MEDIFOCUS INC.

FORM 51-102FI

Management Discussion and Analysis

for the three months ended June 30, 2019

August 29, 2019

The following sets out the Management’s Discussion and Analysis (“MD&A”) of the financial position and results of operations for the three months ended June 30, 2019 of Medifocus Inc. (the “Company”, “Medifocus” or“we”). The MD&Ais dated August 29, 2019 andshould be read in conjunction with the Company’sunauditedcondensed interim consolidated financial statements for the three months ended June 30, 2019 and 2018. All dollar amounts are presented in United States dollars unless otherwise noted. The functional currency of the Company and its subsidiary is the United States dollar, and the presentation currency is the United States dollar. Additional information relating to the Company is available on SEDAR atwww.sedar.com.

Forward-Looking Statements

This management’s discussion and analysis may contain statements that are “Forward-looking Statements”. These include statements about the Company’s expectations, beliefs, plans, objectives and assumptions about future events or performance. These statements are often, but not always, made through the use of words or phrases such as “will likely result”, “are expected to”, “will continue”. “anticipate”, “believes”, “estimate”, “intend”, “plan”, “would”, and “outlook” or statements to the effect that actions, events or results “will”, “may”, “should” or “would” be taken, occur or be achieved. Forward-looking statements are not historical facts, and are subject to a number of risks and uncertainties beyond the Company’s control. Accordingly, the Company’s actual results could differ materially from those suggested by these forward-looking statements for various reasons discussed throughout this analysis. Forward-looking statements are made on the basis of the beliefs, opinions, and estimates of the Company’s management on the date the statements are made and, other than in compliance with applicable securities laws, the Company does not undertake any obligation to update forward-looking statements if the circumstances or management’s beliefs, opinions or estimates should change. Readers should not place undue reliance on forward-looking statements.

Reporting currency

Effective April 1, 2014, the Company changed is reporting and functional currency from the Canadian dollar to the U.S. dollar in anticipation of filing its financial statements with the U.S. Securities and Exchange Commission;

| 2. | Overview of Financial Performance |

The Company recognized revenues of $562,068 for the three months ended June 30, 2019, a decrease of $175,322, or 24%, compared to the same three-month period of 2018. The decrease of total sales is primarily due to the $144,783 decrease in direct product sales. The Prolieve disposal kit supply delayed caused by parts shortage in June 2019 had contributed to the reduction of certain sales during the quarter. Additionally, the insurance reimbursement rates were reduced during the end of FY 2019 and several of our service sales prices were reduced.Our sales had declined in general since the initial cost cutting measures were implemented in August 2014 when the Company started to gradually eliminate sales positions and mobile services in areas where there was low demand and ultimately not profitable. The emerging of other BPH treatment options have also affected our business negatively. As the result of the cost reduction measures implemented,our operating expenses were reduced significantly over the last five years, from $4,651,973 for the fiscal year ended March 31, 2015 to $4,494,867 for the fiscal year ended March 31, 2016 and from $1,996,188 for the fiscal year ended March 31, 2017 to $1,593,789 for the fiscal year ended March 31, 2018. Our operating expenses for the year ended March 31, 2019 were further reduced to $1,358,208 from $1,593,789 for the year ended March 31, 2018.

The Company realized a$116,587 increaseinloss from operation for the three months ended June 30, 2019 from the same period a year ago, largely caused by lower gross profit due to lower sales and reduced sales prices for our product and higher general and administration expenses which were caused by an increase in legal expenses.

The cost of sales for the three months ended June 30, 2019 was $387,390. Gross margin was 31%, changed from 32% a year ago.

| 3. | Company History and Business |

Our business was started by Dr. Augustine Cheung, our former Chief Executive Officer, as an outgrowth of his academic interest and work in the field of microwave technology and the thermotherapy treatment of disease while he was a professor at the University of Maryland and George Washington University. In 1982, he founded A.Y. Cheung Associates Inc. to pursue this work. A.Y. Cheung Associates Inc. changed its name to Cheung Laboratories, Inc. in 1984, and Cheung Laboratories Inc. subsequently changed its name to Celsion Corporation (“Celsion”) in 1998.

At Celsion, Dr. Cheung and his team began developing technologies for the treatment of BPH and breast cancer using thermotherapy technology, leading to the development and commercialization of the Prolieve® system for the treatment of BPH. In 2007, Celsion sold the Prolieve® system and technology to Boston Scientific Corporation (“Boston Scientific”) for $60 million. Dr. Cheung also began developing the APA 1000 system for the treatment of breast cancer. The rights to key elements of APA 1000 were licensed from MIT pursuant to an Exclusive Patent License Agreement (“Patent License Agreement”) dated October 24, 1997.

In 2005 Celsion transferred all its interest in this license and other rights to APA 1000 to its wholly-owned subsidiary, Celsion (Canada) Limited (“Celsion Canada”). On January 16, 2006, Dr. Cheung resigned from Celsion’s board of directors and his position as Celsion’s Chief Scientific Officer, and purchased Celsion Canada for $20,000,000 (Canadian dollars). The purchase price was paid by issuing: (a) a personal $1.5 million promissory note; and (b) an $ 18.5 million royalty payable at the rate of 5% of the net sales on sales of products developed using APA technology, once such products become commercialized. The $1.5 million promissory note was secured by 1,508,050 shares of Celsion’s common stock. After Dr. Cheung’s default on payment of the promissory note, Celsion agreed in 2009 with Dr. Cheung to retain the 1,508,000 shares of Celsion’s common stock that it held as security in full satisfaction of the $1.5 million promissory note.

Medifocus Inc. was incorporated on April 25, 2005 under the Business Corporations Act (Ontario) as a CPC. Under Canadian law, a CPC is a newly created Canadian company having no assets, other than cash, which is permitted to conduct an initial public offering of its securities (“IPO”) and obtain a listing of its shares on the TSXV. A CPC may then uses the funds raised in the IPO to identify and evaluate assets or businesses which, when acquired, qualify the CPC for listing as a regular issuer on the TSXV.

On June 29, 2006 Medifocus Inc., completed its IPO on the TSXV of 4,600,000 shares at a price of $0.20 (Canadian dollars) per share receiving gross proceeds of $920,000 (Canadian dollars). In order to gain improved access to funding, Medifocus Inc. engaged in a share exchange offer with Celsion Canada in 2008 pursuant to which Celsion Canada became a wholly-owned subsidiary of Medifocus. Concurrently with the exchange offer, Medifocus completed a private placement of units, receiving gross proceeds of $2 million (Canadian dollars). In addition, Medifocus issued 903,112 shares to Celsion at a deemed value of $0.50 (Canadian dollars) per share, in partial satisfaction of an approximate $600,000 (Canadian dollars) liability that was owed to Celsion. After the completion of the share exchange transaction, we continued our development of the APA 1000 technology for the treatment of breast cancer. Phase I and Phase II clinical trials were originally completed by Celsion. Subsequently, the Company received approvals from both the FDA and the Canadian Bureau of Medical Devices to conduct a pivotal Phase III breast cancer treatment study. We have begun the pivotal Phase III clinical trials but, such trials have been proceeding at a slow pace due to lack of funding. We plan to complete the pivotal Phase III trial when funding is available.

The Patent License Agreement with MIT was amended on June 16, 2007. The amended agreement requires us to pay MIT a 5% royalty on the net sales of any products derived from APA 1000, and an annual maintenance fee of $50,000. MIT is entitled to receive royalties for so long as the patents relating to the APA technology are valid or the Patent License Agreement is terminated.

On July 24, 2012, we acquired the Prolieve® technology and related assets from Boston Scientific pursuant to an Asset Purchase Agreement dated June 25, 2012, amended on July 24, 2012 (the “Asset Purchase Agreement”). The purchase price was $3,662,115, of which $2,535,610 was paid on the closing of the transaction. Additionally, we entered into a contingent consideration arrangement under which we will pay Boston Scientific up to $2,500,000, to be paid in quarterly installments at a rate of 10% of the sales of Prolieve® products which is estimated to have contingent balance through September 30, 2018. Sales are defined as the gross amount invoiced for sales, distributions, licenses, leases, transfers, and other dispositions. As of June 30, 2018, $1,977,967 is due to Boston Scientific under the contingent consideration arrangement, of which $1,902,387 is past due.

