Exhibit 99.1

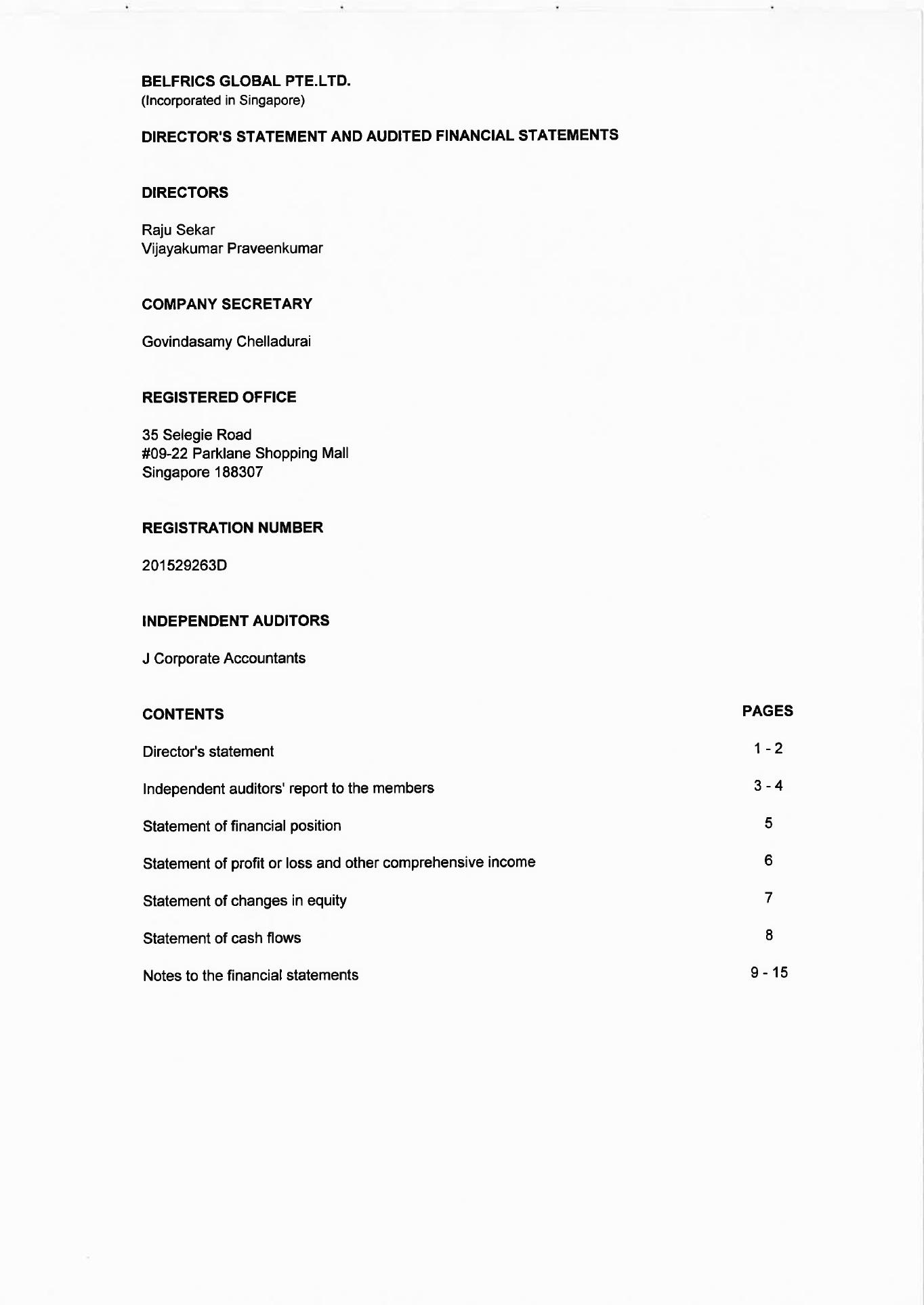

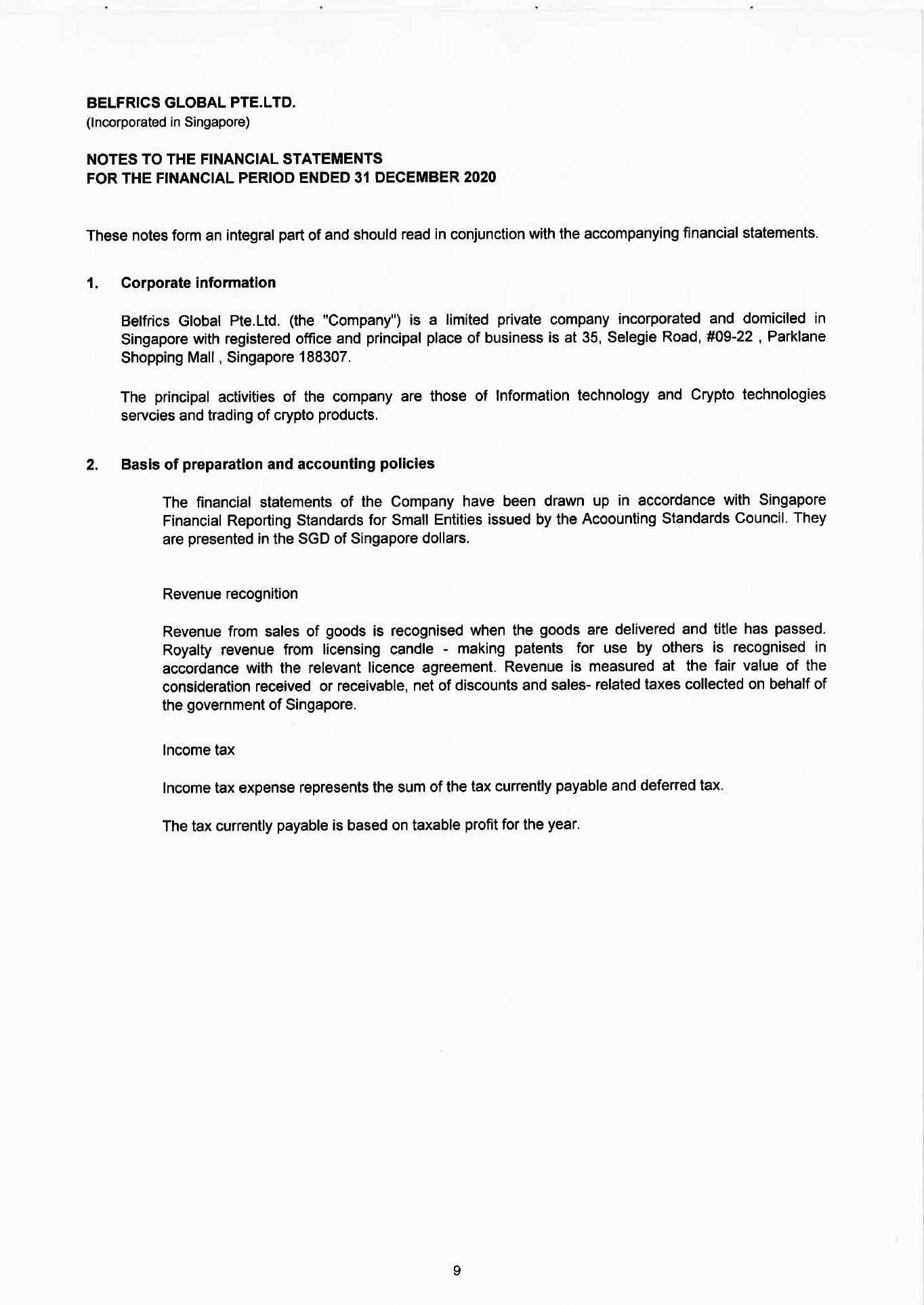

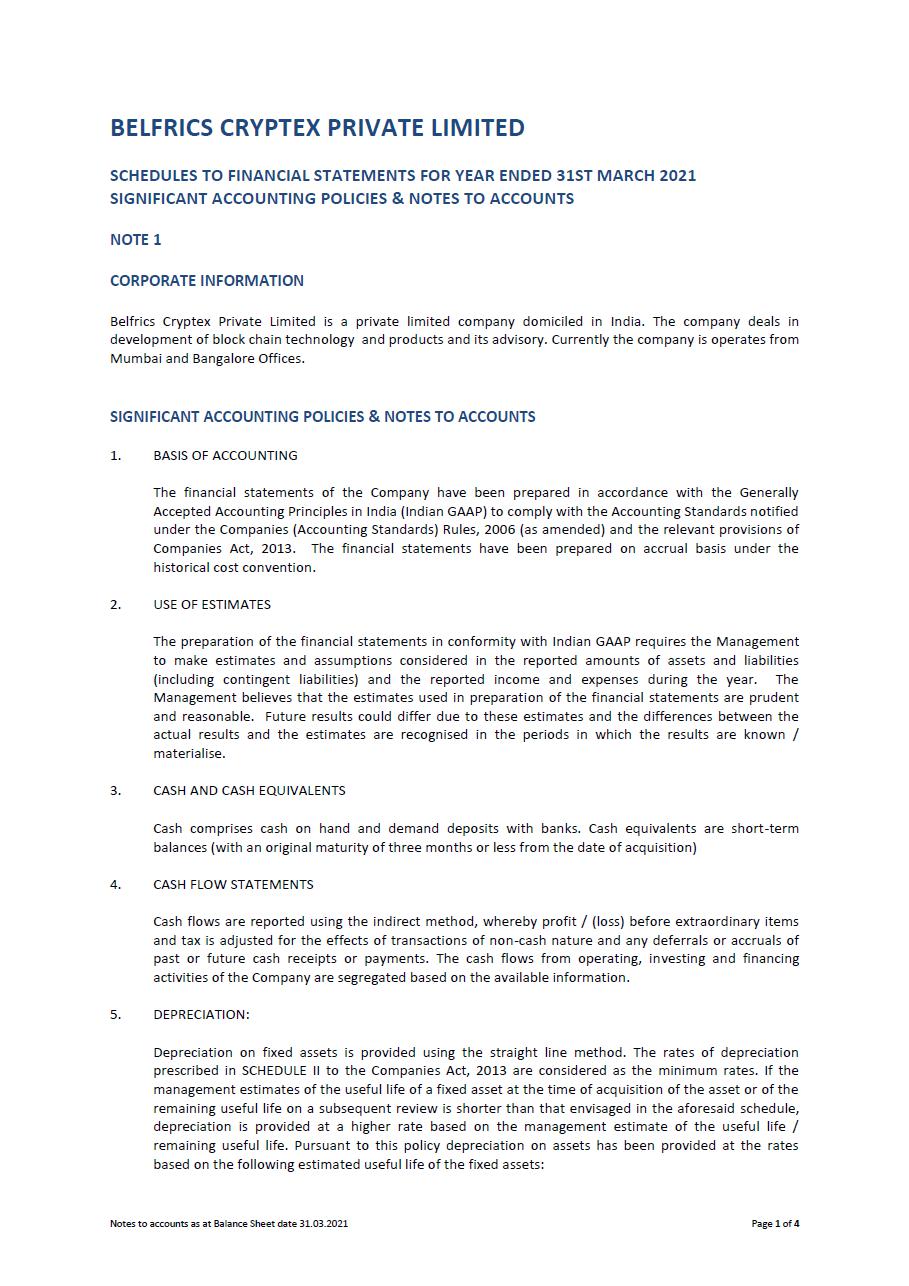

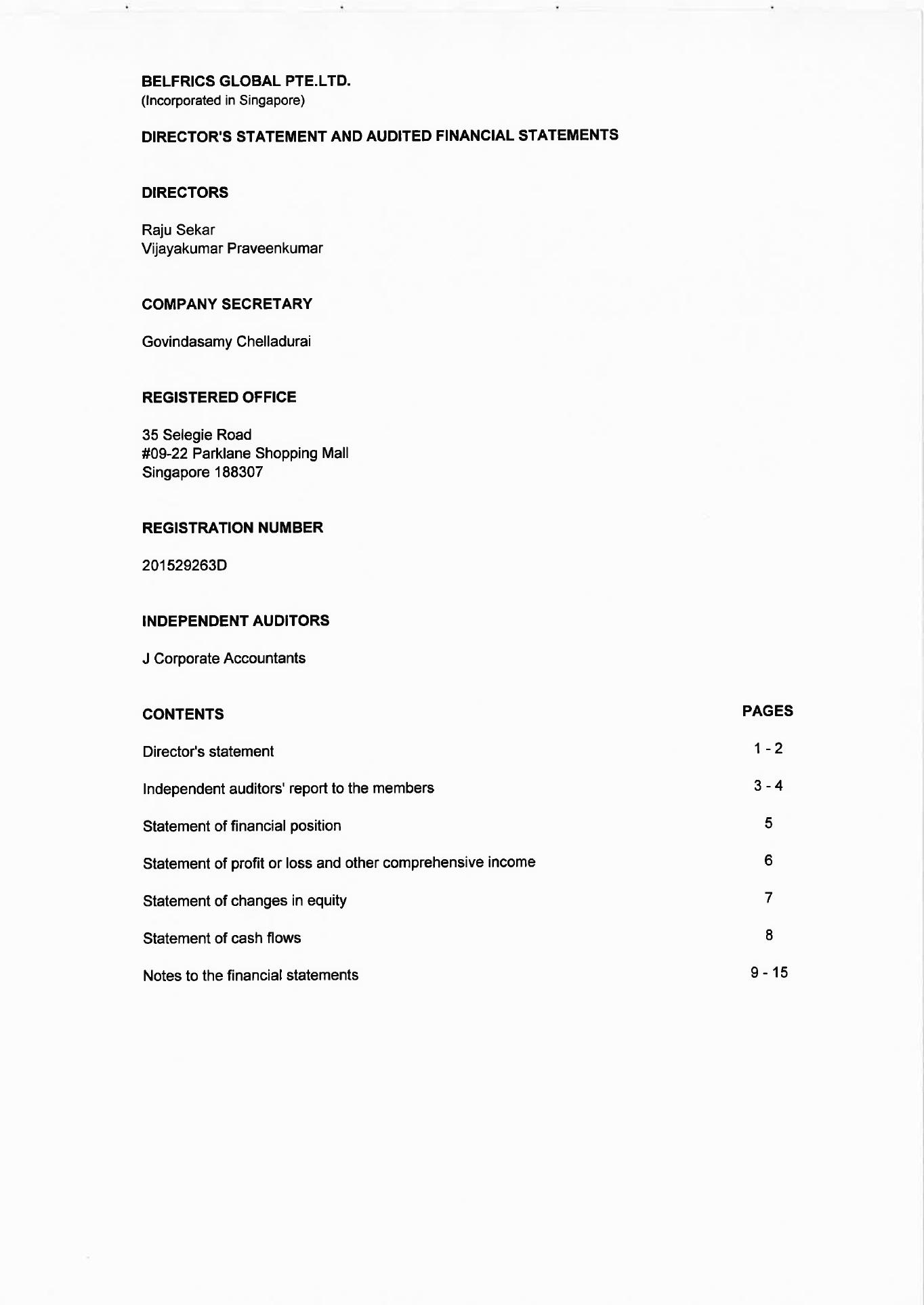

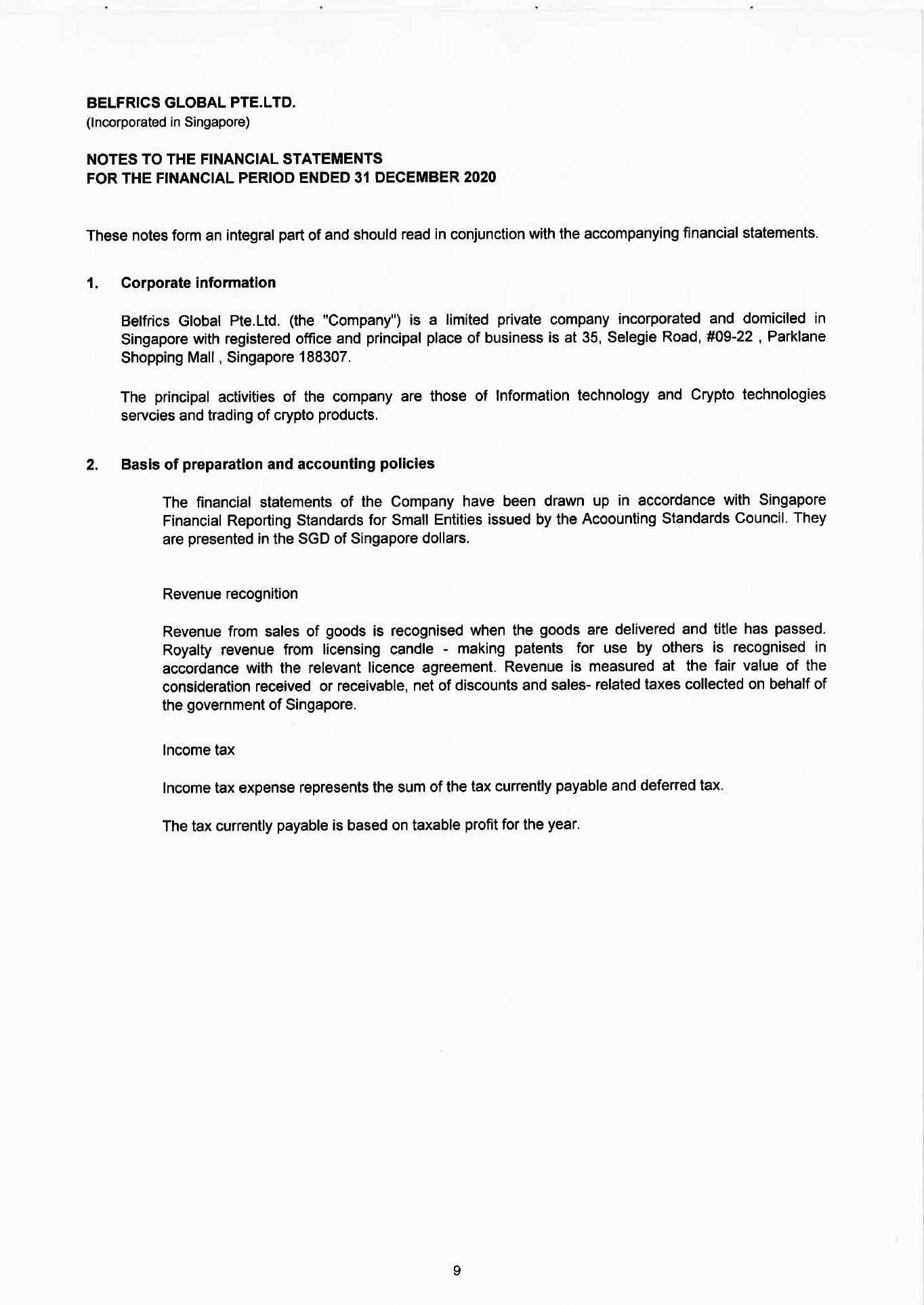

BELFRICS GLOBAL PTE LTD (Incorporated in Singapore) |

REPORT OF THE DIRECTORS FOR THE FINANCIAL YEAR ENDED 30 JUNE 2019

The directors present their report to the members together with the financial statements of the Company for the year ended 30 June 2019.

The directors in office at the date of this report are:-

Raju Sekar

Vijayakumar Praveenkumar

| 2. | ARRANGEMENTS TO ENABLE DIRECTORS TO ACQUIRE BENEFITS | |

Except as disclosed in note 4 below, neither at the end of nor at any time during the financial year was the company a party to any arrangement whose object is to enable the director of the company to acquire benefits by means of the acquisition of shares or debentures of the company or of any other corporate body.

| 3. | DIRECTORS’ CONTRACTUAL BENEFITS |

Since the beginning of the financial year no director has received or become entitled to receive a benefit by reason of a contract made by the Company or a related corporation with the director or with a firm of which he is a member, or with a Company in which he has a substantial financial interest (except in respect of professional fees and/or remuneration as shown in the financial statements).

| 4. | DIRECTORS’ INTEREST IN SHARES AND DEBENTURES |

The directors holding office as at 30 June 2019 and their interests in the share capital of the company as recorded in the register of directors’ shareholdings kept by the company under Section 164 of the Companies Act, Cap.50 is as follows:-

BELFRICS GLOBAL PTE LTD (Incorporated in Singapore) |

REPORT OF THE DIRECTORS FOR THE FINANCIAL YEAR ENDED 30 JUNE 2019

No options were granted during the financial year to take up unissued shares of the company. No shares were issued by virtue of the exercise of options. There were no unissued shares under option at the end of the financial year.

The company has elected under Section 205C (3) of the Companies Act to have the financial statements exempted from audit requirements.

SIGNED ON BEHALF OF THE BOARD OF DIRECTORS

| |

| Raju Sekar | |

| DIRECTOR | |

| | |

| |

| Vijayakumar Praveenkumar | |

| DIRECTOR | |

Dated:

