United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED MARCH 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number -

MEDIFOCUS INC.

(Exact name of Registrant as specified in its charter)

MEDIFOCUS INC.

(Translation of Registrant’s name into English)

Province of Ontario, Canada

(Jurisdiction of incorporation or organization)

10240 Old Columbia Road, Suite G

Columbia, Maryland 21046

(Address of principal executive offices)

Dr. Augustine Cheung

410-290-5734

acheung@medifocusinc.com

10240 Old Columbia Road, Suite G

Columbia, Maryland 21046

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

| | | | |

Title of each class | | | | Name of each exchange on which registered |

| | | | |

| | | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common shares as of the close of the period covered by the annual report.

127,542,120

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes ¨ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes x No

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one)

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP x | | International Financial Reporting Standards as issued By the International Accounting Standards Board ¨ | | Other ¨ |

If “Other” has been check in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

TABLE OF CONTENTS

PART I

In this Registration Statement on Form 20-F, the “Company,” “we,” “us” and “our” refers to Medifocus Inc. and its subsidiaries.

Unless otherwise indicated, all dollar amounts in this registration statement are expressed in United States dollars.

Unless we indicate otherwise, all information in this Report is stated as of March 31, 2015.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in or incorporated by reference in this annual report are “forward-look statements.” Except for the statements of historical fact contained herein, the information presented constitutes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, or variation of such words and phrases that refer to certain actions, events or results to be taken, occur or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Such factors include, among others, the actual results of the Prolieve business, requirements for additional capital, delays in obtaining governmental approvals, as well as those factors discussed in “Item 3. Key Information” and “Item 4. Information on the Company” of this annual report. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

In addition, forward-looking statements represent our estimates and assumptions only as of the date of this annual report. You should carefully review this annual report and the documents that the Company references in this annual report, or that are incorporated by reference into this annual report, with the understanding that the Company’s actual future results may differ materially from what is presented in this annual report.

Except as required by law, the Company assumes no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, expressly state that the safe harbor for forward looking statements does not apply to companies that issue penny stocks. Accordingly, the safe harbor for forward looking statements under the PSLRA is not available to the Company because we are considered to be an issuer of penny stock.

1

| Item 1. | Identity of Directors, Senior Management and Advisers. |

We are filing this Form as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

| Item 2. | Offer Statistics and Expected Timetable. |

We are filing this Form as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

| A. | Selected financial data. |

The following selected financial and other data summarize our historical financial information. We derived the selected balance sheet information as of March 31, 2015, 2014, 2013 and 2012, and the selected statement of operations information for the years ended March 31, 2015, 2014, 2013 and 2012 from our audited financial statements as of those dates, prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The information herein should be read in conjunction with our historical financial statements and the notes thereto included elsewhere in this annual report.See “Item 5. Operating and Financial Review and Prospects,” “Item 8. Financial Information” and “Item 18. Financial Statements.”

We have not provided selected balance sheet data as of March 31, 2011 because our audited financial statements as of that date were prepared in accordance with International Financial Reporting Standards or generally accepted accounting principles in Canada, which differ in certain significant respects from U.S. GAAP. We believe we would have to incur unreasonable expenses to provide this information.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended March 31, | |

Statement of Operations Data | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Total Sales | | $ | 4,219,459 | | | $ | 5,116,506 | | | $ | 1,800,371 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | |

Loss from operations | | | (4,087,985 | ) | | | (4,886,807 | ) | | | (5,333,515 | ) | | | (1,484,302 | ) | | | (2,339,835 | ) |

Net loss | | | (5,971,470 | ) | | | (5,992,897 | ) | | | (5,846,523 | ) | | | (1,665,402 | ) | | | (2,388,252 | ) |

Net loss per common share | | $ | (0.05 | ) | | $ | (0.05 | ) | | $ | (0.07 | ) | | $ | (0.05 | ) | | $ | (0.09 | ) |

Dividends declared | | | — | | | | — | | | | — | | | | — | | | | — | |

Weighted average common shares outstanding - basic and diluted | | | 122,809,928 | | | | 117,260,870 | | | | 84,042,487 | | | | 31,565,402 | | | | 26,002,635 | |

| | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | |

Total assets | | $ | 5,418,487 | | | $ | 7,328,130 | | | $ | 6,268,583 | | | $ | 438,925 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Common stock (no par value) | | | 12,782,563 | | | | 12,372,498 | | | | 12,524,735 | | | | 4,774,837 | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total stockholders’ equity (deficit) | | | (2,897,012 | ) | | | (134,369 | ) | | | 478,084 | | | | (2,553,772 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | |

All amounts are presented in U.S. dollars and in accordance with U.S. GAAP.

2

| B. | Capitalization and indebtedness. |

We are filing this Form as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

| C. | Reasons for the offer and use of proceeds. |

We are filing this Form as an annual report under the Exchange Act and, as such, there is no requirement to provide any information under this item.

An investment in shares of our common stock (which we refer to as the “Shares”) involves a high degree of risk. You should carefully consider the risks described below and the risks described elsewhere in this annual report under the sections entitled “Item 4. Information on the Company” before deciding whether to invest in our shares. The following is a summary of the risk factors that we believe are most relevant to our business. These are factors that, individually or in the aggregate, could cause our actual results to differ significantly from anticipated or historical results. The occurrence of any of the risks could harm our business and cause the price of our common stock to decline, and investors may lose all or part of their investment. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties. The risks and uncertainties described below and in the incorporated documents are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occurs, our business, financial condition and results of operations would suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Special Note Regarding Forward-Looking Statements” at the beginning of Part I of this annual report. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

We have a history of significant losses and expect to continue such losses for the foreseeable future.

Since our inception in 2005, our expenses have substantially exceeded our revenues, resulting in continuing losses and an accumulated deficit of $26,900,315 at March 31, 2015. In addition, our net loss for the year ended March 31, 2015 was $5,971,470. Such operating losses are the result of our commitment to continuing our product research, development and commercialization programs, which is only partially offset by limited revenues from the sale of our Prolieve system and related disposables. We expect to continue to experience significant operating losses unless and until we generate significant revenue from Prolieve, as well as the development of other new products and these products have been clinically tested, approved by the FDA or other regulatory authorities, and successfully commercialized.

We may not be able to generate significant revenue for the foreseeable future.

Since 2005, we have devoted our resources to developing the APA 1000, but we will not be able to market the APA 1000 until we have completed clinical testing and obtained all necessary governmental approvals. On July 26, 2012, we acquired from Boston Scientific Corporation the Prolieve Thermodilatation system business for the treatment of BPH and, since that time, we have assembled a sales and service team to market the Prolieve system. All of our current revenue is derived from sales of our Prolieve control units and more importantly, our single-use treatment catheters and treatments

3

delivered through our mobile service. There can be no assurance as to how much revenue will be generated by Prolieve sales. Our lack of product diversification means that we may be negatively affected by changes in market conditions and in regulation (including regulation affecting reimbursement for our products). In addition, at the present time our APA 1000 system is still in clinical testing stage and cannot be marketed until we have completed clinical testing and obtained necessary governmental approval. Accordingly, our revenue sources are, and will remain extremely limited until and unless our Prolieve system is marketed successfully and/or until our other new products are clinically tested, approved by the FDA or other regulatory authorities, and successfully commercialized. We cannot guarantee that our products will be successfully tested, approved by the FDA or other regulatory authorities, or commercialized, successfully or otherwise, at any time in the foreseeable future, if at all.

