|

Exhibit 99.1

|

2014 RBC Capital Markets’ Global Industrials Conference

September 2014

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH

Forward Looking Statements and Non-GAAP

Financial Measures

Certain statements in this presentation may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; volatility in general business and economic conditions in the markets in which we operate, including, without limitation, factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets, including competition from both manufacturers of high performance thermoplastic corrugated pipe and manufacturers of products using alternative materials; our ability to continue to convert current demand for concrete, steel and PVC pipe products into demand for our high performance thermoplastic corrugated pipe and Allied Products; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; our ability to achieve the acquisition component of our growth strategy; the risk associated with manufacturing processes; our ability to manage our assets; the risks associated with our product warranties; our ability to manage our supply purchasing and customer credit policies; the risks associated with our self-insured programs; our ability to control labor costs and to attract, train and retain highly-qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to project product mix; the risks associated with our current levels of indebtedness; our ability to meet future capital requirements and fund our liquidity needs; and the other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the

Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

This presentation includes certain non-GAAP financial measures to describe the Company’s performance. The reconciliation of those measures to GAAP measures are provided within the appendix of the presentation. Those disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

2

Management Presenters

Joseph Chlapaty

Chairman, President & CEO

Years at the Company: 33

Years in the Industry: 33

Mark Sturgeon

Executive Vice President, Finance & CFO

Years at the Company: 33

Years in the Industry: 33

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

3

ADS – An Industrial Growth Company

The leading player in the industry

The only complete solutions provider for the water management industry, with a history of product innovation

Track record of market share gains with material conversion growing steadily over time

Large addressable opportunity across diverse construction markets

Demonstrated ability to deliver above market growth, EBITDA margin expansion and strong cash flows

Experienced management team with significant ownership stake

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

4

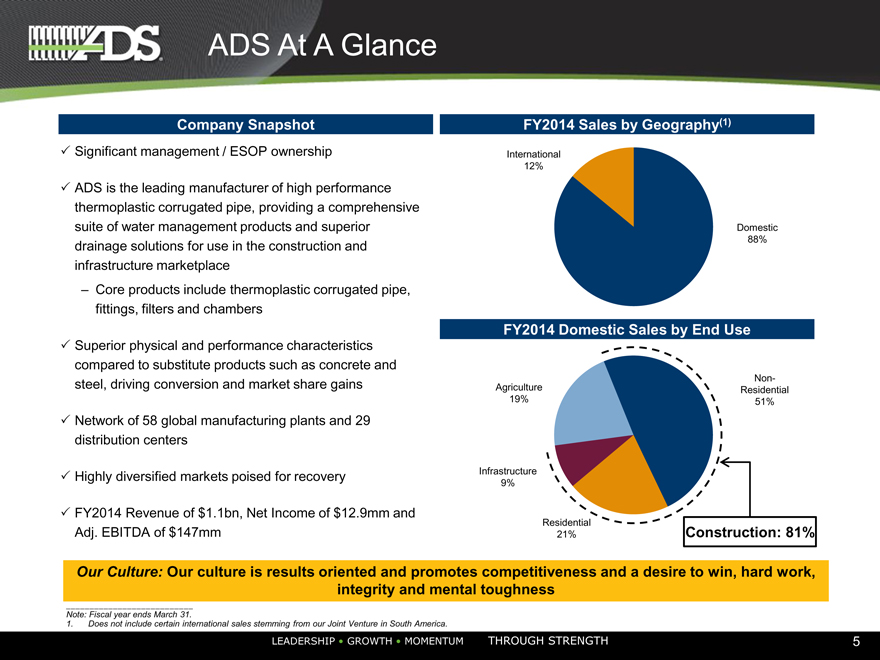

ADS At A Glance

Company Snapshot

Significant management / ESOP ownership

ADS is the leading manufacturer of high performance thermoplastic corrugated pipe, providing a comprehensive suite of water management products and superior drainage solutions for use in the construction and infrastructure marketplace

Core products include thermoplastic corrugated pipe, fittings, filters and chambers

Superior physical and performance characteristics compared to substitute products such as concrete and steel, driving conversion and market share gains

Network of 58 global manufacturing plants and 29 distribution centers

Highly diversified markets poised for recovery

FY2014 Revenue of $1.1bn, Net Income of $12.9mm and Adj. EBITDA of $147mm

FY2014 Sales by Geography(1)

International

12%

Domestic

88%

FY2014 Domestic Sales by End Use

Non-

Agriculture Residential

19% 51%

Infrastructure

9%

Residential

21% Construction: 81%

Our Culture: Our culture is results oriented and promotes competitiveness and a desire to win, hard work, integrity and mental toughness

Note: Fiscal year ends March 31.

1. Does not include certain international sales stemming from our Joint Venture in South America.

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH 5

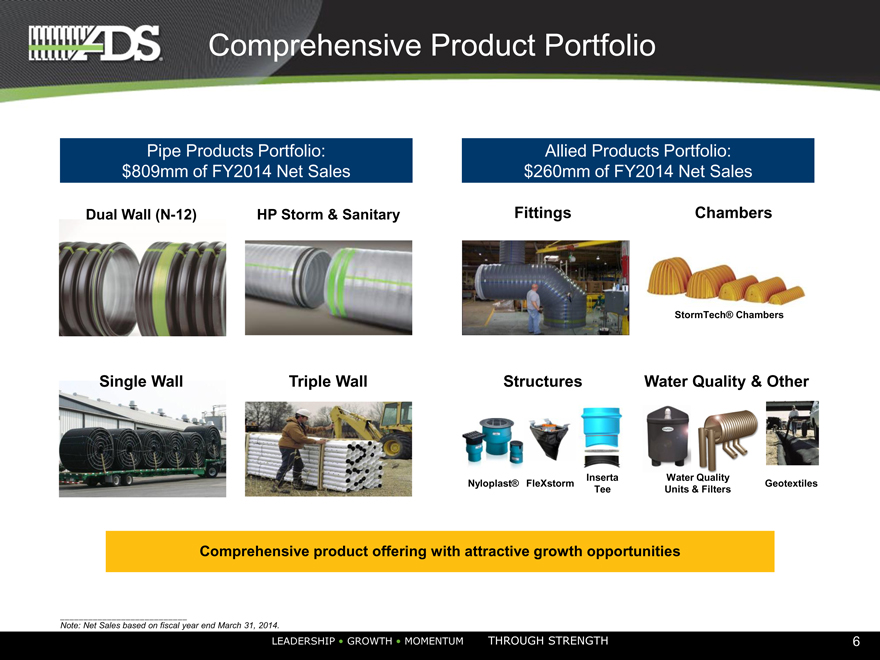

Comprehensive Product Portfolio

Pipe Products Portfolio: Allied Products Portfolio:

$809mm of FY2014 Net Sales $260mm of FY2014 Net Sales

Dual Wall (N-12) HP Storm & Sanitary Fittings Chambers

StormTech® Chambers

Single Wall Triple Wall Structures Water Quality & Other

Inserta Water Quality

Nyloplast® FleXstorm Geotextiles

Tee Units & Filters

Comprehensive product offering with attractive growth opportunities

Note: Net Sales based on fiscal year end March 31, 2014.

