UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material Pursuant to §240.14a-12

KushCo Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing:

(1) Amount previously paid: N/A

(2) Form, Schedule or Registration Statement No.:

(3) Filing party:

(4) Date Filed:

The following communication was sent by KushCo Holdings, Inc. (the "Company") to its employees on May 21, 2021:

KushCo – Integration Update Email

Subject: Our Proposed Merger with Greenlane – Overview of Greenlane’s Business

To: KushCo Employees

From: Nick Kovacevich

Date: Friday, May 21, 2021

Dear fellow KushCo team members:

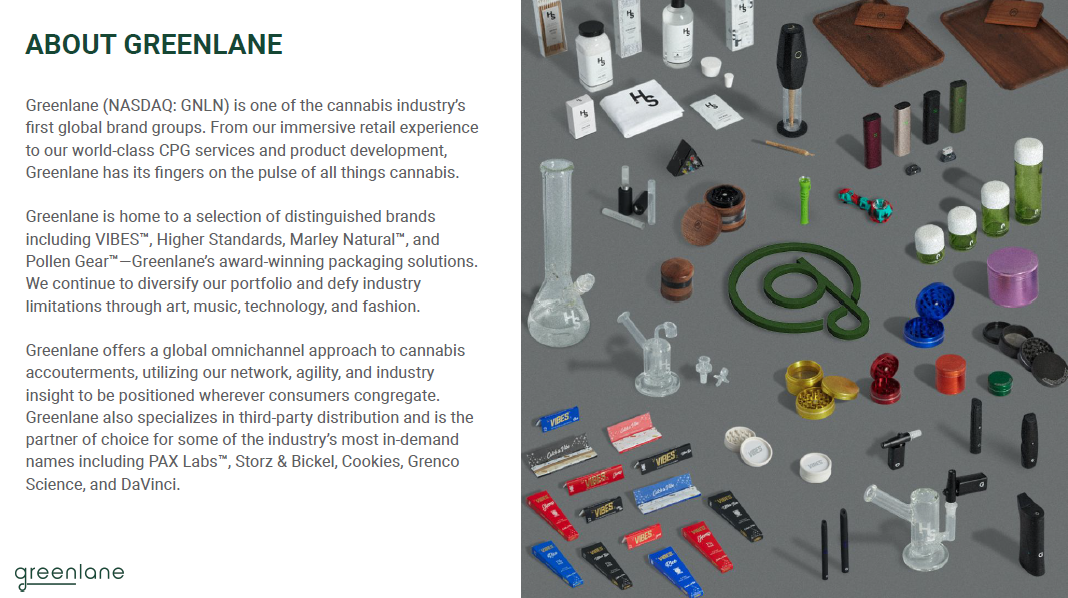

As part of our bi-weekly updates regarding our proposed merger with Greenlane Holdings, Inc (“Greenlane”)1, I wanted to share some additional information about Greenlane’s business. As a reminder, you’ll continue to hear from me and other members of KushCo’s leadership team on a regular basis until the merger is consummated, assuming we receive the requisite stockholder approval and all closing conditions are satisfied.

Today, I’d like to cover two topics: 1) share Greenlane’s latest presentation deck, which provides a comprehensive overview of their business and 2) guide you in accessing additional information on Greenlane’s business.

