Exhibit 99.2

Natera, Inc. Investor presentation Q2 2024 Earnings Call August 8, 2024

Not for reproduction or further distribution. This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995 . All statements other than statements of historical facts contained in this presentation, including statements regarding our market opportunity, our anticipated products and launch schedules, our reimbursement coverage and our product costs, our commercial and strategic partnerships and potential acquisitions, our user experience, our clinical trials and studies, and our strategies, goals and general business and market conditions are forward - looking statements . These forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially, including : we face numerous uncertainties and challenges in achieving our financial projections and goals ; we may be unable to further increase the use and adoption of our products through our direct sales efforts or through our laboratory partners ; we have incurred losses since our inception and we anticipate that we will continue to incur losses for the foreseeable future ; our quarterly results may fluctuate from period to period ; our estimates of market opportunity and forecasts of market growth may prove to be inaccurate ; we may be unable to compete successfully with existing or future products or services offered by our competitors ; we may engage in acquisitions, dispositions or other strategic transactions that may not achieve our anticipated benefits and could otherwise disrupt our business, cause dilution to our stockholders or reduce our financial resources ; we may not be successful in commercializing our cloud - based distribution model ; our products may not perform as expected ; the results of our clinical studies, including our SNP - based Microdeletion and Aneuploidy Registry, or SMART, Study, may not be compelling to professional societies or payors as supporting the use of our tests, particularly for microdeletions screening, or may not be able to be replicated in later studies required for regulatory approvals or clearances ; if either of our primary CLIA - certified laboratories becomes inoperable, we will be unable to perform our tests and our business will be harmed ; we rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and materials and may not be able to find replacements or immediately transition to alternative suppliers ; if we are unable to successfully scale our operations, our business could suffer ; the marketing, sale, and use of Panorama and our other products could result in substantial damages arising from product liability or professional liability claims that exceed our resources ; we may be unable to expand, obtain or maintain third - party payer coverage and reimbursement for our tests, and we may be required to refund reimbursements already received ; third - party payers may withdraw coverage or provide lower levels of reimbursement due to changing policies, billing complexities or other factors ; we could incur substantial costs and delays associated with trying to obtain premarket clearance or approval and incur costs associated with complying with post - market controls, if and when the FDA begins actively regulating our tests pursuant to recently enacted FDA regulations ; litigation or other proceedings, resulting from either third party claims of intellectual property infringement or third party infringement of our technology, is costly, time - consuming and could limit our ability to commercialize our products or services ; any inability to effectively protect our proprietary technology could harm our competitive position or our brand ; and we cannot guarantee that we will be able to service and comply with our outstanding debt obligations or achieve our expectations regarding the conversion of our outstanding convertible notes . We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time . Moreover, we operate in a very competitive and rapidly changing environment . New risks emerge from time to time . It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statement . In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in this presentation may not occur and our actual results could differ materially and adversely from those anticipated or implied . As a result, you should not place undue reliance on our forward - looking statements . Except as required by law, we undertake no obligation to update publicly any forward - looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations . We file reports, proxy statements, and other information with the SEC . Such reports, proxy statements, and other information concerning us is available at http : //www . sec . gov . Requests for copies of such documents should be directed to our Investor Relations department at Natera, Inc . , 13011 McCallen Pass, Building A Suite 100 , Austin, TX 78753 . Our telephone number is ( 650 ) 980 - 9190 . 2 Safe harbor statement

