Exhibit 99.2

Natera, Inc. Investor presentation Third Quarter 2023 Earnings Call November 8, 2023 Confidential Draft

Not for reproduction or further distribution. This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding our market opportunities, our proposed products and launch schedules, our reimbu rse ment coverage and our product costs, our commercial partners and potential acquisitions, our user experience, our clinical trials and studies and related publications, including timelines, our financi al performance, our strategies, our anticipated revenue and financial outlook, our goals and general business and market conditions, are forward - looking statements. These forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially, including : we face numerous uncertainties and challenges in achieving our financial projections and goals ; we may be unable to further increase the use and adoption of our products through our direct sales efforts or through our laboratory partners ; we have incurred losses since our inception and we anticipate that we will continue to incur losses for the foreseeable future ; our quarterly results may fluctuate from period to period ; our estimates of market opportunity and forecasts of market growth may prove to be inaccurate ; we may be unable to compete successfully with existing or future products or services offered by our competitors ; we may engage in acquisitions, dispositions or other strategic transactions that may not achieve our anticipated benefits and could otherwise disrupt our business, cause dilution to our stockholders or reduce our financial resources ; we may not be successful in commercializing our cloud - based distribution model ; our products may not perform as expected ; the results of our clinical studies, including our SNP - based Microdeletion and Aneuploidy Registry, or SMART, Study, may not be compelling to professional societies or payors as supporting the use of our tests, particularly for microdeletions screening, or may not be able to be replicated in later studies required for regulatory approvals or clearances ; if either of our primary CLIA - certified laboratories becomes inoperable, we will be unable to perform our tests and our business will be harmed ; we rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and materials and may not be able to find replacements or immediately transition to alternative suppliers ; if we are unable to successfully scale our operations, our business could suffer ; the marketing, sale, and use of Panorama and our other products could result in substantial damages arising from product liability or professional liability claims that exceed our resources ; we may be unable to expand, obtain or maintain third - party payer coverage and reimbursement for Panorama, Horizon and our other tests, and we may be required to refund reimbursements already received ; third - party payers may withdraw coverage or provide lower levels of reimbursement due to changing policies, billing complexities or other factors ; if the FDA were to begin actively regulating our tests, we could incur substantial costs and delays associated with trying to obtain premarket clearance or approval and incur costs associated with complying with post - market controls ; litigation or other proceedings, resulting from either third party claims of intellectual property infringement or third party infringement of our technology, is costly, time - consuming and could limit our ability to commercialize our products or services ; any inability to effectively protect our proprietary technology could harm our competitive position or our brand ; and we cannot guarantee that we will be able to service and comply with our outstanding debt obligations or achieve our expectations regarding the conversion of our outstanding convertible notes . We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time . Moreover, we operate in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statement . In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and our actual results could differ materially and adversely from those anticipated or implied . As a result, you should not place undue reliance on our forward - looking statements . Except as required by law, we undertake no obligation to update publicly any forward - looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations . We file reports, proxy statements, and other information with the SEC . Such reports, proxy statements, and other information concerning us is available at http : // www . sec . gov . Requests for copies of such documents should be directed to our Investor Relations department at Natera , Inc . , 13011 McCallen Pass, Building A Suite 100 , Austin, TX 78753 . Our telephone number is ( 650 ) 980 - 9190 . 2 Safe harbor statement Confidential Draft

