UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 333-196492

International Western Petroleum, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 46-5034746 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

5525 N. MacArthur Boulevard, Suite 280 Irving, Texas | | 75038 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (855) 809-6900

Securities registered under Section 12(b) of the Act:

| Title of each class: | | Name of each exchange on which registered: |

| None | | None |

Securities registered under Section 12(g) of the Act:

(Title of class)

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232. 405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229. 405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer. [ ] | Accelerated filer. [ ] |

| Non-accelerated filer. [ ] | Smaller reporting company. [X] |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

Aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: N/A.

Number of the issuer’s common stock outstanding as of May 29, 2015: 44,108,297

Documents incorporated by reference: None.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item 1A — Risk Factors” below.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to International Western Petroleum, Inc. and our wholly-owned subsidiaries. “SEC” refers to the Securities and Exchange Commission.

PART I

Item 1. Business.

Our Company

International Western Petroleum, Inc. (“IWP” or the “Company”) was incorporated on February 19, 2014 as a Nevada corporation and is based in Irving, Texas. The Company was formed to conduct operations in the oil and gas industry. We are an oil and natural gas company that focuses on the acquisition, development, and exploration of crude oil and natural gas properties in Texas. The Company was established in recognition of the urgent need for the development of the United States’ oil reserves to help build energy self-sufficiency and economic equilibrium.

As described below under “Operational Plans”, on May 4, 2015, the Company acquired working interests from the Bend Arch Lion 1A Joint Venture and the Bend Arch Lion 1B Joint Venture. The Company, together with its operator, International Western Oil Corporation (“IWO”), plans to drill additional oil and gas wells in 2015. The Company now has a working interest in wells and acreage.

The Company is continually seeking strategic investors to help it develop additional exploration projects located within the Bend Arch area as well as other prime acquisition targets in Central/West Texas. As such, the Company is working on obtaining enough funding to provide a budget for new acquisitions as well as exploration projects to meet its financial objectives during the year ending February 28, 2016.

Business Strategy

We are an exploration-stage oil and natural gas company that focuses on the acquisition, development, and exploration of crude oil and natural gas properties in Texas. The Company is currently managed by business and oil and gas exploration veterans who specialize in the oil and gas acquisition and exploration markets of the Central/West Texas region. The Company’s goal it to tap into the high potential leases of the Central/West Texas region of the United States, aiming to unlock its potential, specifically in the prolific Bend Arch area. This area is approximately 120 miles long and 40 miles wide running from Archer County, Texas in the north to Brown County, Texas in the south. This area has been one of the most active drilling areas during the recent resurgence of United States drilling activities.

The Company’s Chief Executive Officer, Ross Henry Ramsey, and his family have participated in a number of exploration projects with several major oil and gas companies. Management believes that state-of the-art technology is one of the key differentiators of the Company. Oil and natural gas reserve development is a highly technologically oriented industry. Management believes that technology has greatly increased the success rate of finding commercial oil or natural gas deposits. In this context, success rate means the ability to make an oil/gas well that can produce a commercialized quantity of hydrocarbons. In general, the Company expects to apply georadiometry exploration technology to determine the drilling locations and the drilling depths.

Our core business strategy is to: (a) acquire petroleum exploration companies with moderate production growth and add capital to instigate explosive growth; (b) acquire new high-potential hydrocarbon land leases and perform initial explorations on those leases to add value as “proven reserve” properties and then sell them off at multiples of the cost basis; and (c) acquire existing oil and gas production with large reserves, to increase the Company’s value.

Our operation strategy is to identify “prime time” hydrocarbon land leases in West and Central Texas and develop proven oil fields via drilling new wells and re-entering existing low production wells in West Texas to maximize production and enhance valuation of our production assets. We also plan to position the Company in the international marketplace as a petroleum expert in the United States to partner up with multinational oil and gas players after establishing our presence in the Permian Basin of Texas (which we have begun to do via our purchase of working interests from the Bend Arch Lion 1A Joint Venture and the Bend Arch Lion 1B Joint Venture) and applying state-of-the-art exploration technology on our new leases.

Based upon Management’s general management and petroleum exploration experience as well as its geology expertise and its ability to identify high potential acreages and high production fields, Management believes that the Company’s near future valuation as a public company is attractive.

Our immediate revenue strategy is to acquire new hydrocarbon land leases and unlock their potential by drilling a number of wells to be hand-picked by Management and then possibly resell the leases at a multiple of the initial purchase prices.

Rationale

Although the market for oil and gas exploration is very crowded, Management believes there are opportunities for profits to be made. Unlike many major oil companies that often drill very deep wells with a high degree of risk, we are a specialist in shallow well exploration (3,000- 6,000 feet) that is less expensive and has lower risk factors. That is our most important exploration practice.

Management believes our CEO is a true oil man who is a local West Texan who, Management believes, has a special talent in acquiring local “prime time” hydrocarbon land leases that have the high potential for hydrocarbon reserves. Management believes that these prospective leases are currently “under the radar” because the wells that can be drilled in these prospective leases will have the capacity to normally produce only up to 100 barrels (“Bbls”) of oil per day per well. As such, Management believes that these highly valuable leases are not economically justifiable for the major oil and gas companies in the region because such companies, Management believes, need the wells they drill to produce at least 300 Bbls of oil per day per well.

The basis for Management’s belief that the wells that can be drilled in the prospective leases will have the capacity to produce up to 100 barrels of oil per day per well is due to our recent studies of the general areas where we are prospecting the said projects. We have obtained historic production of certain locations from the Railroad Commission of Texas (“Texas RRC”), the state regulatory agency that regulates the oil and gas industry in Texas. According to information from the Texas RRC and from informational products developed by Drillinginfo, Inc., some oil wells in the Ellenberger pay zone at approximately 4,500 feet to 5,000 feet in depth have produced up to an average of 100 barrels per day at the Initial Production (“IP”) of the primary production stage. Please find below some Initial Production data that lists: BOPD (Barrels of Oil per Day) and TD (Total Depth) from neighboring wells in Coleman County. These wells are within 3.5 miles of the location of the Bend Arch Lion project. Despite the historical production of nearby wells, there can be no assurance that the wells that can be drilled in our prospective leases will be productive.

