Exhibit 99.1

Investor Deck May 2018 CB Financial Services, Inc. &

Forward - Looking Statements Statements contained in this investor presentation that are not historical facts may constitute forward - looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 (the “Act”). Such forward - looking statements are subject to significant risks and uncertainties. CB Financial Services, Inc. (the “Company”) intends such forward - looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, changes in market interest rates, general economic conditions, changes in federal and state regulation, actions by our competitors, loan delinquency rates , our ability to integrate the operations of businesses we acquire; our ability to control costs and expenses, and other factors that may be described in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward - looking statement except as may be required by applicable law or regulation. 2

About CB Financial & Community Bank ▪ CB Financial is the holding company for Community Bank ▪ Community Bank was founded in 1901 as the First National Bank of Carmichaels in Carmichaels, PA ▪ The name of the Bank was changed to Community Bank in 1987 ▪ The Bank has remained independent and today is locally managed ▪ In 2006, Community Bank formed a holding company named CB Financial Services, Inc. ▪ Our stock symbol is “CBFV” ▪ In October 2014, CB Financial and Community Bank merged with FedFirst Financial Corporation and First Federal Savings Bank ▪ At that time, CB Financial registered with the SEC and began to trade on NASDAQ ▪ On April 30, 2018, CB Financial and Community Bank merged with First West Virginia Bancorp and Progressive Bank, N.A. 3

