UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

Commission file number 001-36574

VTTI ENERGY PARTNERS LP

(Exact Name of Registrant as Specified in Its Charter)

Republic of the Marshall Islands

(Jurisdiction of incorporation or organization)

25-27 Buckingham Palace Road

London, SW1W 0PP, United Kingdom

(Address of principal executive offices)

Robert Abbott

25-27 Buckingham Palace Road

London, SW1W 0PP, United Kingdom

Telephone: +44 20 3772 0110 Facsimile: +44 20 3772 0119

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on which Required |

| Common units representing limited partnership interests | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

20,125,000 common units representing limited partner interests

20,125,000 subordinated units representing limited partner interests

821,429 general partner units representing general partner interests

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP x | | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

TABLE OF CONTENTS

i

ii

PRESENTATION OF INFORMATION IN THIS REPORT

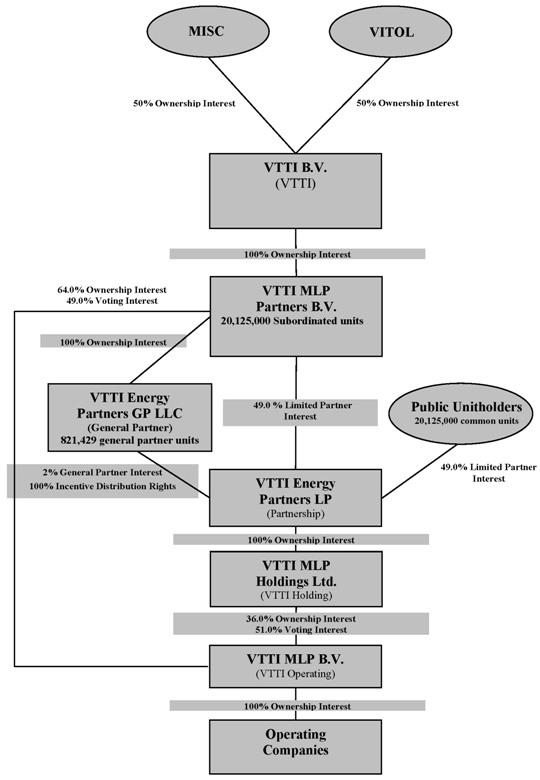

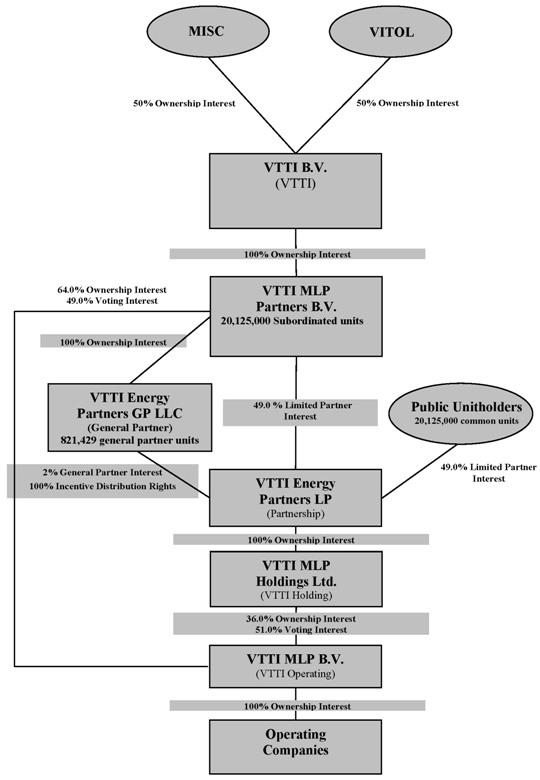

This annual report on Form 20-F for the year ended December 31, 2014 (this “Annual Report”) should be read in conjunction with the consolidated and combined carve-out financial statements and accompanying notes included in this Annual Report. Unless the context otherwise requires, references in this Annual Report to “VTTI Energy Partners,” “we,” “our,” “us” and “the Partnership” or similar terms refer to VTTI Energy Partners LP, a Marshall Islands limited partnership, and its subsidiaries, including VTTI MLP B.V., a company incorporated under the laws of the Netherlands. VTTI MLP B.V., or VTTI Operating, owns, directly or indirectly, 100% of the interests in the entities that own our terminal facilities located in Amsterdam, Netherlands, Belgium, Malaysia and the United States and 90% of the interests in our terminal facilities located in Rotterdam, Netherlands and United Arab Emirates. References in this Annual Report to “VTTI” refer to VTTI B.V., a company incorporated under the laws of the Netherlands and our indirect parent. References in this Annual Report to “our general partner” refer to VTTI Energy Partners GP LLC, a Marshall Islands limited liability company and our general partner. References in this Annual Report to “VTTI Services” refer to VTTI MLP Services Ltd, a company incorporated under the laws of the United Kingdom, an indirect wholly-owned subsidiary of VTTI and the entity that employs our general partner’s executive officers. References in this Annual Report to “Vitol” refer to Vitol Holding B.V., a company incorporated in the Netherlands and a 50% indirect shareholder of VTTI. References in this Annual Report to “MISC” refer to MISC Berhad, a company incorporated in Malaysia and a 50% indirect shareholder of VTTI.

All references in this Annual Report to VTTI Operating for periods prior to our initial public offering, or our “IPO,” on August 6, 2014 refer to the former subsidiaries of VTTI that have interests in our terminal facilities.

Unless otherwise indicated, all references to “dollars”, “US$” and “$” in this Annual Report are to, and amounts are presented in, US Dollars, all references to “£” in this Annual Report are to, and amounts are presented in, British Pounds Sterling and all references to “€” in this Annual Report are to, and amounts are presented in, Euros.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Statements included in this annual report concerning plans and objectives of management for future operations or economic performance, or assumptions related thereto, contain forward-looking statements. In addition, we and our representatives may from time to time make other oral or written statements that are also forward-looking statements. The disclosure and analysis set forth in this Annual Report includes assumptions, expectations, projections, intentions and beliefs about future events in a number of places, particularly in relation to our operations, cash flows, financial position, plans, strategies, business prospects, changes and trends in our business and the markets in which we operate. These statements are intended as “forward-looking statements.” In some cases, predictive, future-tense or forward-looking words such as “believe”, “intend”, “anticipate”, “estimate”, “project”, “forecast”, “plan”, “potential”, “may”, “should”, “could” and “expect” and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. In addition, we and our representatives may from time to time make other oral or written statements which are forward-looking statements, including in our periodic reports that we will file with the Securities & Exchange Commission, or the SEC, other information sent to our unitholders, and other written materials.

