Exhibit 99.2

Natera, Inc. Investor presentation Fourth Quarter 2021 Earnings Call

2 Not for reproduction or further distribution. This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding our market opportunity, our proposed products and launch schedules, our reimburs eme nt coverage and our product costs, our commercial partners and potential acquisitions, our user experience, our clinical trials and studies, our financial performance, our strategies, our ant icipated revenue and financial outlook, our goals and general business and market conditions, are forward - looking statements. These forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to diffe r materially, including: we face numerous uncertainties and challenges in achieving our financial projections and goals; we may be unable to maintain our business and operations as planned due to dis ruptions and economic uncertainty caused by the COVID - 19 pandemic; we may be unable to further increase the use and adoption of Panorama and Horizon through our direct sales efforts or through our laboratory partners; we may be unable to develop and successfully commercialize new products, including Signatera and Prospera; we have incurred losses since our inception and we an ticipate that we will continue to incur losses for the foreseeable future; our quarterly results may fluctuate from period to period; our estimates of market opportunity and forecasts of marke t g rowth may prove to be inaccurate; we may be unable to compete successfully with existing or future products or services offered by our competitors; we may engage in acquisitions, disposit ion s or other strategic transactions that may not achieve our anticipated benefits and could otherwise disrupt our business, cause dilution to our stockholders or reduce our financial resources; we m ay need to raise additional capital to support our business plans, which may not be available when necessary or on favorable terms; we may not be successful in commercializing our cloud - based distribution model; our products may not perform as expected; the results of our clinical studies, including our SNP - based Microdeletion and Aneuploidy RegisTry, or SMART, Study, may not be compelling to profe ssional societies or payors as supporting the use of our tests, particularly in the average - risk pregnancy population or for microdeletions screening, or may not be able to be replicated in la ter studies required for regulatory approvals or clearances; if either of our primary CLIA - certified laboratory facilities becomes inoperable, we will be unable to perform our tests and our business will be harmed; we rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and materials and may not be able to find replacements or immediatel y t ransition to alternative suppliers; if we are unable to successfully scale our operations, our business could suffer; the marketing, sale, and use of Panorama and our other products could result in su bst antial damages arising from product liability or professional liability claims that exceed our resources; we may be unable to expand, obtain or maintain third - party payer coverage and reimbursement fo r Panorama, Horizon and our other tests, and we may be required to refund reimbursements already received; third - party payers may withdraw coverage or provide lower levels of reimbursement due to changing policies, billing complexities or other factors, such as the increased focus by third - party payers on requiring that prior authorization be obtained prior to conducting a test; if the F DA were to begin actively regulating our tests, we could incur substantial costs and delays associated with trying to obtain premarket clearance or approval and incur costs associated with complying w ith post - market controls; litigation or other proceedings, resulting from either third party claims of intellectual property infringement or third party infringement of our technology, is costly, tim e - c onsuming and could limit our ability to commercialize our products or services; any inability to effectively protect our proprietary technology could harm our competitive position or our brand; and we cann ot guarantee that we will be able to service and comply with our outstanding debt obligations or achieve our expectations regarding the conversion of our outstanding convertible notes. We discuss thes e a nd other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic re por ts on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to ti me. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause a ctu al results to differ materially from those contained in any forward - looking statement. In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in thi s presentation may not occur and our actual results could differ materially and adversely from those anticipated or implied. As a result, you should not place undue reliance on our forward - looking statem ents. Except as required by law, we undertake no obligation to update publicly any forward - looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. We file reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information concerning us is availa ble at http://www.sec.gov. Requests for copies of such documents should be directed to our Investor Relations department at Natera, Inc., 13011 McCallen Pass, Building A Suite 100, Austin, TX 78753 . O ur telephone number is (650) 249 - 9090. Safe harbor statement

3 Not for reproduction or further distribution. ● 1.57M total tests processed in FY 2021; ~53% growth vs 2020 and >5K more than preannounce – ~439K total tests processed in Q4 2021 ● FY 2021 total revenue of $625.5M; ~60% growth vs 2020, and above top end of previous guidance range – Total revenue of $173M in Q4 2021 ● Landmark CIRCULATE - Japan study shows Signatera Œ MRD is predictive of chemotherapy benefit in colorectal cancer ● SMART 22q11.2 deletion study published in the American Journal of Obstetrics and Gynecology : landmark 5 - year, 20,000 patients enrolled in trial ● Successful readout of Trifecta study – largest prospective, fully biopsy - matched, kidney dataset to date ● Guiding 2022 total revenue of $770M to $790M; 31% 1 growth at the midpoint over 2021 Recent highlights 1. Pro forma for the one - time Qiagen revenue recognition of $28.3M in 2021

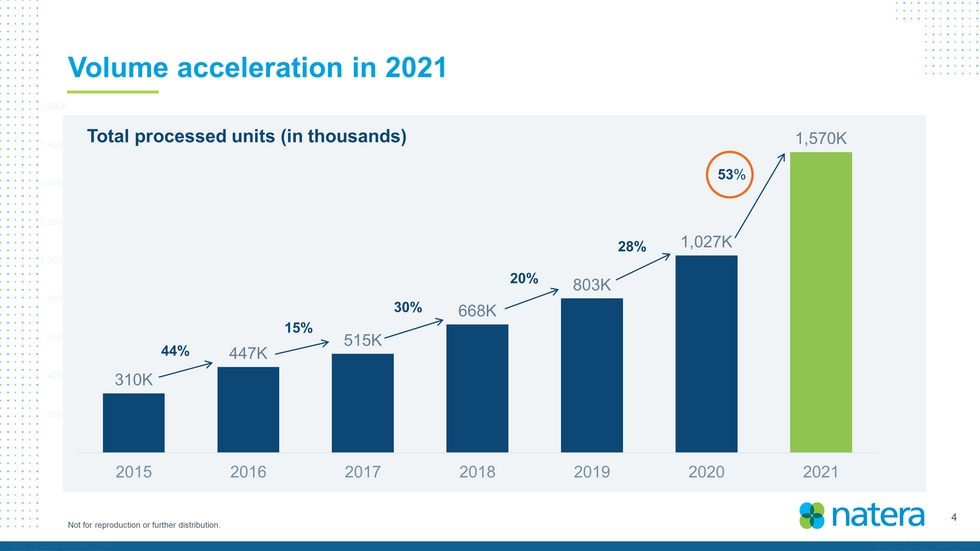

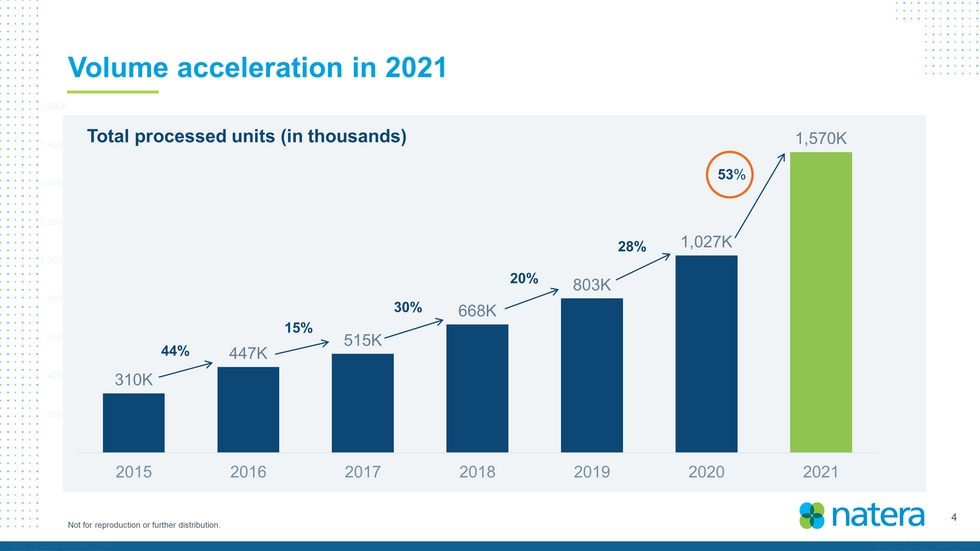

4 Not for reproduction or further distribution. Volume acceleration in 2021 310K 447K 515K 668K 803K 1,027K 1,570K K 200K 400K 600K 800K 1,000K 1,200K 1,400K 1,600K 1,800K 2015 2016 2017 2018 2019 2020 2021 53 % 28% 20% 30% 15% 44% Total processed units (in thousands)

