Any such designation by the board of directors of the Issuer shall be evidenced to the Trustee by filing with the Trustee a certified copy of the resolution of the board of directors of the Issuer giving effect to such designation and an Officer’s Certificate certifying that such designation complied with the foregoing conditions.

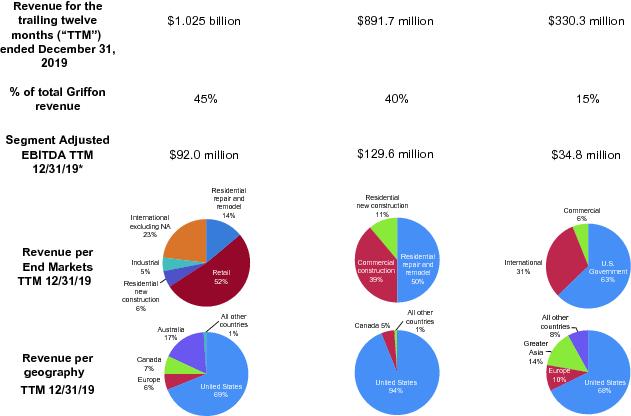

“Segment Adjusted EBITDA”means, with respect to any Person for any period, EBITDA plus unallocated corporate expenses and overhead calculated in a manner consistent with the Issuer’s audited financial statements.

“Senior Credit Facility”means the Credit Facility under the Third Amended and Restated Credit Agreement, dated as of March 22, 2016, as amended, by and among Griffon Corporation, Bank of America, N.A., as administrative agent, Deutsche Bank Securities Inc. and Wells Fargo Bank, National Association as co-syndication agents, BNP Paribas, Capital One, National Association and Citizens Bank, National Association, as co-documentation agents, and the other lenders party thereto, including any guarantees, collateral documents, instruments and agreements executed in connection therewith, and any amendments, supplements, modifications, extensions, renewals, restatements, refundings or refinancings thereof and any indentures or credit facilities or commercial paper facilities with banks or other institutional lenders or investors that replace, refund or refinance any part of the loans, notes, other credit facilities or commitments thereunder, including any such replacement, refunding or refinancing facility or indenture that increases the amount borrowable thereunder or alters the maturity thereof (provided that such increase in borrowings is permitted under “Certain Covenants—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock and Preferred Stock” above).

“Significant Subsidiary”means any Restricted Subsidiary that would be a “significant subsidiary” as defined in Article 1, Rule 1-02 of Regulation S-X, promulgated pursuant to the Securities Act, as such regulation is in effect on the Issue Date.

“Similar Business”means any business conducted or proposed to be conducted by the Issuer and its Restricted Subsidiaries on the Issue Date or any business that is similar, reasonably related, incidental or ancillary thereto.

“Standard Securitization Undertakings”means representations, warranties, covenants, indemnities and guarantees of performance entered into by the Issuer or any Subsidiary of the Issuer which the Issuer has determined in good faith to be customary in an accounts receivable securitization transaction.

“Subordinated Indebtedness”means, with respect to the notes or the Guarantee of a Guarantor,

1. any Indebtedness of the Issuer which is by its terms subordinated in right of payment to the notes, and

2. any Indebtedness of any Guarantor which is by its terms subordinated in right of payment to the Guarantee of such entity of the notes or the Guarantee of a Guarantor.

“Subsidiary”means, with respect to any Person: (1) any corporation, association, or other business entity (other than a partnership, joint venture, limited liability company or similar entity) of which more than 50% of the total voting power of shares of Capital Stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers or trustees thereof is at the time of determination owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of that Person or a combination thereof or is consolidated under GAAP with such Person at such time; and (2) any partnership, joint venture, limited liability company or similar entity of which (x) more than 50% of the capital accounts, distribution rights, total equity and voting interests or general or limited partnership interests, as applicable, are owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of that Person or a combination thereof whether in the form of membership, general, special or limited partnership or otherwise, and (y) such Person or any Restricted Subsidiary of such Person is a controlling general partner or otherwise controls such entity.

“Total Assets”means the total assets of the Issuer and its Restricted Subsidiaries on a consolidated basis, as shown on the most recent consolidated balance sheet of the Issuer and its Restricted Subsidiaries and computed in accordance with GAAP. Total Assets shall be calculated after giving effect to the transaction giving rise to the need to calculate Total Assets.