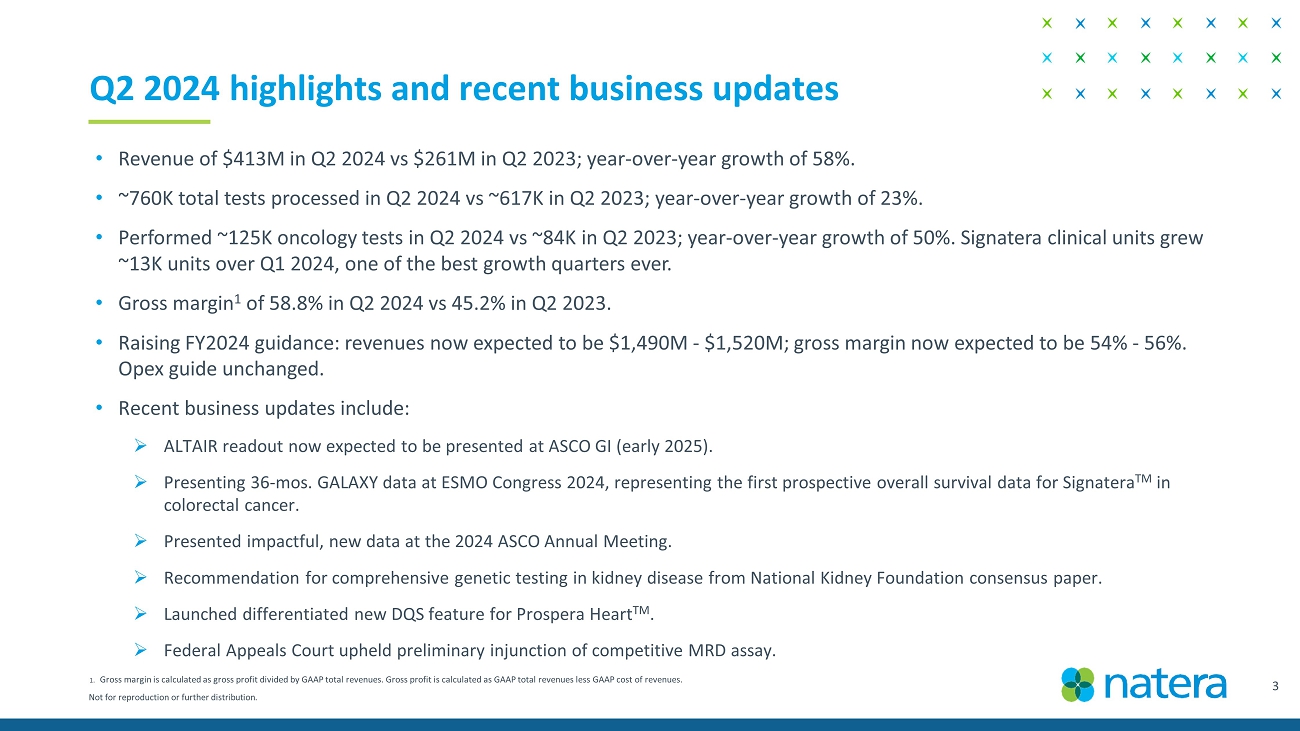

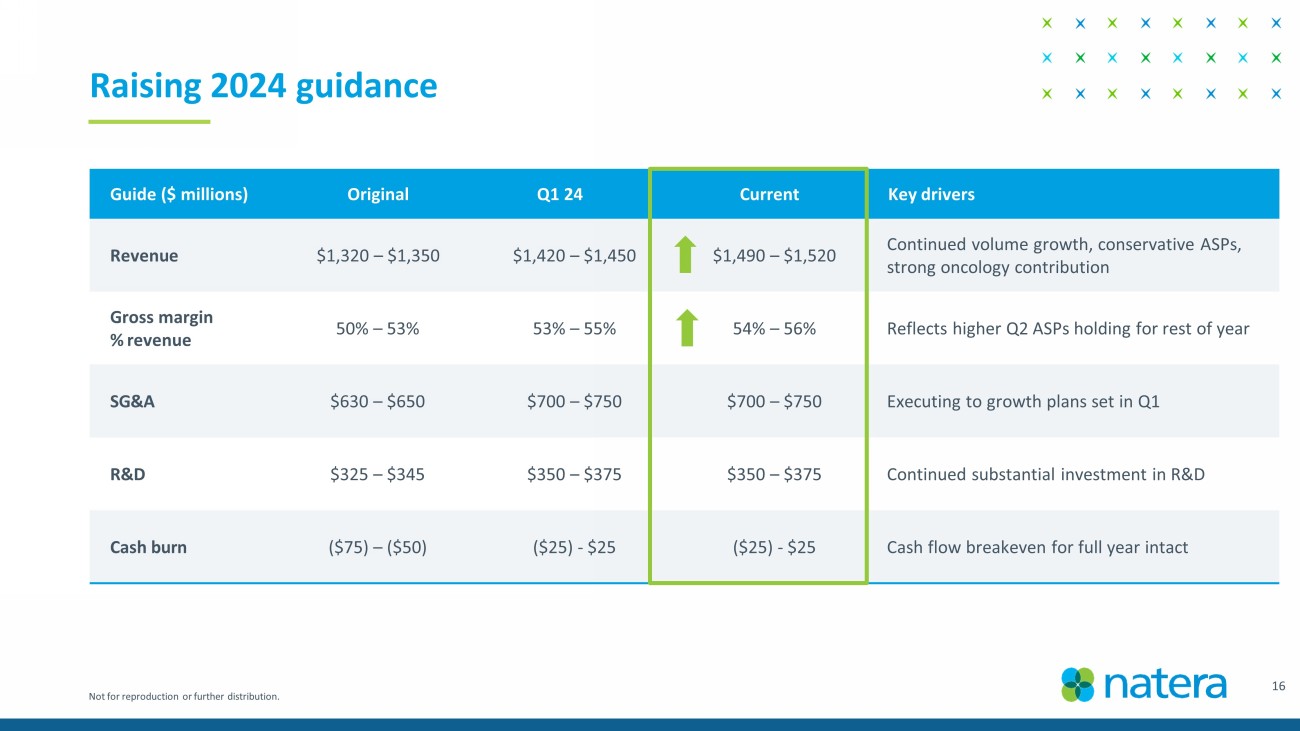

Not for reproduction or further distribution. 3 Q2 2024 highlights and recent business updates • Revenue of $413M in Q2 2024 vs $261M in Q2 2023; year - over - year growth of 58%. • ~760K total tests processed in Q2 2024 vs ~617K in Q2 2023; year - over - year growth of 23%. • Performed ~125K oncology tests in Q2 2024 vs ~84K in Q2 2023; year - over - year growth of 50%. Signatera clinical units grew ~13K units over Q1 2024, one of the best growth quarters ever. • Gross margin 1 of 58.8% in Q2 2024 vs 45.2% in Q2 2023. • Raising FY2024 guidance: revenues now expected to be $1,490M - $1,520M ; gross margin now expected to be 54% - 56%. Opex guide unchanged. • Recent business updates include: » ALTAIR readout now expected to be presented at ASCO GI (early 2025). » Presenting 36 - mos. GALAXY data at ESMO Congress 2024, representing the first prospective overall survival data for Signatera TM in colorectal cancer. » Presented impactful, new data at the 2024 ASCO Annual Meeting. » Endorsement for comprehensive genetic testing in kidney disease from National Kidney Foundation consensus paper. » Launched differentiated new feature for Prospera Heart TM . » Federal Appeals Court upheld preliminary injunction of competitive MRD assay. 1. Gross margin is calculated as gross profit divided by GAAP total revenues. Gross profit is calculated as GAAP total revenues les s GAAP cost of revenues.

