NYSE American: AINC Investor Presentation | January 2022

Page 2 In keeping with the Securities and Exchange Commission (“SEC”) "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," “target,” or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. We undertake no obligation to update or revise the statements made therein, except as may be required by law. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: the continued impact of the COVID-19 pandemic and its effects on travel (including uncertainty relating to any new or continuing governmental restrictions on travel or other factors that impact public behavior) and its impact on our business, financial condition and results from operations; general volatility of the capital markets, the general economy or the hospitality industry, whether the result of market events (including the COVID-19 pandemic and the timing and pace of the economic recovery therefrom) or otherwise, and the market price of our common stock; availability, terms and deployment of capital; our ability to regain Form S-3 eligibility; changes in our industry and the market in which we operate, interest rates or the general economy; the degree and nature of our competition; actual and potential conflicts of interest with or between Remington, Ashford Trust and Braemar, our executive officers and our non-independent directors; availability of qualified personnel; changes in governmental regulations, accounting rules, tax rates and similar matters; legislative and regulatory changes; the possibility that we may not realize any or all of the anticipated benefits from transactions to acquire businesses, including the acquisition of the project management and hotel management businesses previously owned by Remington, and from new business initiatives, including the ERFPs with Ashford Trust and Braemar; disruptions relating to the acquisition or integration of the project management and hotel management businesses previously owned by Remington, which may harm relationships with customers, employees and regulators; and unexpected costs relating to the acquisition or integration of the project management and hotel management businesses previously owned by Remington. These and other risk factors are more fully discussed in the company's filings with the SEC. Adjusted EBITDA is calculated by subtracting or adding to net income (loss): interest expense, income taxes, depreciation, amortization, net income (loss) to non- controlling interests, transaction costs, and other expenses. Adjusted EBITDA is a non-GAAP measure and reconciliations have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. Our business has been and will continue to be materially adversely affected by the impact of, and the public perception of a risk of, a pandemic disease. In December 2019, a novel strain of coronavirus (COVID-19) was identified in Wuhan, China, which has subsequently spread to other regions of the world, and has resulted in increased travel restrictions and extended shutdown of certain businesses in affected regions, including in nearly every state in the United States. Since late February 2020, we have experienced a significant decline in occupancy and RevPAR and we expect the significant occupancy and RevPAR reduction associated with the novel coronavirus (COVID-19) to likely continue as we are recording significant reservation cancellations as well as a significant reduction in new reservations relative to prior expectations. The continued outbreak of the virus in the U.S. has and will likely continue to further reduce travel and demand at our hotels. The prolonged occurrence of the virus has resulted in health or other government authorities imposing widespread restrictions on travel or other market impacts. The hotel industry and our portfolio have and we expect will continue to experience the postponement or cancellation of a significant number of business conferences and similar events. At this time those restrictions are very fluid and evolving. We have been and will continue to be negatively impacted by those restrictions. Given that the type, degree and length of such restrictions are not known at this time, we cannot predict the overall impact of such restrictions on us or the overall economic environment. In addition, even after the restrictions are lifted, the propensity of people to travel and for businesses to hold conferences will likely remain below historical levels for an additional period of time that is difficult to predict. We may also face increased risk of litigation if we have guests or employees who become ill due to COVID-19. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Inc., or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security, and the information contained herein does not form part of any prospectus of Ashford Inc. that may be used to offer or sell securities. Prior to investing in Ashford, potential investors should carefully review Ashford’s periodic filings with the Securities and Exchange Commission, including, but not limited to, Ashford’s most current Form 10-K, Form 10-Q and Form 8-K’s, including the risk factors included therein. Safe Harbor

About Us – Advisor. Operator. Innovator. Page 3 The only publicly-traded asset manager & service provider in the hospitality industry 40+ years of history in the hospitality industry Best-in-class asset management, with deep industry relationships and scale

Our Strategy- Multiple Paths to Growth Best-in-Class Asset Management and Operations with Deep Industry Relationships Page 4 Grow Assets Under Management Expand Service Offerings Grow Third- Party Business Recovery of Hotel Industry

Overview Advisory Platform Perpetual Life Public REITs Page 5 Operating Platform Strategic Market Leading Hospitality Focused Companies NYSE: BHR NYSE: AHT Ashford is an alternative asset management company with a portfolio of strategic operating businesses that provides global asset management, investment management and related services to the real estate and hospitality sectors

Advisory Platform - Secure & Sustainable Long-Term Advisory Agreements Provide Stable Revenue Streams from Advised REITs 70bps Base Advisory Fee on Total Market Capitalization Contractually, Base Fees Cannot Decrease More Than 10% YoY Additional Incentive Fees Based on Total Shareholder Return Cannot be Terminated without Significant Payment to AINC Right to Place Product & Service Companies in Hotels at Market Rates Page 6

