Exhibit 99.1

MEDIFOCUS INC.

FORM 51-102FI

Management Discussion and Analysis

for the three and six months ended

September 30, 2015

November 30, 2015

1

1. Introduction

The following sets out the Management’s Discussion and Analysis (“MD&A”) of the financial position and results of operations for the three and six months ended September 30, 2015 of Medifocus Inc. (the “Company”, “Medifocus” or we). The MD& should be read in conjunction with the Company’s condensed interim consolidated financial statements for the three and six months ended September 30, 2015 and 2014. All dollar amounts are presented in United States dollars unless otherwise noted. The functional currency of the Company and its subsidiary is the United States dollar, and the presentation currency is the United States dollar. Additional information relating to the Company is available on SEDAR atwww.sedar.com.

Forward-Looking Statements

This management’s discussion and analysis may contain statements that are “Forward-looking Statements”. These include statements about the Company’s expectations, beliefs, plans, objectives and assumptions about future events or performance. These statements are often, but not always, made through the use of words or phrases such as “will likely result”, “are expected to”, “will continue”. “anticipate”, “believes”, “estimate”, “intend”, “plan”, “would”, and “outlook” or statements to the effect that actions, events or results “will”, “may”, “should” or “would” be taken, occur or be achieved. Forward-looking statements are not historical facts, and are subject to a number of risks and uncertainties beyond the Company’s control. Accordingly, the Company’s actual results could differ materially from those suggested by these forward-looking statements for various reasons discussed throughout this analysis. Forward-looking statements are made on the basis of the beliefs, opinions, and estimates of the Company’s management on the date the statements are made and, other than in compliance with applicable securities laws, the Company does not undertake any obligation to update forward-looking statements if the circumstances or management’s beliefs, opinions or estimates should change. Readers should not place undue reliance on forward-looking statements.

2. Reporting currency

Effective April 1, 2014, the Company changed is reporting and functional currency from the Canadian dollar to the U.S. dollar in anticipation of filing its financial statements with the U.S. Securities and Exchange Commission.

3. Overview of Financial Performance

The Company recognized revenues of $2,261,370 for the six months ended September 30, 2015. This is a decrease of $29,796 compared to the same six month period of 2014, a decrease of 1.30%. During FY 2015, the Company re-examined its Prolieve sales and costs structure since acquiring the Prolieve business from Boston Scientific Corporation in July 2012. Sales had been developing steadily, but management found that profitability was marginal in some of the sales territories. Management concluded that the Company must refocus the allocation of resources and improve the Prolieve business’ operational efficiency by implementing the following:

| | • | | Create a more efficient sales organization by eliminating less productive sales positions, particularly in territories with high service costs. |

| | • | | Support our customer base in a more profit-oriented sales model with the goal to improve gross margin and profitability. |

| | • | | Grow new accounts by using hybrid mobile service technicians to supplement the sales team. |

| | • | | Focus on major metropolitan markets that generally provide higher margins and require less servicing costs |

| | • | | Re-evaluate uneconomical remote accounts to reduce travel and servicing costs. |

The restructuring involved a reduction of 65% of our sales force. As a result the Company experienced a significant decrease in revenue from Prolieve during the last three quarters of FY 2015 and the first two quarters of FY 2016. However, we expect revenues to stabilize in the remainder of FY 2016 and in FY 2017.

The cost of sales for the six months ended September 30, 2015 was $1,644,972 a decrease of $310,002 for the same period of 2014. Gross margin was 27.3% for the six month period, an increase of 12.6% for the same period ended September 30, 2014. The increase in the gross profit margin is due to the Company’s restructuring of the Prolieve business as the company continues to experience less costs related to mobile sales.

2

During the year ended March 31, 2014, Medifocus created Medifocus Holding Limited, together with Ideal Concept Group Limited to develop our Prolieve business and APA technology in Asia Pacific. Medifocus owns 40% of Medifocus Holdings Limited and Idea Concept Group holds 60%. Medifocus Holdings Limited will evaluate opportunities in Asia Pacific; engage in clinical testing and obtaining approval from China Food and Drug Administration of the People’s Republic of China (“CFDA”) for all products relating to Prolieve and the APA technology.

Medifocus Holdings Limited is required to pay Medifocus a royalty of 5% of the first $10,000,000 in sales of the catheter kits and control units utilized in the Prolieve business. After $10,000,000 in sales has been reached, the royalty decreases to 3%. For all other products developed by Medifocus, Holdings Ltd. is required to pay Medifocus royalty of 7.5% on net sales of such products.

4. Company History and Business

Our business was started by Dr. Augustine Cheung, our President and Chief Executive Officer, as an outgrowth of his academic interest and work in the field of microwave technology and the thermotherapy treatment of disease while he was a professor at the University of Maryland and George Washington University. In 1982, he founded A.Y. Cheung Associates Inc. to pursue this work. A.Y. Cheung Associates Inc. changed its name to Cheung Laboratories, Inc. in 1984, and Cheung Laboratories Inc. subsequently changed its name to Celsion Corporation (“Celsion”) in 1998.

At Celsion, Dr. Cheung began developing technologies for the treatment of BPH and breast cancer using thermotherapy technology, leading to the development and commercialization of the Prolieve system for the treatment of BPH. In 2007, Celsion sold the Prolieve system and technology to Boston Scientific Corporation (“Boston Scientific”) for $60 million. Dr. Cheung also began developing the APA 1000 system for the treatment of breast cancer. The rights to key elements of APA 1000 were licensed from MIT pursuant to an Exclusive Patent License Agreement (“Patent License Agreement”) dated October 24, 1997.

In 2005 Celsion transferred all its interest in this license and other rights to APA 1000 to its wholly-owned subsidiary, Celsion (Canada) Limited (“Celsion Canada”). On January 16, 2006, Dr. Cheung resigned from Celsion’s board of directors and his position as Celsion’s Chief Scientific Officer, and purchased Celsion Canada for $20,000,000 (Canadian dollars). The purchase price was paid by issuing: (a) a personal $1.5 million promissory note; and (b) an $ 18.5 million royalty payable at the rate of 5% of the net sales on sales of products developed using APA technology, once such products become commercialized. The $1.5 million promissory note was secured by 1,508,050 shares of Celsion’s common stock. After Dr. Cheung’s default on payment of the promissory note, Celsion agreed in 2009 with Dr. Cheung to retain the 1,508,000 shares of Celsion’s common stock that it held as security in full satisfaction of the $1.5 million promissory note.

Medifocus Inc. was incorporated on April 25, 2005 under the Business Corporations Act (Ontario) as a CPC. Under Canadian law, a CPC is a newly created Canadian company having no assets, other than cash, which is permitted to conduct an initial public offering of its securities (“IPO”) and obtain a listing of its shares on the TSXV. A CPC may then uses the funds raised in the IPO to identify and evaluate assets or businesses which, when acquired, qualify the CPC for listing as a regular issuer on the TSXV.

On June 29, 2006 Medifocus Inc., completed its IPO on the TSXV of 4,600,000 shares at a price of $0.20 (Canadian dollars) per share receiving gross proceeds of $920,000 (Canadian dollars). In order to gain improved access to funding, Medifocus Inc. engaged in a share exchange offer with Celsion Canada in 2008 pursuant to which Celsion Canada became a wholly-owned subsidiary of Medifocus. Concurrently with the exchange offer, Medifocus completed a private placement of units, receiving gross proceeds of $2 million (Canadian dollars). In addition, Medifocus issued 903,112 shares to Celsion at a deemed value of $0.50 (Canadian dollars) per share, in partial satisfaction of an approximate $600,000 (Canadian dollars) liability that was owed to Celsion. After the completion of the share exchange transaction, we continued our development of the APA 1000 technology for the treatment of breast cancer. Phase I and Phase II clinical trials were originally completed by Celsion. Subsequently, the Company received approvals from both the FDA and the Canadian Bureau of Medical Devices to conduct a pivotal Phase III breast cancer treatment study. We have begun the pivotal Phase III clinical trials but, such trials have been proceeding at a slow pace due to lack of funding. We plan to complete the pivotal Phase III trial when funding is available.

