Ashford Inc. (NYSE American: AINC) Investor Day – October 2, 2018

Strategy Monty Bennett, Chairman & CEO

AINC Strategy High-Potential Growth Platform in the Hospitality Industry Singular Focus on Hotels(1) The only publicly-traded asset manager dedicated solely to the hospitality industry Advises two publicly-traded lodging REITs with $7.8 billion in gross assets Ashford Hospitality Trust (NYSE: AHT) and Braemar Hotels & Resorts (NYSE: BHR)(2) Ritz-Carlton – St. Thomas, USVI Multiple Paths to Growth Expand existing platforms accretively and accelerate returns for incentive fees Start new investment platforms for additional base and incentive fees Invest in, acquire, or incubate strategic businesses that can achieve accelerated growth Marriott – Beverly Hills, CA Proven Performance Best-in-class hotel asset management track record Long history of efficiently accessing debt and equity capital to fuel accretive growth Strong alignment of interest across all Ashford platforms Bardessono – Yountville, CA (1) Data as of 6/30/2018 (2) Ashford Hospitality Prime (AHP) announced re-branding to Braemar Hotels & Resorts (BHR) on 4/23/2018 Ashford Inc. (AINC) Investor Presentation | October 2018 3

Corporate Structure Structural Alignment Maximizes Value of Fee Streams and Strategic Business Investments Real Estate Advisory Hospitality Products & Services Hotels 118 Lismore Gross Assets $5.9B Capital Hotels 12 Gross Assets $1.9B Hotel REITs own real estate Fee-for-service model Work with hotel brands Partner with best-in-class service providers Dedicated CEOs Multiple business lines Subject to REIT restrictions Not subject to REIT rules Typically more capital intensive than services Typically less capital intensive than real estate business Ashford Inc. (AINC) Investor Presentation | October 2018 4

Business Model Unique and Differentiated Business Model Amplifies Revenue Growth Revenue Growth(1) Revenue Diversification(1) Quarterly revenue increased 231% over past 8 quarters Vertically-integrated model maximizes revenue stream Coincides with AINC strategic initiatives Diversifying revenue sources reduces business risk Project management revenues not yet included Advisory services now <50% of (growing) revenues Revenue Growth: +231% Revenue Diversification (Previous 8 Quarters) Other 1% Q3 2016: $16.5M Total $60 $54.8 (in millions) Advisory $50 $48.2 Services 99% $40 AINC Quarterly Revenue $29.7 Q2 2018: $54.8M Total $30 Advisory Services $19.5 $19.6 $19.3 Lismore $20 $16.5 (ex- 9% $13.0 Lismore) 36% $10 J&S Audio Visual $0 43% Other Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 12% (1) Data as of 6/30/2018 Ashford Inc. (AINC) Investor Presentation | October 2018 5

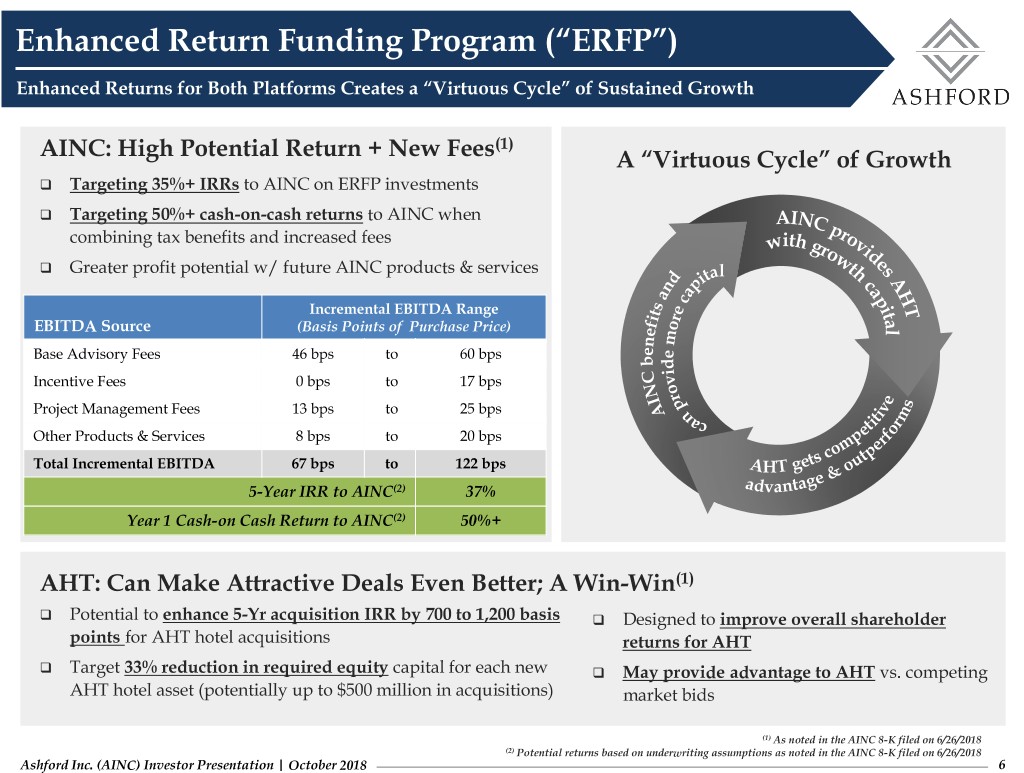

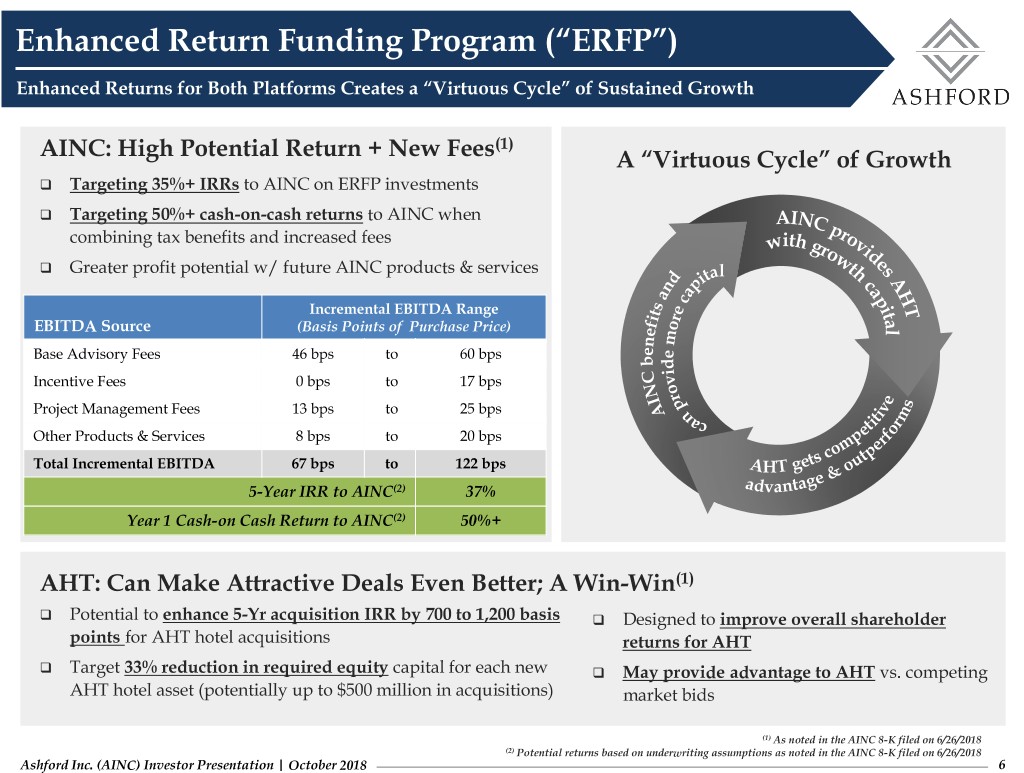

Enhanced Return Funding Program (“ERFP”) Enhanced Returns for Both Platforms Creates a “Virtuous Cycle” of Sustained Growth (1) AINC: High Potential Return + New Fees A “Virtuous Cycle” of Growth Targeting 35%+ IRRs to AINC on ERFP investments Targeting 50%+ cash-on-cash returns to AINC when combining tax benefits and increased fees Greater profit potential w/ future AINC products & services Incremental EBITDA Range EBITDA Source (Basis Points of Purchase Price) Base Advisory Fees 46 bps to 60 bps Incentive Fees 0 bps to 17 bps Project Management Fees 13 bps to 25 bps Other Products & Services 8 bps to 20 bps Total Incremental EBITDA 67 bps to 122 bps 5-Year IRR to AINC(2) 37% Year 1 Cash-on Cash Return to AINC(2) 50%+ AHT: Can Make Attractive Deals Even Better; A Win -Win (1) Potential to enhance 5-Yr acquisition IRR by 700 to 1,200 basis Designed to improve overall shareholder points for AHT hotel acquisitions returns for AHT Target 33% reduction in required equity capital for each new May provide advantage to AHT vs. competing AHT hotel asset (potentially up to $500 million in acquisitions) market bids (1) As noted in the AINC 8-K filed on 6/26/2018 (2) Potential returns based on underwriting assumptions as noted in the AINC 8-K filed on 6/26/2018 Ashford Inc. (AINC) Investor Presentation | October 2018 6

