Q4 and FY 2021 Financial Results May 20, 2021

Management Presenters 2 Scott Barbour President and Chief Executive Officer Scott Cottrill Executive Vice President, Chief Financial Officer Mike Higgins Vice President, Corporate Strategy & Investor Relations

Forward Looking Statements and Non-GAAP Financial Metrics 3 Certain statements in this presentation may be deemed to be forward-looking statements. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; volatility in general business and economic conditions in the markets in which we operate, including the adverse impact on the U.S. and global economy of the COVID-19 global pandemic, and the impact of COVID-19 in the near, medium and long-term on our business, results of operations, financial position, liquidity or cash flows, and other factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets, including competition from both manufacturers of high performance thermoplastic corrugated pipe and manufacturers of products using alternative materials; uncertainties surrounding the integration of acquisitions and similar transactions, including the acquisition of Infiltrator Water Technologies and the integration of Infiltrator Water Technologies; our ability to realize the anticipated benefits from the acquisition of Infiltrator Water Technologies; risks that the acquisition of Infiltrator Water Technologies and related transactions may involve unexpected costs, liabilities or delays; our ability to continue to convert current demand for concrete, steel and polyvinyl chloride (“PVC”) pipe products into demand for our high performance thermoplastic corrugated pipe and Allied Products; the effect of any claims, litigation, investigations or proceedings; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; our ability to remediate the material weakness in our internal control over financial reporting, including remediation of the control environment for our joint venture affiliate ADS Mexicana, S.A. de C.V.; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets, including risks associated with new markets and products associated with our recent acquisition of Infiltrator Water Technologies; our ability to achieve the acquisition component of our growth strategy; the risk associated with manufacturing processes; our ability to manage our assets; the risks associated with our product warranties; our ability to manage our supply purchasing and customer credit policies; the risks associated with our self-insured programs; our ability to control labor costs and to attract, train and retain highly-qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to project product mix; the risks associated with our current levels of indebtedness, including borrowings under our existing credit agreement and outstanding indebtedness under our existing senior notes; fluctuations in our effective tax rate; our ability to meet future capital requirements and fund our liquidity needs; the risk that additional information may arise that would require the Company to make additional adjustments or revisions or to restate the financial statements and other financial data for certain prior periods and any future periods; any delay in the filing of any filings with the Securities and Exchange Commission (“SEC”); the review of potential weaknesses or deficiencies in the Company’s disclosure controls and procedures, and discovering weaknesses of which we are not currently aware or which have not been detected; additional uncertainties related to accounting issues generally; and the other risks and uncertainties described in the Company’s filings with the SEC. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