3

The Patent License Agreement with MIT was amended on June 16, 2007. The amended agreement requires us to pay MIT a 5% royalty on the net sales of any products derived from APA 1000, and an annual maintenance fee of $50,000. MIT is entitled to receive royalties for so long as the patents relating to the APA technology are valid or the Patent License Agreement is terminated.

On July 24, 2012 we acquired the Prolieve technology and related assets from Boston Scientific pursuant to an Asset Purchase Agreement dated June 25, 2012, amended on July 24, 2012 (the “Asset Purchase Agreement”). The purchase price was $3,662,115, of which $2,535,610 was paid on the closing of the transaction. Additionally, we entered into a contingent consideration arrangement under which we will pay Boston Scientific up to $2,500,000, to be paid in quarterly installments at a rate of 10% of the sales of Prolieve products. Sales are defined as the gross amount invoiced for sales, distributions, licenses, leases, transfers, and other dispositions. As of September 30, 2015, approximately $1,944,450 remains payable to Boston Scientific under the contingent consideration arrangement, $917,002 of which is past due.

Our Products

1. The Prolieve Thermodilatation System

Prolieve is used to treat benign prostatic hyperplasia or “BPH.” BPH is a condition in which the prostate gland becomes enlarged and restricts the flow of urine through the urethra. Our clinical studies have shown that the treatment of this condition with the Prolieve system improves urine flow by decreasing the enlarged prostate’s pressure on the urethra through the heating, dilation and shrinking of the prostate tissue surrounding it. The BPH drug therapy market is estimated to be about $4 billion in major developed countries according to Decision Resources Group. This number does not include non-drug treatments and the patients who are on “Watchful Waiting” due to the side effects of some of the treatment options. While the market for minimally invasive BPH treatment is approximately $150 million according to Medtech Insight, we believe that Prolieve can be a viable alternative to drug therapy due to its safety and efficacy profiles and thus has the potential to increase the market for minimally invasive BPH treatment.

What Is Benign Prostatic Hyperplasia?

Millions of aging men experience symptoms resulting from BPH, a non-cancerous urological disease in which the prostate enlarges and constricts the urethra. The prostate is a walnut-sized gland surrounding the male urethra that produces seminal fluid and plays a key role in sperm preservation and transportation. The prostate frequently enlarges with age. As the prostate expands, it compresses or constricts the urethra, thereby restricting the normal passage of urine. This restriction may require a patient to exert excessive bladder pressure to urinate. Because urination is one of the body’s primary means of cleansing impurities, the inability to urinate adequately increases the possibility of infection and bladder and kidney damage.

BPH Symptoms

The symptoms of BPH usually involve problems with emptying the bladder or storing urine in the bladder. However, the severity of the symptoms can vary widely, from mild and barely noticeable to serious and disruptive. Common BPH symptoms include:

| | • | | Pushing or straining to begin urination; |

| | • | | Dribbling after urination; |

| | • | | A frequent need to urinate, sometimes every 2 hours or less; |

| | • | | A recurrent, sudden, or uncontrollable urge to urinate; |

| | • | | Feeling the bladder has not completely emptied after urination; |

| | • | | Pain during urination; and |

| | • | | Waking at night to urinate. |

In extreme cases, a man may be completely unable to urinate. In such situations, emergency medical attention is required.

4

An enlarged prostate does not cause prostate cancer or directly affect sexual function. However, many men experience sexual dysfunction and BPH symptoms at the same time. This is due to aging and the common medical conditions older men often encounter, including vascular disease and diabetes. Because all of these conditions take place with aging, sexual dysfunction tends to be more pronounced in men with BPH.

BPH Complications

BPH is not a form of prostate cancer and does not lead to prostate cancer. Accordingly, BPH is not life-threatening. However, as many men know, BPH may be lifestyle-threatening and can cause great discomfort, inconvenience, and awkwardness and complications such as:

| | • | | Acute urinary retention, which is a condition that results in a complete inability to urinate. A tube called a catheter may be needed to drain urine from the bladder. |

| | • | | Chronic urinary retention, which is a partial blockage of urine flow that causes urine to remain in the bladder. In rare cases, this may lead to kidney damage if it goes undiagnosed for too long. |

| | • | | Urinary tract infection, which can cause pain or burning during urination, foul-smelling urine, or fever and chills. |

| | • | | Other complications from BPH may include bladder stones or bladder infections. |

| | • | | Having BPH does not directly affect one’s sexual function. However, it is common for the symptoms of BPH and sexual dysfunction to occur at the same time. |

Prevalence of BPH and Market Opportunity

BPH is an age-related disorder the incidence of which increases with maturation of the population. According to urologyhealth.org, by age 60, more than half of men have BPH. By age 85, about 90 percent of men have BPH. As the population continues to age and life expectancy increases, the prevalence of BPH can be expected to continue to increase.

Treatment Alternatives for BPH

Several types of treatments are available for enlarged prostate. They include medications, surgery and minimally invasive surgery. The best treatment choice for patients depends on several factors, including how much the symptoms bother them, the size of their prostate, other health conditions the patients may have, their age and preference. If symptoms are not severe, a patient may decide not to have treatment and wait to see whether their symptoms become more bothersome over time.

Watchful Waiting

When a patient first develops symptoms caused by BPH, physicians generally prescribe drugs as the first treatment option, but usually leave the decision to their patients. Due to the low success rate, high costs, side effects and complications associated with BPH drug therapies, some patients diagnosed with BPH prefer to be regularly monitored by their doctors, but choose not to begin a drug therapy. The patients who opt out of therapy fall into a group referred to as “watchful waiting.” Often, BPH symptom persistence and worsening or an acute urinary event may force the patient to move on to some other form of therapy.

Drug Therapy

Medications are the most common treatment for moderate symptoms of prostate enlargement but if a patient stops taking medicine, the symptoms will usually return. Medications used to relieve symptoms of enlarged prostate include several different types of drugs, such as Alpha-Blockers (such as Flomax®) and Alpha Reductase Inhibitors (such as Proscar®). Drug therapy costs approximately $1,000 per year or more in the United States, must be maintained for life, and does not offer consistent relief to a large number of BPH patients. Many of the currently available BPH drugs also have appreciable side effects, such as: headache, fatigue, impotence, dizziness, and low blood pressure.

Surgical Intervention

Two of the primary surgical procedures to treat BPH are transurethral resection of the prostate (“TURP”) and laser procedures. TURP has traditionally been a common procedure for enlarged prostate for many years. It is a procedure in which the prostatic urethra and surrounding diseased tissue in the prostate are trimmed with a telescopic knife, thereby widening the urethral channel for urine flow. While the TURP procedure generally has

5

been considered the most effective treatment available for the relief of BPH symptoms, the procedure has its shortcomings. In the first instance, TURP generally requires from one to three days of post-operative hospitalization. In addition, a substantial percentage, approximately 5-10%, of patients who undergo TURP encounters significant complications, which can include painful urination, infection, impotence, incontinence, and excessive bleeding. Further, retrograde ejaculation, a condition in which semen released during ejaculation enters the bladder rather than exiting the penis, occurs in up to 90% of patients who undergo a TURP procedure, with a long-term side effect in up to 75% of such patients.

Laser surgeries (also called laser therapies) use high-energy lasers to destroy or remove overgrown prostate tissue. Options for laser therapy depend on prostate size, the location of the overgrown areas. During prostate laser surgery, a combined visual scope and laser is inserted through the tip of the patient’s penis into the urethra, which is surrounded by the prostate. Using the laser, doctors remove prostate tissue that are squeezing the urethra and blocking urine flow, thus making a new larger tube for urine to pass through. Lasers use concentrated light to generate precise and intense heat. Risks of laser surgery include: temporary difficulty urinating and post treatment catheterization, urinary tract infection, narrowing of the urethra as scars form, retrograde ejaculation, and erection problems. Accordingly, neither drug therapies nor the surgical alternatives appear to provide fully satisfactory, cost-effective treatment solutions for BPH sufferers.

