc. | 1/4/2017 | 65,000 | $65,000 | $65,000 | 0.57% |

| 35 Tech Partners, LLC | 1/11/2017 | 460,000 | $460,000 | $460,000 | 4.04% |

| City Ridge Realty, LLC | 3/21/2017 | 500,000 | $500,000 | $500,000 | 4.39% |

| Club at Charter Point Realty, LLC | 3/21/2017 | 500,000 | $500,000 | $500,000 | 4.39% |

The Trust in the normal course of business makes investments in financial instruments where the risk of potential loss exists due to changes in the market (market risk), or failure or inability of the counterparty to a transaction to perform (credit and counterparty risk). See below for a detailed description of select principal risks.

Market risk. The Trust’s investments in financial instruments expose it to various risks such as, but not limited to, interest rate and equity. Interest rate risk is the risk that a fixed income investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape of the yield curve or in

any other interest rate relationship. Such changes usually affect securities inversely and can be reduced by diversifying (for example, investing in fixed-income securities with different durations) or hedging (for example, through an interest rate swap).

Equity risk. Equity Risk is the risk that the market values of equities, such as common stocks or equity related investments may decline due to general market conditions, such a political or macroeconomic factors. Additionally, equities may decline in value due to specific factors affecting a related industry or industries. Equity securities and equity related investments generally have greater market price volatility than fixed income securities.

(Continued)

Forefront Income Trust

Notes to Financial Statements

(Unaudited)

Credit and counterparty risks. The Trust is exposed to credit risk to counterparties with whom it transacts with and also bears the risk of settlement default. The Trust may lose money if the issuer or guarantor of a fixed income security is unable or unwilling to make timely principal and/or interest payments, or to otherwise honor its obligations.

10. Subsequent Events

In accordance with GAAP, the Trust has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. Management has evaluated subsequent events through the issuance of these financial statements.

Forefront Income Trust

Additional Information

(Unaudited)

| 1. | Proxy Voting Policies and Voting Record |

A copy of the Trust’s Proxy Voting and Disclosure Policy and the Advisor’s Disclosure Policy are included as Appendix B to the Trust’s Statement of Additional Information and are available, without charge, upon request, by calling 800-773-3863, and on the website of the Securities and Exchange Commission (“SEC”) at sec.gov. Information regarding how the Trust voted proxies relating to portfolio securities during the most recent period ended June 30, is available (1) without charge, upon request, by calling the Trust at the number above and (2) on the SEC’s website at sec.gov.

| 2. | Quarterly Portfolio Holdings |

The Trust files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website at sec.gov. You may review and make copies at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 800-SEC-0330. You may also obtain copies without charge, upon request, by calling the Trust at 800-773-3863.

We are required to advise you within 60 days of the Trust’s fiscal year-end regarding the federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Trust’s period ended March 31, 2017.

During the period, there were $766,803 in income distributions paid by the Trust.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

| 4. | Schedule of Shareholder Expenses |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2016 through March 31, 2017.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

(Continued)

Forefront Income Trust

Additional Information

(Unaudited)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Forefront Income Trust | Beginning Account Value October 1, 2015 | Ending Account Value March 31, 2016 | Expenses Paid During Period* |

| Actual | $1,000.00 | $1,061.10 | $8.99 |

| Hypothetical (5% annual return before expenses) | $1,000.00 | $1,016.21 | $8.80 |

| * | Expenses are equal to the average account value over the period multiplied by the Trust’s annualized expense ratio multiplied by 182/365 (to reflect the one-half year period). |

Approval of Investment Advisory Agreement (Unaudited)

During the reporting period, the Board of Trustees (the “Board”), including the Independent Trustees voting separately, voted twice to approve the continuance of the Investment Advisory Agreement with the Advisor for the Trust: once for an interim period of 45 days (the “Interim Approval”) at an in-person meeting held on October 13, 2016; and then again for an annual term (the “Annual Approval”) at an in-person meeting that began on November 15, 2016 and concluded on November 16, 2016. At each meeting all of the Trustees were present and in the course of their deliberations, the Board was advised by legal counsel.