“Total Leverage Ratio”means, as of the date of determination, the ratio of (a) the Indebtedness (i) minus cash and Cash Equivalents of the Issuer and its Restricted Subsidiaries as of such date of determination (determined after givingpro formaeffect to such Restricted Payment including,

104

without limitation the incurrence of any Indebtedness to finance such Restricted Payment, and each other incurrence, assumption, guarantee, redemption, retirement and extinguishment of Indebtedness as of such date of determination) and (ii) excluding any letter of credit, except to the extent obligations in respect of drawn letters of credit which have not been reimbursed within three business days and Hedging Obligations, except any unpaid termination payments thereunder to (b) EBITDA of the Issuer and its Restricted Subsidiaries for the most recently ended four fiscal quarters ending immediately prior to such date for which internal financial statements are available. For purposes of determining the “Total Leverage Ratio,” “EBITDA” shall be subject to the adjustments applicable to “EBITDA” as provided for in the definition of “Fixed Charge Coverage Ratio”.

“Transaction”means the transactions contemplated by the issuance of the notes on the Issue Date and the amendments to the terms of the Senior Credit Facility as in effect on the Issue Date and the other related transactions consummated in connection with the foregoing on or shortly following the Issue Date.

“Treasury Rate”means, as of any Redemption Date, the yield to maturity as of such Redemption Date of United States Treasury securities with a constant maturity (as compiled and published in the most recent Federal Reserve Statistical Release H.15 (519) that has become publicly available at least two Business Days prior to the Redemption Date (or, if such Statistical Release is no longer published, any publicly available source of similar market data)) most nearly equal to the period from the Redemption Date to March 1, 2023; provided, however, that if the period from the Redemption Date to March 1, 2023, is less than one year, the weekly average yield on actually traded United States Treasury securities adjusted to a constant maturity of one year will be used.

“Trust Indenture Act”means the Trust Indenture Act of 1939, as amended (15 U.S.C. §§77aaa-77bbbb).

“Unrestricted Subsidiary”means:

|

| | 1. | | any Subsidiary of the Issuer which at the time of determination is an Unrestricted Subsidiary (as designated by the Issuer, as provided below); and |

|

| | 2. | | any Subsidiary of an Unrestricted Subsidiary. |

The Issuer may designate any Subsidiary of the Issuer (including any existing Subsidiary and any newly acquired or newly formed Subsidiary) to be an Unrestricted Subsidiary unless such Subsidiary or any of its Subsidiaries owns any Equity Interests or Indebtedness of, or owns or holds any Lien on, any property of, the Issuer or any Subsidiary of the Issuer (other than solely any Subsidiary of the Subsidiary to be so designated);providedthat

|

| | 1. | | any Unrestricted Subsidiary must be an entity of which the Equity Interests entitled to cast at least a majority of the votes that may be cast by all Equity Interests having ordinary voting power for the election of directors or Persons performing a similar function are owned, directly or indirectly, by the Issuer; |

|

| | 2. | | such designation complies with the covenants described under “Certain Covenants—Limitation on Restricted Payments”; and |

|

| | 3. | | each of: |

|

| | (a) | | the Subsidiary to be so designated; and |

|

| | (b) | | its Subsidiaries has not at the time of designation, and does not thereafter, create, incur, issue, assume, guarantee or otherwise become directly or indirectly liable with respect to any Indebtedness pursuant to which the lender has recourse to any of the assets of the Issuer or any Restricted Subsidiary. |

The Issuer may designate any Unrestricted Subsidiary to be a Restricted Subsidiary;providedthat, immediately after giving effect to such designation, no Default shall have occurred and be continuing and the Issuer could incur at least $1.00 of additional Indebtedness pursuant to the Fixed Charge Coverage Ratio test described in the first paragraph under “Certain Covenants—Limitation on Incurrence of Indebtedness and Issuance of Disqualified Stock and Preferred Stock.”

105

Any such designation by the Issuer shall be notified by the Issuer to the Trustee by promptly filing with the Trustee a copy of the resolution of the board of directors of the Issuer or any committee thereof giving effect to such designation and an Officer’s Certificate certifying that such designation complied with the foregoing provisions.

“Voting Stock”of any Person as of any date means the Capital Stock of such Person that is at the time entitled to vote in the election of the board of directors of such Person.

“Weighted Average Life to Maturity”means, when applied to any Indebtedness, Disqualified Stock or Preferred Stock, as the case may be, at any date, the quotient obtained by dividing:

|

| | 1. | | the sum of the products of the number of years from the date of determination to the date of each successive scheduled principal payment of such Indebtedness or redemption or similar payment with respect to such Disqualified Stock or Preferred Stock multiplied by the amount of such payment; by |

|

| | 2. | | the sum of all such payments. |

“Wholly-Owned Subsidiary”of any Person means a Subsidiary of such Person, 100% of the outstanding Equity Interests of which (other than directors’ qualifying shares) shall at the time be owned by such Person or by one or more Wholly-Owned Subsidiaries of such Person.