Not for reproduction or further distribution. 195K 234K 376K 500K 617K 760K 0K 100K 200K 300K 400K 500K 600K 700K 800K Q2'19 Q2'20 Q2'21 Q2'22 Q2'23 Q2'24 Quarterly volumes demonstrate continued momentum Core Volume Drivers • New features and data leading to women’s health account wins • New data and guidelines driving organ health • Signatera continues to ramp 4

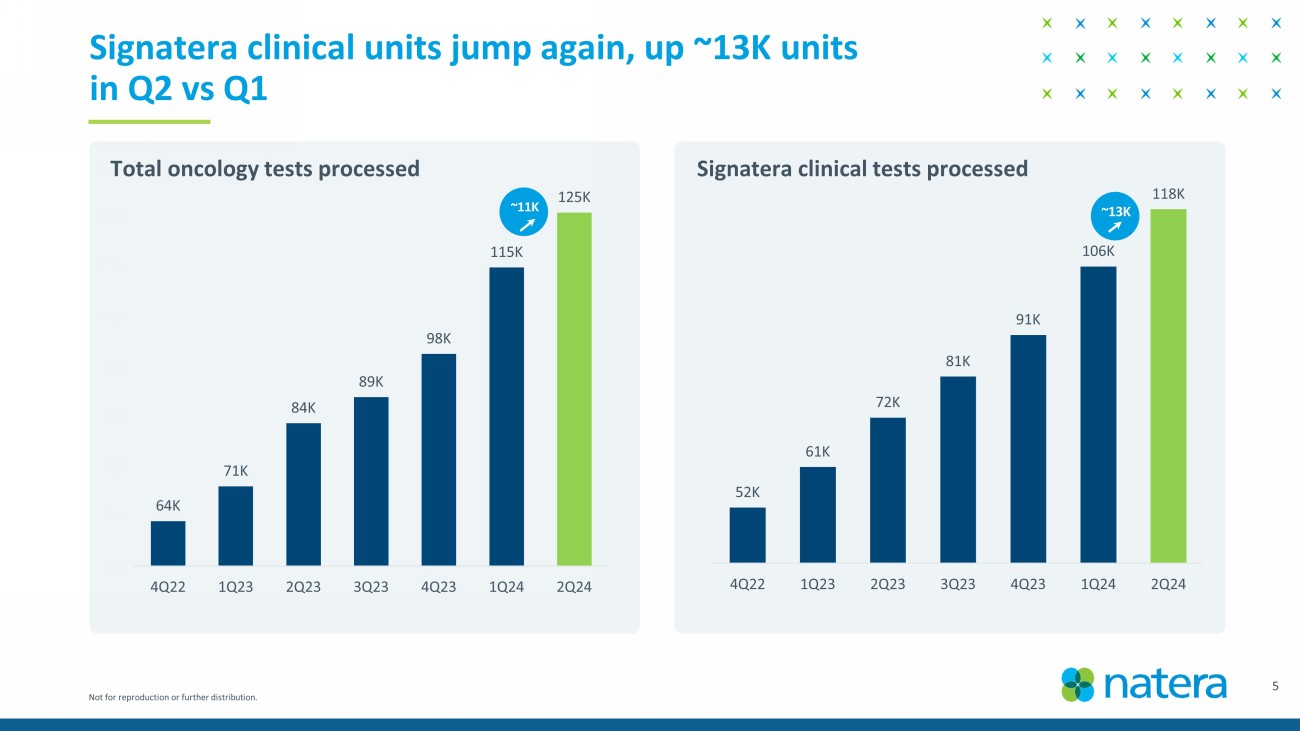

Not for reproduction or further distribution. 52K 61K 72K 81K 91K 106K 118K 40K 50K 60K 70K 80K 90K 100K 110K 120K 130K 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 64K 71K 84K 89K 98K 115K 125K 55K 65K 75K 85K 95K 105K 115K 125K 135K 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 5 Signatera clinical units jump again, up ~13K units in Q2 vs Q1 Total oncology tests processed Signatera clinical tests processed ~13K ~11K