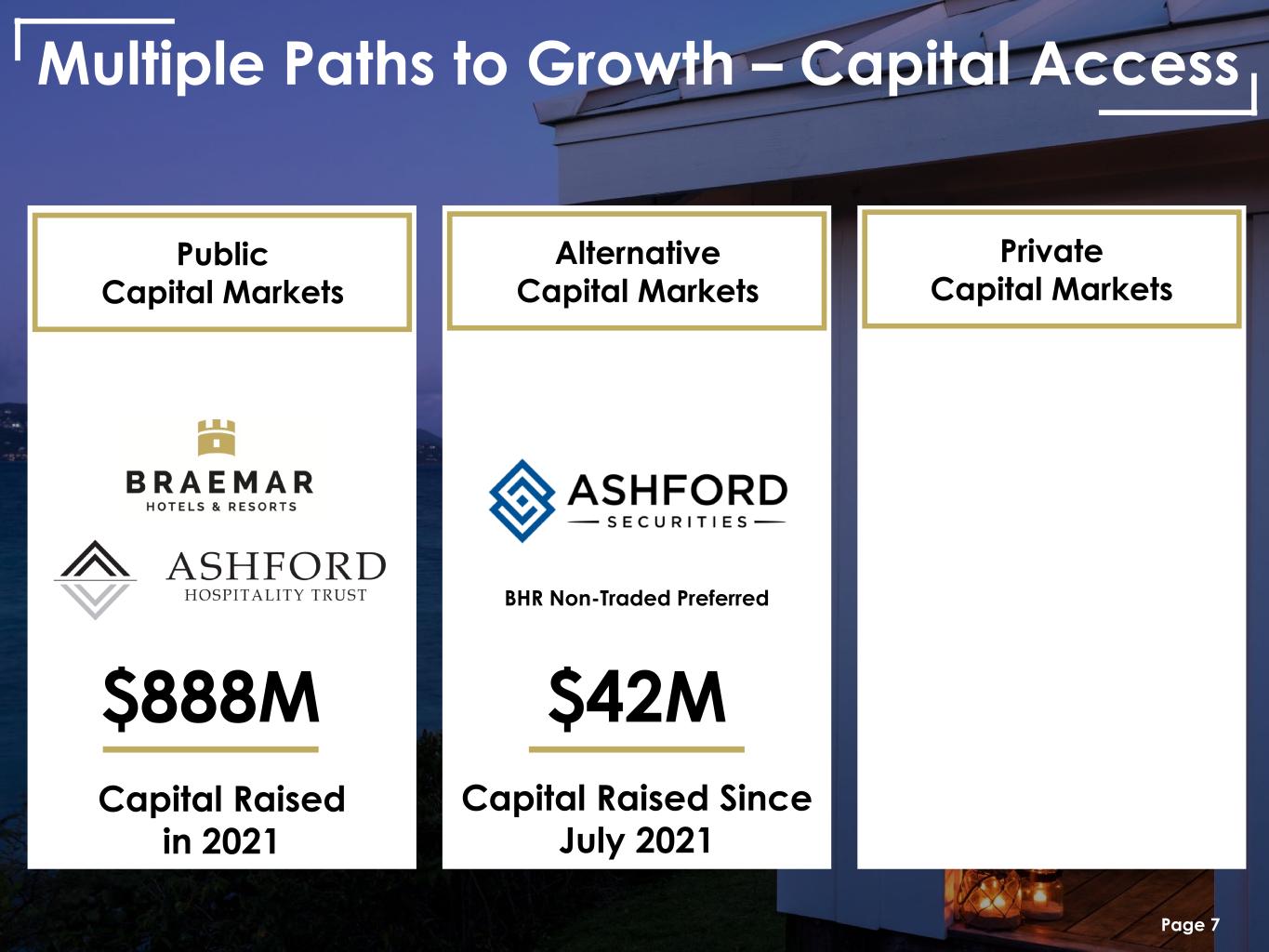

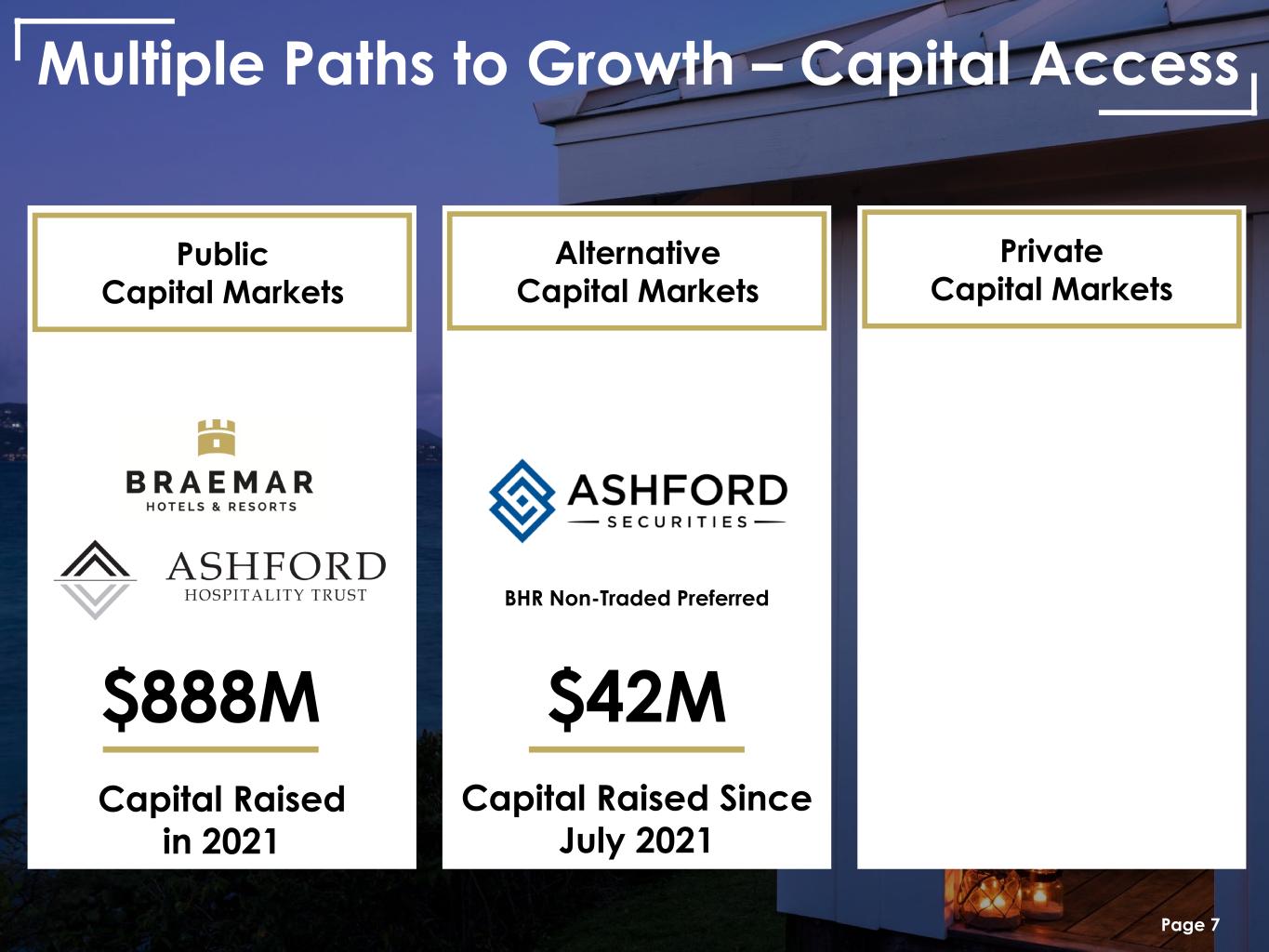

Page 7 Public Capital Markets Multiple Paths to Growth – Capital Access Alternative Capital Markets Private Capital Markets Capital Raised in 2021 $888M Capital Raised Since July 2021 $42M BHR Non-Traded Preferred

Broker/dealer committed to offering highly differentiated investment products to retail and institutional investors • FINRA Member Firm • Non-Traded Preferred Stock • Retail Commitment to Atls is High Page 8 Capital Raise Launched in July 2021 $500M Capital Raised Since July 2021 $42M