Our future is dependent upon our ability to obtain additional financing. If we do not obtain such financing, we may have to cease our operations and investors could lose their entire investment.

We have yet to operate profitably or generate positive cash flows from operations, and there is no assurance that we will operate profitably or will generate positive cash flow in the future. As a result, we have very limited funds, and such funds may not be adequate to take advantage of current, planned and unanticipated business opportunities. Even if our funds prove to be sufficient to pursue current, planned and unanticipated business opportunities, we may not have enough capital to fully develop such opportunities.

Further, our capital requirements relating to the manufacturing and marketing of our products have been, and will continue to be, significant. We are dependent on the proceeds of future financing in order to continue in business and to develop and commercialize proposed products. There can be no assurance that we will be able to raise the additional capital resources necessary to permit us to pursue our business plan. Finally, the continued growth of our business may require additional funding from time to time to be used by us for general corporate purposes, such as acquisitions, investments, repayment of debt, capital expenditures, repurchase of capital stock and additional purposes identified by the Company.

Accordingly, our ultimate success may depend upon our ability to raise additional capital. There can be no assurance that any additional financing will be available to us. As additional capital is needed, we may not be able to obtain additional equity or debt financing. Even if financing is available, it may not be available on terms that are favorable or acceptable to us, or in sufficient amounts to satisfy our requirements. Any inability to obtain additional financing will likely have a material adverse effect on our business operations, and could result in the loss of your entire investment.

Our independent registered public accountants have expressed substantial doubt regarding our ability to continue as a going concern.

Our auditors have expressed their opinion that there is substantial doubt about the Company’s ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of these uncertainties. Our ability to continue as a going concern is dependent upon our ability to successfully raise adequate additional financing and our ability to successfully develop our sales and marketing programs and commence our planned operations. We cannot assure you that we will be able to obtain additional financing or achieve profitability in our operations. Our failure to obtain additional financing or achieve profitability in our operations could require the Company to liquidate our business interests, and could result in the loss of your entire investment.

4

Our failure to have a full-time Chief Financial Officer may negatively affect our business and operations.

Our Chief Financial Officer (or “CFO”) serves only on a part-time basis and may be subject to conflicts of interest. The CFO devotes a portion of his working time to other business endeavors, which may lead to conflicts of interest, including deciding how much time to devote to our affairs. The CFO position is critical to our operations, and our failure to fill this position on a full-time basis may negatively impact our business and operations. It may also lead to the late filing of financial reports and other required disclosures, or the filing of noncompliant financial reports and other required disclosures, which could have numerous consequences, including administrative proceedings by the Securities and Exchange Commission (the “SEC”), claims under Section 10 of the Exchange Act and, if our Shares become listed on a national exchange, cease trade orders or the de-listing of the Shares on such exchange. Further, having a part-time CFO has, and may continue to, negatively impact the effectiveness of our disclosure controls and our internal controls over financial reporting. No assurances can be given that our CFO will transition to a full-time basis, or that we will be able to identify or afford a full-time qualified candidate for this position.

We operate with de-centralized management, and may be unable to hire additional personnel to support, manage and control our operations.

Our CFO performs his functions for us on a part-time, non-exclusive basis, and resides in Toronto, Canada. Further, we believe that we are understaffed and need to hire additional personnel to support, manage and control our operations in order to operate optimally. In the past, the combination of not having our CFO at our headquarters and being understaffed have contributed to the late filing of financial reports in Canada. These late filings resulted in temporary cease trade orders being issued, and a multi-month suspension of trading of our shares on the Toronto Venture Exchange (the “TSXV”). Although the Company has recently hired a qualified outside accounting consultant to minimize this risk. until we become profitable or obtain additional financing, these factors will persist, raising the risk in the future of us making late filings of financial reports in Canada and in the U.S., and having our Shares suspended from trading. Moreover, until we can afford to hire additional staff, we will continue to operate with less than optimal support, management and control of our operations. The Company recently hired a qualified outside accounting consultant to provide support to our management and CFO, but we cannot assure you that such efforts will effectively minimize such risks. If we continue to operate with de-centralized management and insufficient staffing, it may have a material adverse effect on our business.

We identified a material weakness in our internal control over financial reporting that could affect the reliability of our financial statements and have other adverse consequences.

We identified a material weakness in our internal control over financial reporting as of March 31, 2015. We determined that a material weakness existed because we did not employ a sufficient number of qualified accounting personnel to ensure all required adjustments are made to the Company’s books, which would allow for the preparation and presentation of the Company’s financial statements in conformity with accounting principles generally accepted in the United States of America.

Failure to have effective internal control over financial reporting could impair our ability to produce accurate financial statements on a timely basis and could lead to a restatement of our financial statements. If, as a result of deficiencies in our internal control over financial reporting, we cannot provide reliable financial statements, our business decision processes may be adversely affected, our business and results of operations could be harmed, investors could lose confidence in our reported financial information and our ability to obtain additional financing, or additional financing on favorable terms, could be adversely affected. In addition, failure to maintain effective internal control over financial reporting could result in investigations or sanctions by regulatory authorities.

5

In an effort to remediate this material weakness, we retained and have continued to work closely with qualified consultants. Further, we continue to search for qualified personnel and consultants to help ensure proper and timely accounting disclosures. Thus far, retaining outside consultants has not yet remediated this material weakness. Further, we are in the process of updating all internal controls, including financial reporting, and properly documenting all such controls. There can be no assurance that the material weakness identified or that any additional material weaknesses will not arise in the future due to our failure to implement and maintain adequate internal control over financial reporting.

The loss of certain of our key personnel, or any inability to attract and retain additional personnel, could negatively affect our business.

Our future success depends to a significant extent on the continued service of Dr. Augustine Cheung, our President, and John Mon, our Chief Operating Officer. Both of these individuals have been intimately involved with, and primarily responsible for, the invention, development and commercialization efforts for both of our products. The loss of services of either individual would adversely affect our business and our ability to implement our business plan.

Our future success will also depend on our ability to attract, retain and motivate highly skilled personnel to assist us with product development, commercialization and other facets of our business plan. If we fail to hire and retain a sufficient number of qualified individuals to fully meet the needs of the business of the Company, it may have an adverse effect on our business and results of operations.

One of our shareholders owns a significant percentage of our Shares and could exert significant influence over matters requiring shareholder approval.

