Exhibit 99.2

October 23, 2024

Frontier Communications Parent, Inc.

1919 McKinney Ave.

Dallas, TX 75201

Attention: Board of Directors

Dear Members of the Frontier Communications Parent, Inc. (“Frontier” or the “Company”) Board of Directors (the “Board”):

As you know, Glendon Capital Management LP (“Glendon”) is a longtime investor in Frontier, first as a holder of the Company’s debt through the bankruptcy process, and more recently as a nearly 10% shareholder following Frontier’s successful emergence from Chapter 11 in 2021. Our current shareholding makes us one of Frontier’s largest owners.

Frontier has established itself as a best-in-class fiber builder and operator, becoming the largest independent fiber player in only a handful of years. Glendon has been, and remains, incredibly supportive of the management team—which we helped vet and select during the bankruptcy—for successfully executing an industry-leading fiber expansion strategy and delivering a positive inflection in earnings. We have confidence Frontier’s management can continue this differentiated success, with the Company now set up for sustained growth well ahead of its peers. The opportunity to continue the fiber strategy and reach 10 million total locations remains an exciting outcome to us, and we are aligned with the vision to build “Gigabit America” given our belief in the importance of fiber as a critical U.S. infrastructure asset.

While we are not opposed to a sale, we believe the proposed acquisition of Frontier by Verizon Communications Inc. (“Verizon”) at a price of $38.50 per share (the “Verizon Transaction”) substantially undervalues the Company’s existing assets and the future upside potential that rightfully belongs to Frontier shareholders. Certainly, we recognize the strategic merits of combining with a U.S. wireless carrier as the telecommunications industry continues to converge, but we believe a sale at this price does not adequately capture Frontier’s progress and momentum.

Further, the Board’s decision to set the record date before it was announced in the proxy and then to rush a shareholder vote so soon thereafter is both perplexing and disappointing. Importantly, Frontier is expected to release its third quarter earnings in early November and management has promised an investor conference to discuss their outlook and vision. With the current voting deadline on November 13, shareholders are being deprived of this critical opportunity to understand the standalone case for the Company. We find these decisions to be disenfranchising to shareholders.

Accordingly, absent a price that appropriately reflects the value of Frontier’s assets and the Company’s earnings trajectory—and an extension of the record date and date of the special meeting of stockholders— we intend to vote our shares against the Verizon Transaction at Frontier’s upcoming special meeting of stockholders. We simply cannot support $38.50 per share as we have confidence there will be future opportunities to realize a valuation for Frontier well in excess of Verizon’s current offer.

We believe Frontier’s enterprise value (“EV”) is at least $26 billion today, 30% higher than the current $20 billion EV ascribed from the Verizon Transaction.

Based on a review of the Company’s proxy, Frontier’s Board and Strategic Review Committee relied in large part upon discounted free cash flow (“DCF”), comparable company, and precedent M&A multiple analyses from their respective financial advisors that we believe were fundamentally flawed.