1) J& R Petroleum (RRC# 083-36041): 85 BOPD, 250 MCF/Day – Ellenberger Formation – 4,664 feet TD, drilled in 1981;

2) Hrubetz Oil Co. (RRC# 399-33123): 305 BOPD, No Gas – Ellenberger Formation – 4,750 feet TD, drilled in 1983;

3) Hrubetz Oil Co. (RRC# 399-33169): 135 BOPD, No Gas – Ellenberger Formation – 5,588 feet TD, drilled in 1983;

4) Nova Exploration (RRC# 083-34177): 120 BOPD, 230 MCF/Day – Ellenberger Formation – 4,600 feet TD, drilled in 1984;

5) De Prange Oil Co. (RRC# 083-32089): 15 BODP, 1,000 MCF/Day – Gray Sand Formation – 3789 feet TD, drilled in 1980; and

6) De Prange Oil Co. (RRC# 083-31929): 17 BODP, 400 MCF/Day – Gray Sand Formation – 3760 feet TD drilled in 1980.

The Company has a highly committed international team comprised of a 4th generation oil man, an international business executive, and a petroleum expert who will team up with local senior geologists having high credentials and in-depth local experience.

The Company will fully utilize its strength in its knowledge of the capital markets to initially list itself in the OTCQX or OTCQB marketplace of OTC Link as an exploration stage company. Via future growth, the Company has a plan to upgrade to a senior US stock exchange in the near future.

Technologies

Management believes that technology is one of the key differentiators of the Company. Oil and natural gas reserve development is a highly technologically oriented industry; many techniques developed by the industry are now used in other industries, including the space program. Management believes that technological innovations have made it possible for the oil and natural gas industry to furnish the fuels that power the world economy. Management also believes that technology has greatly increased the success rate of finding commercial oil or natural gas deposits. In this context, success rate means the ability to make an oil/gas well that can produce a commercialized quantity of hydrocarbon. According to the website of the hydrocarbon imaging company we plan on hiring, www.hydrocarbonimaging.com, the georadiometry exploration technology that the Company will be using provides a radiometric imaging service that rivals conventional seismic and downhole logging via a surface survey of the “radiation footprint” of a given area of geography. This technology goes beyond conventional techniques in both arenas of cost and reserve identification. In general, the Company expects to apply the following technologies to determine the drilling locations and the drilling depths.

Georadiometry

The use of 3-D Hydrocarbon Imaging brought georadiometric technology into the cutting edge of identifying and quantifying oil reservoirs and reserves with sophisticated field equipment and software integration abilities that aided explorers in locating oil and gas leasehold reserves. All specific drilling recommendations and opinions are based upon the technical results of inferences from global positioning satellites, electrical, and gamma ray devices and calibrated measurements based on georadiometric technology. 3-D Hydrocarbon Imaging rivals conventional seismic and downhole logging for reserve identification. This technology goes beyond conventional techniques in both arenas of cost and reserve identification and has been leveraged to meet the needs of the industry.

Hydrocarbon Satellite Imaging

Hydrocarbon survey maps are generated from several data sources downloaded from scientific instruments installed on Earth orbit satellites. These instruments are designed to retrieve physical data from outer space as well as from the Earth. Instruments installed on the satellites include, for our use, Radar, Infrared (Temperature), Radiation (Radiometrics), Dialectic Potential (Tellurics), Ionization, and Geo-Magnetics. These data sets are stacked and embedded into each data stream that results in the final map interpretation. All of these exploration techniques can be done separately with land based tools but with the use of satellites it is possible to cover much larger areas more economically.

Directional Drilling

Drilling technology has come a long way over the years. Among the most recent advancements in drilling are Rotary Steerable tools which allow three dimensional control of the bit without stopping the drill string. One of the benefits of this technology is increasing the exposed section throughout the target reservoir by drilling through it at an angle. Directional drilling also allows drilling into reservoirs where vertical access is difficult or not possible; for instance, an oilfield under a town, lake, or hard to drill through formation.

Fracturing Technology

Fracturing technology allows the industry to get more oil or natural gas out of each deposit that it finds. Newer stimulation technologies, completion treatment fluids, and enhanced recovery techniques enable the oil or natural gas to move more easily to producing well bores. Hydraulic fracturing techniques create small cracks from the well bore into the reservoir rock. A “propant” (usually sand), is then pumped into the formation to keep the fractures open. These fractures serve as a “highway” for the hydrocarbons to be produced. Horizontal-drilling technologies allow the reservoir to be penetrated horizontally rather than vertically, opening more of the reservoir to the well bore and enhancing recovery. “Acidizing”, is another stimulation technique that is frequently used in carbonate (limestone, dolomite) reservoirs to increase porosity, permeability and to enhance recovery. Sometimes the techniques of fracturing and acidizing are combined in an “acid-frac job” resulting in increased production. Secondary and tertiary recovery techniques can include “water flood” which utilizes water injection wells to push oil from partially depleted reservoirs to recovery wells. CO2 injection wells pressure up the depleted reservoir for the same purpose of increasing production.

Reservoir Estimate

The Company is aiming to acquire hydrocarbon-rich land leases in the Bend Arch region of Texas. The Bend Arch is a prolific structure that, Management believes, still contains a vast amount of commercial hydrocarbons. This structure has yielded a large amount of commercial revenue from hydrocarbon recovery for over 80 years. Management believes that a study of the history of prospecting for oil and gas in the Bend Arch reveals that a treasure trove of oil and gas reserves still exist because, Management believes, early oilmen often failed to use a methodical approach or a calculated drilling program to fully find and develop many of the fields that exist in the Bend Arch.

Historically speaking, in 1917, discovery of the Ranger field stimulated, Management believes, one of the largest exploration and development “booms” in Texas. The Ranger field produces oil from the Atoka-Bend formation, a sandstone-conglomerate reservoir that directly overlies the Barnett formation. Operators drilled more than 1,000 wildcat wells in and around the Fort Worth basin attempting to duplicate the success of Ranger. These wildcat efforts resulted in the discovery of more fields and production from numerous other reservoirs including Strawn fluvial/deltaic sandstone, Atoka-Bend fluvial/deltaic sandstone and conglomerate, Marble Falls carbonate bank limestone, Barnett siliceous shale, and Ellenberger dolomitic limestone.

One of the major leases we are looking at lies on the western edge of Coleman County. This is on the western dip of the Bend Arch as it starts to dip westerly and extend until it merges with the Permian Basin. Management believes that prolific oil and gas revenues have been generated on this western flank of the Arch because of the many folds, anticlines, and strategic traps that are present. Early drilled wells showed both oil and gas in commercial quantities. However, encountering gas before reaching the oil bearing zone resulted, Management believes, in many wells being abandoned because historical data shows that the price of gas per MCF only reached $1.00/MCF in 1980.