5 Not for reproduction or further distribution. Strong growth trends in Q4 Total revenues ($ in millions) Tests processed (thousands) $54 $67 $83 $112 $173 Q4 2017 Q4 2018 Q4 2019 Q4 2020 Q4 2021 138 174 209 295 439 Q4 2017 Q4 2018 Q4 2019 Q4 2020 Q4 2021 24% 24% 54% 35% 26% 20% 49% 41%

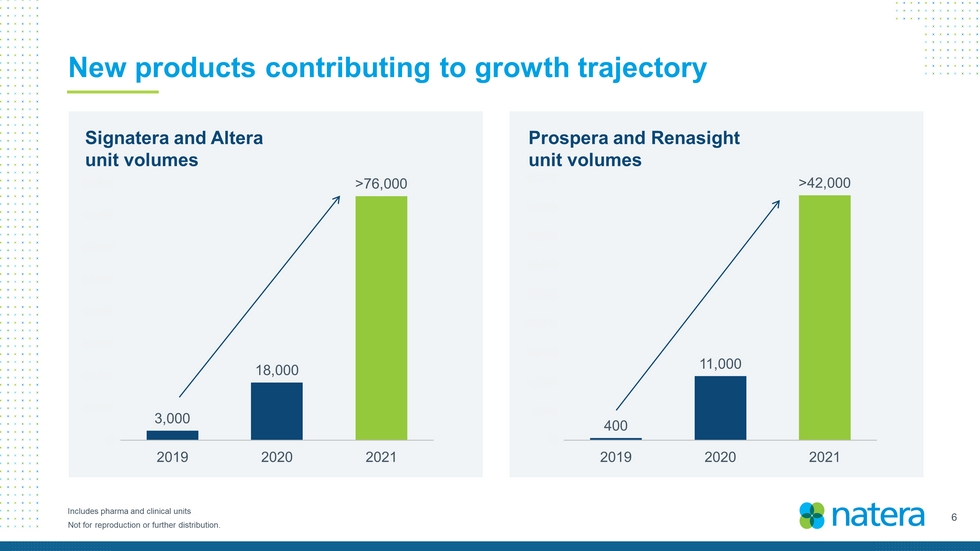

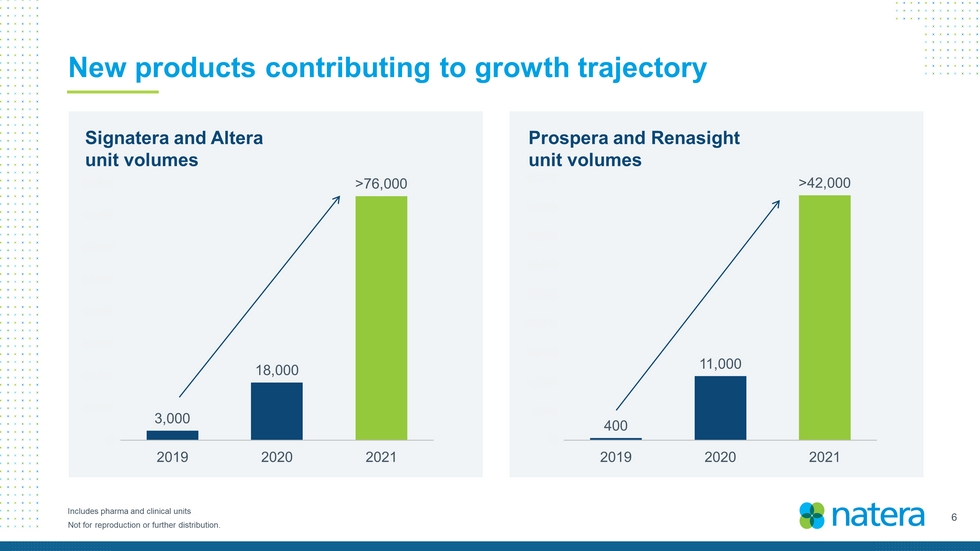

6 Not for reproduction or further distribution. New products contributing to growth trajectory Includes pharma and clinical units Signatera and Altera unit volumes Prospera and Renasight unit volumes 3,000 18,000 > 76,000 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 2019 2020 2021 400 11,000 > 42,000 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 2019 2020 2021