Singapore

BELFRICS GLOBAL PTE LTD (Incorporated in Singapore) |

STATEMENT BY DIRECTORS

REG NO: 201529263D

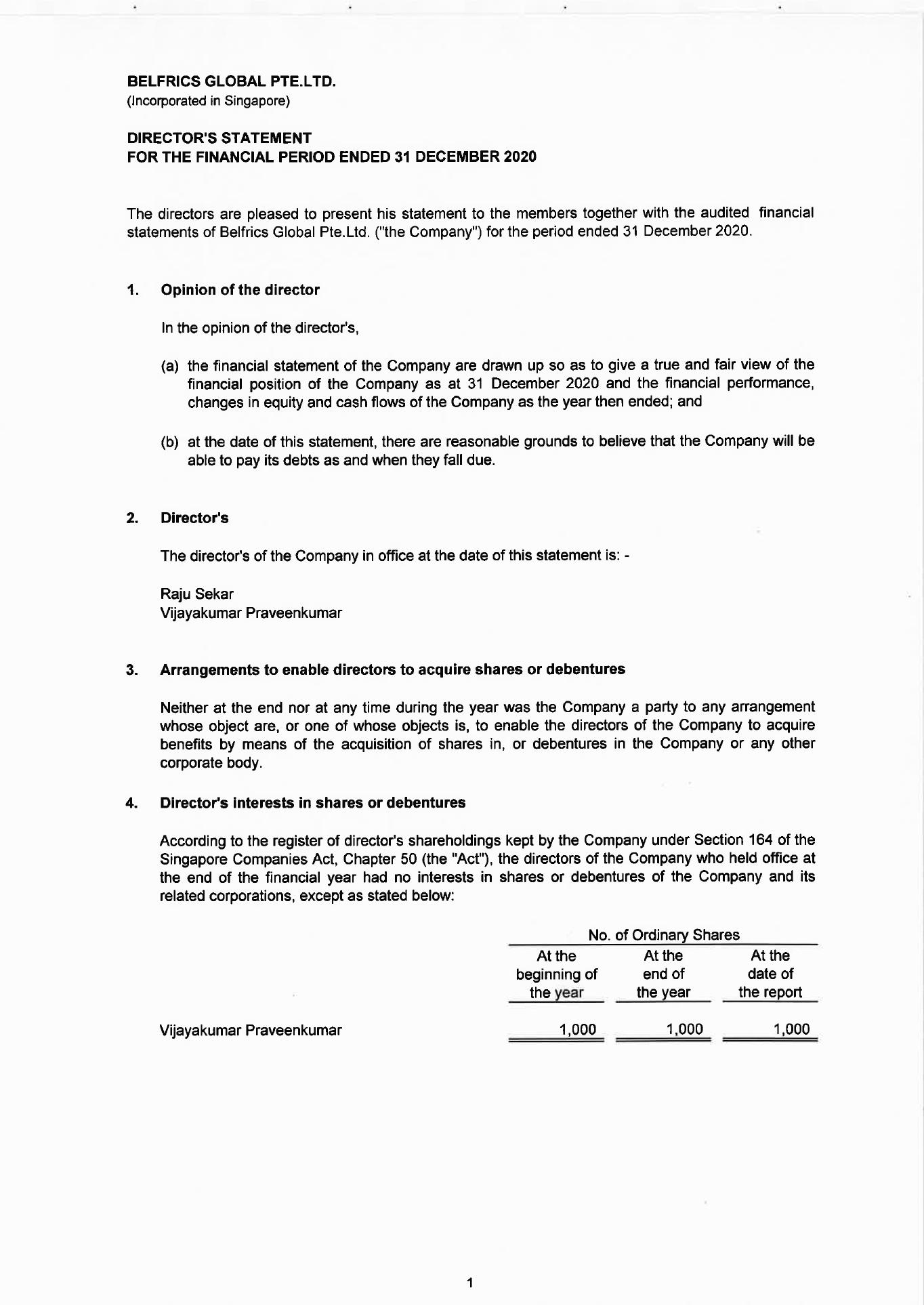

In the opinion of the directors:-

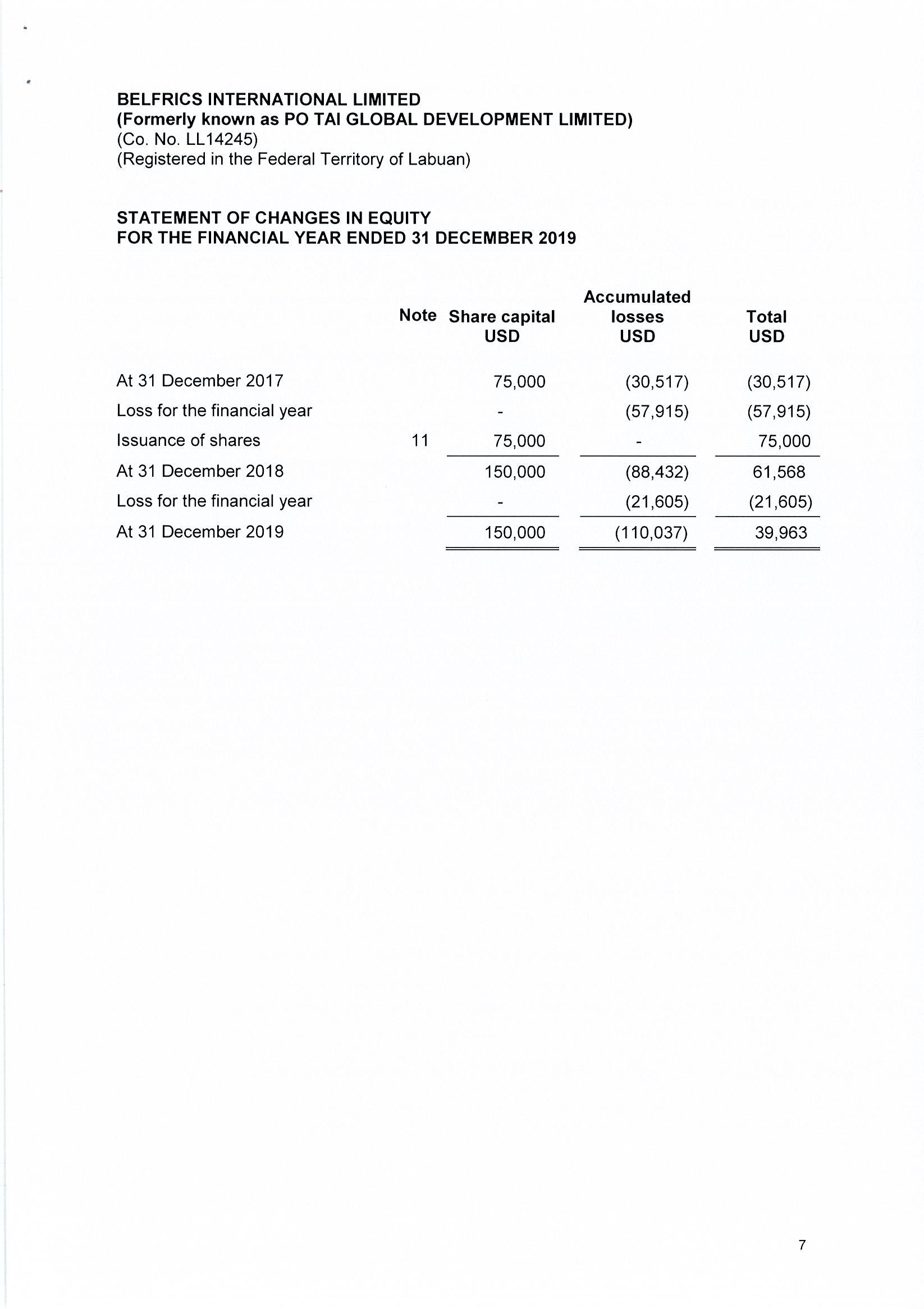

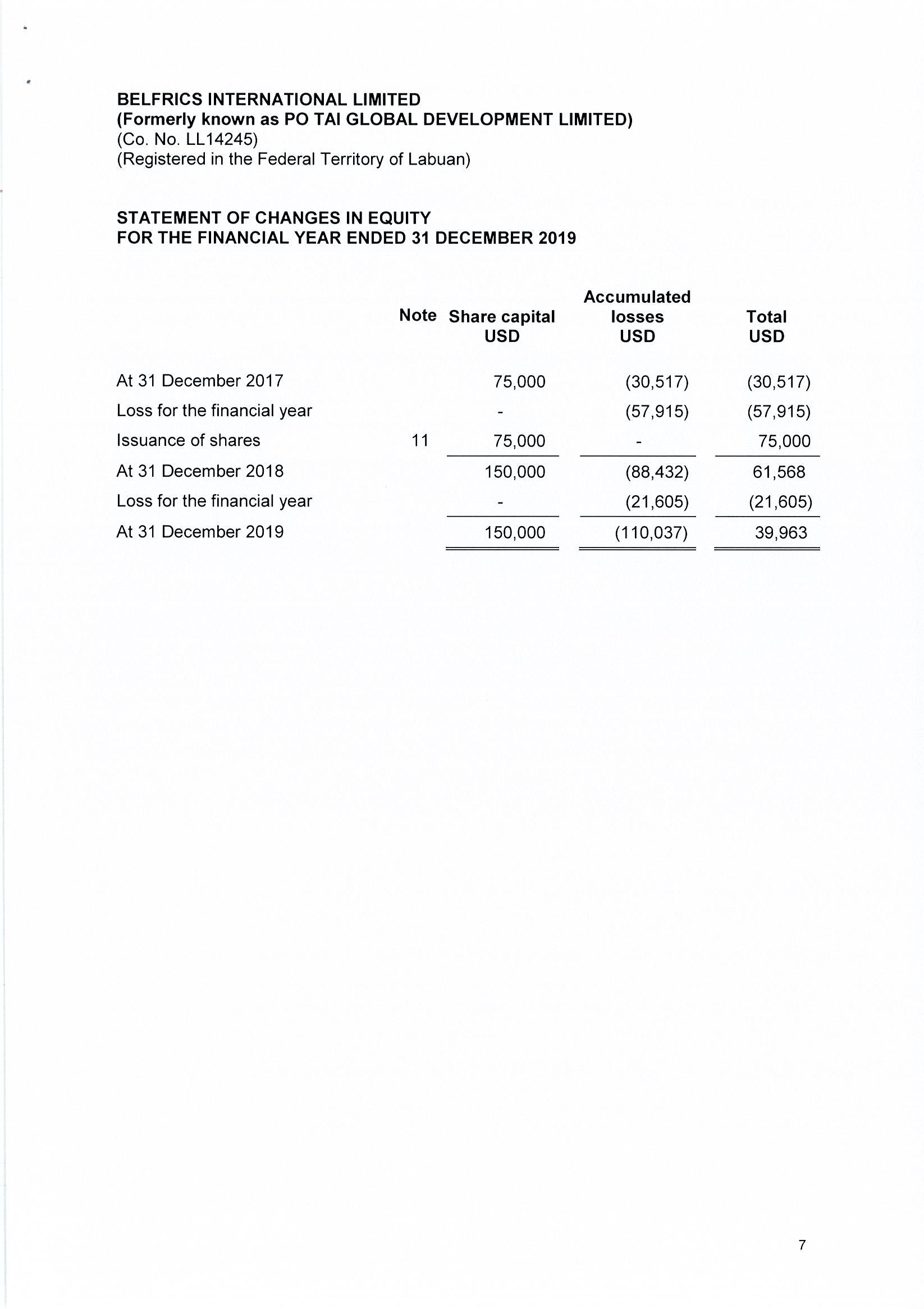

| (a) | The accompanying balance sheet, statement of comprehensive income, statement of changes in equity and the cash flow statement, together with the notes thereto are drawn up so as to give a true and fair view of the state of affairs of the company as at 30 June 2019 and of the results of the business of the Company for the financial year ended on that date; and |

| | |

| (b) | At the date of this statement, having assurance of continued financial support from the Company’s shareholder and director, there are reasonable grounds to believe that the Company will be able to pay its debts as and when they fall due. |

The Board of Directors has authorized these financial statements for issue on the date of this statement.

SIGNED ON BEHALF OF THE DIRECTORS

| | |

| |

| Raju Sekar | |

| DIRECTOR | |

| | |

| |

| |

| Vijayakumar Praveenkumar | |

| DIRECTOR | |

| | |

Dated:

Singapore

BELFRICS GLOBAL PTE LTD (Incorporated in Singapore) |

STATEMENT BY AN EXEMPT PRIVATE COMPANY EXEMPT FROM AUDIT REQUIREMENTS

UNDER SECTION 205C (3) OF THE COMPANIES ACT

| Name of Company: | BELFRICS GLOBAL PTE LTD |

| | |

| Registration No: | 201529263D |

We, Raju Sekar and Vijayakumar Praveenkumar are being the director of the abovementioned company, hereby declare on behalf of the Board of Directors that:

| a) | as at the end of the financial year 30 June 2019, the Company is exempt from audit requirements. |

| | | |

| b) | No notice has been received from any member under Section 205B(6) requiring the Company to obtain an audit of its accounts in relation to the year; and |

| | | |

| c) | The accounting and other records required to be kept by the Company in accordance with Section 199 of the Companies Act have been so kept. |

| | |

| Raju Sekar | |

| DIRECTOR | |

| | |

| |

| |

| Vijayakumar Praveenkumar | |

| DIRECTOR | |

Dated:

Singapore

BELFRICS GLOBAL PTE LTD (Incorporated in Singapore) |

BALANCE SHEET

AS AT 30 JUNE 2019

| | NOTES | | | 2019

| |

| | | | | | S$ | |

| FIXED ASSETS | | | | | | |

| Software | | | | | | | 502,437 | |

| | | | | | | | | |

CURRENT ASSETS | | | | | | | | |

| Cash and cash equivalent | | | 5 | | | | 103 | |

| Director account | | | | | | | 368,134 | |

| Loan and advances | | | | | | | 1,058,787 | |

| | | | | | | | 1,427,024 | |

| CURRENT LIABILITY | | | | | | | | |

| Sundry creditor | | | | | | | 124,751 | |

| Unsecured loan | | | | | | | 11,818 | |

| Other creditors | | | | | | | 1,856,808 | |

| | | | | | | | 1,993,377 | |

| | | | | | | | | |

| Net assets | | | | | | | (63,916 | ) |

| | | | | | | | | |

EQUITY AND RESERVE | | | | | | | | |

| Share capital | | | 3 | | | | 1,000 | |

| Retained earning | | | | | | | (64,916 | ) |

| Share holder’s fund | | | | | | | (63,916 | ) |

The accompanying notes form a part of these accounts.

BELFRICS GLOBAL PTE LTD (Incorporated in Singapore) |

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 JUNE 2019

| | NOTES | | 2019 | |

| | | | S$ | |

| Revenue | | | | - | |

| Purchases | | | | (136,569 | ) |

| GROSS PROFIT | | | | (136,569 | ) |

| | | | | | |

Administratiive expenses | | | | 1,860 | |

| | | | | | |

| Finance cost | | | | (138,429 | ) |

| Profit before tax | 6 | | | (138,429 | ) |

| | | | | | |

| Profit after tax | | | | (138,429 | ) |

| Other comprehensive income | | | | 73,513 | |

| Total comprehensive income for the year | | | (64,916 | ) |

The accompanying notes form a part of these accounts.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 30 JUNE 2019

| | | SHARE | | | RETAINED | | | | |

| | | CAPITAL | | | EARNINGS | | | TOTAL | |

| | | S$ | | | S$ | | | S$ | |

Total comprehensive income for the year | | 1,000 | | | 73,513 | | | 74,513 | |

| | | | | | | | (138,429 | ) | | | (138,429 | ) |

| Balance at 30 June 2019 | | | 1,000 | | | | (64,916 | ) | | | (63,916 | ) |

The accompanying notes form a part of these accounts.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

CASH FLOW STATEMENT

FOR THE YEAR ENDED 30 JUNE 2019

| | | 2019 | |

| | | | S$ | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| (Loss) before tax | | | (138,429 | ) |

| Adjustments for:- Depreciation | | | - | |

| | | | | |

| Operating profit before working capital changes | | | (138,429 | ) |

| | | | | |

| Receivables | | | (1,058,787 | ) |

| Payables | | | 1,993,377 | |

| Cash used in operations | | | 796,161 | |

| Income tax paid | | | - | |

| Net cash used in operating activities | | | 796,161 | |

| | | | | |

| Investing activites | | | | |

| Purchase of plant and equipment | | | (502,437 | ) |

| Net cash flow from investing activities | | | (502,437 | ) |

| | | | | |

| Financing activites | | | | |

| Share capital | | | 1,000 | |

| Other creditor | | | - |

| Amount due from director | | | (294,621 | ) |

| Amount due from related party | | | - | |

| Net cash flow from financing activities | | | (293,621 | ) |

| | | | | |

| Net increase in cash and cash equivalents | | | 103 | |

| Cash and cash equivalents at beginning of year | | | - | |

| Cash and cash equivalents at end of year - NOTE 6 | | | 103 | |

The accompanying notes form a part of these accounts.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

NOTES TO THE FINANCIAL STATEMENTS – 30 JUNE 2019

These notes form an integral part of and should be read in conjunction with the balance sheet, income statement, statement of changes in equity and cash flow statement.

| 1. | CORPORATE INFORMATION AND PRINCIPAL ACTIVITIES |

The Company is domiciled and incorporated as a limited private company in the Republic of Singapore. Its registered office and principal place of business is located at 35 Selegie Road, #01-21, Parklane Shopping Mall, Singapore 188307.

The principal activities of the company are those of information technology. There have been no significant changes in the nature of these activities during the financial year.

The financial statements of the company for the year ended 30 June 2019 were authorized for issue in accordance with the resolution of the directors on

| 2 | SIGNIFICANT ACCOUNTING POLICIES |

The financial statements are prepared in accordance with the Singapore Financial Reporting Standards (“FRS”).