Historical well data for Coleman County, Texas as well as many drilled and producing wells surrounding our prospective leases show, Management believes, that production has come from as many as 5 different pay-zones on a commercial basis. The 5 pay-zones (Fry, Tannehill, Strawn Sands (consisting of Gray, Gardner, and 2 other consolidated sands), Caddo, and Ellenberger) are dispersed on the western flank of the Arch and are present in our prospective leases.

The Bend Arch region has a history of wells producing oil and gas for 40 to 60 years at, Management believes, an attractive commercial rate in primary production mode, secondary recovery mode, and even tertiary recovery mode with, Management believes, time on our side which means modern technology will become more advanced in the future.

Oil & Gas Market Outlook

(Summary of Portions of “The Outlook for Energy: A View to 2040 – Highlights”

http://www.exxonmobil.com/MENA-English/PA/Files/English_Energy_Outlook2013_Highlights.pdf)

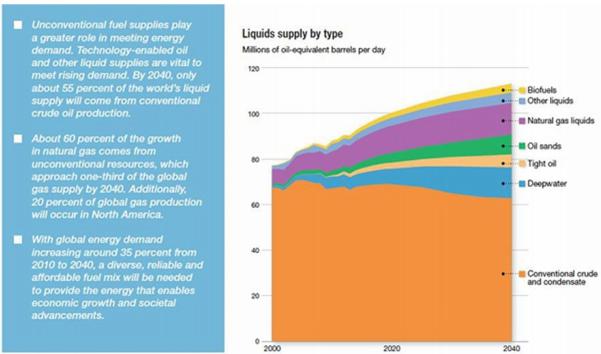

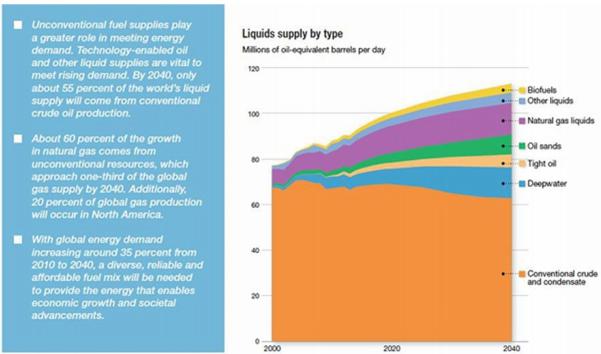

Global energy demand will be about 35% higher in 2040 compared to 2010, as economic output more than doubles and prosperity expands across a world whose population will grow to nearly 9 billion people. Energy demand growth will slow as economies mature, efficiency gains accelerate and population growth moderates.

In the countries belonging to the Organization for Economic Cooperation and Development (OECD) – including countries in North America and Europe – we see energy use remaining essentially flat, even as these countries achieve economic growth and even higher living standards. In contrast, Non OECD energy demand will grow by 65%. China’s surge in energy demand will extend over the next decade then gradually flatten as its economy matures and energy efficiency improves. Elsewhere, billions of people will be working to advance their living standards – requiring more energy.

Demand for coal will peak and begin a gradual decline, in part because of emerging policies that will seek to curb emissions by imposing a cost on higher-carbon fuels. Use of renewable energies and nuclear power will grow significantly.

Natural gas will grow fast enough to overtake coal for the number-two position behind oil. For both oil and natural gas, an increasing share of global supply will come from unconventional sources such as those produced from shale formations.

Global energy-related carbon dioxide (CO2) emissions will grow slowly, then level off around 2030. In the United States and Europe, where a shift from coal to less carbon-intensive fuels such as natural gas already is under way, emissions will decline through 2040.

In one of the most significant development shown over the Outlook for Energy, advancements in drilling technology will cause natural gas to overtake coal as the No. 2 fuel source by 2040. Oil is projected to remain the No.1 fuel. Oil and gas will supply 60% of global demand in 2040, up from 55% percent in 2010.

Sales Strategy

Abilene, Texas is the closest city with oil handling and sales firms. Our sales strategy in relation to spot pricing will be to produce less when the sales price is lower and produce more when the sales price is higher. To maintain the lowest production cost, we will aim to have our inventory be virtually zero. Members of the Ramsey family that are related to our CEO have business relationships with BML and Transport Oil. Once the Company starts producing oil, the Company will leverage these business relationships in order to enter into material agreements with BML and Transport Oil so that, as our tier 1 buyers, they can handle pick-up and sales of our crude stock to refineries.

As such, crude oil will be picked up from the leases as needed during the calendar month. At the end of the month the crude total sales will be tallied by lease and the 30-day average of the daily closing of oil will be tabulated. On or about the 25th of the following month the proceeds checks will be issued to the financial parties of record.

Operational Plans

In 2015, the Company plans to drill new wells and continue to raise enough capital via equity financing options to meet this operational goal in 2015. The Authorization for Expenditure (AFE) for each well of approximately 5,000 feet in total depth is up to $575,000.

Based upon Company management’s general management and petroleum exploration experience as well as its geology expertise and its ability to identify high potential acreages and high production fields, Management believes that the Company’s near future valuation as a public company is attractive.

The Company has prospected several lucrative projects for its exploration in the prolific Bend Arch. After choosing a new prospect, additional research and evaluation was carried out using personal contacts, geologists, seismic, satellite hydrocarbon imaging, and every available resource to glean information and data in order to choose the prime drilling locations. The information provided by the geologist who interpreted the seismic data on the prospect indicates the application of a 3-D computer model to interpret 2-D seismic data. According to reliable sources in the geophysical field, in the absence of actual 3-D seismic data, using 2-D seismic data in a 3-D seismic computer program is a common practice. Management believes using 2-D seismic data in a 3-D seismic computer program gives the geophysicist or geologist an efficient way of looking at and interpreting large amounts of data. Through the interpretation of the seismic data, several “bright spots” have been identified and are the primary targets of this prospect. According to “The Value of 3D Seismic in Today’s Exploration Environment — in Canada and Around the World” by N.M. Cooper (available at http://www.mustagh.com/abstract/OPI_3D.html), utilizing traditional 2-D seismic data has yielded a 60% success rate. Utilizing 2-D seismic data in a 3-D seismic computer program yields an 80% success rate. In this context, success rate means the ability to make an oil/gas well that can produce a commercialized quantity of hydrocarbon.

