Exhibit 99.2

1 Not for reproduction or further distribution. Natera , Inc. Q4 2019 Earnings call February 26, 2020

2 Not for reproduction or further distribution. Safe harbor statement This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding the market opportunity, products and launch schedules, reimbur sem ent coverage and product costs, commercial partners, user experience, clinical trials, financial performance, strategies, anticipated future performance and general business cond iti ons of Natera, Inc. (“Natera”, the “Company”, “we” or “us”), are forward - looking statements. These forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially, including: we face numerous uncertainties and challenges in achieving the financial guidance provided; we may be unable to fu rth er increase the use and adoption of Panorama and Horizon, through our direct sales efforts or through our laboratory partners, or to develop and successfully commercialize ne w p roducts, including Signatera and Prospera ; we have incurred losses since our inception and we anticipate that we will continue to incur losses for the foreseeable future; our q uar terly results may fluctuate from period to period; our estimates of market opportunity and forecasts of market growth may prove to be inaccurate; we may be unable to compete succes sfu lly with existing or future products or services offered by our competitors; we may not be successful in commercializing our cloud - based distribution model; our products may not perform as expected; the results of our clinical studies may not support the use of our tests, particularly in the average - risk pregnancy population or for microdeletions screen ing, or may not be able to be replicated in later studies required for regulatory approvals or clearances; if our sole CLIA - certified laboratory facility becomes inoperable, we will be u nable to perform our tests and our business will be harmed; we rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and mate ria ls and may not be able to find replacements or immediately transition to alternative suppliers; if we are unable to successfully scale our operations, our business could su ffe r; the marketing, sale, and use of Panorama and our other products could result in substantial damages arising from product liability or professional liability claims that exceed our res ources; we may be unable to expand third - party payer coverage and reimbursement for Panorama, Horizon and our other tests, and we may be required to refund reimbursements already re ceived; third - party payers may withdraw coverage or provide lower levels of reimbursement due to changing policies, billing complexities or other factors, such as th e i ncreased focus by third - party payers on requiring that prior authorization be obtained prior to conducting a test; if the FDA were to begin actively regulating our tests, we could incur sub stantial costs and delays associated with trying to obtain premarket clearance or approval and incur costs associated with complying with post - market controls; litigation or other proceed ings, resulting from either third party claims of intellectual property infringement or third party infringement of our technology, is costly, time - consuming and could limit our ability to commercialize our products or services; and any inability to effectively protect our proprietary technology could harm our competitive position or our brand. We discuss thes e a nd other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our periodic reports on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time. Given these uncertainties, you should not place undue reliance on the f orw ard - looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to pr edi ct all risks, nor can we assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially f rom those contained in any forward - looking statement. In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may n ot occur and actual results could differ materially and adversely from those anticipated or implied. Except as required by law, we undertake no obligation to update publicly any forwar d - looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, proxy sta tem ents, and other information with the SEC. Such reports, proxy statements, and other information concerning us is available at investor.natera.com or at http://www.sec.gov . Requests for copies of such documents should be directed to our Investor Relations department at Natera, Inc., 201 Industrial Road, Suite 410, San Carlos, California 94070. Our telephone nu mbe r is (650) 249 - 9090.

3 Not for reproduction or further distribution. Transformative 2019 ● Extended market leadership ● New peer reviewed publications ● Significant COGS reductions ● Improved reimbursement ● Clinical validation data in multiple cancer types ● ~$55 million in cumulative pharma contracted value ● Draft Medicare coverage for Signatera in colorectal cancer ● Foundation Medicine and Beijing Genomics Institute partnerships ● Compelling peer reviewed data ● CLIA validation and operational readiness ● Final positive Medicare coverage for Prospera Reproductive Health Organ Transplantation Oncology

4 Not for reproduction or further distribution. Extend leadership position in reproductive health • Volume growth and improving unit economics • Drive path toward cash flow breakeven Change patient care for transplant recipients • Major clinical launch on track for 2020 Establish Signatera ™ as the new standard for cancer care • Major clinical launch in colorectal cancer • Practice - changing clinical trials with academic and pharma partners Three goals for 2020