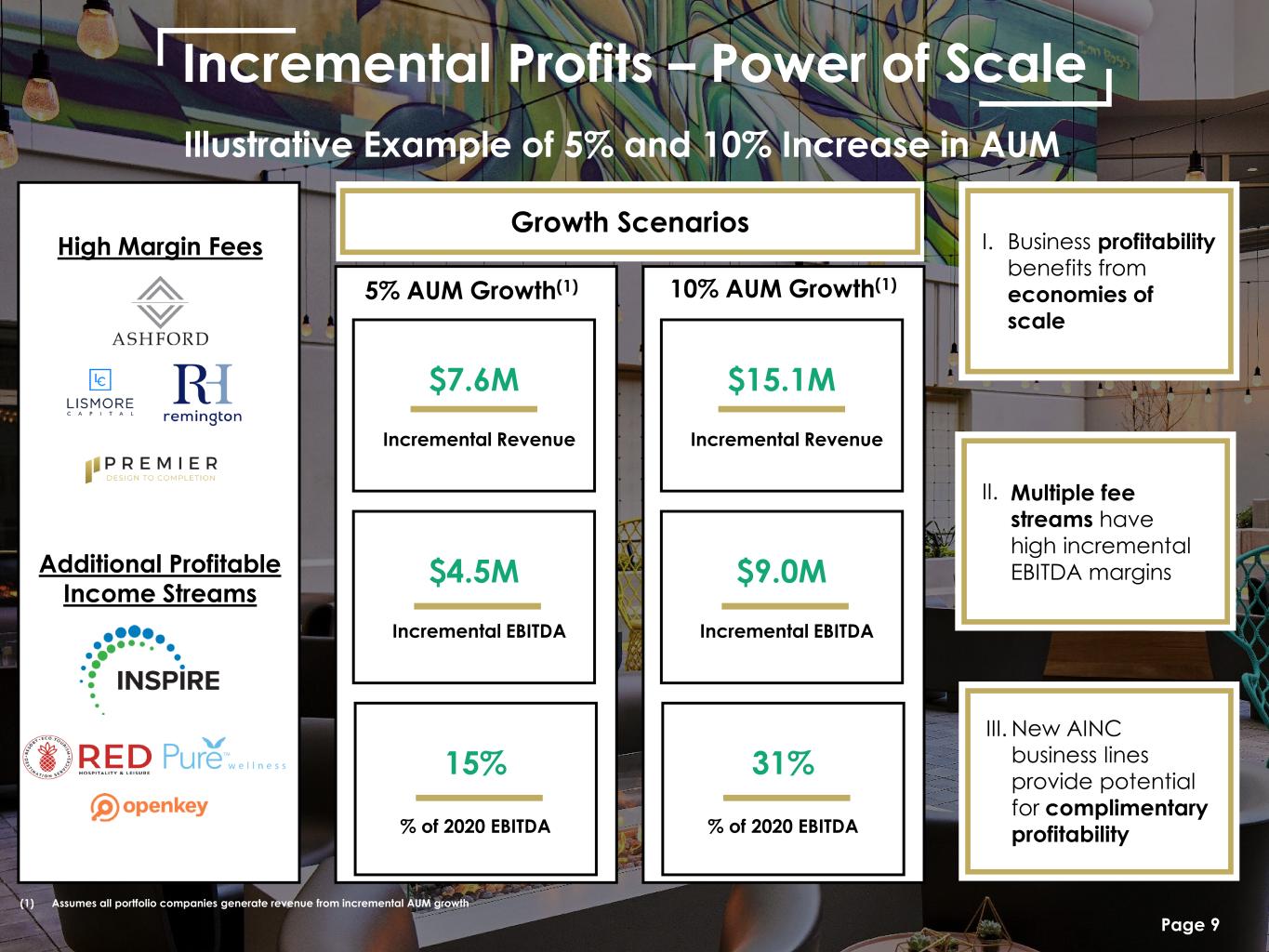

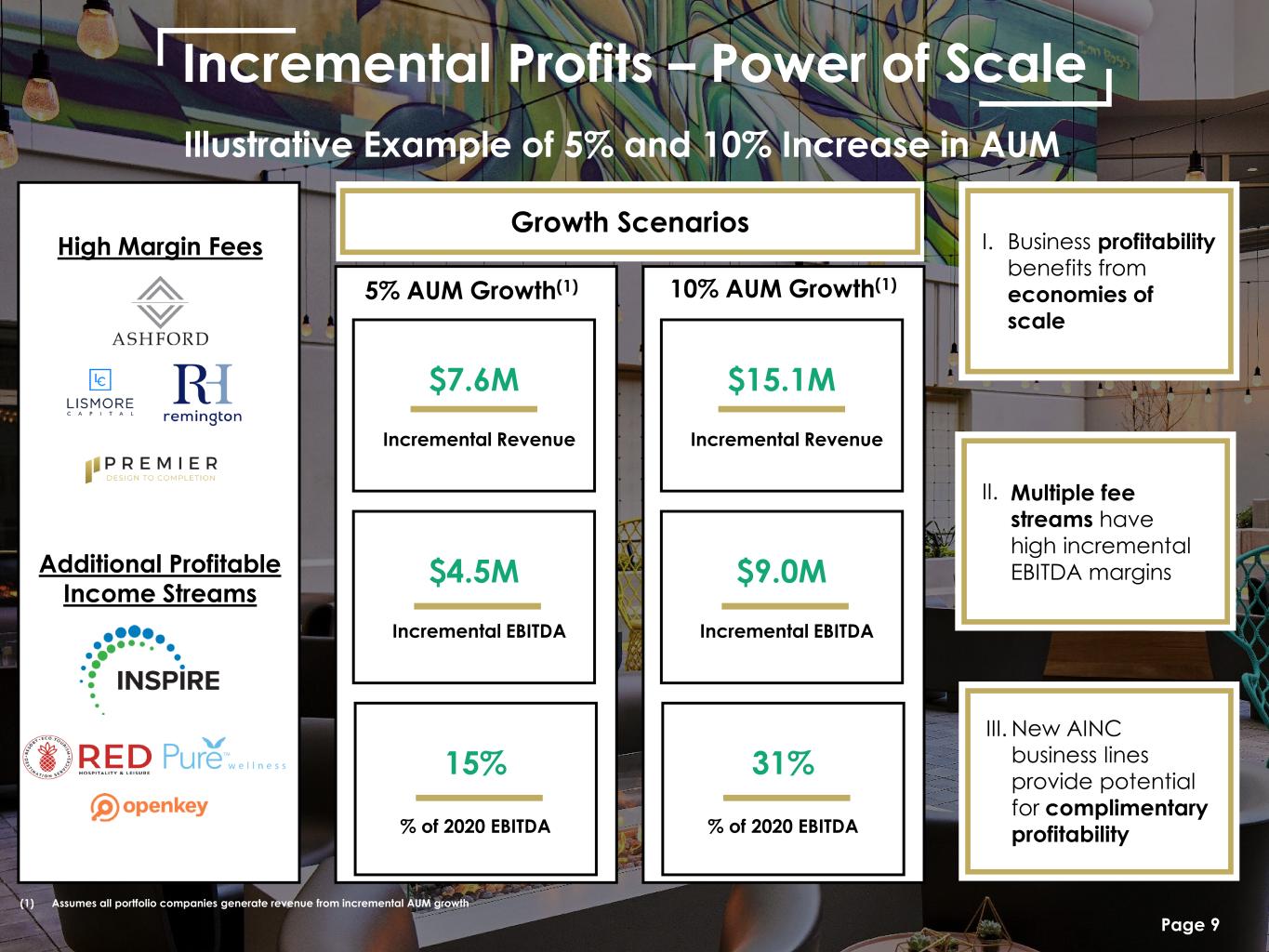

9 Incremental Profits – Power of Scale Illustrative Example of 5% and 10% Increase in AUM High Margin Fees Additional Profitable Income Streams Page 9 Incremental Revenue $7.6M Incremental EBITDA $4.5M % of 2020 EBITDA 15% Incremental Revenue $15.1M Incremental EBITDA $9.0M % of 2020 EBITDA 31% 5% AUM Growth(1) 10% AUM Growth(1) Growth Scenarios II. Multiple fee streams have high incremental EBITDA margins III. New AINC business lines provide potential for complimentary profitability I. Business profitability benefits from economies of scale lti l f str s v high incremental IT r i s (1) Assumes all portfolio companies generate revenue from incremental AUM growth

