- NTRA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Natera (NTRA) DEF 14ADefinitive proxy

Filed: 11 Apr 17, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| NATERA, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: $ | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

April 11, 2017

You are cordially invited to attend the 2017 Annual Meeting of Stockholders of Natera, Inc. that will be held on Tuesday, May 23, 2017 at 12:30 p.m. Pacific Time, at 1300 Island Drive, Redwood City, CA 94065.

Details regarding admission to the Annual Meeting and the business to be conducted are described in the accompanying proxy materials. Also included is a copy of our 2016 Annual Report. We encourage you to read this information carefully.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, by telephone or by mailing a proxy card, if you have requested one. Voting over the Internet, by telephone or by written proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend in person. Please review the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail regarding each of these voting options.

Thank you for your ongoing support of Natera.

| Very truly yours, | ||

| ||

Matthew Rabinowitz |

NATERA, INC.

201 Industrial Road, Suite 410

San Carlos, California 94070

NOTICE OF ANNUAL MEETING

FOR 2017 ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: | Tuesday, May 23, 2017 at 12:30 p.m. Pacific Time. | |||

Place: | 1300 Island Drive, Redwood City, CA 94065. | |||

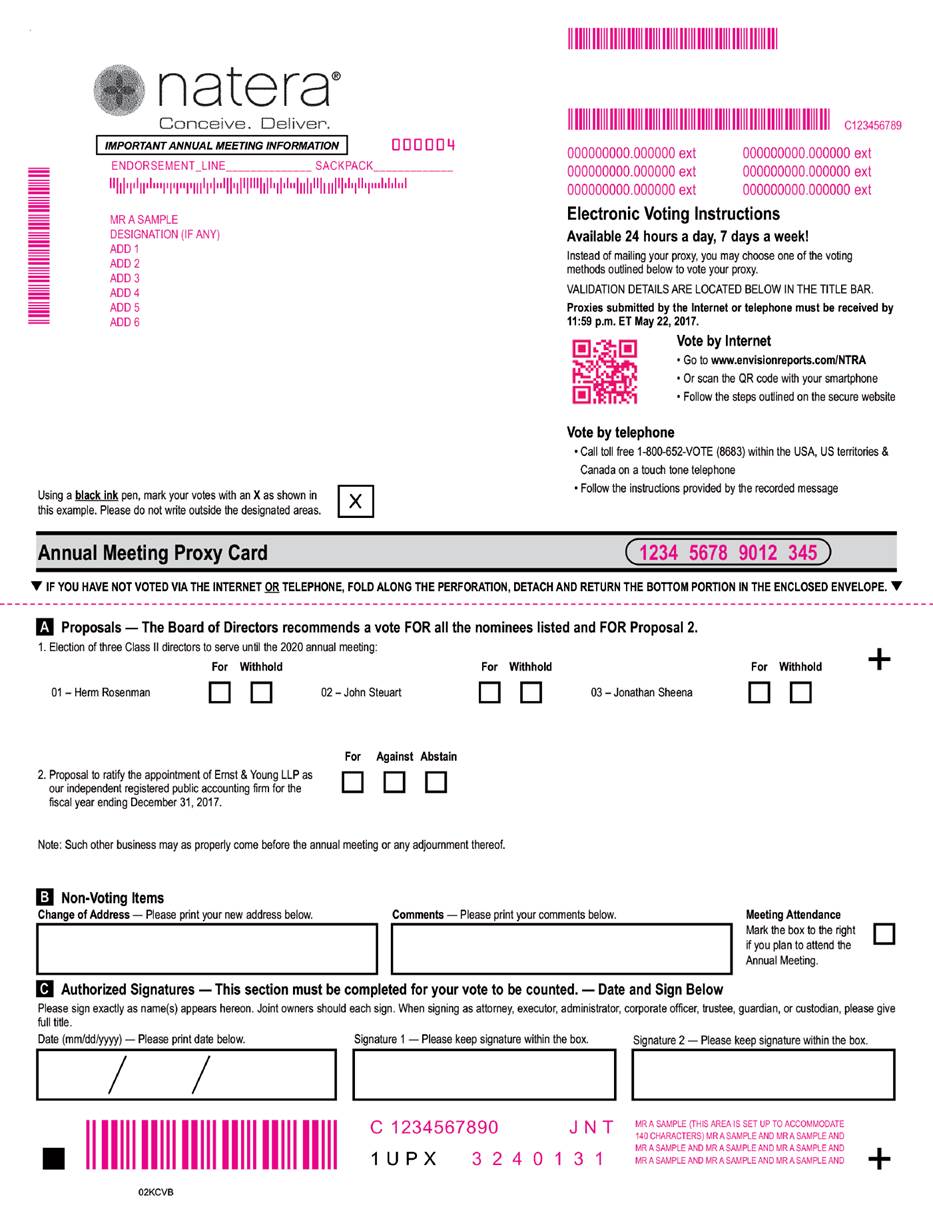

Items of Business: | (1) | To elect the three directors named in the proxy statement accompanying this notice to serve as Class II directors until the annual meeting held in 2020 and until their successors are duly elected and qualified. | ||

(2) | To ratify the appointment of Ernst & Young LLP as Natera, Inc.'s independent registered public accounting firm for the fiscal year ending December 31, 2017. | |||

(3) | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. | |||

These items of business are more fully described in the proxy statement accompanying this notice. | ||||

Adjournments and Postponements: | Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. | |||

Record Date: | You are entitled to vote if you were a stockholder of record as of the close of business on March 31, 2017. | |||

Voting: | Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement and vote on the Internet or by telephone or submit your proxy card, if you have requested one, as soon as possible. For specific instructions on how to vote your shares, please refer to the section entitled "Questions and Answers About Procedural Matters." | |||

A Notice of Internet Availability of Proxy Materials (Notice) has been mailed to stockholders of record on or about April 11, 2017. The Notice contains instructions on how to access our proxy statement for our 2017 Annual Meeting of Stockholders and our 2016 Annual Report to Stockholders on Form 10-K (together, the proxy materials). The Notice also provides instructions on how to vote online, by telephone or by mail and includes instructions on how to receive a paper copy of proxy materials by mail. The proxy materials can be accessed directly at the following Internet address: www.edocumentview.com/NTRA.

If you have any questions regarding this information or the proxy materials, please visit our website at www.natera.com or contact our investor relations department at 650-249-9091 x1471.

