Filed Pursuant to Rule 424(b)(5)

Registration 333-211047

Prospectus supplement

(To prospectus dated August 8, 2016)

VTTI Energy Partners LP

5,250,000 Common units

Representing limited partner interests

We are selling 5,250,000 common units representing limited partner interests in VTTI Energy Partners LP. The underwriters have agreed to purchase our common units from us at a price of $19.05 per common unit, except for the common units to be purchased by VTTI MLP Partners B.V., as set forth below. We will receive approximately $100.3 million of proceeds (before offering expenses payable by us) from our sale of common units in this offering. The underwriters may offer our common units from time to time for sale in one or more transactions on the New York Stock Exchange (the “NYSE”), in the over-the-counter market, through negotiated transactions or otherwise at market prices or at negotiated prices. See “Underwriting.”

We have granted the underwriters an option to purchase up to 787,500 additional common units on the same terms and conditions as set forth above if the underwriters sell more than 5,250,000 common units in this offering. If the underwriters exercise the option in full, the total proceeds to us (before offering expenses payable by us) will be $115.3 million.

VTTI MLP Partners B.V., a wholly-owned subsidiary of VTTI B.V., our indirect parent, has agreed to purchase 1,295,336 common units from the underwriters at $19.30 per common unit, which is the price per common unit paid by the public in the initial distribution. The underwriters will not deduct any discounts or commissions from the price paid by VTTI MLP Partners B.V. and, as a result, we will receive the entire amount paid by VTTI MLP Partners B.V. for such units.

Our common units trade on the NYSE under the symbol “VTTI.” The last reported sale price of our common units on the NYSE on August 8, 2016 was $20.71 per common unit.

Investing in our common units involves risks. You should carefully consider the risk factors described under “Risk Factors” on page S-18 of this prospectus supplement and the other risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus before you make an investment in our common units.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units on or about August 12, 2016 through the book-entry facilities of The Depository Trust Company.

| | |

| J.P. Morgan | | BofA Merrill Lynch |

The date of this prospectus supplement is August 8, 2016.

Table of contents

In making your investment decision, you should rely only on the information contained in this prospectus supplement, the accompanying prospectus, the documents we have incorporated by reference in this prospectus supplement and the accompanying prospectus, and any “free writing prospectus” we may authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone else to give you different information. You should not assume that the information in this prospectus supplement, the accompany prospectus, the documents we have incorporated by reference in this prospectus supplement and the accompanying prospectus, or any “free writing prospectus” we may authorize to be delivered to you is accurate as of any date other than the date on the front of those documents. Our business, financial condition, results of operations and prospects may have changed since such date.

About this prospectus

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common units. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering of common units. Generally, when we refer to the “prospectus,” we refer to both parts combined. If information varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

Any statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Before you invest in our securities, you should carefully read this prospectus supplement, the accompanying prospectus and documents we have incorporated by reference in this prospectus supplement and the accompanying prospectus (including the documents described under the heading “Where You Can Find More Information” in both this prospectus supplement and the accompanying prospectus) and any additional information you may need to make your investment decision.

We are offering to sell the common units, and are seeking offers to buy the common units, only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the common units in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the common units and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

S-1

Where you can find more information

We have filed with the SEC a registration statement on Form F-3 regarding the securities covered by this prospectus supplement. This prospectus supplement does not contain all of the information found in the registration statement. For further information regarding us and the securities offered in this prospectus supplement, you may wish to review the full registration statement, including the exhibits attached thereto. The registration statement, including its exhibits and schedules, may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. Copies of this material can also be obtained upon written request from the Public Reference Section of the SEC at that address, at prescribed rates, or from the SEC’s website atwww.sec.gov free of charge. Please call the SEC at 1-800-SEC-0330 for further information on public reference rooms. Our registration statement can also be inspected and copied at the offices of the New York Stock Exchange.

We are subject to the information requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance therewith, we are required to file with the SEC annual reports onForm 20-F within four months of our fiscal year-end, and provide to the SEC other material information on Form 6-K. These reports and other information may be inspected and copied at the public reference facilities maintained by the SEC or obtained from the SEC’s website as provided above. Our website is located atwww.vttienergypartners.com, and we expect to make our annual reports on Form 20-F and our periodic reports filed with or furnished to the SEC available, free of charge, as soon as reasonably practicable after those reports are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

As a foreign private issuer, we are exempt under the Exchange Act from, among other things, certain rules prescribing the furnishing and content of proxy statements, and our executive officers, directors and principal unitholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act, including the filing of quarterly reports on Form 10-Q or current reports on Form 8-K. However, we intend to make available quarterly reports containing our unaudited interim financial information.