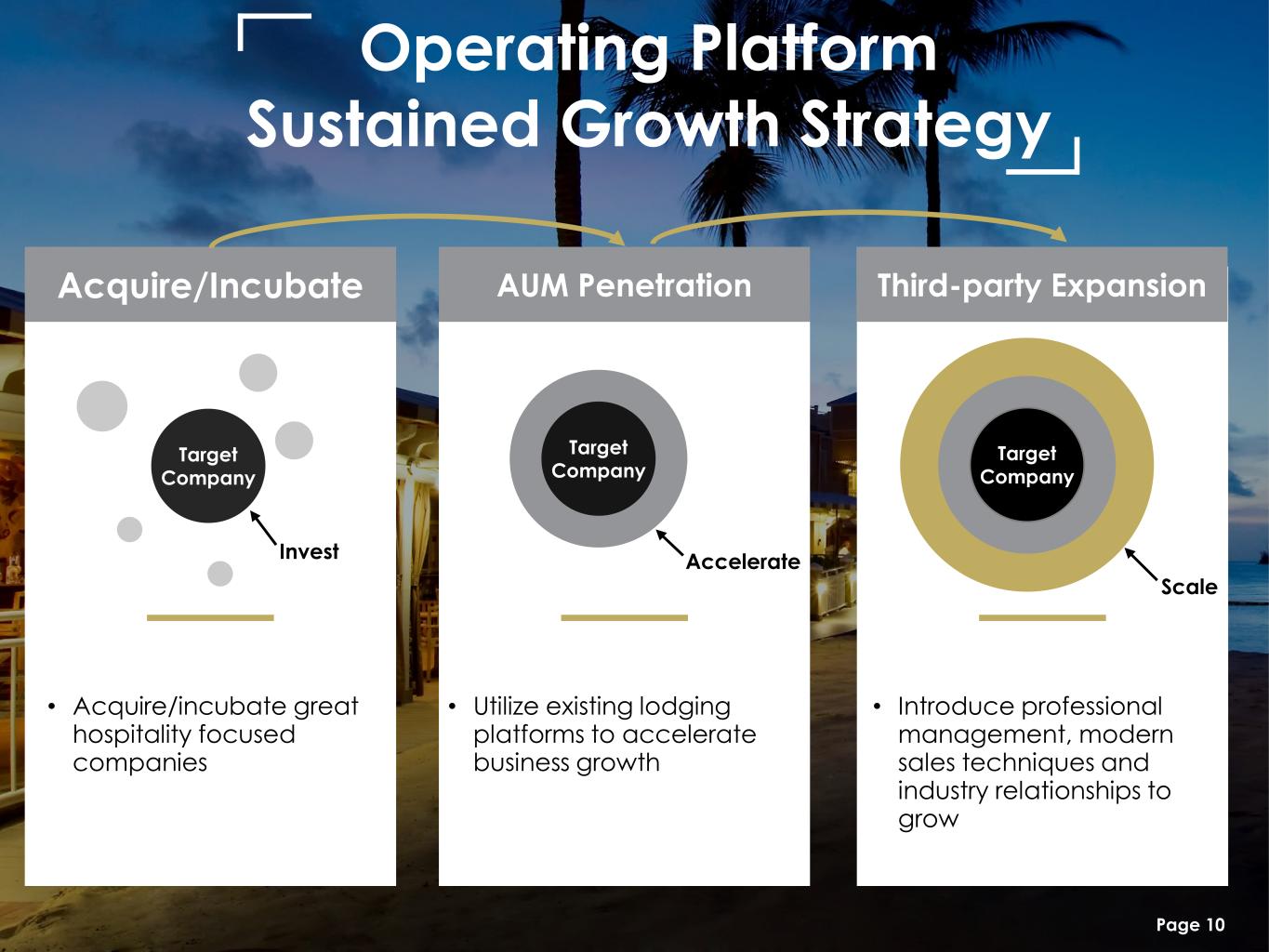

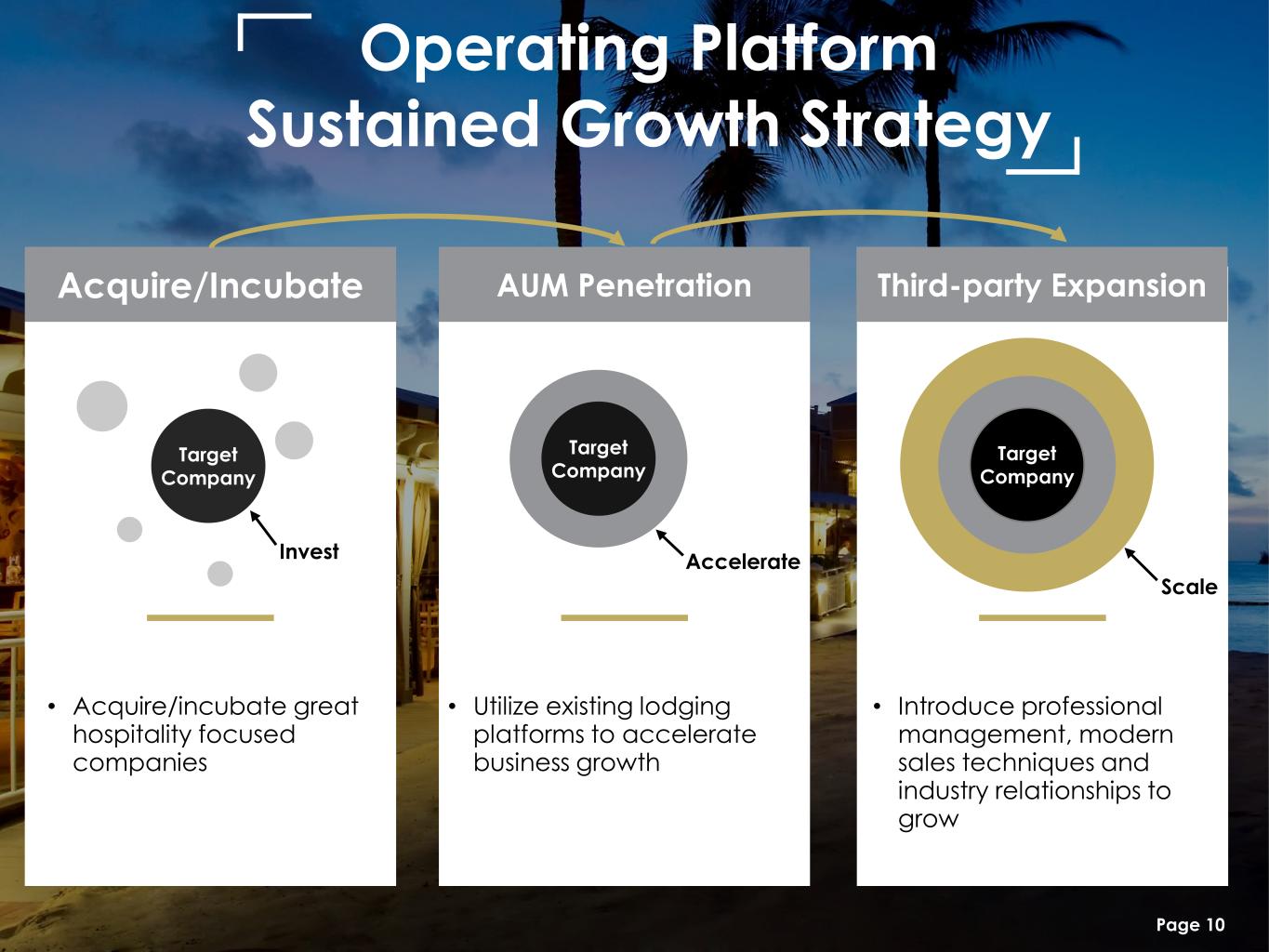

Operating Platform Sustained Growth Strategy Acquire/Incubate Target Company Invest • Acquire/incubate great hospitality focused companies AUM Penetration Target Company Accelerate • Utilize existing lodging platforms to accelerate business growth Third-party Expansion Scale Target Company • Introduce professional management, modern sales techniques and industry relationships to grow Page 10