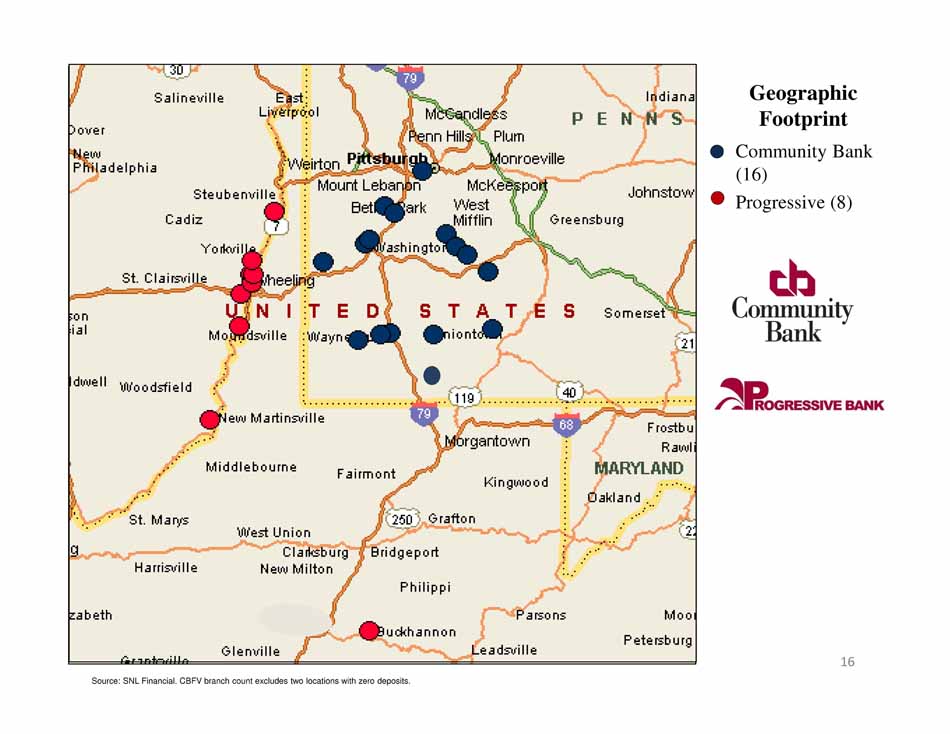

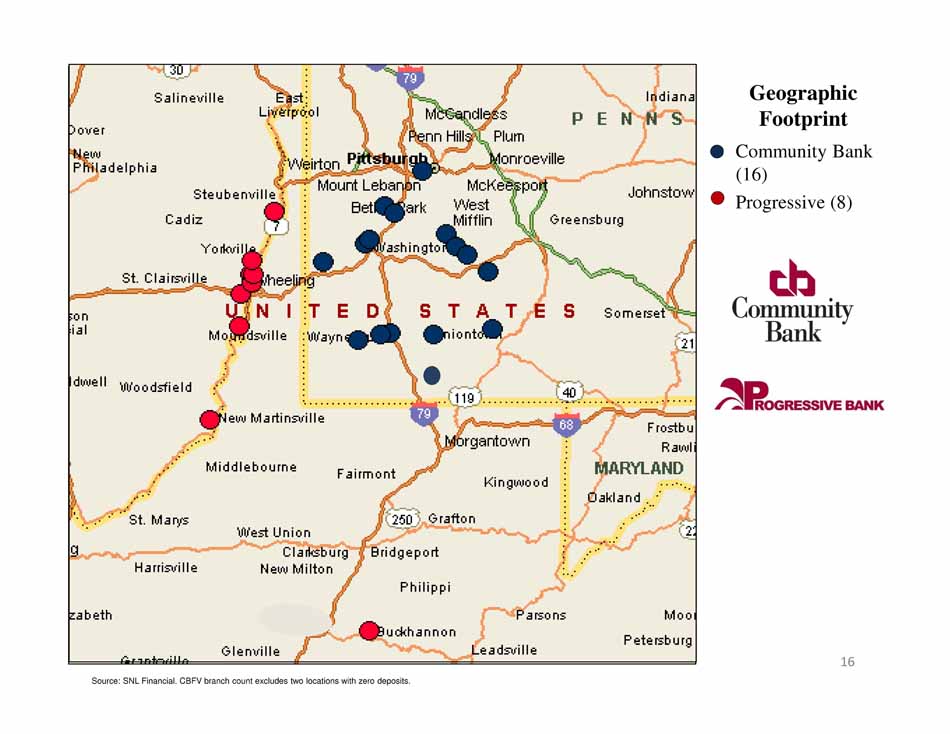

About CB Financial & Community Bank ▪ Community Bank now operates 16 branches in five counties in Southwestern Pennsylvania, 7 branches in West Virginia, and one branch in Eastern Ohio (see the map on slide 16) ▪ Community Bank does business throughout the Tri - State Area of Pennsylvania, West Virginia and Ohio ▪ Community Bank owns an insurance agency, Exchange Underwriters, Inc. ▪ Community Bank also offers wealth management services through the Bishop Group of Janney, Montgomery & Scott ▪ CB Financial is now approximately $1.3 billion in assets and has been recognized for its community service, employer practices, philanthropy, and financial performance ▪ Our business mix and our financial highlights as of and for the quarter ended March 31, 2018 are set forth on the following two slides 4