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH

6

Water Management Solutions

StormTech

Chambers Foundation / Sump Wells

Fittings

Wastewater

Pipe Disposal

Nyloplast

Structures Water Quality

Downspout / Landscape /

Culverts / Edge Drains Window Well Drainage

Project Life Cycle

Technical Design

INFLUENCE Concept & & Permit Bid Construction

Initiation Financial

TO PROJECT Feasibility Specification

ABILITY

TIME

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH 7

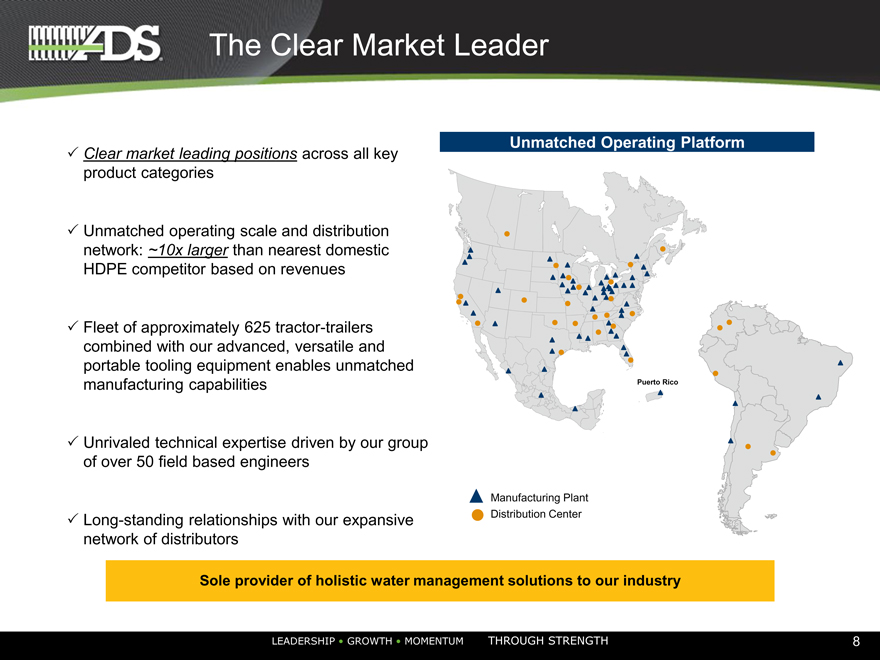

The Clear Market Leader

Unmatched Operating Platform

Clear market leading positions across all key product categories

Unmatched operating scale and distribution network: ~10x larger than nearest domestic HDPE competitor based on revenues

Fleet of approximately 625 tractor-trailers combined with our advanced, versatile and portable tooling equipment enables unmatched manufacturing capabilities Puerto Rico

Unrivaled technical expertise driven by our group of over 50 field based engineers

Manufacturing Plant

Long-standing relationships with our expansive Distribution Center network of distributors

Sole provider of holistic water management solutions to our industry

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

8

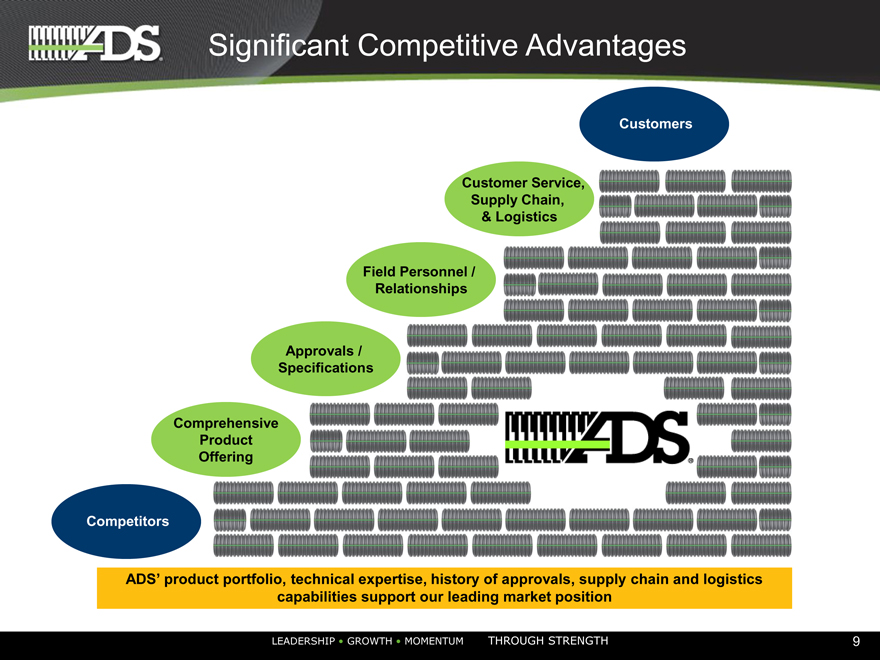

Significant Competitive Advantages

Customers

Customer Service,

Supply Chain,

& Logistics

Field Personnel /

Relationships

Approvals /

Specifications

Comprehensive

Product

Offering

Competitors

ADS’ product portfolio, technical expertise, history of approvals, supply chain and logistics capabilities support our leading market position