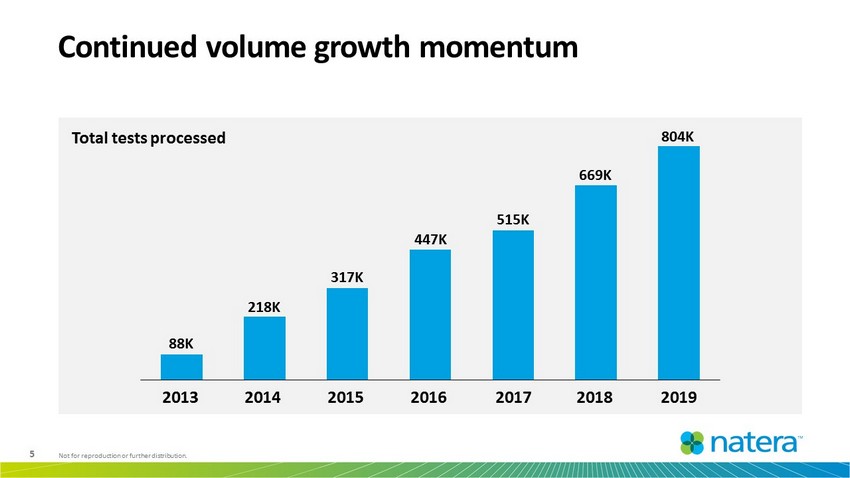

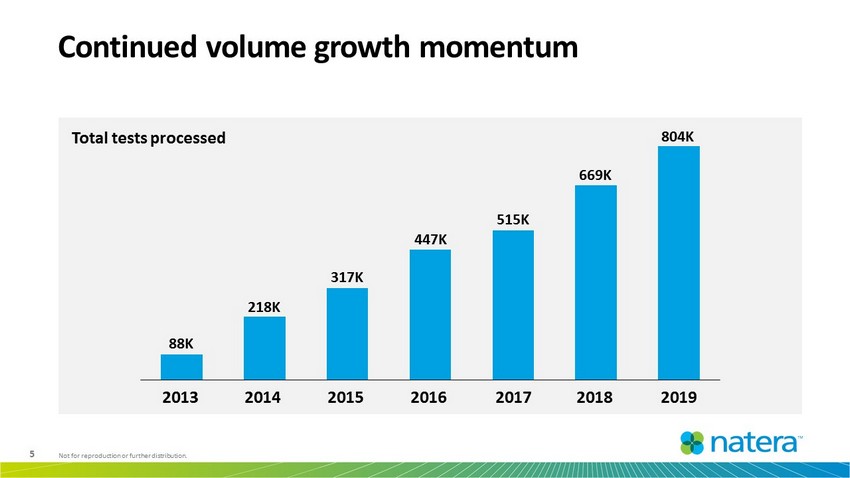

5 Not for reproduction or further distribution. Continued volume growth momentum Total tests processed 88K 218K 317K 447K 515K 669K 804K 2013 2014 2015 2016 2017 2018 2019