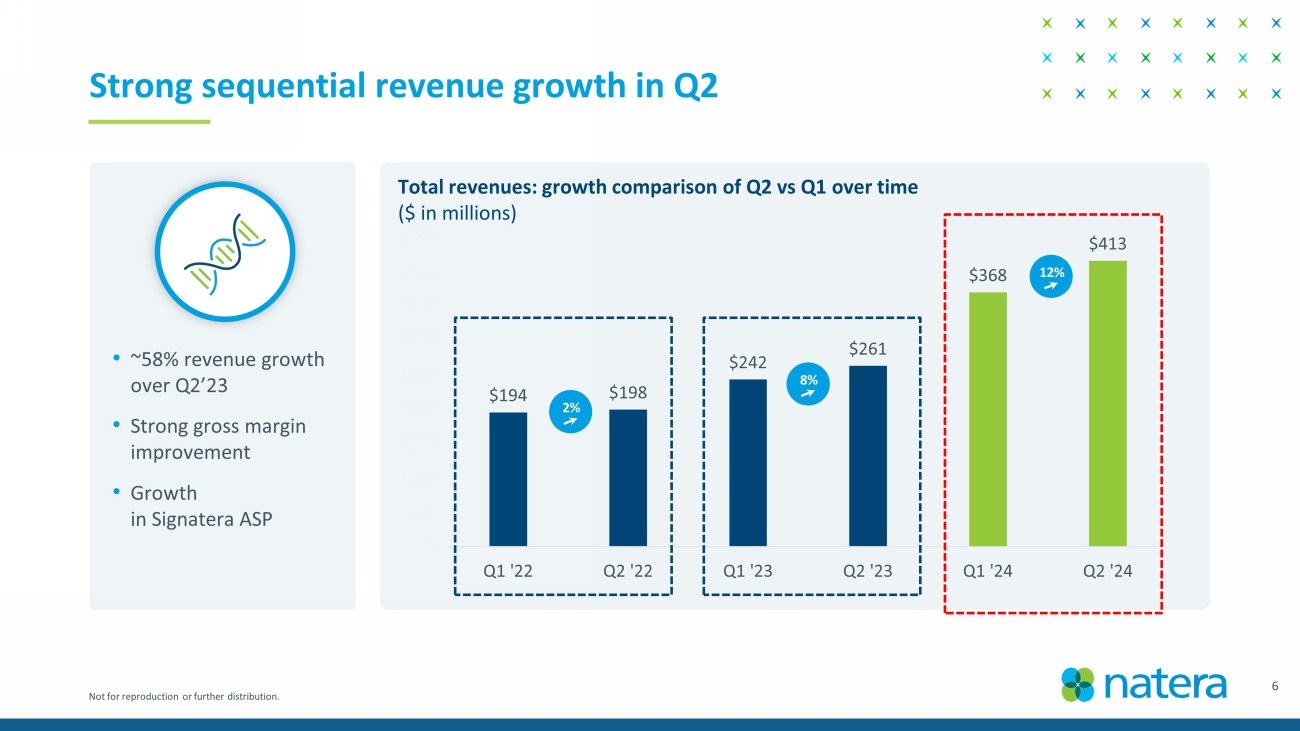

Not for reproduction or further distribution. $194 $198 $242 $261 $368 $413 $M $50M $100M $150M $200M $250M $300M $350M $400M $450M Q1 '22 Q2 '22 Q1 '23 Q2 '23 Q1 '24 Q2 '24 Strong sequential revenue growth in Q2 • ~58% revenue growth over Q2’23 • Strong gross margin improvement • Growth in Signatera ASP Total revenues: growth comparison of Q2 vs Q1 over time ($ in millions) 2 % 12 % 8 % 6

Not for reproduction or further distribution. 39% 45% 45% 51% 57% 59% 35% 40% 45% 50% 55% 60% 65% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 7 ASPs and COGS execution ahead of plan • Underlying gross margins (excluding true ups) increased ~200 bps in Q2 over Q1 • Significant sequential step up in ASPs • Cash collection exceeding expectations, driving true - ups • Continued momentum in COGS projects ~ 2 % true up benefit ~4% true up benefit Gross margins quarterly trend ~4% true up benefit

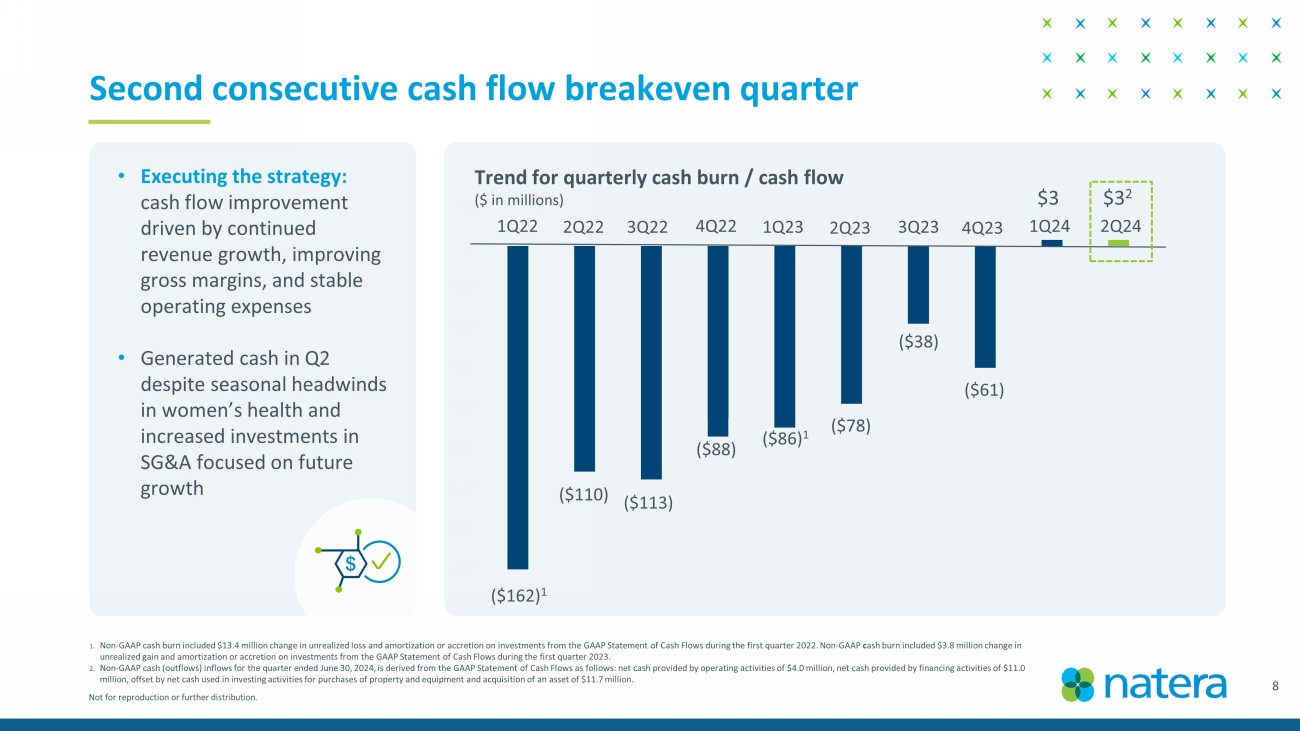

Not for reproduction or further distribution. (180) (160) (140) (120) (100) (80) (60) (40) (20) 0 20 Trend for quarterly cash burn / cash flow ($ in millions) 8 1. Non - GAAP cash burn included $13.4 million change in unrealized loss and amortization or accretion on investments from the GAAP S tatement of Cash Flows during the first quarter 2022. Non - GAAP c ash burn included $3.8 million change in unrealized gain and amortization or accretion on investments from the GAAP Statement of Cash Flows during the first quarter 2 023 . 2. Non - GAAP cash (outflows) inflows for the quarter ended June 30, 2024, is derived from the GAAP Statement of Cash Flows as follow s: net cash provided by operating activities of $4.0 million, net cash provided by financing activities of $11.0 million, offset by net cash used in investing activities for purchases of property and equipment and acquisition of an asset of $11.7 million. Second consecutive cash flow breakeven quarter ($162) 1 ($110) 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 ($113) ($88) ($86) 1 ($78) ($38) ($61) $3 $3 2 2Q24 • Executing the strategy: cash flow improvement driven by continued revenue growth, improving gross margins, and stable operating expenses • Generated cash in Q2 despite seasonal headwinds in women’s health and increased investments in SG&A focused on future growth