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

9

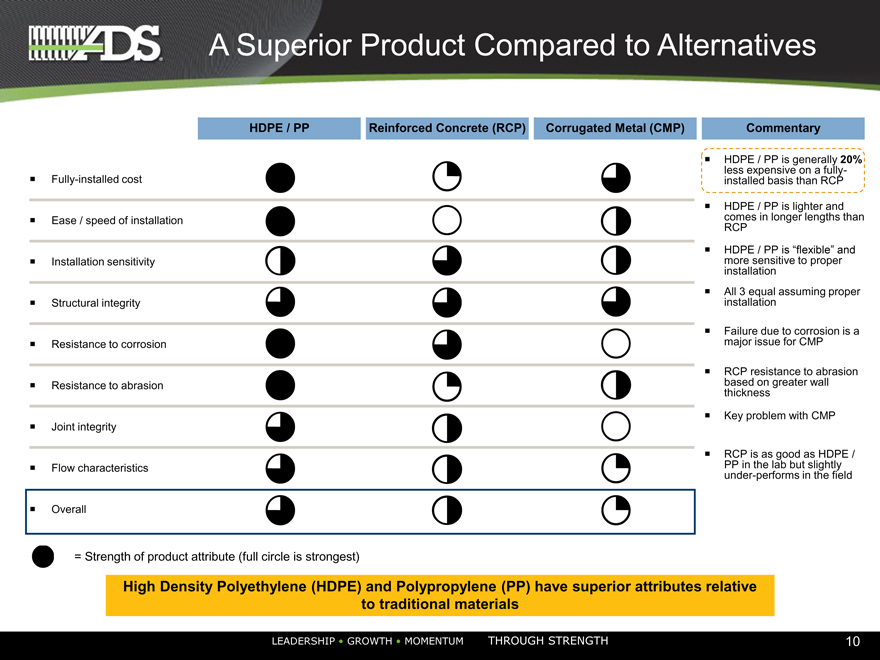

A Superior Product Compared to Alternatives

HDPE / PP

Reinforced Concrete (RCP)

Corrugated Metal (CMP)

Fully-installed cost

Ease / speed of installation

Installation sensitivity

Structural integrity

Resistance to corrosion

Resistance to abrasion

Joint integrity

Flow characteristics

Overall

= Strength of product attribute (full circle is strongest)

Commentary

HDPE / PP is generally 20% less expensive on a fully- installed basis than RCP

HDPE / PP is lighter and comes in longer lengths than RCP

HDPE / PP is “flexible” and more sensitive to proper installation

All 3 equal assuming proper installation

Failure due to corrosion is a major issue for CMP

RCP resistance to abrasion based on greater wall thickness

Key problem with CMP

RCP is as good as HDPE /PP

in the lab but slightly

under-performs in the field

High Density Polyethylene (HDPE) and Polypropylene (PP) have superior attributes relative to traditional materials

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

10

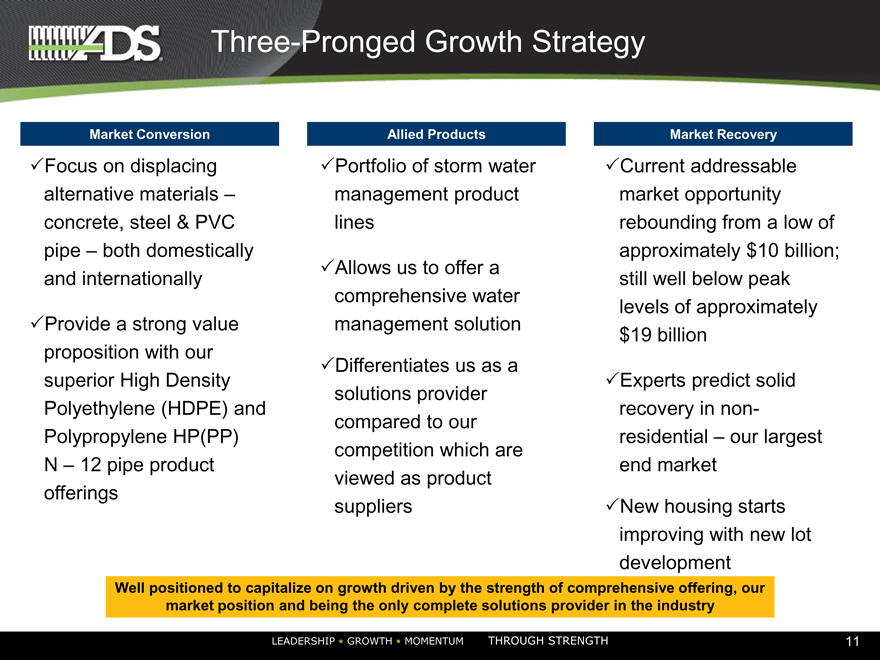

Three-Pronged Growth Strategy

Market Conversion

Focus on displacing alternative materials – concrete, steel & PVC pipe – both domestically and internationally

Provide a strong value proposition with our superior High Density Polyethylene (HDPE) and Polypropylene HP(PP) N – 12 pipe product

offerings

Allied Products

Portfolio of storm water management product lines

Allows us to offer a comprehensive water management solution

Differentiates us as a solutions provider compared to our competition which are viewed as product suppliers

Market Recovery

Current addressable market opportunity rebounding from a low of approximately $10 billion; still well below peak levels of approximately $19 billion

Experts predict solid recovery in non-residential – our largest

end market

New housing starts improving with new lot development

Well positioned to capitalize on growth driven by the strength of comprehensive offering, our market position and being the only complete solutions provider in the industry