Mr. Tak Cheung Yam, a former director of the Company, through Integrated Assets Management (Asia) Ltd, currently owns 26,023,106 Shares, or 14.97% of the Company’s outstanding common stock. Together with Integrated Assets Management (Asia) Ltd, Mr. Yam also owns exercisable warrants and options to purchase an additional 18,595,833 Shares. If Mr. Yam chooses to exercise all these warrants and options, he will control 23.18% of our Common Stock. In addition, Mr. Yam, through Integrated Assets Management (Asia) Ltd, owns a convertible note that can be converted into 7,400,000 Shares. If Mr. Yam chooses to convert the note to Shares, and to exercise all his warrants and options, he will effectively control 26.03% of our outstanding shares. As a result, Mr. Yam may have significant influence over our management, our decision-making process, our business strategy and affairs and matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, such as mergers, consolidations or the sale of substantially all of our assets. Mr. Yam’s interests may differ from those of other shareholders of the Company, and, Mr. Yam will have the ability to exercise influence over our business and may take actions that are not in our or our public shareholders’ best interests. Furthermore, this concentration of ownership may have the effect of delaying or preventing a change in control, including a merger, consolidation or other business combination involving us, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control, even if such a change in control would benefit our other stockholders.

Our internal sales and marketing capability is limited and we may need to enter into alliances with others possessing such capabilities to commercialize our products internationally.

Currently our primary source of revenue is through the sales of disposable catheter treatment kits and mobile services in the U.S. Consequently, we are dependent upon our limited sales and marketing capability for the successful marketing of our Prolieve system. There can be no assurance that we will establish adequate sales and distribution capabilities or be successful in gaining market acceptance for our Prolieve system.

6

We intend to market our other products, if and when such products are approved for commercialization by the FDA or other regulatory authorities, either directly or through other strategic alliances and distribution arrangements with third parties. There can be no assurance that we will be able to enter into third-party marketing or distribution arrangements on advantageous terms or at all. To the extent that we do enter into such arrangements, we will be dependent on our marketing and distribution partners. In entering into third-party marketing or distribution arrangements, we expect to incur significant additional expense. There can be no assurance that, to the extent that we sell products directly or we enter into any commercialization arrangements with third parties, such third parties will establish adequate sales and distribution capabilities or be successful in gaining market acceptance for our products and services.

We do not manufacture the Prolieve system ourselves, and rely on a third-party supplier to supply us with the proprietary disposable catheters used with our Prolieve system.

The Prolieve systems we currently have in inventory were manufactured by Sanmina Corporation for Boston Scientific Corporation prior to our acquisition of the Prolieve assets, and we do not currently have an agreement with Sanmina for the production of additional Prolieve systems. Accordingly, if our current inventory becomes insufficient to meet the business growth in both the U.S. and international markets, we will have to engage Sanmina Corporation, or another manufacturer, to produce such additional systems. Further, the proprietary disposable catheter kits used with the Prolieve system are manufactured by Lake Regional Medical Center (formerly Accellent Inc.) in its facility in Mexico. Due to the complexity of these catheter kits, as well as FDA standards applicable to manufacturers of such kits, the Company has not identified an alternative supplier for these catheter kits. If, for any reason, we are unable to obtain new Prolieve systems manufactured by Sanmina Corporation, or we are no longer able to purchase the catheter kits from Lake Regional Medical Center in sufficient amounts, on an as-needed basis and on acceptable terms, or if either manufacturer becomes unable or unwilling to continue to supply us with new Prolieve systems and disposable catheter kits, it would have a material adverse effect on our business and operations. There can be no assurance that we could find new manufacturers to fulfill our needs, that any such manufacturer would be FDA approved, or that such manufacturers would be willing to provide us with the required products under commercially acceptable terms. If we are unable to find additional manufacturers and suppliers and it results in a disruption to our business, there would be a material adverse effect on our business and results of operations.

The slow pace of our APA 1000 Breast Cancer System’s Phase III clinical trials could result in additional delays and increased costs of completing the trials in the future.

Our main focus at this time is attaining profitability for our Prolieve business. Accordingly, we have allocated most of our resources to this goal, compounding this with the lack of funding the progress of the pivotal Phase III clinical trials of our APA 1000 breast cancer treatment system has been very slow. We estimate that the Phase III clinical trials will cost approximately $7,500,000. We currently do not have the financing in place to accelerate and complete these trials. There can be no assurance that such financings will be available at all, or on terms favorable to us. Further, there can be no assurance as to when, or even if, we will succeed in making Prolieve profitable. Our inability to do so may make it more difficult for us to raise funds for the pivotal Phase III clinical trial of the APA 1000. In the event that we are able achieve profitable Prolieve operations, there can be no assurance that we will be able to generate enough funds from the Prolieve business to finance the pivotal Phase III clinical trial. Furthermore, we cannot predict the effect of the slow pace of the pivotal Phase III trial could have on the costs and other critical aspects of the Phase III clinical trial. There is the risk that this uncertainty could negatively impact our business plans, and our ability to raise additional funds for further development of our APA 1000 business.

7

We may not receive regulatory approval from the U.S. Food and Drug Administration (“FDA”) to market the APA 1000.

Drugs and medical devices in the United States are regulated by the FDA, which requires that new medicines and medical devices be demonstrated to be both safe and effective. This is accomplished by conducting staged clinical trials that are subject to the FDA’s review, analysis and approval. While the Phase I and Phase II clinical trials for APA 1000 have been completed, and we received approval from the FDA and Health Canada to begin the pivotal Phase III clinical trials, as of today, a very limited number of patients out of a planned 238 person trial in the pivotal Phase III clinical trial, have been treated with APA 1000. There can be no assurance that our Phase III clinical trial will be completed, and if it is completed, that it will demonstrate APA 1000’s safety and efficacy, and that we will subsequently receive the FDA’s approval for us to commence marketing. In the event that we complete the pivotal Phase III clinical trial and receive FDA approval to market APA 1000, there can be no assurance that APA 1000 will be adopted for use by the healthcare industry, and that this business will be profitable. If the APA 1000 is not adopted for use by the healthcare industry, or we are not able to become profitable, it would have a material adverse effect on our business and results of operations.

We may not succeed in developing a meaningful market share of the benign prostatic hyperplasia (“BPH”) treatment markets with Prolieve, and our Prolieve business may not become profitable.

The BPH market is highly competitive, and is presently dominated by large, international pharmaceutical companies that promote the use of proprietary drugs to treat this condition. These companies, which include, Eli Lilly, Glaxo Smith Kline, Merck & Co., and others, aggressively market their drugs to primary care physicians, and to consumers through television, print, digital and other media. Because the market for BPH treatment is large and growing, and the manufacturers of these medications have made substantial investments in their development and marketing, we expect them to vigorously defend their market positions. In addition, we face strong competition from surgical and other minimally invasive treatment modalities. Although we have received a PMA from the FDA for our Prolieve system for the treatment of BPH, we can offer no assurance that the Prolieve system will be accepted by the medical community widely. Because our financial, marketing and sales resources are much smaller than those of the pharmaceutical companies, we are at significant competitive disadvantage, which will make it difficult for us to substantially expand our Prolieve business. Our inability to expand our Prolieve business achieve profitability and capture significant market share of the BPH treatment market will adversely affect us.