Greenlane Presentation Deck

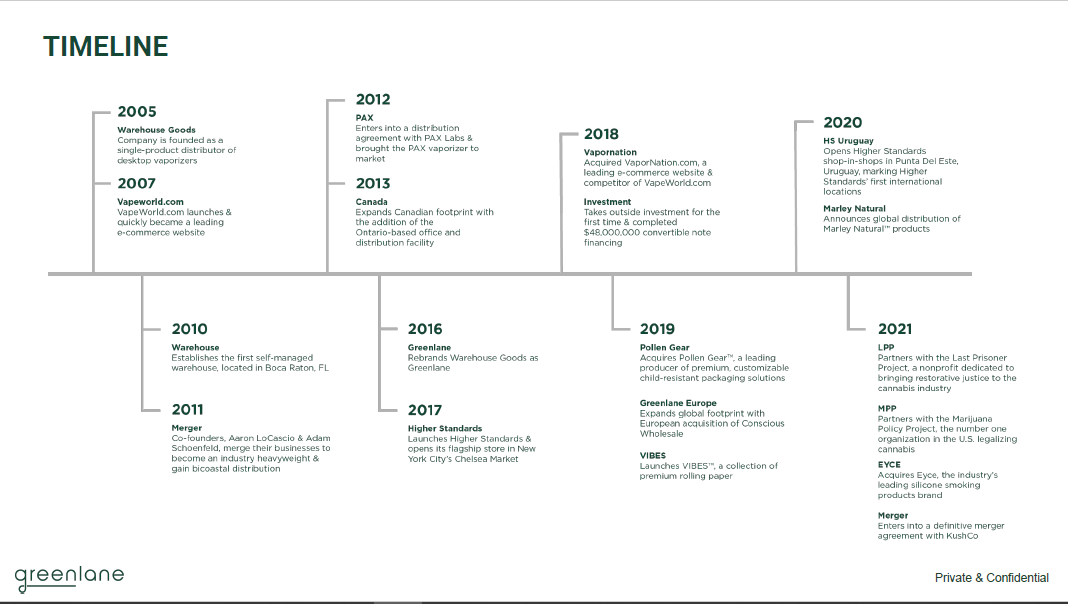

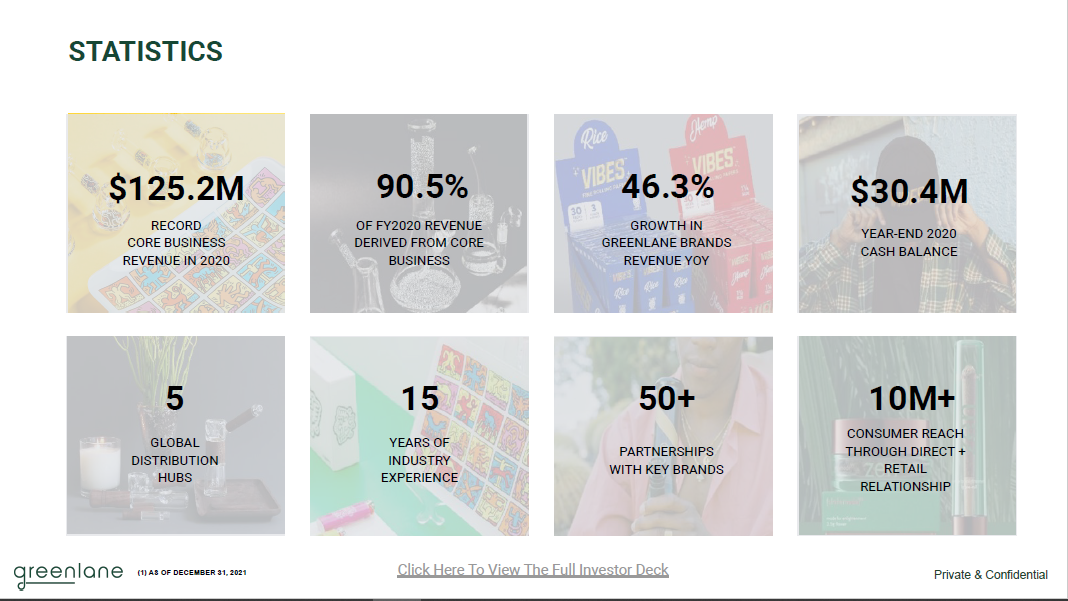

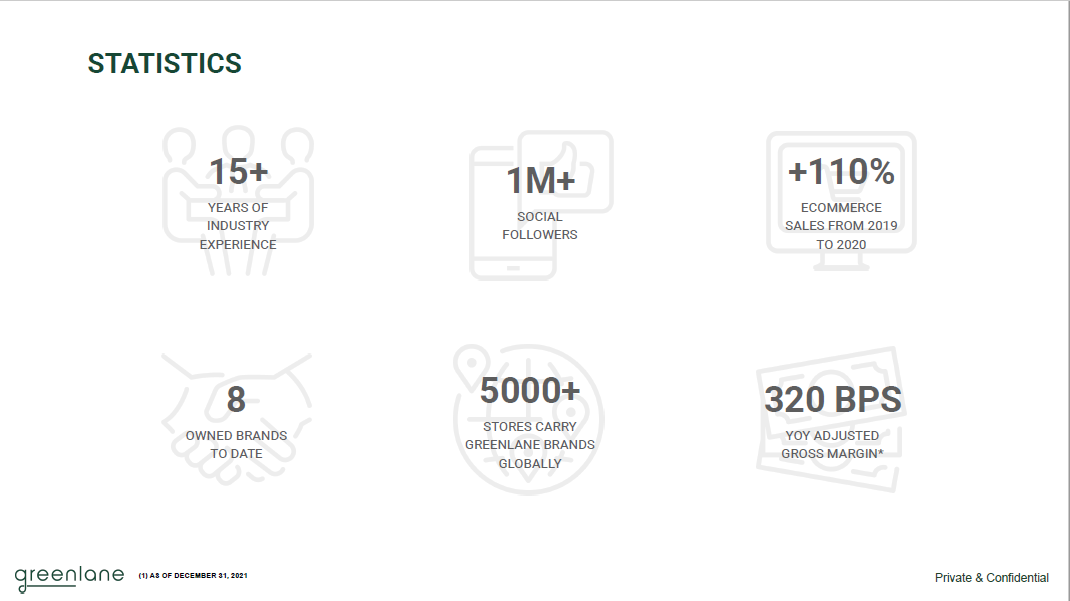

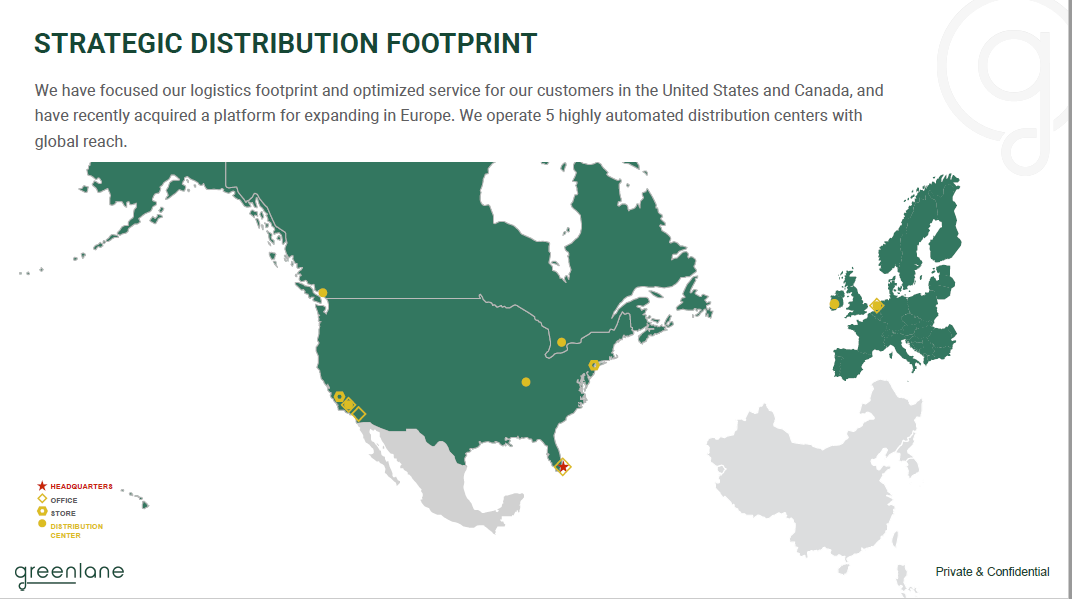