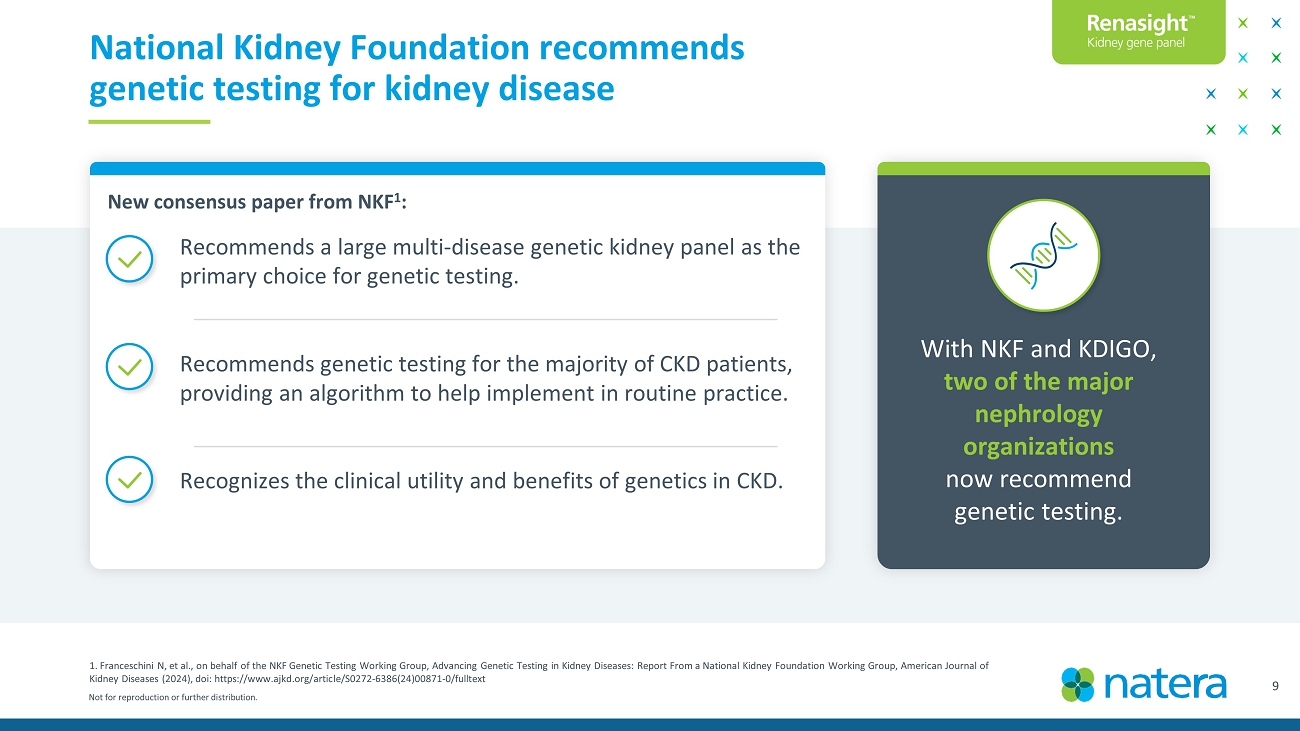

Not for reproduction or further distribution. 9 1. Franceschini N, et al., on behalf of the NKF Genetic Testing Working Group, Advancing Genetic Testing in Kidney Diseases: Report From a Na ti onal Kidney Foundation Working Group, American Journal of Kidney Diseases (2024), doi : https://www.ajkd.org/article/S0272 - 6386(24)00871 - 0/fulltext National Kidney Foundation endorses genetic testing for kidney disease Recommends a large multi - disease genetic kidney panel as the primary choice for genetic testing. Recommends genetic testing for the majority of CKD patients, providing an algorithm to help implement in routine practice. Recognizes the clinical utility and benefits of genetics in CKD. With NKF and KDIGO, two of the major nephrology organizations now recommend genetic testing. New consensus paper from NKF 1 :

