Exhibit 99.2

1 Not for reproduction or further distribution. Natera, Inc. First quarter 2020 Earnings presentation May 6, 2020

2 Not for reproduction or further distribution. Safe harbor statement This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding the market opportunity, products and launch s che dules, reimbursement coverage and product costs, commercial partners, user experience, clinical trials, financial performance, strategies, anticipated future performance and gen eral business conditions of Natera, Inc. (“Natera”, the “Company”, “we” or “us”), are forward - looking statements. These forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially, including: we face numerous uncertainties and challenges in achieving our financial projections ; o perating our business in light of the COVID - 19 pandemic; we may be unable to further increase the use and adoption of Panorama and Horizon, through our direct sales efforts or through our laboratory partners, or to develop and successfully commercialize new products, including Signatera and Prospera; we have incurred losses since our inception an d w e anticipate that we will continue to incur losses for the foreseeable future; our quarterly results may fluctuate from period to period; our estimates of market opportu nit y and forecasts of market growth may prove to be inaccurate; we may be unable to compete successfully with existing or future products or services offered by our competitors; we may not be successful in commercializing our cloud - based distribution model; our products may not perform as expected; the results of our clinical studies may not support th e use of our tests, particularly in the average - risk pregnancy population or for microdeletions screening, or may not be able to be replicated in later studies required for regul ato ry approvals or clearances; if our sole CLIA - certified laboratory facility becomes inoperable, we will be unable to perform our tests and our business will be harmed; we rely on a lim ited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and materials and may not be able to find replacements or immediately trans iti on to alternative suppliers; if we are unable to successfully scale our operations, our business could suffer; the marketing, sale, and use of Panorama and our other products co uld result in substantial damages arising from product liability or professional liability claims that exceed our resources; we may be unable to expand third - party payer cover age and reimbursement for Panorama, Horizon and our other tests, and we may be required to refund reimbursements already received; third - party payers may withdraw coverage or p rovide lower levels of reimbursement due to changing policies, billing complexities or other factors, such as the increased focus by third - party payers on requiring that pr ior authorization be obtained prior to conducting a test; if the FDA were to begin actively regulating our tests, we could incur substantial costs and delays associated with try ing to obtain premarket clearance or approval and incur costs associated with complying with post - market controls; litigation or other proceedings, resulting from either third party cl aims of intellectual property infringement or third party infringement of our technology, is costly, time - consuming and could limit our ability to commercialize our products or services; and any inability to effectively protect our proprietary technology could harm our competitive position or our brand. We discuss these and other risks and uncertainties i n g reater detail in the sections entitled “Risk Factors” and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our periodic reports on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time. Given these uncertainties, you should not place undue reliance on the forward - looking statements. Mor eover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, no r can we assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from tho se contained in any forward - looking statement. In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied. Except as required by law, we undertake no obligation to update publicly any fo rward - looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, p rox y statements, and other information with the SEC. Such reports, proxy statements, and other information concerning us is available at http://www.sec.gov . Requests for copies of such documents should be directed to our Investor Relations department at Natera, Inc., 201 Industrial Road, Suite 410, San Carlos, California 94070. Our telephone number is ( 650 ) 249 - 9090.