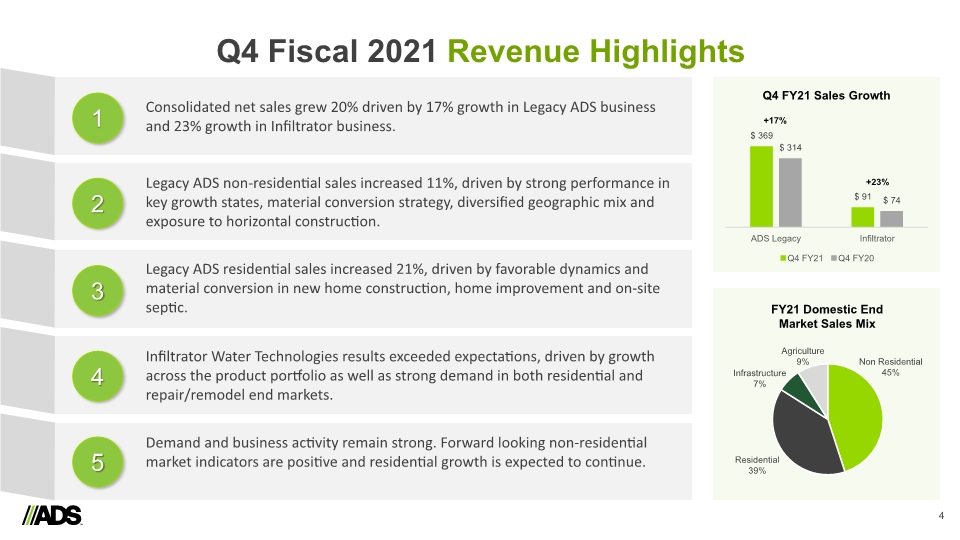

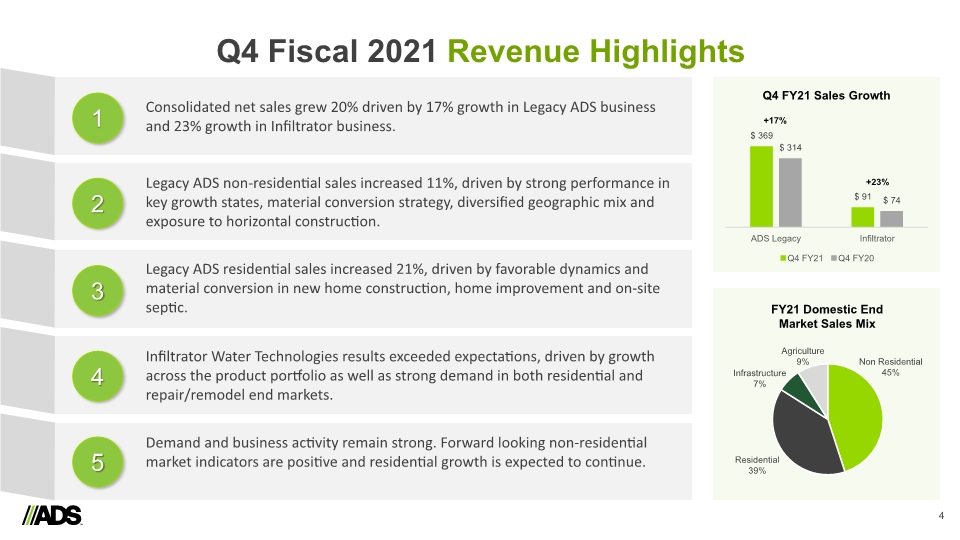

Q4 Fiscal 2021 Revenue Highlights 4 Legacy ADS residential sales increased 21%, driven by favorable dynamics and material conversion in new home construction, home improvement and on-site septic. Infiltrator Water Technologies results exceeded expectations, driven by growth across the product portfolio as well as strong demand in both residential and repair/remodel end markets. Demand and business activity remain strong. Forward looking non-residential market indicators are positive and residential growth is expected to continue. Legacy ADS non-residential sales increased 11%, driven by strong performance in key growth states, material conversion strategy, diversified geographic mix and exposure to horizontal construction. Consolidated