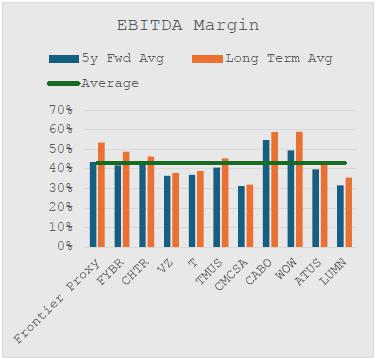

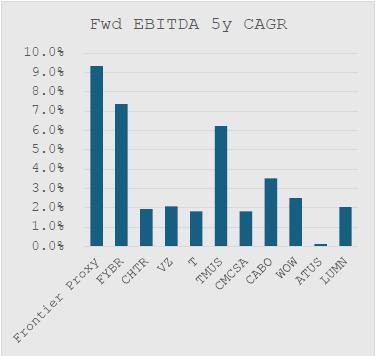

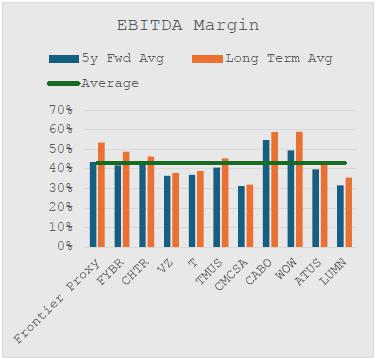

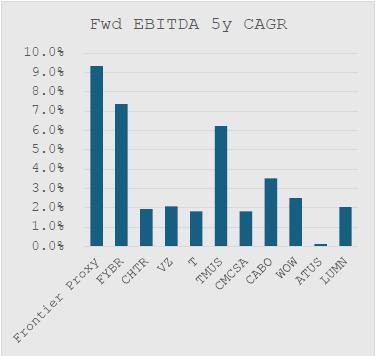

Frontier is a uniquely superior fiber infrastructure asset, by far the largest pure-play fiber provider and growing earnings significantly faster than its peers while also delivering above average EBITDA margins and normalized cash flow conversion. Frontier’s differentiated success with fiber expansions, superior growth trajectory, and earnings profile render the peer comparable analysis irrelevant and therefore inadequate as a valuation methodology. Precedent fiber transactions (relevant ones) and an accurate DCF analysis are required to properly value Frontier.

| · | The Verizon Transaction’s $20 billion EV for Frontier represents 8.5x EV/EBITDA (2025E street consensus estimate). The Company’s closest comparable public telecom peer, with respect to quality of earnings and growth projections, is T-Mobile, currently trading at ~11x EV/EBITDA (2025E). This multiple is the most appropriate when adjusting public peers for differences in growth and cash flow. Further, we believe the appropriate private market multiple range is 15-20x, currently being tested by at least one rumored sale process of a comparable fiber asset. Though again, the differences in cash flow timing and trajectory, among many other factors, render this overly simplistic approach insufficient. |

| |  |

| See Note 1 | | See Note 2 |

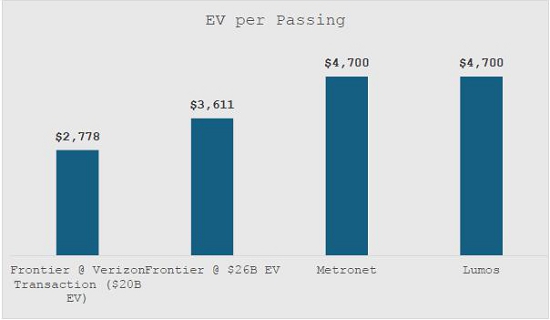

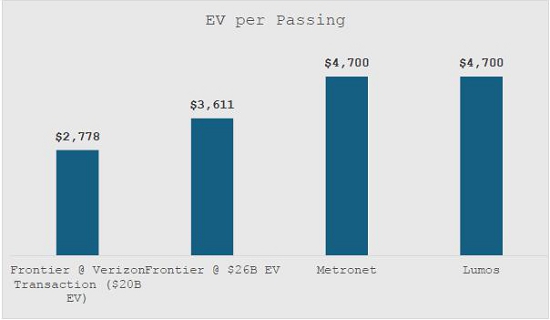

| · | Surprisingly, neither financial advisor mentions the July 2024 acquisition of Metronet by a joint venture between T-Mobile and KKR, the most recent and relevant comparable transaction. Nor do they mention the April 2024 acquisition of Lumos by T-Mobile and EQT. We believe these transactions created a clear market value for fiber assets of approximately $4,700 per location passed (range of $4,000-$5,000 based on bounds of reasonable assumptions), versus the current Verizon Transaction which implies a value for Frontier’s fiber passings at an unjustifiable discount, even when giving no value to copper assets (which generated nearly $700 million of TTM EBITDA through 6/30/24). |

| · | Metronet is a particularly relevant comparable asset, as Frontier shares similar overall fiber penetration and both networks are executing a multi-year expansion. Further, Metronet transacted most recently and best represents the current market valuation for fiber assets. Reviewing the history outlined in the proxy, we noted Verizon proactively initiated discussion with Frontier just before the Metronet deal was publicly announced. To maximize comparability and reduce the assumptions needed, we choose to look at EV today relative to fiber passings today, understanding that both Metronet and Frontier have plans to build additional fiber in the future. |

| · | When considering the value per fiber passing established by the Metronet and Lumos deals, and assigning zero value to copper assets, a minimum enterprise value for Frontier of $26 billion ($61 per share) is easily supported. |