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

11

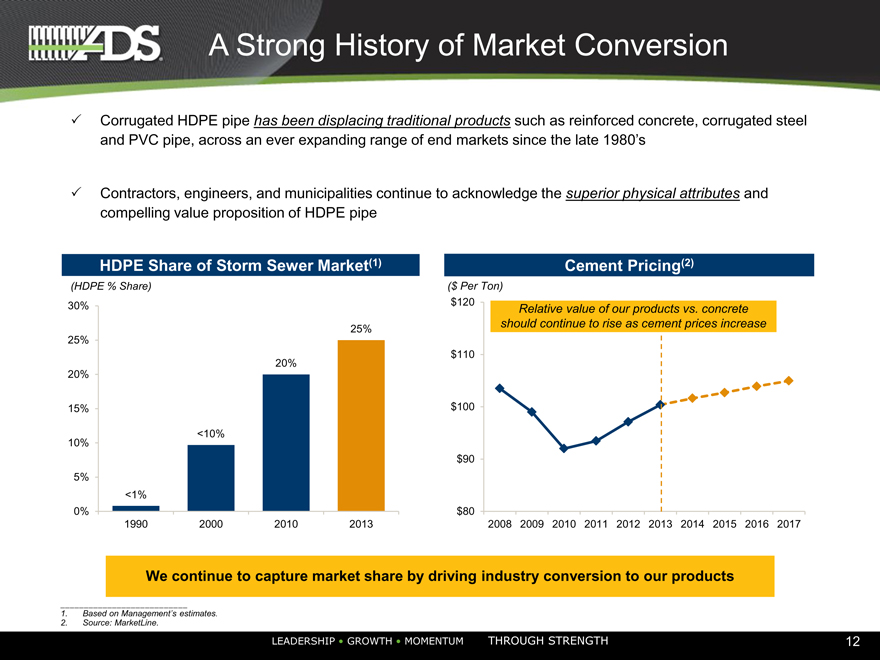

A Strong History of Market Conversion

Corrugated HDPE pipe has been displacing traditional products such as reinforced concrete, corrugated steel and PVC pipe, across an ever expanding range of end markets since the late 1980’s

Contractors, engineers, and municipalities continue to acknowledge the superior physical attributes and compelling value proposition of HDPE pipe

We continue to capture market share by driving industry conversion to our products

1. Based on Management’s estimates.

2. Source: MarketLine.

LEADERSHIP • GROWTH • MOMENTUM

HDPE share of strom sever market(1) Comment pricing(2)

THROUGH STRENGTH

12

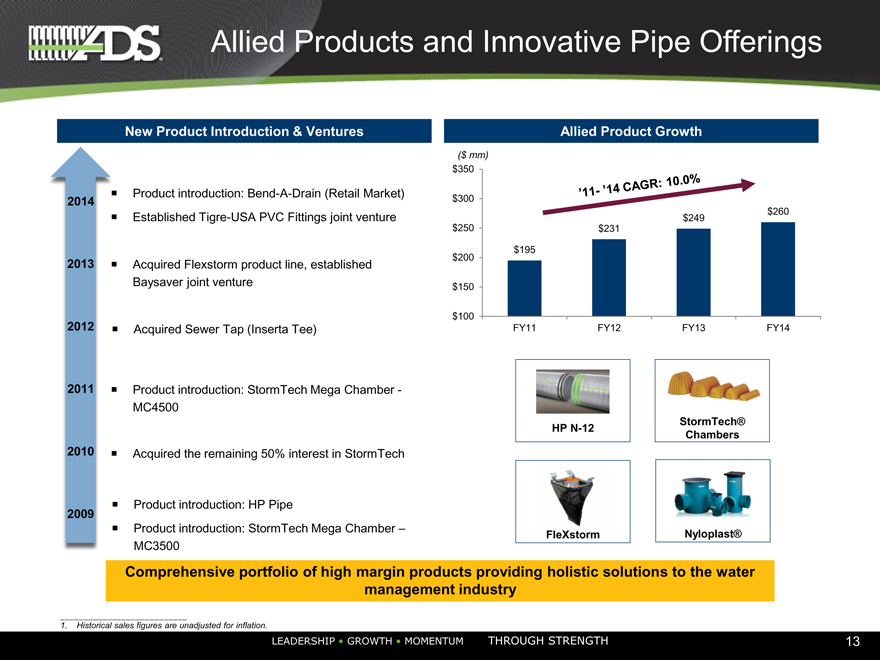

Allied Products and Innovative Pipe Offerings

New Product Introduction & Ventures

Product introduction: Bend-A-Drain (Retail Market)

2014

Established Tigre-USA PVC Fittings joint venture

2013 Acquired Flexstorm product line, established

Baysaver joint venture

2012 Acquired Sewer Tap (Inserta Tee)

2011 Product introduction: StormTech Mega Chamber -

MC4500

2010 Acquired the remaining 50% interest in StormTech

Product introduction: HP Pipe

2009

Product introduction: StormTech Mega Chamber –

MC3500

Allied Product Growth

($ mm)

$350

$300

$260

$249

$250 $231 ‘11 -’14 CAGR: 10.0%

$195

$200

$150

$100

FY11 FY12 FY13 FY14

HP N-12 StormTech®

Chambers

FleXstorm Nyloplast®

Comprehensive portfolio of high margin products providing holistic solutions to the water management industry

1. Historical sales figures are unadjusted for inflation.

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

13

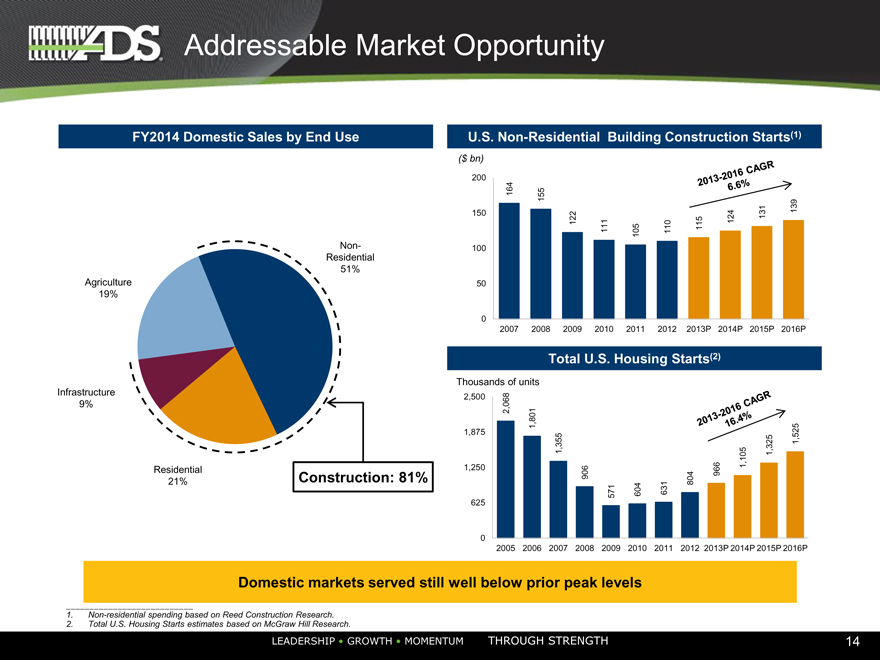

Addressable Market Opportunity

FY2014 Domestic Sales by End Use U.S. Non-Residential Building Construction Starts(1)