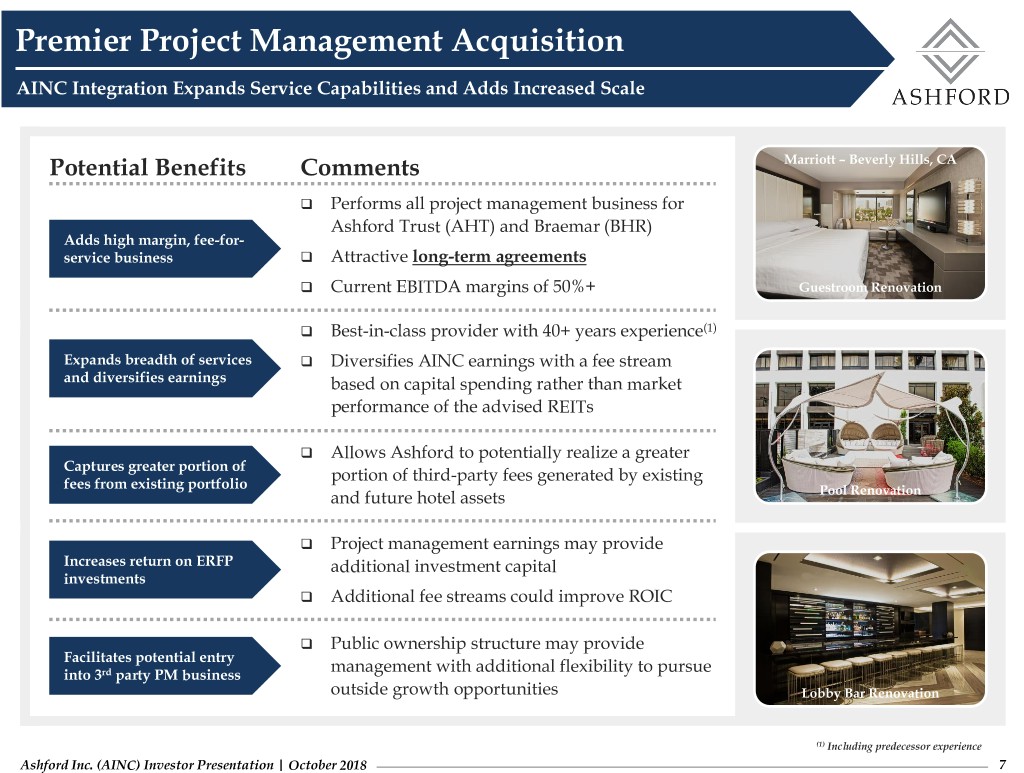

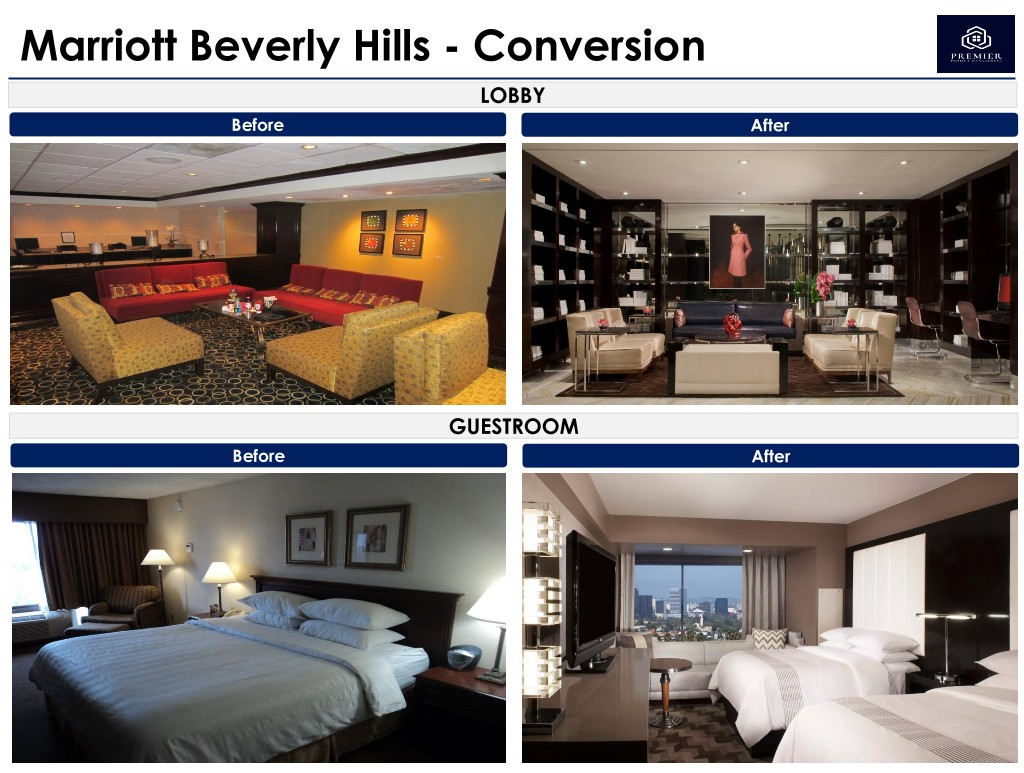

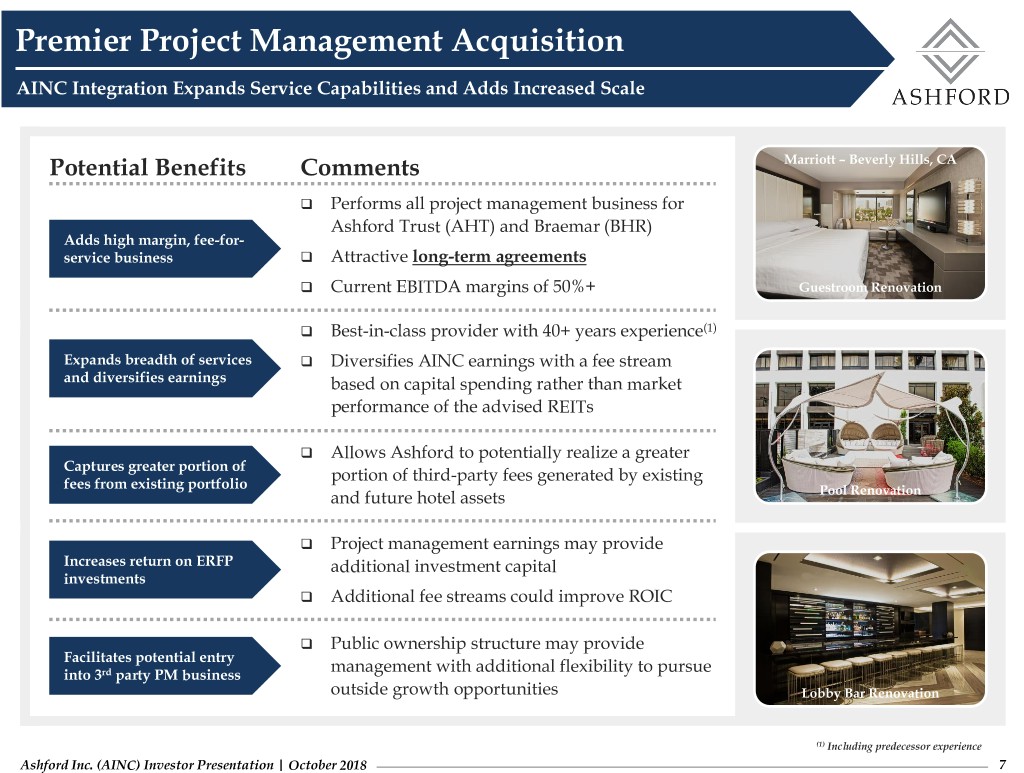

Premier Project Management Acquisition AINC Integration Expands Service Capabilities and Adds Increased Scale Potential Benefits Comments Marriott – Beverly Hills, CA Performs all project management business for Ashford Trust (AHT) and Braemar (BHR) Adds high margin, fee-for- service business Attractive long-term agreements Current EBITDA margins of 50%+ Guestroom Renovation Best-in-class provider with 40+ years experience(1) Expands breadth of services Diversifies AINC earnings with a fee stream and diversifies earnings based on capital spending rather than market performance of the advised REITs Allows Ashford to potentially realize a greater Captures greater portion of fees from existing portfolio portion of third-party fees generated by existing and future hotel assets Pool Renovation Project management earnings may provide Increases return on ERFP additional investment capital investments Additional fee streams could improve ROIC Public ownership structure may provide Facilitates potential entry into 3rd party PM business management with additional flexibility to pursue outside growth opportunities Lobby Bar Renovation (1) Including predecessor experience Ashford Inc. (AINC) Investor Presentation | October 2018 7

Strategy Execution Rob Hays, Co-President & CSO Jeremy Welter, Co-President & COO

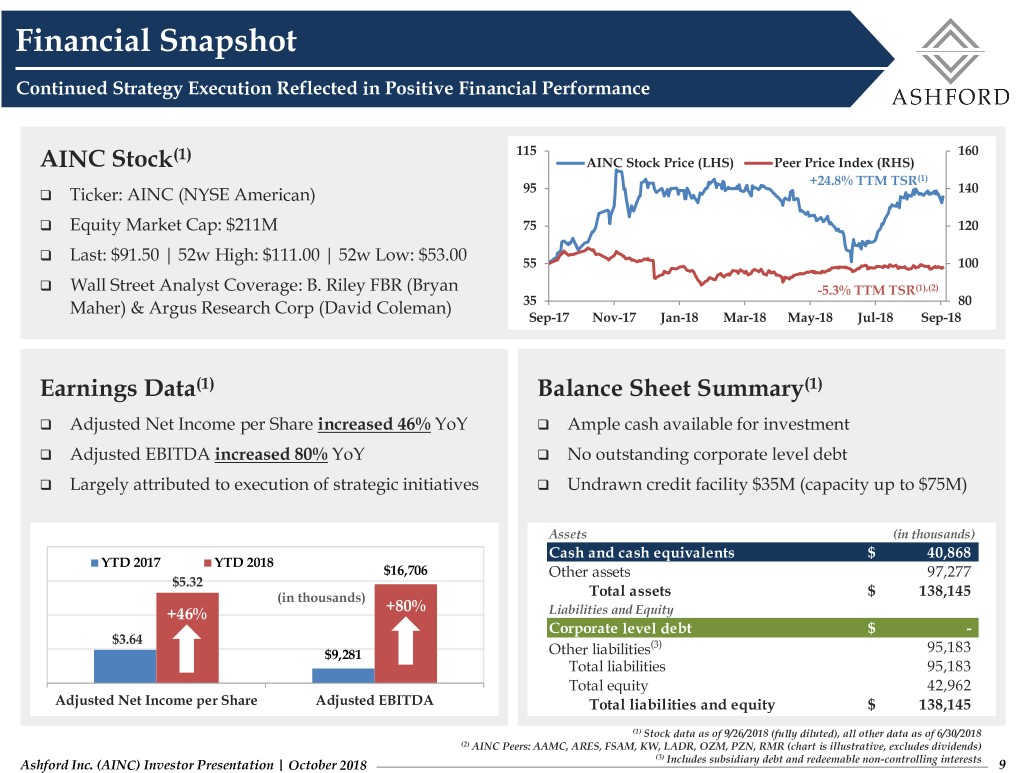

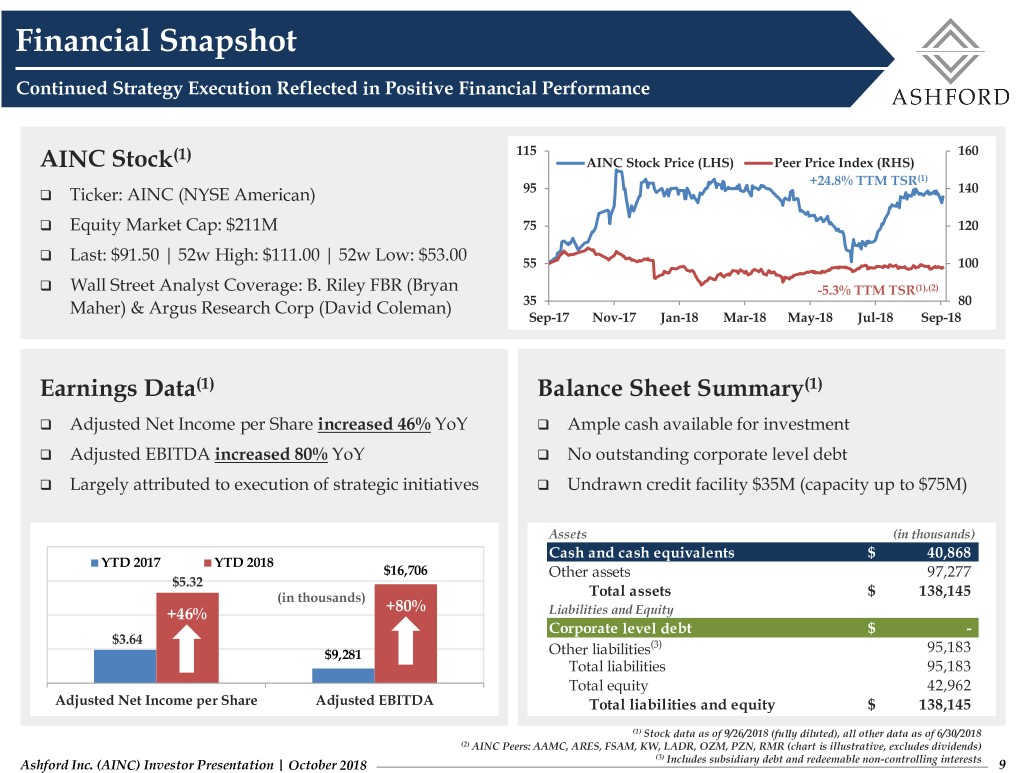

Financial Snapshot Continued Strategy Execution Reflected in Positive Financial Performance (1) 115 160 AINC Stock AINC Stock Price (LHS) Peer Price Index (RHS) +24.8% TTM TSR(1) Ticker: AINC (NYSE American) 95 140 +52.5% TTM TSR(1) Equity Market Cap: $211M 75 120 Last: $91.50 | 52w High: $111.00 | 52w Low: $53.00 55 100 +13.5% TTM TSR(1),(2) Wall Street Analyst Coverage: B. Riley FBR (Bryan -5.3% TTM TSR(1),(2) Maher) & Argus Research Corp (David Coleman) 35 80 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Earnings Data(1) Balance Sheet Summary(1) Adjusted Net Income per Share increased 46% YoY Ample cash available for investment Adjusted EBITDA increased 80% YoY No outstanding corporate level debt Largely attributed to execution of strategic initiatives Undrawn credit facility $35M (capacity up to $75M) Assets (in thousands) Cash and cash equivalents $ 40,868 YTD 2017 YTD 2018 $16,706 Other assets 97,277 $5.32 Total assets $ 138,145 (in thousands) +46% +80% Liabilities and Equity Corporate level debt $ - $3.64 (3) $9,281 Other liabilities 95,183 Total liabilities 95,183 Total equity 42,962 Adjusted Net Income per Share Adjusted EBITDA Total liabilities and equity $ 138,145 (1) Stock data as of 9/26/2018 (fully diluted), all other data as of 6/30/2018 (2) AINC Peers: AAMC, ARES, FSAM, KW, LADR, OZM, PZN, RMR (chart is illustrative, excludes dividends) (3) Ashford Inc. (AINC) Investor Presentation | October 2018 Includes subsidiary debt and redeemable non-controlling interests 9