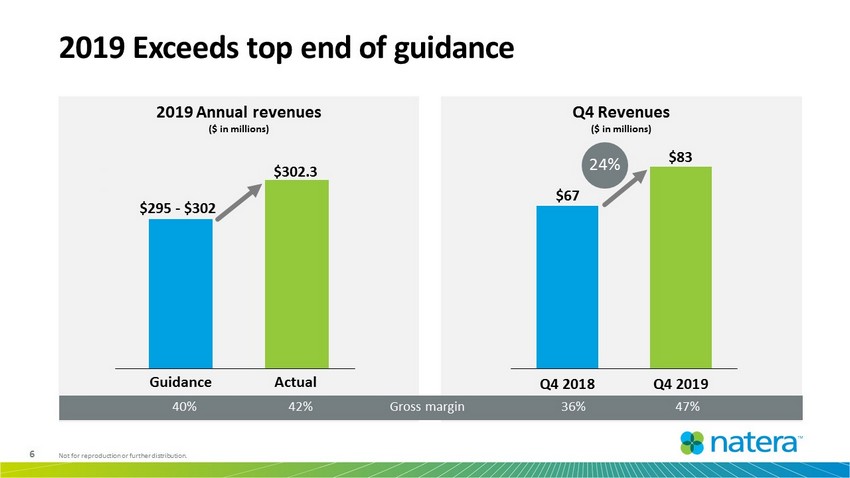

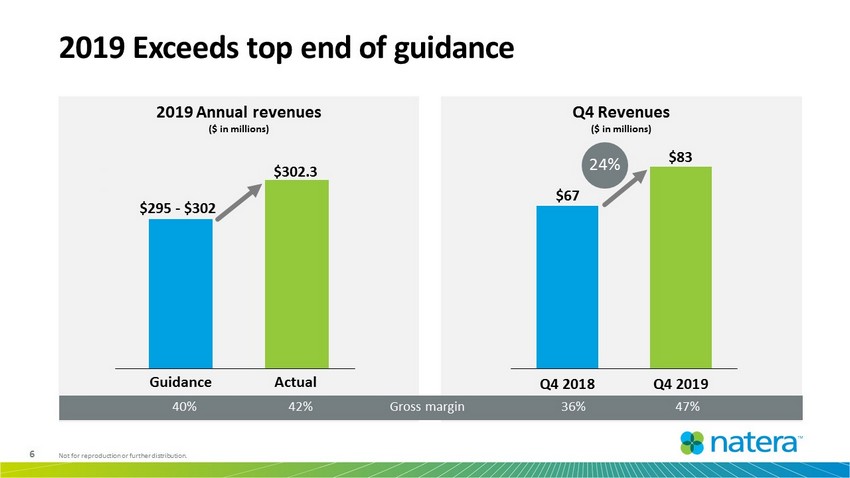

6 Not for reproduction or further distribution. 2019 Annual revenues ($ in millions) 2019 Exceeds top end of guidance Q4 Revenues ($ in millions) $67 $83 Q4 2018 Q4 2019 24% $302 .3 $285.0 $287.0 $289.0 $291.0 $293.0 $295.0 $297.0 $299.0 $301.0 $303.0 $295 - $302 Guidance Actual Gross margin 40% 47% 36% 42%

