- WFRD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Weatherford International (WFRD) DEF 14ADefinitive proxy

Filed: 13 Mar 18, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule §240.14a-12 | |

Weatherford International plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount previously paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing party:

| |||

| 4) | Date Filed:

| |||

| Weatherford International plc | |||||

| PROXY STATEMENT2018 | ||||||

| NOTICE OF ANNUAL GENERAL | ||||||

| MEETING OF SHAREHOLDERS | ||||||

| To be held on April 27, 2018 | ||||||

OUR COMMITMENT TO SUSTAINABILITY Fundamental to our sustainability goals is our focus on being a good corporate citizen, maintaining excellence in the quality of our work, safety of our employees, and in our efforts to protect the environment as we help provide energy vital to economic development and quality of life. In 2017, our Sustainability Committee – which is comprised of leaders from a cross-section of our organization – tightened our focus to identify key areas for growth and improvement in our sustainability program. We understand that sustainability is an ever-evolving journey and seek to make material progress by zeroing in on core issues. Some of Our Goals and Objectives Include: • Reduce our total electricity use by 6%. • Issue Charitable Giving Standard to all employees, triggering them to record charitable giving and sponsorship requests in a central portal. • Further our Diverse and Inclusive (D&I) initiative by issuing D&I training on bias — conscious and unconscious — so that we raise our enterprise culture bar to ensure respect and inclusivity always and for everyone. • Launch revised Supplier Code of Conduct including enhanced supplier obligations regarding human rights and other matters.

VOTING INSTRUCTIONS

Agenda items for your vote

Items

| Board Recommendation

| Reason for Recommendation

| Proxy Page

| |||||

1. |

Election of Directors |

FOReach nominee |

The Board believes its members collectively have the skills and expertise needed to successfully continue to oversee the implementation of Weatherford’s strategic plan for the benefit of shareholders, employees, and other stakeholders |

4 | ||||

2. |

Ratify appointment of Independent Auditors and authorize auditors’ remuneration |

FOR |

Based on the recommendation of the Audit Committee |

16 | ||||

3. |

Approve executive compensation |

FOR |

The Board believes Weatherford’s executive compensation program effectively aligns executive compensation with performance |

18 | ||||

VOTING DEADLINE

5:59 a.m. Central European Time on April 26, 2018 (11:59 p.m. Eastern Time on April 25, 2018)

|

Voting instructions for shareholders of record and beneficial shareholders

You may vote using one of the following options. In all cases, have your proxy card or voting instructions form in hand and follow the instructions.

| By mail

Follow the instructions to mark, sign, and date your proxy card

|  | By phone

Use any touch-tone telephone to transmit your voting instructions

1-800-690-6903

|  | By internet

Use the internet to transmit your voting instructions

www.proxyvote.com

|

Shareholder Feedback

Feedback from our shareholders is important to us and considered carefully. Your Board will be available at the Annual General Meeting to respond to any questions shareholders may raise regarding our activities. Once again, we invite interested parties to submit feedback through our Annual General Meeting website,www.weatherfordannualmeeting.com.

Weatherford International plc – 2018 Proxy Statement III

A MESSAGE FROM YOUR

BOARD OF DIRECTORS

To our Fellow Shareholders,

2017 has been an important year for Weatherford. We have taken significant steps to strengthen our organization, welcomed new management and directors, and laid the foundation to achieve sustainable growth. Weatherford’s ongoing transformation has kept the Board busy, and the Company has responded with energy, skill, and application. Together, we have already made considerable progress.

New Leadership

In April 2017, Mark A. McCollum took over as President and Chief Executive Officer. In short order, he began reshaping Weatherford’s culture, management team, and structure to create a more cost-efficient, process-oriented, standardized, and disciplined organization. Mark’s appointment is the most visible of a series of substantial changes aimed at strengthening and enhancing our Company to ensure long-term stability, profitability, and growth.

At some point, most companies go through periods of transition, and a capacity to evolve and develop is fundamental to successful world-class organizations. The critical issue for leaders is to identify the necessary improvements, acknowledge the scale of required change, and manage these adjustments in a measurable and timely fashion. With our capable management team, which, under Mark’s leadership, is infused with renewed focus and drive, we look forward to aligning our top priorities with our vision for the future success of our Company.

Board Refreshment

In line with the Company’s ongoing transformation, the structure of Weatherford’s Board changed significantly over the past year. Concurrent with the departure of our former CEO, we separated the roles of Chairman and CEO and appointed William E. Macaulay as the Independent Chairman of the Board. We believe these decisions will increase our Board’s independence and lead to stronger monitoring and oversight.

Additionally, we were pleased to welcome Roxanne J. Decyk, David S. King, and Angela A. Minas as Independent Directors in 2017 and 2018. They bring valuable industry and leadership experience to our Board, as well as fresh perspective. Since 2013, we have appointed eight new Directors to our Board and as a result, the average tenure of the Director nominees at our 2018 Annual Meeting is 4.4 years. Current directors David Butters and Robert Moses will not be standing for re-election in 2018. We are grateful for all they have contributed to Weatherford during their many years of service.

2017 Strategic Actions

|

|

|

|

| ||||

WELCOMED A NEW CEO AND COO | REDUCED NONPRODUCTIVE TIME 23% YOY (Per 1,000 operating hours) | COMPLETED ORGANIZATION REALIGNMENT | ENHANCED BOARD DIVERSITY | COMPLETED NON-CORE ASSET SALE |

Weatherford International plc – 2018 Proxy Statement IV

Living by Our Core Values

Values are central to the direction and strength of a company and provide the guiding principles to inspire employees and promote engagement. Last year, we took a pivotal step in enhancing our organizational health by introducing our Company’s mission and core values, reinvigorating the “One Weatherford” spirit. Our core values unite employees around a common culture, and the One Weatherford mentality encourages them to put these values into action and work as a united team. From the office to the field, you will hear employees affirm “individually, we are impressive but together we are unstoppable — we are One Weatherford.” We are encouraged to see these concepts become embedded in our business. Our mission, core values, and One Weatherford spirit are presented in more detail in the following proxy summary.

The Weatherford Opportunity

Ours is a technology-adept company with outstanding operational effectiveness and a competitive portfolio that we can extend into key markets. We understand what it means to orient a business around our customers, with whom we share strong collaborative relationships across the world.

There is a tremendous amount of opportunity to unlock within Weatherford. We recognize the value of being adaptable and we embrace change — a characteristic essential to our long-term growth.

We are not waiting for a macro-level economic shift to strengthen our results; rather, we are focused on improving our financial performance independent of market conditions. Our top priority is to strengthen our balance sheet, with a goal to cut our debt ratios in half by the end of 2019. This achievement will allow us to seize opportunities and grow as a company.

Accordingly, we have a detailed strategy to generate $1 billion in improved earnings over the next 18 to 24 months. As a part of this strategy, we are redefining the way our business operates across operations, supply chain, manufacturing, sales, and functional support. We are also undertaking a significant evaluation of all of our product and service lines to align our portfolio with our long-term vision. Going forward, Weatherford will be a more focused and streamlined organization, with a culture defined by quality performance, discipline, and accountability. Although such transformational work takes time, it is yielding tangible results, and we remain committed to maximizing returns for our shareholders.

Our Commitment

Weatherford delivers innovative technologies and services designed to meet the world’s current and future energy needs in a safe, ethical, and sustainable manner. The services we offer are vital to many of the world’s leading energy companies. You can be assured that as stewards of your Company, we will utilize Weatherford’s unique resources and assets to deliver sustainable and profitable growth for all of our stakeholders.

We thank you for your support and we look forward to our Annual General Meeting.

|

|

|

|

|

| |||||

| Mohamed A. Awad | David J. Butters | Roxanne J. Decyk | John D. Gass | Emyr Jones Parry | Francis S. Kalman | |||||

|

|

|

|

|

| |||||

| David S. King | William E. Macaulay | Mark A. McCollum | Angela A. Minas | Robert K. Moses, Jr. | Guillermo Ortiz |

Weatherford International plc – 2018 Proxy Statement V

PROXY SUMMARY

Setting the Stage for Our Future

The year was marked by significant focus on planning and delivering tangible results to reinforce our Company’s position as a strong, viable, and innovative industry leader.