($ bn)

200

164 155

150 122 124 131 139

111 105 110 115

Non- 100

Residential

51%

Agriculture 50

19%

0

2007 2008 2009 2010 2011 2012 2013P 2014P 2015P 2016P

Total U.S. Housing Starts(2)

Thousands of units

Infrastructure 2,500

9% 2,068 1,801

1,875 1,525

1,355 1,325

Residential 1,250 966 1,105

21% Construction: 81% 906 804

571 604 631

625

0

2005 2006 2007 2008 2009 2010 2011 2012 2013P 2014P 2015P 2016P

Domestic markets served still well below prior peak levels

1. Non-residential spending based on Reed Construction Research.

2. Total U.S. Housing Starts estimates based on McGraw Hill Research.

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

14

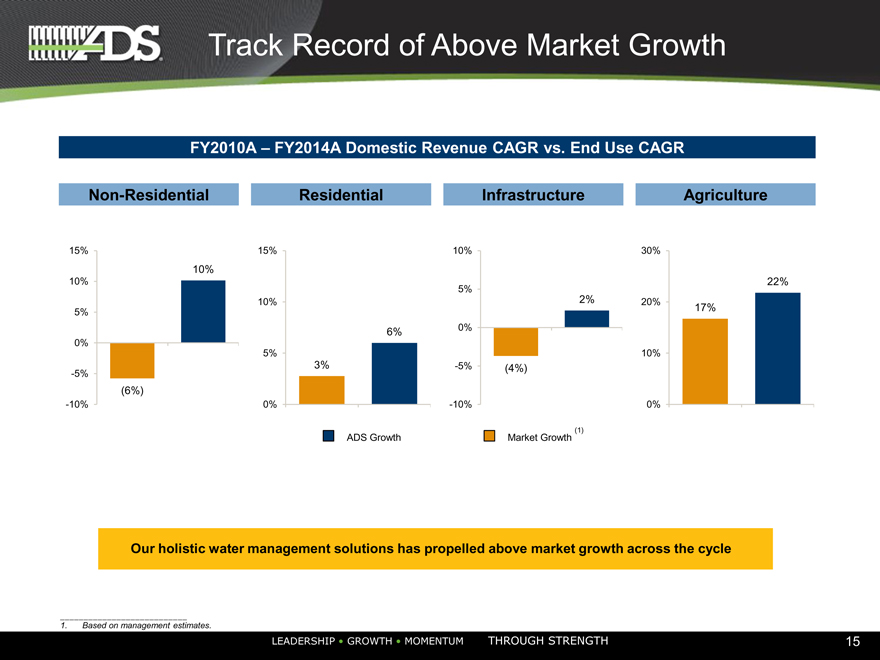

Track Record of Above Market Growth

FY2010A – FY2014A Domestic Revenue CAGR vs. End Use CAGR

Non-Residential Residential Infrastructure Agriculture

15% 15% 10% 30%

10%

10% 22%

5%

10% 2% 20%

5% 17%

6% 0%

0%

5% 10%

-5% 3% -5%(4%)

(6%)

-10% 0% -10% 0%

ADS Growth Market Growth (1)

Our holistic water management solutions has propelled above market growth across the cycle

1. Based on management estimates.

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH 15

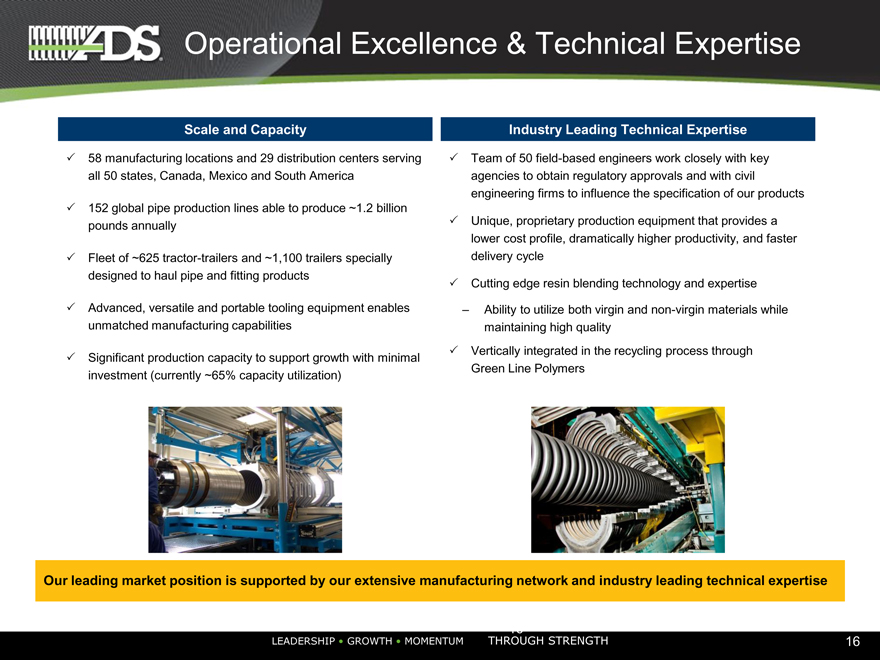

Operational Excellence & Technical Expertise

Scale and Capacity

58 manufacturing locations and 29 distribution centers serving all 50 states, Canada, Mexico and South America

152 global pipe production lines able to produce ~1.2 billion pounds annually

Fleet of ~625 tractor-trailers and ~1,100 trailers specially designed to haul pipe and fitting products

Advanced, versatile and portable tooling equipment enables unmatched manufacturing capabilities

Significant production capacity to support growth with minimal investment (currently ~65% capacity utilization)

Industry Leading Technical Expertise

Team of 50 field-based engineers work closely with key agencies to obtain regulatory approvals and with civil engineering firms to influence the specification of our products

Unique, proprietary production equipment that provides a lower cost profile, dramatically higher productivity, and faster delivery cycle

Cutting edge resin blending technology and expertise

Ability to utilize both virgin and non-virgin materials while maintaining high quality

Vertically integrated in the recycling process through Green Line Polymers

Our leading market position is supported by our extensive manufacturing network and industry leading technical expertise

