- CBFV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

CB Financial Services (CBFV) DEF 14ADefinitive proxy

Filed: 7 Apr 20, 10:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

CB FINANCIAL SERVICES, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| N/A | ||

| (2) | Aggregate number of securities to which transactions applies: | |

| N/A | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| N/A | ||

| (4) | Proposed maximum aggregate value of transaction: | |

| N/A | ||

| (5) | Total fee paid: | |

| N/A | ||

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | ||

| N/A | |||

| (2) | Form, Schedule or Registration Statement No.: | ||

| N/A | |||

| (3) | Filing Party: | ||

| N/A | |||

| (4) | Date Filed: | ||

| N/A |

April 17, 2020

Dear Fellow Stockholder:

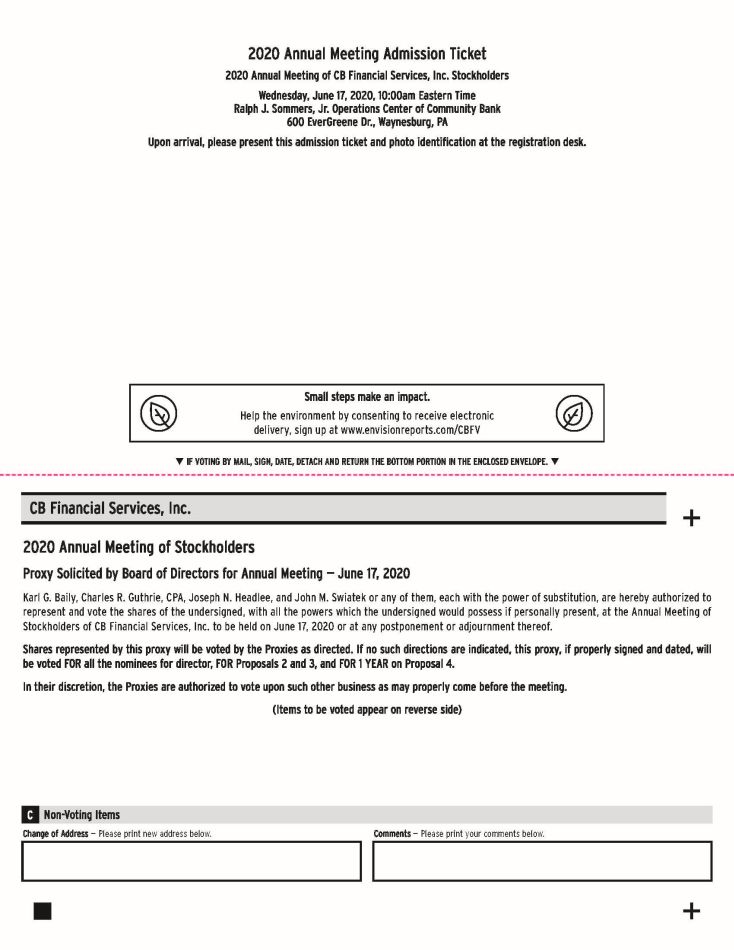

You are cordially invited to attend the annual meeting of stockholders of CB Financial Services, Inc. (the “Company”), the holding company for Community Bank. The meeting will be held at the Ralph J. Sommers, Jr. Operations Center of Community Bank, 600 EverGreene Drive, Waynesburg, Pennsylvania, on Wednesday, June 17, 2020, at 10:00 a.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. Directors and officers of the Company, as well as representatives of Baker Tilly Virchow Krause, LLP, the Company’s independent registered public accounting firm, will be present to respond to appropriate questions from stockholders.

It is important that your shares are represented at the meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote by promptly completing and mailing the enclosed proxy card or by voting via the Internet or by telephone. Internet and telephone voting instructions appear on the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card or voted via the Internet or by telephone.

We look forward to seeing you at the meeting.

Sincerely,

|  | |

| Mark E. Fox | Barron P. “Pat” McCune, Jr. | |

| Chairman of the Board | President & Chief Executive Officer |

Special Notice Regarding Change in Date, Location and Time of Day of Annual Meeting –The Annual Meeting of Stockholders will be held at the Ralph J. Sommers Operations Center of Community Bank located at 600 EverGreene Drive, Waynesburg, Pennsylvania, on Wednesday, June 17, 2020 at 10:00 a.m., local time, rather than at the Hampton Inn in Waynesburg, Pennsylvania, on Wednesday, May 20, 2020 at 1:00 p.m., local time, as the Company announced previously.

Special Notice Regarding In-Person Attendance at Annual Meeting – In light of the ongoing health concerns relating to the COVID-19 coronavirus pandemic and to best protect the health and welfare of the Company’s employees, stockholders and community, the Company urges that stockholdersDO NOT ATTEND the Annual Meeting in person this year. Stockholders are nevertheless urged to vote their proxies by mail or by voting via the Internet or by telephone.

100 North Market Street

Carmichaels, Pennsylvania 15320

(724) 966-5041

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE | 10:00 a.m., local time, on Wednesday, June 17, 2020. |

| PLACE | Ralph J. Sommers, Jr. Operations Center of Community Bank, |

| 600 EverGreene Drive, Waynesburg, Pennsylvania. |

| ITEMS OF BUSINESS | (1) | To elect five directors to serve for a term of three years. |

| (2) | To ratify the appointment of Baker Tilly Virchow Krause, LLP to serve as the independent registered public accounting firm for the fiscal year ending December 31, 2020. |

| (3) | To hold an advisory (non-binding) vote to approve the compensation of the named executive officers as disclosed in the accompanying proxy statement. |

| (4) | To hold an advisory (non-binding) vote to determine whether the stockholder advisory vote to approve the compensation of the named executive officers should occur every one, two or three years. |

| (5) | To transact such other business as may properly come before the meeting and any adjournment or postponement of the meeting. |

| RECORD DATE | In order to vote, you must have been a stockholder at the close of business on April 3, 2020. |