Forward-looking statements appear in a number of places in this Annual Report and include statements with respect to, but are not limited to, such matters as:

| | • | | future operating or financial results and future revenues and expenses; |

| | • | | our future financial condition and liquidity; |

| | • | | significant interruptions in the operations of our customers; |

| | • | | future supply of, and demand for, refined petroleum products and crude oil; |

| | • | | our ability to renew or extend terminaling services agreements; |

| | • | | the credit risk of our customers; |

| | • | | our ability to retain our key customers, including Vitol; |

| | • | | operational hazards and unforeseen interruptions, including interruptions from terrorist attacks, hurricanes, floods or severe storms; |

1

| | • | | volatility in energy prices; |

| | • | | competition from other terminals; |

| | • | | changes in trade patterns and the global flow of oil; |

| | • | | future or pending acquisitions of terminals or other assets, business strategy, areas of possible expansion and expected capital spending or operating expenses; |

| | • | | the ability of our customers to obtain access to shipping, barge facilities, third party pipelines or other transportation facilities; |

| | • | | maintenance or remediation capital expenditures on our terminals; |

| | • | | environmental and regulatory conditions, including changes in such laws relating to climate change or greenhouse gases; |

| | • | | health and safety regulatory conditions, including changes in such laws; |

| | • | | costs and liabilities in responding to contamination at our facilities; |

| | • | | our ability to obtain financing; |

| | • | | restrictions in our Credit Facilities (as defined herein), including expected compliance and effect of restrictive covenants in such facilities; |

| | • | | fluctuations in currencies and interest rates; |

| | • | | the adoption of derivatives legislation by Congress; |

| | • | | our ability to retain key officers and personnel; |

| | • | | the expected cost of, and our ability to comply with, governmental regulations and self-regulatory organization standards, as well as standard regulations imposed by our customers applicable to our business; |

| | • | | risks associated with our international operations; |

| | • | | compliance with the U.S. Foreign Corrupt Practices Act or the U.K. Bribery Act; |

| | • | | risks associated with VTTI’s potential business activities involving countries, entities, and individuals subject to restrictions imposed by U.S. or other governments; |

| | • | | tax liabilities associated with indirect taxes on the products we service; and |

| | • | | other factors listed from time to time in the reports and other documents that we file with the SEC. |

These and other forward-looking statements are made based upon our management’s current plans, expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties, including those risks discussed in “Item 3. Key Information—Risk Factors.” The risks, uncertainties and assumptions involve known and unknown risks and are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements.

We undertake no obligation to update or revise any forward-looking statements contained in this Annual Report, whether as a result of new information, future events, a change in our views or expectations or otherwise. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

2

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| A. | Selected Financial Data |

The following table presents, in each case for the periods and as of the dates indicated, our selected consolidated and combined carve-out financial and operating data, which includes, for periods prior to the closing of our IPO on August 6, 2014, combined carve-out financial and operating data of the former subsidiaries of VTTI that have interests in the Partnership’s terminals.

The selected statement of operations and statement of cash flows data of the Partnership for the periods ending December 31, 2014, 2013 and 2012 and balance sheet data as of December 31, 2014 and 2013 has been derived from our consolidated and combined carve-out financial statements included elsewhere in this annual report. The selected balance sheet data as of December 31, 2012 has been derived from the combined carve-out financial statements of the Partnership that are not included herein.

The following financial data should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and the consolidated and combined financial statements and accompanying notes included in this Annual Report.

| | | | | | | | | | | | |

| | | Year Ended December 31 | |

| | | 2014 | | | 2013 | | | 2012 | |

| | | (in US$ millions, except per unit and

operating data) | |

Statement of Operations Data: | | | | | | | | | | | | |

Total Revenues | | $ | 303.2 | | | $ | 299.2 | | | $ | 257.6 | |

| | | | | | | | | | | | |

Total operating expenses | | | 190.8 | | | | 180.1 | | | | 157.7 | |

| | | | | | | | | | | | |

Total operating income | | | 112.4 | | | | 119.1 | | | | 99.9 | |

| | | | | | | | | | | | |

Total other expense, net | | | (31.1 | ) | | | (31.4 | ) | | | (19.6 | ) |

| | | | | | | | | | | | |

Income before income tax expense | | | 81.3 | | | | 87.7 | | | | 80.3 | |

Income tax expense | | | (16.3 | ) | | | (17.7 | ) | | | (14.2 | ) |

| | | | | | | | | | | | |

Net income | | $ | 65.0 | | | $ | 70.0 | | | $ | 66.1 | |

| | | | | | | | | | | | |

Non-controlling interest | | | (20.9 | ) | | | (5.5 | ) | | | (5.2 | ) |

| | | | | | | | | | | | |

Net income attributable to parents’ equity | | $ | 44.1 | | | $ | 64.5 | | | $ | 60.9 | |

| | | | | | | | | | | | |

Statement of Cash Flow Data: | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 134.0 | | | $ | 149.9 | | | $ | 121.1 | |

Net cash used in investing activities | | | (121.2 | ) | | | (84.7 | ) | | | (146.1 | ) |

Net cash (used in)/provided by financing activities | | | (28.9 | ) | | | (51.0 | ) | | | 54.5 | |

Other Financial Data: | | | | | | | | | | | | |

Adjusted EBITDA(1) | | $ | 181.3 | | | $ | 186.5 | | | $ | 155.4 | |

Distributions declared per unit | | $ | 0.422283 | | | | — | | | | — | |

Balance Sheet Data (at period end): | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 36.3 | | | $ | 54.5 | | | $ | 38.7 | |

Total assets | | | 1,613.0 | | | | 1,658.5 | | | | 1,584.4 | |

Total liabilities | | | 777.8 | | | | 1,012.8 | | | | 880.8 | |

Total partners’/owners’ equity | | | 835.2 | | | | 645.7 | | | | 703.6 | |

Operating Data: | | | | | | | | | | | | |

Gross storage capacity, end of period (MMBbls) | | | 35.5 | | | | 35.5 | | | | 35.3 | |

| (1) | We define Adjusted EBITDA as net income (loss) before interest expense, income tax expense, depreciation and amortization expense, as further adjusted to reflect certain other non-cash and non-recurring items. |

3

Adjusted EBITDA is a non-GAAP supplemental financial measure that management and external users of our consolidated and combined financial statements, such as industry analysts, investors, lenders and rating agencies, may use to assess our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods, and the viability of acquisitions and other capital expenditure projects and the returns on investment in various opportunities.

We believe that the presentation of Adjusted EBITDA in this Annual Report provides useful information to management in assessing our financial condition and results of operations. The U.S. GAAP measure most directly comparable to Adjusted EBITDA is net income. Our non-GAAP financial measure of Adjusted EBITDA should not be considered as an alternative to U.S. GAAP net income. Adjusted EBITDA has important limitations as an analytical tool because it excludes some but not all items that affect net income. You should not consider Adjusted EBITDA in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Because Adjusted EBITDA may be defined differently by other companies in our industry, our definitions of Adjusted EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. The following table reconciles Adjusted EBITDA to net income for each of the periods indicated.

| | | | | | | | | | | | |

| | | Year Ended December 31 | |

| | | 2014 | | | 2013 | | | 2012 | |

| | | (in US$ millions, except operating data) | |

Net Income | | $ | 65.0 | | | $ | 70.0 | | | $ | 66.1 | |

Interest expense, including affiliates | | | 21.1 | | | | 30.0 | | | | 18.9 | |

Other items(a) | | | 8.2 | | | | 1.4 | | | | 0.7 | |

Depreciation and amortization | | | 70.7 | | | | 67.4 | | | | 55.5 | |

Income tax expense | | | 16.3 | | | | 17.7 | | | | 14.2 | |

| | | | | | | | | | | | |

Adjusted EBITDA | | $ | 181.3 | | | $ | 186.5 | | | $ | 155.4 | |

| | | | | | | | | | | | |

| (a) | Other items consist of non-cash items in operating expenses, anticipated timing differences between the recognition and receipt of revenues, foreign currency gains/losses and derivatives gains/losses. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Some of the following risks relate principally to the industry in which we operate and to our business in general. Other risks relate principally to the securities market and to ownership of our partnership units. The occurrence of any of the events described in this section could significantly and negatively affect our business, financial condition, operating results or cash available for distributions or the trading price of our common units.