See Note 3

| · | Frontier’s recent activity in the ABS market saw the Company raise debt at roughly $3,400 per passing, before adding in any equity layer. Assuming even a razor thin 5.5% equity cushion for the ABS transaction implies a value for fiber of $3,600 per passing, and when applied to Frontier’s 7.2 million fiber passings, as of June 2024, yields a valuation of $26 billion. |

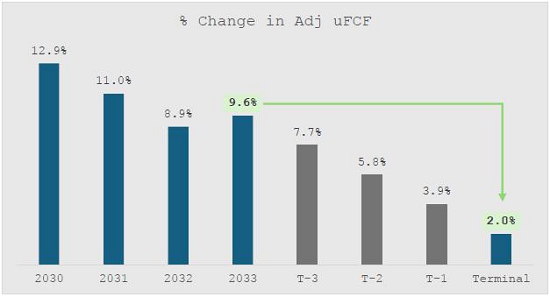

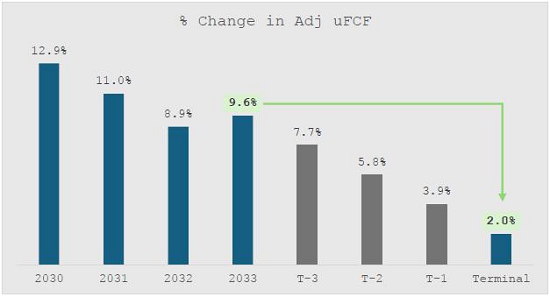

| · | The DCF analysis in the Company’s proxy is equally amiss. With management’s proxy Standalone Case forecasting a 12.6% CAGR in adjusted unlevered free cash flow (“uFCF”) in the years leading up to terminal, the 1.25% terminal growth rate assumed by the advisors (average over the ranges) is much too low. Frontier’s growth is driven by gradually increasing fiber penetration, thus a near complete evaporation of the growth rate at the terminal year is nonsensical. Moreover, the weighted average cost of capital (“WACC”) assumed by the advisors does not capture any value created when considering Verizon’s significantly lower cost of capital. |

| · | Any choice of WACC and terminal growth rate can be translated to an implied EV/EBITDA multiple. Looking at the assumptions used by the financial advisors presented in the proxy, on average across their respective ranges, results in an implied terminal multiple of only 6.7x. This multiple, in the context of Frontier’s cash flow growing at 12.6% (5y CAGR) leading up to the terminal year, is entirely inconsistent with the observable universe of public comparable companies. There is an intellectual disconnect between Frontier’s growth and the valuation metrics used in the proxy DCF analysis. |

See Note 4

| · | Simply, we disagree with the financial advisors’ terminal growth rate assumptions when considering the trend presented in the Standalone Case. The proxy DCF uses a range of 0.75% - 1.75% for terminal growth. In the most basic approach, we believe a realistic growth rate to be 2.5% - 3.5%, resulting in an EV for Frontier of $24 - $28 billion ($53 - $68 per share). |

| · | For a more nuanced approach, we adopt a WACC consistent with the financial advisors’ range and then replace the growth rate collapse in the proxy DCF with a gradual decline over time, three years as a reasonable case. |

| · | A modest terminal growth rate range of 2.0% - 2.5%, after a three year phase in period, and WACC of 8% in the DCF analysis yields an EV of $24 - $26 billion ($53 - $61 per share). |

| · | Lastly, the $38.50 per share price gives no consideration to the opportunity available to Verizon from operating synergies and the ability to pursue the Unconstrained Capital Case, as described in the proxy. If Frontier continues to execute as expected, with fiber passings nearing management’s target and free cash flow inflecting to positive, acquiring Frontier at an enterprise value of $26 billion would still be a bargain when factoring in even a portion of these opportunities. |

Frontier’s strategic review process and decision to sell was ill-timed and commenced before the Company had reported key results from its fiber network upgrade and before the strategic value of fiber in the emerging world of wireless convergence had further crystalized. The timing of the record date and special meeting for the Verizon Transaction only serve to exacerbate our concerns, as they deprive shareholders of necessary information and time to properly evaluate their options.

At the current price, Verizon would be walking away with a steal. This simply cannot be allowed without objection. Our analysis of the most recent and relevant comparable transactions as well as expected future cash flows both prove the inadequacy of a $20 billion enterprise valuation for Frontier.

We urge the Board to go back to the negotiation table to obtain an increased offer from Verizon in accordance with the value of Frontier’s assets and the Company’s exciting growth prospects. Until then, Glendon will be voting against the Verizon Transaction.