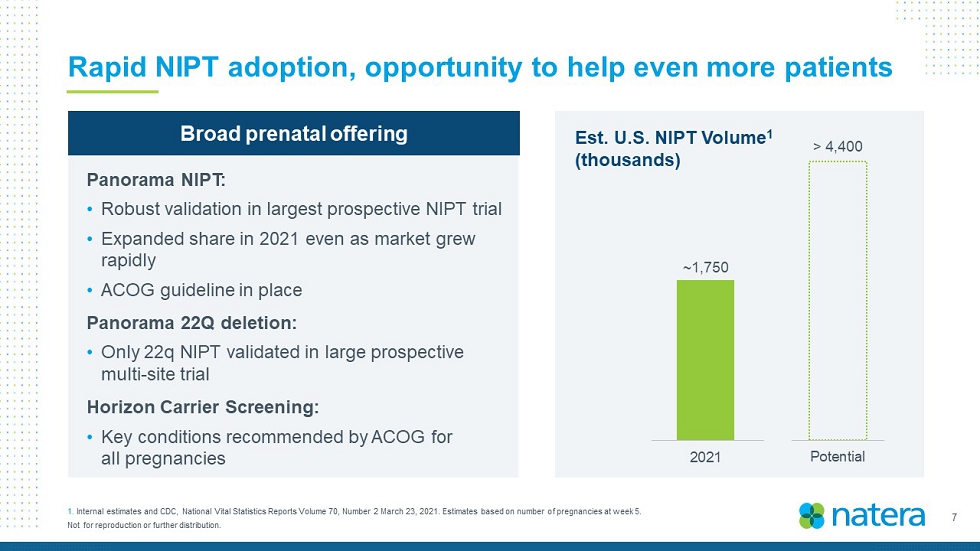

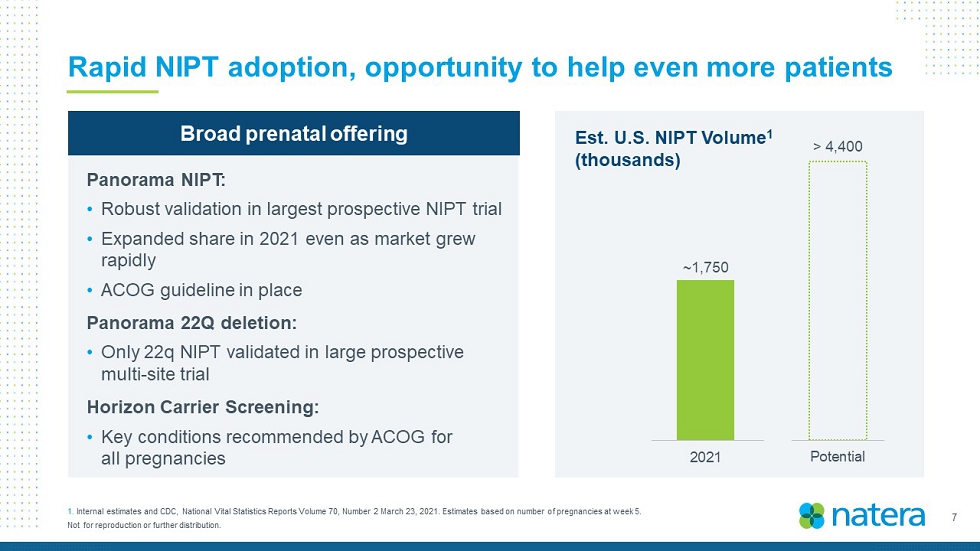

7 Not for reproduction or further distribution. Rapid NIPT adoption, opportunity to help even more patients 1. Internal estimates and CDC, National Vital Statistics Reports Volume 70, Number 2 March 23, 2021. Estimates based on number o f p regnancies at week 5. Est. U.S. NIPT Volume 1 (thousands) ~ 1,200 ~ 1,750 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2020 2021 Potential > 4,400 Broad p renatal offering Panorama NIPT : • Robust validation in largest prospective NIPT trial • Expanded share in 2021 even as market grew rapidly • ACOG guideline in place Panorama 22Q deletion: • Only 22q NIPT validated in large prospective multi - site trial Horizon Carrier Screening : • Key conditions recommended by ACOG for all pregnancies

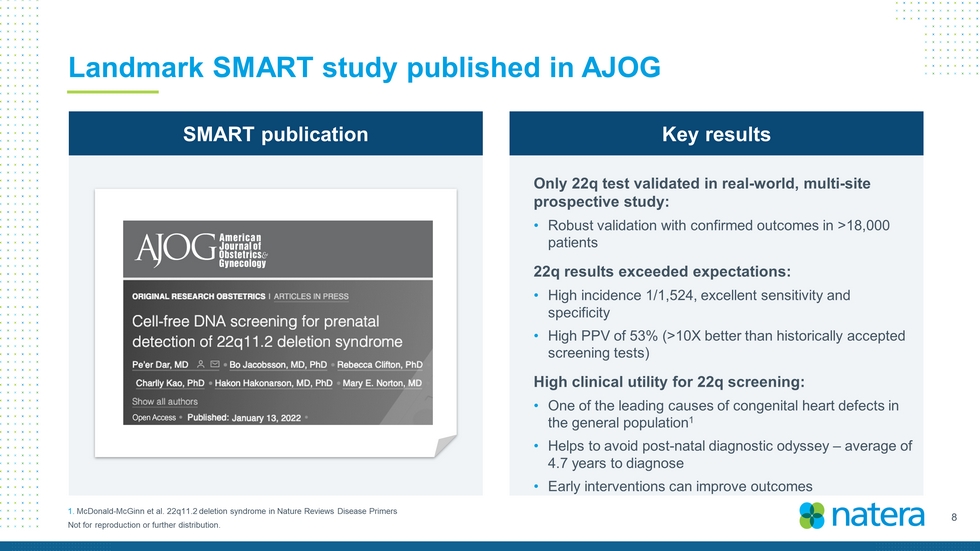

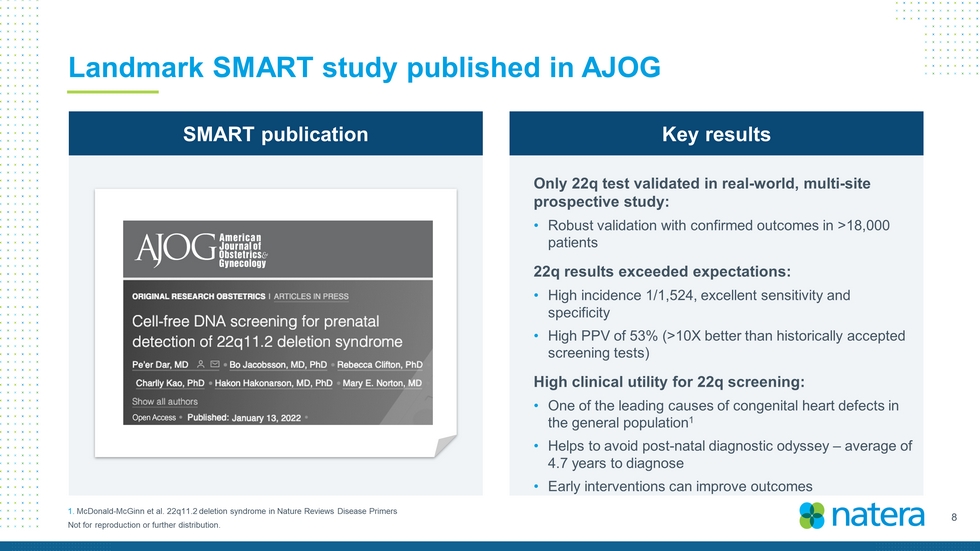

8 Not for reproduction or further distribution. Landmark SMART study published in AJOG SMART publication Key results Only 22q test validated in real - world, multi - site prospective study: • Robust validation with confirmed outcomes in >18,000 patients 22q results exceeded expectations : • High i ncidence 1/1,524 , e xcellent sensitivity and specificity • High PPV of 53% (>10X better than historically accepted screening tests) High clinical utility for 22q screening: • One of the leading causes of congenital heart defects in the general population 1 • Helps to avoid post - natal diagnostic odyssey – average of 4.7 years to diagnose • Early interventions can improve outcomes 1. McDonald - McGinn et al. 22q11.2 deletion syndrome in Nature Reviews Disease Primers