The financial statements are presented in Singapore dollars (which is also the functional currency of the company) and have been prepared on historical cost basis except as disclosed in the accounting policies below.

Receivables are stated invoiced amount, less allowance for doubtful in collection and are written off when they are considered to be uncollectible. The net amount approximates fair value.

Payables are carried at cost which is the fair value of the consideration to be paid in the future for goods and services received, whether or not billed to the company.

Payables include trade and non-trade balances.

| d) | Revenue recognition and revenue |

Revenue is recognized to the extent that it is probable that economic benefits will flow to the company and the revenue could be reliably measured.

Revenue for services is recognized upon their completion and acceptance by customers.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

NOTES TO THE FINANCIAL STATEMENTS – 30 JUNE 2019

| 2. | SIGNIFICANT ACCOUNTING POLICIES - CONTINUED |

Provisions are recognized when:-

| (i) | the company has a present obligation (legal or constructive) as a result of a past event; |

| | | |

| (ii) | it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation; and |

| | | |

| (iii) | a reliable estimate can be made of the amount of the obligation. |

The tax expense is determined on the basis of tax effect accounting, using the liability method. Deferred income tax is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. Tax rates enacted or substantively enacted by the balance sheet date are used to determine deferred income tax.

Deferred tax assets are recognized to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilized.

| (g) | Cash and cash equivalent |

Cash and cash equivalents comprise cash balances in hand and at bank.

The company contributes to the Central Provident Fund (CPF), a defined contribution plan regulated and managed by the Government of Singapore. The company’s contributions to CPF are charged to the income statement in the year to which the contributions relate.

| ii) | Employee leave entitlement |

Employees are required to take their annual leave before end of the calendar year or face forfeiture of leave.

Rental lease is charged to the income statement on a straight-line basis over the lease term. Lease incentives, if any recognized as an integral part of net consideration agreed for the use of the leased asset. Penalty payments on early termination, if any, are recognized in the income statement when incurred.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

NOTES TO THE FINANCIAL STATEMENTS – 30 JUNE 2019

| 2. | SIGNIFICANT ACCOUNTING POLICIES - CONTINUED |

Related party refers to a party that has the ability to control the other party or exercise significant influence over the other party in making financial and operating decision.

The carrying amounts of the company’s assets subject to impairment are reviewed at each balance sheet date to determine whether there is any indication of impairment. If any such indication exists, the asset’s recoverable amount is estimated. An impairment loss is recognized whenever the carrying amount of an asset exceeds its recoverable amount. Recoverable amount is defined as the higher of value in use and net selling price.

Any impairment loss is charged to the income statement unless it reverses a previous revaluation in which case it is charged to equity.

Financial instruments carried on the balance sheet include, trade debtors, trade creditors, amount due to director, accrual and cash and cash equivalents. The particular recognition methods adopted are disclosed in the individual policy statements associated with each item.

Government grants are recognized at their fair value where there is reasonable assurance that the grant will be received and all attaching conditions will be complied.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

NOTES TO THE FINANCIAL STATEMENTS – 30 JUNE 2019

| | | 2019 | |

| | | S$ | |

| Issued and fully paid | | | |

| Ordinary shares | | | 1,000 | |

The holders of ordinary shares are entitled to receive dividends as and when declared by the company. All ordinary shares carry one vote per share without restrictions. The ordinary share has no par value.

The amount due by director is unsecured, interest free, non-trade in nature and repayable on demand.

| 5. | CASH AND CASH EQUIVALENT |

| | | 2019 | |

| | | S$ | |

| Accounting (loss) | | | (138,429 | ) |

| Tax at 17% | | | (23,533 | ) |

| Deferred tax | | | 23,533 | |

| Income tax expenses | | | - | |

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

NOTES TO THE FINANCIAL STATEMENTS – 30 JUNE 2019

| 7. | FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES |

Though the company has no written risk management policies and guidelines, the directors have adopted policies that seek to mitigate these risks in a cost-effective manner.

Credit risk

The company’s credit risk is negligible. There was no concentration of credit risk.

Liquidity risk

The company monitors and maintains a level of cash and bank balances deemed adequate to finance the Company’s operations.

Interest rate risk

The company has no significant exposure to market risk for changes in interest rates because it has no borrowings from any external sources.

Fair value

The carrying amounts of the company’s financial assets and liabilities as reflected in the balance sheet approximate their fair value.

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

CONTENTS

| INDEX | | PAGE |

| | | |

| REPORT OF THE DIRECTORS | | 1-2 |

| | | |

STATEMENT BY DIRECTORS | | 3 |

| | | |

STATEMENT BY AN EXEMPT PRIVATE COMPANY | | 4 |

| | | |

BALANCE SHEET | | 5 |

| | | |

INCOME STATEMENT | | 6 |

| | | |

STATEMENT OF CHANGES IN EQUITY | | 7 |

| | | |

CASH FLOW STATEMENT | | 8 |

| | | |

NOTES TO THE FINANCIAL STATEMENTS | | 9-13 |

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

Registration No. 201529263D

ANNUAL REPORT FOR THE YEAR ENDED

30 JUNE 2019

BELFRICS GLOBAL PTE LTD

(Incorporated in Singapore)

DETAILED INCOME STATEMENT

FOR THE YEAR ENDED 30 JUNE 2019

| | | 2019 | |

| | | S$ | |

| Revenue | | - | |

| Purchases | | | (136,569 | ) |

| Gross (loss) | | | (136,569 | ) |

Less: Administrative expenses | | | | |

| Secreterial fee | | | 1,860 | |

| | | 1,860 | |

| Net (loss) before tax | | | (138,429 | ) |

This statement does not form part of the accounts.

BELFRICS TANZANIA LIMITED

DAR ES SALAAM

AUDITED FINANCIAL STATEMENTS

FOR

THE YEAR ENDED 31ST DECEMBER, 2019.