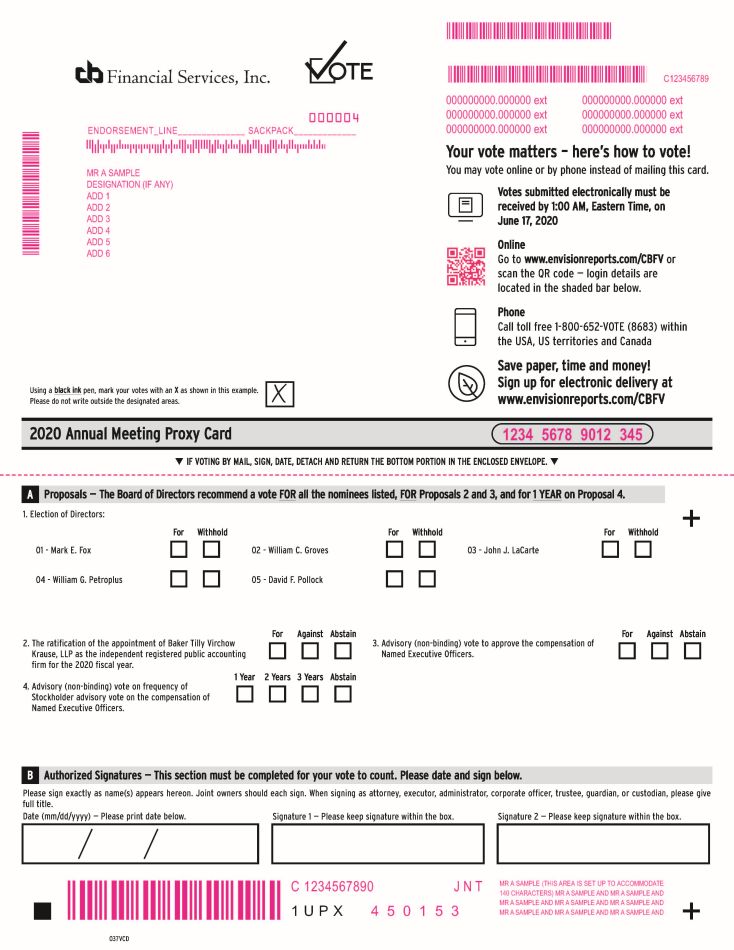

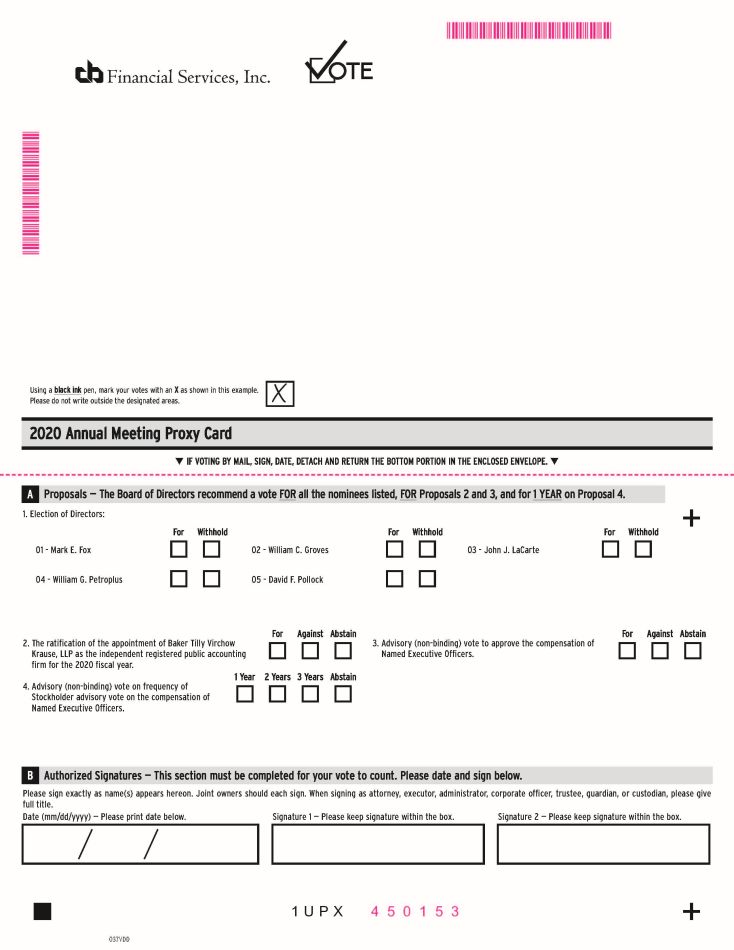

| PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares via the Internet, by telephone or by completing and returning the proxy card or voting instruction card sent to you. You can revoke your proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. |

| By Order of the Board of Directors, | |

| |

| Elizabeth A. Calvario | |

| Corporate Secretary |

Carmichaels, Pennsylvania

April 17, 2020

Special Notice Regarding Change in Date, Location and Time of Day of Annual Meeting –The Annual Meeting of Stockholders will be held at the Ralph J. Sommers Operations Center of Community Bank located at 600 EverGreene Drive, Waynesburg, Pennsylvania, on Wednesday, June 17, 2020 at 10:00 a.m., local time, rather than at the Hampton Inn in Waynesburg, Pennsylvania, on Wednesday, May 20, 2020 at 1:00 p.m., local time, as the Company announced previously.

Special Notice Regarding In-Person Attendance at Annual Meeting – In light of the ongoing health concerns relating to the COVID-19 coronavirus pandemic and to best protect the health and welfare of the Company’s employees, stockholders and community, the Company urges that stockholdersDO NOT ATTEND the Annual Meeting in person this year. Stockholders are nevertheless urged to vote their proxies by mail or by voting via the Internet or by telephone.

PROXY STATEMENT

OF

CB FINANCIAL SERVICES, INC.

(Holding Company for Community Bank)

GENERAL INFORMATION

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of CB Financial Services, Inc. (the “Board”) for the 2020 annual meeting of stockholders and for any adjournment or postponement of the meeting. In this proxy statement, we may also refer to CB Financial Services, Inc. as “CB Financial,” the “Company,” “we,” “our” or “us” and to Community Bank as the “Bank.”

We are holding the 2020 annual meeting of stockholders at the Ralph J. Sommers, Jr. Operations Center of Community Bank, 600 EverGreene Drive, Waynesburg, Pennsylvania, on Wednesday, June 17, 2020, at 10:00 a.m., local time.

We intend to mail this proxy statement and the enclosed proxy card to stockholders of record beginning on or about April 17, 2020.

Special Notice Regarding Change in Date, Location and Time of Day of Annual Meeting –The Annual Meeting of Stockholders will be held at the Ralph J. Sommers Operations Center of Community Bank located at 600 EverGreene Drive, Waynesburg, Pennsylvania, on Wednesday, June 17, 2020 at 10:00 a.m., local time, rather than at the Hampton Inn in Waynesburg, Pennsylvania, on Wednesday, May 20, 2020 at 1:00 p.m., local time, as the Company announced previously.

Special Notice Regarding In-Person Attendance at Annual Meeting – In light of the ongoing health concerns relating to the COVID-19 coronavirus pandemic and to best protect the health and welfare of the Company’s employees, stockholders and community, the Company urges that stockholdersDO NOT ATTEND the Annual Meeting in person this year. Stockholders are nevertheless urged to vote their proxies by mail or by voting via the Internet or by telephone.

Important Notice Regarding the Availability of Proxy Materials FOR THE STOCKHOLDERS’ Meeting to be held on JUNE 17, 2020

This proxy statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the Securities and Exchange Commission are available online athttp://www.envisionreports.com/CBFV.

INFORMATION ABOUT VOTING

Who Can Vote at the Meeting

You are entitled to vote your shares of Company common stock that you owned as of April 3, 2020. As of the close of business on that date, 5,393,712 shares of Company common stock were outstanding. Each share of common stock has one vote.

The Company’s Articles of Incorporation provides that record holders of the Company’s common stock who beneficially own, either directly or indirectly, in excess of 15% of the Company’s outstanding shares are not entitled to any vote with respect to those shares held in excess of the 15% limit, subject to limited exceptions.

Ownership of Shares; Attending the Meeting

You may own shares of the Company in one or more of the following ways:

| · | Directly in your name as the stockholder of record; and |

| · | Indirectly through a broker, bank or other holder of record in “street name.” |

If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us or to vote in person at the meeting.

If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction form that accompanies your proxy materials. Your broker, bank or other holder of record may allow you to provide voting instructions by telephone or by the Internet. Please see the instruction form provided by your broker, bank or other holder of record that accompanies this proxy statement. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. Examples of proof of ownership are a recent brokerage statement or a letter from a bank or broker. If you want to vote your shares of CB Financial common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or other nominee who is the record holder of your shares.

| 1 |

Quorum and Voting

Quorum. We will have a quorum and will be able to conduct the business of the annual meeting if the holders of a majority of the outstanding shares of common stock entitled to vote are present at the meeting, either in person or by proxy.

Vote Required for Proposals. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected up to the maximum number of directors to be elected at the annual meeting. The maximum number of directors to be elected at the annual meeting is five.

In voting on the ratification of the appointment of Baker Tilly Virchow Krause, LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To ratify the appointment of Baker Tilly Virchow Krause, LLP, the affirmative vote of a majority of the votes cast at the annual meeting is required.

In voting on the proposal to approve the compensation of the named executive officers, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To approve the compensation of the named executive officers, the affirmative vote of a majority of the votes cast at the annual meeting is required.

In voting on the frequency of the stockholder vote to approve the compensation of the named executive officers, you may vote for a frequency of one, two or three years, or you may abstain from voting. This proposal will be determined by a plurality of the votes cast.