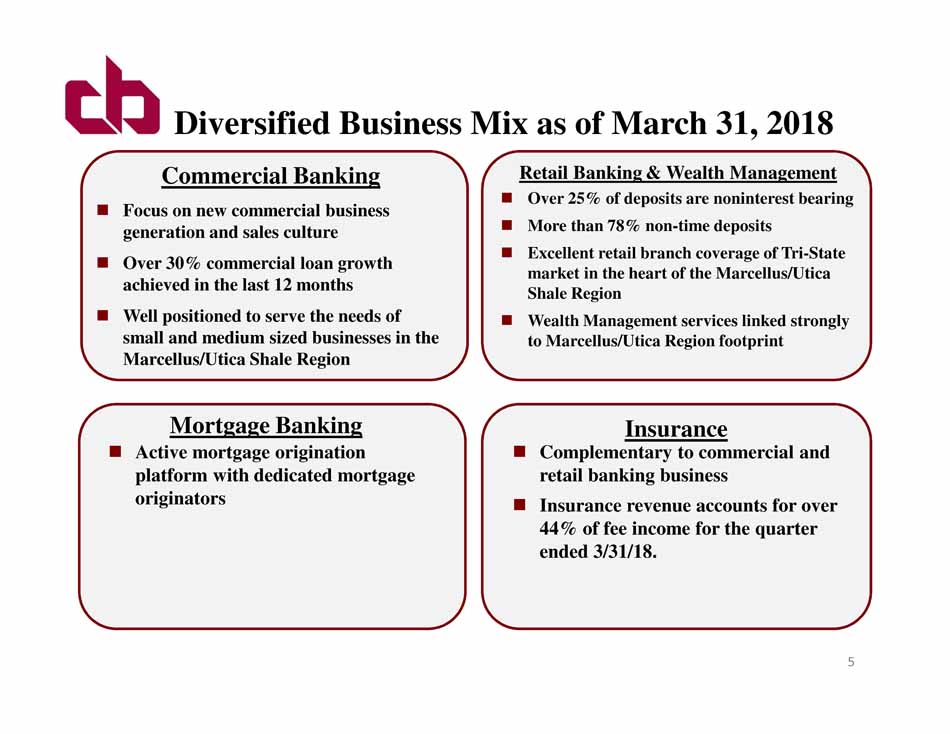

Diversified Business Mix as of March 31, 2018 Retail Banking & Wealth Management Commercial Banking Insurance Mortgage Banking Over 25% of deposits are noninterest bearing More than 78% non - time deposits Excellent retail branch coverage of Tri - State market in the heart of the Marcellus/Utica Shale Region Wealth Management services linked strongly to Marcellus/Utica Region footprint F ocus on new commercial business generation and sales culture Over 30% commercial loan growth achieved in the last 12 months Well positioned to serve the needs of small and medium sized businesses in the Marcellus/Utica Shale Region Active mortgage origination platform with dedicated mortgage originators Complementary to commercial and retail banking business Insurance revenue accounts for over 44% of fee income for the quarter ended 3/31/18. 5

CB Financial Highlights (as of 3/31/2018) ▪ Assets of $966 Million ▪ Gross Loans of $781 Million ▪ Deposits and Sweep Accounts of $774 Million ▪ 1.03% Loans - to - Deposit Ratio ▪ Common Equity Tier 1 Capital of $84 Million ▪ Loan Growth of 5% in the first quarter of 2018 6