net sales grew 20% driven by 17% growth in Legacy ADS business and 23% growth in Infiltrator business. Q4 FY21 Sales Growth +17% +23% FY21 Domestic End Market Sales Mix

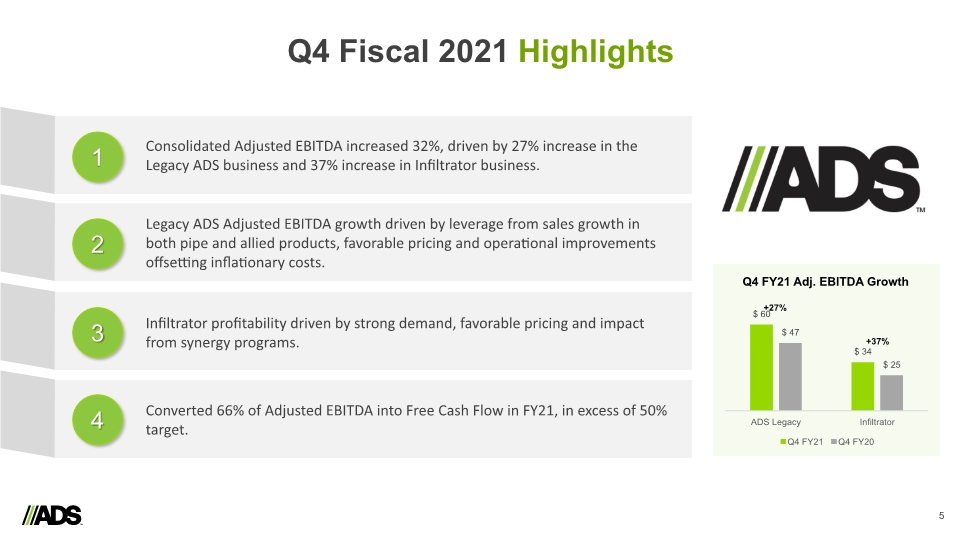

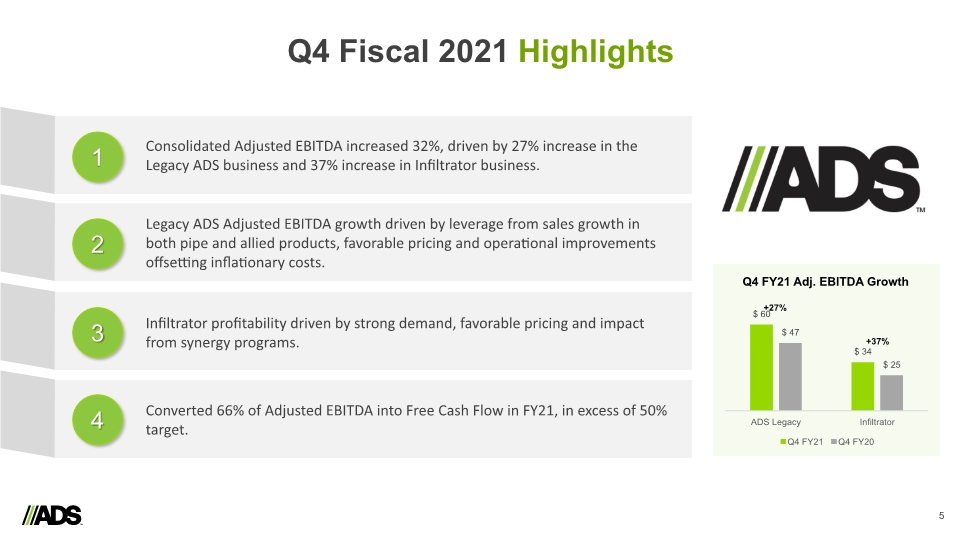

Q4 Fiscal 2021 Highlights 5 Infiltrator profitability driven by strong demand, favorable pricing and impact from synergy programs. Converted 66% of Adjusted EBITDA into Free Cash Flow in FY21, in excess of 50% target. Legacy ADS Adjusted EBITDA growth driven by leverage from sales growth in both pipe and allied products, favorable pricing and operational improvements offsetting inflationary costs. Consolidated Adjusted EBITDA increased 32%, driven by 27% increase in the Legacy ADS business and 37% increase in Infiltrator business. Q4 FY21 Adj. EBITDA Growth +27% +37%