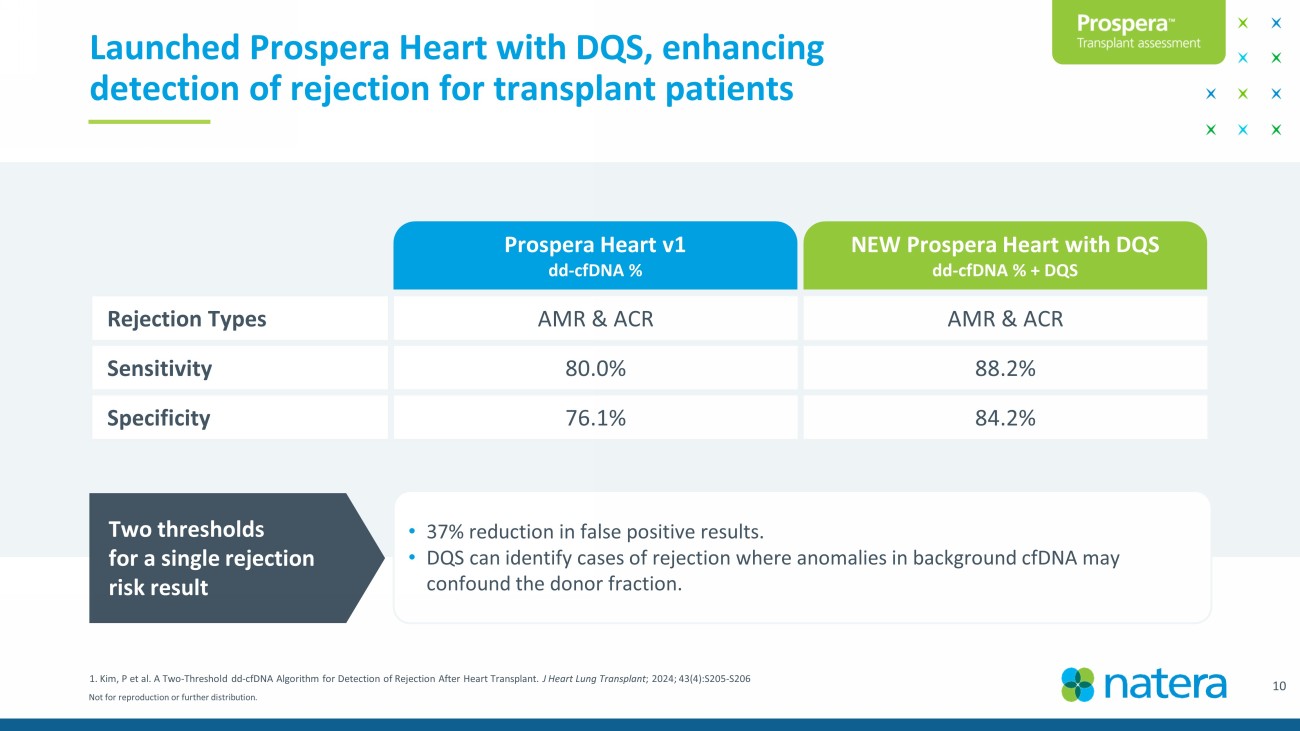

Not for reproduction or further distribution. 10 1. Kim, P et al. A Two - Threshold dd - cfDNA Algorithm for Detection of Rejection After Heart Transplant. J Heart Lung Transplant ; 2024; 43(4):S205 - S206 Launched Prospera Heart with DQS, enhancing detection of rejection for transplant patients Rejection Types AMR & ACR AMR & ACR Sensitivity 80.0% 88.2% Specificity 76.1% 84.2% • 37% reduction in false positive results. • DQS can identify cases of rejection where anomalies in background cfDNA may confound the donor fraction. Two thresholds for a single rejection risk result Prospera Heart v1 dd - cfDNA % NEW Prospera Heart with DQS dd - cfDNA % + DQS

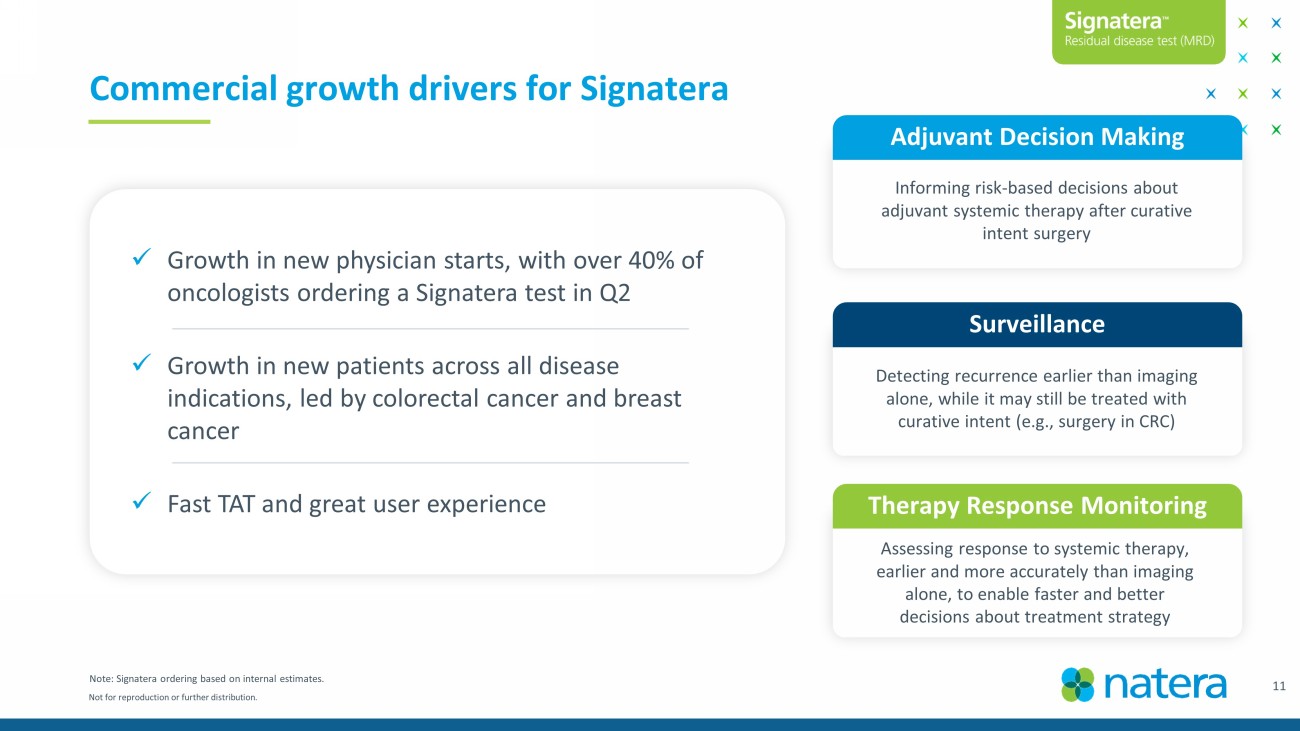

Not for reproduction or further distribution. Commercial growth drivers for Signatera 11 Adjuvant Decision Making Surveillance Detecting recurrence earlier than imaging alone, while it may still be treated with curative intent (e.g., surgery in CRC) Informing risk - based decisions about adjuvant systemic therapy after curative intent surgery Therapy Response Monitoring Assessing response to systemic therapy, earlier and more accurately than imaging alone, to enable faster and better decisions about treatment strategy Note: Signatera ordering based on internal estimates. x Growth in new physician starts, with over 40% of oncologists ordering a Signatera test in Q2 x Growth in new patients across all disease indications, led by colorectal cancer and breast cancer x Fast TAT and great user experience