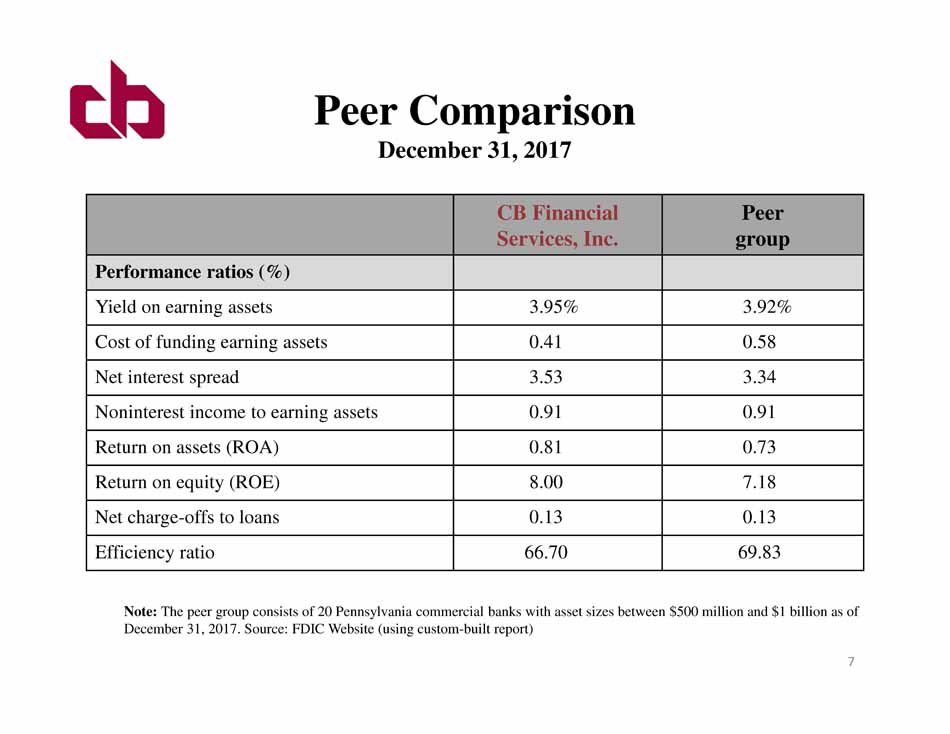

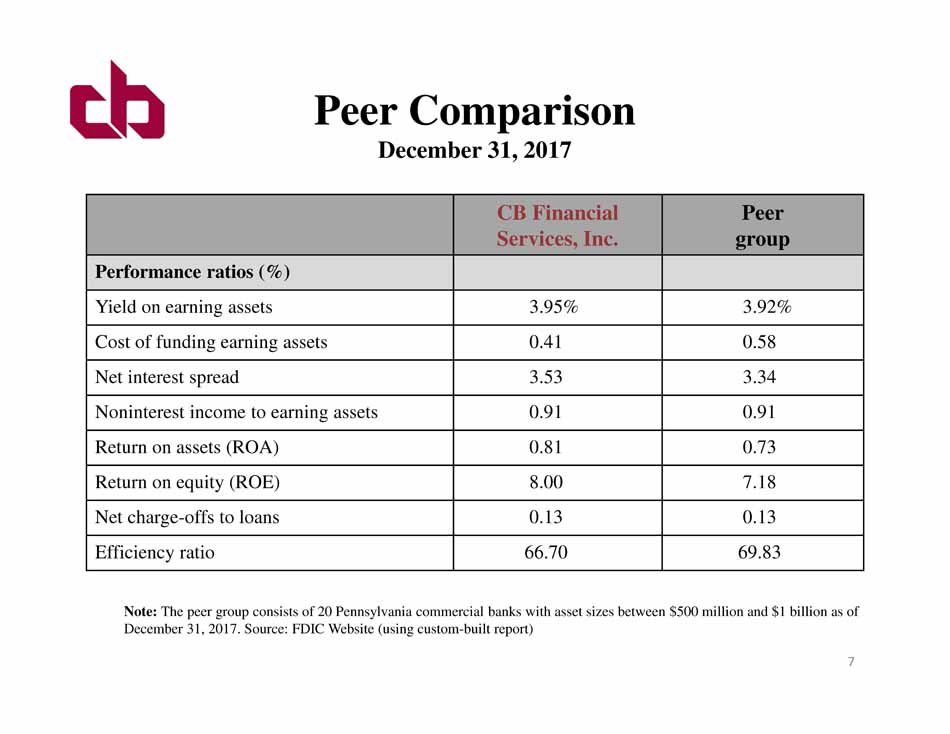

Peer Comparison December 31, 2017 CB Financial Services, Inc. Peer group Performance ratios (%) Yield on earning assets 3.95% 3.92% Cost of funding earning assets 0.41 0.58 Net interest spread 3.53 3.34 Noninterest income to earning assets 0.91 0.91 Return on assets (ROA) 0.81 0.73 Return on equity (ROE) 8.00 7.18 Net charge - offs to loans 0.13 0.13 Efficiency ratio 66.70 69.83 Note: The peer group consists of 20 Pennsylvania commercial banks with asset sizes between $500 million and $1 billion as of December 31, 2017. Source: FDIC Website (using custom - built report) 7

Peer Comparison December 31, 2017 CB Financial Services, Inc. Peer group Condition ratios (%) Loss allowance to loans 1.18 % 1.18% Loss allowance to noncurrent loans 215.17 169.21 Noncurrent loans plus other real estate owned to assets 0.47 0.64 Noncurrent loans to total loans 0.55 0.70 Net loans and leases to deposits 95.10 87.14 Equity capital to assets 9.68 10.18 Total risk - based capital ratio 13.47 15.12 Note: The peer group consists of 20 Pennsylvania commercial banks with asset sizes between $500 million and $1 billion as of December 31, 2017. Source: FDIC Website (using custom - built report) 8

