UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to Section 240.14a-12 |

PARAMOUNT GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

2017 ANNUAL MEETING . Supplemental Information . May 10, 2017

Annual Meeting of Stockholders to be Held on May 18, 2017 1 We are writing to ask for your support by voting in accordance with the recommendations of our Board of Directors on all of the proposals included in our 2017 Proxy Statement, which was filed on April 7, 2017. In particular, we are requesting your vote FOR Proposal 2, the approval of the annual advisory vote on the compensation paid to our named executive officers (“NEOs”). We take a very disciplined, “pay-for-performance” approach to executive compensation. We believe that our executive compensation program strongly aligns the compensation of our NEOs with performance, as detailed in our 2017 Proxy Statement titled “Executive Compensation – Compensation Discussion and Analysis.” We are providing this supplemental information to summarize some of the key aspects which highlight our “pay-for-performance” philosophy, including the significant difference between “Reported Pay” and “Realized Pay.” We were pleased to receive the support of over 97% of the votes cast on our say-on-pay proposal last year and look forward to receiving strong support again this year.

PGRE Executive Compensation Strongly Aligned with Performance 2 We believe our executive compensation program is well designed to incentivize the creation of long-term shareholder value by aligning the compensation structure for executives with the achievement of our business strategies and to maximize total shareholder return over the long term. Formulaic short-term incentive compensation program implemented in 2016 based on the achievement of rigorous financial and operational goals (for CEO, 75% based on performance against pre-established quantitative corporate objectives and 25% based on performance against pre-established qualitative individual objectives). Bonus exchange program incentivizes further alignment with shareholders by encouraging election to receive short-term incentive compensation in equity. Performance-based equity awards, which are only earned based on absolute and relative total shareholder return (“TSR”) over a multi-year performance period, comprise 70% of CEO’s long-term equity awards. No increases to CEO base salary since IPO in 2014. Total compensation heavily weighted towards equity-based compensation (85.5% of total direct compensation in 2016 for our CEO).