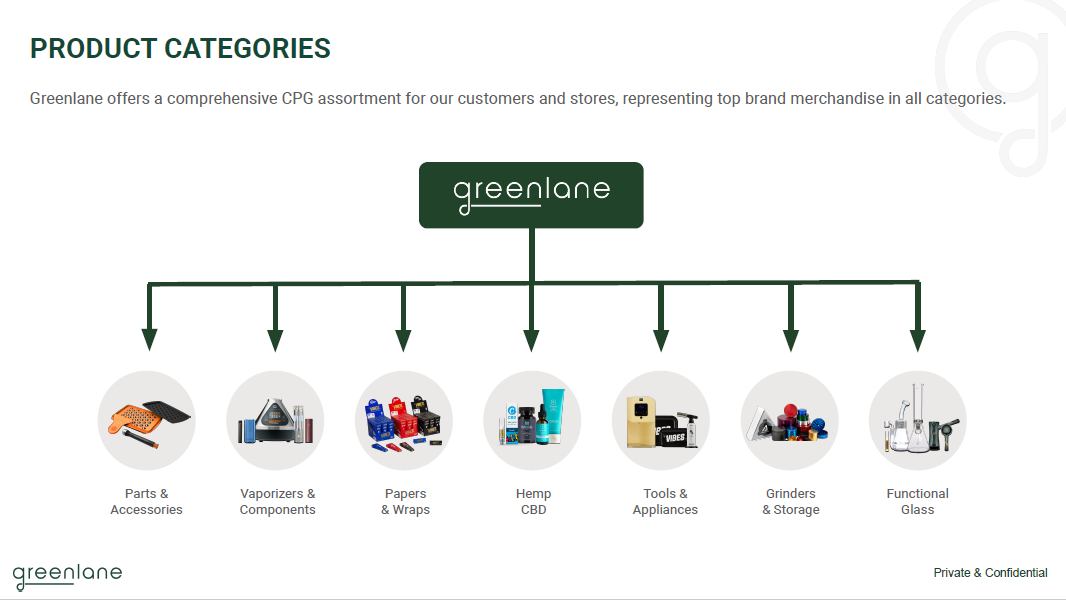

We are excited to be making substantial progress in our integration planning process, and wanted to take a moment to provide a more comprehensive overview of Greenlane’s business.