Growing Asset & Enterprise Value Disciplined Focus and Proactive Risk Management Grows Fees by Increasing TEV Opportunistically Grow Assets Systematically Preserve Assets +25.5% CAGR (gross assets) since 2003 AHT IPO(1) Actively manage downside risk Spun-out luxury segment in 2013 to spur growth Interest rate hedges produced $234M of income Potential for select-service hotel and other platforms between 2008-2013 Focus on long-term shareholder value for all platforms Advised REITs hold $587M cash & cash equivalents(1) Ashford’s Historical Asset Growth: +25.5% CAGR(1) 10,000 300 (in $ millions) BHR Gross Assets AHT Gross Assets S&P 500 (RHS-Normalized) 8,000 250 BHR: $1.9B 6,000 200 Active risk management mitigated $2.4B CNL Acquisition loss of AUM during financial crisis AHT: $5.9B 4,000 150 $1.7B Highland Acquisition 2,000 100 S&P 500 declined 48% during financial crisis(2) 0 50 Dec-03 Dec-04 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 (1) Data as of 6/30/2018 (2) Based on SPX Index quarterly price level change between 2007 and 2009 Ashford Inc. (AINC) Investor Presentation | October 2018 10

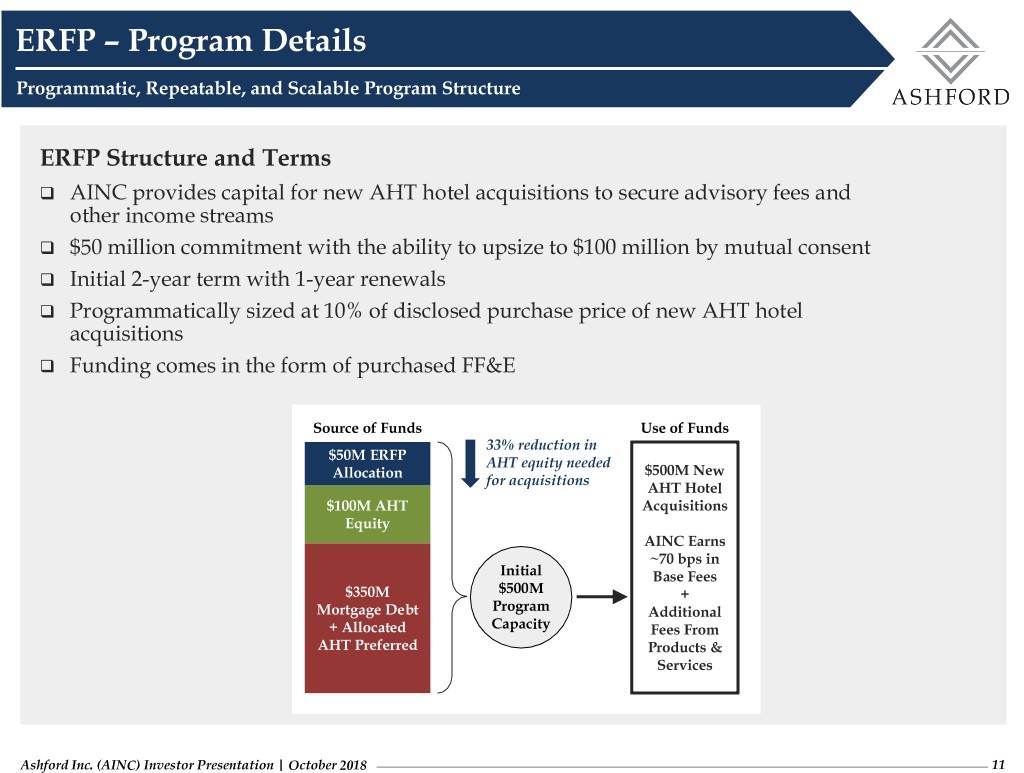

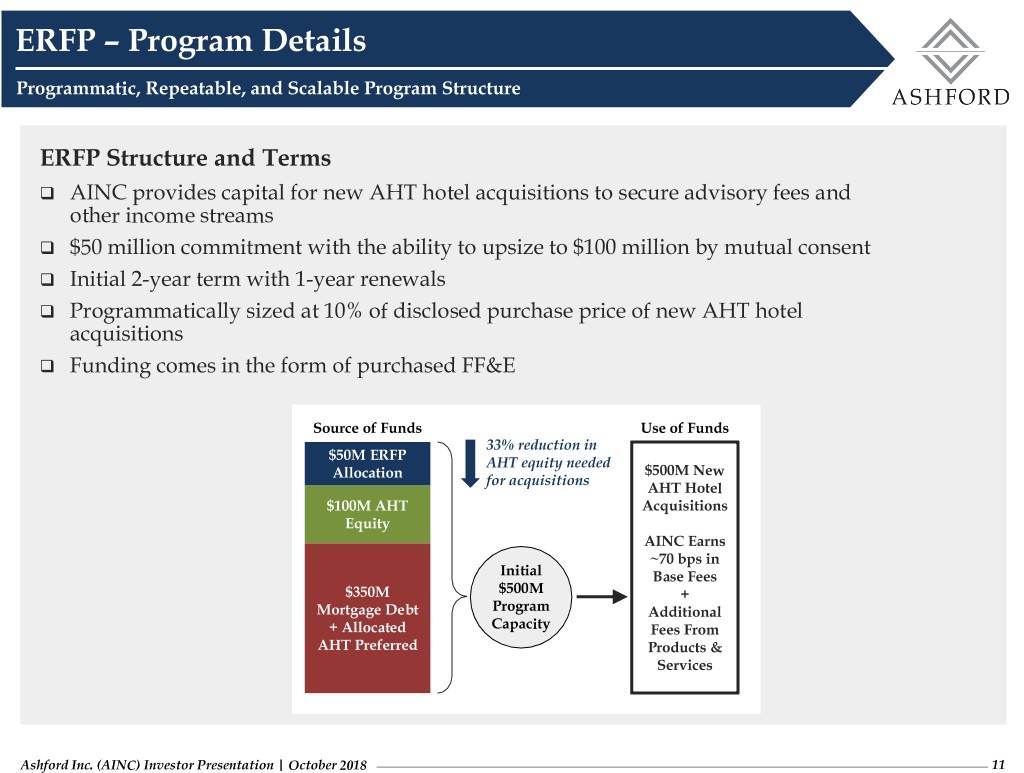

ERFP – Program Details Programmatic, Repeatable, and Scalable Program Structure ERFP Structure and Terms AINC provides capital for new AHT hotel acquisitions to secure advisory fees and other income streams $50 million commitment with the ability to upsize to $100 million by mutual consent Initial 2-year term with 1-year renewals Programmatically sized at 10% of disclosed purchase price of new AHT hotel acquisitions Funding comes in the form of purchased FF&E Source of Funds Use of Funds 33% reduction in $50M ERFP AHT equity needed Allocation $500M New for acquisitions AHT Hotel $100M AHT Acquisitions Equity AINC Earns ~70 bps in Initial Base Fees $350M $500M + Mortgage Debt Program Additional + Allocated Capacity Fees From AHT Preferred Products & Services Ashford Inc. (AINC) Investor Presentation | October 2018 11

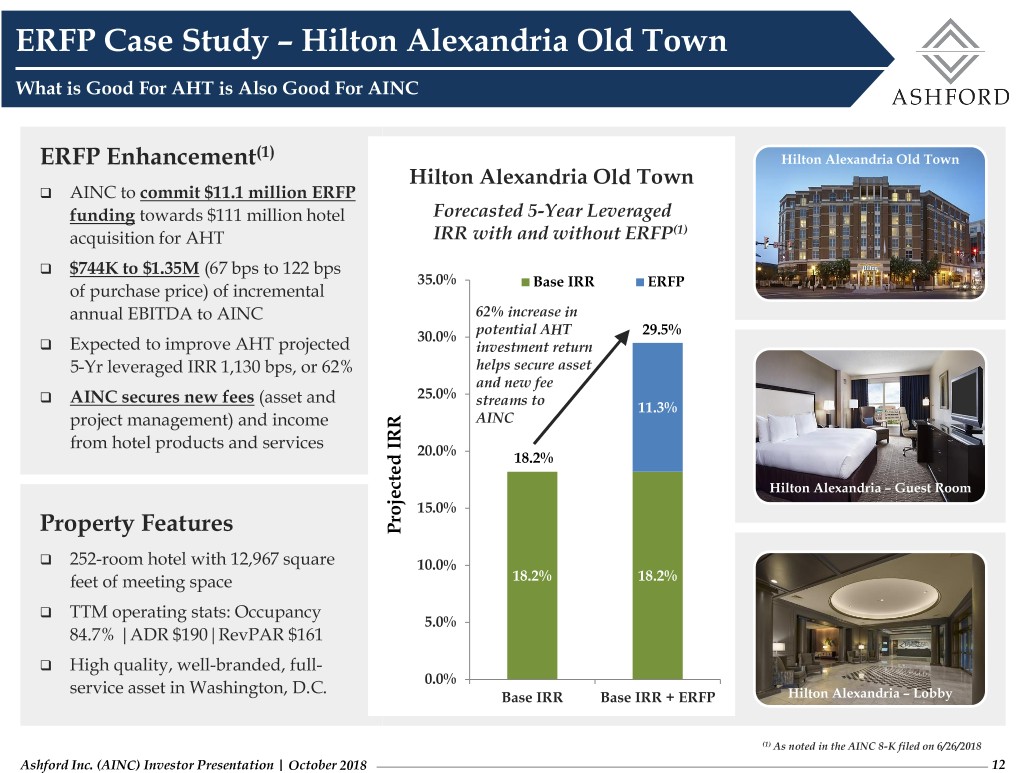

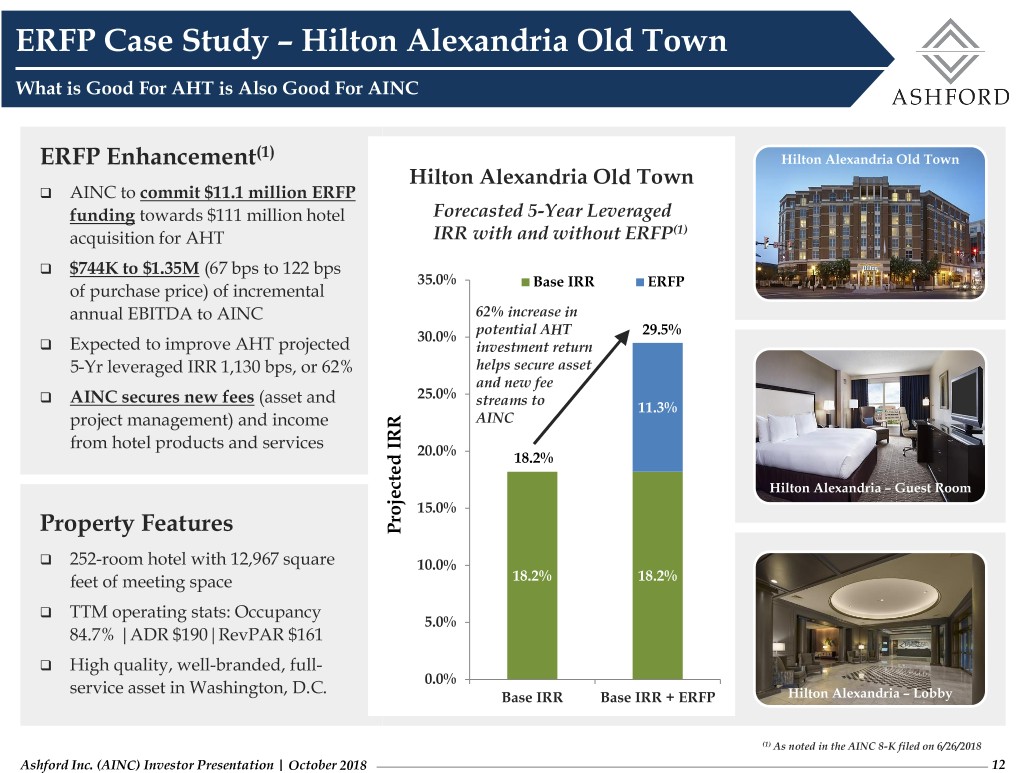

ERFP Case Study – Hilton Alexandria Old Town What is Good For AHT is Also Good For AINC (1) ERFP Enhancement Hilton Alexandria Old Town Hilton Alexandria Old Town AINC to commit $11.1 million ERFP funding towards $111 million hotel Forecasted 5-Year Leveraged (1) acquisition for AHT IRR with and without ERFP $744K to $1.35M (67 bps to 122 bps 35.0% Base IRR ERFP of purchase price) of incremental annual EBITDA to AINC 62% increase in potential AHT 29.5% 30.0% Expected to improve AHT projected investment return 5-Yr leveraged IRR 1,130 bps, or 62% helps secure asset and new fee AINC secures new fees (asset and 25.0% streams to 11.3% project management) and income AINC from hotel products and services 20.0% 18.2% Hilton Alexandria – Guest Room 15.0% Property Features ProjectedIRR 252-room hotel with 12,967 square 10.0% feet of meeting space 18.2% 18.2% TTM operating stats: Occupancy 5.0% 84.7% |ADR $190|RevPAR $161 High quality, well-branded, full- 0.0% service asset in Washington, D.C. Base IRR Base IRR + ERFP Hilton Alexandria – Lobby (1) As noted in the AINC 8-K filed on 6/26/2018 Ashford Inc. (AINC) Investor Presentation | October 2018 12