MKUKI Consultants

Certified Public Accountants & Tax Consultants

Dar es Salaam

FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019

REPORT OF THE DIRECTORS

FOR THE YEAR ENDED 31 DECEMBER 2019

| 1. | The Directors of Belfrics Tanzania Limited present their report together with the financial statements for the year ended 31 December 2019, which disclose the state of affairs of the entity as at 31 December 2019 and the results of the operation for the year ended on that date. |

| 2. | INCORPORATION AND REGISTERED OFFICE |

Belfrics Tanzania Limited is a private company that was registered on 2nd February, 2018 and given registration number 141049 by registrar of companies under the Companies Act, 2002 Cap 212 of the laws of Tanzania. Its registered office is Plot 38 South Ursino, New Bagamoyo Road, Kinondoni Dar es Salaam

Belfrics Tanzania Limited carries on business of ICT in Blockchain Technology. The company operates in Plot 38 South Ursino, New Bagamoyo Road, Kinondoni Dar Es Salaam and other parts in the United Republic of Tanzania.

| 4. | COMPOSITION OF THE BOARD OF DIRECTORS |

The directors of the company who held office during the year and up to the date of this report are:

| Name | | Nationality | | Position |

| Praveen Kumar Vijayakumar | | Non Tanzanian | | Director |

| Aziz Rashid Chonya | | Tanzanian | | Director |

Directors’ interest in the shares of the company

None of the Directors have any beneficial interest in the issued share capital of the company as at 31 December 2019.

The Board consists of four directors. The Board takes overall responsibility for the Company, including responsibility for identifying key risk areas, considering and monitoring investment decisions, considering significant financial matters and reviewing the performance of management business plans and budgets. The Board is also responsible for ensuring that a comprehensive system of internal control policies and procedures is operative, and for compliance with sound corporate governance principles. The company is committed to the principles of effective corporate governance. The directors also recognize the importance of integrity, transparency and accountability.

| 6. | CAPITAL STRUCTURE AND SHAREHOLDING |

Capital Structure

The Company’s capital structure for the year is shown below:

Authorized, :

The authorized share capital of the company is Tanzania Shillings One Billion (Tshs.100,000,000) divided into Five Hundred Thousand (500,000) ordinary shares at Tanzania Shillings Two Hundred (Tshs. 200) each.

Shareholding

The authorized share capital is held by:

| Name | | Number | | | 2019 Nominal value | |

| | | | | | TZS | |

| Praveerkumar Vijayakumar | | | 499,999 | | | | 99,999,800 | |

| Aziz Rashid Chonya | | | 1 | | | | 200 | |

| Total | | | 500,000 | | | | 100,000,000 | |

The performance of the Company for the year is set out on page 7 of these financial statements. During the year no dividend was declared and approved.

| 8. | RISK MANAGEMENT AND INTERNAL CONTROL |

The Board accepts final responsibility for the risk management and internal control system of the company. It is the task of management to ensure that adequate internal financial and operational control systems are developed and maintained on an going basis in order to provide reasonable assurance regarding:

| | ● | The business is owned by two shareholders |

| | ● | The safeguarding of the company’s assets |

| | ● | Compliance with applicable laws and regulations |

| | ● | The reliability of accounting records |

| | ● | Business sustainability under normal as well as adverse conditions; and |

| | ● | Responsible behaviors towards all stakeholders |

The efficiency of any internal control system is dependent on strict observance of prescribed measure. There is always a risk of non-compliance of such measures by staff.

Whilst no system, of internal control can provide absolute assurance against misstatement or losses, the company system is designed to provide the Board with reasonable assurance that the procedures in place are operating effectively.

The Board assessed the internal control systems throughout the financial year ended 31 December 2019 and is of the opinion that they met accepted criteria. The Board is directly responsible for risk and internal control assessment as a separate audit committee is not considered necessary.

INDEPENDENT AUDITORS’ REPORT

To the Directors of

BELFRICS TANZANIA LIMITED

Report on the financial statement

We have audited the accompanying financial statements of Belfrics Tanzania Limited as set out on page 8 to 24, which comprise the statement of financial position as at 31 December 2019 and the statement of Profit or loss and other comprehensive income, a statement of changes in equity and statement of cash flows for the year then ended, and a summary of significant accounting policies and other explanatory notes.

Directors’ responsibility for the financial statements

Directors are responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Reporting Standards and in compliance with the Companies Act, Cap 212 Act NO.12 of 2002. This responsibility includes: designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate for the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion the accompanying financial statements give a true and fair view of the state of the company’s financial affairs at 31 December 2019 and of its loss and cash flows for the year then ended in accordance with International Financial Reporting Standards and the Companies Act, CAP 212 Act No. 12 of 2002.

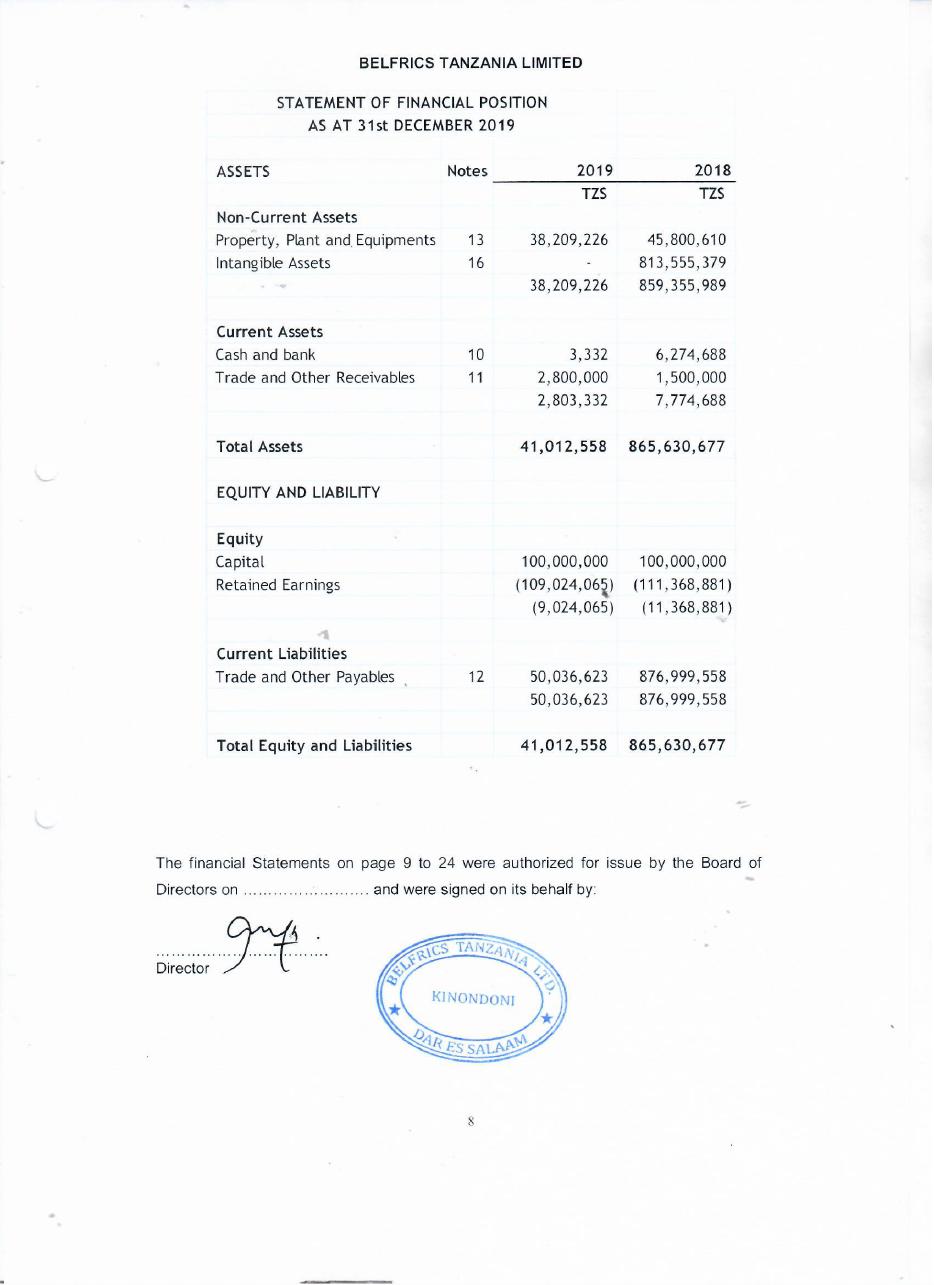

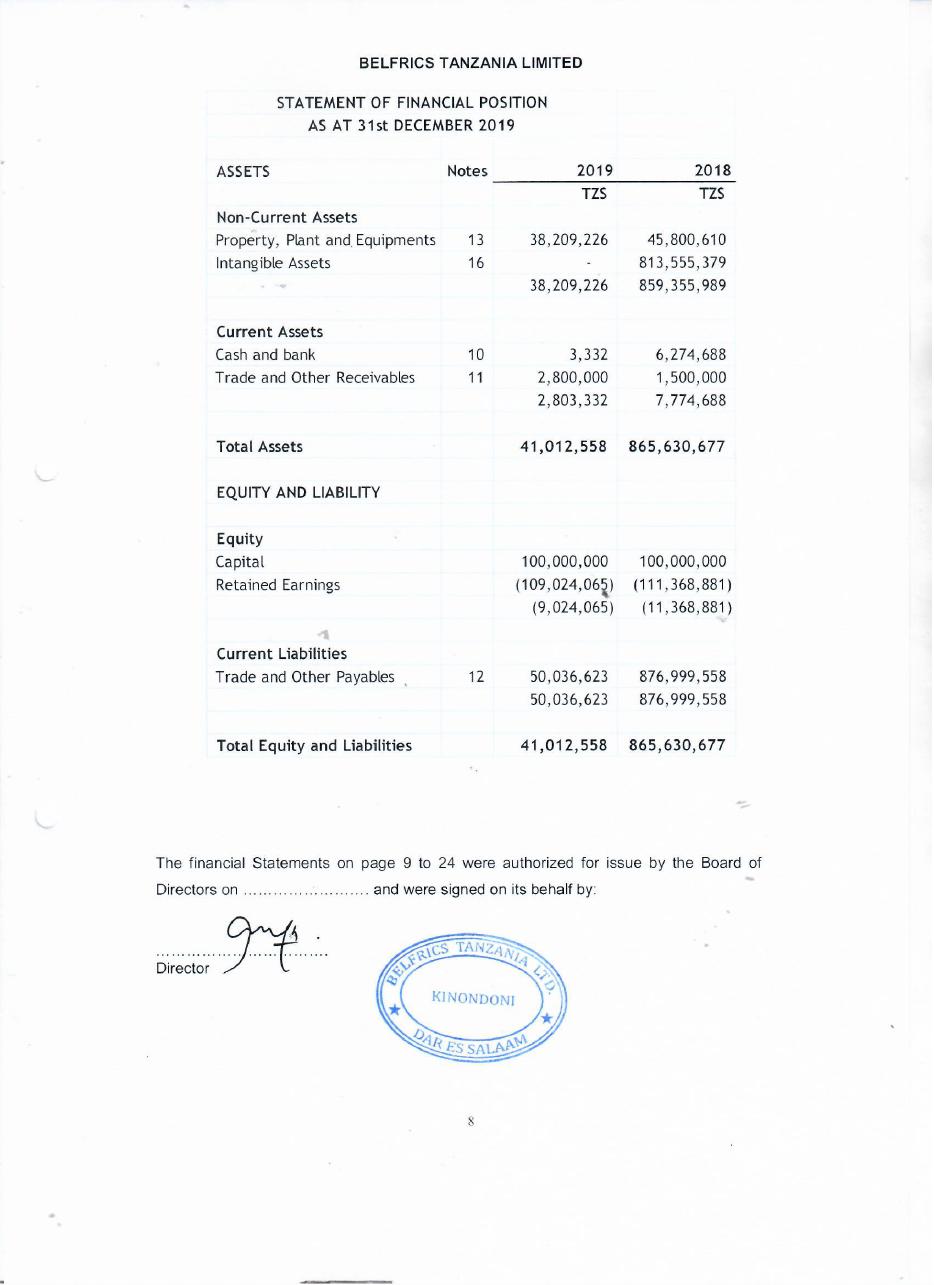

BELFRICS TANZANIA LIMITED

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31st DECEMBER 2019

| | | NOTE | | 2019 | | | 2018 | |

| | | | | | | | | |

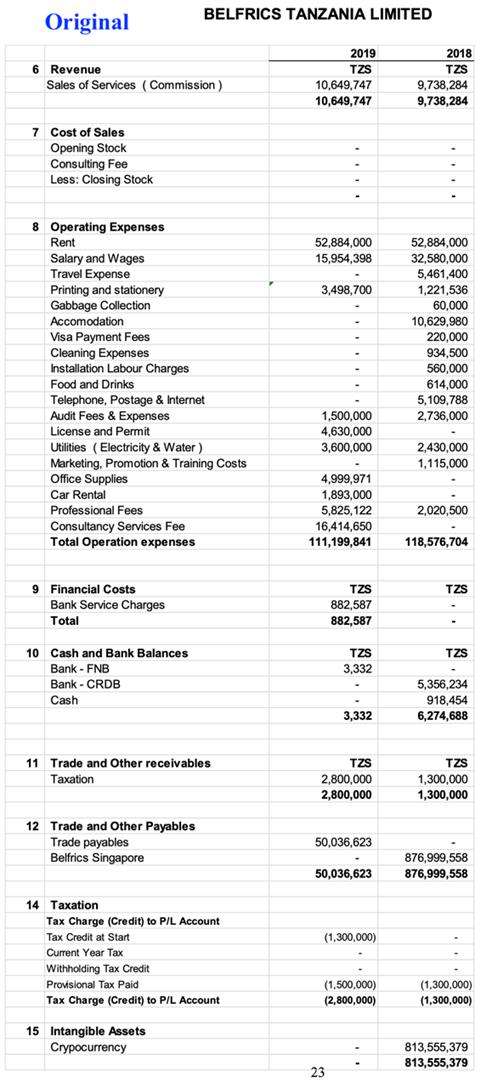

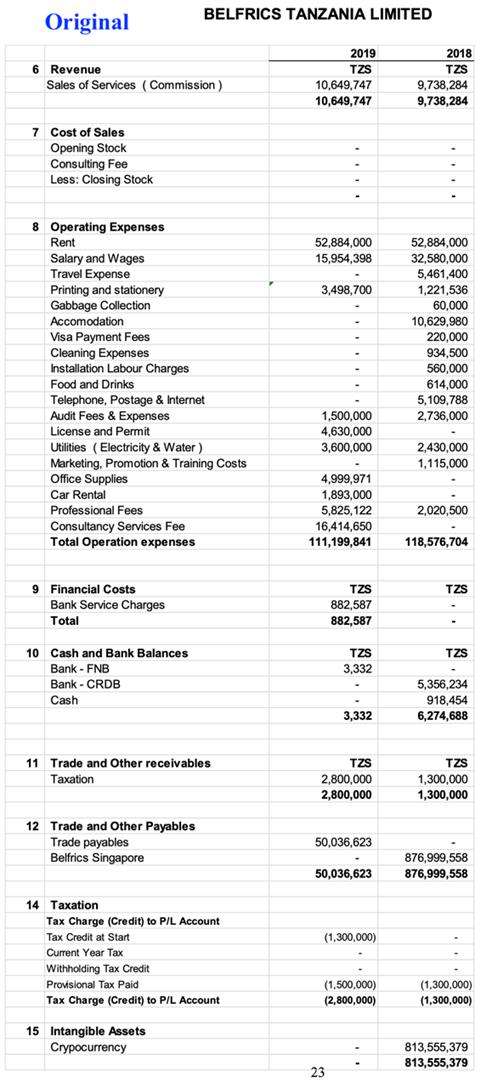

| Sales Revenue | | 6 | | | 10,649,747 | | | | 9,738,284 | |

| Cost of Sales | | 7 | | | - | | | | - | |

| Gross Profit | | | | | 10,649,747 | | | | 9,738,284 | |

| | | | | | | | | | | |

| Administrative Costs | | | | | | | | | | |

| Operating costs | | 8 | | | 111,199,841 | | | | 118,576,704 | |

| Finance charges | | 9 | | | 882,587 | | | | - | |

| Depreciation of Non-current assets | | 13 | | | 7,591,384 | | | | 2,530,461 | |

| | | | | | 119,673,812 | | | | 121,107,165 | |

| | | | | | | | | | | |

| Net Profit before tax | | | | | (109,024,065 | ) | | | (111,368,881 | ) |

| | | | | | | | | | | |

| Less: Corporate tax provision | | | | | - | | | | - | |

| Net Profit for the year | | | | | (109,024,065 | ) | | | (111,368,881 | ) |

| | | | | | | | | | | |

| Other Comprehensive Income | | | | | - | | | | - | |

| | | | | | | | | | | |

| Total comprehensive income for the year | | | | | (109,024,065 | ) | | | (111,368,881 | ) |

