- ECC Dashboard

-

Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Eagle Point Credit (ECC) PRE 14APreliminary proxy

Filed: 28 Mar 17, 12:00am

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

EAGLE POINT CREDIT COMPANY INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

EAGLE POINT CREDIT COMPANY INC.

20 Horseneck Lane

Greenwich, CT 06830

April , 2017

Dear Stockholder:

You are cordially invited to attend the 2017 Annual Meeting of Stockholders (the “Meeting”) of Eagle Point Credit Company Inc. (the “Company”) to be held on May 16, 2017 at 8:00 a.m., Eastern Time, at 20 Horseneck Lane, Greenwich, CT 06830.

The Notice of the Annual Meeting of Stockholders and the Proxy Statement accompanying this letter describe the business to be conducted at the Meeting. At the Meeting, holders of the outstanding shares of the Company’s common stock and the outstanding shares of the Company’s preferred stock, voting together as a single class, will be asked to (1) elect one director of the Company, and (2) approve an amended and restated investment advisory agreement between the Company and Eagle Point Credit Management LLC. Additionally, holders of the outstanding shares of the Company’s preferred stock, voting separately as a single class, will be asked to elect one director of the Company.

It is important that your shares be represented at the Meeting. If you are unable to attend the Meeting in person, please complete, date and sign the enclosed proxy card and promptly return it in the envelope provided.Your vote is important.

Sincerely yours,

| /s/ Thomas P. Majewski |

Thomas P. Majewski, Chief Executive Officer

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 16, 2017

The Proxy Statement and the Annual Report to Stockholders for the fiscal year ended December 31, 2016 are available atwww.eaglepointcreditcompany.com.

In addition, copies of the Company’s most recent annual and semiannual report, including financial statements, have previously been transmitted to the Company’s stockholders. The Company will furnish to any stockholder upon request, without charge, an additional copy of the Company’s most recent annual report and semiannual report to stockholders. Annual reports and semiannual reports to stockholders may be obtained by writing to Courtney Fandrick, Secretary, Eagle Point Credit Company Inc., 20 Horseneck Lane, Greenwich, CT 06830, by calling toll-free (844) 810-6501 or by visiting the Company’s website atwww.eaglepointcreditcompany.com.

The following information applicable to the Meeting is found in the Proxy Statement and accompanying proxy card:

| • | The date, time and location of the meeting; |

| • | A list of the matters intended to be acted on and the recommendation of the Company’s Board of Directors regarding those matters; and |

| • | Any control/identification numbers that you need to access your proxy card. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2017

EAGLE POINT CREDIT COMPANY INC.

20 Horseneck Lane

Greenwich, CT 06830

To the Stockholders of Eagle Point Credit Company Inc. (the “Company”):

Notice is hereby given that an Annual Meeting of Stockholders of the Company (the “Meeting”) will be held at the offices of the Company at 20 Horseneck Lane, Greenwich, CT 06830, on Tuesday, May 16, 2017 at 8:00 a.m., Eastern Time.

At the Meeting, you will be asked to elect two (2) directors of the Company, as outlined below and more fully described in the accompanying Proxy Statement:

| 1. | Mr. Kevin F. McDonald, to be voted upon by holders of the outstanding shares of the Company’s common stock and preferred stock, voting together as a single class, to serve until the 2020 annual meeting of stockholders or until his successor is duly elected and qualifies; |

| 2. | Mr. Thomas P. Majewski, to be voted upon by holders of the outstanding shares of the Company’s preferred stock, voting separately as a single class, to serve until the 2020 annual meeting of stockholders or until his successor is duly elected and qualifies; and |

In addition, at the Meeting, you will be asked to approve an amended and restated investment advisory agreement by and between the Company and Eagle Point Credit Management LLC, to be voted upon by holders of the outstanding shares of the Company’s common stock and preferred stock, voting together as a single class.

The Board of Directors of the Company has fixed the close of business on March 31, 2017 as the record date for the determination of stockholders of the Company entitled to receive notice of, and to vote at, the Meeting or any adjournment(s) or postponement(s) thereof. The enclosed proxy is being solicited on behalf of the Board of Directors of the Company.

| By order of the Board of Directors of the Company | |

| /s/ Courtney B. Fandrick | |

| Courtney B. Fandrick | |

| Secretary | |

Greenwich, CT

April , 2017

It is important that your shares be represented at the Meeting in person or by proxy, no matter how many shares you own. If you do not expect to attend the Meeting, please complete, date, sign and return the enclosed proxy in the accompanying envelope, which requires no postage if mailed in the United States. Please mark and mail your proxy promptly in order to save any additional costs of further proxy solicitations and in order for the Meeting to be held as scheduled. If you have any questions regarding the proxy materials please call (844) 810-6501.

EAGLE POINT CREDIT COMPANY INC.

20 Horseneck Lane

Greenwich, CT 06830

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 16, 2017

April , 2017

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board,” and each member, a “Director”) of the holders of the capital stock (the “Stockholders”) of Eagle Point Credit Company Inc. (the “Company,” “we,” “us” or “our”) of proxies to be voted at the 2017 Annual Meeting of Stockholders (the “Meeting”) and any adjournment(s) or postponement(s) thereof. The Meeting will be held at our offices, which are located at 20 Horseneck Lane, Greenwich, CT 06830, on Tuesday, May 16, 2017 at 8:00 a.m., Eastern Time. The Notice of Annual Meeting of Stockholders (the “Notice”), this Proxy Statement and the enclosed proxy card are first being sent to Stockholders on or about April , 2017. A copy of the Company’s Annual Report for the fiscal year ended December 31, 2016 (the “Annual Report”) was previously transmitted to the Stockholders and is also available to Stockholders, without charge, upon request by writing to Courtney Fandrick, Secretary, Eagle Point Credit Company Inc., 20 Horseneck Lane, Greenwich, CT 06830, by calling (844) 810-6501 or by visiting the Company’s website atwww.eaglepointcreditcompany.com.

The Board has fixed the close of business on March 31, 2017 as the record date (the “Record Date”) for the determination of Stockholders entitled to notice of, and to vote at, the Meeting. The Meeting is scheduled as a meeting of all Stockholders. As of the Record Date, [16,474,879] shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), were issued and outstanding, 1,818,000 shares of the Company’s 7.75% Series A Term Preferred Stock due 2022, par value $0.001 per share (the “Preferred A Stock”), were issued and outstanding, and 1,840,000 shares of the Company’s 7.75% Series B Term Preferred Stock due 2026, par value $0.001 per share (the “Preferred B Stock” and together with the Preferred A Stock, the “Preferred Stock”), were issued and outstanding.

Stockholders of record may vote by mail by returning a properly executed proxy card or in person by attending the Meeting. Shares of Common Stock and Preferred Stock represented by duly executed and timely delivered proxies will be voted as instructed on the proxy.If you execute and return the enclosed proxy and no vote is indicated, your proxy will be voted FOR each proposal described in this Proxy Statement.

At any time before it has been voted, your proxy may be revoked in one of the following ways: (1) by a signed, written letter of revocation delivered on any business day before the date of the Meeting to the Secretary of the Company at 20 Horseneck Lane, Greenwich, CT 06830, (2) by properly completing and executing a later-dated proxy and returning it in time to be received before the Meeting, or (3) by attending the Meeting and voting in person. Please call (844) 810-6501 for information on how to obtain directions to attend the Meeting and vote in person.

