Exhibit (a)(1)(A)

TCW DIRECT LENDING LLC

and its wholly owned subsidiary,

TCW MIDDLE MARKET LENDING OPPORTUNITIES BDC, INC.

Offer to Exchange Limited Liability Company Units of

TCW DIRECT LENDING LLC

for Shares of Common Stock of

TCW MIDDLE MARKET LENDING OPPORTUNITIES BDC, INC.

THE EXCHANGE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY

TIME, ON JUNE 21, 2018 UNLESS THE EXCHANGE OFFER IS EXTENDED OR TERMINATED.

TCW Direct Lending LLC (“Direct Lending,” also known as “Fund VI”), together with its wholly owned subsidiary, TCW Middle Market Lending Opportunities BDC, Inc. (the “Extension Fund”), is offering to exchange (the “exchange offer”) outstanding common limited liability company units of Direct Lending (“Units”) that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equivalent number of shares of common stock, par value $0.001 per share, of the Extension Fund (“Common Stock”).

Each Unit represents an initial capital commitment to Direct Lending of $100.

For each Unit tendered and accepted in the exchange offer, you will receive one share of Common Stock. The obligation of Direct Lending and the Extension Fund to exchange Units for shares of Common Stock is subject to the terms and conditions listed under “The Exchange Offer—Conditions to Completion of the Exchange Offer,” including that at least 5,033,675 Units of Direct Lending (approximately 25% of the outstanding Units) are validly tendered and not validly withdrawn prior to the expiration of the exchange offer.

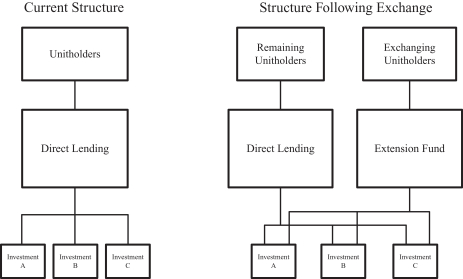

At the time of the completion of the exchange offer, a pro rata share of all of the assets and liabilities held by Direct Lending immediately prior to the completion of the exchange offer, including each of Direct Lending’s portfolio investments, will be transferred to the Extension Fund in proportion to the number of Units that are validly tendered and accepted for exchange, as described herein. Following the closing of the exchange offer and the other related transactions described herein, the Extension Fund will no longer be a subsidiary of Direct Lending.

Each tendering unitholder will also be required to enter into a new subscription agreement with the Extension Fund pursuant to which the unitholder will make a capital commitment to the Extension Fund to purchase additional shares of Common Stock. The aggregate amount of each capital commitment will equal the pro rata portion of the tendering unitholder’s available commitment to Direct Lending as of the closing date of the exchange offer corresponding to the percentage of its Units tendered and accepted for exchange relative to all Units held by the tendering unitholder as of the date of the Extension Fund’s acceptance of the subscription agreement, subject to the terms and conditions thereof. Each tendering unitholder may confirm the amount of its available commitment to Direct Lending by contacting TCW Asset Management Company LLC (the “Adviser”) prior to the execution and delivery of its subscription agreement.

You should read carefully the terms and conditions of the exchange offer described in this offer to exchange memorandum (“Offer to Exchange”).Although the boards of directors of Direct Lending and the Extension Fund have approved the exchange offer, none of Direct Lending, the Extension Fund or any of their respective directors or officers, the Adviser or any of the dealer managers makes any recommendation, or authorizes any person to make a recommendation, as to whether you should exchange all, some or none of your Units. You must make your own decision after reading this document and consulting with your advisors.

Direct Lending is aclosed-end,non-diversified management investment company that is a Delaware limited liability company. The Extension Fund is incorporated in Delaware and will operate as aclosed-end,non-diversified management investment company. Direct Lending has elected, and the Extension Fund will elect, to be regulated as a business development company under the Investment Company Act of 1940, as amended. Direct Lending is, and the Extension Fund will be, externally managed by the Adviser, a wholly owned subsidiary of The TCW Group, Inc. The investment objective of both Direct Lending and the Extension Fund is to generate attractiverisk-adjusted returns primarily through direct investments in senior secured loans tomiddle-market companies or other issuers. Units of Direct Lending are not, and shares of Common Stock of the Extension Fund will not be, currently listed on any national securities exchange. Subsequent to the closing of the exchange offer, subject to market conditions, the Extension Fund expects to conduct an initial public offering and a listing of its Common Stock. However, there can be no assurance when an initial public offering and listing will, if ever, be completed.

See “Risk Factors” beginning on page 33 for a discussion of factors that you should consider in connection with the exchange offer.

This document concisely describes the Extension Fund, the exchange offer and other related matters that you ought to know before tendering Units in the exchange offer and should be retained for future reference. You can also obtain information about Direct Lending and the Extension Fund from documents that each has filed or will file with the Securities and Exchange Commission (“SEC”), and such documents are available upon oral or written request and without charge from the Adviser. See “Incorporation by Reference” and “Where You Can Find More Information” for instructions on how to obtain such information.

Ownership of the Common Stock is subject to risks, including the risk of total loss of investment. The types of securities in which the Extension Fund will invest are subject to special risks. For example, the Extension Fund will invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “high yield” and “junk,” are subject to significant risks with respect to their respective issuers’ ability to pay interest and repay principal.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be exchanged under this Offer to Exchange or determined if this Offer to Exchange is truthful or complete. Any representation to the contrary is a criminal offense.

THE SECURITIES BEING OFFERED PURSUANT TO THIS EXCHANGE OFFER ARE BEING OFFERED PURSUANT TO EXEMPTIONS FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), PROVIDED BY RULE 506(B) UNDER SECTION (4)(A)(2) OF THE SECURITIES ACT, CERTAIN STATE SECURITIES LAWS AND CERTAIN RULES AND REGULATIONS PROMULGATED THEREUNDER.

| | |

TCW Direct Lending LLC 200 Clarendon Street, 51st Floor Boston, MA 02116 (617) 936-2275 | | TCW Middle Market Lending Opportunities BDC, Inc. 200 Clarendon Street, 51st Floor Boston, MA 02116 (617) 936-2275 |

The dealer managers for the exchange offer are:

| | |

| BofA Merrill Lynch | | Morgan Stanley |

The date of this Offer to Exchange is May 21, 2018.