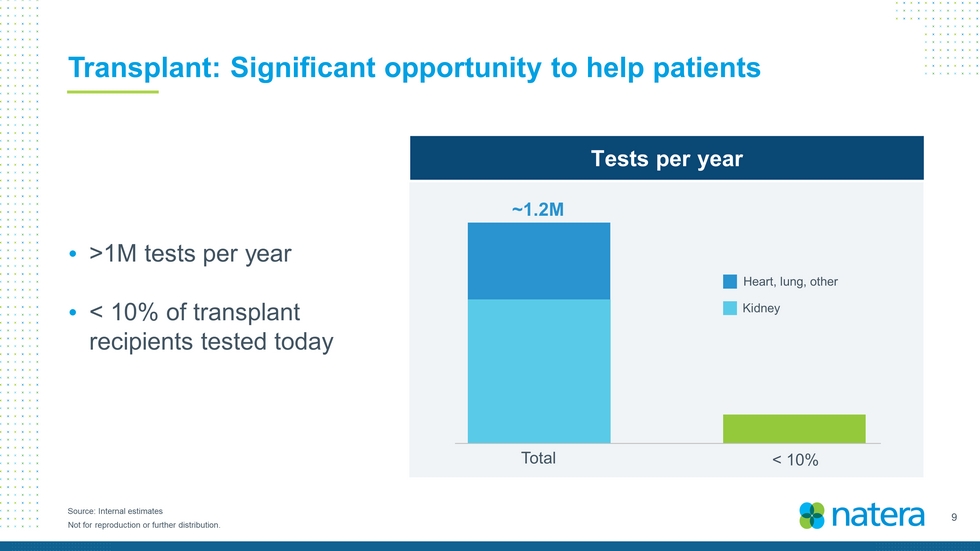

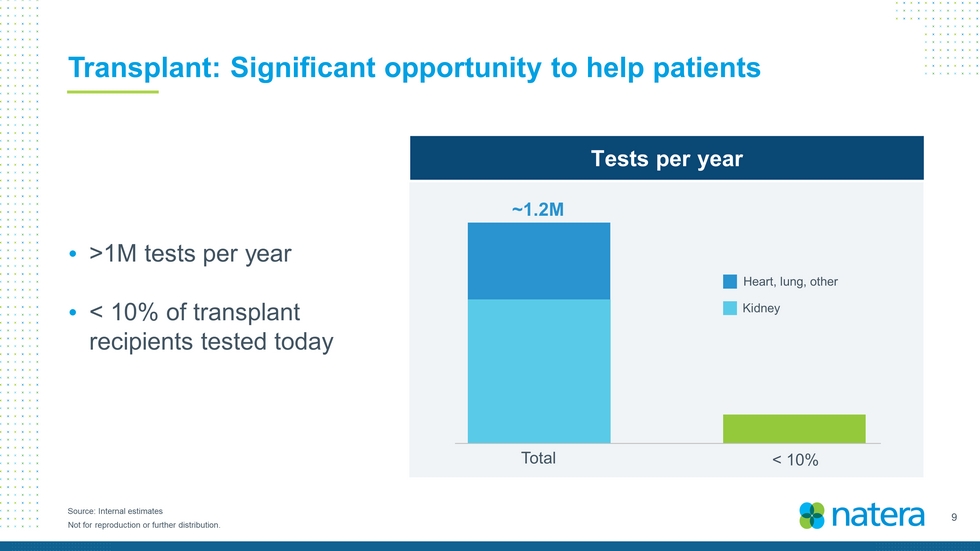

9 Not for reproduction or further distribution. Source: Internal estimates Transplant: Significant opportunity to help patients >1M tests per year < 10% of transplant recipients tested today Tests per year < 10% Total ~1.2M Heart, lung, other Kidney

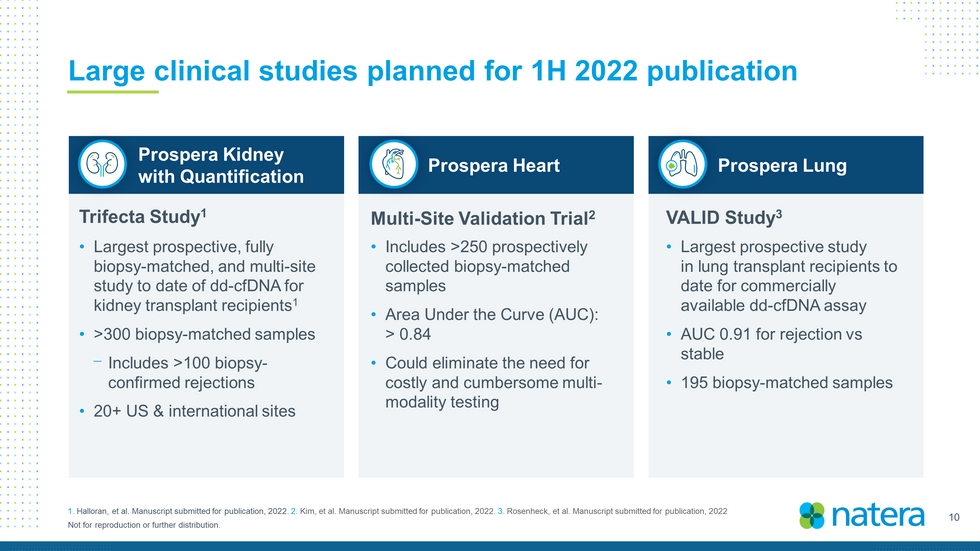

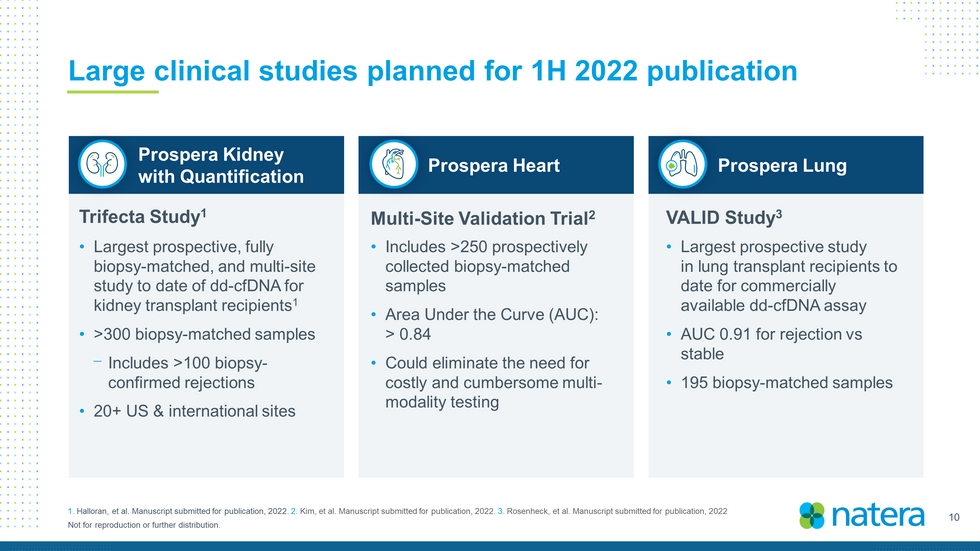

10 Not for reproduction or further distribution. Large clinical studies planned for 1H 2022 publication 1. Halloran, et al. Manuscript submitted for publication, 2022. 2. Kim, et al. Manuscript submitted for publication, 2022. 3. Rosenheck , et al. Manuscript submitted for publication, 2022 Trifecta Study 1 Multi - Site Validation Trial 2 VALID Study 3 • Largest prospective, fully biopsy - matched, and multi - site study to date of dd - cfDNA for kidney transplant recipients 1 • >300 biopsy - matched samples ⎻ Includes >100 biopsy - confirmed rejections • 20+ US & international sites • Includes >250 prospectively collected biopsy - matched samples • Area Under the Curve (AUC): > 0.84 • Could eliminate the need for costly and cumbersome multi - modality testing • Largest prospective study in lung transplant recipients to date for commercially available dd - cfDNA assay • AUC 0.91 for rejection vs stable • 195 biopsy - matched samples Prospera Heart Prospera Kidney with Quantification Prospera Lung

11 Not for reproduction or further distribution. Source: Internal estimates Expanding Oncology TAM opportunity ctDNA / liquid biopsy Therapy selection $6B Early detection $30B Monitoring/MRD $15B

12 Not for reproduction or further distribution. Signatera staged for efficiency and growth • Commercial footprint built – ready for future growth, currently at only 10% capacity • Median t urnaround time 19 days for first test including tumor exome; 6 days for subsequent tests • Online portals and EMR integration for easy test ordering and reporting • Intuitive recurring order infrastructure Commercial Reach Robust Operations Cutting - edge UX • >100 studies in the clinical pipeline • >20 publications expected in 2022 Clinical Data