S-2

Incorporation by reference

The SEC allows us to “incorporate by reference” into this prospectus information that we file with the SEC. This means that we can disclose important information to you without actually including the specific information in this prospectus by referring you to other documents filed separately with the SEC. The information incorporated by reference is an important part of this prospectus. Information that we later provide to the SEC, and which is deemed to be “filed” with the SEC, automatically will update information previously filed with the SEC, and may replace information in this prospectus.

We incorporate by reference into this prospectus the documents listed below:

| • | | our annual report on Form 20-F for the fiscal year ended December 31, 2015 filed with the SEC on April 29, 2016 (our “2015 Annual Report”); |

| • | | our reports on Form 6-K furnished to the SEC on May 4, 2016 and August 8, 2016; |

| • | | all subsequent annual reports on Form 20-F filed prior to the termination of this offering; |

| • | | all subsequent reports on Form 6-K furnished to the SEC prior to the termination of this offering that we identify in such current reports as being incorporated by reference into the registration statement of which this prospectus is a part; and |

| • | | the description of our common units contained in our Registration Statement on Form 8-A (File No. 001-36574), filed with the SEC on July 28, 2014, including any subsequent amendments or reports filed for the purpose of updating such description. |

These reports contain important information about us, our financial condition and our results of operations.

You may obtain any of the documents incorporated by reference in this prospectus from the SEC through its public reference facilities or its website at the addresses provided above. We will also provide, free of charge upon written or oral request, to each person to whom this prospectus is delivered, including any beneficial owner of our common units, a copy of any document incorporated by reference in this prospectus, but which has not been delivered with the prospectus. Copies of these documents also may be obtained on the “Investor Relations” section of our website atwww.vttienergypartners.com. Requests for such information should be made to us at the following address:

VTTI Energy Partners LP

25-27 Buckingham Palace Road

London, SW1W 0PP, United Kingdom

+44 20 3772 0100

S-3

Forward-looking statements

This prospectus and the documents we incorporate by reference contain certain forward-looking statements concerning plans and objectives of management for future operations or economic performance, or assumptions related thereto. All such statements are “forward-looking statements.” Such statements include, in particular, statements about our plans, strategies, business prospects, changes and trends in our business, and the markets in which we operate. In some cases, you can identify the forward-looking statements by the use of words such as “may,” “could,” “should,” “would,” “expect,” “plan,” “anticipate,” “intend,” “forecast,” “believe,” “estimate,” “predict,” “propose,” “potential,” “continue” or the negative of these terms or other comparable terminology. In addition, we and our representatives may from time to time make other oral or written statements that are also forward-looking statements. These forward-looking statements reflect management’s current views only as of the date of this prospectus and are not intended to give any assurance as to future results. As a result, unitholders are cautioned not to rely on any forward-looking statements.

Forward-looking statements appear in a number of places in this prospectus and the documents we incorporate by reference and include statements with respect to, among other things:

| • | | future operating or financial results and future revenues and expenses; |

| • | | our ability to consummate the Acquisition described below; |

| • | | our ability to increase distributions; |

| • | | our future financial condition and liquidity; |

| • | | significant interruptions in the operations of our customers; |

| • | | future supply of, and demand for, refined petroleum products and crude oil; |

| • | | our ability to renew or extend terminaling services agreements; |

| • | | the credit risk of our customers; |

| • | | our ability to retain our key customers, including Vitol; |

| • | | operational hazards and unforeseen interruptions, including interruptions from terrorist attacks, hurricanes, floods or severe storms; |

| • | | volatility in energy prices; |

| • | | competition from other terminals; |

| • | | changes in trade patterns and the global flow of oil; |

| • | | future or pending acquisitions of terminals or other assets, business strategy, areas of possible expansion and expected capital spending or operating expenses; |

| • | | the ability of our customers to obtain access to shipping, barge facilities, third party pipelines or other transportation facilities; |

| • | | maintenance or remediation capital expenditures on our terminals; |

| • | | environmental and regulatory conditions, including changes in such laws relating to climate change or greenhouse gases; |

| • | | health and safety regulatory conditions, including changes in such laws; |