How We Count Votes. If you return valid proxy instructions or attend the meeting in person, we will count your shares to determine whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted to determine the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the proposal to ratify the appointment of Baker Tilly Virchow Krause, LLP to serve as the Company’s independent registered public accounting firm, we will not count abstentions and broker non-votes as votes cast. Therefore, abstentions and broker non-votes will have no effect on the outcome of the vote on the proposal. Similarly, abstentions and broker non-votes will have no effect on the outcome of either the advisory (non-binding) vote on the compensation of the named executive officers or the advisory (non-binding) vote on the frequency of the stockholder advisory vote on the compensation of the named executive officers.

Effect of Not Casting Your Vote

If you hold your shares in street name, you must cast your vote if you want it to count in the election of directors (Item 1), in the advisory (non-binding) vote regarding the compensation of the named executive officers (Item 3) and in the advisory (non-binding) vote regarding frequency of the vote on the compensation of the named executive officers (Item 4). Current stock market regulations prohibit your bank or broker from voting your uninstructed shares in the election of directors and on certain other matters on a discretionary basis. Therefore, if you hold your shares in street name and you do not instruct your bank or broker how to vote on Items 1, 3 or 4, no votes will be cast on these matters on your behalf. These are referred to as “broker non-votes.” Your bank or broker, however, has discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Item 2).

Voting by Proxy

The Company’s Board is sending you this proxy statement to request that you allow your shares of Company common stock to be represented at the annual meeting by the persons named on the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Board.

| 2 |

The Board unanimously recommends that you vote:

| · | “FOR” all the nominees for director; |

| · | “FOR” the ratification of the appointment of Baker Tilly Virchow Krause, LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020; |

| · | “FOR” the approval of the compensation of the Company’s named executive officers; and |

| · | “FOR” the approval of a stockholder advisory (non-binding) vote on the compensation of the Company’s named executive officers every one year. (Note: Stockholders are not voting to approve or disapprove of this recommendation.) |

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your shares of Company common stock may be voted by the persons named in the proxy card on the new meeting date, provided that the new meeting occurs within 30 days of the original date of the annual meeting and you have not revoked your proxy. We do not currently know of any other matters to be presented at the annual meeting.

Instead of voting by completing and mailing a proxy card, registered stockholders can vote their shares of Company common stock via the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate stockholders’ identities, allow stockholders to provide their voting instructions and confirm that their instructions have been recorded properly. Specific instructions for Internet and telephone voting appear on the enclosed proxy card.The deadline for voting via the Internet or by telephone is 1:00 a.m., Eastern Time, on June 17, 2020.

Revoking Your Proxy

Whether you vote by mail, telephone or via the Internet, if you are a registered stockholder, unless otherwise noted, you may later revoke your proxy by:

| · | sending a written statement to that effect to the Company’s Corporate Secretary; |

| · | submitting a properly signed proxy card with a later date; |

| · | voting by telephone or via the Internet at a later time (if initially able to vote in that manner) so long as such vote is received by the applicable time and date set forth above for registered stockholders; or |

| · | voting in person at the annual meeting. |

If you hold your shares through a bank, broker, trustee or nominee and you have instructed the bank, broker, trustee or nominee to vote your shares, you must follow the directions received from you bank, broker, trustee or nominee to change those instructions.

CORPORATE GOVERNANCE

Director Independence

The Company’s Board currently consists of 14 members, all of whom are independent under the listing requirements of the NASDAQ Stock Market except for Richard B. Boyer, Ralph Burchianti and Ralph J. Sommers, Jr., who are our employees. In determining the independence of directors, the Board considered the various deposit, loan and other relationships that each director has with the Bank, including loans and lines of credit outstanding to Mark Fox, Charles R. Guthrie, CPA, Joseph Headlee, John LaCarte, Roberta Robinson Olejasz and David Pollock or to their related entities, as well as the transactions disclosed under “Other Information Relating to Directors and Executive Officers—Transactions with Related Persons”, but determined in each case that these relationships did not interfere with their exercise of independent judgment in carrying out their responsibilities as directors.

Board Leadership Structure and Board’s Role in Risk Oversight

Mr. Fox serves as Chairman of the Board and Mr. Guthrie serves as Vice Chairman of the Board. The Board believes this arrangement is appropriate given that more than a simple majority of the members of the Board are independent. The Board believes that the independent directors, working together, provide strong, independent oversight of the Company’s management and affairs. The Board has not designated a lead independent director.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. The Company faces several risks, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk and reputation risk. Management is responsible for the daily management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. To do this, the Chairman of the Board meets regularly with management to discuss strategy and the risks facing the Company. Senior management attends the Board meetings and is available to address any questions or concerns raised by the Board on risk management and any other matters. The independent members of the Board, working together, provide strong, independent oversight of the Company’s management and affairs through its standing committees and, when necessary, special meetings of independent directors.

| 3 |

Corporate Governance Policy

The Board has adopted a corporate governance policy to govern certain activities, including: the duties and responsibilities of directors; the composition, responsibilities and operations of the Board; the establishment and operation of Board committees; succession planning; convening executive sessions of independent directors; the Board’s interaction with management and third parties; and the evaluation of the performance of the Board and of the President and Chief Executive Officer.

Board Committees

The following table identifies the Board’s standing committees and their members as of December 31, 2019. All members of each committee are independent in accordance with the listing requirements of the NASDAQ Stock Market. Each committee operates under a written charter that is approved by the Board and that governs its composition, responsibilities and operation. Each committee reviews and reassesses the adequacy of its charter at least annually. The charter of each committee is available at the Investor Relations section of the Bank’s website (https://www.communitybank.tv).

| Director | Audit Committee | Compensation Committee | Nominating/ Corporate Governance Committee | |||

| Karl G. Baily | Vice Chairman | X | ||||

| Jonathan A. Bedway | X | X | ||||

| Richard B. Boyer | ||||||

| Ralph Burchianti | ||||||

| Mark E. Fox | X | X | X | |||

| William C. Groves | X | Chairman | ||||

| Charles R. Guthrie, CPA | Chairman | X | X | |||

| Joseph N. Headlee | X | Vice Chairman | ||||

| John J. LaCarte | X | Chairman | X | |||

| Patrick G. O’Brien(1) | ||||||

| Roberta Robinson Olejasz | X | X | ||||

| William G. Petroplus | X | |||||

| David F. Pollock | X | X | ||||

| Ralph J. Sommers, Jr. | ||||||

| John M. Swiatek | Vice Chairman | X | ||||

| Number of meetings in fiscal 2019 | 9 | 6 | 1 |

| (1) | Mr. O’Brien resigned from the Board effective January 8, 2020. |

Audit Committee

The Audit Committee is responsible for providing oversight relating to our consolidated financial statements and financial reporting process, systems of internal accounting and financial controls, internal audit function, annual independent audit and the compliance and ethics programs established by management and the Board. The Audit Committee is also responsible for engaging the Company’s independent registered public accounting firm and monitoring its conduct and independence. The Company’s Board has designated Charles R. Guthrie, CPA as an “audit committee financial expert” under the rules of the Securities and Exchange Commission.

| 4 |

Compensation Committee

The Compensation Committee approves the compensation objectives for the Company and the Bank, establishes the compensation for the Company’s and Bank’s executive management and conducts the performance review of the President and Chief Executive Officer. The Compensation Committee reviews and evaluates all components of compensation, including salaries, cash incentive plans, long-term incentive plans and various employee benefit matters. The Compensation Committee also administers and has discretionary authority over the issuance of equity awards under the Company’s equity incentive plan. Decisions by the Compensation Committee with respect to the compensation of executive officers, except for the issuance of equity awards, are approved by the full Board. The Committee also assists the Board in evaluating potential candidates for executive positions. With respect to other executive officers, the Chief Executive Officer recommends their annual compensation based on both individual and company-wide performance, subject to review and approval of the Compensation Committee and the Board. In addition, the Compensation Committee may delegate to management certain of its duties and responsibilities, including the adoption, amendment, modification or termination of the Bank’s tax-qualified retirement plans and health and welfare plans. The Compensation Committee also reviews the form and amount of compensation paid to our non-management directors from time to time.

The Compensation Committee has sole authority and responsibility under its charter to approve the engagement of any compensation consultant it uses and the fees for those services. The Compensation Committee did not engage the services of a compensation consultant during 2019.

Nominating/Corporate Governance Committee

The Nominating/Corporate Governance Committee assists the Board in: (i) identifying individuals qualified to become Board members, consistent with criteria approved by the Board; (ii) recommending to the Board the director nominees for the next annual meeting; (iii) implementing policies and practices relating to corporate governance, including implementation of and monitoring adherence to corporate governance guidelines; (iv) leading the Board in its annual review of the Board’s performance; and (v) recommending director nominees for each committee.

Minimum Qualifications for Director Nominees.The Nominating/Corporate Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board. A candidate must meet the eligibility requirements set forth in the Company’s Bylaws, which include an age limitation and a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board or committee governing documents.

If a candidate is deemed eligible for election to the Board, the Nominating/Corporate Governance Committee will then evaluate the following criteria in selecting nominees:

| · | contributions to the range of talent, skill and expertise of the Board; |

| · | financial, regulatory and business experience, knowledge of the banking and financial service industries, familiarity with the operations of public companies and ability to read and understand financial statements; |

| · | familiarity with the Company’s market area and participation in and ties to local businesses and local civic, charitable and religious organizations; |

| · | personal and professional integrity, honesty and reputation; |

| · | the ability to represent the best interests of the stockholders of the Company and the best interests of the institution; |

| · | the ability to devote sufficient time and energy to the performance of his or her duties; |

| · | independence as that term is defined under applicable Securities and Exchange Commission and stock exchange listing criteria; and |

| · | current equity holdings in the Company. |

The Nominating/Corporate Governance Committee also will consider any other factors it deems relevant, including diversity, competition, size of the Board and regulatory disclosure obligations.

With respect to nominating an existing director for re-election to the Board, the Nominating/Corporate Governance Committee will consider and review an existing director’s attendance and performance at Board meetings and at meetings of committees on which he or she serves; length of Board service; the experience, skills and contributions that the existing director brings to the Board; and independence.

| 5 |

Director Nomination Process. For purposes of identifying nominees for the Board, the Nominating/Corporate Governance Committee relies on personal contacts of the committee members and other members of the Board, as well as its knowledge of members of the communities served by the Bank. The Nominating/Corporate Governance Committee will also consider director candidates recommended by stockholders according to the policy and procedures set forth below. The Nominating/Corporate Governance Committee has not previously used an independent search firm to identify nominees.

In evaluating potential nominees, the Nominating/Corporate Governance Committee determines whether the candidate is eligible and qualified for service on the Board by evaluating the candidate under the criteria set forth above. If such individual fulfills these criteria, the Nominating/Corporate Governance Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Consideration of Stockholder Recommendations. It is the policy of the Nominating/Corporate Governance Committee to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board. The Nominating/Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board and the Nominating/Corporate Governance Committee does not perceive a need to increase the size of the Board. In order to avoid the unnecessary use of the Nominating/Corporate Governance Committee’s resources, the Nominating/Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders. To submit a recommendation of a director candidate to the Nominating/Corporate Governance Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Nominating/Corporate Governance Committee, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| 4. | As to the stockholder making the recommendation, the name and address of such stockholder as they appear on the Company’s records; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

| 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Nominating/Corporate Governance Committee at least 120 calendar days before the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Board and Committee Meetings

During the fiscal year ended December 31, 2019, the Company’s Board of Directors held 12 meetings; the Bank’s Board of Directors held 13 meetings and the Exchange Underwriters’ Board of Directors held 4 meetings. No director attended less than 75% of the total meetings of the Company’s and the Bank’s Board of Directors and the respective committees on which such director served during the fiscal year.

Director Attendance at Annual Meeting of Stockholders

The Board encourages each director to attend the Company’s annual meeting of stockholders. All of the Company’s directors then serving attended last year’s annual meeting of stockholders.

Code of Ethics and Business Conduct

The Company has adopted a code of ethics and business conduct which applies to all of the Company’s and the Bank’s directors, officers and employees. A copy of the code of ethics and business conduct is available on the Investor Relations section of the Bank’s website (https://www.communitybank.tv).

| 6 |

REPORT OF THE AUDIT COMMITTEE

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301,Communications with Audit Committee, which include matters related to the conduct of the audit of the Company’s consolidated financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm, required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management. In concluding that the registered public accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm who, in its report, express an opinion on the conformity of the Company’s consolidated financial statements to generally accepted accounting principles in the United States. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the Company’s consolidated financial statements are presented in accordance with generally accepted accounting principles in the United States, that the audit of the Company’s consolidated financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent registered public accounting firm is “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee has recommended to the Board, and the Board has approved, that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 for filing with the Securities and Exchange Commission. The Audit Committee also has approved, subject to stockholder ratification, the selection of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020.

Audit Committee of the Board of Directors of

CB Financial Services, Inc.

Charles R. Guthrie, CPA, Chairman

Karl G. Baily, Vice Chairman

Mark E. Fox

William C. Groves

John J. LaCarte

Roberta Robinson Olejasz

| 7 |

DIRECTOR COMPENSATION

The following table sets forth the compensation received by individuals who served as directors, and who were not also named executive officers, of the Company during the fiscal year ended December 31, 2019.

| Director | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards | Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | ||||||

| Karl G. Baily | $31,200 | $30,440 | $— | $— | $3,320 | $64,960 | ||||||

| Jonathan A. Bedway | 31,200 | 30,440 | — | — | 3,320 | 64,960 | ||||||

| Mark E. Fox | 51,200 | 30,440 | — | — | 3,320 | 84,960 | ||||||

| William C. Groves | 42,000 | 30,440 | — | — | 3,320 | 75,760 | ||||||

| Charles R. Guthrie, CPA | 44,800 | 30,440 | — | — | 3,320 | 78,560 | ||||||

| Joseph N. Headlee | 31,200 | 30,440 | — | — | 3,320 | 64,960 | ||||||

| John J. LaCarte | 34,800 | 30,440 | — | — | 3,320 | 68,560 | ||||||

| Roberta Robinson Olejasz | 31,200 | 30,440 | — | — | 3,320 | 64,960 | ||||||

| William G. Petroplus | 31,200 | 30,440 | — | — | 125,987 | (3) | 187,627 | |||||

| David F. Pollock | 34,800 | 30,440 | — | — | 3,320 | 68,560 | ||||||

| Ralph J. Sommers, Jr. | 37,292 | 30,440 | — | — | 61,313 | (2) | 129,045 | |||||

| John M. Swiatek | 31,200 | 30,440 | — | — | 3,320 | 64,960 | ||||||

| (1) | Reflects the aggregate grant date fair value for restricted stock awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718 – Share Based Payment, based on the closing price of the Company’s common stock on the grant date ($30.44 per share on December 14, 2019). Restricted stock awards were issued under the CB Financial Services, Inc. 2015 Equity Incentive Plan (the “2015 Equity Incentive Plan”) and vest over 5 years with 20% vesting on December 14, 2020. As of December 31, 2019, each listed director had outstanding stock awards of 1,600 shares.See “Executive Compensation – Equity Incentive Plan.” |

| (2) | Includes salary ($50,000) and bonus ($2,600) paid in accordance with the employment agreement between the Bank and Mr. Sommers. See“Executive Compensation – Employment Agreements.” |

| (3) | Includes four monthly payments on the First West Virginia (“FWVB”) former executive consulting agreement between the Bank and Mr. Petroplus that ended on April 30, 2019 and final lump sum payment. See“Consulting Agreement with Mr. Petroplus.” |

Consulting Agreement with Mr. Petroplus.Mr. Petroplus, the former President and Chief Executive Officer of FWVB, was a party to a consulting agreement with the Bank, that became effective April 30, 2018 upon the consummation of the merger of FWVB with and into the Company. Pursuant to the consulting agreement, Mr. Petroplus provided consulting services to the Bank for a 12-month period ending on May 1, 2019. As consideration for the foregoing, Mr. Petroplus was entitled to (1) $50,000, paid in equal monthly installments in arrears over the 12-month consulting period; and (2) a lump sum payment of $106,000, payable within 10 business days following the completion of the 12-month consulting period.

| 8 |

STOCK OWNERSHIP

The Company does not know of any person to be the beneficial owner of more than 5% of the Company’s outstanding common stock as of April 3, 2020.

The following table provides information as of April 3, 2020, about the shares of Company common stock that may be considered to be beneficially owned by each nominee for director, by each continuing director, by the executive officers named in the Summary Compensation Table and by all directors and executive officers of the Company as a group. A person may be considered to beneficially own any shares of common stock over which he has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting and investment power with respect to the shares shown and none of the named individuals has pledged any of his shares.

| Name | Number of Shares Owned | Percent of Common Stock Outstanding(1) | |||

| Directors: | |||||

| Karl G. Baily | 23,816 | (2)(5) | * | ||

| Jonathan A. Bedway | 15,249 | * | |||

| Richard B. Boyer | 23,042 | (5) | * | ||

| Ralph Burchianti | 75,406 | (4) | 1.4% | ||

| Mark E. Fox | 17,711 | (3)(5) | * | ||

| William C. Groves | 24,935 | (4) | * | ||

| Charles R. Guthrie, CPA | 18,223 | (3)(5) | * | ||

| Joseph N. Headlee | 25,556 | * | |||

| John J. LaCarte | 68,692 | (3) | 1.3% | ||

| Roberta Robinson Olejasz | 5,618 | * | |||

| William G. Petroplus | 12,574 | (2)(5) | * | ||

| David F. Pollock | 42,566 | * | |||

| Ralph J. Sommers, Jr. | 27,036 | * | |||

| John M. Swiatek | 18,364 | (5) | * | ||

| Executive Officers Who Are Not Directors: | |||||

| Barron P. McCune, Jr. | 75,631 | (2) | 1.4% | ||

| Jamie L. Prah, CPA | 12,703 | * | |||

| Jennifer L. George | 15,489 | (5) | * | ||

All Directors and Executive Officers as a Group: (17 persons) | 502,611 | 9.3% | |||

| * | Represents less than 1% of the Company’s outstanding shares. |

| (1) | Based on 5,393,712 shares of the Company’s common stock outstanding and entitled to vote as of April 3, 2020. |

| (2) | Includes shares owned indirectly through a spouse or child as follows: Mr. Baily – 400 shares, Mr. Petroplus – 2,683 shares and Mr. McCune – 5,330 shares. |

| (3) | Includes shares held by a corporation or limited partnership as follows: Mr. Fox – 725 shares, Mr. Guthrie – 48 shares and Mr. LaCarte – 28,656 shares. |

| (4) | Includes shares owned indirectly through an investment club as follows: Mr. Groves – 316 shares and Mr. Burchianti – 313 shares. The investment club, in which Messrs. Groves and Burchianti each has approximately 14% interest, owns a total of 2,200 shares. |

| (5) | Includes shares owned through a retirement account as follows: Mr. Baily – 1,850 shares, Mr. Boyer – 11,989 shares, Mr. Fox –5,498 shares, Mr. Guthrie – 5,817 shares, Mr. Petroplus – 450 shares, Mr. Swiatek – 6,334 shares and Ms. George – 3,047 shares. |

| 9 |

ITEMS OF BUSINESS TO BE VOTED ON BY STOCKHOLDERS

Item 1 — Election of Directors

The Board consists of 14 members. The Board is divided into three classes, each with three-year staggered terms, with approximately one-third of the directors elected each year.

The five nominees who have been nominated for election at the annual meeting to serve for a three-year term or until their successors have been duly elected and qualified are: Mark E. Fox, William C. Groves, John J. LaCarte, William G. Petroplus and David F. Pollock. The nominees are currently directors of the Company and the Bank.

Unless you indicate that your shares should not be voted for one or more nominee(s), the Board intends that the proxies solicited by it will be voted for the election of all the Board’s nominees. If any nominee is unable to serve, the persons named in the proxy card intend to vote your shares to approve the election of any substitute proposed by the Board. At this time, we know of no reason why any nominee might be unable to serve.

The Board unanimously recommends that stockholders vote “FOR” all the nominees.

Information regarding the nominees for election at the annual meeting is provided below. Unless otherwise stated, each individual has held his current occupation for the last five years. The age indicated for each individual is as of December 31, 2019. The starting year of service as a director includes service on the Board of Directors of the Bank, on FedFirst Financial Corporation (“FedFirst”) and its former subsidiary First Federal Savings Bank or on FWVB and its former subsidiary Progressive Bank, N.A., as applicable.

Board Nominees for Terms Ending in 2023

Mark E. Fox. Mr. Fox, age 61, has served as a director since 1998 and was appointed Chairman of the Board in May 2019 after serving as Vice Chairman since July 2018. Mr. Fox has more than 36 years’ experience as the owner and manager of Fox Ford, Inc., a local car dealership. Since 2013, he has served as the President of Fox Ford, Inc. Before that time, he served as Vice President of Fox Ford, Inc. He holds a bachelors’ degree in accounting and a Masters of Business Administration (“MBA”) degree from Waynesburg University.

Mr. Fox’s experience in managing a local business provides the Board with insight into economic and business trends in the Bank’s market area.

William C. Groves. Mr. Groves, age 78, has served as a director since 1996. Since 1980 he has served as the President of Haulit Trucking, Inc. Mr. Groves previously served as township supervisor of Cumberland Township from 2003 until 2019.

Mr. Groves’s experience in managing a local business and his long-standing ties to the local community provide the Board with valuable insight on the Bank’s local market area.

John J. LaCarte. Mr. LaCarte, age 53, earned his MBA from the University of Rochester and brings broad entrepreneurial, strategic and corporate governance experience and expertise to the Board. He is the President of Washington County based LaCarte Enterprises, Inc., a holding company that owns and operates various multi-state business interests that include Model Dry Cleaners, LLC, Model Uniforms, LLC, Model Apparel, LLC and Stoney’s Brewing Company. Additionally, Mr. LaCarte is President of LaCarte Development Company, an enterprise focused on the development and ownership of commercial properties in Western Pennsylvania and North Eastern Ohio. An active volunteer in his local community, Mr. LaCarte serves on various non-profit boards and foundations.

Mr. LaCarte was elected as a director of FedFirst in 1998 and appointed as the Chairman of the Board in 2004. During his tenure, FedFirst successfully completed the acquisition of a wholly owned insurance agency, two public stock offerings and the successful merger with CB Financial in 2014.

William G. Petroplus, Mr. Petroplus, age 72, served as a director of FWVB since 1998 and served as FWVB’s Chairman of the Board of Directors since 2016. Mr. Petroplus also served as a director of Progressive Bank and was a director of Progressive Bank since 1986. Prior to his appointment as President and Chief Executive Officer, he was appointed as the Interim President and Chief Executive Officer of FWVB and Progressive Bank in December 2013. Mr. Petroplus had previously served as Chairman of the Nominating Committee and as a member of the Corporate Governance/Human Resource Compensation Committee of FWVB prior to his appointment as Interim President and Chief Executive Officer.

Mr. Petroplus is a graduate of West Virginia University and the West Virginia University College of Law. Mr. Petroplus has 45 years’ experience as an attorney. He has been with the law firm Petroplus & Gaudino, PLLC since 1999. His legal background and training provide him with an excellent framework within which to offer advice and counsel in a highly regulated banking industry. He also is the sole member of GWP Realty LLC, a real estate investment and rental limited liability company. Mr. Petroplus’s expertise in laws and regulations, that pertain to, but are not limited to real estate law, commercial lending, corporate law and fiduciary matters, contribute insight to the Board on such matters.

| 10 |

David F. Pollock. Mr. Pollock, age 65, has served as a director since 2006. Mr. Pollock has been a practicing attorney for over 34 years. He is a Managing Partner in the law firm of Pollock Morris, LLC and, since 2008, has been a Managing Partner of P&S Development, LLC, a real estate development company.

Mr. Pollock’s legal knowledge and real estate development experience in the Bank’s market area significantly contribute to the depth of the Board.

Directors Continuing in Office

The following directors have terms ending in 2021:

Karl G. Baily. Mr. Baily, age 68, has served as a director since 1996. He retired as President of Coldwell Banker Baily Real Estate and Vice President of Baily Insurance Agency, Inc. in 2012.

Mr. Baily provides the Board with long-standing knowledge of the local real estate market and the local community.

Ralph Burchianti.Mr. Burchianti, age 64, was appointed to director in 2019 and has been employed by the Bank since August 1985 and serves as Senior Executive Vice President – Chief Credit Officer.

Mr. Burchianti provides the Board with knowledge of our geographic footprint and his extensive management and leadership of loan administration and credit culture.

Roberta Robinson Olejasz.Ms. Olejasz, age 48, served as a director of FWVB and Progressive Bank since 2014. Ms. Olejasz has been the dealer operator of Bob Robinson Chevrolet-Buick-GMC-Cadillac Inc. since 2005 and serves as the finance manager of the dealership. Ms. Olejasz is a director and past Chairman of the West Virginia Automobile and Truck Dealers Association, a member of the visiting committee of the West Virginia University College of Business and Economics, and a board member of the Wheeling Chamber of Commerce. Ms. Olejasz received a Bachelor of Science degree in Management from Virginia Commonwealth University and a MBA from West Virginia University.

Ms. Olejasz brings a strong sense of executive management and leadership to the Board. In addition, Ms. Olejasz’s experience as the dealer operator of Bob Robinson Chevrolet-Buick-GMC-Cadillac Inc. equips her to understand and guide management decisions and actions relating to planning, risk management, marketing and capital management.

Ralph J. Sommers, Jr.Mr. Sommers, age 80, has served as a director since 1983. He previously served as Chairman of the Board from 1999 until May 2019 and as Chief Executive Officer of the Bank from 1982 to 2005.

Mr. Sommers’ long history with the Bank and his knowledge of its market area are valuable assets to the Board.

John M. Swiatek. Mr. Swiatek, age 62, served as a director of FedFirst since 2010. He is currently a partner in the Swiatek Melone Group, a strategic marketing, communications and public relations practice. Previously, he served as Managing Director of Innovation Sports & Entertainment, a division of The Innovation Group. Before joining The Innovation Group in 2011, he was the Director of the Sports, Entertainment and Marketing division of GSP Consulting Corporation. Mr. Swiatek also co-founded and served as the President and Managing Partner of the Washington Wild Things, a minor league professional baseball team in Washington, Pennsylvania, from 2001 until 2009.

Mr. Swiatek brings to the Board extensive business background in finance, management and marketing. In addition, he is familiar with our market areas as well as the surrounding greater Pittsburgh metropolitan area.

The following directors have terms ending in 2022:

Jonathan A. Bedway, Mr. Bedway, age 54, served as a director of FWVB and Progressive Bank since 2014. Mr. Bedway is the founder and President of Bedway Development Corporation, a commercial construction contractor and a commercial real estate developer. Mr. Bedway is also the President of the following entities: Double J Real Estate, LLC; Bedway Group, Inc.; Broadway Realty; Bedway Land & Minerals; and Groway, LLC. Mr. Bedway serves on the Board of Wheeling Country Day School where he is the President of the Board of Trustees. Mr. Bedway is a graduate of The Linsly School and West Virginia University with a Bachelor of Science degree.

Mr. Bedway’s 28 years of experience as the owner of a successful construction and development company and his experience and knowledge of the local and regional commercial real estate market are beneficial in reviewing and attracting commercial loans.

Richard B. Boyer. Mr. Boyer, age 61, served as a director of FedFirst since 2002. He has been the President of Exchange Underwriters, Inc. since 1989.

As President of Exchange Underwriters, Mr. Boyer brings to the Board knowledge of the insurance industry and the operations of Exchange Underwriters, which he has managed for over 27 years.

| 11 |

Charles R. Guthrie, CPA. Mr. Guthrie, age 60, has served as a director since 2005. He is the President of Guthrie Belczyk and Associates, P.C., an accounting firm. Until 2012, Mr. Guthrie served as a registered representative of LPL, an investment company. Mr. Guthrie has been a Certified Public Accountant since 1982. He serves on committees of various community organizations in the Bank’s local market area.

Mr. Guthrie’s expertise in accounting and corporate management and his community involvement are valuable assets to the Board.

Joseph N. Headlee. Mr. Headlee, age 70, has served as a director since 2002. Until August 2018, Mr. Headlee was a partner in Wayne Lumber Company and remains a partner in the Headlee Partnership. He has held these positions since 1982 and 1980, respectively. Mr. Headlee also has served as Treasurer of Franklin Township Sewage Authority.

Mr. Headlee brings to the Board experience in business management and marketing and familiarity with the Bank’s market area.

Executive Officers Who Are Not Directors

Below is information regarding our executive officers who are not directors of the Company or the Bank. The individuals have held his or her current position for at least the last five years, unless otherwise stated. The age presented is as of December 31, 2019.

Barron P. McCune, Jr. Mr. McCune, age 66, has been employed by the Company and the Bank on an interim basis since January 2020 and serves as President and Chief Executive Officer. Mr. McCune previously served as a director of the Company and the Bank from 1992 until his retirement in January 2019, Vice Chairman of the Company from 2006 until his retirement in January 2019, Chief Executive Officer of the Company and the Bank from 2005 until his retirement in June 2018 and President of the Company and the Bank from 1999 until May 2017. Before joining the Bank in 1992, Mr. McCune practiced law for 20 years and performed legal work for the Bank. He holds a bachelor’s degree from Duke University and a law degree from the University of Denver School of Law.

Jamie L. Prah, CPA. Mr. Prah, age 49, has been employed by the Company and the Bank since May 2019, and serves as Executive Vice President and Chief Financial Officer after previously serving as Executive Vice President and Chief Administrative Officer of the Company and the Bank. Previously, Mr. Prah served as Chief Executive Officer, from November 2015 until April 2019, and Senior Vice President, from May 2015 until November 2015, of Union Building and Loan Savings Bank. Mr. Prah also served as Interim Assistant Chief Financial Officer of the Bank from November 2014 until December 2014 to assist with certain transition matters related to the completion of the merger of FedFirst with the Company and the merger of First Federal Savings Bank, the wholly-owned subsidiary of FedFirst, with the Bank, both effective on October 31, 2014. Prior to the merger, Mr. Prah served as Senior Vice President and Chief Financial Officer of FedFirst and First Federal Savings Bank since 2011.

Jennifer L. George. Ms. George, age 47, has served as Executive Vice President and Chief Operations Officer of the Bank since May 2019. Ms. George joined the Bank in October 2014 as part of the FedFirst merger and served as Senior Vice President of Retail, Human Resources and Compliance. Previously, Ms. George served as Senior Vice President and Chief Risk Officer and Vice President of Bank Operations with First Federal Savings Bank.

Item 2 — Ratification of the Appointment of the Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed Baker Tilly Virchow Krause, LLP to serve as the Company’s independent registered public accounting firm for the 2020 fiscal year, subject to ratification by stockholders. A representative of Baker Tilly Virchow Krause, LLP is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he desire to do so.

If the ratification of the appointment of the independent registered public accounting firm is not approved by a majority of the votes cast at the annual meeting, the Audit Committee may consider other independent registered public accounting firms.

The Board unanimously recommends that stockholders vote “FOR” the ratification of the appointment of Baker Tilly Virchow Krause, LLP to serve as the Company’s independent registered public accounting firm for the 2020 fiscal year.

| 12 |

Audit Fees. Baker Tilly Virchow Krause, LLP has served as the Company’s independent registered public accounting firm since October 1, 2014. The following table sets forth the fees that it billed to the Company for the fiscal years ended December 31, 2019 and 2018, respectively.

| Fiscal 2019 | Fiscal 2018 | |||||||

| Audit Fees(1) | $ | 298,000 | $ | 167,200 | ||||

| Audit-Related Fees(2) | 12,300 | 110,869 | ||||||

| Tax Fees(3) | 30,610 | 17,899 | ||||||

| All Other Fees(4) | 10,130 | 10,500 | ||||||

| Total Fees | $ | 351,040 | $ | 306,468 | ||||

| (1) | Includes fees incurred in connection with the integrated audit of the annual consolidated financial statements and audit of internal controls over financial reporting and the review of the interim consolidated financial statements included in the quarterly reports filed with the SEC, consents issued in connection with filing registration statements, as well as work generally only the independent auditor can reasonably be expected to provide, such as statutory audits, consents and assistance with and review of documents filed with the SEC and administrative and out of pocket expenses. |

| (2) | Includes fees for audit of opening balance sheet and purchase accounting adjustments related to the merger with FWVB and audit of employee benefit plans. |

| (3) | Includes fees for tax compliance services including preparation of federal and state tax returns, planning advice and completion of Form 8937 filing requirement for the FWVB merger. |

| (4) | Includes fees for Cost Segregation Study engagement performed on the Barron P. “Pat” McCune Jr. Corporate Center. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm.The Audit Committee has adopted a policy for approval of audit and permitted non-audit services by the Company’s independent registered public accounting firm. The Audit Committee will consider annually and approve the provision of audit services by the independent registered public accounting firm and, if appropriate, approve the provision of certain defined audit and non-audit services. The Audit Committee also will consider on a case-by-case basis and, if appropriate, approve specific engagements.

Any proposed specific engagement may be presented to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, to the Audit Committee or one or more of its members. The member or members to whom such authority is delegated shall report any specific approval of services at its next regular meeting. The Audit Committee will regularly review summary reports detailing all services being provided to the Company by its independent registered public accounting firm.

During the fiscal year ended December 31, 2019, all audit-related fees, tax fees, and all other fees set forth in the table above were approved by the Audit Committee.

Item 3 – Advisory (Non-Binding) Vote to Approve the Compensation of Named Executive Officers

The federal securities laws require the Company to hold a stockholder advisory (non-binding) vote on the compensation of its named executive officers, as described in the tabular disclosure regarding named executive officer compensation and the accompanying narrative disclosure in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s stockholders the opportunity to endorse or not endorse the Company’s executive compensation program and policies through a vote on the following resolution:

“Resolved, that the Company’s stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as described in the tabular disclosure regarding named executive officer compensation and the accompanying narrative disclosure in this proxy statement.”

Because the vote is advisory, it will not be binding upon the Company or the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board unanimously recommends a vote “FOR” approval of the compensation of the Company’s named executive officers.

| 13 |

Item 4 – Advisory (Non-Binding) Vote on Frequency of Stockholder Advisory Vote on the Compensation of Named Executive Officers

The federal securities laws also require the Company to hold, at least once every six years, a stockholder advisory (non-binding) vote on the frequency of a stockholder advisory vote on the compensation of the Company’s named executive officers. This proposal gives the Company’s stockholders the opportunity to determine whether the frequency of a stockholder advisory (non-binding) vote on the compensation of the named executive officers will be every one, two or three years. Stockholders may also abstain from voting. The Company will hold the next frequency vote no later than at the Company’s 2026 Annual Meeting of Stockholders.

Because the vote is advisory, it will not be binding on the Company or the Board. However, the Compensation Committee of the Board will take into account the outcome of the vote when considering the frequency of a stockholder vote on executive compensation.

The Board has determined that having a stockholder advisory (non-binding) vote on the compensation of the named executive officers every year is the best approach because the Compensation Committee reviews and determines the primary elements of compensation, namely salary and cash bonus, each year.

The Board unanimously recommends conducting a vote to approve the compensation of the named executive officers every year.Note: Shareholders are not voting to approve or disapprove of this recommendation.

EXECUTIVE COMPENSATION

Summary Compensation Table. The following information is furnished for the principal executive officer of the Company or its subsidiaries and the two most highly-compensated executive officers (other than the principal executive officer) of the Company and its subsidiaries whose total compensation for the fiscal year ended December 31, 2019, exceeded $100,000. These individuals are sometimes referred to in this proxy statement as the “named executive officers.”

| Name and | Stock | Option | All Other | ||||||||||

| Principal Position | Year | Salary | Bonus | Awards(1) | Awards(1) | Compensation(3) | Total | ||||||

| Patrick G. O’Brien | 2019 | $403,375 | $ ― | $76,100 | $ ― | $35,799 | $515,274 | ||||||

| Former President & Chief | 2018 | 365,449 | 50,000 | 25,450 | ― | 45,732 | 486,631 | ||||||

| Executive Officer(2) | 2017 | 257,861 | 30,943 | ― | 25,461 | 43,466 | 357,731 | ||||||

| Ralph Burchianti | 2019 | $243,764 | $32,851 | $45,660 | $ ― | $44,293 | $366,568 | ||||||

| Senior Executive Vice | 2018 | 236,505 | 25,000 | 15,270 | ― | 31,602 | 308,377 | ||||||

| President & Chief | 2017 | 195,191 | 22,661 | ― | 20,369 | 27,493 | 265,714 | ||||||

| Credit Officer | |||||||||||||

| Richard B. Boyer | 2019 | $345,738 | $36,760 | $30,440 | $ ― | $48,721 | $461,659 | ||||||

| Senior Vice President of | 2018 | 275,251 | 25,000 | 19,088 | ― | 77,113 | 396,452 | ||||||

| Insurance Operations | 2017 | 251,396 | 44,186 | 23,063 | 10,495 | 66,063 | 395,203 | ||||||

| (1) | These amounts represent the grant date fair value of the awards issued to the named executive officers under the 2015 Equity Incentive Plan, as determined in accordance with applicable accounting standards. Although the full grant date fair value of the stock option awards is reflected in the above table, the actual value of the stock options, if any, realized by the named executive officers will depend on the extent to which the market value of the Company common stock exceeds the exercise price of the stock option on the date of exercise. Accordingly, there is no assurance that the value realized by a named executive officer will be at or near the estimated value reflected in the above table. |

| (2) | Barron P. McCune, Jr. succeeded Mr. O’Brien as President and Chief Executive Officer effective January 8, 2020. |

| (3) | The following table details the amounts reported in the “All Other Compensation” column for 2019. The table may exclude perquisites which did not exceed $10,000 in the aggregate for each named executive officer. |

| Mr. O’Brien | Mr. Boyer | Mr. Burchianti | ||||||||||

| Employer contributions to 401(k) plan | $ | 14,000 | $ | 14,000 | $ | 35,025 | ||||||

| Employer insurance premiums | 16,207 | 24,933 | 7,967 | |||||||||

| Company car | 2,542 | 6,205 | — | |||||||||

| Cell phone | 2,012 | 1,374 | 360 | |||||||||

| Cash in lieu of dividends on restricted stock awards | 960 | 720 | 576 | |||||||||

| Imputed income on split dollar life insurance | 78 | 1,489 | 365 | |||||||||

| Total | $ | 35,799 | $ | 48,721 | $ | 44,293 | ||||||

| 14 |

Employment Agreements.The Bank has entered into employment agreements with Messrs. McCune, Sommers, Burchianti and Boyer (referred to below as the “executives” or “executive”). Exchange Underwriters, Inc. is also a party to the employment agreement with Mr. Boyer.

The employment agreement with Mr. McCune was entered into on January 8, 2020 in connection with his appointment as President and Chief Executive Officer of the Company and the Bank. Mr. McCune’s employment agreement has a one-year term and provides for an annual base salary of $402,000 and a signing bonus of $50,000. In addition, Mr. McCune is entitled to participate in the bonus programs and benefit plans that are made available by the Bank to management employees. Mr. McCune will be reimbursed for all reasonable business expenses incurred, including the reasonable cost of Mr. McCune and his spouse to travel between his principal place of employment with the Bank and his permanent residence in Wyoming as necessary and appropriate. Mr. McCune will also be entitled to use of a company-purchased automobile and will be reimbursed for all operating expenses of the automobile. Prior to the expiration of the term, either the Bank or Mr. McCune may terminate Mr. McCune’s employment relationship for any reason (or no reason) by providing the other party with 30 days’ advance written notice. Upon such event, the Bank’s sole obligation under the employment agreement would be to pay any accrued but unearned compensation earned by Mr. McCune through the date of termination, provided, however that the Board may, at its sole discretion, pay Mr. McCune a bonus pursuant the Bank’s bonus programs for which Mr. McCune is a participant.

The employment agreements for Messrs. Sommers, Burchianti and Boyer have a term that begins October 31, 2014 and continues 36 months after May 1, 2015. On each anniversary date (which is defined as May 1 of each calendar year), each employment agreement will extend for one year such that the remaining term will be for 36 months thereafter, provided that disinterested members of the Bank’s Board of Directors conduct a comprehensive performance evaluation of the executive and affirmatively approve the extension.

Each employment agreement provides for an annual base salary rate of $50,000, $280,600 and $255,759 for Messrs. Sommers, Burchianti and Boyer, respectively. In addition to base salary, each executive (except Mr. Boyer) is entitled to participate in bonus programs and benefit plans that are made available by the Bank to management employees. In lieu of participating in the Bank’s bonus programs, Mr. Boyer is entitled to receive: (i) 25% of all first year commissions generated by any salesperson of Exchange Underwriters, Inc. (including himself) from the sales of new insurance policies, which the commissions earned will be paid on a monthly basis; and (ii) an annual bonus equal to 20% of the year-over-year growth in Exchange Underwriters, Inc.’s annual audited net income, excluding any net income effect from the completion of any agency acquisition.

Each executive will be reimbursed for all reasonable business expenses incurred. Moreover, Messrs. Sommers and Boyer are entitled to use of a company-purchased automobile and will be reimbursed for all operating expenses of the automobile.

In the event of the executive’s involuntary termination of employment for reasons other than cause, disability or death, or if the executive resigns during the term of the employment agreement for “good reason,” The Bank will provide the executive with the following severance benefits:

| · | continued base salary payments (at the rate in effect as of the date of determination) for the greater of 12 months or the remaining term of the employment agreement, payable in accordance with regular payroll practices; and |

| · | continued life insurance and non-taxable medical and dental coverage, which will end upon the earlier of the completion of the remaining term of the employment agreement or the date on which the executive receives substantially similar benefits from another employer. |

For purposes of the employment agreements, “good reason” is defined as: (i) a material reduction in the executive’s base salary or benefits (other than a reduction that is part of a good faith, overall reduction applicable to all employees); (ii) a material reduction in the executive’s authorities, duties or responsibilities; or (iii) a material breach of the employment agreement by the Bank.

Upon the occurrence of the executive’s termination for any reason (other than for cause) on or after the effective time of a change in control of the Company or the Bank, then in lieu of the severance benefits immediately above, the Bank or any successor will provide the executive with the following severance benefits:

| · | a benefit equal to three times the executive’s highest annual rate of base salary earned during the calendar year of the executive’s date of termination or either of the three calendar years immediately preceding the date of termination, payable in equal installments according to regular payroll practices; and |

| · | continued life insurance and non-taxable medical and dental coverage until the earlier of: (i) three years after the executive’s date of termination; or (ii) the date on which the executive receives substantially similar benefits from another employer. |

Upon any termination of employment (except following a change in control), each executive is required to adhere to non-competition and non-solicitation covenants for one year.

| 15 |

Separation and Release Agreement with Mr. O’Brien. In connection with Mr. O’Brien’s resignation as President and Chief Executive Officer, the Company, the Bank and Mr. O’Brien entered into a Separation and Release Agreement dated January 8, 2020. Pursuant to the Separation and Release Agreement, the Bank will pay Mr. O’Brien: (1) a gross amount of $450,000, payable in 26 equal bi-weekly installments; and (2) to the extent that Mr. O’Brien elects to continue to participate in the Bank’s group health insurance plan, 12 equal monthly installment payments equal to the monthly COBRA premium in effect for the level of coverage in effect for Mr. O’Brien under the Bank’s group health plan. The parties agreed that Mr. O’Brien would provide consulting services until January 31, 2020, during which he was compensated $1,019.65 per day. The Separation and Release Agreement requires that Mr. O’Brien adhere to non-competition and non-solicitation covenants for one year following his date of resignation.

Non-Equity Bonus Program. The Bank maintains a bonus program designed to align the interests of employees of the Bank with the overall performance of CB Financial and the Bank. Employees selected by the Board of Directors are eligible to participate in the bonus program. Each employee’s bonus amount is designated as a percentage of base salary and is determined based on the satisfaction of objective performance targets related to net income, loan growth, and efficiency ratio, and, in certain cases, subjective performance targets related to stockholder value and brand enhancement. Each factor of the bonus calculation is weighted with net income accounting for 50%, loan growth and efficiency ratio accounting for 20% each, and stockholder value and brand enhancement accounting for 5% each.

Split Dollar Agreements. The Bank has entered into split dollar life insurance agreements with each Messrs. Sommers and Burchianti. Under each agreement, the executive’s designated beneficiary will be entitled to share in the proceeds under a life insurance policy owned by the Bank on the life of the executive. The death benefit payable to each executive is $200,000, provided, however that the death benefit must not exceed the executive’s net-at-risk portion of the proceeds (which is the difference between the cash surrender value of the policy and the total proceeds payable under the policy upon the death of the insured). If the executive’s termination occurs subsequent to a change in control of the Bank, the executive will be 100% vested in his death benefit. The Bank is the sole beneficiary of any death proceeds remaining after the executive’s death benefit has been paid to his designated beneficiary.

The Bank also has assumed the split dollar life insurance agreement between First Federal Savings Bank and Mr. Boyer in connection with the Company’s merger with FedFirst.This agreement provides Mr. Boyer with a cash payment if he dies while in service with the Bank. Under the terms of the agreement, the Bank is the owner of and pays all the premiums on the life insurance policy under which Mr. Boyer is insured. Under the agreement, upon Mr. Boyer’s death his designated beneficiary is entitled to $1,000,000 if he dies before age 65 and $500,000 if he dies after age 65. The Bank is entitled to any remaining insurance proceeds. If Mr. Boyer terminates his employment before attaining his normal retirement age, his division of the insurance proceeds will be prorated based on his years of service with the Bank.

401(k) Plan. The Bank maintains the 401(k) Profit Sharing Plan, a tax-qualified defined contribution retirement plan (the “401(k) Plan”), for all employees who have satisfied the 401(k) Plan’s eligibility requirements. Each eligible employee can begin participating in the 401(k) Plan on the first day of the calendar quarter following the attainment of age 18 and completion of six months of service.

A participant may contribute up to 100% of his or her compensation to the 401(k) Plan on a pre-tax or post-tax (referred to as a “Roth” contribution) basis, subject to the limitations imposed by the Internal Revenue Code. For 2019, the salary deferral contribution limit was $19,000 provided, however, that a participant over age 50 may contribute an additional $6,000 to the 401(k) Plan. Each plan year, the Bank makes a matching contribution, based on each participant’s salary deferral contribution. The matching contribution formula is currently a 25% match of employee 401(k) Plan deferrals (if any) up to the first 4% of compensation deferred. In addition to salary deferral contributions, the 401(k) Plan provides that the Bank will make a safe harbor employer contribution to each eligible participant’s account equal to 3% of the participant’s compensation earned during the plan year (referred to as a “safe harbor contribution”). A participant is always 100% vested in his or her salary deferral and safe harbor contributions.