The Company has plans to design a cost effective operation budget for each exploration project and each budget will vary depending on the total depth of drilling and whether it is a new drilling or a re-entry. For each project, the Company plans on hiring selected operators to work under the close supervision of a core team of Company geologists, engineers and scientists.

The exploration process is a 2-phase process: 1) Drilling and Testing and 2) Well Completion. The Company plans on hiring drilling specialists and technical consultants designated to oversee the drilling for each well during the Drilling and Testing phase. For the Well Completion process, the Company will hire technical data collectors and cementing operators to ensure the best performance upon perforating the wells at different pay zones based on thorough technical advisory work done by our internal and external geologists before production.

At the moment, the Company has prospected several projects:

The Bend Arch Henry Project is a small project located at the border of Taylor and Jones County, north west of Abilene, Texas. This would be a shallow drilling program (approximately 3,000 feet) which would be designed to drill and produce oil mainly from the “Cook Sand” pay zone and “Hope Lime” pay zone that lie above the “Caddo-Ellenberger” zone. Management has access to the geology survey report as well as mud log and open hole log of some existing wells nearby; and, per this data, the wells found oil. In general, wells in the vicinity of our Henry project have already produced, Management believes, an average of 220,000 Bbls per well. There are multiple wells in this area that have been producing, Management believes, for over 66 years.

The Bend Arch North Anderson Project is focused on the “Flippen Lime” pay zone at an approximate depth of 2,450 feet. The prospect acreage is located west of and adjacent to the Anson North and Anson town site fields, which is located immediately North of the City of Anson, Jones County. The fields produced from the Flippen Lime and Cook Sand. The Flippen produced a cumulative total of 140,586 barrels and the Cook Sand approximately 134,919 barrels. The Flippen lime potentials varied from 10 Barrels of Oil per Day (“BOPD”) up to as much as 135 BOPD. In view of the data to which Management has access, the North Anson Prospect, Management believes, offers excellent possibilities for substantial production from the Flippen formation.

The Bend Arch Lion Project is a multi-well exploration opportunity that includes several drilling programs. In May 2015, the Company acquired working interests in two drilling joint venture programs as described in more detail below. Management believes this is an initial step in implementing our business plan.

Following the end of the fiscal year ended February 28, 2015, the Company, on May 4, 2015 acquired a 39.5% working interest from IWO in the Bend Arch Lion 1A Joint Venture (the Pittard Bend Arch White property encompassing 160 acres – State ID# 21488) (the “1A Venture”) and a 50% working interest in the Bend Arch Lion 1B Joint Venture (the Pittard Bend Arch Red property encompassing 160 acres - State ID# 13121) (the “1B Venture”). By acquiring these working interests, the Company will directly receive the share of working interest revenue (after accounting for applicable taxes, expenses, and landowner royalties) IWO was receiving prior to the acquisitions.

As of May 4, 2015, the 1A Venture property had four (4) oil and gas wells. These wells have been in production since April 3, 2014. The Company’s management believes that, based on IWO’s geology analysis after actual drillings, there is a reserve of approximately 5.3 million barrels of total oil in place and approximately 215,000 primary recoverable barrels in the 1A Venture. The 1B Venture property has one new oil and gas well which has recently come into full production since April 16, 2015. This well started with an initial production rate of 119 barrels of oil per day and 250,000 cubic feet of gas per day. To date, the Company has finished the final completion process of two (2) additional wells, thus totaling three (3) producing oil and gas wells in the 1B Venture. During the summer of 2015, the Company, with IWO as the operator, plans to drill three (3) additional wells from this 1B Venture with an estimated total cost of $1,725,000 using the 1B Venture’s budget. These acquisitions are described in more detail below, under “Item 13. Certain Relationships and Related Transactions, and Director Independence”.

Mr. Ramsey and Dr. Tran, the Company’s President, Chief Executive and Chief Financial officer and Secretary, respectively, directors and majority shareholders, are significant shareholders of International Western Petroleum Corporation (“IWPO”), the parent and 100% owner of IWO. Mr. Ramsey and Dr. Tran serve in similar positions with the Company, IWPO, and IWO. Although they are separate entities, IWPO does not engage in any business activities beyond serving as IWO’s parent. IWO is IWPO’s operating company. IWO currently serves as a Texas-licensed oil and gas operator and on-site consultant for the Company with regard to the 1A Venture and the 1B Venture. IWO also provides the Company with full geology reports, on-site survey work, reserve analysis and additional geology consulting work on an as-needed basis.

Intellectual Property

None.

Employees

We presently have five individuals performing services for the Company, who we consider employees and not independent contractors: Ross Henry Ramsey, our Chief Executive Officer, President, and Chief Financial Officer; Benjamin Tran, our Chairman and Secretary; Steve Phu, our Executive Vice President; Jeff Phu, our Vice President of International Relations; and Tony Vu, our Vice President of Business Development.

During the fiscal year ending on February 28, 2015 and the interim period ending on the date on which this report was filed, the Company did not pay these five employees compensation in the form of salary through an established payroll.

Mr. Ramsey devotes approximately 42 hours per week to our affairs and approximately 18 hours per week in total to the affairs of IWPO and IWO. Mr. Ramsey serves as Chief Executive Officer and President of both IWPO and IWO. Mr. Ramsey plans to dedicate 100% of his time to the Company after the Company becomes a publicly traded company.

Mr. Tran devotes approximately 35 hours per week to our affairs and approximately 10 hours per week in total to the affairs of IWPO and IWO. Mr. Tran serves as Secretary and Director of both IWPO and IWO. Mr. Tran plans to dedicate 90% of his time to the Company after the Company becomes a publicly traded company.

Mr. Steve Phu, Mr. Jeff Phu and Mr. Tony Vu, each devotes approximately 8 hours per week to our business and corporate development affairs. They are part-time employees.

Dr. Syed Ahmad is our consulting Chief Geologist who is devoted to our core projects on an as needed basis. We plan to convert his working status to a full time employee upon achieving our immediate financial goals.

Item 1A. Risk Factors.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Cautionary Note Regarding Forward-Looking Statements” for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this annual report.