Purpose of Meeting

At the Meeting, Stockholders will be asked to elect two (2) Directors as outlined below:

| 1. | Mr. Kevin F. McDonald, to be elected by holders of the outstanding shares of Common Stock and Preferred Stock, voting together as a single class, to serve until the 2020 annual meeting of stockholders or until his successor is duly elected and qualifies; and |

| 2. | Mr. Thomas P. Majewski, to be elected by holders of the outstanding shares of Preferred Stock, voting separately as a single class, to serve until the 2020 annual meeting of stockholders or until his successor is duly elected and qualifies. |

In addition, at the Meeting, you will be asked to approve an amended and restated investment advisory agreement (the “New Advisory Agreement”) by and between the Company and Eagle Point Credit Management LLC (the “Adviser”), to be voted upon by holders of the outstanding shares of the Company’s common stock and preferred stock, voting together as a single class.

Quorum

A quorum must be present at the Meeting for any business to be conducted. The presence at the Meeting, in person or by proxy, of the holders of a majority of the Company’s capital stock entitled to vote at the Meeting will constitute a quorum. Proxies that reflect abstentions will be treated as shares present for quorum purposes. In addition, shares held of record by brokers or nominees as to which voting instructions have not been received from the beneficial owners or the persons entitled to vote, and the broker or nominee does not otherwise have discretionary power to vote on non-routine matters, will be entitled to vote on at least one proposal at the Meeting and will be treated as shares present for quorum purposes.

If a quorum is not present at the Meeting, the presiding officer shall have power to adjourn the Meeting from time to time, without notice other than announcement at the Meeting, until a quorum shall be present or represented. At such adjourned Meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the Meeting as originally noticed. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned Meeting, a notice of the adjourned Meeting shall be given to each Stockholder entitled to vote at the Meeting.

Vote Required

The Stockholders of record on the Record Date will be entitled to one vote per share on each matter to which they are entitled to vote and that is to be voted on by Stockholders, and a fractional vote with respect to fractional shares, with no cumulative voting rights in the election of Directors. Votes cast by proxy or in person at the Meeting will be counted by the Company’s proxy tabulation firm.

Election of Directors. The election of a Director requires the affirmative vote of a plurality of the votes cast at the Meeting in person or by proxy. Therefore, a plurality of the votes cast at the Meeting by holders of Common Stock and Preferred Stock must be “FOR” the election of Mr. McDonald for him to be re-elected as a Director, and a plurality of the votes cast at the Meeting by holders of Preferred Stock must be “FOR” the election of Mr. Majewski for him to be re-elected as a Director. If you vote “Withhold” with respect to a nominee, your shares will not be voted with respect to the person indicated. Such abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on the election.

| 2 |

Approval of New Advisory Agreement. As required by the Investment Company Act of 1940, as amended (the “1940 Act”), the approval of the New Advisory Agreement requires the affirmative vote of the lesser of (1) 67% or more of the voting securities (the Common Stock and Preferred Stock voting together as a single class) present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (2) more than 50% of the outstanding voting securities (the Common Stock and Preferred Stock voting together as a single class). Abstentions will have the effect of a vote against approval of the New Advisory Agreement. Approval of a new investment advisory agreement is a non-routine matter. As a result, if you hold shares in “street name” through a broker, bank or other nominee, your broker, bank or nominee will not be permitted to exercise voting discretion with respect to approval of the New Advisory Agreement at the Annual Meeting. Therefore, if you do not vote and you do not give your broker or other nominee specific instructions on how to vote for you, then your broker cannot vote with respect to approval of the New Advisory Agreement and shares held by you will have the same effect as votes cast against approval of the New Advisory Agreement.

Additional Information

The Company will bear the expense of the solicitation of proxies for the Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice and the enclosed proxy card. The Company intends to use the services of American Stock Transfer & Trust Company, LLC, its transfer agent, and Broadridge Financial Solutions, Inc., a provider of investor communications solutions, to aid in the distribution and collection of proxy votes. The Company expects to pay market rates for such services. We have requested that brokers, nominees, fiduciaries and other persons holding shares of Common Stock or Preferred Stock in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners. We will reimburse such persons for their reasonable expenses in so doing. In addition, proxies may be solicited in person and/or by telephone, mail or facsimile transmission by Directors or officers of the Company, officers or employees of the Adviser, Eagle Point Administration LLC, our administrator (the “Administrator”), and/or by a retained solicitor. No additional compensation will be paid to such Directors, officers or regular employees for such services. If the Company retains a solicitor, the Company has estimated that it would pay approximately $10,000 for such services. If the Company engages a solicitor, you could be contacted by telephone on behalf of the Company and urged to vote. The solicitor will not attempt to influence how you vote your shares, but will only ask that you take the time to cast a vote. You may also be asked if you would like to vote over the telephone and to have your vote transmitted to our proxy tabulation firm.

As of the date of this Proxy Statement, the Board, the Company’s officers and the Adviser know of no business to come before the Meeting other than as set forth in the Notice. If any other business is properly brought before the Meeting, the persons named as proxies will vote in their sole discretion.

| 3 |

PROPOSAL 1: ELECTION OF DIRECTORS

The Board is currently comprised of six (6) Directors, four (4) of whom are not “interested persons” (as defined in the 1940 Act) of the Company (the “Independent Directors”). The Board is divided into three classes with the term of only one class expiring at each annual meeting. Classes I, II and III are each comprised of two (2) Directors.

The Nominating Committee (the “Nominating Committee”) of the Company and the Board have recommended Mr. McDonald and Mr. Majewski for re-election as Class III Directors by the Stockholders. Accordingly, at the Meeting, the holders of Common Stock and Preferred Stock, voting together as a single class, are being asked to re-elect Mr. McDonald as a Class III Director, and the holders of Preferred Stock, voting separately as a single class, are being asked to re-elect Mr. Majewski as a Class III Director, each to serve until the 2020 annual meeting of stockholders or until his respective successor is duly elected and qualifies.

Messrs. McDonald and Majewski are currently serving as Class III Directors and have agreed to continue to serve as Class III Directors, if re-elected. If either Mr. McDonald or Mr. Majewski is not available for re-election at the time of the Meeting, the persons named as proxies will vote for such substitute nominee(s) as the Nominating Committee and the Board may select. The Board has no reason to believe that either Mr. McDonald or Mr. Majewski will be unable or unwilling to serve.

A Stockholder can vote for, or withhold its vote with respect to, any nominee.In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each nominee.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE RE-ELECTION OF EACH NOMINEE.

Information about the Board

The business of the Company is managed under the direction of the Board. Subject to the provisions of the Company’s certificate of incorporation, its bylaws and applicable state law, the Directors have all powers necessary and convenient to carry out this responsibility, including the election and removal of the Company’s officers. The Board is divided into three classes, with the term of only one class expiring at each annual meeting of the stockholders.

Class I Directors. Mr. Scott W. Appleby and Mr. Jeffrey L. Weiss are currently serving as Class I Directors. Messrs. Appleby and Weiss were most recently elected to serve as Directors at the 2015 annual meeting of stockholders. Their term expires at the 2018 annual meeting of stockholders.

Class II Directors. Mr. James R. Matthews and Mr. Paul E. Tramontano are currently serving as Class II Directors. Messrs. Matthews and Tramontano were most recently elected to serve as Directors at the 2016 annual meeting of stockholders. Their term expires at the 2019 annual meeting of stockholders.