Attached to this email is a presentation document, which provides a high-level overview of Greenlane’s business. We will be going over this document during our companywide meeting later today, but please have a look beforehand, and if helpful, feel free to review it side-by-side with our latest company presentation, which can be found on our IR website at www.ir.kushco.com or by clicking here.

Where to Find Additional Information on Greenlane’s Business

We hope that this presentation document provides you with a better understanding of Greenlane’s business, and will share additional information, as needed, going forward. However, if you are interested in learning more about Greenlane’s business, I encourage you to visit their website at www.gnln.com, where you can explore and learn more about Greenlane’s current management team, history, accolades, and brands, among other relevant information.

You can also visit Greenlane’s IR website at www.investor.gnln.com, where you can find all their historical press releases, financial information, events and presentations. It’s worth noting that Greenlane released their first quarter 2021 financial results earlier this week, and I encourage you all to check out their latest earnings release and listen to the replay of their first quarter 2021 earnings call webcast for a more recent snapshot of their financial performance.

Last, but not least, I encourage you to sign up to Greenlane’s investor email alerts at https://investor.gnln.com/shareholder-services/email-alerts to stay apprised of the latest press releases and events.

As a reminder, if you have any questions related to the merger or Greenlane’s business in general, please submit your questions by emailing Ask@kushco.com. We will continue to collect them and ensure that you receive answers in a timely fashion.

We appreciate all your hard work to ensure KushCo’s continued success, as we move along with our integration plans. We look forward to bringing together these two teams into one family, and remain excited by the potential to become one of the largest and most established ancillary companies in an

industry that we believe is just beginning to explode. Stay tuned for more updates, and I wish you all a happy weekend!

Cheers,

Nick Kovacevich | KushCo Holdings, Inc. | CEO

6261 Katella Ave Ste 250, Cypress, CA 90630

nick@kushco.com | call/text: 714.462.1523

This electronic message contains information from KushCo Holdings, Inc. The contents may be privileged and confidential and are intended for the use of the intended addressee(s) only. If you are not an intended addressee, note that any disclosure, copying, distribution, or use of the contents of this message is prohibited. If you have received this e-mail in error, please contact me immediately.

[1] Greenlane is a NASDAQ listed public reporting company under ticker “GNLN”. KushCo is traded on the OTCQX market under ticker “KSHB”.

Cautionary Statement Regarding Forward-Looking Statements

This communication includes forward-looking statements. These forward-looking statements generally can be identified by phrases such as “will,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. These statements are based on management’s current expectations, beliefs and assumptions. While KushCo’s management believes the assumptions underlying the forward-looking statements and information are reasonable, such information is necessarily subject to uncertainties and may involve certain risks, many of which are difficult to predict and are beyond management’s control. These risks include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (2) the outcome of any legal proceedings that may be instituted against the parties and others following announcement of the Merger Agreement; (3) the inability to consummation the proposed merger due to the failure to obtain the requisite stockholder approvals or the failure to satisfy other conditions to completion of the proposed merger; (4) risks that the proposed transaction disrupts current plans and operations of KushCo and/or Greenlane; (5) the ability to recognize the anticipated benefits of the proposed merger; and (6) the amount of the costs, fees, expenses and charges related to the proposed merger; and the other risks and important factors contained and identified in KushCo’s and Greenlane’s filings with the SEC, such as their respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2020, any of which could cause actual results to differ materially from the forward-looking statements in this communication.

There can be no assurance that the proposed merger will in fact be consummated. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this communication. Neither KushCo nor Greenlane is under any duty to update any of these forward-looking statements after the date of this communication, nor to conform prior statements to actual results or revised expectations, and neither KushCo nor Greenlane intends to do so.

Important Information for Investors and Stockholders

In connection with the proposed merger, Greenlane expects to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Greenlane and KushCo that also constitutes a prospectus of Greenlane, which joint proxy statement will be mailed or otherwise disseminated to Greenlane’s and KushCo’s respective stockholders when it becomes available. Greenlane and KushCo also plan to file other relevant documents with the SEC regarding the proposed merger. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors and security holders may obtain free copies of the registration statement and the joint proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by KushCo and Greenlane with the SEC at the SEC’s website at www.sec.gov. Copies of the documents filed by the companies will be available free of charge on their respective websites at www.kushco.com and www.gnln.com.

Participants in Solicitation

KushCo, Greenlane and their respective directors and executive officers may be considered participants in the solicitation of proxies in connection with the proposed merger. Information about the directors and executive officers of KushCo is set forth in its proxy statement for its 2021 annual meeting of stockholders, which was filed with the SEC on December 28, 2020. Information about the directors and executive officers of Greenlane is set forth in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on April 24, 2020. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.