ACTIONS

|

RESULTS

| |||

MARCH 2017

Announced new President and CEO, Mark A. McCollum |

Gained an accomplished and respected leader with:

· Extensive financial and executive leadership experience in the oilfield industry

· Deep knowledge of the oilfield services market and how to navigate its challenges

· Strong commitment to driving financial discipline and improving organizational health | |||

APRIL 2017

Established our mission and core values |

Re-energized and united our workforce by buildinga common One Weatherford culture focused on:

· Ethics and integrity

· Discipline and accountability

· Flawless execution

· Collaboration and partnership

· Innovation and technology leadership

· Commitment to sustainability | |||

AUGUST 2017

Welcomed new Executive Vice President and Chief Operating Officer, Karl Blanchard |

Unified previously siloed segments of the business under a leader with:

· More than 35 years of experience in the oilfield services sector

· Extensive track record of delivering operational excellence, strong financial performance, and disciplined growth

· Deep understanding of how to capitalize on technology portfolios | |||

NOVEMBER 2017

Completed organizational realignment, paving the way for a transformation that is targeted to yield $1B in improved earnings within 18–24 months |

Marked the start of our transformation, which will:

· Redefine the way we operate from a number of aspects, including operations, supply chain, manufacturing, sales, and functional support

· Improve profits by further lowering our support-cost ratio, rationalizing our manufacturing footprint, enabling more disciplined supplier management, realizing field efficiencies, and gaining additional market share

· Encourage integration and create synergies | |||

NOVEMBER 2017 — NOVEMBER 2019

Define our path to sustainable growth |

Created a comprehensive corporate transformation plan that includes:

· Sale of U.S. hydraulic fracturing business —$430M (complete)

· Sale of land drilling rigs business

· Further non-core divestitures

· Additional cost savings

· Improved profitability |

Our Results

Our 2017 accomplishments lay the critical foundation for change in 2018 and beyond as we continue on our path to delivering improved financial performance and long- term shareholder value. | » | REFRESHED OUR LEADERSHIP TEAM | ||

| » | LOWERED OUR SUPPORT RATIO | |||

| » | REDUCED NONPRODUCTIVE TIME | |||

| » | POSITIONED OURSELVES TO ACHIEVE SIGNIFICANT COST SAVINGS | |||

| » | REDEFINED OUR CULTURE AND FOCUSED ON ORGANIZATIONAL HEALTH | |||

| » | DIVERSIFIED OUR BOARD | |||

| » | MONETIZED NON-CORE ASSETS |

Weatherford International plc – 2018 Proxy Statement VI

The Board recommends a vote FOR each of the 10 director nominees

| ||||

ITEM 1 | ELECTION OF DIRECTORS | The Board believes its members collectively have the skills and expertise needed to successfully continue to oversee the implementation of Weatherford’s strategic plan for the benefit of shareholders, employees and other stakeholders. | ||

See page 4 for further information about our director nominees.

|

OUR DIRECTOR NOMINEES

Our Board is committed to ensuring the Company’s business affairs are managed in an effective and accountable manner. To achieve this, the composition of our Board is carefully considered and evaluated to bring the appropriate range of skills and experience in relevant areas including finance, exploration and production, environment, public policy, international business and leadership, and oilfield services that will enable our Board to help guide the Company’s strategic objectives and maintain high corporate governance practices.

Name

| Title

| Committees

| ||||||

| MOHAMED A. AWAD |

Chairman (retired), Schlumberger – Middle East and Asia

|

· Compensation · Health, Safety and Environment

| |||||

| ROXANNE J.DECYK |  |

Executive Vice President (retired), Royal Dutch Shell

|

· Compensation · Health, Safety and Environment

| ||||

| JOHN D.GASS |

Vice President (retired),

|

· Compensation (Chair) · Health, Safety and Environment

| |||||

| EMYRJONES PARRY |

Chancellor (former),

|

· Corporate Governance and Nominating · Health, Safety and Environment (Chair)

| |||||

| FRANCIS S. KALMAN |

EVP and CFO (retired),

|

· Audit (Chair) · Corporate Governance and Nominating

| |||||

| DAVID S.KING |  |

Chief Executive Officer (retired), Archer Company Ltd.

|

· Audit · Health, Safety and Environment

| ||||

| WILLIAM E. MACAULAY |

Executive Chairman, First Reserve

|

· Independent Chairman of the Board of Weatherford

| |||||

| MARK A.McCOLLUM |

President and CEO,

|

· Not applicable

| |||||

| ANGELA A.MINAS |  |

Chief Financial Officer (former), DCP Midstream Partners

|

· Audit · Health, Safety and Environment

| ||||

| GUILLERMOORTIZ |

Partner and Chairman, BTG Pactual Mexico

|

· Audit (Vice Chair) · Compensation

|

Board Orientation and Education

Our Board is committed to understanding all facets of our Company. Upon joining our Board, each new Director attends a detailed orientation program, developing relationships with our management as well as planning future site visits to our operations and manufacturing facilities. Upon joining the Board, Ms. Decyk, Mr. King, and Ms. Minas will meet with organizational leaders to discuss the key elements of our risk, tax, compliance, assurance services, and investor relations programs, as well as with our CEO and General Counsel.

Our Board is also encouraged to participate in industry organizations, continuing education and seminars that will better prepare them to provide guidance on key topics such as corporate governance and industry operations. For example, in 2017, all Directors participated in-person in a tailored training from a third-party expert in the field of corporate governance where they discussed best practices and other relevant governance topics.

Weatherford International plc – 2018 Proxy Statement VII

CORPORATE GOVERNANCE

Our Board is committed to delivering the highest standards of corporate governance to all of its shareholders, employees, and customers. As such, our Board and its committees meet regularly to ensure our processes recognize best practices and remain aligned with our strategic financial and operational goals.

Strengthening our Board

Our Board regularly reviews each Director’s experience, expertise, skills, and qualifications to ensure our Board is as effective as possible for our shareholders. After a comprehensive review of potential directors’ skills and qualifications, the Board unanimously recommends that Roxanne J. Decyk, David S. King, and Angela A. Minas are elected to Weatherford’s Board of Directors as they each bring valuable perspective and experience that will help guide our global organization and drive sustained shareholder value.

| Roxanne J. Decyk

Executive Vice President (retired), Royal Dutch Shell

“During my extensive tenure with a leading oil and gas operator, I have witnessed Weatherford’s capabilities from the customer’s perspective. I am confident in the opportunity that lies within Weatherford today and am excited to contribute to the Company’s success in fulfilling its strategic vision that will ultimately deliver significant shareholder value.” |

Director Selection Criteria

Candidates for director nominee are selected for their character, judgment, business experience and acumen, as well as other factors established by the Committee. The following, while not exhaustive of the factors considered by the Committee, describes the qualifications the Committee would use when reviewing candidates for director nominees, Directors must:

• Possess the highest personal and professionalethics, integrity, and values and be committed to representing the long-term interests of the shareholders;

• Have personal and professional reputations consistent with the image and reputation of Weatherford;

• Make meaningful and significant contributions and discussions during all Board and Committee meetings;

• Have a record of accomplishment in their chosen professional field and demonstrate sound business judgment; and

• Have industry, financial and/ or accounting experience and be able to share their expertise and experience to the benefit of Weatherford’s management.

| ||||||||||||

|

David S. King

Chief Executive Officer (retired), Archer Company

“Having spent my career in the oilfield service sector as both a competitor of Weatherford and as a customer, I believe the Company’s future is bright. We know all of our shareholders, customers, and the industry alike want to see us succeed. I look forward to leveraging my executive leadership and operational expertise to help the Company ascend to new heights.” | |||||||||||||

|

Angela A. Minas

Chief Financial Officer (former), DCP Midstream Partners

“After more than three decades in the energy industry, I recognize Weatherford as an important competitor in the oilfield services sector. Having led corporate transformations, I fully support the Company’s strategy and am confident that Weatherford has both the talent and technology to emerge a strong and healthy company.” |

Weatherford International plc – 2018 Proxy Statement VIII

Our Board Structure

In November of 2016, upon the departure of our founder and former CEO, Bernard Duroc-Danner, the Company separated the roles of Chairman and CEO and appointed William E. Macaulay as Independent Chairman of the Board. In March 2017, Mark A. McCollum was appointed President, Chief Executive Officer, and Director.