Premier Project Management – Business Overview Experienced Team Provides Array of Services Across Nearly All Major Hotel Brands Business Description Provides comprehensive in-house project management services including: Oversight, coordination, planning and execution of ground-up development, renovation, conversion, and other major capital expenditure projects for hotels Decades of experience in project management, purchasing, and design Managed over $1.7 billion of development, renovations, and other major capital projects Approximately 85 employees Services Provided Brand Experience Brand Architectural Interior Construction Negotiations Oversight Design Management & Approvals Project Lender Accounting Management +80%Reporting +68% FF&E FF&E FF&E FF&E Freight Installation & Purchasing Warehousing Management Supervision Ashford Inc. (AINC) Investor Presentation | October 2018 13

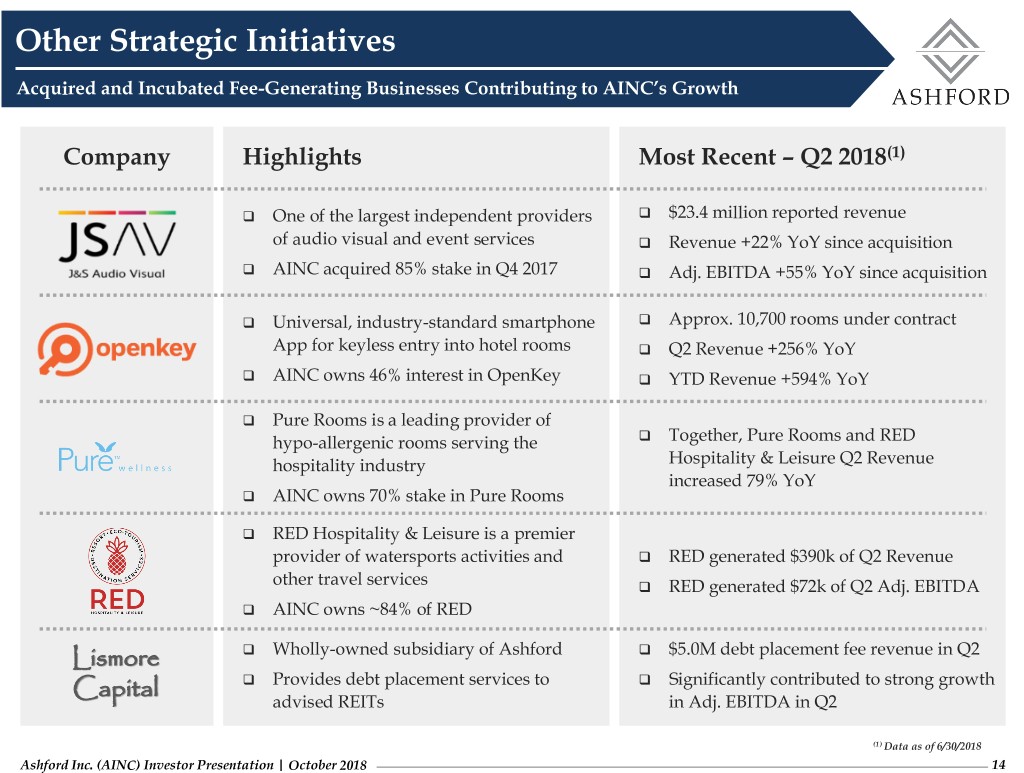

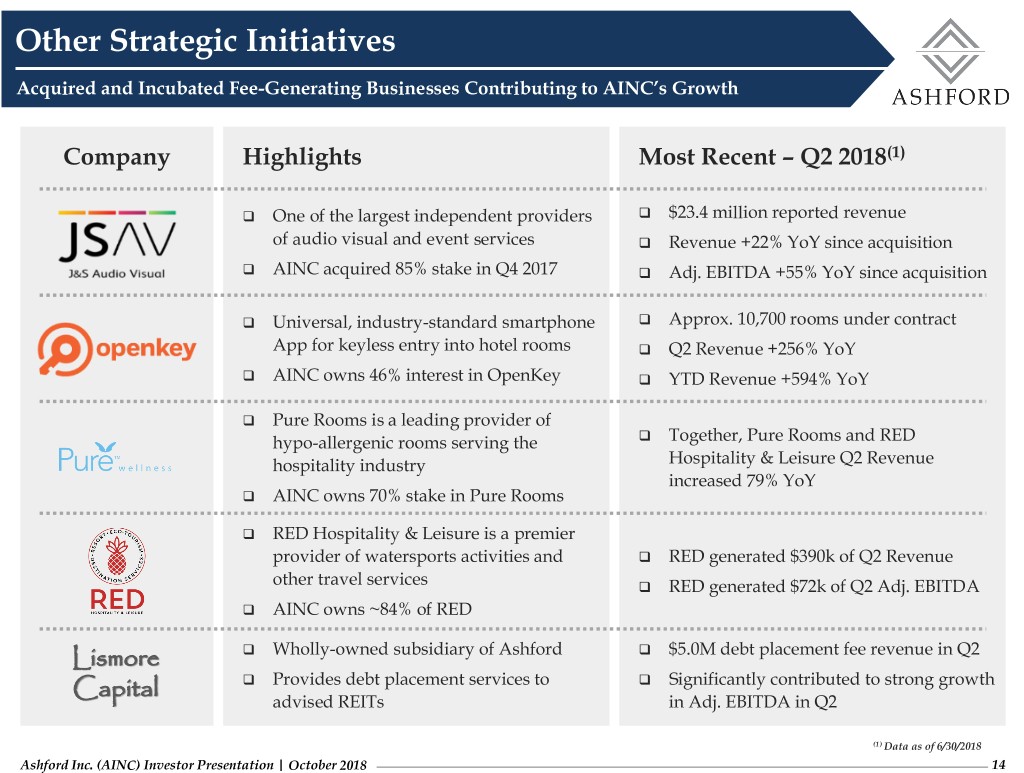

Other Strategic Initiatives Acquired and Incubated Fee-Generating Businesses Contributing to AINC’s Growth Company Highlights Most Recent – Q2 2018(1) One of the largest independent providers $23.4 million reported revenue of audio visual and event services Revenue +22% YoY since acquisition AINC acquired 85% stake in Q4 2017 Adj. EBITDA +55% YoY since acquisition Universal, industry-standard smartphone Approx. 10,700 rooms under contract App for keyless entry into hotel rooms Q2 Revenue +256% YoY AINC owns 46% interest in OpenKey YTD Revenue +594% YoY Pure Rooms is a leading provider of hypo-allergenic rooms serving the Together, Pure Rooms and RED hospitality industry Hospitality & Leisure Q2 Revenue increased 79% YoY AINC owns 70% stake in Pure Rooms RED Hospitality & Leisure is a premier provider of watersports activities and RED generated $390k of Q2 Revenue other travel services RED generated $72k of Q2 Adj. EBITDA AINC owns ~84% of RED Lismore Wholly-owned subsidiary of Ashford $5.0M debt placement fee revenue in Q2 Provides debt placement services to Significantly contributed to strong growth Capital advised REITs in Adj. EBITDA in Q2 (1) Data as of 6/30/2018 Ashford Inc. (AINC) Investor Presentation | October 2018 14

