Advanced Drainage Systems Q1 Fiscal 2020 Financial Results & Infiltrator Acquisition Announcement

Management Presenters Scott Barbour President and Chief Executive Officer Scott Cottrill Executive Vice President, Chief Financial Officer Mike Higgins Vice President, Corporate Strategy & Investor Relations

Call Agenda Q1 Fiscal 2020 Results Infiltrator Acquisition Q&A

Forward Looking Statements and Non-GAAP Financial Metrics Certain statements in this presentation may be deemed to be forward-looking statements. Such statements include, but are not limited to, statements regarding the anticipated timing for the issuance of additional historic and future financial information and related filings. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; volatility in general business and economic conditions in the markets in which we operate, including, without limitation, factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets, including competition from both manufacturers of high performance thermoplastic corrugated pipe and manufacturers of products using alternative materials; uncertainties surrounding the integration of acquisitions and similar transactions, including the recently completed acquisition of Infiltrator and the integration of Infiltrator; our ability to realize the anticipated benefits from the acquisition of Infiltrator; risks that acquisitions of Infiltrator and related transactions may involve unexpected costs, liabilities and delays; our ability to continue to convert current demand for concrete, steel and PVC pipe products into demand for our high performance thermoplastic corrugated pipe and Allied Products; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; our ability to remediate the material weakness in our internal control over financial reporting; including remediation of the control environment for our joint venture affiliate ADS Mexicana, S.A. de C.V. as described in “Item 9A Controls and Procedures” of our Annual Report Form 10-K for the year ended March 31, 2019; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; including risks associated with new markets and products associated with our recent acquisition of Infiltrator; our ability to achieve the acquisition component of our growth strategy; the risk associated with manufacturing processes; our ability to manage our assets; the risks associated with our product warranties; our ability to manage our supply purchasing and customer credit policies; the risks associated with our self-insured programs; our ability to control labor costs and to attract, train and retain highly-qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to project product mix; the risks associated with our current levels of indebtedness; fluctuations in our effective tax rate, including from the recently enacted Tax Cuts and Jobs Act; changes to our operating results, cash flows and financial condition attributable to the recently enacted Tax Cuts and Jobs Act; our ability to meet future capital requirements and fund our liquidity needs; the risk that additional information may arise during the course of the Company’s ongoing accounting review that would require the Company to make additional adjustments or revisions or to restate the financial statements and other financial data for certain prior periods and any future periods; a conclusion that the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) were ineffective; the review of potential weaknesses or deficiencies in the Company’s disclosure controls and procedures, and discovering further weaknesses of which we are not currently aware or which have not been detected; additional uncertainties related to accounting issues generally and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation includes certain non-GAAP financial measures to describe the Company’s performance. The reconciliation of those measures to GAAP measures are provided within the appendix of the presentation. Those disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

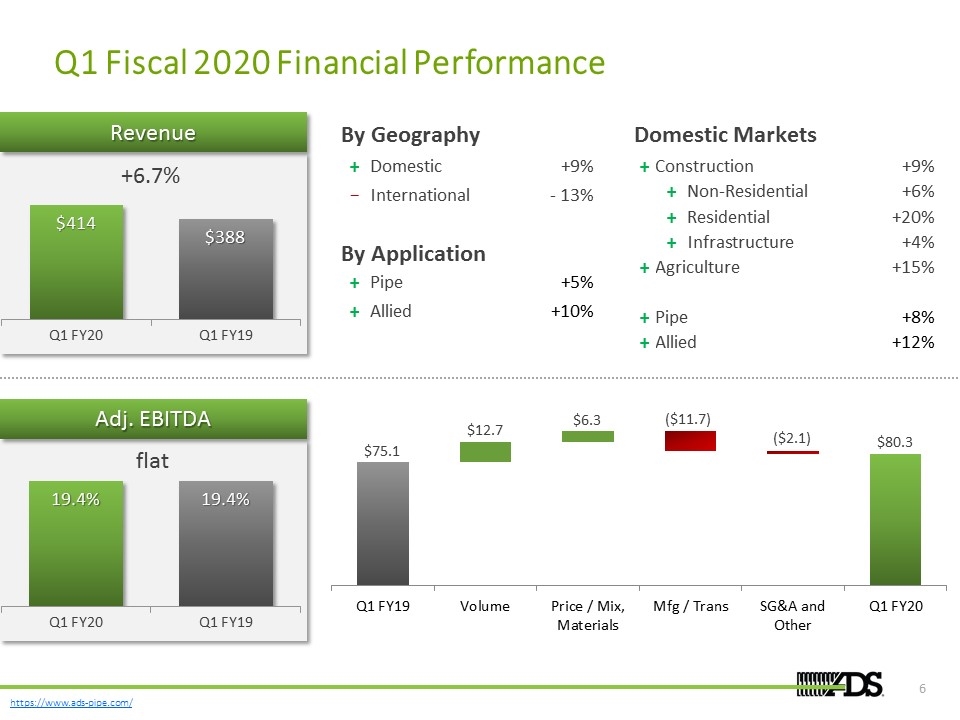

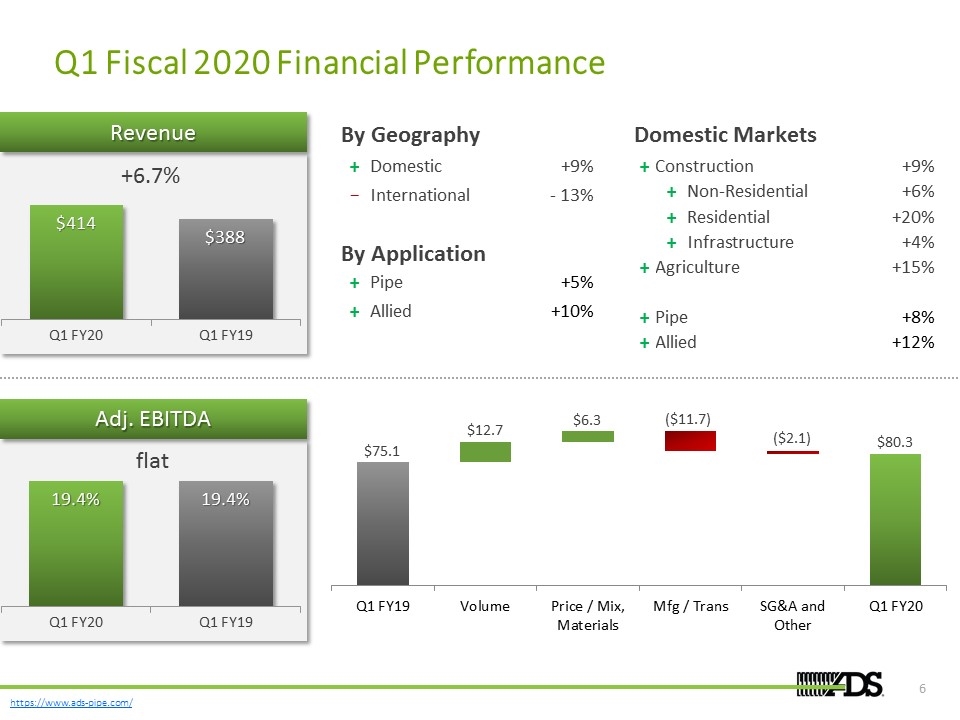

Q1 FY 2020 Highlights Domestic construction market sales grew 6% despite record rainfall in the quarter, in led by non-residential and residential construction. Profitability driven by strong sales growth, favorable material cost and disciplined execution, partially offset by inventory absorption headwind from fourth quarter production. Strong cash flow generation primarily driven by working capital improvement. 1 2 3 Net sales growth of 7% driven by both Pipe and Allied products. Domestic sales grew 9%, with growth in all end markets.

Q1 Fiscal 2020 Financial Performance flat (USD, in millions) +6.7% Domestic Markets + Construction +9% + Non-Residential +6% + Residential +20% + Infrastructure +4% + Agriculture +15% + Pipe +8% + Allied +12% By Geography + Domestic +9% − International - 13% By Application + Pipe +5% + Allied +10% $75.1 $12.7 $6.3 ($11.7) ($2.1) $80.3 Revenue Adj. EBITDA

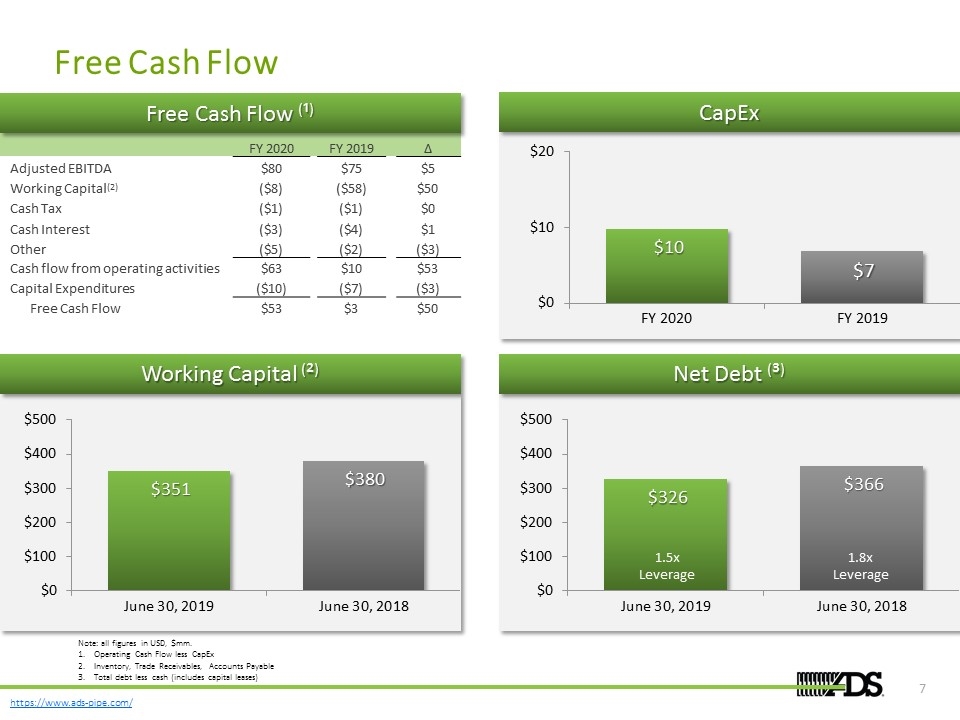

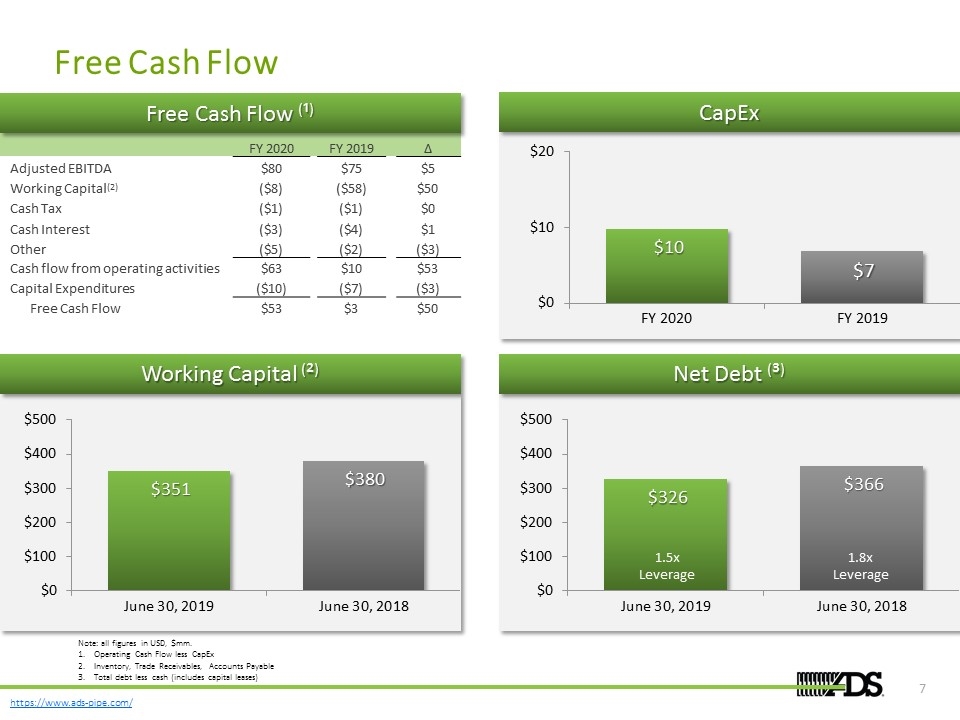

Free Cash Flow % of Sales 2.7% 3.5% Net Debt (³) 1.5x Leverage 1.8x Leverage CapEx Working Capital (²) FY 2020 FY 2019 ∆ Adjusted EBITDA $80 $75 $5 Working Capital(2) ($8) ($58) $50 Cash Tax ($1) ($1) $0 Cash Interest ($3) ($4) $1 Other ($5) ($2) ($3) Cash flow from operating activities $63 $10 $53 Capital Expenditures ($10) ($7) ($3) Free Cash Flow $53 $3 $50 Free Cash Flow (¹) Note: all figures in USD, $mm. Operating Cash Flow less CapEx Inventory, Trade Receivables, Accounts Payable Total debt less cash (includes capital leases)