By splitting these roles, Mr. Macaulay is able to focus on and tangibly oversee the Company’s management (including the CEO), Board leadership, and governance-related matters, while Mr. McCollum is able to exclusively focus on the Company’s strategy, day-to-day operations, as well as financial organizational health.

We believe this leadership structure best serves the Company and its shareholders at this time as it strengthens the integrity and independence of our Board and reduces potential conflicts in the areas of performance evaluation, executive compensation, succession planning, and the recruitment of new Directors.

| In 2017, we fundamentally strengthened the structure and function of our Board. Infused and renewed with fresh perspectives, collectively we will leverage the tremendous leadership experience and operational expertise of our Directors to help guide the Company as it aims to deliver strong financial performance and disciplined growth for all of its shareholders.” |

— William E. Macaulay,

Independent Chairman of the Board

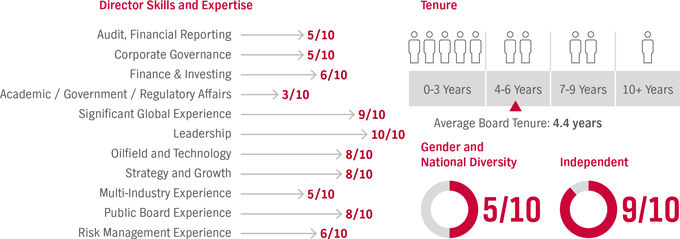

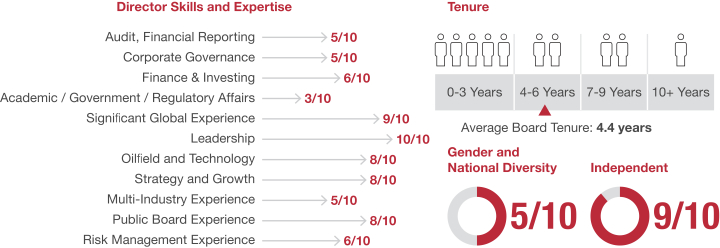

Directors’ Skills, Tenure, and Diversity

Please see the following information regarding our directors’ significant skills and expertise, tenure, and diversity.

ITEM 2 | RATIFY APPOINTMENT OF INDEPENDENT AUDITORS |

The Board recommends a vote FOR the ratification of KPMG LLP and KPMG Chartered Accountants

Based on the recommendation of the Audit Committee

See page 16 for further information.

|

ITEM 3 | APPROVE EXECUTIVE COMPENSATION |

The Board recommends a vote FOR the approval of our executive compensation program

The Board believes Weatherford’s executivecompensation program effectively aligns executive compensation with performance.Seepage 18 for further information.

|

Weatherford International plc – 2018 Proxy Statement IX

Director Skills and Expertise Tenure Audit, Financial Reporting 5/10 Corporate Governance 5/10 Finance & Investing 6/10Academic / Government / Regulatory Affairs 3/10 0-3 Years 4-6 Years 7-9 Years 10+ Years Significant Global Experience 9/10 Average Board Tenure: 4.4 years Leadership 10/10 Gender and Oilfield and Technology 8/10Strategy and Growth National Diversity Independent 8/10Multi-Industry Experience 5/10Public Board Experience 8/10 5/10 9/10 Risk Management Experience 6/10

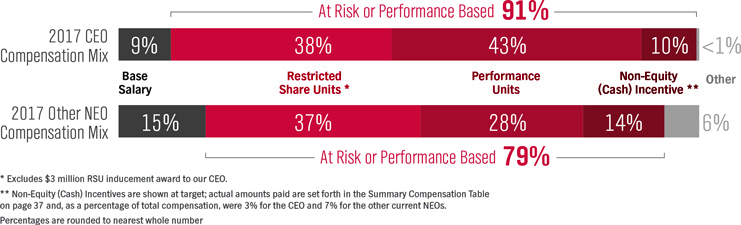

COMPENSATION HIGHLIGHTS

The Compensation Committee aims to provide a framework that aligns the interest of our executive officers with those of our shareholders. This compensation philosophy is designed to support key financial and strategic objectives as well as drive and reward strong business performance providing a clear link between pay and performance. The Compensation Program, which gives due consideration to shareholder feedback, continues to evolve to ensure superior value to our shareholders.

Our 2017 Performance

$5.7 BILLION REVENUE | $413 MILLION EBITDA | NEGATIVE FREE CASH FLOW | SUPPORT RATIO REDUCED TO 30% | QUALITY NONPRODUCTIVE TIME REDUCED 23% YOY | SAFETY TRIR / VPR | INDIVIDUAL QUALITY | ||||||||||||||||||

ABOVE THRESHOLD ACHIEVEMENT | BELOW THRESHOLD ACHIEVEMENT | BELOW THRESHOLD ACHIEVEMENT | SUPERIOR ACHIEVEMENT | ABOVE TARGET ACHIEVEMENT | BELOW THRESHOLD ACHIEVEMENT | THRESHOLD TO SUPERIOR ACHIEVEMENT |

Principal Elements of Compensation

Our compensation program is designed to reward our NEOs for the achievement of strategic and operational goals, and emphasizes long-term performance for Weatherford’s shareholders.

Base Salary | Annual Incentive | Performance Share Units | Restricted Share Units | |||||

| DELIVERY | Cash | Equity | ||||||

| OBJECTIVE | Provides regular income at reasonable, competitive levels | Rewards contributions to annual targets and individual performance | Correlates realized pay with increases in shareholder value | Incentivizes management contributions to long-term increases in shareholder value | ||||

| PERFORMANCE PERIOD | Short-term | Long-term | ||||||

| 2017 RESULTS | Market-based salaries; limited cash bonus | No vesting; no payout | Awarded | |||||

Target Compensation Mix

Weatherford International plc – 2018 Proxy Statement X

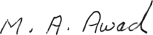

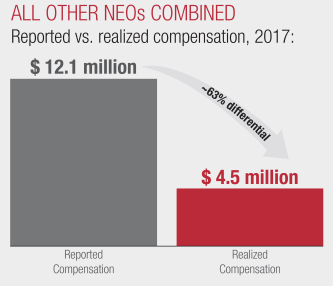

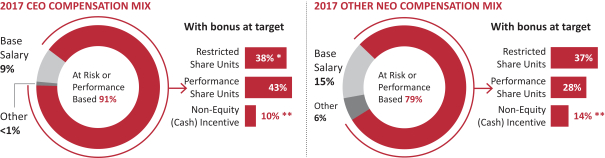

2017 CEO Compensation Mix At Risk or Performance Based 91% 9% 38% 43% 10% <1% Base Salary Restricted Share Units* Performance Units Non-Equity (Cash) Incentive** other 2017 Other NEO Compensation Mix 15% 37% 28% 14% 6% At Risk or Performance Based 79% * Excludes $3 million RSU inducement award to our CEO. ** Non-Equity (Cash) Incentives are shown at target; actual amounts paid are set forth in the Summary Compensation Table on page XX and, as a percentage of total compensation, were 3% for the CEO and 7% for the other current NEOs. Percentages are rounded to nearest whole number

NOTICE OF 2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS

April 27, 2018

10:00 a.m. (Central European Time)

Lorzensaal Cham, Cham, Canton of Zug, Switzerland

AGENDA

| 1. | By separate resolutions, to elect the ten individuals named in this Proxy Statement as directors of Weatherford International plc (the “Company”) until the 2019 annual general meeting of shareholders of the Company (the “2019 AGM”) or, in each case, until his or her earlier death, retirement, resignation or removal from the position of director. |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm and auditor for the financial year ending December 31, 2018 and KPMG Chartered Accountants, Dublin, as the Company’s statutory auditor under Irish law to hold office until the close of the 2019 AGM, and to authorize the Board of Directors of the Company, acting through the Audit Committee, to determine the auditors’ remuneration. |

| 3. | To approve, in an advisory vote, the compensation of our named executive officers. |

The foregoing items, including the votes required in respect of each, are set forth and more fully described in the accompanying Proxy Statement.

RECORD DATE

March 2, 2018

VOTING

Only registered shareholders as of the close of business on the record date will be entitled to attend, vote or grant proxies to vote at the Annual General Meeting. Any such registered shareholder may appoint one or more proxies, by any of the means outlined in the Proxy Statement, to attend, speak and vote in his or her place at the Annual General Meeting. A proxy holder need not be a registered shareholder. Proxies must be received by the Voting Deadline set forth in the Proxy Statement.