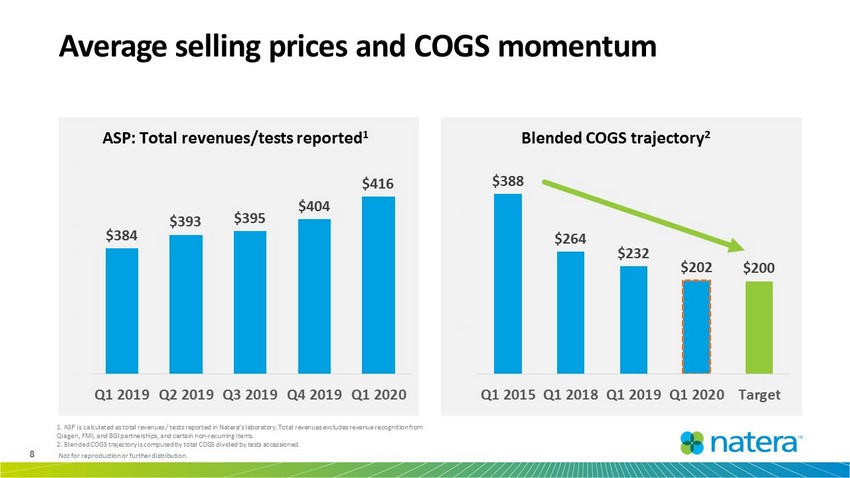

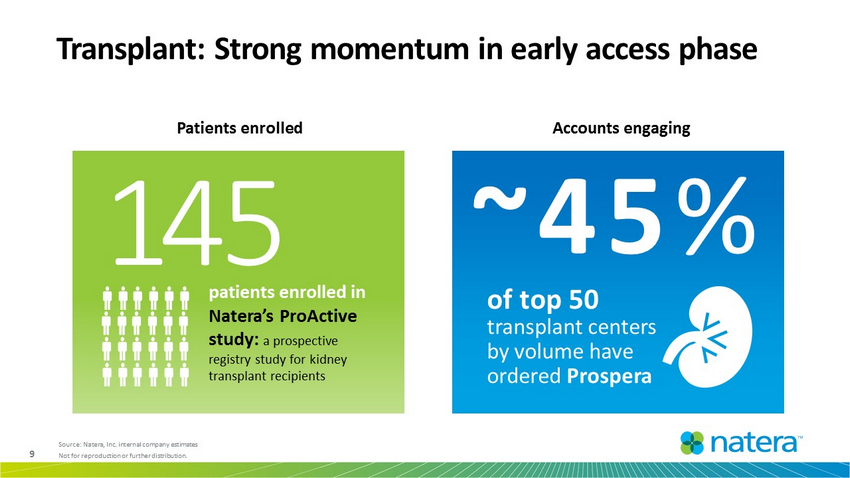

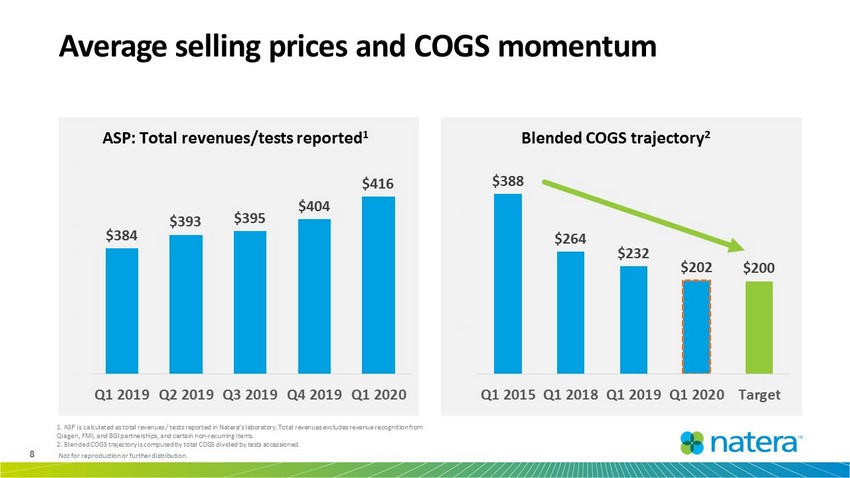

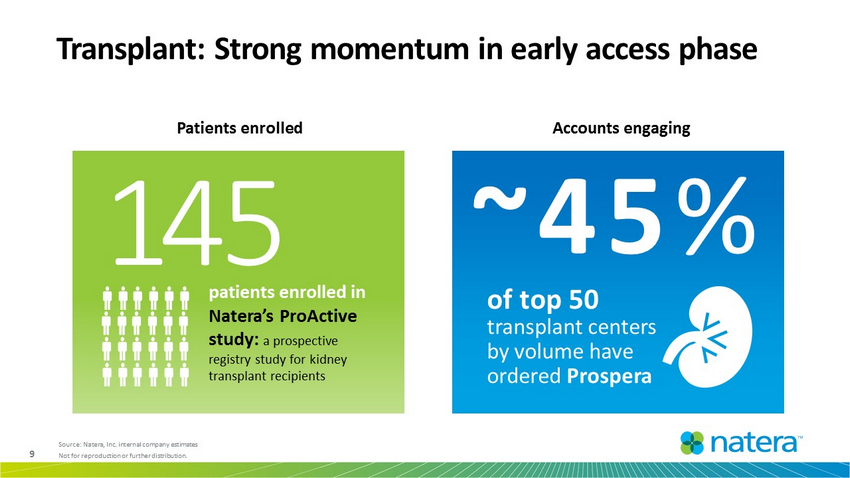

3 Not for reproduction or further distribution. ● Total revenues of $94M in Q1 2020, up 41% vs. Q1 2019 on strong volume growth, growing ASPs, partnership revenue ● Achieved $202 in COGS per unit: close to our long - term target of $200 ● Successful early access program for Prospera: ~45% of top 50 centers have ordered and first 145 patients enrolled in the ProActive registry trial ● Responded to COVID - 19 by implementing safety protocols in our lab, scaling remote - ordering capabilities for patients and physicians ● Coverage for Panorama extended by >20 million lives during COVID - 19 ● Successfully completed ~$278.9M convertible debt offering Recent highlights