All stockholders are cordially invited to attend the Annual Meeting in person.

| By order of the board of directors, | ||

| ||

Matthew Rabinowitz Chief Executive Officer, President and Chairman |

This notice of annual meeting, proxy statement and accompanying form of proxy card are being made available on or about April 11, 2017.

| | Page | |||

|---|---|---|---|---|

QUESTIONS AND ANSWERS ABOUT PROCEDURAL MATTERS | 1 | |||

Annual Meeting | 1 | |||

Stock Ownership | 2 | |||

Quorum and Voting | 2 | |||

Stockholder Proposals and Director Nominations | 6 | |||

Additional Information about the Proxy Materials | 7 | |||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 23, 2017 | 8 | |||

PROPOSAL ONE—ELECTION OF DIRECTORS | 9 | |||

General | 9 | |||

Nominees | 9 | |||

Information Regarding the Nominees and Other Directors | 9 | |||

PROPOSAL TWO—RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 13 | |||

General | 13 | |||

Principal Accounting Fees and Services | 13 | |||

Pre-Approval of Audit and Non-Audit Services | 13 | |||

CORPORATE GOVERNANCE | 15 | |||

Code of Conduct | 15 | |||

Board Composition | 15 | |||

Director Independence | 15 | |||

Board Leadership Structure | 16 | |||

Board Committees | 16 | |||

Stockholder Recommendations for Nominations to the Board of Directors | 18 | |||

Compensation Committee Interlocks and Insider Participation | 18 | |||

Meetings of the Board of Directors | 19 | |||

Board Oversight of Risk | 19 | |||

Director Compensation | 19 | |||

Stockholder Communications with the Board of Directors | 22 | |||

EXECUTIVE OFFICERS | 23 | |||

EXECUTIVE COMPENSATION | 24 | |||

Summary Compensation Table | 24 | |||

Narrative Explanation of Compensation Arrangements with Our Named Executive Officers | 24 | |||

Outstanding Equity Awards at 2016 Fiscal Year-End | 27 | |||

Severance and Change in Control Benefits | 28 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 30 | |||

EQUITY COMPENSATION PLAN INFORMATION | 33 | |||

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 34 | |||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 35 | |||

AUDIT COMMITTEE REPORT | 36 | |||

OTHER MATTERS | 37 | |||

i

NATERA, INC.

201 Industrial Road, Suite 410

San Carlos, California 94070

PROXY STATEMENT FOR 2017 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with solicitation of proxies by our board of directors for use at the 2017 annual meeting of stockholders (the Annual Meeting) to be held at 12:30 p.m. Pacific Time on Tuesday, May 23, 2017, and any postponements or adjournments thereof. The Annual Meeting will be held at 1300 Island Drive, Redwood City, CA 94065. Beginning on or about April 11, 2017, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the Notice) containing instructions on how to access our proxy materials. As used in this proxy statement, the terms "Natera," "we," "us," and "our" mean Natera, Inc. and its subsidiaries unless the context indicates otherwise.

QUESTIONS AND ANSWERS ABOUT PROCEDURAL MATTERS

You can find directions on how to instruct us to send future proxy materials to you by email at www.edocumentview.com/NTRA. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our annual meetings on the environment. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

1

Beneficial owners—Many Natera stockholders hold their shares through a broker, trustee or other nominee, rather than directly in their own name. If your shares are held in a brokerage account or by a bank or another nominee, you are considered the "beneficial owner" of shares held in "street name." The Notice was forwarded to you by your broker, trustee or nominee who is considered, with respect to those shares, the stockholder of record.

As the beneficial owner, you have the right to direct your broker, trustee or nominee on how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since beneficial owners are not stockholders of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker's procedures for obtaining a legal proxy. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction card for you to use.

2

stockholders of Natera. Each holder of common stock will have the right to one vote per share of common stock. A proxy submitted by a stockholder may indicate that the shares represented by the proxy are not being voted ("withhold," or "abstain") with respect to a particular matter.

Under the General Corporation Law of the State of Delaware and our bylaws, abstentions and broker "non-votes" are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting.

A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Beneficial owners—If you are a beneficial owner holding shares through a bank, broker or other nominee, please refer to your Notice or other information forwarded by your bank or broker to see which voting options are available to you.

3

Proposal Two—The affirmative vote of a majority of votes cast is required to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

then the persons named as proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

If you are a stockholder of record and you do not return a proxy card and do not vote your shares, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

4

Beneficial owners—If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote on "routine" matters but cannot vote on "non-routine" matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote."

Please note that brokers may not vote your shares on the election of directors in the absence of your specific instructions as to how to vote, so we encourage you to provide instructions to your broker regarding the voting of your shares.

If you are a stockholder of record, you may change your vote by (i) filing with our Corporate Secretary, prior to your shares being voted at the Annual Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy card relating to the same shares, or (ii) by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not, by itself, revoke a proxy). A stockholder of record that has voted on the Internet or by telephone may also change his or her vote by later making a timely and valid Internet or telephone vote.

If you are a beneficial owner of shares held in street name, you may change your vote (i) by submitting new voting instructions to your broker, trustee or other nominee or (ii) if you have obtained a legal proxy from the broker, trustee or other nominee that holds your shares giving you the right to vote the shares, by attending the Annual Meeting and voting in person.

Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to our Corporate Secretary or should be sent so as to be delivered to our principal executive offices, Attention: Corporate Secretary.

5

Stockholder Proposals and Director Nominations

Requirements for stockholder proposals to be considered for inclusion in our proxy materials—Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at our 2018 annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. In order to be included in the proxy statement for the 2018 annual meeting of stockholders, stockholder proposals must be received by our Corporate Secretary no later than December 12, 2017, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the Exchange Act).

Requirements for stockholder proposals to be brought before an annual meeting—In addition, our bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by our board of directors or any committee thereof or any stockholder, who (i) is a stockholder of record on the date of the giving of such notice and on the record date for the determination of stockholders entitled to vote at such meeting, (ii) is entitled to vote at such meeting, and (iii) has delivered written notice to our Corporate Secretary no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations.

6

Our bylaws also provide that the only business that may be conducted at an annual meeting is business that is (i) specified in the notice of meeting (or any supplement thereto) given by or at the direction of our board of directors, (ii) otherwise properly brought before the meeting by or at the direction of our board of directors (or any committee thereof) or (iii) properly brought before the meeting by a stockholder who has delivered written notice to our Corporate Secretary no later than the Notice Deadline (as defined below).

The "Notice Deadline" is defined as that date which is not less than 90 days nor more than 120 days prior to the one year anniversary of the previous year's annual meeting of stockholders. As a result, the Notice Deadline for the 2018 annual meeting of stockholders is between January 23, 2018 and February 22, 2018.

If a stockholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we need not present the proposal for vote at such meeting.

Recommendation of director candidates—You may recommend candidates to our board of directors for consideration by our nominating and corporate governance committee by following the procedures set forth below in "Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors."

Additional Information about the Proxy Materials

7

to access and receive separate proxy cards. Upon written request, we will deliver promptly a separate copy of the Notice and, if applicable, the proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of the Notice and, if applicable, the proxy materials, stockholders should send their requests to our principal executive offices, Attention: Corporate Secretary. Stockholders who hold shares in street name (as described below) may contact their brokerage firm, bank, broker-dealer, or other similar organization to request information about householding.

Any written requests for additional information, copies of the proxy materials and 2016 Annual Report, notices of stockholder proposals, recommendations for candidates to our board of directors, communications to our board of directors or any other communications should be sent to the address above.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON MAY 23, 2017.

The proxy statement and annual report to stockholders is available at www.edocumentview.com/NTRA.

8

PROPOSAL ONE

ELECTION OF DIRECTORS

Our board of directors may establish the authorized number of directors from time to time by resolution. The number of authorized directors is currently nine. Our board of directors is currently comprised of nine members who are divided into three classes with staggered three-year terms. A director serves in office until his or her respective successor is duly elected and qualified or until his or her earlier death or resignation. Our certificate of incorporation and bylaws that are in effect authorize only our board of directors to fill vacancies on our board of directors until the next annual meeting of stockholders. Any additional directorships resulting from an increase in the authorized number of directors would be distributed among the three classes so that, as nearly as possible, each class would consist of one-third of the authorized number of directors. Your proxy cannot be voted for a greater number of persons than the number of nominees named in this proxy statement.