16

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH 16

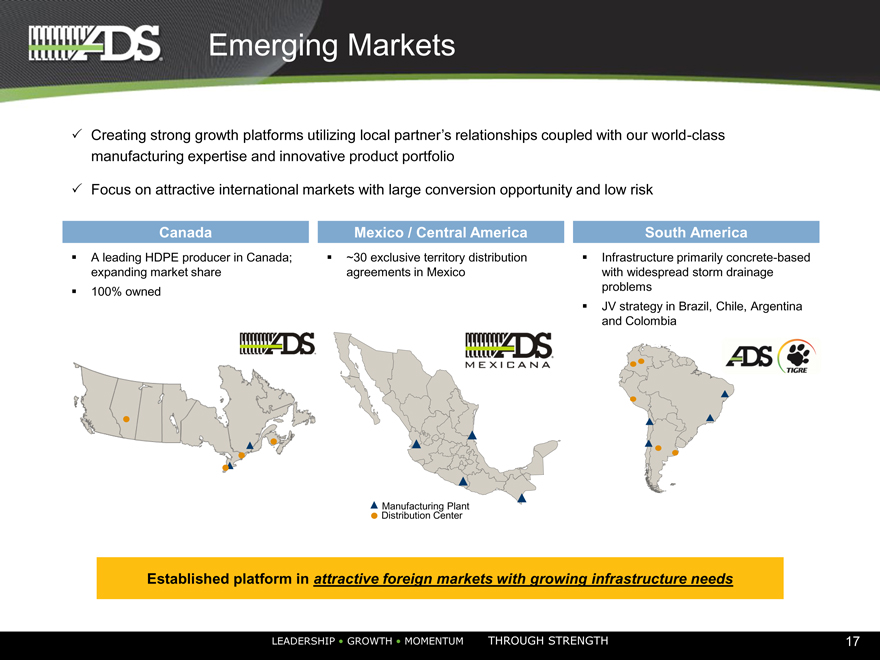

Emerging Markets

Creating strong growth platforms utilizing local partner’s relationships coupled with our world-class manufacturing expertise and innovative product portfolio

Focus on attractive international markets with large conversion opportunity and low risk

Canada

Mexico / Central America

South America

A leading HDPE producer in Canada; expanding market share

100% owned

~30 exclusive territory distribution agreements in Mexico

Infrastructure primarily concrete-based with widespread storm drainage problems

JV strategy in Brazil, Chile, Argentina and Colombia

Manufacturing Plant

Distribution Center

Established platform in attractive foreign markets with growing infrastructure needs

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

17

Financial Overview

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

Financial Highlights

Above-Market Growth

Attractive End Market Dynamics

Strong Earnings Momentum

Attractive Cash Flow Dynamics

Unmatched track record in driving market conversion to our products from traditional products with a long runway ahead

Ability to deliver complete solutions through our comprehensive portfolio of products and expansive distribution network

Well positioned to capitalize on recovery in our core domestic end markets

Poised to benefit from operating leverage and improving product mix

Ongoing focus on cost management and operational efficiency

Significant production capacity supports low capex requirements to fund growth

Minimal interest expense given conservative capital structure

Proven history of generating strong free cash flows

Well positioned to drive continued growth

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

19

First Fiscal Quarter 2015 Highlights

Quarterly net sales increased 12.0%

Adjusted EBITDA of $49.2 million

Adjusted earnings per fully converted share of $0.25

As of July 30, 2014; fully converted shares of common stock outstanding of 73.2 million

Note: Historical financial information available from our Form S-1 and recent financial performance available from our Form 10-Q in the Investor Relations

section of our web site – ADS-Pipe.com

LEADERSHIP • GROWTH • MOMENTUM THROUGH STRENGTH 20

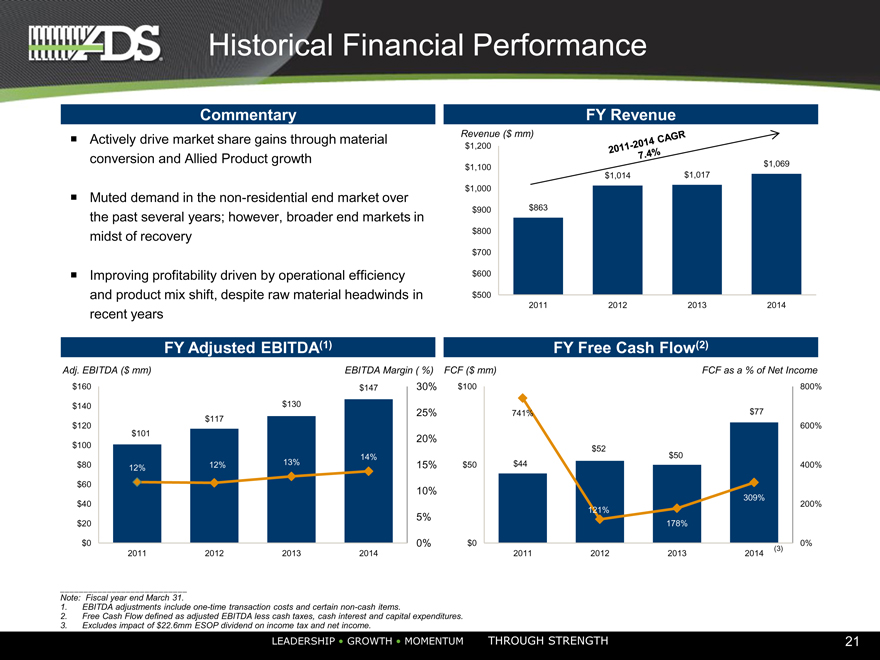

Historical Financial Performance

Commentary

Actively drive market share gains through material conversion and Allied Product growth

Muted demand in the non-residential end market over the past several years; however, broader end markets in midst of recovery

Improving profitability driven by operational efficiency and product mix shift, despite raw material headwinds in recent years

FY Revenue

Revenue ($ mm)

$1,200

$1,100 $1,069

$1,014 $1,017

$1,000

$900 $863

$800

$700

$600

$500

2011 2012 2013 2014

FY Adjusted EBITDA(1)

FY Free Cash Flow(2)

Adj. EBITDA ($ mm) EBITDA Margin ( %) FCF ($ mm) FCF as a % of Net Income

$160 $147 30% $100 800%

$140 $130

25% 741% $77

$117

$120 600%

$101 20%

$100 $52

14% $50

$80 12% 12% 13% 15% $50 $44 400%

$60

10%

309%

$40 200%

121%

5%

$20 178%

$0 0% $0 0%

(3)

2011 2012 2013 2014 2011 2012 2013 2014

Note: Fiscal year end March 31.