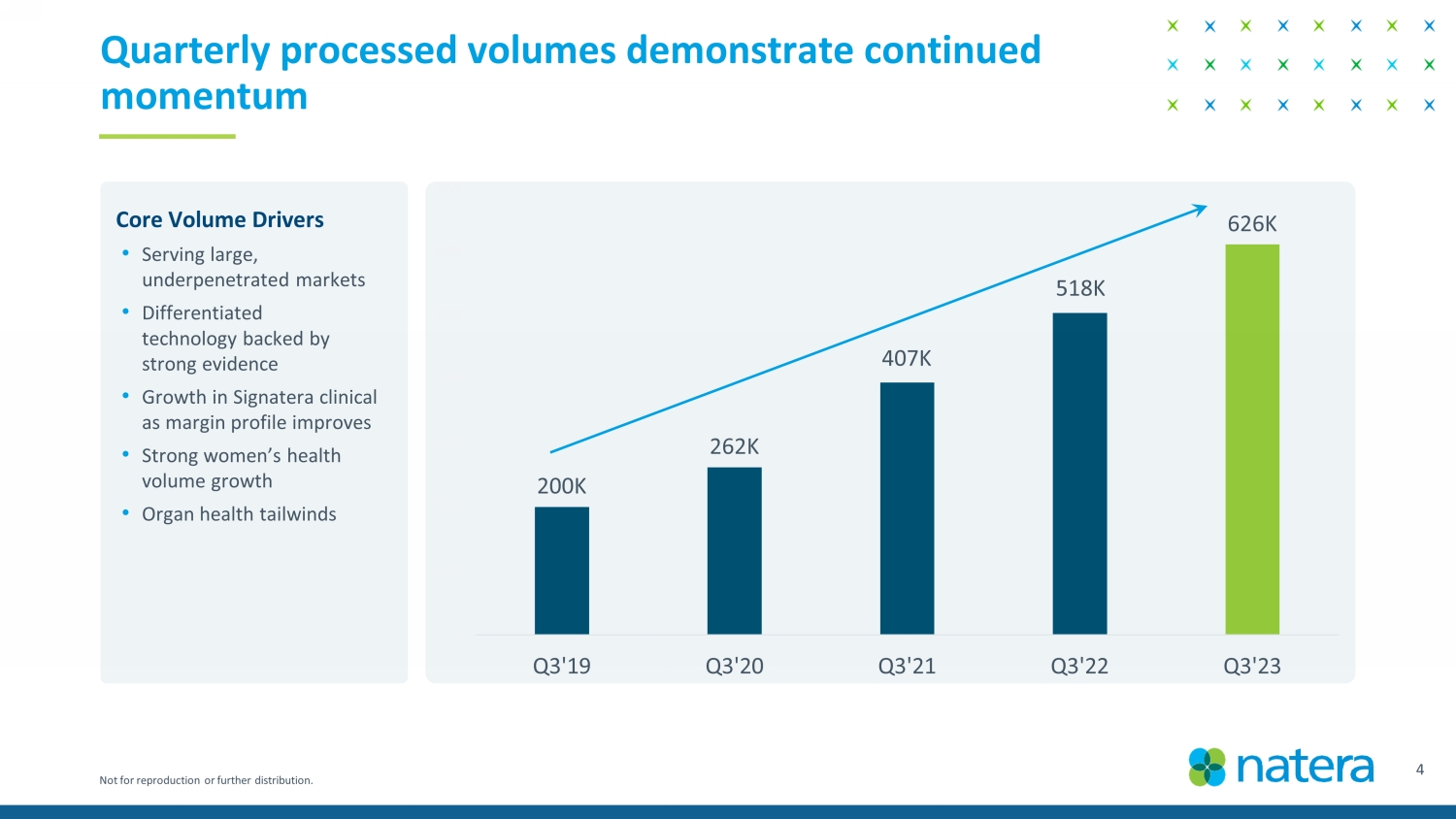

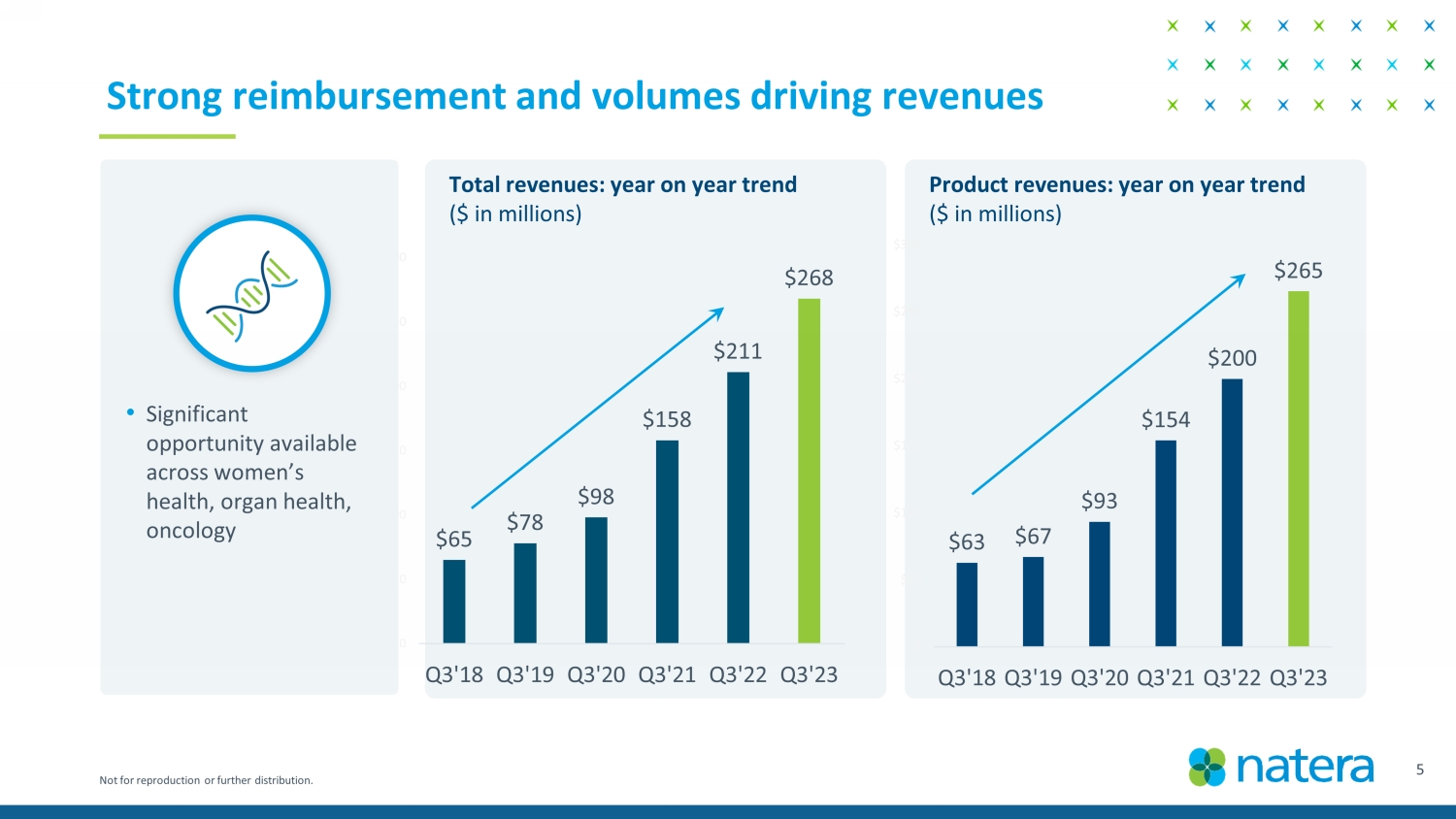

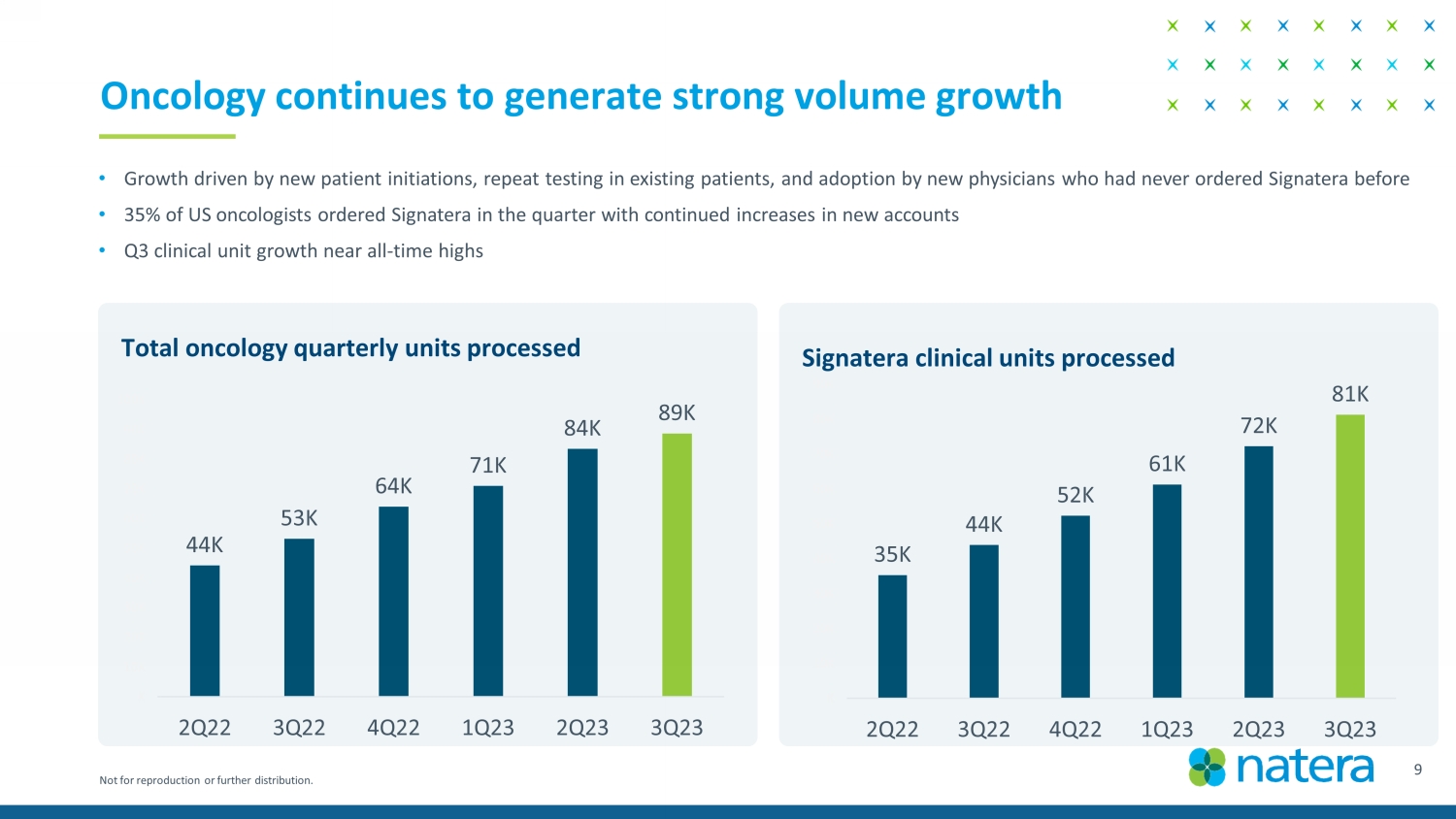

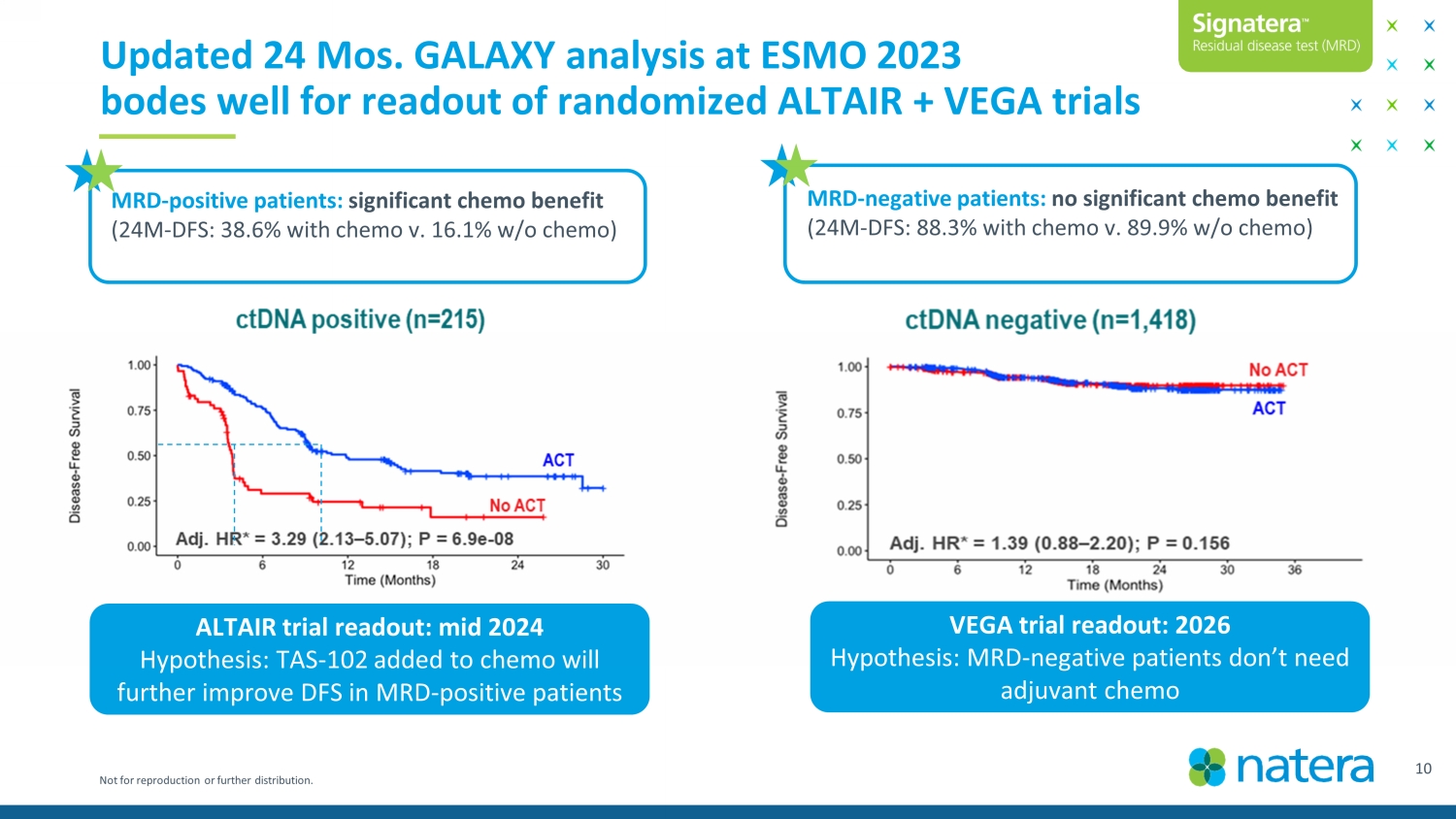

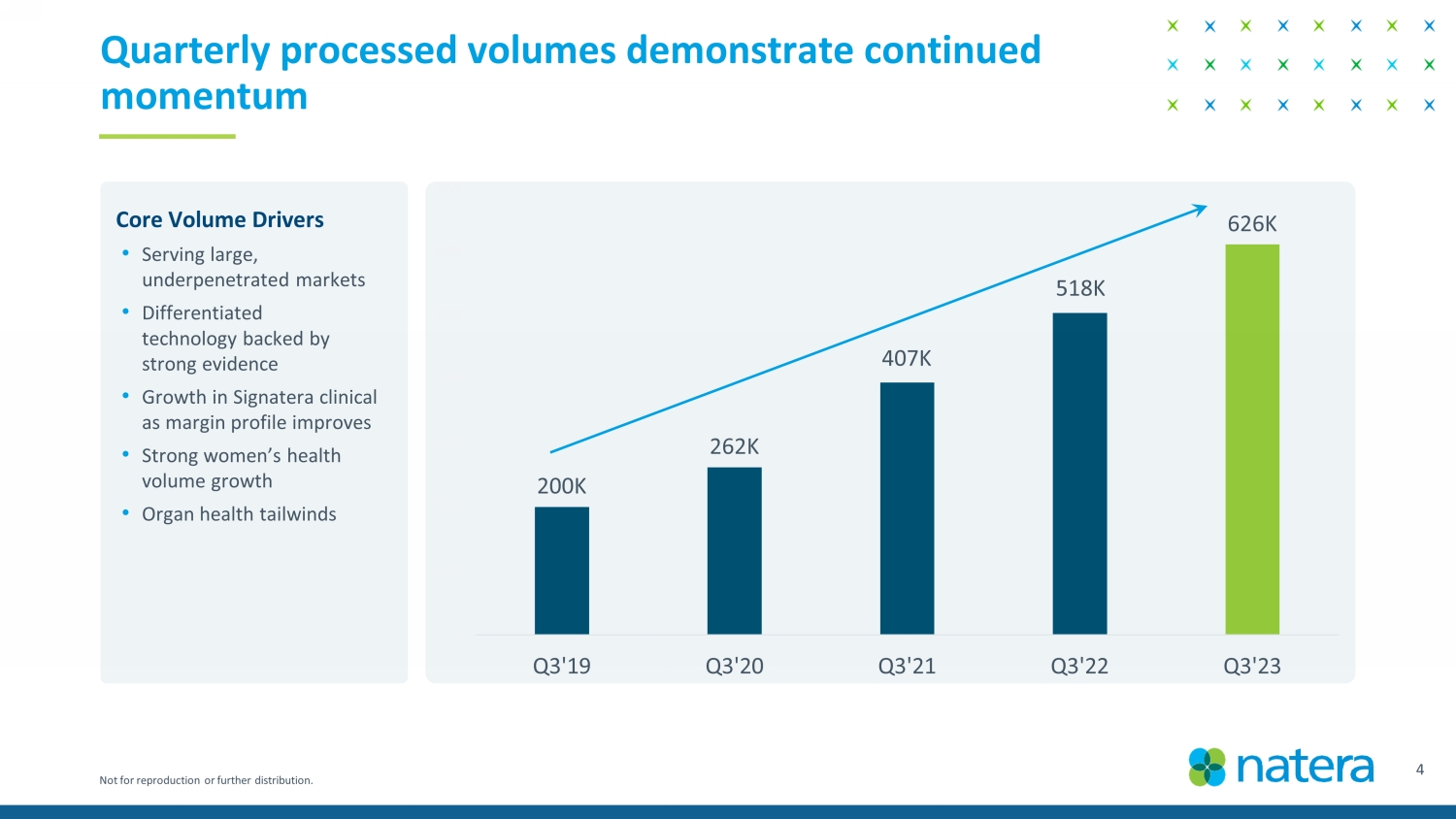

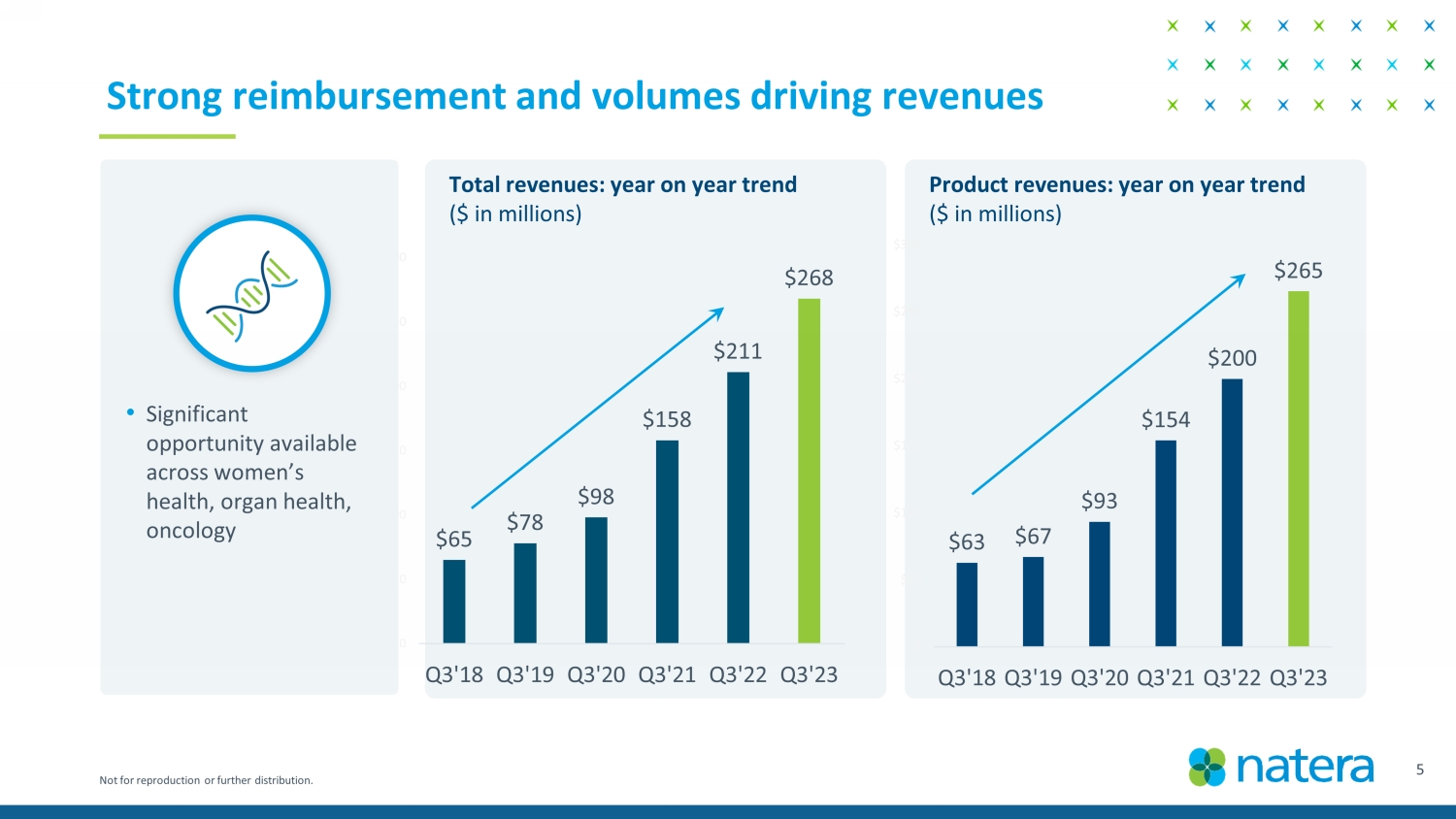

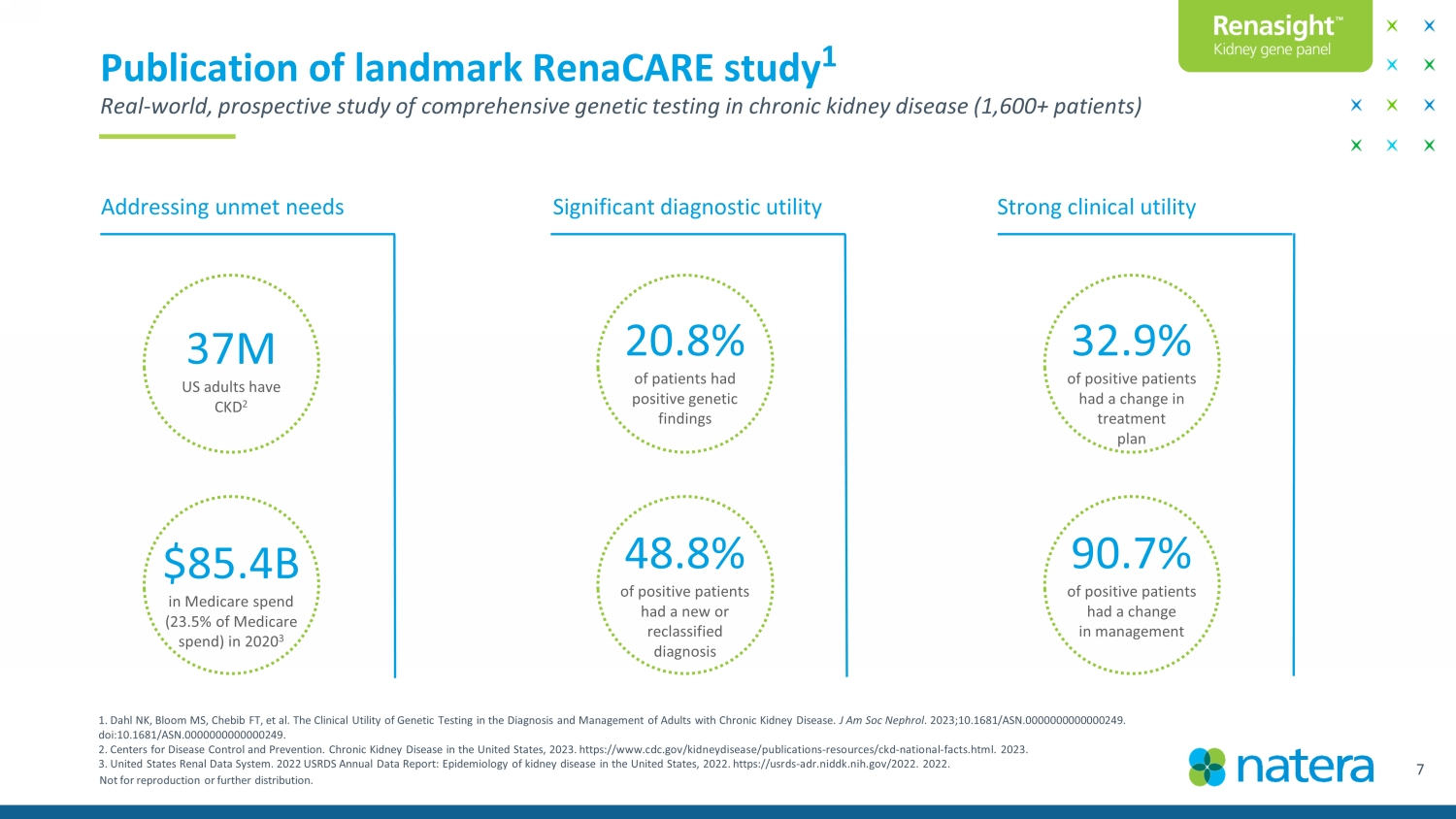

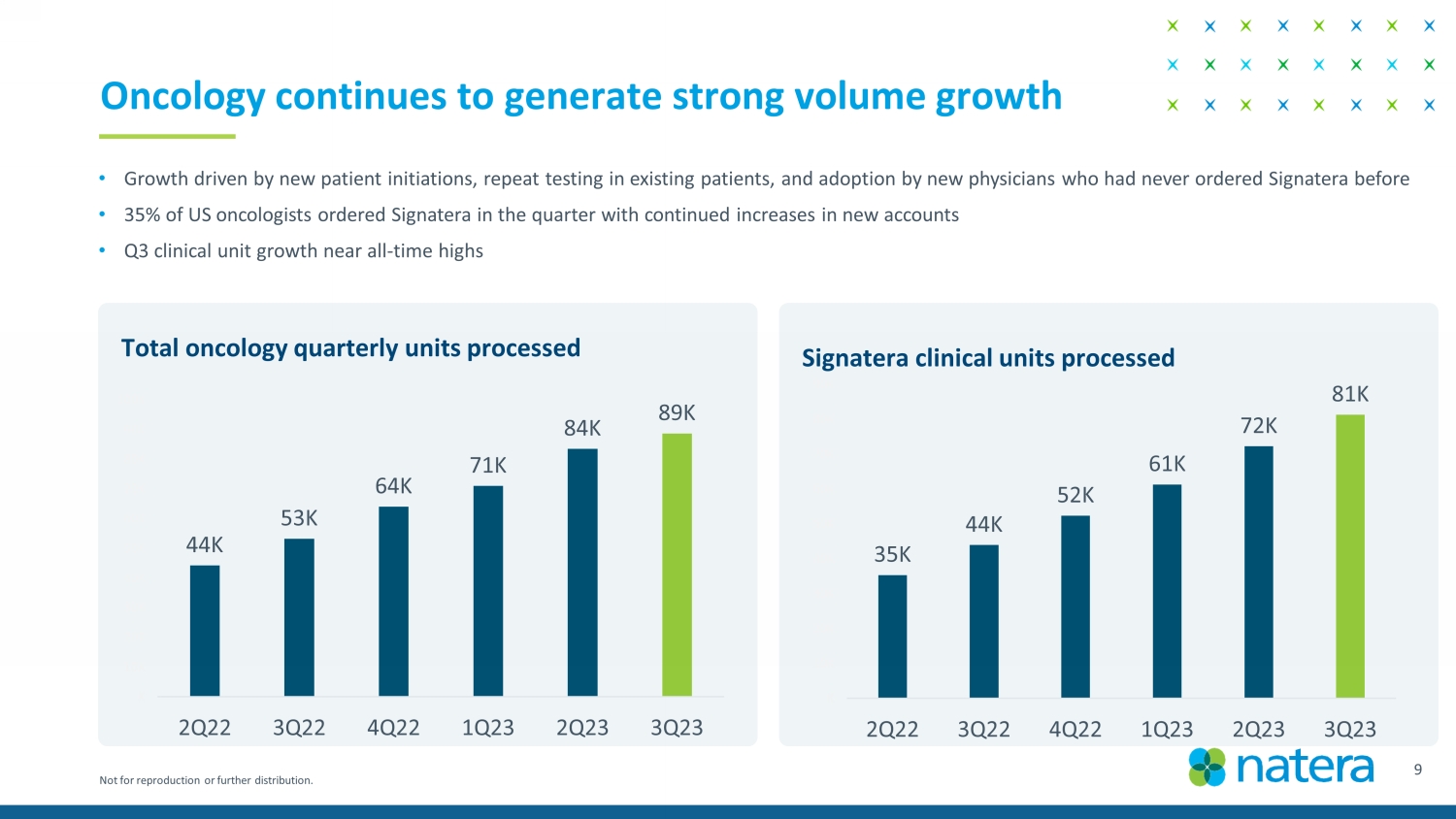

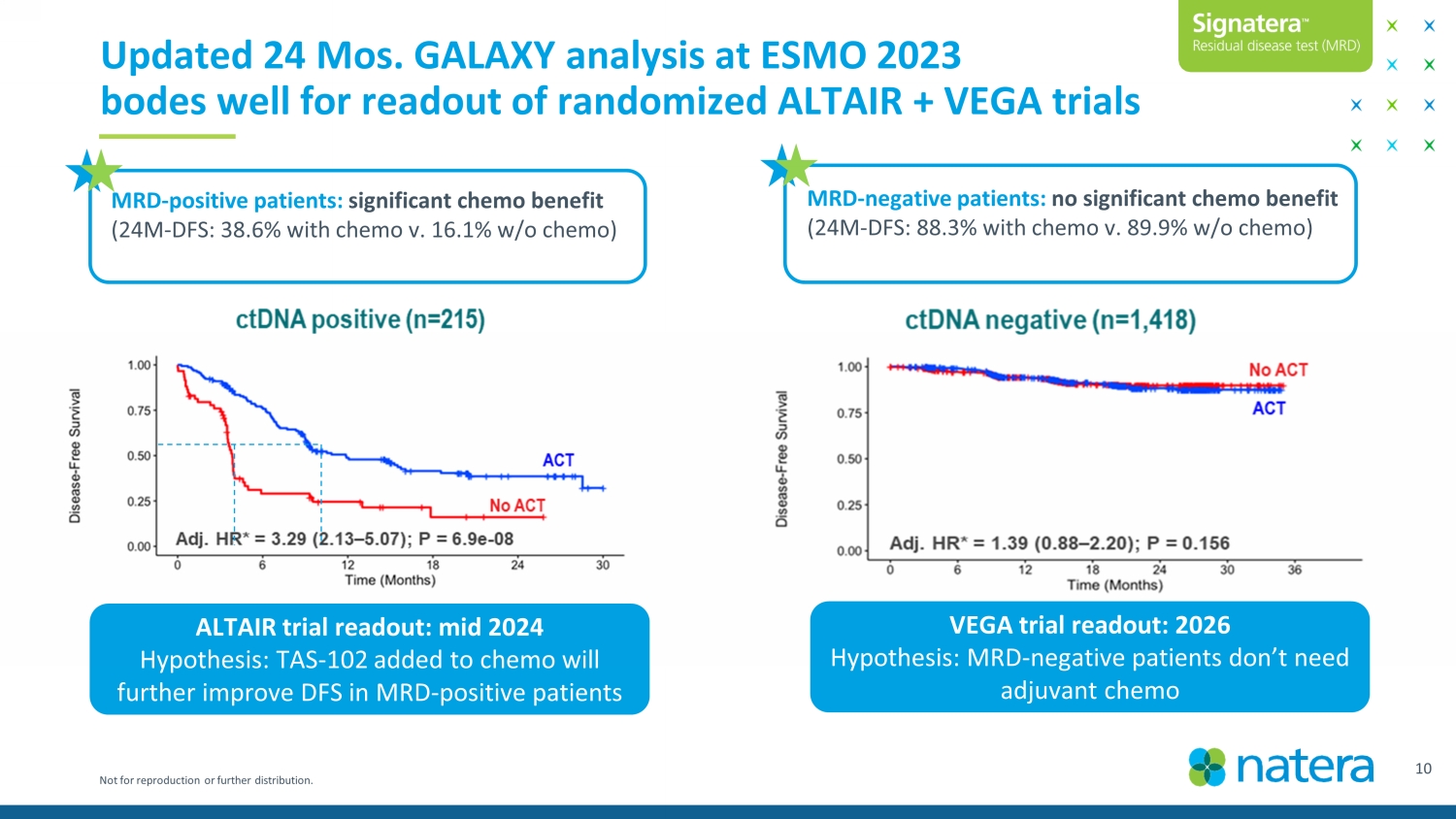

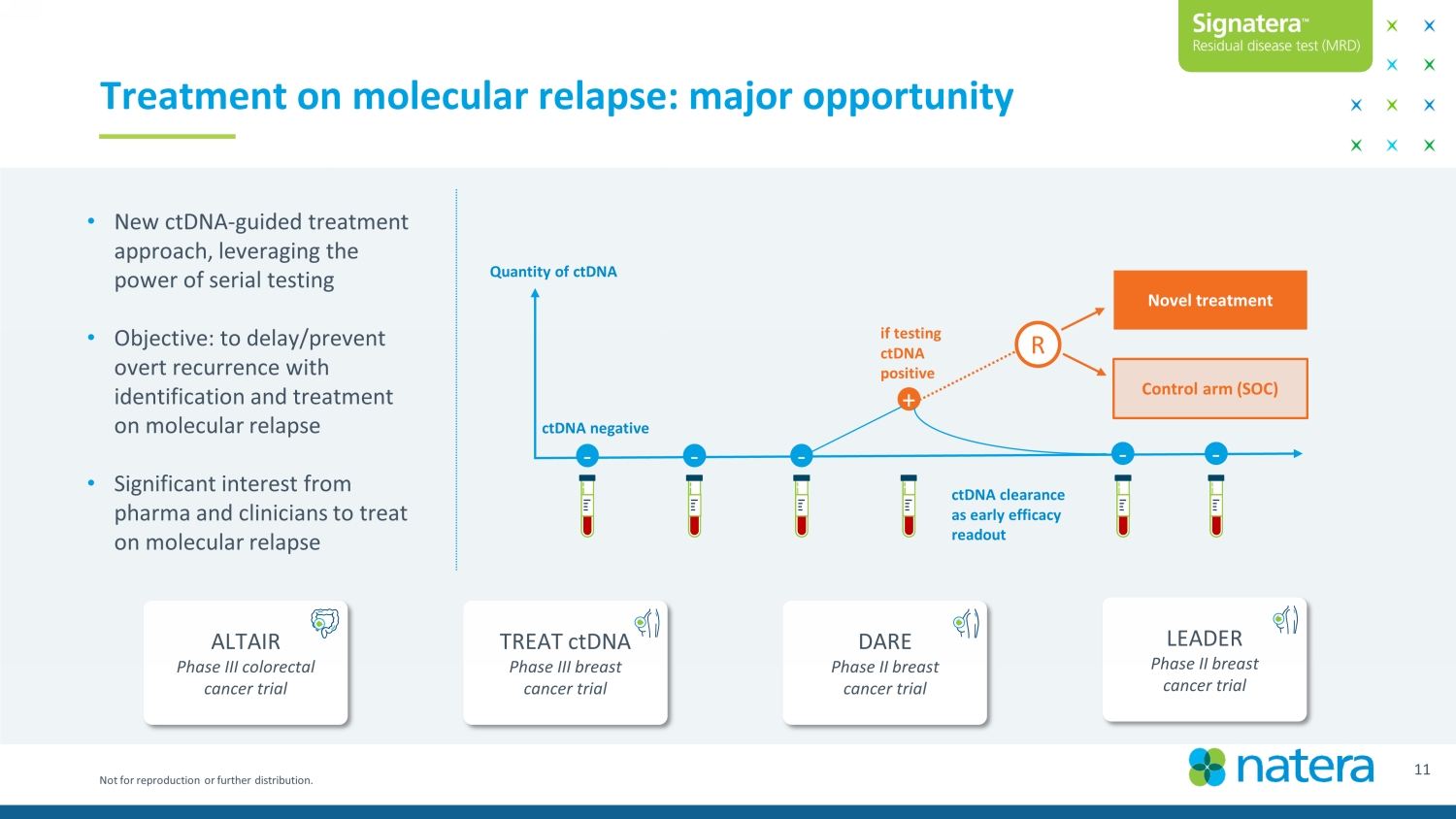

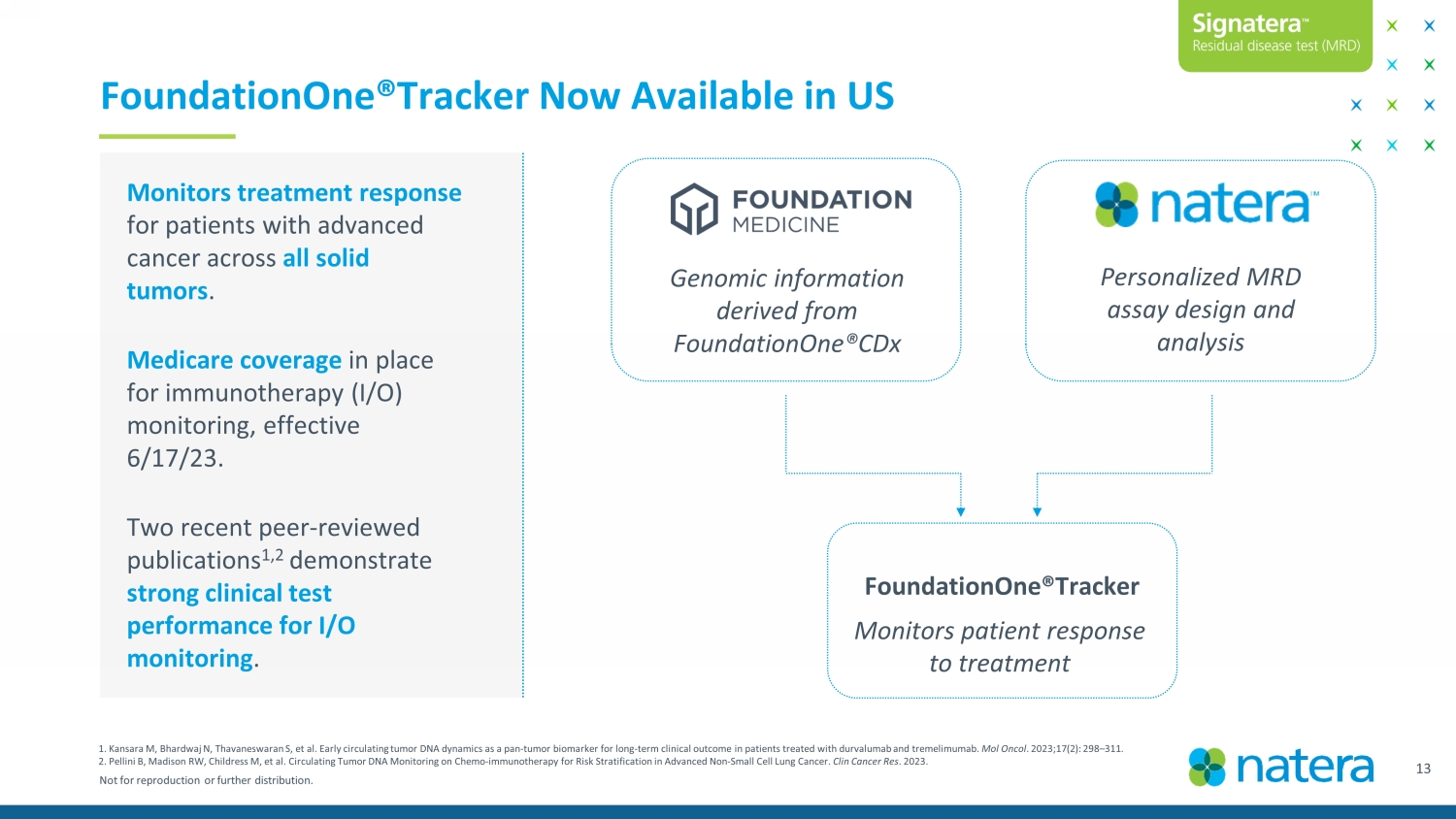

Not for reproduction or further distribution. • $268M in total revenue, 27% growth over Q3 2022. Product revenues grew 33% year on year. • Processed 626K units, up 21% year on year. • Processed 81K Signatera clinical units, up 85% vs. Q3 2022 and up 9K units vs. Q2 2023, second largest unit growth quarter. • 45% gross margin on organic ASP and COGS improvements. • Cash burn 1 of $38M, ~50% reduction vs. Q2 2023 and ~68% reduction vs. Q3 2022. • Raising revenue guide to new range of $1,035M - $1,050M and gross margin to a range of 43% - 44%; reducing cash burn guide