Our Products

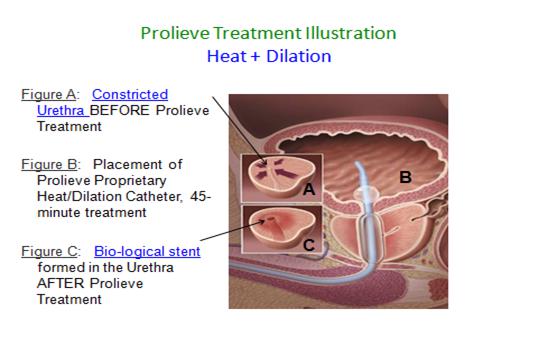

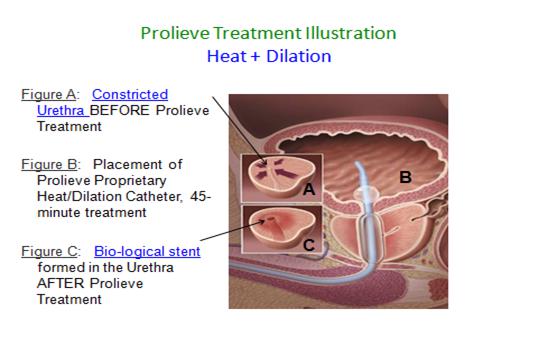

A. Prolieve® Thermodilatation™ System

Our first commercial heat-based therapy system, Prolieve®, is used to treat benign prostatic hyperplasia or “BPH.” BPH is a condition in which the prostate gland becomes enlarged and restricts the flow of urine through the urethra. Our clinical studies have shown that the treatment of this condition with the Prolieve® system improves urine flow by decreasing the enlarged prostate’s pressure on the urethra through the heating, dilation and shrinking of the prostate tissue surrounding it. The BPH drug therapy market is estimated to be about $4 billion in major developed countries according to Decision Resources Group. This number does not include non-drug treatments and the patients who are on “Watchful Waiting” due to the side effects of some of the treatment options. While the market for minimally invasive BPH treatment is approximately $150 million according to Medtech Insight, we believe that Prolieve®® can be a viable alternative to drug therapy due to its safety and efficacy profiles and thus has the potential to increase the market for minimally invasive BPH treatment.

What Is Benign Prostatic Hyperplasia?

Millions of aging men experience symptoms resulting from BPH, a non-cancerous urological disease in which the prostate enlarges and constricts the urethra. The prostate is a walnut-sized gland surrounding the male urethra that produces seminal fluid and plays a key role in sperm preservation and transportation. The prostate frequently enlarges with age. As the prostate expands, it compresses or constricts the urethra, thereby restricting the normal passage of urine. This restriction may require a patient to exert excessive bladder pressure to urinate. Because urination is one of the body’s primary means of cleansing impurities, the inability to urinate adequately increases the possibility of infection and bladder and kidney damage.

BPH Symptoms

The symptoms of BPH usually involve problems with emptying the bladder or storing urine in the bladder. However, the severity of the symptoms can vary widely, from mild and barely noticeable to serious and disruptive. Common BPH symptoms include:

| ● | Pushing or straining to begin urination; |

| ● | Dribbling after urination; |

| ● | A frequent need to urinate, sometimes every 2 hours or less; |

| ● | A recurrent, sudden, or uncontrollable urge to urinate; |

| ● | Feeling the bladder has not completely emptied after urination; |

| ● | Pain during urination; and |

| ● | Waking at night to urinate. |

In extreme cases, a man may be completely unable to urinate. In such situations, emergency medical attention is required.

An enlarged prostate does not cause prostate cancer or directly affect sexual function. However, many men experience sexual dysfunction and BPH symptoms at the same time. This is due to aging and the common medical conditions older men often encounter, including vascular disease and diabetes. Because these conditions take place with aging, sexual dysfunction tends to be more pronounced in men with BPH.

BPH Complications

BPH is not a form of prostate cancer and does not lead to prostate cancer. Accordingly, BPH is not life-threatening. However, as many men know, BPH may be lifestyle-threatening and can cause great discomfort, inconvenience, and awkwardness and complications such as:

| ● | Acute urinary retention, which is a condition that results in a complete inability to urinate. A tube called a catheter may be needed to drain urine from the bladder. |

| ● | Chronic urinary retention, which is a partial blockage of urine flow that causes urine to remain in the bladder. In rare cases, this may lead to kidney damage if it goes undiagnosed for too long. |

| ● | Urinary tract infection, which can cause pain or burning during urination, foul-smelling urine, or fever and chills. |

| ● | Other complications from BPH may include bladder stones or bladder infections. |

| ● | Having BPH does not directly affect one’s sexual function. However, it is common for the symptoms of BPH and sexual dysfunction to occur at the same time. |

Prevalence of BPH and Market Opportunity

BPH is an age-related disorder the incidence of which increases with maturation of the population. According to urologyhealth.org, by age 60, more than half of men have BPH. By age 85, about 90 percent of men have BPH. As the population continues to age and life expectancy increases, the prevalence of BPH can be expected to continue to increase.

Treatment Alternatives for BPH

Several types of treatments are available for enlarged prostate. They include medications, surgery and minimally invasive surgery. The best treatment choice for patients depends on several factors, including how much the symptoms bother them, the size of their prostate, other health conditions the patients may have, their age and preference. If symptoms are not severe, a patient may decide not to have treatment and wait to see whether their symptoms become more bothersome over time.

Watchful Waiting

When a patient first develops symptoms caused by BPH, physicians generally prescribe drugs as the first treatment option, but usually leave the decision to their patients. Due to the low success rate, high costs, side effects and complications associated with BPH drug therapies, some patients diagnosed with BPH prefer to be regularly monitored by their doctors, but choose not to begin a drug therapy. The patients who opt out of therapy fall into a group referred to as “watchful waiting.” Often, BPH symptom persistence and worsening or an acute urinary event may force the patient to move on to some other form of therapy.

Drug Therapy

Medications are the most common treatment for moderate symptoms of prostate enlargement but if a patient stops taking medicine, the symptoms will usually return. Medications used to relieve symptoms of enlarged prostate include several types of drugs, such as Alpha-Blockers (such as Flomax®) and Alpha Reductase Inhibitors (such as Proscar®). Drug therapy costs approximately $1,000 per year or more in the United States, must be maintained for life, and does not offer consistent relief to many BPH patients. Many of the currently available BPH drugs also have appreciable side effects, such as: headache, fatigue, impotence, dizziness, and low blood pressure.

Surgical Intervention

Two of the primary surgical procedures to treat BPH are transurethral resection of the prostate (“TURP”) and laser procedures. TURP has traditionally been a common procedure for enlarged prostate for many years. It is a procedure in which the prostatic urethra and surrounding diseased tissue in the prostate are trimmed with a telescopic knife, thereby widening the urethral channel for urine flow. While the TURP procedure generally has been considered the most effective treatment available for the relief of BPH symptoms, the procedure has its shortcomings. In the first instance, TURP generally requires from one to three days of post-operative hospitalization. In addition, a substantial percentage, approximately 5-10%, of patients who undergo TURP encounter significant complications, which can include painful urination, infection, impotence, incontinence, and excessive bleeding. Further, retrograde ejaculation, a condition in which semen released during ejaculation enters the bladder rather than exiting the penis, occurs in up to 90% of patients who undergo a TURP procedure, with a long-term side effect in up to 75% of such patients.

Laser surgeries (also called laser therapies) use high-energy lasers to destroy or remove overgrown prostate tissue. Options for laser therapy depend on prostate size, the location of the overgrown areas. During prostate laser surgery, a combined visual scope and laser is inserted through the tip of the patient’s penis into the urethra, which is surrounded by the prostate. Using the laser, doctors remove prostate tissue that are squeezing the urethra and blocking urine flow, thus making a new larger tube for urine to pass through. Lasers use concentrated light to generate precise and intense heat. Risks of laser surgery include: temporary difficulty urinating and post treatment catheterization, urinary tract infection, narrowing of the urethra as scars form, retrograde ejaculation, and erection problems.