Risks Related to Our Business

LIMITED OPERATING HISTORY

The Company was formed on February 19, 2014. Prior to that time, the Company had no operations upon which an evaluation of the Company and its prospects could be based. Exploration stage companies, such as the Company, even those already having acquisition candidates, are subject to all of the risks inherent in the establishment of any new business. Our financial viability is dependent upon raising funds and successfully executing our business plan. The likelihood of our success must be considered in the light of the challenges, both expected and unexpected, frequently encountered in connection with starting and expanding a new business. Accordingly, we are planning to align our primarily fixed expense levels with our expectation of future revenues. As a result, we may be unable to adjust spending in a timely manner to compensate for unexpected shortfalls in any forthcoming revenue. Any such shortfalls will have an immediate adverse impact on our operating results and financial condition which could cause investors to lose all or a substantial part of their investment.

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM HAS EXPRESSED SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE AS A GOING CONCERN.

The audited financial statements included in this Form 10-K have been prepared assuming that we will continue as a going concern and do not include any adjustments that might result if we cease to continue as a going concern. We have incurred significant losses since our inception. Also, we are an early stage company that has not yet started generating revenue. These conditions raise substantial doubt about our ability to continue as a going concern.

There can be no assurance that we will have adequate capital resources to fund planned operations or that any additional funds will be available to us when needed or at all, or, if available, will be available on favorable terms or in amounts required by us. If we are unable to obtain adequate capital resources to fund operations, we may be required to delay, scale back or eliminate some or all of our operations, which may have a material adverse effect on our business, results of operations and ability to operate as a going concern.

AS WE CONTINUE TO DEVELOP OUR OPERATIONS, WE WILL NEED SUBSTANTIAL CAPITAL TO FUND OUR OPERATIONS, AND IF WE ARE NOT ABLE TO OBTAIN SUFFICIENT CAPITAL, WE MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

The Company currently has a working interest in wells and acreage. As we continue to develop and expand our operations, we will need to make substantial capital expenditures for the acquisition of petroleum exploration companies, hydrocarbon land leases, and existing oil and gas production with large reserves, and for drilling new wells and re-entering existing low production wells. We intend to finance our capital expenditures primarily through our cash flows from operations, bank borrowings, and public and private equity and debt offerings. Lower crude oil and natural gas prices, however, would reduce our cash flows. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the shares being offered for resale by the selling security holders.

Further, if the condition of the credit and capital markets materially declines, we might not be able to obtain financing on terms we consider acceptable, if at all. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the development of similar services undertaken by our competition; and (iii) the amount of our capital expenditures. We cannot assure you that we will be able to obtain capital in the future to meet our needs. If we cannot obtain financing, we may be required to limit our expansion and decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

In addition, weakness and/or volatility in domestic and global financial markets or economic conditions may increase the interest rates that lenders require us to pay and adversely affect our ability to finance our capital expenditures through equity or debt offerings or other borrowings. A reduction in our cash flows (for example, as a result of lower crude oil and natural gas prices) and the corresponding adverse effect on our financial condition and results of operations may also increase the interest rates that lenders require us to pay. In addition, a substantial increase in interest rates would decrease our net cash flows available for reinvestment. Any of these factors could have a material and adverse effect on our business, financial condition and results of operations.

The oil and gas business is characterized by high fixed costs resulting from the significant capital outlays associated with the acquisition, development, and exploration of crude oil and natural gas properties. We are dependent on the production and sale of quantities of crude oil at product margins sufficient to cover operating costs, including any increases in costs resulting from future inflationary pressures or market conditions and increases in costs of fuel and power necessary in operating our facilities. Furthermore, future major capital investment, various environmental compliance related projects, regulatory requirements, or competitive pressures could result in additional capital expenditures, which may not produce a return on investment. Such capital expenditures may require significant financial resources that may be contingent on our access to capital markets and commercial bank loans. Additionally, other matters, such as regulatory requirements or legal actions, may restrict our access to funds for capital expenditures

Our ability to generate operating cash flow is subject to many of the risks and uncertainties that exist in our industry, some of which we may not be able to anticipate at this time. Future cash flows from operations are subject to a number of risks and variables, such as the level of production from existing wells, prices of natural gas and oil, our success in developing and producing new reserves and the other risk factors discussed herein. Our ability to obtain capital from other sources, such as the capital markets, other financing and asset sales, is dependent upon many of those same factors as well as the orderly functioning of credit and capital markets. If such proceeds are inadequate to fund our planned spending, we would be required to reduce our capital spending, seek to sell different or additional assets or pursue other funding alternatives, and we could have a reduced ability to replace our reserves and increase liquids production.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our Common Stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control.

YOU WILL EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND OUR PREFERRED STOCK.

If we raise additional capital through the issuance of equity or convertible debt securities, the percentage ownership of our company held by existing shareholders will be reduced and those shareholders may experience significant dilution. In addition, we may also have to issue securities that may have rights, preferences and privileges senior to our Common Stock. In the event we seek to raise additional capital through the issuance of debt or its equivalents, this will result in increased interest expense.

WE WILL BE DEPENDENT UPON KEY PERSONNEL FOR THE FORESEEABLE FUTURE.

Given our early stage of development, we are highly dependent on our executive officers, employees, and contractors. Although we believe that we will be able to identify, engage and motivate qualified personnel, an inability to do so could adversely affect our ability to market, sell, and develop our products and services. Any difficulty to attracting and retaining key people could have an adverse effect on our business.

SIGNIFICANT ADVERSE IMPACT TO OUR CAPITAL RESERVE OF ANY LIABLE UNINSURED CLAIM

We do not have any insurance to cover potential risks and liabilities, including, but not limited to, injuries or economic losses arising out of or relating to our omission or errors in providing our services. Even if we decide to obtain insurance coverage in the future, it is possible that: (1) we may not be able to get enough insurance to meet our needs; (2) we may have to pay very high premiums for the additional coverage; (3) we may not be able to acquire any insurance for certain types of business risk; or (4) we may have gaps in coverage for certain risks. We may be exposed to potential uninsured claims for which we could have to expend significant amounts of capital. Consequently, if we were found liable for a significant uninsured claim in the future, we may be forced to expend a significant amount of our capital to resolve the uninsured claim.