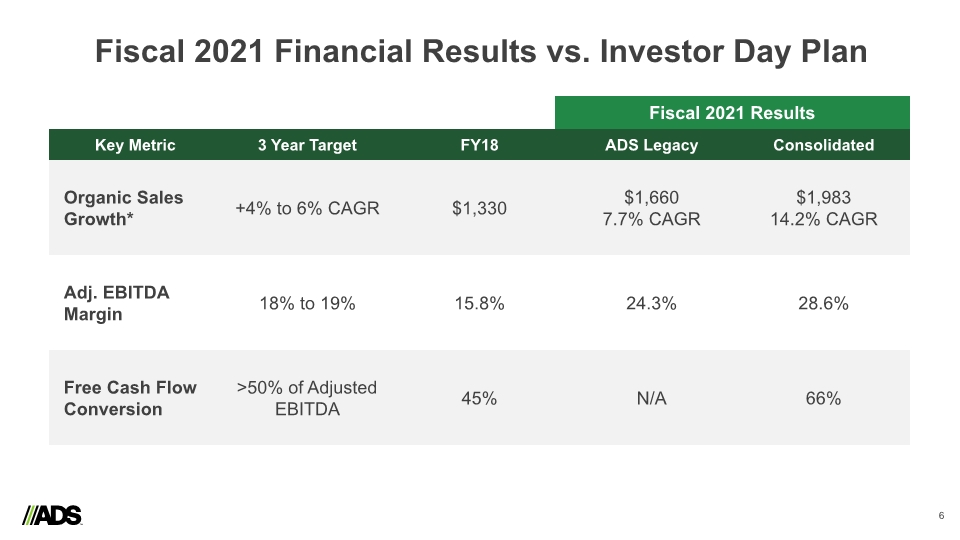

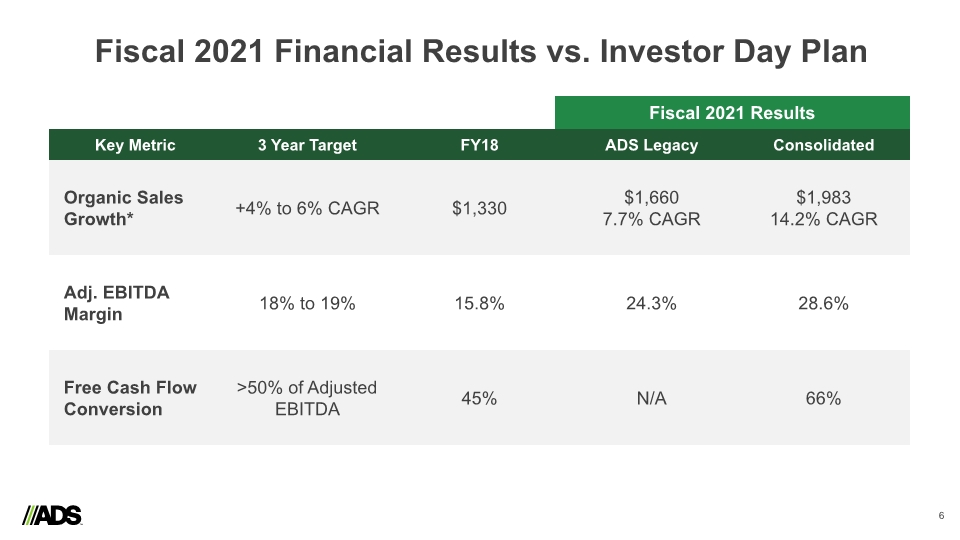

6 Fiscal 2021 Financial Results vs. Investor Day Plan Fiscal 2021 Results

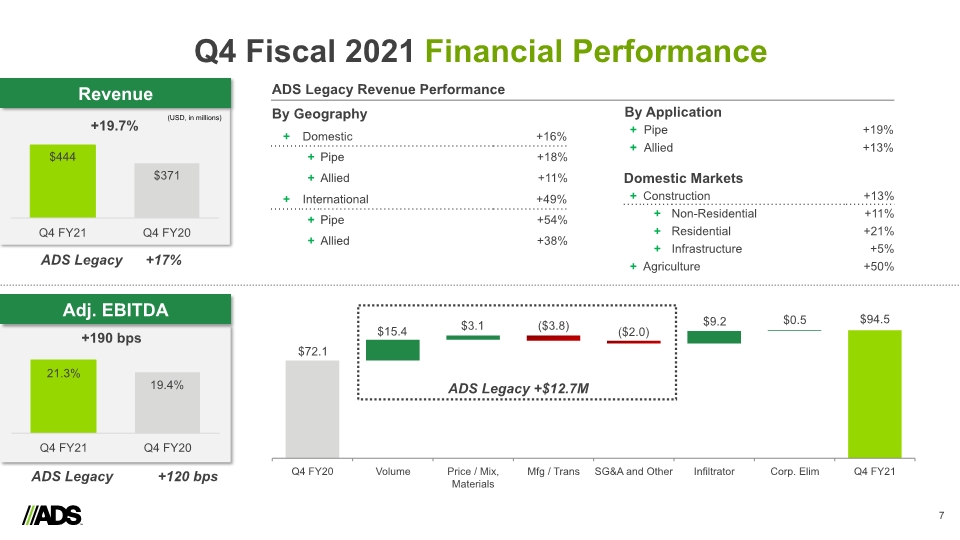

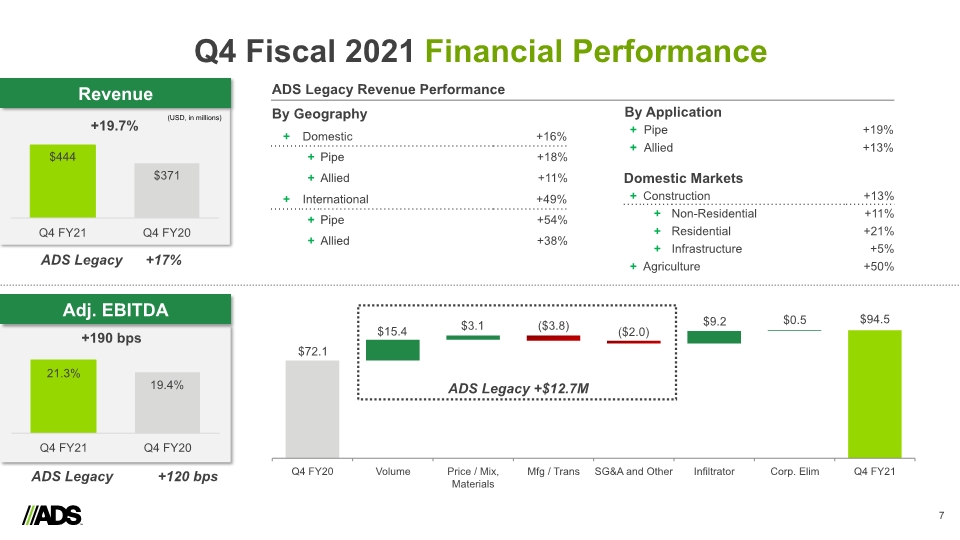

Q4 Fiscal 2021 Financial Performance 7 +190 bps (USD, in millions) +19.7% $72.1 $15.4 $3.1 ($2.0) $9.2 $94.5 Revenue Adj. EBITDA ($3.8) $371 $444 19.4% 21.3% ADS Legacy +$12.7M $0.5