106

CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

This section is a discussion of U.S. federal income tax considerations relating to the exchange offer. This summary does not provide a complete analysis of all potential tax considerations. The information provided below is based on the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury Regulations, Internal Revenue Service (“IRS”) rulings and pronouncements, and judicial decisions all as now in effect and all of which are subject to change or differing interpretations, possibly with retroactive effect. There can be no assurances that the IRS will not challenge one or more of the tax consequences described herein, and we have not obtained, nor do we intend to obtain, a ruling from the IRS with respect to the U.S. federal income consequences of the exchange offer. The summary generally applies only to beneficial owners of the notes that hold the notes as capital assets. This discussion does not purport to deal with all aspects of U.S. federal income taxation that may be relevant to a particular beneficial owner in light of the beneficial owner’s circumstances (for example, persons subject to the alternative minimum tax provisions of the Code, or a U.S. Holder (as defined below) whose “functional currency” is not the U.S. dollar). Also, it is not intended to be wholly applicable to all categories of investors, some of which may be subject to special rules (such as dealers in securities or currencies, traders in securities that elect to use a mark-to-market method of accounting, banks, thrifts, regulated investment companies, real estate investment trusts, insurance companies, tax-exempt entities, tax-deferred or other retirement accounts, certain former citizens or residents of the United States, persons holding notes as part of a hedging, conversion or integrated transaction or a straddle, or persons deemed to sell notes under the constructive sale provisions of the Code). Finally, the summary does not describe the effect of the U.S. federal estate and gift tax laws on U.S. Holders or the effects of any applicable foreign, state or local laws.

***************************

THIS SUMMARY IS FOR GENERAL INFORMATION AND IS NOT TAX ADVICE WITH RESPECT TO ANY SPECIFIC INVESTOR IN LIGHT OF SUCH INVESTOR’S PARTICULAR CIRCUMSTANCES. INVESTORS SHOULD CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AND THE CONSEQUENCES OF U.S. FEDERAL ESTATE OR GIFT TAX LAWS, FOREIGN, STATE AND LOCAL LAWS, AND TAX TREATIES.

***************************

As used herein, the term “U.S. Holder” means a beneficial owner of the notes that, for U.S. federal income tax purposes is (1) an individual who is a citizen or resident of the United States, (2) a corporation, or an entity treated as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States or any state of the United States, including the District of Columbia, (3) an estate the income of which is subject to U.S. federal income taxation regardless of its source, or (4) a trust if it (a) is subject to the primary supervision of a U.S. court and the control of one of more U.S. persons or (b) has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

If a partnership (including an entity or arrangement, domestic or foreign, treated as a partnership for U.S. federal income tax purposes) is a beneficial owner of a note, the tax treatment of a partner in the partnership will depend upon the status of the partner and the activities of the partnership. A beneficial owner of a note that is a partnership, and partners in such partnership, should consult their own tax advisors about the U.S. federal income tax consequences of the exchange offer.

The exchange of old notes for exchange notes pursuant to the exchange offer will not be a taxable exchange for U.S. federal income tax purposes, and therefore, a holder will not recognize gain or loss as a result of this exchange. Further, for U.S. federal income tax purposes, the exchange notes will have the same tax attributes as the old notes, including without limitation, the same tax basis and holding period that the holder had in the old notes immediately before the exchange offer.

107

BOOK-ENTRY; DELIVERY AND FORM

The certificates representing the exchange notes will be issued in fully registered form without interest coupons (each a “Global Note”) and will be deposited with the trustee as a custodian for The Depository Trust Company (“DTC”) and registered in the name of a nominee of DTC.

The Global Notes

We expect that pursuant to procedures established by DTC (i) upon the issuance of the Global Notes, DTC or its custodian will credit, on its internal system, the principal amount at maturity of the individual beneficial interests represented by such Global Notes to the respective accounts of persons who have accounts with such depositary and (ii) ownership of beneficial interests in the Global Notes will be shown on, and the transfer of such ownership will be effected only through, records maintained by DTC or its nominee (with respect to interests of participants) and the records of participants (with respect to interests of persons other than participants). Ownership of beneficial interests in the Global Notes will be limited to persons who have accounts with DTC (“participants”) or persons who hold interests through participants. Holders may hold their interests in the Global Notes directly through DTC if they are participants in such system, or indirectly through organizations which are participants in such system.