Notes and related statements forming part of these financial statements are set out on pages 13 to 24

BELFRICS TANZANIA LIMITED

STATEMENT OF CHANGE IN EQUITY

FOR THE YEAR ENDED 31st DECEMBER 2019

| | | Share Capital | | | Retained Earnings | | | Total | |

| | | TZS | | | TZS | | | TZS | |

| As at 1 January 2019 | | | 100,000,000 | | | | (111,368,881 | ) | | | (11,368,881 | ) |

| Profit for the year | | | - | | | | (109,024,065 | ) | | | (109,024,065 | ) |

| Additions for the year | | | - | | | | - | | | | - | |

| As at 31 September 2019 | | | 100,000,000 | | | | (220,392,946 | ) | | | (120,392,946 | ) |

| | | | | | | | | | | | | |

| As at 1 January 2018 | | | 100,000,000 | | | | - | | | | 100,000,000 | |

| Profit for the year | | | - | | | | (111,368,881 | ) | | | (111,368,881 | ) |

| Additions for the year | | | - | | | | - | | | | - | |

| As at 31 September 2018 | | | 100,000,000 | | | | (111,368,881 | ) | | | (11,368,881 | ) |

Notes and related statements forming part of these financial statements are set out on pages 12 to 24.

BELFRICS TANZANIA LIMITED

STATEMENT OF CASH FLOW

FOR THE YEAR ENDED 31st DECEMBER 2019

| | | 2019 | | | 2018 | |

| | | | | | | |

| Profit / Loss as per Account | | | (109,024,065 | ) | | | (111,368,881 | ) |

| Add back: | | | | | | | | |

| Depreciation | | | 7,591,384 | | | | 2,530,461 | |

| | | | (101,432,681 | ) | | | (108,838,420 | ) |

| Change in Working Capital | | | | | | | | |

| (Increase)/Decrease in Trade and Other Receivables | | | - | | | | - | |

| Increase/(Decrease) in Trade and Other Payables | | | - | | | | 876,999,558 | |

| Cash Flows from Operation | | | (101,432,681 | ) | | | (768,161,138 | ) |

| | | | | | | | | |

| Tax Paid | | | - | | | | (1,500,000 | ) |

| | | | - | | | | (1,500,000 | ) |

| | | | | | | | | |

| Net Cash Flows from Operating Activities | | | (101,432,681 | ) | | | (769,661,138 | ) |

| | | | | | | | | |

| Less: Investing Activities | | | | | | | | |

| Purchase of property, plant and equipment | | | - | | | | (48,331,071 | ) |

| Cash flow after Investing activities | | | - | | | | (48,331,071 | ) |

| | | | | | | | | |

| Financing Activities | | | | | | | | |

| Capital | | | - | | | | 100,000,000 | |

| Shareholder Loan | | | 95,161,325 | | | | 724,266,897 | |

| Cash Flows After financing activities | | | 95,161,325 | | | | 824,266,897 | |

| | | | | | | | | |

| Cash and Cash Equivalent | | | (6,271,356 | ) | | | 6,274,688 | |

| Add: Opening Cash / Bank | | | 6,274,688 | | | | - | |

| Net Cash and cash Equivalent | | | 3,332 | | | | 6,274,688 | |

Notes and related statements forming part of these financial statements are set out on pages 12 to 24.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019

Belfrics Tanzania Limited (‘the Company’) is incorporated in Tanzania under the Companies Act 2002 as a private limited liability company, and is domiciled in Tanzania. The financial statements of the Company are for the year ended 31 December 2019.

| 2. | BASIS OF PREPARATION AND GOING CONCERN Statement of Compliance |

The financial statements are prepared in accordance with International Financial Reporting Standard (IFRS) and its international adopted by the International Accounting Standards Board (IASB) and comply with the requirements of the Tanzanian Companies Act, 2002.

Basis of preparation

The financial statements are prepared under the historical cost conversion and in accordance with International Financial Reporting Standards. The financial statements are presented in Tanzania shillings (TZS), except where otherwise indicated.

The preparation of financial statements in conformity with IFRSs requires management to make judgement, estimates and assumptions that affect the application of policies and reported amount of assets and liabilities, income and expenses. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making the judgement about carrying values of assets and liabilities that are not readily apparently from other sources. Actual results may differ from these estimates.

The estimate and underlying assumption are reviewed on ongoing basis. Revision to accounting estimate are recognised in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and future period if the revision affects both current and future periods.

Going Concern

The financial statements are prepared on the basis of accounting policies applicable to a going concern basis. This basis presumes that funds will be available to finance future operation and that the realization of assets and settlement of liabilities will occur in the ordinary course of business.

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all years presented, unless otherwise stated.

Revenue comprised amounts commissioned for the services supplied in Block chain capacity building and trainings (Belfrics Academy) during the year, excluding value added tax and trade discount. Revenue is recognised when the company has delivered the services to the customer has accepted the performance of the work to be satisfactory and collectability of the related receivables is reasonably assured.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| (i) | Functional and presentation currency |

Items included in the financial statements are measured using the currency of the primary economic environment in which the entity operates or the currency that mainly influences sales price for goods and services, and labour, material or other costs of providing goods and services (“the functional currency”). The financial statements are presented in Tanzania Shillings, which is the Company’s functional and presentation currency.

| (ii) | Transactions and balances |

Transactions denominated in currencies other than functional currency are translated into the Tanzanian Shillings using the exchange rates prevailing at the dates of the transactions. Monetary assets and liabilities at the reporting date, which are expressed in foreign currencies, are translated into Tanzanian Shillings at the spot rate ruling at that date. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at the year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in profit and loss. Non- monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value is determined. The gain or loss arising on translation of non-monetary items measured at fair value is treated in line with the recognition of gains or losses on change in fair value of the item.

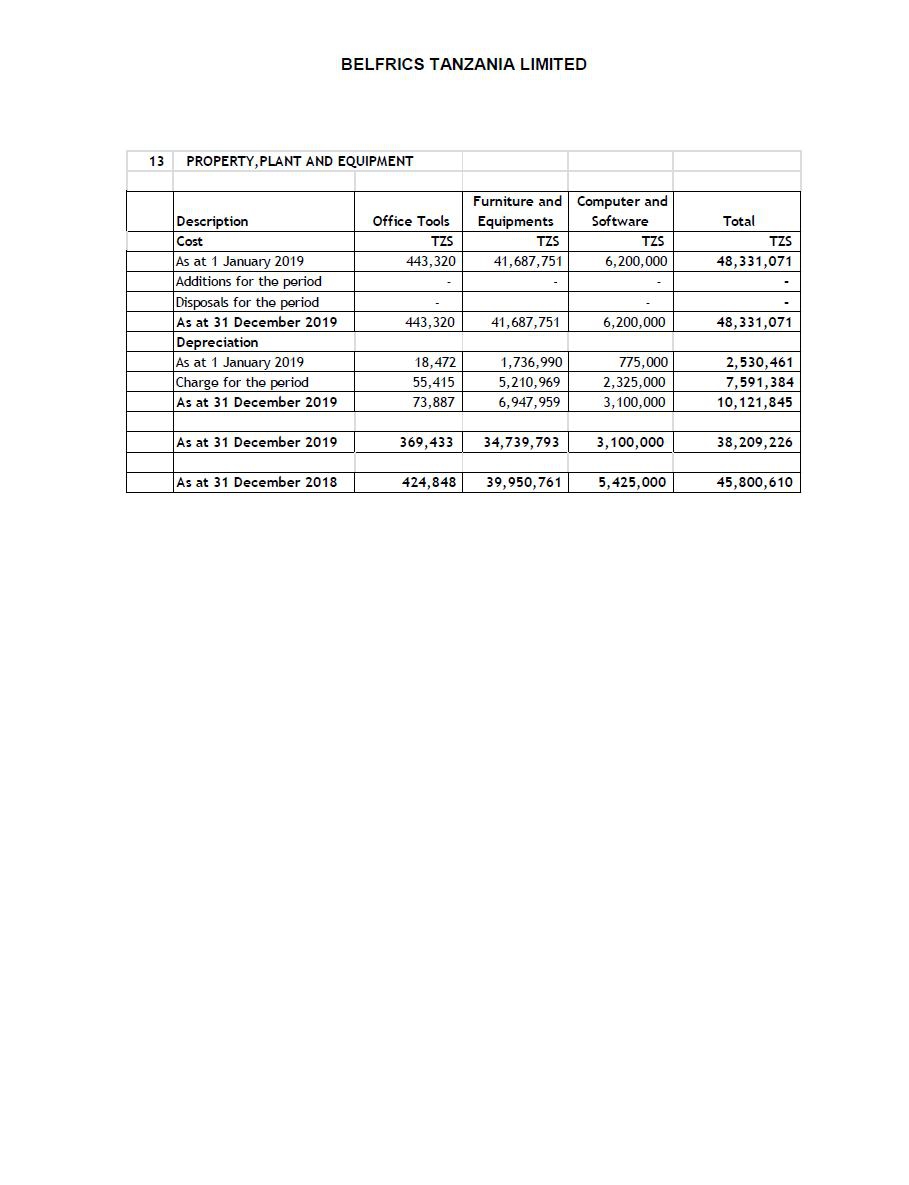

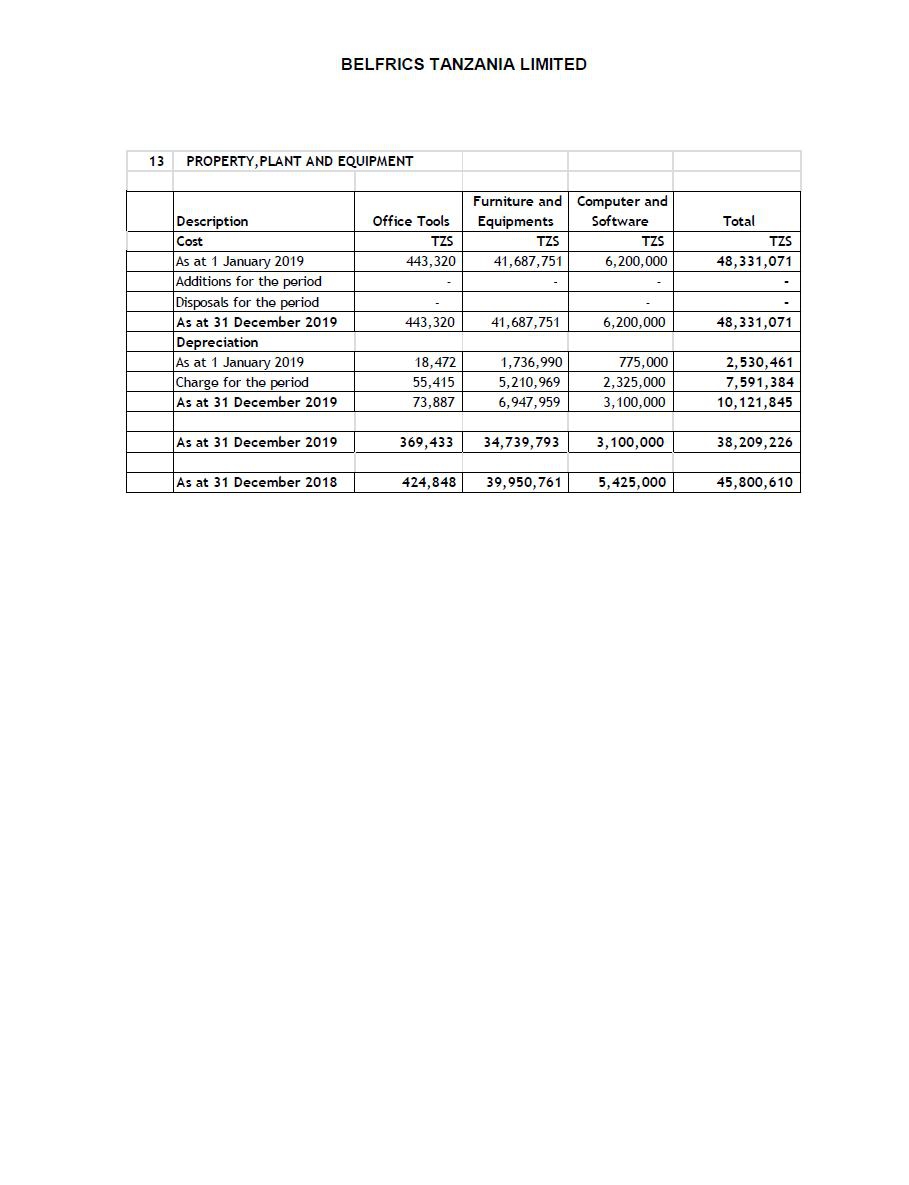

Item of property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is provided so as to write off the cost of fixed assets on straight line basis over their expected useful lives. The principal annual rates used for this purpose, which are consistent with those used in prior period are as follows:

| Office Tools | | | 12.50 | % |

| Furniture and Equipments | | | 12.50 | % |

| Computer and Software | | | 37.50 | % |

| d) | Cash and cash equivalents |

For purpose of the cash flow statement cash and cash equivalent comprise cash in hand, deposit held on call with the banks.

| e) | Trade and other receivable |

Trade receivable are recognised initially at fair value and subsequently measured at amortised cost using effective interest method, less provision for impairment. A provision for impairment of the trade receivable is established when there is objective evidence that the Company will not be able to collect all amounts due according to the original terms of the receivables. The amount of the provision is the difference between the assets carrying amounts and the present value of the estimated future cash flows, discounted at the effective interest rate. The amount of the provision is recognised in the profit and loss account.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| f) | Trade and other payable |

Payable are obligation for pay for goods or services that have been acquired in the ordinary course of business from suppliers. Accounts payable are classified as current liabilities if payment is due within one year or less. If not, they are presented as non-current liabilities.