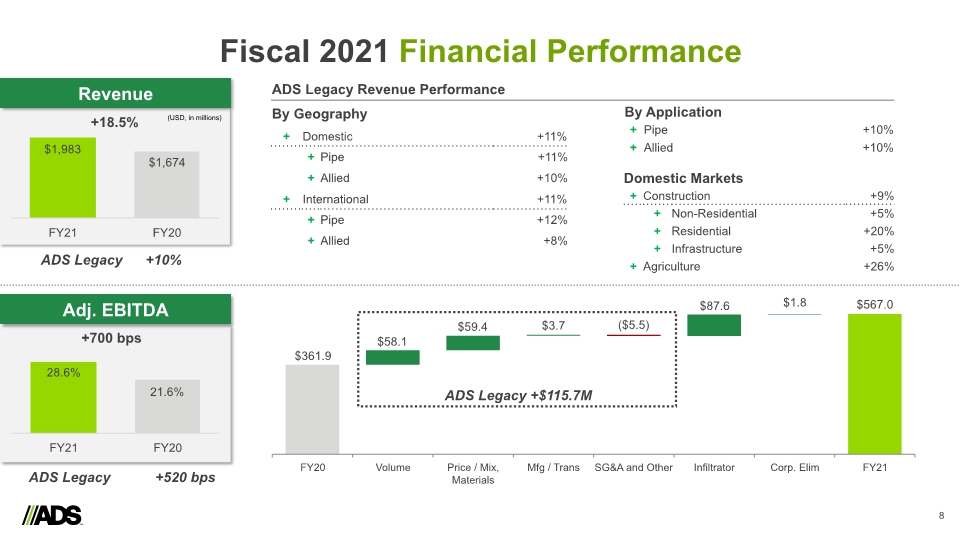

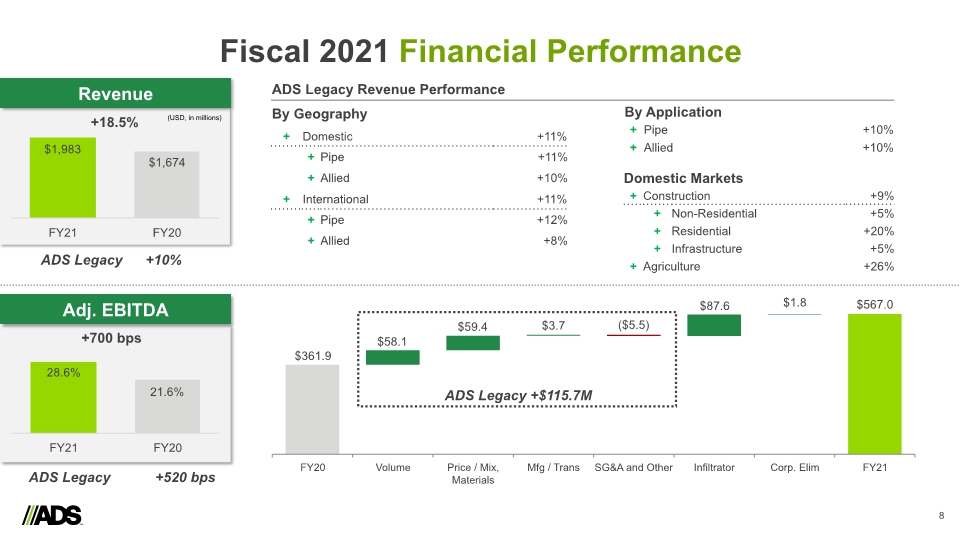

Fiscal 2021 Financial Performance 8 +700 bps (USD, in millions) +18.5% $361.9 $58.1 $59.4 ($5.5) $87.6 $567.0 Revenue Adj. EBITDA $3.7 $1,674 $1,983 21.6% 28.6% ADS Legacy +$115.7M $1.8

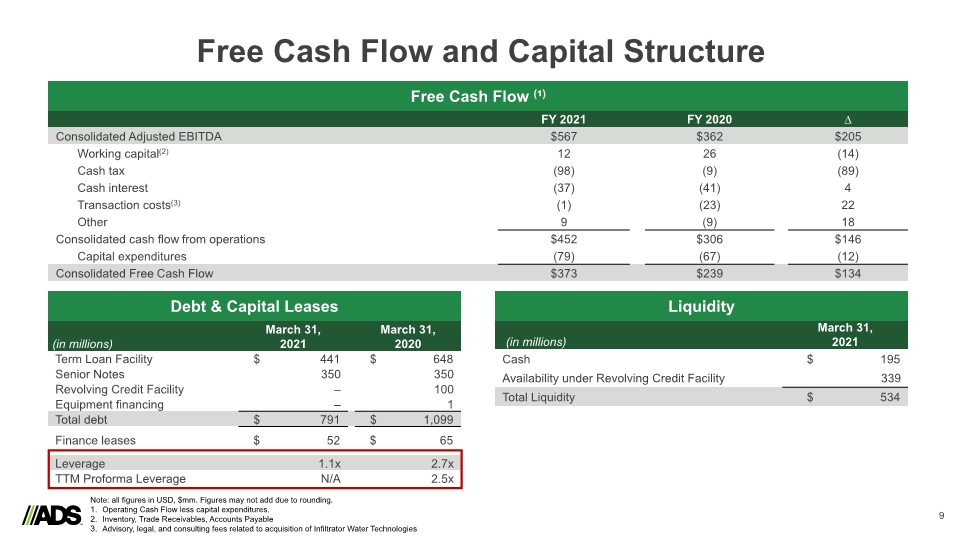

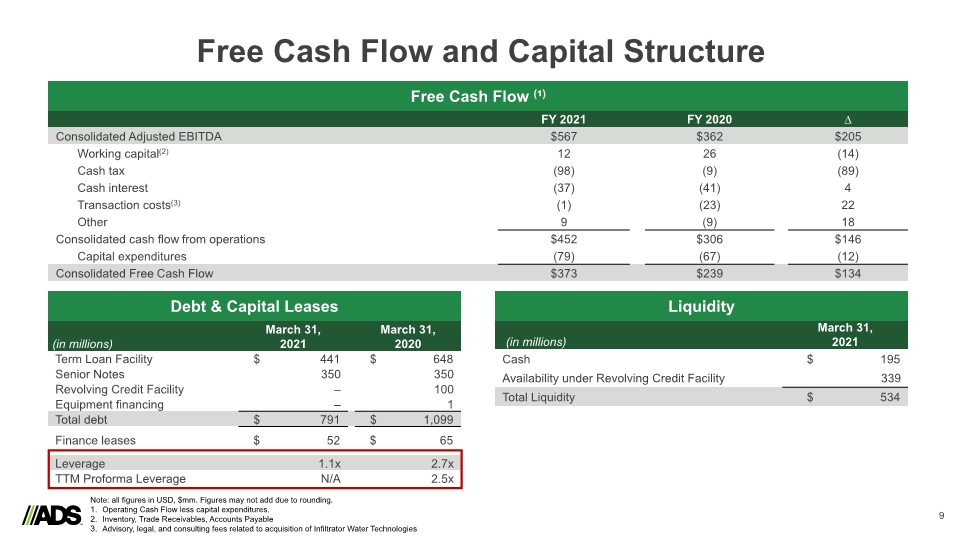

Free Cash Flow and Capital Structure 9 Free Cash Flow (¹) Note: all figures in USD, $mm. Figures may not add due to rounding. Operating Cash Flow less capital expenditures. Inventory, Trade Receivables, Accounts Payable Advisory, legal, and consulting fees related to acquisition of Infiltrator Water Technologies Debt & Capital Leases Liquidity