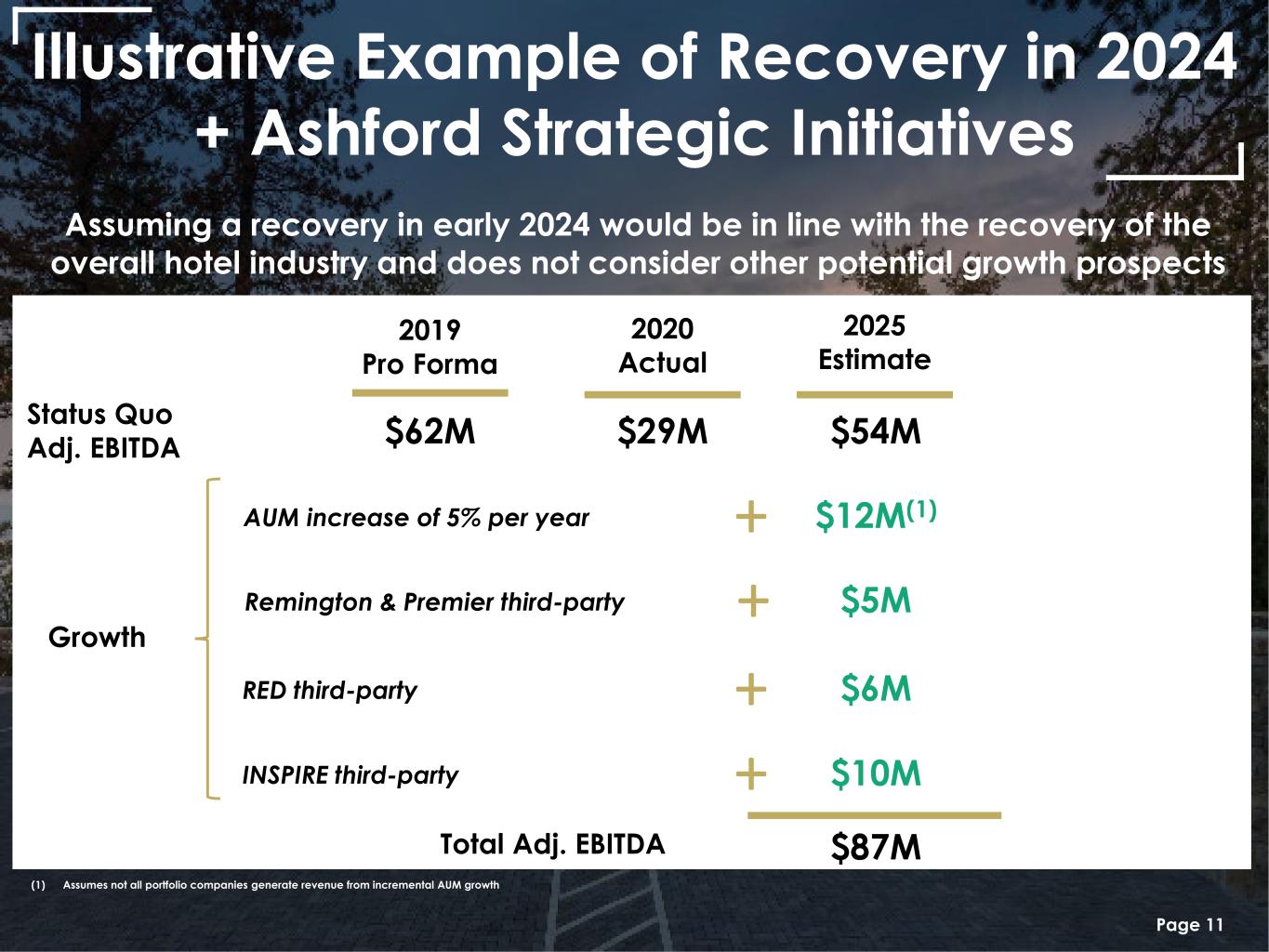

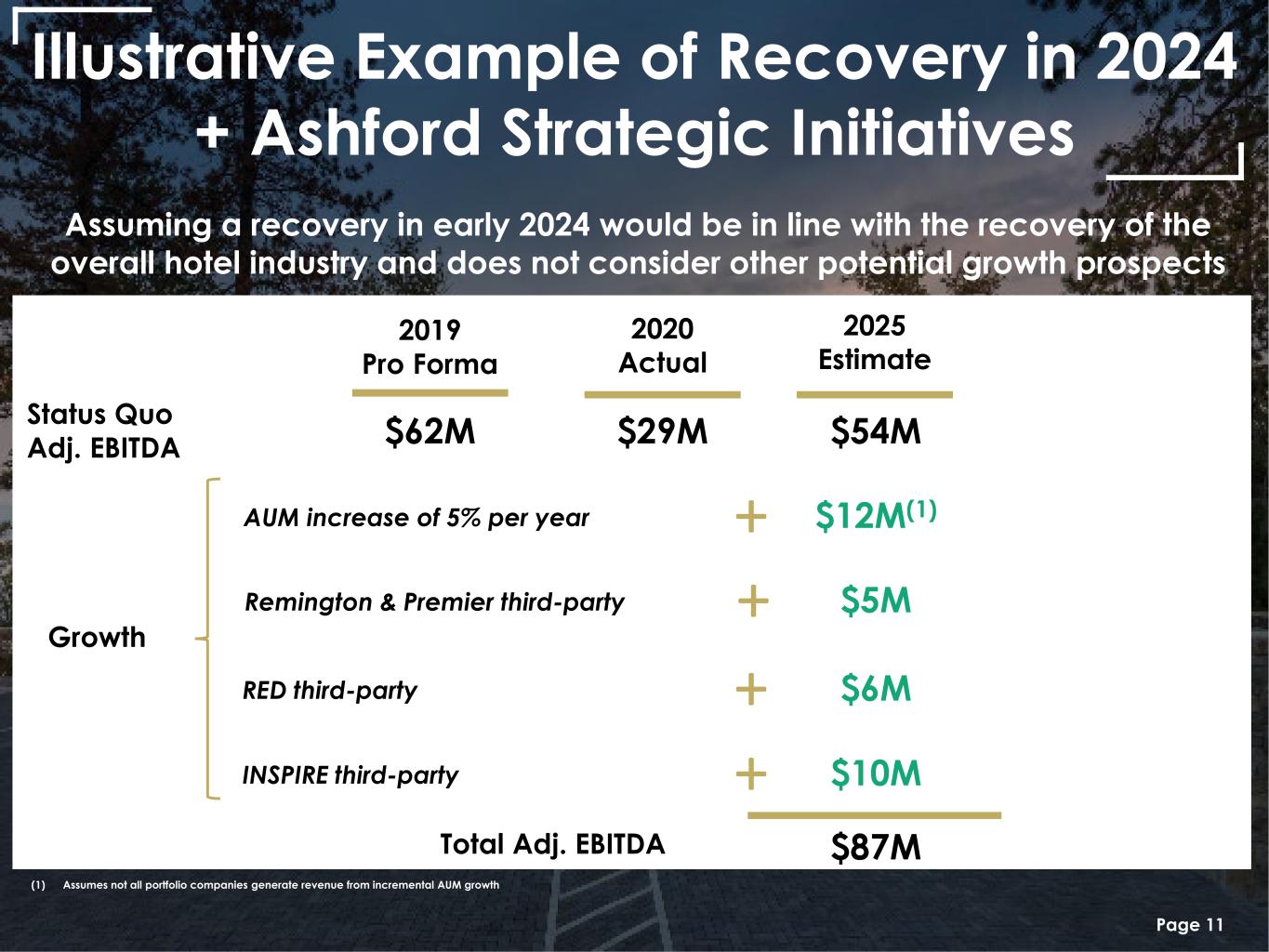

Page 11 Illustrative Example of Recovery in 2024 + Ashford Strategic Initiatives 2019 Pro Forma 2020 Actual Status Quo Adj. EBITDA $62M $29M $54M $5MRemington & Premier third-party + $12M(1)AUM increase of 5% per year + $6MRED third-party + Total Adj. EBITDA $87M $10MINSPIRE third-party + 2025 Estimate (1) Assumes not all portfolio companies generate revenue from incremental AUM growth Growth Assuming a recovery in early 2024 would be in line with the recovery of the overall hotel industry and does not consider other potential growth prospects