Three Class II directors have been nominated for election at the Annual Meeting, each for a three-year term expiring in 2020. Upon the recommendation of our nominating and corporate governance committee, our board of directors has nominatedHerm Rosenman, John Steuart andJonathan Sheena for election as Class II directors. The term of office of each person elected as director will continue until such director's term expires in 2020, or until such director's successor has been duly elected and qualified.

Information Regarding the Nominees and Other Directors

Nominees for Class II Directors for a Term Expiring in 2020

Herm Rosenman, 69, has served as a member of our board of directors since February 2017, and served as our Chief Financial Officer from February 2014 to January 2017. Dr. Rabinowitz, our Chief Executive Officer, as well as several non-employee members of our board of directors, recommended Mr. Rosenman to the board of directors as a director candidate. Prior to joining our company, he held the position of senior vice president—finance and chief financial officer at Gen-Probe Incorporated, a developer, manufacturer and marketer of diagnostic and screening products using nucleic acid probes, from June 2001 to August 2012, when Gen-Probe was acquired by Hologic, Inc., a diagnostic products, medical imaging systems, and surgical products company. From August 2012 to February 2014, Mr. Rosenman focused on his board memberships. Mr. Rosenman has served on the board of directors of Oxford Immunotec Global PLC, a commercial-stage diagnostics company, since 2013, and of Vivus, Inc., a biopharmaceutical company, since 2013. Mr. Rosenman also previously served on the board of directors of Medistem, Inc., a stem cell therapy company, ARYx Therapeutics Inc., a private drug discovery and development company, Infinity Pharmaceuticals, Inc., a drug discovery and development company, and a number of privately held companies. Our board of directors believes that Mr. Rosenman is qualified to serve as a director based on his experience as our Chief Financial Officer and his experience in the biopharmaceutical industry. Mr. Rosenman holds a B.B.A. in accounting and finance from Pace University and an M.B.A. in finance from the Wharton School of the University of Pennsylvania.

John Steuart, 55, has served as a member of our board of directors since 2007. Mr. Steuart has been a managing director at Prolog Ventures, a venture capital firm, since 2013. From 2012 to 2013, Mr. Steuart served as an independent consultant. From 2004 to 2012, Mr. Steuart served as a managing director at Claremont Creek Ventures, a venture capital firm. Mr. Steuart currently serves on the boards of directors of a number of private companies. Mr. Steuart holds a Bachelor of Science degree

9

in Economics from the University of California, Berkeley. Our board of directors believes that Mr. Steuart is qualified to serve as a director based on his financial and managerial experience, his service on other private company boards of directors and his familiarity with technology companies. Mr. Steuart currently serves as the chair of our audit committee and also serves on our compensation committee.

Jonathan Sheena, 44, is a co-founder of our company and has served as a member of our board of directors and as our Chief Technology Officer since 2007. In 1999, Mr. Sheena co-founded PhoneSpots, Inc. (formerly PocketThis, Inc.), a mobile technology company serving mobile carriers worldwide. Mr. Sheena holds a Bachelor of Science in Electrical Engineering and Computer Science, and a Master of Engineering in Electrical Engineering and Computer Science, from the Massachusetts Institute of Technology. Our board of directors believes that Mr. Sheena is qualified to serve as a director based on his experience as our co-founder and Chief Technology Officer, his experience with entrepreneurial companies, and his particular familiarity with technology companies.

Incumbent Class III Directors Whose Term Expires in 2018

Roelof F. Botha, 43, has served as a member of our board of directors since 2007. Mr. Botha has been with Sequoia Capital, a venture capital firm, since 2003, and has been a managing member of Sequoia Capital Operations, LLC since 2007. From 2000 to 2003, Mr. Botha served in a number of roles at PayPal, Inc., ultimately as the chief financial officer. Mr. Botha currently serves on the board of directors of Square, Inc., a provider of payments, financial and marketing services, and a number of private companies. Mr. Botha holds a Bachelor of Science in Actuarial Science, Economics, and Statistics from the University of Cape Town and an M.B.A. from Stanford University. Our board of directors believes that Mr. Botha is qualified to serve as a director based on his financial and managerial experience, his service on other public and private company boards of directors and his familiarity with technology companies. Mr. Botha is our Lead Independent Director and currently serves on our audit committee and nominating and corporate governance committee.

Todd Cozzens, 61, has served as a member of our board of directors since 2011. Mr. Cozzens has been a managing partner at Leerink Capital Partners, an asset management firm, since 2015. Mr. Cozzens was a consultant with Sequoia Capital, a venture capital firm, from 2012 to 2015. From 2010 to 2012, Mr. Cozzens served as chief executive officer of Optum Accountable Care Solutions, a business unit of Optum/UnitedHealth Group. From 2000 to 2010, Mr. Cozzens served as chief executive officer of Picis Inc., a provider of electronic medical record software to hospitals, until its acquisition by the UnitedHealth Group in 2010. Mr. Cozzens currently serves on the boards of directors of a number of private companies. Mr. Cozzens holds a Bachelor of Arts degree from Marquette University, and completed the Program for Management Development at Harvard University. Our board of directors believes that Mr. Cozzens is qualified to serve as a director based on his financial and managerial experience, his service on private company boards of directors and his experience with healthcare technology and information systems. Mr. Cozzens currently serves as the chair of our compensation committee and also serves on our audit committee.

Matthew Rabinowitz, Ph.D., 44, is a co-founder of our company and has served as a member of our board of directors and as our Chief Executive Officer since 2005 and as Chairman of our board of directors since May 2015. Prior to co-founding our company, Dr. Rabinowitz served from 2000 to 2003 as chief executive officer and from 2003 to 2007 as chief technology officer of Rosum Corporation, a location services technology company. Dr. Rabinowitz has multiple publications in signal processing, machine learning, bio-informatics, and high-throughput genetic testing. He received the Scott Helt Memorial Award from the Institute of Electrical and Electronics Engineers and received Technology Pioneer Awards from the World Economic Forum for founding Rosum Corporation and Natera. He currently serves on the board of directors of a private company. Dr. Rabinowitz holds a Bachelor of Science degree in Engineering and Physics, a Master of Science in Electrical Engineering, and a

10

Ph.D. in Electrical Engineering, from Stanford University. Our board of directors believes that Dr. Rabinowitz is qualified to serve as a director based on his experience as our co-founder and Chief Executive Officer, his service on a private company board, and his experience in the technology industry.