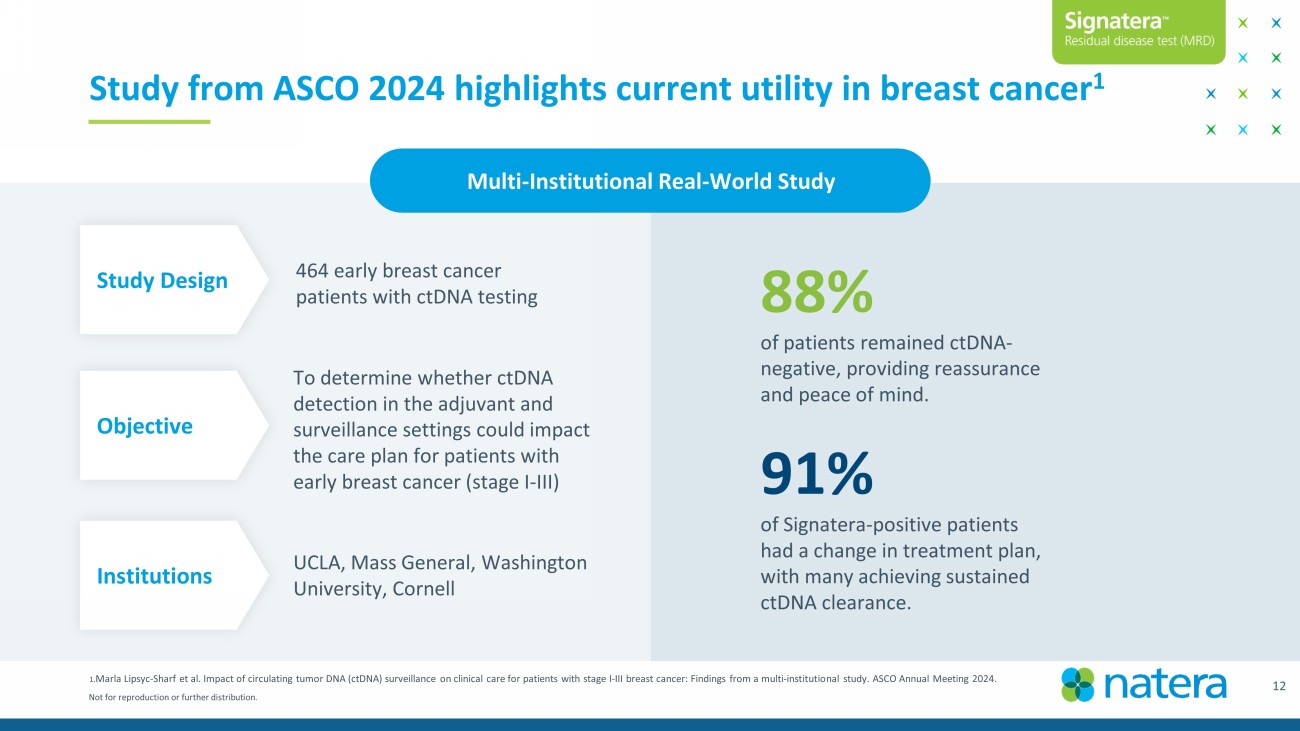

Not for reproduction or further distribution. 1. Marla Lipsyc - Sharf et al. Impact of circulating tumor DNA ( ctDNA ) surveillance on clinical care for patients with stage I - III breast cancer: Findings from a multi - institutional study. ASCO Ann ual Meeting 2024. 88% of patients remained ctDNA - negative, providing reassurance and peace of mind. 91% of Signatera - positive patients had a change in treatment plan, with many achieving sustained ctDNA clearance. Study from ASCO 2024 highlights current utility in breast cancer 1 Multi - Institutional Real - World Study To determine whether ctDNA detection in the adjuvant and surveillance settings could impact the care plan for patients with early breast cancer (stage I - III) Objective Institutions UCLA, Mass General, Washington University, Cornell Study Design 464 early breast cancer patients with ctDNA testing 12