to $260M - $280M. • Published RenaCARE study for chronic kidney disease , demonstrating significant diagnostic and clinical utility of Renasight . • Presented 24 - mos data from GALAXY, reinforcing Signatera’s predictive and prognostic value in colorectal cancer. • Participating in randomized, Ph III EORTC trial in early - stage breast cancer, adding to pipeline of clinical trials studying treatment on molecular relapse. • Published additional studies in lung cancer, strengthening clinical evidence in this patient population. • Announced broad clinical launch and Medicare coverage of FoundationOne®Tracker . 3 Q3 highlights Confidential Draft 1. Cash burn for the period ended Sept. 30, 2022, is derived from the GAAP Statement of Cash Flows as follows: net cash used in ope rating activities of $102.2 million, cash used in investing activities for purchases of property and equipment of $12.2 million, offset by cash provided in financing activities of $1.4 million. Cash burn for the period ended Sept. 30, 2023, is d eri ved from the GAAP Statement of Cash Flows as follows: net cash used in operating activities of $29.6 million, cash used in investing activities for purchases of property and equipment of $9.1 million, offset by cash provided in financing activities of $0.6 million (which excludes the September 2023 equity offering cash inflow).

Not for reproduction or further distribution. 200K 262K 394K 503K 626K K 100K 200K 300K 400K 500K 600K 700K Q3'19 Q3'20 Q3'21 Q3'22 Q3'23 Quarterly processed volumes demonstrate continued momentum Core Volume Drivers • Serving large, underpenetrated markets • Differentiated technology backed by strong evidence • Growth in Signatera clinical as margin profile improves • Strong women’s health volume growth • Organ health tailwinds 407K 4 Confidential Draft 518K

Not for reproduction or further distribution. $65 $78 $98 $158 $211 $268 $0 $50 $100 $150 $200 $250 $300 Q3'18 Q3'19 Q3'20 Q3'21 Q3'22 Q3'23 Strong reimbursement and volumes driving revenues • Significant opportunity available across