Our Approach: The Prolieve Thermodilatation System

The Prolieve Thermodilatation System was originally and primarily developed and commercialized by our current management, product development, clinical and regulatory teams. Such development occurred while such teams were employed at Celsion Corporation from 1997 to 2004, at an estimated cost of $20,000,000. Further, the development and commercialization occurred under the leadership of Dr. Augustine Cheung, who was Celsion’s president at the time. Dr. Cheung is currently our chief executive officer. As discussed above, Celsion sold the Prolieve system, technology and related assets to Boston Scientific Corporation in 2007 for $60 million. In June 2012, Medifocus reached an agreement with Boston Scientific for the purchase of all of the assets of its Prolieve business, including all Prolieve inventory, the mobile service distribution assets, as well as the intellectual property associated with the Prolieve technology.

Prolieve is an in-office procedure that minimizes patient discomfort and the need for post-treatment catheterization. In a randomized one-year clinical trial, conducted at 14 centers across the United States, patients undergoing treatment with Prolieve achieved measurably greater improvement in symptoms after three months compared to a control group using a drug, Proscar, which is commonly prescribed to treat BPH condition.

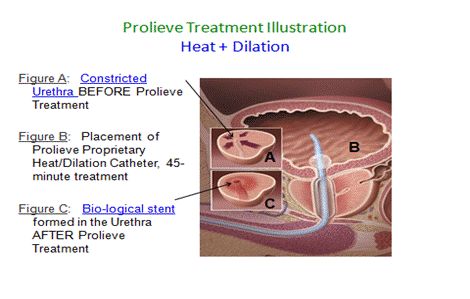

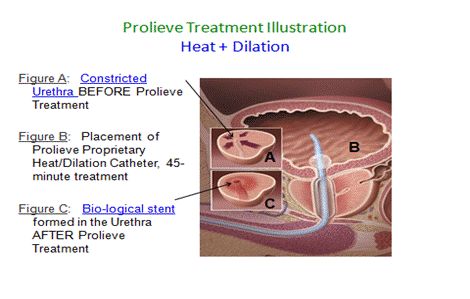

The purpose of the Prolieve system is to provide a relatively painless and effective alternative to drug therapy and certain types of surgical procedures to treat the symptoms of BPH. Prolieve is a minimally invasive treatment option for BPH. Unlike other microwave-based BPH treatments, Prolieve utilizes both microwave heat, delivered via a catheter, and proprietary balloon compression to both heat the prostate and dilate the prostatic urethra, and to shrink enlarged prostate tissue. The 45-minute Prolieve treatment is administered on an outpatient basis in a physician’s office and can be done with topical anesthesia only. We estimate that over 100,000 patients have been treated since the FDA PMA was granted. Many patients treated with Prolieve experience immediate symptom relief. Based upon a study conducted by Boston Scientific (the “Prolieve Study”), patients treated with the Prolieve system experienced a symptom reduction of 22% three days following treatment. Furthermore, most patients that undergo the Prolieve treatment do not require post-treatment catheterization. Based upon the Prolieve Study, 94% of patients that underwent the Prolieve treatment were catheter free immediately following the treatment, and 100% of such patients were catheter free after three days. Accordingly, we believe that patients that undergo the Prolieve treatment should be able to resume their normal activities shortly after the treatment.

The Prolieve system is comprised of two components. The first component is a freestanding module that contains a microwave generator and computerized controls that regulates and monitors the delivery of heat to the enlarged prostate tissue. The second component is our proprietary disposable catheter that is attached to the module. This component contains an internal balloon that is inflated after it is inserted through the urethra to the point of constriction. Upon inflation of the balloon, the tissue is heated by microwaves delivered via the catheter, resulting in dilation of the urethra. Our computer system in the module monitors and regulates the heat being applied to ensure maximum safety and efficiency. The Prolieve system is covered by 55 core patents, which were acquired as part of the acquisition of the Prolieve assets from Boston Scientific Corporation in 2012.

6

The combined effect of this “heat plus compression” therapy is twofold: first, the heat denatures the proteins in the wall of the urethra, causing a stiffening of the opening created by the inflated balloon, forming a biological stent. Second, the heat serves effectively to kill off prostate cells outside the wall of the urethra, thereby creating sufficient space for the enlarged natural opening. In addition, the Prolieve system’s temperature (46º C to 54º C) is sufficient to kill prostatic cells surrounding the urethra wall, thereby creating space for the enlargement of the urethra opening. However, the relatively low temperature is not sufficient to cause swelling in the urethra.

The Prolieve system is designed with patients’ needs and comfort in mind. In general, it does not require sedation or post-operative catheterization and provides rapid symptomatic relief from BPH. BPH patients can be treated using Prolieve in urologic offices throughout the United States. In addition, the Prolieve treatment is also made available to physicians utilizing our nationwide mobile service.

The Prolieve system is currently in use in the United States. Although it is generating revenue, (gross revenues of $2,261,370 for the six months ended September 30, 2015) our Prolieve operations are not, and have never been profitable, and there can be no assurance that they will ever become profitable.

Since acquiring the Prolieve assets from Boston Scientific Corporation in July 2012, we have been concentrating our corporate development efforts on developing these assets into a business. We are focusing on increasing sales from our installed base of systems, and from our mobile systems, described below. We have been increasing the number of persons directly supporting our Prolieve operations from eight in July 2012 to twenty-one at September 30, 2015. The Prolieve operations are currently supported by three sales professionals, eleven mobile technicians, one schedule coordinator, three persons responsible for regulatory compliance matters, and three engineering and support staff.

Boston Scientific Corporation had sold approximately 250 Prolieve systems and approximately 80,000 disposable catheter kits in the United States prior to Boston Scientific Corporation’s sale of the Prolieve assets to us in 2012. Our current business strategy is to increase revenues from these installed systems. In the U.S. market, we do not intend to actively market the Prolieve system itself but, rather, our strategy is to grow revenue through the direct sale of disposable catheter kits to physicians with Prolieve systems installed and, increasingly, through our mobile service, which eliminates physicians’ need to purchase, and learn how to operate, the Prolieve system. However, if U.S. or international customers choose to purchase the Prolieve system itself, we will accommodate such costumers’ needs to the best of our ability.

We currently have approximately 120 systems that were acquired as part of the Prolieve asset purchase from Boston Scientific Corporation. We do not currently have an agreement with a manufacturer for the production of additional Prolieve systems, although we believe that there are several qualified medical device contract manufacturers, including Sanmina, that are capable of manufacturing the system if our current inventory is depleted. At this time, 100% of our revenues come from the sales of our disposable catheters used in each treatment or the provision of mobile services that provide therapy using our disposable catheters. The disposable catheters are manufactured in Mexico by Lake Region Medical Center, formerly known as Accelent Corporation. We currently have an

7

agreement with Lake Region Medical Center to supply these catheters, pursuant to which we order the number of catheters we estimate we will need for a 12-month period. We have no other source of catheters at the present time. Due to the complicated nature of these kits, as well as FDA manufacturing standards imposed on suppliers, the Company does not believe that an alternate supplier of catheters is readily available.

In addition to the Prolieve technology, the installed base of Prolieve systems and related patents acquired from Boston Scientific Corporation, we also acquired a fleet of 15 vans, each equipped with two Prolieve systems. This mobile fleet allows us to provide Prolieve therapy to patients whose health care providers do not have access to one of our permanently installed systems. The mobile Prolieve system is identical to the permanently installed systems.

Our mobile Prolieve systems are deployed by our dispatcher and scheduler upon the request of a physician. Our scheduler then coordinates the timing of the requested appointment with one of our medical technicians. On the day of the appointment, our medical technician arrives at the physician’s office and the Prolieve module is brought into the physician’s office. Under the physician’s supervision, a catheter is inserted into the urethra to the point of constriction, and the Prolieve treatment is administered by our medical technician under the physician’s supervision. In most cases, the patient’s symptoms are eliminated immediately and normal urination bladder function is restored.

Competition

There are several treatment options for BPH. The first is traditional surgery, known as trans-urethral resection procedure, or “TURP.” This surgery requires a hospital stay, sedation, and a post-operative recovery period. Further, we are aware of two other minimally invasive, microwave-based, treatments with which we compete. The first such treatment is offered by Urologix. The second is offered by Thermatrix. Unlike these two treatments, which solely utilize heat, our Prolieve therapy combines heat and compression (via the inflated balloon).