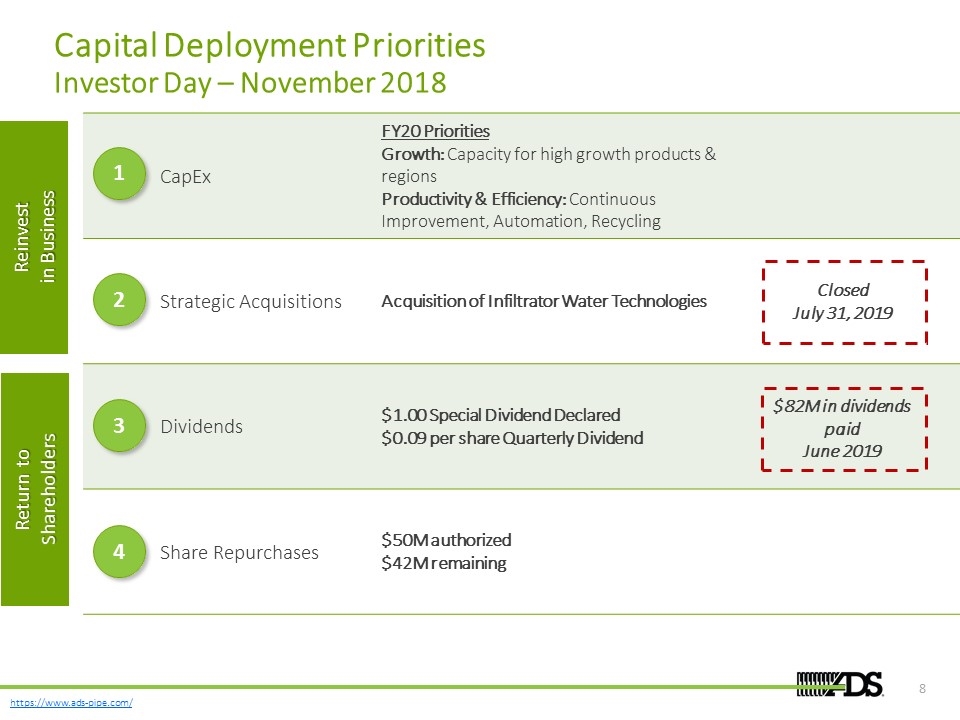

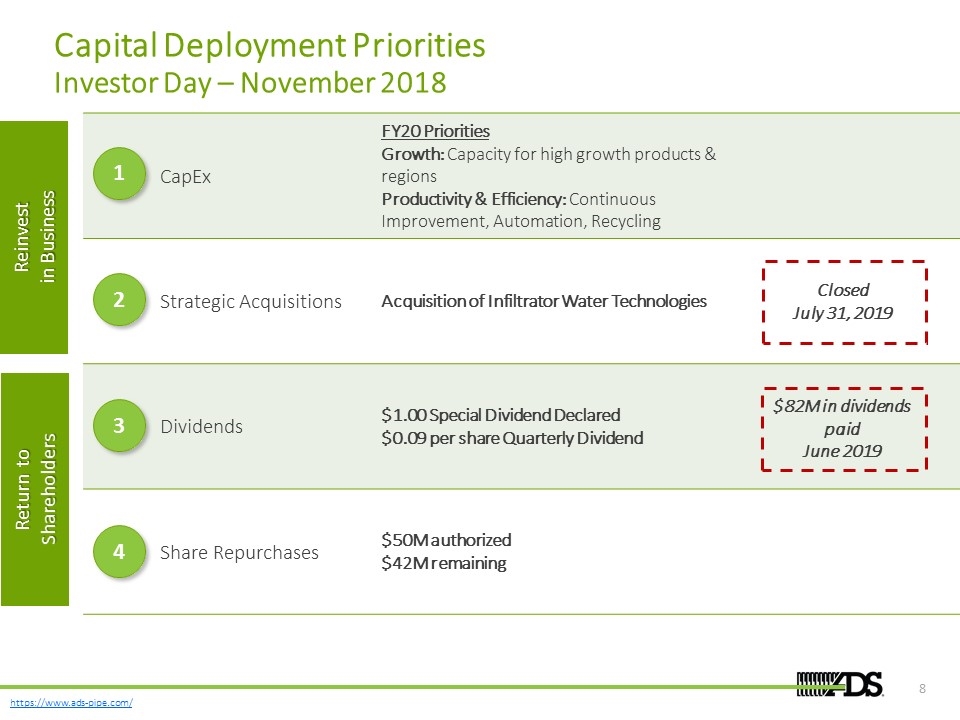

Capital Deployment Priorities Investor Day – November 2018 CapEx FY20 Priorities Growth: Capacity for high growth products & regions Productivity & Efficiency: Continuous Improvement, Automation, Recycling Strategic Acquisitions Acquisition of Infiltrator Water Technologies Dividends $1.00 Special Dividend Declared $0.09 per share Quarterly Dividend Share Repurchases $50M authorized $42M remaining 1 2 3 4 Reinvest in Business Return to Shareholders $82M in dividends paid June 2019 Closed July 31, 2019

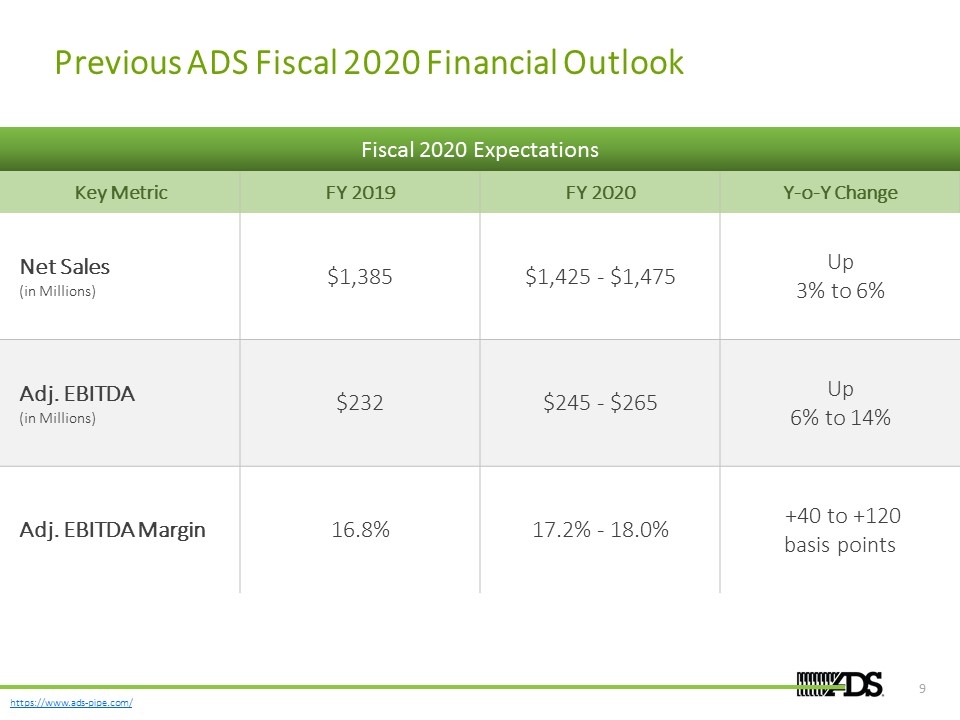

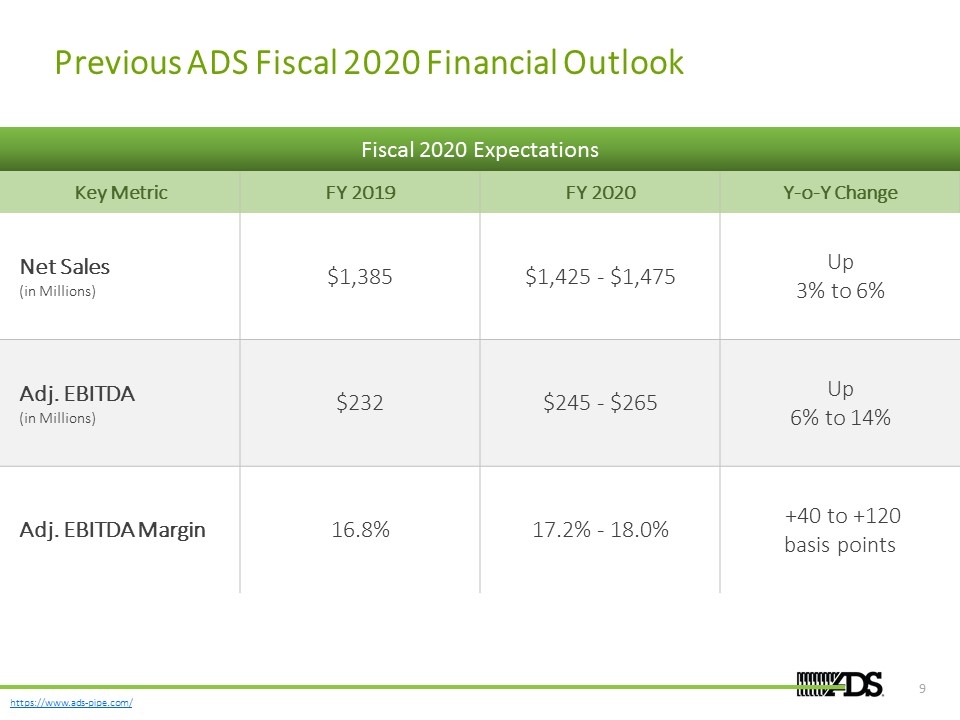

Previous ADS Fiscal 2020 Financial Outlook Key Metric FY 2019 FY 2020 Y-o-Y Change Net Sales (in Millions) $1,385 $1,425 - $1,475 Up 3% to 6% Adj. EBITDA (in Millions) $232 $245 - $265 Up 6% to 14% Adj. EBITDA Margin 16.8% 17.2% - 18.0% +40 to +120 basis points Fiscal 2020 Expectations

Infiltrator Acquisition

Qualitative Financial Strategic A Compelling Strategic Acquisition Combines leaders in stormwater management and on-site septic wastewater management Shared strategy on gaining share by driving conversion from traditional materials Strong distribution networks Complementary and scaled recycling operations Increases ADS’ Adjusted EBITDA margins by 360 bps, LTM 3/31/19, without the impact of synergies ~$20 - $25 million in synergies to be realized by Year 3 Accretive to EPS in first year ROIC > WACC Infiltrator is a world-class operating platform and a leading manufacturer of plastic chambers and tanks in the highly attractive on-site septic business Builds upon Infiltrator’s and ADS’ successful operating partnership that has been in place for over 15 years Complementary cultures, similar growth strategies and a shared commitment to innovation and recycling

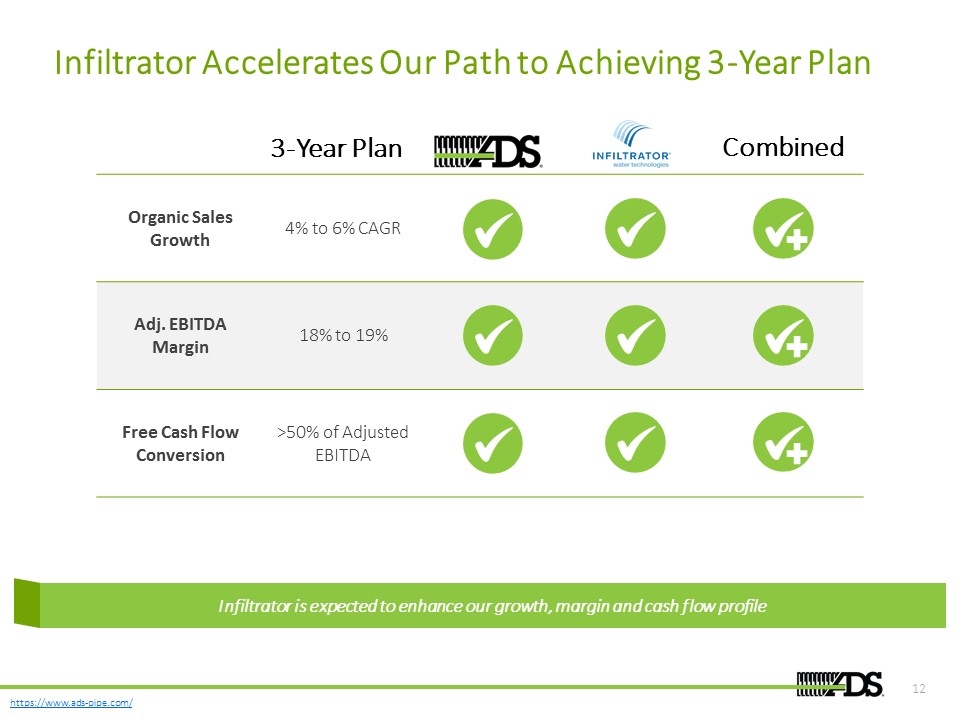

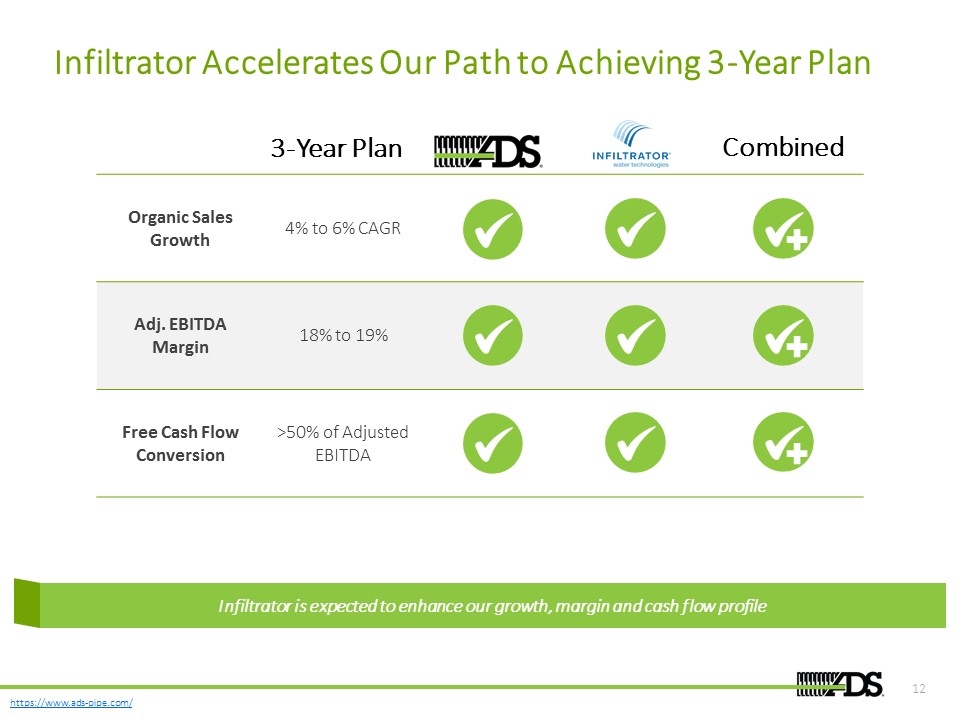

Infiltrator Accelerates Our Path to Achieving 3-Year Plan Organic Sales Growth 4% to 6% CAGR Adj. EBITDA Margin 18% to 19% Free Cash Flow Conversion >50% of Adjusted EBITDA Infiltrator is expected to enhance our growth, margin and cash flow profile 3-Year Plan Combined