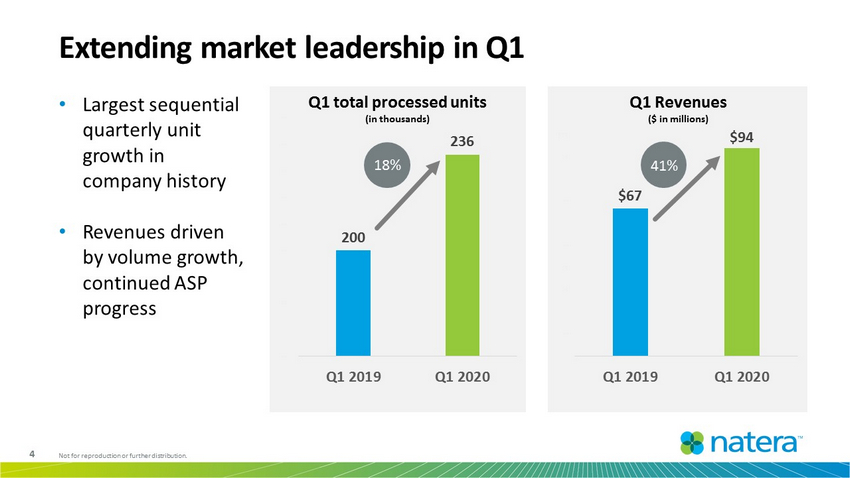

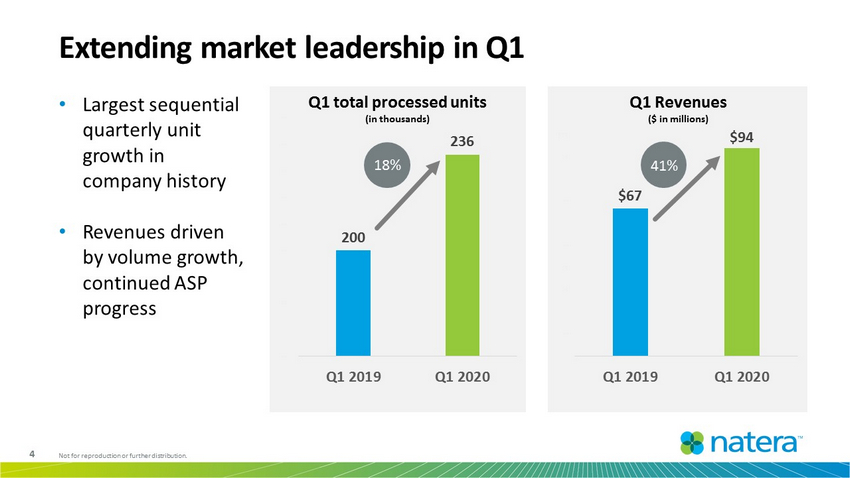

4 Not for reproduction or further distribution. 200 236 160K 170K 180K 190K 200K 210K 220K 230K 240K 250K Q1 2019 Q1 2020 $67 $94 $ $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 Q1 2019 Q1 2020 Q1 total processed units (in thousands) Extending market leadership in Q1 Q1 Revenues ($ in millions) • Largest sequential quarterly unit growth in company history • Revenues driven by volume growth, continued ASP progress 41% 18 %

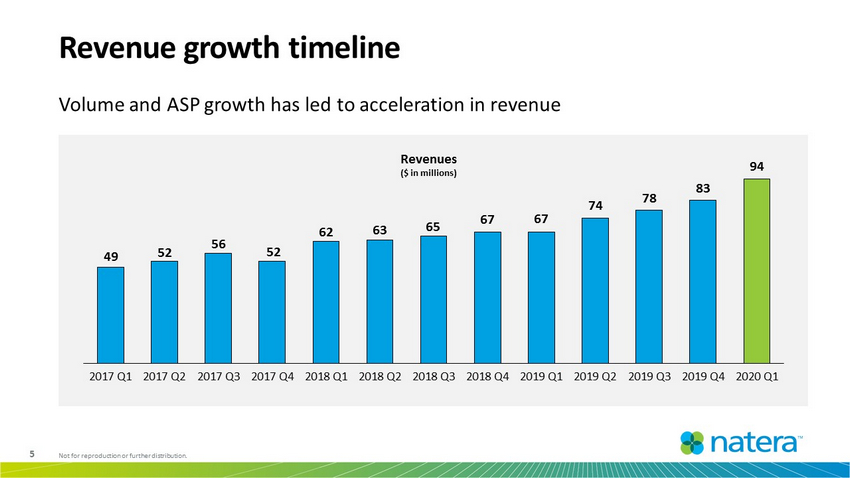

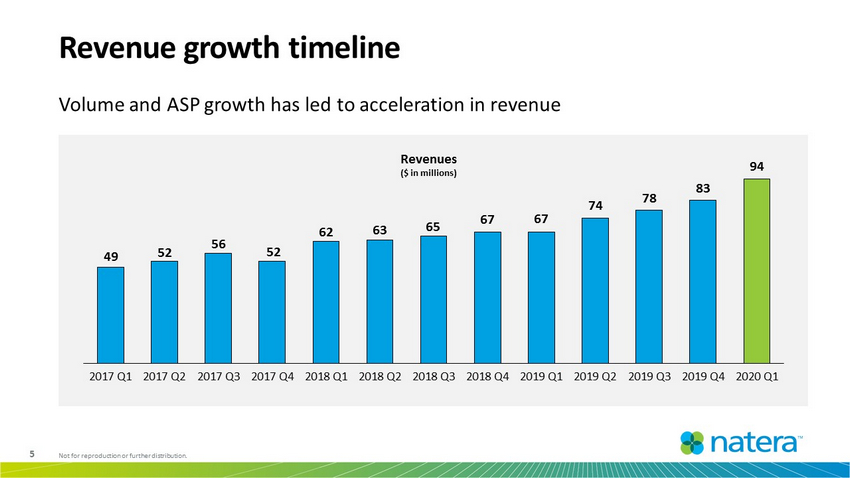

5 Not for reproduction or further distribution. Revenue growth timeline Volume and ASP growth has led to acceleration in revenue 49 52 56 52 62 63 65 67 67 74 78 83 94 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 Revenues ($ in millions)