UNCERTAINTY OF PROFITABILITY

Our business model requires significant investment in acquisitions and explorations, and, if and to the extent our business grows, we will need to hire new employees. Specifically, our profitability will depend upon our success at accomplishing the following tasks:

| | ● | implementing and executing our business model; |

| | | |

| | ● | establishing name recognition and a reputation for value with domestic and worldwide investors and partners; |

| | | |

| | ● | implementing results-oriented explorations, domestic and worldwide distribution and sales strategies; and |

| | | |

| | ● | developing sound business relationships with key strategic partners, and hiring and retaining skilled employees. |

Additionally, our revenues and operating results may vary significantly from quarter-to-quarter due to a number of factors, including:

| | ● | economic conditions generally, as well as those specific to the oil and gas industry; |

| | | |

| | ● | our ability to manage relationships with industry and distribution partners to sell our production; |

| | | |

| | ● | our ability to access capital as needed, on terms which are fair and reasonable to the Company; |

| | | |

| | ● | our ability to successfully to produce high quality oil, and get that product to buyers in the intended manner; and |

| | | |

| | ● | the ability of third-party vendors to manage their procurement and delivery operations. |

MANAGEMENT OF GROWTH

Successful expansion of our business will depend on our ability to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically, we will need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic environment as well as in our target geographic exploration locations. Expansion has the potential to place significant strains on financial, management, and operational resources, yet failure to expand will inhibit our profitability goals.

WE ARE ENTERING A POTENTIALLY HIGHLY COMPETITIVE MARKET

We may face substantial competition in the oil and gas industry. To Management’s knowledge, there are many exploration companies in the oil and gas industry which will compete directly with us. There are many large, well-capitalized, private and public companies in this industry, which have the resources, lease access, loyal buyers and expertise to drill and produce oil if they wish to do so. Many of our existing and potential competitors have substantially greater financial, technical and marketing resources than we do. These competitors may be able to adopt more aggressive pricing policies. This type of pricing pressure could force us to offer discounts, decreasing our profit margin.

CONFLICTS OF INTEREST

The Company’s principal executive officers and Directors also control a majority of the outstanding shares of the Company’s stock, and will continue to do so for the foreseeable future. As a result, no other persons can or will be able to effect any Company action except with the consent of these officers and directors, and in certain matters (such as compensation, incentive stock ownership, and continues employment), there may be an inherent conflict of interest unless such persons agree to abstain from voting on such matters, which they are not legally required to do. Our officers and directors may also serve as officers and directors of other entities that are not affiliated with us. Such non-affiliates may be involved in similar business enterprises to ours.

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to be approximately $25,000 per year. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

WE ARE AN “EMERGING GROWTH COMPANY,” AND ANY DECISION ON OUR PART TO COMPLY ONLY WITH CERTAIN REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO “EMERGING GROWTH COMPANIES” COULD MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we expect and fully intend to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards. We have elected to rely on these exemptions and reduced disclosure requirements applicable to “emerging growth companies” and expect to continue to do so.

WE MAY NOT BE ABLE TO MEET THE ACCELERATED FILING AND INTERNAL CONTROL REPORTING REQUIREMENTS IMPOSED BY THE SEC WHICH MAY RESULT IN A DECLINE IN THE PRICE OF OUR SHARES OF COMMON STOCK AND AN INABILITY TO OBTAIN FUTURE FINANCING.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the SEC adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting as well as the operating effectiveness of the company’s internal controls. We will be required to include a report of management on its internal control over financial reporting. The internal control report must include a statement

| ● | Of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting; |

| | | |

| | ● | Of management’s assessment of the effectiveness of its internal control over financial reporting as of year-end; and |

| | | |

| | ● | Of the framework used by management to evaluate the effectiveness of our internal control over financial reporting. |

Furthermore, our independent registered public accounting firm will be required to file its attestation report separately on our internal control over financial reporting on whether it believes that we have maintained, in all material respects, effective internal control over financial reporting.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market price of our Common Stock and our ability to secure additional financing as needed.

THE JOBS ACT ALLOWS US TO DELAY THE ADOPTION OF NEW OR REVISED ACCOUNTING STANDARDS THAT HAVE DIFFERENT EFFECTIVE DATES FOR PUBLIC AND PRIVATE COMPANIES.

Since we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act, this election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

OUR SHARES OF COMMON STOCK WILL NOT BE REGISTERED UNDER THE EXCHANGE ACT AND AS A RESULT WE WILL HAVE LIMITED REPORTING DUTIES WHICH COULD MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

Our shares of Common Stock are not registered under the Exchange Act. As a result, we will not be subject to the federal proxy rules and our directors, executive officers and 10% beneficial holders will not be subject to Section 16 of the Exchange Act. In additional our reporting obligations under Section 15(d) of the Exchange Act may be suspended automatically if we have fewer than 300 shareholders of record on the first day of our fiscal year. Our common shares are not registered under the Securities Exchange Act of 1934, as amended, and we do not intend to register our shares of Common Stock under the Exchange Act for the foreseeable future, provided that, we will register our shares of Common Stock under the Exchange Act if we have, after the last day of our fiscal year, more than either (i) 2000 persons; or (ii) 500 shareholders of record who are not accredited investors, in accordance with Section 12(g) of the Exchange Act. As a result, although, upon the effectiveness of the Registration Statement of which this prospectus forms a part, we will be required to file annual, quarterly, and current reports pursuant to Section 15(d) of the Exchange Act, as long as our shares of Common Stock are not registered under the Exchange Act, we will not be subject to Section 14 of the Exchange Act, which, among other things, prohibits companies that have securities registered under the Exchange Act from soliciting proxies or consents from shareholders without furnishing to shareholders and filing with the Securities and Exchange Commission a proxy statement and form of proxy complying with the proxy rules. In addition, so long as our shares of Common Stock are not registered under the Exchange Act, our directors and executive officers and beneficial holders of 10% or more of our outstanding shares of Common Stock will not be subject to Section 16 of the Exchange Act. Section 16(a) of the Exchange Act requires executive officers and directs, and persons who beneficially own more than 10% of a registered class of equity securities to file with the SEC initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of shares of Common Stock and other equity securities, on Forms 3, 4 and 5, respectively. Such information about our directors, executive officers, and beneficial holders will only be available through this (and any subsequent) Registration Statement, and periodic reports we file thereunder. Furthermore, so long as our shares of Common Stock are not registered under the Exchange Act, our obligation to file reports under Section 15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year (other than a fiscal year in which a registration statement under the Securities Act has gone effective), we have fewer than 300 shareholders of record. This suspension is automatic and does not require any filing with the SEC. In such an event, we may cease providing periodic reports and current or periodic information, including operational and financial information, may not be available with respect to our results of operations.

BECAUSE OUR COMMON STOCK IS NOT REGISTERED UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, OUR REPORTING OBLIGATIONS UNDER SECTION 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, MAY BE SUSPENDED AUTOMATICALLY IF WE HAVE FEWER THAN 300 SHAREHOLDERS OF RECORD ON THE FIRST DAY OF OUR FISCAL YEAR.