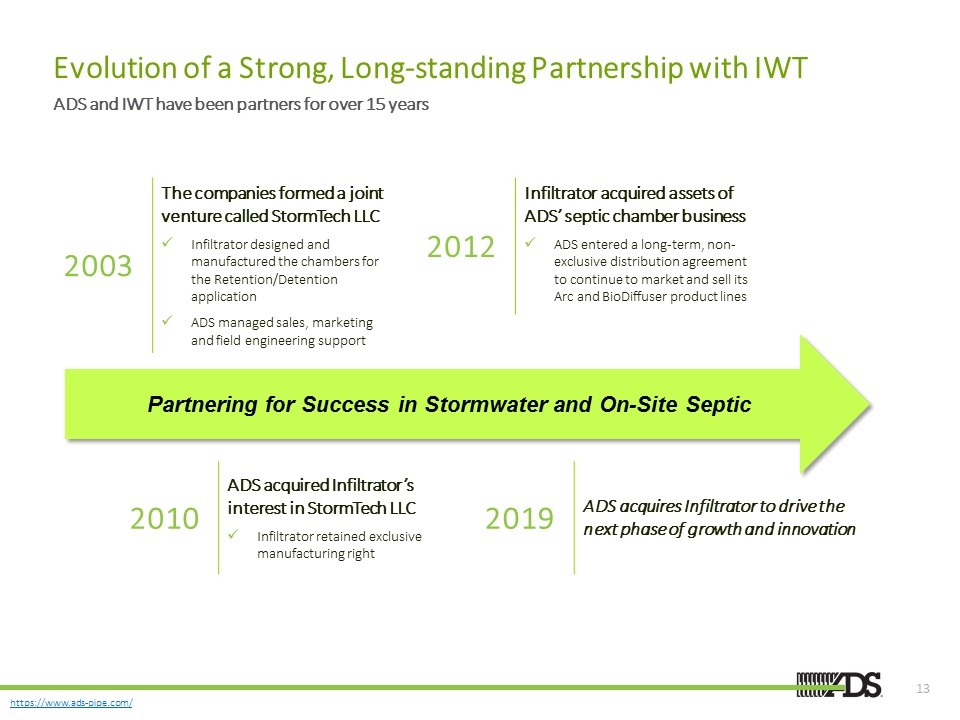

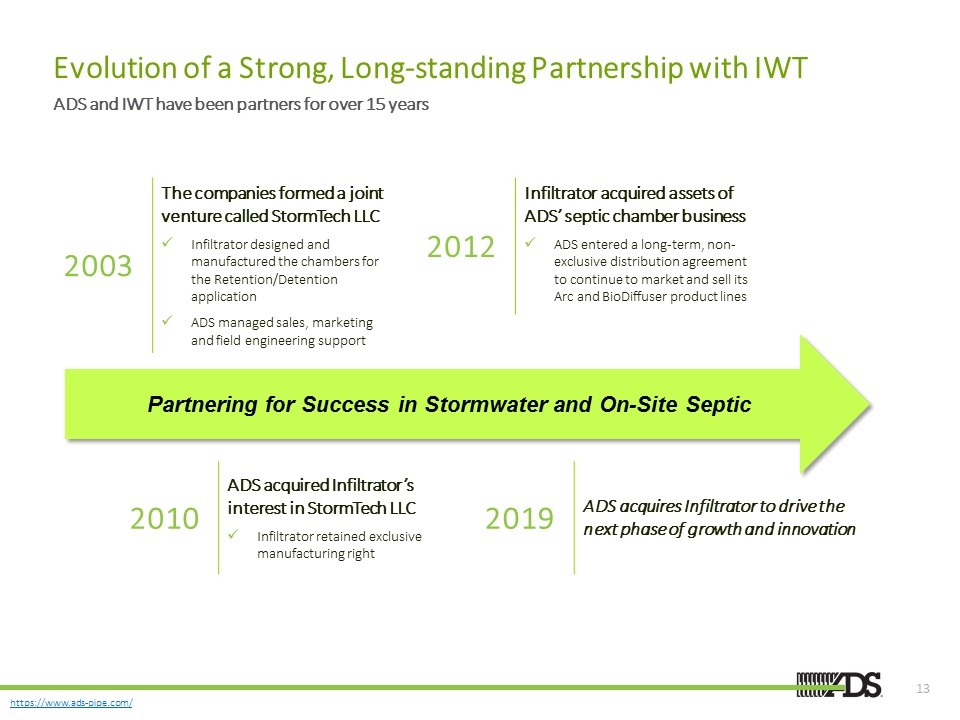

Evolution of a Strong, Long-standing Partnership with IWT ADS and IWT have been partners for over 15 years Partnering for Success in Stormwater and On-Site Septic 2003 The companies formed a joint venture called StormTech LLC Infiltrator designed and manufactured the chambers for the Retention/Detention application ADS managed sales, marketing and field engineering support 2012 Infiltrator acquired assets of ADS’ septic chamber business ADS entered a long-term, non-exclusive distribution agreement to continue to market and sell its Arc and BioDiffuser product lines 2010 ADS acquired Infiltrator’s interest in StormTech LLC Infiltrator retained exclusive manufacturing right 2019 ADS acquires Infiltrator to drive the next phase of growth and innovation

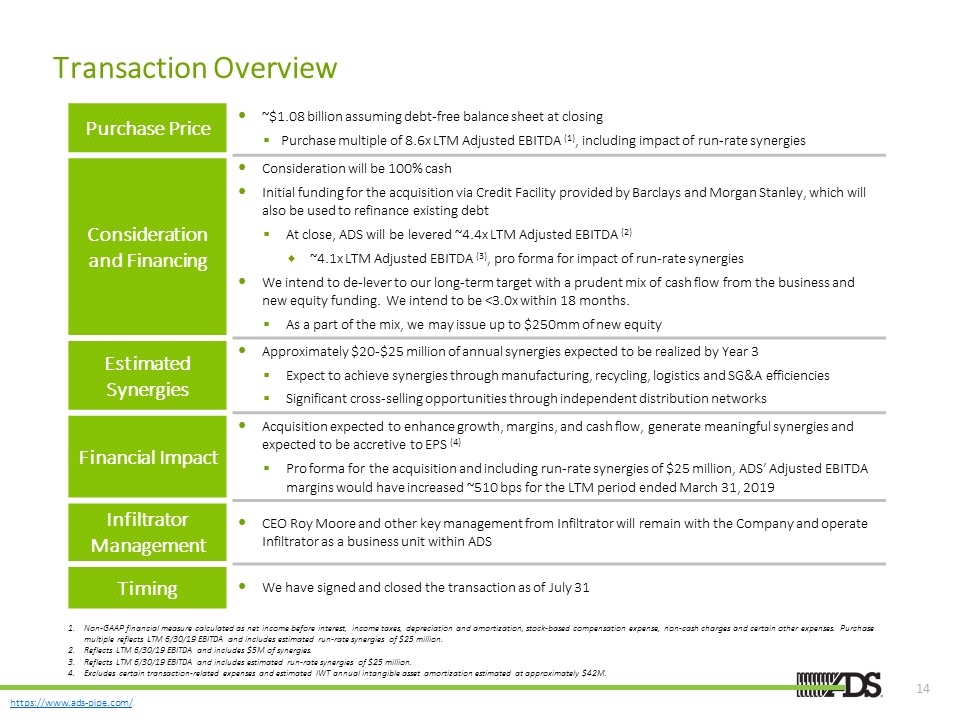

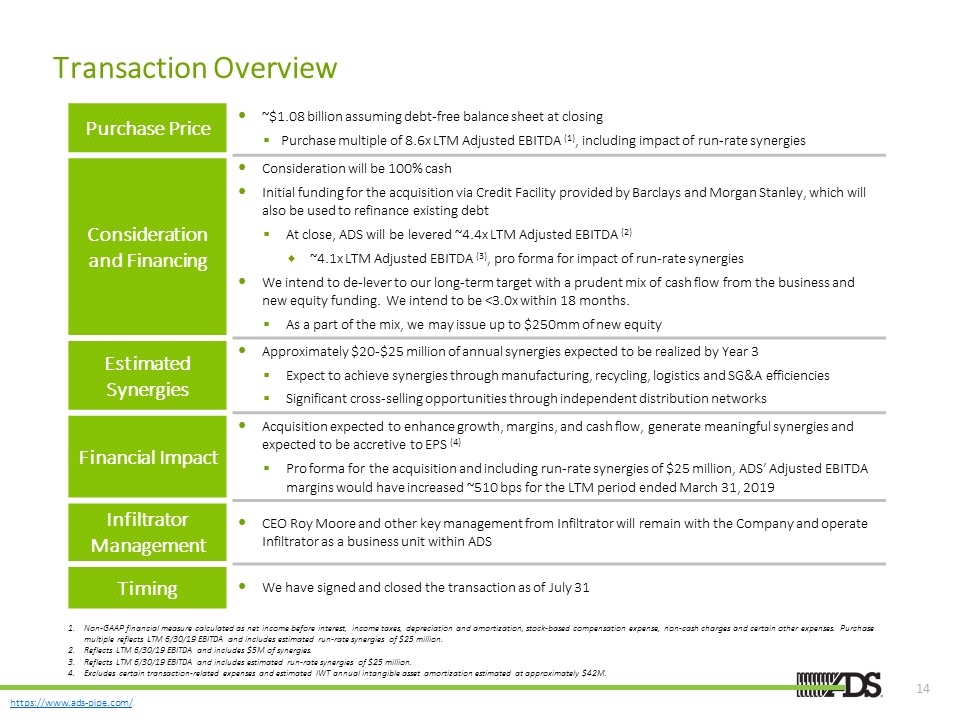

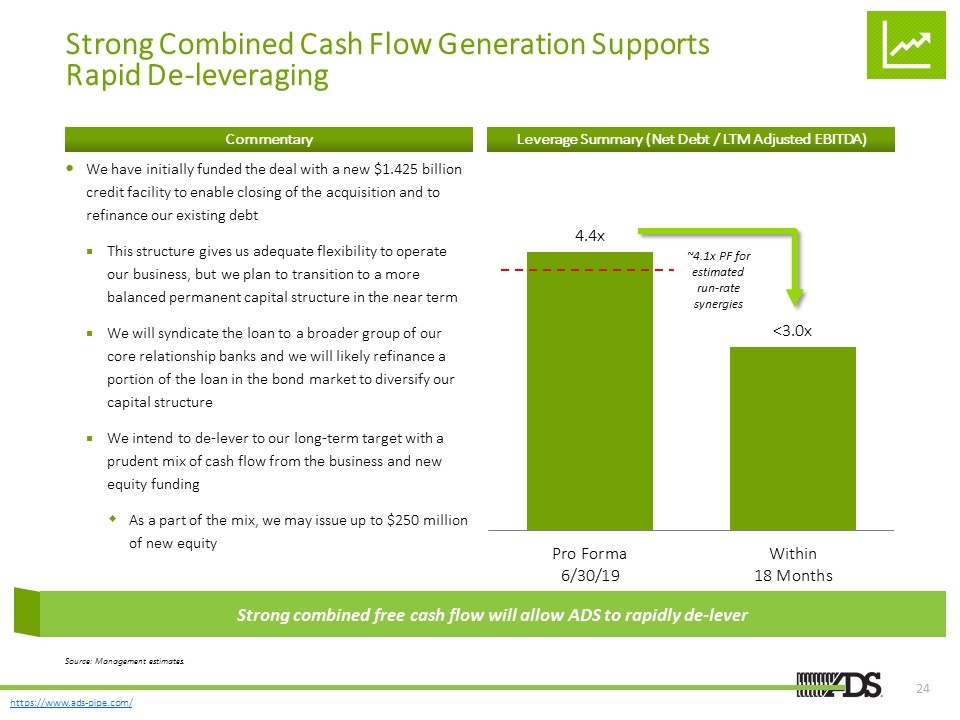

Transaction Overview Non-GAAP financial measure calculated as net income before interest, income taxes, depreciation and amortization, stock-based compensation expense, non-cash charges and certain other expenses. Purchase multiple reflects LTM 6/30/19 EBITDA and includes estimated run-rate synergies of $25 million. Reflects LTM 6/30/19 EBITDA and includes $5M of synergies. Reflects LTM 6/30/19 EBITDA and includes estimated run-rate synergies of $25 million. Excludes certain transaction-related expenses and estimated IWT annual intangible asset amortization estimated at approximately $42M. Purchase Price ~$1.08 billion assuming debt-free balance sheet at closing Purchase multiple of 8.6x LTM Adjusted EBITDA (1), including impact of run-rate synergies Consideration and Financing Consideration will be 100% cash Initial funding for the acquisition via Credit Facility provided by Barclays and Morgan Stanley, which will also be used to refinance existing debt At close, ADS will be levered ~4.4x LTM Adjusted EBITDA (2) ~4.1x LTM Adjusted EBITDA (3), pro forma for impact of run-rate synergies We intend to de-lever to our long-term target with a prudent mix of cash flow from the business and new equity funding. We intend to be <3.0x within 18 months. As a part of the mix, we may issue up to $250mm of new equity Estimated Synergies Approximately $20-$25 million of annual synergies expected to be realized by Year 3 Expect to achieve synergies through manufacturing, recycling, logistics and SG&A efficiencies Significant cross-selling opportunities through independent distribution networks Financial Impact Acquisition expected to enhance growth, margins, and cash flow, generate meaningful synergies and expected to be accretive to EPS (4) Pro forma for the acquisition and including run-rate synergies of $25 million, ADS’ Adjusted EBITDA margins would have increased ~510 bps for the LTM period ended March 31, 2019 Infiltrator Management CEO Roy Moore and other key management from Infiltrator will remain with the Company and operate Infiltrator as a business unit within ADS Timing We have signed and closed the transaction as of July 31