Class III Directors. Mr. Thomas P. Majewski and Mr. Kevin F. McDonald are currently serving as Class III Directors. Messrs. Majewski and McDonald were elected to serve as Directors on May 1, 2014 pursuant to a written resolution of the sole equityholder of the Company at that time with an initial term expiring at the Meeting. Messrs. McDonald and Majewski will continue to serve as Class III Directors if re-elected at the Meeting.

| 4 |

Board Leadership Structure. Currently, and assuming the nominees are re-elected as proposed, the Board consists and will continue to consist of six (6) Directors, four (4) of whom are Independent Directors and two (2) of whom are “interested persons” as defined in the 1940 Act. Each Independent Director also meets the definition of “independent director” in the corporate governance standards of the New York Stock Exchange as applicable to closed-end management investment companies. Messrs. Appleby, McDonald, Tramontano and Weiss qualify as Independent Directors. The Board has appointed Mr. Matthews, who is an interested person of the Company, to serve as Chairperson (the “Chairperson”) of the Board. The Chairperson presides at meetings of the Directors and may call meetings of the Board and any Board committee whenever he deems necessary. The Chairperson participates in the preparation of the agenda for meetings of the Board and the identification of information to be presented to the Board with respect to matters to be acted upon by the Board. The Chairperson also generally acts as a liaison with our management, officers and attorneys and other Directors between meetings. The Chairperson may perform such other functions as may be requested by the Board from time to time. Except for any duties specified pursuant to our certificate of incorporation or bylaws, or as assigned by the Board, the designation of a Director as Chairperson does not impose on that Director any duties, obligations or liability that are greater than the duties, obligations or liability imposed on any other Director, generally.

The Board has designated Mr. Weiss as “Lead Independent Director.” The Lead Independent Director generally acts as a liaison between the other Independent Directors and our management, officers and attorneys between Board meetings. The Lead Independent Director may perform such other functions as may be requested by the Board from time to time. Except for any duties specified pursuant to our certificate of incorporation or bylaws, or as assigned by the Board, the designation of a Director as Lead Independent Director does not impose on that Director any duties, obligations or liability that are greater than the duties, obligations or liability imposed on any other Director, generally.

The Board has established two standing committees to facilitate oversight of the management of the Company: the Audit Committee (the “Audit Committee”) of the Company and the Nominating Committee. The functions and role of each committee are described below under “Board Committees and Meetings.” The membership of each committee consists of all of the Independent Directors, which the Board believes allows them to participate in the full range of the Board’s oversight duties.

The Board reviews its leadership structure periodically, and the Board believes that the current leadership structure is appropriate because it allows the Board to exercise informed judgment over matters under its purview, and it allocates areas of responsibility among committees or working groups of Directors and the full Board in a manner that enhances effective oversight. The Board also believes that having a majority of Independent Directors is appropriate and in the best interest of the Stockholders. Nevertheless, the Board also believes that having interested persons serve on the Board brings corporate and financial viewpoints that are, in the Board’s view, crucial elements in its decision-making process. In addition, the Board believes that Mr. Majewski, Managing Partner of the Adviser, provides the Board with the Adviser’s perspective in managing and sponsoring us. The leadership structure of the Board may be changed, at any time and in the discretion of the Board, including in response to changes in circumstances or our characteristics.

Risk Oversight. As a registered investment company, we are subject to a variety of risks, including investment risks, financial risks, compliance risks and operational risks. As part of its overall activities, the Board oversees the management of our risk management structure by various departments of the Adviser and the Administrator, as well as by our Chief Compliance Officer (“CCO”). The responsibility to manage our risk management structure on a day-to-day basis is subsumed within the Adviser’s overall investment management responsibilities. The Adviser has its own, independent interest in risk management.

| 5 |

The Board recognizes that it is not possible to identify all of the risks that may affect us or to develop processes and controls to eliminate or mitigate their occurrence or effects. The Board discharges risk oversight as part of its overall activities. In addressing issues regarding our risk management between meetings, appropriate representatives of the Adviser communicate with the Chairperson, the relevant committee chair or our CCO, who is directly accountable to the Board. As appropriate, the Chairperson and the committee chairs confer among themselves, with our CCO, the Adviser, other service providers and external fund counsel to identify and review risk management issues that may be placed on the full Board’s agenda and/or that of an appropriate committee for review and discussion with management.

Information about the Directors and Nominees

The following table provides information concerning the Directors/Director nominees.

Name, Address(1) and Age | Position(s) Held with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During the Past 5 Years | |||

| Class III Director Nominees Independent Director | ||||||

| Kevin F. McDonald Age: 51 | Class III Director | Since May 2014; Term expires 2017 (2020 if re-elected) | Director of Business Development of Folger Hill Asset Management, LP since December 2014; Principal of Taylor Investment Advisors, LP since March 2002; Chief Executive Officer of Taylor Investment Advisors, LP from 2006 to December 2014. | |||

| Interested Director | ||||||

| Thomas P. Majewski(2) Age: 42 | Class III Director and Chief Executive Officer | Since May 2014; Term expires 2017 (2020 if re-elected) | Managing Partner of the Adviser since September 2012; Managing Director and U.S. Head of CLO Banking at RBS Securities Inc. from September 2011 to September 2012. | |||

Directors Not Up for Re-Election at the Meeting Independent Directors | ||||||

| Scott W. Appleby Age: 52 | Class I Director | Since May 2014; Term expires 2018 | President of Appleby Capital, Inc. since April 2009. | |||

| Jeffrey L. Weiss Age: 56 | Class I Director | Since May 2014; Term expires 2018 | Private Investor since June 2012; Global Head of Financial Institutions at Barclays from August 2008 to June 2012. | |||

| Paul E. Tramontano Age: 55 | Class II Director | Since May 2014; Term expires 2019 | Senior Managing Director and Portfolio Manager at First Republic Investment Management since October 2015; Co-Chief Executive Officer of Constellation Wealth Advisors LLC from April 2007 to October 2015. | |||

| 6 |

| Name, Address(1) and Age | Position(s) Held with the Company | Term of Office and Length of Time Served | Principal Occupation(s) During the Past 5 Years | |||

| Interested Director | ||||||

| James R. Matthews(3) Age: 49 | Class II Director and Chairperson of the Board | Since May 2014; Term expires 2019 | Principal of Stone Point Capital LLC since October 2011; Senior Managing Director and Co-Head of Private Equity for Evercore Partners Inc. from January 2007 to October 2011. | |||

| (1) | The business address of each Director is c/o Eagle Point Credit Company Inc., 20 Horseneck Lane, Greenwich, CT 06830. |

| (2) | Mr. Majewski is an interested person of the Company due to his position as Chief Executive Officer of the Company and his position with the Adviser. |

| (3) | Mr. Matthews is an interested person of the Company due to his position with Stone Point Capital LLC (“Stone Point”), which is an affiliate of the Adviser. |

None of the Directors serves, nor have they served during the last five years, on the board of directors of another company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (or subject to the reporting requirements of Section 15(d) of the Exchange Act), or registered as an investment company under the 1940 Act (including any other companies in a fund complex with us).

The following table states the dollar range of equity securities of the Company beneficially owned as of the Record Date by each Director and Director nominee.

| Name of Director/Nominee | Dollar Range of Equity Securities in the Company(1)(2) | |

| Interested Directors | ||

| Thomas P. Majewski | [Over $100,000] | |

| James R. Matthews | None | |

| Independent Directors | ||

| Scott W. Appleby | [Over $100,000] | |

| Kevin F. McDonald | [Over $100,000] | |

| Paul E. Tramontano | [Over $100,000] | |

| Jeffrey L. Weiss | [Over $100,000] |

| (1) | Securities are valued as of the Record Date. |

| (2) | Dollar ranges are as follows: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000 and over $100,000. |

To the knowledge of the Company, as of the Record Date, none of the Independent Directors or their immediate family members owned securities of the Adviser or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Adviser.