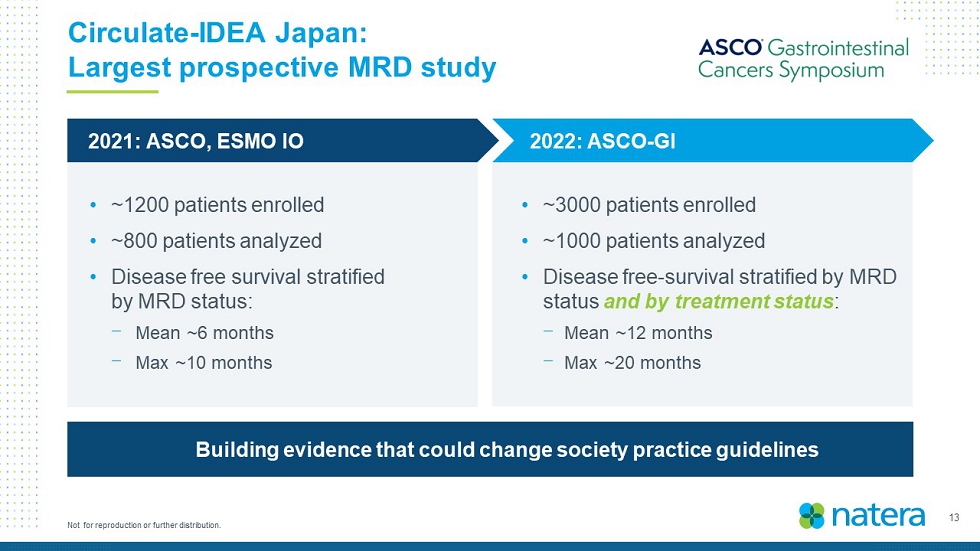

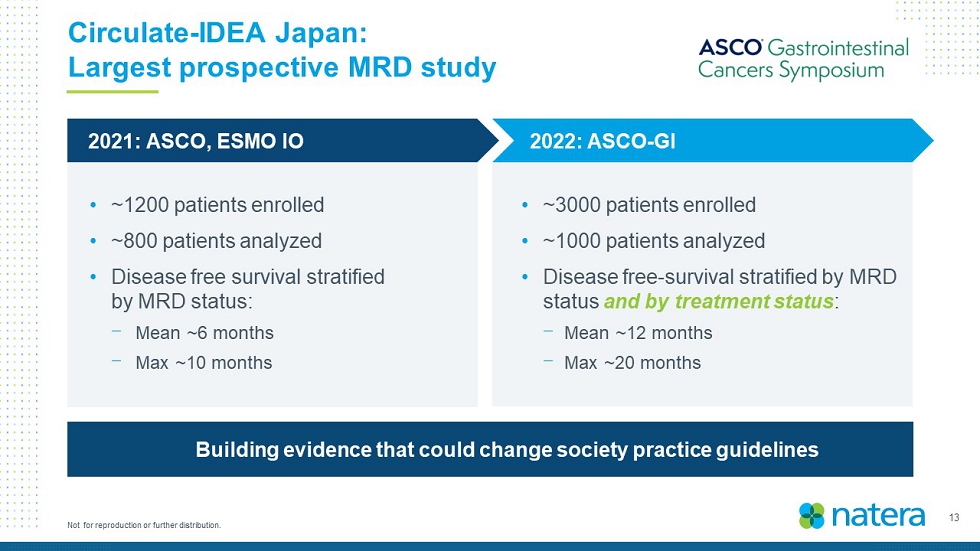

13 Not for reproduction or further distribution. Circulate - IDEA Japan: Largest prospective MRD study • ~1200 patients enrolled • ~800 patients analyzed • Disease free survival stratified by MRD status: ⎻ Mean ~ 6 months ⎻ Max ~10 months • ~3000 patients enrolled • ~1000 patients analyzed • Disease free - survival stratified by MRD status and by treatment status : ⎻ Mean ~ 12 months ⎻ Max ~20 months 2022: ASCO - GI 2021: ASCO, ESMO IO Building evidence that could change society practice guidelines

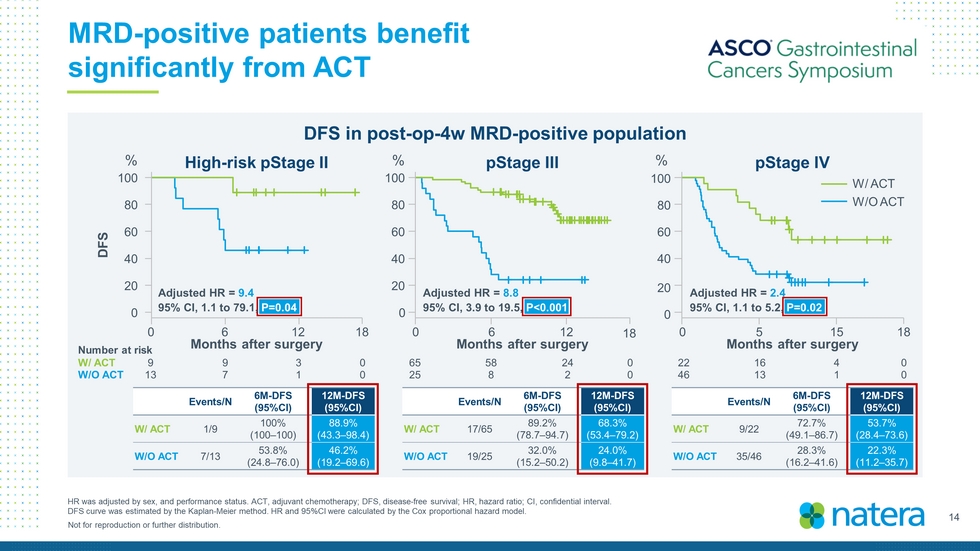

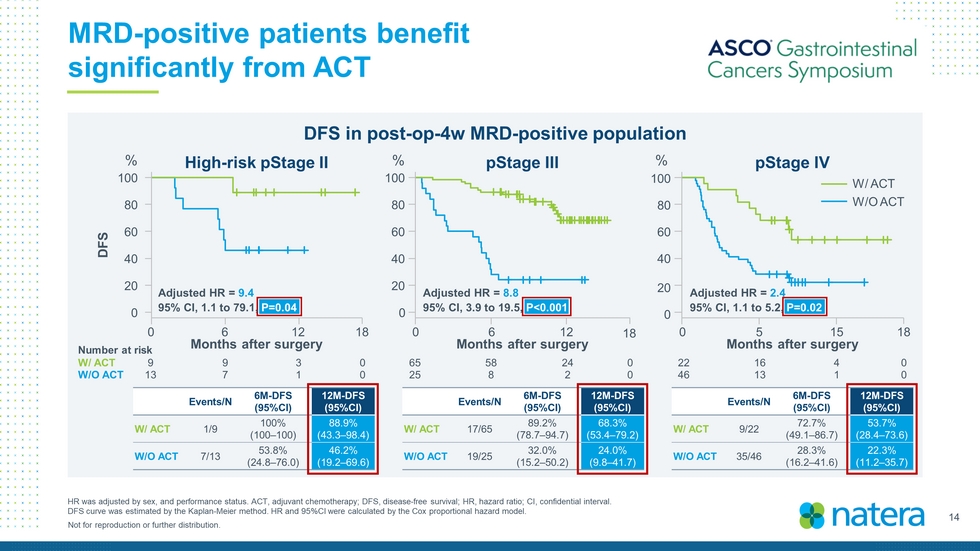

14 Not for reproduction or further distribution. MRD - positive patients benefit significantly from ACT HR was adjusted by sex, and performance status. ACT, adjuvant chemotherapy; DFS, disease - free survival; HR, hazard ratio; CI, co nfidential interval. DFS curve was estimated by the Kaplan - Meier method. HR and 95%CI were calculated by the Cox proportional hazard model. DFS in post - op - 4w MRD - positive population Number at risk W/ ACT W/O ACT 9 9 3 0 13 7 1 0 65 58 24 0 25 8 2 0 22 16 4 0 46 13 1 0 High - risk pStage II pStage III pStage IV 100 80 60 40 20 0 DFS % 0 6 12 18 Months after surgery Months after surgery Months after surgery 100 80 60 40 20 0 % 0 6 12 18 Adjusted HR = 9.4 95% CI, 1.1 to 79.1, P=0.04 Adjusted HR = 8.8 95% CI, 3.9 to 19.5, P<0.001 100 80 60 40 20 0 % 0 5 15 18 W/ ACT W/O ACT Adjusted HR = 2.4 95% CI, 1.1 to 5.2, P=0.02 Events/N 6M - DFS (95%CI) 12M - DFS (95%CI) W/ ACT 1/9 100% (100 – 100) 88.9% (43.3 – 98.4) W/O ACT 7/13 53.8% (24.8 – 76.0) 46.2% (19.2 – 69.6) Events/N 6M - DFS (95%CI) 12M - DFS (95%CI) W/ ACT 17/65 89.2% (78.7 – 94.7) 68.3% (53.4 – 79.2) W/O ACT 19/25 32.0% (15.2 – 50.2) 24.0% (9.8 – 41.7) Events/N 6M - DFS (95%CI) 12M - DFS (95%CI) W/ ACT 9/22 72.7% (49.1 – 86.7) 53.7% (28.4 – 73.6) W/O ACT 35/46 28.3% (16.2 – 41.6) 22.3% (11.2 – 35.7)