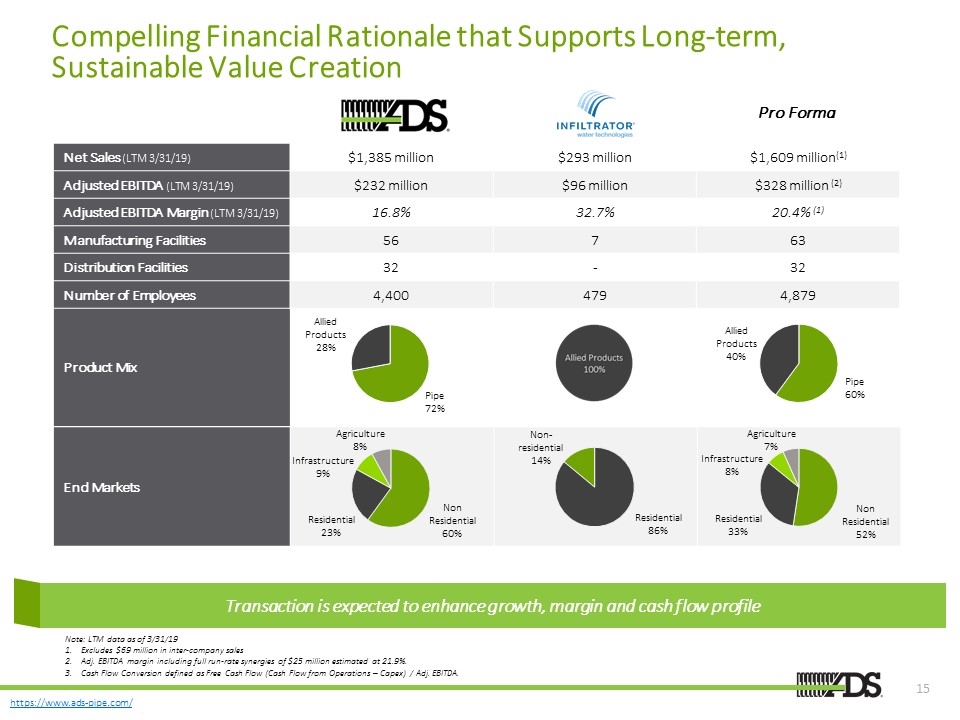

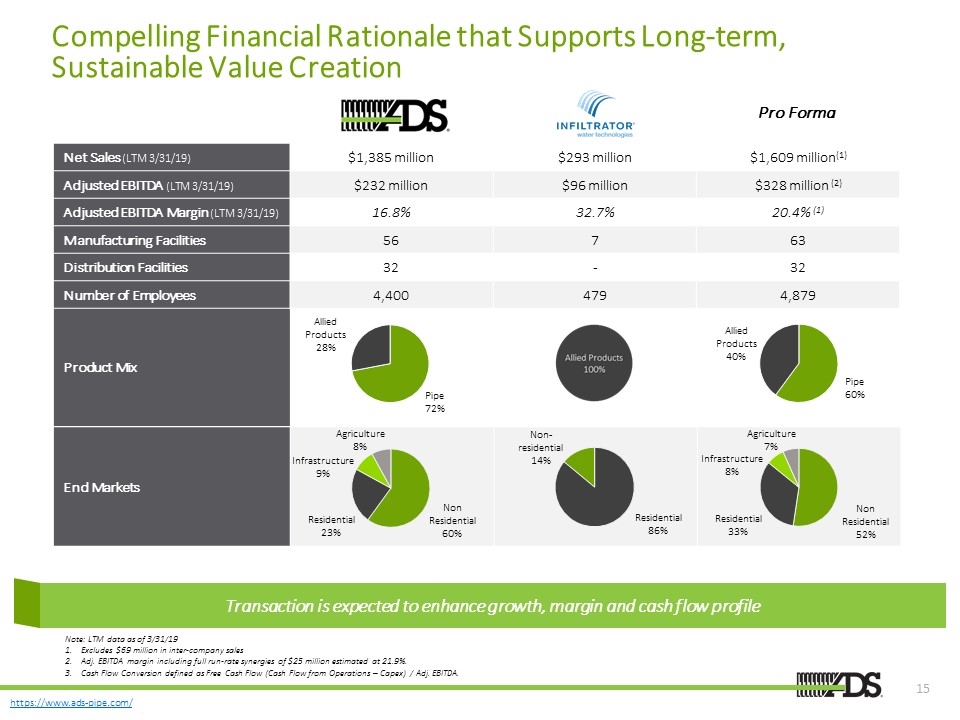

Compelling Financial Rationale that Supports Long-term, Sustainable Value Creation End Markets Product Mix Net Sales (LTM 3/31/19) $1,385 million $293 million $1,609 million(1) Adjusted EBITDA (LTM 3/31/19) $232 million $96 million $328 million (2) Adjusted EBITDA Margin (LTM 3/31/19) 16.8% 32.7% 20.4% (1) Manufacturing Facilities 56 7 63 Distribution Facilities 32 - 32 Number of Employees 4,400 479 4,879 Pro Forma Non Residential 60% Residential 23% Infrastructure 9% Agriculture 8% Non- residential 14% Non Residential 52% Residential 33% Infrastructure 8% Agriculture 7% Residential 86% Note: LTM data as of 3/31/19 Excludes $69 million in inter-company sales Adj. EBITDA margin including full run-rate synergies of $25 million estimated at 21.9%. Cash Flow Conversion defined as Free Cash Flow (Cash Flow from Operations – Capex) / Adj. EBITDA. Transaction is expected to enhance growth, margin and cash flow profile

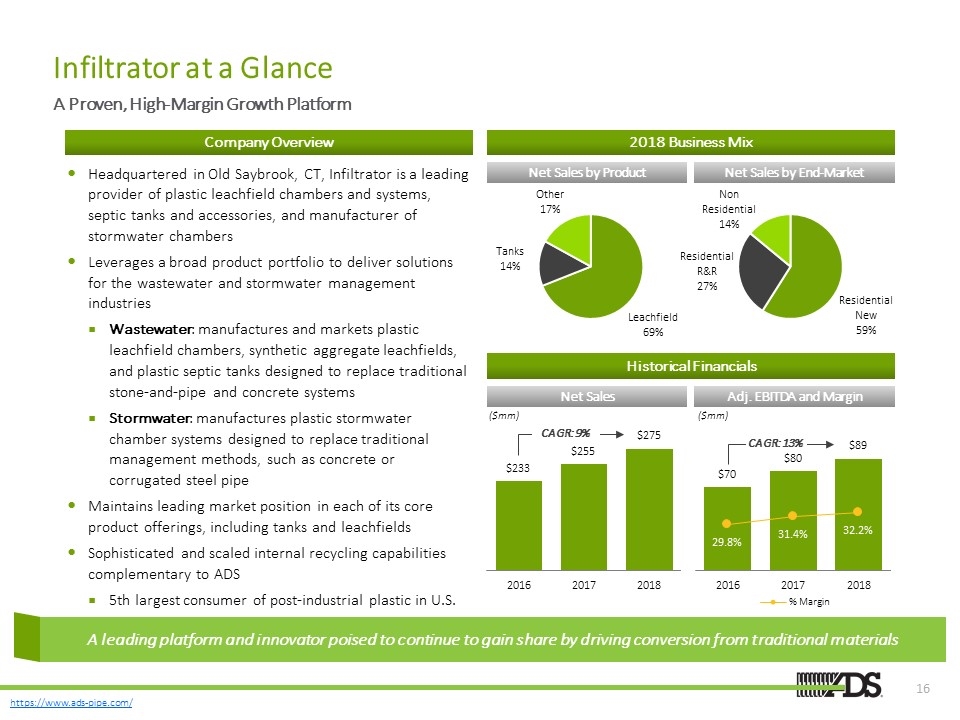

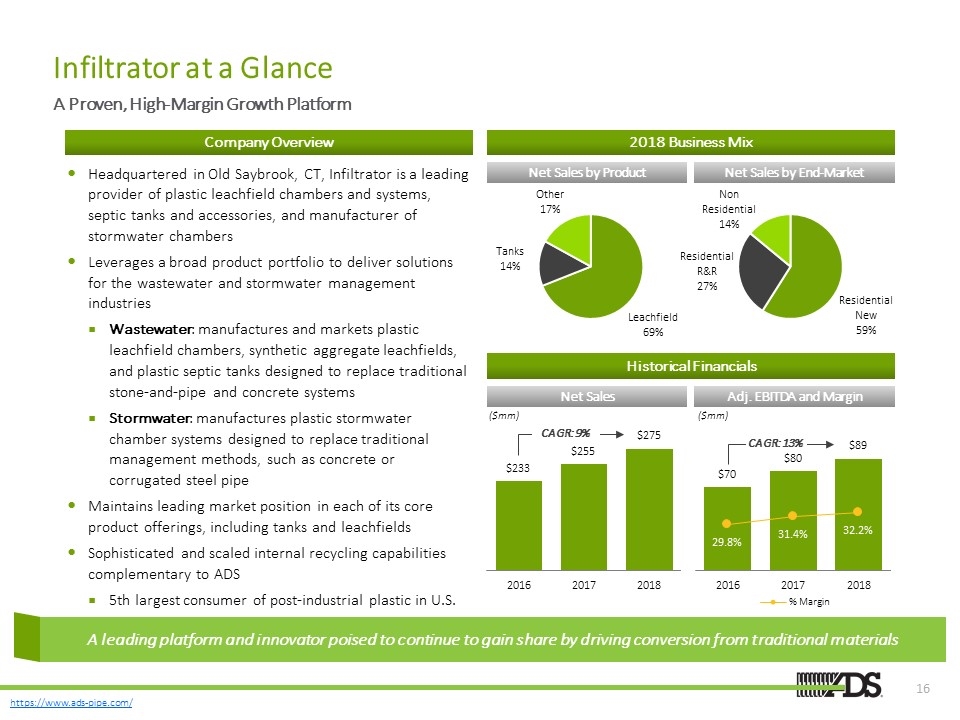

Infiltrator at a Glance A Proven, High-Margin Growth Platform Historical Financials Company Overview 2018 Business Mix Net Sales by Product Net Sales by End-Market Net Sales Adj. EBITDA and Margin Headquartered in Old Saybrook, CT, Infiltrator is a leading provider of plastic leachfield chambers and systems, septic tanks and accessories, and manufacturer of stormwater chambers Leverages a broad product portfolio to deliver solutions for the wastewater and stormwater management industries Wastewater: manufactures and markets plastic leachfield chambers, synthetic aggregate leachfields, and plastic septic tanks designed to replace traditional stone-and-pipe and concrete systems Stormwater: manufactures plastic stormwater chamber systems designed to replace traditional management methods, such as concrete or corrugated steel pipe Maintains leading market position in each of its core product offerings, including tanks and leachfields Sophisticated and scaled internal recycling capabilities complementary to ADS 5th largest consumer of post-industrial plastic in U.S. CAGR: 9% CAGR: 13% A leading platform and innovator poised to continue to gain share by driving conversion from traditional materials

Investment Highlights Builds on ADS’ Core Strengths and Enhances Position as a Leader in Water Management Solutions Expands and Diversifies ADS’ Addressable Opportunity into Highly Related and Attractive On-Site Septic business Acquisition Expected to Enhance Growth, Margins and Cash Flow and to Generate Significant Synergies Infiltrator is a Leading Platform and Innovator Poised to Continue to Gain Share by Driving Conversion from Traditional Materials ADS and Infiltrator Have Complementary Cultures, Similar Growth Strategies and a Shared Commitment to Innovation Strengthens ADS’ Commitment to Sustainability with Best-in-Class Polypropylene (PP) and Polyethylene (PE) Recycling Capabilities Infiltrator is Led by a World Class Management Team with a Proven Ability to Generate Above Market Growth and Margins