S-4

| • | | costs and liabilities in responding to contamination at our facilities; |

| • | | our ability to obtain financing; |

| • | | restrictions in our credit facilities and debt agreements, including expected compliance and effect of restrictive covenants in such facilities and debt agreements; |

| • | | fluctuations in currencies and interest rates; |

| • | | the adoption of new derivatives regulations or modifications to existing regulations by the U.S. Commodity Futures Trading Commission; |

| • | | our ability to retain key officers and personnel; |

| • | | the expected cost of, and our ability to comply with, governmental regulations and self-regulatory organization standards, as well as standard regulations imposed by our customers applicable to our business |

| • | | risks associated with our international operations; |

| • | | compliance with the U.S. Foreign Corrupt Practices Act or the U.K. Bribery Act; |

| • | | risks associated with VTTI’s potential business activities involving countries, entities, and individuals subject to restrictions imposed by U.S. or other governments; |

| • | | tax liabilities associated with indirect taxes on the products we service; and |

| • | | other factors listed from time to time in the reports and other documents that we file with the SEC. |

Factors that might cause future results to differ materially from those expressed or implied in the forward-looking statements include, but are not limited to:

| • | | continued low prices for petroleum products and crude oil; |

| • | | significant interruptions of the operations of our customers, which may adversely affect our customers’ performance of their obligations under our terminaling services agreements and other contracts; |

| • | | general economic downturns, which could result in reduced future supply of, and demand for, refined petroleum products and crude oil, upon which our financial results are dependent; |

| • | | our ability to renew or extend our existing terminaling services agreements; |

| • | | our dependence on Vitol and a relatively limited number of other key customers for a significant portion of our revenues; |

| • | | risks inherent in our customers’ operation of ships, including interruptions from severe weather, for which we may not be adequately insured; |

| • | | environmental and regulatory conditions, including changes in laws and regulations or actions taken by regulatory authorities; |

| • | | economic and regulatory factors affecting incentives for our customers to hold positions in crude oil and refined petroleum products; |

| • | | our competitors’ ability to provide services similar to ours at a lower rate; |

| • | | our strategy of expansion of existing assets and acquisition of new assets may not result in expected revenue increases and may expose us to additional economic and regulatory risks; |

S-5

| • | | our growth may be limited by a lack of economically feasible targets for acquisition; |

| • | | VTTI’s ability to perform under guarantees and indemnities; |

| • | | estimated future maintenance and replacement capital expenditures; |

| • | | the expected cost of, and our ability to comply with, environmental, health and safety laws; |

| • | | risks inherent in handling refined petroleum products and crude oil, including the discharge of pollutants; |

| • | | our ability to obtain financing to fund capital expenditures, acquisitions and other corporate activities, funding by banks of their financial commitments, and our ability to meet our obligations under our credit facilities; |

| • | | fluctuations in currencies, exchange rates and interest rates; |

| • | | our ability to attract and retain key personnel management; |

| • | | risks inherent in international operations, including terrorist acts, political unrest, governmental corruption, the inability to repatriate income and other forms of government regulation and economic conditions that are beyond our control; |

| • | | our ability to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other similar statutes; |

| • | | risks inherent to our organizational structure, including our obligation to distribute all of our available cash and potential conflicts of interest of our general partner and its affiliates; |

| • | | the anticipated taxation of our partnership and distributions to our unitholders; |

| • | | future sales of our common units in the public market; |

| • | | potential liability from future litigation; and |

| • | | other factors discussed in the “Risk Factors” section of this prospectus supplement and in the “Risk Factors” described in our Annual Report on Form 20-F for the year ended December 31, 2015, filed with the SEC on April 29, 2016, which is incorporated herein by reference. |

We undertake no obligation to update any forward-looking statement after the date on which such statement is made, whether as a result of new information, future events, a change in our views or expectations or otherwise, except as required by applicable law. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, we cannot assess the effect of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement. We make no prediction or statement about the performance of our common units or other securities.

S-6

Summary

This summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. You should read the entire prospectus carefully, including the historical financial statements and the notes to those financial statements incorporated herein by reference, before investing in our common units. Unless otherwise noted, the information presented in this prospectus assumes that the underwriters’ option to purchase additional common units is not exercised. You should read “Risk Factors” beginning on page S-18 of this prospectus supplement and beginning on page 5 of our 2015 Annual Report for more information about important risks that you should consider carefully before buying our common units. Unless otherwise indicated, all references to “dollars”, “US$” and “$” in this prospectus are to, and amounts are presented in, U.S. Dollars and all references to “€” in this prospectus are to, and amounts are presented in, Euros.