Accordingly, neither drug therapies nor the surgical alternatives appear to provide fully satisfactory, cost-effective treatment solutions for BPH sufferers.

Our Approach: The Prolieve® Thermodilatation™ System

The Prolieve® Thermodilatation™ System was originally and primarily developed and commercialized by our current management, product development, clinical and regulatory teams. Such development occurred while such teams were employed at Celsion Corporation from 1997 to 2004, at an estimated cost of $20,000,000. As discussed above, Celsion sold the Prolieve® system, technology and related assets to Boston Scientific Corporation in 2007 for $60 million. In June 2012, Medifocus reached an agreement with Boston Scientific for the purchase of all of the assets of its Prolieve® business, including all Prolieve® inventory, the mobile service distribution assets, as well as the intellectual property associated with the Prolieve® technology.

Employing a patented 46 Fr. dilating balloon that enhances the efficiency of thermotherapy via a small microwave antenna embedded within a disposable 18 Fr. treatment catheter, Prolieve® Transurethral Thermodilatation™ (TUTD™) is the only FDA-approved Thermodilatation™ device on the market for treating BPH. Prolieve® TUTD™ is a fast in-office procedure performed under local anesthesia, with more than 100,000 cases thus far successfully performed in the U.S. since the initial FDA’s PMA approval for the device. Nearly 90% of all treated patients do not require a post treatment urinary catheter, in contrast to the vast majority of patients treated with other minimally-invasive BPH therapies. Thus, in addition to providing immediate symptomatic relief for BPH patients, Prolieve® has demonstrated long-term durable clinical benefits in the completed study accepted by the FDA.

In a randomized one-year clinical trial, conducted at 14 centers across the United States, patients undergoing treatment with Prolieve® achieved measurably greater improvement in symptoms after three months compared to a control group using a drug, Proscar, which is commonly prescribed to treat BPH condition.

Based upon a study conducted by Boston Scientific (the “Prolieve® Study”), patients treated with the Prolieve® system experienced a symptom reduction of 22% three days following treatment. Furthermore, most patients that undergo the Prolieve® treatment do not require post-treatment catheterization. Based upon the Prolieve® Study, 94% of patients that underwent the Prolieve® treatment were catheter free immediately following the treatment, and 100% of such patients were catheter free after three days. Accordingly, we believe that patients that undergo the Prolieve® treatment should be able to resume their normal activities shortly after the treatment.

Five Year Post Study Approved

In May 2018, the United States Food and Drug Administration (FDA) completed the review of the Company’s rigorous FDA mandated Post Approval Study (PAS). The 5-year follow-up study has satisfactorily fulfilled the PAS requirements. The PAS was conducted on a cohort of 225 symptomatic BPH patients treated with the Company’s Prolieve® Thermodilatation™ System. The 12-year PAS with 5-year follow-up data confirms long-term safety, efficacy and durability with improved lower urinary tract symptoms, urinary flow rate, quality of life, and minimal sexual side effects when compared to an untreated age-matched male population. In addition, the PAS has demonstrated stabilization of serum Prostate-Specific Antigen (PSA) level and prostate size during the 5-year follow-up period. The table below summarizes the key findings of the PAS:

| 85%Post-Treatment Catheter-Free Rate |

Minimal/No SexualSideEffects: ErectileDysfunction: 0.3 per 100person-years Retrograde Ejaculation: 0.3 per 100person-years |

Improvementof Mean AUASymptomScore: Baseline =20.1 vs.Year 5 =12.8 |

ImprovementofPeakFlow Rate (Qmax):Baseline =8.6mL/secvs.Year 5 =12.8 mL/sec |

Improvementof Quality of Life (QoL) Score:Baseline =22.0 vs.Year 5 =16.5 |

Stabilizationof BPHSymptoms:83%reported No Progression atYear5 |

Stabilizationof SerumPSAandProstate Size |

The Prolieve® system is comprised of two components. The first component is a freestanding module that contains a microwave generator and computerized controls that regulates and monitors the delivery of heat to the enlarged prostate tissue. The second component is our proprietary disposable catheter that is attached to the module. This component contains an internal balloon that is inflated after it is inserted through the urethra to the point of constriction. Upon inflation of the balloon, the tissue is heated by microwaves delivered via the catheter, resulting in dilation of the urethra. Our computer system in the module monitors and regulates the heat being applied to ensure maximum safety and efficiency. The Prolieve® system is covered by 45 core patents, which were acquired as part of the acquisition of the Prolieve®® assets from Boston Scientific Corporation in 2012.

The combined effect of this “heat plus compression” therapy is twofold: first, the heat denatures the proteins in the wall of the urethra, causing a stiffening of the opening created by the inflated balloon, forming a biological stent. Second, the heat serves effectively to kill off prostate cells outside the wall of the urethra, thereby creating sufficient space for the enlarged natural opening. In addition, the Prolieve® system’s temperature (46º C to 54º C) is sufficient to kill prostatic cells surrounding the urethra wall, thereby creating space for the enlargement of the urethra opening. However, the relatively low temperature is not sufficient to cause swelling in the urethra.

The Prolieve® system is designed with patients’ needs and comfort in mind. In general, it does not require sedation or post-operative catheterization and provides rapid symptomatic relief from BPH. BPH patients can be treated using Prolieve® in urologic offices throughout the United States. In addition, the Prolieve® treatment is also made available to physicians utilizing our mobile service.

Since acquiring the Prolieve® assets from Boston Scientific Corporation in July 2012, we have been concentrating our corporate development efforts on developing these assets into a business. We are focusing on increasing sales from our installed base of systems and from our mobile service. In addition, the Company entered into distribution agreement with seven independent distributors in certain territories in the U.S. and Puerto Rico. Boston Scientific Corporation had sold approximately 250 Prolieve® systems and approximately 80,000 disposable catheter kits in the United States prior to Boston Scientific Corporation’s sale of the Prolieve®® assets to us in 2012. Our current business strategy is to utilize social media, key opinion leaders, centers of excellence and independent mobile service providers to increase the utility and market presence of Prolieve®. In the U.S. market, we do not intend to actively market the Prolieve® system itself but, rather, our strategy is to grow revenue through the direct sale of disposable catheter kits to physicians with Prolieve® systems installed and, increasingly, through independent distributors and our mobile service, which eliminates physicians’ need to purchase, and learn how to operate, the Prolieve® system. However, if U.S. or international customers choose to purchase the Prolieve® system itself, we will accommodate their needs to the best of our ability.

We currently have approximately 165 systems that were acquired as part of the Prolieve®® asset purchase from Boston Scientific Corporation. We do not currently have an agreement with a manufacturer to produce additional Prolieve® systems, although we believe that there are several qualified medical device contract manufacturers, including Sanmina, that are capable of manufacturing the system if our current inventory is depleted. For the year ended March 31, 2019, 100% of our revenues came from the sales of our disposable catheters used in each treatment or the provision of mobile services that provide therapy using our disposable catheters. The disposable catheters are manufactured in Mexico by Lake Region Medical Center, formerly known as Accelent Corporation. We currently have an agreement with Lake Region Medical Center to supply these catheters, pursuant to which we order the number of catheters we estimate we will need for a 12-month period. We have no other source of catheters at the present time. Due to the complicated nature of these kits, as well as FDA manufacturing standards imposed on suppliers, the Company does not believe that an alternate supplier of catheters is readily available.

In addition to the Prolieve® technology, the installed base of Prolieve® systems and related patents acquired from Boston Scientific Corporation, we also acquired a fleet of 15 vans, each equipped with two Prolieve® systems. Currently we own nine vans. This mobile fleet allows us to provide Prolieve® therapy to patients in certain geographical areas whose health care providers do not have access to one of our permanently installed systems. The mobile Prolieve® system is identical to the permanently installed systems.

Our mobile Prolieve® systems are deployed by our scheduler upon the request of a physician. Our scheduler then coordinates the timing of the requested appointment with one of our medical technicians. On the day of the appointment, our medical technician arrives at the physician’s office and the Prolieve® module is brought into the physician’s office. Under the physician’s supervision, a catheter is inserted into the urethra to the point of constriction, and the Prolieve® treatment is administered by our medical technician under the physician’s supervision.