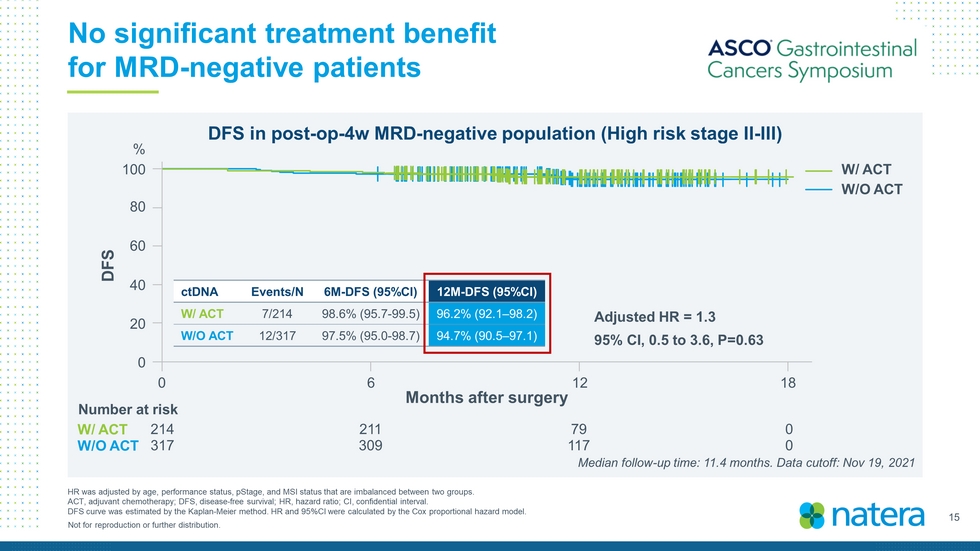

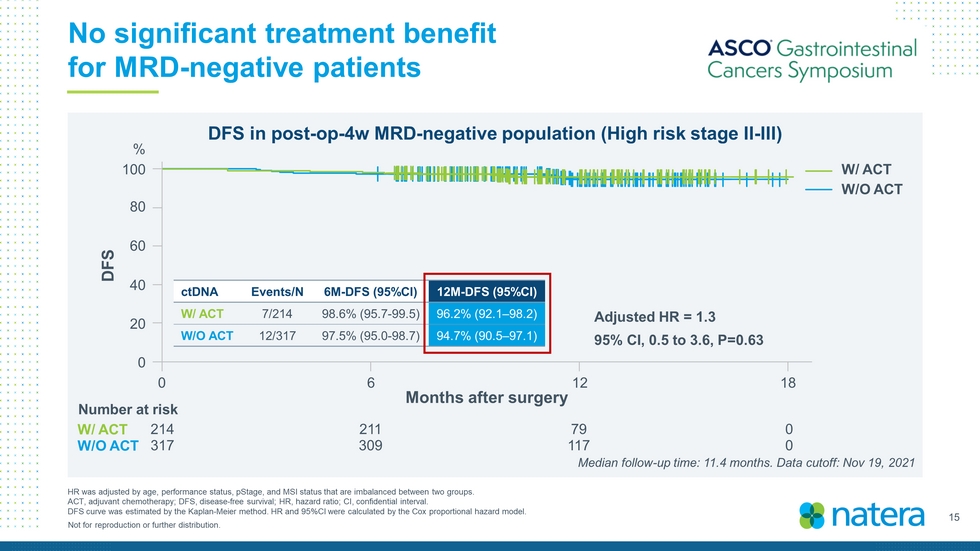

15 Not for reproduction or further distribution. No significant treatment benefit for MRD - negative patients HR was adjusted by age, performance status, pStage , and MSI status that are imbalanced between two groups. ACT, adjuvant chemotherapy; DFS, disease - free survival; HR, hazard ratio; CI, confidential interval. DFS curve was estimated by the Kaplan - Meier method. HR and 95%CI were calculated by the Cox proportional hazard model. DFS in post - op - 4w MRD - negative population (High risk stage II - III) Months after surgery 100 80 60 40 20 0 DFS 0 6 12 18 W/ ACT W/O ACT Adjusted HR = 1.3 95% CI, 0.5 to 3.6, P=0.63 ctDNA Events/N 6M - DFS (95%CI) 12M - DFS (95%CI) W/ ACT 7/214 98.6% (95.7 - 99.5) 96.2% (92.1 – 98.2) W/O ACT 12/317 97.5% (95.0 - 98.7) 94.7% (90.5 – 97.1) % 214 211 79 0 317 309 117 0 Median follow - up time: 11.4 months. Data cutoff: Nov 19, 2021 Number at risk W/ ACT W/O ACT