Sincerely,

| /s/ Holly Kim Olson | |

| | |

| Holly Kim Olson | |

| Partner | |

| Glendon Capital Management LP | |

THIS IS NOT A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. DO NOT SEND US YOUR PROXY CARD. GLENDON CAPITAL MANAGEMENT IS NOT ASKING FOR YOUR PROXY CARD AND WILL NOT ACCEPT PROXY CARDS IF SENT. GLENDON CAPITAL MANAGEMENT IS NOT ABLE TO VOTE YOUR PROXY, NOR DOES THIS COMMUNICATION CONTEMPLATE SUCH AN EVENT.

This letter does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. This letter does not recommend the purchase or sale of a security. There is no assurance or guarantee with respect to the prices at which any securities of Frontier Communications Parent, Inc. (the "Company") will trade, and such securities may not trade at prices that may be implied herein. In addition, this letter and the discussions and opinions herein are for general information only, and are not intended to provide financial, legal or investment advice. Each shareholder of the Company should independently evaluate the proxy materials and make a decision that aligns with their own financial interests, consulting with their own advisers, as necessary.

This letter contains forward-looking statements. Forward-looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words "expects", "anticipates", "believes", "intends", "estimates", "plans", "will be" and similar expressions. Although Glendon Capital ("Glendon ") believes that the expectations reflected in forward-looking statements contained herein are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties—many of which are difficult to predict and are generally beyond the control of Glendon or the Company—that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In addition, the foregoing considerations and any other publicly stated risks and uncertainties should be read in conjunction with the risks and cautionary statements discussed or identified in the Company's public filings with the U.S. Securities and Exchange Commission, including those listed under "Risk Factors" in the Company's annual reports on Form 10-K and quarterly reports on Form 10-Q and those related to the Pending Transaction (as defined below). The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Glendon does not undertake any obligation to update or revise any forward-looking information or statements. Certain information included in this press release is based on data obtained from sources considered to be reliable. Any analyses provided herein is intended to assist the reader in evaluating the matters described herein and may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should not be viewed as factual and should not be relied upon as an accurate prediction of future results. All figures are estimates and, unless required by law, are subject to revision without notice.

Glendon’s fund currently beneficially owns shares of the Company. This fund is in the business of trading (i.e., buying and selling) securities and intends to continue trading in the securities of the Company. You should assume this fund will from time to time sell all or a portion of its holdings of the Company in open market transactions or otherwise, buy additional shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative instruments relating to such shares. Consequently, Glendon’s beneficial ownership of shares of, and/or economic interest in, the Company may vary over time depending on various factors, with or without regard to Glendon’s views of the pending transaction involving the Company and Verizon Communications (the "Pending Transaction") or the Company's business, prospects, or valuation (including the market price of the Company's shares), including, without limitation, other investment opportunities available to Glendon, concentration of positions in the portfolios managed by Glendon, conditions in the securities markets, and general economic and industry conditions. Without limiting the generality of the foregoing, in the event of a change in the Company's share price on or following the date hereof, Glendon’s funds may buy additional shares or sell all or a portion of its holdings of the Company (including, in each case, by trading in options, puts, calls, swaps, or other derivative instruments relating to the Company's shares). Glendon also reserves the right to change the opinions expressed herein and its intentions with respect to its investment in the Company, and to take any actions with respect to its investment in the Company as it may deem appropriate, and disclaims any obligation to notify the market or any other party of any such changes or actions, except as required by law.

Notes:

| 1. | “Frontier Proxy” refers to the Standalone Case presented in the Company proxy materials. EBITDA and margin for the peer set, including FYBR, are street consensus estimates available from Bloomberg as of October 18, 2024. “5y Fwd Avg” is the average over the period from 2024 through 2028, inclusive. “Long Term Avg” is the average over the period from 2029 through 2031, inclusive. |

| 2. | “Fwd EBITDA 5y CAGR” is over the period from 2024 to 2029. |

| 3. | Metronet and Lumos EV per passing derived from publicly available information and industry analyst reports. Fronter EV per passing based on 7.2M passings as of 6/30/24 and zero value for copper assets. |

| 4. | Adjusted unlevered free cash flow from the Standalone Case as presented in the Company proxy. |