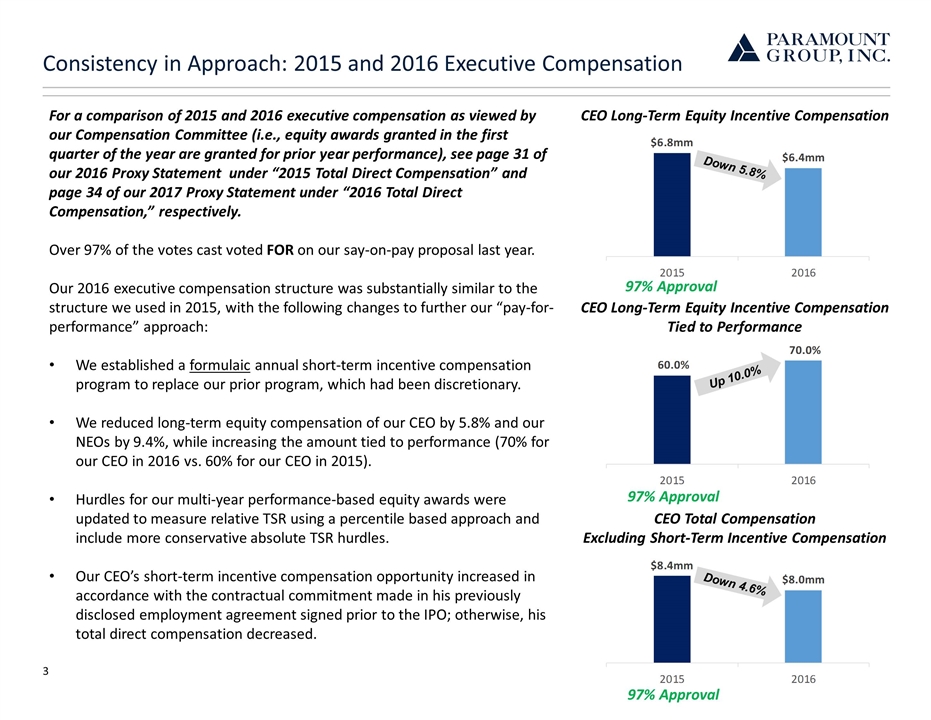

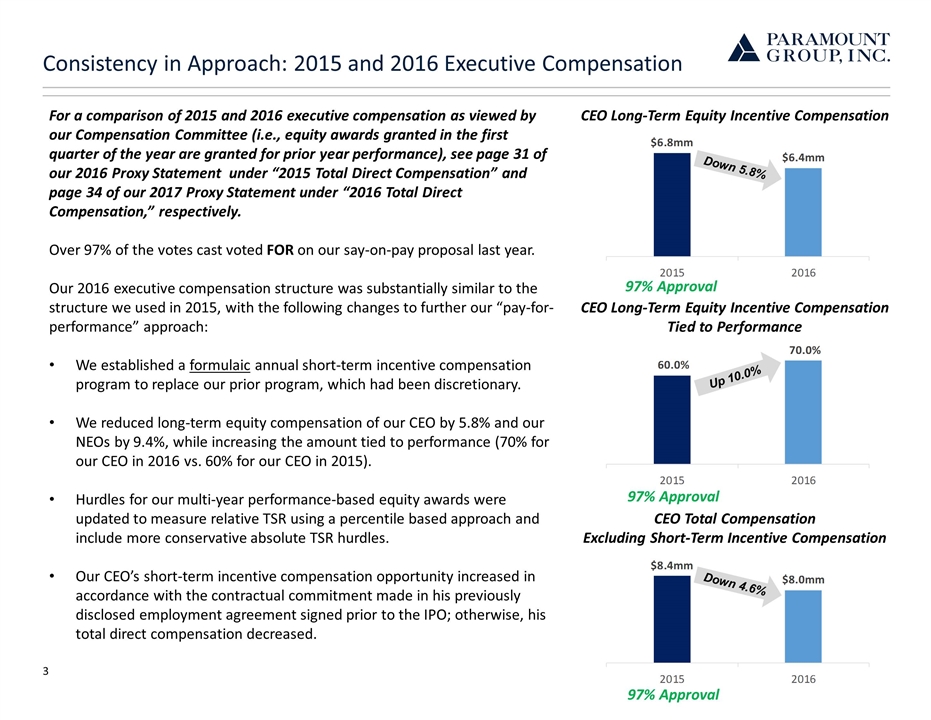

Up 10.0% Consistency in Approach: 2015 and 2016 Executive Compensation For a comparison of 2015 and 2016 executive compensation as viewed by our Compensation Committee (i.e., equity awards granted in the first quarter of the year are granted for prior year performance), see page 31 of our 2016 Proxy Statement under “2015 Total Direct Compensation” and page 34 of our 2017 Proxy Statement under “2016 Total Direct Compensation,” respectively. Over 97% of the votes cast voted FOR on our say-on-pay proposal last year. Our 2016 executive compensation structure was substantially similar to the structure we used in 2015, with the following changes to further our “pay-for-performance” approach: We established a formulaic annual short-term incentive compensation program to replace our prior program, which had been discretionary. We reduced long-term equity compensation of our CEO by 5.8% and our NEOs by 9.4%, while increasing the amount tied to performance (70% for our CEO in 2016 vs. 60% for our CEO in 2015). Hurdles for our multi-year performance-based equity awards were updated to measure relative TSR using a percentile based approach and include more conservative absolute TSR hurdles. Our CEO’s short-term incentive compensation opportunity increased in accordance with the contractual commitment made in his previously disclosed employment agreement signed prior to the IPO; otherwise, his total direct compensation decreased. CEO Long-Term Equity Incentive Compensation Down 5.8% CEO Long-Term Equity Incentive Compensation Tied to Performance 97% Approval 97% Approval CEO Total Compensation Excluding Short-Term Incentive Compensation Down 4.6% 97% Approval 3