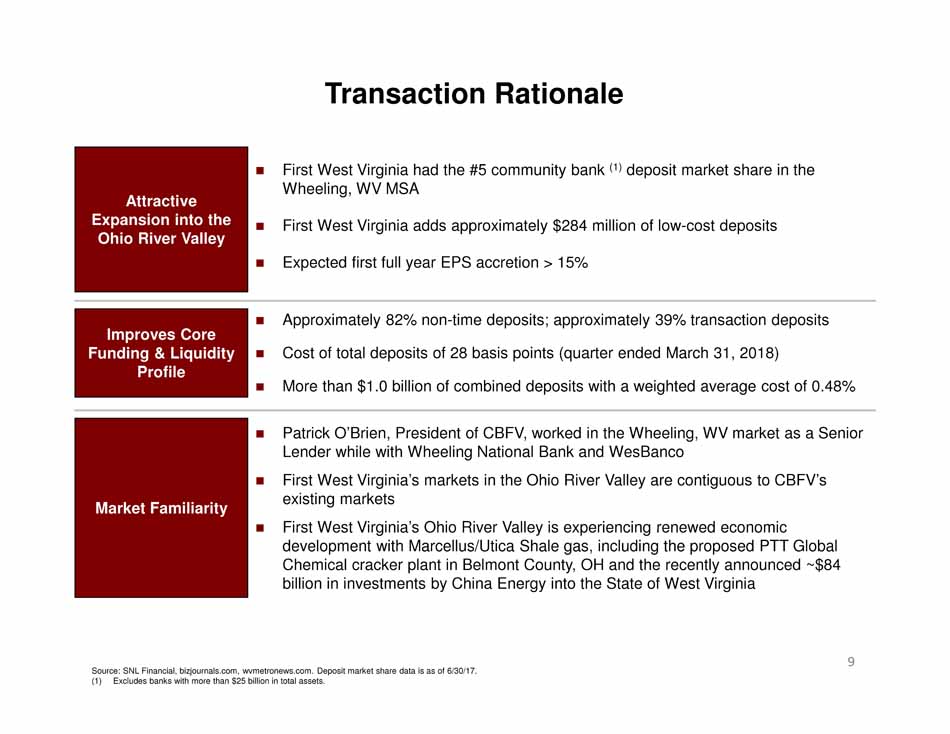

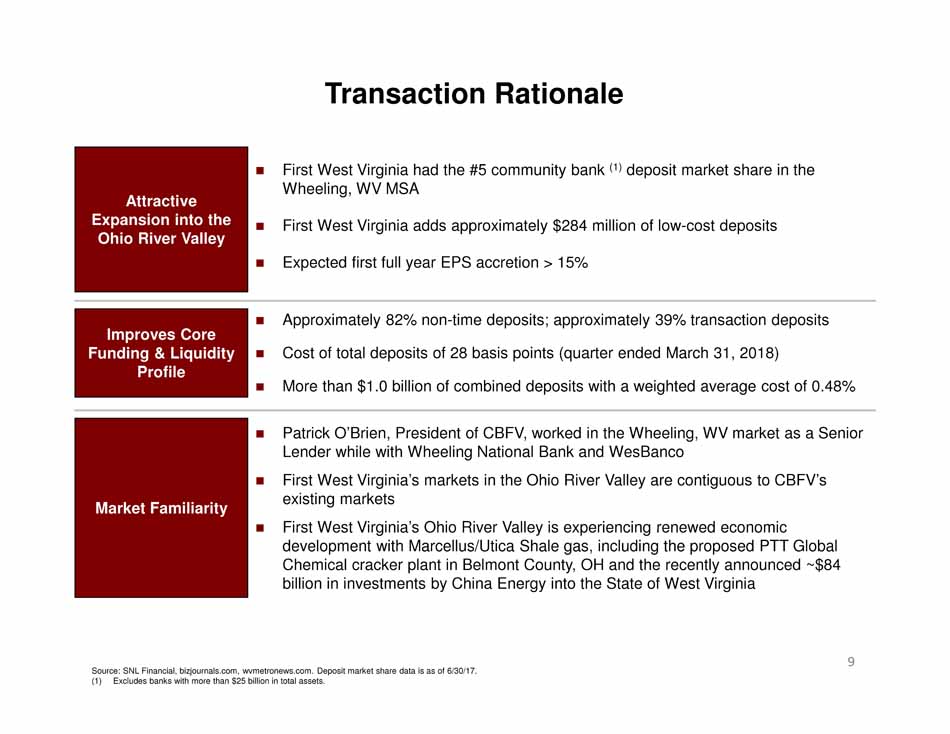

Attractive Expansion into the Ohio River Valley Improves Core Funding & Liquidity Profile Market Familiarity First West Virginia had the #5 community bank (1) deposit market share in the Wheeling, WV MSA First West Virginia adds approximately $ 284 million of low - cost deposits Expected first full year EPS accretion > 15% Approximately 82% non - time deposits; approximately 39% transaction deposits Cost of total deposits of 28 basis points (quarter ended March 31, 2018) More than $1.0 billion of combined deposits with a weighted average cost of 0.48% Patrick O’Brien, President of CBFV, worked in the Wheeling, WV market as a Senior Lender while with Wheeling National Bank and WesBanco First West Virginia’s markets in the Ohio River Valley are contiguous to CBFV’s existing markets First West Virginia’s Ohio River Valley is experiencing renewed economic development with Marcellus/Utica Shale gas, including the proposed PTT Global Chemical cracker plant in Belmont County, OH and the recently announced ~$84 billion in investments by China Energy into the State of West Virginia Transaction Rationale Source: SNL Financial , bizjournals.com, wvmetronews.com . Deposit market share data is as of 6/30/17. (1) Excludes banks with more than $25 billion in total assets. 9