Compensation. As compensation for serving on the Board, for the fiscal year ending December 31, 2017, each Independent Director will receive an annual fee of $75,000. The chairman of the Audit Committee will receive an additional annual fee of $12,500 and the chairman of the Nominating Committee will receive an additional annual fee of $5,000 for their services in these capacities. In addition, each Independent Director will receive $1,750 for each regularly scheduled Board meeting attended, $500 for each other Board meeting attended at which action is taken, and $500 for each committee meeting attended at which action is taken (except that separate compensation for committee meetings is not received if such meeting is held on the same day as a meeting of the Board), as well as reasonable out-of-pocket expenses incurred in attending such meetings.

| 7 |

Directors do not currently receive any pension or retirement benefits from the Company.

The following table provides information concerning the compensation paid to the Directors for the fiscal year ended December 31, 2016. Each Director who is a director, officer, partner, member or employee of the Adviser, or of any entity controlling, controlled by or under common control with the Adviser, including any Director who is an “interested person” (as such term is defined in the 1940 Act”) of the Company, serves without any compensation from the Company.

| Name of Director/Nominee | Aggregate Compensation from the Company to Director/Nominees for the Fiscal Year ended December 31, 2016 | |||

| Independent Directors | ||||

| Scott W. Appleby | $ | 92,000 | ||

| Kevin F. McDonald | $ | 87,000 | ||

| Thomas P. Majewski | $ | 87,500 | ||

| Jeffrey L. Weiss | $ | 51,250 | * | |

| Interested Directors | ||||

| Thomas P. Majewski | $ | — | ||

| James R. Matthews | $ | — | ||

* Does not reflect $49,250 relating to the year ended December 31, 2016 that was payable to Mr. Weiss as of December 31, 2016.

Director Qualifications. Although the Nominating Committee has general criteria that guides its choice of candidates to serve as Independent Directors, there are no specific required qualifications for Board membership. See “— Board Committees and Meetings — Nominating Committee.” The Board believes that the different perspectives, viewpoints, professional experience, education and individual qualities of each Director represent a diversity of experiences and a variety of complementary skills. When considering potential nominees to fill vacancies on the Board, and as part of its annual self-evaluation, the Board reviews the mix of skills and other relevant experiences of the Directors.

In respect of each current Director, the individual’s substantial professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Company, were a significant factor in the determination by the Board that the individual is qualified to serve as a Director. The following is a summary of various qualifications, experiences and skills of each Director (in addition to business experience during the past five years set forth in the table above) that contributed to the Board’s conclusion that an individual is qualified to serve on the Board. References to qualifications, experiences and skills are not intended to hold out the Board or individual Directors as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

| 8 |

Independent Directors

Scott W. Appleby. Mr. Appleby is the President of Appleby Capital, Inc. and has more than 20 years of banking experience at Appleby Capital, Deutsche Bank, Robertson Stephens, ABN Amro and Paine Webber. As a senior equity analyst, he has written on global exchanges, alternative asset managers and financial technology. He was also one of the first Internet analysts and, in 1997, the first analyst to cover the electronic brokerage industry. Mr. Appleby remains an active writer and speaker on financial technology and Wall Street trends. Mr. Appleby serves on a number of private company and community boards. Mr. Appleby holds an M.B.A. from Cornell University and a B.S. from the University of Vermont.

Kevin F. McDonald (Nominee). Mr. McDonald has served as Director of Business Development of Folger Hill Asset Management, LP since December 2014. Mr. McDonald is also a Principal of Taylor Investment Advisors, LP which he co-founded in 2002 and served as the Chief Executive Officer from 2006 to December 2014. Previously, Mr. McDonald was a Director at Larch Lane Advisors LLC, an alternative asset management firm specializing in multi-manager hedge fund portfolios, from 1999 to 2001. Mr. McDonald was a Vice President in the futures and options group at JP Morgan Securities from 1994 to 1999 and served as an Assistant Treasurer and proprietary fixed-income trader at BSI Bank (subsidiary of Generali S.P.A.) from 1991 to 1994. Mr. McDonald began his career at Chemical Bank in 1989 where he was a credit analyst in the corporate finance group. Mr. McDonald holds a B.A. from the University of Virginia.

Paul E. Tramontano. Mr. Tramontano has served as a Senior Managing Director and Portfolio Manager at First Republic Investment Management since October 2015. Prior to joining First Republic Investment Management, he was the founder and Co-Chief Executive Officer at Constellation Wealth Advisors LLC for eight years and was responsible for managing Constellation’s East Coast operations as well as serving on both the investment and executive management committees. Prior to forming Constellation, Mr. Tramontano spent 17 years at Citi Smith Barney, most recently as a Managing Director and Senior Advisor of Citi Family Office. Mr. Tramontano holds a B.S. from Villanova University and attended the Certified Investment Management program at the Wharton School of Business at the University of Pennsylvania.

Jeffrey L. Weiss. Mr. Weiss is a former Managing Director at Lehman Brothers and Barclays, where he also held a number of senior leadership positions. Mr. Weiss is currently a private investor (since 2012). From 2008 to 2012, Mr. Weiss served as Global Head of Financial Institutions at Barclays. Prior to joining Barclays, Mr. Weiss spent 25 years with Lehman Brothers, most recently as a Managing Director. From 2005 to 2008, Mr. Weiss served on Lehman’s management committee. From 2007 to 2008, Mr. Weiss was responsible for the financial institutions group businesses. From 2003 to 2007, Mr. Weiss had global responsibility for all new issue origination. From 1999 to 2003, Mr. Weiss was responsible for all global debt capital markets and also served on the investment banking committee. From 1996 to 1999, Mr. Weiss had global responsibility for all new issue risk and also served on the fixed-income executive committee. From 1992 to 1996, Mr. Weiss was responsible for the U.S. fixed-income syndicate business. From 1984 to 1992, Mr. Weiss served as a credit trader focusing on a number of different sectors. Mr. Weiss serves as the Treasurer and a board member of City Harvest. Mr. Weiss holds a B.S. from the University of Wisconsin.

| 9 |

Interested Directors

Thomas P. Majewski (Nominee). Mr. Majewski is a Managing Partner and founder of the Adviser. Mr. Majewski has been involved in the formation and/or monetization of many collateralized loan obligation (“CLO”) transactions across multiple market cycles. Mr. Majewski led the creation of some of the earliest refinancing CLOs, introducing techniques that are now commonplace in the market. He has spent his entire career in the structured finance and credit markets. Mr. Majewski is a member of the Adviser’s investment committee and board of managers. Mr. Majewski’s experience in the CLO market dates back to the 1990s. Prior to joining the Adviser in September 2012, Mr. Majewski was a Managing Director and U.S. Head of CLO Banking at RBS Securities Inc. (“RBS”) from September 2011 through September 2012, where he was responsible for all aspects of RBS’s new-issue CLO platform. Prior to joining RBS, Mr. Majewski was the U.S. country head at AMP Capital Investors (US) Ltd. from August 2010 through September 2011, where he was responsible for investing in credit and other private assets on behalf of several Australian investors. Mr. Majewski also has held leadership positions within the CLO groups at Merrill Lynch Pierce Fenner and Smith Inc., JPMorgan Securities Inc. and Bear, Stearns & Co. Inc. Mr. Majewski serves as a director of Black Mountain Systems, LLC, a portfolio company of Trident VI, L.P. and related investment vehicles. Mr. Majewski has a B.S. from Binghamton University and has been a Certified Public Accountant (inactive).