women’s health, organ health, oncology 5 Product revenues: year on year trend ($ in millions) Confidential Draft Total revenues: year on year trend ($ in millions) $63 $67 $93 $154 $200 $265 $ $50 $100 $150 $200 $250 $300 Q3'18 Q3'19 Q3'20 Q3'21 Q3'22 Q3'23

Not for reproduction or further distribution. Volume - based initiatives impacting margin: CA NIPT, carrier screening, Signatera volume growth One - time benefits: COGS credit, lumpy pharma payment ASPs and COGS execution driving organic gross margin gains • Significant sequential step up in Signatera ASPs • Cash collections accelerating • Con tinued momentum in COGS projects Gross margin quarterly trend 6 41% 39% 45% 45% 36% 37% 38% 39% 40% 41% 42% 43% 44% 45% 46% 4Q22 1Q23 2Q23 3Q23 Organic: ASP, COGS trends ahead of plan Confidential Draft

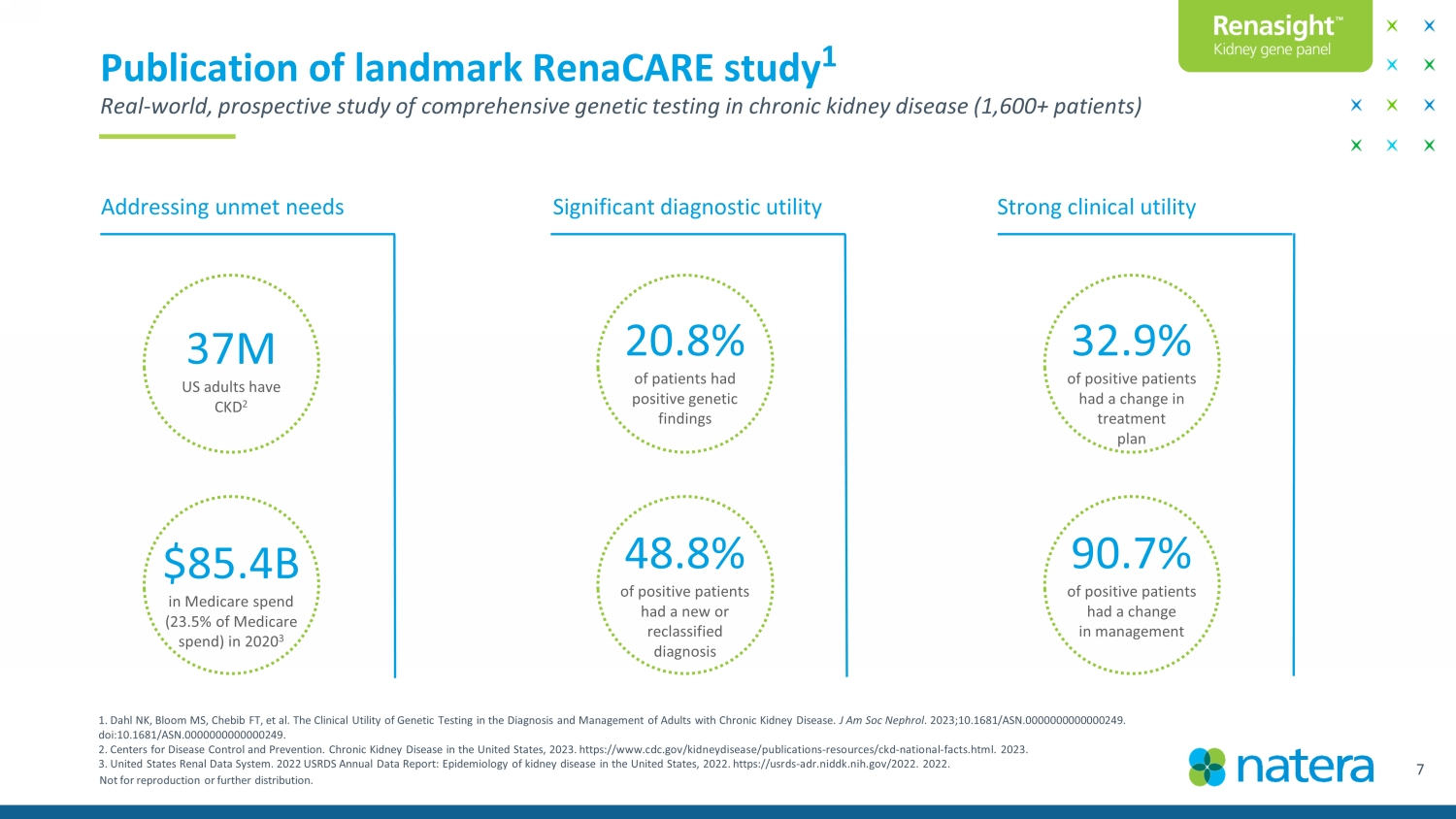

Not for reproduction or further distribution. 7 Publication of landmark RenaCARE study 1 Real - world, prospective study of comprehensive genetic testing in chronic kidney disease (1,600+ patients) 20.8% of patients had positive genetic findings 32.9% of positive patients had a change in treatment plan 37M US adults have CKD 2 Addressing unmet needs Significant diagnostic utility Strong clinical utility 48.8% of positive patients had a new or reclassified diagnosis 90.7% of positive patients had a change in management $85.4B in Medicare spend (23.5% of Medicare spend) in 2020 3 Confidential Draft 1. Dahl NK, Bloom MS, Chebib FT, et al. The Clinical Utility of Genetic Testing in the Diagnosis and Management of Adults with Chronic Kidney Disease. J Am Soc Nephrol . 2023;10.1681/ASN.0000000000000249. doi:10.1681/ASN.0000000000000249. 2. Centers for Disease Control and Prevention. Chronic Kidney Disease in the United States, 2023. https://www.cdc.gov/kidneyd ise ase/publications - resources/ckd - national - facts.html. 2023. 3. United States Renal Data System. 2022 USRDS Annual Data Report: Epidemiology of kidney disease in the United States, 2022. ht tps://usrds - adr.niddk.nih.gov/2022. 2022.