1. EBITDA adjustments include one-time transaction costs and certain non-cash items.

2. Free Cash Flow defined as adjusted EBITDA less cash taxes, cash interest and capital expenditures.

3. Excludes impact of $22.6mm ESOP dividend on income tax and net income.

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

21

Appendix

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

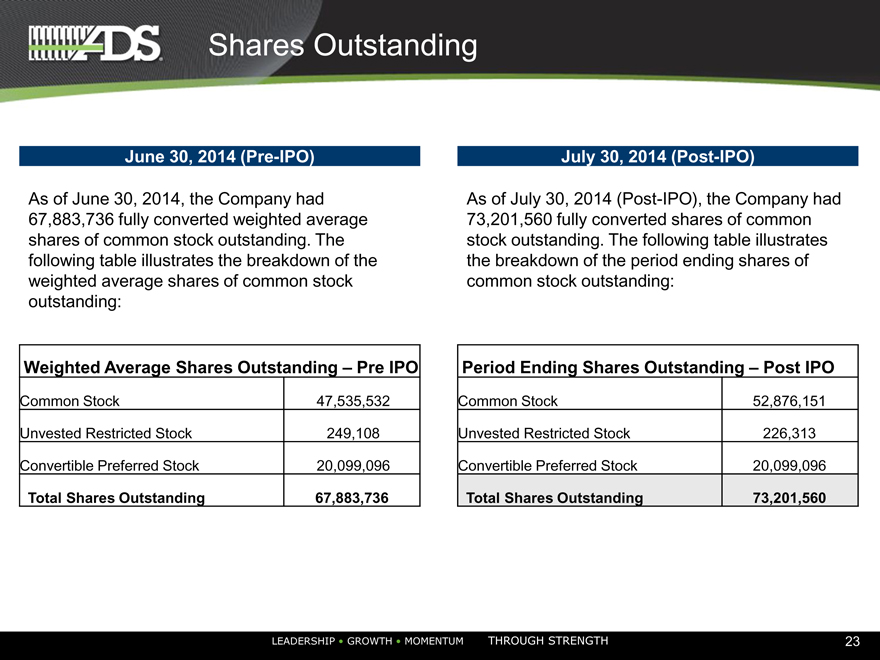

Shares Outstanding

June 30, 2014 (Pre-IPO)

As of June 30, 2014, the Company had 67,883,736 fully converted weighted average shares of common stock outstanding. The following table illustrates the breakdown of the weighted average shares of common stock outstanding:

Weighted Average Shares Outstanding – Pre IPO

Common Stock 47,535,532

Unvested Restricted Stock 249,108

Convertible Preferred Stock 20,099,096

Total Shares Outstanding 67,883,736

July 30, 2014 (Post-IPO)

As of July 30, 2014 (Post-IPO), the Company had 73,201,560 fully converted shares of common stock outstanding. The following table illustrates the breakdown of the period ending shares of common stock outstanding:

Period Ending Shares Outstanding – Post IPO

Common Stock 52,876,151

Unvested Restricted Stock 226,313

Convertible Preferred Stock 20,099,096

Total Shares Outstanding 73,201,560

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

23

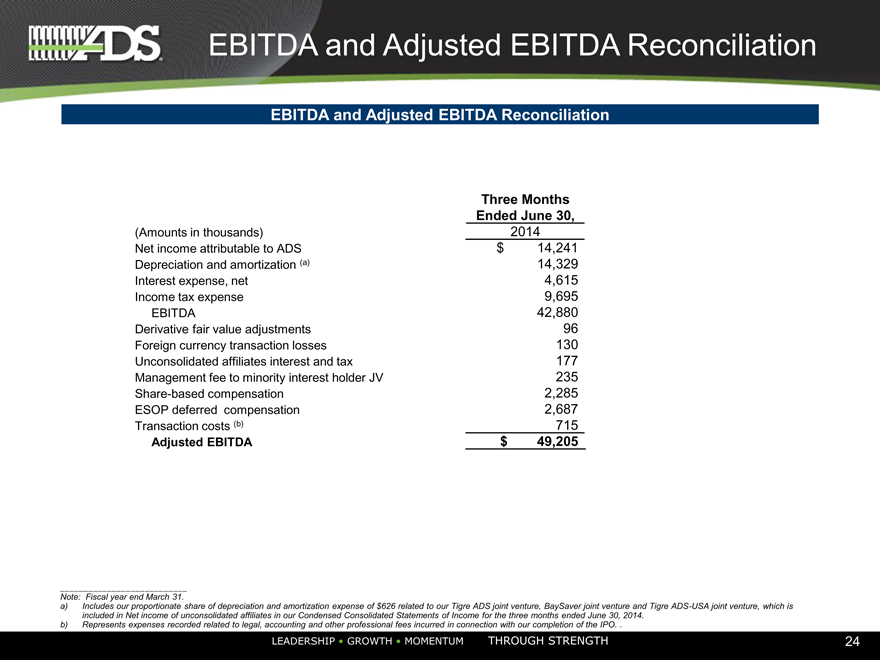

EBITDA and Adjusted EBITDA Reconciliation

EBITDA and Adjusted EBITDA Reconciliation

Three Months

Ended June 30,

(Amounts in thousands) 2014

Net income attributable to ADS $ 14,241

Depreciation and amortization (a) 14,329

Interest expense, net 4,615

Income tax expense 9,695

EBITDA 42,880

Derivative fair value adjustments 96

Foreign currency transaction losses 130

Unconsolidated affiliates interest and tax 177

Management fee to minority interest holder JV 235

Share-based compensation 2,285

ESOP deferred compensation 2,687

Transaction costs (b) 715

Adjusted EBITDA $ 49,205

Note: Fiscal year end March 31.

a) Includes our proportionate share of depreciation and amortization expense of $626 related to our Tigre ADS joint venture, BaySaver joint venture and Tigre ADS-USA joint venture, which is included in Net income of unconsolidated affiliates in our Condensed Consolidated Statements of Income for the three months ended June 30, 2014.

b) Represents expenses recorded related to legal, accounting and other professional fees incurred in connection with our completion of the IPO. .