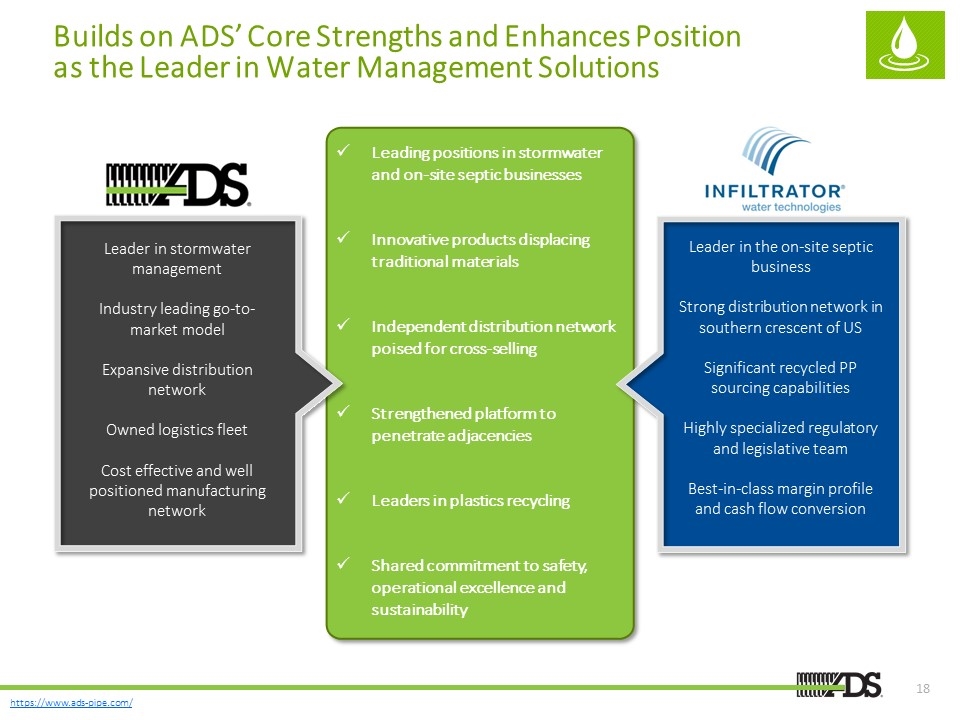

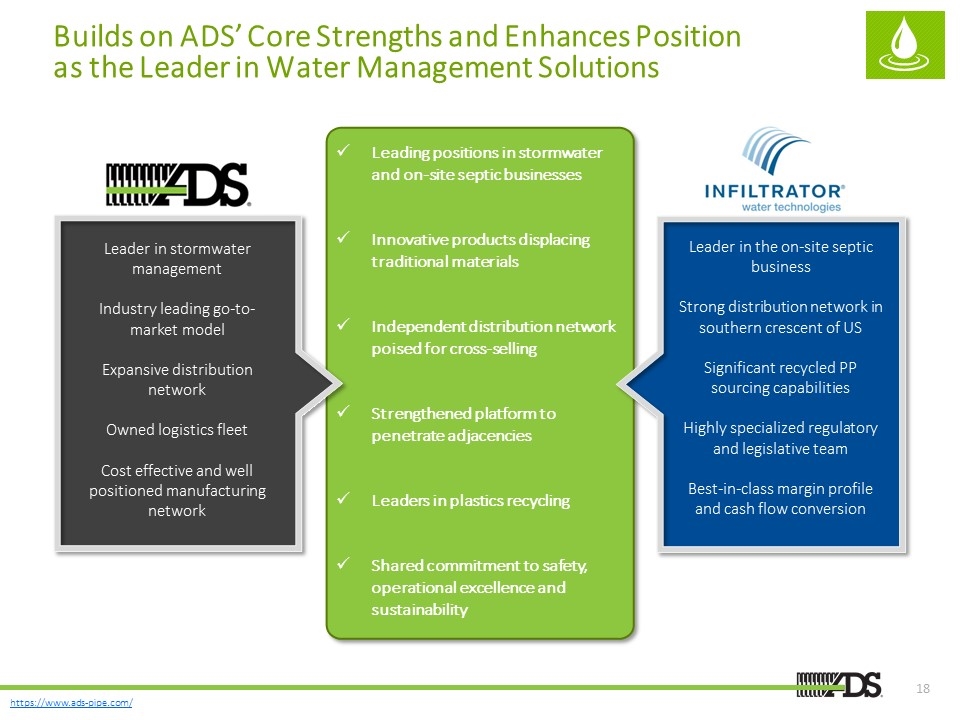

Builds on ADS’ Core Strengths and Enhances Position as the Leader in Water Management Solutions Leader in stormwater management Industry leading go-to-market model Expansive distribution network Owned logistics fleet Cost effective and well positioned manufacturing network Leading positions in stormwater and on-site septic businesses Innovative products displacing traditional materials Independent distribution network poised for cross-selling Strengthened platform to penetrate adjacencies Leaders in plastics recycling Shared commitment to safety, operational excellence and sustainability Leader in the on-site septic business Strong distribution network in southern crescent of US Significant recycled PP sourcing capabilities Highly specialized regulatory and legislative team Best-in-class margin profile and cash flow conversion

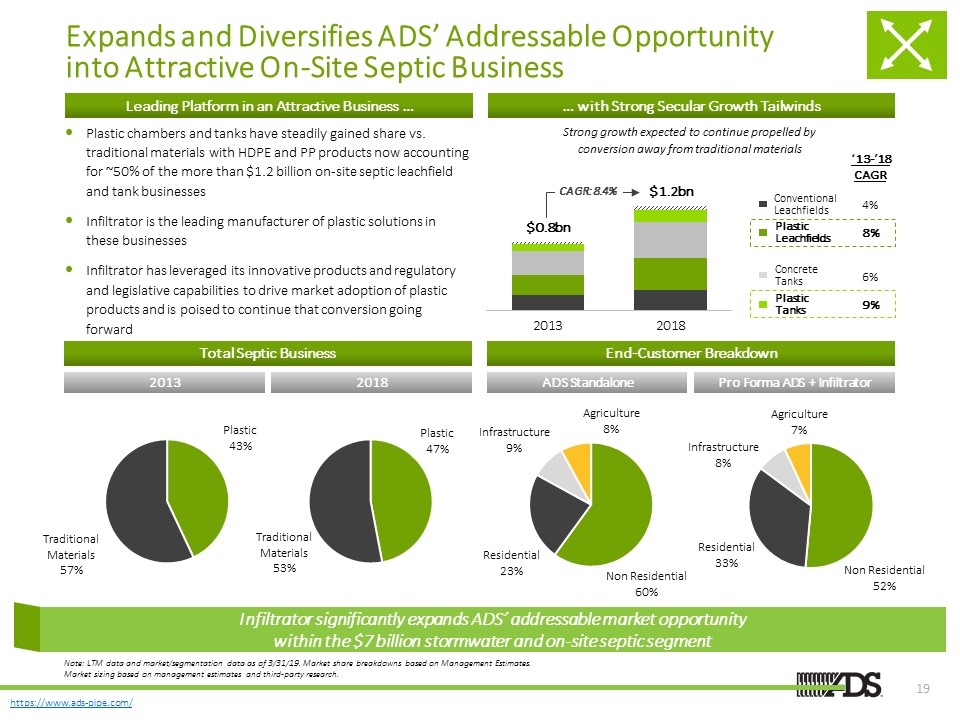

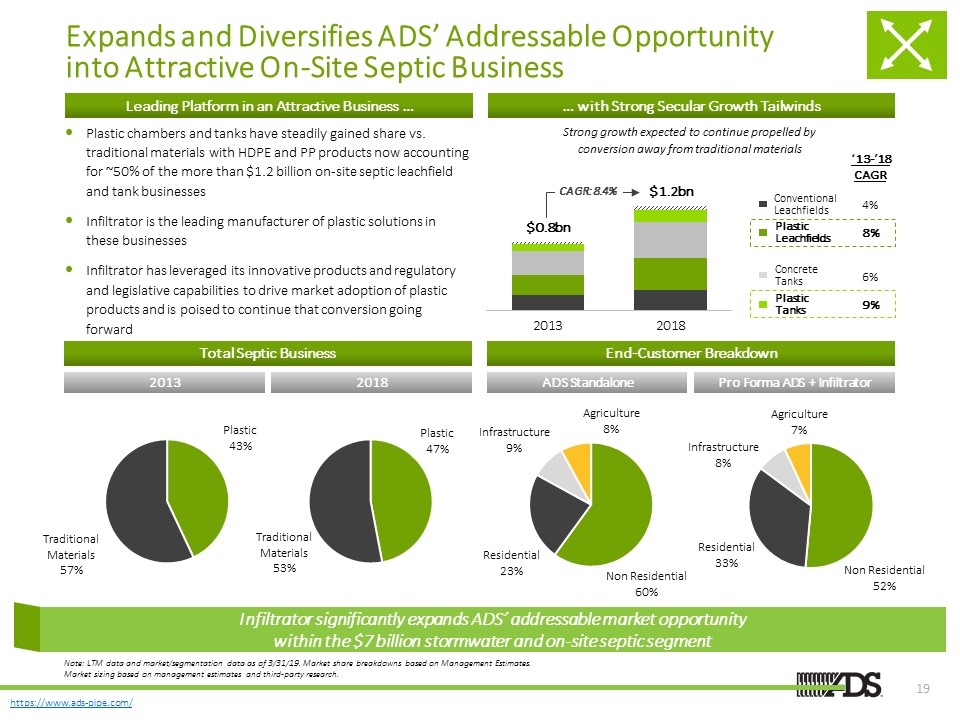

Expands and Diversifies ADS’ Addressable Opportunity into Attractive On-Site Septic Business Plastic chambers and tanks have steadily gained share vs. traditional materials with HDPE and PP products now accounting for ~50% of the more than $1.2 billion on-site septic leachfield and tank businesses Infiltrator is the leading manufacturer of plastic solutions in these businesses Infiltrator has leveraged its innovative products and regulatory and legislative capabilities to drive market adoption of plastic products and is poised to continue that conversion going forward Leading Platform in an Attractive Business … … with Strong Secular Growth Tailwinds End-Customer Breakdown ‘13-’18 CAGR Conventional Leachfields 4% Plastic Leachfields 8% Concrete Tanks 6% Plastic Tanks 9% Strong growth expected to continue propelled by conversion away from traditional materials ADS Standalone Pro Forma ADS + Infiltrator CAGR: 8.4% Note: LTM data and market/segmentation data as of 3/31/19. Market share breakdowns based on Management Estimates. Market sizing based on management estimates and third-party research. Infiltrator significantly expands ADS’ addressable market opportunity within the $7 billion stormwater and on-site septic segment Total Septic Business 2013 2018

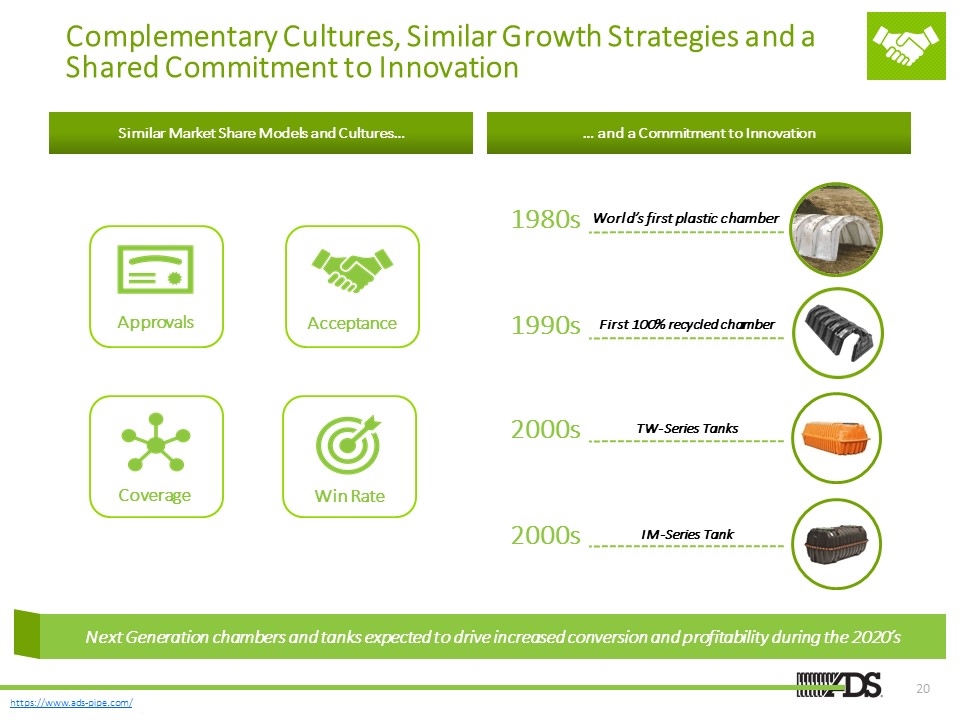

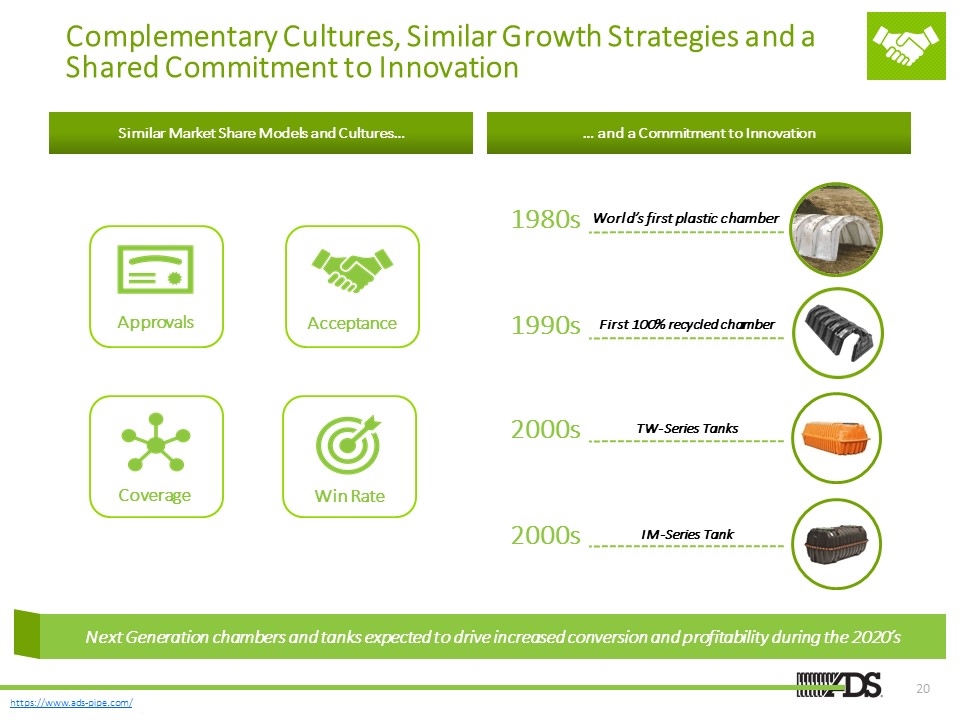

Complementary Cultures, Similar Growth Strategies and a Shared Commitment to Innovation Similar Market Share Models and Cultures… … and a Commitment to Innovation Next Generation chambers and tanks expected to drive increased conversion and profitability during the 2020’s Approvals 1980s World’s first plastic chamber 1990s First 100% recycled chamber 2000s TW-Series Tanks 2000s IM-Series Tank Acceptance Coverage Win Rate