Incumbent Class I Directors Whose Term Expires in 2019

James I. Healy, M.D., Ph.D., 52, has served as a member of our board of directors since November 2014. Dr. Healy has been a general partner at Sofinnova Ventures, a venture capital firm, since 2000. Prior to Sofinnova Ventures, Dr. Healy held various positions at Sanderling Ventures, a venture capital firm, Bayer Healthcare Pharmaceuticals (as successor to Miles Laboratories), a research based pharmaceutical company and ISTA Pharmaceuticals, Inc., a company specializing in ophthalmic pharmaceutical products. Dr. Healy is currently on the board of directors of Ascendis Pharma A/S, a clinical-stage biopharmaceutical company; Auris Medical Holding AG, a specialty pharmaceutical company focused on tinnitus; Coherus BioSciences, Inc., a biologics platform company; Edge Therapeutics, a clinical-stage biotechnology company; Obseva SA, a clinical-stage biopharmaceutical company; and several private companies. Previously, Dr. Healy served as a board member of Anthera Pharmaceuticals, Inc., a biopharmaceutical company focused on inflammation and autoimmune diseases; Amarin Corporation plc, a commercial-stage biopharmaceutical company; Durata Therapeutics, Inc., a pharmaceutical company focused on infectious and acute diseases; InterMune, Inc., a biotechnology company focused on orphan fibrotic pulmonary disease; KaloBios Pharmaceuticals, Inc., a biopharmaceutical company focused on the development of monoclonal antibody therapeutics; Hyperion Therapeutics, Inc., a commercial-stage orphan disease company; and a number of private companies. Dr. Healy holds a Bachelor of Arts in Molecular Biology and Scandinavian Studies from the University of California at Berkeley, and an M.D. and Ph.D. in Immunology from Stanford University School of Medicine. Our board of directors believes that Dr. Healy is qualified to serve as a director due to his significant medical background, extensive experience investing and working in the life science industry, and his extensive service on the boards of directors of other public and private life sciences companies. Dr. Healy currently serves as the chair of our nominating and corporate governance committee and also serves on our compensation committee.

Edward C. Driscoll, Jr., Ph.D., 64, has served as a member of our board of directors since 2007. Dr. Driscoll has been a partner with Decheng Capital, a venture capital firm, since October 2016, and has been a partner with Claremont Creek Ventures, a venture capital firm, since 2006, first as a venture partner, then a technology partner, and, since 2012, a director. Dr. Driscoll currently serves on the boards of directors of a number of private companies. In addition, from 2005 to 2013, Dr. Driscoll was an angel investor with Health Tech Capital, Silicom Ventures and Sand Hill Angels. From December 1995 to April 2005, Dr. Driscoll was founder, president and chief executive officer of Be Here Corporation, an internet, broadcast and videoconferencing technology company. From June 1993 to June 1995, Dr. Driscoll served as chief executive officer of Focus Surgery, Inc., a non-invasive surgical equipment company. From December 1987 to June 1993, Dr. Driscoll held various roles at Diasonics, a digital imaging and medical device company. Dr. Driscoll holds a Bachelor of Arts in Photography and Computer Science from the University of Pennsylvania, a Master of Architecture and Master of Landscape Architecture from Harvard University , and a Ph.D. in Digital Imaging from Stanford University. Our board of directors believes that Dr. Driscoll is qualified to serve as a director based on his over 30 years of experience in the medical diagnostics field, his financial and managerial expertise, and service on other private company boards of directors. Dr. Driscoll currently serves on our nominating and corporate governance committee.

Gail Marcus, 60, joined our board of directors in March 2017. Ms. Marcus has served as a consultant and practice leader in the healthcare consulting practice of Exceptional Leaders International, a consulting company, since 2015, and as an Assistant Professor & Director of the Global

11

Healthcare Management and Biomedical Informatics programs at the Massachusetts College of Pharmacy and Health Sciences since 2016. From 2012 to 2015, Ms. Marcus served as Chief Executive Officer and President of Calloway Laboratories, a provider of clinical toxicology laboratory services. Prior to that, Ms. Marcus held a variety of leadership roles with diagnostics, pharmacy benefit management and managed care companies. Ms. Marcus currently serves on the boards of directors of a private company and a non-profit organization, and sits on the Centers for Medicare & Medicaid Services Advisory Panel on Clinical Diagnostic Laboratory Tests. Our board of directors believes that Ms. Marcus is qualified to serve as a director based on her financial and managerial experience and service on other boards of directors. Ms. Marcus holds a Bachelor of Art in Spanish and Mathematics from Wesleyan University, an M.S.E. in Computer and Information Sciences from the University of Pennsylvania Moore School of Engineering, an M.B.A. from the Wharton School of the University of Pennsylvania, and is pursuing a Doctorate of Health Administration from the Medical University of South Carolina.

There are no family relationships among any of our directors or executive officers. See "Corporate Governance" and "Corporate Governance—Director Compensation" below for additional information regarding our board of directors.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE CLASS II NOMINEES NAMED ABOVE.

12

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed the firm of Ernst & Young LLP, independent registered public accountants, to audit our financial statements for the year ending December 31, 2017. Ernst & Young LLP has audited our financial statements since the year ended December 31, 2011.

Notwithstanding its selection and even if our stockholders ratify the selection, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during the year if the audit committee believes that such a change would be in the best interests of the company and its stockholders.

At the Annual Meeting, the stockholders are being asked to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2017. Our audit committee is submitting the selection of Ernst & Young LLP to our stockholders because we value our stockholders' views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of Ernst & Young LLP will be present at the Annual Meeting and they will have an opportunity to make statements and will be available to respond to appropriate questions from stockholders.

If this proposal does not receive the affirmative approval of a majority of the votes cast on the proposal, the audit committee would reconsider the appointment.

Principal Accounting Fees and Services

The following table sets forth all fees paid or accrued by us for professional audit services and other services rendered by Ernst & Young LLP during the years ended December 31, 2016 and 2015:

| | 2016 | 2015 | |||||

|---|---|---|---|---|---|---|---|

Audit Fees(1) | $ | 1,089,075 | $ | 1,821,969 | |||

Audit-Related Fees | — | — | |||||

Tax Fees(2) | 17,000 | 45,833 | |||||

All Other Fees | — | — | |||||

| | | | | | | | |

Total Fees | $ | 1,106,075 | $ | 1,867,802 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Pre-Approval of Audit and Non-Audit Services

Consistent with requirements of the SEC and the Public Company Accounting Oversight Board regarding auditor independence, our audit committee is responsible for the appointment, compensation and oversight of the work of our independent registered public accounting firm. In recognition of this responsibility, our audit committee, or the chair if such approval is needed between meetings of the audit committee, generally pre-approves of all audit and permissible non-audit services provided by the

13

independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2017.

14

Our board of directors has adopted a code of conduct that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior officers. The full text of our code of conduct is posted in the Investor Relations section of our website at http://investor.natera.com. We intend to disclose future amendments to, or waiver of, our code of conduct, at the same location on our website identified above.

Our business affairs are managed under the direction of our board of directors, which is currently composed of nine members. Six of our directors—Messrs. Botha, Cozzens and Steuart, Drs. Driscoll and Healy, and Ms. Marcus—are independent within the meaning of the listing rules of the Nasdaq Global Select Market (Nasdaq). Our board of directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election.

Directors in a particular class will be elected for three-year terms at the annual meeting of stockholders in the year in which their terms expire. As a result, only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Each director's term continues until the election and qualification of his or her successor or the earlier of his or her death, resignation or removal. The classification of our board of directors may have the effect of delaying or preventing changes in our control or management.

Our common stock is listed on Nasdaq. The listing rules of this stock exchange generally require that a majority of the members of a listed company's board of directors be independent. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company's audit, compensation, and nominating and corporate governance committees be independent. Under Nasdaq rules, a director will only qualify as an "independent director" if, in the opinion of that company's board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our board of directors has determined that none of our non-employee directors has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under Nasdaq rules. The independent members of our board of directors will hold separate regularly scheduled executive session meetings at which only independent directors are present.