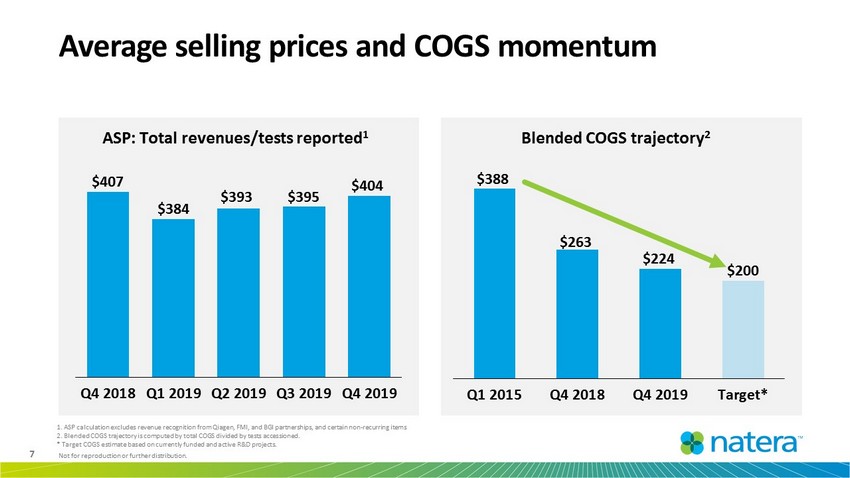

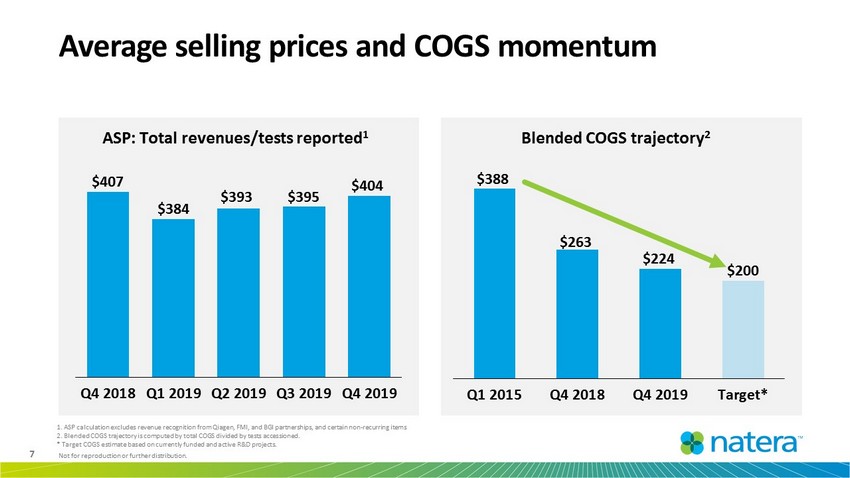

7 Not for reproduction or further distribution. Average selling prices and COGS momentum ASP: Total revenues/tests reported 1 $388 $263 $224 $200 Q1 2015 Q4 2018 Q4 2019 Target* Blended COGS trajectory 2 1. ASP calculation excludes revenue recognition from Qiagen, FMI, and BGI partnerships, and certain non - recurring items 2. Blended COGS trajectory is computed by total COGS divided by tests accessioned. * Target COGS estimate based on currently funded and active R&D projects. $407 $384 $393 $395 $404 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019

8 Not for reproduction or further distribution. $42 $56 $70 $84 $98 3% 4% 5% 6% 7% Transplant: Pathway to significant revenues Revenue sensitivity ($ in millions) ● $2B market ● < 5% penetrated < 5% Total Total tests greenfield Market penetration Source: Natera, I nc . internal company estimates

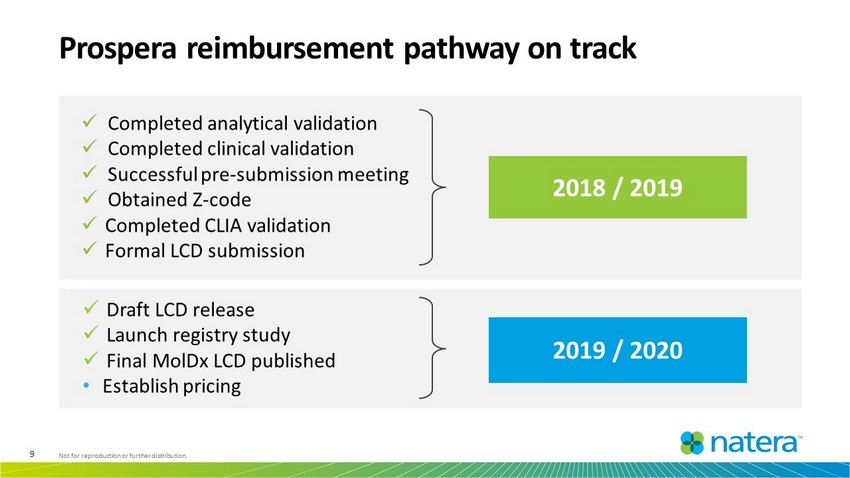

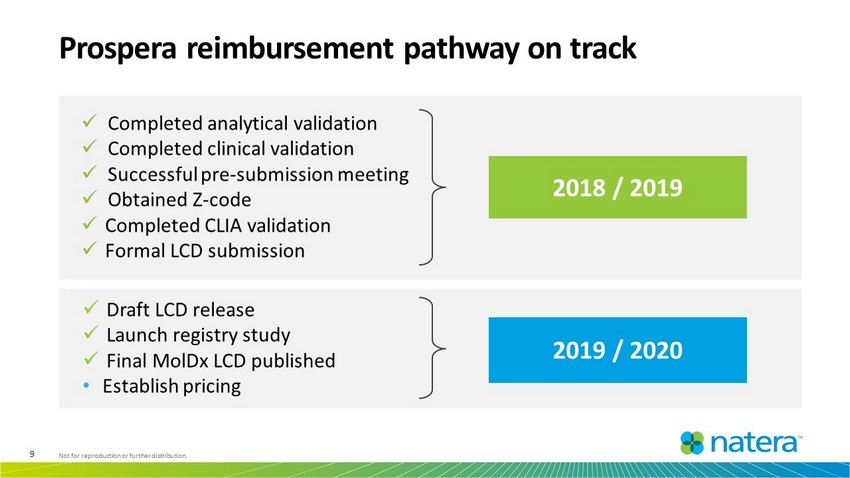

9 Not for reproduction or further distribution. Prospera reimbursement pathway on track 2018 / 2019 2019 / 2020 x Completed analytical validation x Completed clinical validation x Successful pre - submission meeting x Obtained Z - code x Completed CLIA validation x Formal LCD submission x Draft LCD release x Launch registry study x Final MolDx LCD published • Establish pricing