DISTRIBUTION OF PROXY MATERIALS

This notice, the Proxy Statement (of which this notice forms a part), our Annual Report on Form10-K, and our Irish Statutory Accounts are available electronically on our website at www.weatherford.com. These materials were mailed or made available to each registered shareholder in our share register as of the record date on or about March 13, 2018. Any shareholder may also obtain a copy of these documents by contacting our U.S. Investor Relations Department at 2000 St. James Place, Houston, Texas 77056 or by telephone at +1 (713)836-4000.

ANNUAL REPORT AND FINANCIAL STATEMENTS

During the Annual General Meeting the Company’s management will present Weatherford’s Irish Statutory Accounts for the fiscal year ended December 31, 2017, along with related directors’ and auditor’s reports, and review the Company’s affairs.

March 13, 2018

| By Order of the Board of Directors |

|

| Christina M. Ibrahim |

Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting to be Held on April 27, 2018: The Proxy Statement of Weatherford International plc, our 2017 Annual Report and Irish Statutory Accounts are available at: www.proxyvote.com.

Weatherford International plc — 2018 Proxy Statement

Weatherford International plc — 2018 Proxy Statement

MEETING AND VOTING INFORMATION

Annual General Meeting: April 27, 2018 at 10:00 a.m. (Central European Time), Lorzensaal Cham, Cham, Canton of Zug, Switzerland.

GENERAL

In this Proxy Statement, “Weatherford,” “the Company,” “we,” “us” and “our” refer to Weatherford International plc, an Irish public limited company and Swiss tax resident.

Our principal executive offices in Switzerland are located at Weststrasse 1, 6340 Baar, Switzerland, and our telephone number is +41.22.816.1500.

References to “$” or “USD” in this Proxy Statement are references to United States dollars and references to “CHF” are references to Swiss francs.

This Proxy Statement and proxy card are being made available on behalf of our Board of Directors, or our “Board,” to all shareholders beginning on or about March 13, 2018.

AGENDA

Proposal

| Required Approval

| Board

| ||||

1. | Election of Directors. By separate resolutions, to elect each of the ten individuals named in this Proxy Statement until the 2019 AGM or, in each case, until his or her earlier death, retirement, resignation or removal from the position of director.

| Majority of Votes Cast | FOR each nominee | |||

2. | Ratify Appointment of Independent Auditors. To ratify the appointment of KPMG LLP as our independent registered public accounting firm and auditor for the fiscal year ending December 31, 2018 and KPMG Chartered Accountants, Dublin as the Company’s statutory auditor under Irish law to hold office until the close of the 2019 AGM, and to authorize the Board of Directors, acting through the Audit Committee, to determine the auditors’ remuneration.

| Majority of Votes Cast | FOR | |||

3. | Approve Executive Compensation. To approve, in an advisory vote, the compensation of our named executive officers.

| Majority of Votes Cast

| FOR | |||

During the Annual General Meeting, management will present the Company’s Irish Statutory Accounts for the fiscal year ended December 31, 2017 and review the Company’s affairs.

WHO CAN VOTE

All registered shareholders at the close of business on March 2, 2018 (the “Record Date”) have the right to notice of, and to vote, in person or by proxy, at the Annual General Meeting. Registered shareholders are entitled, on a poll, to one vote per ordinary share on all matters submitted to a vote of shareholders at the Annual General Meeting, so long as those shares are represented at the Annual General Meeting in person or by proxy. A registered shareholder may appoint one or more proxies to attend, speak and vote in their place at the Annual General Meeting. A proxy holder does not need to be a registered shareholder.

MEETING ATTENDANCE

If you wish to attend the Annual General Meeting in person, you will need to bring proof of identification along with proof of your share ownership. If your shares are held beneficially in the name of a bank, broker or other nominee, you may bring a bank or brokerage account statement as your proof of ownership of shares as of the record date.

Registered shareholders who wish to so participate in the Annual General Meeting may do so by attending in person or at the offices of our Irish lawyers, Matheson, located at 70 Sir John Rogerson’s Quay, Dublin 2, Ireland, at the time of the meeting. All attendees will need to bring proof of identification along with proof of share ownership.

Weatherford International plc — 2018 Proxy Statement 1

PROXY STATEMENT

HOW TO VOTE

To ensure your representation at the Annual General Meeting, we request that you grant your proxy to vote on each of the proposals in this Proxy Statement and any other matters that may properly come before the meeting to the persons named in the proxy card by voting in one of the ways described on page iii no later than the Voting Deadline (defined below) whether or not you plan to attend.

Voting Deadline: 5:59 a.m. (Central European Time) on April 26, 2018 (11:59 p.m. (Eastern Time) on April 25, 2018).

Most of our individual beneficial owners hold their shares through a brokerage account and therefore are not listed in our share registry.

Shareholders who hold their shares through a broker or other nominee (in “street name”) must vote their shares in the manner prescribed by their broker or other nominee. Shareholders who hold their shares in this manner and wish to vote in person at the meeting must obtain a valid proxy from the organization that holds their shares.This may be very difficult for an individual shareholder to do, so individual shareholders holding in street name are strongly encouraged to submit their proxy to their broker, who in turn will vote in accordance with their directions. See “Quorum and Voting” as to the effect of brokernon-votes.

QUORUM AND VOTING

A quorum at our Annual General Meeting will be two or more persons holding or representing by proxy more than 50% of the total issued voting rights of our ordinary shares. As of the Record Date, there were approximately 993,680,800 ordinary shares issued and entitled to vote.

For purposes of determining a quorum, abstentions and “brokernon-votes” present in person or by proxy are counted as represented. A “brokernon-vote” occurs when a nominee (such as a broker) holding shares for a beneficial owner abstains from voting on a particular proposal because the nominee does not have discretionary voting power for that proposal and has not received instructions from the beneficial owner on how to vote those shares.

If you are a beneficial shareholder and your broker or other nominee holds your shares in its name (in “street name”), the broker generally has discretion to vote your shares with respect to “routine” proposals. The “routine” proposal in this Proxy Statement is Proposal 2. All other proposals (i.e., Proposals 1 and 3) are“non-routine” and your broker may not vote your shares. Accordingly, if you hold your shares in “street name,” your broker will not be able to vote your shares on these matters unless your broker receives voting instructions from you.

Approval of each proposal will be decided by an “ordinary resolution” (i.e., by a simple majority of the votes cast “For” or “Against,” in person or by proxy, provided a quorum is present). Abstentions and broker“non-votes” will not affect the voting results for any agenda items under Irish law or NYSE rules.

The election of each director nominee will be considered and voted upon as a separate proposal. There is no cumulative voting in the election of directors. If the proposal for the election of a director nominee does not receive the required majority of the votes cast, then the director will not be elected and the position on the Board that would have been filled by the director nominee will become vacant. The Board has the ability to fill the vacancy upon the recommendation of its Corporate Governance and Nominating Committee, subject tore-election by the Company’s shareholders at the next annual general meeting of shareholders.

The chart below summarizes the voting requirements and effects of brokernon-votes and abstentions on the outcome of the vote for the proposals at the Annual General Meeting.

| Proposal | Required Approval | Broker Discretionary Voting Allowed | Broker Non-Votes | Abstentions | ||||

1. Election of Directors

| Majority of Votes Cast

| No

| No effect

| No effect

| ||||

2. Ratify Appointment of Independent Auditors

| Majority of Votes Cast

| Yes

| N/A

| No effect

| ||||

3. Approve Executive Compensation

| Majority of Votes Cast

| No

| No effect

| No effect

| ||||

PROXIES

A copy of either:

| (i) | a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) notifying each shareholder entitled to vote at the Annual General Meeting how to vote and how to electronically access a copy of this Proxy Statement and our Annual Report and Irish Statutory Accounts for the year ended December 31, 2017 (the “Proxy Materials)” or |

| (ii) | the Proxy Materials and proxy card |

2 Weatherford International plc — 2018 Proxy Statement

PROXY STATEMENT

are being sent to each shareholder registered in our share register as of the Record Date. Shareholders not registered in our share register as of the Record Date, will not be entitled to attend, vote or grant proxies to vote at the Annual General Meeting. Your vote and proxy are being solicited by our Board of Directors in favor of Christina M. Ibrahim or, failing her, Mark A. McCollum (the “Proxy Holders”), for use at the Annual General Meeting.