According to Medtech Insight, the surgical and minimally invasive treatment market for BPH is approximately $150 million in the U.S. However, the majority of BPH patients undergoing treatment today choose medical therapy instead of surgery. Pursuant to such medical therapy, patients take daily doses of medicine to shrink the prostate in order to improve function. These medicines are known to cause side effects, and must be taken daily to be effective. We believe our Prolieve treatment can be a viable alternative to drug therapy due the demonstrated efficacy and side effect profile. We intend to explore the possibility of delivering the Prolieve treatment using our mobile service at general practitioners’ offices to provide a treatment option for BPH patients who are in drug therapy and patients on “Watchful Waiting”.

Prescribed medicines for BPH treatment in major industrialized countries is currently believed to be approximately $4 billion annually. These medicines are manufactured and sold by some of the world’s largest pharmaceutical companies, including Eli Lilly, Glaxo Smith Kline and Merck & Co. These companies market their drugs to physicians and directly to the public through television, radio, the internet and conventional print media. With the substantial investment made by these companies in developing, commercializing and marketing these drugs, and the size of the BPH treatment market, these companies represent a significant competitive threat to our Prolieve therapy, and to our company. We are also aware that non-prescription herbal supplements promoted to relieve BPH symptoms are being aggressively marketed to the public; these products also compete with Prolieve.

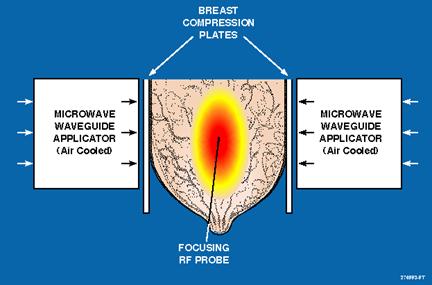

2.Adaptive Phased Array Technology (APA 1000)

The APA 1000, which is a minimally invasive breast cancer treatment, is developed, but has not been cleared by the FDA for commercial use. Both Phase I and Phase II clinical trials were completed by Celsion, establishing the system’s safety and efficacy on a limited scale. We have begun pivotal Phase III clinical trials, but have proceeded slowly in such trials because of insufficient funds. We are planning to complete the pivotal Phase III clinical trial of APA 1000 when we obtain adequate funding to do so. The Phase III clinical trial is designed to demonstrate that the combination of focused heat and neo-adjuvant chemotherapy could shrink the size of the tumor 40% more over using chemotherapy alone. In the Phase II clinical trial, a 50% increase in tumor size reduction using focused heat and neo-adjuvant chemotherapy was observed over using chemotherapy alone. In the Phase II trial, two heat treatments were applied while in the Phase III trial, three heat treatments are applied. We believe that, if the Phase III trial is successful, it will show that the combination of focused heat and neo-adjuvant chemotherapy could downsize a cancer tumor enough to allow a surgeon to perform a lumpectomy rather than a mastectomy, thereby preserving the affected breast.

The APA 1000 system delivers heat precisely to breast tumors. While using heat to kill cancerous tumors has been considered effective for many years, heat therapy has not become a part of standard treatment for cancer because of the inability to safely apply it to tumors without damaging healthy tissue. When treating cancer, physicians seek to

8

minimize damage to healthy tissue. It is our belief that the APA 1000 system precisely focuses microwave heat on diseased tissue, sparing adjacent tissue. Precision is achieved through the utilization of “Star Wars” technology that we have exclusively licensed from MIT and have adapted for medical use in our APA 1000 system.

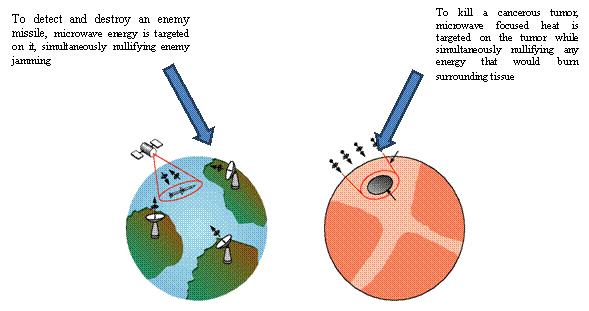

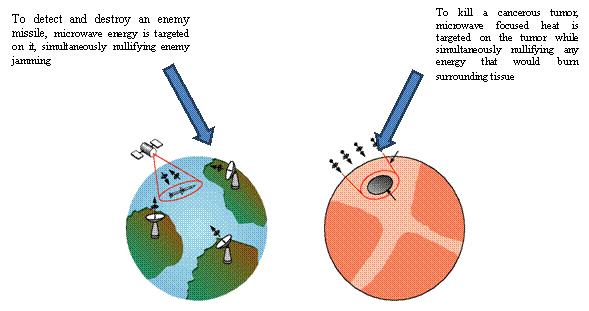

Adaptive Phased Array Technology Illustration

Our current management team has been working with researchers at Massachusetts Institute of Technology (“MIT”) who had developed, originally for the U.S. Department of Defense, a microwave control technology known as “Adaptive Phased Array,” or “APA.” This technology permits properly designed microwave devices to focus and concentrate energy targeted at diseased tissue areas deep within the body and to heat them selectively, without adverse impact on surrounding healthy tissue. Since licensing the APA technology from MIT, our management team has been working together with Dr. Alan J. Fenn, the inventor of the patented technology. This collaboration has included technology transfer and technical/engineering assistance to develop and design our current APA Breast Cancer treatment device. In addition, Dr. Fenn has collaborated and advised the Company on the design of the clinical protocol, clinical study support, and device usage training of the current FDA breast cancer study as well as assisting the Company in developing new clinical protocol and new treatment devices using the APA technology licensed from MIT.

In the treatment of breast cancer, the APA technology applies the same principal used in MIT’s “Star Wars” program of detecting missiles.

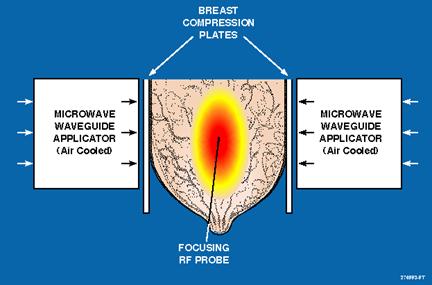

APA 1000 Breast Cancer Treatment Illustration

| | • | | An RF needle probe inserted at tumor center provides feedback signal to focus microwave energy at tumor center to induce shrinkage without harming surrounding tissue. |

| | • | | Focused microwave energy (43-44°C) combined with chemotherapy achieves an average of 88% tumor size reduction in Phase II clinical trials. |

9

Treatment with APA 1000 may accomplish several objectives. First, we believe that it destroys many cancer cells, and substantially shrinks cancerous cells that are not destroyed. If tumors are shrunk small enough, a patient may not need to have the entire breast removed. Second, we believe that the application of APA 1000 heat therapy boosts the effectiveness of subsequent chemotherapy and radiation therapy.

There can be no assurance that we will complete the pivotal Phase III clinical trial, or that the FDA will approve of the APA 1000 for sale in the United States. Even if the APA 1000 successfully completes the pivotal Phase III clinical trial and the FDA permits us to sell this system, there can be no assurance that it will be adopted by health care industry.

As stated earlier, we are progressing at a slow pace through Phase III clinical trials due to lack of funding, and are currently focusing our corporate activities and resources on expanding our Prolieve operations. We estimate that the cost of completing Phase III clinical trials will be approximately $7,500,000. We currently plan, subject to obtaining financing, to fully resume of the pivotal Phase III trial during the present calendar year, although there can be no assurance we will resume clinical trials.

10

Further, in anticipation of commencing the pivotal Phase III clinical trial, we previously negotiated arrangements with physicians and medical centers in the United States and Canada to conduct this trial. Because the pace of the trial has been slow, there can be no assurance that the persons and institutions with which we have previously made arrangements will be available to proceed on the same terms, or at all, when we are ready. In such event, we would then need to make alternative arrangements, of which there can be no assurance.