Risks Inherent in Our Business

We may not have sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner, to enable us to pay the minimum quarterly distribution to our unitholders.

We may not have sufficient cash each quarter to pay the full amount of our minimum quarterly distribution of $0.2625 per unit, or $1.05 per unit per year, which requires us to have available cash of approximately $10,781,250 per quarter, or $43,125,000 per year, based on the number of common, subordinated and general partner units outstanding. The amount of cash we can distribute on our common, subordinated and general partner units principally depends upon the amount of cash we generate from our operations, which fluctuates from quarter to quarter based on, among other things:

| | • | | the volumes of refined petroleum products and crude oil we handle; |

4

| | • | | the terminaling services fees with respect to volumes that we handle; |

| | • | | damage to pipelines, facilities, related equipment and surrounding properties caused by hurricanes, earthquakes, floods, fires, severe weather, explosions and other natural disasters and acts of terrorism; |

| | • | | leaks or accidental releases of products or other materials into the environment, whether as a result of human error or otherwise; |

| | • | | planned or unplanned shutdowns of the refineries and industrial production facilities owned by or supplying our customers; |

| | • | | prevailing economic and market conditions; |

| | • | | difficulties in collecting our receivables because of credit or financial problems of customers; |

| | • | | the effects of new or expanded health, environmental and safety regulations; |

| | • | | governmental regulation, including changes in governmental regulation of the industries in which we operate; |

| | • | | weather conditions; and |

In addition, the actual amount of cash we will have available for distribution depends on other factors, some of which are beyond our control, including:

| | • | | the level of capital expenditures we make; |

| | • | | the cost of acquisitions; |

| | • | | our debt service requirements and other liabilities; |

| | • | | fluctuations in our working capital needs; |

| | • | | our ability to borrow funds and access capital markets; |

| | • | | restrictions contained in debt agreements to which we are a party; and |

| | • | | the amount of cash reserves established by our general partner. |

The amount of cash we have available for distribution to holders of our common, subordinated and general partner units depends primarily on our cash flow rather than on our profitability, which may prevent us from making distributions, even during periods in which we record net earnings.

The amount of cash we have available for distribution depends primarily upon our cash flow and not solely on profitability, which is affected by non-cash items. As a result, we may make cash distributions during periods when we record losses for financial accounting purposes and may not make cash distributions during periods when we record net earnings for financial accounting purposes.

Our business would be adversely affected if the operations of our customers experienced significant interruptions. In certain circumstances, the obligations of many of our key customers under their terminaling services agreements may be reduced, suspended or terminated, which would adversely affect our financial condition and results of operations.

We are dependent upon the uninterrupted operations of certain facilities owned or operated by third parties, such as the pipelines, barges and retail fuel distribution assets, as well as refineries and other production facilities that produce products we handle. Any significant interruption at these facilities or inability to transport products to or from these facilities or to or from our customers for any reason would adversely affect our results of operations, cash flow and ability to make

5

distributions to our unitholders. Operations at our facilities and at the facilities owned or operated by our customers and their suppliers could be partially or completely shut down, temporarily or permanently, as the result of any number of circumstances that are not within our control, such as:

| | • | | catastrophic events, including hurricanes and floods; |

| | • | | explosion, breakage, accidents to machinery, storage tanks or facilities; |

| | • | | environmental remediation; |

| | • | | labor difficulties; and |

| | • | | disruptions in the supply of products to or from our facilities, including the failure of third party pipelines or other facilities. |

Additionally, terrorist attacks and acts of sabotage could target oil and gas production facilities, refineries, processing plants, terminals and other infrastructure facilities.

Our terminaling services agreements with many of our key customers provide that, if any of a number of events occur, including certain of those events described above, which we refer to as events of force majeure, and the event significantly delays or renders performance impossible with respect to a facility, usually for a specified minimum period of days, our customer’s obligations would be temporarily suspended with respect to that facility. In that case, a customer’s fixed terminaling services fees may be reduced or suspended, even if we are contractually restricted from recontracting out the storage space in question during such force majeure period, or the contract may be subject to termination. There can be no assurance that we are adequately insured against such risks. As a result, our revenue and results of operations could be materially adversely affected.

Our financial results depend on the demand for refined petroleum products and crude oil, and general economic downturns could result in lower demand for these products for a sustained period of time.

There has historically been a strong link between the development of the world economy and demand for energy, including oil and natural gas. Any sustained decrease in demand for refined petroleum products and crude oil in the markets served by our terminals could result in a reduction in storage usage in our terminals, which would reduce our cash flow and our ability to make distributions to our unitholders. Due to our lack of diversification in asset type, an adverse development in this business could have a significantly greater impact on our results of operations and cash available for distribution to our unitholders than if we maintained more diverse assets.

Our financial results may also be affected by uncertain or changing economic conditions within certain regions. If economic and market conditions are uncertain or adverse conditions exist, spread or deteriorate, we may experience material impacts on our business, financial condition and results of operations.

Furthermore, if global events were to change international trade patterns and shift the global flow of oil to other regions of the world, our terminals may no longer be strategically located. Large independent terminal operators are strategically located near major supply and demand hubs which naturally form along export routes of a supply-source or in proximity to demand centers. If macroeconomic events, such as a severe economic recession or depression, were to shift the global flow of oil to other regions of the world and away from the regions we currently service, our terminals may not be optimally positioned to service the new centers. Such shifts could adversely affect our results of operations and financial condition and our ability to make distributions to our unitholders.

Other factors that could lead to a sustained decrease in market demand for refined petroleum products and crude oil include:

| | • | | the level of worldwide oil and gas production and any disruption of those supplies; |

| | • | | higher fuel taxes or other governmental or regulatory actions that increase, directly or indirectly, the cost of gasoline and diesel; |

| | • | | a sustained increase in the market price of crude oil or shortage of refining capacity that leads to higher refined petroleum product prices; |

6

| | • | | an increase in automotive engine fuel economy, whether as a result of a shift by consumers to more fuel-efficient vehicles or technological advances by manufacturers; and |

| | • | | the increased use of alternative fuel sources, such as ethanol, biodiesel, fuel cells and solar, electric and battery-powered engines. |

Any decrease in supply and marketing activities may result in reduced storage volumes at our terminal facilities, which would adversely affect our financial condition and results of operations.

If we are unable to renew or extend the terminaling services agreements we have with our customers, our ability to make distributions to our unitholders will be reduced.