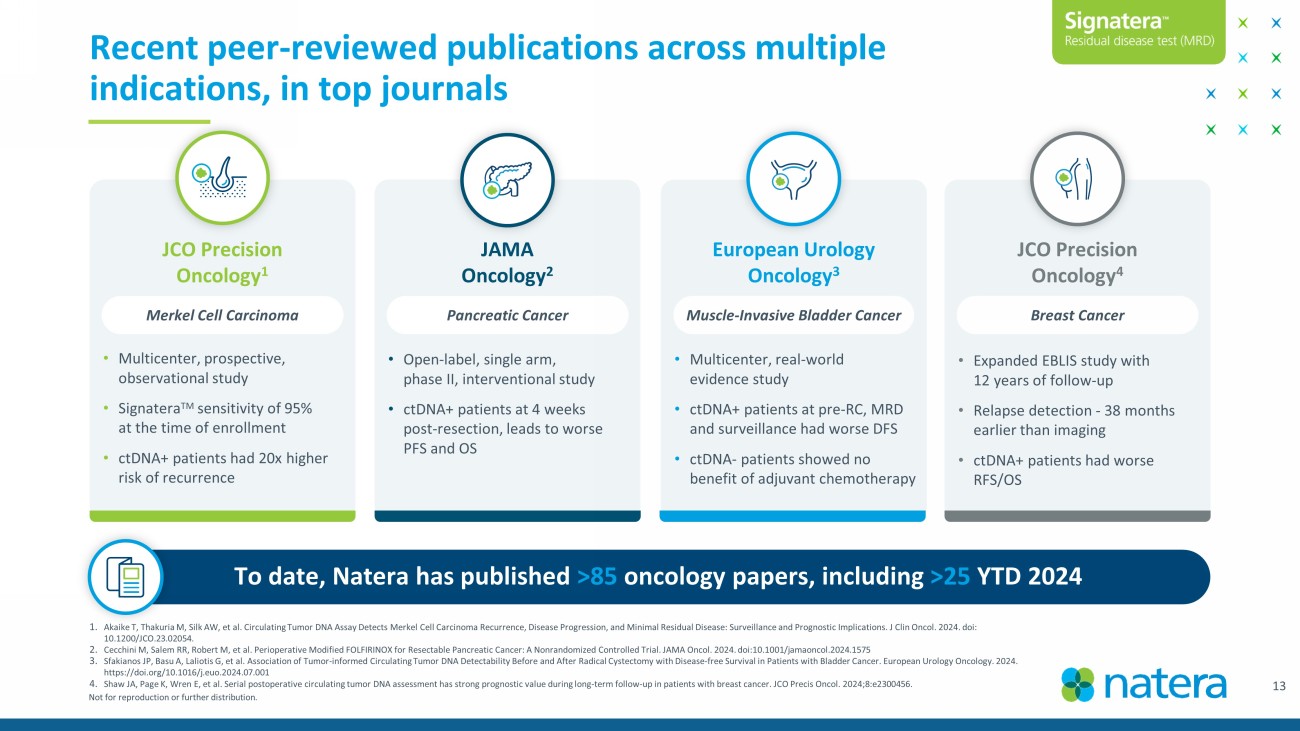

Not for reproduction or further distribution. 13 Recent peer - reviewed publications across multiple indications, in top journals To date, Natera has published >85 oncology papers, including >25 YTD 2024 Multicenter, real - world evidence study ctDNA+ patients at pre - RC, MRD and surveillance had worse DFS ctDNA - patients showed no benefit of adjuvant chemotherapy JCO Precision Oncology 1 JAMA Oncology 2 European Urology Oncology 3 JCO Precision Oncology 4 • Multicenter, prospective, observational study • Signatera TM sensitivity of 95% at the time of enrollment • ctDNA+ patients had 20x higher risk of recurrence • Open - label, single arm, phase II, interventional study • ctDNA+ patients at 4 weeks post - resection, leads to worse PFS and OS • Multicenter , real - world evidence study • ctDNA+ patients at pre - RC, MRD and surveillance had worse DFS • ctDNA - patients showed no benefit of adjuvant chemotherapy • Expanded EBLIS study with 12 years of follow - up • Relapse detection - 38 months earlier than imaging • ctDNA+ patients had worse RFS/OS Merkel Cell Carcinoma Pancreatic Cancer Muscle - Invasive Bladder Cancer Breast Cancer 1. Akaike T, Thakuria M, Silk AW, et al. Circulating Tumor DNA Assay Detects Merkel Cell Carcinoma Recurrence, Disease Progression, and Minimal Res id ual Disease: Surveillance and Prognostic Implications. J Clin Oncol. 2024. doi : 10.1200/JCO.23.02054. 2. Cecchini M, Salem RR, Robert M, et al. Perioperative Modified FOLFIRINOX for Resectable Pancreatic Cancer: A Nonrandomized Controlled Trial. JAMA Oncol. 2024. doi:10.1001/jamaoncol.2024.1575 3. Sfakianos JP, Basu A, Laliotis G, et al. Association of Tumor - informed Circulating Tumor DNA Detectability Before and After Radical Cystectomy with Disease - fr ee Survival in Patients with Bladder Cancer. European Urology Oncology. 2024. https://doi.org/10.1016/j.euo.2024.07.001 4. Shaw JA, Page K, Wren E, et al. Serial postoperative circulating tumor DNA assessment has strong prognostic value during long - te rm follow - up in patients with breast cancer. JCO Precis Oncol. 2024;8:e2300456.

Not for reproduction or further distribution. 14 Trial GALAXY (36 - mos outcomes data) ALTAIR IMvigor011 CIRCULATE France TREAT ctDNA VEGA MODERN CIRCULATE - US Indication CRC CRC Bladder CRC Breast CRC Bladder CRC RCT/NR NR RCT RCT RCT RCT RCT RCT RCT Phase N/A III III III III III II/III II/III Category Prospective, observational Escalation Escalation and de - escalation Escalation Escalation De - escalation Escalation and de - escalation Escalation and de - escalation Est. # of patients ~2,200 ~240 ~800 ~2,130 ~220 ~1,240 ~1,250 ~1,900 2024 2025 2026 and Beyond Key phase III clinical trials in colorectal, bladder and breast cancers

Not for reproduction or further distribution. FY24 Q2 financial overview 15 1. Cash and investments also include cash equivalents and restricted cash. 2. This balance reflects net carrying value for the Convertible Senior Notes under ASC 470 - 20 while the gross principal amounts out standing is $287.5 million as of June 30, 2024. ($ in millions, except for per share data) Balance sheet Jun 30, 2024 Dec 31, 2023 Change Y/Y Cash & investments 1 $887.1 $879.0 $8.1 UBS line of credit $80.4 $80.4 $ — Convertible senior notes 2 $283.6 $282.9 $0.7 FY24 Q2 FY23 Q2 Change Y/Y Product revenues $411.4 $258.3 $153.1 Licensing and other revenues $2.0 $3.1 ($1.1) Total revenues $413.4 $261.4 $152.0 Gross margin % 58.8% 45.2% 13.6% R&D $89.1 $78.2 $10.9 SG&A $198.0 $152.5 $45.5 Net loss per diluted share ($0.30) ($0.97) $0.67

Not for reproduction or further distribution. Guide ($ millions) Original Q1 24 Current Key drivers Revenue $ 1,320 – $1, 350 $ 1,420 – $1, 450 $ 1,490 – $1,520 Continued volume growth, conservative ASPs, strong oncology contribution Gross margin % revenue 50 % – 53 % 53 % – 55 % 54 % – 56 % Reflects higher Q2 ASPs holding for rest of year SG&A $ 630 – $ 650 $ 700 – $ 750 $ 700 – $ 750 Executing to growth plans set in Q1 R&D $325 – $345 $ 350 – $ 375 $ 350 – $ 375 Continued substantial investment in R&D Cash burn ($ 75) – ($ 50) ( $25) - $25 ( $25) - $25 Cash flow breakeven for full year intact Raising 2024 guidance 16

©202 4 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution. ®