So long as DTC, or its nominee, is the registered owner or holder of the notes, DTC or such nominee, as the case may be, will be considered the sole owner or holder of the notes represented by such Global Notes for all purposes under the Indenture. No beneficial owner of an interest in the Global Notes will be able to transfer that interest except in accordance with DTC’s procedures, in addition to those provided for under the Indenture with respect to the notes.

Payments of the principal of and premium (if any) and interest (including additional interest) on the Global Notes will be made to DTC or its nominee, as the case may be, as the registered owner thereof. None of Griffon, the trustee or any paying agent will have any responsibility or liability for any aspect of the records relating to or payments made on account of beneficial ownership interests in the Global Notes or for maintaining, supervising or reviewing any records relating to such beneficial ownership interest.

The Company expects that DTC or its nominee, upon receipt of any payment of principal, premium, if any, or interest (including additional interest) on the Global Notes, will credit participants’ accounts with payments in amounts proportionate to their respective beneficial interests in the principal amount of the Global Notes as shown on the records of DTC or its nominee. The Company also expects that payments by participants to owners of beneficial interests in the Global Notes held through such participants will be governed by standing instructions and customary practice, as is now the case with securities held for the accounts of customers registered in the names of nominees for such customers. Such payments will be the responsibility of such participants.

Transfers between participants in DTC will be effected in the ordinary way through DTC’s same-day funds system in accordance with DTC rules and will be settled in same-day funds. If a holder requires physical delivery of notes in certificated form (“Certificated Securities”) for any reason, including to sell notes to persons in states which require physical delivery of the notes, or to pledge such securities, such holder must transfer its interest in a Global Note in accordance with the normal procedures of DTC and the procedures set forth in the Indenture.

DTC has advised us that it will take any action permitted to be taken by a holder of notes (including the presentation of notes for exchange as described below) only at the direction of one or more participants to whose account the DTC interests in the Global Notes are credited and only in respect of such portion of the aggregate principal amount of notes as to which such participant or participants has or have given such direction. However, if there is an event of default under the Indenture, DTC will exchange the Global Notes for Certificated Securities, which it will distribute to its participants.

DTC has advised us as follows: DTC is a limited purpose trust company organized under the laws of the State of New York, a member of the Federal Reserve System, a “clearing corporation” within the meaning of the Uniform Commercial Code and a “Clearing Agency” registered pursuant

108

to the provisions of Section 17A of the Exchange Act. DTC was created to hold securities for its participants and facilitate the clearance and settlement of securities transactions between participants through electronic book-entry changes in accounts of its participants, thereby eliminating the need for physical movement of certificates. Participants include securities brokers and dealers, banks, trust companies and clearing corporations and certain other organizations. Indirect access to the DTC system is available to others such as banks, brokers, dealers and trust companies that clear through or maintain a custodial relationship with a participant, either directly or indirectly (“indirect participants”).

Although DTC has agreed to the foregoing procedures in order to facilitate transfers of interests in the Global Notes among participants of DTC, it is under no obligation to perform such procedures, and such procedures may be discontinued at any time. Neither we nor the trustee will have any responsibility or liability for the performance by DTC or its participants or indirect participants of their respective obligations under the rules and procedures governing their operations.

Certificated Securities

Certificated Securities shall be issued in exchange for beneficial interests in the Global Notes (i) if requested by a holder of such interests or (ii) if DTC is at any time unwilling or unable to continue as a depositary for the Global Notes and a successor depositary is not appointed by Griffon within 90 days.

109

PLAN OF DISTRIBUTION

Under existing SEC interpretations, we expect that the exchange notes will be freely transferable by holders other than our affiliates after the exchange offer without further registration under the Securities Act if the holder of the exchange notes represents that it is acquiring the exchange notes in the ordinary course of its business, that it has no arrangement or understanding with any person to participate in the distribution of the exchange notes and that it is not an affiliate of ours, as such terms are interpreted by the SEC; provided that broker-dealers receiving exchange notes in the exchange offer will have a prospectus delivery requirement with respect to resales of such exchange notes as discussed below. While the SEC has not taken a position with respect to this particular transaction, under interpretations of the staff of the SEC contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1983), which related to transactions structured substantially like this exchange offer, participating broker-dealers may fulfill their prospectus delivery requirements with respect to exchange notes (other than a resale of an unsold allotment of the old notes) with this prospectus.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for old notes where such old notes were acquired as a result of market-making activities or other trading activities. We have agreed that, for a period ending on the earlier of (i) 180 days from the date on which the registration statement of which this prospectus forms a part becomes or is declared effective and (ii) the date on which a broker-dealer is no longer required to deliver a prospectus in connection with market-making or other trading activities, we will make this prospectus, as amended or supplemented, available to any broker-dealer for use in connection with any such resale.