We request that you grant your proxy to vote on each of the proposals in this notice and any other matters that may properly come before the meeting to the Proxy Holders by completing, signing, dating and returning the proxy card in accordance with the instructions thereon, for receipt by us no later than the Voting Deadline, whether or not you plan to attend.

If you are a registered holder and you properly complete and submit your proxy card in a timely manner, you will be legally designating the individual or individuals named by you in the proxy card, or if you do not name your proxy or proxies, the Proxy Holders, to vote your shares in accordance with your instructions indicated on the card. If you are a registered shareholder and properly complete and submit your proxy card in a timely manner without naming your proxy or proxies and you do not indicate how your shares are to be voted, then the Proxy Holders will vote as the Board of Directors recommends on each proposal and if other matters properly come before the Annual General Meeting, the Proxy Holders will have your authority to vote your shares in their discretion on such matters.

We may accept a proxy by any form of communication permitted by Irish law and as the Board of Directors may approve in accordance with our Articles of Association (“Articles”).

REVOKING YOUR PROXY

If you are a registered shareholder, you may revoke your proxy by:

| • | writing to the Corporate Secretary at Weststrasse 1, 6340 Baar, Switzerland, or at the Company’s registered office, 70 Sir John Rogerson’s Quay, Dublin 2, Ireland, such that the revocation is received at least one hour prior to the commencement of the Annual General Meeting; or |

| • | submitting a later-dated proxy via mail, to the address specified in the proxy materials, for receipt by us no later than the Voting Deadline. |

If you have revoked your proxy as described above, you may attend and vote in person at the Annual General Meeting.

If you are not a registered holder, but you hold your shares through a broker or other nominee, you must follow the instructions provided by your broker or other nominee if you wish to revoke a previously granted proxy, since attending the Annual General Meeting alone will not revoke any proxy.

MULTIPLE PROXY CARDS

If you receive multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts and are registered in different names. You should complete and return each of the proxy cards to ensure that all of your shares are voted.

COST OF PROXY SOLICITATION

We have retained Okapi Partners LLC to solicit proxies from our shareholders at an estimated fee of $20,000, plus expenses. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, electronically, by telephone or by mail. Proxy materials also will be furnished without cost to brokers and other nominees to forward to the beneficial owners of shares held in their names. All costs of proxy solicitation will be borne by the Company.

QUESTIONS

You may call our proxy solicitor, Okapi Partners LLC, toll-free at (855)305-0857 (U.S. callers) or +1 (212)297-0720 (international callers), or our U.S. Investor Relations Department at +1 (713)836-4000, or email us at investor.relations@weatherford.com if you have any questions or need directions to be able to attend the meeting and vote in person.

Please Vote. Your Vote is Important.

Weatherford International plc — 2018 Proxy Statement 3

AGENDA ITEM 1 - ELECTION OF DIRECTORS

The Board of Directors recommends that you vote“FOR” each nominee for director.

Upon the recommendation of the Corporate Governance and Nominating Committee, the Company’s Board of Directors has nominated the following ten nominees to be elected at the Annual General Meeting: Mohamed A. Awad, Roxanne J. Decyk, John D. Gass, Emyr Jones Parry, Francis S. Kalman, David S. King, William E. Macaulay, Mark A. McCollum, Angela A. Minas and Guillermo Ortiz.

All of thenon-employee nominees for director, i.e.,all of the nominees other than Mr. McCollum, are independent under the rules of the NYSE.

Each director is an existing director who, in accordance with the Articles, shall retire at the Annual General Meeting and is eligible forre-election.

Each director elected will serve until the 2019 AGM or, in each case, until his or her earlier death, retirement, resignation or removal from the position of director. All of our nominees have consented to serve as directors. Our Board of Directors has no reason to believe that any of the nominees will be unable to act as a director.

The vote will be held by a separate resolution for each director nominee. A director nominee will bere-elected if approved by an ordinary resolution (i.e.,a simple majority of the votes cast “For” or “Against”). If you properly submit a proxy card but do not indicate how you wish to vote, the Proxy Holders will vote for all of the listed nominees for director.

DIRECTORS’ DIVERSITY OF SKILLS AND EXPERTISE

Our Board’s composition is carefully considered by the Corporate Governance and Nominating Committee to ensure diversity in the broadest sense – of culture, background, outlook, experience, and tenure to bring together multiple, complementary perspectives. The Board membership qualifications and nomination process can be found in our Corporate Governance Principles at www.weatherford.com by clicking on the “Investor Relations” section then “Corporate Governance,” then “Corporate Documents,” then selecting “Corporate Governance Principles.”

Our director nominees bring a powerful range of skills and experience in relevant areas, including finance, exploration and production, environment, public policy, international business and leadership, as well as oilfield services. This unique and highly impactful cross section of capabilities enables our Board to help guide the Company’s strategic objectives and leading corporate governance practices. Further, while each member of our Board has held significant leadership positions in their respective professional fields, of equal importance is each director’s personal ethics and integrity. Each of our directors embodies the highest degree of personal and professional standards, arming them with the qualified insights to deliver sustainable shareholder value.

Directors’ Skills, Tenure, and Diversity

Please see the following information regarding our directors’ significant skills and expertise, tenure, and diversity.

4 Weatherford International plc — 2018 Proxy Statement

Director Skills and Expertise Audit, Financial Reporting 5/10 Corporate Governance 5/10 Finance & Investing 6/10 Academic / Government / Regulatory Affairs 3/10 Significant Global Experience 9/10 Leadership 10/10 Oilfield and Technology 8/10 Strategy and Growth 8/10 Multi-Industry Experience 5/10 Public Board Experience 8/10 Risk Management Experience 6/10 Tenure 0-3 Years 4-6 Years 7-9 Years 10+ Years Average Board Tenure: 4.4 years Gender and National Diversity 5/10 Independent 9/10

AGENDA ITEM 1

|

MOHAMED A. AWAD

Background

Mr. Awad is a retired executive who most recently served as Chairman of Schlumberger–Middle East and Asia, a role he held from 2001 to 2012. Mr. Awad joined Schlumberger in 1981 and over the next 30 years, held positions of increasing responsibility, both internationally and in the U.S., including in the wireline, well services, drilling and measurement, oilfield services and corporate groups. In addition to his role at Schlumberger, Mr. Awad served as a director of Arabian Drilling Company in Saudi Arabia from 2005 until 2012.

Education

University of Tulsa, M.S., Petroleum Engineering

Cairo University, B.S., Petroleum Engineering

Relevant qualifications and experience

• Wealth of experience with a career in the oilfield services industry spanning 30+ years

• Strong technology background which enables him to help guide the Company’s strategic direction

• Deep appreciation for diversity established through international leadership experience

• Expertise in Middle East and Asia regions proves beneficial in conducting business in emerging markets | |

AGE:68 DIRECTOR SINCE: 2014 COMMITTEES: Compensation Health, Safety and Environment OTHER PUBLIC COMPANY BOARDS: None

| ||

|

ROXANNE J. DECYK

Background

Ms. Decyk is a retired executive who most recently served as Former Executive Vice President of Global Government Relations for Royal Dutch Shell plc, a role she held from 2009 to 2010. From 2008 until 2009, Ms. Decyk served as Corporate Affairs and Sustainable Development Director of Royal Dutch Shell plc, from 2005 to 2009, she served on the Executive Committee and from 2005 to 2008, she served as Corporate Affairs Director. Prior thereto, Ms. Decyk was Senior Vice President — Corporate Affairs and Human Resources of Shell Oil Company and Vice President of Corporate Strategy of Shell International Limited. She was previously a director of Petrofac Limited from 2011 until May 2015, andSnap-on Incorporated from 1993 until June 2014.

Education

University of Illinois at Urbana-Champaign, B.A., English Literature

Marquette University Law School, J.D.