Income earned from provision of technical services to mining companies is subject to withholding tax as a final tax on the same basis as individuals. Income from technical mining services is recognised gross of such taxes and the withholding tax is included under tax charge for the year.

Income tax expense is the charge to the profit and loss account in respect of the current income tax. Current tax is the amount of income tax payable on the taxable profit for the period determined in accordance with the Tanzania Income Tax Act, 2004

The company has defined contribution plan. A defined contribution plan is a pension plan under which the company pays fixed contributions into a separate entity.

Under the defined contribution, the Company contributes to a publicly administered pension plan (NSSF) on a mandatory basis. The Company has no further payment obligation once the contributions have been paid. The contributions are recognised as an employee benefits when they are due.

Initial recognition and measurement

Financial assets within the scope of IAS 39 are classified as financial assets at fair value through profit or loss, loans and receivables, held-to-maturity investments or available-for- sale financial assets, as appropriate. The Company determines the classification of its financial assets at initial recognition.

All financial assets are recognised initially at fair value plus, in the case of investments not at fair value through profit or loss, directly attributable transaction costs.

Purchases or sales of financial assets that require delivery of assets within a time frame established by regulation or convention in the marketplace (regular way trades) are recognised on the trade date, i.e., the date that the Company commits to purchase or sell the asset.

The Company’s financial assets include cash and short-term deposits (included under cash and cash equivalents), trade and other receivables. All the Company’s financial assets are classified as loans and receivables.

Subsequent measurement

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. After initial measurement, such financial assets are subsequently measured at amortised cost using the effective interest rate method (EIR), less impairment. Amortised cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

The EIR amortisation is not included in finance income in profit or loss. The losses arising from impairment are recognised in profit or loss if applicable.

De-recognition

A financial asset, or where applicable a part of a financial asset or part of a group of similar financial assets is derecognised when:

| | ● | The rights to receive cash flows from the asset have expired; |

| | ● | The Company has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash flows in full without material delay to a third party under a ‗pass-through’ arrangement; and either (a) the Company has transferred substantially all the risks and rewards of the asset, or (b) the Company has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset. |

When the Company has transferred its rights to receive cash flows from an asset, or has entered into a pass-through arrangement, and has neither transferred nor retained substantially all of the risks and rewards of the asset nor transferred control of the asset, the asset is recognised to the extent of the Company’s continuing involvement in the asset.

| i) | Financial assets (continued) |

In that case, the Company also recognises an associated liability. The transferred asset and the associated liability are measured on a basis that reflects the rights and obligations that the Company has retained. Continuing involvement that takes the form of a guarantee over the transferred asset is measured at the lower of the original carrying amount of the asset and the maximum amount of consideration that the Company could be required to repay.

Impairment of financial assets

The Company assesses at each reporting date whether there is any objective evidence that a financial asset or a group of financial assets is impaired. A financial asset or a group of financial assets is deemed to be impaired if, and only if, there is objective evidence of impairment as a result of one or more events that has occurred after the initial recognition of the asset (an incurred ‗loss event’) and that loss event has an impact on the estimated future cash flows of the financial asset or the group of financial assets that can be reliably estimated. Evidence of impairment may include indications that the debtor or a group of debtors is experiencing significant financial difficulty, default or delinquency in interest or principal payments, the probability that they will enter bankruptcy or other financial reorganisation and where observable data indicate that there is a measurable decrease in the estimated future cash flows, such as changes in arrears or economic conditions that correlate with defaults.

Financial assets carried at amortised cost

For financial assets carried at amortised cost, the Company first assesses whether objective evidence of impairment exists individually for financial assets that are individually significant, or collectively for financial assets that are not individually significant. If the Company determines that no objective evidence of impairment exists for an individually assessed financial asset, whether significant or not, it includes the asset in a group of financial assets with similar credit risk characteristics and collectively assesses them for impairment. Assets that are individually assessed for impairment and for which an impairment loss is, or continues to be, recognised are not included in a collective assessment of impairment.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| i) | Financial instruments (continued) |

Financial assets carried at amortised cost (continued)

If there is objective evidence that an impairment loss has been incurred, the amount of the loss is measured as the difference between the assets’ carrying amount and the present value of estimated future cash flows (excluding future expected credit losses that have not yet been incurred). The present value of the estimated future cash flows is discounted at the financial asset’s original effective interest rate. If a financial asset has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate.

The carrying amount of the asset is reduced through the use of an allowance account and the amount of the loss is recognised in profit or loss. Interest income continues to be accrued on the reduced carrying amount and is accrued using the rate of interest used to discount the future cash flows for the purpose of measuring the impairment loss. The interest income is recorded as part of finance income in profit or loss.

Financial assets, together with the associated allowance, are written off when there is no realistic prospect of future recovery and all collateral has been realised or has been transferred to the Company. If, in a subsequent year, the amount of the estimated impairment loss increases or decreases because of an event occurring after the impairment was recognised, the previously recognised impairment loss is increased or reduced by adjusting the allowance account. If a future write-off is later recovered, the recovery is credited to profit or loss.

Initial recognition and measurement

Financial liabilities within the scope of IAS 39 are classified as financial liabilities at fair value through profit or loss, loans and borrowings measured at amortised cost, or as derivatives designated as hedging instruments in an effective hedge, as appropriate. The Company determines the classification of its financial liabilities at initial recognition.

All financial liabilities are recognised initially at fair value and in the case of loans and borrowings measured at amortised cost, plus directly attributable transaction costs.

The Company’s financial liabilities include trade and other payables and interest bearing borrowings.

Subsequent measurement

After initial recognition, trade and other payables and interest-bearing borrowings are subsequently measured at amortised cost using the effective interest rate method. Gains and losses are recognised in profit or loss when the liabilities are derecognised as well as through the EIR amortisation process.

Amortised cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR. The EIR amortisation is included in finance costs in profit or loss.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| i) | Financial instruments (continued) |

| ii) | Financial liabilities (continued) |

De-recognition

A financial liability is de-recognised when the obligation under the liability is discharged or cancelled or expires.

When an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing liability are substantially modified, such an exchange or modification is treated as a de-recognition of the original liability and the recognition of a new liability. The difference in the respective carrying amounts is recognised in profit or loss.

Amortised cost is calculated by taking into account any discount or premium on acquisition and fees or costs that are an integral part of the EIR. The EIR amortisation is included in finance costs in profit or loss.

| iii) | Offsetting of financial instruments |

Financial assets and financial liabilities are offset and the net amount is reported in the statement of financial position if there is a currently enforceable legal right to offset the recognised amounts and there is an intention to settle on a net basis, to realise the assets and settle the liabilities simultaneously.

| j) | Changes in accounting policies |

New and amended standards that became effective

The accounting policies adopted are consistent with those used in the previous year. The following new and amended standards and interpretations that became effective for the Company during the year did not have any impact on the accounting policies, financial position or performance of the Company:

| | a) | Amendments to IAS 19 Defined Benefit Plans: Employee Contributions |

| | | |

| | b) | Annual Improvements 2010-2012 Cycle |

| | | |

| | ● | IFRS 2 Share-based Payment |

| | ● | IFRS 3 Business Combinations |

| | ● | IFRS 8 Operating Segments |

| | ● | IAS 16 Property, Plant and Equipment and IAS 38 Intangible Assets |

| | ● | IAS 24 Related Party Disclosures |

| | | |

| | c) | Annual Improvements 2011-2013 Cycle |

| | | |

| | ● | IFRS 3 Business Combinations |

| | ● | IFRS 13 Fair Value Measurement |

| | ● | IAS 40 Investment Property |

Standards issued or amended but not yet effective

The standards and interpretations that are issued, but not yet effective, up to the date of issuance of the Company’s financial statements are disclosed below. The Company intends to adopt these standards, if applicable, when they become effective.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

IFRS 9 Financial Instruments

In July 2014, the IASB issued the final version of IFRS 9 Financial Instruments that replaces IAS 39 Financial Instruments: Recognition and Measurement and all previous versions of IFRS 9. IFRS 9 brings together all three aspects of the accounting for financial instruments project: classification and measurement, impairment and hedge accounting. IFRS 9 is effective for annual periods beginning on or after 1 January 2019, with early application permitted. Except for hedge accounting, retrospective application is required but providing comparative information is not compulsory. For hedge accounting, the requirements are generally applied prospectively, with some limited exceptions.

The Company plans to adopt the new standard on the required effective date. During 2019, the Company has performed a high-level impact assessment of all three aspects of IFRS 9. This preliminary assessment is based on currently available information and may be subject to changes arising from further detailed analyses or additional reasonable and supportable information being made available to the Company in the future. Overall, the Company expects no significant impact on its statement of financial position and equity except for the effect of applying the impairment requirements of IFRS 9. The Company expects a higher

Standards issued or amended but not yet effective (continued)

loss allowance resulting in a negative impact on equity and will perform a detailed assessment in the future to determine the extent.

IFRS 15 Revenue from Contracts with Customers

IFRS 15 was issued in May 2014 and establishes a five-step model to account for revenue arising from contracts with customers. Under IFRS 15, revenue is recognised at an amount that reflects the consideration to which an entity expects to be entitled in exchange for transferring goods or services to a customer.

The new revenue standard will supersede all current revenue recognition requirements under IFRS. Either a full retrospective application or a modified retrospective application is required for annual periods beginning on or after 1 January 2019, when the IASB finalises their amendments to defer the effective date of IFRS 15 by one year. Early adoption is permitted. The Company plans to adopt the new standard on the required effective date using the full retrospective method. During 2019, the Company performed a preliminary assessment of IFRS 15, which is subject to changes arising from a more detailed ongoing analysis. Furthermore, the Company is considering the clarifications issued by the IASB in an exposure draft in July 2015 and will monitor any further developments. The Company is still assessing the impact the new standard will have on its revenue.

Amendments to IAS 7 Statement of cash flows

The improvements to disclosures require companies to provide information about changes in their financing liabilities. The amendments will help investors to evaluate changes in liabilities arising from financing activities, including changes from cash flows and non-cash changes (such as foreign exchange gains or losses).

The improvements are part of the Board’s Disclosure Initiative—a portfolio of projects aimed at improving the effectiveness of disclosures in financial reports.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 4. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| j) | Changes in accounting policies (continued) |

The IAS 7 amendments become mandatory for annual periods beginning on or after 1 January 2019. The impact of the amendments is being assessed by the Company.

IFRS 16 Leases

The scope of the new standard includes leases of all assets, with certain exceptions. A lease is defined as a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration. The key features of the new standard are:

| | ● | The new standard requires lessees to account for all leases under a single on-balance sheet model (subject to certain exemptions) in a similar way to finance leases under IAS 17. |

| | ● | Lessees recognise a liability to pay rentals with a corresponding asset, and recognise interest expense and depreciation separately. |

Standards issued or amended but not yet effective (continued)

| | ● | The new standard includes two recognition exemptions for lessees – leases of ‘low- value’ assets (e.g., personal computer) and short-term leases (i.e., leases with a lease term of 12 months or less). |

| | ● | Reassessment of certain key considerations (e.g., lease term, variable rents based on an index or rate, discount rate) by the lessee is required upon certain events. |

| | ● | Lessor accounting is substantially the same as today’s lessor accounting, using IAS 17’s dual classification approach. |

The new standard is effective for annual periods beginning on or after 1 January 2019. Early application is permitted, but not before an entity applies IFRS 15. The new standard permits a lessee to choose either a full retrospective or a modified retrospective transition approach. The new standard’s transition provisions permit certain reliefs.

The new standard requires lessees and lessors to make more extensive disclosures than under IAS 17. The impact of the new standard is being assessed by the Company.

Other standards issued but not yet effective

The following new and amended standards are not expected to have an impact on the financial statements of the Company:

| | a) | Amendments to IFRS 11 Joint Arrangements: Accounting for Acquisitions of Interests |

| | b) | Amendments to IAS 16 and IAS 38: Clarification of Acceptable Methods of Depreciation and Amortisation |

| | c) | IFRS 14 Regulatory Deferral Accounts |

| | d) | Amendments to IAS 16 and IAS 41 Agriculture: Bearer Plants |

| | e) | Amendments to IAS 27: Equity Method in Separate Financial Statements |

| | f) | Amendments to IFRS 10 and IAS 28: Sale or Contribution of Assets between an Investor and its Associate or Joint Venture Annual Improvements 2012-2014 Cycle - These improvements are effective for annual periods beginning on or after 1 January 2019. |

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| j) | Changes in accounting policies (continued) |

| | ● | IFRS 5 Non-current Assets Held for Sale and Discontinued Operations |

| | ● | IFRS 7 Financial Instruments: Disclosures - Servicing contracts and Applicability of the amendments to IFRS 7 to condensed interim financial statements |

| | ● | IAS 19 Employee Benefits |

| | ● | IAS 34 Interim Financial Reporting |

| h) | Amendments to IAS 1 Disclosure Initiative |

| i) | Amendments to IFRS 10, IFRS 12 and IAS 28 Investment Entities: Applying the Consolidation Exception |

| 4. | SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS |

The preparation of the financial statements requires management to make judgments, estimates and assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, the accompanying disclosures and the disclosure of contingent liabilities. Uncertainty about these assumptions and estimates could result in outcomes that require a material adjustment to the carrying amount of assets or liabilities affected in future periods.

Judgments

In the process of applying the Company’s accounting policies, management has made the judgments, apart from those involving estimations, which have had significant effects on the amounts recognized in the financial statements.

Operating lease commitments – Company as lessee

The Company has entered into lease agreements for office space. The Company has determined that it does not retain significant risks and rewards of ownership of these properties and so accounts for them as operating leases.

Estimates and assumptions

The key assumptions concerning the future and other key sources of estimation uncertainty at the reporting date, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year, are described below. The Company based its assumptions and estimates on parameters available when the financial statements were prepared. Existing circumstances and assumptions about future developments may, however, change due to market changes or circumstances arising beyond the control of the Company. Such changes are reflected in the assumptions when they occur.

Asset useful lives

Critical estimates are made by the directors in determining depreciation rates for property, plant and equipment and their residual values. The depreciation rates are based on the estimated useful lives of the assets. The rates used are set out in Note 3(c) and the carrying amounts of property, plant and equipment are set in Note 14.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

Impairment of non-financial assets

Impairment exists when the carrying amount of an asset or cash generating unit exceeds its recoverable amount, which is the higher of its fair value less costs of disposal and its value in use. The fair value less costs of disposal calculation is based on available data from binding sales transactions, conducted at arm’s length, for similar assets or observable market prices less incremental costs for disposing of the asset. When value in use calculations are undertaken, management must estimate the expected future cash flows from the asset or cash generating unit and choose a suitable discount rate in order to calculate the present value of the cash flow.

Taxes

Uncertainties exist with respect to the interpretation of complex tax regulations, changes in tax laws, and the amount and timing of future taxable income. Given the wide range of international business relationships and the long-term nature and complexity of existing contractual agreements, differences arising between the actual results and the assumptions made, or future changes to such assumptions, could necessitate future adjustments to tax income and expense already recorded. The Company establishes provisions, based on reasonable estimates, for possible consequences of audits by the tax authorities.