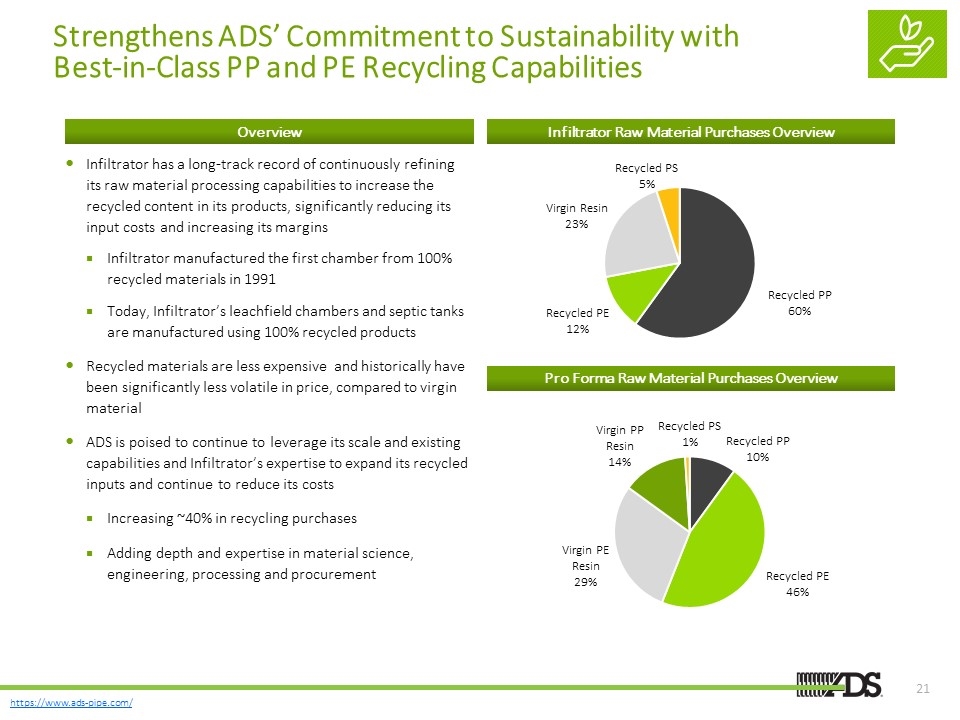

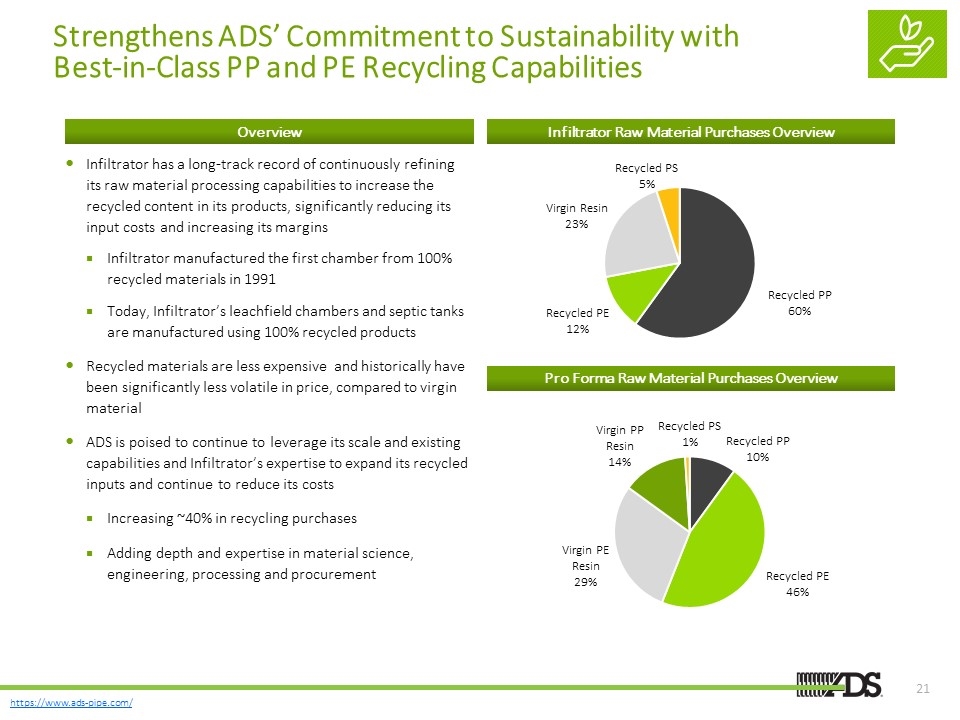

Strengthens ADS’ Commitment to Sustainability with Best-in-Class PP and PE Recycling Capabilities Overview Infiltrator Raw Material Purchases Overview IWT Material Input Composition by Product Leachfield Chambers Post-Industrial (54%) Post-Consumer (23%) Septic Tanks ADS Supplied Virgin (23%) StormTech Chambers Pro Forma Raw Material Purchases Overview Infiltrator has a long-track record of continuously refining its raw material processing capabilities to increase the recycled content in its products, significantly reducing its input costs and increasing its margins Infiltrator manufactured the first chamber from 100% recycled materials in 1991 Today, Infiltrator’s leachfield chambers and septic tanks are manufactured using 100% recycled products Recycled materials are less expensive and historically have been significantly less volatile in price, compared to virgin material ADS is poised to continue to leverage its scale and existing capabilities and Infiltrator’s expertise to expand its recycled inputs and continue to reduce its costs Increasing ~40% in recycling purchases Adding depth and expertise in material science, engineering, processing and procurement

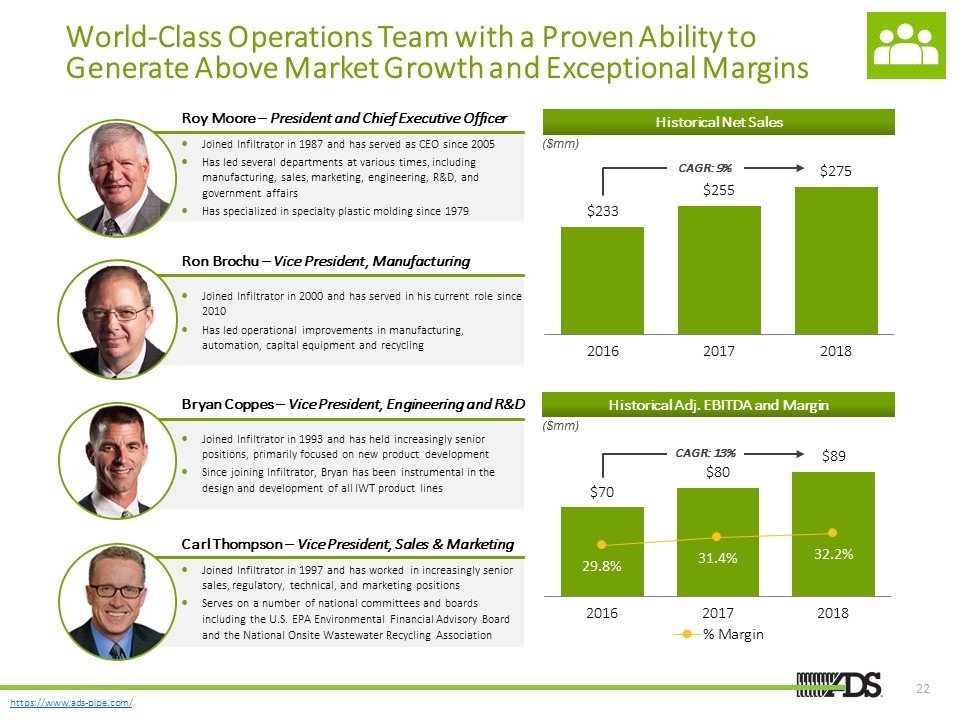

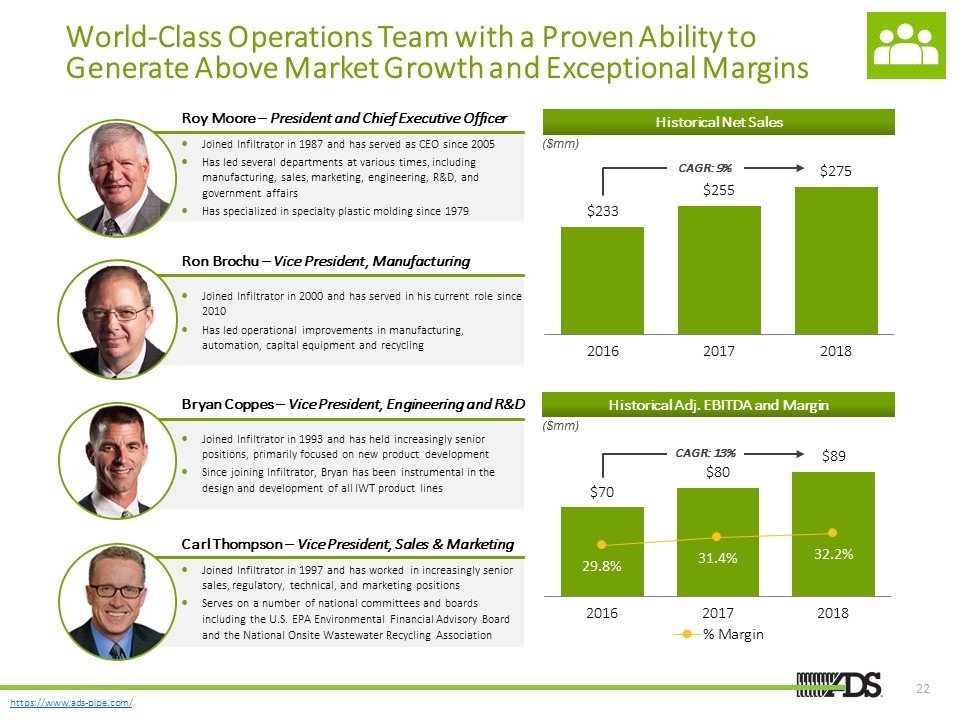

1 IWT’s management team has deep industry experience and is well-positioned to drive future growth Joined Infiltrator in 1987 and has served as CEO since 2005 Has led several departments at various times, including manufacturing, sales, marketing, engineering, R&D, and government affairs Has specialized in specialty plastic molding since 1979 Joined Infiltrator in 2000 and has served in his current role since 2010 Has led operational improvements in manufacturing, automation, capital equipment and recycling Joined Infiltrator in 1993 and has held increasingly senior positions, primarily focused on new product development Since joining Infiltrator, Bryan has been instrumental in the design and development of all IWT product lines Joined Infiltrator in 1997 and has worked in increasingly senior sales, regulatory, technical, and marketing positions Serves on a number of national committees and boards including the U.S. EPA Environmental Financial Advisory Board and the National Onsite Wastewater Recycling Association Roy Moore – President and Chief Executive Officer Ron Brochu – Vice President, Manufacturing Bryan Coppes – Vice President, Engineering and R&D Carl Thompson – Vice President, Sales & Marketing World-Class Operations Team with a Proven Ability to Generate Above Market Growth and Exceptional Margins Historical Net Sales Historical Adj. EBITDA and Margin ($mm) ($mm) CAGR: 9% CAGR: 13%

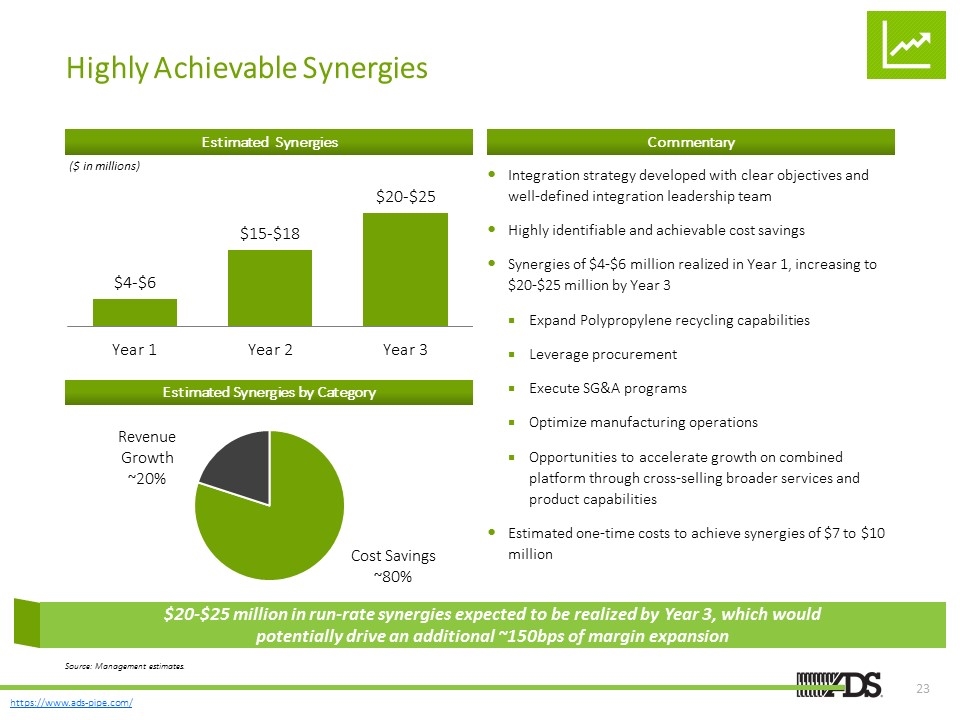

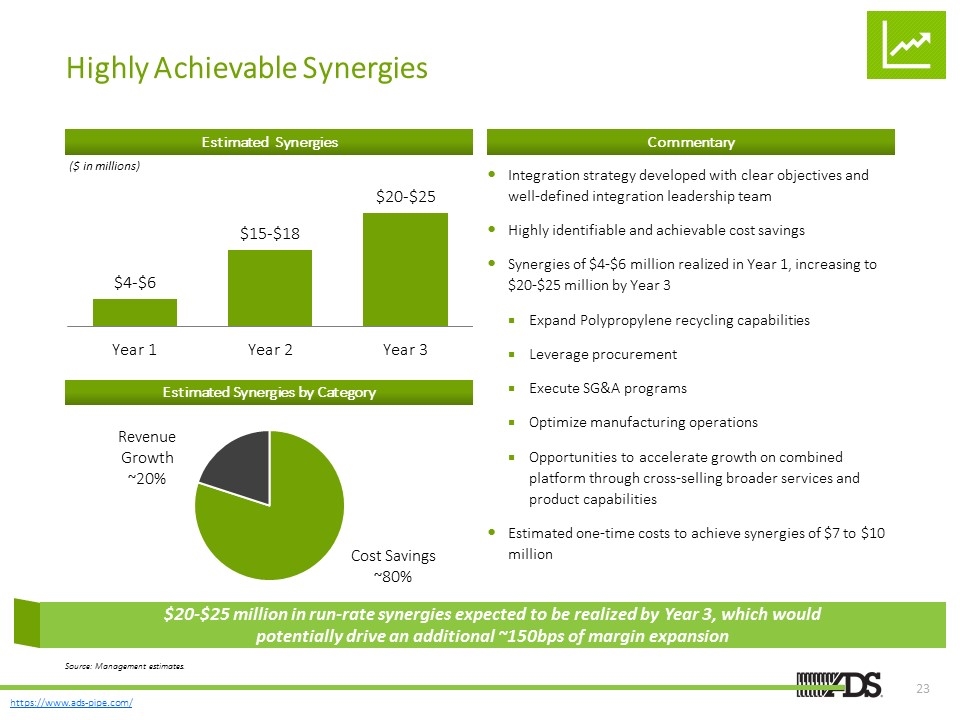

Highly Achievable Synergies 1 $20-$25 million in run-rate synergies expected to be realized by Year 3, which would potentially drive an additional ~150bps of margin expansion Estimated Synergies Commentary Integration strategy developed with clear objectives and well-defined integration leadership team Highly identifiable and achievable cost savings Synergies of $4-$6 million realized in Year 1, increasing to $20-$25 million by Year 3 Expand Polypropylene recycling capabilities Leverage procurement Execute SG&A programs Optimize manufacturing operations Opportunities to accelerate growth on combined platform through cross-selling broader services and product capabilities Estimated one-time costs to achieve synergies of $7 to $10 million Estimated Synergies by Category Source: Management estimates.