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors, or any other board committee: accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or be an affiliated person of the listed company or any of its subsidiaries. Each member of our audit committee, Messrs. Botha, Cozzens and Steuart, qualifies as an independent director pursuant to Rule 10A-3.

15

Pursuant to our Corporate Governance Guidelines, our board of directors may separate or combine the roles of the chairman of the board of directors and chief executive officer when and if it deems it advisable and in our best interests and in the best interests of our stockholders to do so. These roles are currently combined as our board of directors is currently chaired by Dr. Rabinowitz, who is also our Chief Executive Officer. The board of directors believes that it is in the best interest of the company and its stockholders for Dr. Rabinowitz to serve in both roles given his knowledge of our company and industry.

In addition, pursuant to our Corporate Governance Guidelines, if the chairman of our board of directors is not an independent director, the board of directors will appoint a Lead Independent Director to facilitate communication between management, the independent directors and the chairman of our board of directors, as well as participate in setting agendas for meetings and presiding at executive sessions of the board of directors. Our board of directors has appointed Mr. Botha as the current Lead Independent Director.

Our board of directors believes that having a combined chairman and chief executive officer, along with a Lead Independent Director, is the appropriate leadership structure for us at this time. We believe that this structure provides appropriate leadership and oversight of the company and facilitates effective functioning of both management and the board of directors. Our Corporate Governance Guidelines are posted in the Investor Relations section of our website at http://investor.natera.com.

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. Our board of directors and its committees set schedules for meeting throughout the year and can also hold special meetings and act by written consent from time to time, as appropriate. Our board of directors has delegated various responsibilities and authority to its committees as generally described below. The committees will regularly report on their activities and actions to the full board of directors. Each member of each committee of our board of directors qualifies as an independent director in accordance with Nasdaq listing standards. Each committee of our board of directors has a written charter approved by our board of directors. Copies of each charter are posted in the Investor Relations section of our website at http://investor.natera.com.

Audit Committee

Our audit committee was established in May 2015. During the year ended December 31, 2016, our audit committee held four meetings. The members of our audit committee are comprised of Messrs. Botha, Cozzens and Steuart, each of whom is independent under the rules and regulations of the SEC and the listing standards of Nasdaq applicable to audit committee members and each of whom can read and understand fundamental financial statements. Mr. Steuart serves as chair of the audit committee. Our board of directors has determined that Mr. Steuart qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of Nasdaq.

The audit committee of our board of directors oversees our accounting practices, system of internal controls, audit processes and financial reporting processes. Among other things, our audit committee is responsible for reviewing our disclosure controls and processes and the adequacy and effectiveness of our internal controls. It also discusses the scope and results of the audit with our independent registered public accounting firm, reviews with our management and our independent registered public accounting firm our interim and year-end operating results and, as appropriate, initiates inquiries into aspects of our financial affairs. Our audit committee is responsible for establishing procedures for the receipt, retention and treatment of complaints regarding accounting,

16

internal accounting controls or auditing matters, and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. In addition, our audit committee has sole and direct responsibility for the appointment, retention, compensation and oversight of the work of our independent registered public accounting firm, including approving services and fee arrangements. Significant related party transactions will be approved by our audit committee before we enter into them, as required by applicable rules and listing standards.

Compensation Committee

Our compensation committee was established in October 2013. During the year ended December 31, 2016, our compensation committee held four meetings. The members of our compensation committee are Messrs. Cozzens and Steuart and Dr. Healy, each of whom our board of directors has determined qualify as independent under Rule 10C of the Exchange Act and related Nasdaq listing standards, and each of whom is an "outside director" as such term is defined under Section 162(m) of the Internal Revenue Code of 1986, as amended, and a "non-employee director" as such term is defined under Rule 16b-3 of the Exchange Act. Mr. Cozzens serves as chair of the compensation committee. The purpose of our compensation committee is to discharge the responsibilities of our board of directors relating to compensation policies and programs. Among other things, specific responsibilities of our compensation committee include evaluating the performance of our chief executive officer and determining our chief executive officer's compensation. The compensation committee also determines the compensation of our other executive officers in consultation with our chief executive officer. In addition, our compensation committee administers our stock-based compensation plans, including granting equity awards and approving modifications of such awards. Our compensation committee also reviews and approves various other compensation policies and matters.

During our year ended December 31, 2016, our compensation committee engaged the services of Radford, a compensation consulting firm, to advise the compensation committee regarding the amount and types of compensation that we provide to our executive and senior officers and directors and how our compensation practices compared to the compensation practices of other companies. Radford reports directly to the compensation committee. Radford does not provide any services to us other than the services provided to the compensation committee. The compensation committee believes that Radford does not have any conflicts of interest in advising the compensation committee under applicable SEC rules or Nasdaq listing standard.

Our executive officers may make recommendations on the form and amount of executive compensation, but the compensation committee makes the final decision and is not bound by executive officer recommendations. Our compensation committee has delegated authority to a committee of executive officers to grant options and restricted stock units to employees who (i) are not "officers" under Rule 16a-1(f) under the Securities Exchange Act of 1934, as amended or (ii) do not report directly to our Chief Executive Officer.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee was established in May 2015. During the year ended December 31, 2016, our nominating and corporate governance committee held two meetings. The members of our nominating and corporate governance committee are Mr. Botha and Drs. Driscoll and Healy, each of whom is independent under the rules and regulations of the SEC and Nasdaq. Dr. Healy serves as chair of the nominating and corporate governance committee. The nominating and corporate governance committee oversees the nomination of directors, including, among other things, identifying, evaluating and making recommendations of nominees to our board of directors and evaluates the performance of our board of directors and individual directors. Our nominating and corporate governance committee is also responsible for reviewing developments in

17

corporate governance practices, evaluating the adequacy of our governance practices and making recommendations to our board of directors concerning corporate governance matters.

When considering potential candidates for membership on our board of directors, our nominating and corporate governance committee considers relevant business and other experience and demonstrated character and judgment as described in our Policies and Procedures for Director Candidates, which are posted in the Investor Relations section of our website at http://investor.natera.com. There are no differences in the manner in which our nominating and corporate governance committee evaluates a candidate that is recommended for nomination for membership on our board of directors by a stockholder, as opposed to a candidate that is recommended for nomination for membership on the board of directors by our nominating and corporate governance committee and our board of directors.

In addition to the considerations described above, our nominating and corporate governance committee considers the current composition of the board of directors in its evaluation of candidates for membership. The board of directors believes that factors such as range and diversity of expertise, perspective in areas relevant to our business, character, judgment, diversity, age, independence, expertise, experience, length of service and other commitments as it relates to each individual board member as well as the board of directors as a whole are important considerations in determining board composition. The nominating and corporate governance committee believes that, as a group, the nominees for election at the Annual Meeting complement the overall composition of our board of directors and bring a diverse range of backgrounds, experiences and perspectives to the board of directors' deliberations.

The nominating and corporate governance committee will consider stockholder nominations for directors submitted in accordance with the procedure set forth in our bylaws and Policies and our Procedures for Director Candidates, which are each posted in the Investor Relations section of our website at http://investor.natera.com, as further described below under "Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors." Our nominating and corporate governance committee has not received any recommended nominations from any of our stockholders in connection with the 2017 Annual Meeting.