As of December 31, 2014, after giving effect to VTTI’s guarantee pursuant to the omnibus agreement entered into at the time of our IPO of the rates of certain capacity currently contracted by Vitol for a specified period of time after the Vitol terminaling services agreements expire, the average remaining tenor of our terminaling services agreements was more than four years. If any one or more of our key customers does not renew or extend its terminaling services agreement after expiration of the applicable commitment, or if we are unable to renew or extend such agreement at comparable or higher pricing, our ability to make cash distributions to unitholders will be reduced. Additionally, we may incur substantial costs if modifications to our terminals are required by a new or renegotiated terminal services agreement. The occurrence of any one or more of these events could have a material impact on our financial condition and results of operations.

We are exposed to the credit risk of VTTI and our customers, and any material nonpayment or nonperformance by VTTI or our key customers could adversely affect our financial results and cash available for distribution.

We are subject to the risk of loss resulting from nonpayment or nonperformance by VTTI and our customers. Our credit procedures and policies may not be adequate to fully eliminate customer credit risk. If we fail to adequately assess the creditworthiness of existing or future customers or unanticipated deterioration in their creditworthiness, any resulting increase in nonpayment or nonperformance by them and our inability to re-market or otherwise use the storage capacity could have a material adverse effect on our business, financial condition, results of operations and ability to pay distributions to our unitholders. In addition, some of our customers may have material financial and liquidity issues or may, as a result of operational incidents or other events, be disproportionately affected as compared to larger, better capitalized companies. Pursuant to the omnibus agreement that we entered into in connection with the our IPO, VTTI has guaranteed the rates of certain capacity currently contracted by Vitol for a specified period of time after the Vitol terminaling services agreements expire. Any material nonpayment or nonperformance by VTTI or any of our key customers could have a material adverse effect on our revenue and cash flows and our ability to make cash distributions to our unitholders.

We depend on Vitol and a relatively limited number of our other key customers for a significant portion of our revenues.

A significant percentage of our revenue is attributable to a relatively limited number of customers, including Vitol. Our top five customers accounted for 92% of our revenue for the year ended December 31, 2014. Vitol individually accounted for 77% of our revenue for the year ended December 31, 2014. Because of Vitol’s position as a major customer of our business, events which adversely affect Vitol’s creditworthiness may, in particular, adversely affect our financial condition or results of operations. If we acquire additional terminals from VTTI pursuant to the rights of first offer granted to us by VTTI pursuant to the omnibus agreement we entered into at the time of the IPO or otherwise, or if we enter into new or expanded agreements, the percentage of our revenue generated by Vitol may increase and our exposure to these risks would increase. Further, if Vitol does not renew certain terminaling services agreements, at the end of any such agreement’s duration, VTTI will either contract a third-party customer to replace Vitol’s commitments at that terminal or reimburse us for any losses resulting from Vitol’s expiring contract for a certain period. If such were to occur, we would then rely on VTTI for an increased percentage of our revenue. We expect our exposure to concentrated risk of non-payment or non-performance to continue as long as we remain substantially dependent on a relatively limited number of customers for a substantial portion of our revenue.

Our operations are subject to operational hazards and unforeseen interruptions, including interruptions from hurricanes, floods or severe storms, for which we may not be adequately insured.

Our operations are currently located in Europe, the Middle East, Asia, and the United States and are subject to operational hazards and unforeseen interruptions, including interruptions from hurricanes, floods or severe storms, which have historically impacted such regions with some regularity. We may also be affected by factors such as other adverse weather, accidents, fires,

7

explosions, hazardous materials releases, mechanical failures, disruptions in supply infrastructure or logistics and other events beyond our control. In addition, our operations are exposed to other potential natural disasters, including tornadoes, storms, floods and earthquakes. If any of these events were to occur, we could incur substantial losses because of personal injury or loss of life, severe damage to and destruction of property and equipment, and pollution or other environmental damage resulting in curtailment or suspension of our related operations.

We are not fully insured against all risks incident to our business. Furthermore, we may be unable to maintain or obtain insurance of the type and amount we desire at reasonable rates. As a result of market conditions, premiums and deductibles for certain of our insurance policies have increased and could escalate further. In addition sub-limits have been imposed for certain risks. In some instances, certain insurance could become unavailable or available only for reduced amounts of coverage. If we were to incur a significant liability for which we are not fully insured, it could have a material adverse effect on our financial condition, results of operations and cash available for distribution to unitholders.

Changing volatility in energy prices, certain market structures (including backwardated markets), changing specifications or new government regulations could discourage our storage customers from holding positions in crude oil or refined petroleum products, which could adversely affect the demand for our storage services.

Because we do not own any of the crude oil or refined petroleum products that we handle and do not engage in the trading of refined petroleum products or crude oil, we have minimal direct exposure to risks associated with fluctuating commodity prices. These risks do, however, indirectly influence our activities and results of operations over the long term. Petroleum product prices may be in contango (future prices higher than current prices) or backwardated (future prices lower than current prices) depending on market expectations for future supply and demand. In either situation, our customers regularly move products through our terminals. However, if the prices of refined products and crude oil become relatively stable, the market remains in a prolonged backwardated state, or if federal or state regulations are passed that discourage our customers from storing those commodities, demand for our terminaling services could decrease, in which case we may be unable to renew contracts for our terminaling services or be forced to reduce the rates we charge for our terminaling services, either of which would reduce the amount of cash we generate. Further, changes in product specifications could reduce the need for our customers to contract for terminal services.

Competition from other terminals that are able to supply our customers with comparable storage capacity at a lower price could adversely affect our financial condition and results of operations.

We compete with terminal and storage companies, including major integrated oil companies, of widely varying sizes, financial resources and experience that may be able to supply our customers with terminaling services on a more competitive basis. Our ability to compete could be harmed by factors we cannot control, including:

| | • | | our competitors’ construction of new assets or redeployment of existing assets in a manner that would result in more intense competition in the markets we serve; |

| | • | | the perception that another company may provide better service; and |

| | • | | the availability of alternative supply points or supply points located closer to our customers’ operations. |

Any combination of these factors could result in our customers utilizing the assets and services of our competitors instead of our assets and services, or our being required to lower our prices or increase our costs to retain our customers, either of which could adversely affect our results of operations, financial position or cash flows, as well as our ability to pay cash distributions to our unitholders.

Our expansion of existing assets and construction or acquisition of new assets may not result in revenue increases and will be subject to regulatory, environmental, political, legal and economic risks, which could adversely affect our operations and financial condition.

A part of our strategy to grow and increase distributions to unitholders is dependent on our ability to expand existing assets and to construct or acquire additional assets. The construction or acquisition of a new terminal, or the expansion of an existing terminal, such as by increasing storage capacity or otherwise, involves numerous regulatory, environmental, political and legal uncertainties, most of which are beyond our control. Moreover, we may not receive sufficient long-term contractual commitments from customers to provide the revenue needed to support such projects. As a result, we may construct or acquire new facilities that are not able to attract enough customers to achieve our expected investment return, which could adversely affect our results of operations and financial condition and our ability to make distributions to our unitholders.

8

If we undertake these projects, they may not be completed on schedule or at all or at the budgeted cost. We may be unable to negotiate acceptable interconnection agreements with third party pipelines to provide destinations for increased storage services. Even if we receive sufficient multi-year contractual commitments from customers to provide the revenue needed to support such projects and we complete our construction projects as planned, we may not realize an increase in revenue for an extended period of time. For instance, if we build a new terminal, the construction will occur over an extended period of time, and we will not receive any material increases in revenues until after completion of the project. Any of these circumstances could adversely affect our results of operations and financial condition and our ability to make distributions to our unitholders.