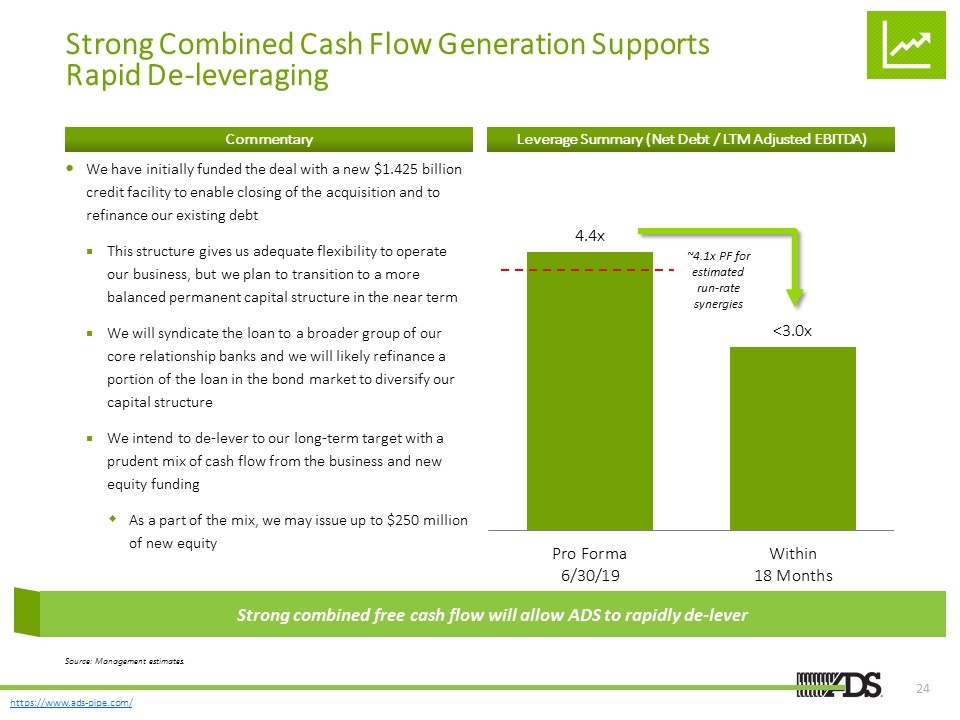

Strong Combined Cash Flow Generation Supports Rapid De-leveraging 1 Strong combined free cash flow will allow ADS to rapidly de-lever We have initially funded the deal with a new $1.425 billion credit facility to enable closing of the acquisition and to refinance our existing debt This structure gives us adequate flexibility to operate our business, but we plan to transition to a more balanced permanent capital structure in the near term We will syndicate the loan to a broader group of our core relationship banks and we will likely refinance a portion of the loan in the bond market to diversify our capital structure We intend to de-lever to our long-term target with a prudent mix of cash flow from the business and new equity funding As a part of the mix, we may issue up to $250 million of new equity Commentary Leverage Summary (Net Debt / LTM Adjusted EBITDA) ~4.1x PF for estimated run-rate synergies Source: Management estimates.

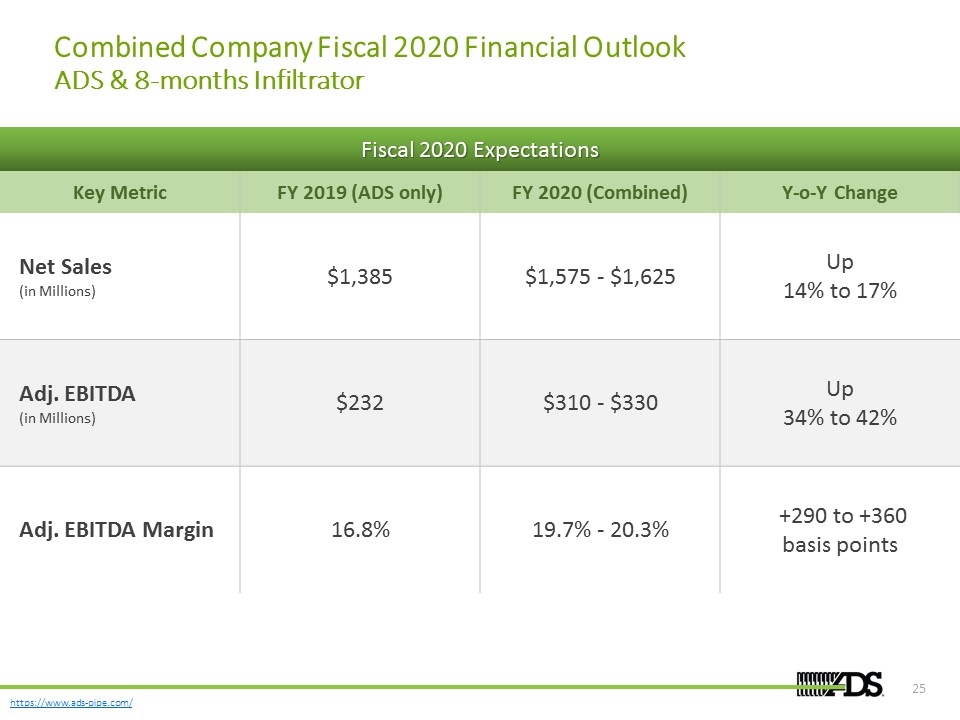

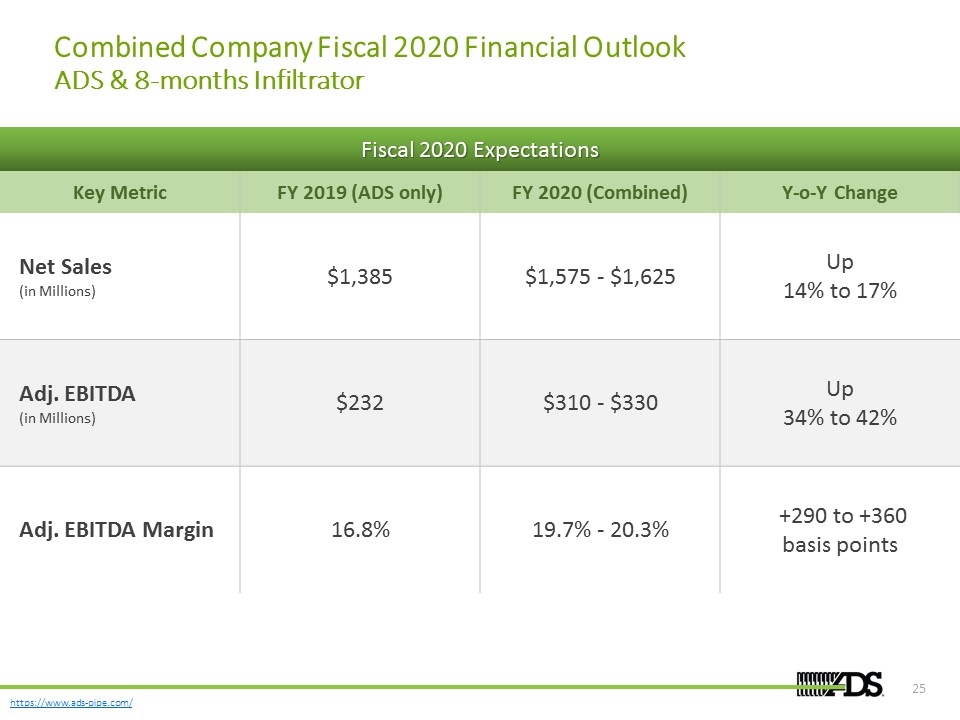

Combined Company Fiscal 2020 Financial Outlook ADS & 8-months Infiltrator Key Metric FY 2019 (ADS only) FY 2020 (Combined) Y-o-Y Change Net Sales (in Millions) $1,385 $1,575 - $1,625 Up 14% to 17% Adj. EBITDA (in Millions) $232 $310 - $330 Up 34% to 42% Adj. EBITDA Margin 16.8% 19.7% - 20.3% +290 to +360 basis points Fiscal 2020 Expectations

Investment Highlights Builds on ADS’ Core Strengths and Enhances Position as a Leader in Water Management Solutions Expands and Diversifies ADS’ Addressable Opportunity into Highly Related and Attractive On-Site Septic business Acquisition Expected to Enhance Growth, Margins and Cash Flow and to Generate Significant Synergies Infiltrator is a Leading Platform and Innovator Poised to Continue to Gain Share by Driving Conversion from Traditional Materials ADS and Infiltrator Have Complementary Cultures, Similar Growth Strategies and a Shared Commitment to Innovation Strengthens ADS’ Commitment to Sustainability with Best-in-Class Polypropylene (PP) and Polyethylene (PE) Recycling Capabilities Infiltrator is Led by a World Class Management Team with a Proven Ability to Generate Above Market Growth and Margins

Q&A Session

Closing Remarks Domestic construction market sales grew 6% despite record rainfall in the quarter, in led by non-residential and residential construction. Infiltrator acquisition expected to enhance growth, margins, cash flow and generate significant synergies. Positioned for continued above-market growth in fiscal 2020 due to conversion strategy and strong growth of key products. 1 2 3 Fiscal 2020 off to a strong start. Steady demand in core domestic construction markets expected to continue. Focused on building shareholder value through sustained profitability improvements and disciplined execution. 4

Appendix

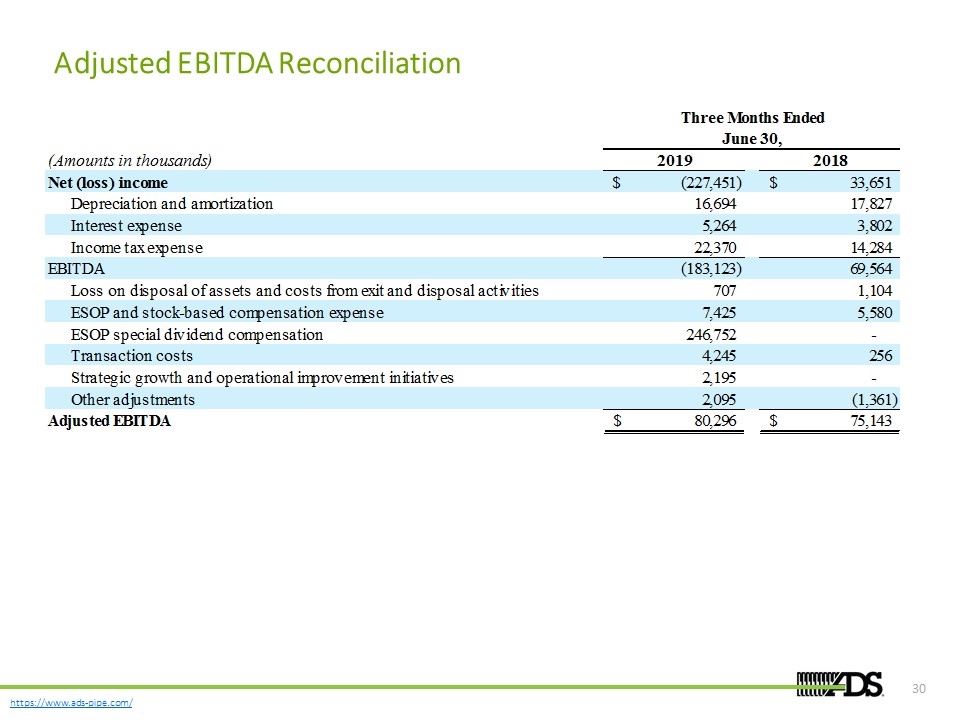

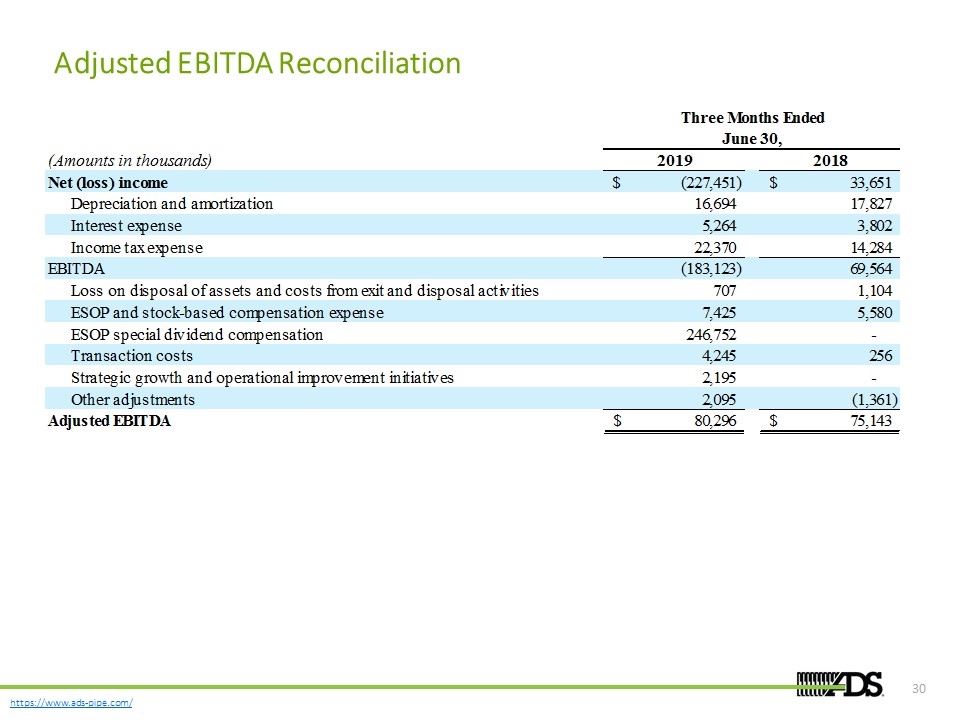

Adjusted EBITDA Reconciliation Three Months Ended Fiscal Year Ended June 30, June 30, (Amounts in thousands) 2019 2018 2019 2018 Net (loss) income $-,227,451 $33,651 $81,466 $64,792 Depreciation and amortization 16,694 17,827 71,900 75,003 Interest expense 5,264 3,802 18,618 15,262 Income tax expense 22,370 14,284 30,049 11,411 EBITDA -,183,123 69,564 ,202,033 ,166,468 Loss on disposal of assets and costs from exit and disposal activities 707 1,104 3,647 15,003 ESOP and stock-based compensation expense 7,425 5,580 6,532 7,121 ESOP special dividend compensation ,246,752 0 15,296 11,724 Transaction costs 4,245 256 699 1,362 Strategic growth and operational improvement initiatives 2,195 0 0 Other adjustments 2,095 -1,361 3,450 0 Adjusted EBITDA $80,296 $75,143 $,231,960 $,210,230