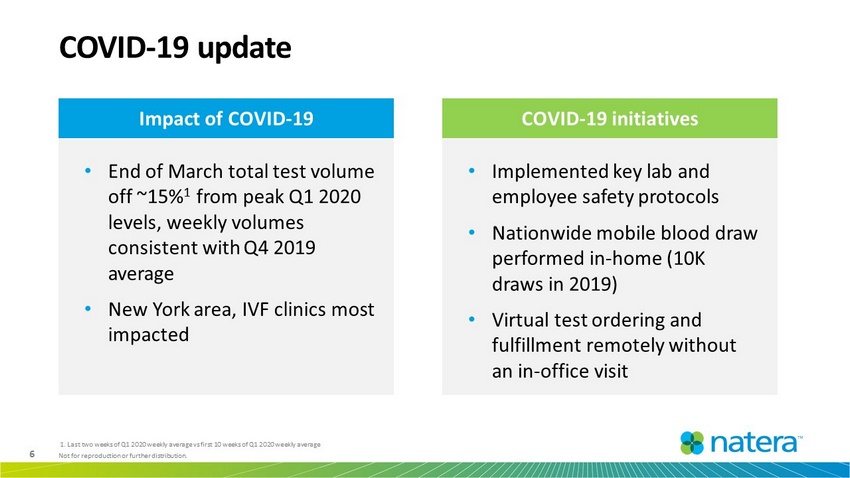

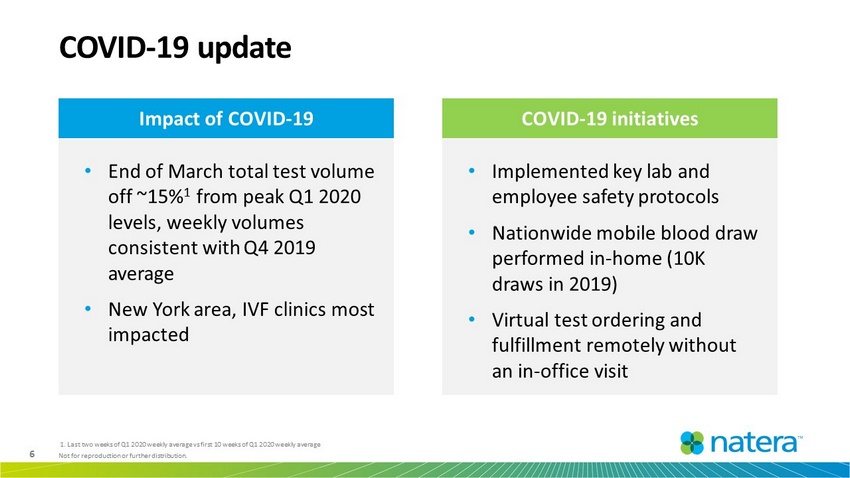

6 Not for reproduction or further distribution. • Implemented key lab and employee safety protocols • Nationwide mobile blood draw performed in - home (10K draws in 2019) • Virtual test ordering and fulfillment remotely without an in - office visit COVID - 19 update COVID - 19 initiatives • End of March total test volume off ~15% 1 from peak Q1 2020 levels, weekly volumes consistent with Q4 2019 average • New York area, IVF clinics most impacted Impact of COVID - 19 1. Last two weeks of Q1 2020 weekly average vs first 10 weeks of Q1 2020 weekly average

7 Not for reproduction or further distribution. Average risk NIPT coverage recently expanded >20M Lives

8 Not for reproduction or further distribution. $388 $264 $232 $202 $200 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 Q1 2015 Q1 2018 Q1 2019 Q1 2020 Target Average selling prices and COGS momentum ASP: Total revenues/tests reported 1 Blended COGS trajectory 2 1. ASP is calculated as total revenues / tests reported in Natera’s laboratory. Total revenues excludes revenue recognition f rom Qiagen, FMI, and BGI partnerships, and certain non - recurring items. 2. Blended COGS trajectory is computed by total COGS divided by tests accessioned. $384 $393 $396 $404 $416 $300 $320 $340 $360 $380 $400 $420 $440 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020

9 Not for reproduction or further distribution. Transplant: Strong momentum in early access phase Patients enrolled Accounts engaging Source: Natera, I nc . internal company estimates o f top 50 transplant centers by volume have ordered Prospera ~45 % patients enrolled in Natera’s ProActive study: a prospective registry study for kidney transplant recipients 1 45