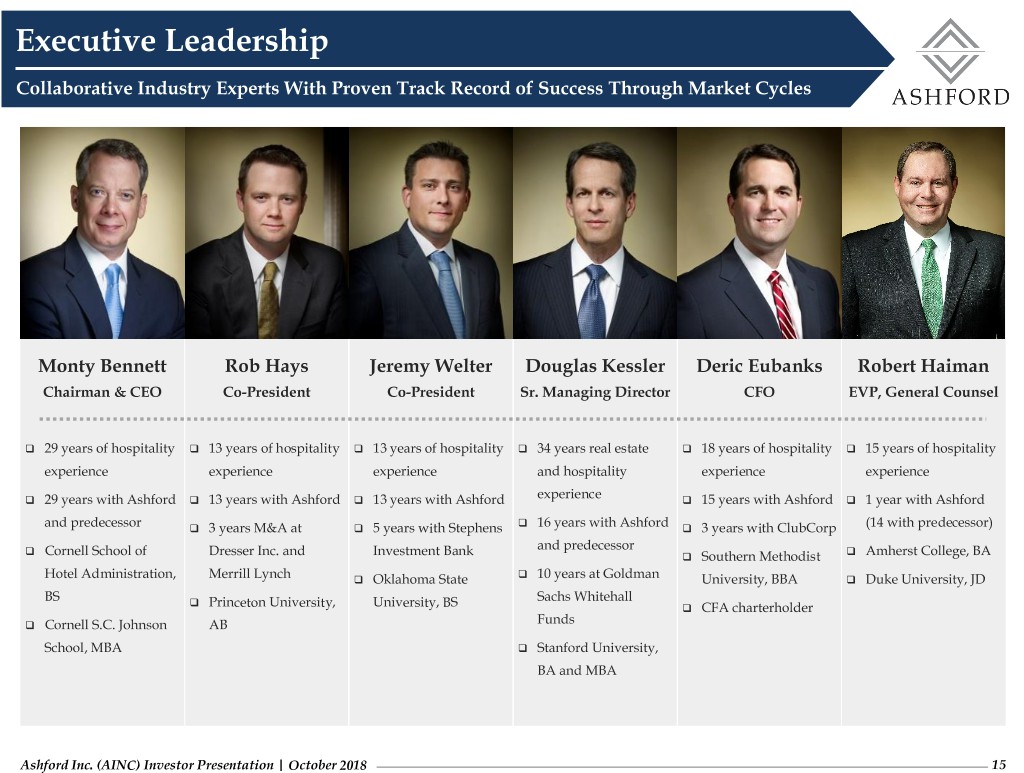

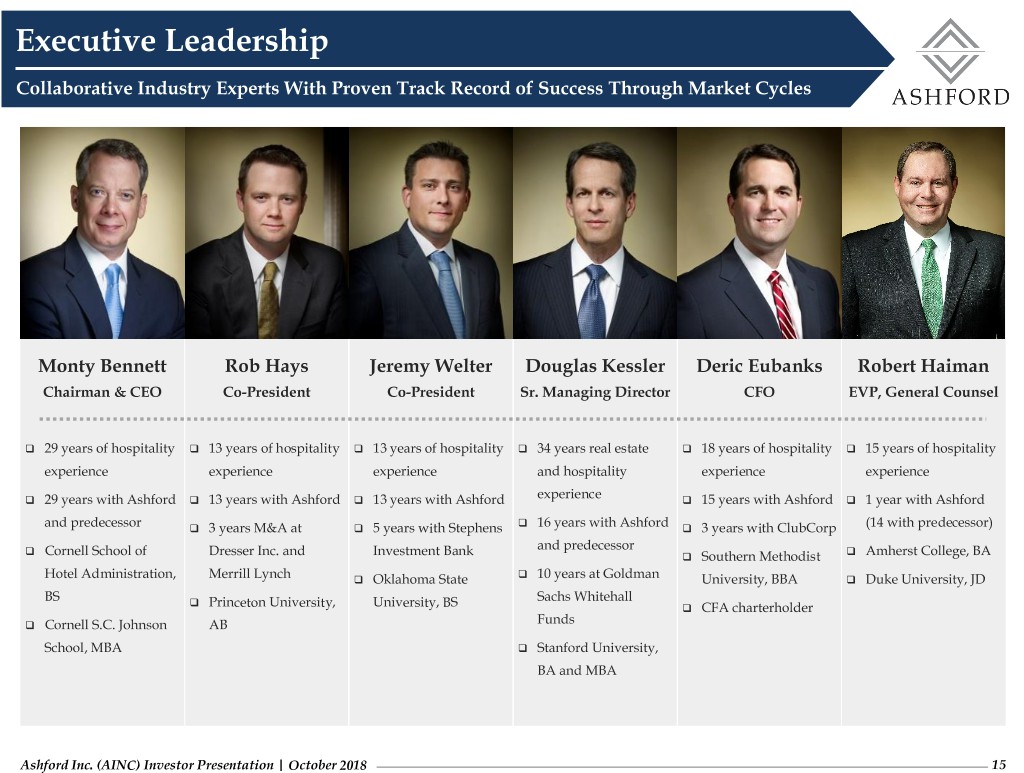

Executive Leadership Collaborative Industry Experts With Proven Track Record of Success Through Market Cycles Monty Bennett Rob Hays Jeremy Welter Douglas Kessler Deric Eubanks Robert Haiman Chairman & CEO Co-President Co-President Sr. Managing Director CFO EVP, General Counsel 29 years of hospitality 13 years of hospitality 13 years of hospitality 34 years real estate 18 years of hospitality 15 years of hospitality experience experience experience and hospitality experience experience 29 years with Ashford 13 years with Ashford 13 years with Ashford experience 15 years with Ashford 1 year with Ashford and predecessor 3 years M&A at 5 years with Stephens 16 years with Ashford 3 years with ClubCorp (14 with predecessor) and predecessor Cornell School of Dresser Inc. and Investment Bank Southern Methodist Amherst College, BA Hotel Administration, Merrill Lynch Oklahoma State 10 years at Goldman University, BBA Duke University, JD BS Sachs Whitehall Princeton University, University, BS CFA charterholder Cornell S.C. Johnson AB Funds School, MBA Stanford University, BA and MBA Ashford Inc. (AINC) Investor Presentation | October 2018 15

Ashford Inc. (NYSE American: AINC)

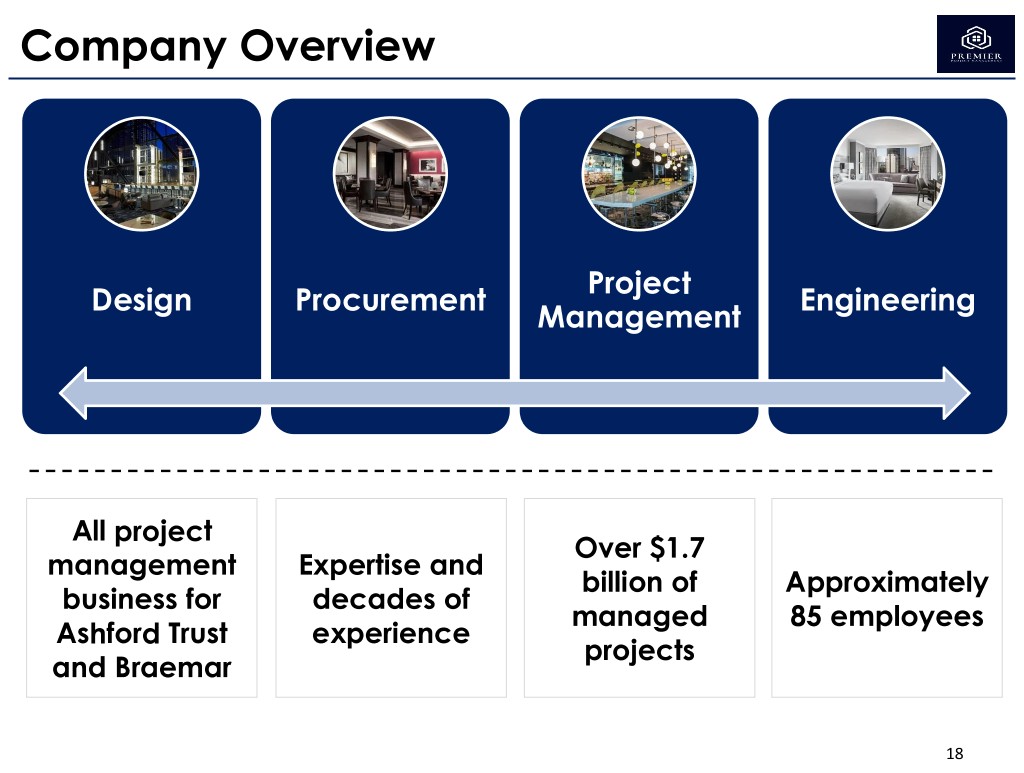

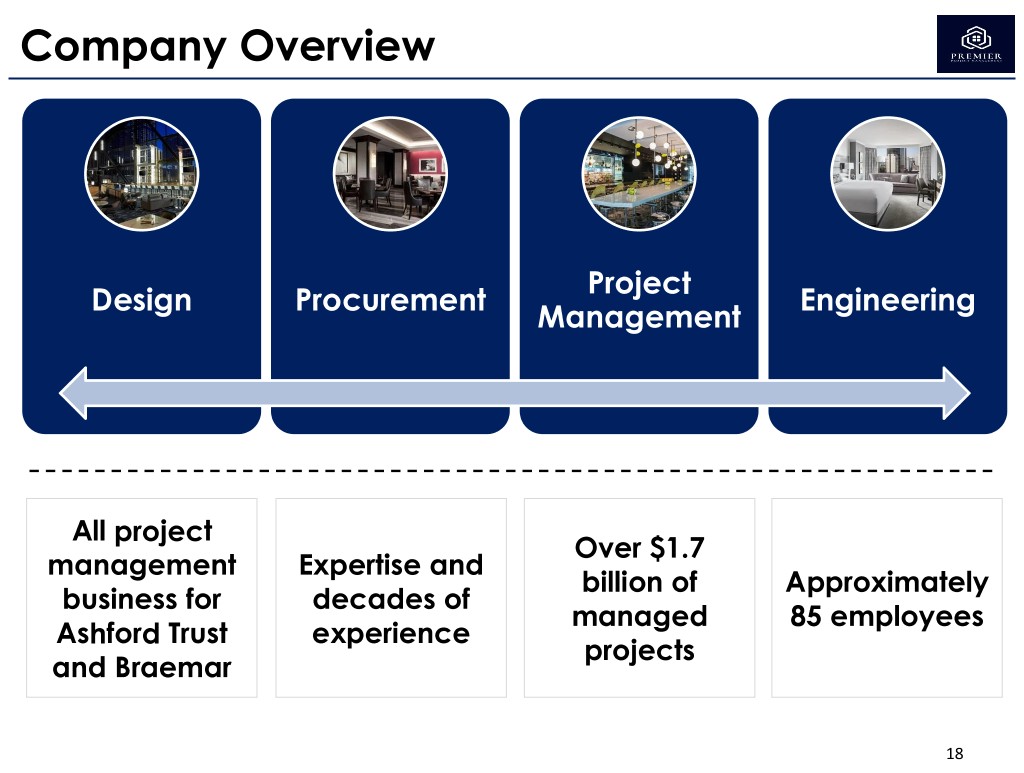

Company Overview Project Design Procurement Engineering Management All project Over $1.7 management Expertise and billion of Approximately business for decades of managed 85 employees Ashford Trust experience projects and Braemar 18