Competition

There are several treatment options for BPH. The first is traditional surgery, known as trans-urethral resection procedure, or “TURP.” This surgery requires a hospital stay, sedation, and a post-operative recovery period. Other newer BPH treatment technologies include Urolift and Rezum. We are aware that Urologix LLC offers microwave-based treatment with which we compete. Unlike the Urologix’ treatment, which solely utilizes heat, our Prolieve®® therapy combines heat and compression (via the inflated balloon). According to Medtech Insight, the surgical and minimally invasive treatment market for BPH is approximately $150 million in the U.S.

However, the majority of BPH patients undergoing treatment today choose medical therapy instead of surgery. Pursuant to such medical therapy, patients take daily doses of medicine to shrink the prostate in order to improve function. These medicines are known to cause side effects, and must be taken daily to be effective. We believe our Prolieve® treatment can be a viable alternative to drug therapy due the demonstrated efficacy and side effect profile.

Prescribed medicines for BPH treatment in major industrialized countries is currently believed to be approximately $4 billion annually. These medicines are manufactured and sold by some of the world’s largest pharmaceutical companies, including Eli Lilly, Glaxo Smith Kline and Merck & Co. These companies market their drugs to physicians and directly to the public through television, radio, the internet and conventional print media. With the substantial investment made by these companies in developing, commercializing and marketing these drugs, and the size of the BPH treatment market, these companies represent a significant competitive threat to our Prolieve® therapy, and to our company. We are also aware that non-prescription herbal supplements promoted to relieve BPH symptoms are being aggressively marketed to the public; these products also compete with Prolieve®.

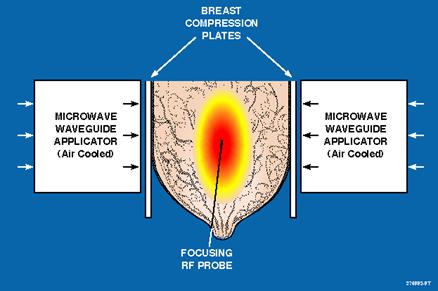

B. Adaptive Phased Array Technology (APA 1000)

Our second product, APA 1000, which is a minimally invasive breast cancer treatment, is developed, but has not been cleared by the FDA for commercial use. Both Phase I and Phase II clinical trials were completed by Celsion, establishing the system’s safety and efficacy on a limited scale. We have begun pivotal Phase III clinical trials, but have proceeded slowly in such trials because of insufficient funds. The Phase III clinical trial is designed to demonstrate that the combination of focused heat and neo-adjuvant chemotherapy could shrink the size of the tumor 40% more over using chemotherapy alone. In the Phase II clinical trial, a 50% increase in tumor size reduction using focused heat and neo-adjuvant chemotherapy was observed over using chemotherapy alone. In the Phase II trial, two heat treatments were applied while in the Phase III trial, three heat treatments are applied. We believe that, if the Phase III trial is successful, it will show that the combination of focused heat and neo-adjuvant chemotherapy could downsize a cancer tumor enough to allow a surgeon to perform a lumpectomy rather than a mastectomy, thereby preserving the affected breast.

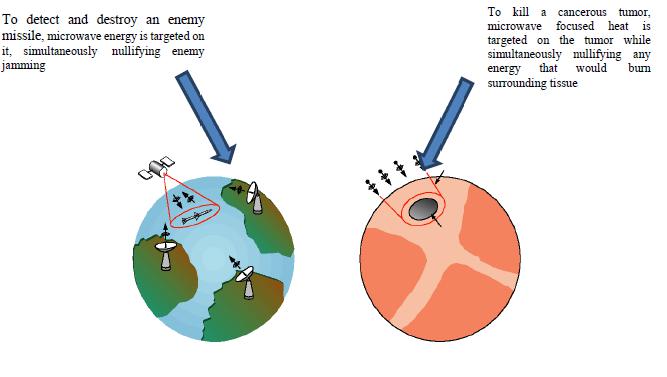

The APA 1000 system delivers heat precisely to breast tumors. While using heat to kill cancerous tumors has been considered effective for many years, heat therapy has not become a part of standard treatment for cancer because of the inability to safely apply it to tumors without damaging healthy tissue. When treating cancer, physicians seek to minimize damage to healthy tissue. It is our belief that the APA 1000 system precisely focuses microwave heat on diseased tissue, sparing adjacent tissue. Precision is achieved through the utilization of “Star Wars” technology that we have exclusively licensed from MIT and have adapted for medical use in our APA 1000 system.

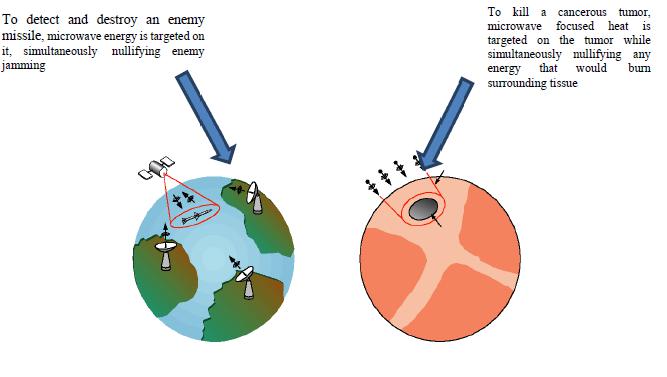

Adaptive Phased Array Technology Illustration

Our microwave control technology known as “Adaptive Phased Array,” or “APA.”, was originally developed at Massachusetts Institute of Technology (“MIT”) for the U.S. Department of Defense. This technology permits properly designed microwave devices to focus and concentrate energy targeted at diseased tissue areas deep within the body and to heat them selectively, without adverse impact on surrounding healthy tissue. In the treatment of breast cancer, the APA technology applies the same principal used in MIT’s “Star Wars” program of detecting missiles.

In the treatment of breast cancer, the APA technology applies the same principal used in MIT’s “Star Wars” program of detecting missiles.

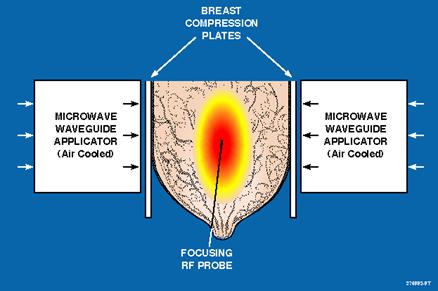

APA 1000 Breast Cancer Treatment Illustration

| ● | An RF needle probe inserted at tumor center provides feedback signal to focus microwave energy at tumor center to induce shrinkage without harming surrounding tissue. |

| ● | Focused microwave energy (43-44°C) combined with chemotherapy achieves an average of 88% tumor size reduction in Phase II clinical trials. |

Treatment with APA 1000 may accomplish several objectives. First, we believe that it destroys many cancer cells, and substantially shrinks cancerous cells that are not destroyed. If tumors are shrunk small enough, a patient may not need to have the entire breast removed. Second, we believe that the application of APA 1000 heat therapy boosts the effectiveness of subsequent chemotherapy and radiation therapy.

There can be no assurance that we will complete the pivotal Phase III clinical trial, or that the FDA will approve of the APA 1000 for sale in the United States. Even if the APA 1000 successfully completes the pivotal Phase III clinical trial and the FDA permits us to sell this system, there can be no assurance that it will be adopted by health care industry.

As stated earlier, we are progressing at a very slow pace through Phase III clinical trials due to lack of funding, and are currently focusing our corporate activities and resources on expanding our Prolieve® operations. We estimate that the cost of completing Phase III clinical trials will be approximately $7,500,000. Subject to obtaining financing, we may resume of the pivotal Phase III trial in the future. We previously negotiated arrangements with physicians and medical centers in the United States and Canada to conduct this trial. Because the pace of the trial has been slow, we have closed the clinical site in Canada. There can be no assurance that the remaining site in the U.S. will be interested in continuing the study trials. If it is not, we would then need to make alternative arrangements, of which there can be no assurance.