Stockholder Recommendations for Nominations to the Board of Directors

Our nominating and corporate governance committee has adopted Policies and Procedures for Director Candidates. Stockholder recommendations for candidates to our board of directors must be received by December 31st of the year prior to the year in which the recommended candidates will be considered for nomination, must be directed in writing to Natera, Inc., 201 Industrial Road, Suite 410, San Carlos, CA 94070, Attention: Corporate Secretary, and must include the candidate's name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between us and the candidate within the last three years and evidence of the recommending person's ownership of our capital stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for membership on the board of directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, other commitments and the like, personal references and an indication of the candidate's willingness to serve.

Compensation Committee Interlocks and Insider Participation

As noted above, during the year ended December 31, 2016 and currently, the compensation committee of our board of directors is comprised of Messrs. Cozzens and Steuart and Dr. Healy. None of our executive officers serves, or served during our year ended December 31, 2016, as a member of

18

the board of directors or compensation committee of any other entity that has or has had one or more executive officers serving as a member of our board of directors or our compensation committee.

Meetings of the Board of Directors

The full board of directors met seven times during the year ended December 31, 2016. No director attended fewer than 75% of the total number of meetings of the board of directors and of any committees of the board of directors of which he or she was a member during the year ended December 31, 2016.

It is our policy that directors are invited and encouraged to attend our annual meetings of stockholders. We have scheduled our Annual Meeting on the same day as a regularly scheduled board of directors meeting in order to facilitate attendance by the members of our board of directors. Six of our then seven directors attended our annual meeting of stockholders in 2016.

One of the key functions of our board of directors is informed oversight of our risk management process. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure. Our executive and senior officers are responsible for the day-to-day management of the material risks we face. Our board of directors administers its oversight function directly as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. For example, our audit committee is responsible for overseeing the management of risks associated with our financial reporting, accounting and auditing matters; our compensation committee oversees the management of risks associated with our compensation policies and programs; and our nominating and corporate governance committee oversees the management of risks associated with director independence, conflicts of interest, composition and organization of our board of directors and director succession planning.

Our board of directors approves the form and amount of director compensation. Our compensation committee and executive officers may make recommendations on the form and amount of director compensation, but the board makes the final decision and is not bound by compensation committee or executive officer recommendations.

Under our non-employee director compensation program, as amended in August 2015, non-employee directors receive an annual stock option grant of 11,169 shares to be granted at each annual meeting of stockholders. Each such option will vest in full following the completion of 12 months of continuous service as a member of our board of directors following the grant date, provided that such option will become fully vested on the date of our next annual stockholder meeting following the date of grant if such date is less than 12 months from the grant date. In addition, new non-employee directors are eligible to receive an initial stock option grant of 16,530 shares, to be granted on or as soon as reasonably practicable following the date of such director's initial election to our board of directors. Such option vests in equal annual installments over three years of continuous service following the director's election to our board of directors. Further, each option held by a non-employee director will become fully vested if we are subject to a change in control prior to the termination of a director's service.

19

In addition, each non-employee director is eligible to receive compensation for his or her service on our board of directors or committees thereof consisting of annual cash retainers as follows.

Position | Retainer | |||

|---|---|---|---|---|

Board Member | $ | 35,000 | ||

Lead Independent Director | 15,000 | |||

Audit Committee Chair | 15,000 | |||

Compensation Committee Chair | 12,000 | |||

Nominating and Corporate Governance Committee Chair | 10,000 | |||

Audit Committee Member | 7,500 | |||

Compensation Committee Member | 6,000 | |||

Nominating and Corporate Governance Committee Member | 5,000 | |||

Under our director compensation program, as amended in August 2015, each non-employee director may elect to receive all or a portion of his or her annual cash retainer(s) in the form of fully vested options to purchase shares of our common stock. Such options are granted by our compensation committee on a quarterly basis, in arrears, with an aggregate grant date fair value equal to the cash amount that would otherwise be payable, with the number of shares subject to such options computed in accordance with the Black-Scholes model used by us for valuing options in our financial statements. Each such option has a term of ten years (subject to earlier expiration upon the termination of the director's service) and is granted with an exercise price equal to the closing price per share of our common stock on the grant date.

We have a policy of reimbursing our directors for their reasonable out-of-pocket expenses incurred in attending board of directors and committee meetings.

The following table sets forth information about the compensation for service during the year ended December 31, 2016 of the non-employee members of our board of directors who served as a director during such year. A non-employee director is a director who is not employed by us and who does not receive compensation from us or have a business relationship with us that would require disclosure under certain SEC rules. Other than as set forth in the table and described more fully below, we did not pay any fees to, make any equity awards or non-equity awards to or pay any other compensation to the non-employee members of our board of directors for service during the year ended December 31, 2016. Neither Dr. Rabinowitz, our Chief Executive Officer, nor Mr. Sheena, our Chief Technology Officer, received any compensation from us for service as a director during the year ended December 31, 2016 and are not included in the table below.

Name | Fees Earned or Paid in Cash ($)(1) | Option Awards ($)(2)(3)(4) | Total ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Roelof F. Botha | 162,893 | 162,893 | ||||||||

Todd Cozzens | 54,500 | 100,409 | 154,909 | |||||||

Dr. Edward C. Driscoll, Jr. | 140,398 | 140,398 | ||||||||

Dr. James I. Healy | 51,000 | 100,409 | 151,409 | |||||||

John Steuart | 156,389 | 156,389 | ||||||||

20

year ended December 31, 2016 filed on March 16, 2017, for a discussion of the assumptions made by us in determining the grant date fair values of our equity awards. Amount consists of: (i) $15,620 with respect to the option granted to Mr. Botha on April 8, 2016, $100,409 with respect to the option granted to Mr. Botha on June 10, 2016, $15,624 with respect to the option granted to Mr. Botha on August 12, 2016, $15,622 with respect to the option granted to Mr. Botha on November 11, 2016, and $15,618 with respect to the option granted to Mr. Botha on February 10, 2017; (ii) $100,409 with respect to the option granted to Mr. Cozzens on June 10, 2016; (iii) $9,996 with respect to the option granted to Dr. Driscoll on April 8, 2016, $100,409 with respect to the option granted to Dr. Driscoll on June 10, 2016, $9,996 with respect to the option granted to Dr. Driscoll on August 12, 2016, $10,003 with respect to the option granted to Dr. Driscoll on November 11, 2016, and $9,993 with respect to the option granted to Dr. Driscoll on February 10, 2017; (iv) $100,409 with respect to the option granted to Dr. Healy on June 10, 2016; and (v) $13,992 with respect to the option granted to Mr. Steuart on April 8, 2016, $100,409 with respect to the option granted to Mr. Steuart on June 10, 2016, $13,993 with respect to the option granted to Mr. Steuart on August 12, 2016, $13,999 with respect to the option granted to Mr. Steuart on November 11, 2016, and $13,996 with respect to the option granted to Mr. Steuart on February 10, 2017.