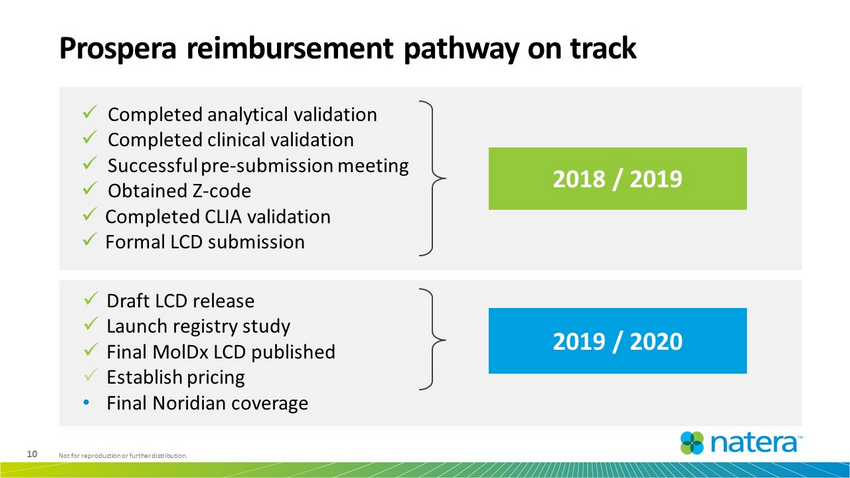

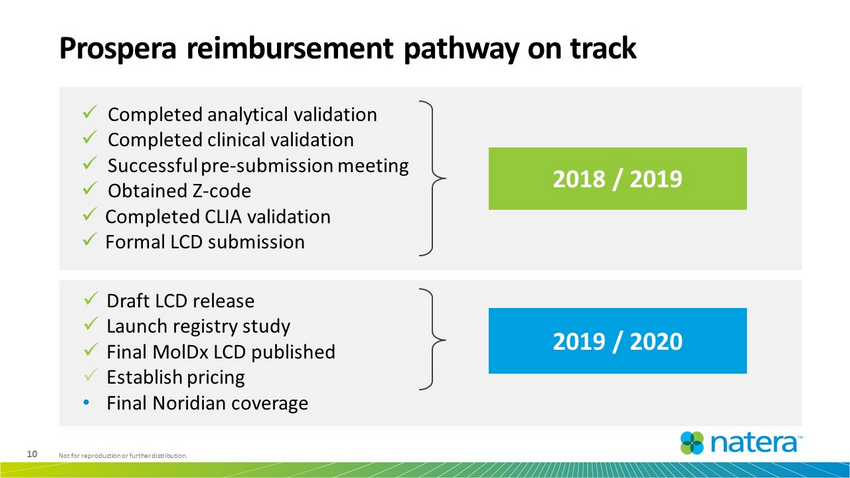

10 Not for reproduction or further distribution. Prospera reimbursement pathway on track 2018 / 2019 2019 / 2020 x Completed analytical validation x Completed clinical validation x Successful pre - submission meeting x Obtained Z - code x Completed CLIA validation x Formal LCD submission x Draft LCD release x Launch registry study x Final MolDx LCD published x Establish pricing • Final Noridian coverage

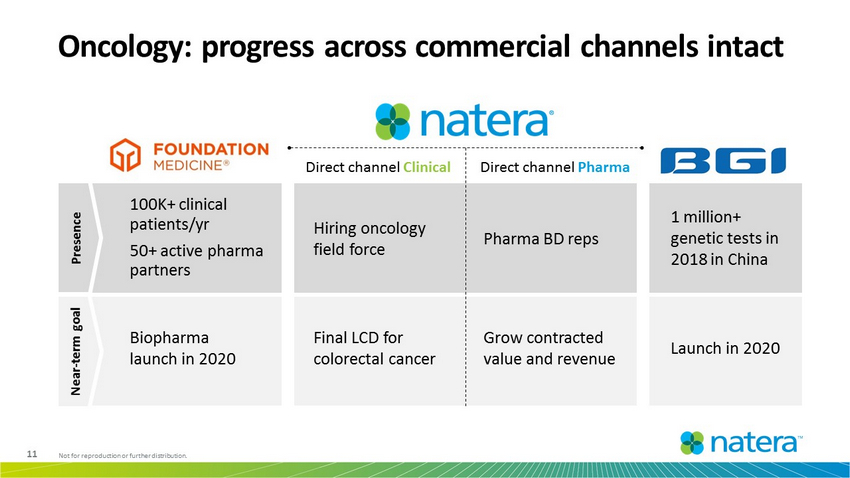

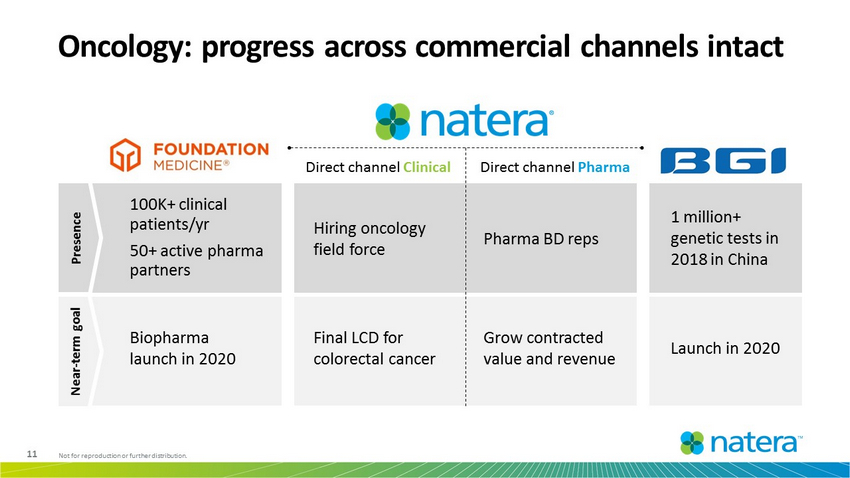

11 Not for reproduction or further distribution. Oncology: progress across commercial channels intact Direct channel Clinical Direct channel Pharma Pharma BD reps Hiring oncology field force 100K+ clinical patients/yr 50+ active pharma partners 1 million+ genetic tests in 2018 in China Grow contracted value and revenue Launch in 2020 Biopharma launch in 2020 Final LCD for colorectal cancer Presence Near - term goal