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

24

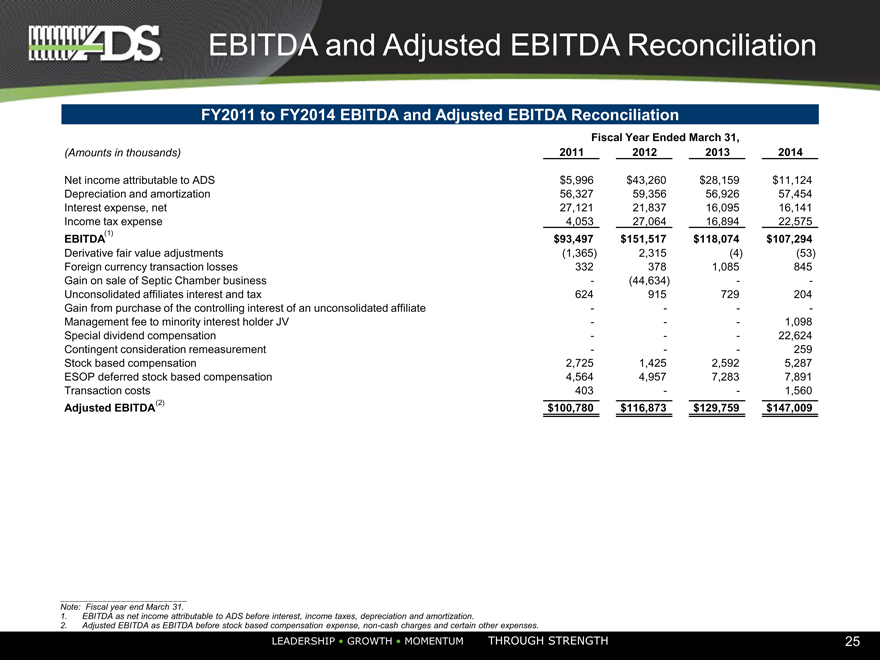

EBITDA and Adjusted EBITDA Reconciliation

FY2011 to FY2014 EBITDA and Adjusted EBITDA Reconciliation

Fiscal Year Ended March 31,

(Amounts in thousands) 2011 2012 2013 2014

Net income attributable to ADS $5,996 $43,260 $28,159 $11,124

Depreciation and amortization 56,327 59,356 56,926 57,454

Interest expense, net 27,121 21,837 16,095 16,141

Income tax expense 4,053 27,064 16,894 22,575

EBITDA(1) $93,497 $151,517 $118,074 $107,294

Derivative fair value adjustments(1,365) 2,315(4)(53)

Foreign currency transaction losses 332 378 1,085 845

Gain on sale of Septic Chamber business -(44,634) —

Unconsolidated affiliates interest and tax 624 915 729 204

Gain from purchase of the controlling interest of an unconsolidated affiliate — —

Management fee to minority interest holder JV ——1,098

Special dividend compensation ——22,624

Contingent consideration remeasurement ——259

Stock based compensation 2,725 1,425 2,592 5,287

ESOP deferred stock based compensation 4,564 4,957 7,283 7,891

Transaction costs 403 — 1,560

Adjusted EBITDA(2) $100,780 $116,873 $129,759 $147,009

Note: Fiscal year end March 31.

1.EBITDA as net income attributable to ADS before interest, income taxes, depreciation and amortization.

2. Adjusted EBITDA as EBITDA before stock based compensation expense, non-cash charges and certain other expenses.

LEADERSHIP • GROWTH • MOMENTUM

THROUGH STRENGTH

25

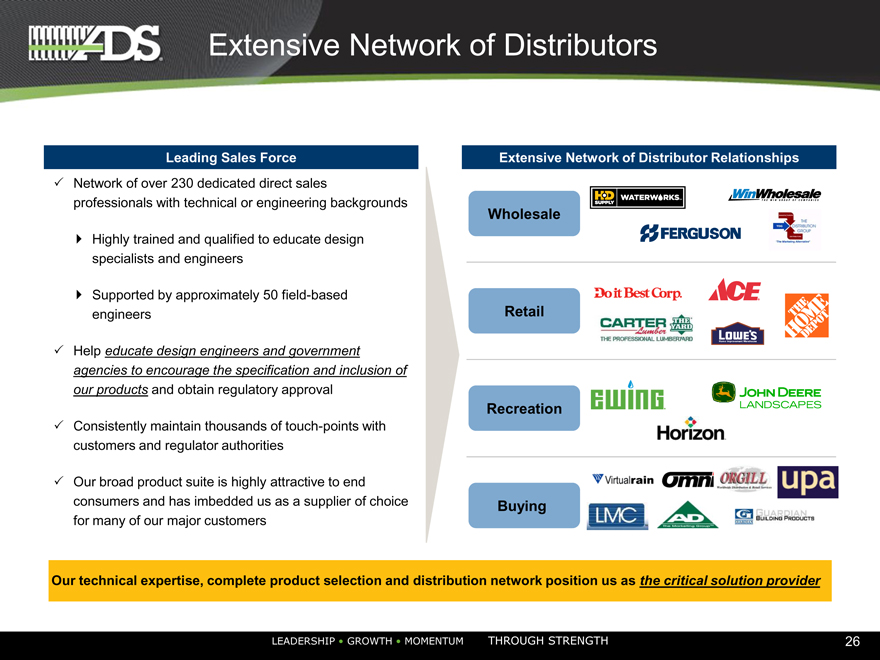

Extensive Network of Distributors

Leading Sales Force

Network of over 230 dedicated direct sales professionals with technical or engineering backgrounds

Highly trained and qualified to educate design specialists and engineers

Supported by approximately 50 field-based engineers

Help educate design engineers and government agencies to encourage the specification and inclusion of our products and obtain regulatory approval

Consistently maintain thousands of touch-points with customers and regulator authorities

Our broad product suite is highly attractive to end consumers and has imbedded us as a supplier of choice for many of our major customers

Extensive Network of Distributor Relationships

[Graphic Appears Here]

Our technical expertise, complete product selection and distribution network position us as the critical solution provider

RSHIP • GROWTH • MOMENTUM THROUGH STRENGTH 26