Unless the context otherwise requires, references in this prospectus to “VTTI Energy Partners LP,” “the “Partnership,” “we,” “our,” “us” or similar terms refer to VTTI Energy Partners LP, a Marshall Islands limited partnership, and its subsidiaries, including VTTI MLP B.V., a company incorporated under the laws of the Netherlands. VTTI MLP B.V., or VTTI Operating, owns, directly or indirectly, 100% of the interests in the entities that own our terminal facilities located in Amsterdam, Netherlands, Belgium, Malaysia and the United States and 90% of the interests in our terminal facilities located in Rotterdam, Netherlands and United Arab Emirates. References in this prospectus to “our general partner” refer to VTTI Energy Partners GP LLC, a Marshall Islands limited liability company and the general partner of the Partnership. References in this prospectus to “VTTI Holdings” refer to VTTI MLP Holdings Ltd., a company incorporated in the United Kingdom and a wholly-owned subsidiary of the Partnership. References in this prospectus to “VTTI” refer to VTTI B.V., a company incorporated under the laws of the Netherlands and our indirect parent. References in this prospectus to “Vitol” refer to Vitol Holding B.V., a company incorporated in the Netherlands and its affiliates. VTTI is indirectly owned by Vitol Holding B.V., its affiliates and its investment partners in Vitol Investment Partnership Limited, which we refer to as “VIP.”

Overview

We are a fee-based, growth-oriented publicly traded limited partnership formed in April 2014 by VTTI, one of the world’s largest independent energy terminaling businesses, to own, operate, develop and acquire refined petroleum product and crude oil terminaling and related energy infrastructure assets on a global scale. Our assets as of June 30, 2016, consist of a 42.6% interest in VTTI Operating, which owns a portfolio of 6 terminals with 396 tanks and 35.7 million barrels of refined petroleum product and crude oil storage capacity located in Europe, the Middle East, Asia, and North America. Our network of terminal facilities represents one of the largest independent portfolios of refined petroleum product and crude oil terminaling assets in the world when measured by total storage capacity.

S-7

Our terminals

Our terminals are generally located in major international supply and demand centers for refined petroleum products and crude oil and provide critical midstream infrastructure services to our customers at these key international market hubs. A variety of transportation interconnections are available to move our customers’ products to and from our terminal facilities such as ships and barges, roads, railroads and pipelines. The following table sets forth information regarding our terminals as of June 30, 2016:

| | | | | | | | | | | | | | | | | | | | |

| Terminal location | | Year

constructed/

acquired | | | Products | | Gross storage

capacity

(Mmbbls) | | | # of tanks | | | Maximum

draft (feet) | | | Connectivity |

| EUROPE |

Amsterdam, The Netherlands | | | 2006 | | | Refined Petroleum Products | | | 8.6 | | | | 210 | | | | 46 | | | Ship, barge, road, railroad |

Rotterdam, The Netherlands(1) | | | 2006 | | | Refined Petroleum Products | | | 7.0 | | | | 28 | | | | 69 | | | Ship, barge, road, railroad, pipeline |

Antwerp, Belgium | | | 2010 | | | Crude Oil, Refined Petroleum Products, LPG | | | 4.3 | | | | 46 | | | | 46 | | | Ship, barge, road, railroad, pipeline |

|

| MIDDLE EAST |

Fujairah, United Arab Emirates(2) | | | 2007 | | | Crude Oil, Refined Petroleum Products | | | 7.4 | | | | 47 | | | | 54 | | | Ship, barge, road, pipeline |

|

| ASIA |

| | | | | | |

Johore, Malaysia Phase One | | | 2012 | | | Refined Petroleum Products | | | 5.6 | | | | 41 | | | | 56 | | | Ship, barge, road |

|

| NORTH AMERICA |

Seaport Canaveral, United States of America | | | 2010 | | | Refined Petroleum Products | | | 2.8 | | | | 24 | | | | 39 | | | Ship, barge, road, pipeline |

TOTAL | | | | | | | | | 35.7 | | | | 396 | | | | | | | |

|

| (1) | | VTTI Operating indirectly owns 90% of the economic interest in the Rotterdam terminal; SK Terminal B.V. owns the remaining 10%. |

| (2) | | VTTI Operating indirectly owns 90% of the economic interest in the Fujairah terminal; Fujairah Petroleum Co. owns the remaining 10%. |

Our pending acquisition

On August 8, 2016, our wholly-owned subsidiary, VTTI Holdings, entered into a Purchase and Sale Agreement with VTTI MLP Partners B.V., a wholly-owned subsidiary of VTTI (the “Purchase and Sale Agreement”) pursuant to which we will acquire an additional 8.4% economic interest in VTTI Operating and associated pro-rata net debt from VTTI MLP Partners B.V. for cash consideration of $96.2 million (the “Purchase Price”), subject to customary closing conditions (the “Acquisition”).