Recent health care reform laws in the U.S. could have a negative impact on our business.

Our business, financial condition, results of operations and cash flows could be significantly and adversely affected by recent healthcare reform legislation, including, most immediately, by the medical device excise tax that became effective on January 1, 2013. The Patient Protection and Affordable Care Act and Health Care and Education Reconciliation Act of 2010 (the “Healthcare Reform Acts”) were enacted into law in March 2010. As a company that operated in the United States, the Healthcare Reform Acts may materially impact our business and operations. Certain provisions of the Healthcare Reform Acts will not be effective for a number of years and there are many programs and requirements for which the details have not yet been fully established. Accordingly, it is unclear what the full impact will be from the Healthcare Reform Acts.

However, beginning in January 2013, the Healthcare Reform Acts impose a 2.3% excise tax on sales of our Prolieve products in the United States. We expect the new tax will materially and adversely affect our business, cash flows and results of operations. The Healthcare Reform Acts also contain a number of Medicare provisions aimed at improving quality and decreasing costs. The Medicare provisions include value-based payment programs, increased funding of comparative effectiveness research, reduced hospital payments for avoidable readmissions and hospital acquired conditions, and pilot programs to evaluate alternative payment methodologies that promote care coordination (such as bundled physician and hospital payments). Additionally, the Healthcare Reform Acts include a reduction in the annual rate of

8

inflation for Medicare payments to hospitals that began in 2011 and the establishment of an independent payment advisory board to recommend ways of reducing the rate of growth in Medicare spending beginning in 2014. We cannot predict what healthcare programs and regulations will ultimately be implemented at the federal or state level, or the effect of any future legislation or regulation. However, any changes that lower reimbursement for our products or reduce medical procedure volumes could have a material adverse effect our business and results of operations.

Our APA 1000 system and future products utilizing the adaptive phased array technology depend on license agreements with MIT to permit us to use patented technologies.

Our success depends, in substantial part, on our ability to maintain our rights under license agreements that grant us the rights to use patented technologies. We have entered into a license agreement with MIT under which we have exclusive rights to commercialize medical treatment products and procedures based on MIT’s Adaptive Phased Array technology. The MIT license agreement contains license fee, royalty and/or research support provisions, testing and regulatory milestones, and other performance requirements that we must meet by certain deadlines. If we were to breach these or other provisions of the license agreement, we could lose our ability to use the subject technology, as well as compensation for our efforts in developing or exploiting the technology. Any such loss of rights and access to technology could have a material adverse effect on our business.

Further, we cannot guarantee that any patent or other technology rights licensed to us by others will not be challenged or circumvented successfully by third parties, or that the rights granted will provide adequate protection. We are aware of published patent applications and issued patents belonging to others, and it is not clear whether any of these patents or applications, or other patent applications of which we may not have any knowledge, will require us to alter any of our potential products or processes, pay licensing fees to others or cease certain activities. Litigation, which could result in substantial costs, may also be necessary to enforce any patents issued to or licensed by us or to determine the scope and validity of others’ claimed proprietary rights. We also rely on trade secrets and confidential information that we seek to protect, in part, by confidentiality agreements with our corporate partners, collaborators, employees, and consultants. We cannot guarantee that these agreements will not be breached, that, even if not breached, that they are adequate to protect our trade secrets, that we will have adequate remedies for any breach or that our trade secrets will not otherwise become known to, or will not be discovered independently by, competitors.

We may not be able to protect the intellectual property that is integral to our business, or we may be subject to claims of intellectual property infringement by third parties, either of which could have a material adverse effect on our business.

Much of our potential success and value lies in our ownership and use of intellectual property. Our inability or failure to protect our intellectual property may negatively affect our business and value. Our ability to compete effectively is dependent in large part upon the maintenance and protection of the intellectual property we own and licenses from MIT. We will rely on patents, trademarks, trade secret and copyright law, as well as confidentiality procedures to establish and protect our intellectual property rights. It may be possible for a third party to copy or otherwise obtain and use the proprietary technology presently owned by or licensed to us without authorization. Policing unauthorized use of our intellectual property is difficult. The steps we take may not prevent misappropriation of our intellectual property, and the agreements we enter into may not be enforceable. In addition, effective intellectual property protection may be unavailable or limited in some jurisdictions outside the United States. Litigation may be necessary in the future to enforce or protect our intellectual property rights or to determine the validity and scope of the proprietary rights of others. Such litigation could cause us to incur substantial costs and divert resources away from our business, which in turn could have a material adverse effect on our business, results of operations, financial condition and profitability.

9

We may be subject to damaging and disruptive intellectual property litigation.

Although we are not currently aware that our products or services infringe any published patents or registered trademarks, we may be subject to infringement claims in the future. Because patent applications are kept confidential for a period of time after filing, applications may have been filed that, if issued as patents, could relate to our business.

Parties making claims of infringement may be able to obtain injunctive or other equitable relief that could effectively block us from providing its products and services in the United States and other jurisdictions and could cause us to pay substantial damages. In the event of a successful claim of infringement, we may need to obtain one or more licenses from third parties, which may not be available at a reasonable cost, if at all. The defense of any lawsuit could result in time-consuming and expensive litigation, regardless of the merits of such claims, as well as resulting damages, license fees, royalty payments and restrictions on our ability to provide products or services, any of which could harm our business.

Intellectual property rights are difficult to enforce in China, which could harm our business.

Chinese commercial law is relatively undeveloped compared with the commercial law in many of our other major markets and limited protection of intellectual property is available in China as a practical matter. We have formed a joint venture with Ideal Concepts Inc. to commercialize our products in the “Asia Pacific,” including China. Accordingly, any local design, manufacture, distribution or marketing of products that we undertake in China could subject us to an increased risk that unauthorized parties will be able to copy or otherwise obtain or use our intellectual property, which could harm our business. We may also have limited legal recourse in the event we encounter patent or trademark infringers, which could have a material adverse effect on our business and results of operations.

Our business is subject to numerous and evolving state, federal and foreign regulations and we may not be able to secure the government approvals needed to develop and market our products.

Our research and development activities, pre-clinical tests and clinical trials, and ultimately the manufacturing, marketing and labeling of our products, are all subject to extensive regulation by the FDA and foreign regulatory agencies. Pre-clinical testing and clinical trial requirements and the regulatory approval process typically take years and require the expenditure of substantial resources. Further, additional government regulation may be established that could prevent or delay regulatory approval of our product candidates. Delays or rejections in obtaining regulatory approvals would adversely affect our ability to commercialize any product candidates and our ability to generate product revenues or royalties.