If we are unable to make acquisitions on economically acceptable terms, our future growth would be limited, and any acquisitions we make may reduce, rather than increase, our cash generated from operations on a per unit basis.

A part of our strategy to grow our business and increase distributions to unitholders is dependent on our ability to make acquisitions over time that result in an increase in our cash available for distribution per unit. If we are unable to make acquisitions from third parties or VTTI because we are unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts, we are unable to obtain financing for these acquisitions on economically acceptable terms or we are outbid by competitors, our future growth and ability to increase distributions will be limited. Furthermore, even if we do consummate acquisitions that we believe will be accretive, they may in fact result in a decrease in our cash available for distribution per unit. Any acquisition involves potential risks, some of which are beyond our control, including, among other things:

| | • | | mistaken assumptions about revenues and costs, including synergies; |

| | • | | an inability to integrate successfully the businesses we acquire; |

| | • | | an inability to hire, train or retain qualified personnel to manage and operate our business and newly acquired assets; |

| | • | | the assumption of unknown liabilities; |

| | • | | limitations on rights to indemnity from the seller; |

| | • | | mistaken assumptions about the overall costs of equity or debt; |

| | • | | the diversion of management’s attention from other business concerns; |

| | • | | unforeseen difficulties operating in new product areas or new geographic areas; and |

| | • | | customer or key employee losses at the acquired businesses. |

If we consummate any future acquisitions, our capitalization and results of operations may change significantly, and unitholders will not have the opportunity to evaluate the economic, financial and other relevant information that we will consider in determining the application of these funds and other resources.

We have entered into an omnibus agreement with VTTI that exposes us to various risks and uncertainties.

In connection with our IPO, we entered into an omnibus agreement with VTTI. Pursuant to this agreement, we have a right of first offer to purchase the remaining 64.0% of the profit shares of VTTI Operating and other currently owned and future terminaling and related energy infrastructure assets held by VTTI, which assets we refer to as our “ROFO Assets”, if VTTI decides to sell them. The consummation and timing of any future acquisitions pursuant to this right will depend upon, among other things, VTTI’s willingness to offer a subject asset for sale and obtain any necessary consents, the determination that the asset is suitable for our business at that particular time, our ability to agree on a mutually acceptable price, our ability to negotiate an acceptable purchase agreement and terminal services agreement with respect to the asset and our ability to obtain financing on acceptable terms. We can offer no assurance that we will be able to successfully consummate any future acquisitions pursuant to our right of first offer, and VTTI is under no obligation to accept any offer that we may choose to make. In addition, we may decide not to exercise our right of first offer if and when any ROFO Assets are offered for sale, and our decision will not be subject to unitholder approval.

9

Also pursuant to the omnibus agreement, VTTI has guaranteed the rates of certain capacity currently contracted by Vitol for a specified period of time after the Vitol terminaling services agreements expire, resulting in an overall weighted average contract tenor as of December 31, 2014, of more than four years. In addition, VTTI has agreed, for a period of five years from the closing of our IPO, to make us whole, in certain circumstances, for certain environmental liabilities, tax liabilities and defects in title to the assets contributed to us by VTTI at the time of the IPO. If VTTI is unable or unwilling to perform such guarantee or indemnification, it could have a material adverse effect on our financial position, results of operations or cash flows and our ability to make cash distributions to unitholders will be reduced.

Our operations are subject to national and state laws and regulations relating to product quality specifications, and we could be subject to damages based on claims brought against us by our customers or lose customers as a result of the failure of products we distribute to meet certain quality specifications.

Various national and state agencies prescribe specific product quality specifications for refined products, including vapor pressure, sulfur content, ethanol content and biodiesel content. Changes in product quality specifications or blending requirements could reduce our product volumes at our terminals, require us to incur additional handling costs or require capital expenditures. For example, mandated increases in use of renewable fuels could require the construction of additional storage and blending equipment. If we are unable to recover these costs through increased revenues, our cash flows and ability to pay cash distributions to our unitholders could be adversely affected. Violations of product quality laws attributable to our operations could subject us to significant fines and penalties as well as negative publicity. In addition, changes in the quality of the products we receive on our pipeline system could reduce or eliminate our ability to blend products.

We have a responsibility to ensure the quality and purity of the products loaded at our loading racks. Off-specification product distributed for public use, even if not a violation of specific product quality laws, could result in poor engine performance or even engine damage. This type of incident could result in liability claims regarding damages caused by the off-specification fuel or could result in negative publicity, impacting our ability to retain existing customers or to acquire new customers, any of which could have a material adverse impact on our results of operations and cash flows.

Revenues we generate from excess throughput and ancillary fees vary based upon the product volume handled at our terminals and the activity levels of our customers. Any short- or long-term decrease in the demand for the refined petroleum products and crude oil we handle, or any interruptions to the operations of certain of our customers, could reduce the amount of cash we generate and adversely affect our ability to make distributions to our unitholders.

For the year ended December 31, 2014, we generated 10% of our revenues, respectively, from excess throughput, ancillary fees and other miscellaneous revenue. Our storage customers pay us excess throughput fees to receive product volume on their behalf that exceeds the base storage services contemplated in their agreed upon monthly storage services fee. Our storage customers pay us ancillary fees for services such as mixing, blending and heating petroleum products and transferring products between our tanks or to rail or truck. Other miscellaneous revenue includes such items as payments from local authorities as compensation for agreed infrastructure investments.

The revenues we generate from excess throughput and ancillary fees vary based upon the product volume accepted at or withdrawn from our terminals and the activity levels of our customers. Our customers are not obligated to pay us any excess throughput fees unless we move product volume across our terminals or pipelines on their behalf. If one or more of our customers were to slow or suspend its operations, or otherwise experience a decrease in demand for our services, our revenues under our agreements with such customers would be reduced or suspended, resulting in a decrease in the revenues we generate.

Any reduction in the capability of our customers to obtain access to ships, barges, third party pipelines or other transportation facilities, or to continue utilizing them at current costs, could cause a reduction of volumes transported through our terminals.

Many users of our terminals are dependent upon third party shipping and barge operations, pipelines or other transportation providers to receive and deliver refined petroleum products and crude oil. Any interruptions or reduction in the capabilities of these modes of transportation would result in reduced volumes transported through our terminals. Similarly, increased demand for these services could result in reduced allocations to our existing customers, which also could reduce volumes transported through our terminals. Allocation reductions of this nature are not infrequent and are beyond our control. In addition, if the costs to us or our storage service customers to transport crude oil or refined products significantly increase, our profitability could be reduced. Any such increases in cost, interruptions or allocation reductions that, individually or in the aggregate, are material or continue for a sustained period of time could have a material adverse effect on our financial position, results of operations or cash flows.

10

Many of our terminal and storage assets have been in service for many years, which could result in increased maintenance or remediation expenditures, which could adversely affect our business, results of operations, financial condition and our ability to make cash distributions to our unitholders.

Our terminal and storage assets are generally long-lived assets. As a result, some of those assets have been in service for many years. The age and condition of these assets could result in increased maintenance or remediation expenditures. Any significant increase in these expenditures could adversely affect our business, results of operations, financial condition and our ability to make cash distributions to our unitholders.

We may incur significant costs and liabilities in complying with environmental, health and safety laws and regulations, which are complex and frequently changing.

Our operations involve the transport and storage of refined petroleum products and crude oil and are subject to international, federal, state, and local laws and regulations governing, among other things, the gathering, storage, handling and transportation of petroleum and hazardous substances, the emission and discharge of materials into the environment, the generation, management and disposal of wastes, and other matters otherwise relating to the protection of the environment. Our operations are also subject to various laws and regulations relating to occupational health and safety. Compliance with this complex array of international, federal, state, and local laws and implementing regulations is difficult and may require significant capital expenditures and operating costs to mitigate or prevent pollution. Moreover, in the ordinary course of business, accidental spills, discharges or other releases of petroleum or hazardous substances into the environment and neighboring areas may occur, for which we may incur substantial liabilities to investigate and remediate. Failure to comply with applicable environmental, health, and safety laws and regulations may result in the assessment of sanctions, including administrative, civil or criminal penalties, permit revocations, and injunctions limiting or prohibiting some or all of our operations.

We cannot predict what additional environmental, health, and safety legislation or regulations will be enacted or become effective in the future or how existing or future laws or regulations will be administered or interpreted with respect to our operations. Many of these laws and regulations are becoming increasingly stringent and in certain regions, such as the United States and Europe, our industry is experiencing greater scrutiny. The cost of compliance with these requirements can be expected to increase over time. These expenditures or costs for environmental, health, and safety compliance could have a material adverse effect on our financial condition, results of operations or cash flows.

We could incur significant costs and liabilities in responding to contamination that has or will occur at our facilities.

Many of our terminal facilities have been used for transportation, storage and distribution of refined petroleum products and crude oil for a number of years. Although we have utilized operating and disposal practices that were standard in the industry at the time, hydrocarbons and wastes from time to time may have been spilled or released on or under the terminal properties. In addition, certain of our terminal properties were previously owned and operated by other parties and those parties from time to time also may have spilled or released hydrocarbons or wastes. Our terminal properties are subject to international, federal, state and local laws that impose investigatory and remedial obligations, some of which are joint and several or strict liability obligations without regard to fault, to address and prevent environmental contamination. We may incur significant costs and liabilities in responding to any soil and groundwater contamination that occurs on our properties, even if the contamination was caused by prior owners and operators of our facilities.

Climate change legislation or regulations restricting emissions of greenhouse gases could result in increased operating and capital costs and reduced demand for our storage services.

Emissions of greenhouse gases, or GHGs, such as carbon dioxide and methane, have been linked to climate change. Climate change and the costs that may be associated with its impacts and the regulation of GHGs have the potential to affect our business in many ways, including negatively impacting the costs we incur in providing our services and the demand for our services (due to change in both costs and weather patterns). In February 2005, the Kyoto Protocol to the United Nations Framework Convention on Climate Change, or the Kyoto Protocol, entered into force. Many of the countries in which we do business (but not the United States) ratified the Kyoto Protocol, and we have been subject to its requirements, particularly in the European Union. The first commitment period of the Kyoto Protocol ended in 2012, but it was nominally extended past its expiration date with a requirement for a new legal construct to be put into place by 2015. To that end, the framework for a

11

new international agreement is being negotiated. In addition, in November 2014, President Obama announced that the United States would seek to cut net greenhouse gas emissions 26-28 percent below 2005 levels by 2025 in return for China’s commitment to seek to peak emissions around 2030, with concurrent increases in renewable energy. On March 31, 2015, the United States formally submitted its proposal to the United Nations.

Although it is not possible at this time to accurately estimate how potential future laws or regulations addressing GHG emissions would impact our business, any future international or federal laws or implementing regulations that may be adopted to address GHG emissions could require us to incur increased operating costs and could adversely affect demand for the refined petroleum products and crude oil we store. The potential increase in the costs of our operations resulting from any legislation or regulation to restrict emissions of GHGs could include new or increased costs to operate and maintain our facilities, install new emission controls on our facilities, acquire allowances to authorize our greenhouse gas emissions, pay any taxes related to our GHG emissions and administer and manage a GHG emissions program. While we may be able to include some or all of such increased costs in the rates charged for our services, such recovery of costs is uncertain. Moreover, incentives to conserve energy or use alternative energy sources could reduce demand for our services. We cannot predict with any certainty at this time how these possibilities may affect our operations. Many scientists have concluded that increasing concentrations of GHGs in the Earth’s atmosphere may produce climate change that could have significant physical effects, such as increased frequency and severity of storms, droughts, and floods and other climatic events; if such effects were to occur, they could have an adverse effect on our operations.

Debt that we, VTTI or our subsidiaries incur in the future may limit our flexibility to obtain financing and to pursue other business opportunities.

VTTI Operating entered into a €500 million revolving credit facility, the VTTI Operating Revolving Credit Facility, in connection with our IPO, and exercised its accordion feature to expand the facility to €580 million in March 2015. Further, a subsidiary of VTTI Operating, ATT Tanjung Bin Sdn. Bhd., or ATB, entered into a related party facility agreement, the ATB Phase 2 Facility, with VTTI B.V. which provides a maximum borrowing under the facility of $95.0 million, in connection with the construction of phase 2 of our Johore terminal. We refer to the VTTI Operating Revolving Credit Facility and the ATB Phase 2 Facility as our Credit Facilities. Our future level of debt and the future level of debt of VTTI or our subsidiaries could have important consequences to us, including the following:

| | • | | our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes may be impaired or such financing may not be available on favorable terms; |

| | • | | our funds available for operations, future business opportunities and cash distributions to unitholders will be reduced by that portion of our cash flow required to make interest payments on our debt; |

| | • | | we may be more vulnerable to competitive pressures or a downturn in our business or the economy generally; and |

| | • | | our flexibility in responding to changing business and economic conditions may be limited. |

Restrictions in our Credit Facilities could adversely affect our business, financial condition, results of operations, ability to make distributions to unitholders and value of our common units.

The operating and financial restrictions and covenants in our Credit Facilities could limit our and our subsidiaries’ ability to, among other things:

| | • | | incur or guarantee additional debt; |

| | • | | make distributions on or redeem or repurchase units; |

| | • | | make certain investments and acquisitions; |

| | • | | make capital expenditures; |

| | • | | abandon ongoing capital expenditures; |

| | • | | incur certain liens or permit them to exist; |

| | • | | enter into certain types of transactions with affiliates; |

12

| | • | | merge or consolidate with another company; and |

| | • | | transfer, sell or otherwise dispose of assets. |

Due to its ownership and control of our general partner, VTTI has the ability to prevent VTTI Operating and us from taking actions that would cause VTTI to violate any covenants in, or otherwise to be in default under VTTI’s $270.0 million senior secured revolving credit facility, or the VTTI Revolving Credit Facility. In deciding whether to prevent VTTI Operating or us from taking any such action, VTTI has no fiduciary duty to us or our unitholders. Moreover, if we desire to take any action, to the extent such action would not be permitted under the VTTI Revolving Credit Facility, VTTI would be required to seek the consent of the lenders under its revolving credit facility. VTTI’s compliance with the covenants in its revolving credit facility may restrict our ability to undertake certain actions that might otherwise be considered beneficial to us, including borrowing under the VTTI Operating Revolving Credit Facility to finance operations or expansions or to distribute cash to our unitholders.

Any debt instruments that VTTI or any of its affiliates enter into in the future, including any amendments to our Credit Facilities, may include additional or more restrictive limitations that may impact our ability to conduct our business. These additional restrictions could adversely affect our ability to finance our future operations or capital needs or engage in, expand or pursue our business activities.

The VTTI Operating Revolving Credit Facility and the VTTI Revolving Credit Facility contain covenants requiring the borrowers thereunder to maintain certain financial ratios. Their ability to meet those financial ratios and tests can be affected by events beyond our control, and we cannot assure you that they will meet those ratios and tests.

In addition, the VTTI Operating Revolving Credit Facility and the VTTI Revolving Credit Facility contain events of default customary for transactions of this nature, including:

| | • | | failure to make payments; |

| | • | | failure to comply with covenants and financial ratios; |

| | • | | institution of insolvency or similar proceedings; and |

| | �� | | occurrence of a change of control. |

Also, the VTTI Operating Revolving Credit Facility and the VTTI Revolving Credit Facility have default provisions that apply to any other material indebtedness that we may have.

The provisions of our Credit Facilities may affect our ability to obtain future financing and pursue attractive business opportunities and our flexibility in planning for, and reacting to, changes in business conditions. In addition, a failure to comply with the provisions of our Credit Facilities could result in a default or an event of default that could enable its lenders to declare the outstanding principal of that debt, together with accrued and unpaid interest, to be immediately due and payable. Such event of default would also permit lenders to foreclose on our assets serving as collateral for the obligations under our Credit Facilities. If the payment of the debt is accelerated, its assets may be insufficient to repay such debt in full. As a result, our results of operations and, therefore, our ability to distribute cash to unitholders, could be materially and adversely affected, and our unitholders could experience a partial or total loss of their investment.

Increases in interest rates could adversely impact our unit price, our ability to issue equity or incur debt for acquisitions or other purposes, and our ability to make cash distributions at our intended levels.

Interest rates may increase in the future. As a result, interest rates on our Credit Facilities or future credit facilities and debt offerings could be higher than current levels, causing our financing costs to increase accordingly. As with other yield-oriented securities, our unit price will be impacted by our level of our cash distributions and implied distribution yield. The distribution yield is often used by investors to compare and rank yield-oriented securities for investment decision-making purposes. Therefore, changes in interest rates, either positive or negative, may affect the yield requirements of investors who invest in our units, and a rising interest rate environment could have an adverse impact on our unit price and our ability to issue equity or incur debt for acquisitions or other purposes and to make cash distributions at our intended levels.

13

The implementation of derivatives legislation could have an adverse impact on our and our customers’ ability to hedge business risks.

Certain countries (e.g., the G-20 group of industrialized nations) have adopted or are considering adopting legislation that regulates derivative transactions, which include certain instruments used in our risk management activities. For example, in the United States the Dodd-Frank Act was signed into law in July 2010. The Dodd-Frank Act requires the Commodity Futures Trading Commission (the CFTC) and the SEC to promulgate rules and regulations relating to, among other things, swaps and options, participants in the derivatives markets, clearing, margining and trading of swaps and recordkeeping and reporting of swap transactions. In general, the Dodd-Frank Act subjects swap transactions and participants to greater regulation and supervision by the CFTC and the SEC and will require many swaps to be cleared through a CFTC- or SEC-registered clearing facility and executed on a designated contract market (DCM) or swap execution facility (SEF), unless an exception, such as the end-user exception, applies.

While many of the U.S. regulations implementing the Dodd-Frank Act are already in effect, the implementation process is still ongoing, and we cannot yet predict the ultimate effect of the regulations on our business. As the CFTC further designates swap contracts as required to be cleared and traded on a trading facility, the utility of an end-user exception will become even more important. Our ability or inability to rely on the end-user exception may change the profitability of our trades or the efficiency of our hedging.

In its rulemaking under the Dodd-Frank Act, the CFTC is finalizing its final regulations to set position limits for certain futures and option contracts in the major energy markets and for swaps that are their economic equivalents, although certain bona fide hedging transactions would be exempt from these position limits provided that various conditions are satisfied. Once finalized, the position limits rule and its companion rule on aggregation may have an impact on our ability to hedge our exposure to certain enumerated commodities.

The CFTC, the SEC and U.S. Prudential regulators are finalizing rules and regulations on margining and providing collateral for uncleared swaps in the over the counter (OTC) markets, coupled with the rules on capital for swap dealers. The intention behind these regulations is to make it economically indifferent for a participant in commodities markets to trade a futures contract on a DCM, a cleared swap or an option on a SEF or to enter into an OTC swap with a swap dealer or another counterparty because each of these contracts will be subject to margining either by a clearing house or a swap counterparty. Although Congress in 2015 enacted certain exemptions to the margining requirement for the end-users, it is uncertain how the CFTC will implement these margining requirements in the market and whether swap dealers will be penalized by regulators with higher capital charges for entering into uncleared swaps and options; as a result, it is difficult to estimate future costs of compliance with these regulations.

Under the Dodd-Frank Act, the CFTC is also directed generally to prevent price manipulation and fraud in the following two markets: (a) physical commodities traded in interstate commerce, including physical energy and other commodities, as well as (b) financial instruments, such as futures, options and swaps. Pursuant to the Dodd-Frank Act, the CFTC has adopted additional anti-market manipulation, anti-fraud and disruptive trading practices regulations that prohibit, among other things, fraud and price manipulation in the physical commodities, futures, options and swaps markets. The CFTC is developing its enforcement program under its new authorities under the Dodd Frank Act and at this time it is impossible to quantify the risks of potential enforcement action from the CFTC. Should we violate these laws and regulations, we could be subject to CFTC enforcement action and material penalties, and sanctions.

The CFTC also has finalized other regulations, including critical rulemakings on the definition of “swap,” “security-based swap,” “swap dealer” and “major swap participant.” To further define the term “swap,” the CFTC has issued several interpretations clarifying whether certain forwards with optionality will remain as forwards and generally exempt from the Dodd Frank restrictions or would qualify as options on commodities and therefore swaps. Once finalized, this interpretation may have an impact on our ability to enter into certain forwards.

Legislation and regulations such as the Dodd-Frank Act could increase the operational and transactional cost of derivatives contracts and affect the number and/or creditworthiness of counterparties available to us or our customers. If we reduce our use of derivatives as a result of the Dodd-Frank Act and regulations, our results of operations may become more volatile and our cash flows may be less predictable, which could adversely affect our ability to plan for and fund capital expenditures.

In addition to the Dodd-Frank Act, the European Union and other foreign regulators have adopted and are implementing local reforms generally comparable with the reforms under the Dodd-Frank Act. Implementation and enforcement of these regulatory provisions may reduce our ability to hedge our market risks with non-U.S. counterparties and may make our transactions involving cross-border swaps more expensive and burdensome. Additionally, the lack of regulatory equivalency across jurisdictions may increase compliance costs and make it more difficult to satisfy our regulatory obligations.

14

Our executive officers and certain key personnel are critical to our business, and these officers and key personnel may not remain with us in the future.

Our future success depends upon the continued service of our executive officers and other key personnel. If we lose the services of one or more of our executive officers or key employees, our business, operating results and financial condition could be harmed.

Our international operations involve additional risks, which could adversely affect our business.

As a result of our international operations, we may be exposed to economic, political and other uncertainties, including risks of:

| | • | | terrorist acts, armed hostilities, war and civil disturbances; |

| | • | | significant governmental influence over many aspects of local economies; |

| | • | | seizure, nationalization or expropriation of property or equipment; |

| | • | | repudiation, nullification, modification or renegotiation of contracts; |

| | • | | limitations on insurance coverage, such as war risk coverage, in certain areas; |

| | • | | foreign and U.S. monetary policy and foreign currency fluctuations and devaluations; |

| | • | | the inability to repatriate income or capital; |

| | • | | complications associated with repairing and replacing equipment in remote locations; |

| | • | | import-export quotas, wage and price controls, imposition of trade barriers; |

| | • | | U.S. and foreign sanctions or trade embargoes; |

| | • | | regulatory or financial requirements to comply with foreign bureaucratic actions; |

| | • | | changing taxation policies, including confiscatory taxation; |

| | • | | other forms of government regulation and economic conditions that are beyond our control; and |

| | • | | governmental corruption. |

Any disruption caused by these factors could have a material adverse effect on the growth of our business, financial condition, results of operations and ability to make distributions to unitholders.

Fluctuations in exchange rates or exchange controls could result in losses to us.

As a result of our international operations, we are exposed to fluctuations in foreign exchange rates due to revenues being received and operating expenses paid in currencies other than U.S. Dollars. Accordingly, we may experience currency exchange losses or a reduced amount of cash available for distribution if we have not hedged our exposure to a foreign currency, or if revenues are received in currencies that are not readily convertible. We may also be unable to collect revenues because of a shortage of convertible currency available to the country of operation, controls over the repatriation of income or capital or controls over currency exchange.

We are exposed with respect to our terminals in Europe, which receive their revenue in Euro. Although we are currently offsetting a portion of our Euro revenues with our operating costs denominated in Euro and we currently have in place a Euro to U.S. Dollar cash flow hedging program, if, in the future, we are required to receive a greater portion of our

15

revenues in Euro, we may be unable to offset such revenue with operating expenses owed in Euro and, as a result, may incur substantial foreign exchange losses. We also have operating expenses in other currencies, such as the Malaysian Ringgit and the UAE Dirham. Exchanges at market rates may result in substantial foreign exchange losses.

Because we report our operating results in U.S. Dollars, changes in the value of the U.S. Dollar also result in fluctuations in our reported revenues and earnings. In addition, under U.S. GAAP, all foreign currency-denominated monetary assets and liabilities are revalued and reported based on the prevailing exchange rate at the end of the reporting period. This revaluation may cause us to report significant non-monetary foreign currency exchange gains and losses in certain periods. These gains and losses could have a material impact on our operating results.

Failure to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, and other similar statutes in the countries in which we operate could result in fines, criminal penalties, contract terminations and an adverse effect on our business.

We and our affiliates currently operate our terminals in a number of countries throughout the world, including some with developing economies. Also, the existence of state or government-owned oil-related enterprises puts us in contact with persons who may be considered “foreign officials” or “foreign public officials” under the U.S. Foreign Corrupt Practices Act of 1977, or the FCPA, and the Bribery Act 2010 of the Parliament of the United Kingdom, or the U.K. Bribery Act, respectively. We are committed to doing business in accordance with all applicable anti-corruption laws and have adopted a code of business conduct and ethics, as well as recordkeeping and internal accounting controls, which are consistent and in full compliance with the FCPA and the U.K. Bribery Act. We are subject, however, to the risk that we, VTTI, our affiliated entities or our or their respective officers, directors, employees and agents may take actions determined to be in violation of such anti-corruption laws, including the FCPA and the U.K. Bribery Act. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, curtailment of VTTI’s operations in certain jurisdictions, and might adversely affect our business, results of operations or financial condition. In addition, actual or alleged violations could damage our reputation and ability to do business. Furthermore, detecting, investigating and resolving actual or alleged violations would be expensive and consume significant time and attention of our senior management.

In order to effectively compete in some foreign jurisdictions, we may utilize local agents and/or establish joint ventures with local operators or strategic partners. All of these activities involve interaction by our agents with non-U.S. government officials. Even though some of our agents and partners may not themselves be subject to the FCPA, the U.K. Bribery Act or other anti-bribery laws to which we may be subject, if our agents or partners make improper payments to non-U.S. government officials in connection with engagements or partnerships with us, we could be investigated and potentially found liable for violation of such anti-bribery laws and could incur civil and criminal penalties and other sanctions, which could have a material adverse effect on our business, financial position, results of operations and cash flows.

If our business activities involve countries, entities and individuals that are subject to restrictions imposed by the U.S. or other governments, we could be subject to enforcement action and our reputation and the market for our common units could be adversely affected.

U.S. sanctions have been tightened in recent years to target the activities of non-U.S. companies, such as us. In particular, sanctions against Iran have been significantly expanded. In 2010, the U.S. enacted the Comprehensive Iran Sanctions Accountability and Divestment Act, or CISADA, which expanded the scope of the Iran Sanctions Act. Among other things, CISADA expands the prohibitions applicable to non-U.S. companies, such as us, and introduces limits on the ability of companies and persons to do business or trade with Iran when such activities relate to the investment, supply or export of refined petroleum or petroleum products.

On August 10, 2012, the U.S. signed into law the Iran Threat Reduction and Syria Human Rights Act of 2012, or the Iran Threat Reduction Act, which places further restrictions on the ability of non-U.S. companies to do business or trade with Iran and Syria. Perhaps the most significant provision in the Iran Threat Reduction Act is that prohibitions in the existing Iran sanctions applicable to U.S. persons will now apply to any foreign entity owned or controlled by a U.S. person (essentially making the U.S. sanctions against Iran as expansive as U.S. sanctions against Cuba). However, we do not believe this provision is applicable to us, as we are primarily owned and controlled by non-U.S. persons.

The other major provision in the Iran Threat Reduction Act is that issuers of securities must disclose to the SEC in their annual and quarterly reports filed after February 6, 2013 if the issuer or “any affiliate” has “knowingly” engaged in certain activities involving Iran or other sanctioned entities during the timeframe covered by the report. The disclosure must describe the nature and extent of the activity in detail and the SEC will publish the disclosure on its website. For certain disclosed activities, the President must then initiate an investigation and determine whether sanctions on the issuer or its

16

affiliate will be imposed. Such negative publicity and the possibility that sanctions could be imposed would present a risk for any issuer that is knowingly engaged in disclosable conduct or that has an affiliate that is knowingly engaged in such conduct. At this time, we are not aware of activity conducted by ourselves, VTTI or any affiliate of VTTI that would trigger an SEC disclosure requirement, although if we or any of our affiliates engage in any of these activities, we, as an issuer, would be required to make a disclosure under the Iran Threat Reduction Act.