Relevant qualifications and experience

• Significant experience in corporate strategy and planning

• Experience in various executive leadership positions for international, integrated energy companies

• Extensive knowledge in human resources and executive compensation

• Expertise in global government affairs | |

AGE:65 DIRECTOR SINCE: 2017 COMMITTEES: Compensation Health, Safety and Environment OTHER PUBLIC COMPANY BOARDS: Ensco plc Orbital ATK, Inc. DigitalGlobe Inc.

| ||

Weatherford International plc — 2018 Proxy Statement 5

AGENDA ITEM 1

|

JOHN D. GASS

Background

Mr. Gass is a retired executive who was formerly a Vice President of Chevron Corporation and President of Chevron Gas and Midstream, a role held from 2003 until 2012. Mr. Gass joined Chevron in 1974 and his career spanned 38 years during which he held positions of increasing responsibility in engineering, operations and executive management, serving both domestically and various global locations.

Mr. Gass has been a director of Southwestern Energy Company since November 2012. He became a director of Suncor Energy Inc. in February 2014. Mr. Gass serves on the Vanderbilt University School of Engineering Board of Visitors and is on the Advisory Board for the Vanderbilt Eye Institute. He is a member of the American Society of Civil Engineers and the Society of Petroleum Engineers.

Education

Vanderbilt University, B.E., Civil Engineering

Tulane University, M.E., Civil Engineering

Relevant qualifications and experience

• 38 years of experience in the energy exploration and production industry, providing insight into the needs and priorities of the Company’s clients

• Executive leadership experience, with a strong emphasis in operational strategy, major project development, and executive management

• Significant international experience in Europe, Africa and the Asia Pacific region | |

AGE:65 DIRECTOR SINCE: 2013 COMMITTEES: Compensation (Chair) Health, Safety and Environment OTHER PUBLIC COMPANY BOARDS: Southwestern Energy Company Suncor Energy Inc.

| ||

|

EMYR JONES PARRY

Background

Sir Emyr served as the Chancellor of Aberystwyth University, located in Wales, from 2008 to 2017 and was Chairman of the All Wales Convention, a body established by the Welsh Assembly Government to review Wales’s constitutional arrangements, from 2007 to 2009. He was Chairman of the Corporate and Social Responsibility External Advisory Group of First Group plc, a transport operator, from 2008 to 2011 and was the Chairman of Redress, a human rights organization, from 2008 to 2016. Sir Emyr previously held numerous diplomatic positions, including UK Permanent Representative to the UN from 2003 to 2007 and UK Ambassador to NATO from 2001 to 2003, specializing in European Union affairs including energy policy. He was also the President of the Learned Society of Wales from May of 2014 to May of 2017.

Education

University of Cardiff, B.Sc., Theoretical Physics

University of Cambridge, Ph.D., Polymer Physics

Relevant qualifications and experience

• Wealth of government relations, diplomatic and negotiations experience

• High level of public and social policy knowledge

• Important international perspective, with an emphasis on global issues and European markets

• Years of dedicated focus on social responsibility, sustainability and human rights | |

AGE:70 DIRECTOR SINCE: 2010 COMMITTEES: Health, Safety and Environment (Chair) Corporate Governance and Nominating OTHER PUBLIC COMPANY BOARDS: None

| ||

6 Weatherford International plc — 2018 Proxy Statement

AGENDA ITEM 1

|

FRANCIS S. KALMAN

Background

Mr. Kalman serves as a senior advisor to a private investment subsidiary of Tudor, Pickering, Holt and Co., LLC that specializes in direct investments in upstream, midstream and oilfield service companies. Mr. Kalman served as Executive Vice President of McDermott International, Inc. from 2002 until his retirement in 2008 and as Chief Financial Officer from 2002 until 2007. From 2000 to 2002, he was Senior Vice President and Chief Financial Officer of Chemical Logistics Corporation; from 1999 to 2000, he was a principal of Pinnacle Equity Partners, LLC; from 1998 to 1999, he was Executive Vice President and Chief Financial Officer of Chemical Logistics Corporation; and from 1996 to 1997, he was Senior Vice President and Chief Financial Officer of Keystone International, Inc.

Mr. Kalman started his career as a Certified Public Accountant with PriceWaterhouse and Co. In addition to the above, he has served in various financial capacities with Atlantic Richfield Company (1975 to 1982), United Gas Pipeline (1982 to 1991) and AmericanRef-Fuel (1991 to 1996).

In addition to his existing directorships, during the past five years, Mr. Kalman has also served on the board of Pride International, Inc., which merged into Ensco plc, CHC Group Ltd. and Kraton Corporation.

Education

Long Island University, B.S., Accounting

Relevant qualifications and experience

• Extensive knowledge in accounting and financial reporting

• Chief financial officer experience and serving as chairman of the audit committee of other public companies

• Executive leadership and strategic planning experience in the international energy service industry

• Experience in multiple components of the energy industry, including internationally | |

AGE:70 DIRECTOR SINCE: 2013 COMMITTEES: Audit (Chair) Corporate Governance and Nominating OTHER PUBLIC COMPANY BOARDS: Ensco plc

| ||

|

DAVID S. KING

Background

Mr. King has more than 35 years’ experience in the international oilfield service industry, including serving in executive operational leadership positions at Halliburton Company. He retired from Halliburton in 2010 where he served as the President of the Completions and Production Division, a $7 billion business. In 2013, he came out of retirement when he was recruited to serve as CEO of Archer Company Ltd. In this capacity, Mr. King was instrumental in driving a turnaround, which created strong financial and operational performance over six consecutive quarters and led to the successful divestiture of their North American assets in 2015. Mr. King recently retired from Archer in 2016. During the past five years, Mr. King has served as a director on the board of Seventy Seven Energy Inc.

Education

University of Alabama, B.S., Civil Engineering

Harvard Business School, Advanced Management Program

Relevant qualifications and experience

• More than 35 years of broad experience in the oilfield service industry

• Significant Chief Executive Officer and Board experience

• Highly qualified operational leader with keen understanding of customer needs

• Extensive knowledge of oilfield services technology | |

AGE:61 DIRECTOR SINCE: 2017 COMMITTEES: Audit Health, Safety and Environment OTHER PUBLIC COMPANY BOARDS: None

| ||

Weatherford International plc — 2018 Proxy Statement 7

AGENDA ITEM 1

|

WILLIAM E. MACAULAY

Background

Mr. Macaulay is the Executive Chairman of First Reserve, a global private equity and infrastructure firm focused on the energy industry. He has been with First Reserve since 1983. Mr. Macaulay is jointly responsible for supervision of the firm’s investment program and strategy, as well as overall management of the firm. Mr. Macaulay sits on all of the firm’s investment committees. Mr. Macaulay served as a director of Weatherford Enterra from October 1995 to May 1998. Mr. Macaulay also served as Director of Corporate Finance for Oppenheimer & Co., Inc., where he worked from 1972 to 1982.

Previously, Mr. Macaulay served as Chairman of CHC Group Ltd., Dresser-Rand Group, Inc., Foundation Coal Holdings Inc. and Pride International, and as a director of Dresser, Inc. and National Oilwell Varco.

Education

City College of New York, B.B.A.

University of Pennsylvania, Wharton School of Business, M.B.A.

Relevant qualifications and experience

• Serves as Chairman, i.e., the lead director, of the Company’s Board

• Significant investment and financial expertise as previous chairman of one of the world’s leading energy and natural gas resources private equity firms

• Chief executive officer experience

• Extensive knowledge of the oilfield service industry

• Expansive depth of knowledge of the Company’s business, as a result of his 20+ years of experience with the Company and its predecessor | |

AGE:72 DIRECTOR SINCE: 1998 COMMITTEES: None – Chairman of the Board OTHER PUBLIC COMPANY BOARDS: None

| ||

|

MARK A. MCCOLLUM

Background

Mr. McCollum has over 36 years of leadership experience in the energy sector. Most recently he served as Chief Financial Officer of Halliburton Company, a position he started in 2008 and resumed in July of 2016 following an interim role as Chief Integration Officer during the pendency of Halliburton’s proposed acquisition of Baker Hughes Incorporated. Prior to joining Halliburton, Mr. McCollum held a number of senior positions at Tenneco, Inc., including Chief Financial Officer, and served as an Audit and Advisory Partner in Arthur Andersen’s Energy Division, where he began his career. He is also a registered CPA in the State of Texas. Mr. McCollum is a member of the Board of Directors and the Audit and Compensation Committees at Archrock, Inc., previously known as Exterran Holdings. He is a member of the Board of Regents of Baylor University and he also serves on the board of trustees for Baylor College of Medicine and the advisory board of Every Village.