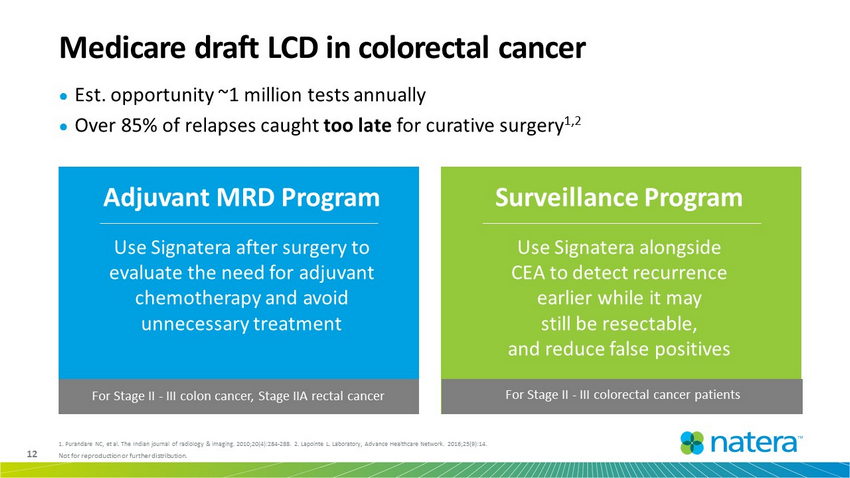

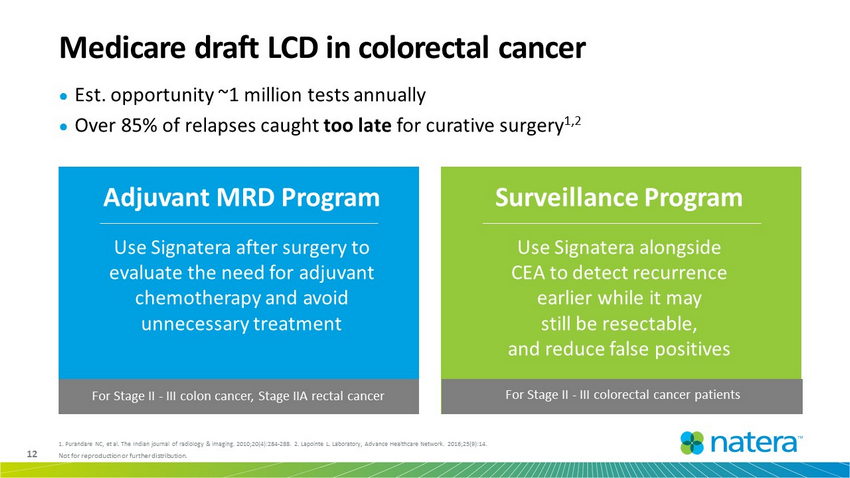

12 Not for reproduction or further distribution. ● Est. opportunity ~1 million tests annually ● Over 85% of relapses caught too late for curative surgery 1,2 Medicare draft LCD in colorectal cancer Adjuvant MRD Program Use Signatera after surgery to evaluate the need for adjuvant chemotherapy and avoid unnecessary treatment Surveillance Program Use Signatera alongside CEA to detect recurrence earlier while it may still be resectable, and reduce false positives For Stage II - III colon cancer, Stage IIA rectal cancer For Stage II - III colorectal cancer patients 1. Purandare NC, et al. The Indian journal of radiology & imaging. 2010;20(4):284 - 288. 2. Lapointe L. Laboratory, Advance Healt hcare Network. 2016;25(9):14.