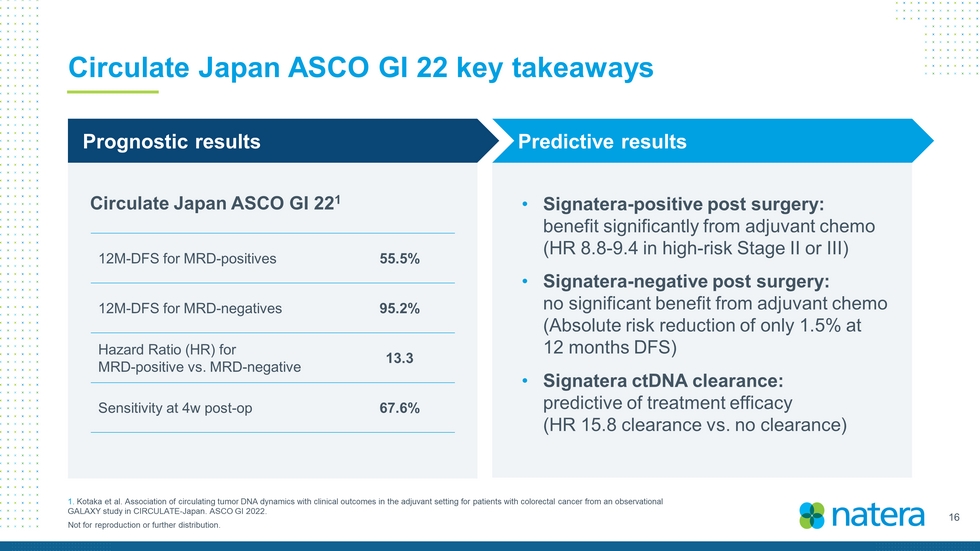

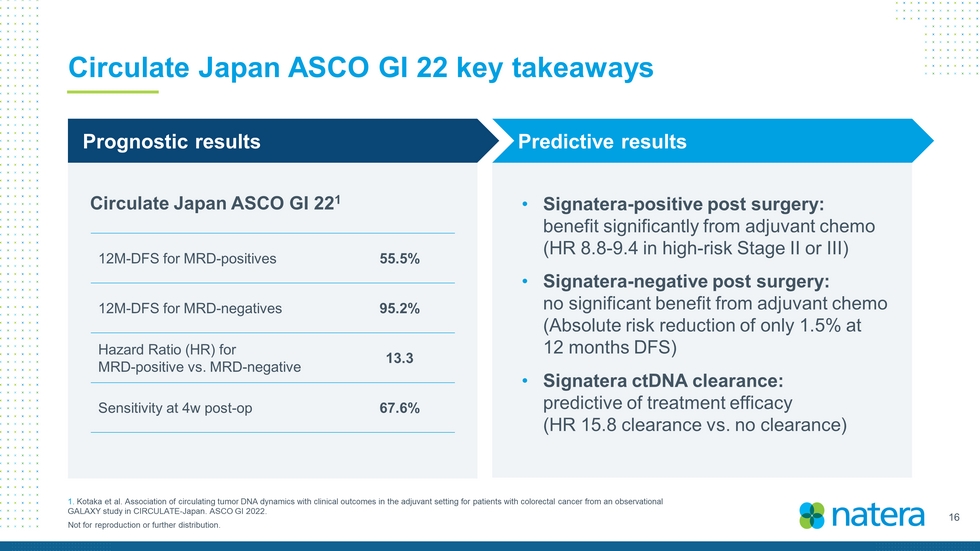

16 Not for reproduction or further distribution. Circulate Japan ASCO GI 22 key takeaways 1. Kotaka et al. Association of circulating tumor DNA dynamics with clinical outcomes in the adjuvant setting for patients with colorec ta l cancer from an observational GALAXY study in CIRCULATE - Japan. ASCO GI 2022. Circulate Japan ASCO GI 22 1 • Signatera - positive post surgery: benefit significantly from adjuvant chemo (HR 8.8 - 9.4 in high - risk Stage II or III) • Signatera - negative post surgery: no significant benefit from adjuvant chemo (Absolute risk reduction of only 1.5% at 12 months DFS) • Signatera ctDNA clearance: predictive of treatment efficacy (HR 15.8 clearance vs. no clearance) Predictive results Prognostic results 12M - DFS for MRD - positives 55.5% 12M - DFS for MRD - negatives 95.2% Hazard Ratio (HR) for MRD - positive vs. MRD - negative 13.3 Sensitivity at 4w post - op 67.6%

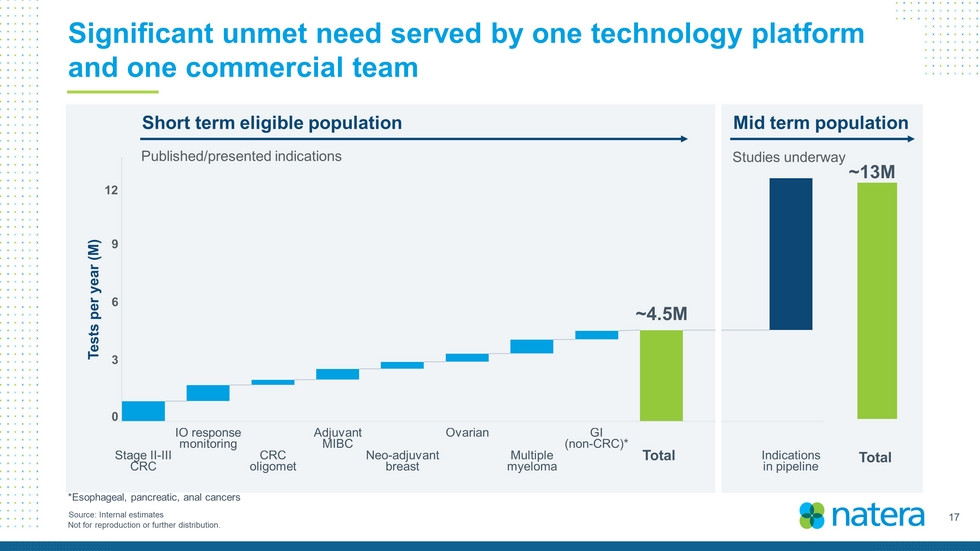

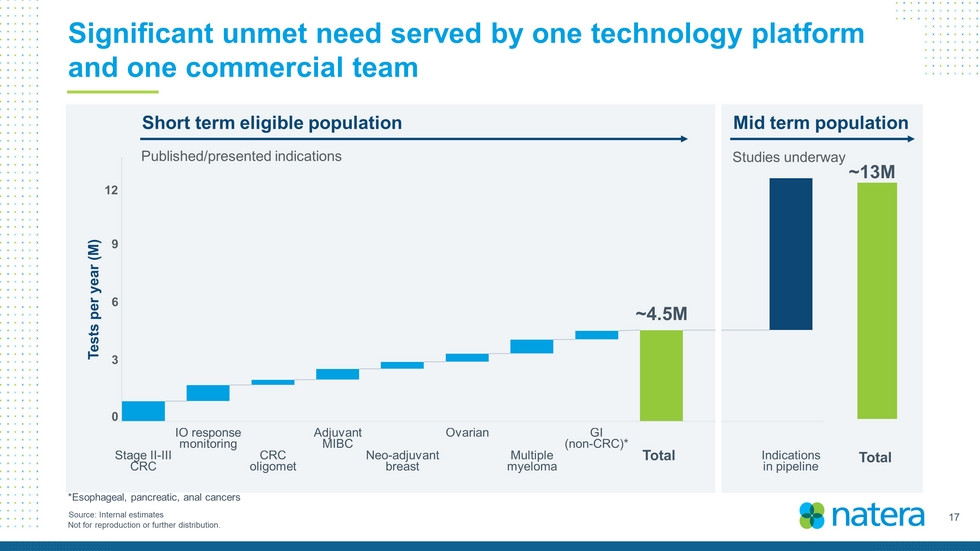

17 Not for reproduction or further distribution. Significant unmet need served by one technology platform and one commercial team ~4.5M ~13M Total Source: Internal estimates Tests per year (M) Total 0 3 6 9 12 Short term eligible population Mid term population Published/presented indications Studies underway *Esophageal, pancreatic, anal cancers