James R. Matthews. Mr. Matthews was appointed to the Board as a representative of the Adviser and the Trident V Funds. Mr. Matthews is currently a Principal of Stone Point. Mr. Matthews is a member of the Adviser’s investment committee and board of managers. He joined Stone Point from Evercore Partners, where he was a Senior Managing Director and Co-Head of Private Equity. From 2000 to 2007, Mr. Matthews was with Welsh, Carson, Anderson & Stowe, where he was a General Partner and focused on investments in the information services and business services sectors. Previously, Mr. Matthews was a General Partner of J.H. Whitney & Co. and started his career as an Analyst in the mergers and acquisitions group of Salomon Brothers Inc. Mr. Matthews is a board member of Frenkel & Company and a director of the Trident Company portfolio companies Alliant Insurance Services, Inc., Black Mountain Systems, LLC, Enhanced Capital Holdings, Inc., NEBCO Insurance Services, LLC and Tree Line Capital Partners, LLC. Mr. Matthews holds a B.S. from Boston College and an M.B.A. from the Harvard Graduate School of Business Administration.

Board Committees and Meetings

The Board has established two standing committees to facilitate oversight of the management of the Company: the Audit Committee and the Nominating Committee.

Audit Committee. The members of the Audit Committee are Messrs. Appleby, McDonald, Tramontano and Weiss, each of whom is an Independent Director. Each member of the Audit Committee is financially literate with at least one having accounting or financial management expertise. The Board has adopted a written charter for the Audit Committee, which was included as Appendix A to the proxy statement for the 2015 annual meeting of stockholders filed with the Securities and Exchange Commission (the “SEC”) on April 15, 2015. The Audit Committee recommends to the full Board the independent registered public accounting firm for us, oversees the work of the independent registered public accounting firm in connection with the Company’s audit, communicates with the independent registered public accounting firm on a regular basis and provides a forum for the independent registered public accounting firm to report and discuss any matters it deems appropriate at any time. The Audit Committee is also responsible for establishing guidelines and making recommendations to the Board regarding the valuation of the Company’s investments, which are considered when the Board determines, within the meaning of the 1940 Act, the value of the Company’s investments. Mr. Weiss currently serves as chair of the Audit Committee.

Nominating Committee. The members of the Nominating Committee are Messrs. Appleby, McDonald, Tramontano and Weiss, each of whom is an Independent Director. The Board has adopted a written charter for the Nominating Committee, which was included as Appendix B to the proxy statement for the 2015 annual meeting of stockholders filed with the SEC on April 15, 2015. The Nominating Committee periodically reviews the committee structure, conducts an annual self-assessment of the Board and makes the final selection and nomination of candidates to serve as Independent Directors. The Board nominates and selects the interested Directors and the officers. Mr. Appleby serves as chair of the Nominating Committee.

| 10 |

In reviewing a potential nominee and in evaluating the re-nomination of current Independent Directors, the Nominating Committee will generally apply the following criteria: (1) the nominee’s reputation for integrity, honesty and adherence to high ethical standards; (2) the nominee’s business acumen, experience and ability to exercise sound judgment; (3) a commitment to understand the Company and the responsibilities of a director of an investment company; (4) a commitment to regularly attend and participate in meetings of the Board and its committees; (5) the ability to understand potential conflicts of interest involving management of the Company and to act in the interests of all Stockholders; and (6) the absence of a real or apparent conflict of interest that would impair the nominee’s ability to represent the interests of all Stockholders and to fulfill the responsibilities of an Independent Director. The Nominating Committee does not necessarily place the same emphasis on each criteria and each nominee may not have each of these qualities.

As long as an existing Independent Director continues, in the opinion of the Nominating Committee, to satisfy these criteria, we anticipate that the Nominating Committee would favor the re-nomination of an existing Independent Director rather than nominate a new candidate. Consequently, while the Nominating Committee will consider nominees recommended by Stockholders to serve as Independent Directors, the Nominating Committee may only act upon such recommendations if there is a vacancy on the Board or a committee and it determines that the selection of a new or additional Independent Director is in the Company’s best interests. In the event that a vacancy arises or a change in membership is determined to be advisable, the Nominating Committee will, in addition to any Stockholder recommendations, consider candidates identified by other means, including candidates proposed by members of the Nominating Committee. The Nominating Committee may retain a consultant to assist it in a search for a qualified candidate.

The Nominating Committee has not adopted a formal policy with regard to the consideration of diversity in identifying individuals for election as Independent Directors, but the Nominating Committee will consider such factors as it may deem are in the best interests of the Company and the Stockholders. Such factors may include the individual’s professional experience, education, skills and other individual qualities or attributes, including gender, race or national origin.

Consideration of Candidates Recommended by Stockholders. The Nominating Committee will review and consider nominees recommended by Stockholders to serve as Independent Directors, provided that the recommending Stockholder follows the procedures for Stockholders to submit nominee candidates as set forth in the Company’s bylaws and Nominating Committee’s charter, and summarized here.

Any Stockholder recommendation for Independent Director must be submitted in compliance with all of the pertinent provisions of Rule 14a-8 under the Exchange Act to be considered by the Nominating Committee. In evaluating a nominee recommended by a Stockholder, the Nominating Committee, in addition to the criteria discussed above, may consider the objectives of the Stockholder in submitting that nomination and whether such objectives are consistent with the interests of all Stockholders. If the Board determines to include a Stockholder’s candidate among the slate of nominees, the candidate’s name will be placed on the Company’s proxy card. If the Nominating Committee or the Board determines not to include such candidate among the Board’s designated nominees and the Stockholder has satisfied the requirements of Rule 14a-8, the Stockholder’s candidate will be treated as a nominee of the Stockholder who originally nominated the candidate. In that case, the candidate will not be named on the proxy card distributed with the Company’s proxy statement.

| 11 |

A Stockholder who is entitled to vote at the applicable annual meeting and who has complied with the advance notice procedures of the Company’s bylaws may submit nominations for Independent Director pursuant to timely notice in writing to the Secretary. To be timely, the Stockholder’s notice must be delivered by a nationally recognized courier service or mailed by first class United States mail, postage or delivery charges prepaid, and received at the principal executive offices of the Company addressed to the attention of the Secretary not less than ninety (90) days nor more than one hundred twenty (120) days in advance of the anniversary of the date the Company’s proxy statement was released to the Stockholders in connection with the previous year’s annual meeting of Stockholders; provided, however, that in the event that no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than thirty (30) days from the date contemplated at the time of the previous year’s proxy statement, notice by the Stockholder must be received by the Secretary not later than the close of business on the later of (x) the ninetieth (90th) day prior to such annual meeting and (y) the seventh (7th) day following the day on which public announcement of the date of such meeting is first made. Such Stockholder’s notice to the Secretary shall set forth (i) as to each person whom the Stockholder proposes to nominate for election or reelection as a Director, (a) the name, age, business address and residence address of the person, (b) the principal occupation or employment of the person, (c) the class and number of shares of capital stock of the Company that are beneficially owned by the person and (d) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to the rules and regulations of the SEC under Section 14 of the Exchange Act, and (ii) as to the Stockholder giving the notice (a) the name and record address of the Stockholder and (b) the class and number of shares of capital stock of the Company that are beneficially owned by the Stockholder. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a Director. No person nominated by a Stockholder as an Independent Director shall be eligible for election as a Director unless nominated in accordance with the procedures set forth herein. An officer of the Company presiding at an annual meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing procedure, and if he or she should so determine, he or she shall so declare to the meeting and the defective nomination shall be disregarded.

Meetings. The Board meets regularly four times each year to discuss and consider matters concerning the Company, and also holds special meetings to address matters arising between regular meetings. The Independent Directors regularly meet outside the presence of management. Regular meetings generally take place in-person; other meetings may take place in-person or by telephone. During the fiscal year ended December 31, 2016, the Board held four regular meetings and three special meetings. The Audit Committee met in separate session four times and the Nominating Committee met in separate session two times. Each Director attended, in person or via teleconference, 75% or more of the aggregate number of meetings of the Board and the committees on which such Director served and that were held during the fiscal year ended December 31, 2016.

The Directors are not required to attend the Company’s annual meetings of stockholders but are encouraged to do so. Each of the six (6) Directors attended the 2016 annual meeting of stockholders.

| 12 |

PROPOSAL 2: APPROVAL OF NEW ADVISORY AGREEMENT

The Board approved the New Advisory Agreement, subject to stockholder approval, for the reasons discussed below. THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE APPROVAL OF THE NEW ADVISORY AGREEMENT. IF THE PROPOSAL IS NOT APPROVED, THE CURRENT ADVISORY AGREEMENT WILL REMAIN IN EFFECT.

As compared to the current investment advisory agreement dated June 6, 2014 by and between the Company and the Adviser (the “Current Advisory Agreement”), the New Advisory Agreement would: (1) reflect the changes in the structure of the Company since the Company commenced operations, including that the Company has issued classes of securities other than common stock; (2) clarify the description of the methodology for how the compensation of the Adviser is calculated and specifically provide that any portion of the incentive fee attributable to deferred interest will be paid to the Adviser, without interest, only if and to the extent the Company actually receives such interest in cash; (3) clarify the application of the 1940 Act voting standards to the stockholder vote requirement for approval of the annual renewal (as applicable), termination or amendment of the New Advisory Agreement; and (4) make certain other immaterial changes.

The other material terms of the New Advisory Agreement would remain unchanged from the Current Advisory Agreement. The complete text of the New Advisory Agreement is attached asAppendix A to this Proxy Statement.

Summary of the Current Advisory Agreement

Services. Subject to the overall supervision of the Board, the Adviser manages the day-to-day operations of, and provides investment advisory and management services to, us. Under the terms of the Current Advisory Agreement, the Adviser:

| • | determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| • | identifies, evaluates and negotiates the structure of the investments we make (including performing due diligence on our prospective investments); |

| • | closes and monitors the investments we make; and |

| • | provides us with other investment advisory, research and related services as we may from time to time require. |

The Adviser’s services under the Current Advisory Agreement are not exclusive, and both it and its members, officers and employees are free to furnish similar services to other persons and entities so long as its services to us are not impaired.

The Current Advisory Agreement was most recently re-approved by the Board in May 2016. A discussion regarding the basis for the Board’s approval of the Current Advisory Agreement is included in our semi-annual report for the period ended June 30, 2016.

| 13 |

Duration and Termination. Unless earlier terminated as described below, the Current Advisory Agreement will remain in effect if approved annually by the Board or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a majority of our directors who are not “interested persons” of any party to such agreement, as such term is defined in Section 2(a)(19) of the 1940 Act. The Current Advisory Agreement will automatically terminate in the event of its assignment. The Current Advisory Agreement may also be terminated by us without penalty upon not less than 60 days’ written notice to the Adviser and by the Adviser upon not less than 90 days’ written notice to us.

Indemnification. The Current Advisory Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, the Adviser and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Adviser’s services under the Current Advisory Agreement or otherwise as our investment adviser.

Management Fee and Incentive Fee. We pay the Adviser a fee for its services under the Current Advisory Agreement consisting of two components — a base management fee and an incentive fee.

The base management fee is calculated and payable quarterly in arrears and equals an annual rate of 1.75% of our “Total Equity Base.” “Total Equity Base” means the net asset value (“NAV”) of our common stockholders and the paid-in capital of our preferred stock. These management fees are paid by our common stockholders and are not paid by holders of preferred stock or the holders of any other types of securities that we may issue. Base management fees for any partial calendar quarter will be appropriately pro-rated. The base management fee does not increase when we borrow funds, but will increase if we issue additional shares of preferred stock.

In addition, we pay the Adviser an incentive fee based on our performance. The incentive fee is calculated and payable quarterly in arrears and equals 20% of our “Pre-Incentive Fee Net Investment Income” for the immediately preceding quarter, subject to a hurdle and a “catch up” feature. No incentive fees are payable to our investment adviser in respect of any capital gains. For this purpose, “Pre-Incentive Fee Net Investment Income” means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from an investment) accrued during the calendar quarter, minus our operating expenses for the quarter (including the base management fee, expenses payable to the Administrator under the administration agreement (the “Administration Agreement”), between us and the Administrator, and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee). Pre-Incentive Fee Net Investment Income includes accrued income that we have not yet received in cash, such as the amount of any market discount we may accrue on debt instruments we purchase below par value, as well as any such amounts received (or accrued) in kind. Pre-Incentive Fee Net Investment Income does not include any capital gains.

Pre-Incentive Fee Net Investment Income, expressed as a rate of return on the value of our net assets at the end of the immediately preceding calendar quarter, is compared to a hurdle of 2.00% of our NAV per quarter (8.00% annualized). For such purposes, our quarterly rate of return is determined by dividing our Pre-Incentive Fee Net Investment Income by our reported net assets as of the prior period end. Our net investment income used to calculate this part of the incentive fee is also included in the calculation of the Total Equity Base which is used to calculate the 1.75% base management fee.

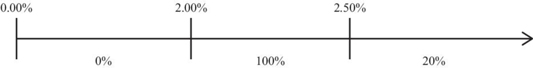

The incentive fee is paid to the Adviser as follows:

| • | no incentive fee in any calendar quarter in which our Pre-Incentive Fee Net Investment Income does not exceed the hurdle of 2.00% of our NAV; |

| 14 |

| • | 100% of our Pre-Incentive Fee Net Investment Income with respect to that portion of such Pre-Incentive Fee Net Investment Income, if any, that exceeds the hurdle but is less than 2.50% of our NAV in any calendar quarter (10.00% annualized). We refer to this portion of our Pre-Incentive Fee Net Investment Income (which exceeds the hurdle but is less than 2.50% of our NAV) as the “catch-up.” The “catch-up” is meant to provide the Adviser with 20% of our Pre-Incentive Fee Net Investment Income as if a hurdle did not apply if this net investment income meets or exceeds 2.50% of our NAV in any calendar quarter; and |

| • | 20% of the amount of our Pre-Incentive Fee Net Investment Income, if any, that exceeds 2.50% of our NAV in any calendar quarter (10.00% annualized) is payable to the Adviser (that is, once the hurdle is reached and the catch-up is achieved, 20% of all Pre-Incentive Fee Net Investment Income thereafter is paid to the Adviser). |

You should be aware that a rise in the general level of interest rates can be expected to lead to higher interest rates applicable to our investments. Accordingly, an increase in interest rates would make it easier for us to meet or exceed the incentive fee hurdle rate and may result in a substantial increase of the amount of incentive fees payable to the Adviser with respect to Pre-Incentive Fee Net Investment Income.