5. Going Concern

The Company’s operations are subject to certain risks and uncertainties including, among others, current and potential competitors with greater resources, dependence on significant customers, lack of operating history and uncertainty of future profitability and possible fluctuations in financial results. Since inception, the Company has incurred substantial operating losses, principally from expenses associated with the Company’s research and development, financing activities, and development of new technologies. The Company believes these expenditures are essential for the commercialization of its technologies. The Company expects its operating losses to continue for the foreseeable future as it continues its product development efforts and undertakes its sales and marketing activities. Due to continued substantial operating losses, there is substantial doubt regarding the Company’s ability to continue as a going concern. The Company’s ability to achieve profitability is dependent upon its ability to obtain governmental approvals, produce, and market and sell its new product candidates. There can be no assurance that the Company will be able to commercialize its technology successfully or that profitability will ever be achieved. The operating results of the Company have fluctuated significantly in the past. The Company expects that its operating results will fluctuate significantly in the future and will depend on a number of factors, many of which are outside the Company’s control.

The Company will need substantial additional funding in order to complete the development, testing and commercialization of its product candidates. The commitment to these projects will require additional external funding, at least until the Company is able to generate sufficient cash flow from the sale of one or more of its products to support its continued operations. If adequate funding is not available, the Company may be required to delay, scale back or eliminate certain aspects of its operations or attempt to obtain funds through unfavorable arrangements with partners or others that may force it to relinquish rights to certain of its technologies, products or potential markets or that could impose onerous financial or other terms. Furthermore, if the Company cannot fund its ongoing development and other operating requirements, particularly those associated with its obligations to conduct clinical trials under its licensing agreements, it will be in breach of these licensing agreements and could therefore lose its license rights, which could have material adverse effects on its business. Additionally, the Company is not in compliance with the provisions of outstanding debt agreements, and it has not remitted quarterly royalty payments to Boston Scientific Corporation pursuant to the terms of its purchase agreement for Prolieve. The Company has not paid interest owing to certain holders of the convertible debentures, and is in a technical default of the terms of the debentures. The investors have not accelerated the terms of the debenture. Management is continuing its efforts to obtain additional funds through equity financing and through the negotiation of debt agreements to ensure that the Company can meet its obligations and sustain operations.

The financial statements do not include any adjustments relating to recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence.

11

6. Results of Operations

Comparison of Three Months Ended September 30, 2015 and 2014

The table below summarizes our results of operations for the three months ended September 30, 2015 and 2014:

| | | | | | | | |

| | | Three months ending

September 30, | |

| | | 2015 | | | 2014 | |

Sales | | | | | | | | |

Products | | $ | 357,006 | | | $ | 179,855 | |

Services | | | 779,354 | | | | 461,842 | |

| | | | | | | | |

Total Sales | | | 1,136,360 | | | | 641,697 | |

| | | | | | | | |

Costs of Sales | | | | | | | | |

Products | | | 172,977 | | | | 117,576 | |

Services | | | 641,284 | | | | 681,229 | |

| | | | | | | | |

Total Costs of Sales | | | 814,261 | | | | 798,805 | |

| | | | | | | | |

Gross Profit | | | 322,099 | | | | (157,108 | ) |

| | | | | | | | |

Operating Expenses | | | | | | | | |

Research and development | | | 161,903 | | | | 73,226 | |

Sales and marketing | | | 409,530 | | | | 440,962 | |

General and administrative | | | 708,473 | | | | 754,273 | |

| | | | | | | | |

Total Operating Expenses | | | 1,279,906 | | | | 1,268,461 | |

| | | | | | | | |

Loss from Operations | | | (957,807 | ) | | | (1,425,569 | ) |

| | | | | | | | |

Other Income (Expense) | | | | | | | | |

Interest and discount accretion | | | (343,758 | ) | | | (398,204 | ) |

Loss from change in fair value of contingent consideration | | | (44,492 | ) | | | (189,228 | ) |

Net loss from equity method investment | | | — | | | | (55,735 | ) |

Other income (expense) | | | 47,879 | | | | 24,522 | |

| | | | | | | | |

Total Other Income (Expense) | | | (340.371 | ) | | | (618,645 | ) |

| | | | | | | | |

Net Loss | | $ | (1,298,178 | ) | | $ | (2,044,214 | ) |

| | | | | | | | |

Sales

The Company’s revenue from the sale of its Prolieve system products and services increased from $641,697 for the three months ended September 30, 2014 to $1,136,360 for the three months ended September 30, 2015. Product sales in 2015 and 2014 consisted solely of single-use catheters. The increase of 77% was due to a significant decrease in product revenue in 2014 as a result of our restructuring of the Prolieve operation initiated in August 2014.

We anticipate that sales of Prolieve products and service will continue to increase in fiscal year 2016 as a result of our continuing efforts to sell our single-use catheters product and services across the U.S. While we expect single-use catheter product sales to increase in 2016 over the 2015 levels, we expect sales of our mobile services to continue to increase at a somewhat higher rate.

Costs of Good Sold, Costs of Services and Gross Profit

The costs of sales for products primarily include the cost of products sold to customers on a first-in first-out basis, along with amortization expense of our Prolieve intellectual property, warranty costs, warehousing costs, freight and handling charges. Costs of sales for services consist primarily of the cost of products sold to customers on a first-in

12

first-out basis, along with amortization expense of our Prolieve intellectual property, warranty costs, warehousing costs, freight, handling charges, and additionally, costs to provide mobile services to our patients, including depreciation of our mobile consoles and vehicle fleet, payroll, benefit costs and travel expenses.

Costs of products sold as a percentage of product sales was 48% for the three months ended September 30, 2015 as compared to 65% for the three months ended September 30, 2014, and costs of services as a percentage of services sales was 82% for the three months ended September 30, 2015 as compared to 148% for the three months ended September 30, 2014. As a result, total gross profit increased from a negative gross profit of $157,108 for the three months ended September 30, 2014 to a gross profit of $322,099 for the three months ended September 30, 2015. The gross profit related to our product sales increased as fixed amortization expense of our intangible assets had a lesser impact. Gross profit related to our services sales increased due to the Company’s restructuring of the Prolieve business in August 2014. We anticipate that as our sales continue to grow and that our gross margins on both product sales and services will continue to increase as the effect of fixed charges have a relative lesser impact on total margin and the Company strives to be cost effective.

Net Loss

Our net loss of $1,298,178 decreased from our net loss of $2,044,214 for the three months ended September 30, 2015 and 2014, respectively. The decrease in our net loss is due to the increase in our gross profit of approximately $480,000 along with other expenses of approximately $280,000 for the three months ended September 30, 2015 as compared to the same period in 2014.

Research and Development Expenses

For the three months ended September 30, 2015, the Company incurred research and development expenses of $161,903 an increase from the $73,226 for the three months ended September 30, 2014. Research and development expenses for both periods consisted primarily of costs incurred with respect to the Phase III clinical study for our APA 1000 Breast Cancer System, as well as costs related to the Prolieve post-marketing study.

Sales and Marketing Expenses

Sales and marketing expenses include the costs of our sales force (including labor, travel, and other direct marketing expenses) for Prolieve and other business promotion costs.

Sales and marketing expenses for the three months ended September 30, 2015 were $409,530, a decrease of 7% from the three months ended September 30, 2014 expenses of $440,962. The decrease is primarily the result of the restructuring of the Prolieve business in the Company’s efforts to reduce costs by eliminating certain sales positions and scaling back marketing activities and travel expenses. The company continues to monitor sales and marketing costs related to our efforts to the Prolieve business more efficiently.

General and Administrative Expenses

General and administrative expenses for the three months ended September 30, 2015 decreased 6% to $708,473, from the three month ended September 30, 2014 expenses of $754,273, as there was a decrease in legal and accounting fees, corporate salaries and related benefits and consultant fees as the company focused on operating more efficiently. Further, our expenses associated with legal and accounting fees and consulting fees were higher during the three months ended September 30, 2014 because the company was going through the process of initial registration under the Exchange Act. The company will continue to find ways to decrease costs related to corporate expenses.