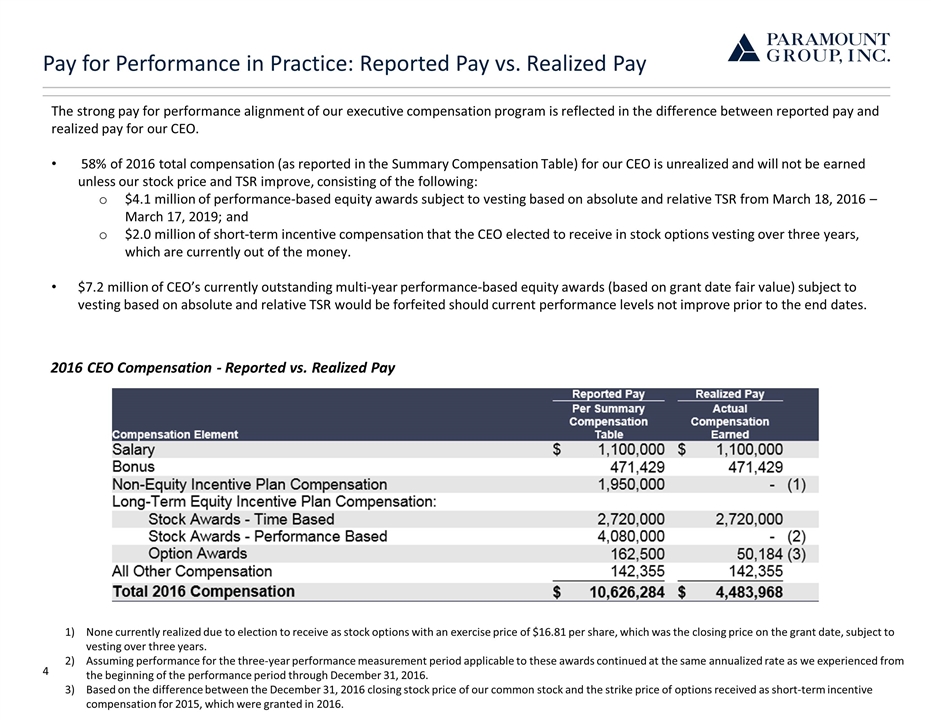

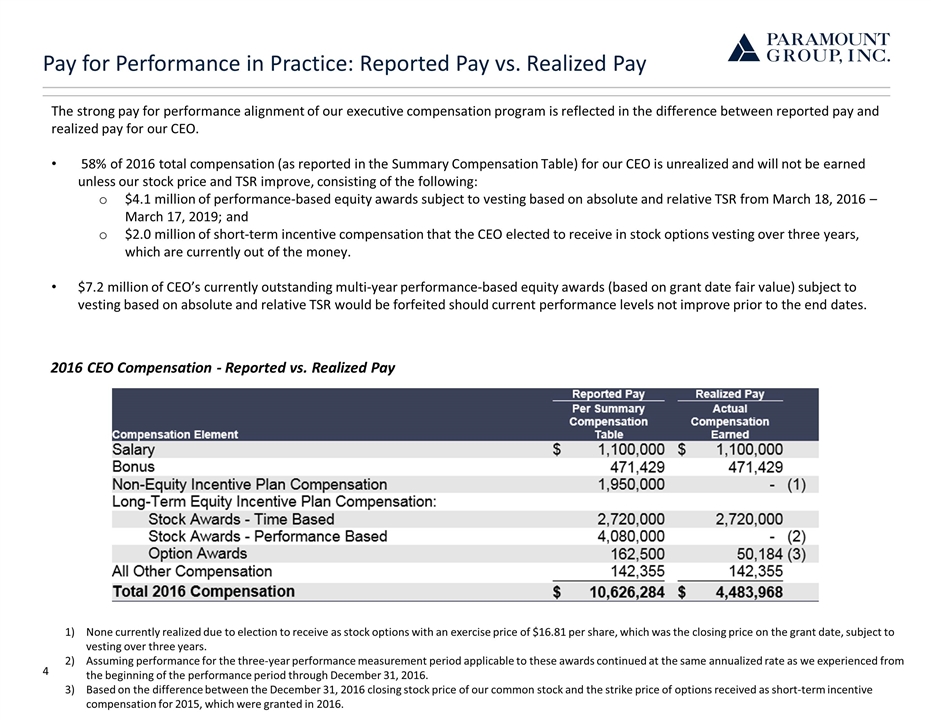

Pay for Performance in Practice: Reported Pay vs. Realized Pay The strong pay for performance alignment of our executive compensation program is reflected in the difference between reported pay and realized pay for our CEO. 58% of 2016 total compensation (as reported in the Summary Compensation Table) for our CEO is unrealized and will not be earned unless our stock price and TSR improve, consisting of the following: $4.1 million of performance-based equity awards subject to vesting based on absolute and relative TSR from March 18, 2016 – March 17, 2019; and $2.0 million of short-term incentive compensation that the CEO elected to receive in stock options vesting over three years, which are currently out of the money. $7.2 million of CEO’s currently outstanding multi-year performance-based equity awards (based on grant date fair value) subject to vesting based on absolute and relative TSR would be forfeited should current performance levels not improve prior to the end dates. 4 None currently realized due to election to receive as stock options with an exercise price of $16.81 per share, which was the closing price on the grant date, subject to vesting over three years. Assuming performance for the three-year performance measurement period applicable to these awards continued at the same annualized rate as we experienced from the beginning of the performance period through December 31, 2016. Based on the difference between the December 31, 2016 closing stock price of our common stock and the strike price of options received as short-term incentive compensation for 2015, which were granted in 2016. 2016 CEO Compensation - Reported vs. Realized Pay

PGRE CEO Compensation in Context: Using a True Peer Group Matters We believe the amount of our CEO’s total compensation for 2016 relative to a correctly constructed peer group is appropriate, particularly when considering the overall structure of our compensation programs and the amount of unrealized performance-based compensation. When evaluating our CEO compensation relative to that of other companies, it is important to use an appropriate peer group. Boston Properties, Inc., SL Green Realty Corp. and Vornado Realty Trust are all primary competitors of ours that: are focused on the same type of assets (i.e., Class A office properties in select CBD markets); our investors and analysts compare us against; compete with us for talent and deal flow; and have CEOs based in New York City. We believe that an appropriately structured peer group for analyzing our CEO compensation must include these three primary competitors, notwithstanding their larger size, and should not consist predominantly of REITs focused on investing in suburban or other lower cost markets or in non-office properties. 5

Annual Meeting Of Stockholders to be Held on May 18, 2017 We encourage you to vote FOR the approval of the annual advisory vote on the compensation paid to our named executive officers (Proposal 2). Thank you for your continued support! 6 Lizanne Galbreath David O’Connor Karin Klein Compensation Committee Chairperson Compensation Committee Member Compensation Committee Member