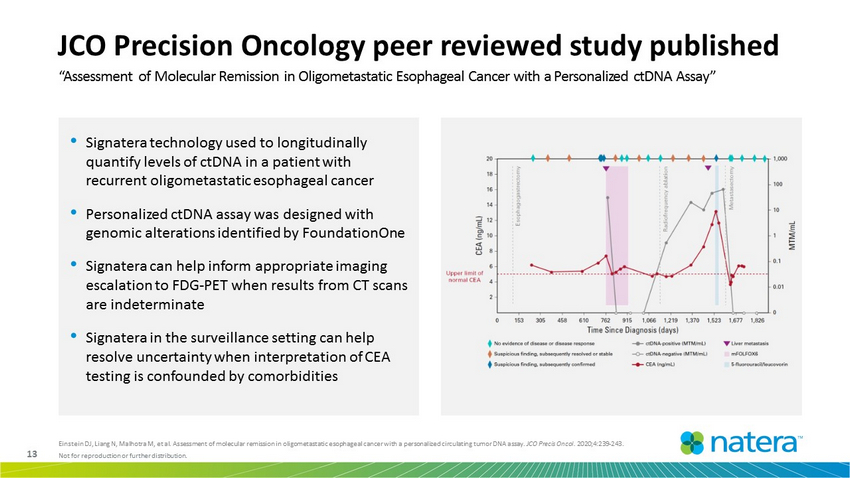

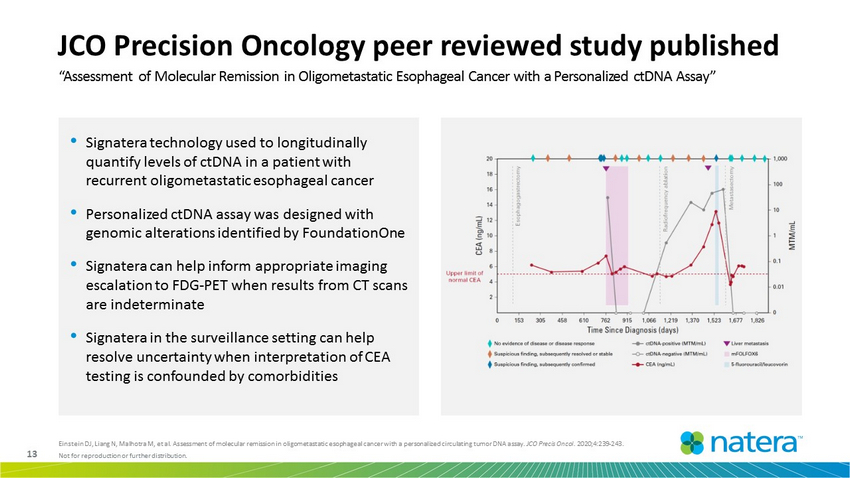

13 Not for reproduction or further distribution. • Signatera technology used to longitudinally quantify levels of ctDNA in a patient with recurrent oligometastatic esophageal cancer • Personalized ctDNA assay was designed with genomic alterations identified by FoundationOne • Signatera can help inform appropriate imaging escalation to FDG - PET when results from CT scans are indeterminate • Signatera in the surveillance setting can help resolve uncertainty when interpretation of CEA testing is confounded by comorbidities “Assessment of Molecular Remission in Oligometastatic Esophageal Cancer with a Personalized ctDNA Assay” Einstein DJ, Liang N, Malhotra M, et al. Assessment of molecular remission in oligometastatic esophageal cancer with a person ali zed circulating tumor DNA assay. JCO Precis Oncol. 2020;4:239 - 243. JCO Precision Oncology peer reviewed study published

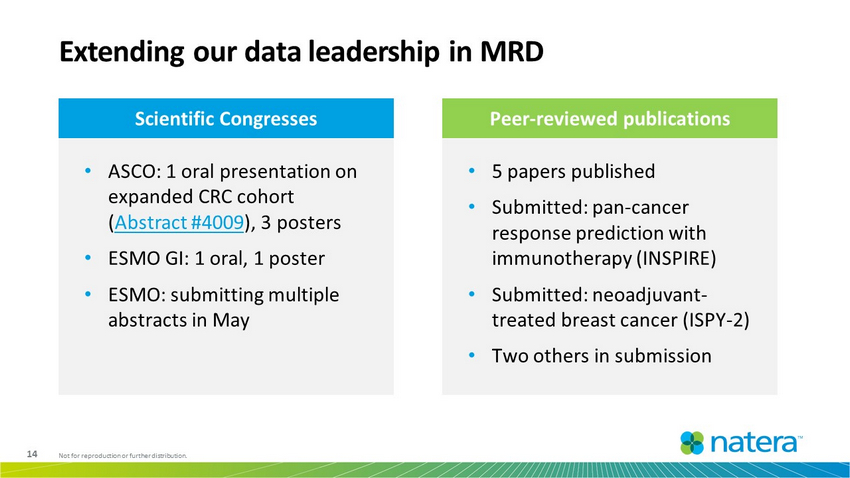

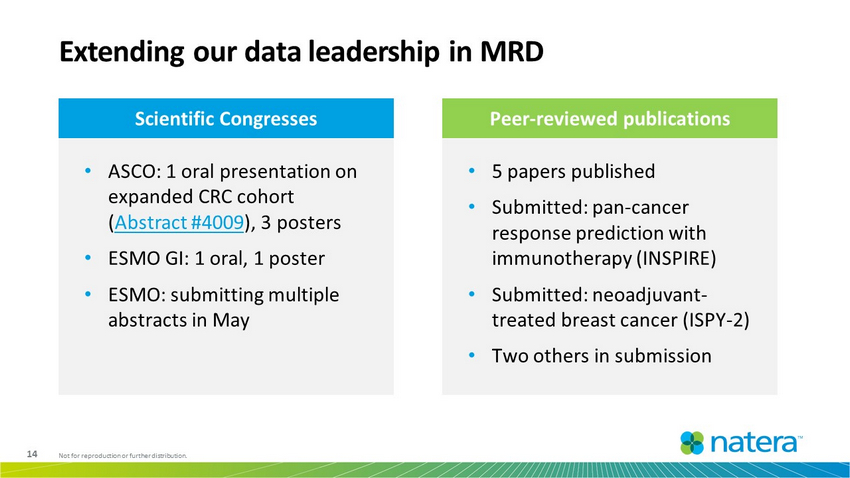

14 Not for reproduction or further distribution. Extending our data leadership in MRD • 5 papers published • Submitted: pan - cancer response prediction with immunotherapy (INSPIRE) • Submitted: neoadjuvant - treated breast cancer (ISPY - 2) • Two others in submission Peer - reviewed publications • ASCO: 1 oral presentation on expanded CRC cohort ( Abstract #4009 ) , 3 posters • ESMO GI: 1 oral, 1 poster • ESMO: submitting multiple abstracts in May Scientific Congresses