10 Not for reproduction or further distribution. 1 Sigdel TK, et al. J. Clin. Med. 2019, 8, 19. 2 . Bloom RD, et al. J Am Soc Nephrol . 2017 Jul;28(7):2221 - 2232. Prospera outperforms 1 st generation dd - cfDNA test ● More sensitive and specific than serum creatinine ● Assessed all types of rejection, including TCMR ● First published dd - cfDNA assay to identify subclinical rejection Largest published renal transplant dd - cfDNA validation study 2 Highest reported overall sensitivity 2 ABMR and TCMR Highest reported performance to assess T - cell mediated rejection 2 Sensitivity First, only test to identify subclinical rejection 2 Sensitivity 217 89% 100% 92% 107 59% 27% NA Other Commercial Assay 2 Natera 1

11 Not for reproduction or further distribution. 2019 pharma total contracted value goal achieved • >50 Pharma deals signed to date • Multiple prospective studies signed & planned in CRC, NSCLC, Pancreatic, Bladder, HCC, Breast, other • Benefit for pharma trials: 1. Study enrichment: treating only MRD - positive patients, for higher drug efficacy 2. Early endpoint: observing MRD clearance, for faster study results 2018 2019 Goal 2019 Actual $9.1M $40M - $50M $55M Cumulative value of signed contracts