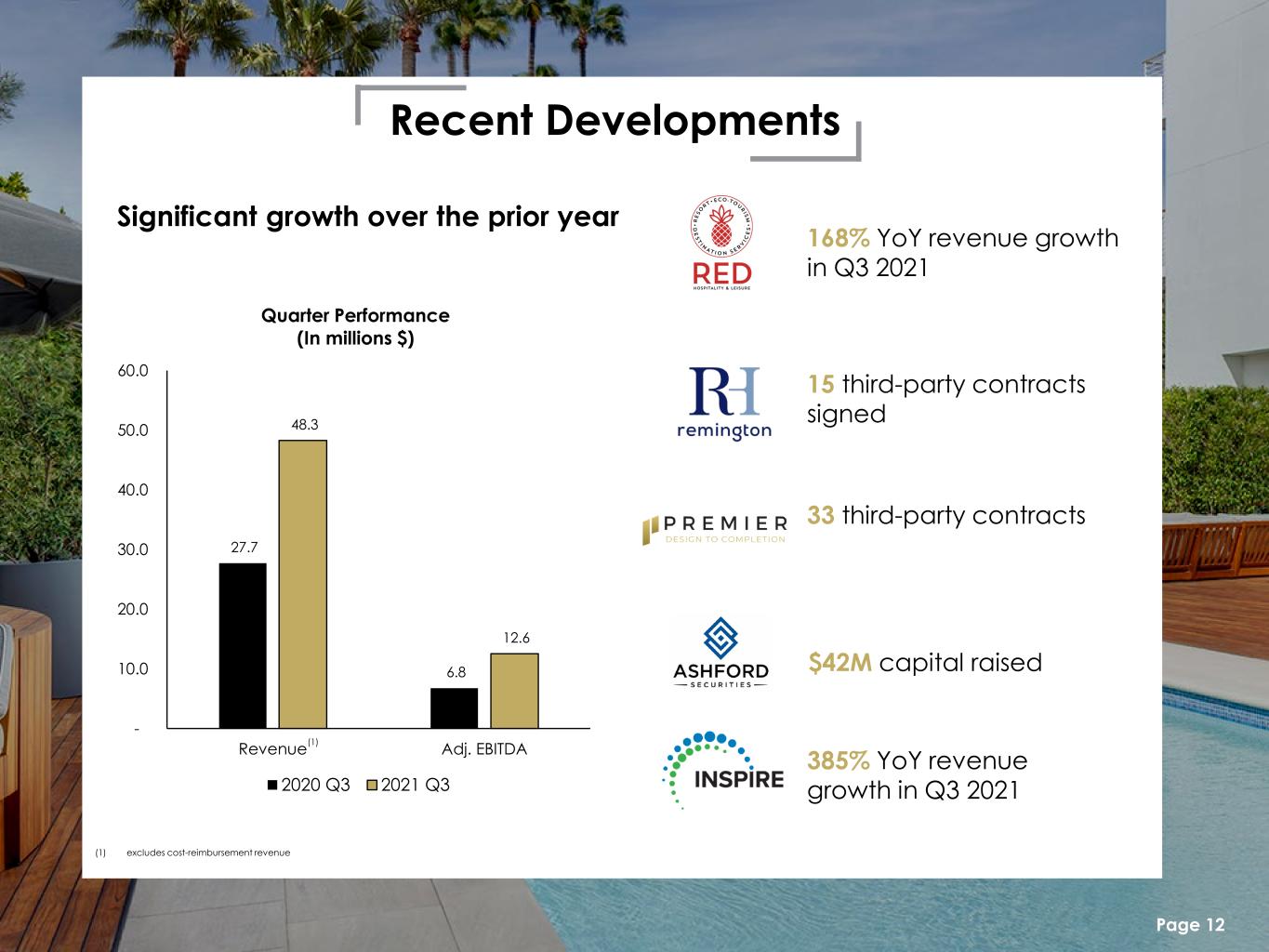

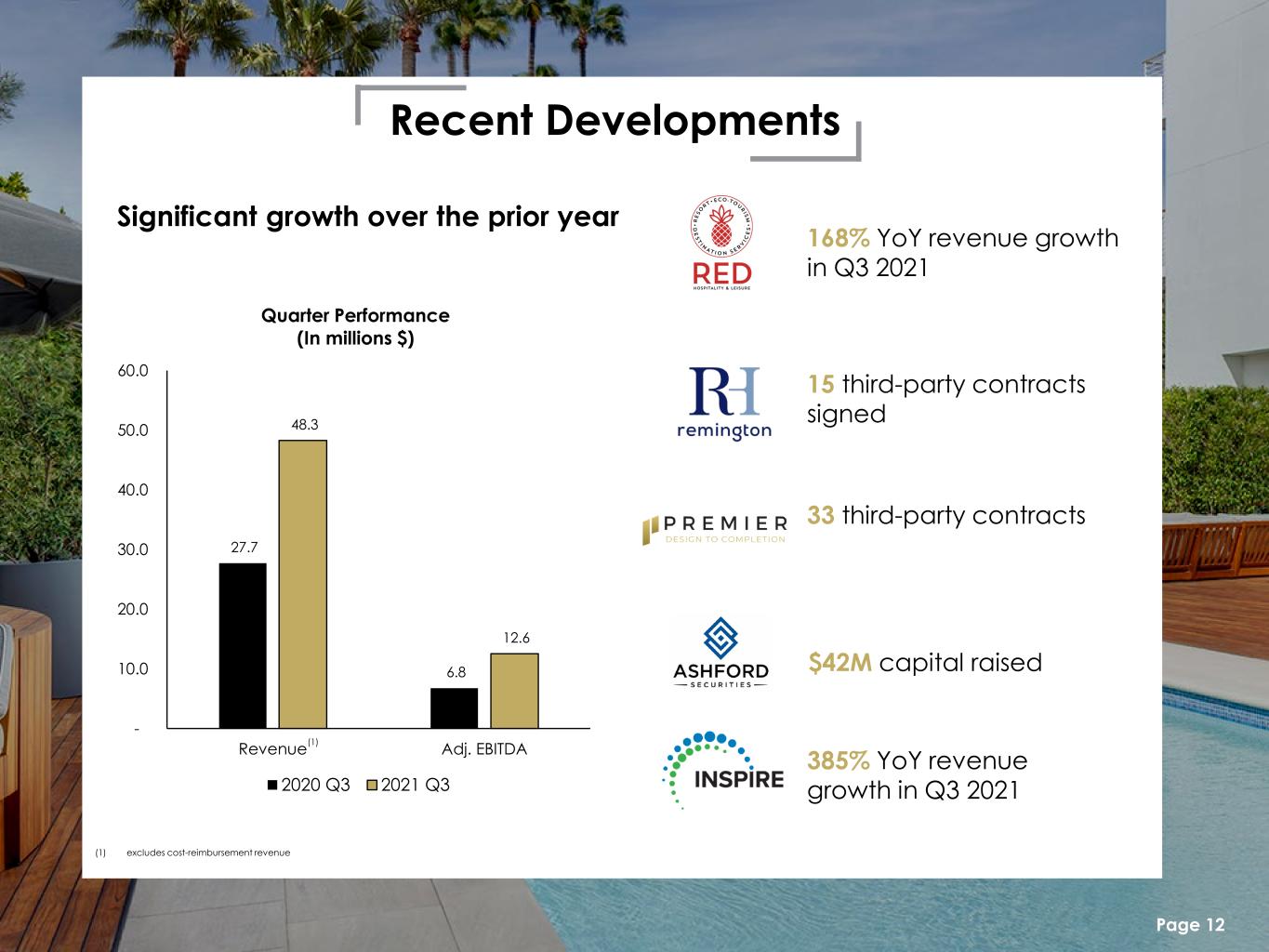

Recent Developments Page 12 168% YoY revenue growth in Q3 2021 15 third-party contracts signed 33 third-party contracts $42M capital raised 385% YoY revenue growth in Q3 2021 27.7 6.8 48.3 12.6 - 10.0 20.0 30.0 40.0 50.0 60.0 Revenue Adj. EBITDA Quarter Performance (In millions $) 2020 Q3 2021 Q3 (1) (1) excludes cost-reimbursement revenue Significant growth over the prior year