The amount of such provisions is based on various factors, such as experience of previous tax audits and differing interpretations of tax regulations by the taxable entity and the responsible tax authority. Such differences of interpretation may arise on a wide variety of issues, depending on the conditions prevailing in the country.

Deferred tax assets are recognised for unused tax losses to the extent that it is probable that taxable profit will be available against which the losses can be utilised. Significant management judgement is required to determine the amount of the deferred tax assets that can be recognised, based upon the likely timing and the level of future taxable profits together with future tax planning strategies.

| 5. | FINANCIAL RISK MANAGEMENT |

The Company has exposure to the following risks from its use of financial instruments:

| | - | Credit risk |

| | - | Liquidity risk |

| | - | Market risk |

The company’s Director have overall responsibility of the establishment and oversight of the company’s risk management framework.

Credit risk

The company has established a credit policy under which each new customer is analysed individually for creditworthiness before the Company’s standard payment and delivery terms and conditions are offered.

Liquidity risk

The company’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the company’s reputation. All liquidity policies and procedures are subject to review and approval by the Board of Directors.

BELFRICS TANZANIA LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2019 (Continued)

Market Risk

Market risk is the risk that changes in the market prices, such as foreign exchange rates, interest rates etc. will affect the company’s income or the value of its holdings of financial instruments. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while optimizing the return.

BELFRICS TANZANIA LIMITED

DAR ES SALAAM

AUDITED FINANCIAL STATEMENTS

FOR

THE YEAR ENDED 31ST DECEMBER, 2020.

MKUKI Consultants

Certified Public Accountants & Tax Consultants

Dar es Salaam

FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2020

REPORT OF THE DIRECTORS

FOR THE YEAR ENDED 31 DECEMBER 2020

| 1. | The Directors of Belfrics Tanzania Limited present their report together with the financial statements for the year ended 31 December 2020, which disclose the state of affairs of the entity as at 31 December 2020 and the results of the operation for the year ended on that date. |

| 2. | INCORPORATION AND REGISTERED OFFICE |

Belfrics Tanzania Limited is a private company that was registered on 2nd February, 2018 and given registration number 141049 by registrar of companies under the Companies Act, 2002 Cap 212 of the laws of Tanzania. Its registered office is Plot 38 South Ursino, New Bagamoyo Road, Kinondoni Dar es Salaam

Belfrics Tanzania Limited carries on business of ICT in Blockchain Technology. The company operates in Plot 38 South Ursino, New Bagamoyo Road, Kinondoni Dar Es Salaam and other parts in the United Republic of Tanzania.

| 4. | COMPOSITION OF THE BOARD OF DIRECTORS |

The directors of the company who held office during the year and up to the date of this report are:

| Name | | Nationality | | Position |

| Praveen Kumar Vijayakumar | | Non Tanzanian | | Director |

| Azizi Rashid Chonya | | Tanzanian | | Director |

Directors’ interest in the shares of the company

None of the Directors have any beneficial interest in the issued share capital of the company as at 31 December 2020.

The Board consists of four directors. The Board takes overall responsibility for the Company, including responsibility for identifying key risk areas, considering and monitoring investment decisions, considering significant financial matters and reviewing the performance of management business plans and budgets. The Board is also responsible for ensuring that a comprehensive system of internal control policies and procedures is operative, and for compliance with sound corporate governance principles. The company is committed to the principles of effective corporate governance. The directors also recognize the importance of integrity, transparency and accountability.

| 6. | CAPITAL STRUCTURE AND SHAREHOLDING |

Capital Structure

The Company’s capital structure for the year is shown below:

Authorized, :

The authorized share capital of the company is Tanzania Shillings One Billion (Tshs.100,000,000) divided into Five Hundred Thousand (500,000) ordinary shares at Tanzania Shillings Two Hundred (Tshs. 200) each.

Shareholding

The authorized share capital is held by:

| Name | | Number | | | 2020 Nominal value | |

| | | | | | TZS | |

| Praveerkumar Vijayakumar | | | 499,999 | | | | 99,999,800 | |

| Azizi Rashid Chonya | | | 1 | | | | 200 | |

| Total | | | 500,000 | | | | 100,000,000 | |

The performance of the Company for the year is set out on page 7 of these financial statements. During the year no dividend was declared and approved.

| 8. | RISK MANAGEMENT AND INTERNAL CONTROL |

The Board accepts final responsibility for the risk management and internal control system of the company. It is the task of management to ensure that adequate internal financial and operational control systems are developed and maintained on an going basis in order to provide reasonable assurance regarding:

| | ● | The business is owned by two shareholders |

| | ● | The safeguarding of the company’s assets |

| | ● | Compliance with applicable laws and regulations and supervisory requirements. |

| | ● | The reliability of accounting records |

| | ● | Business sustainability under normal as well as adverse conditions; and |

| | ● | Responsible behaviors towards all stakeholders |

The efficiency of any internal control system is dependent on strict observance of prescribed measure. There is always a risk of non-compliance of such measures by staff.

Whilst no system, of internal control can provide absolute assurance against misstatement or losses, the company system is designed to provide the Board with reasonable assurance that the procedures in place are operating effectively.

The Board assessed the internal control systems throughout the financial year ended 31 December 2019 and is of the opinion that they met accepted criteria. The Board is directly responsible for risk and internal control assessment as a separate audit committee is not considered necessary.

INDEPENDENT AUDITORS’ REPORT

To the Directors of

BELFRICS TANZANIA LIMITED

Report on the financial statement

We have audited the accompanying financial statements of Belfrics Tanzania Limited as set out on page 8 to 24, which comprise the statement of financial position as at 31 December 2020 and the statement of Profit or loss and other comprehensive income, a statement of changes in equity and statement of cash flows for the year then ended, and a summary of significant accounting policies and other explanatory notes.

Directors’ Responsibility For The Financial Statements

Directors are responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Reporting Standards and in compliance with the Companies Act, Cap 212 Act NO.12 of 2002. This responsibility includes: designing, implementing and maintaining internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable in the circumstances.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors’ judgement, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate for the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion the accompanying financial statements give a true and fair view of the state of the company’s financial affairs at 31 December 2020 and of its loss and cash flows for the year then ended in accordance with International Financial Reporting Standards and the Companies Act, CAP 212 Act No. 12 of 2002.

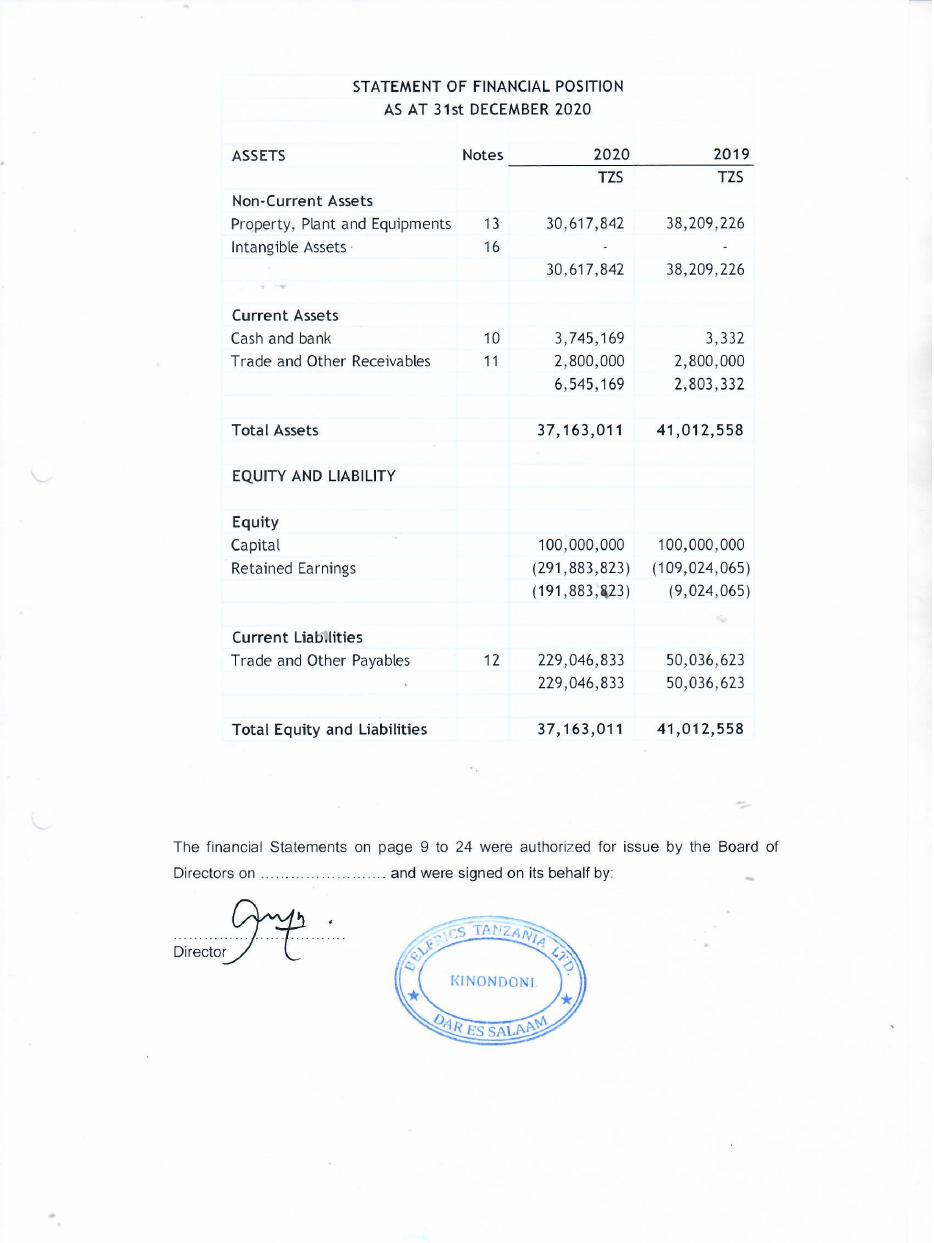

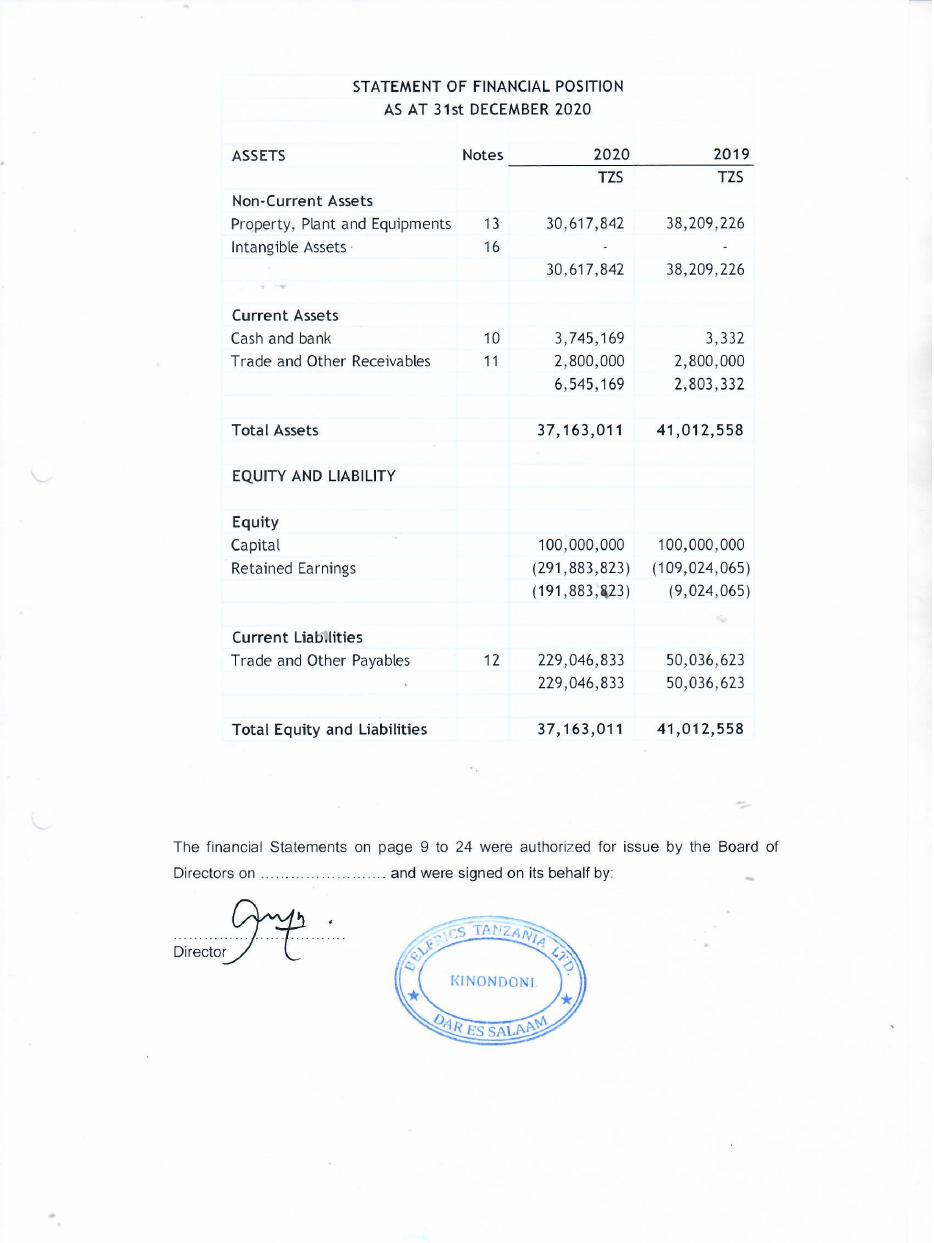

| STATEMENT OF COMPREHENSIVE INCOME |

| FOR THE FINANCIAL YEAR ENDED 31st DECEMBER 2020 |

| | | NOTE | | 2020 | | | 2019 | |

| | | | | | | | | |

| | | | | | | | | |

| Sales Revenue | | 6 | | | 2,036,404 | | | | 10,649,747 | |

| Cost of Sales | | 7 | | | - | | | | - | |

| Gross Profit | | | | | 2,036,404 | | | | 10,649,747 | |

| | | | | | | | | | | |

| Administrative Costs | | | | | | | | | | |

| Operating costs | | 8 | | | 65,541,600 | | | | 111,199,841 | |

| Finance charges | | 9 | | | 394,296 | | | | 882,587 | |

| Depreciation of Non-current assets | | 13 | | | 7,591,384 | | | | 7,591,384 | |

| | | | | | 73,527,280 | | | | 119,673,812 | |

| | | | | | | | | | | |

| Net Profit before tax | | | | | (71,490,876 | ) | | | (109,024,065 | ) |

| | | | | | | | | | | |

| Less: Corporate tax provision | | | | | - | | | | - | |

| Net Profit for the year | | | | | (71,490,876 | ) | | | (109,024,065 | ) |

| | | | | | | | | | | |

| Other Comprehensive Income | | | | | - | | | | - | |

| | | | | | | | | | | |

| Total comprehensive income for the year | | | | | (71,490,876 | ) | | | (109,024,065 | ) |