Other Income (Expense)

Other income (expense) primarily consists of interest and accretion expense, losses from change in the fair value of the contingent consideration. Total other income (expense) of ($340,371) in 2015 reflects a decrease from our total other income (expense) of ($618,645) in September 30, 2014 primarily due to changes in the fair value of the contingent consideration in 2015.

13

Comparison of Six Months Ended September 30, 2015 and 2014

The table below summarizes our results of operations for the six months ended September 30, 2015 and 2014:

| | | | | | | | |

| | | Six months ending

September 30, | |

| | | 2015 | | | 2014 | |

Sales | | | | | | | | |

Products | | $ | 684,694 | | | $ | 1,058,654 | |

Services | | | 1,577,276 | | | | 1,232,512 | |

| | | | | | | | |

Total Sales | | | 2,261,370 | | | | 2,291,166 | |

| | | | | | | | |

Costs of Sales | | | | | | | | |

Products | | | 348,870 | | | | 540,301 | |

Services | | | 1,296,102 | | | | 1,414,673 | |

| | | | | | | | |

Total Costs of Sales | | | 1,644,972 | | | | 1,954,974 | |

| | | | | | | | |

Gross Profit | | | 616,398 | | | | 336,192 | |

| | | | | | | | |

Operating Expenses | | | | | | | | |

Research and development | | | 244,546 | | | | 125,997 | |

Sales and marketing | | | 662,897 | | | | 1,090,337 | |

General and administrative | | | 1,303,470 | | | | 1,598,928 | |

| | | | | | | | |

Total Operating Expenses | | | 2,210,913 | | | | 2,815,262 | |

| | | | | | | | |

Loss from Operations | | | (1,594,515 | ) | | | (2,479,070 | ) |

| | | | | | | | |

Other Income (Expense) | | | | | | | | |

Interest and discount accretion | | | (685,013 | ) | | | (671,848 | ) |

Loss from change in fair value of contingent consideration | | | (81,640 | ) | | | (189,228 | ) |

Net loss from equity method investment | | | — | | | | (55,735 | ) |

Other income (expense) | | | 34,921 | | | | 12,049 | |

| | | | | | | | |

Total Other Income (Expense) | | | (731,732 | ) | | | (904,762 | ) |

| | | | | | | | |

Net Loss | | $ | (2,326,247 | ) | | $ | (3,383,832 | ) |

| | | | | | | | |

Sales

The Company’s revenue from the sale of its Prolieve system products and services decreased from $2,291,166 for the six months ended September 30, 2014 to $2,261,370 for the six months ended September 30, 2015. Product sales in 2015 and 2014 consisted solely of single-use catheters. The slight decrease of total sales for the six months ended September 30, 2015 is due to a significant decrease in product sales of 35.3% offset by increase in service revenue of 28.0% from 2014 as a result of our restructuring of the Prolieve operation initiated in August 2014.

We anticipate that sales of Prolieve products and service will continue to increase in fiscal year 2016 as a result of our continuing efforts to sell our single-use catheters product and services across the U.S. While we expect single-use catheter product sales to increase in 2016 over the 2015 levels, we expect sales of our mobile services to continue to increase at a somewhat higher rate.

Costs of Good Sold, Costs of Services and Gross Profit

The costs of sales for products primarily include the cost of products sold to customers on a first-in first-out basis, along with amortization expense of our Prolieve intellectual property, warranty costs, warehousing costs, freight and handling charges. Costs of sales for services consist primarily of the cost of products sold to customers on a first-in

14

first-out basis, along with amortization expense of our Prolieve intellectual property, warranty costs, warehousing costs, freight, handling charges, and additionally, costs to provide mobile services to our patients, including depreciation of our mobile consoles and vehicle fleet, payroll, benefit costs and travel expenses.

Costs of products sold as a percentage of product sales was 51% for the six months ended September 30, 2015 and September 30, 2014, and costs of services as a percentage of services sales was 82% for the six months ended September 30, 2015 as compared to 115% for the three months ended September 30, 2014. As a result, total gross profit increased from $336,192 for the six months ended September 30, 2014 to $616,398 for the six months ended September 30, 2015. The gross profit percentage related to our product sales remained constant for the six month period ended September 30, 2015. Gross profit related to our services sales increased due to the Company’s restructuring of the Prolieve business in August 2014. We anticipate that as our sales continue to grow, margins on both product sales and services will increase as the effect of fixed charges continue to have a relative lesser impact on total margin.

Net Loss

Our net loss of $2,236,247 decreased from our net loss of $3,383,832 for the six months ended September 30, 2015 and 2014, respectively. The significant decrease in our net loss is due to several factors. The company had completed its restructuring of the Prolieve business noted above, lower general and administrative and sales and marketing expenses in the current year, and decreased losses on the fair value of the contingent consideration offset by increased research and development expenses.

Research and Development Expenses

For the six months ended September 30, 2015, the Company incurred research and development expenses of $244,546 an increase from the $125,997 for the six months ended September 30, 2014. Research and development expenses for both periods consisted primarily of costs incurred with respect to the Phase III clinical study for our APA 1000 Breast Cancer System, as well as costs related to the Prolieve post-marketing study.

Sales and Marketing Expenses

Sales and marketing expenses include the costs of our sales force (including labor, travel, and other direct marketing expenses) for Prolieve and other business promotion costs.

Sales and marketing expenses for the six months ended September 30, 2015 were $662,897, a decrease of 39% from the six months ended September 30, 2014 expenses of $1,090,337. The decrease is primarily the result of the restructuring of the Prolieve business in the Company’s efforts to reduce costs by eliminating certain sales positions and scaling back marketing activities and travel expenses. The company continues to monitor sales and marketing costs related to our efforts to the Prolieve business more efficiently.

General and Administrative Expenses

General and administrative expenses for the six months ended September 30, 2015 decreased 19% to $1,303,470, from the six month ended September 30, 2014 expenses of $1,598,928, as there was a decrease in legal and accounting fees, corporate salaries, payroll costs and consultant fees as the company focused on operating more efficiently. Further, our expenses associated with legal and accounting fees and consulting fees were higher during the six months ended September 30, 2014 because the company was going through the process of initial registration under the Exchange Act. The company will continue to find ways to decrease costs related to corporate expenses.

Other Income (Expense)

Other income (expense) primarily consists of interest and accretion expense, losses from our equity method investments and changes in the fair value of contingent consideration related to our Prolieve acquisition. Total other income (expense) of ($731,732) in 2015 reflects decreased expense from our total other income (expense) of ($904,762) in September 30, 2014 is primarily due to decreased losses in the fair value of the contingent consideration.

15

7. Business Acquisition

On July 24, 2012 the Company purchased from Boston Scientific Corporation all of the assets, and assumed certain liabilities, relating to the Prolieve Thermodilatation System (“Prolieve”), a FDA approved device for the treatment of Benign Prostatic Hyperplasia (“BPH”). The total purchase consideration consisted of the following:

| | | | |

Cash | | $ | 2,535,610 | |

Fair value of contingent consideration | | | 1,126,505 | |

| | | | |

Total consideration | | $ | 3,662,115 | |

| | | | |

The maximum amount payable pursuant to the terms of the contingent consideration is $2.5 million; its fair value was determined by calculating its present value based on its payment terms using an interest rate of 24% (the Company’s estimated unsecured borrowing rate). The contingent consideration is paid quarterly at a rate of 10% of sales of Prolieve products. The fair value of the contingent consideration is adjusted for changes in the estimated future payments with the amount of adjustment reflected in profit or loss.

The Company accounted for its acquisition of Prolieve by recording all tangible assets and intangible assets acquired, and liabilities assumed, at their respective fair values on the acquisition date. The fair value assigned to identifiable intangible assets acquired was determined using a cost approach and was based on the Company’s best estimates; this intangible asset is being amortized on a straight-line basis over its estimated useful life of ten years.