Operating Platform Page 13

2019 Revenue(1) $25.6M 2019 Adj. EBITDA $14.0M Summary Premier is an industry leading construction & renovation services company with over 25 years of experience in every facet of the process. The approach is to gain our partners’ trust by thinking and acting like an owner from concept to completion. Highlights Interior Design Architecture Procurement Project Management Construction Development $2B+ Projects Managed 250+ Full Property Renovations Numerous Design Awards (Including 3 from Marriott) (1) Excludes cost reimbursement revenue Page 14 New Third-Party Contracts 33 Achievements

2019 Revenue(1) $34.1M 2019 Adj. EBITDA $21.5M Summary Founded in 1968, Remington is a dynamic and growing hotel management company providing top quality service and expertise in property management. Currently, Remington has 86 hotels under management across 25 states and Washington D.C., representing 17 brands including 13 independent and boutique properties. Highlights 41 Marriott Properties 31 Hilton Properties 2 IHG Properties 1 Hyatt Properties 13 Independent Properties $900M+ Revenue Under Management(2) (1) Excludes cost reimbursement revenue (2) As of 2019 Page 15 Achievements New Third-Party Contracts 15

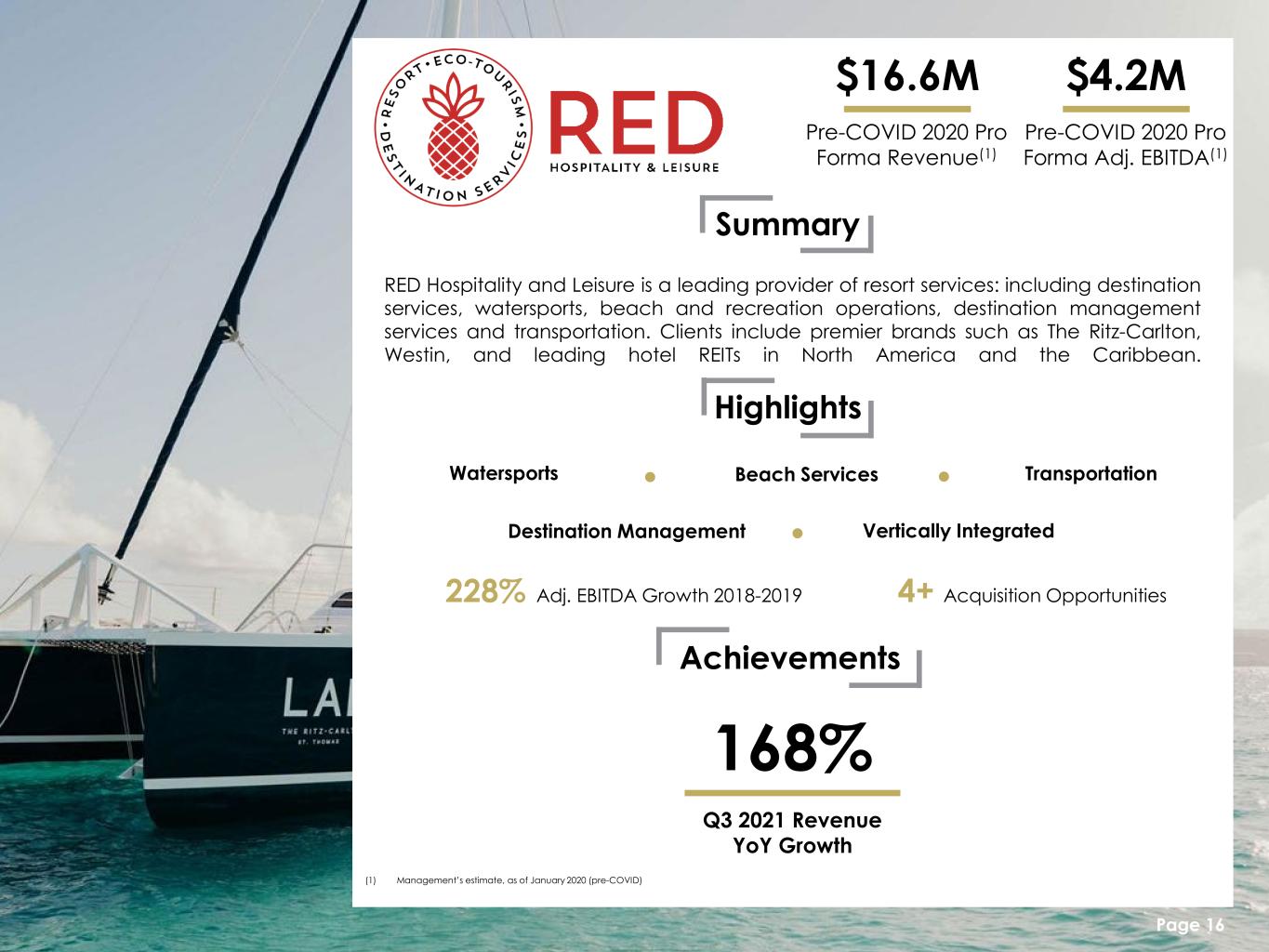

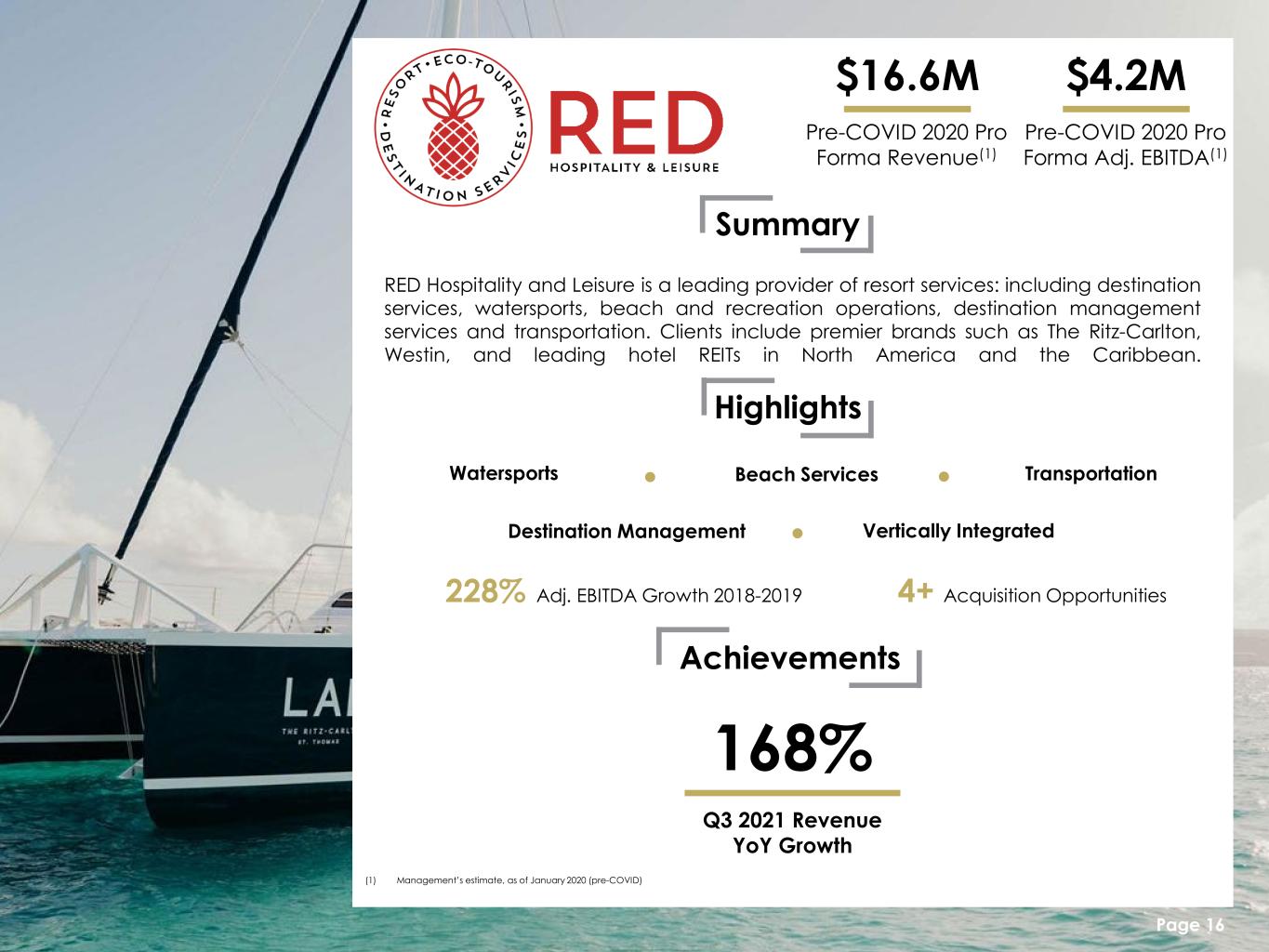

Pre-COVID 2020 Pro Forma Revenue(1) $16.6M Pre-COVID 2020 Pro Forma Adj. EBITDA(1) $4.2M RED Hospitality and Leisure is a leading provider of resort services: including destination services, watersports, beach and recreation operations, destination management services and transportation. Clients include premier brands such as The Ritz-Carlton, Westin, and leading hotel REITs in North America and the Caribbean. Watersports Beach Services Transportation Destination Management Vertically Integrated 228% Adj. EBITDA Growth 2018-2019 4+ Acquisition Opportunities (1) Management’s estimate, as of January 2020 (pre-COVID) Page 16 Summary Highlights Achievements Q3 2021 Revenue YoY Growth 168%