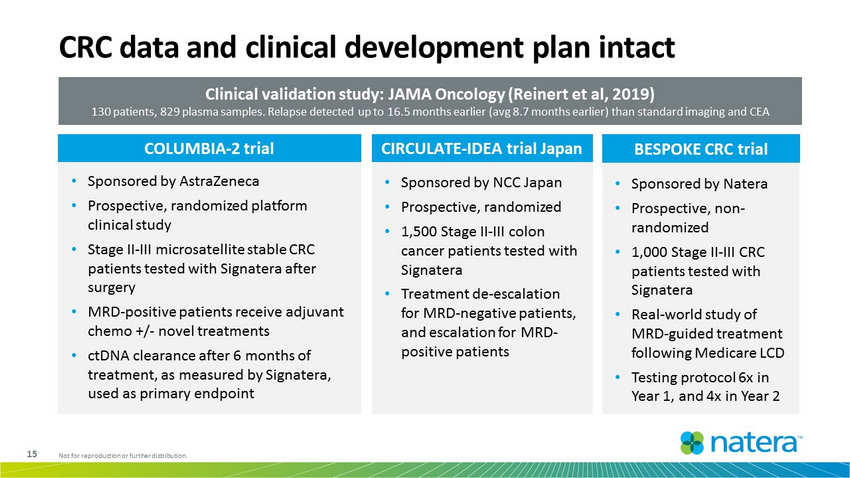

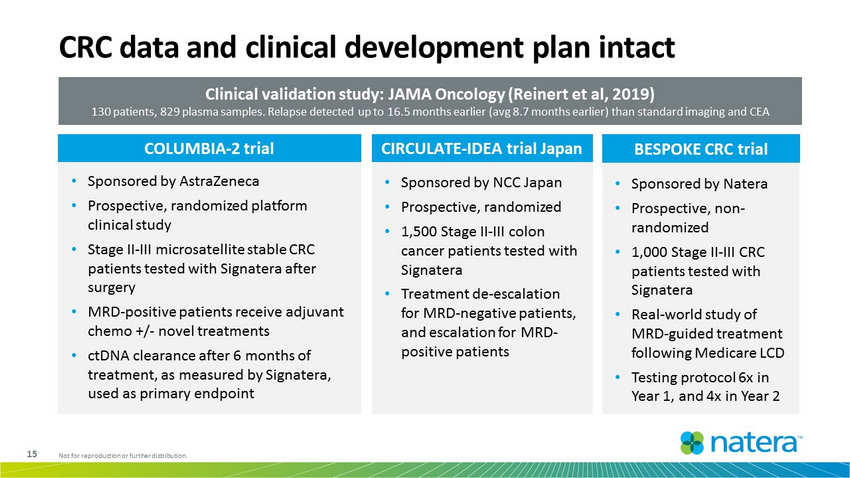

15 Not for reproduction or further distribution. • Sponsored by Natera • Prospective, non - randomized • 1,000 Stage II - III CRC patients tested with Signatera • Real - world study of MRD - guided treatment following Medicare LCD • Testing protocol 6x in Year 1, and 4x in Year 2 • Sponsored by NCC Japan • Prospective, randomized • 1,500 Stage II - III colon cancer patients tested with Signatera • Treatment de - escalation for MRD - negative patients, and escalation for MRD - positive patients CRC data and clinical development plan intact BESPOKE CRC trial CIRCULATE - IDEA trial Japan Clinical validation study: JAMA Oncology (Reinert et al, 2019) 130 patients, 829 plasma samples. Relapse detected up to 16.5 months earlier (avg 8.7 months earlier) than standard imaging a nd CEA • Sponsored by AstraZeneca • Prospective, randomized platform clinical study • Stage II - III microsatellite stable CRC patients tested with Signatera after surgery • MRD - positive patients receive adjuvant chemo +/ - novel treatments • ctDNA clearance after 6 months of treatment, as measured by Signatera, used as primary endpoint COLUMBIA - 2 trial

16 Not for reproduction or further distribution. Signatera colorectal cancer – Medicare reimbursement pathway on track 2019 2020 x Successful pre - submission meeting x Obtained Z - code x Completed clinical validation x CLIA soft launch x Formal LCD submission x Draft LCD release x Launch registry trial • Final LCD published • Final pricing

17 Not for reproduction or further distribution. Balance Sheet Pro Forma 3 Q1’20 Q4’19 Change QoQ Cash & Investments 2 $605.6 $405.9 $441.0 ($35.1) UBS Line of Credit $50.1 $50.1 $50.1 $0.0 OrbiMed Debt Facility $ — $72.9 $73.7 ($0.8) Convertible Senior Notes $287.5 $ — $ — $0.0 F inancial overview ($ in millions, except for per share data) P&L Q1’20 Q1’19 Change Product Revenues $87.0 $63.3 $23.7 Licensing and Other Revenues $7.0 $3.5 $3.5 Total Revenues $94.0 $66.8 $27.2 Gross Margin% 1 52% 35% 1,700 bps R&D $18.2 $11.4 $6.8 SG&A $65.7 $43.8 $21.9 Net Loss Per Diluted Share ($0.45) ($0.54) $0.09 1. Gross margin is calculated as gross profit divided by GAAP total revenues. Gross profit is calculated as GAAP total revenues les s GAAP cost of revenues. 2. Cash and investments also include cash equivalents and restricted cash. 3. Pro forma balance sheet data includes net proceeds of $278.9 million Natera received in the convertible note financing and payoff of the Orbimed debt facility of $79.2 million (including early pre - payment penalty fees and accrued interest) subsequent to March 31, 2020 . This also includes the Convertible Senior Notes shown is the aggregate principal amount, not reflecting the adjustments required under ASC 470 - 20.