Our Common Stock is not registered under the Exchange Act, and we do not intend to register our Common Stock under the Exchange Act for the foreseeable future (provided that, we will register our Common Stock under the Exchange Act if we have, after the last day of our fiscal year, $10,000,000 in total assets and either more than 2,000 shareholders of record or 500 shareholders of record who are not accredited investors (as such term is defined by the Securities and Exchange Commission), in accordance with Section 12(g) of the Exchange Act). As long as our Common Stock is not registered under the Exchange Act, our obligation to file reports under Section 15(d) of the Exchange Act will be automatically suspended if, on the first day of any fiscal year (other than a fiscal year in which a registration statement under the Securities Act has gone effective), we have fewer than 300 shareholders of record. This suspension is automatic and does not require any filing with the SEC. In such an event, we may cease providing periodic reports and current or periodic information, including operational and financial information, may not be available with respect to our results of operations.

OUR ARTICLESOF INCORPORATION PROVIDE FOR INDEMNIFICATION OF OFFICERS AND DIRECTORS AT OUR EXPENSE AND LIMIT THEIR LIABILITY WHICH MAY RESULT IN A MAJOR COST TO US AND HURT THE INTERESTS OF OUR SHAREHOLDERS BECAUSE CORPORATE RESOURCES MAY BE EXPENDED FOR THE BENEFIT OF OFFICERS AND/OR DIRECTORS.

The Company’s Certificate of Incorporation and By-Laws include provisions that eliminate the personal liability of the directors of the Company for monetary damages to the fullest extent possible under the laws of the State of Nevada or other applicable law. These provisions eliminate the liability of directors to the Company and its stockholders for monetary damages arising out of any violation of a director of his fiduciary duty of due care. Under Nevada law, however, such provisions do not eliminate the personal liability of a director for (i) breach of the director’s duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction from which the director derived an improper benefit. These provisions do not affect a director’s liabilities under the federal securities laws or the recovery of damages by third parties.

REPORTING REQUIREMENTS UNDER THE EXCHANGE ACT AND COMPLIANCE WITH THE SARBANES-OXLEY ACT OF 2002, INCLUDING ESTABLISHING AND MAINTAINING ACCEPTABLE INTERNAL CONTROLS OVER FINANCIAL REPORTING, ARE COSTLY AND MAY INCREASE SUBSTANTIALLY.

The rules and regulations of the SEC require a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal, accounting, auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) requires, among other things, that we design, implement and maintain adequate internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically qualified personnel we have may make it difficult for us to design, implement and maintain adequate internal controls over financial reporting. In the event that we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls, we may not be able to produce reliable financial reports or report fraud, which may harm our overall financial condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

We are working with our legal, accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas. However, we anticipate that the expenses that will be required in order to adequately prepare for being a public company could be material. We estimate that the aggregate cost of increased legal services; accounting and audit functions; personnel, such as a chief financial officer familiar with the obligations of public company reporting; consultants to design and implement internal controls; and financial printing alone will be a few hundred thousand dollars per year and could be several hundred thousand dollars per year. In addition, if and when we retain independent directors and/or additional members of senior management, we may incur additional expenses related to director compensation and/or premiums for directors’ and officers’ liability insurance, the costs of which we cannot estimate at this time. We may also incur additional expenses associated with investor relations and similar functions, the cost of which we also cannot estimate at this time. However, these additional expenses individually, or in the aggregate, may also be material.

In addition, being a public company could make it more difficult or more costly for us to obtain certain types of insurance, including directors’ and officers’ liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

The increased costs associated with operating as a public company may decrease our net income or increase our net loss, and may cause us to reduce costs in other areas of our business or increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

THE COMPANY MAY BE SUBJECT TO LITIGATION IN THE FUTURE WHICH COULD IMPACT THE FINANCIAL HEALTH OF THE COMPANY.

Currently there are no legal proceedings pending or threatened against the Company. However, from time to time, we may become involved in various lawsuits and legal proceedings that arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

Risks Related to the Exploration Business

AS WE CONTINUE TO DEVELOP OUR OPERATIONS, OUR PRODUCTION REVENUES MAY BE ADVERSELY AFFECTED BY CHANGES IN OIL AND GAS PRICES AND IF WE ARE UNABLE TO BRING NEW OIL WELLS TO PRODUCTION WITH REASONABLE PRODUCTION CAPACITY.

The Company is an early stage company in the oil and gas industry, which now has a working interest in wells and acreage. As we continue to develop our operations, to generate revenues and profits, the Company must own majority interests of new production. The only way for the Company to reach strong stable production capacity is to raise enough capital to help the Company gain control of new working interests in any future production wells. Any significant changes in oil prices or any inability on our part to anticipate or react to such changes could result in reduced revenues and profits and erosion of our competitive and financial position. Our success also depends on our ability to acquire good hydrocarbon production and bringing new oil wells to production with reasonable production capacity. In addition, changes from very shallow well to semi shallow well exploration or geographical exploration locations could result in higher costs of production and higher risks.

AS WE CONTINUE TO DEVELOP OUR OPERATIONS, PRODUCTION REVENUE MAY DECREASE OVER TIME DUE TO A VARIETY OF FACTORS.

As we continue to develop our operations, production revenue may decrease over time due to a variety of factors, including the aging of re-entry wells, changes in hydrocarbon flows, depletion, natural disasters, weather, negative publicity resulting from regulatory action or litigation against companies in our industry, or a downturn in economic conditions or taxes specifically targeting the consumption of oil and gas. Any of these changes may reduce our projected production revenues. Our success is also dependent on our technology innovations and applications, including maintaining production capacity, and the effectiveness of our advertising campaigns, marketing programs and market positioning. Although we will devote significant resources to meeting our revenue goals, there can be no assurance as to our ability either to explore new projects and launch successful new production, or to effectively execute explorations and new acquisitions. In addition, both the launch and ongoing success of new production and acquisitions are inherently uncertain, especially as to their appeal to our investors.