15 Pre-COVID 2020 Pro Forma Revenue(1) $123.7M Pre-COVID 2020 Pro Forma Adj. EBITDA(1) $14.0M Summary Inspire, formerly known as JSAV, is a creative technology company that produces memorable events every day. Its customer-oriented team partners with over 95 hotels and convention centers to deliver more than 2,500 events annually. Inspire is the only audio visual provider owned by a Hospitality company, affording it strategic alignment of operating philosophy and core principals with both hoteliers and their guests. Highlights Event Production Creative Services Digital Events Collaborative Sales Immersive Content Continental Presence 30+ Years of Event Experience$100M+ Annual Revenues (1) Management’s estimate, as of January 2020 (pre-COVID) Page 17 Achievements Q3 2021 Revenue YoY Growth 385%

Annual Recurring Revenue Booked $1.0M Doors Under Contract 27,700 OpenKey is the industry standard for universal mobile keyless entry in hotels. With locations in 10 countries on 3 continents and in over 50 cities, OpenKey is the largest mobile key provider for independent hotels and soft brands worldwide. Contact Free Check-in Secure Digital Keys White-Label Apps Integrated Hardware Multi-Family Offerings Signed MSAs with Major Brands Page 18 Summary Highlights Achievements Q3 2021 Revenue YoY Growth 48%

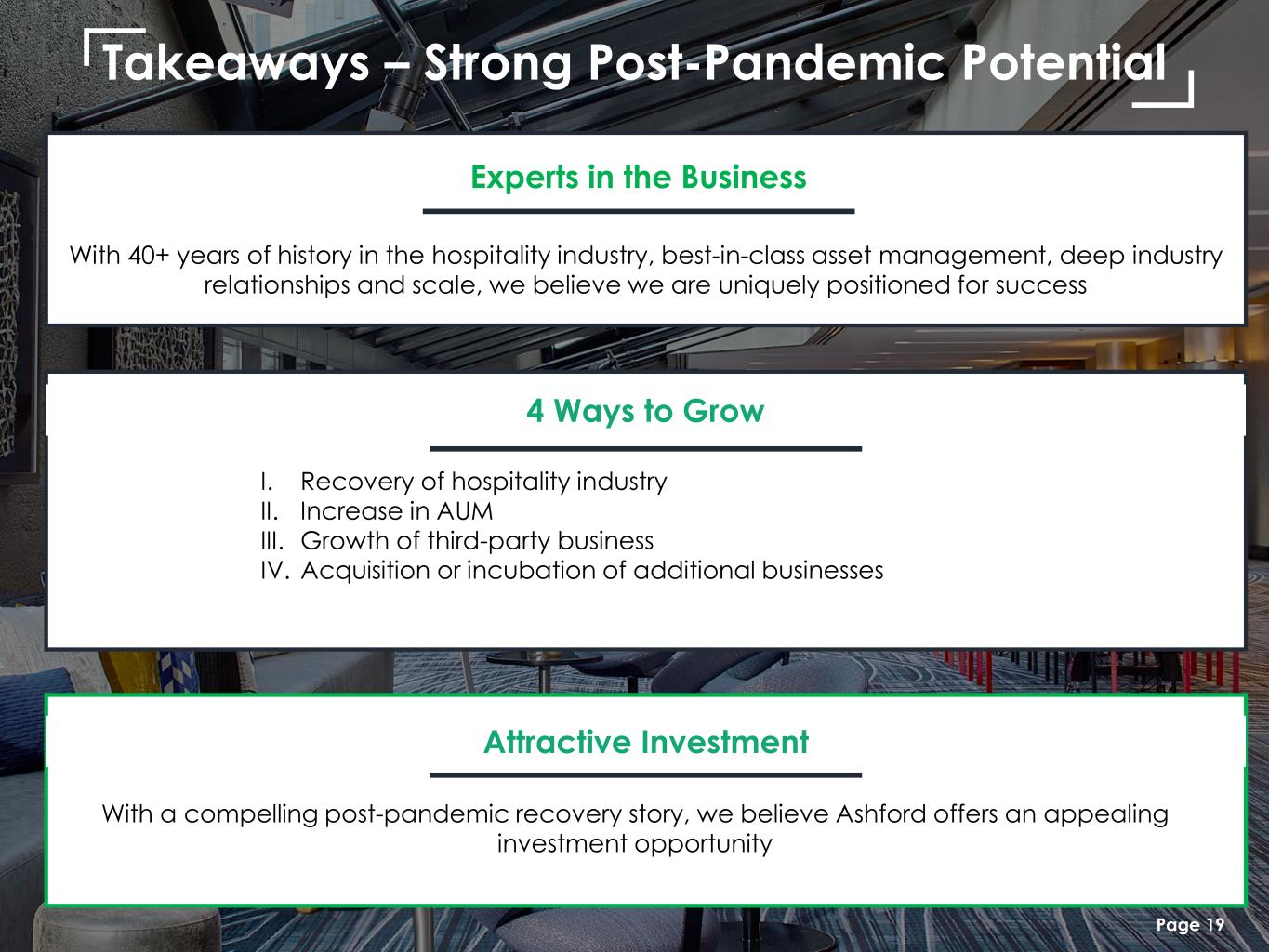

Takeaways – Strong Post-Pandemic Potential I. Recovery of hospitality industry II. Increase in AUM III. Growth of third-party business IV. Acquisition or incubation of additional businesses 4 Ways to Grow Page 19 Attractive Investment With a compelling post-pandemic recovery story, we believe Ashford offers an appealing investment opportunity With 40+ years of history in the hospitality industry, best-in-class asset management, deep industry relationships and scale, we believe we are uniquely positioned for success Experts in the Business

NYSE American: AINC Investor Presentation | January 2022