The portion of such incentive fee that is attributable to deferred interest (such as payment-in-kind interest or original issue discount) will be paid to the Adviser, without interest, only if and to the extent we actually receive such interest in cash, and any accrual will be reversed if and to the extent such interest is reversed in connection with any write-off or similar treatment of the investment giving rise to any deferred interest accrual. Any reversal of such amounts would reduce net income for the quarter by the net amount of the reversal (after taking into account the reversal of incentive fees payable) and would result in a reduction of the incentive fees for such quarter.

No incentive fee is payable to the Adviser on capital gains, whether realized or unrealized. In addition, the amount of the incentive fee is not affected by any realized or unrealized losses that we may suffer.

The payment of monthly dividends on our preferred stock (including on any shares of preferred stock that may be held by officers or other affiliates of the Adviser) is not subject to Pre-Incentive Fee Net Investment Income meeting or exceeding any hurdle rate.

The following is a graphical representation of the calculation of the incentive fee as well as examples of its application.

Quarterly Incentive Fee Based on Net Investment Income

Pre-Incentive Fee Net Investment Income

(expressed as a percentage of the value of net assets)

| 15 |

Examples of Quarterly Incentive Fee Calculation (amounts expressed as a percentage of the value of net assets, and are not annualized)*

Alternative 1:

Assumptions

Investment income (including interest, distributions, fees, etc.) = 1.25%

Hurdle rate(1) = 2.00%

Base management fee(2) = 0.4375%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.25%

Pre-Incentive Fee Net Investment Income

(investment income – (base management fee + other expenses)) = 0.5625%

Pre-Incentive Fee Net Investment Income does not exceed the hurdle rate, therefore there is no incentive fee.

Alternative 2:

Assumptions

Investment income (including interest, distributions, fees, etc.) = 2.70%

Hurdle rate(1) = 2.00%

Base management fee(2) = 0.4375%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.25%

Pre-Incentive Fee Net Investment Income

(investment income – (base management fee + other expenses)) = 2.0125%

Pre-Incentive Fee Net Investment Income exceeds the hurdle rate, therefore there is an incentive fee.

Incentive fee = (100% × “Catch-Up”) + (the greater of 0% AND (20% × (Pre-Incentive Fee Net Investment Income – 2.50%)))

= (100.0% × (Pre-Incentive Fee Net Investment Income – 2.00%)) + 0%

= 100.0% × (2.0125% – 2.00%)

= 100.0% × 0.0125%

= 0.0125%

Alternative 3:

Assumptions

Investment income (including interest, distributions, fees, etc.) = 3.25%

Hurdle rate(1) = 2.00%

Base management fee(2) = 0.4375%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.25%

Pre-Incentive Fee Net Investment Income

(investment income – (base management fee + other expenses)) = 2.5625%

| 16 |

Pre-Incentive Fee Net Investment Income exceeds the hurdle rate, therefore there is a incentive fee.

Incentive fee = (100% × “Catch-Up”) + (the greater of 0% AND (20% × (Pre-Incentive Fee Net Investment Income – 2.50%)))

= (100.0% × (2.50% – 2.00%)) + (20% × (Pre-Incentive Fee Net Investment Income – 2.50%))

= (100.0% × (2.50% – 2.00%)) + (20% × (2.5625% – 2.50%))

= 0.5000% + .0125%

= 0.5125%

| (*) | The hypothetical amount of Pre-Incentive Fee Net Investment Income shown is based on a percentage of net assets. |

| (1) | Represents 8.00% annualized hurdle rate. |

| (2) | Represents 1.75% annualized base management fee. |

| (3) | Excludes organizational and offering expenses. |

During the fiscal years ended December 31, 2016 and 2015, we incurred base management and incentive fees of $12.8 million and $11.1 million, respectively, and paid $12.2 million and $9.0 million, respectively, to the Adviser pursuant to the Current Advisory Agreement.

Payment of Expenses. The Adviser’s investment team, when and to the extent engaged in providing investment advisory and management services, and the compensation and routine overhead expenses of such personnel allocable to such services, are provided and paid for by the Adviser. We will bear all other costs and expenses of our operations and transactions, including (without limitation): (1) the cost of calculating our NAV (including the cost and expenses of any independent valuation firm); (2) interest payable on debt, if any, incurred to finance our investments; (3) fees and expenses incurred by the Adviser or payable to third parties relating to, or associated with, making or disposing of investments, including legal fees and expenses, travel expenses and other fees and expenses incurred by the Adviser or payable to third parties in performing due diligence on prospective investments, monitoring our investments and, if necessary, enforcing our rights; (4) brokerage fees and commissions; (5) federal and state registration fees and exchange listing fees; (6) federal, state and local taxes; (7) costs of offerings or repurchases of our common stock and other securities; (8) the base management fee and any incentive fee; (9) distributions on our shares; (10) administration fees payable to the Administrator under the Administration Agreement; (11) direct costs and expenses of administration and operation, including printing, mailing, long distance telephone and staff; (12) transfer agent and custody fees and expenses; (13) independent director fees and expenses; (14) the costs of any reports, proxy statements or other notices to our stockholders, including printing costs; (15) costs of holding stockholder meetings; (16) litigation, indemnification and other non-recurring or extraordinary expenses; (17) fees and expenses associated with marketing and investor relations efforts; (18) dues, fees and charges of any trade association of which we are a member; (19) fees and expenses associated with independent audits and outside legal costs; (20) fidelity bond, directors and officers/errors and omissions liability insurance, and any other insurance premiums; (21) costs associated with our reporting and compliance obligations under the 1940 Act and applicable U.S. federal and state securities laws; and (22) all other expenses reasonably incurred by us or the Administrator in connection with administering our business, suchas the allocable portion of overhead and other expenses incurred by the Administrator in performing its obligations under the Administration Agreement, including rent, the fees and expenses associated with performing compliance functions, and our allocable portion of the costs of compensation and related expenses of our chief compliance officer, chief financial officer, chief operating officer and any support staff.

| 17 |

Summary of the New Advisory Agreement

As compared to the Current Advisory Agreement, the New Advisory Agreement would: (1) reflect the changes in the structure of the Company since the Company commenced operations, including that the Company has issued classes of securities other than common stock; (2) clarify the description of the methodology for how the compensation of the Adviser is calculated and specifically provide that any portion of the incentive fee attributable to deferred interest will be paid to the Adviser, without interest, only if and to the extent the Company actually receives such interest in cash; (3) clarify the application of the 1940 Act voting standards to the stockholder vote requirement for approval of the annual renewal (as applicable), termination or amendment of the New Advisory Agreement; and (4) make certain other immaterial changes. The other material terms of the New Advisory Agreement would remain unchanged from the Current Advisory Agreement.

As discussed further in the section entitled “Board Consideration of the New Advisory Agreement,” the Board believes that the New Advisory Agreement is in the best interest of the Company because the changes being proposed would update the terms of the Current Agreement to reflect the current operations and structure of the Company more precisely and clarify certain potential existing ambiguity in the Current Agreement and would not alter the fee rate or amounts paid to the Adviser.

Changes Reflective of Changes in Company Structure. The New Advisory Agreement reflects that the Company has issued classes of securities other than common stock, including the Preferred Stock and a class of debt securities, by referencing these types of securities where appropriate throughout the New Advisory Agreement. This clarification does not result in any substantive changes to the terms of the New Advisory Agreement.

Adviser Compensation.For its services, the Adviser would continue to be entitled to receive a base management fee and incentive fee from the Company. Each of these fees will continue to be calculated in the same manner as calculated under the Current Advisory Agreement.