The following summarizes the fair value of the assets acquired assumed in the transaction:

| | | | |

Inventory | | $ | 463,338 | |

Equipment | | | 736,662 | |

Intangible assets | | | 2,462,115 | |

| | | | |

Total consideration | | $ | 3,662,115 | |

| | | | |

8. Medifocus Holding Joint Venture

On November 8, 2013, we entered into an agreement with Ideal Concept Group Limited (“Ideal Concept”) to develop our Prolieve business and APA technology in a geographic area referred to as “Asia Pacific” in the agreement (the “JV Agreement”). The countries comprising of Asia Pacific are not specified in the JV Agreement. Pursuant to the JV Agreement, Medifocus and Ideal Concept agreed to capitalize a company, Medifocus Holding Limited (“Medifocus Holding”), to develop this business. Medifocus Holding was incorporated in the British Virgin Islands on June 28, 2012.

The JV Agreement states that, at the outset, Ideal Concept will own 60% of Medifocus Holding and the Company will own 40%. Through September 30, 2015, Medifocus Inc. has made total contributions to Medifocus Holding of approximately $214,735 in cash and Prolieve equipment. In addition to capital contributions, the shareholders are obligated to provide loans to the JV of up to HKD 4,000,000 (or approximately $520,000). Ideal Concept previously agreed, through November 8, 2014, to loan the Company funds necessary to satisfy our portion of the required shareholder contributions to Medifocus Holding. Such loan would bear interest at 6% per year and be secured by our ownership interest in Medifocus Holding. No such loans were made to us by Ideal Concept and, based on Medifocus Holdings’ current business plan; we do not expect to make any further investments or loans in the joint venture.

Pursuant to the terms of the JV Agreement and a License and Distribution Agreement dated as of November 8, 2013, Medifocus Holding will engage in clinical testing, and obtaining approval from China Food and Drug Administration of the People’s Republic of China (“CFDA”) for all products relating to Prolieve and the APA technology. Medifocus Holding has been in communication with the CFDA and is currently in the process of preparing the required documentation with the CFDA for commercialization of Prolieve in China. There is no assurance that the CFDA will approve Prolieve for commercialization in China. Additionally, Medifocus Holding has been in discussions with several hospitals in China regarding conducting clinical testing. As of the date of this quarterly report, no clinical testing has begun in China.

16

The JV Agreement outlines the respective obligations of Ideal Concept and ourselves. The Company will be responsible for: (i) providing Medifocus Holding with an exclusive license to our rights in the Prolieve business and APA technology; (ii) applying for and maintaining the patents and other intellectual property rights throughout the world; (iii) directing and managing all research and development activities in Asia Pacific; and (iv) providing on-site and off-site technical support and training to Medifocus Holding’s personnel. Ideal Concept’s responsibilities will include: (i) formulating a business plan to evaluate opportunities in Asia Pacific; (ii) assisting in the performance of clinical trials relating to CFDA approval; (iii) providing assistance in establishing manufacturing arrangements for products; and (iv) managing the financial affairs of Medifocus Holding, including the cash flow, arranging funding, and assisting in developing markets in Asia Pacific.

Medifocus Holding is required to pay us a royalty of 5% of the first $10,000,000 in sales of the catheter kits and control units utilized in the Prolieve business. After $10,000,000 in sales has been reached, the royalty decreases to 3%. For all other products we develop, Medifocus Holding is required to pay us a royalty of 7.5% on net sales of such products.

9. Liquidity and capital resources

The Company’s primary cash requirements are to fund operations, including research and development programs and collaborations, to support general and administrative activities, and to fund acquisitions of products or businesses. The Company’s future capital requirements will depend on many factors, including, but not limited to:

| | • | | sales of the Company’s Prolieve products and services; |

| | • | | pricing and payment terms with customers; |

| | • | | costs of raw materials and payment terms with suppliers; |

| | • | | capital expenditures and equipment purchases to support product launches; and |

| | • | | business and product acquisitions. |

In December 2013, the Company raised gross proceeds of $3.6 million from the sale of convertible redeemable promissory notes and warrants (the “Units”). Each Unit consists of (i) a $10,000 face value convertible redeemable promissory note, bearing 8% annual interest and due in three years (“Note”), which is convertible into shares of common stock beginning six months after the Closing Date of the offering at a conversion price of $0.25 per share, and (ii) three-year warrants to purchase 20,000 shares of common stock at a price of $0.30 per Share. The net proceeds from the offering is to be used for Prolieve operations and for general corporate purposes, including research and development activities, capital expenditures, repayment of debt and working capital.

In a second closing in March 2014, the Company issued 200 additional Units to the investors, receiving gross proceeds of $2,000,000. The additional notes are convertible into 8,000,000 shares of common stock. Each warrant entitles the holder to acquire 20,000 common shares (for a total of 4,000,000 common shares) at an exercise price of $0.30 per share and expire on December 18, 2016. The warrants were classified as equity and were recorded as additional paid in capital at their estimated fair value of $572,999.

Our $0.6 million unsecured promissory note made to a lender in July 2012 and the accrued but unpaid interest of $0.2 million as of December 31, 2013, was originally due October 23, 2013. The lender extended the due date of this promissory note to June 30, 2014 and we are currently in discussion with the lender to negotiate a payment plan for this note. During FY 2015, the company made payments towards principal and interest. Subsequent to March 31, 2015 we have made no principal and interest payments to the lender and are currently in negotiations with the lender regarding the extension of the due date. If such negotiations fail, the lender may declare all amounts due and payable immediately. The lender would not have a right to seize any of the Company’s assets because the promissory note is unsecured. Further, if the lender were to retain counsel or initiate litigation to enforce its rights and interests under the promissory note, the Company would be required to pay all reasonable costs and expenses of the lender.

In the fiscal year ending March 31, 2015, the Company raised approximately $1.6 million from the sale of Units. Each Unit was priced at $0.16 and consists of one Share, and a detachable stock purchase warrant to purchase one Share at $0.25 per share.

The Company extends credit to customers on an unsecured basis and payment terms are typical 30 days from delivery or service. The Company’s receivables have increased significantly since its acquisition of Prolieve in July 2012 as a result of increasing sales of Prolieve products and services. Management uses the aging account method to assess the company’s allowance for doubtful accounts. The aging method uses the number of days outstanding the underlying invoices have been past due. Receivables are written off when it is determined that the underlying invoices are uncollectible. The Company maintained an allowance for doubtful accounts of $60,569 as of September 30, 2015.

17

The Company will need substantial additional funding in order to complete the development, testing and commercialization of its product candidates. The commitment to these projects will require additional external funding, at least until the Company is able to generate sufficient cash flow from sale of one or more of its products to support its continued operations. If adequate funding is not available, the Company may be required to delay, scale back or eliminate certain aspects of its operations or attempt to obtain funds through unfavorable arrangements with partners or others that may force it to relinquish rights to certain of its technologies, products or potential markets or that could impose onerous financial or other terms. Furthermore, if the Company cannot fund its ongoing development and other operating requirements, particularly those associated with its obligations to conduct clinical trials under its licensing agreements, it will be in breach of these licensing agreements and could therefore lose its license rights, which could have material adverse effects on its business. Management is continuing its efforts to obtain additional funds so that the Company can meet its obligations and sustain operations.

We do not have any committed sources of financing and cannot give assurance that alternate funding will be available in a timely manner, on acceptable terms or at all. We may need to pursue dilutive equity financings, such as the issuance of shares of common stock, convertible debt or other equity-linked securities, which financings could dilute the percentage ownership of our current common stockholders and could significantly lower the market value of our common stock.

Our cash and cash equivalents of approximately $374,799 on hand at September 30, 2015 are not sufficient to fund operations through September 30, 2016. We estimate that the external funding requirement for the next 12 months will be approximately $8 million to grow the Prolieve business in the U.S. and internationally, to accelerate the APA 1000’s Phase III clinical trials, and to start the research and development activities in the heat-activated immunotherapy business that the Company intends to pursue. We will need to raise substantial additional capital in the near future to fund our planned future operations beyond 2015, and we anticipate that such financing transactions will likely be dilutive to our current shareholders. If we are not able to raise additional capital, we will need to take certain measures to reduce our operating costs, including reducing our staff, curtailing our research and development efforts and our clinical trials, and reducing the costs we plan spend to grow our Prolieve business. As such, we would not be able to maintain the growth of the Prolieve business, complete the development, testing and commercialization of our product candidates.