As of December 31, 2016, Mr. Botha held outstanding options to purchase 21,943 shares of our common stock; Mr. Cozzens held outstanding options to purchase 92,027 shares of our common stock; Dr. Driscoll held outstanding options to purchase 18,065 shares of our common stock; Dr. Healy held outstanding options to purchase 11,169 shares of our common stock; and Mr. Steuart held outstanding options to purchase 20,822 shares of our common stock. None of our directors has been granted any stock awards.

21

Stockholder Communications with the Board of Directors

Stockholders wishing to communicate with the board of directors or with an individual member of the board of directors may do so by writing to the board of directors or to the particular member of the board of directors, care of the Corporate Secretary by mail to our principal executive offices, Attention: Corporate Secretary. The envelope should indicate that it contains a stockholder communication. All such stockholder communications will be forwarded to the director or directors to whom the communications are addressed.

22

The following table provides information concerning our executive officers as of March 20, 2017:

Name | Age | Position(s) | |||

|---|---|---|---|---|---|

Matthew Rabinowitz | 44 | Chief Executive Officer, President and Chairman | |||

Jonathan Sheena | 44 | Chief Technology Officer and Director | |||

Michael Brophy | 37 | Chief Financial Officer | |||

Matthew Rabinowitz, Ph.D. See biographical information set forth above under "Proposal One—Election of Directors—Information Regarding the Nominees and Other Directors."

Jonathan Sheena. See biographical information set forth above under "Proposal One—Election of Directors—Information Regarding the Nominees and Other Directors."

Michael Brophy has served as our Chief Financial Officer since February 2017. Previously, he served as our Senior Vice President, Finance and Investor Relations since September 2016, and prior to that, as our Vice President, Corporate Development and Investor Relations since September 2015. Prior to joining Natera, Mr. Brophy served as an executive director from January 2014 to September 2015, and as a vice president from 2011 to 2013, in the investment banking division at Morgan Stanley where he focused on advising corporate clients in the life science tools and diagnostics sector. Mr. Brophy holds an M.B.A. from the University of California, Los Angeles and a Bachelor of Science in Economics from the United States Air Force Academy.

23

The following table provides information concerning the compensation of our chief executive officer and our two other most highly compensated executive officers, whom we refer to as our named executive officers, for the years ended December 31, 2015 and 2016.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Option Awards ($)(1) | Non-Equity Incentive Plan Compensation ($) | Total ($) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Matthew Rabinowitz | 2016 | 452,625 | — | — | 1,672,043 | (2) | 225,275 | (3) | 2,349,943 | |||||||||||||

Chief Executive Officer, | 2015 | 300,000 | 33,689 | — | 8,318 | — | 342,007 | |||||||||||||||

President, and Chairman | ||||||||||||||||||||||

Jonathan Sheena | 2016 | 321,000 | — | — | 552,080 | (4) | 117,143 | (3) | 990,223 | |||||||||||||

Chief Technology Officer | 2015 | 300,000 | 33,689 | — | — | — | 333,689 | |||||||||||||||

Herm Rosenman | 2016 | 288,316 | — | 575,400 | (7) | — | — | (6) | 863,716 | |||||||||||||

Chief Financial Officer(5) | 2015 | 275,000 | 32,460 | — | — | — | 307,460 | |||||||||||||||

Narrative Explanation of Compensation Arrangements with Our Named Executive Officers

The compensation paid to our named executive officers for the fiscal year ended December 31, 2016 consisted of (i) base salary, (ii) performance-based incentive compensation under our Management Cash Incentive Plan, and (iii) long-term incentive compensation in the form of stock options and (with respect to Mr. Rosenman) restricted stock units (RSUs).

24

The base salaries of all of our executive officers are reviewed from time to time and adjusted when our compensation committee or board of directors determines an adjustment is appropriate. Dr. Rabinowitz's base salary is $500,000 and was last increased in April 2016, and he is eligible to earn an annual bonus of up to $250,000. Although Dr. Rabinowitz spends significant time with us and is highly active in our management, he has the ability to spend up to one business day per week on other commitments pursuant to his employment agreement. Mr. Sheena's base salary is $325,000 and was last increased in April 2016, and he is eligible to earn an annual bonus of up to $130,000. Mr. Rosenman's base salary was $290,000 at the time of his resignation effective January 31, 2017 and was last increased in April 2016. Mr. Rosenman was eligible to earn an annual bonus of up to $80,000.

In general, considerations taken into account by us when determining types and amounts of compensation payable to our named executive officers include, but are not limited to (i) overall company performance, (ii) each executive's level and scope of responsibility, (iii) compensation paid to similarly situated executives of companies with which we compete for executive talent and (iv) the vesting schedule and value of previously granted awards.

The significant changes in compensation paid to our named executive officers from 2015 to 2016 reflect (i) judgments by our compensation committee regarding the frequency and size of equity-based awards granted to our named executive officers, which resulted in no equity awards being granted to such named executive officers in 2015, and (ii) an increase in base salary and target incentive compensation for our named executive officers in 2016. The increase in base salary and annual target bonus for our named executive officers that became effective in April 2016, and the equity awards made to such named executive officers in the year ended December 31, 2016, reflected judgments by our compensation committee related to such factors.

The largest portion of the increase from 2015 to 2016 resulted from all three of our named executive officers receiving substantial equity awards in 2016 and no new equity awards in 2015. We did not grant any equity awards to our named executive officers in 2015 because our board of directors and our compensation committee determined that the unvested portions of the outstanding awards held by our named executive officers at that time provided significant retention value and incentive to these officers.

Pursuant to their amended letter agreements with us, our named executive officers are eligible to receive certain benefits in the event of our change in control or if their employment is terminated under certain circumstances, as described in the footnotes to the "Outstanding Equity Awards at 2016 Fiscal Year-End" table and under "Severance and Change in Control Benefits" below.

Certain Developments Following End of Our 2016 Fiscal Year

Stock Option Matters

In December 2014, Dr. Rabinowitz was granted a stock option to purchase 613,496 shares of our common stock, at an exercise price of $5.3953 per share. As of December 31, 2016, such option vested over five years of continuous service following the vesting commencement date set forth in the prior column, with 40% vesting on November 19, 2016, and the remainder in 36 substantially equal monthly installments thereafter. In January 2017, the vesting schedule of such option was amended to provide that 60% of such option will vest on November 19, 2017, with the remainder vesting in 24 substantially equal monthly installments thereafter, subject to provision by Dr. Rabinowitz of continuous service on each such vesting date.

Resignation of Chief Financial Officer

In January 2017, Mr. Rosenman resigned his employment as our chief financial officer and, effective February 2017, he was elected to our board of directors. In connection with such resignation

25

and election, and in recognition of his service to us, our board of directors modified the restricted stock unit award granted to him on April 8, 2016, to provide for continued vesting of such award in accordance with its terms in connection with Mr. Rosenman's service as a director.

Appointment of Chief Financial Officer

In January 2017, our board of directors appointed Michael Brophy as our chief financial officer, effective February 2017. In connection with such appointment, Mr. Brophy entered into an amended letter agreement with us, pursuant to which his annual base salary is $330,000 and his annual target bonus is equal to 40% of such base salary.

Employee Benefits and Perquisites

Our named executive officers are eligible to participate in our health and welfare plans to the same extent as are all full-time employees generally. We generally do not provide our named executive officers with perquisites or other personal benefits.