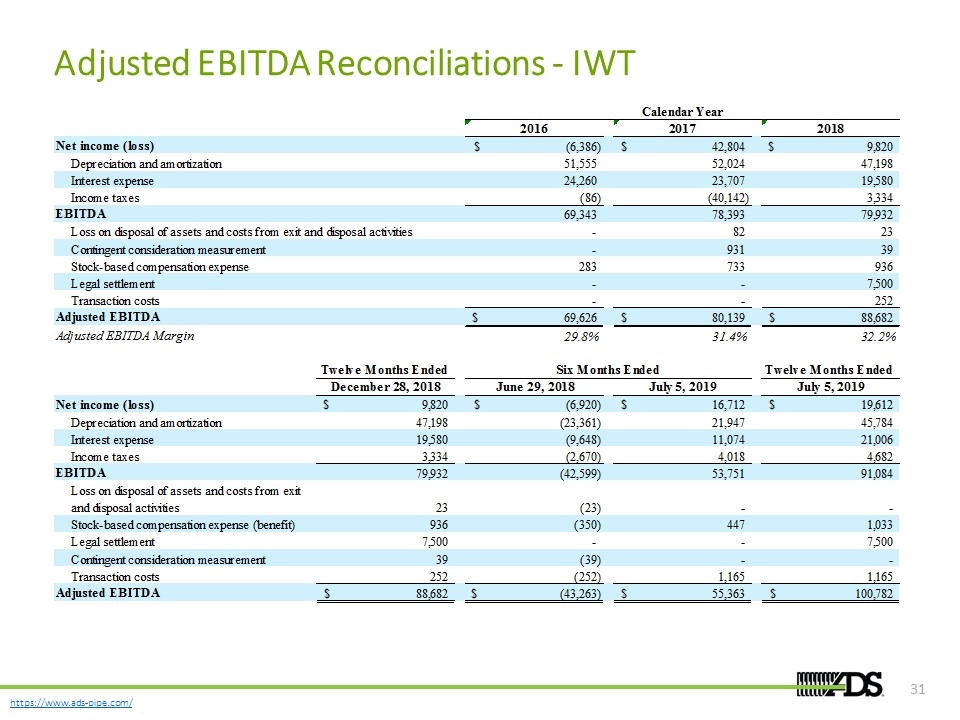

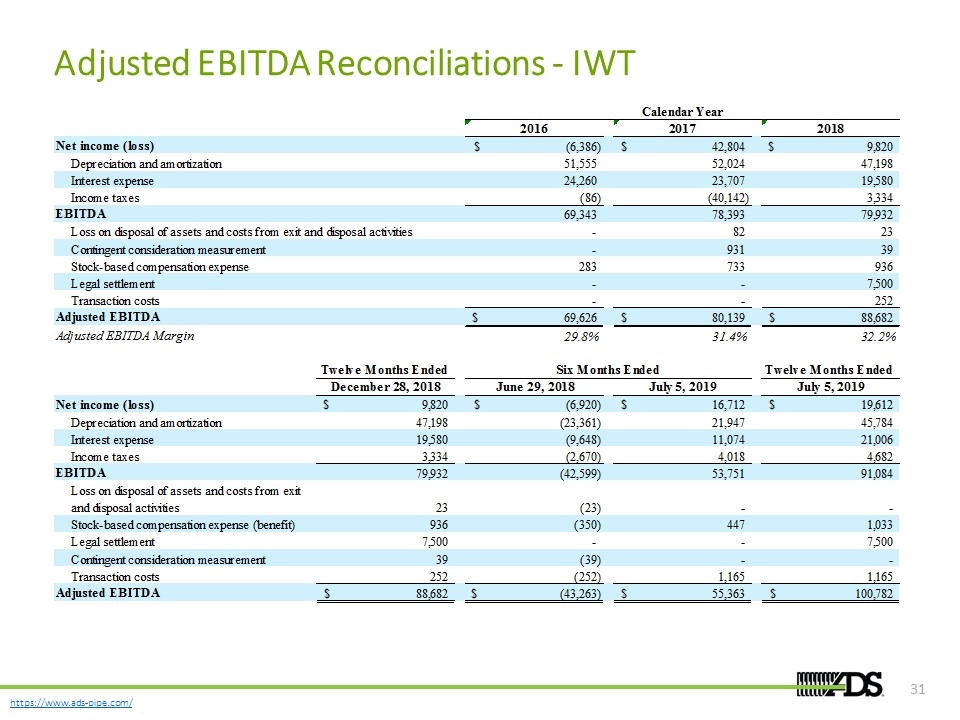

Adjusted EBITDA Reconciliations - IWT Calendar Year 2016 2017 2018 Net income (loss) $-6,386 $42,804 $9,820 Depreciation and amortization 51,555 52,024 47,198 Interest expense 24,260 23,707 19,580 Income taxes -86 ,-40,142 3,334 EBITDA 69,343 78,393 79,932 Loss on disposal of assets and costs from exit and disposal activities 0 82 23 Contingent consideration measurement 0 931 39 Stock-based compensation expense 283 733 936 Legal settlement 0 0 7,500 Transaction costs 0 0 252 Adjusted EBITDA $69,626 $80,139 $88,682 Adjusted EBITDA Margin 0.29831957976640361 0.3139923048592228 0.32224798145335359 Twelve Months Ended Six Months Ended Twelve Months Ended December 28, 2018 June 29, 2018 July 5, 2019 July 5, 2019 Net income (loss) $9,820 $-6,920 $16,712 $19,612 Depreciation and amortization 47,198 ,-23,361 21,947 45,784 Interest expense 19,580 -9,648 11,074 21,006 Income taxes 3,334 -2,670 4,018 4,682 EBITDA 79,932 ,-42,599 53,751 91,084 Loss on disposal of assets and costs from exit and disposal activities 23 -23 0 0 Stock-based compensation expense (benefit) 936 -,350 447 1,033 Legal settlement 7,500 0 0 7,500 Contingent consideration measurement 39 -39 0 0 Transaction costs 252 -,252 1,165 1,165 Adjusted EBITDA $88,682 $,-43,263 $55,363 $,100,782

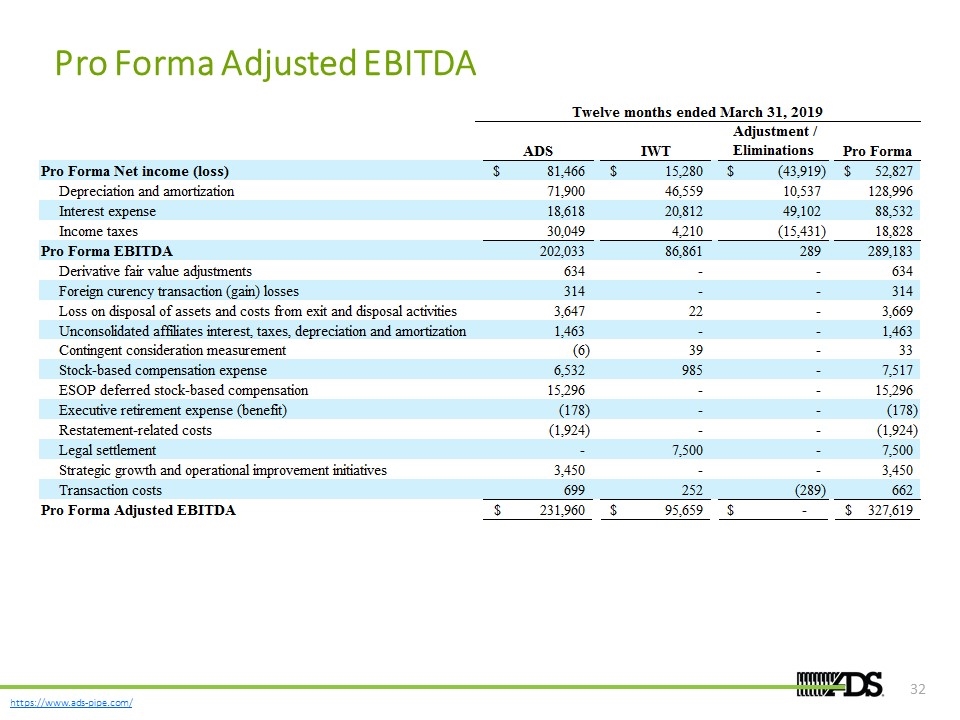

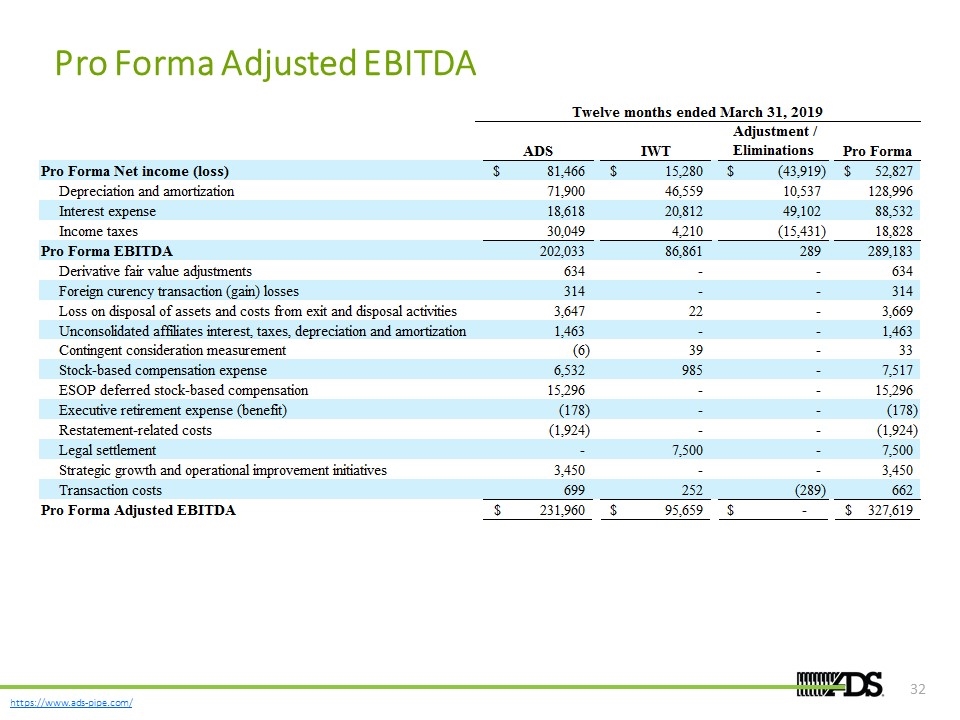

Pro Forma Adjusted EBITDA Calendar Year 2016 2017 2018 Net income (loss) $-6,386 $42,804 $9,820 Depreciation and amortization 51,555 52,024 47,198 Interest expense 24,260 23,707 19,580 Income taxes -86 ,-40,142 3,334 EBITDA 69,343 78,393 79,932 Loss on disposal of assets and costs from exit and disposal activities 0 82 23 Contingent consideration measurement 0 931 39 Stock-based compensation expense 283 733 936 Legal settlement 0 0 7,500 Transaction costs 0 0 252 Adjusted EBITDA 69,626 80,139 88,682 Adjusted EBITDA Margin 0.29831957976640361 0.3139923048592228 0.32224798145335359 Twelve months ended March 31, 2019 ADS IWT Adjustment / Eliminations Pro Forma Pro Forma Net income (loss) $81,466 $15,280 $,-43,919 $52,827 Depreciation and amortization 71,900 46,559 10,537 ,128,996 Interest expense 18,618 20,812 49,102 88,532 Income taxes 30,049 4,210 ,-15,431 18,828 Pro Forma EBITDA ,202,033 86,861 289 ,289,183 Derivative fair value adjustments 634 0 0 634 Foreign curency transaction (gain) losses 314 0 0 314 Loss on disposal of assets and costs from exit and disposal activities 3,647 22 0 3,669 Unconsolidated affiliates interest, taxes, depreciation and amortization 1,463 0 0 1,463 Contingent consideration measurement -6 39 0 33 Stock-based compensation expense 6,532 984.5 0 7,516.5 ESOP deferred stock-based compensation 15,296 0 0 15,296 Executive retirement expense (benefit) -,178 0 0 -,178 Restatement-related costs -1,924 0 0 -1,924 Legal settlement 0 7,500 0 7,500 Strategic growth and operational improvement initiatives 3,450 0 0 3,450 Transaction costs 699 252 -,289 662 Pro Forma Adjusted EBITDA $,231,960 $95,658.5 $0 $,327,618.5