Education

Baylor University, Bachelor Degree in Business Administration, Major in Accounting and Business Law

Relevant qualifications and experience

• Extensive knowledge of and experience in the oilfield service industry

• Significant leadership experience, with a strong background in accounting and finance

• Deep understanding of the challenges facing the industry

• Strong knowledge of customer demands and desires

• Commitment to organizational discipline | |

AGE:59 DIRECTOR SINCE: 2017 COMMITTEES: None OTHER PUBLIC COMPANY BOARDS: ArchRock, Inc.

| ||

8 Weatherford International plc — 2018 Proxy Statement

AGENDA ITEM 1

|

ANGELA A. MINAS

Background

Ms. Minas has more than 30 years of experience in the energy sector. Most recently, she served as the Chief Financial Officer of DCP Midstream Partners LP a role she held from 2008 to 2012, and the Chief Financial Officer of Constellation Energy Partners LLC, a role she held from 2006 to 2008. Prior to her experience in the master limited partnership sector, Ms. Minas served as Senior Vice President, Global Consulting at Science Applications International Corporation and as a partner at Arthur Andersen LLP, leading the firm’s North American oil and gas consulting practice. Ms. Minas also serves as a director of Westlake Chemical Partners LP and the general partner of CNX Midstream Partners LP. She currently serves on the Council of Overseers at Rice University Gradule Business School.

Education

Rice University, Jesse H. Jones Graduate Business School, M.B.A., Finance and Accounting

Rice University, B.A., Managerial Studies

Relevant qualifications and experience

• Extensive executive leadership and board experience, including audit committee experience

• Deep understanding of oil and gas, and broader energy sectors

• Significant financial and accounting expertise with strong knowledge of the capital markets

• Proven track record of implementing high-performing corporate growth strategies and business transformation initiatives | |

AGE:53 DIRECTOR SINCE: 2018 COMMITTEES: Audit Health, Safety and Environment OTHER PUBLIC COMPANY BOARDS: Westlake Chemical Partners LP CNX Midstream Partners LP

|

|

GUILLERMO ORTIZ

Background

Dr. Ortiz is currently a partner and Chairman for BTG Pactual for Latin America, a Latin American investment bank based in Brazil. He served as the Chairman of Banorte, the third largest bank in Mexico from 2010 until 2014; Governor of the Bank of Mexico from 1998 until 2009; and as Chairman of the Board of the Bank for International Settlements (BIS) in 2009. He previously served as Secretary of Finance and Public Credit in Mexico from 1994 to 1998. Dr. Ortiz was also Executive Director at the International Monetary Fund and is a director of several internationalnon-profit organizations. He is currently a member of “The Group of Thirty,” an international body of leading financiers and academics.

Education

National Autonomous University of Mexico, B.A., Economics

Stanford University, M.Sc. and Ph.D., Economics

Relevant qualifications and experience

• Extensive international finance and banking experience in the public and private sector

• Expertise regarding global economic matters and multi-national financing, an important element of the Company’s global strategy

• International perspective, with a focus on Latin America

• Frequent speaker, author of topical articles, and educator, providing a current perspective on financial matters | |

AGE:69 DIRECTOR SINCE: 2010 COMMITTEES: Audit (Vice Chair) Compensation OTHER PUBLIC COMPANY BOARDS: Grupo Aeroportuario del Sureste S.A.B. de C.V. Mexichem S.A.B. de C.V. Vitro S.A.B. de C.V. BTG Pactual

|

Weatherford International plc — 2018 Proxy Statement 9

AGENDA ITEM 1

OUR BOARD AND OUR BOARD COMMITTEES

The Board directs and oversees the management of the business and affairs of the Company, and serves as the ultimate decision-making body of the Company, except for those matters reserved to our shareholders. The Board oversees the Weatherford management team, to whom it has delegated responsibility for the Company’sday-to-day operations. While the Board’s oversight role is very broad and may concentrate on different areas from time to time, its primary areas of focus are oversight, strategy, governance and compliance, as well as assessing management and making changes as circumstances warrant. In many of these areas, significant responsibilities are delegated to the Board’s Committees, which in turn are responsible for reporting to the Board on their activities and actions. Our Board has established the following committees: Audit; Compensation; Corporate Governance and Nominating; and Health, Safety and Environment, all of which are further described below. Members are as of the date of this Proxy Statement and, as indicated, Mr. Butters and Mr. Moses, will not be standing forre-election in accordance with our mandatory retirement policy.

AUDIT COMMITTEE |

COMPENSATION COMMITTEE |

CORPORATE GOVERNANCE ANDNOMINATING COMMITTEE

|

HEALTH, SAFETY AND ENVIRONMENT COMMITTEE | |||||||||||||||||||||||||||

Members: Mr. Butters(Retiring), Mr. Kalman (Chair), Mr. King, Ms. Minas, Dr. Ortiz (Vice Chair)

|

Members: Mr. Awad, Ms. Decyk, Mr. Gass (Chair), Dr. Ortiz |

Members: Mr. Butters (Chair) (Retiring), Sir Emyr Jones Parry, Mr. Kalman |

Members: Mr. Awad, Ms. Decyk, Mr. Gass, Sir Emyr Jones Parry (Chair), Mr. King, Ms. Minas, Mr. Moses(Retiring)

| |||||||||||||||||||||||||||

Primary Responsibilities:

• Overseeing the integrity of our financial reporting process and systems of internal accounting and financial controls;

• reviewing our financial statements;

• overseeing our compliance with legal and regulatory requirements;

• together with the Board, being responsible for the appointment, compensation, retention, and oversight of our independent auditor;

• overseeing our independent auditor’s qualifications and independence; and

• overseeing the performance of our internal assurance function, including internal audits and investigations, and our independent auditor.

| Primary Responsibilities:

• Monitoring and reviewing the Company’s overall compensation and benefits program design to ensure program discourages excess risk taking;

• assessing compensation program’s continued competiveness and consistency with compensation philosophy, corporate strategy and objectives;

• reviewing and approving corporate goals and objectives;

• reviewing, with the CEO, and approving each component of compensation of our executive officers;

• selecting appropriate compensation peer groups; and

• making decisions regarding severance, executive compensation plans, incentive compensation plans and equity-based plans and administering such plans.

| Primary Responsibilities:

• Identifying individuals qualified to serve as Board members;

• recommending director nominees for each annual general meeting of shareholders, to fill any vacancies, and recommending directors for each committee;

• reviewing and structuring our compensation policy regarding fees and equity compensation paid and granted to our directors;

• reviewing and recommending changes to the Company’s Corporate Governance Principles for Board approval;

• overseeing the Board in its annual review of the Board’s and management’s performance;

• overseeing director education;

• oversee the Company’s risk-management process in relation to corporate governance and business standards; and

• succession planning for the Company’s CEO and reviewing CEO’s succession planning for other executive officers.

| Primary Responsibilities:

• Reviewing the Company’s policies relating to quality, health, safety, security, environmental stewardship, and corporate responsibility and overseeing adherence and enforcement of these policies and related programs;

• overseeing the Company’s initiatives to promote safety awareness among all employees;

• reviewing strategy and resources of the Company’s QHHSE organization and approving the annual QHHSE plan, including related processes;

• reviewing periodic updates on significant technology, health, safety, environmental and sustainable-development and social and public policy issues;

• reviewing findings related to any QHSSE incident and making periodic facility visits;

• ensuring annual preparation and review of a sustainability report; and

• assisting the Board with oversight of the Company’s risk-management and security processes.

| |||||||||||||||||||||||||||

Meetings in 2017: 9

| Meetings in 2017: 5

| Meetings in 2017: 4

| Meetings in 2017: 4

| |||||||||||||||||||||||||||

10 Weatherford International plc — 2018 Proxy Statement

AGENDA ITEM 1

Our Board believes sound corporate governance processes and practices, as well as high ethical standards, are critical to handling challenges and to achieving business success. We embrace leading governance practices and also conduct ongoing reviews of our governance structure and processes to reflect shareholder input and changing circumstances. Below are highlights of our corporate governance practices and principles.