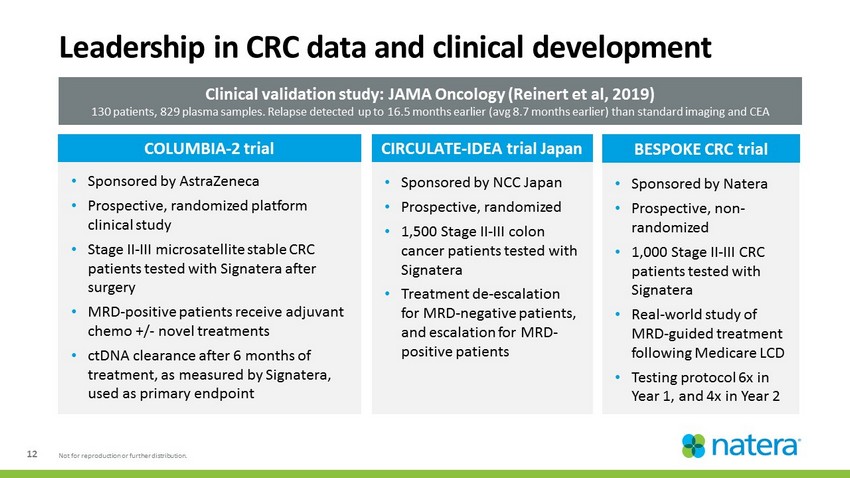

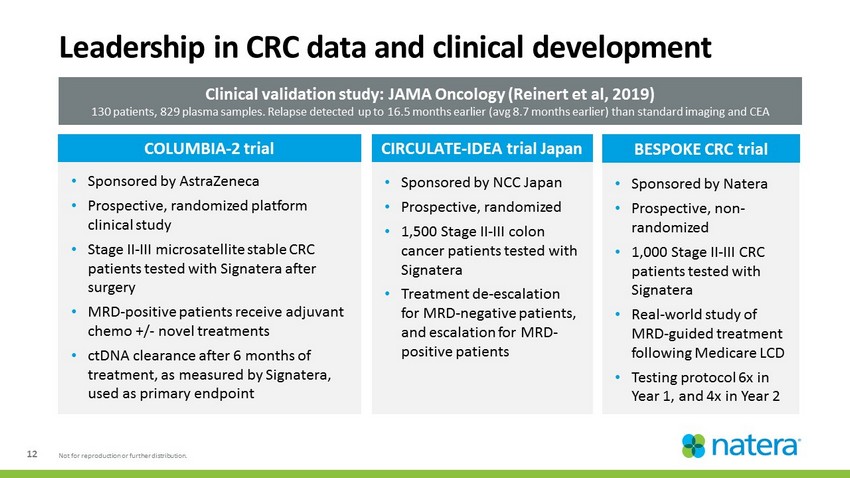

12 Not for reproduction or further distribution. • Sponsored by Natera • Prospective, non - randomized • 1,000 Stage II - III CRC patients tested with Signatera • Real - world study of MRD - guided treatment following Medicare LCD • Testing protocol 6x in Year 1, and 4x in Year 2 • Sponsored by NCC Japan • Prospective, randomized • 1,500 Stage II - III colon cancer patients tested with Signatera • Treatment de - escalation for MRD - negative patients, and escalation for MRD - positive patients Leadership in CRC data and clinical development BESPOKE CRC trial CIRCULATE - IDEA trial Japan Clinical validation study: JAMA Oncology (Reinert et al, 2019) 130 patients, 829 plasma samples. Relapse detected up to 16.5 months earlier (avg 8.7 months earlier) than standard imaging a nd CEA • Sponsored by AstraZeneca • Prospective, randomized platform clinical study • Stage II - III microsatellite stable CRC patients tested with Signatera after surgery • MRD - positive patients receive adjuvant chemo +/ - novel treatments • ctDNA clearance after 6 months of treatment, as measured by Signatera, used as primary endpoint COLUMBIA - 2 trial

13 Not for reproduction or further distribution. ● Est. opportunity ~1 million tests annually ● Over 85% of relapses caught too late for curative surgery 1,2 Medicare draft LCD in Colorectal cancer MRD Program Use Signatera after surgery to evaluate the need for adjuvant chemotherapy and avoid unnecessary treatment Surveillance Program Use Signatera alongside CEA to detect recurrence earlier while it may still be resectable, and reduce false positives For Stage II - III colon cancer, Stage IIA rectal cancer For Stage II - III colorectal cancer patients 1. Purandare NC, et al. The Indian journal of radiology & imaging. 2010;20(4):284 - 288. 2. Lapointe L. Laboratory, Advance Healt hcare Network. 2016;25(9):14.

14 Not for reproduction or further distribution. Signatera colorectal cancer – Medicare reimbursement pathway on track 2019 2020 x Successful pre - submission meeting x Obtained Z - code x Completed clinical validation x CLIA soft launch x Formal LCD submission x Draft LCD release x Launch registry trial • Final LCD published • Final pricing