The Acquisition and its Purchase Price were approved by the board of directors of our general partner and the conflicts committee of the board of directors (the “conflicts committee”). The conflicts committee retained an outside financial advisor to assist it in evaluating the Acquisition and the purchase price offered by VTTI. In determining that entry into the Purchase and Sale Agreement and the consummation of the Acquisition is in our

S-8

best interests, the conflicts committee engaged and obtained the views of the financial advisor as to the fairness of the Purchase Price and the fair value of the economic interest in VTTI Operating. The conflicts committee reviewed and discussed the potential terms of the Acquisition with the financial advisor.

We intend to use a portion of the net proceeds of this offering, and the related capital contribution to us by our general partner, to fund the Purchase Price for the Acquisition.

We expect the Acquisition to close on September 1, 2016, subject to the satisfaction of customary closing conditions. If these conditions are not satisfied or waived, we will not complete the Acquisition. This offering is not conditioned on the closing of the Acquisition. The Acquisition may not close as anticipated or it may close with adjusted terms. Please read “Risk Factors” for further information. If the Acquisition does not close, we will use the net proceeds from this offering and the related capital contribution to us by our general partner for general partnership purposes. See “Risk Factors—The pending Acquisition may not close as anticipated or may close with adjusted terms.”

The acquisition of the additional economic interests in VTTI Operating is expected to be accretive to the Partnership’s distributable cash flow and to implement the Partnership’s strategy to deliver distribution growth to its unitholders. The Partnership’s announcement on July 25, 2016 of a quarterly distribution of $0.3204 per unit (corresponding to an annualized distribution of $1.2816 per unit) for the second quarter of 2016 represented an increase of 3.1% as compared to the Partnership’s quarterly distribution of $0.31085 for the first quarter of 2016. Any future increases in our distributions would be conditioned upon, among other things, the closing of the Acquisition, the approval of such increases by our board of directors and the absence of any material adverse developments or potentially attractive opportunities that would make such future increases inadvisable.

Our ROFO assets

At the time of our initial public offering in August 2014 (our “IPO”), we entered into an omnibus agreement with VTTI pursuant to which VTTI granted us a right of first offer on the remaining ownership of VTTI Operating and all other currently owned and future terminaling and related energy infrastructure assets held by VTTI. We refer to these rights as our “ROFO Assets.” Pursuant to this right, for as long as VTTI retains its ownership interest in our general partner, VTTI will be required to offer us the first opportunity to acquire the ROFO Assets if it decides to sell any of them. The consummation and timing of any acquisition of assets owned by VTTI will depend upon, among other things, VTTI’s willingness to offer the asset for sale and obtain any necessary third party consents, the determination that the asset is suitable for our business at that particular time, our ability to agree on a mutually acceptable price, our ability to negotiate an acceptable purchase agreement with respect to the asset and our ability to obtain financing on acceptable terms. While VTTI is not obligated to sell us any assets or promote and support the successful execution of our growth plan and strategy, we believe that VTTI’s significant economic stake in us provides it with a strong incentive to do so. Other than the Purchase and Sale Agreement, we do not have a current agreement or understanding with VTTI to purchase any ROFO Assets.