ANY DAMAGE TO OUR REPUTATION COULD HAVE AN ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Maintaining a good reputation globally is going to be critical to the Company here and abroad. If we fail to maintain high standards for our work ethic and integrity, including with regard to our production results, our reputation could be jeopardized. Adverse publicity about these types of concerns, or the incidence of “dry holes” in exploration or low production wells, whether or not valid, may cause production and delivery disruptions. If any of our production wells becomes depleted for any reason, is mishandled or causes injury, we may be subject to legal liability. A widespread non-commercialized production or a significant depletion could cause our production to be disrupted for a period of time, which could further reduce our revenue and damage our corporate image. Failure to maintain high ethical, social and environmental standards for all of our operations and activities or adverse publicity regarding our responses to health concerns, our environmental impact, including drilling and production materials, energy use and waste management, or other sustainability issues, could jeopardize our reputation. In addition, water is a limited resource in many parts of the world. Our reputation could be damaged if we do not act responsibly with respect to water use of our exploration purposes. Failure to comply with local laws and regulations, to maintain an effective system of internal controls or to provide accurate and timely financial statement information could also hurt our reputation. Damage to our reputation or loss of buyer confidence in our oil production for any of these reasons could result in decreased demand for our products and could have a material adverse effect on our business, financial condition and results of operations, as well as require additional resources to rebuild our reputation.

AS WE CONTINUE TO DEVELOP OUR OPERATIONS, CHANGES IN THE LEGAL AND REGULATORY ENVIRONMENT COULD LIMIT OUR BUSINESS ACTIVITIES, INCREASE OUR OPERATING COSTS, AND REDUCE DEMAND FOR OUR PRODUCTION OR RESULT IN LITIGATION.

As we continue to develop our operations, we will be subject to various laws and regulations administered by federal, state and local governmental agencies in the United States. These laws and regulations may change, sometimes dramatically, as a result of political, economic or social events. Such regulatory environment changes may include changes in: laws related to advertising and deceptive marketing practices; accounting standards; taxation requirements, including taxes specifically targeting the consumption of our products; anti-trust laws; and environmental laws, including laws relating to the regulation of oil and gas production. Changes in laws, regulations or governmental policy and related interpretations may alter the environment in which we do business and, therefore, may impact our results or increase our costs or liabilities. Governmental entities or agencies in jurisdictions where we plan to operate may also impose new quality or production requirements, or other restrictions. Regulatory authorities under whose laws we operate may also have enforcement powers that can subject us to actions such as product recall, seizure of products or other sanctions, which could have an adverse effect on our sales or damage our reputation.

The Company expects to use hydraulic fracturing in its operations. Hydraulic fracturing is a commonly used process that involves injecting water, sand, and small volumes of chemicals into the wellbore to fracture the hydrocarbon-bearing rock thousands of feet below the surface to facilitate higher flow of hydrocarbons into the wellbore. Various federal legislative and regulatory initiatives have been undertaken which could result in additional requirements or restrictions being imposed on hydraulic fracturing operations. For example, the Department of Interior has issued proposed regulations that would apply to hydraulic fracturing operations on wells that are subject to federal oil and gas leases and that would impose requirements regarding the disclosure of chemicals used in the hydraulic fracturing process as well as requirements to obtain certain federal approvals before proceeding with hydraulic fracturing at a well site. These regulations, if adopted, would establish additional levels of regulation at the federal level that could lead to operational delays and increased operating costs.

The US Congress has considered legislation that would require additional regulation affecting the hydraulic fracturing process. Consideration of new federal regulation and increased state oversight continues to arise. The US Environmental Protection Agency (“EPA”) announced in the first quarter of 2010 its intention to conduct a comprehensive research study on the potential effects that hydraulic fracturing may have on water quality and public health. The EPA issued a final report in June 2014.

At the same time, legislation and/or regulations have been adopted in several states that require additional disclosure regarding chemicals used in the hydraulic fracturing process but that include protections for proprietary information. Legislation and/or regulations are being considered at the state and local level that could impose further chemical disclosure or other regulatory requirements (such as restrictions on the use of certain types of chemicals or prohibitions on hydraulic fracturing operations in certain areas) that could affect our operations. The adoption of any future federal, state, or local laws or implementing regulations imposing reporting obligations on, or limiting or banning, the hydraulic fracturing process could make it more difficult to complete natural gas and oil wells and could have a material adverse effect on our liquidity, consolidated results of operations, and consolidated financial condition.

DISRUPTION OF OUR PROPOSED SUPPLY CHAIN COULD HAVE AN ADVERSE IMPACT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Our ability and the ability of our suppliers, business partners, including drillers, operators, and independent buyers, to make, move and sell our products is critical to our success. Damage or disruption to our or their manufacturing or distribution capabilities due to adverse weather conditions, natural disaster, fire, terrorism, the outbreak or escalation of armed hostilities, pandemics, strikes and other labor disputes or other reasons beyond our or their control, could impair our ability to produce oil. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, could adversely affect our business, financial condition and results of operations, as well as require additional resources to restore our supply chain.

AS WE CONTINUE TO DEVELOP OUR OPERATIONS, WE WILL BE SUBJECT TO HAZARDS AND RISKS INHERENT IN THE DRILLING, PRODUCTION, AND TRANSPORTATION OF CRUDE OIL AND NATURAL GAS.

As we continue to develop our operations, we will be subject to hazards and risks inherent in the drilling, production, and transportation of crude oil and natural gas, including: i) well blowouts, explosions and cratering, ii) pipeline ruptures and spills, iii) fires, iv) formations with abnormal pressures, v) equipment malfunctions, vi) natural disasters and vii) surface spillage and surface or ground water contamination from petroleum constituents or hydraulic fracturing chemical additives. Failure or loss of equipment, as the result of equipment malfunctions, cyber-attacks, or natural disasters such as hurricanes, could result in property damages, personal injury, environmental pollution and other damages for which we could be liable. Litigation arising from a catastrophic occurrence, such as a well blowout, explosion, or fire at a location where our equipment and services are used, or ground water contamination from hydraulic fracturing chemical additives may result in substantial claims for damages. Ineffective containment of a drilling well blowout or pipeline rupture, or surface spillage and surface or ground water contamination from petroleum constituents or hydraulic fracturing chemical additives could result in extensive environmental pollution and substantial remediation expenses. If a significant amount of our production is interrupted, our containment efforts prove to be ineffective or litigation arises as the result of a catastrophic occurrence, our cash flows, and, in turn, our results of operations could be materially and adversely affected.

Risks Related to Our Common Stock

THERE IS NO ASSURANCE OF A PUBLIC MARKET OR THAT OUR COMMON STOCK WILL EVER TRADE ON A RECOGNIZED EXCHANGE. THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.