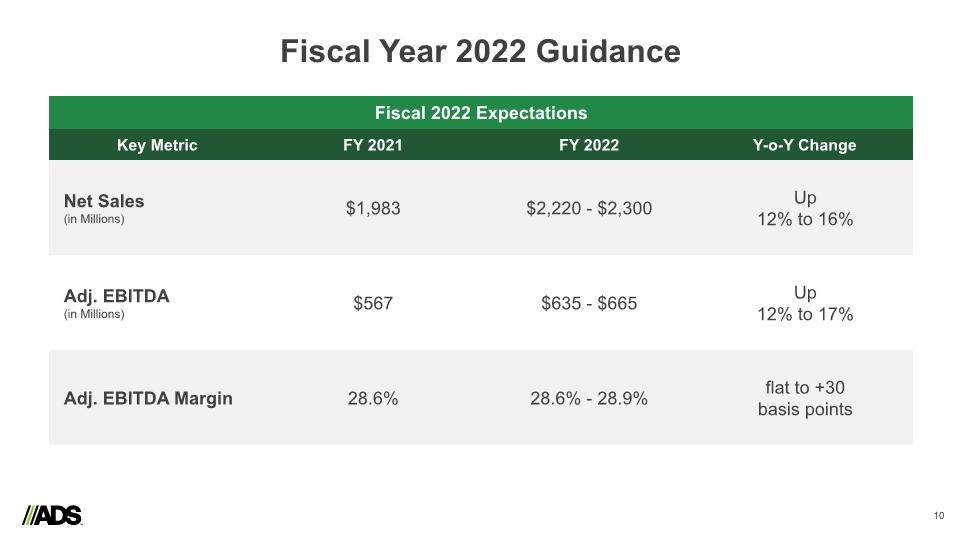

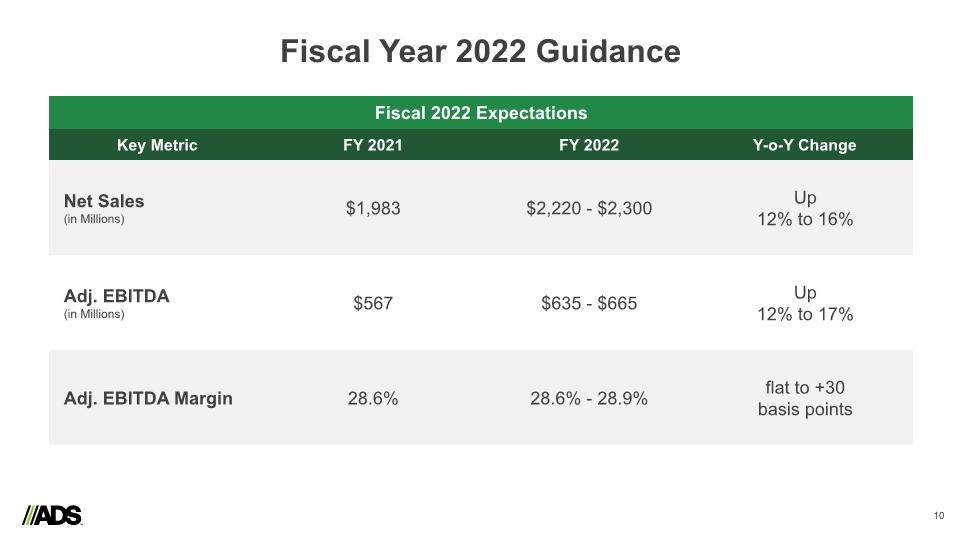

Fiscal Year 2022 Guidance 10 Fiscal 2022 Expectations

Q&A

Closing Remarks 12 Continue to focus on disciplined execution, capitalizing on favorable market dynamics, operational productivity initiatives, recycling programs and capital deployment initiatives as we build on strong FY21 results. Strong profitability and free cash flow conversion expected to enable investment in growth, productivity, safety and other strategic investments. Project quotes, order rate and backlog are strong year-over-year. Demand and business activity remain strong with positive forward looking market indicators. Significant outperformance of domestic end markets in FY21 due to material conversion, complete water management solutions and strategic sales growth strategies.