Effective April 1, 2016, the Company adopted ASU 2014-15,Presentation of Financial Statements-Going Concern (Subtopic 205-40), which requires management to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date the financial statements are issued. Management’s evaluations are based on relevant conditions and events that are known and reasonably to be knowable as of August 29, 2019. Based on the following, management believes that it is probable that management will be unable to meet its obligations as they come due within one year that the financial statements are issued.

The Company’s operations are subject to certain risks and uncertainties including, among others, current and potential competitors with greater resources, lack of operating history and uncertainty of future profitability and possible fluctuations in financial results. Since inception, the Company has incurred substantial operating losses, principally from expenses associated with the Company’s Prolieve® operation, research and development and financing activities. The Company believes these expenditures are essential for the commercialization of its technologies. The Company expects its operating losses to continue in the near future as it continues its Prolieve® sales and marketing activities. Due to continued operating losses, there is substantial doubt regarding the Company’s ability to continue as a going concern. The Company’s ability to achieve profitability is dependent upon its ability to operate its Prolieve® business profitably and to obtain governmental approvals, produce, and market and sell its new product candidates. There can be no assurance that the Company will be able to commercialize its technology successfully or that profitability will ever be achieved. The operating results of the Company have fluctuated significantly in the past. The Company expects that its operating results will fluctuate significantly in the future and will depend on a number of factors, many of which are outside the Company’s control.

The Company will need substantial additional funding in order to sustain its operation, to complete the development, testing and commercialization of its product candidates. The commitment to these projects will require additional external funding, at least until the Company is able to generate sufficient cash flow from the sale of one or more of its products to support its continued operations. If adequate funding is not available, the Company may be required to delay, scale back or eliminate certain aspects of its operations or attempt to obtain funds through unfavorable arrangements with partners or others that may force it to relinquish rights to certain of its technologies, products or potential markets or that could impose onerous financial or other terms. Furthermore, if the Company cannot fund its ongoing development and other operating requirements, particularly those associated with its obligations to conduct clinical trials under its licensing agreements, it will be in breach of these licensing agreements and could therefore lose its license rights, which could have material adverse effects on its business. Additionally, the Company is not in compliance with the provisions of outstanding debt agreements, and it has not remitted quarterly royalty payments to Boston Scientific Corporation pursuant to the terms of its purchase agreement for Prolieve. The Company has not paid interest owing to certain holders of the convertible debentures, and is in default of the terms of the debentures.

Management is continuing its efforts to obtain additional funds through equity financing and through the negotiation of debt agreements to ensure that the Company can meet its obligations and sustain operations. Additionally, the Company is reducing costs of operations, as the Company is eliminating certain positions that do not hold value to the Company.

The consolidated financial statements do not include any adjustments relating to recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence

Comparison of Three Months Ended June 30, 2019 and 2018

The table below summarizes our results of operations for the three months ended June 30, 2019 and 2018:

| | | Three months ended June 30, | |

| | | 2019 | | | 2018 | |

| Sales | | | | | | |

| Products | | $ | 183,359 | | | $ | 328,142 | |

| Services | | | 378,709 | | | | 409,248 | |

| Total Sales | | | 562,068 | | | | 737,390 | |

| Costs of Sales | | | | | | | | |

| Products | | | 109,402 | | | | 197,985 | |

| Services | | | 277,988 | | | | 288,348 | |

| Total Costs of Sales | | | 387,390 | | | | 486,333 | |

| Gross Profit | | | 174,678 | | | | 251,057 | |

| Operating Expenses | | | | | | | | |

| Research and development | | | 27,733 | | | | 27,409 | |

| Sales and marketing | | | 16,175 | | | | 7,310 | |

| General and administrative | | | 312,313 | | | | 288,348 | |

| Total Operating Expenses | | | 356,221 | | | | 316,013 | |

| Loss from Operations | | | (181,543 | ) | | | (64,956 | ) |

| Other Income (Expense) | | | | | | | | |

| Interest and discount accretion | | | (245,070 | ) | | | (230,955 | ) |

| Loss from change in fair value of contingent consideration (Note 2) | | | (667 | ) | | | (14,793 | ) |

| Gain on recovery of HST receivable | | | — | | | | — | |

| Other income (expense) | | | (22,104 | ) | | | 29,244 | |

| Total Other Income (Expense) | | | (267,841 | ) | | | (216,504 | ) |

| Net Loss | | $ | (449,384 | ) | | $ | (281,460 | ) |

| Net Loss per share basic and diluted | | $ | (0.00 | ) | | $ | (0.00 | ) |

| Weighted average common shares outstanding—basic and diluted | | | 184,984,215 | | | | 184,984,215 | |

Sales

The Company’s revenue from the sale of its Prolieve® products and services decreased 24% from $737,390 for the three months ended June 30, 2018 to $562,068 for the three months ended June 30, 2019. Product sales during the quarters ended June 30, 2019 and June 30, 2018 consisted solely of single-use catheters. The decrease of total sales for the quarter ended June 30, 2019 is due to the decrease in direct product sales caused by the lack of supply for our Prolieve® disposable kits. Additionally, a reduction in insurance reimbursement rates has caused a decrease in our sales revenue.

Costs of Goods Sold, Costs of Services and Gross Profit

The costs of sales for products primarily include the cost of products sold to customers on a first-in first-out basis, along with amortization expense of our Prolieve® intellectual property, warranty costs, warehousing costs, freight and handling charges. Costs of sales for services consist primarily of the costs to provide mobile services to our patients, including depreciation of our mobile consoles and vehicle fleet, and payroll and benefit costs.

Costs of goods sold as a percentage of product sales was 60% for the three months ended June 30, 2019 as compared to 67% for the three months ended June 30, 2018. The decrease is primarily due to the reduction of the fixed amortization expense for the three months in 2019. Costs of services as a percentage of services sales was 73% for the three months ended June 30, 2019, as compared to 68% for the three months ended June 30, 2018. The increase is due to lower weighted average selling price and higher express shipping cost at the end of the quarter caused by the Prolieve® disposable kit supply issues, offset by the reduction of the fixed amortization costs. The total gross profit decreased to $174,678 for the three months ended June 30, 2019 from $238,790 for the three months ended June 30, 2018, as a result of decreased revenue.

Net Loss

Our loss from operation for the quarter ended June 30, 2019 was $181,543, an increase of $116,587, or 179%, from the same quarter in 2018, primarily due to the decrease in gross profit from lower sales and the increase in operating expenses. Our net loss of $449,382 for the quarter ended June 30, 2019, compared to $281,460 for the same period in 2018.

Research and Development Expenses

For the three months ended June 30, 2019, the Company incurred research and development expenses of $27,733, slight increase from the $27,409 for the same period in 2018.

Sales and Marketing Expenses

Sales and marketing expenses primarily include Prolieve® promotion costs, such as trade shows, costs of travel, and other direct marketing expenses for Prolieve® and other business promotion costs. Sales and marketing expenses for the three months ended June 30, 2019 were $16,175, compared to $7,310 for three months ended June 30, 2018. The increase is primarily caused by the higher travel expenses for trade shows and increased in-house marketing. The Company plans to utilize social media, direct mailing, and independent distributors to sustain and grow its Prolieve® business.

General and Administrative Expenses

General and administrative expenses for the three months ended June 30, 2019 increased $23,965, or 8% to $312,313, from $288,348 for three month ended June 30, 2018. The increase is primarily due to the legal fee expenses incurred for a lawsuit filed against the Company.

Other Income (Expense)

Other income (expense) primarily consists of interest and accretion expense, losses from change in the fair value of the contingent consideration. Total other income (expense) of ($267,839) for the three months ended June 30, 2019 reflects an increase from our total other income (expense) of ($216,504) for three months ended June 30, 2018, largely due to the increase in interest expenses and a loss in the change in foreign exchange rates for the 3 months ending June 30, 2019 as compared to a gain in foreign exchange rates for the 3 months ending June 30, 2018

On July 24, 2012 the Company purchased from Boston Scientific Corporation all of the assets, and assumed certain liabilities, relating to the Prolieve® Thermodilatation System (“Prolieve®”), a FDA approved device for the treatment of Benign Prostatic Hyperplasia (“BPH”). The total purchase consideration consisted of the following:

| Cash | | $ | 2,535,610 | |

| Fair value of contingent consideration | | | 1,126,505 | |

| Total consideration | | $ | 3,662,115 | |

The maximum amount payable pursuant to the terms of the contingent consideration is $2.5 million. The fair value was determined by calculating its present value based on its payment terms using an interest rate of 24% (the Company’s estimated unsecured borrowing rate). The contingent consideration is paid quarterly at a rate of 10% of sales of Prolieve® products. The fair value of the contingent consideration is adjusted for changes in the estimated future payments with the adjustment being reflected in profit or loss.