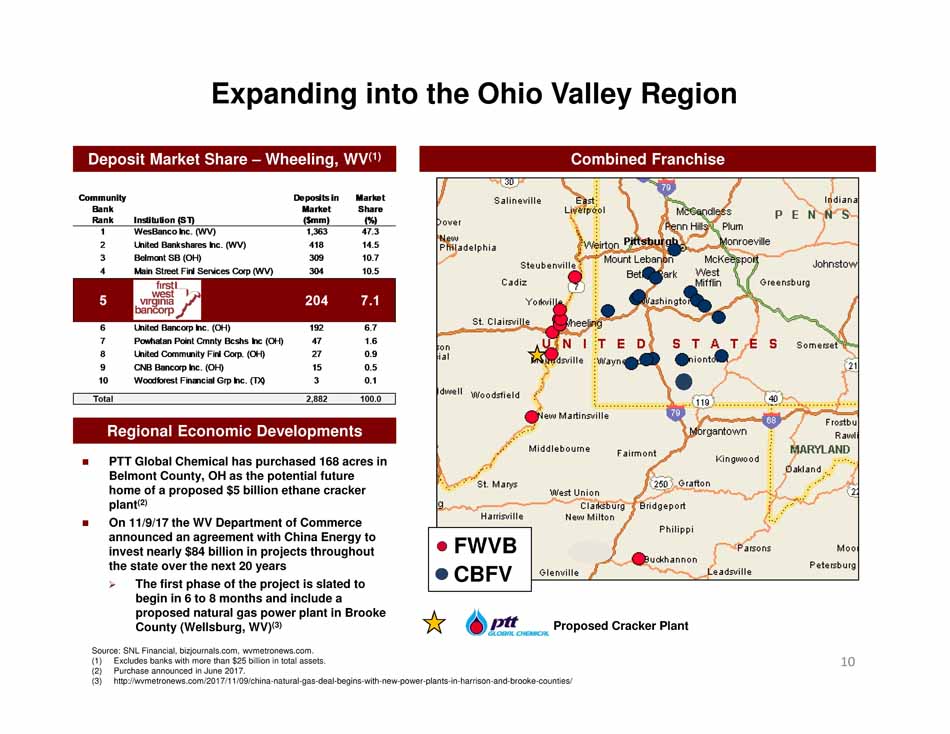

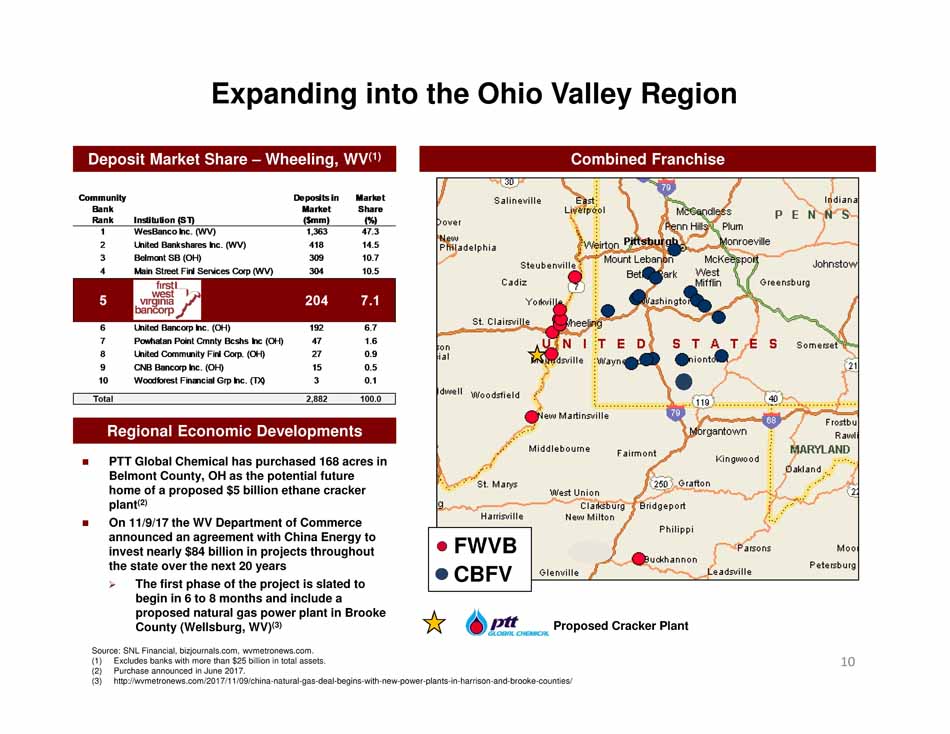

Regional Economic Developments Deposit Market Share – Wheeling, WV (1) Combined Franchise Expanding into the Ohio Valley Region Source: SNL Financial, bizjournals.com, wvmetronews.com. (1) Excludes banks with more than $25 billion in total assets . (2) Purchase announced in June 2017. (3) http://wvmetronews.com/2017/11/09/china - natural - gas - deal - begins - with - new - power - plants - in - harrison - and - brooke - counties/ FWVB CBFV Proposed Cracker Plant Community Bank Rank Institution (ST) Deposits in Market ($mm) Market Share (%) 1 WesBanco Inc. (WV) 1,363 47.3 2 United Bankshares Inc. (WV) 418 14.5 3 Belmont SB (OH) 309 10.7 4 Main Street Finl Services Corp (WV) 304 10.5 5 204 7.1 6 United Bancorp Inc. (OH) 192 6.7 7 Powhatan Point Cmnty Bcshs Inc (OH) 47 1.6 8 United Community Finl Corp. (OH) 27 0.9 9 CNB Bancorp Inc. (OH) 15 0.5 10 Woodforest Financial Grp Inc. (TX) 3 0.1 Total 2,882 100.0 PTT Global Chemical has purchased 168 acres in Belmont County, OH as the potential future home of a proposed $5 billion ethane cracker plant (2) On 11/9/17 the WV Department of Commerce announced an agreement with China Energy to invest nearly $84 billion in projects throughout the state over the next 20 years » The first phase of the project is slated to begin in 6 to 8 months and include a proposed natural gas power plant in Brooke County (Wellsburg, WV) (3) 10

Our Economic Future ▪ Community Bank is excited about the economic prospects for the Tri - State area and particularly for the resurgence of the Ohio Valley ▪ The primary driver for this economic renaissance is the revolution in natural gas production and consumption occasioned by the development of the Marcellus Shale and the Utica Shale 11

Shale Gas Drives PetroChemical ▪ Shell Chemical Appalachia is building a “massive multi - billion dollar petrochemical plant” (known as an ethane cracker) in Potter Township, Beaver County ▪ Construction began in 2017, and expected to create over 6,000 construction jobs and employ 600 people permanently ▪ Scheduled to be completed in the early 2020’s, it is expected to produce 1.6 million tons a year of ethylene, which is used in products ranging from food packaging to automotive parts 12