Not for reproduction or further distribution. 8 RenaCARE findings address key diagnostic gaps in CKD 1 A genetic diagnosis unveils a prognosis and treatment options that are now patient - specific Non - specific CKD diagnoses Undefined CKD subtype Utilization of targeted therapies Unnecessary diagnostic biopsies Clinical diagnoses are often based on non - specific criteria that mask CKD’s true cause (e.g. diabetes, hypertension, hematuria, proteinuric glomerulopathy) Lack of a genetic diagnosis limits targeted therapeutic options and access to clinical trials Confidential Draft Unknown cause of CKD A causative diagnosis could not be derived from clinical features alone 18.2% of these patients received a positive genetic result 87.5% of positive patients received a new diagnosis 23.8% of positive patients had a change in treatment plan Without definitive genetic subtypes, specific treatment pathways can be obscured (as exemplified by PKD1 vs PKD2 in cystic nephropathy) Genetic testing can obviate the need for invasive, diagnostic biopsies 14.7% of these patients received a positive genetic result 70.0% of positive patients received a new or reclassified diagnosis 22.5% of positive patients had a change in treatment plan 49.6% of patients with cystic nephropathy had a positive genetic result 79.2% of positive patients received a genetic subtype confirming the clinical presentation 49.2% of positive patients had a change in treatment plan 35.5% of positive patients received a diagnosis that could make them eligible for 1 of 24 available therapeutics 270+ clinical trials of therapeutics across Renasight conditions 19.4% of patients with a biopsy prior to genetic testing had a positive genetic finding 71.1% of these patients received a new genetic diagnosis, suggesting the potential to avoid diagnostic biopsies if Renasight is done first 1. Dahl NK, Bloom MS, Chebib FT, et al. The Clinical Utility of Genetic Testing in the Diagnosis and Management of Adults with Chronic Kidney Disease. J Am Soc Nephrol . 2023;10.1681/ASN.0000000000000249. doi:10.1681/ASN.0000000000000249.

Not for reproduction or further distribution. RenaCARE study highlights utility of Renasight in CKD 1 A genetic diagnosis unveils a prognosis and treatment options that are now patient - specific Non - specific CKD diagnoses Undefined CKD subtype Clinical diagnoses are often based on non - specific criteria that mask CKD’s true cause (e.g. diabetes, hypertension, hematuria, proteinuric glomerulopathy) Confidential Draft Unknown cause of CKD A causative diagnosis could not be derived from clinical features alone 18.2% of these patients received a positive genetic result 87.5% of positive patients received a new diagnosis 23.8% of positive patients had a change in treatment plan Without definitive genetic subtypes, specific treatment pathways can be obscured (e.g. PKD1 / PKD2 in cystic nephropathy) 14.7% of these patients received a positive genetic result 70.0% of positive patients received a new or reclassified diagnosis 22.5% of positive patients had a change in treatment plan 49.6% of patients with cystic nephropathy had a positive genetic result 79.2% of positive patients received a new genetic subtype 49.2% of positive patients had a change in treatment plan 1. Dahl NK, Bloom MS, Chebib FT, et al. The Clinical Utility of Genetic Testing in the Diagnosis and Management of Adults with Chronic Kidney Disease. J Am Soc Nephrol . 2023;10.1681/ASN.0000000000000249. doi:10.1681/ASN.0000000000000249. Cutting cross clinical categories: • 35.5% of Renasight - positive patients were eligible for an approved targeted therapy • 71.1% of Renasight - positive patients with prior biopsy could have avoided the biopsy 9

Not for reproduction or further distribution. Oncology continues to generate strong volume growth 10 Total oncology quarterly units processed 44K 53K 64K 71K 84K 89K K 10K 20K 30K 40K 50K 60K 70K 80K 90K 100K 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Signatera clinical units processed 35K 44K 52K 61K 72K 81K K 10K 20K 30K 40K 50K 60K 70K 80K 90K 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 • Growth driven by new patient initiations, repeat testing in existing patients, and adoption by new physicians who had never o rde red Signatera before • 35% of US oncologists ordered Signatera in the quarter with continued increases in new accounts • Q3 clinical unit growth near all - time highs Confidential Draft

Not for reproduction or further distribution. 11 Updated 24 Mos. GALAXY analysis at ESMO 2023 bodes well for readout of randomized ALTAIR + VEGA trials MRD - positive patients: significant chemo benefit (24M - DFS: 38.6% with chemo v. 16.1% w/o chemo) MRD - negative patients: no significant chemo benefit (24M - DFS: 88.3% with chemo v. 89.9% w/o chemo) ALTAIR trial readout: mid 2024 Hypothesis: TAS - 102 added to chemo will further improve DFS in MRD - positive patients VEGA trial readout: 2026 Hypothesis: MRD - negative patients don’t need adjuvant chemo Confidential Draft

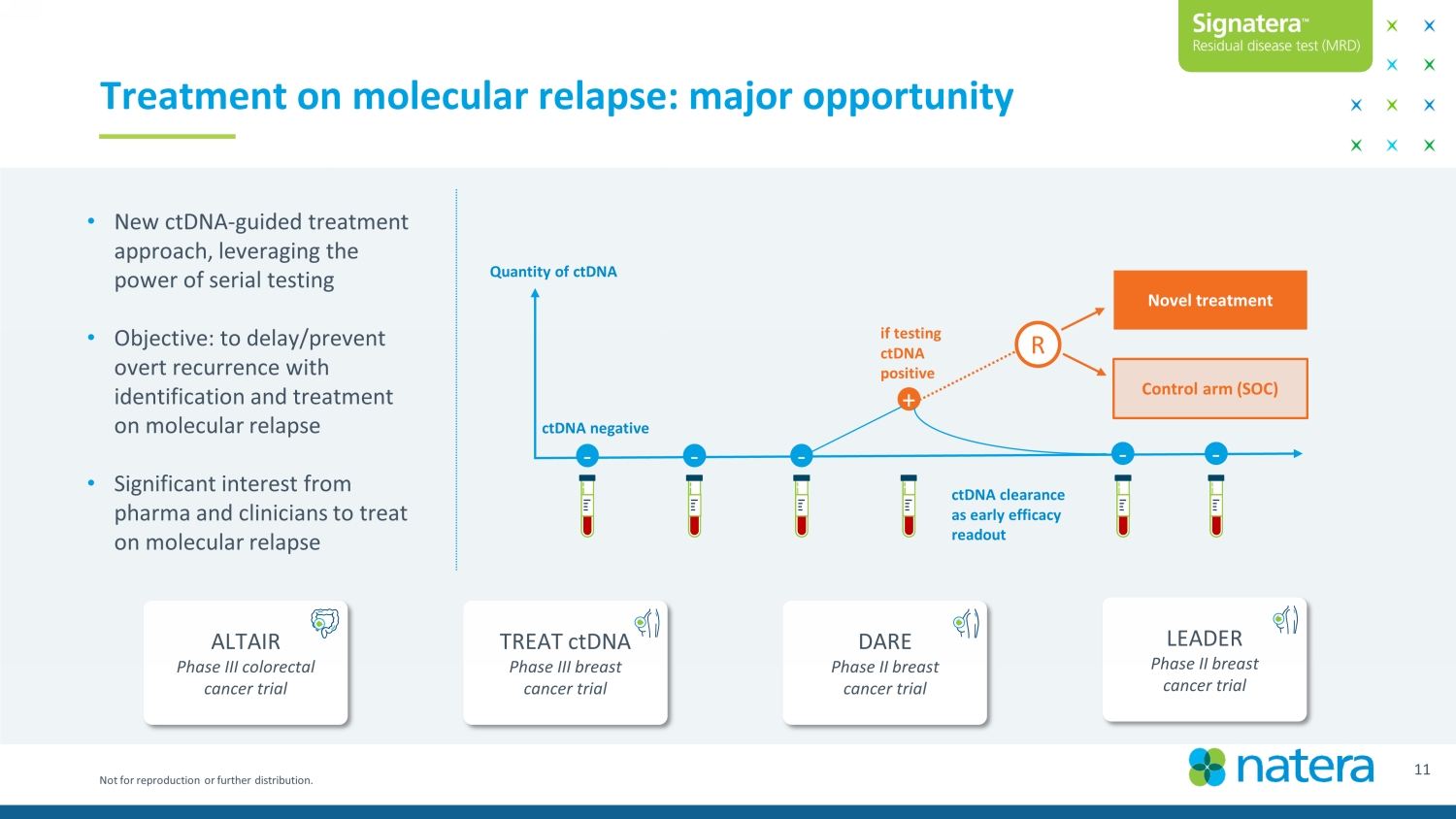

Not for reproduction or further distribution. • New ctDNA - guided treatment approach, leveraging the power of serial testing • Objective: to delay/prevent overt recurrence with identification and treatment on molecular relapse • Significant interest from pharma and clinicians to treat on molecular relapse 12 Treatment on molecular relapse: major opportunity TREAT ctDNA Phase III breast cancer trial ALTAIR Phase III colorectal cancer trial Confidential Draft LEADER Phase II breast cancer trial DARE Phase II breast cancer trial - - + - Novel treatment Control arm (SOC) if testing ctDNA positive ctDNA negative - R - Quantity of ctDNA ctDNA clearance as early efficacy readout

Not for reproduction or further distribution. 13 Growing body of evidence in lung cancer across settings Neoadjuvant setting Adjuvant setting Metastatic setting Stage I - III neoadjuvant NSCLC Cascone et al, 2023 NeoCoast platform trial evaluated dual IO combinations in stage I - III NSCLC patients. All patients experiencing MPR or pCR were molecular responders (>50% ctDNA reduction). Stage I - III unresectable NSCLC Lebow et al, 2023 82% pre - treatment detection 100% longitudinal sensitivity and specificity to progression. Stage I - III resectable NSCLC Abbosh et al, 2017 93% longitudinal recurrence sensitivity and 100% specificity. Empower - Lung1 1 ASCO 2023 Week 3 & 9 ctDNA dynamics were predictive of overall survival. IMpower131 1 Pellini et al, 2023 Monitoring with F1Tracker during induction chemoIO can inform maintenance therapy decisions. Confidential Draft 1. Studies conducted in collaboration with Foundation Medicine, Inc.