Net Cash Used In Operations

Net cash used in operating activities was $905,925 for the six months ended September 30, 2015 compared to $1,952,429 during the six months ended September 30, 2014. The reduction in the use of cash in 2015 of approximately $1,046,000 is primarily due to the decrease in net loss, an increase in the Company’s accounts payable balances in 2015 compared to significant decreases in accounts payable in 2014 offset by an increases in our inventory levels.

Net Cash Provided by/Used in Investing Activities

Net cash used in investing activities for the six months ended September 30, 2015 and 2014 was $0 and $26,355, respectively, as there were limited investing transactions in both periods.

Net Cash Used in Financing Activities

Net cash provided by financing activities was $1,265,786 for the six months ended September 30, 2014. During the six months ended September 30, 2014, the company received financing of approximately $1,400,000 offset by principal payments of approximately $178,000 on notes payable. There was no financing activity for the six months ended September 30, 2015.

18

10. Risk Factors

An investment in shares of our common stock (which we refer to as the “Shares”) involves a high degree of risk. You should carefully consider the risks described below and the risks described elsewhere in this quarterly report under the sections entitled “Item 4. Information on the Company” before deciding whether to invest in our shares. The following is a summary of the risk factors that we believe are most relevant to our business. These are factors that, individually or in the aggregate, could cause our actual results to differ significantly from anticipated or historical results. The occurrence of any of the risks could harm our business and cause the price of our common stock to decline, and investors may lose all or part of their investment. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties. The risks and uncertainties described below and in the incorporated documents are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occurs, our business, financial condition and results of operations would suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Special Note Regarding Forward-Looking Statements” at the beginning of Part I of this interim report. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

We have a history of significant losses and expect to continue such losses for the foreseeable future.

Since our inception in 2005, our expenses have substantially exceeded our revenues, resulting in continuing losses and an accumulated deficit of $29,226,562 at September 30, 2015. In addition, our net loss for the six month period ended September 30, 2015 was $2,326,247. Such operating losses are the result of our commitment to continuing our product research, development and commercialization programs, which is only partially offset by limited revenues from the sale of our Prolieve system and related disposables. We expect to continue to experience significant operating losses unless and until we generate significant revenue from Prolieve, as well as the development of other new products and these products have been clinically tested, approved by the FDA or other regulatory authorities, and successfully commercialized.

We may not be able to generate significant revenue for the foreseeable future.

Since 2005, we have devoted our resources to developing the APA 1000, but we will not be able to market the APA 1000 until we have completed clinical testing and obtained all necessary governmental approvals. On July 26, 2012, we acquired from Boston Scientific Corporation the Prolieve Thermodilatation system business for the treatment of BPH and, since that time, we have assembled a sales and service team to market the Prolieve system. All of our current revenue is derived from sales of our Prolieve control units and more importantly, our single-use treatment catheters and treatments delivered through our mobile service. There can be no assurance as to how much revenue will be generated by Prolieve sales. Our lack of product diversification means that we may be negatively affected by changes in market conditions and in regulation (including regulation affecting reimbursement for our products). In addition, at the present time our APA 1000 system is still in clinical testing stage and cannot be marketed until we have completed clinical testing and obtained necessary governmental approval. Accordingly, our revenue sources are, and will remain extremely limited until and unless our Prolieve system is marketed successfully and/or until our other new products are clinically tested, approved by the FDA or other regulatory authorities, and successfully commercialized. We cannot guarantee that our products will be successfully tested, approved by the FDA or other regulatory authorities, or commercialized, successfully or otherwise, at any time in the foreseeable future, if at all.

Our future is dependent upon our ability to obtain additional financing. If we do not obtain such financing, we may have to cease our operations and investors could lose their entire investment.

We have yet to operate profitably or generate positive cash flows from operations, and there is no assurance that we will operate profitably or will generate positive cash flow in the future. As a result, we have very limited funds, and such funds may not be adequate to take advantage of current, planned and unanticipated business opportunities. Even if our funds prove to be sufficient to pursue current, planned and unanticipated business opportunities, we may not have enough capital to fully develop such opportunities.

Further, our capital requirements relating to the manufacturing and marketing of our products have been, and will continue to be, significant. We are dependent on the proceeds of future financing in order to continue in business and to develop and commercialize proposed products. There can be no assurance that we will be able to raise the additional capital resources necessary to permit us to pursue our business plan. Finally, the continued growth of our business may require additional funding from time to time to be used by us for general corporate purposes, such as acquisitions, investments, repayment of debt, capital expenditures, repurchase of capital stock and additional purposes identified by the Company.

19

Accordingly, our ultimate success may depend upon our ability to raise additional capital. There can be no assurance that any additional financing will be available to us. As additional capital is needed, we may not be able to obtain additional equity or debt financing. Even if financing is available, it may not be available on terms that are favorable or acceptable to us, or in sufficient amounts to satisfy our requirements. Any inability to obtain additional financing will likely have a material adverse effect on our business operations, and could result in the loss of your entire investment.

Our independent registered public accountants have expressed substantial doubt regarding our ability to continue as a going concern.

Our auditors have expressed their opinion that there is substantial doubt about the Company’s ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of these uncertainties. Our ability to continue as a going concern is dependent upon our ability to successfully raise adequate additional financing and our ability to successfully develop our sales and marketing programs and commence our planned operations. We cannot assure you that we will be able to obtain additional financing or achieve profitability in our operations. Our failure to obtain additional financing or achieve profitability in our operations could require the Company to liquidate our business interests, and could result in the loss of your entire investment.

Our decision to not have a full-time Chief Financial Officer may negatively affect our business and operations.

Our Chief Financial Officer (or “CFO”) serves only on a part-time basis and may be subject to conflicts of interest. The CFO devotes a portion of his working time to other business endeavors, which may lead to conflicts of interest, including deciding how much time to devote to our affairs. The CFO position is critical to our operations, and our failure to fill this position on a full-time basis may negatively impact our business and operations. It may also lead to the late filing of financial reports and other required disclosures, or the filing of noncompliant financial reports and other required disclosures, which could have numerous consequences, including administrative proceedings by the Securities and Exchange Commission (the “SEC”), claims under Section 10 of the Exchange Act and, if our Shares become listed on a national exchange, cease trade orders or the de-listing of the Shares on such exchange. Further, having a part-time CFO has, and may continue to, negatively impact the effectiveness of our disclosure controls and our internal controls over financial reporting. No assurances can be given that our CFO will transition to a full-time basis, or that we will be able to identify or afford a full-time qualified candidate for this position.

We operate with de-centralized management, and may be unable to hire additional personnel to support, manage and control our operations.

Our CFO performs his functions for us on a part-time, non-exclusive basis, and resides in Toronto, Canada. Further, we believe that we are understaffed and need to hire additional personnel to support, manage and control our operations in order to operate optimally. In the past, the combination of not having our CFO at our headquarters and being understaffed have contributed to the late filing of financial reports in Canada. These late filings resulted in temporary cease trade orders being issued, and a multi-month suspension of trading of our shares on the Toronto Venture Exchange (the “TSXV”). Although the Company has recently hired a qualified outside accounting consultant to minimize this risk. Until we become profitable or obtain additional financing, these factors will persist, raising the risk in the future of us making late filings of financial reports in Canada and in the U.S., and having our Shares suspended from trading. Moreover, until we can afford to hire additional staff, we will continue to operate with less than optimal support, management and control of our operations. The Company recently hired a qualified outside accounting consultant to provide support to our management and CFO, but we cannot assure you that such efforts will effectively minimize such risks. If we continue to operate with de-centralized management and insufficient staffing, it may have a material adverse effect on our business.

We identified a material weakness in our internal control over financial reporting that could affect the reliability of our financial statements and have other adverse consequences.

We identified a material weakness in our internal control over financial reporting as of March 31, 2015. We determined that a material weakness existed because we did not employ a sufficient number of qualified accounting personnel to ensure all required adjustments are made to the Company’s books which would allow for the preparation and presentation of the Company’s financial statements in conformity with accounting principles generally accepted in the United States of America.

20