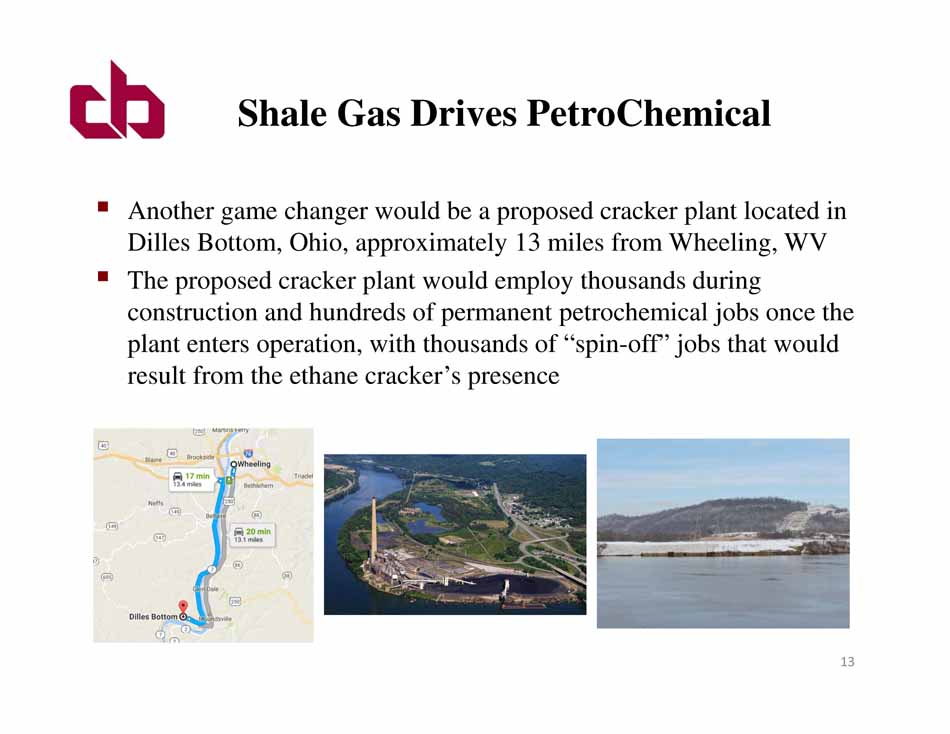

Shale Gas Drives PetroChemical ▪ Another game changer would be a proposed cracker plant located in Dilles Bottom, Ohio, approximately 13 miles from Wheeling, WV ▪ The proposed cracker plant would employ thousands during construction and hundreds of permanent petrochemical jobs once the plant enters operation, with thousands of “spin - off” jobs that would result from the ethane cracker’s presence 13

Shale Gas Drives PetroChemical ▪ WVU - led research identifies areas for a Natural Gas Storage ‘Hub’. Top areas are Belmont, Ohio, Brooke and Hancock Counties. To view the full report, go to, http :// aongrc.nrcce.wvu.edu/wp - content/uploads/MASTER_Final_Report_8 - 29 - 2017.pdf ▪ According to the study, Natural Gas Storage facilities could yield up to 100,000 permanent new jobs, and up to $2.9 billion in new federal, state and local tax revenue annually ▪ U.S. Senator Joe Manchin has described the hub this way, “This is a game - changer for us. It’s a real field of dreams.” ▪ Marcellus/Utica average daily production has grown from 3 billion cubic feet (BCF) in 2010 to more than 24 BCF today, forecasted to grow to as much as 40 BCF in the next 5 years ▪ Sweet spots are in the Utica in eastern Ohio and in the Marcellus in northern WV and southwestern PA; These areas represent 40 percent of the total gas production 14

15 Shale Gas Drives PetroChemical ▪ November 2017: West Virginia announces $83.7 billion gas development deal with China Energy ▪ West Virginia Commerce Secretary Woody Thrasher has revealed that the first projects in a blockbuster agreement between the state and China are natural gas power plants, likely one in Harrison County and one in Brooke County ▪ West Virginia enjoys a strong relationship with China Energy, including ongoing research initiatives with West Virginia University

Source: SNL Financial. CBFV branch count excludes two locations with zero deposits. Geographic Footprint • Community Bank (16) • Progressive (8) 16 Weston

As the map below demonstrates , the combination of Community Bank’s market presence in the heart of the Marcellus, and Progressive Bank’s market presence in the heart of the Utica, allows Community Bank to serve an economy that has enormous upside potential. Source: U.S. Energy Information Administration and SNL Financial. Map of Marcellus / Utica Shale Region Community Bank Market Area Progressive Market Area 17

Empower our experienced, high quality employees to provide superior customer service in all aspects of our business Create a service culture which builds full relationships with our customers Grow commercial, mortgage, and consumer loans; commercial deposits; insurance; and wealth management Evolve toward more electronic/digital products and processes Qualify for the Russell 2000 Index Strive for 0.90% ROA and 9.0% ROE Maintain and seek to increase our annual dividend of $0.88 per share Be the Community Bank of choice in the Marcellus/Utica Shale Region for residents and small and medium sized businesses Strategic Vision for CB Financial & Community Bank 18