Appendix 13

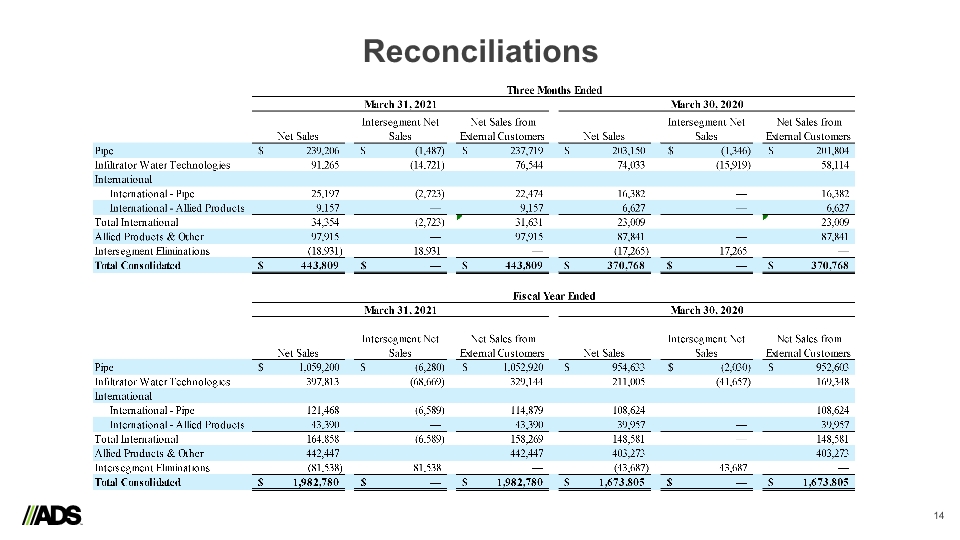

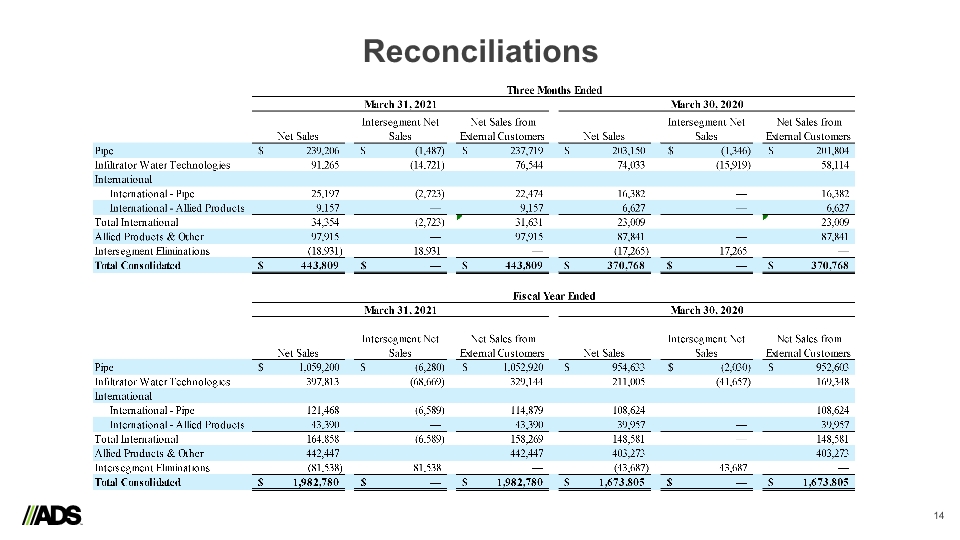

Reconciliations 14

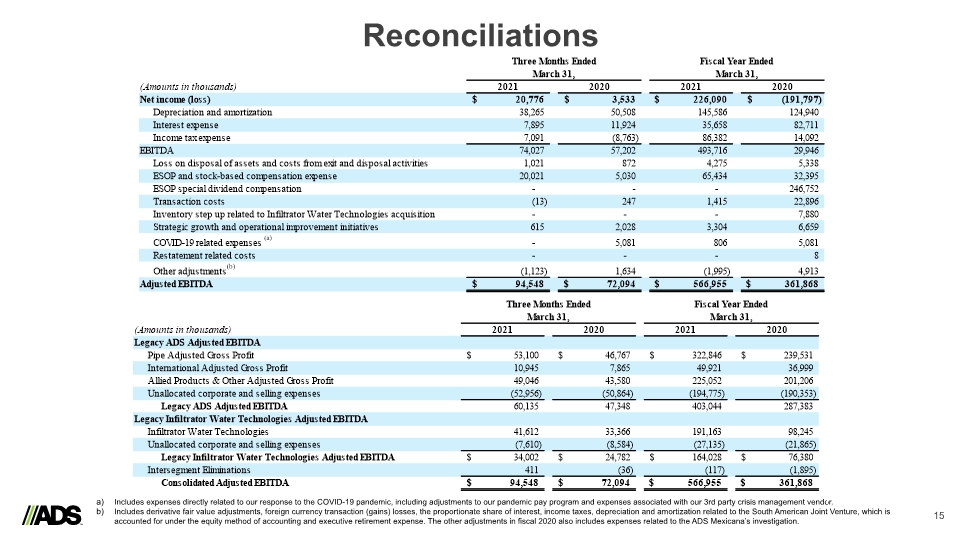

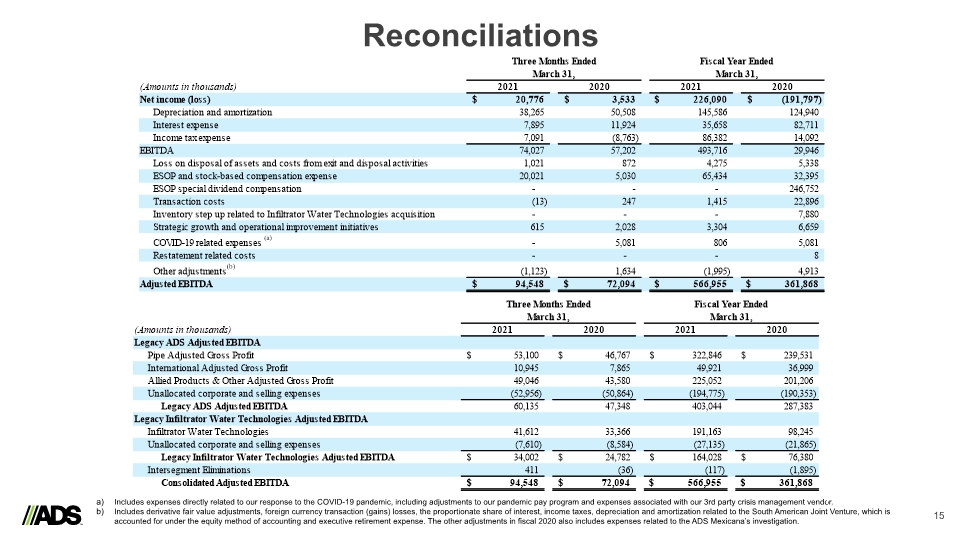

Reconciliations 15 Includes expenses directly related to our response to the COVID-19 pandemic, including adjustments to our pandemic pay program and expenses associated with our 3rd party