The Company accounted for its acquisition of Prolieve® by recording all tangible assets and intangible assets acquired, and liabilities assumed, at their respective fair values on the acquisition date. The fair value assigned to identifiable intangible assets acquired was determined using a cost approach and was based on the Company’s best estimates; this intangible asset is being amortized on a straight-line basis over its estimated useful life of ten years.

The following summarizes the fair value of the assets acquired assumed in the transaction:

| Inventory | | $ | 463,338 | |

| Equipment | | | 736,662 | |

| Intangible assets | | | 2,462,115 | |

| Total consideration | | $ | 3,662,115 | |

| | 6. | Medifocus Holding Joint Venture |

On November 8, 2013, we entered into an agreement with Ideal Concept Group Limited (“Ideal Concept”) to develop our Prolieve® business and APA technology in a geographic area referred to as “Asia Pacific” in the agreement (the “JV Agreement”). The countries comprising of Asia Pacific are not specified in the JV Agreement. Pursuant to the JV Agreement, Medifocus and Ideal Concept agreed to capitalize a company, Medifocus Holding Limited (“Medifocus Holding”), to develop this business. Medifocus Holding was incorporated in the British Virgin Islands on June 28, 2012.

The JV Agreement states that, at the outset, Ideal Concept will own 60% of Medifocus Holding and we will own 40%. Through March 31, 2015, Medifocus Inc. has made total contributions to Medifocus Holding of approximately $214,735 in cash and Prolieve® equipment. In addition to capital contributions, the shareholders are obligated to provide loans to the JV of up to HKD 4,000,000 (or approximately $520,000). Ideal Concept previously agreed, through November 8, 2014, to loan us the funds necessary to satisfy our portion of the required shareholder contributions to Medifocus Holding. Such loan would bear interest at 6% per year and be secured by our ownership interest in Medifocus Holding. No such loans were made to us by Ideal Concept and we did not make any further investments or loans in the joint venture. Pursuant to the terms of our joint venture, our equity ownership in Medifocus Holdings LLC had been reduced over the last two years and was eventually bought out by Ideal Concept in March 2016.

Pursuant to the terms of the JV Agreement and a License and Distribution Agreement dated as of November 8, 2013, Medifocus Holding will engage in clinical testing, and obtaining approval from China Food and Drug Administration of the People’s Republic of China (“CFDA”) for all products relating to Prolieve® and the APA technology. Medifocus Holding has been in communication with the CFDA and continues to evaluate the regulatory requirements for commercialization of Prolieve® in China. There is no assurance that the CFDA will approve Prolieve® for commercialization in China. Additionally, Medifocus Holding has been in discussions with several hospitals in China regarding conducting clinical testing. As of the date of this annual report, no clinical testing has begun in China. During fiscal 2016, Medifocus Holding entered into a distribution agreement with a South Korea-based distributor to market Prolieve® in South Korea, subject to regulatory approvals from the South Korean government.

Medifocus Holding is required to pay us a royalty of 5% of the first $10,000,000 in sales of the catheter kits and control units utilized in the Prolieve® business. After $10,000,000 in sales has been reached, the royalty decreases to 3%. For all other products we develop, Medifocus Holding is required to pay us a royalty of 7.5% on net sales of such products.

| | 7. | Liquidity and capital resources |

The Company’s primary cash requirements are to fund operations, including research and development programs and collaborations, and to support general and administrative activities. The Company’s future capital requirements will depend on many factors, including, but not limited to:

| ● | sales of the Company’s Prolieve® products and services; |

| ● | pricing and payment terms with customers; |

| ● | costs of the disposable catheter kits and payment terms with suppliers; and |

| ● | capital expenditures and equipment purchases to support product launches |

In December 2013, the Company raised gross proceeds of $ 3,540,000 from the sale of convertible redeemable promissory notes and warrants (the “Units”). Each Unit consists of (i) a $10,000 face value convertible redeemable promissory note, bearing 8% annual interest and due in three years (“Note”), which is convertible into shares of common stock beginning six months after the Closing Date of the offering at a conversion price of $0.25 per share, and (ii) three-year warrants to purchase 20,000 shares of common stock at a price of $0.30 per Share. The net proceeds from the offering was used for Prolieve® operations including research and development activities, capital expenditures, repayment of debt and working capital.

In a second closing in March 2014, the Company issued 200 additional Units to the investors, receiving gross proceeds of $2,000,000. The additional notes are convertible into 8,000,000 shares of common stock. Each warrant entitles the holder to acquire 20,000 common shares (for a total of 4,000,000 common shares) at an exercise price of $0.30 per share and expire on December 18, 2016. The warrants were classified as equity and were recorded as additional paid in capital at their estimated fair value of $572,999.

Our $0.43 million unsecured promissory note made to a lender in July 2012 (included in our contractual obligations table on page 38) and the accrued but unpaid interest of $CAD 0.2 million as of December 31, 2013, was originally due October 23, 2013. The lender has extended the due date of this promissory note to June 30, 2014 and we are currently in discussion with the lender to negotiate a payment plan for this note. Subsequent to March 31, 2015 we have made no principal and interest payments to the lender and are currently in negotiations with the lender regarding the extension of the due date. If such negotiations fail, the lender may declare all amounts due and payable immediately. The lender would not have a right to seize any of the Company’s assets because the promissory note is unsecured. Further, if the lender were to retain counsel or initiate litigation to enforce its rights and interests under the promissory note, the Company would be required to pay all reasonable costs and expenses of the lender.

In the fiscal year ending March 31, 2015, the Company raised approximately $1.6 million from the sale of Units. Each Unit was priced at $0.16 and consists of one Share, and a detachable stock purchase warrant to purchase one Share at $0.25 per share.

The company also received funds prior to March 31, 2015 for common shares in the amount of $1,705,000 for future shares to be issued. On May 12, 2015, the company issued 38,750,000 common shares at a price of $0.044 per common share for gross proceeds of $ 1,705,000 as part of this transaction.

For the fiscal year ending March 31, 2016, the Company received gross proceeds of $775,000 from the sale of common stock and warrants (the “Units”). Each Unit was priced at $10,000 and consists of 200,000 Shares, and a detachable stock purchase warrant to purchase 100,000 Shares at $0.10 per share.

In the quarter ended June 30, 2016, the Company obtained a loan of $200,000 from a lender at a monthly interest rate of 1.25%. The loan was secured with all the intellectual property and proprietary rights related to the Prolieve® system. Subsequently, in August 2016, the Company obtained an additional $200,000 in loan from the same lender, at the same terms, and secured with the same intellectual property and proprietary rights related to the Prolieve® system. In October 2016, the Company obtained an additional $100,000 in loan from the same lender, at the same terms, and secured with the same intellectual property and proprietary rights related to the Prolieve® system.

The Company extends credit to customers on an unsecured basis and payment terms are typical 30 to 60 days from delivery or service. Management assesses the collectability of its receivables based on a periodic customer-by-customer analysis, considering historical collection experience as well as customer-specific conditions; when a specific customer account is determined to be uncollectible the Company provides an allowance equal to the estimated uncollectible amounts. Receivables are written off when it is determined that amounts are uncollectible. The Company established an allowance for doubtful accounts of approximately $39,556 as of June 30, 2018,

Our cash and cash equivalents of approximately $79,990 on hand at June 30, 2018 are not sufficient to fund operations through June 30, 2019. We estimate that the external funding requirement for the next 12 months will be at least $500,000 to maintain and grow the Prolieve® business in the U.S. and the essential corporate activities. The Company is currently in default with certain lenders and creditors, and owed Boston Scientific Corporation $1,977,967 in accrued but unpaid sales royalties. We have suspended the APA 1000’s Phase III clinical trials and the research and development activities in the heat-activated immunotherapy business due to the lack of funding. If we are not able to raise additional capital, we will need to take certain measures to further reduce our operating costs, including reducing our staff, curtailing our research and development efforts and our clinical trials, and reducing the costs we plan to spend to operate our Prolieve® business. As such, we would not be able to achieve the growth of the Prolieve® business, complete the development, testing and commercialization of our product candidates. If adequate funding is not available, the Company will delay, scale back or eliminate certain aspects of its operations or attempt to obtain funds through unfavorable arrangements with partners or others that may force it to relinquish rights to certain of its technologies, products or potential markets or that could impose onerous financial or other terms. The Management is continuing its efforts to obtain additional funds so that the Company can meet its operating obligations and sustain operations.