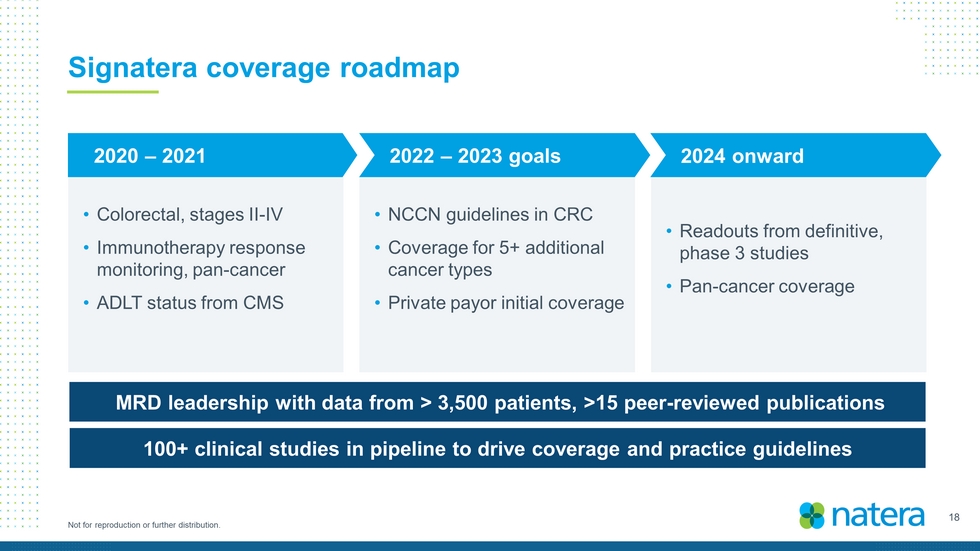

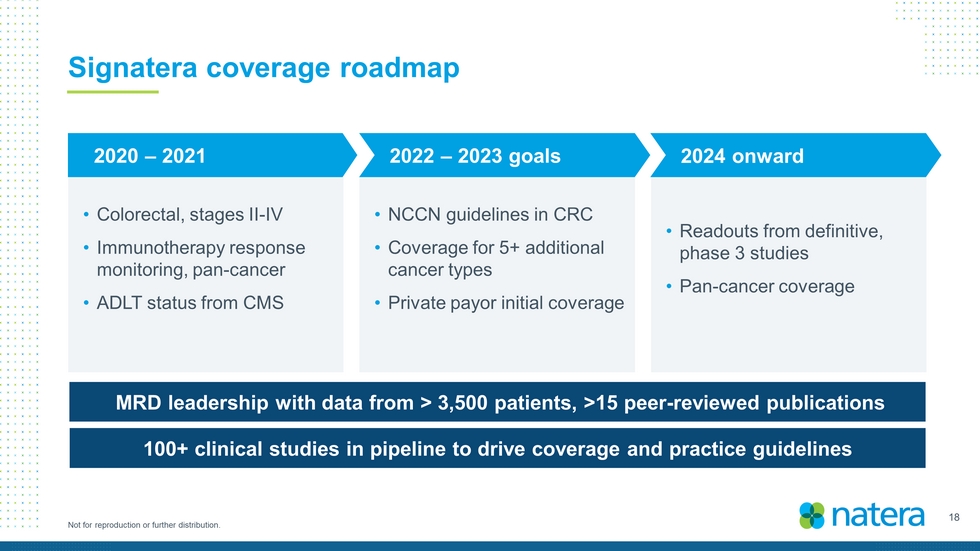

18 Not for reproduction or further distribution. Signatera coverage roadmap • Colorectal, stages II - IV • Immunotherapy response monitoring, pan - cancer • ADLT status from CMS MRD leadership with data from > 3,500 patients, > 15 peer - reviewed publications 100+ clinical studies in pipeline to drive coverage and practice guidelines • NCCN guidelines in CRC • Coverage for 5+ additional cancer types • Private payor initial coverage • Readouts from definitive, phase 3 studies • Pan - cancer coverage 2022 – 2023 goals 2020 – 2021 2024 onward

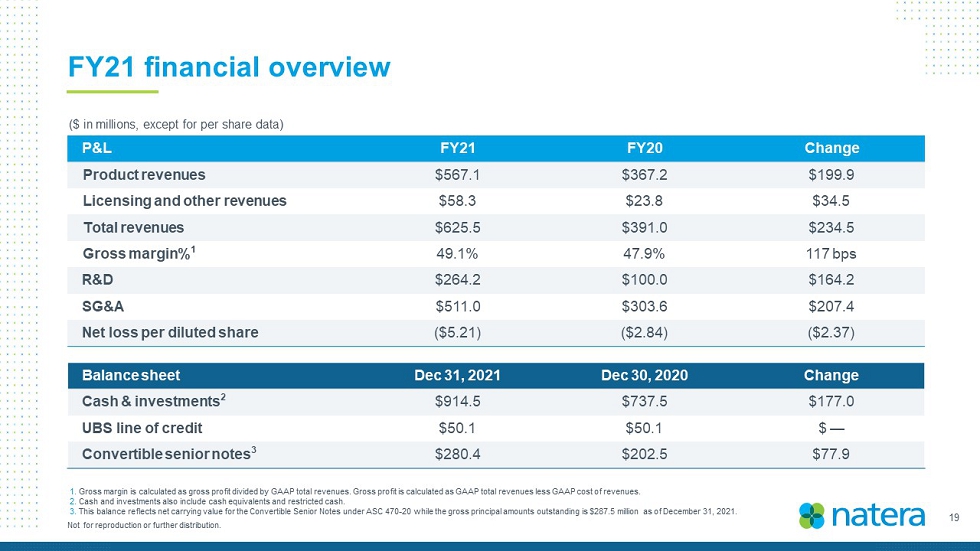

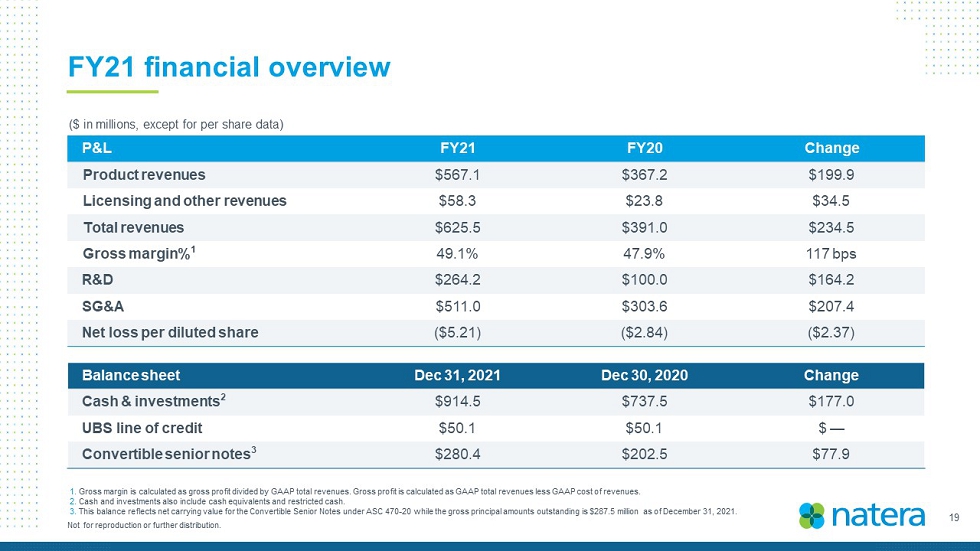

19 Not for reproduction or further distribution. FY21 financial overview ($ in millions, except for per share data) Balance sheet Dec 31, 2021 Dec 30, 2020 Change Cash & investments 2 $914.5 $737.5 $177.0 UBS line of credit $50.1 $50.1 $ — Convertible senior notes 3 $280.4 $202.5 $77.9 P&L FY21 FY20 Change Product revenues $567.1 $367.2 $199.9 Licensing and other revenues $58.3 $23.8 $34.5 Total revenues $625.4 $391.0 $234.4 Gross margin% 1 49.1% 47.9% 117 bps R&D $264.2 $100.0 $164.2 SG&A $511.0 $303.6 $207.4 Net loss per diluted share ($5.21) ($2.84) ($2.37) 1. Gross margin is calculated as gross profit divided by GAAP total revenues. Gross profit is calculated as GAAP total revenues les s GAAP cost of revenues. 2. Cash and investments also include cash equivalents and restricted cash. 3. This balance reflects net carrying value for the Convertible Senior Notes under ASC 470 - 20 while the gross principal amounts out standing is $287.5 million as of December 31, 2021.

20 Not for reproduction or further distribution. 2022 annual guidance Guide $ (millions) Key drivers Revenue $770 - $790 Continued volume growth, conservative ASPs, growing contribution from new products Gross margin % revenue 46% – 48% Conservative ASP assumptions, rapid growth in pan - cancer Signatera , new patients getting the upfront exome SG&A $560 – $590 Full commercial teams for Oncology, Organ Health in place R&D $340 - $360 Large clinical trials designed to drive broad adoption in oncology and transplant Cash burn $370 - $400 Maturing OpEx supporting multi - year revenue growth

21 Not for reproduction or further distribution. ©2020 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution. ©2022 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution.