Investor Presentation October 2021

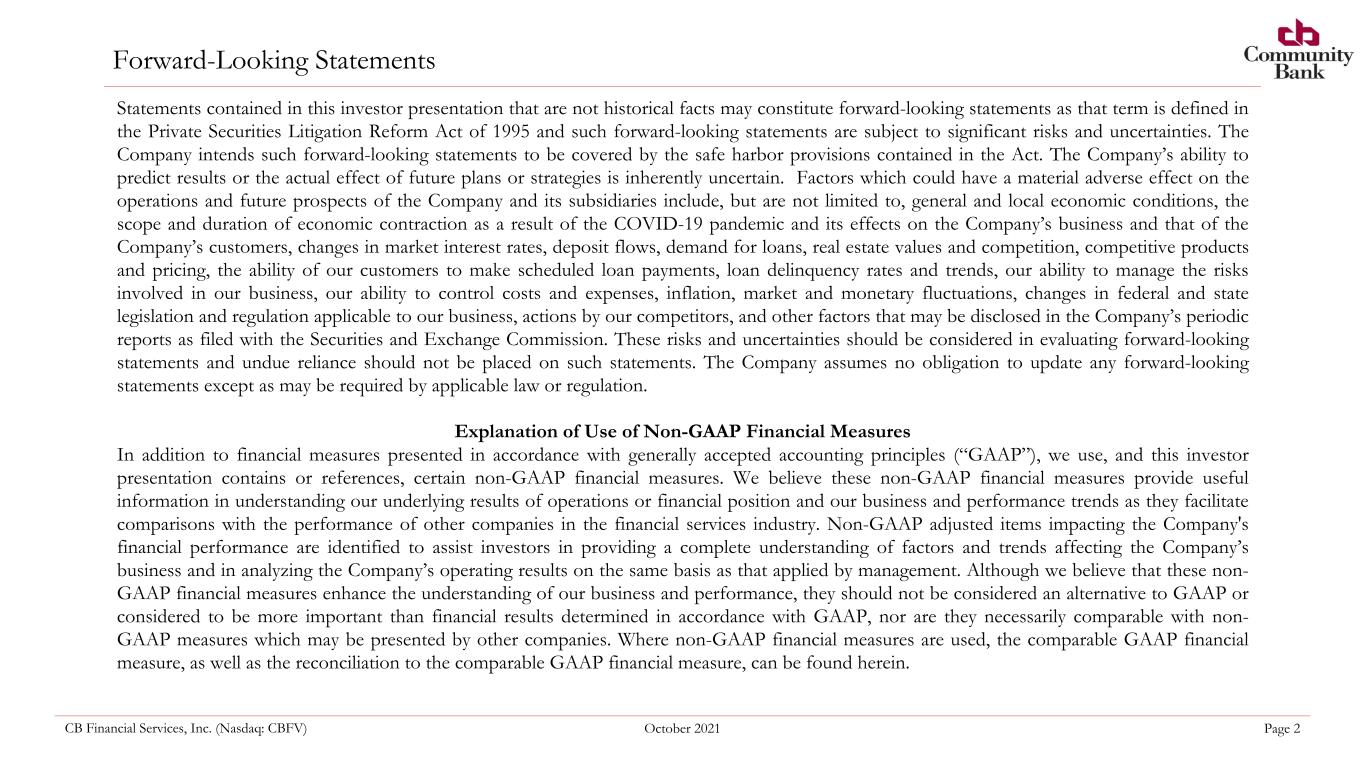

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 2 Forward-Looking Statements Statements contained in this investor presentation that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and such forward-looking statements are subject to significant risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, general and local economic conditions, the scope and duration of economic contraction as a result of the COVID-19 pandemic and its effects on the Company’s business and that of the Company’s customers, changes in market interest rates, deposit flows, demand for loans, real estate values and competition, competitive products and pricing, the ability of our customers to make scheduled loan payments, loan delinquency rates and trends, our ability to manage the risks involved in our business, our ability to control costs and expenses, inflation, market and monetary fluctuations, changes in federal and state legislation and regulation applicable to our business, actions by our competitors, and other factors that may be disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements except as may be required by applicable law or regulation. Explanation of Use of Non-GAAP Financial Measures In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), we use, and this investor presentation contains or references, certain non-GAAP financial measures. We believe these non-GAAP financial measures provide useful information in understanding our underlying results of operations or financial position and our business and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Non-GAAP adjusted items impacting the Company's financial performance are identified to assist investors in providing a complete understanding of factors and trends affecting the Company’s business and in analyzing the Company’s operating results on the same basis as that applied by management. Although we believe that these non- GAAP financial measures enhance the understanding of our business and performance, they should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non- GAAP measures which may be presented by other companies. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found herein.

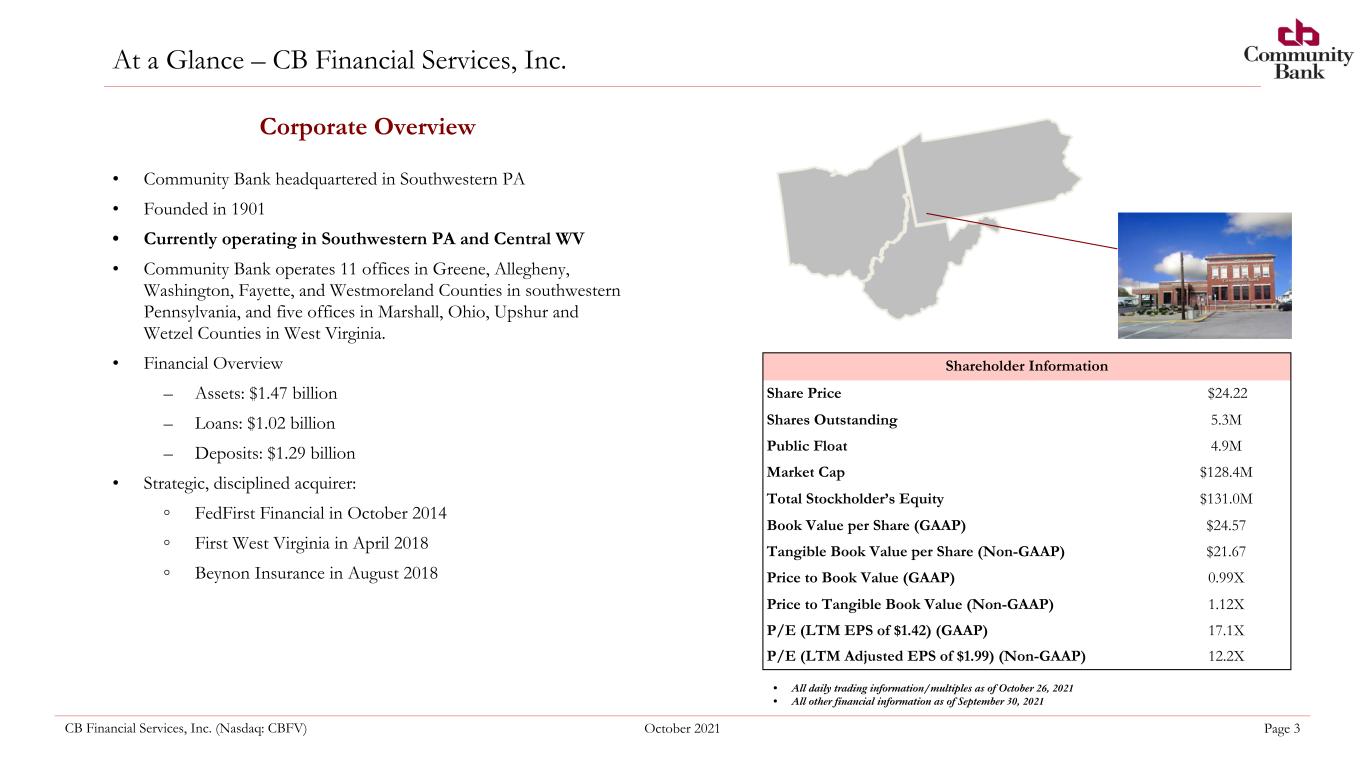

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 3 At a Glance – CB Financial Services, Inc. Shareholder Information Share Price $24.22 Shares Outstanding 5.3M Public Float 4.9M Market Cap $128.4M Total Stockholder’s Equity $131.0M Book Value per Share (GAAP) $24.57 Tangible Book Value per Share (Non-GAAP) $21.67 Price to Book Value (GAAP) 0.99X Price to Tangible Book Value (Non-GAAP) 1.12X P/E (LTM EPS of $1.42) (GAAP) 17.1X P/E (LTM Adjusted EPS of $1.99) (Non-GAAP) 12.2X • Community Bank headquartered in Southwestern PA • Founded in 1901 • Currently operating in Southwestern PA and Central WV • Community Bank operates 11 offices in Greene, Allegheny, Washington, Fayette, and Westmoreland Counties in southwestern Pennsylvania, and five offices in Marshall, Ohio, Upshur and Wetzel Counties in West Virginia. • Financial Overview – Assets: $1.47 billion – Loans: $1.02 billion – Deposits: $1.29 billion • Strategic, disciplined acquirer: ◦ FedFirst Financial in October 2014 ◦ First West Virginia in April 2018 ◦ Beynon Insurance in August 2018 Corporate Overview • All daily trading information/multiples as of October 26, 2021 • All other financial information as of September 30, 2021

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 4 Community Bank Mission Statement Community Bank is an exceptional, independent financial institution. We will provide our customers with valuable, appropriate products and outstanding personal service. Community Bank strives to continue to grow and continue to create value for our shareholders. Our employees will be treated fairly and given opportunities for personal growth. We will be closely involved in improving our communities.

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 5 Third Quarter 2021: Goals and Accomplishments 01 03 02 Well-positioned to capitalize on continued U.S. housing market recovery Continued Progress on Optimization Efforts – Significant reduction in non-interest expense and salaries while still expanding revenue producing initiatives – Finalized Purchase and Assumption Agreement to sell two West Virginia locations (closing expected in Q4 2021) Grow Loans and Deposits – Total loans, including loans held for sale and excluding PPP loans, increased $17.0 million, or 7.0% annualized, from June 30, 2021 – Loan growth is paramount given a low-interest rate environment and excess cash – Deposits grew both year-over-year and quarter-over-quarter Active Stock Buyback Plan – On June 10, 2021, CB authorized a program to repurchase up to $7.5 million of the Company's outstanding common stock – As of October 25, 2021, the Company had repurchased $3.1 million of the Company's common stock (135,968 shares) at an average price of $23.02 per share 02 Increased Securities Purchases to Utilize Available Liquidity – Increased $76.0 million, or 52.3%, to $221.4 million at September 30, 2021 – Expected $650,000 increase in pre-tax income, or 6bps of incremental margin to bottom line annually

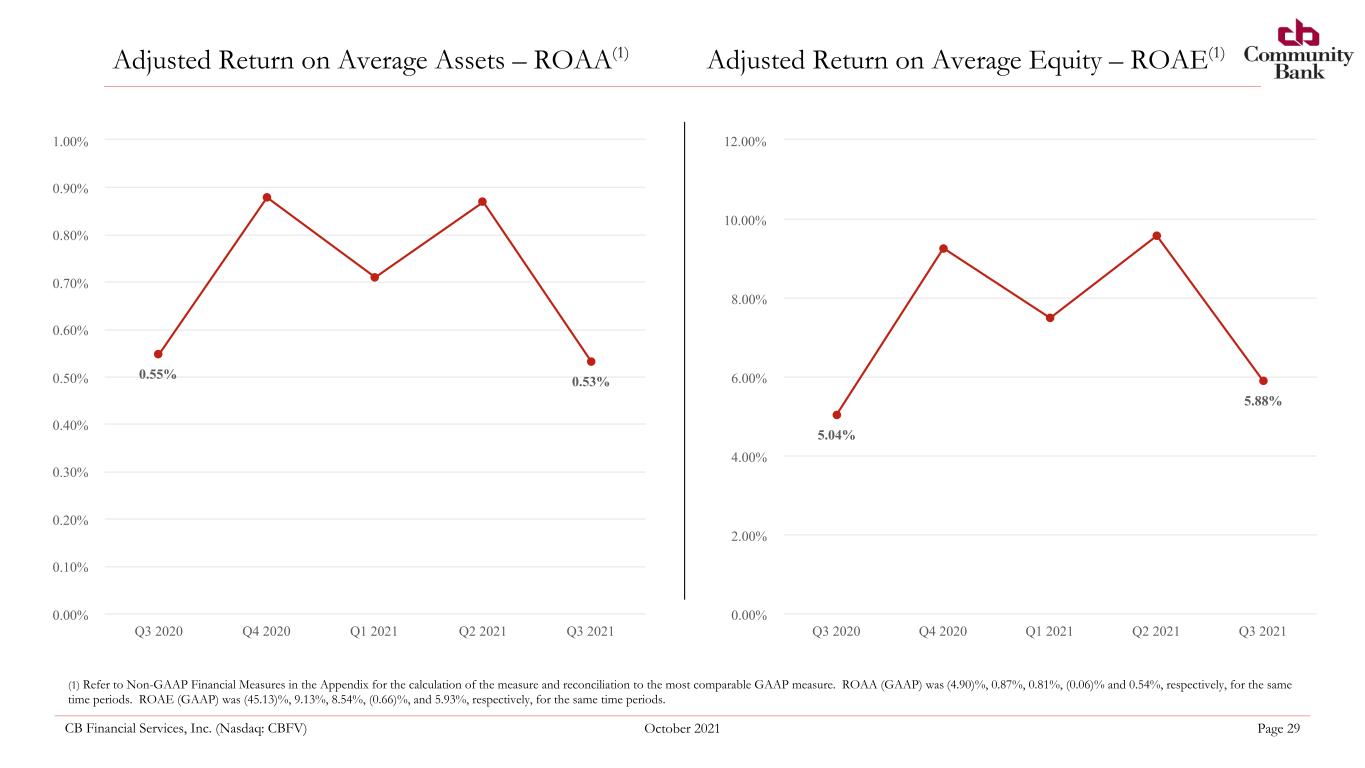

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 6 Third Quarter 2021 Highlights Solid Profitability During Optimization Efforts (1) Refer to Non-GAAP Financial Measures in the Appendix for the calculation of the measure and reconciliation to the most comparable GAAP measure. (comparison to December 31, 2020) Reported Adjusted (non-GAAP) $2.0M Reported Adjusted (non-GAAP)1 NI $2.0M $0.36EPS $0.37 0.53% 0.54% 5.88% 5.93% ROAA ROAE Net Income (NI) Loans and Deposits Book Value Q2 2021 net income (GAAP) was $2.0M, or $0.37 per diluted share, compared to net loss of $(17.4)M, or $(3.22) per diluted share, in the prior year period* Adjusted net income (non-GAAP) was $2.0M, or $0.36 per diluted share, compared to $1.9M, or $0.36 per diluted share Total loans as of September 30, 2021 were $1.02B, a decrease of $25.7M compared to the prior year end Total deposits as of September 30, 2021 were $1.29B, an increase of $63.2M compared to the prior year end Book value per share was $24.57 at September 30, 2021, compared to $24.76 at the prior year end Tangible book value per share was $21.67 at September 30, 2021, compared to $21.42 at the prior year end (1). 135,968Shares Repurchased (at October 25, 2021)* Prior-year period included non-cash charges related to goodwill impairment that was due to economic conditions triggered by the COVID-19 pandemic

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 7 Branch Optimization and Operational Efficiency Efforts Expected Costs / Savings Expected non-recurring pre- tax costs during 2021 of up to $7.9 million. This estimated cost excludes the impact of the expected premium from sale of branches (currently projected to be $5.1 million in Q4 2021). CB anticipates these ongoing savings being incremental to net income beginning in 2022. Writedown on fixed assets $2.3 million $2.3 million Branch Optimization: $3.0 Million Operational Efficiency and Revenue Generation: $2.5 – 3.5 Million Impairment of intangible assets $1.2 million $1.2 million Contracted services $0.7 million $1.9 million Employee severance costs $0.3 million $0.3 million Branch lease impairment $0.3 million $0.3 million Professional fees $0.2 million $0.2 million Data processing fees $0.1 million $0.1 million Legal and other $0.03 million $0.08 million Total $5.1 million $6.3 million YTD Expenses at 9/30 Expected Savings in 2022 and Future YearsYTD Expenses at 6/30

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 8 Branch Optimization and Operational Efficiency Initiative Management has consolidated six branches and in process of divesting two others: Consolidation • Monongahela, PA • Perryopolis, PA • Pioneer, PA • Southpointe, PA • Bellaire, OH • Wellsburg, WV Divestiture: • New Martinsville, WV • Buckhannon, WV A comprehensive review of Community Bank’s branch network and operating environment has been completed with the following priorities: • Improve profitability • Improve efficiency • Investment in digital marketing and technology • Increased automation in back-office operations • Thorough evaluation of individualized processes and identified 185 specific areas for improvement, including: ◦ Infrastructure / Client experience improvements • Employees focused on customers / clients Identifying Solutions to Improve Operating Performance Branch Consolidation and Divestitures Support Brand While Enhancing Customer Loyalty and Engagement From the Top of the Organization to Every ATM!

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 9 Increasing Efficiency In our Branch Network ◦ Reduced overall branch locations from 24 to 14 over the past 6 quarters ◦ No deterioration in deposits ◦ Gaining traction in reduction of non- interest expense and salaries Branch Optimization Efforts # of Branches 16222224 23 1622

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 10 Divestiture of Two West Virginia Branches on Track to Close in Q4 2021 Purchase and Assumption Agreement with Citizens Bank of West Virginia, Inc. Citizens has agreed to assume certain deposit liabilities and to acquire certain loans, as well as cash, real property, personal property and other fixed assets associated with the two branches. Deposit and loan balances at the branch locations as of September 30, 2021 were approximately $102.6 million and $6.5 million, respectively. Citizens will pay a 5% deposit premium on the total deposits transferred. Pending divestiture is expected to close in the fourth quarter of 2021 with a projected $5.1 million gain on sale. Allows for Community Bank to focus on its core markets surrounding Southwestern PA as well as advance efficiency throughout the organization. Branch Optimization Initiative

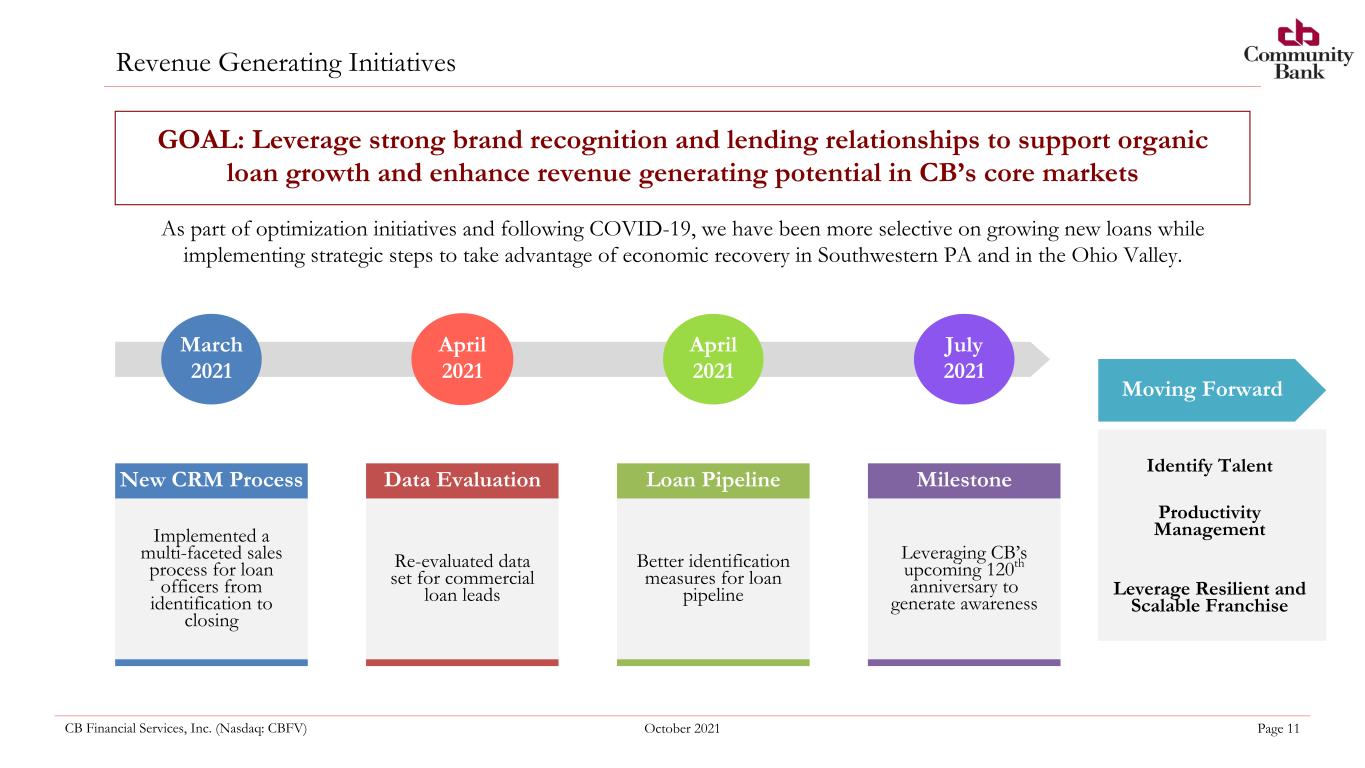

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 11 Revenue Generating Initiatives GOAL: Leverage strong brand recognition and lending relationships to support organic loan growth and enhance revenue generating potential in CB’s core markets As part of optimization initiatives and following COVID-19, we have been more selective on growing new loans while implementing strategic steps to take advantage of economic recovery in Southwestern PA and in the Ohio Valley. March 2021 April 2021 April 2021 July 2021 New CRM Process Data Evaluation Loan Pipeline Milestone Implemented a multi-faceted sales process for loan officers from identification to closing Leveraging CB’s upcoming 120th anniversary to generate awareness Better identification measures for loan pipeline Re-evaluated data set for commercial loan leads Moving Forward Identify Talent Productivity Management Leverage Resilient and Scalable Franchise

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 12 • Empower our experienced, high-quality employees to provide superior customer service in all aspects of our business ◦ Net Promoter Score of 45 vs. a U.S. bank average of 35 (higher number represents an increasingly satisfied customer base) • Create a sales and service culture which builds full relationships with our customers • Utilize technology investments to enhance speed of process while improving customer experience • Enhance profitability and efficiency potential while continuing to invest for future growth • Continue our track record of opportunistic growth in the robust Pittsburgh MSA and across our footprint • Evolve toward more electronic/digital products and processes driving greater efficiency and expand our brand awareness in our market by utilizing digital and other outlets • Leverage our credit culture and strong loan underwriting as a foundation to uphold our asset quality metrics Building on Core Strengths Be the Community Bank of choice across our footprint for residents and small and medium-sized businesses

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 13 Diversified Business • Well-positioned to serve the needs of small and medium- sized businesses across our footprint • Growing presence within the Pittsburgh MSA • Strong asset quality Commercial Banking Retail Banking Mortgage Banking Insurance Brokerage • Active mortgage origination platform with dedicated mortgage originators • Robust housing market • Expanding mortgage banking platform into legacy markets • Continued momentum and growth following the Beynon Insurance acquisition in August 2018 • Complementary to commercial and retail banking business • Currently operating in Southwestern PA, Ohio River Valley and Central WV

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 14 ▪ Population of approximately 2.3 million with a median household income of nearly $64,000, which is projected to increase 10.2% in the next 5 years ▪ Large market for energy, healthcare, technology, and manufacturing companies(1) ▪ Highly educated labor force from Carnegie Mellon University, University of Pittsburgh, and Duquesne University(1) ▪ Fortune 500 companies headquartered in Pittsburgh MSA include: Kraft Heinz, PNC Financial Services, PPG Industries, U.S. Steel, Alcoa, Dick’s Sporting Goods, and WESCO International(2) ▪ Carnegie Mellon University and the University of Pittsburgh have helped to bring tech jobs and innovation to the area and tech giants like Uber and Facebook have opened offices in Pittsburgh ▪ Substantial medical services investment is happening regionally: – UPMC is investing $2 billion in 3 new specialty hospitals in Pittsburgh and is constructing a new hospital facility in Washington County, PA – UPMC said it plans to break ground on the 900,000-square-foot heart and transplant hospital in the second half of 2022, according to the Pittsburgh Business Journal. Construction is slated to take about four years, and UPMC expects the facility to open in late 2026. Large Employers in Operating AreaPittsburgh Metropolitan Area Attractive Operating Markets ~ New Infrastructure 1. https://datausa.io/profile/geo/pittsburgh-pa-metro-area/ 2. http://fortune.com/fortune500/ Opening of Southern Beltway from I-79 in Washington County to Pittsburgh International Airport ▪ Pittsburgh's first major highway in decades ▪ 110,000 drivers connected between Washington County and Pittsburgh International Airport

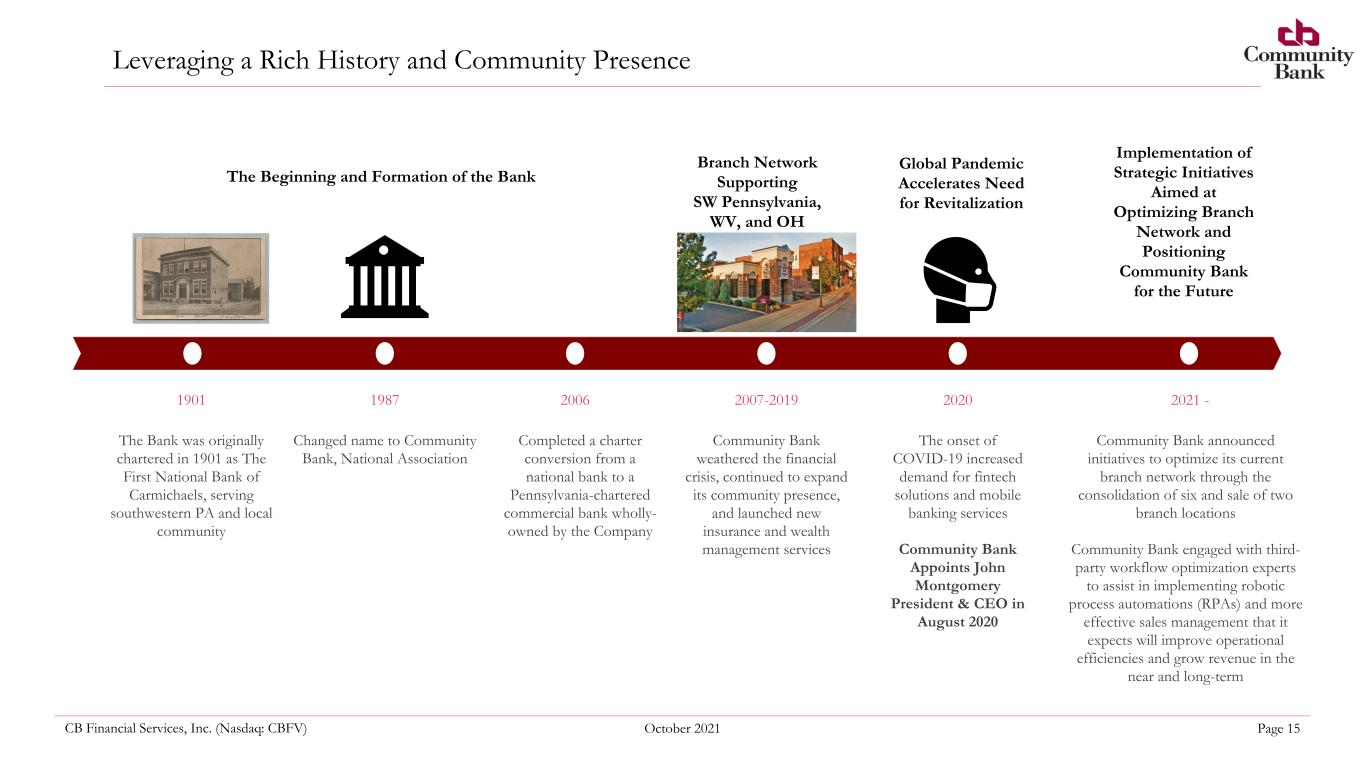

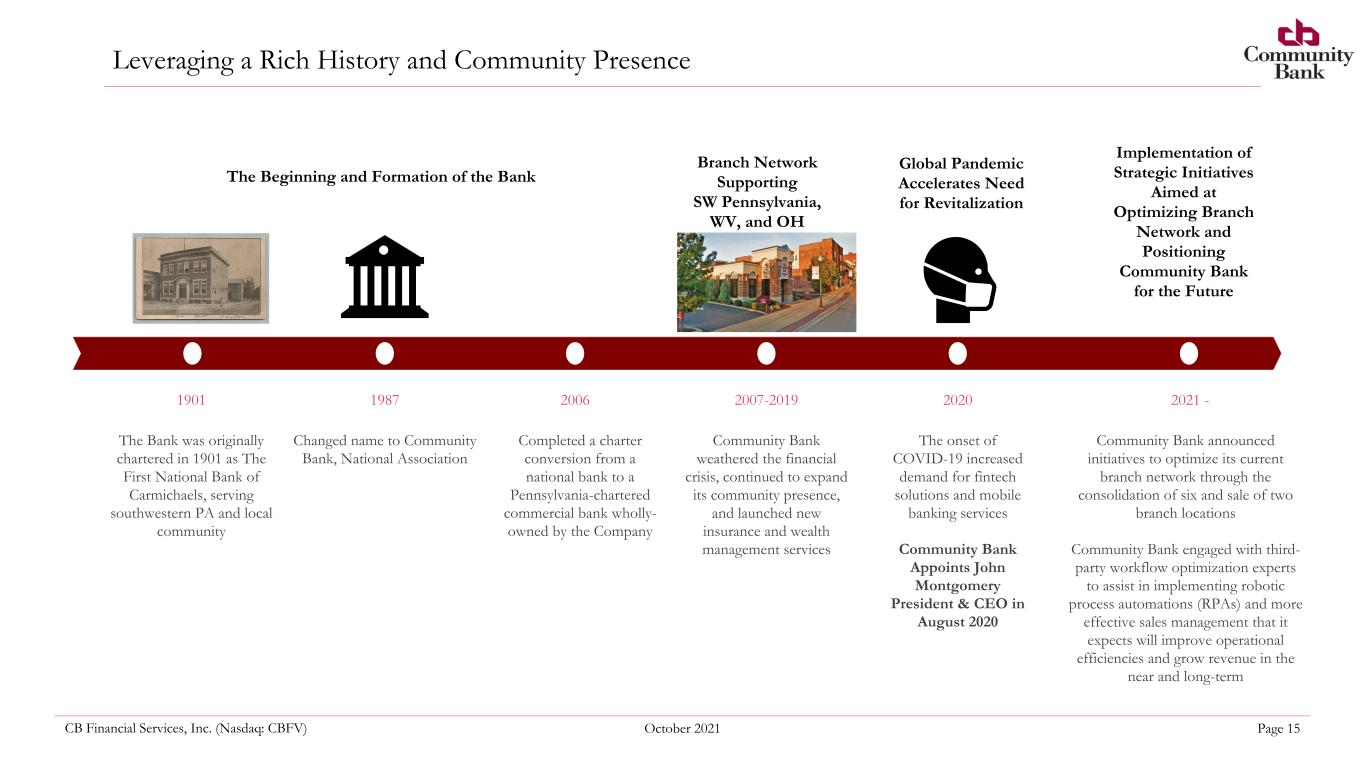

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 15 Leveraging a Rich History and Community Presence 1901 1987 2006 2007-2019 2020 2021 - The Bank was originally chartered in 1901 as The First National Bank of Carmichaels, serving southwestern PA and local community Changed name to Community Bank, National Association Community Bank weathered the financial crisis, continued to expand its community presence, and launched new insurance and wealth management services The onset of COVID-19 increased demand for fintech solutions and mobile banking services Community Bank Appoints John Montgomery President & CEO in August 2020 The Beginning and Formation of the Bank Branch Network Supporting SW Pennsylvania, WV, and OH Global Pandemic Accelerates Need for Revitalization Completed a charter conversion from a national bank to a Pennsylvania-chartered commercial bank wholly- owned by the Company Community Bank announced initiatives to optimize its current branch network through the consolidation of six and sale of two branch locations Community Bank engaged with third- party workflow optimization experts to assist in implementing robotic process automations (RPAs) and more effective sales management that it expects will improve operational efficiencies and grow revenue in the near and long-term Implementation of Strategic Initiatives Aimed at Optimizing Branch Network and Positioning Community Bank for the Future

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 16 ZIRR Creates NIM Pressures on All Banks Disruption by Technology and FinTech Online and Mobile Delivery of Services is Essential Evaluating Market Changes ~ Need to Adapt Changing Consumer Behavior Requirements for Instant Service to Fulfill Expectations (One Click) 0%

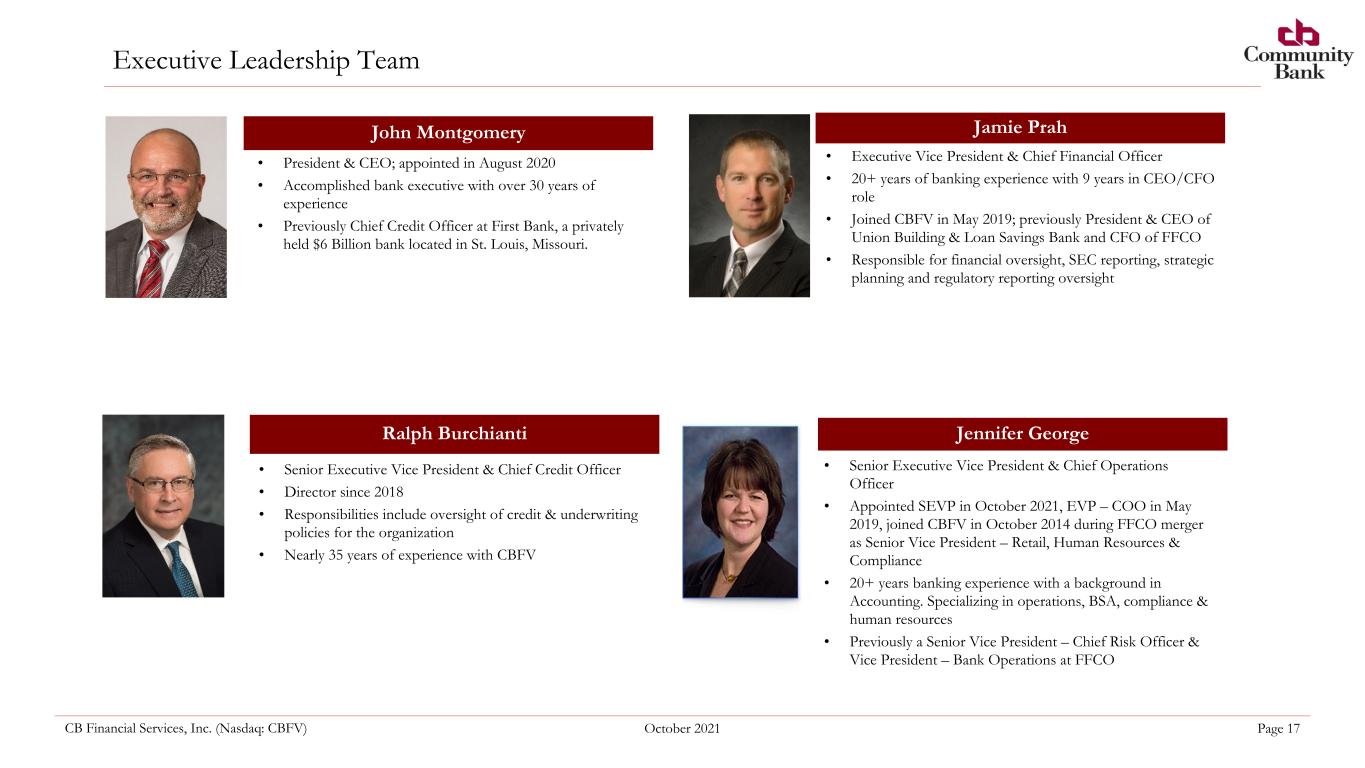

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 17 • President & CEO; appointed in August 2020 • Accomplished bank executive with over 30 years of experience • Previously Chief Credit Officer at First Bank, a privately held $6 Billion bank located in St. Louis, Missouri. Jamie Prah • Executive Vice President & Chief Financial Officer • 20+ years of banking experience with 9 years in CEO/CFO role • Joined CBFV in May 2019; previously President & CEO of Union Building & Loan Savings Bank and CFO of FFCO • Responsible for financial oversight, SEC reporting, strategic planning and regulatory reporting oversight John Montgomery Jennifer GeorgeRalph Burchianti • Senior Executive Vice President & Chief Credit Officer • Director since 2018 • Responsibilities include oversight of credit & underwriting policies for the organization • Nearly 35 years of experience with CBFV • Senior Executive Vice President & Chief Operations Officer • Appointed SEVP in October 2021, EVP – COO in May 2019, joined CBFV in October 2014 during FFCO merger as Senior Vice President – Retail, Human Resources & Compliance • 20+ years banking experience with a background in Accounting. Specializing in operations, BSA, compliance & human resources • Previously a Senior Vice President – Chief Risk Officer & Vice President – Bank Operations at FFCO Executive Leadership Team

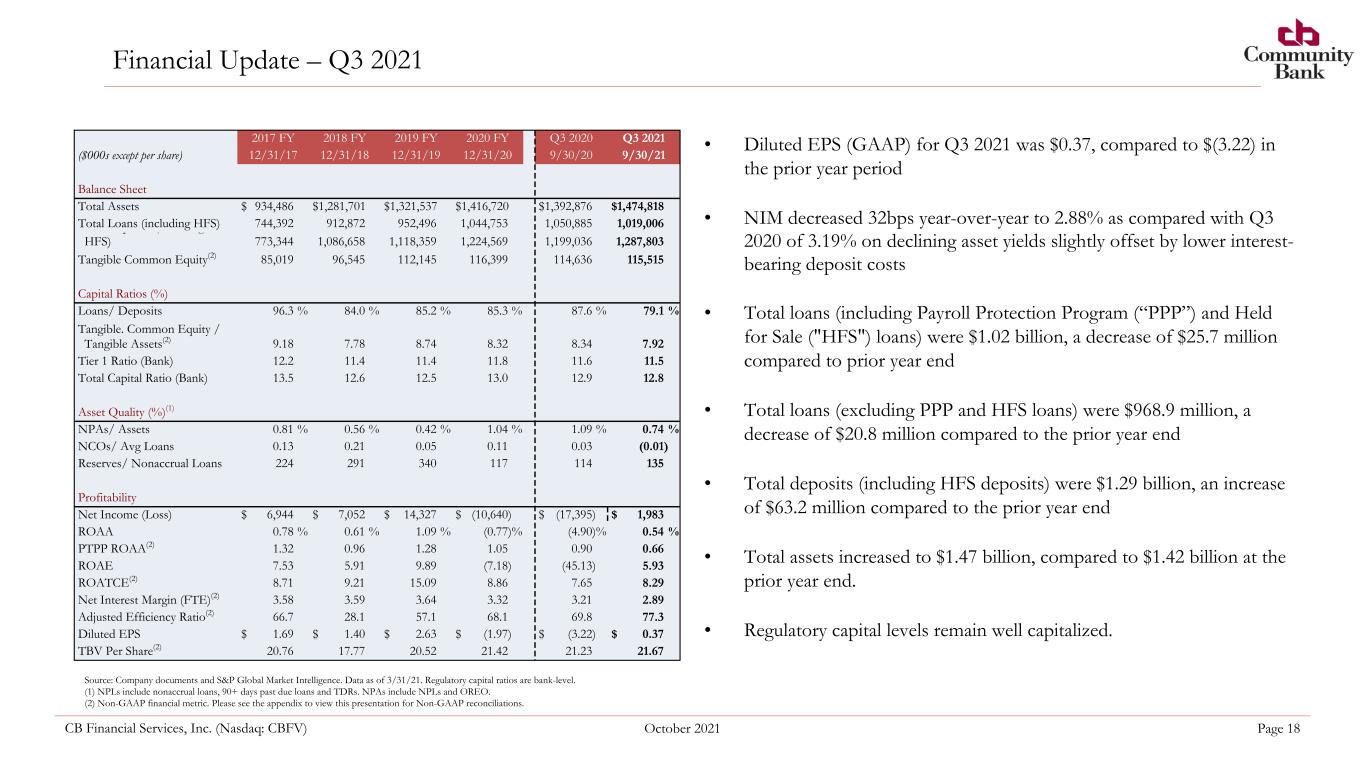

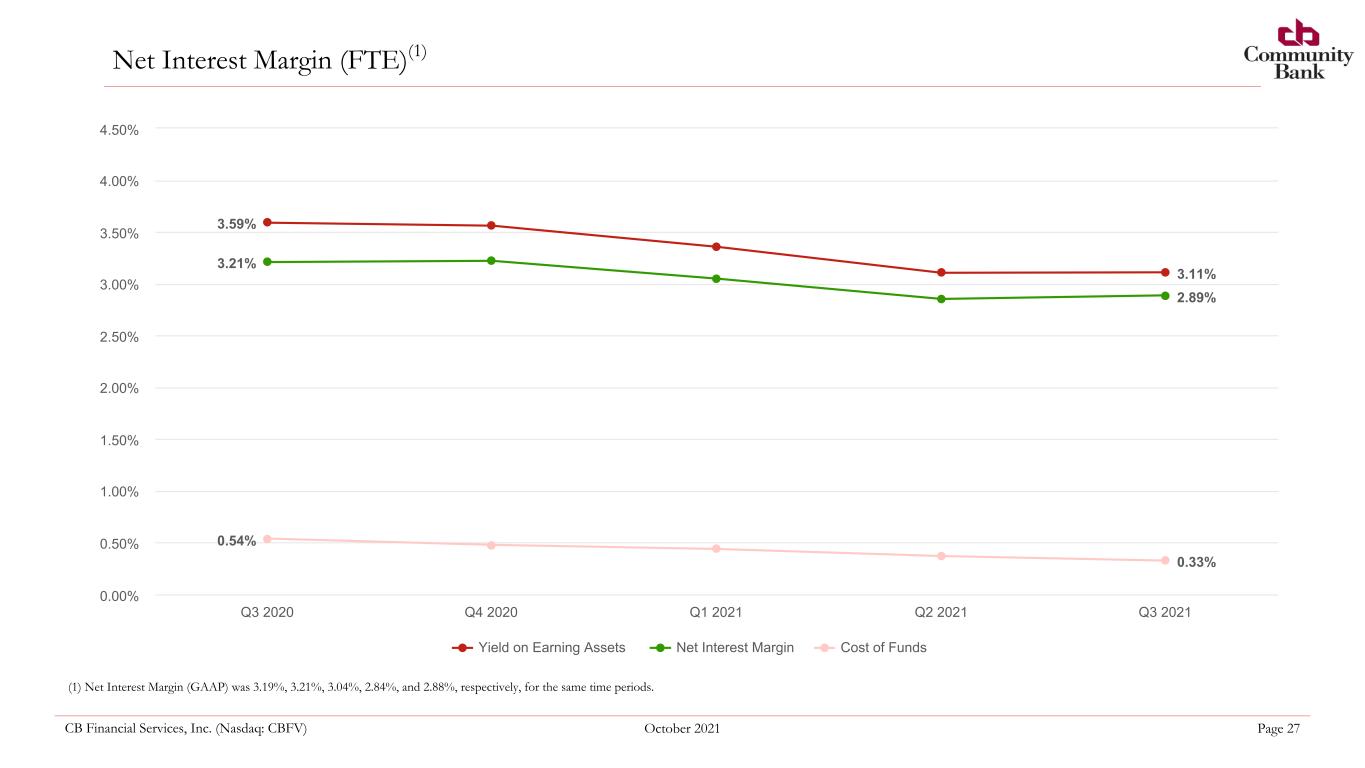

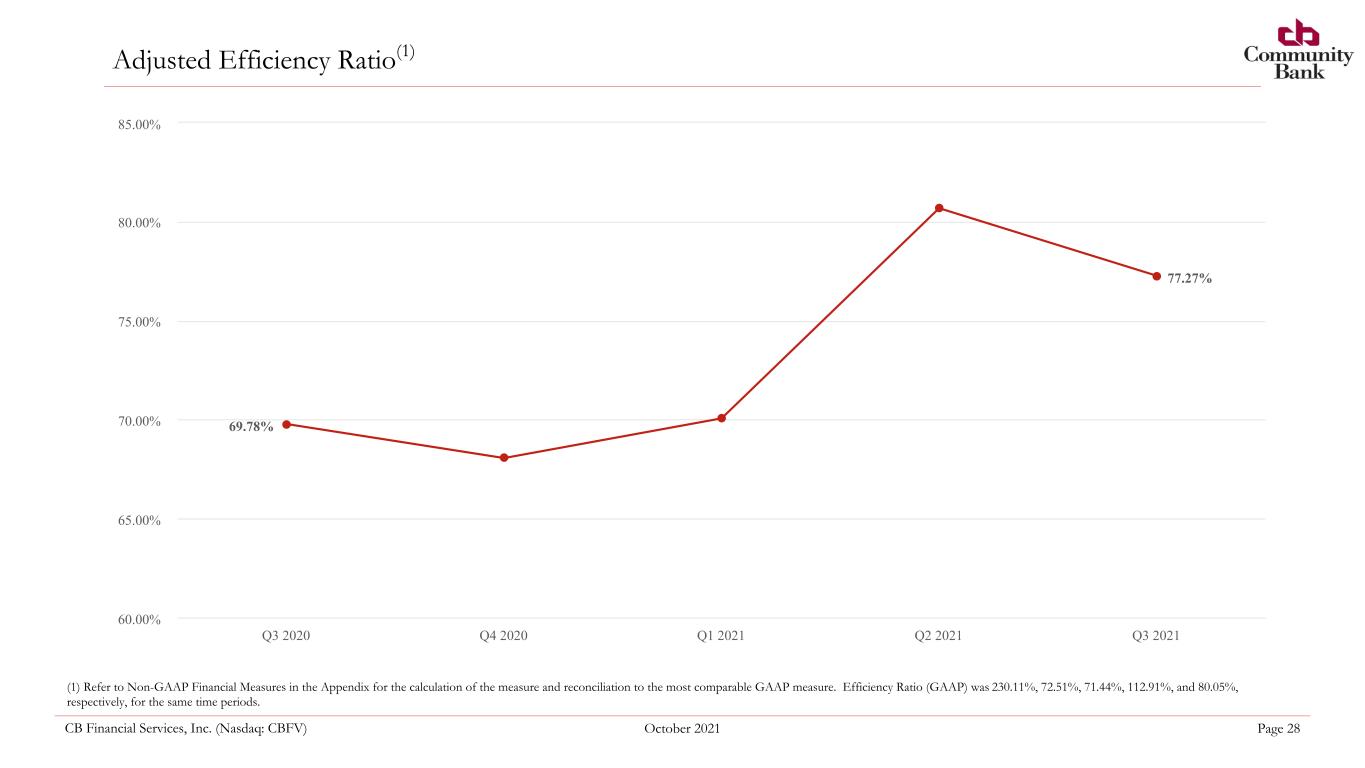

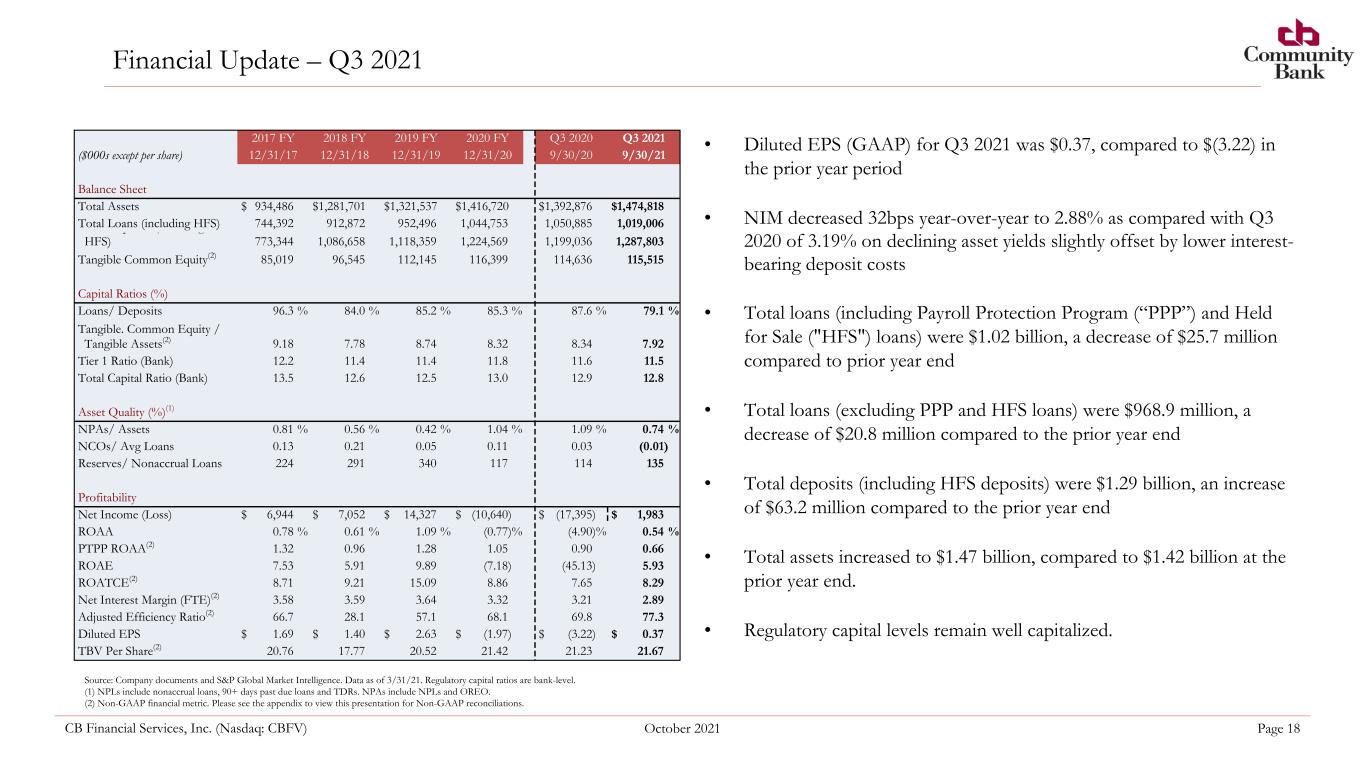

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 18 Financial Update – Q3 2021 2017 FY 2018 FY 2019 FY 2020 FY Q3 2020 Q3 2021 ($000s except per share) 12/31/17 12/31/18 12/31/19 12/31/20 9/30/20 9/30/21 Balance Sheet Total Assets $ 934,486 $ 1,281,701 $ 1,321,537 $ 1,416,720 $ 1,392,876 $ 1,474,818 Total Loans (including HFS) 744,392 912,872 952,496 1,044,753 1,050,885 1,019,006 Total Deposits (including HFS) 773,344 1,086,658 1,118,359 1,224,569 1,199,036 1,287,803 Tangible Common Equity(2) 85,019 96,545 112,145 116,399 114,636 115,515 Capital Ratios (%) Loans/ Deposits 96.3 % 84.0 % 85.2 % 85.3 % 87.6 % 79.1 % Tangible. Common Equity / Tangible Assets(2) 9.18 7.78 8.74 8.32 8.34 7.92 Tier 1 Ratio (Bank) 12.2 11.4 11.4 11.8 11.6 11.5 Total Capital Ratio (Bank) 13.5 12.6 12.5 13.0 12.9 12.8 Asset Quality (%)(1) NPAs/ Assets 0.81 % 0.56 % 0.42 % 1.04 % 1.09 % 0.74 % NCOs/ Avg Loans 0.13 0.21 0.05 0.11 0.03 (0.01) Reserves/ Nonaccrual Loans 224 291 340 117 114 135 Profitability Net Income (Loss) $ 6,944 $ 7,052 $ 14,327 $ (10,640) $ (17,395) $ 1,983 ROAA 0.78 % 0.61 % 1.09 % (0.77) % (4.90) % 0.54 % PTPP ROAA(2) 1.32 0.96 1.28 1.05 0.90 0.66 ROAE 7.53 5.91 9.89 (7.18) (45.13) 5.93 ROATCE(2) 8.71 9.21 15.09 8.86 7.65 8.29 Net Interest Margin (FTE)(2) 3.58 3.59 3.64 3.32 3.21 2.89 Adjusted Efficiency Ratio(2) 66.7 28.1 57.1 68.1 69.8 77.3 Diluted EPS $ 1.69 $ 1.40 $ 2.63 $ (1.97) $ (3.22) $ 0.37 TBV Per Share(2) 20.76 17.77 20.52 21.42 21.23 21.67 • Diluted EPS (GAAP) for Q3 2021 was $0.37, compared to $(3.22) in the prior year period • NIM decreased 32bps year-over-year to 2.88% as compared with Q3 2020 of 3.19% on declining asset yields slightly offset by lower interest- bearing deposit costs • Total loans (including Payroll Protection Program (“PPP”) and Held for Sale ("HFS") loans) were $1.02 billion, a decrease of $25.7 million compared to prior year end • Total loans (excluding PPP and HFS loans) were $968.9 million, a decrease of $20.8 million compared to the prior year end • Total deposits (including HFS deposits) were $1.29 billion, an increase of $63.2 million compared to the prior year end • Total assets increased to $1.47 billion, compared to $1.42 billion at the prior year end. • Regulatory capital levels remain well capitalized. Source: Company documents and S&P Global Market Intelligence. Data as of 3/31/21. Regulatory capital ratios are bank-level. (1) NPLs include nonaccrual loans, 90+ days past due loans and TDRs. NPAs include NPLs and OREO. (2) Non-GAAP financial metric. Please see the appendix to view this presentation for Non-GAAP reconciliations.

Key Financial Metrics

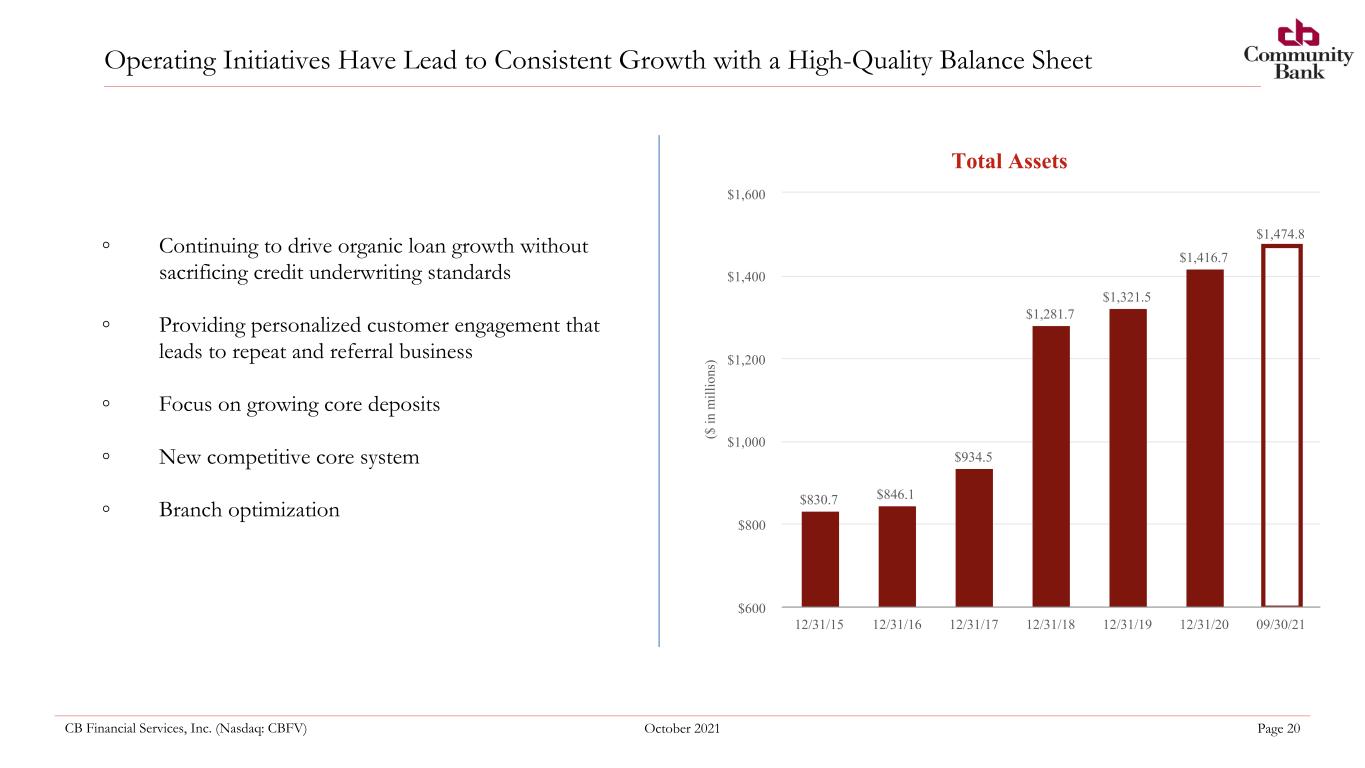

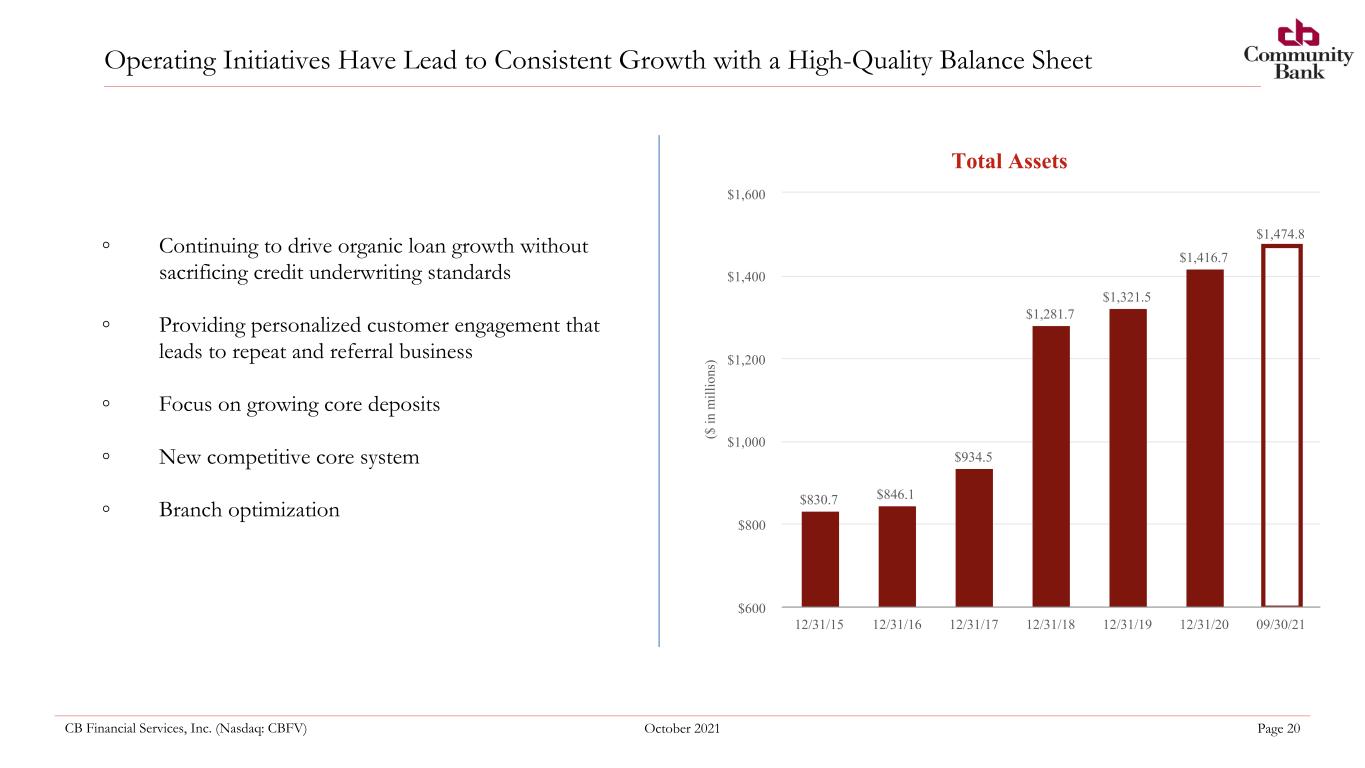

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 20 ◦ Continuing to drive organic loan growth without sacrificing credit underwriting standards ◦ Providing personalized customer engagement that leads to repeat and referral business ◦ Focus on growing core deposits ◦ New competitive core system ◦ Branch optimization Operating Initiatives Have Lead to Consistent Growth with a High-Quality Balance Sheet ($ in m ill io ns ) Total Assets $830.7 $846.1 $934.5 $1,281.7 $1,321.5 $1,416.7 $1,474.8 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 09/30/21 $600 $800 $1,000 $1,200 $1,400 $1,600

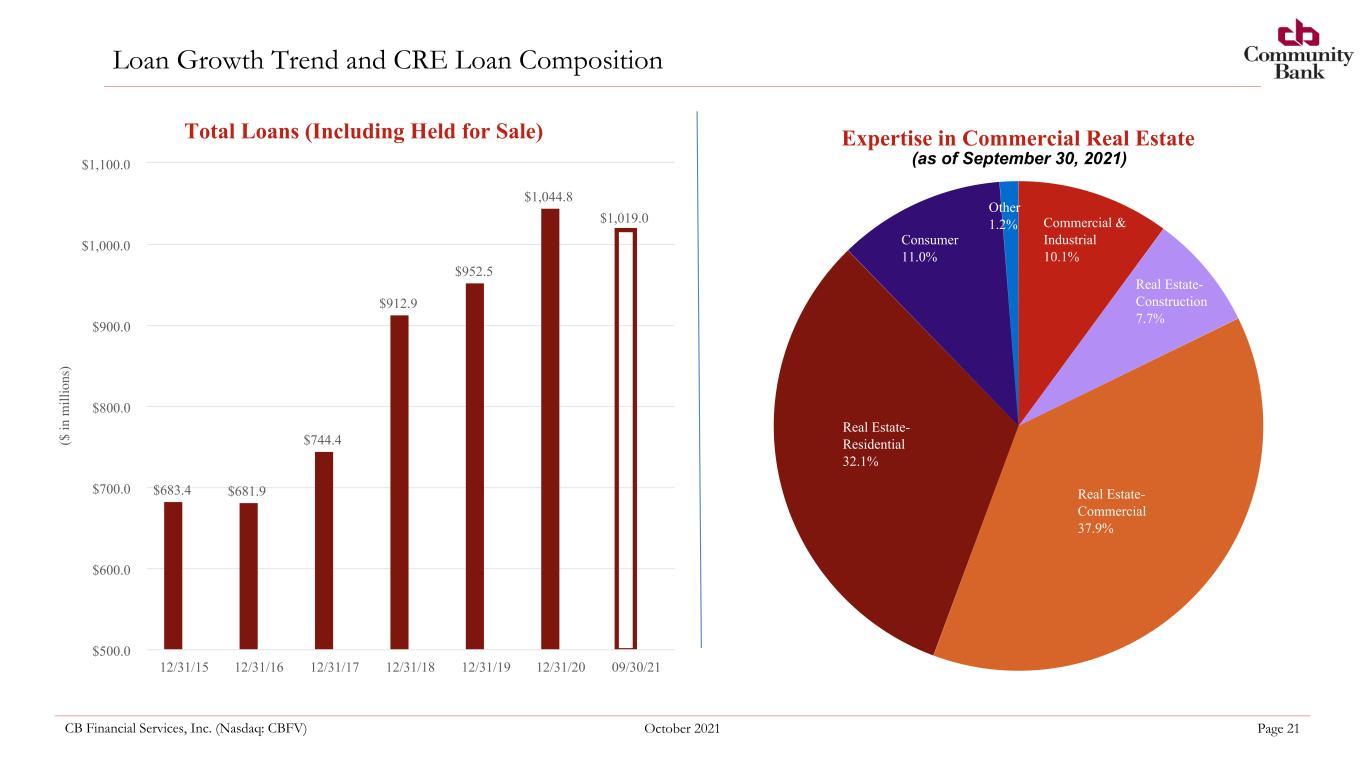

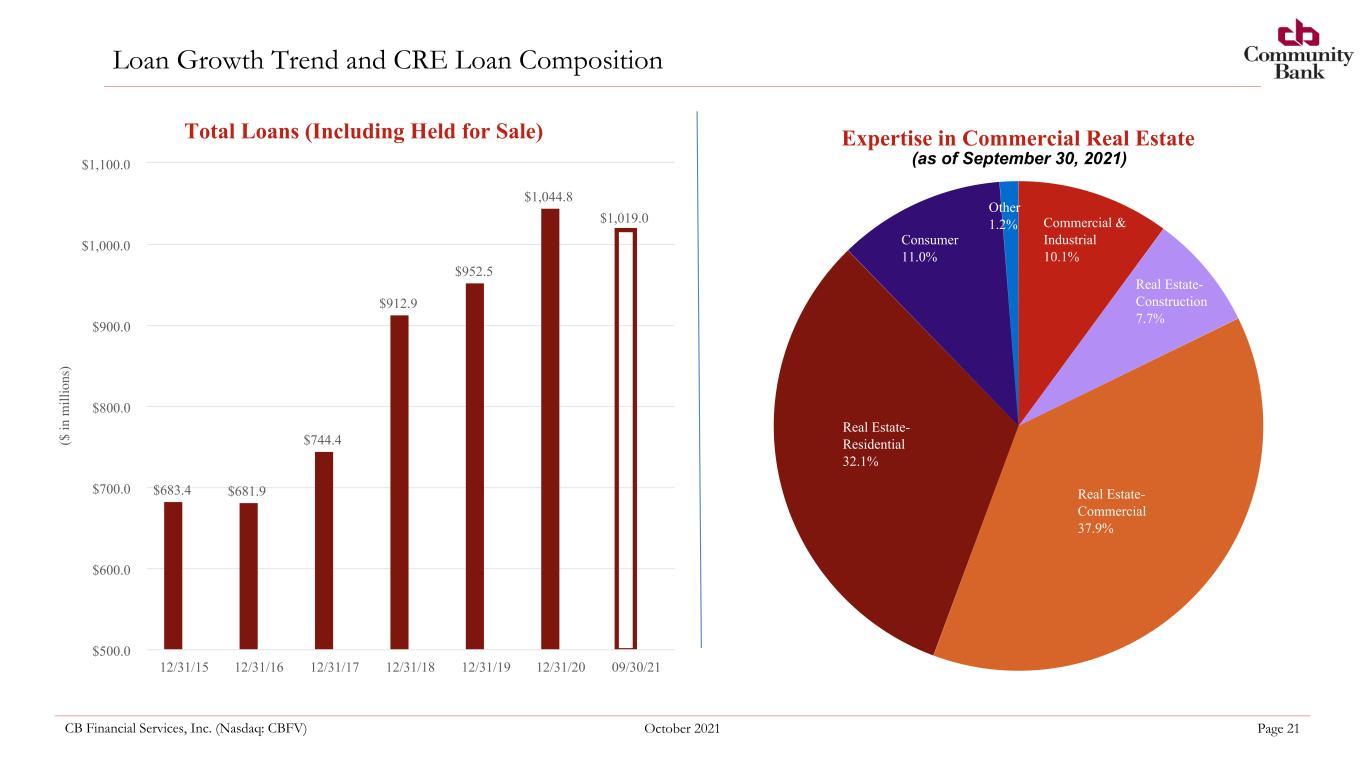

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 21 Loan Growth Trend and CRE Loan Composition (as of September 30, 2021) ($ in m ill io ns ) Total Loans (Including Held for Sale) $683.4 $681.9 $744.4 $912.9 $952.5 $1,044.8 $1,019.0 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 09/30/21 $500.0 $600.0 $700.0 $800.0 $900.0 $1,000.0 $1,100.0 Expertise in Commercial Real Estate Commercial & Industrial 10.1% Real Estate- Construction 7.7% Real Estate- Commercial 37.9% Real Estate- Residential 32.1% Consumer 11.0% Other 1.2%

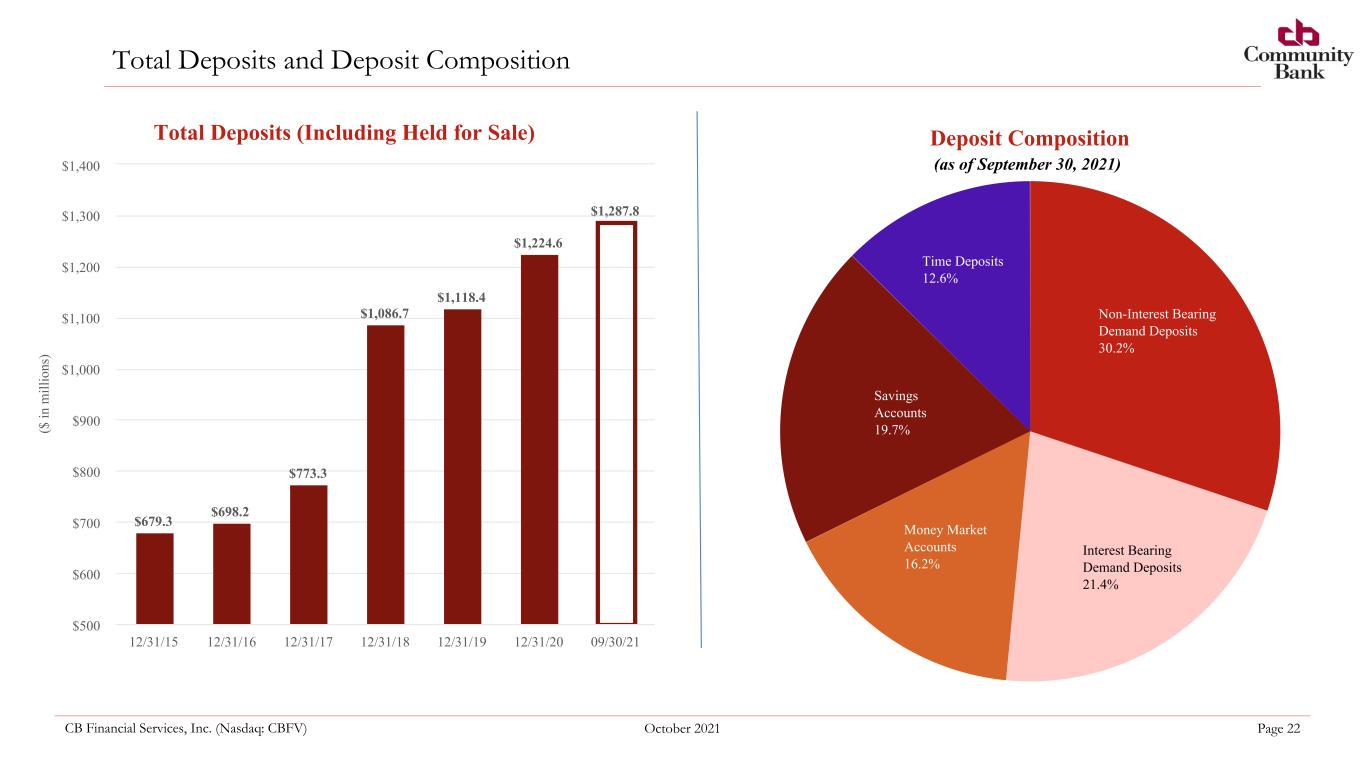

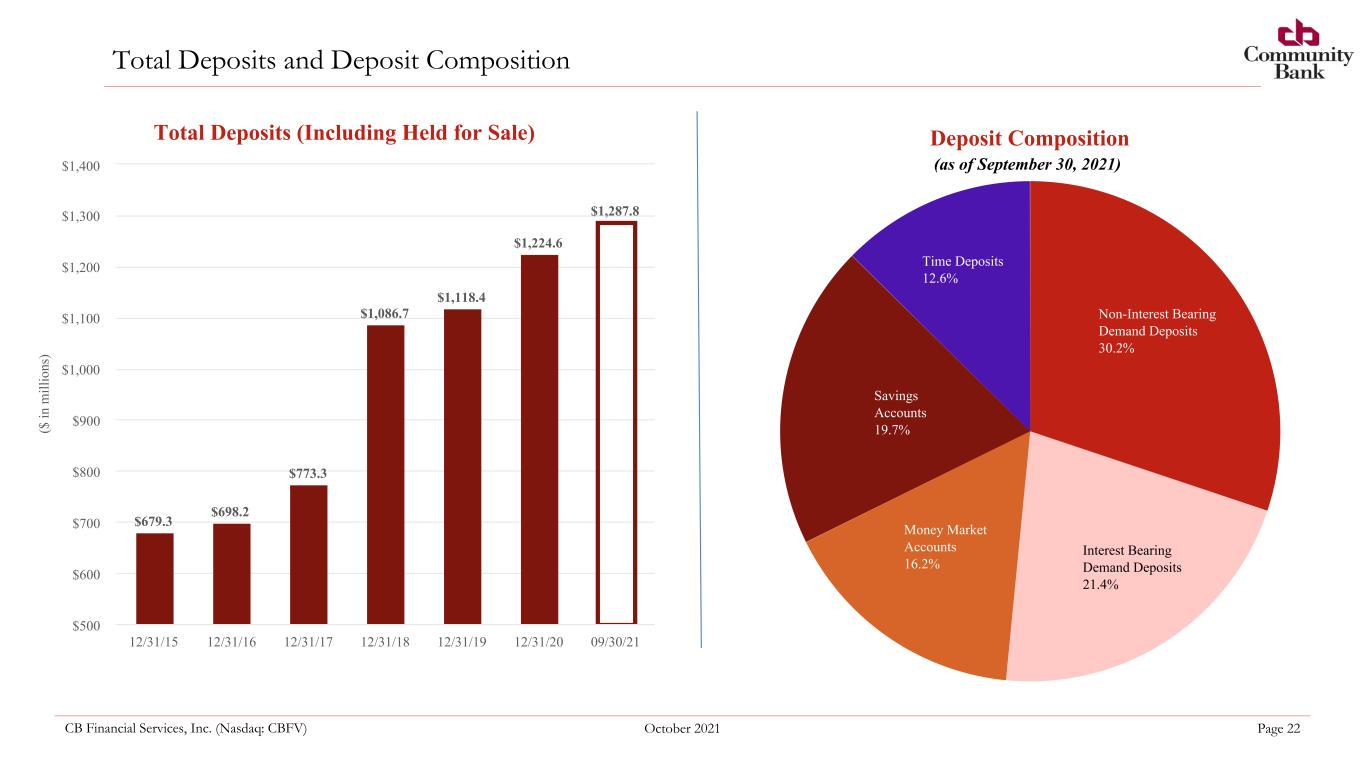

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 22 Total Deposits and Deposit Composition (as of September 30, 2021) ($ in m ill io ns ) Total Deposits (Including Held for Sale) $679.3 $698.2 $773.3 $1,086.7 $1,118.4 $1,224.6 $1,287.8 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 09/30/21 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 Deposit Composition Non-Interest Bearing Demand Deposits 30.2% Interest Bearing Demand Deposits 21.4% Money Market Accounts 16.2% Savings Accounts 19.7% Time Deposits 12.6%

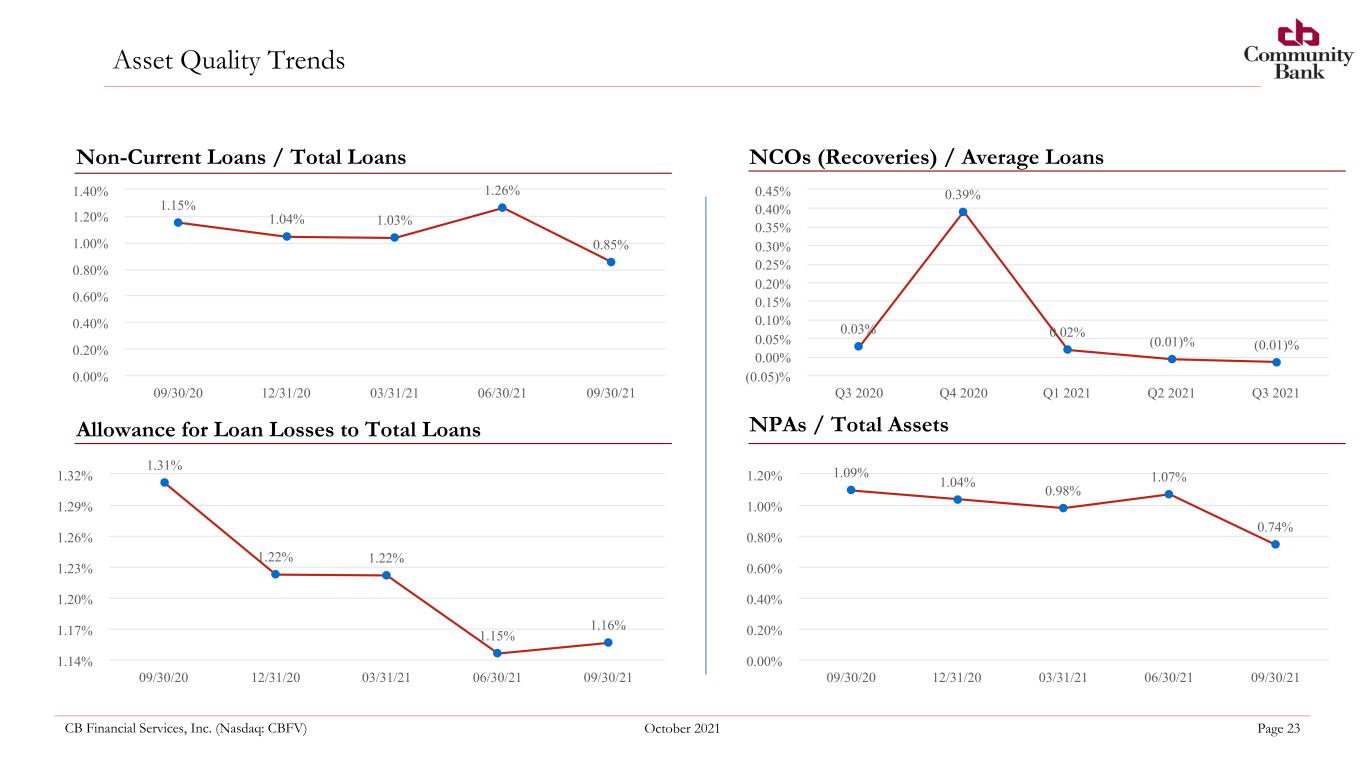

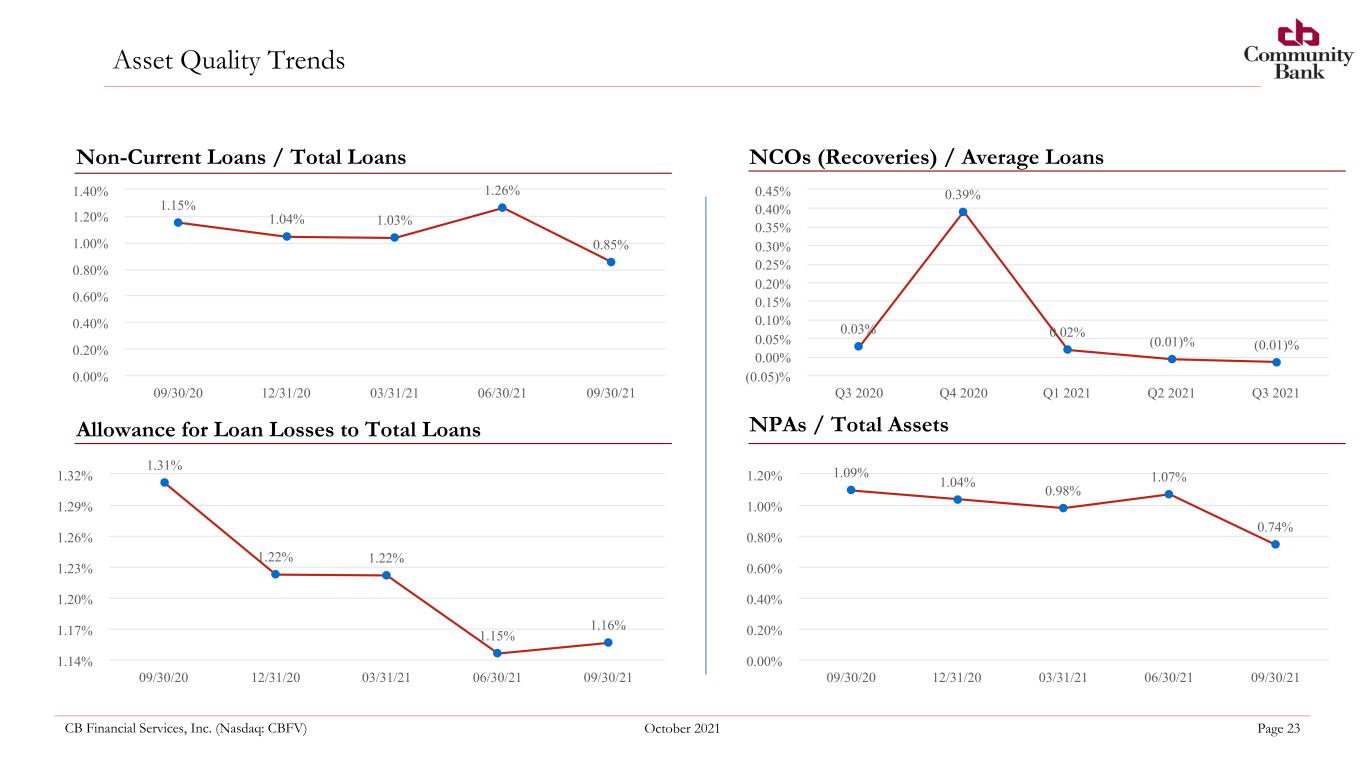

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 23 Asset Quality Trends NCOs (Recoveries) / Average LoansNon-Current Loans / Total Loans Allowance for Loan Losses to Total Loans NPAs / Total Assets 1.15% 1.04% 1.03% 1.26% 0.85% 09/30/20 12/31/20 03/31/21 06/30/21 09/30/21 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 0.03% 0.39% 0.02% (0.01)% (0.01)% Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 (0.05)% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% 1.31% 1.22% 1.22% 1.15% 1.16% 09/30/20 12/31/20 03/31/21 06/30/21 09/30/21 1.14% 1.17% 1.20% 1.23% 1.26% 1.29% 1.32% 1.09% 1.04% 0.98% 1.07% 0.74% 09/30/20 12/31/20 03/31/21 06/30/21 09/30/21 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20%

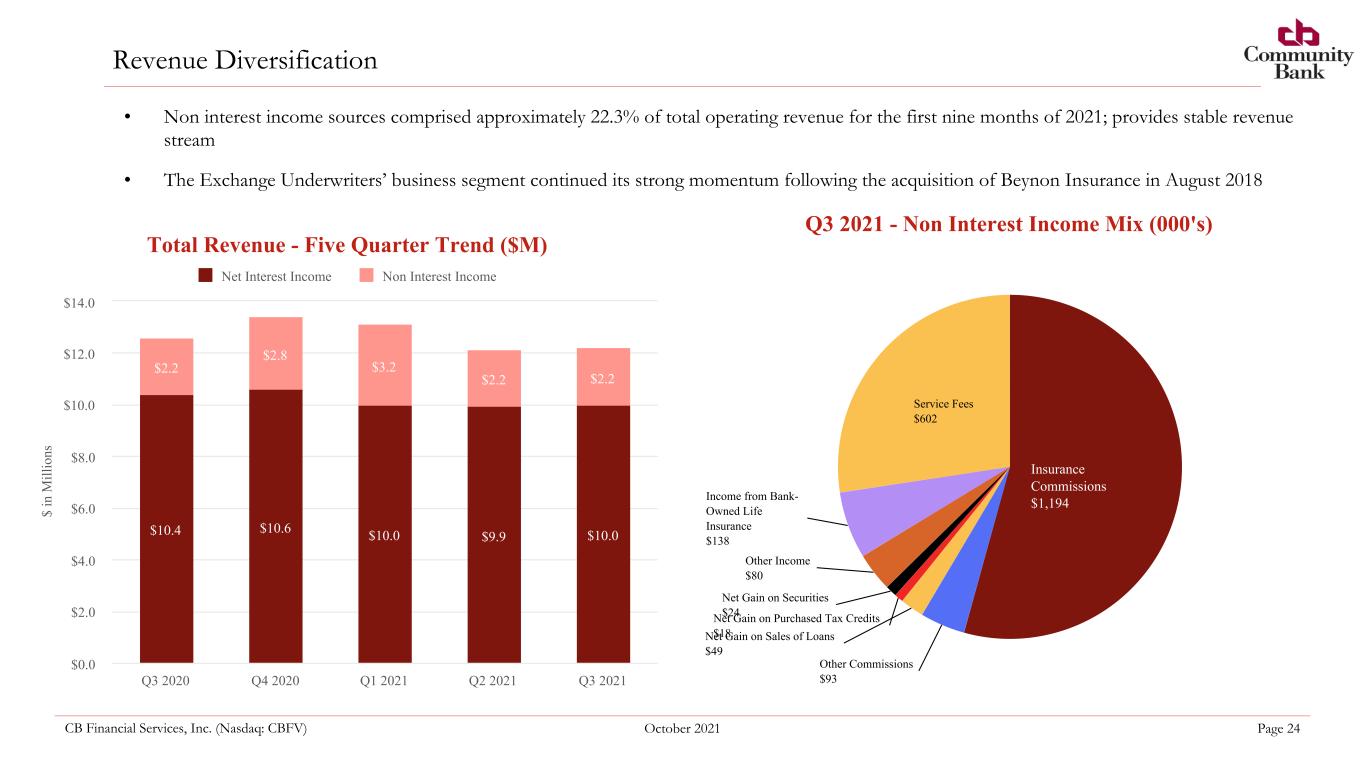

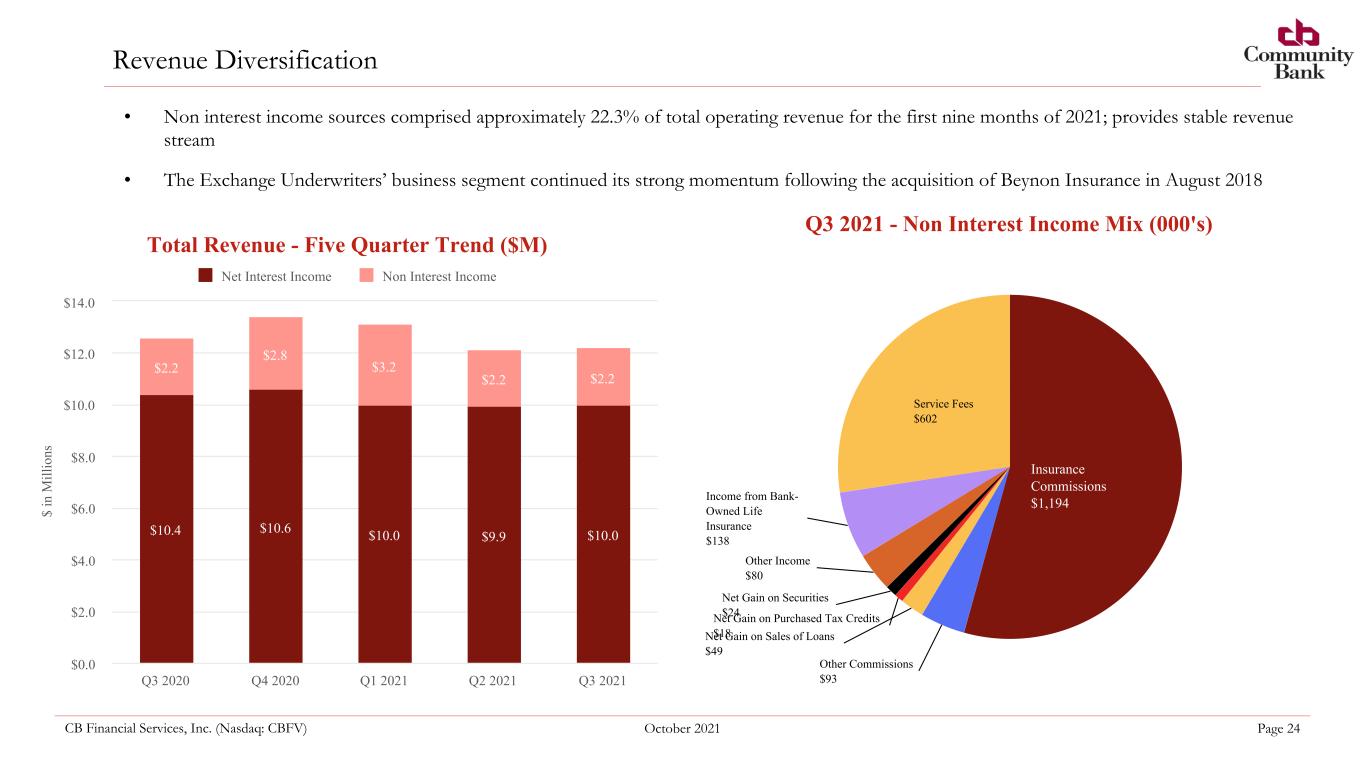

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 24 Revenue Diversification • Non interest income sources comprised approximately 22.3% of total operating revenue for the first nine months of 2021; provides stable revenue stream • The Exchange Underwriters’ business segment continued its strong momentum following the acquisition of Beynon Insurance in August 2018 $ in M ill io ns Total Revenue - Five Quarter Trend ($M) $10.4 $10.6 $10.0 $9.9 $10.0 $2.2 $2.8 $3.2 $2.2 $2.2 Net Interest Income Non Interest Income Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 Q3 2021 - Non Interest Income Mix (000's) Insurance Commissions $1,194 Other Commissions $93 Net Gain on Sales of Loans $49 Net Gain on Purchased Tax Credits $18 Net Gain on Securities $24 Other Income $80 Income from Bank- Owned Life Insurance $138 Service Fees $602

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 25 Net Income (Loss) and Adjusted Net Income(1) – Last 5 Quarters (1) Refer to Non-GAAP Financial Measures in the Appendix for the calculation of the measure and reconciliation to the most comparable GAAP measure. Net (Loss) Income $ in 000's $(17,395) $(223) $3,079 $2,845 $1,983 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $(20,000) $(15,000) $(10,000) $(5,000) $0 $5,000 Adjusted Net Income (1) $ in 000's $1,942 $3,119 $2,492 $3,217 $1,966 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500

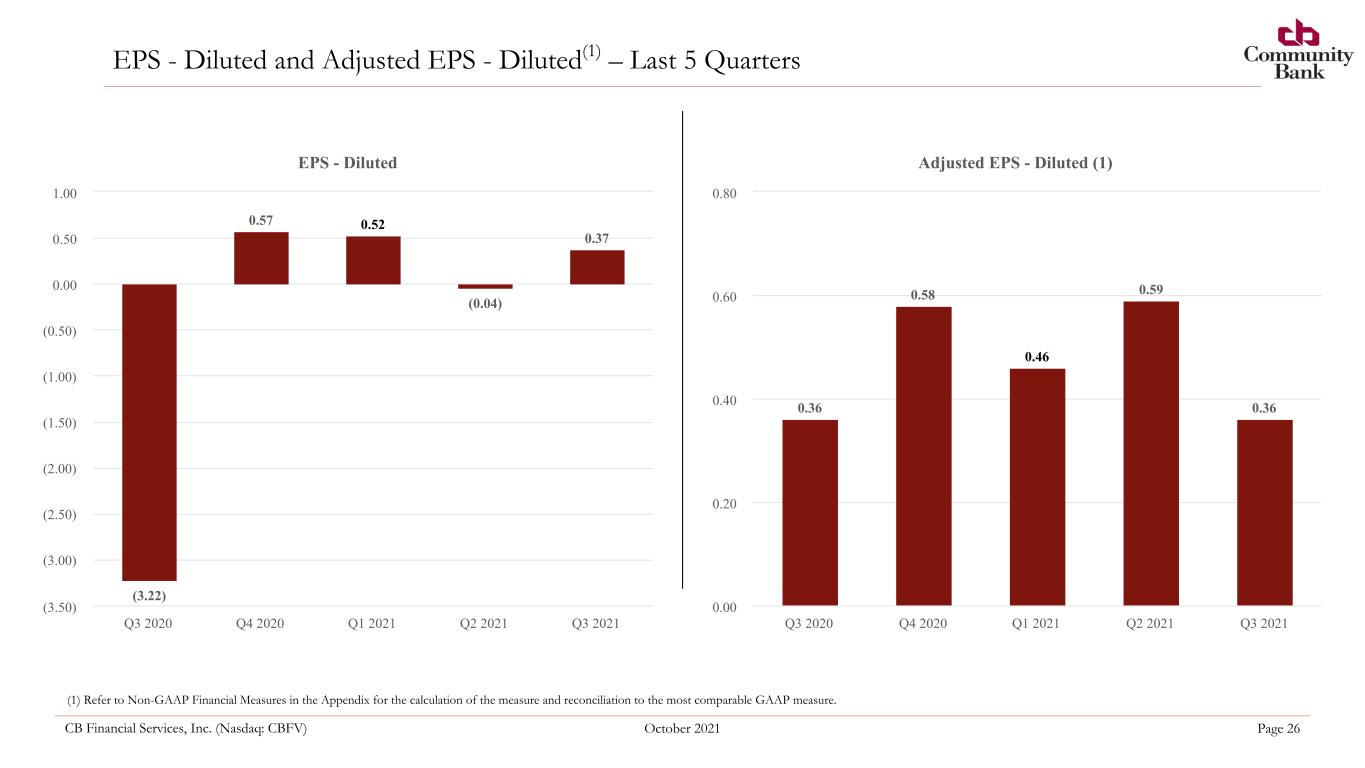

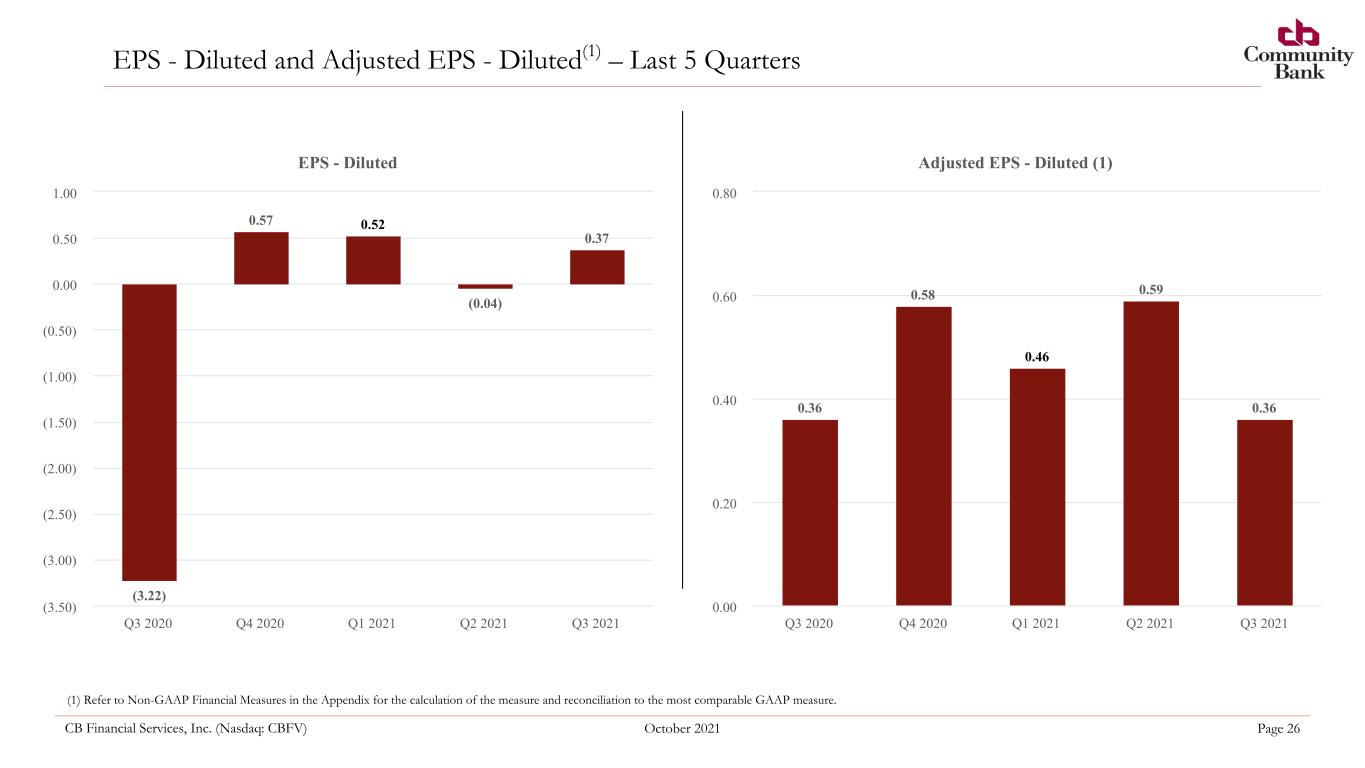

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 26 EPS - Diluted and Adjusted EPS - Diluted(1) – Last 5 Quarters (1) Refer to Non-GAAP Financial Measures in the Appendix for the calculation of the measure and reconciliation to the most comparable GAAP measure. EPS - Diluted (3.22) 0.57 0.52 (0.04) 0.37 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 (3.50) (3.00) (2.50) (2.00) (1.50) (1.00) (0.50) 0.00 0.50 1.00 Adjusted EPS - Diluted (1) 0.36 0.58 0.46 0.59 0.36 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 0.00 0.20 0.40 0.60 0.80

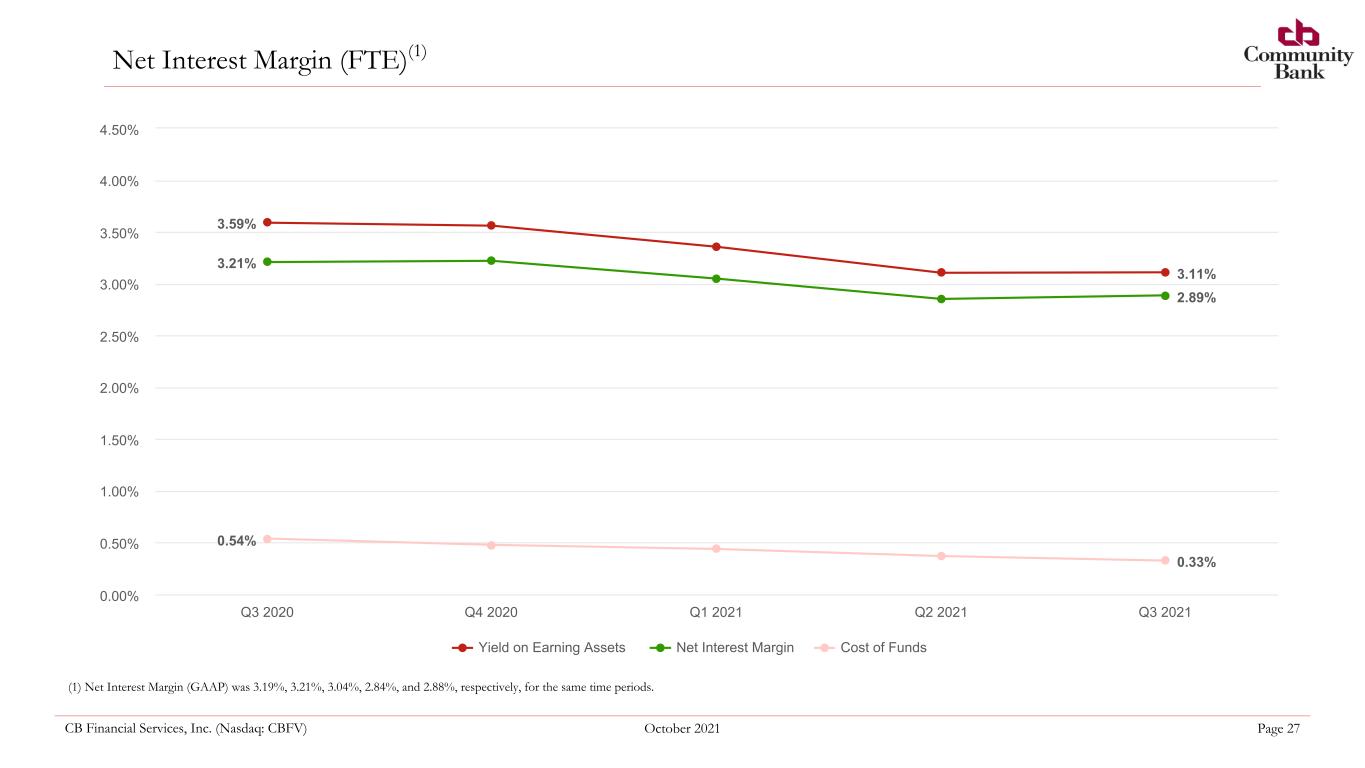

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 27 Net Interest Margin (FTE)(1) (1) Net Interest Margin (GAAP) was 3.19%, 3.21%, 3.04%, 2.84%, and 2.88%, respectively, for the same time periods. 3.59% 3.11% 3.21% 2.89% 0.54% 0.33% Yield on Earning Assets Net Interest Margin Cost of Funds Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50%

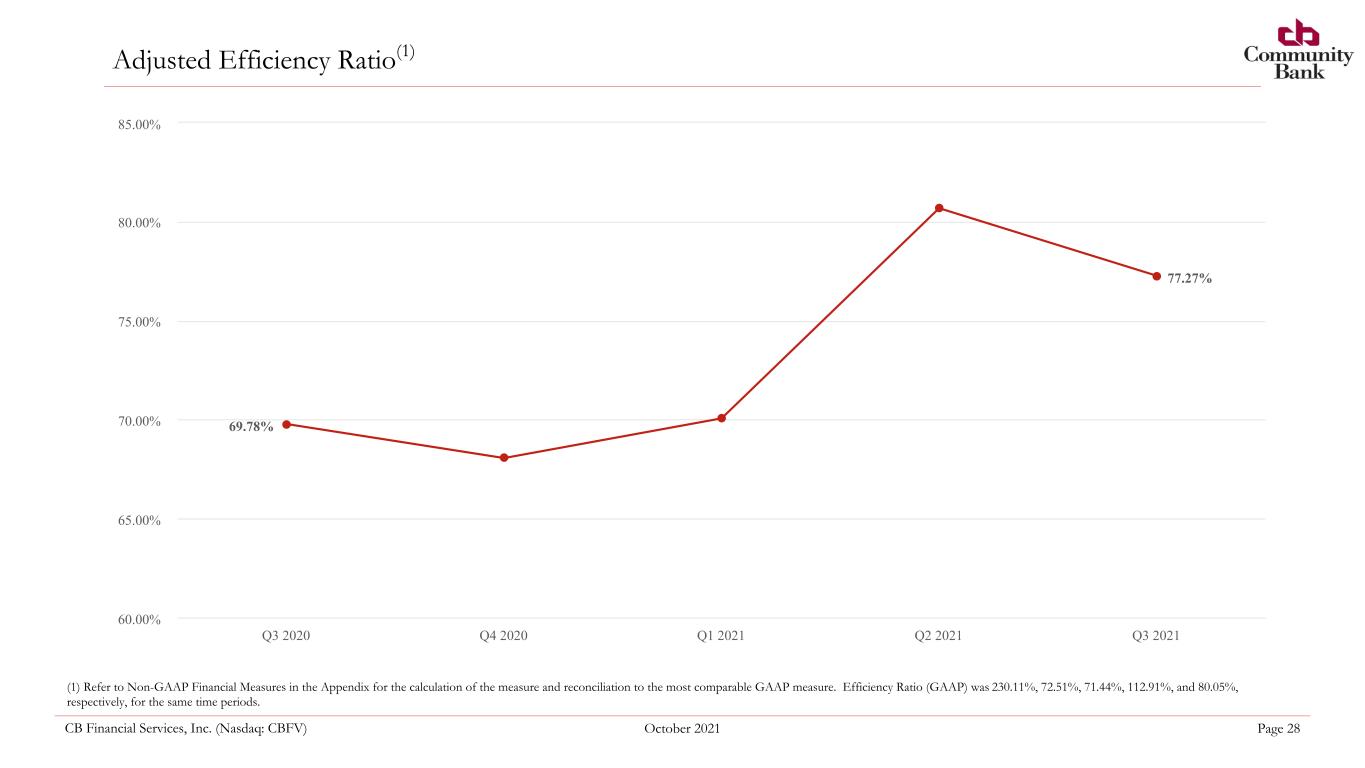

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 28 Adjusted Efficiency Ratio(1) (1) Refer to Non-GAAP Financial Measures in the Appendix for the calculation of the measure and reconciliation to the most comparable GAAP measure. Efficiency Ratio (GAAP) was 230.11%, 72.51%, 71.44%, 112.91%, and 80.05%, respectively, for the same time periods. 69.78% 77.27% Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 60.00% 65.00% 70.00% 75.00% 80.00% 85.00%

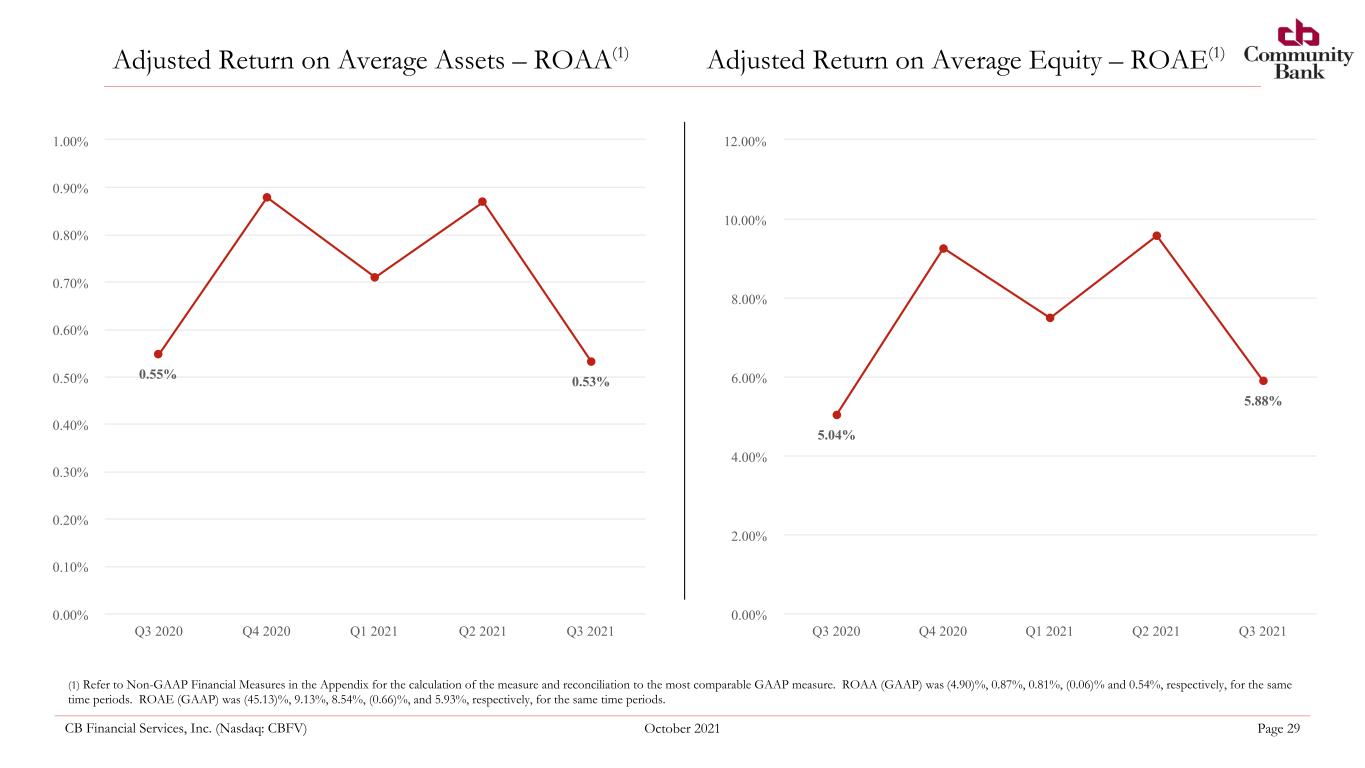

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 29 Adjusted Return on Average Assets – ROAA(1) Adjusted Return on Average Equity – ROAE(1) (1) Refer to Non-GAAP Financial Measures in the Appendix for the calculation of the measure and reconciliation to the most comparable GAAP measure. ROAA (GAAP) was (4.90)%, 0.87%, 0.81%, (0.06)% and 0.54%, respectively, for the same time periods. ROAE (GAAP) was (45.13)%, 9.13%, 8.54%, (0.66)%, and 5.93%, respectively, for the same time periods. 0.55% 0.53% Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 5.04% 5.88% Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00%

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 30 Strong Capital Ratios (Community Bank) 11.62% 11.62% 12.88% 7.63% 11.79% 11.79% 13.04% 7.81% 11.53% 11.53% 12.78% 7.38% September 30, 2020 December 31, 2020 September 30, 2021 Common Equity Tier 1 Capital (to Risk Weighted Assets) Tier 1 Capital (to Risk Weighted Assets) Total Capital (to Risk Weighted Assets) Tier 1 Leverage (to Adjusted Total Assets) 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00%

Moving Forward – Building a Stronger Community Investing for the Future Adaptive to New Consumer Expectations Engaging with Loyal Customers and Winning New Ones

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 32 Contact Information Company Contact: John H. Montgomery President and Chief Executive Officer Phone: (724) 225-2400 Investor Relations Adam Prior Phone: (212) 836-9606 Email: aprior@equityny.com NASDAQ Capital Market: CBFV 100 N. Market Street Carmichaels, PA 15320 Phone: 724-966-5041 Fax: 724-966-7867

Appendix

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 34 Selected Consolidated Financial Information (Dollars in thousands) (Unaudited) Selected Financial Condition Data 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 ASSETS Cash and Due From Banks $ 173,523 $ 172,010 $ 230,000 $ 160,911 $ 112,169 Securities 221,351 208,472 142,156 145,400 158,956 Loans Held for Sale 17,407 11,409 — — — Loans Real Estate: Residential 317,373 322,480 339,596 344,142 343,955 Commercial 379,621 360,518 370,118 373,555 353,904 Construction 78,075 85,187 77,714 72,600 69,178 Commercial and Industrial PPP 32,703 49,525 60,380 55,096 71,028 Other Commercial and Industrial 69,657 70,666 68,551 71,717 73,287 Consumer 112,087 106,404 111,650 113,854 117,364 Other 12,083 12,666 13,688 13,789 22,169 Total Loans 1,001,599 1,007,446 1,041,697 1,044,753 1,050,885 Allowance for Loan Losses (11,581) (11,544) (12,725) (12,771) (13,780) Loans, Net 990,018 995,902 1,028,972 1,031,982 1,037,105 Premises and Equipment Held for Sale 795 795 — — — Premises and Equipment, Net 18,502 18,682 20,240 20,302 20,439 Bank-Owned Life Insurance 25,190 25,052 24,916 24,779 24,639 Goodwill 9,732 9,732 9,732 9,732 9,732 Intangible Assets, Net 5,740 6,186 7,867 8,399 8,931 Accrued Interest and Other Assets 12,560 13,373 12,938 15,215 20,905 Total Assets $ 1,474,818 $ 1,461,613 $ 1,476,821 $ 1,416,720 $ 1,392,876 LIABILITIES Deposits Held for Sale $ 102,647 $ 102,557 $ — $ — $ — Deposits Non-Interest Bearing Demand Deposits 373,320 368,452 377,137 340,569 335,287 Interest Bearing Demand Accounts 244,004 246,920 280,929 259,870 245,850 Money Market Accounts 190,426 176,824 198,975 199,029 188,958 Savings Accounts 232,679 226,639 246,725 235,088 232,691 Time Deposits 144,727 154,718 180,697 190,013 196,250 Total Deposits 1,185,156 1,173,553 1,284,463 1,224,569 1,199,036 Short-Term Borrowings 42,623 39,054 45,352 41,055 42,061 Other Borrowings 6,000 6,000 6,000 8,000 11,000 Accrued Interest and Other Liabilities 7,405 7,913 7,230 8,566 7,480 Total Liabilities 1,343,831 1,329,077 1,343,045 1,282,190 1,259,577 STOCKHOLDERS’ EQUITY $ 130,987 $ 132,536 $ 133,776 $ 134,530 $ 133,299

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 35 Selected Consolidated Financial Information Three Months Ended Nine Months Ended Selected Operating Data 09/30/21 06/30/21 03/31/21 12/31/20 09/30/20 09/30/21 09/30/20 Interest and Dividend Income Loans, Including Fees 9,718 9,936 10,146 10,833 10,709 29,800 32,050 Securities: Taxable 843 635 646 725 753 2,124 2,894 Tax-Exempt 71 74 78 78 79 223 291 Dividends 19 24 20 20 19 63 59 Other Interest and Dividend Income 135 151 98 99 96 384 418 Total Interest and Dividend Income 10,786 10,820 10,988 11,755 11,656 32,594 35,712 Interest Expense Deposits 715 827 947 1,036 1,150 2,489 4,136 Short-Term Borrowings 25 24 23 25 28 72 112 Other Borrowings 36 35 41 60 62 112 194 Total Interest Expense 776 886 1,011 1,121 1,240 2,673 4,442 Net Interest and Dividend Income 10,010 9,934 9,977 10,634 10,416 29,921 31,270 (Recovery) Provision for Loan Losses — (1,200) — — 1,200 (1,200) 4,000 Net Interest and Dividend Income After (Recovery) Provision for Loan Losses 10,010 11,134 9,977 10,634 9,216 31,121 27,270 Noninterest Income: Service Fees 602 614 546 560 554 1,762 1,646 Insurance Commissions 1,194 1,209 1,595 1,403 1,079 3,998 3,475 Other Commissions 93 173 165 105 76 431 374 Net Gain on Sales of Loans 49 31 86 388 435 166 1,003 Net Gain (Loss) on Securities 24 11 447 213 (59) 482 20 Net Gain on Purchased Tax Credits 18 17 18 16 15 53 46 Net Loss on Disposal of Fixed Assets — (3) — (13) (65) (3) (48) Income from Bank-Owned Life Insurance 138 136 137 140 140 411 417 Other Income (Loss) 80 31 180 (34) (2) 291 (240) Total Noninterest Income 2,198 2,219 3,174 2,778 2,173 7,591 6,693 Noninterest Expense: Salaries and Employee Benefits 4,787 5,076 4,894 5,126 5,124 14,757 14,683 Occupancy 615 1,024 710 606 759 2,349 2,191 Equipment 205 311 266 234 220 782 701 Data Processing 541 607 518 476 482 1,666 1,367 FDIC Assessment 293 249 250 344 172 792 493 PA Shares Tax 224 225 265 350 355 714 963 Contracted Services 1,441 750 687 577 531 2,878 1,471 Legal and Professional Fees 180 419 189 185 161 788 567 Advertising 225 193 140 178 148 558 486 Other Real Estate Owned (Income) (89) (26) (38) (39) (12) (153) (30) Amortization of Intangible Assets 446 503 532 532 532 1,481 1,596 Intangible Assets and Goodwill Impairment — 1,178 — — 18,693 1,178 18,693 Writedown of Fixed Assets 2 2,268 — 240 884 2,270 884 Other 903 945 982 916 919 2,830 2,977 Total Noninterest Expense 9,773 13,722 9,395 9,725 28,968 32,890 47,042 Income (Loss) Before Income Tax Expense (Benefit) 2,435 (369) 3,756 3,687 (17,579) 5,822 (13,079) Income Tax Expense (Benefit) 452 (146) 911 608 (184) 1,217 640 Net Income (Loss) 1,983 (223) 2,845 3,079 (17,395) 4,605 (13,719) (Dollars in thousands) (Unaudited)

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 36 Per Common Share Data (1) Non-GAAP financial metric. Please see the appendix to view this presentation for Non-GAAP reconciliations. Three Months Ended Nine Months Ended Per Common Share Data 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 9/30/21 9/30/20 Dividends Per Common Share $ 0.24 $ 0.24 $ 0.24 $ 0.24 $ 0.24 $ 0.72 $ 0.72 Earnings (Loss) Per Common Share - Basic 0.37 (0.04) 0.52 0.57 (3.22) 0.85 (2.54) Earnings (Loss) Per Common Share - Diluted 0.37 (0.04) 0.52 0.57 (3.22) 0.85 (2.54) Adjusted Earnings Per Common Share - Diluted (Non-GAAP) (1) 0.36 0.59 0.46 0.58 0.36 1.42 1.03 Weighted Average Common Shares Outstanding - Basic 5,373,032 5,432,234 5,434,374 5,404,874 5,395,342 5,412,989 5,406,710 Weighted Average Common Shares Outstanding - Diluted 5,390,128 5,432,234 5,436,881 5,406,068 5,395,342 5,420,792 5,406,710 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 Common Shares Outstanding 5,330,401 5,409,077 5,434,374 5,434,374 5,398,712 Book Value Per Common Share $ 24.57 $ 24.50 $ 24.62 $ 24.76 $ 24.69 Tangible Book Value per Common Share (Non-GAAP) (1) 21.67 21.56 21.38 21.42 21.23 Stockholders’ Equity to Assets 8.9 % 9.1 % 9.1 % 9.5 % 9.6 % Tangible Common Equity to Tangible Assets (Non-GAAP) (1) 7.9 8.1 8.0 8.3 8.3

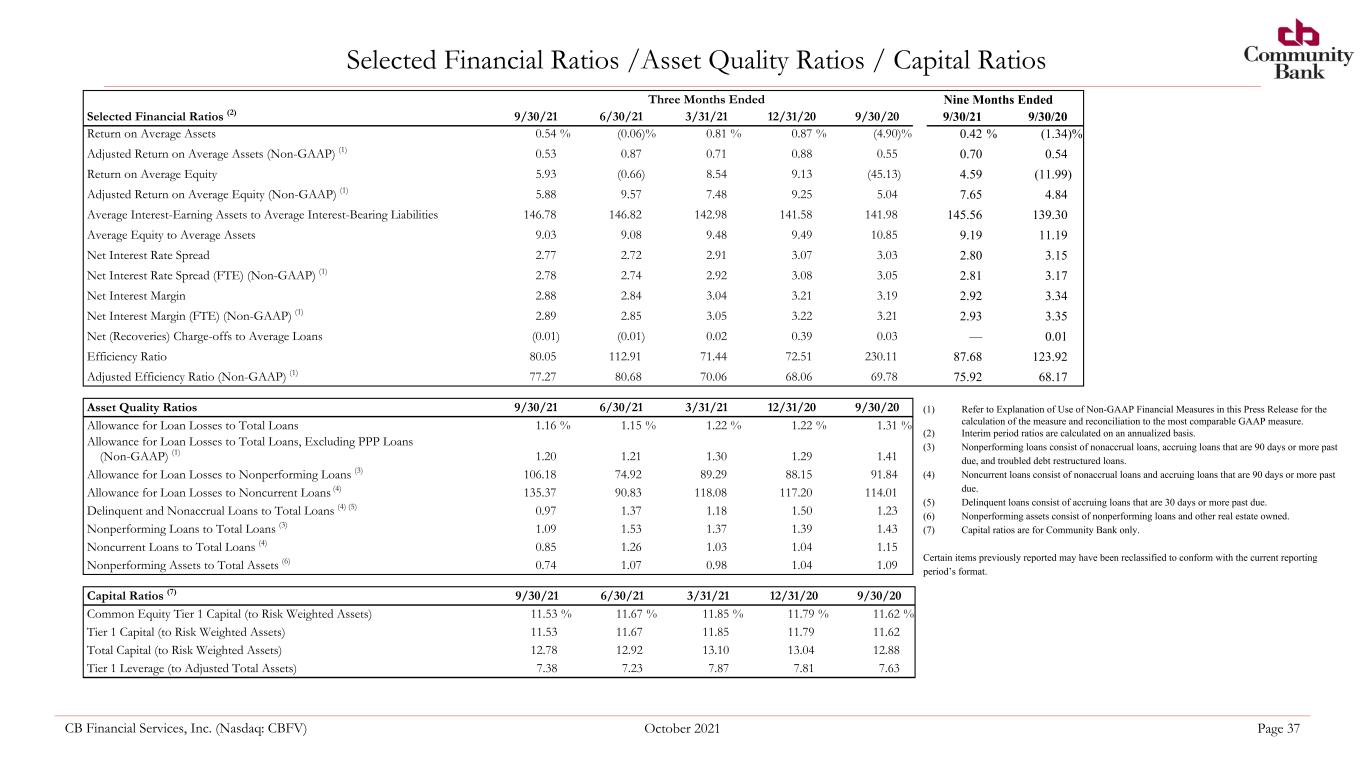

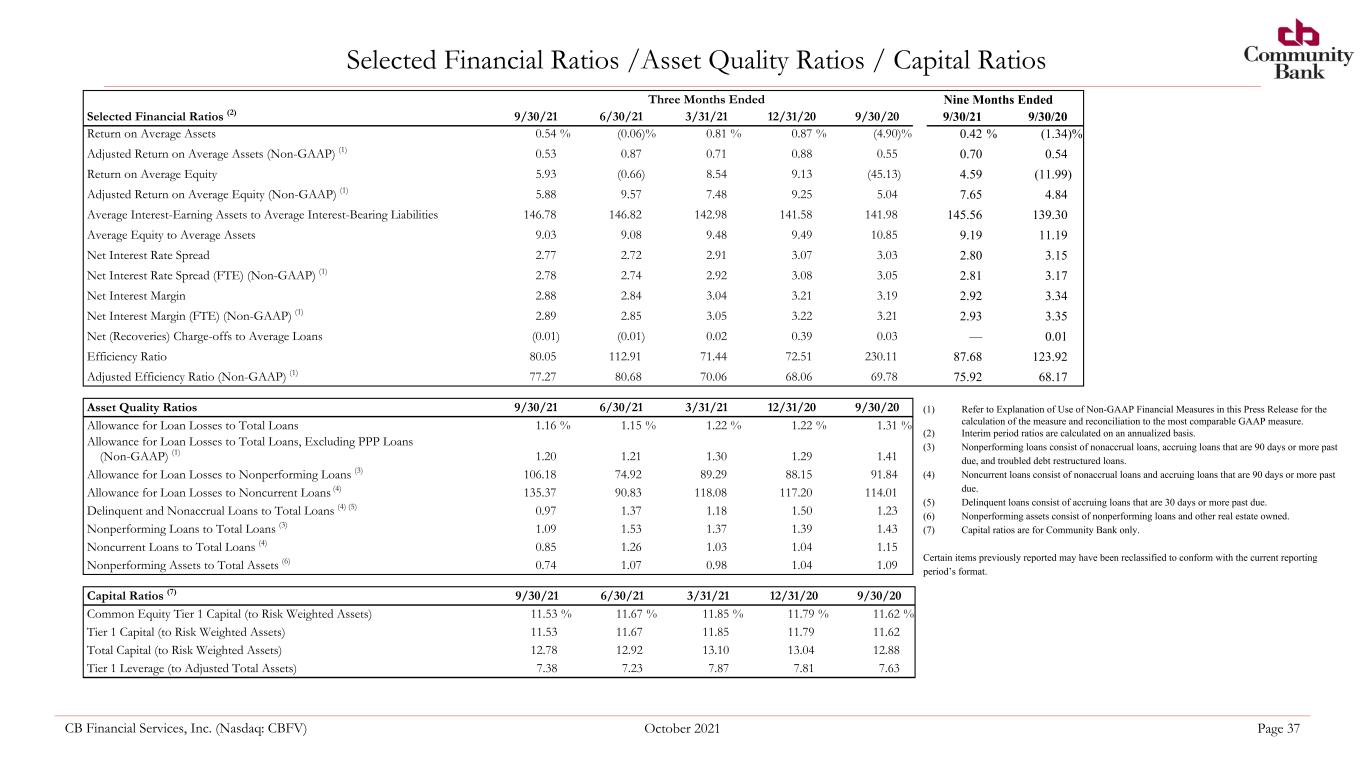

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 37 Selected Financial Ratios /Asset Quality Ratios / Capital Ratios Three Months Ended Nine Months Ended Selected Financial Ratios (2) 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 9/30/21 9/30/20 Return on Average Assets 0.54 % (0.06) % 0.81 % 0.87 % (4.90) % 0.42 % (1.34) % Adjusted Return on Average Assets (Non-GAAP) (1) 0.53 0.87 0.71 0.88 0.55 0.70 0.54 Return on Average Equity 5.93 (0.66) 8.54 9.13 (45.13) 4.59 (11.99) Adjusted Return on Average Equity (Non-GAAP) (1) 5.88 9.57 7.48 9.25 5.04 7.65 4.84 Average Interest-Earning Assets to Average Interest-Bearing Liabilities 146.78 146.82 142.98 141.58 141.98 145.56 139.30 Average Equity to Average Assets 9.03 9.08 9.48 9.49 10.85 9.19 11.19 Net Interest Rate Spread 2.77 2.72 2.91 3.07 3.03 2.80 3.15 Net Interest Rate Spread (FTE) (Non-GAAP) (1) 2.78 2.74 2.92 3.08 3.05 2.81 3.17 Net Interest Margin 2.88 2.84 3.04 3.21 3.19 2.92 3.34 Net Interest Margin (FTE) (Non-GAAP) (1) 2.89 2.85 3.05 3.22 3.21 2.93 3.35 Net (Recoveries) Charge-offs to Average Loans (0.01) (0.01) 0.02 0.39 0.03 — 0.01 Efficiency Ratio 80.05 112.91 71.44 72.51 230.11 87.68 123.92 Adjusted Efficiency Ratio (Non-GAAP) (1) 77.27 80.68 70.06 68.06 69.78 75.92 68.17 Asset Quality Ratios 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 Allowance for Loan Losses to Total Loans 1.16 % 1.15 % 1.22 % 1.22 % 1.31 % Allowance for Loan Losses to Total Loans, Excluding PPP Loans (Non-GAAP) (1) 1.20 1.21 1.30 1.29 1.41 Allowance for Loan Losses to Nonperforming Loans (3) 106.18 74.92 89.29 88.15 91.84 Allowance for Loan Losses to Noncurrent Loans (4) 135.37 90.83 118.08 117.20 114.01 Delinquent and Nonaccrual Loans to Total Loans (4) (5) 0.97 1.37 1.18 1.50 1.23 Nonperforming Loans to Total Loans (3) 1.09 1.53 1.37 1.39 1.43 Noncurrent Loans to Total Loans (4) 0.85 1.26 1.03 1.04 1.15 Nonperforming Assets to Total Assets (6) 0.74 1.07 0.98 1.04 1.09 Capital Ratios (7) 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 Common Equity Tier 1 Capital (to Risk Weighted Assets) 11.53 % 11.67 % 11.85 % 11.79 % 11.62 % Tier 1 Capital (to Risk Weighted Assets) 11.53 11.67 11.85 11.79 11.62 Total Capital (to Risk Weighted Assets) 12.78 12.92 13.10 13.04 12.88 Tier 1 Leverage (to Adjusted Total Assets) 7.38 7.23 7.87 7.81 7.63 (1) Refer to Explanation of Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure. (2) Interim period ratios are calculated on an annualized basis. (3) Nonperforming loans consist of nonaccrual loans, accruing loans that are 90 days or more past due, and troubled debt restructured loans. (4) Noncurrent loans consist of nonaccrual loans and accruing loans that are 90 days or more past due. (5) Delinquent loans consist of accruing loans that are 30 days or more past due. (6) Nonperforming assets consist of nonperforming loans and other real estate owned. (7) Capital ratios are for Community Bank only. Certain items previously reported may have been reclassified to conform with the current reporting period’s format.

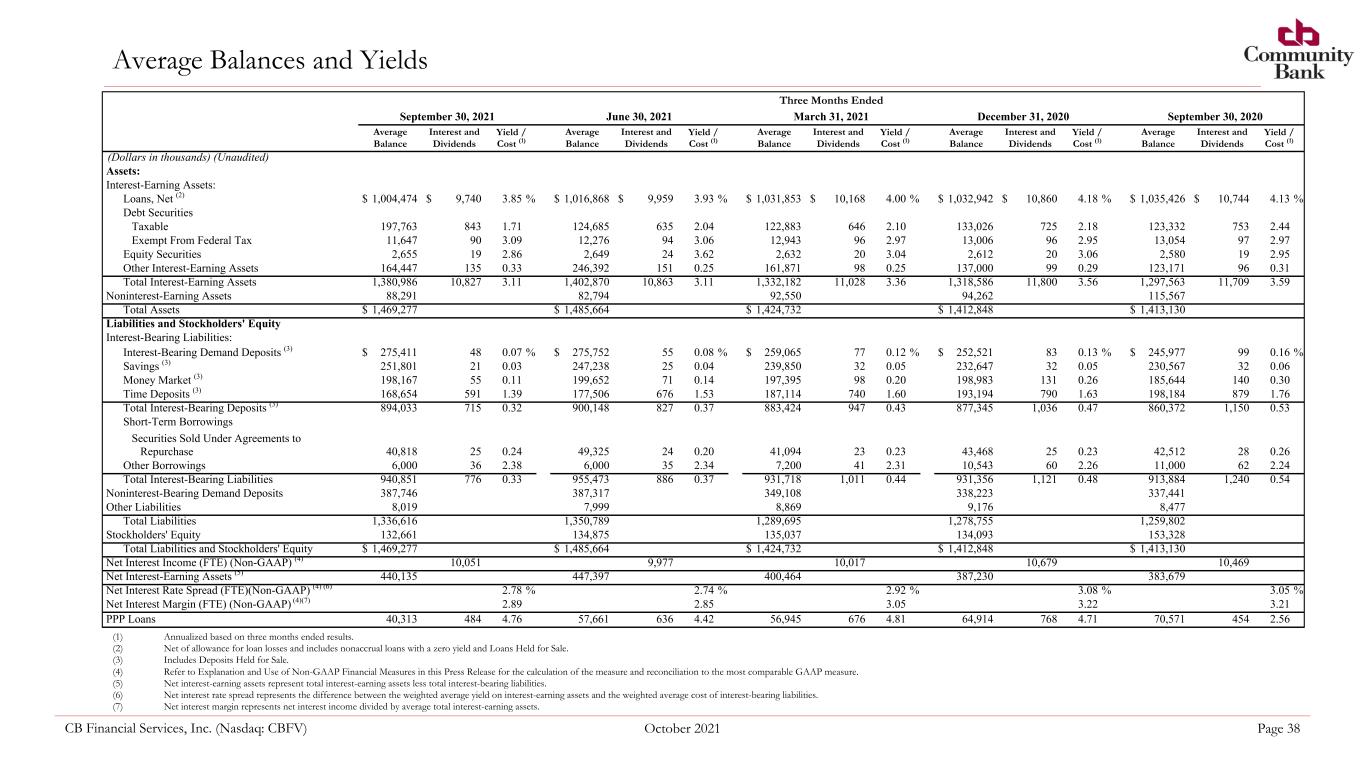

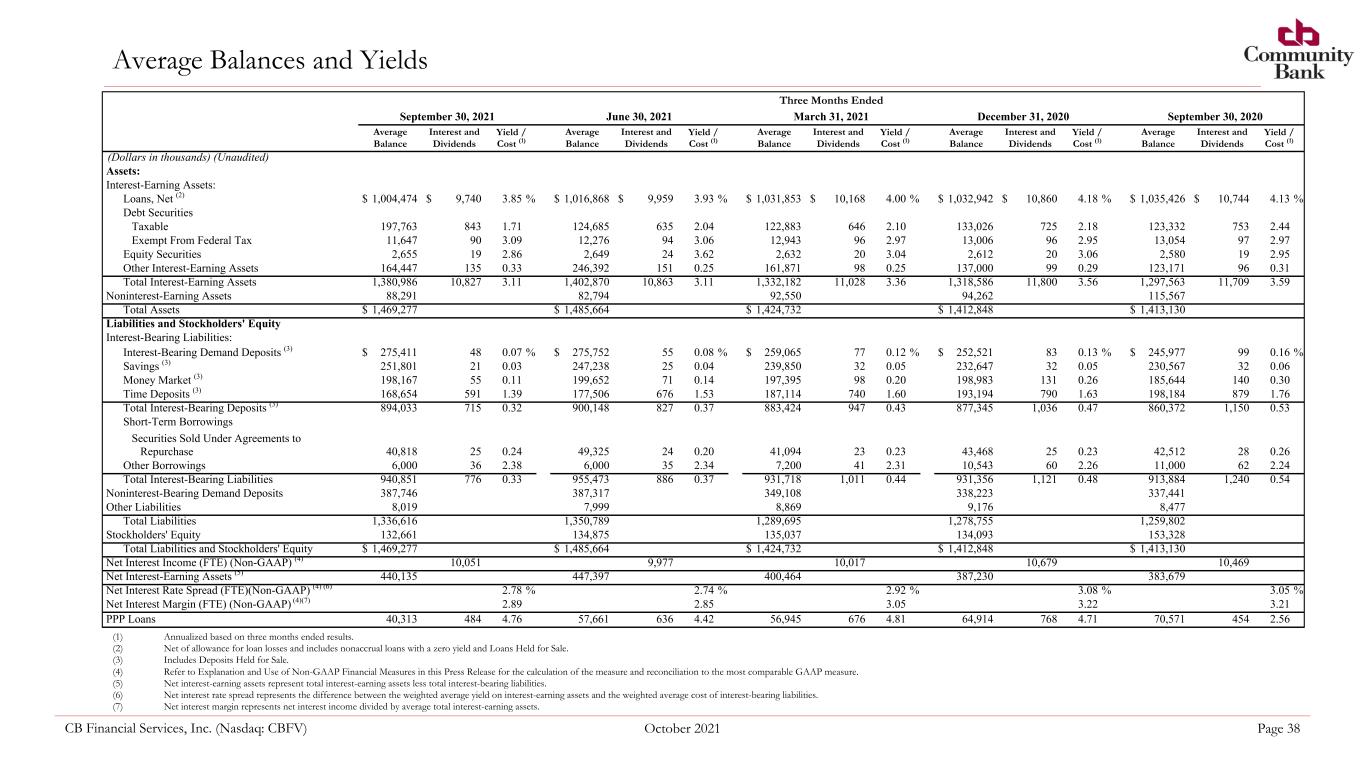

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 38 Average Balances and Yields (1) Annualized based on three months ended results. (2) Net of allowance for loan losses and includes nonaccrual loans with a zero yield and Loans Held for Sale. (3) Includes Deposits Held for Sale. (4) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure. (5) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities. (6) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities. (7) Net interest margin represents net interest income divided by average total interest-earning assets. Three Months Ended September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 September 30, 2020 Average Balance Interest and Dividends Yield / Cost (1) Average Balance Interest and Dividends Yield / Cost (1) Average Balance Interest and Dividends Yield / Cost (1) Average Balance Interest and Dividends Yield / Cost (1) Average Balance Interest and Dividends Yield / Cost (1) (Dollars in thousands) (Unaudited) Assets: Interest-Earning Assets: Loans, Net (2) $ 1,004,474 $ 9,740 3.85 % $ 1,016,868 $ 9,959 3.93 % $ 1,031,853 $ 10,168 4.00 % $ 1,032,942 $ 10,860 4.18 % $ 1,035,426 $ 10,744 4.13 % Debt Securities Taxable 197,763 843 1.71 124,685 635 2.04 122,883 646 2.10 133,026 725 2.18 123,332 753 2.44 Exempt From Federal Tax 11,647 90 3.09 12,276 94 3.06 12,943 96 2.97 13,006 96 2.95 13,054 97 2.97 Equity Securities 2,655 19 2.86 2,649 24 3.62 2,632 20 3.04 2,612 20 3.06 2,580 19 2.95 Other Interest-Earning Assets 164,447 135 0.33 246,392 151 0.25 161,871 98 0.25 137,000 99 0.29 123,171 96 0.31 Total Interest-Earning Assets 1,380,986 10,827 3.11 1,402,870 10,863 3.11 1,332,182 11,028 3.36 1,318,586 11,800 3.56 1,297,563 11,709 3.59 Noninterest-Earning Assets 88,291 82,794 92,550 94,262 115,567 Total Assets $ 1,469,277 $ 1,485,664 $ 1,424,732 $ 1,412,848 $ 1,413,130 Liabilities and Stockholders' Equity Interest-Bearing Liabilities: Interest-Bearing Demand Deposits (3) $ 275,411 48 0.07 % $ 275,752 55 0.08 % $ 259,065 77 0.12 % $ 252,521 83 0.13 % $ 245,977 99 0.16 % Savings (3) 251,801 21 0.03 247,238 25 0.04 239,850 32 0.05 232,647 32 0.05 230,567 32 0.06 Money Market (3) 198,167 55 0.11 199,652 71 0.14 197,395 98 0.20 198,983 131 0.26 185,644 140 0.30 Time Deposits (3) 168,654 591 1.39 177,506 676 1.53 187,114 740 1.60 193,194 790 1.63 198,184 879 1.76 Total Interest-Bearing Deposits (3) 894,033 715 0.32 900,148 827 0.37 883,424 947 0.43 877,345 1,036 0.47 860,372 1,150 0.53 Short-Term Borrowings Securities Sold Under Agreements to Repurchase 40,818 25 0.24 49,325 24 0.20 41,094 23 0.23 43,468 25 0.23 42,512 28 0.26 Other Borrowings 6,000 36 2.38 6,000 35 2.34 7,200 41 2.31 10,543 60 2.26 11,000 62 2.24 Total Interest-Bearing Liabilities 940,851 776 0.33 955,473 886 0.37 931,718 1,011 0.44 931,356 1,121 0.48 913,884 1,240 0.54 Noninterest-Bearing Demand Deposits 387,746 387,317 349,108 338,223 337,441 Other Liabilities 8,019 7,999 8,869 9,176 8,477 Total Liabilities 1,336,616 1,350,789 1,289,695 1,278,755 1,259,802 Stockholders' Equity 132,661 134,875 135,037 134,093 153,328 Total Liabilities and Stockholders' Equity $ 1,469,277 $ 1,485,664 $ 1,424,732 $ 1,412,848 $ 1,413,130 Net Interest Income (FTE) (Non-GAAP) (4) 10,051 9,977 10,017 10,679 10,469 Net Interest-Earning Assets (5) 440,135 447,397 400,464 387,230 383,679 Net Interest Rate Spread (FTE)(Non-GAAP) (4) (6) 2.78 % 2.74 % 2.92 % 3.08 % 3.05 % Net Interest Margin (FTE) (Non-GAAP) (4)(7) 2.89 2.85 3.05 3.22 3.21 PPP Loans 40,313 484 4.76 57,661 636 4.42 56,945 676 4.81 64,914 768 4.71 70,571 454 2.56

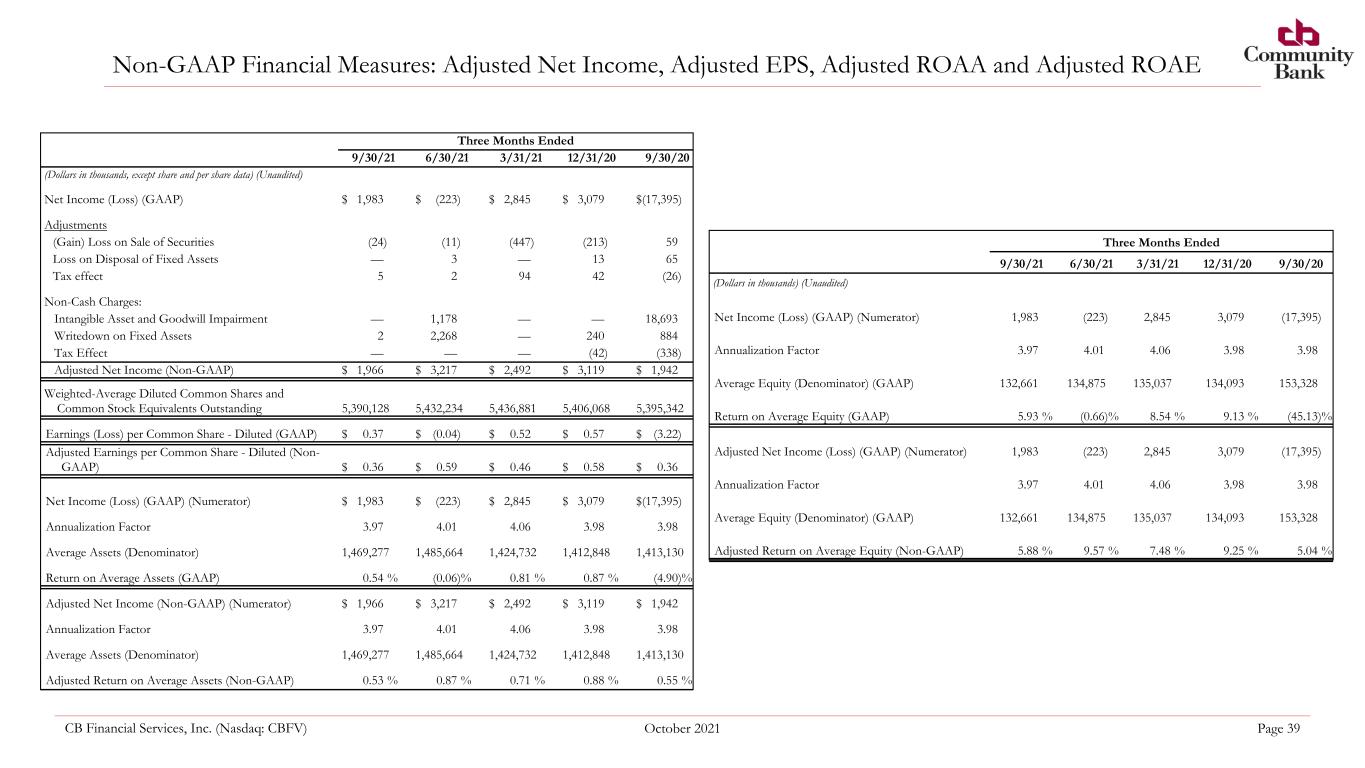

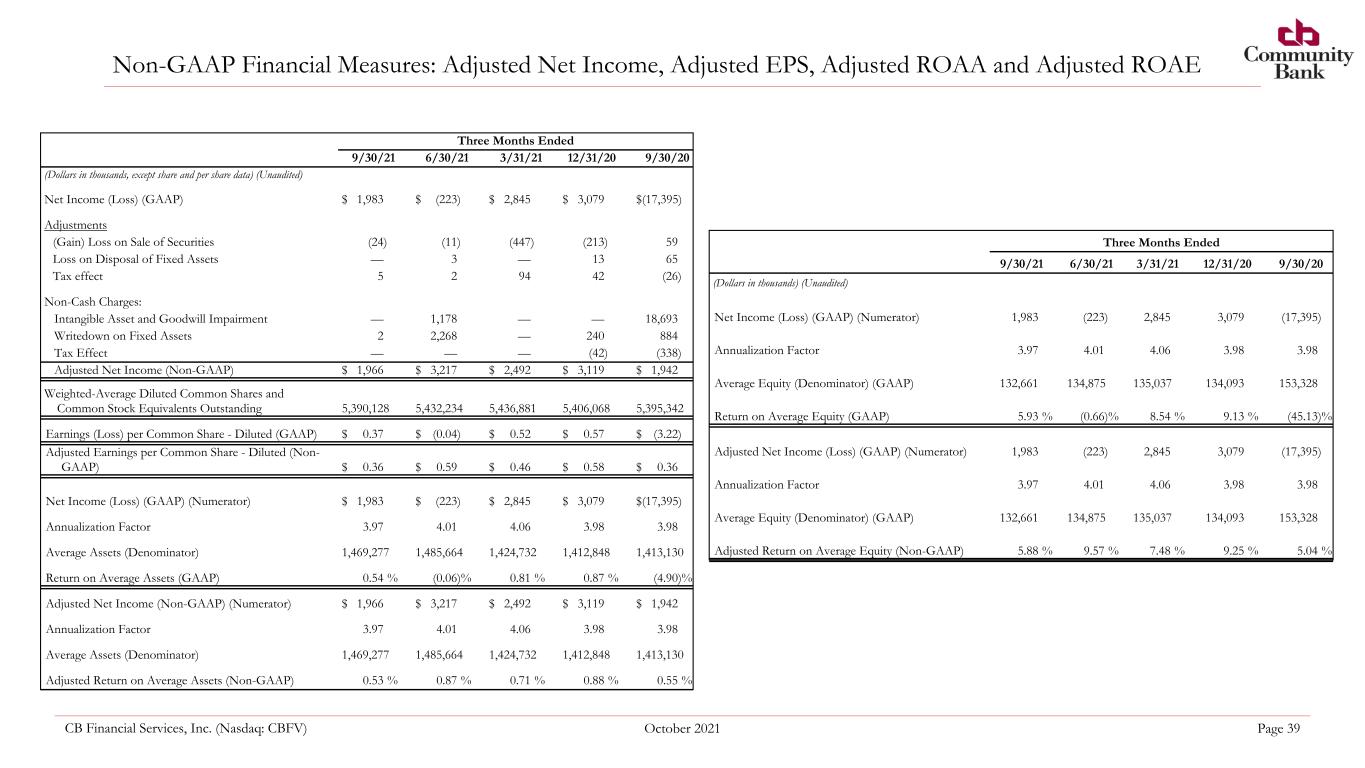

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 39 Non-GAAP Financial Measures: Adjusted Net Income, Adjusted EPS, Adjusted ROAA and Adjusted ROAE Three Months Ended 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 (Dollars in thousands, except share and per share data) (Unaudited) Net Income (Loss) (GAAP) $ 1,983 $ (223) $ 2,845 $ 3,079 $ (17,395) Adjustments (Gain) Loss on Sale of Securities (24) (11) (447) (213) 59 Loss on Disposal of Fixed Assets — 3 — 13 65 Tax effect 5 2 94 42 (26) Non-Cash Charges: Intangible Asset and Goodwill Impairment — 1,178 — — 18,693 Writedown on Fixed Assets 2 2,268 — 240 884 Tax Effect — — — (42) (338) Adjusted Net Income (Non-GAAP) $ 1,966 $ 3,217 $ 2,492 $ 3,119 $ 1,942 Weighted-Average Diluted Common Shares and Common Stock Equivalents Outstanding 5,390,128 5,432,234 5,436,881 5,406,068 5,395,342 Earnings (Loss) per Common Share - Diluted (GAAP) $ 0.37 $ (0.04) $ 0.52 $ 0.57 $ (3.22) Adjusted Earnings per Common Share - Diluted (Non- GAAP) $ 0.36 $ 0.59 $ 0.46 $ 0.58 $ 0.36 Net Income (Loss) (GAAP) (Numerator) $ 1,983 $ (223) $ 2,845 $ 3,079 $ (17,395) Annualization Factor 3.97 4.01 4.06 3.98 3.98 Average Assets (Denominator) 1,469,277 1,485,664 1,424,732 1,412,848 1,413,130 Return on Average Assets (GAAP) 0.54 % (0.06) % 0.81 % 0.87 % (4.90) % Adjusted Net Income (Non-GAAP) (Numerator) $ 1,966 $ 3,217 $ 2,492 $ 3,119 $ 1,942 Annualization Factor 3.97 4.01 4.06 3.98 3.98 Average Assets (Denominator) 1,469,277 1,485,664 1,424,732 1,412,848 1,413,130 Adjusted Return on Average Assets (Non-GAAP) 0.53 % 0.87 % 0.71 % 0.88 % 0.55 % Three Months Ended 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 (Dollars in thousands) (Unaudited) Net Income (Loss) (GAAP) (Numerator) 1,983 (223) 2,845 3,079 (17,395) Annualization Factor 3.97 4.01 4.06 3.98 3.98 Average Equity (Denominator) (GAAP) 132,661 134,875 135,037 134,093 153,328 Return on Average Equity (GAAP) 5.93 % (0.66) % 8.54 % 9.13 % (45.13) % Adjusted Net Income (Loss) (GAAP) (Numerator) 1,983 (223) 2,845 3,079 (17,395) Annualization Factor 3.97 4.01 4.06 3.98 3.98 Average Equity (Denominator) (GAAP) 132,661 134,875 135,037 134,093 153,328 Adjusted Return on Average Equity (Non-GAAP) 5.88 % 9.57 % 7.48 % 9.25 % 5.04 %

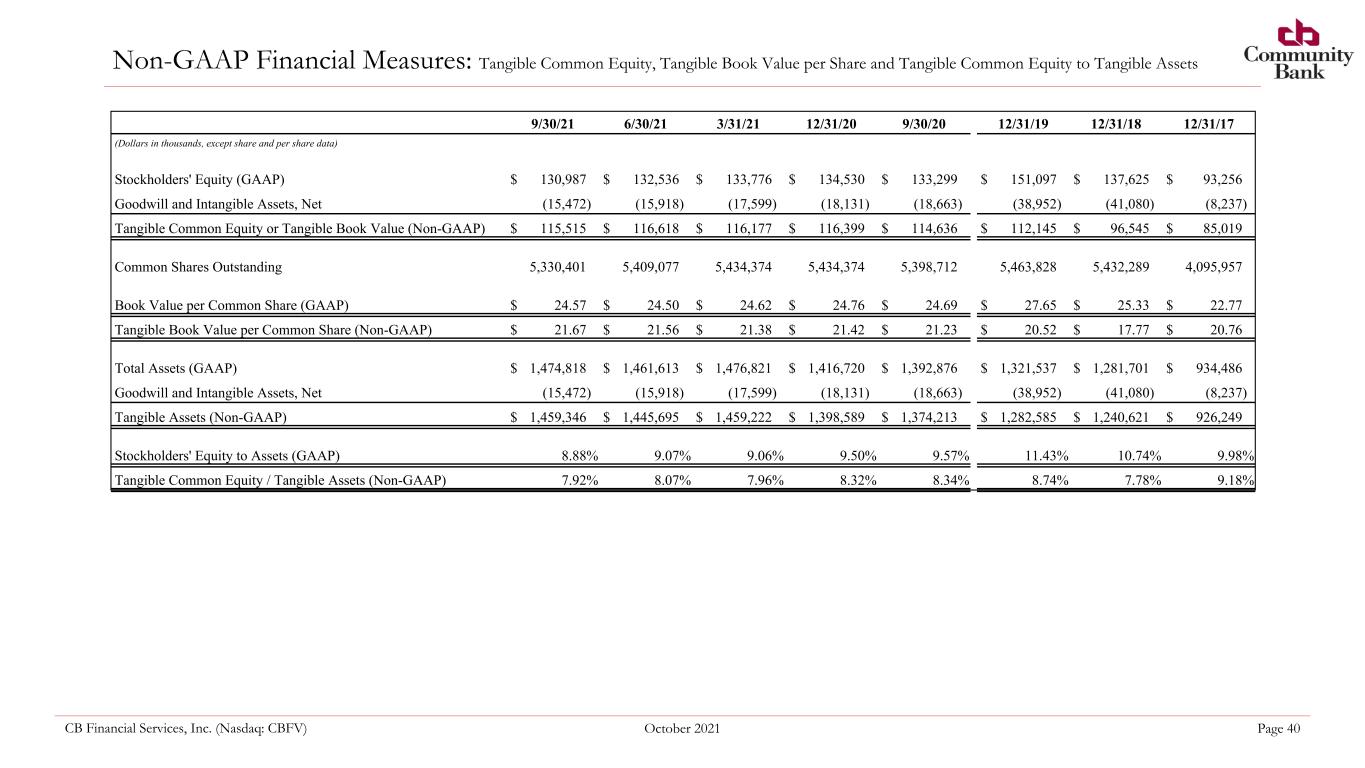

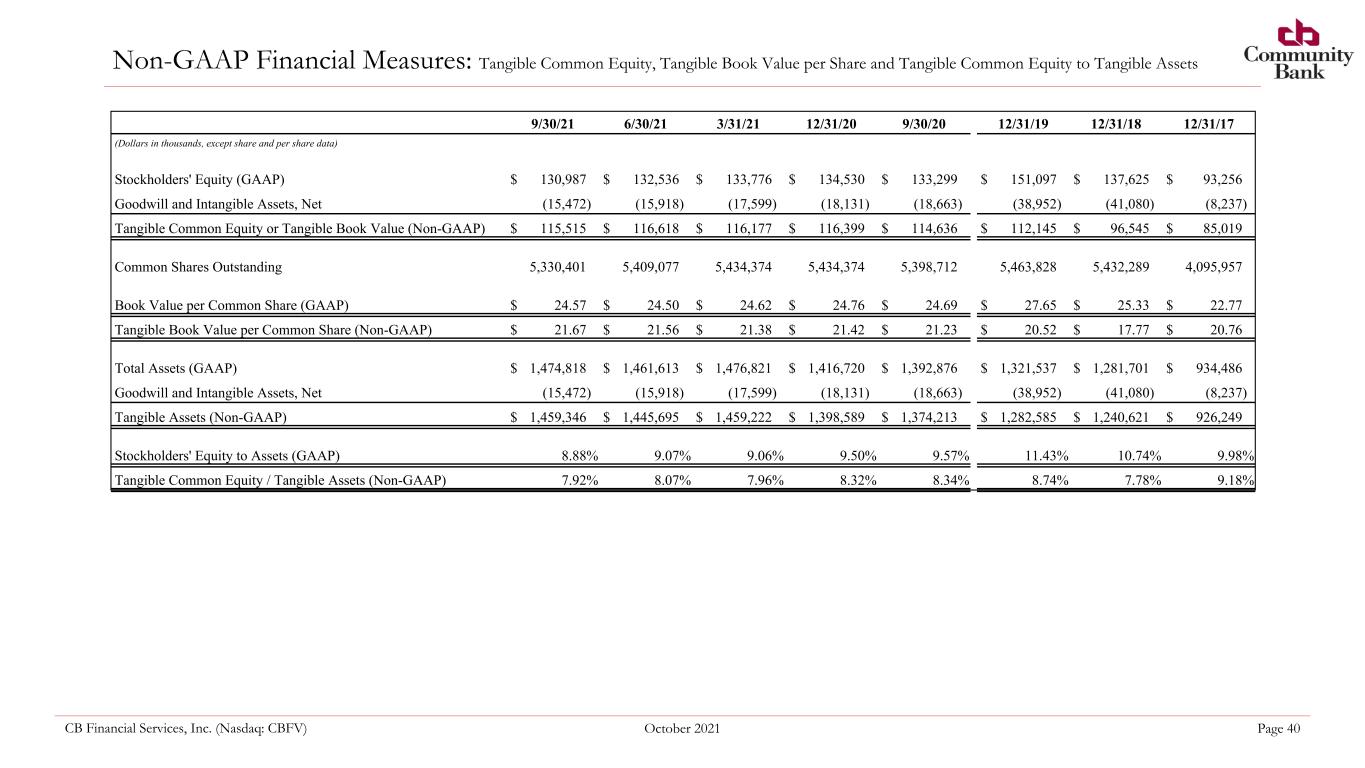

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 40 Non-GAAP Financial Measures: Tangible Common Equity, Tangible Book Value per Share and Tangible Common Equity to Tangible Assets 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 12/31/19 12/31/18 12/31/17 (Dollars in thousands, except share and per share data) Stockholders' Equity (GAAP) $ 130,987 $ 132,536 $ 133,776 $ 134,530 $ 133,299 $ 151,097 $ 137,625 $ 93,256 Goodwill and Intangible Assets, Net (15,472) (15,918) (17,599) (18,131) (18,663) (38,952) (41,080) (8,237) Tangible Common Equity or Tangible Book Value (Non-GAAP) $ 115,515 $ 116,618 $ 116,177 $ 116,399 $ 114,636 $ 112,145 $ 96,545 $ 85,019 Common Shares Outstanding 5,330,401 5,409,077 5,434,374 5,434,374 5,398,712 5,463,828 5,432,289 4,095,957 Book Value per Common Share (GAAP) $ 24.57 $ 24.50 $ 24.62 $ 24.76 $ 24.69 $ 27.65 $ 25.33 $ 22.77 Tangible Book Value per Common Share (Non-GAAP) $ 21.67 $ 21.56 $ 21.38 $ 21.42 $ 21.23 $ 20.52 $ 17.77 $ 20.76 Total Assets (GAAP) $ 1,474,818 $ 1,461,613 $ 1,476,821 $ 1,416,720 $ 1,392,876 $ 1,321,537 $ 1,281,701 $ 934,486 Goodwill and Intangible Assets, Net (15,472) (15,918) (17,599) (18,131) (18,663) (38,952) (41,080) (8,237) Tangible Assets (Non-GAAP) $ 1,459,346 $ 1,445,695 $ 1,459,222 $ 1,398,589 $ 1,374,213 $ 1,282,585 $ 1,240,621 $ 926,249 Stockholders' Equity to Assets (GAAP) 8.88 % 9.07 % 9.06 % 9.50 % 9.57 % 11.43 % 10.74 % 9.98 % Tangible Common Equity / Tangible Assets (Non-GAAP) 7.92 % 8.07 % 7.96 % 8.32 % 8.34 % 8.74 % 7.78 % 9.18 %

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 41 Non-GAAP Financial Measures: Return on Average Tangible Common Equity Three Months Ended Full Year 9/30/21 9/30/20 12/31/20 12/31/19 12/31/18 12/31/17 (Dollars in thousands) Net Income (Loss) (GAAP) $ 1,983 $ (17,395) $ (10,640) $ 14,327 $ 7,052 $ 6,944 Amortization of Intangible Assets, Net 446 532 2,128 1,532 1,167 348 Goodwill Impairment — 18,693 18,693 — — — Adjusted Net Income (Non-GAAP) (Numerator) $ 2,429 $ 1,830 $ 10,181 $ 15,859 $ 8,219 $ 7,292 Annualization Factor 3.97 3.98 1.00 1.00 1.00 1.00 Average Stockholders' Equity (GAAP) $ 132,661 $ 153,328 $ 148,132 $ 144,903 $ 119,300 $ 92,263 Average Goodwill and Intangible Assets, Net (15,754) (37,503) (33,207) (39,782) (30,012) (8,504) Average Tangible Common Equity (Non-GAAP) (Denominator) $ 116,907 $ 115,825 $ 114,925 $ 105,121 $ 89,288 $ 83,759 Return on Average Equity (GAAP) 5.93 % (45.13) % (7.18) % 9.89 % 5.91 % 7.53 % Return on Average Tangible Common Equity (Non-GAAP) 8.24 % 6.29 % 8.86 % 15.09 % 9.21 % 8.71 %

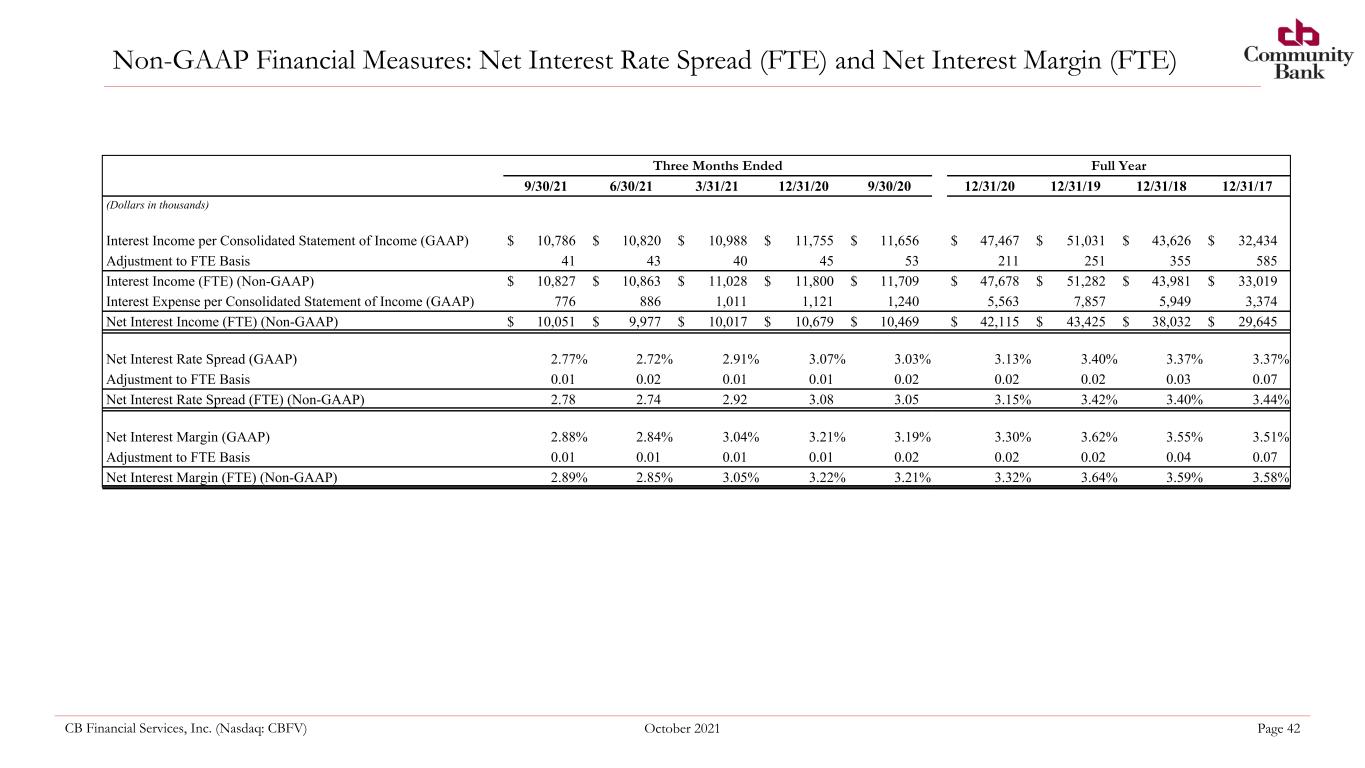

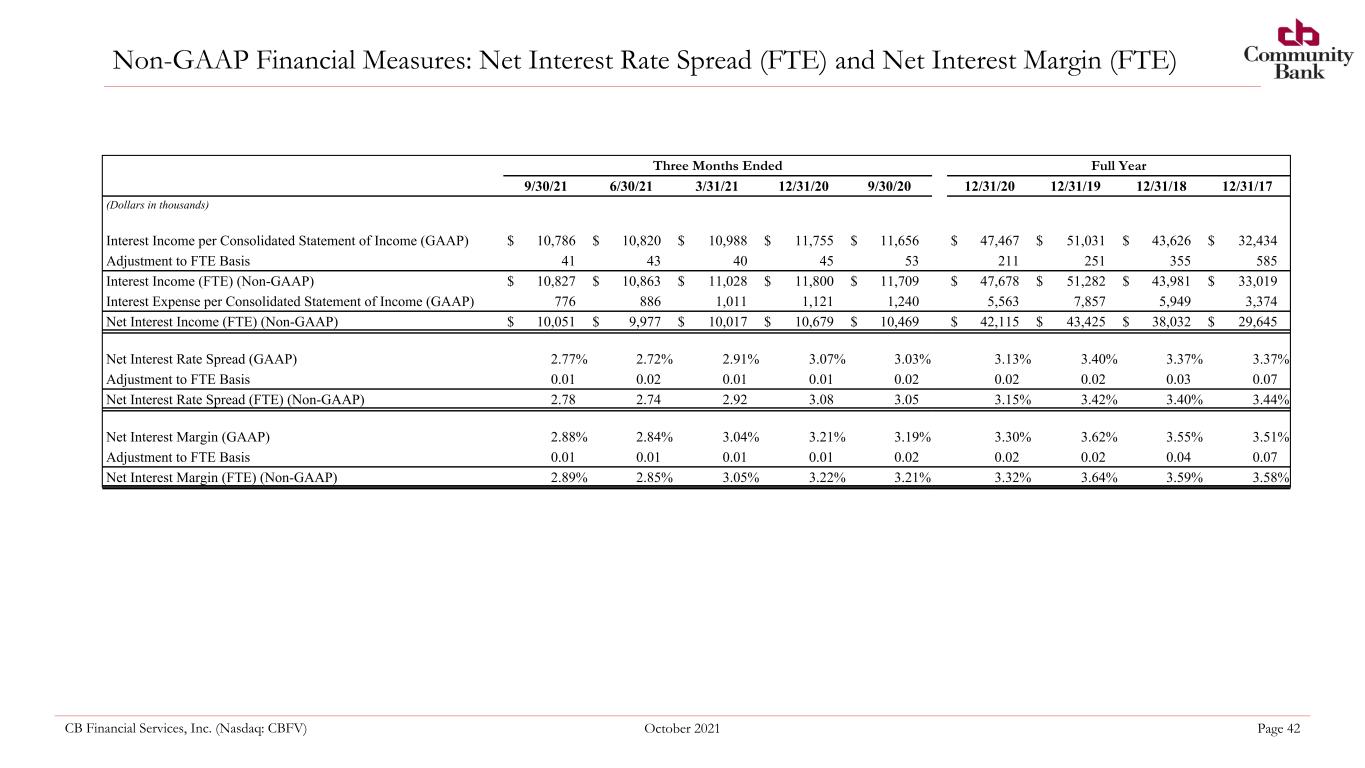

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 42 Non-GAAP Financial Measures: Net Interest Rate Spread (FTE) and Net Interest Margin (FTE) Three Months Ended Full Year 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 12/31/20 12/31/19 12/31/18 12/31/17 (Dollars in thousands) Interest Income per Consolidated Statement of Income (GAAP) $ 10,786 $ 10,820 $ 10,988 $ 11,755 $ 11,656 $ 47,467 $ 51,031 $ 43,626 $ 32,434 Adjustment to FTE Basis 41 43 40 45 53 211 251 355 585 Interest Income (FTE) (Non-GAAP) $ 10,827 $ 10,863 $ 11,028 $ 11,800 $ 11,709 $ 47,678 $ 51,282 $ 43,981 $ 33,019 Interest Expense per Consolidated Statement of Income (GAAP) 776 886 1,011 1,121 1,240 5,563 7,857 5,949 3,374 Net Interest Income (FTE) (Non-GAAP) $ 10,051 $ 9,977 $ 10,017 $ 10,679 $ 10,469 $ 42,115 $ 43,425 $ 38,032 $ 29,645 Net Interest Rate Spread (GAAP) 2.77 % 2.72 % 2.91 % 3.07 % 3.03 % 3.13 % 3.40 % 3.37 % 3.37 % Adjustment to FTE Basis 0.01 0.02 0.01 0.01 0.02 0.02 0.02 0.03 0.07 Net Interest Rate Spread (FTE) (Non-GAAP) 2.78 2.74 2.92 3.08 3.05 3.15 % 3.42 % 3.40 % 3.44 % Net Interest Margin (GAAP) 2.88 % 2.84 % 3.04 % 3.21 % 3.19 % 3.30 % 3.62 % 3.55 % 3.51 % Adjustment to FTE Basis 0.01 0.01 0.01 0.01 0.02 0.02 0.02 0.04 0.07 Net Interest Margin (FTE) (Non-GAAP) 2.89 % 2.85 % 3.05 % 3.22 % 3.21 % 3.32 % 3.64 % 3.59 % 3.58 %

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 43 Non-GAAP Financial Measures: Adjusted Efficiency Ratio Three Months Ended Full Year 9/30/21 6/30/21 3/31/21 12/31/20 9/30/20 12/31/20 12/31/19 12/31/18 12/31/17 (Dollars in thousands) Efficiency Ratio (GAAP) Noninterest expense (GAAP) $ 9,773 $ 13,722 $ 9,395 $ 9,725 $ 28,968 $ 56,767 $ 34,960 $ 34,848 $ 24,636 Net Interest and Dividend Income (GAAP) 10,010 9,934 9,977 10,634 10,416 41,904 43,174 37,677 29,060 Noninterest Income (GAAP) 2,198 2,219 3,174 2,778 2,173 9,471 8,567 7,686 7,264 Operating Revenue (GAAP) 12,208 12,153 13,151 13,412 12,589 51,375 51,741 45,363 36,324 Efficiency Ratio (GAAP) 80.05 % 112.91 % 71.44 % 72.51 % 230.11 % 110.50 % 67.57 % 76.82 % 67.82 % Adjusted Efficiency Ratio (Non-GAAP) Noninterest expense (GAAP) $ 9,773 $ 13,722 $ 9,395 $ 9,725 $ 28,968 $ 56,767 $ 34,960 $ 34,848 $ 24,636 Less: Other Real Estate Owned (Income) (89) (26) (38) (39) (12) (69) (103) 48 (349) Amortization of Intangible Assets, Net 446 503 532 532 532 2,128 2,127 1,556 544 Intangible Assets and Goodwill Impairment — 1,178 — — 18,693 18,693 1,178 18,693 — Writedown on Fixed Assets 2 2,268 — 240 884 1,124 2,270 884 — Merger Expense — — — — — — — 854 356 Adjusted Noninterest Expense (Non-GAAP) $ 9,414 $ 9,799 $ 8,901 $ 8,992 $ 8,871 $ 34,891 $ 29,488 $ 12,813 $ 24,085 Net Interest and Dividend Income (GAAP) 10,010 9,934 9,977 10,634 10,416 41,904 43,174 37,677 29,060 Noninterest Income (GAAP) 2,198 2,219 3,174 2,778 2,173 9,471 8,567 7,686 7,264 Less: Net Gain (Loss) on Securities 24 11 447 213 (59) 233 140 (63) 199 Net (Loss) Gain on Disposal of Fixed Assets — (3) — (13) (65) (61) 2 (137) — Adjusted Noninterest Income (Non-GAAP) 2,174 2,211 2,727 2,578 2,297 9,299 8,425 7,886 7,065 Adjusted Operating Revenue (Non-GAAP) 12,184 12,145 12,704 13,212 12,713 51,203 51,599 45,563 36,125 Adjusted Efficiency Ratio (Non-GAAP) 77.27 % 80.68 % 70.06 % 68.06 % 69.78 % 68.14 % 57.15 % 28.12 % 66.67 %

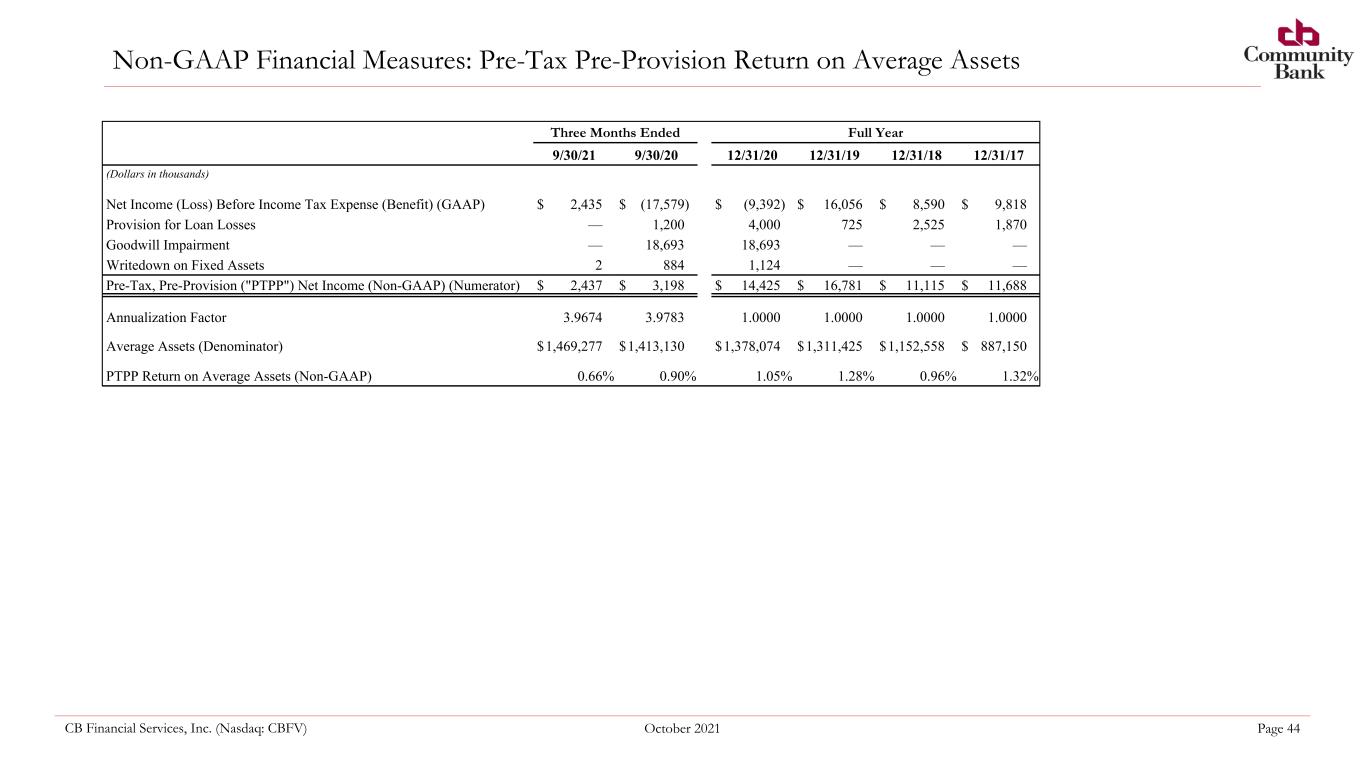

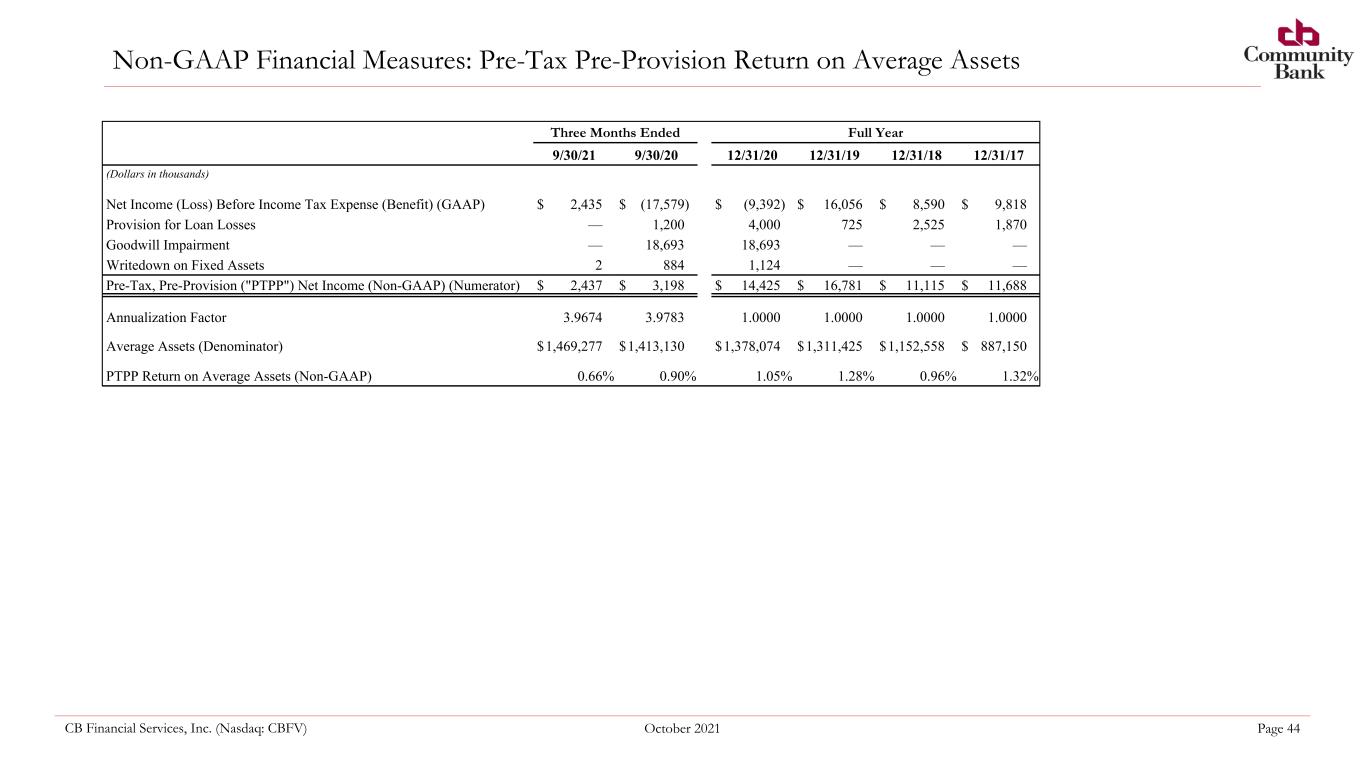

CB Financial Services, Inc. (Nasdaq: CBFV) October 2021 Page 44 Non-GAAP Financial Measures: Pre-Tax Pre-Provision Return on Average Assets Three Months Ended Full Year 9/30/21 9/30/20 12/31/20 12/31/19 12/31/18 12/31/17 (Dollars in thousands) Net Income (Loss) Before Income Tax Expense (Benefit) (GAAP) $ 2,435 $ (17,579) $ (9,392) $ 16,056 $ 8,590 $ 9,818 Provision for Loan Losses — 1,200 4,000 725 2,525 1,870 Goodwill Impairment — 18,693 18,693 — — — Writedown on Fixed Assets 2 884 1,124 — — — Pre-Tax, Pre-Provision ("PTPP") Net Income (Non-GAAP) (Numerator) $ 2,437 $ 3,198 $ 14,425 $ 16,781 $ 11,115 $ 11,688 Annualization Factor 3.9674 3.9783 1.0000 1.0000 1.0000 1.0000 Average Assets (Denominator) $ 1,469,277 $ 1,413,130 $ 1,378,074 $ 1,311,425 $ 1,152,558 $ 887,150 PTPP Return on Average Assets (Non-GAAP) 0.66 % 0.90 % 1.05 % 1.28 % 0.96 % 1.32 %