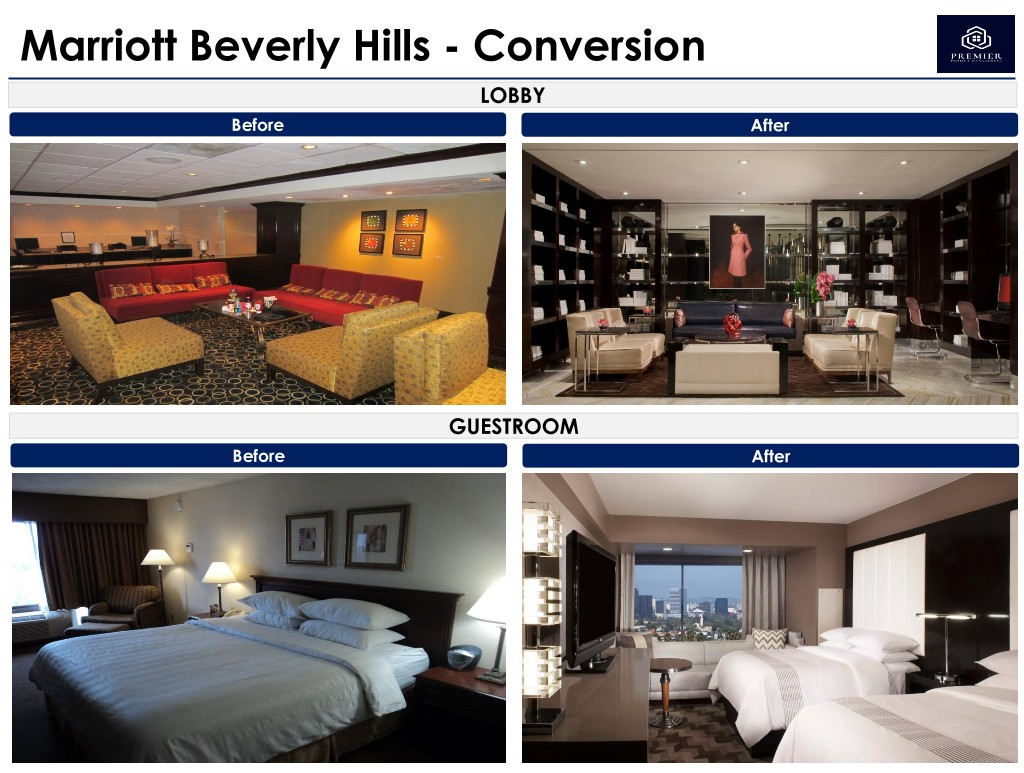

Marriott Beverly Hills - Conversion LOBBY Before After GUESTROOM Before After 19

Silversmith - Renovation RESTAURANT Before After GUESTROOM Before After 20

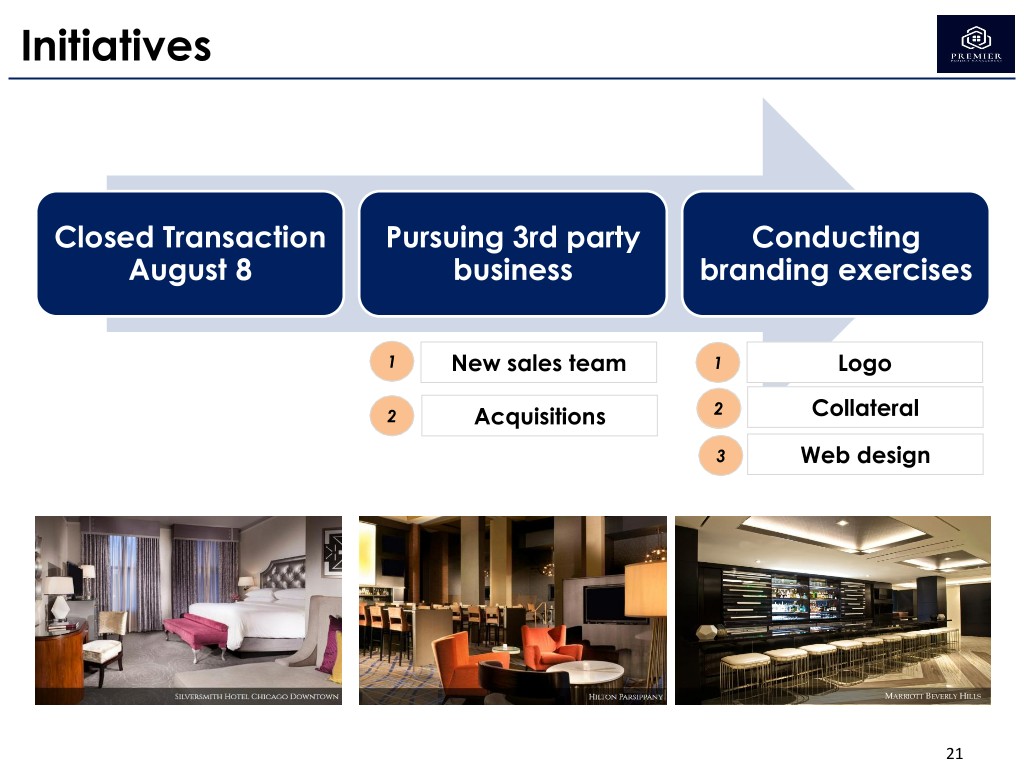

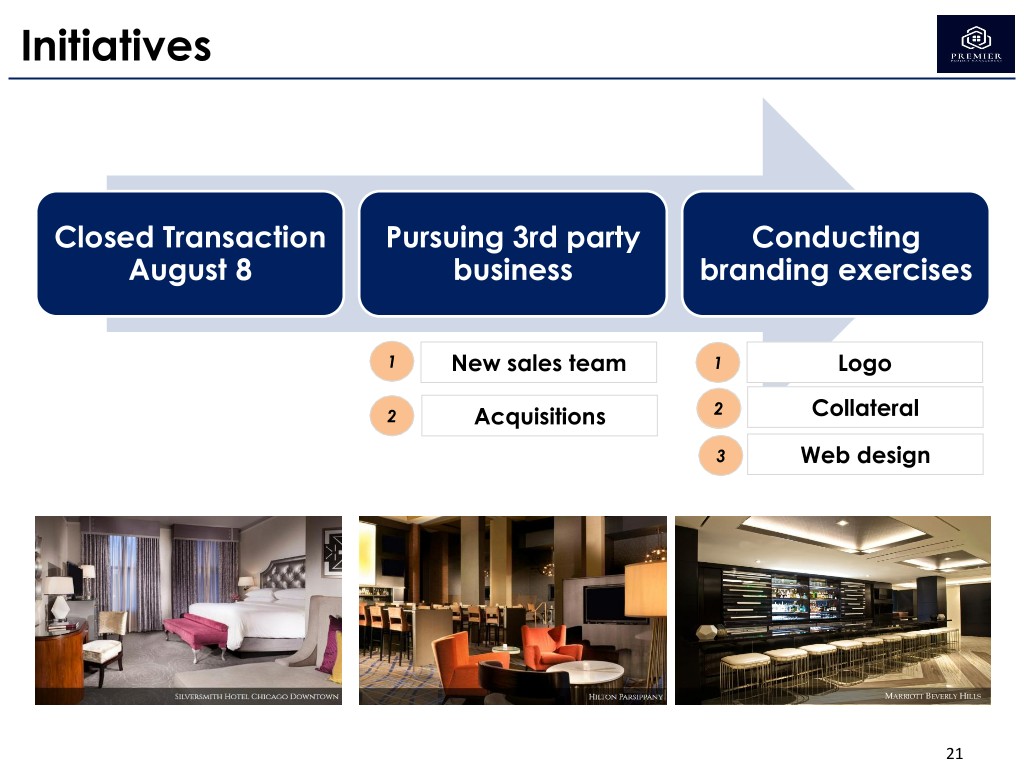

Initiatives Closed Transaction Pursuing 3rd party Conducting August 8 business branding exercises 1 New sales team 1 Logo 2 Acquisitions 2 Collateral 3 Web design MARRIOTT BEVERLY HILLS 21

Value Proposition 1 One stop for hotel renovations and projects • Design, procurement, contracting, and construction management • Corporate engineers ASHTON FT. WORTH 2 Stealth renovations in hotels • Maintain great guest satisfaction during a renovation • Maintain good RevPAR during a renovation 3 Great design staff • High quality renovations that stay within budget • Brand relationships to get designs approved HILTON FT. WORTH 4 Great hotel vendor relationships • High quality and reliable FF&E vendors • Great GCs who understand stealth renovations and working within an operating hotel HILTON MINNEAPOLIS 22

Breadth of Work Brand Negotiations & Architectural Interior Design Approvals Oversight Construction Accounting Management RENAISSANCE NASHVILLE FF&E Purchasing Lender Reporting SERVICES SILVERSMITH FF&E Freight FF&E Installation & FF&E Warehousing Management Supervision SOFITEL CHICAGO BRANDEXPERIENCE RITZ-CARLTON ATLANTA 23

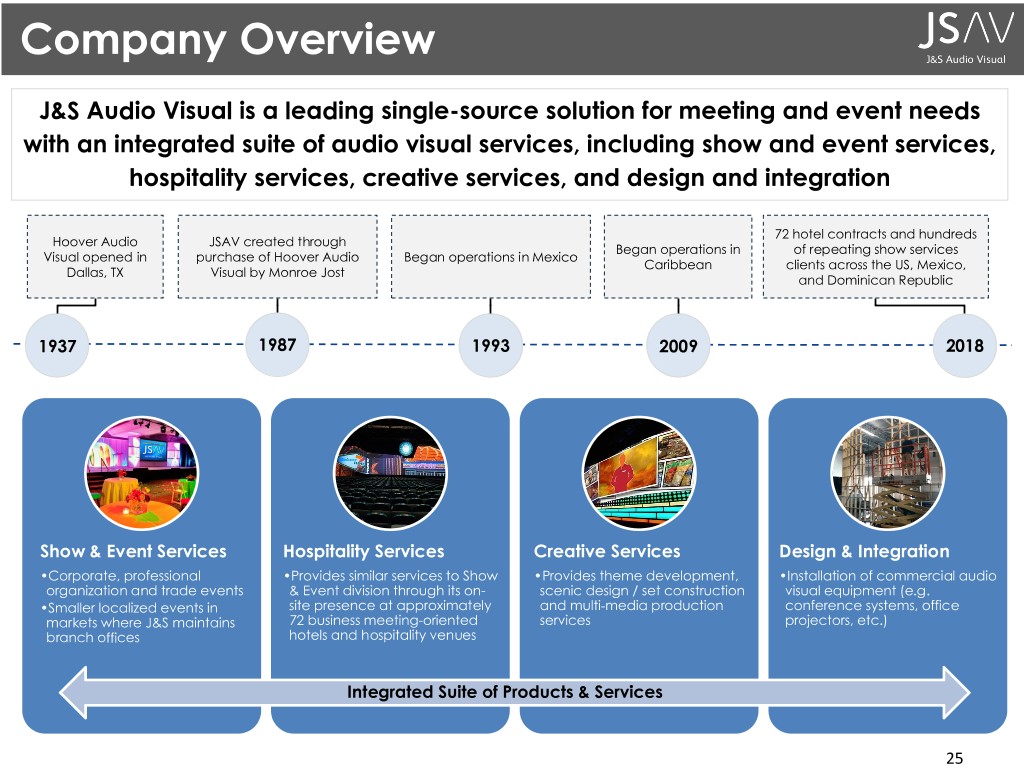

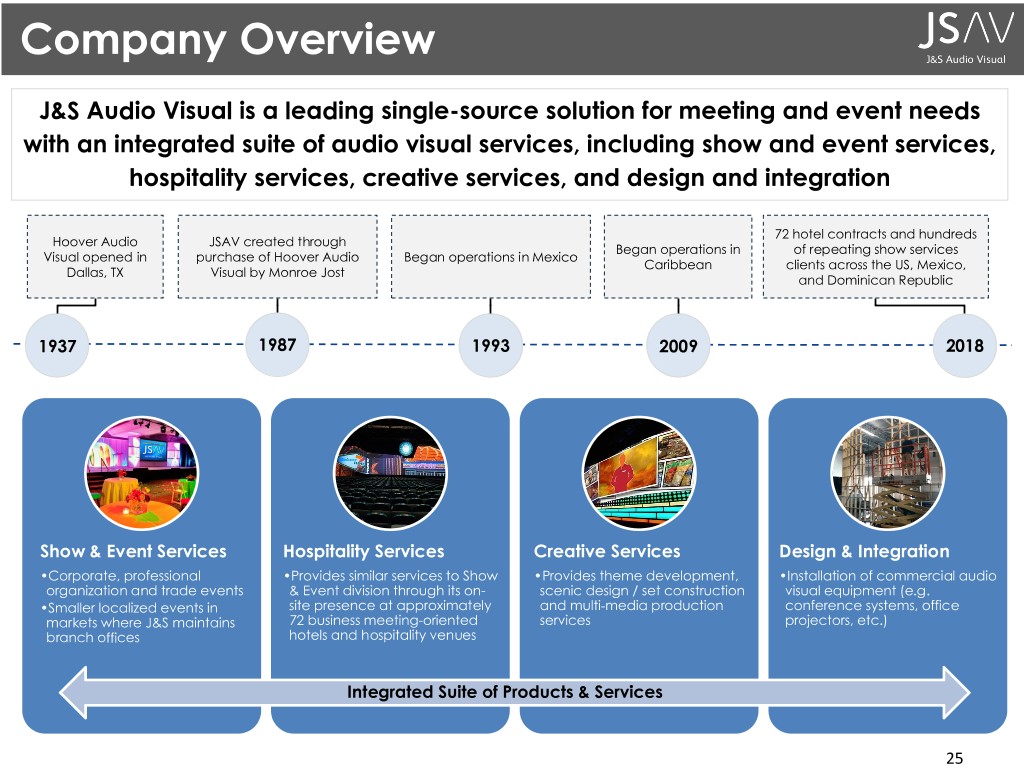

Company Overview J&S Audio Visual is a leading single-source solution for meeting and event needs with an integrated suite of audio visual services, including show and event services, hospitality services, creative services, and design and integration 72 hotel contracts and hundreds Hoover Audio JSAV created through Began operations in of repeating show services Visual opened in purchase of Hoover Audio Began operations in Mexico Caribbean clients across the US, Mexico, Dallas, TX Visual by Monroe Jost and Dominican Republic 1937 1987 1993 2009 2018 Show & Event Services Hospitality Services Creative Services Design & Integration •Corporate, professional •Provides similar services to Show •Provides theme development, •Installation of commercial audio organization and trade events & Event division through its on- scenic design / set construction visual equipment (e.g. •Smaller localized events in site presence at approximately and multi-media production conference systems, office markets where J&S maintains 72 business meeting-oriented services projectors, etc.) branch offices hotels and hospitality venues Integrated Suite of Products & Services 25

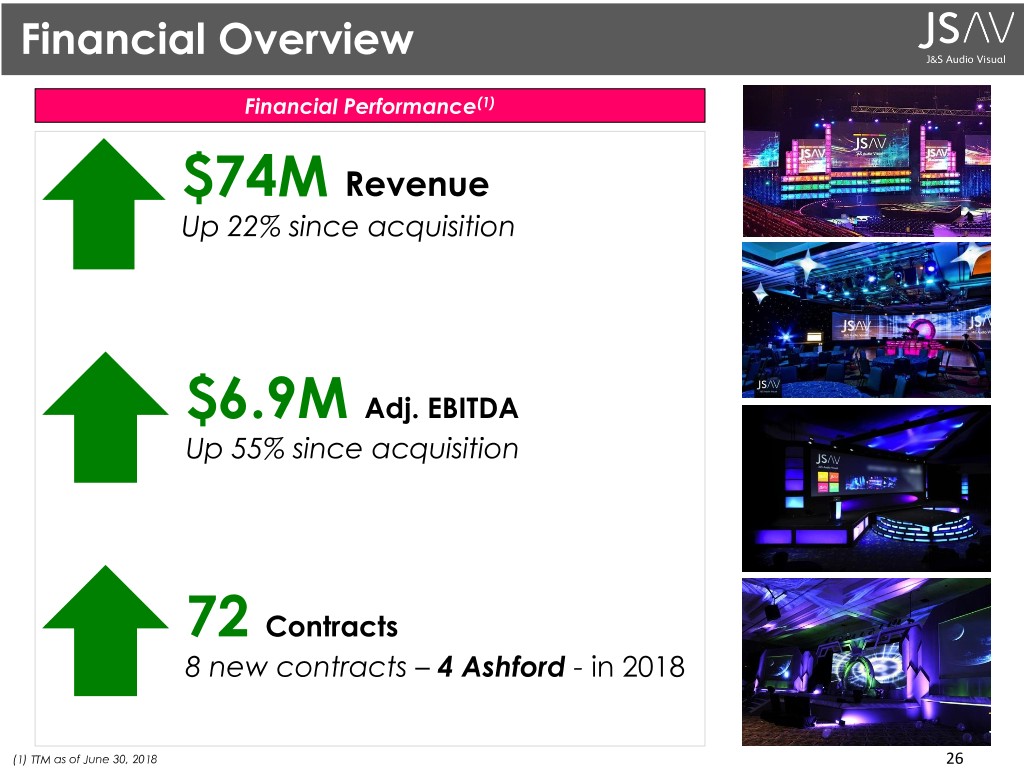

Financial Overview Financial Performance(1) $74M Revenue Up 22% since acquisition $6.9M Adj. EBITDA 182 Up 55% since acquisition 72 Contracts 8 new contracts – 4 Ashford - in 2018 (1) TTM as of June 30, 2018 26