crisis management vendor. Includes derivative fair value adjustments, foreign currency transaction (gains) losses, the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense. The other adjustments in fiscal 2020 also includes expenses related to the ADS Mexicana’s investigation.

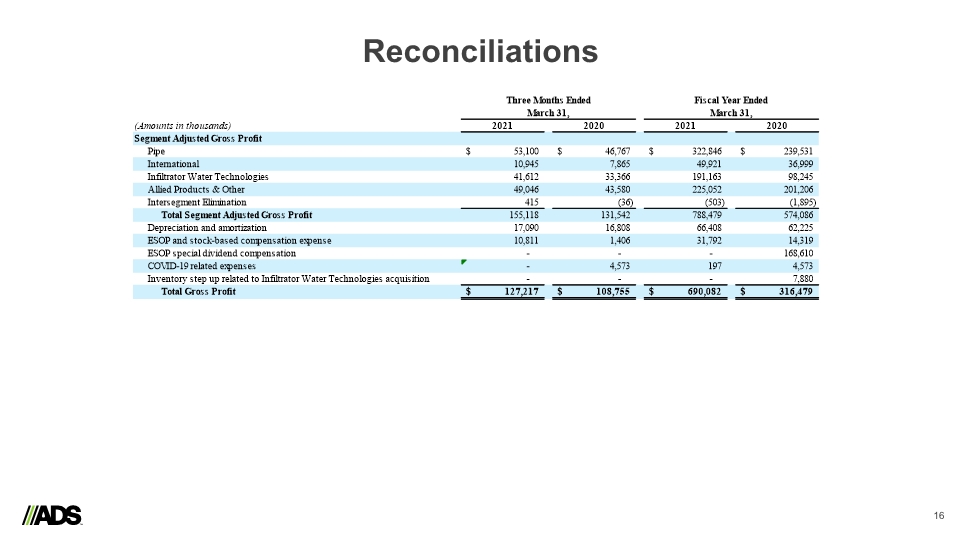

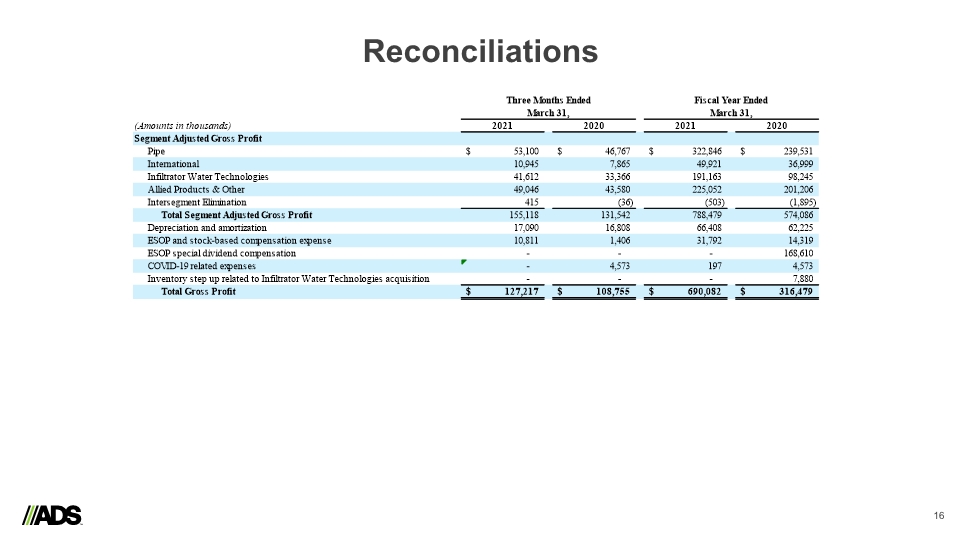

Reconciliations 16