Notes and related statements forming part of these financial statements are set out on pages 13 to 24

| STATEMENT OF CHANGES IN EQUITY |

| FOR THE FINANCIAL YEAR ENDED 31st DECEMBER 2020 |

| | | Share Capital | | | Retained Earnings | | | Total | |

| | | TZS | | | TZS | | | TZS | |

| As at 1 January 2020 | | | 100,000,000 | | | | (220,392,946 | ) | | | (120,392,946 | ) |

| Profit for the year | | | - | | | | (71,490,876 | ) | | | (71,490,876 | ) |

| Additions for the year | | | - | | | | - | | | | - | |

| As at 31 September 2020 | | | 100,000,000 | | | | (291,883,823 | ) | | | (191,883,823 | ) |

| | | | | | | | | | | | | |

| As at 1 January 2019 | | | 100,000,000 | | | | (111,368,881 | ) | | | (11,368,881 | ) |

| Profit for the year | | | - | | | | (109,024,065 | ) | | | (109,024,065 | ) |

| Additions for the year | | | - | | | | - | | | | - | |

| As at 31 September 2019 | | | 100,000,000 | | | | (220,392,946 | ) | | | (120,392,946 | ) |

Notes and related statements forming part of these financial statements are set out on pages 12 to 24.

| STATEMENT OF CASH FLOW |

| FOR THE FINANCIAL YEAR ENDED 31st DECEMBER 2020 |

| | | 2020 | | | 2019 | |

| | | | | | | |

| Profit / Loss as per Account | | | (71,490,876 | ) | | | (109,024,065 | ) |

| Add back: | | | | | | | | |

| Depreciation | | | 7,591,384 | | | | 7,591,384 | |

| | | | (63,899,492 | ) | | | (101,432,681 | ) |

| Change in Working Capital | | | | | | | | |

| (Increase)/Decrease in Trade and Other Receivables | | | (1,800,000 | ) | | | - | |

| Increase/(Decrease) in Trade and Other Payables | | | (177,210,211 | ) | | | - | |

| Cash Flows from Operation | | | (242,909,703 | ) | | | (101,432,681 | ) |

| | | | | | | | | |

| Tax Paid | | | - | | | | - | |

| | | | - | | | | - | |

| | | | | | | | | |

| Net Cash Flows from Operating Activities | | | (242,909,703 | ) | | | (101,432,681 | ) |

| | | | | | | | | |

| Less: Investing Activities | | | | | | | | |

| Purchase of property, plant and equipment | | | - | | | | - | |

| Cash flow after Investing activities | | | - | | | | - | |

| | | | | | | | | |

| Financing Activities | | | | | | | | |

| Capital | | | - | | | | - | |

| Shareholder Loan | | | 246,651,539 | | | | 95,161,325 | |

| Cash Flows After financing activities | | | 246,651,539 | | | | 95,161,325 | |

| | | | | | | | | |

| Cash and Cash Equivalent | | | 3,741,836 | | | | (6,271,356 | ) |

| Add: Opening Cash / Bank | | | 3,332 | | | | 6,274,688 | |

| Net Cash and cash Equivalent | | | 3,745,168 | | | | 3,332 | |

Notes and related statements forming part of these financial statements are set out on pages 12 to 24.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2020

Belfrics Tanzania Limited (‘the Company’) is incorporated in Tanzania under the Companies Act 2002 as a private limited liability company, and is domiciled in Tanzania. The financial statements of the Company are for the year ended 31 December 2020.

| 2. | BASIS OF PREPARATION AND GOING CONCERN |

Statement of Compliance

The financial statements are prepared in accordance with International Financial Reporting Standard (IFRS) and its international adopted by the International Accounting Standards Board (IASB) and comply with the requirements of the Tanzanian Companies Act, 2002.

Basis of preparation

The financial statements are prepared under the historical cost conversion and in accordance with International Financial Reporting Standards. The financial statements are presented in Tanzania shillings (TZS), except where otherwise indicated.

The preparation of financial statements in conformity with IFRSs requires management to make judgement, estimates and assumptions that affect the application of policies and reported amount of assets and liabilities, income and expenses. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis of making the judgement about carrying values of assets and liabilities that are not readily apparently from other sources. Actual results may differ from these estimates.

The estimate and underlying assumption are reviewed on ongoing basis. Revision to accounting estimate are recognised in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and future period if the revision affects both current and future periods.

Going Concern

The financial statements are prepared on the basis of accounting policies applicable to a going concern basis. This basis presumes that funds will be available to finance future operation and that the realization of assets and settlement of liabilities will occur in the ordinary course of business.

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all years presented, unless otherwise stated.

Revenue comprised amounts commissioned for the services supplied in Block chain capacity building and trainings ( Belfrics Academy ) during the year, excluding value added tax and trade discount. Revenue is recognised when the company has delivered the services to the customer has accepted the performance of the work to be satisfactory and collectability of the related receivables is reasonably assured.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2020 (Continued)

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) |

| (i) | Functional and presentation currency |

Items included in the financial statements are measured using the currency of the primary economic environment in which the entity operates or the currency that mainly influences sales price for goods and services, and labour, material or other costs of providing goods and services (“the functional currency”). The financial statements are presented in Tanzania Shillings, which is the Company’s functional and presentation currency.

| (ii) | Transactions and balances |

Transactions denominated in currencies other than functional currency are translated into the Tanzanian Shillings using the exchange rates prevailing at the dates of the transactions. Monetary assets and liabilities at the reporting date, which are expressed in foreign currencies, are translated into Tanzanian Shillings at the spot rate ruling at that date. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at the year-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in profit and loss. Non- monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value is determined. The gain or loss arising on translation of non-monetary items measured at fair value is treated in line with the recognition of gains or losses on change in fair value of the item.

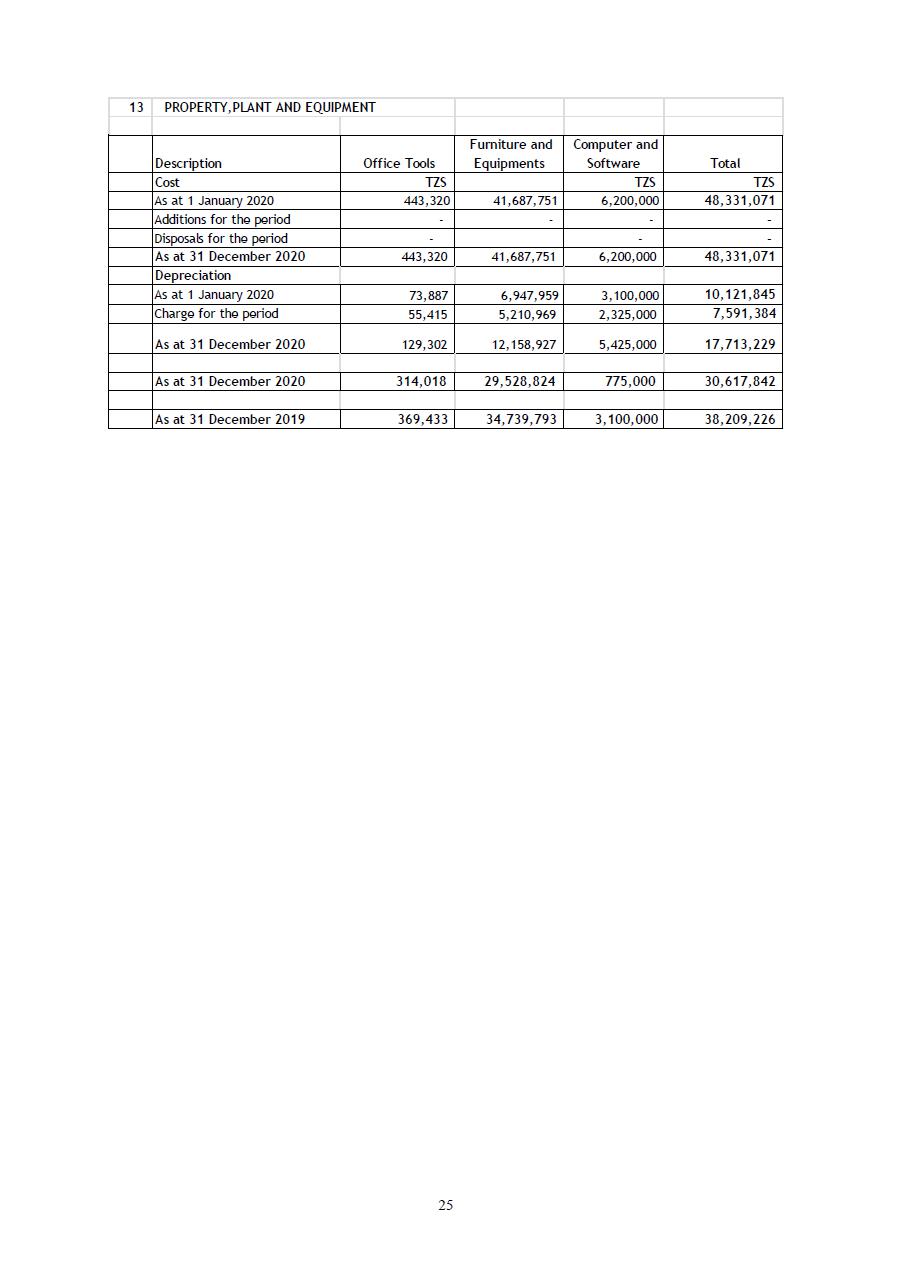

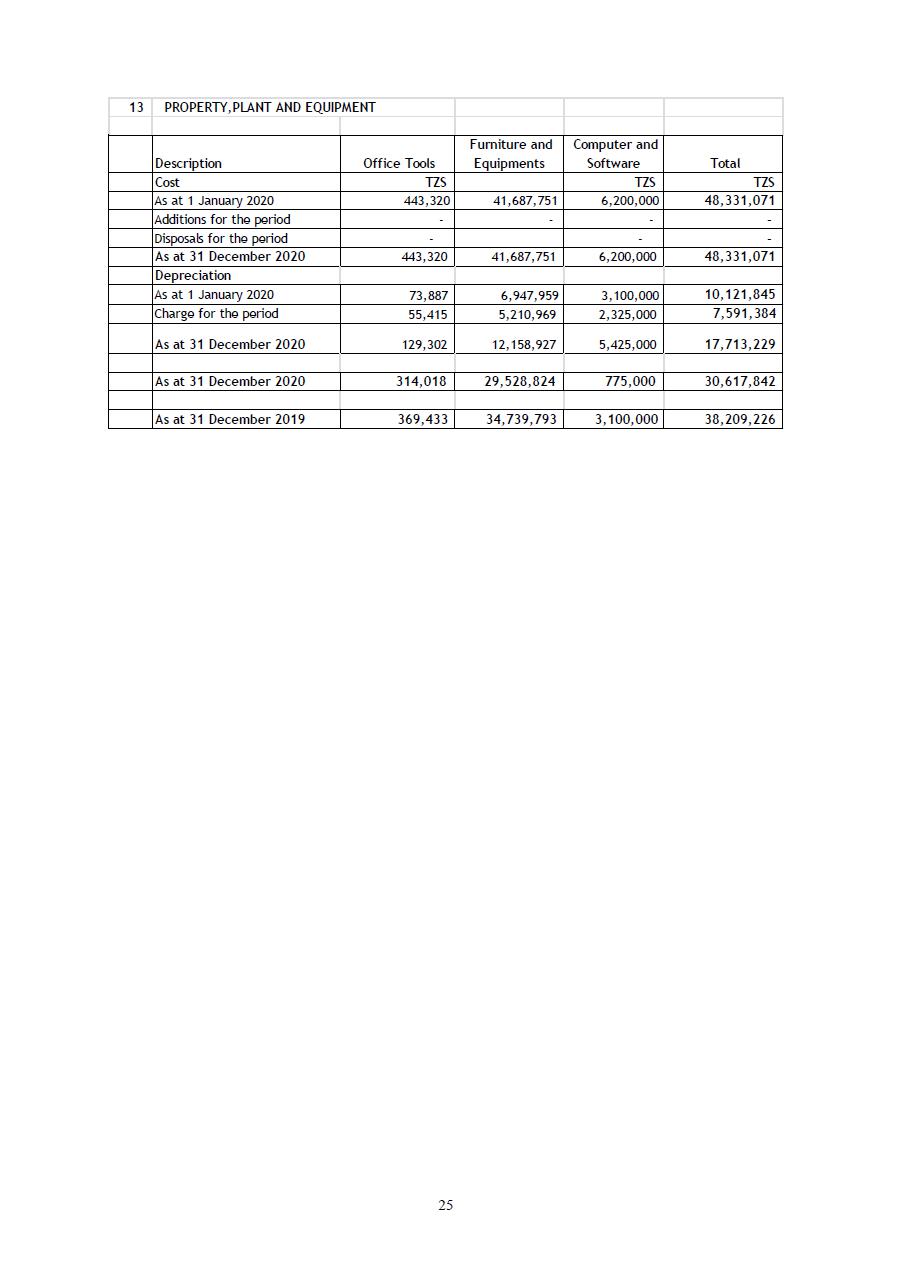

Item of property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is provided so as to write off the cost of fixed assets on straight line basis over their expected useful lives. The principal annual rates used for this purpose, which are consistent with those used in prior period are as follows:

| Office Tools | | | 12.50 | % |

| Furniture and Equipments | | | 12.50 | % |

| Computer and Software | | | 37.50 | % |

| d) | Cash and cash equivalents |

For purpose of the cash flow statement cash and cash equivalent comprise cash in hand, deposit held on call with the banks.

| e) | Trade and other receivable |

Trade receivable are recognised initially at fair value and subsequently measured at amortised cost using effective interest method, less provision for impairment. A provision for impairment of the trade receivable is established when there is objective evidence that the Company will not be able to collect all amounts due according to the original terms of the receivables. The amount of the provision is the difference between the assets carrying amounts and the present value of the estimated future cash flows, discounted at the effective interest rate. The amount of the provision is recognised in the profit and loss account.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2020 (Continued)

| f) | Trade and other payable |

Payable are obligation for pay for goods or services that have been acquired in the ordinary course of business from suppliers. Accounts payable are classified as current liabilities if payment is due within one year or less. If not, they are presented as non-current liabilities.

Income earned from provision of technical services to mining companies is subject to withholding tax as a final tax on the same basis as individuals. Income from technical mining services is recognised gross of such taxes and the withholding tax is included under tax charge for the year.

Income tax expense is the charge to the profit and loss account in respect of the current income tax. Current tax is the amount of income tax payable on the taxable profit for the period determined in accordance with the Tanzania Income Tax Act, 2004

The company has defined contribution plan. A defined contribution plan is a pension plan under which the company pays fixed contributions into a separate entity.

Under the defined contribution, the Company contributes to a publicly administered pension plan (NSSF) on a mandatory basis. The Company has no further payment obligation once the contributions have been paid. The contributions are recognised as an employee benefits when they are due.