New Hotel Contracts New Contracts 182 27

New Hotel Contracts (cont.) New Contracts 182 28

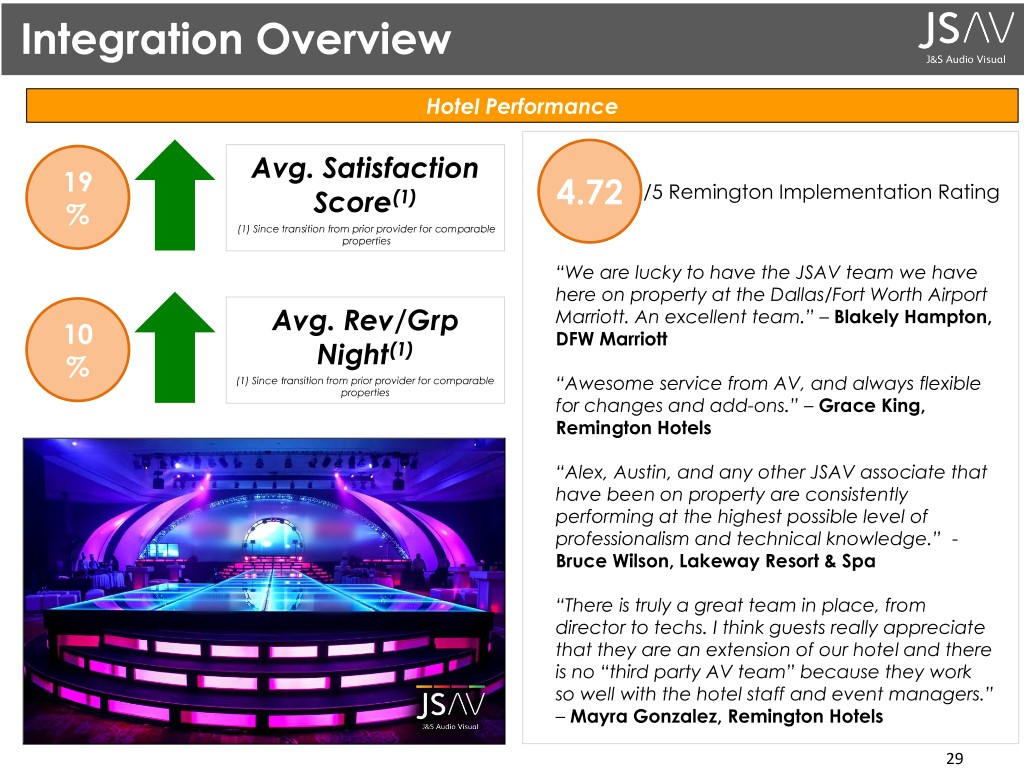

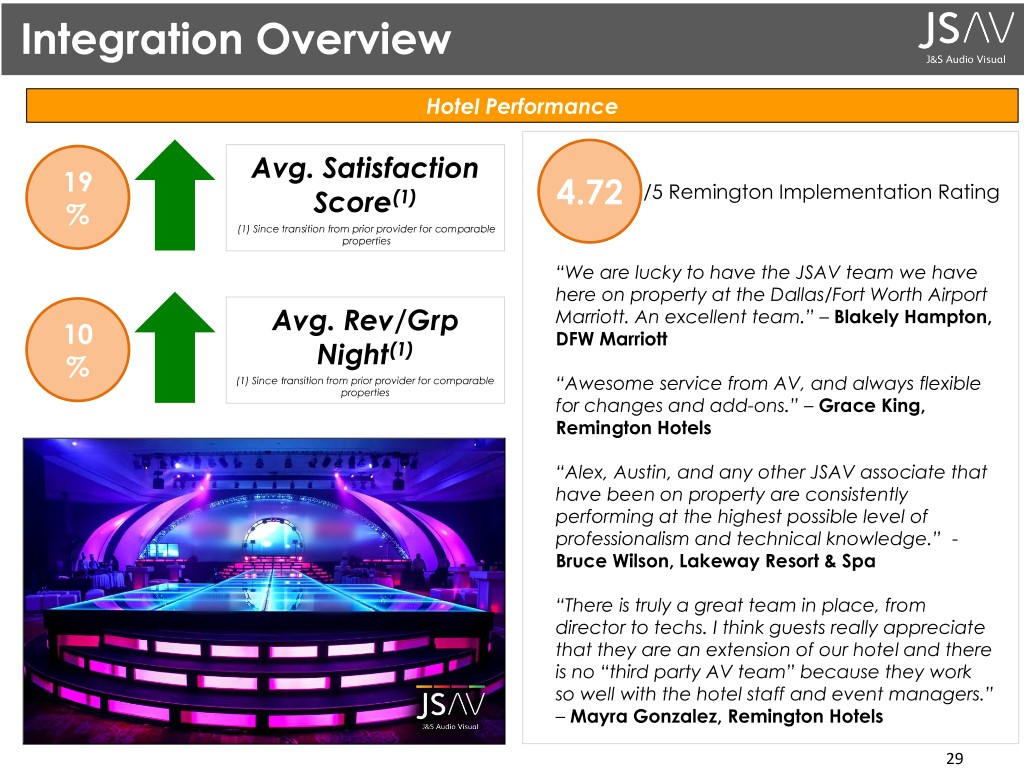

Integration Overview Hotel Performance 19 Avg. Satisfaction Score(1) 4.72 /5 Remington Implementation Rating % (1) Since transition from prior provider for comparable properties “We are lucky to have the JSAV team we have here on property at the Dallas/Fort Worth Airport Avg. Rev/Grp Marriott. An excellent team.” – Blakely Hampton, 10 DFW Marriott (1) Night % (1) Since transition from prior provider for comparable properties “Awesome service from AV, and always flexible for changes and add-ons.” – Grace King, Remington Hotels 182 “Alex, Austin, and any other JSAV associate that have been on property are consistently performing at the highest possible level of professionalism and technical knowledge.” - Bruce Wilson, Lakeway Resort & Spa “There is truly a great team in place, from director to techs. I think guests really appreciate that they are an extension of our hotel and there is no “third party AV team” because they work so well with the hotel staff and event managers.” – Mayra Gonzalez, Remington Hotels 29

Opportunities Opportunities • MSAs with major stay brands • Developed sales team • Performance improvement and optimization 182• Continued momentum in Mexico One and Only Resort, Cabo Montage Resort, Cabo 30

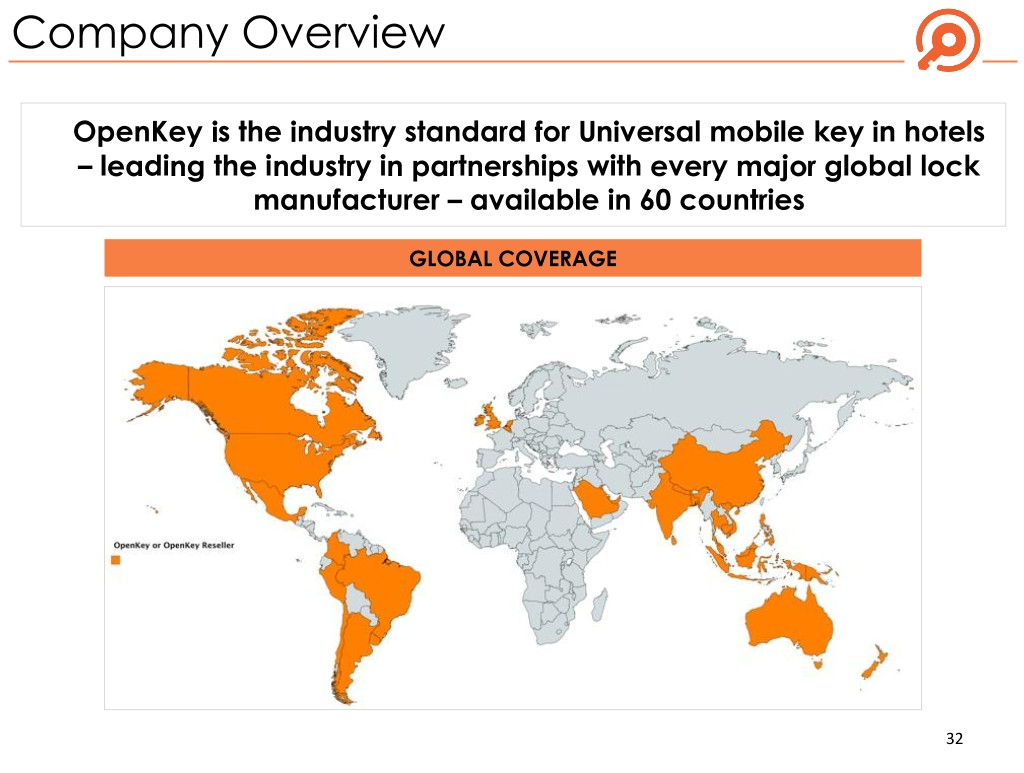

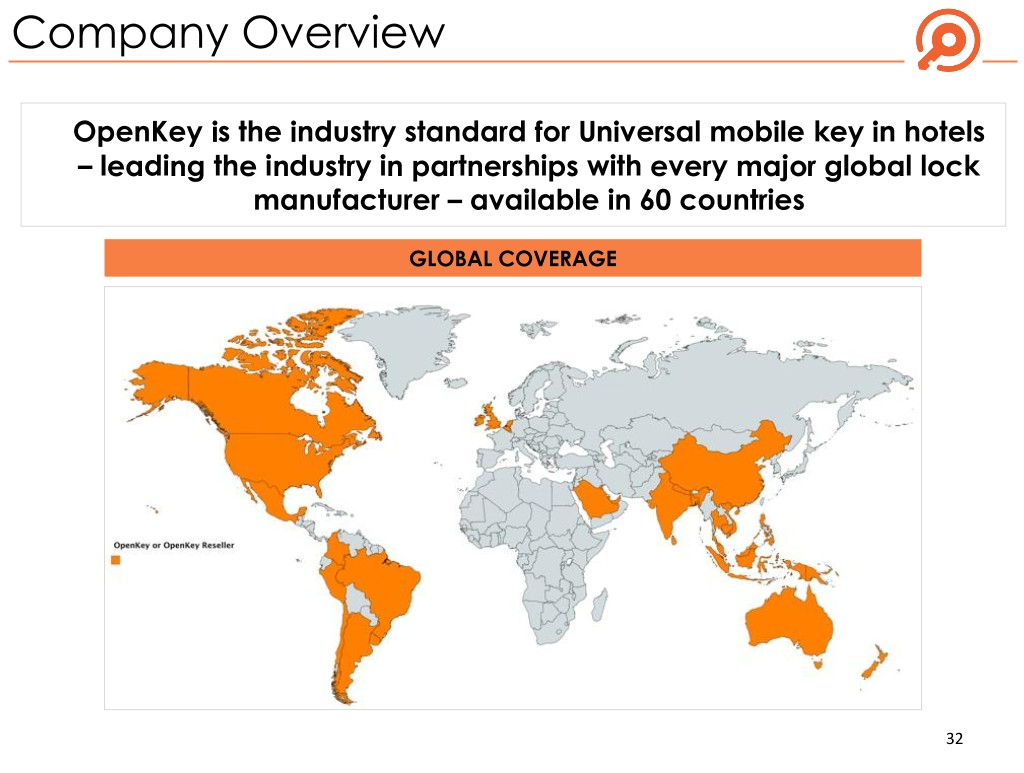

Company Overview OpenKey is the industry standard for Universal mobile key in hotels – leading the industry in partnerships with every major global lock manufacturer – available in 60 countries GLOBAL COVERAGE 32

Operational Overview UNDER CONTRACT LIVE 82 ~10,700 51 ~6,600 HOTELS ROOMS HOTELS ROOMS 5 CONSECUTIVE QUARTERS OF REVENUE GROWTH Q1 Q2 Q3 Q4 Q1 47% 72% 67% 160% 71% 17 17 17 17 18 YEAR OVER YEAR 1,000% 1,176% 33