Retirement Benefits

We have established a 401(k) tax-deferred savings plan, which permits participants, including our named executive officers, to make contributions by salary deduction pursuant to Section 401(k) of the Internal Revenue Code of 1986, as amended. We are responsible for administrative costs of the 401(k) plan. Effective April 2016, we have elected to match contributions made by our employees, including our named executive officers, to the 401(k) plan. We match the employee's contributions to the 401(k) plan in an amount equal to 50% of the employee's contribution, up to 6% of the employee's compensation (comprising base salary and bonus) and subject to other limitations under applicable laws. For all employees hired on or after January 1, 2015, matching contributions vest 25% after the first full year of service, 50% after the second full year of service, 75% after the third full year of service, and 100% after the fourth full year of service. Matching contributions are fully vested for all employees hired before January 1, 2015, including all of our named executive officers.

Equity Compensation

We offer stock options and restricted stock units to our named executive officers as the long-term incentive component of our compensation program. We typically grant equity awards to new hires upon their commencing employment with us. Stock options allow employees to purchase shares of our common stock at a price per share equal to the fair market value of our common stock on the date of grant and may or may not be intended to qualify as "incentive stock options" for U.S. federal income tax purposes. Restricted stock units provide full value awards to our employees upon vesting of such awards without requiring the recipient to pay an exercise price or purchase price for such awards. Generally, our equity awards vest over four years, subject to the employee's continued employment with us on each vesting date.

In 2016, we granted equity awards to our named executive officers as described in the "Outstanding Equity Awards at Fiscal 2016 Year-End" table below, as well as to a significant number of our other employees.

As described in the footnotes to the "Outstanding Equity Awards at 2016 Fiscal Year-End" table and under "Severance and Change in Control Benefits," equity awards granted to our named executive officers are subject to accelerated vesting in the event such officer is subject to an involuntary termination or if we experience a change in control. In the event of a conflict between the terms of their amended letter agreements with us and the vesting acceleration provisions approved by our board of directors with respect to such awards, Dr. Rabinowitz and Mr. Sheena will be entitled to whichever provision provides them with the greatest benefit.

26

Outstanding Equity Awards at 2016 Fiscal Year-End

The following table provides information regarding each unexercised option and all unvested stock held by each of our named executive officers as of December 31, 2016. The number of shares subject to each award and, where applicable, the exercise price per share, reflect all changes as a result of our capitalization adjustments.

The vesting schedule applicable to each outstanding award is described in the footnotes to the table below.

In general, options granted to our named executive officers prior to 2012 are immediately exercisable with respect to all of the option shares, subject to our repurchase right in the event that the executive's service terminates before vesting in such shares.

| | Option Awards | Stock Awards | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name | Vesting Commencement Date | Number of Securities Underlying Unexercised Options (#) Vested | Number of Securities Underlying Unexercised Options (#) Unvested | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested(1) ($) | |||||||||||||||

Matthew Rabinowitz | 5/19/2011 | 341,032 | (2) | 0 | 0.5542 | 5/18/2021 | ||||||||||||||||

| 9/1/2012 | 248,800 | (3) | 0 | 1.2551 | (*) | 9/19/2017 | ||||||||||||||||

| 9/1/2012 | 324,205 | (3) | 0 | 1.1410 | 9/19/2022 | |||||||||||||||||

| 2/25/2014 | 630,036 | (4) | 0 | 2.6569 | 2/24/2024 | |||||||||||||||||

| 11/20/2014 | 245,398 | (5) | 368,098 | 5.3953 | 12/9/2024 | |||||||||||||||||

| 4/1/2016 | 0 | (6) | 300,000 | 9.59 | 4/7/2026 | |||||||||||||||||

Jonathan Sheena | 9/1/2012 | 459,799 | (3) | 0 | 1.1410 | 9/19/2022 | ||||||||||||||||

| 2/25/2014 | 545,714 | (4) | 0 | 2.6569 | 2/24/2024 | |||||||||||||||||

| 11/20/2014 | 51,124 | (7) | 71,575 | 5.3953 | 12/9/2024 | |||||||||||||||||

| 4/1/2016 | 0 | (6) | 100,000 | 9.59 | 4/7/2026 | |||||||||||||||||

Herm Rosenman | 2/10/2014 | 138,404 | (8) | 0 | 2.6569 | 2/24/2024 | ||||||||||||||||

| 4/1/2016 | 20,000 | (9) | $ | 234,200 | ||||||||||||||||||

27

Severance and Change in Control Benefits

Pursuant to amended letter agreements entered into with each of Dr. Rabinowitz and Mr. Sheena in June 2007, if we terminate the employment of Dr. Rabinowitz or Mr. Sheena for reasons other than cause, or if such executive resigns for good reason, then he will be eligible to receive:

"Cause" means an officer's:

"Good reason" means a resignation after one of the following conditions has come into existence without the officer's consent:

"Permanent disability" means the officer's inability to perform the essential functions of his position, with or without reasonable accommodation, for at least 120 consecutive days due to a physical or mental impairment.

In addition, in the event that we are subject to a change in control, 50% of the then-unvested portion of any equity or equity-based awards granted to Dr. Rabinowitz or Mr. Sheena will become fully vested and, if applicable, exercisable, and the remaining unvested portion will vest over the shorter of 12 months or the then-remaining vesting period. Further, if, following a change in control, such named executive officer is terminated other than due to cause or permanent disability, or if the officer

28

resigns due to a reduction in his base salary or following notice that his principal workplace will be relocated by more than 30 miles, all of his then-unvested equity or equity-based awards will become fully vested and, if applicable, exercisable.

A "Change in Control" means the consummation of our merger or consolidation with or into another entity or our dissolution, liquidation or winding up.

29

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of March 20, 2017 for:

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

Applicable percentage ownership is based on 52,803,837 shares of common stock outstanding at March 20, 2017. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of common stock subject to options and restricted stock units held by that person or entity that are currently exercisable or that will become exercisable within 60 days of March 20, 2017. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Natera, Inc., 201 Industrial Road, Suite 410, San Carlos, California 94070.

| | Shares Beneficially Owned | ||||||

|---|---|---|---|---|---|---|---|

Name of Beneficial Owner | Shares | % | |||||

Named Executive Officers and Directors: | |||||||

Roelof F. Botha(1) | 850,683 | 1.61 | |||||

Michael Brophy(2) | 42,500 | * | |||||

Todd Cozzens(3) | 80,858 | * | |||||

Edward C. Driscoll, Jr.(4) | 8,424 | * | |||||

James I. Healy(5) | — | — | |||||

Gail Marcus | — | — | |||||

Matthew Rabinowitz(6) | 4,124,267 | 7.58 | |||||

Herm Rosenman(7) | 181,354 | * | |||||

Jonathan Sheena(8) | 1,616,957 | 3.01 | |||||

John Steuart(9) | 99,394 | * | |||||

All Executive Officers and Directors as a Group (10 persons) | 7,004,437 | 12.57 | |||||

5% Stockholders: | |||||||

Entities affiliated with Sequoia Capital(10) | 7,744,460 | 14.66 | |||||

Entities affiliated with Claremont Creek(11) | 7,020,856 | 13.29 | |||||

Capital World Investors(12) | 4,190,609 | 7.94 | |||||

Entities affiliated with Sofinnova Ventures(13) | 3,100,560 | 5.87 | |||||

30

31