We will not receive any proceeds from the exchange offer or from any sale of exchange notes by brokers-dealers. Exchange notes received by broker-dealers for their own account pursuant to the exchange offer may be sold from time to time in one or more transactions in the over-the-counter market, in negotiated transactions, through the writing of options on the exchange notes or a combination of such methods of resale, at market prices prevailing at the time of resale, at prices related to such prevailing market prices or negotiated prices. Any such resale may be made directly to purchasers or to or through brokers or dealers who may receive compensation in the form of commissions or concessions from any such broker-dealer and/or the purchasers of any such exchange notes. Any broker-dealer that resells the exchange notes that were received by it for its own account pursuant to the exchange offer and any broker or dealer that participates in a distribution of such exchange notes may be deemed to be an “underwriter” within the meaning of the Securities Act and any profit of any such resale of exchange notes and any commissions or concessions received by any such persons may be deemed to be underwriting compensation under the Securities Act. The letter of transmittal states that by acknowledging that it will deliver and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act.

110

LEGAL MATTERS

Certain legal matters with regard to the validity of the exchange notes and the exchange note guarantees will be passed upon for us by Dechert LLP, New York, New York.

EXPERTS

The audited consolidated financial statements, financial statement schedule and management’s assessment of the effectiveness of internal control over financial reporting incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference into this prospectus the information in other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information contained in documents filed earlier with the SEC or contained in this prospectus or a prospectus supplement. We incorporate by reference in this prospectus the documents listed below:

|

| | • | | Our Annual Report on Form 10-K for the year ended September 30, 2019, filed with the SEC on November 22, 2019, including portions of our Proxy Statement to the extent specifically incorporated by reference therein; |

|

| | • | | Our Quarterly Report on Form 10-Q for the quarter ended December 31, 2019, filed with the SEC on January 31, 2020; |

|

| | • | | Our Current Report on Form 8-K filed with the SEC on February 4, 2020; |

|

| | • | | Our Current Report on Form 8-K filed with the SEC on February 5, 2020; and |

|

| | • | | Our Current Report on Form 8-K filed with the SEC on February 20, 2020. |

Any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after (i) the date of the initial registration statement and prior to effectiveness of the registration statement and (ii) the date of this prospectus and before the offering is terminated are also “incorporated by reference” into this prospectus except that, unless otherwise indicated, any information furnished under Item 2.02 or Item 7.01 of any Current Report on Form 8-K is not incorporated by reference. Notwithstanding the foregoing, we are not incorporating any document or information deemed to have been furnished and not filed in accordance with SEC rules.

Upon written or oral request, you will be provided with a copy of the incorporated documents without charge (not including exhibits to the respective documents unless the exhibits are specifically incorporated by reference into the respective documents). You may submit such a request for this material at the following address and telephone number:

Griffon Corporation

712 Fifth Avenue

New York, NY 10019

(212) 957-5000

In order to ensure timely delivery, you must request such documents no later than five business days before the expiration date of the exchange offer.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Securities Exchange Act of 1934, and we file unaudited quarterly and audited annual reports, proxy and information statements and other information with the SEC. The SEC maintains an Internet site which provides online access to reports, proxy and information statements and other information regarding registrants that file electronically with the SEC at the addresshttp://www.sec.gov. In addition, we post our filed

111

documents on our website athttp://www.griffon.com. Except for the documents incorporated by reference into this prospectus, the information on our website is not part of this prospectus.

While any notes remain outstanding, we will make available, on request, to any holder and any prospective purchaser of notes the information required pursuant to Rule 144A(d)(4) under the Securities Act during any period in which we are not subject to Section 13 or 15(d) of the Exchange Act.

112

$850,000,000

Griffon Corporation

OFFER TO EXCHANGE

5.75% Senior Notes due 2028 and related Guarantees

for

all outstanding 5.75% Senior Notes due 2028 and related Guarantees

that have been registered under the Securities Act of 1933

Prospectus

March 24, 2020

No person has been authorized to give any information or to make any representation other than those contained in this prospectus, and, if given or made, any information or representations must not be relied upon as having been authorized. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities to which it relates or an offer to sell or the solicitation of an offer to buy these securities in any circumstances in which this offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made under this prospectus shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since the date of this prospectus.

Until May 3, 2020, all broker-dealers that effect transactions in these securities, whether or not participating in this exchange offer, may be required to deliver a prospectus. This is in addition to the broker-dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.