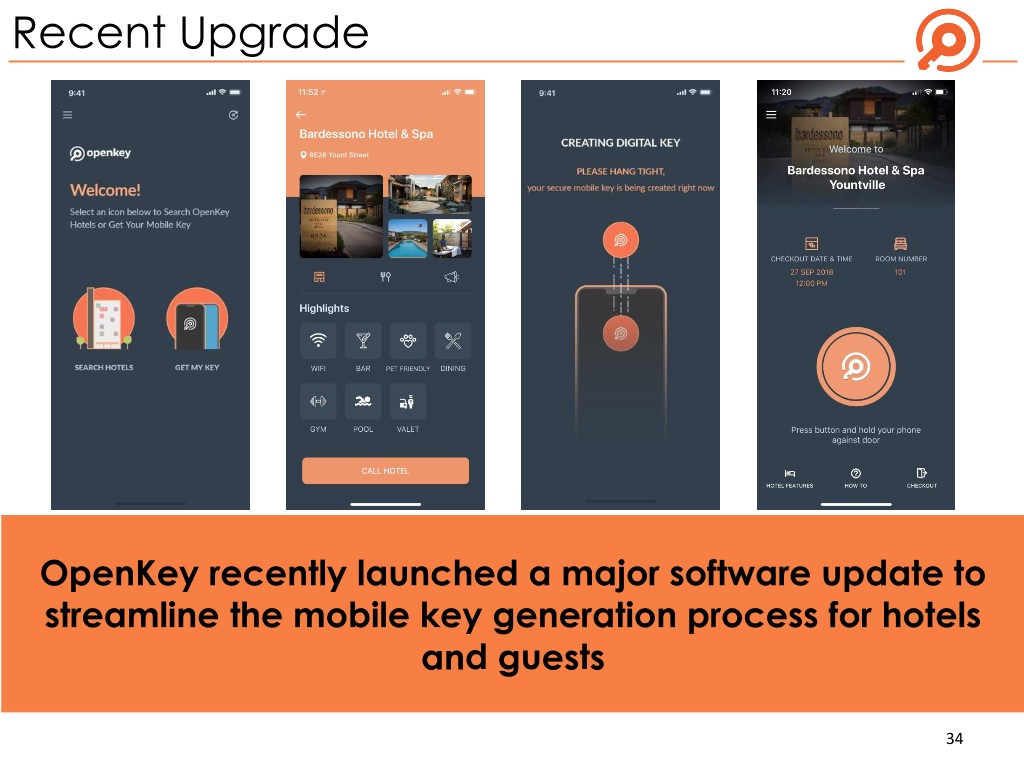

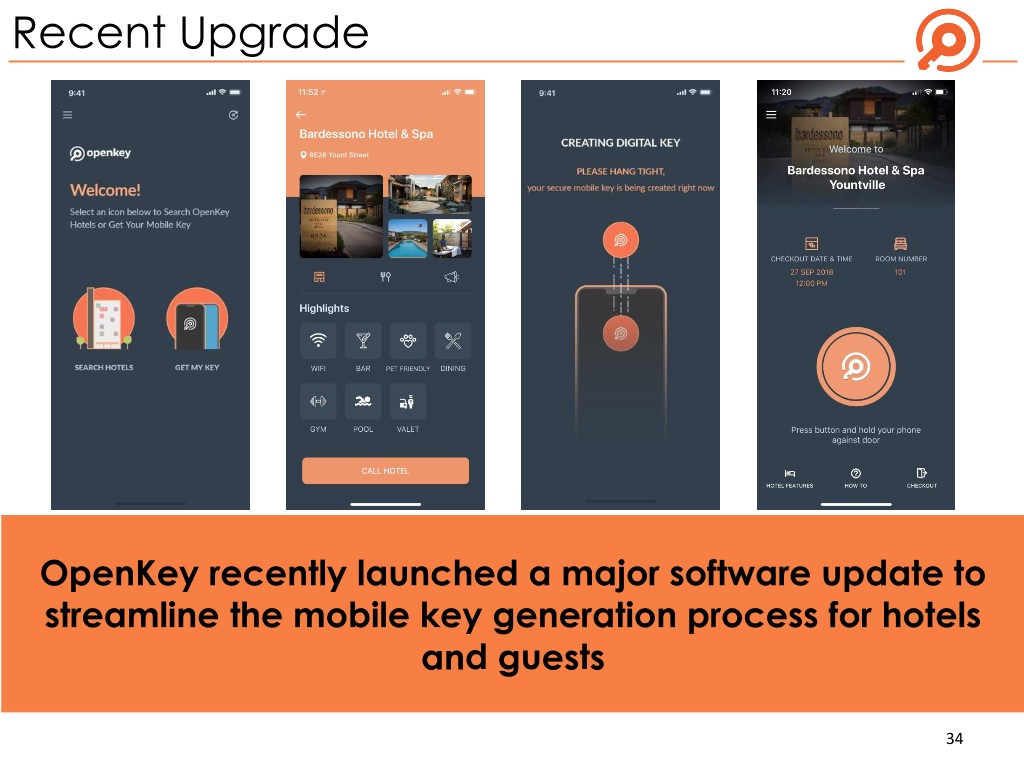

Recent Upgrade OpenKey recently launched a major software update to streamline the mobile key generation process for hotels and guests 34

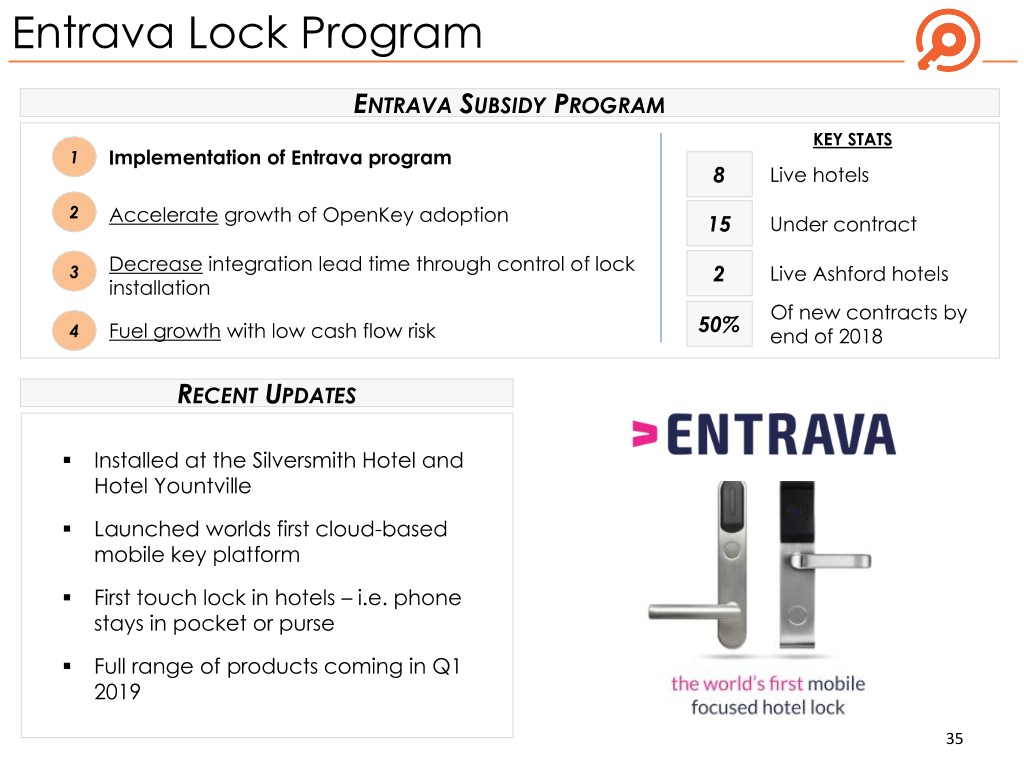

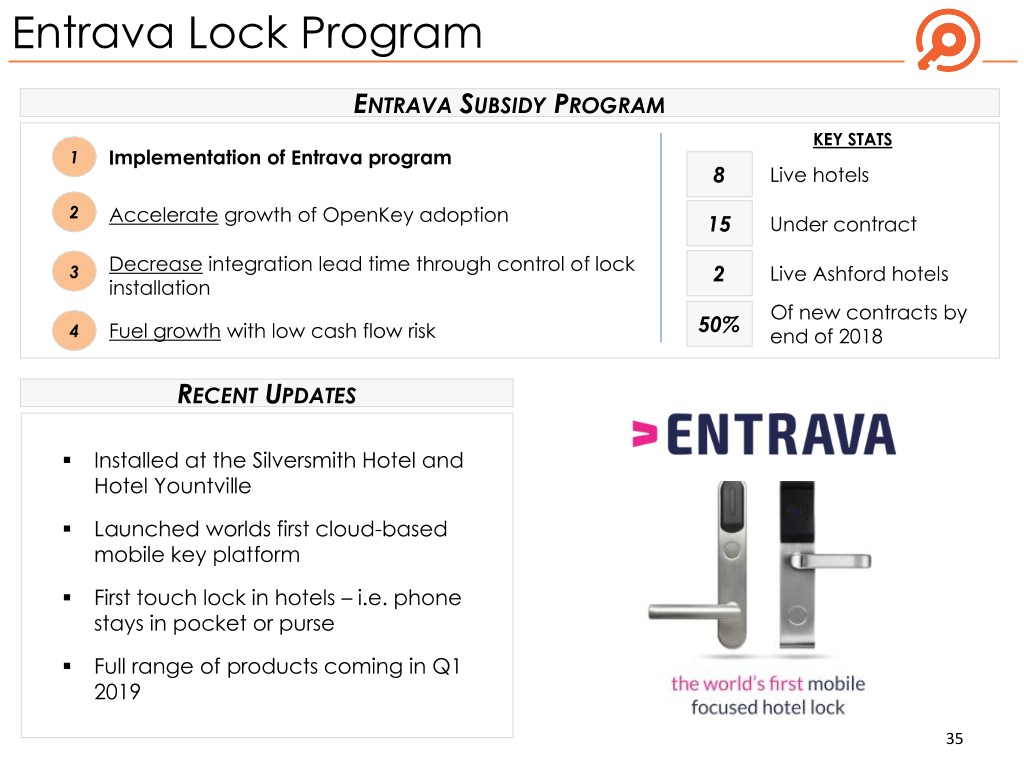

Entrava Lock Program ENTRAVA SUBSIDY PROGRAM KEY STATS 1 Implementation of Entrava program 8 Live hotels 2 Accelerate growth of OpenKey adoption 15 Under contract Decrease integration lead time through control of lock 3 2 Live Ashford hotels installation Of new contracts by 50% 4 Fuel growth with low cash flow risk end of 2018 RECENT UPDATES . Installed at the Silversmith Hotel and Hotel Yountville . Launched worlds first cloud-based mobile key platform . First touch lock in hotels – i.e. phone stays in pocket or purse . Full range of products coming in Q1 2019 35

Company Overview Celebrating over 30 years in business, RED Hospitality & Leisure is the oldest and most well respected watersports company in the Virgin Islands. RESORT SERVICES ECO-TOURISM DESTINATION SERVICES Plan and Concierge, Sailing, sunset coordinate off-site recreation, pool tours, snorkeling & activities and deck, beach scuba diving, tours transportation for services and more & cruises large groups 37

Operational Overview REBUILDING CORE BUSINESS • Restored Island Time to pre-hurricane operating condition • Have acquired or planned acquisition of 4 of 7 critical fleet vessels to core operations Jost Boat – Apr. 2018 Island Time – Jan. 2018 Day Dreamer– Mar. 2018 Jost Boat – Apr. 2018 Jammincat (Planned Acquisition) – Oct. 2018 Fast Cat – Jun. 2018 38

Opportunities EXPANSION IN USVI • Long-term ferry contract for The Westin St. John (new contract) . Expected annual revenue of $2M and annual EBITDA of $700K will almost double the size of the legacy company • Ritz-Carlton Destination Club Ritz-Carlton Destination Club EXPANSION WITHIN ASHFORD PROPERTIES • Plan to get into an Ashford hotel outside of the Ritz St. Thomas by end of 2019 . Possible expansion into Ashford’s Key West and Sarasota markets . Possible expansion into other resort markets Westin St. John EXPANSION IN CARIBBEAN MARKET Cayman Islands • Potential Opportunities: . Cayman Islands . Ritz-Carlton properties throughout the Caribbean 39