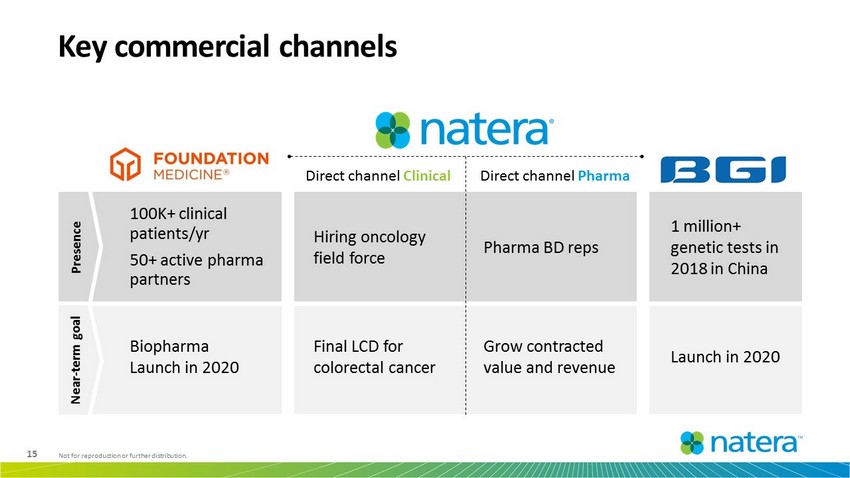

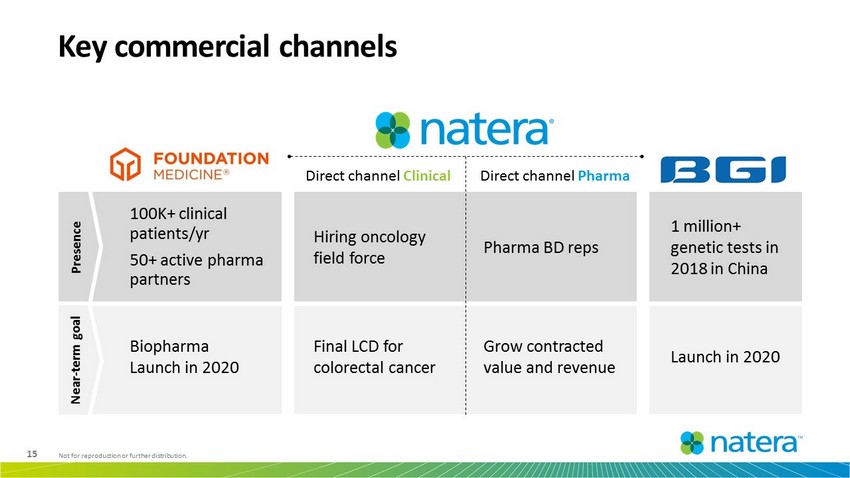

15 Not for reproduction or further distribution. Key commercial channels Direct channel Clinical Direct channel Pharma Pharma BD reps Hiring oncology field force 100K+ clinical patients/yr 50+ active pharma partners 1 million+ genetic tests in 2018 in China Grow contracted value and revenue Launch in 2020 Biopharma Launch in 2020 Final LCD for colorectal cancer Presence Near - term goal