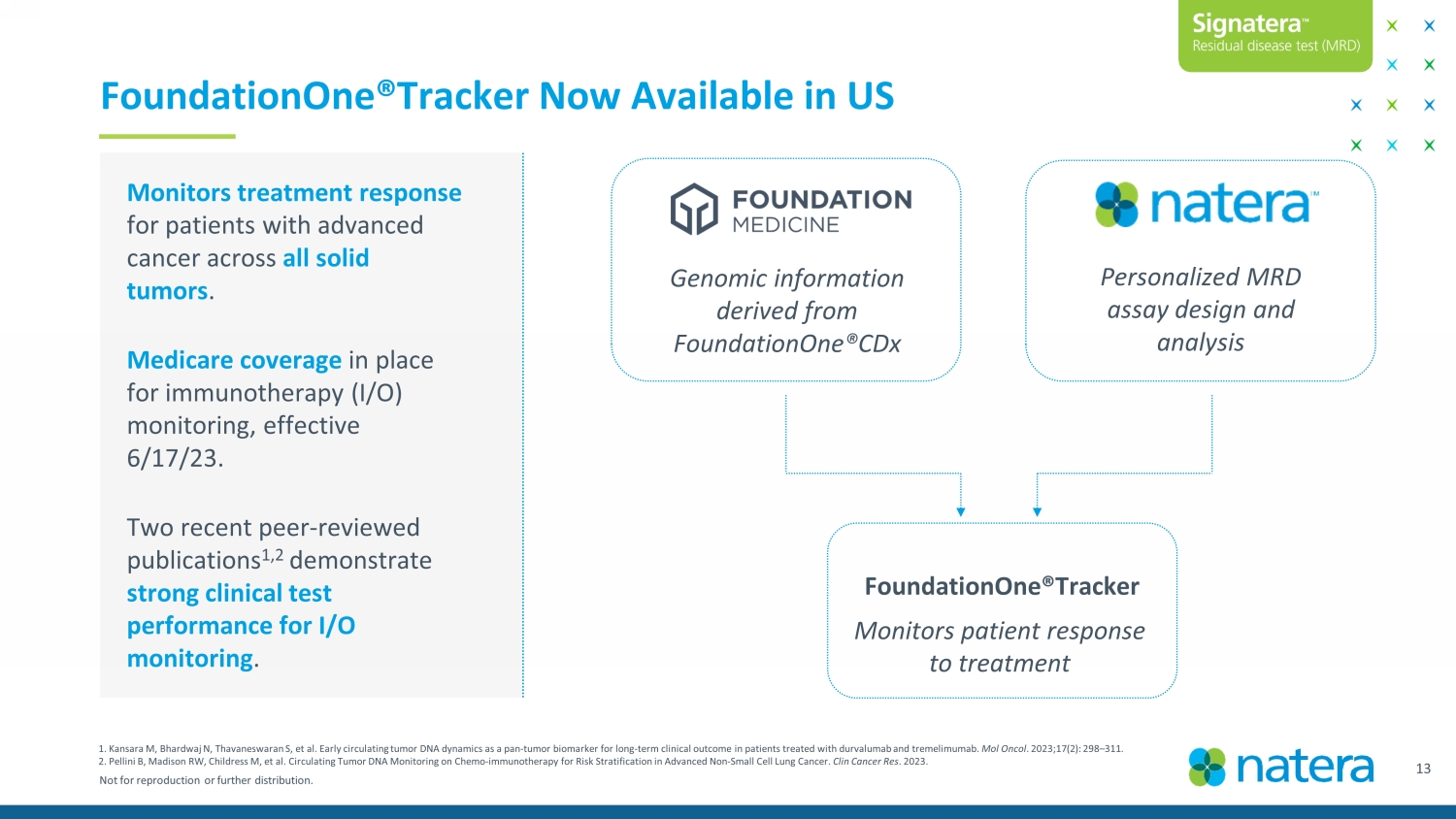

Not for reproduction or further distribution. FoundationOne®Tracker Now Available in US 14 Confidential Draft FoundationOne®Tracker Monitors treatment response for patients with advanced cancer across all solid tumors . Medicare coverage in place for immunotherapy (I/O) monitoring, effective 6/17/23. Two recent peer - reviewed publications 1,2 demonstrate strong clinical test performance for I/O monitoring . Personalized MRD assay design and analysis Genomic information derived from FoundationOne®CDx Monitors patient response to treatment 1. Kansara M, Bhardwaj N, Thavaneswaran S, et al. Early circulating tumor DNA dynamics as a pan-tumor biomarker for long-term clinical outcome in patients treated wi th durvalumab and tremelimumab . Mol Oncol . 2023;17(2): 298 – 311. 2. Pellini B, Madison RW, Childress M, et al. Circulating Tumor DNA Monitoring on Chemo - immunotherapy for Risk Stratification in Advanced Non - Small Cell Lung Cancer. Clin Cancer Res . 2023.

Q3 23 financial overview ($ in millions, except for per share data) Balance sheet September 30, 2023 Dec 31, 2022 Change Q/Q Cash & investments 1 $936.6 $898.4 $38.2 UBS line of credit $80.4 $80.4 $ — Convertible senior notes 2 $282.6 $281.7 $0.9 P&L Q3’23 Q3’22 Change Y/Y Product revenues $265.2 $199.8 $65.4 Licensing and other revenues $3.1 $10.8 ($7.7) Total revenues $268.3 $210.6 $57.7 Gross margin% 45.1% 44.7% 41 bps R&D $77.2 $65.5 $11.7 SG&A $154.7 $147.7 $7.0 Net loss per diluted share ($0.95) ($1.25) $0.30 1. Cash and investments also include cash equivalents and restricted cash. 2. This balance reflects net carrying value for the Convertible Senior Notes under ASC 470 - 20 while the gross principal amounts outstanding is $287.5 million as of September 30, 2023. Confidential Draft 15

Not for reproduction or further distribution. $162 2 $110 $113 1 $88 $86 2 $78 $38 1 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 1Q23 2Q23 3Q22 4Q22 1Q23 2Q23 3Q23 Cash burn reduction target ahead of plan • Expected cash burn reduction compared to 2022 of more than $200M on continued revenue growth and reduction in operating expenses. • Cash burn reductions will fluctuate quarter to quarter based on working capital dynamics. • Improved trends on DSOs and Signatera ASPs driven by broader coverage, reimbursement execution. • Strong sequential growth in Q3 on stable commercial footprint. Quarterly cash burn trend ($ in millions) 1. Cash burn for the period ended Sept. 30, 2022, is derived from the GAAP Statement of Cash Flows as follows: net cash used in ope rating activities of $102.2 million, cash used in investing activities for purchases of property and equipment of $12.2 million, offset by cash provided in financing activities of $1.4 million. Cash burn for the p eri od ended Sept. 30, 2023, is derived from the GAAP Statement of Cash Flows as follows: net cash used in operating activities of $29.6 million, cash used in investing activities for purchases of property and equipmen t o f $9.1 million, offset by cash provided in financing activities of $0.6 million (which excludes the September 2023 equity offering cash inflow). 2. Cash burn included $13.4 million change in unrealized loss and amortization or accretion on investments during the first quar ter 2022. Cash burn included $3.8 million change in unrealized gain and amortization or accretion on investments during the first quarter 2023. 16 Confidential Draft 1Q22 2Q22

Not for reproduction or further distribution. Guide ($ millions) Original Q1 23 Q2 23 Current Key drivers Revenue $ 980 – $ 1,000 $ 995 – $ 1,015 $1,015 – $1,035 $1,035 – $1,050 Continued volume growth, conservative ASPs, strong oncology contribution Gross margin % revenue 4 1 % – 4 4 % 4 1 % – 4 4 % 4 1 % – 4 4 % 4 3 % – 4 4 % ASPs, COGS trends continue to mature SG&A $5 10 – $5 40 $5 10 – $5 40 $5 40 – $5 80 $5 40 – $5 80 Stable trend vs. 2022 on mature commercial platforms R&D $3 25 – $3 45 $3 25 – $3 45 $3 25 – $3 45 $3 25 – $3 45 Focused investments in COGS reduction projects, clinical trials Cash burn $3 00 – $ 325 $3 00 – $ 325 $3 00 – $ 325 $ 260 – $ 280 More than $200M reduction in cash burn vs. 2022 2023 guidance: raising revenue & gross margin; reducing cash burn 17 Confidential Draft

Rich slate of potential future growth catalysts 18 Not for reproduction or further distribution. Potential guideline inclusion for Signatera , 22Q, Expanded Carrier Screening, Organ Health New product launches in Oncology and Women’s health Key data readouts in oncology including Altair CRC, treatment on molecular recurrence, early cancer detection Continued core business momentum in volume growth, ASP improvements, COGS reductions Signatera commercial launch in Japan serving a very large unmet need

©202 3 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution. ®