The FDA and foreign regulatory agencies require that the safety and efficacy of product candidates be supported through adequate and well-controlled clinical trials. If the results of pivotal clinical trials do not establish the safety and efficacy of our product candidates to the satisfaction of the FDA and other foreign regulatory agencies, we will not receive the approvals necessary to market such product candidates.

Even if regulatory approval of a product candidate is granted, the approval may include significant limitations on the indicated uses for which the product may be marketed. In addition, we are subject to inspections and regulations by the FDA. Medical devices must also continue to comply with the FDA’s Quality System Regulation, or QSR. Compliance with such regulations requires significant expenditures of time and effort to ensure full technical compliance. The FDA stringently applies regulatory standards for manufacturing.

10

We are subject to the periodic inspection of our clinical trials, facilities, procedures and operations and/or the testing of our products by the FDA to determine whether our systems and processes are in compliance with FDA regulations. Following such inspections, the FDA may issue notices on Form 483 and warning letters that could cause us to modify certain activities identified during the inspection. A Form 483 notice is generally issued at the conclusion of an FDA inspection and lists conditions the FDA inspectors believe may violate FDA regulations. FDA guidelines specify that a warning letter is issued only for violations of “regulatory significance” for which the failure to adequately and promptly achieve correction may be expected to result in an enforcement action.

Failure to comply with FDA and other governmental regulations can result in fines, unanticipated compliance expenditures, recall or seizure of products, total or partial suspension of production and/or distribution, suspension of the FDA’s review of product applications, enforcement actions, injunctions and criminal prosecution. Under certain circumstances, the FDA also has the authority to revoke previously granted product approvals. Although we have internal compliance programs, if these programs do not meet regulatory agency standards or if our compliance is deemed deficient in any significant way, it could have a material adverse effect on the Company.

We are also subject to record keeping and reporting regulations, including FDA’s mandatory Medical Device Reporting, or MDR, regulation. Labeling and promotional activities are regulated by the FDA and, in certain instances, by the Federal Trade Commission.

Many states in which we do or in the future may do business or in which our products may be sold impose licensing, labeling or certification requirements that are in addition to those imposed by the FDA. There can be no assurance that one or more states will not impose regulations or requirements that have a material adverse effect on our ability to sell our products.

In many of the foreign countries in which we may do business or in which our products may be sold, we will be subject to regulation by national governments and supranational agencies as well as by local agencies affecting, among other things, product standards, packaging requirements, labeling requirements, import restrictions, tariff regulations, duties and tax requirements. There can be no assurance that one or more countries or agencies will not impose regulations or requirements that could have a material adverse effect on our ability to sell our products.

Failure to comply with applicable regulatory requirements, can result in, among other things, warning letters, fines, injunctions and other equitable remedies, civil penalties, recall or seizure of products, total or partial suspension of production, refusal of the government to grant approvals, pre-market clearance or pre-market approval, withdrawal of approvals and criminal prosecution of the Company and its employees, all of which would have a material adverse effect on our business.

We could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act.

Our business operations in countries outside the United States, for example through our Chinese joint venture, may be subject to anti-corruption laws and regulations, including restrictions imposed by the Foreign Corrupt Practices Act (the “FCPA”). The FCPA and similar anti-corruption laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business. We cannot provide assurance that our internal controls and procedures will always protect us from criminal acts committed by our employees or third parties with whom we work. If we are found to be liable for violations of the FCPA or similar anti-corruption laws in international jurisdictions, either due to our own acts or out of inadvertence, or due to the acts or inadvertence of others, we could suffer from criminal or civil penalties which could have a material and adverse effect on our results of operations, financial condition and cash flows.

11

The success of our products may be harmed if the government, private health insurers and other third-party payors do not provide sufficient coverage or reimbursement.

Our current and future revenues are subject to uncertainties regarding health care reimbursement and reform. Our ability to commercialize our new cancer treatment system successfully will depend in part on the extent to which reimbursement for the costs of such products and related treatments will be available from government health administration authorities, private health insurers and other third-party payors. The reimbursement status of newly approved medical products is subject to significant uncertainty. We cannot guarantee that adequate third-party insurance coverage will be available for us to establish and maintain price levels sufficient for us to realize an appropriate return on our investment in developing new therapies. Government, private health insurers, and other third-party payors are increasingly attempting to contain health care costs by limiting both coverage and the level of reimbursement for new therapeutic products approved for marketing by the FDA. Accordingly, even if coverage and reimbursement are provided by government, private health insurers, and third-party payors for uses of our products, market acceptance of these products would be adversely affected if the reimbursement available proves to be unprofitable for health care providers. We may be unable to sell our products on a profitable basis if third-party payers deny coverage, or provide low reimbursement rates.

Our products may not achieve sufficient acceptance by the medical community to sustain our business.

Although we have received a PMA from the FDA for our Prolieve system for the treatment of BPH, we can offer no assurance that the Prolieve system will be accepted by the medical community widely. Our breast cancer treatment development project using the APA technology is currently in Phase III clinical trials. It may prove not to be effective in practice. If testing and clinical practice do not confirm the safety and efficacy of our systems or, even if further testing and practice produce positive results but the medical community does not view these new forms of treatment as effective and desirable, our efforts to market our new products may fail, with material adverse consequences to our business.

We face intense competition and the failure to compete effectively could adversely affect our ability to develop and market our products.

There are many companies and other institutions engaged in research and development of various technologies, both for prostate disease and cancer treatment products that seek treatment outcomes similar to those that we are pursuing. We believe that the level of interest by others in investigating the potential of possible competitive treatments and alternative technologies will continue and may increase. Potential competitors engaged in all areas of BPH and cancer treatment research in the United States and other countries include, among others, major pharmaceutical, specialized technology companies, and universities and other research institutions. Most of our competitors and potential competitors have substantially greater financial, technical, human and other resources, and may also have far greater experience, than do we, both in pre-clinical testing and human clinical trials of new products and in obtaining FDA and other regulatory approvals. One or more of these companies or institutions could succeed in developing products or other technologies that are more effective than the products and technologies that we have been or are developing, or which would render our technology and products obsolete and non-competitive. Furthermore, if we are permitted to commence commercial sales of any of our products, we will also be competing, with respect to manufacturing efficiency and marketing, with companies having substantially greater resources and experience in these areas.

12

If we become subject to product liability claims, we may be required to pay damages that exceed our insurance coverage and the value of our assets.

We currently carry product liability insurance in the amount of $5,000,000 per occurrence, which may be inadequate to satisfy liabilities we may incur. Any claim brought against us, regardless of its merit, could result in the increase of our product liability insurance rates or our inability to obtain future coverage on acceptable terms, or at all. In addition, if our product liability coverage is inadequate to pay a damage award, we would have to pay any shortfall out of our assets, which may be insufficient, or by securing additional funds, of which there can be no assurance. Even a meritless or unsuccessful product liability claim made against us could harm our reputation, cause us to incur significant legal fees and result in the diversion of management’s attention from managing our business. Any of these occurrences or events would have a material adverse effect on our business.

Our newly formed joint venture with Ideal Concepts Inc. could cause us to effectively transfer rights to our technology in major markets in Asia, and to lose rights to sell and market our products in Asia.

We recently formed a joint venture with Ideal Concept Inc. As a new business, this joint venture is subject to a variety of risks including, without limitation, obtaining adequate financing to operate the business, recruiting management with expertise to market, promote, and produce products and having the capability of obtaining required regulatory approvals from various foreign governments in order sell products. Pursuant to the terms of our joint venture, our equity ownership in the joint venture can be reduced, and eventually eliminated, if we are unable to contribute financing to it in the future. This is a distinct possibility because of our current financial condition, and also because we will be borrowing funds from Ideal Concept Inc. to enable us to contribute a portion of the funds required to be invested by us in the joint venture. In addition, our right to receive royalties from the sale of products by the joint venture will prove to be worthless if there are no sales.

We could have disagreements with Ideal Concepts Inc. over the territory covered by the joint venture, and over other key aspects of the joint venture.

The territory covered by the joint venture is described as “Asia Pacific”, which is not defined in the agreement. In addition, other important aspects, terms and conditions of the joint venture are absent or unclear in the agreement establishing the joint venture. Accordingly, we could have disagreements with Ideal Concepts Inc. over rights and responsibilities of Ideal Concepts Inc. and us, as well as on other issues. If not resolved, these issues could have adverse consequences on the joint venture, make it difficult or impossible to sell products, result in litigation and cause us to incur substantial liabilities.

Damage to our reputation, for whatever reason, could have a material adverse effect on our business.

Our ability to market and sell Prolieve, APA 1000 and new products in major world markets, including the United States, could be adversely affected in the future by negative publicity resulting from, among others, the joint venture, adverse regulatory decisions by international bodies related to our products, controversy surrounding our products and the businesses activities of the joint venture, litigation arising from the joint venture and use of products, over which we will have very little, if any, control.

We have elected to use the extended transition period for complying with new or revised accounting standards.

Pursuant to Section 107(b) of the United States Jumpstart Our Business Startups Act, enacted on April 5, 2012 (the “JOBS Act”), we have elected to use the extended transition period for complying with new or revised accounting standards for an “emerging growth company.” This election will permit, but not require, us to delay the adoption of new or revised accounting standards that will have different effective dates for public and private companies until those standards apply to private companies. Consequently, our financial statements may not be comparable to companies that comply with public company effective dates.

13

Our Shares are deemed to be “Penny Stocks,” which means that there are significant restrictions on stockbrokers and dealers recommending our Shares for purchase.

Our common stock is considered to be a “penny stock” pursuant to the rules promulgated under Section 15(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result, our securities are subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in the sale of shares of penny stock to persons other than established customers or “accredited investors” (as such term is defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”)). Under such rules, a broker-dealer must, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the SEC, which specifies information about penny stocks and the nature and significance of risks of the penny stock market. A broker-dealer must also provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer, and sales person in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from the penny stock rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for stock that is subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules may discourage investor interest in and limit the marketability of our securities, and limit the current investors’ ability to sell their shares of our common stock.

We may never pay dividends.

We have never declared or paid any dividends on our Shares since our inception. We do not intend to pay cash dividends on our Shares for the foreseeable future, and currently intend to retain any future earnings to fund the development and growth of our business. The payment of cash dividends, if any, on the Shares will rest solely within the discretion of our board of directors and will depend, among other things, upon our earnings, capital requirements, financial condition, and other relevant factors. We currently intend to use any revenues, as well as proceeds from any financings, to assist us in obtaining our business objectives, and not for the payment of any dividends upon our Shares.

Shareholders may suffer dilution of the value of their Shares by our issuance of additional Shares in the future.

As of March 31, 2015, we have outstanding debt, warrants and options that are convertible or exchangeable into 137,043,719 Shares. Additionally, we have plans to sell and issue additional Shares, or other securities that are convertible into Shares, in the future, in order to raise funds and for other purposes. The issuance of additional Shares, whether through the conversion of convertible notes, the exercise of warrants or options, or an issuance of Shares in connection with a financing, will dilute our current shareholders’ ownership in the Company, and will reduce shareholders’ voting power proportionally.

Future sales of Shares, securities convertible into Shares, and other securities may negatively affect our stock price.

Future sales of Shares and/or other securities that are convertible into Shares could have a significant negative effect on the market price of our Shares, and the number of Shares outstanding could increase substantially. This increase, in turn, could dilute future earnings per share. Dilution and the availability of a large amount of securities for sale, and the possibility of additional issuances and sales of Shares or other classes of securities may negatively affect both the trading price and liquidity of our Shares.

14

The market for our Shares is, and may continue to be, limited and highly volatile, which may generally affect any future price of our Shares.

The lack of an orderly market for our common stock may negatively affect the volume of trading and market price for our common stock.

Historically, the volume of trades for our Shares has been limited. Moreover, the prices at which our Shares have traded have fluctuated widely on a percentage basis. There can be no assurance as to the prices at which our Shares will trade in the future, although they may continue to fluctuate significantly. Prices for our Shares will be determined in the marketplace and may be influenced by many factors, including, without limitation, the following:

| | • | | the depth and liquidity of the markets for our Shares; |

| | • | | investor perception of the Company and the industry in which we participate; |

| | • | | general economic and market conditions; |

| | • | | statements or changes in opinions, ratings or earnings estimates made by brokerage firms or industry analysts relating to the market in which we do business or relating to us specifically, as has occurred in the past; |

| | • | | quarterly variations in our results of operations; |

| | • | | general market conditions or market conditions specific to technology industries; and |

| | • | | domestic and international macroeconomic factors. |

An active trading market for the Shares may not exist in the future. Even if a market for our Shares continues to exist, investors may not be able to resell their Shares at or above the purchase price for which such investors purchased such Shares.

In addition, the stock market has recently experienced extreme price and volume fluctuations. These fluctuations are often unrelated to the operating performance of the specific companies. As a result of the factors identified above, a stockholder (due to personal circumstances) may be required to sell its Shares at a time when our stock price is depressed due to random fluctuations, possibly based on factors beyond our control.

| Item 4. | Information on the Company. |

Emerging Growth Company Status

We are an “emerging growth company” as defined in section 3(a) of the Exchange Act, as amended by the United States Jumpstart Our Business Startups Act, enacted on April 5, 2012 (the “JOBS Act”), and will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which we have total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the SEC) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act; (c) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a ‘large accelerated filer’, as defined in Exchange Act Rule 12b–2.

15

Generally, a company that registers any class of its securities under section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act, a management report on internal controls over financial reporting and, subject to an exemption available to companies that meet the definition of a “smaller reporting company” in Exchange Act Rule 12b-2, an auditor attestation report on management’s assessment of internal controls over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report in our annual reports filed under the Exchange Act, even if we do not qualify as a “smaller reporting company”. In addition, section 103(a)(3) of the Sarbanes-Oxley Act of 2002 has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from any rules of the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the company.

Any U.S. domestic issuer that is an emerging growth company is able to avail itself to the reduced disclosure obligations regarding executive compensation in periodic reports and proxy statements, and to not present to its shareholders a nonbinding advisory vote on executive compensation, obtain approval of any golden parachute payments not previously approved, or present the relationship between executive compensation actually paid and our financial performance. As a foreign private issuer, we are not subject to such requirements, and will not become subject to such requirements even if we were to cease to be an emerging growth company.

As a reporting issuer under the securities legislation of the Canadian provinces of Ontario, British Columbia, and Alberta, we are required to comply with all new or revised accounting standards that apply to Canadian public companies. Pursuant to Section 107(b) of the JOBS Act, an emerging growth company may elect to utilize an extended transition period for complying with new or revised accounting standards for public companies until such standards apply to private companies. We have elected to utilize this extended transition period. However, while we have elected to utilize this extended transition period, our audited consolidated financial statements as of March 31, 2015 reflect the adoption of all required accounting standards for public companies.

| | A. | History and development of the company. |

General

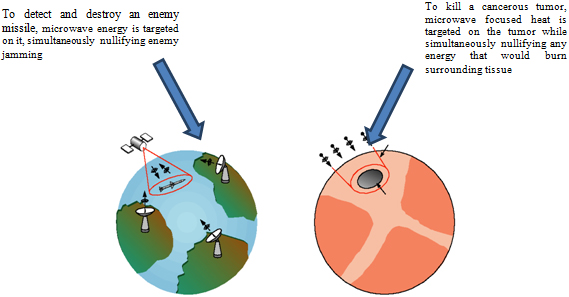

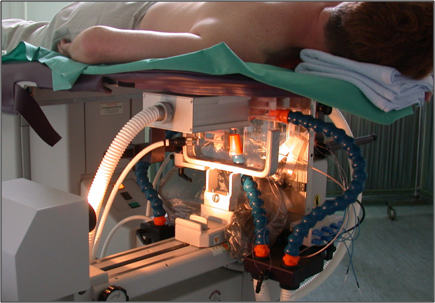

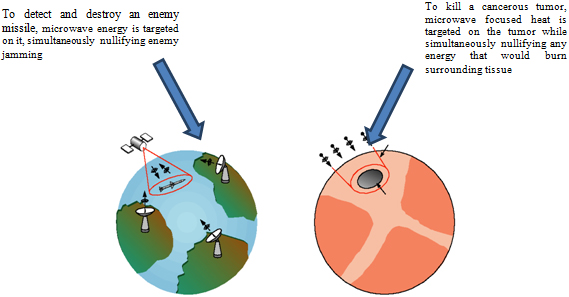

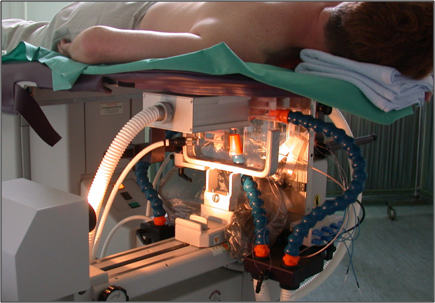

We are in the business of developing and selling medical device systems that deliver precisely focused, microwave-generated heat to diseased tissue, thereby destroying or shrinking it. We have developed two thermotherapy platforms for delivering this heat. The first platform delivers heat via a catheter that is inserted through a body opening directly to the diseased tissue. The catheter is attached to a modular, free-standing unit that generates controls and monitors the heat delivery. We refer to this platform as our “Endo-thermotherapy platform.” Our Prolieve Thermodilation System (“Prolieve”), utilized for the treatment of BPH, discussed below, uses this method. The Prolieve system has been commercialized and we are currently generating limited revenues from it.

Our second thermotherapy platform delivers heat to the diseased tissue via microwave beams delivered from outside of the body. The beams are precisely focused on the diseased tissue by utilizing sophisticated identification and targeting technology which we have licensed from MIT. This technology was originally developed at MIT as part of the United States’ “Star Wars” missile shield defense system, but we have adapted this technology for use in our products. With this method of heat delivery, a fine needle probe is inserted into the targeted tissue using conventional radio frequency positioning technology. This probe acts as a receptor for the microwave generated heat beams that are delivered to the targeted tissue from a module incorporating the MIT technology. We refer to this technology of heat delivery as our Adaptive Phased Array or “APA platform”. Our APA 1000 system for the treatment of

16

breast cancer, discussed below, uses this technology. APA 1000 has not been approved for use by the FDA to treat locally advanced tumors in breast cancer patients. We have completed Phase I and Phase II clinical trials for APA 1000. We have begun conducting pivotal Phase III clinical trial, but the progress of the clinical trials has been slow due to insufficient funding. Subject to the availability of funds, we plan to fully resume the pivotal Phase III clinical trial during the current fiscal year.

We believe that our two focused heat technology platforms can provide the design basis for the future development of additional cancer treatment systems for surface, subsurface and deep internal localized and regional cancers. We also believe that our technology platforms could form the basis for us to develop new therapeutic systems in the future that may (i) prevent breast cancer, and (ii) have cosmetic applications in treating cellulite and minimally invasive liposuction.

History

Our business was started by Dr. Augustine Cheung, our President and Chief Executive Officer, as an outgrowth of his academic interest and work in the field of microwave technology and the thermotherapy treatment of disease while he was a professor at the University of Maryland and George Washington University. In 1982, he founded A.Y. Cheung Associates Inc. to pursue this work. A.Y. Cheung Associates Inc. changed its name to Cheung Laboratories, Inc. in 1984, and Cheung Laboratories Inc. subsequently changed its name to Celsion Corporation (“Celsion”) in 1998.

At Celsion, Dr. Cheung began developing technologies for the treatment of BPH and breast cancer using thermotherapy technology, leading to the development and commercialization of the Prolieve system for the treatment of BPH. In 2007, Celsion sold the Prolieve system and technology to Boston Scientific Corporation (“Boston Scientific”) for $60 million. Dr. Cheung also began developing the APA 1000 system for the treatment of breast cancer. The rights to key elements of APA 1000 were licensed from MIT pursuant to an Exclusive Patent License Agreement (“Patent License Agreement”) dated October 24, 1997.