In considering the Interim Approval of the Investment Advisory Agreement for the Trust and reaching their conclusion with respect thereto, the Board reviewed and analyzed various factors that it determined were relevant, including the nature and extent of the services provided by the Adviser, the costs of services provided by the Adviser, the extent to which economies of scale are realized, the investment performance of the Trust and the Adviser and whether fee levels reflect economies of scale. After reviewing information provided by the Advisor in response to requests from the Board, the Board concluded that there were questions and additional information to be gathered regarding: (i) corporate ownership of the Advisor; (ii) an update on the possible resolution of a litigation matter between the Fund’s largest shareholder and affiliates of the Adviser; (iii) a review of Fund investments; (iv) a proposal for a new, independent Chief Compliance Officer; (v) proposals for successors to the Fund’s administrative service providers and distributor; and (vi) additional information regarding the Advisor, including the Advisor’s financial circumstances. Following discussion, the Board unanimously concluded that continuance of the Investment Advisory Agreement for an interim period of 45 days to allow the Adviser additional time to gather information responsive to the Board’s supplemental requests was in the best interests of the Trust and its shareholders.

In considering the Annual Approval of the Investment Advisory Agreement for the Trust and reaching their conclusion with respect thereto, the Board received and reviewed information provided by the Advisor in response to requests of the Board and counsel, including the supplemental information requested by the Board in connection with the Interim Approval. In this regard: (i) the Board had received documentation of the Adviser’s ownership and correction of the same in the Adviser’s Form ADV; (ii) the Board had received a satisfactory update on the possible resolution of the litigation matter; (iii) the Board had received information on the Fund’s investments, including a documented explanation of an incorrect signature with respect to a Fund investment; (iv) the Fund and the Adviser had engaged an independent compliance consulting firm and an independent Chief Compliance Officer for the Fund; (v) the Board had received an update on the Fund’s service providers, including a commitment to provide services until the end of the current year from the current service providers and an update on potential replacement service providers from Fund management and the Trust’s new Chief Compliance Officer; and (vi) the Board had received an updated response to the Board’s request for further information from the Adviser and reviewed the same (including, without limitation, confirmation that the Adviser had satisfied amounts “due from Adviser” that were previously outstanding at the October meeting). Following discussion, the Board reviewed and analyzed various factors that it determined were relevant, including the factors described below.

Services to be Provided. The Trustees considered the nature, quality and scope of the investment advisory services that had been provided to the Trust by the Adviser in the past and the services that were expected to continue in the future. The Trustees reviewed the Adviser’s services since inception, including its portfolio management of the Trust, coordination of services among the Trust’s service providers, compliance procedures and practices, current efforts to replace service providers and efforts to make the Trust available to potential investors and increase assets in the Trust. The Trustees also noted that the Trust’s president is an employee of the Adviser, and serves the Trust without additional compensation from the Trust. After reviewing the foregoing information and further information in the Adviser’s responses to a request for information from the Board and the exhibits and supplement thereto, the Board concluded that the quality, extent, and nature of the services to be provided by the Adviser are satisfactory for the Trust.

Performance Results. The Trustees considered the performance results of the Trust over various time periods. They reviewed information comparing the Trust’s performance with the performance of other, similar mutual funds and with its benchmark indices, discussed some of the comparable funds, and reviewed the performance information provided. The Trustees noted the Trust’s performance was positive relative to that of its peer group, that peer group consisting of closed-end funds that invest in high yield fixed-income securities including senior loans and asset-backed loans. Following further discussion, the Trustees concluded that the Trust’s performance was satisfactory.

Costs of Services to be Provided and Profitability of the Adviser. The Trustees considered the investment advisory fee and other expenses paid by the Trust directly and in comparison to information regarding the advisory fee and expenses incurred by other, similar funds provided in an exhibit to the Adviser Response. The Trustees also discussed the current Expense Limitation Agreement, the fact that the Adviser was waiving fees and reimbursing expenses, and the amount of fees waived and expenses reimbursed. The Trustees also considered the Trust’s advisory fee structure, concluding that the advisory fee structure is appropriate and within the range of what would have been negotiated at arm’s length.

Economies of Scale and Fee Levels. In this regard, the Trustees considered that the Trust’s fee arrangement with the Adviser involves both an advisory fee and an Expense Limitation Agreement, the Adviser had expended considerable amounts to date in launching the Trust and supplementing the costs of its first two years of operations, and the Adviser has indicated a willingness to consider breakpoints in the advisory fee structure in the future if and when the Adviser has sustained profitability from the services to the Trust. The Board noted that the Trust’s expenses have been and will likely continue to be supplemented by the Adviser for a period of time, and the Trust will benefit from economies of scale under its agreements with service providers as the Trust grows. The Board noted that the Trust is the Adviser’s only current client and as such that there were no other clients for which the Board could compare the fees charged by the Adviser.

After full consideration of the above factors as well as other factors, the Board unanimously concluded that continuance of the Investment Advisory Agreement for an additional one year term was in the best interests of the Trust and its shareholders.

(This page has been left blank intentionally.)