We do not have any committed sources of financing and cannot give assurance that alternate funding will be available in a timely manner, on acceptable terms or at all. We may need to pursue dilutive equity financings, such as the issuance of shares of common stock, convertible debt or other equity-linked securities, which financings could dilute the percentage ownership of our current common stockholders and could significantly lower the market value of our common stock.

Net Cash Provided by Operations

Net cash used in operating activities was $69,824 for the three months ended June 30, 2019 compared to the $6,268 net cash used in operating activities during the three months ended June 30, 2018. The increase in the use of cash of approximately $63,556 is primarily due to an increase in net loss n offset by a decrease in cash used for accounts payable.

Net Cash Provided by/Used in Investing Activities

There were no investing transactions for the three months ending 2019 or 2018.

Net Cash Used in Financing Activities

There were no financing activities for the three months ended June 30, 2019 and 2018.

An investment in shares of our common stock (which we refer to as the “Shares”) involves a high degree of risk. You should carefully consider the risks described below and the risks described elsewhere in this annual report under the sections entitled “Item 4. Information on the Company” before deciding whether to invest in our shares. The following is a summary of the risk factors that we believe are most relevant to our business. These are factors that, individually or in the aggregate, could cause our actual results to differ significantly from anticipated or historical results. The occurrence of any of the risks could harm our business and cause the price of our common stock to decline, and investors may lose all or part of their investment. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider the following to be a complete discussion of all potential risks or uncertainties. The risks and uncertainties described below and in the incorporated documents are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occurs, our business, financial condition and results of operations would suffer. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Special Note Regarding Forward-Looking Statements” at the beginning of Part I of this annual report. Except as required by law, we undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise.

We have a history of significant losses and expect to continue such losses for the foreseeable future.

Since our inception in 2005, our expenses have substantially exceeded our revenues, resulting in continuing losses and an accumulated deficit of $36,443,359 at March 31, 2019. In addition, our net loss for the year ended March 31, 2019 was $1,470,532. Such operating losses are the result of limited revenues from our Prolieve® sales not being sufficient to offset the expenses associated with the Prolieve® operation and other corporate expenses. We may continue to experience operating losses unless and until we generate significant revenue from Prolieve®, as well as the development of other new products and these products have been clinically tested, approved by the FDA or other regulatory authorities, and successfully commercialized.

Litigation.

In June 2018, W.L. Pate, JR and Charles C. Shelton filed a lawsuit in the District Court of Harris County, Texas to seek monetary relief of over $200,000 but not more than $1,000,000 from Medifocus Inc. for a transaction that did not materialize. Although the Company does not believe the suit has any merits and has not accrued for any amount in its financial statements as of March 31, 2019, any judgement unfavorable to the Company can potentially cause significant financial hardship and other damages to the Company. In addition, certain note holders of the Company had threatened to take legal actions against the Company due to the default on the notes. Such legal actions will also cause significant financial hardship and other damages to the Company.

We may not be able to generate significant revenue for the foreseeable future.

Prior to July 2012, we devoted our resources to maintaining and developing the APA 1000. We will not be able to market the APA 1000 until we have completed clinical testing and obtained all necessary governmental approvals. On July 26, 2012, we acquired from Boston Scientific Corporation the Prolieve® business for the treatment of BPH and, since that time, we had assembled a sales and service team to market the Prolieve® system. Due to our cost reduction measures implemented since March 2016, we currently do not have a dedicated sales team to market Prolieve®. Our current revenue is primarily derived from sales of our single-use treatment catheters, treatments delivered through our mobile service and limited sales of Prolieve® consoles. Our lack of product diversification means that we may be negatively affected by changes in market conditions and in regulation (including regulation affecting reimbursement for our products). In addition, at the present time our APA 1000 system is still in clinical testing stage and cannot be marketed until we have completed clinical testing and obtained necessary governmental approval. Accordingly, our revenue sources are, and will remain extremely limited until and unless our Prolieve® system is marketed successfully and/or until our other new products are clinically tested, approved by the FDA or other regulatory authorities, and successfully commercialized. We cannot guarantee that our products will be successfully tested, approved by the FDA or other regulatory authorities, or commercialized, successfully or otherwise, at any time in the foreseeable future, if at all.

Our future may depend on our ability to obtain additional financing. If we do not obtain such financing, we may have to cease our operations and investors could lose their entire investment.

We have yet to operate profitably or generate positive cash flows from operations on annual basis, and there is no assurance that we will operate profitably or will generate positive cash flow in the future. As a result, we have very limited funds, and such funds may not be adequate to take advantage of current, planned and unanticipated business opportunities. Even if our funds prove to be sufficient to pursue current, planned and unanticipated business opportunities, we may not have enough capital to fully develop such opportunities. As of March 31, 2019, our total liabilities exceeded our tangible assets by $11,177,420.

We are dependent on the proceeds of future financing in order to grow the Prolieve® business and to develop and commercialize other products. There can be no assurance that we will be able to raise the additional capital resources necessary to permit us to pursue our business plan. Finally, the continued growth of our business may require additional funding from time to time to be used by us for general corporate purposes, such as acquisitions, investments, repayment of debt, capital expenditures, repurchase of capital stock and additional purposes identified by the Company.

Accordingly, our ultimate success may depend upon our ability to raise additional capital. There can be no assurance that any additional financing will be available to us. As additional capital is needed, we may not be able to obtain additional equity or debt financing. Even if financing is available, it may not be available on terms that are favorable or acceptable to us, or in sufficient amounts to satisfy our requirements. Any inability to obtain additional financing will likely have a material adverse effect on our business operations and could result in the loss of your entire investment.

Our independent registered public accountants have expressed substantial doubt regarding our ability to continue as a going concern.

Our auditors have expressed their opinion that there is substantial doubt about the Company’s ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of these uncertainties. Our ability to continue as a going concern is dependent upon our ability to successfully raise adequate additional financing and our ability to successfully develop our sales and marketing programs and commence our planned operations. We cannot assure you that we will be able to obtain additional financing or achieve profitability in our operations. Our failure to obtain additional financing or achieve profitability in our operations could require the Company to liquidate our business interests, and could result in the loss of your entire investment.

The loss of certain of our key personnel, or any inability to attract and retain additional personnel, could negatively affect our business.

Our future success depends to a significant extent on the continued service of certain key employees who have been intimately involved with, and primarily responsible for, the invention, development and commercialization efforts for our technology and products. The loss of services of those key employees could adversely affect our business and our ability to implement our business plan.

Our future success will also depend on our ability to attract, retain and motivate highly skilled personnel to assist us with product development, commercialization and other facets of our business plan. If we fail to hire and retain a sufficient number of qualified individuals to fully meet the needs of the business of the Company, it may have an adverse effect on our business and results of operations.

One of our shareholders owns a significant percentage of our Shares and could exert significant influence over matters requiring shareholder approval.

Mr. Tak Cheung Yam, a former director of the Company, through Integrated Assets Management (Asia) Ltd, currently owns 25,386,742 Shares, or 13.72% of the Company’s outstanding common stock. In addition, Mr. Yam, through Integrated Assets Management (Asia) Ltd, owns convertible notes in the amount of $2,811,737, including accrued and unpaid interest. As a result, Mr. Yam may have considerable influence over our management, our decision-making process, our business strategy and affairs and matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, such as mergers, consolidations or the sale of substantially all of our assets. Mr. Yam’s interests may differ from those of other shareholders of the Company, and, Mr. Yam will have the ability to exercise influence over our business and may take actions that are not in our or our public shareholders’ best interests. Furthermore, this concentration of ownership may have the effect of delaying or preventing a change in control, including a merger, consolidation or other business combination involving us, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control, even if such a change in control would benefit our other stockholders.