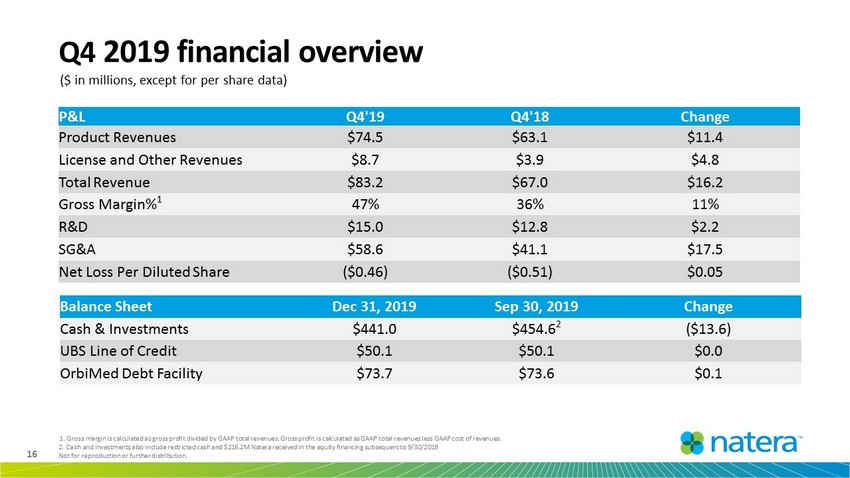

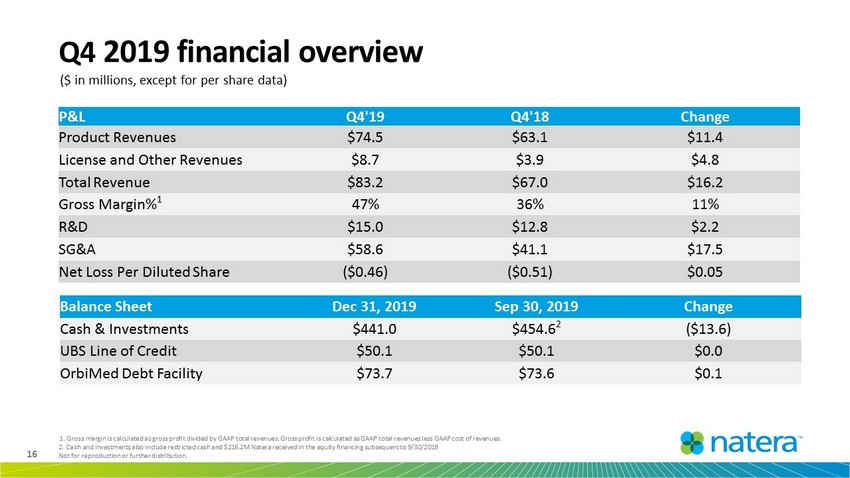

16 Not for reproduction or further distribution. Balance Sheet Dec 31, 2019 Sep 30, 2019 Change Cash & Investments $441.0 $454.6 2 ($13.6) UBS Line of Credit $50.1 $50.1 $0.0 OrbiMed Debt Facility $73.7 $73.6 $0.1 Q4 2019 financial overview ($ in millions, except for per share data) P&L Q4'19 Q4'18 Change Product Revenues $74.5 $63.1 $11.4 License and Other Revenues $8.7 $3.9 $4.8 Total Revenue $83.2 $67.0 $16.2 Gross Margin% 1 47% 36% 11% R&D $15.0 $12.8 $2.2 SG&A $58.6 $41.1 $17.5 Net Loss Per Diluted Share ($0.46) ($0.51) $0.05 1. Gross margin is calculated as gross profit divided by GAAP total revenues. Gross profit is calculated as GAAP total revenu es less GAAP cost of revenues. 2. Cash and investments also include restricted cash and $216.2M Natera received in the equity financing subsequent to 9/30/2 019

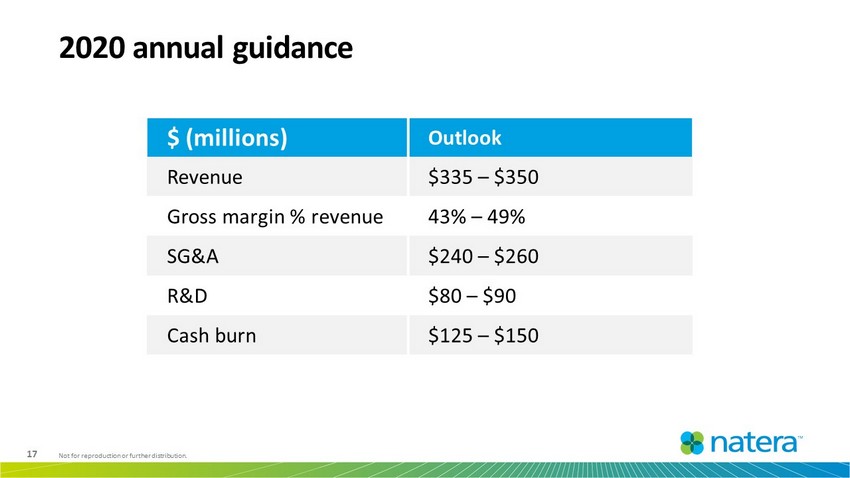

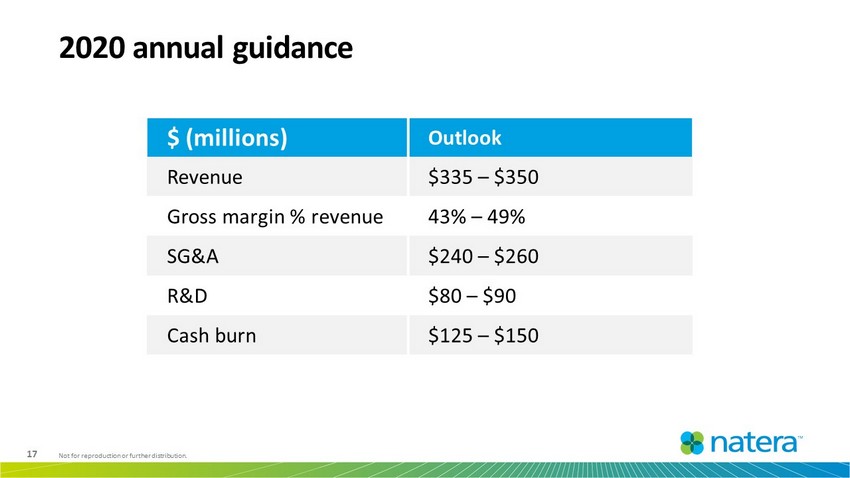

17 Not for reproduction or further distribution. 2020 annual guidance $ (millions) Outlook Revenue $335 – $350 Gross margin % revenue 43% – 49% SG&A $240 – $260 R&D $80 – $90 Cash burn $125 – $150

18 Not for reproduction or further distribution. 2020 investments support rapid growth • Commercial leadership position • COGS reductions: - Algorithm improvements - Automation - Alternative sequencing platforms • Commercial channel to launch colorectal cancer test • Support partner product development and launch • Clinical trials to support additional CMS submissions Reproductive health • Commercial channel to launch Prospera test • Clinical trials to support broad market penetration Oncology Organ transplant