The New Advisory Agreement clarifies the description of the methodology for how the compensation of the Adviser is calculated. In this regard, the New Advisory Agreement clarifies the methodology for calculating the base management fee in that it specifically provides (1) the timing in which the base management fee is calculated each calendar quarter, (2) that the base management fee is based on amounts as of the end of the most recently completed calendar quarter, and (3) that the base management fee is adjusted to the extent any Common Stock or Preferred Stock is issued or repurchased during a given quarter. The New Advisory Agreement also clarifies that interest expense paid on debt will constitute an operating expense for purposes of calculating the incentive fee.

The New Advisory Agreement also specifically provides that, consistent with current practice, (1) any portion of the incentive fee that is attributable to deferred interest (such as payment-in-kind interest or original issue discount) will be paid to the Adviser, without interest, only if and to the extent the Company actually receives such interest in cash, and (2) any accrual of such deferred interest will be reversed if and to the extent such deferred interest is reversed in connection with any write-off or similar event. The New Advisory Agreement also specifically provides that the Adviser may, to the extent permitted by law, elect to defer all or a portion of its fees for a specified period of time.

| 18 |

These changes serve to clarify the terms that describe the methodology for how the compensation of the Adviser is calculated, and more specifically describe the treatment of certain earnings and deferrals. These changes do not alter the fee rate or any amounts to be paid to the Adviser, or the methodology pursuant to which the fees are currently calculated under the Current Advisory Agreement.

Stockholder Vote Requirements. The New Advisory Agreement clarifies that the vote required to approve the annual renewal (as applicable), termination, or amendment of the Agreement is a majority of the outstanding voting securities of the Company, as defined in Section 2(a)(42) of the 1940 Act. Section 2(a)(42) of the 1940 Act defines the vote of a majority of the outstanding voting securities of a company as the vote, at the annual or a special meeting of the security holders of such company duly called, (A) of 67 per centum or more of the voting securities present at such meeting, if the holders of more than 50 per centum of the outstanding voting securities of such company are present or represented by proxy; or (B) of more than 50 per centum of the outstanding voting securities of such company, whichever is the less. These changes clarify any ambiguity as to what vote is required where the voting standard is not stated in the Current Agreement with specificity.

Board Consideration of the New Advisory Agreement

At an in person meeting held on February 14, 2017, the Board, including all of the Independent Directors (voting separately), unanimously voted to approve the New Advisory Agreement by and between the Company and the Adviser for an initial one-year period, and to recommend approval of the New Advisory Agreement by the Stockholders. The Board considered that the New Advisory Agreement will not take effect unless the New Advisory Agreement is approved by the Stockholders.

The Board considered that, as compared to the Current Advisory Agreement, the material terms of the New Advisory Agreement would remain unchanged except that the New Advisory Agreement would: (1) reflect the changes in the structure of the Company since the Company commenced operations, including that the Company has issued classes of securities other than common stock; (2) clarify the description of the methodology for how the compensation of the Adviser is calculated and specifically provide that any portion of the incentive fee attributable to deferred interest will be paid to the Adviser, without interest, only if and to the extent the Company actually receives such interest in cash; (3) clarify the application of the 1940 Act voting standards to the stockholder vote requirement for approval of the annual renewal (as applicable), termination or amendment of the New Advisory Agreement; and (4) make certain other immaterial changes. The Board considered that these changes would update the terms of the Company’s advisory agreement to reflect the current operations and structure of the Company more precisely and clarify certain potential existing ambiguity in the Current Advisory Agreement. The Board further considered that these changes would not alter the fee rate or amounts paid to the Adviser.

| 19 |

The Board further considered that, at a meeting held on May 10, 2016, in conjunction with the Board’s annual review of the Current Advisory Agreement, the Board, including all of the Independent Directors, had unanimously voted to continue the Current Advisory Agreement. The Board considered that, in reaching a decision to continue the Current Advisory Agreement, it had considered all the factors the Board believed relevant, including, among other things, the following: (1) the nature, extent and quality of services to be performed by the Adviser; (2) the investment performance of the Company and the Adviser; (3) the costs of providing services to the Company; (4) the profitability of the relationship between the Company and the Adviser; (5) comparative information on fees and expenses borne by other comparable registered investment companies or business development companies and, as applicable, other advised accounts; (6) comparative registered investment companies’ or business development companies’ performance and other competitive factors and, as applicable, those of other advised accounts; (7) the extent to which economies of scale would be realized as the Company grows; and (8) whether fee levels reflect these economies of scale for the benefit of the Company’s investors. The Board considered assurances from the Adviser that the approval of the changes contemplated under the New Advisory Agreement would not have resulted in any material changes to the nature, extent and quality of services provided to the Company, including the investment process or strategies employed in the management of the Company and the day-to-day management of the Company and the personnel primarily responsible for such management, or to any of the factors and information the Board had previously considered. The Board also considered assurances from the Adviser that the Adviser was aware of no additional developments other than the changes contemplated under the New Advisory Agreement and not already disclosed to the Board since May 10, 2016 that would be a material consideration to the Board in connection with its consideration of the New Advisory Agreement. The Board also considered that, notwithstanding the initial term of the New Advisory Agreement, the Board would conduct an annual review of the New Advisory Agreement at its meeting to be held in May 2017, during which it would again consider the factors and comparative information noted above.

Based on its evaluation of the information reviewed and the factors detailed above, the Board reached a determination, through the exercise of its business judgment, that the terms of the New Advisory Agreement, including the advisory fees paid by the Company, are fair and reasonable in light of the services to be provided to the Company by the Adviser and other factors considered, that the Adviser has served in the best interest of the Company and its stockholders as its investment adviser, that the terms of the New Advisory Agreement are suitable to the Company’s business purposes and investment objectives, and that the New Advisory Agreement should be approved and recommended for approval by stockholders.

The Board’s decision to approve the New Advisory Agreement was not based on any single factor, but rather was based on a comprehensive consideration of all the information discussed above and provided to the Board at its meetings throughout the year. The Board did not assign relative weights to the factors considered by it as the Board conducted an overall analysis of these factors. Individual members of the Board may have given different weights to different factors.

| 20 |

ADDITIONAL INFORMATION

Stockholder Communications with the Board

Stockholders may communicate with the Directors as a group or individually. Stockholder communications must (1) be in writing and be signed by the Stockholder and (2) identify the class and number of shares of Common Stock or Preferred Stock held by the Stockholder. Any such communication should be sent to the Board or an individual Director c/o the Secretary at the following address: 20 Horseneck Lane, Greenwich, CT 06830. The Secretary or his designee is responsible for reviewing properly submitted Stockholder communications. The Secretary shall either (1) provide a copy of each properly submitted Stockholder communication to the Board at its next regularly scheduled meeting or (2) forward the communication to the Director(s) promptly after receipt if the Secretary determines that the communication requires more immediate attention. The Secretary may, in good faith, determine that a Stockholder communication should not be provided to the Board or Director(s) because it does not reasonably relate to the Company or its operations, management, activities, policies, service providers, Board, officers, Stockholders or other matters relating to an investment in the Company or otherwise routine or ministerial in nature.

These procedures do not apply to (1) any communication from a Director or an officer of the Company, (2) any communication from an employee or agent of the Company, unless such communication is made solely in such employee’s or agent’s capacity as a Stockholder, or (3) any Stockholder proposal submitted pursuant to Rule 14a-8 under the Exchange Act or any communication made in connection with such a proposal. The Directors are not required to make themselves available to Stockholders for communications, other than by the aforementioned procedures.

Security Ownership of Certain Beneficial Owners and Management