Our internal sales and marketing capability is limited and we may need to enter into alliances with others possessing such capabilities to commercialize our products internationally.

Currently our primary source of revenue is through the sales of disposable catheter treatment kits and mobile services in the U.S., as well as limited number of Prolieve® consoles to our distributor in Asia. We are dependent upon our limited sales and marketing capability for the successful marketing of our Prolieve® system. There can be no assurance that we will establish adequate sales and distribution capabilities or be successful in gaining market acceptance for our Prolieve® system.

We intend to market our other products, either directly or through other strategic alliances and distribution arrangements with third parties. There can be no assurance that we will be able to enter into third-party marketing or distribution arrangements on advantageous terms or at all. To the extent that we do enter into such arrangements, we will be dependent on our marketing and distribution partners. In entering into third-party marketing or distribution arrangements, we expect to incur significant additional expense. There can be no assurance that, to the extent that we sell products directly or we enter into any commercialization arrangements with third parties, such third parties will establish adequate sales and distribution capabilities or be successful in gaining market acceptance for our products and services.

We do not manufacture the Prolieve® system ourselves, and rely on a third-party supplier to supply us with the proprietary disposable catheters used with our Prolieve® system.

The Prolieve® systems we currently have in inventory were manufactured by Sanmina Corporation for Boston Scientific Corporation prior to our acquisition of the Prolieve® assets, and we do not currently have an agreement with Sanmina for the production of additional Prolieve® systems. Accordingly, if our current inventory becomes insufficient to meet the business growth in both the U.S. and international markets, we will have to engage Sanmina Corporation, or another manufacturer, to produce such additional systems. Further, the proprietary disposable catheter kits used with the Prolieve® system are manufactured by Lake Regional Medical Center (formerly Accellent Inc.) in its facility in Mexico. Due to the complexity of these catheter kits, as well as FDA standards applicable to manufacturers of such kits, the Company has not identified an alternative supplier for these catheter kits. If, for any reason, we are unable to obtain new Prolieve® systems manufactured by Sanmina Corporation, or we are no longer able to purchase the catheter kits from Lake Regional Medical Center in sufficient amounts, on an as-needed basis and on acceptable terms, or if either manufacturer becomes unable or unwilling to continue to supply us with new Prolieve® systems and disposable catheter kits, it would have a material adverse effect on our business and operations. There can be no assurance that we could find new manufacturers to fulfill our needs, that any such manufacturer would be FDA approved, or that such manufacturers would be willing to provide us with the required products under commercially acceptable terms. If we are unable to find additional manufacturers and suppliers and it results in a disruption to our business, there would be a material adverse effect on our business and results of operations.

The slow pace of our APA 1000 Breast Cancer System’s Phase III clinical trials could result in additional delays and increased costs of completing the trials in the future.

Our focus now is attaining profitability for our Prolieve® business. Accordingly, we have allocated most of our resources to this goal, compounding this with the lack of funding, the progress of the pivotal Phase III clinical trials of our APA 1000 breast cancer treatment system has been very slow. We estimate that the Phase III clinical trials will cost approximately $7,500,000. We currently do not have the financing in place to complete these trials. There can be no assurance that such financings will be available at all, or on terms favorable to us. Further, there can be no assurance as to when, or even if, we will succeed in making Prolieve® profitable. Our inability to do so may make it more difficult for us to raise funds for the pivotal Phase III clinical trial of the APA 1000. If we are able achieve profitable Prolieve® operations, there can be no assurance that we will be able to generate enough funds from the Prolieve® business to finance the pivotal Phase III clinical trial. Furthermore, we cannot predict the effect of the slow pace of the pivotal Phase III trial could have on the costs and other critical aspects of the Phase III clinical trial. There is the risk that this uncertainty could negatively impact our business plans, and our ability to raise additional funds for further development of our APA 1000 business.

We may not receive regulatory approval from the U.S. Food and Drug Administration (“FDA”) to market the APA 1000.

Drugs and medical devices in the United States are regulated by the FDA, which requires that new medicines and medical devices be demonstrated to be both safe and effective. This is accomplished by conducting staged clinical trials that are subject to the FDA’s review, analysis and approval. While the Phase I and Phase II clinical trials for APA 1000 have been completed, and we received approval from the FDA and Health Canada to begin the pivotal Phase III clinical trials, as of today, a very limited number of patients out of a planned 238-person trial in the pivotal Phase III clinical trial, have been treated with APA 1000. There can be no assurance that our Phase III clinical trial will be completed, and if it is completed, that it will demonstrate APA 1000’s safety and efficacy, and that we will subsequently receive the FDA’s approval for us to commence marketing. If we complete the pivotal Phase III clinical trial and receive FDA approval to market APA 1000, there can be no assurance that APA 1000 will be adopted for use by the healthcare industry, and that this business will be profitable.

We may not succeed in developing a meaningful market share of the benign prostatic hyperplasia (“BPH”) treatment markets with Prolieve®, and our Prolieve® business may not become profitable.

The BPH market is highly competitive, and is presently dominated by large, international pharmaceutical companies that promote the use of proprietary drugs to treat this condition. These companies, which include, Eli Lilly, Glaxo Smith Kline, Merck & Co., and others, aggressively market their drugs to primary care physicians, and to consumers through television, print, digital and other media. Because the market for BPH treatment is large and growing, and the manufacturers of these medications have made substantial investments in their development and marketing, we expect them to vigorously defend their market positions. In addition, we face intense competition from surgical and other minimally invasive treatment modalities. Because our financial, marketing and sales resources are much smaller than those of the pharmaceutical companies, we are at significant competitive disadvantage, which will make it difficult for us to substantially expand our Prolieve® business.

Recent or future health care reform laws in the U.S. could have a negative impact on our business.

Our business, financial condition, results of operations and cash flows could be significantly and adversely affected by recent or future healthcare reform legislation. We cannot predict what healthcare programs and regulations will ultimately be implemented at the federal or state level, or the effect of any future legislation or regulation. However, any changes that lower reimbursement for our products or reduce medical procedure volumes could have a material adverse effect our business and results of operations.

Our APA 1000 system and future products utilizing the adaptive phased array technology depend on the license agreement with MIT, and our immunotherapy and gene therapy development and commercialization efforts utilizing the heat-activated gene technology depend on the license agreement with Duke University to permit us to use patented technologies.

Our success depends, in substantial part, on our ability to maintain our rights under license agreements that grant us the rights to use patented technologies. We have entered into a license agreement with MIT under which we have exclusive rights to commercialize medical treatment products and procedures based on MIT’s Adaptive Phased Array technology. The MIT license agreement contains license fee, royalty and/or research support provisions, testing and regulatory milestones, and other performance requirements that we must meet by certain deadlines. If we breach these or other provisions of the license agreements, we could lose our ability to use the subject technologies and it could have a material adverse effect on our business. Further, we cannot guarantee that any patent or other technology rights licensed to us by others will not be challenged or circumvented successfully by third parties, or that the rights granted will provide adequate protection. We are aware of published patent applications and issued patents belonging to others, and it is not clear whether any of these patents or applications, or other patent applications of which we may not have any knowledge, will require us to alter any of our potential products or processes, pay licensing fees to others or cease certain activities. Litigation, which could result in substantial costs, may also be necessary to enforce any patents issued to or licensed by us or to determine the scope and validity of others’ claimed proprietary rights. We also rely on trade secrets and confidential information that we seek to protect, in part, by confidentiality agreements with our corporate partners, collaborators, employees, and consultants. We cannot guarantee that these agreements will not be breached, that, even if not breached, that they are adequate to protect our trade secrets, that we will have adequate remedies for any breach or that our trade secrets will not otherwise become known to, or will not be discovered independently by, competitors.

We may not be able to protect the intellectual property that is integral to our business, or we may be subject to claims of intellectual property infringement by third parties, either of which could have a material adverse effect on our business.