In 2005 Celsion transferred all its interest in this license and other rights to APA 1000 to its wholly-owned subsidiary, Celsion (Canada) Limited (“Celsion Canada”). On January 16, 2006, Dr. Cheung resigned from Celsion’s board of directors and his position as Celsion’s Chief Scientific Officer, and purchased Celsion Canada for $20,000,000 (Canadian dollars). The purchase price was paid by issuing: (a) a personal $1.5 million promissory note; and (b) an $ 18.5 million royalty payable at the rate of 5% of the net sales on sales of products developed using APA technology, once such products become commercialized. The $1.5 million promissory note was secured by 1,508,050 shares of Celsion’s common stock. After Dr. Cheung’s default on payment of the promissory note, Celsion agreed in 2009 with Dr. Cheung to retain the 1,508,000 shares of Celsion’s common stock that it held as security in full satisfaction of the $1.5 million promissory note.

Medifocus Inc. was incorporated on April 25, 2005 under the Business Corporations Act (Ontario) as a CPC. Under Canadian law, a CPC is a newly created Canadian company having no assets, other than cash, which is permitted to conduct an initial public offering of its securities (“IPO”) and obtain a listing of its shares on the TSXV. A CPC may then uses the funds raised in the IPO to identify and evaluate assets or businesses which, when acquired, qualify the CPC for listing as a regular issuer on the TSXV.

On June 29, 2006 Medifocus Inc., completed its IPO on the TSXV of 4,600,000 shares at a price of $0.20 (Canadian dollars) per share receiving gross proceeds of $920,000 (Canadian dollars). In order to gain improved access to funding, Medifocus Inc. engaged in a share exchange offer with Celsion Canada in 2008 pursuant to which Celsion Canada became a wholly-owned subsidiary of Medifocus.

17

Concurrently with the exchange offer, Medifocus completed a private placement of units, receiving gross proceeds of $2 million (Canadian dollars). In addition, Medifocus issued 903,112 shares to Celsion at a deemed value of $0.50 (Canadian dollars) per share, in partial satisfaction of an approximate $600,000 (Canadian dollars) liability that was owed to Celsion. After the completion of the share exchange transaction, we continued our development of the APA 1000 technology for the treatment of breast cancer. Phase I and Phase II clinical trials were originally completed by Celsion. Subsequently, the Company received approvals from both the FDA and the Canadian Bureau of Medical Devices to conduct a pivotal Phase III breast cancer treatment study. We have begun the pivotal Phase III clinical trials but, such trials have been proceeding at a slow pace due to lack of funding. We plan to complete the pivotal Phase III trial when funding is available.

The Patent License Agreement with MIT was amended on June 16, 2007. The amended agreement requires us to pay MIT a 5% royalty on the net sales of any products derived from APA 1000, and an annual maintenance fee of $50,000. MIT is entitled to receive royalties for so long as the patents relating to the APA technology are valid or the Patent License Agreement is terminated.

On July 24, 2012 we acquired the Prolieve technology and related assets from Boston Scientific pursuant to an Asset Purchase Agreement dated June 25, 2012, amended on July 24, 2012 (the “Asset Purchase Agreement”). The purchase price was $3,662,115, of which $2,535,610 was paid on the closing of the transaction. Additionally, we entered into a contingent consideration arrangement under which we will pay Boston Scientific up to $2,500,000, to be paid in quarterly installments at a rate of 10% of the sales of Prolieve products. Sales are defined as the gross amount invoiced for sales, distributions, licenses, leases, transfers, and other dispositions. At March 31, 2015, approximately 2,190,867 remains payable to Boston Scientific under the contingent consideration arrangement, $728,632 of which is past due.

See the information contained in the subsection titled “Our Products” of the section titled “B. Business Overview,” below.

As a medical technology company, all of our products marketed in the United States are regulated by the FDA. The FDA has established extensive rules, policies and procedures regarding the approval of new products and technologies for use in the United States. Generally, the FDA requires that a new technology undergo controlled human studies to determine safety and efficacy before the technology can be marketed and sold. Typically, such studies are conducted in three separate clinical trials, Phase I and Phase II to establish safety and efficacy on a modest sized sample, leading to a larger pivotal Phase III trial. We operate in a highly competitive environment, our business is speculative in nature, and we face substantial risks and challenges. Please refer to “Risk Factors” in “Item 3. Key Information.”

Our Products

Prolieve

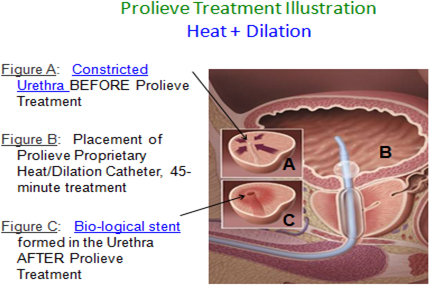

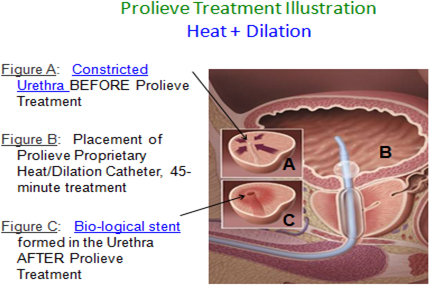

Our first commercial heat-based therapy system, Prolieve, is used to treat benign prostatic hyperplasia or “BPH.” BPH is a condition in which the prostate gland becomes enlarged and restricts the flow of urine through the urethra. Our clinical studies have shown that the treatment of this condition with the Prolieve system improves urine flow by decreasing the enlarged prostate’s pressure on the urethra through the heating, dilation and shrinking of the prostate tissue surrounding it. The BPH drug therapy market is estimated to be about $4 billion in major developed countries according to Decision Resources Group.

18

This number does not include non-drug treatments and the patients who are on “Watchful Waiting” due to the side effects of some of the treatment options. While the market for minimally invasive BPH treatment is approximately $150 million according to Medtech Insight, we believe that Prolieve can be a viable alternative to drug therapy due to its safety and efficacy profiles and thus has the potential to increase the market for minimally invasive BPH treatment.

What Is Benign Prostatic Hyperplasia?

Millions of aging men experience symptoms resulting from BPH, a non-cancerous urological disease in which the prostate enlarges and constricts the urethra. The prostate is a walnut-sized gland surrounding the male urethra that produces seminal fluid and plays a key role in sperm preservation and transportation. The prostate frequently enlarges with age. As the prostate expands, it compresses or constricts the urethra, thereby restricting the normal passage of urine. This restriction may require a patient to exert excessive bladder pressure to urinate. Because urination is one of the body’s primary means of cleansing impurities, the inability to urinate adequately increases the possibility of infection and bladder and kidney damage.

BPH Symptoms

The symptoms of BPH usually involve problems with emptying the bladder or storing urine in the bladder. However, the severity of the symptoms can vary widely, from mild and barely noticeable to serious and disruptive. Common BPH symptoms include:

| | • | | Pushing or straining to begin urination; |

| | • | | Dribbling after urination; |

| | • | | A frequent need to urinate, sometimes every 2 hours or less; |

| | • | | A recurrent, sudden, or uncontrollable urge to urinate; |

| | • | | Feeling the bladder has not completely emptied after urination; |

| | • | | Pain during urination; and |

| | • | | Waking at night to urinate. |