| HIGHLIGHTS | ||||||

| Director Independence | ✓ | 9 out of 10 of our directors are independent. | ||||

| Chairman of the Board | ✓ | We have an independent Chairman of the Board who, among other items: | ||||

| • | reviews Board meeting schedules and agendas to assure there is an adequate number of scheduled meetings and sufficient time for discussion of all agenda items and all topics deemed important by the independent directors are included; | |||||

| • | presides at all meetings of the Board, including executive sessions, and can call for executive sessions of the Board’s independent directors, if and when deemed appropriate; | |||||

| • | leads the Board’s annual evaluation of the Chief Executive Officer; | |||||

| • | monitors and collaborates with management regarding corporate governance matters; and | |||||

| • | is available for communication with shareholders, in coordination with management, when appropriate. | |||||

| Committee Structure | ✓ | Our Committees are composed entirely of independent directors; on an annual basis, the Corporate Governance and Nominating Committee evaluates and recommends Committee chairs to the Board and assesses the appropriateness of any further chair rotations. | ||||

| Executive Sessions | ✓ | Independent directors meet regularly in executive session, including after all regularly scheduled meetings; in 2017, executive sessions were held at each of the regularly scheduled Board meetings and, if appropriate, certain Committee meetings. | ||||

| Annual Voting | ✓ | Each member of our Board is elected annually with a majority voting standard for uncontested elections. | ||||

| Shareholder Rights | ✓ | Shareholders representing 10% or more of outstanding shares can call a special shareholders meeting. | ||||

| Annual Board and Committee Self Evaluation | ✓ | The Board and each Committee conduct annual self-evaluations. In addition, each independent director completes an individual evaluation of each other director. | ||||

| Share Ownership Guidelines | ✓ | Subject to a five-year transition period, our directors are required to own at least five times their annual cash retainer; our CEO is required to own at least six times his annual base salary; and our other NEOs are required to own three times their annual base salary. | ||||

| Risk Oversight | ✓ | Our entire Board is responsible for risk management of the Company, and our Committees have particular oversight of certain key risks, including those that are identified in the Company’s enterprise risk management program. | ||||

| Succession Planning | ✓ | CEO succession planning is done annually in executive session; additionally, the CEO reports to the Board on at least an annual basis concerning management development and succession planning for all other key positions. | ||||

| Over-boarding | ✓ | All of our directors (other than one) serve on three or less public company boards; one director serves on four public company boards in addition to the Company. | ||||

| Mandatory Retirement | ✓ | We have a mandatory retirement policy for all directors following the earlier of (i) his or her 72nd birthday and (ii) his or her 15th year of service as a director; however, to facilitate transition, all directors who were elected at the 2015 annual general meeting are not subject to mandatory retirement until such director’s 75th birthday. In connection with this policy, two directors are retiring this year. | ||||

| Code of Business Conduct | ✓ | We have a robust and comprehensive Code of Business Conduct that applies to all employees and each director. | ||||

ADDITIONAL BOARD INFORMATION

Board Meetings: During 2017, the Board met five times; all of the directors participated in at least 75% of all Board of Directors and respective Committee meetings. It is our policy that directors are expected to attend each annual general meeting of shareholders. All of our directors attended last year’s meeting.

Committee Charters: The charter for each Committee of our Board of Directors is available on our website at www.weatherford.com, by clicking on “Investor Relations,” then “Corporate Governance,” then “Corporate Documents,” then the name of the applicable committee charter.

Independence: Each Committee is composed entirely of independent directors.

Weatherford International plc — 2018 Proxy Statement 11

AGENDA ITEM 1

Committee Members:The Board has determined that each member of the Audit Committee is “financially literate” pursuant to the listing standards of the NYSE and that Mr. Kalman and Dr. Ortiz are each an “audit committee financial expert,” as defined by applicable U.S. Securities and Exchange Commission (the “SEC”) rules, because of each of their individual extensive financial experience. All members of the Compensation Committee satisfy the qualification standards of section 162(m) (“section 162(m)”) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), and Section 16 of the Exchange Act.

Additional information regarding Corporate Governance at Weatherford can be found on our website atwww.weatherford.comin the “Investor Relations” section.

RISK MANAGEMENT OVERSIGHT

The Board has implemented an Enterprise Risk Management (ERM) system to identify and evaluate varying levels of risk and their potential impact on the enterprise, as well as steps to further mitigate those risks. Management representatives of the ERM committee present quarterly to the Audit Committee and annually to the full Board. Therefore, the Board is responsible for the oversight of overall risk management for the Company, and the Audit Committee is responsible for financial and compliance reporting as well as risk assessment.

As part of its oversight function, the Audit Committee discusses and implements guidelines and policies concerning financial and compliance risk assessment and management, including the process by which major financial and compliance risk exposure is monitored and mitigated. The Audit Committee works with members of management to assess and monitor risks facing the Company’s business and operations, as well as the effectiveness of the Company’s guidelines and policies for managing and assessing financial and compliance risk. The Audit Committee meets and discusses, as appropriate, issues regarding the Company’s risk management policies and procedures directly with those individuals responsible forday-to-day risk management in the Company’s assurance and compliance departments. The Audit Committee has also established policies and procedures for thepre-approval of all services provided by the independent registered public accounting firm as described in “Audit CommitteePre-Approval Policy” in this Proxy Statement. In addition, the Audit Committee has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received by the Company regarding its accounting, internal controls, Code of Conduct and other matters.

The Corporate Governance and Nominating Committee periodically provides oversight with respect to risks associated with our corporate governance policies and practices, including our Corporate Governance Principles. The Corporate Governance and Nominating Committee also oversees and reviews, on an annual basis, an evaluation of the Board and each of our Board Committees, and a director peer evaluation. The results of those evaluations are also considered as part of the Corporate Governance and Nominating Committee’s recommendations for Committee service and rotation, as appropriate.

The Compensation Committee reviews our compensation plans and practices to ensure they do not encourage excessive risk-taking, and, instead, encourage behaviors that support sustainable value creation. See “Risk Analysis of our Compensation Programs” in the Compensation Discussion and Analysis section of this Proxy Statement.

Our Health, Safety and Environment Committee oversees the Company’s policies and practices to promote good stewardship, to encourage safety awareness, to monitor safety performance and to provide suggestions to management for the resolution of health, safety and environmental concerns, all with a view towards reducing risks in those areas.

SUCCESSION PLANNING AND LEADERSHIP DEVELOPMENT

In addition to oversight of risk management, one of the priorities of our Board is to ensure that the Company has a long-term and evolving program for effective leadership development and succession. Our Board is committed to talent management and ensuring strong and effective leadership in the Company’s global management structure. Throughout the year, the Board is presented with high-potential leadership candidates and regularly updated on key talent metrics, including diversity, recruiting and development programs. The CEO reports to the Board on an annual (or more frequent, as needed) basis concerning management development and succession planning for other key positions. In addition, the Corporate Governance and Nominating Committee conducts annual CEO succession planning in executive session.

MANDATORY RETIREMENT

In 2017, we further enhanced our Corporate Governance Principles by updating and revising our mandatory retirement policy. Our policy now requires that eachnon-employee director retire from the Board immediately prior to the annual general meeting of shareholders following the earlier of (i) his or her 72nd birthday and (ii) his or her 15th year of service as a director. In order to allow a smooth transition of our existing directors, the requirement was previously automatically waived for each director elected at the 2015 Annual General Meeting (i.e., such directors were grandfathered in), however we have now enhanced our policy so the grandfather/waiver provision expires after such director’s 75th birthday. We believe this policy will help increase diversity and allow for more frequent Board refreshment. In furtherance of this policy, two current directors, Mr. David J. Butters and Mr. Robert K. Moses, Jr. are retiring and will not stand forre-election this year.

DIRECTOR INDEPENDENCE

The Board has affirmatively determined that eachnon-employee director is independent under the rules of the NYSE and the SEC. As contemplated by NYSE rules, the Board has adopted categorical standards to assist it in making independence determinations. These standards are available on our website atwww.weatherford.com, by clicking on “Investor Relations,” then “Corporate Governance,” then “Corporate Documents,” then “Corporate Governance Principles.” However, in making independence determinations, the Board considers and reviews all relationships with each director, whether or not they fall within the categorical standards. None of the independent directors had relationships relevant to an independence determination that were outside the scope of the Board’s categorical standards.

12 Weatherford International plc — 2018 Proxy Statement

AGENDA ITEM 1

RELATED PERSON TRANSACTIONS