S-9

VTTI owns the following refined petroleum product and crude oil terminaling assets as of June 30, 2016 that may be suitable to our operations in the future:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Terminal location | | Year

constructed/

acquired | | | Products | | | Gross

storage

capacity

(Mmbbls)(1) | | | # of

tanks | | | Maximum

draft (feet) | | | Connectivity | |

Ventspils, Latvia(1) | | | 2007 | | |

| Crude Oil,

Refined

Petroleum

Products |

| | | 7.5 | | | | 105 | | | | 49 | | | | Ship, road, railroad, pipeline | |

Vasiliko, Cyprus(2) | | | 2014 | | |

| Refined

Petroleum

Products |

| | | 3.4 | | | | 28 | | | | 59 | | | | Ship, barge, road | |

Buenos Aires, Argentina | | | 1996 | | |

| Refined

Petroleum

Products |

| | | 1.4 | | | | 24 | | | | 34 | | | | Ship, barge, road | |

Mombasa, Kenya | | | 2012 | | |

| Refined

Petroleum

Products |

| | | 0.7 | | | | 10 | | | | 43 | | | | Ship, barge, pipeline | |

Kaliningrad, Russia | | | 2005 | | |

| Refined

Petroleum

Products |

| | | 0.3 | | | | 7 | | | | 28 | | | | Ship, barge, road, railroad | |

Lagos, Nigeria(3) | | | 2010 | | |

| Refined

Petroleum

Products |

| | | 0.1 | | | | 2 | | | | 36 | | | | Ship, barge, road | |

Johore, Malaysia Phase Two(4) | | | 2015 | | |

| Refined

Petroleum

Products |

| | | 1.6 | | | | 12 | | | | 56 | | | | Ship, barge, road | |

Fujairah, United Arab Emirates Phase 3(5) | |

| Under

construction |

| |

| Refined

Petroleum

Products |

| | | 2.7 | | | | 5 | | | | 54 | | | | Ship, barge, road, pipeline | |

Cape Town, South Africa(6) | |

| Under

construction |

| |

| Refined

Petroleum

Products |

| | | 0.8 | | | | 12 | | | | 39 | | | | Ship, barge, road, pipeline | |

| | | | | | |

TOTAL | | | | | | | | | | | 18.5 | | | | 205 | | | | | | | | | |

| |

| (1) | | VTTI indirectly owns 49% of the economic interest in the Latvia terminal; AS Ventspils Nafta owns the remaining 51%. |

| (2) | | The Vasiliko terminal became operational in November 2014. |

| (3) | | VTTI indirectly owns 50% of the economic interest in the Nigeria terminal; Nigeria Industrial and Domestic Gas Company Limited owns the remaining 50%. |

| (4) | | Johore, Malaysia Phase 2 (“ATB Phase 2”) assets are legally owned by our subsidiary ATB Tanjung Bin Sdn. Bhd. but are currently for the economic benefit of VTTI. See “Item 7 Major Unitholders and Related Party Transactions – B. Related Party Transactions” of our 2015 Annual Report. |

| (5) | | VTTI Operating indirectly owns 90% of the economic interest in Fujairah, United Arab Emirates Phase 3; Fujairah Petroleum Co. owns the remaining 10%. |

| (6) | | VTTI indirectly owns 70% of the economic interest in the Cape Town terminal, and Thebe Energy Proprietary Limited and Jicaro Proprietary Limited own the remaining 15% and 15%, respectively. |

S-10

Recent financial results

On August 8, 2016, we announced our preliminary financial results for the quarter ended June 30, 2016, during which we generated revenues of $76.4 million, operating income of $30.1 million and net income of $17.2 million, compared to revenues of $70.9 million, operating income of $28.5 million and net income of $20.3 million for the quarter ended June 30, 2015.

The increase in our revenues and operating income for the quarter ended June 30, 2016 compared to the quarter ended June 30, 2015 was primarily due to $3.5 million of revenue from ATB Phase 2, which became operational in the third quarter of 2015, and additional revenue of $1.8 million at our Amsterdam terminal resulting from a combination of increased tank rental rates and new customers. The increase in revenues was offset by an increase in total operating expenses of $3.9 million, which was primarily due to an increase in operational related expenses and higher depreciation expense. The decrease in net income was primarily due to an overall increase in other expenses and an increase in deferred income tax expense for the quarter ended June 30, 2016 compared to the quarter ended June 30, 2015.

Our independent registered public accounting firm has not performed a review of our financial information for the three months ended June 30, 2016. As a result, the preliminary results for the three months ended June 30, 2016 set forth above may be subject to change.

Other recent developments

On July 25, 2016, our general partner’s board of directors declared a quarterly cash distribution, for the quarter ended June 30, 2016, of $0.3204 per common and subordinated unit, which will be paid on August 12, 2016 to all unitholders of record as of August 8, 2016. This distribution represents an increase of $0.00955 per unit, or 3.1%, over the distribution paid in respect of the first quarter of 2016. Since our IPO, we have increased our quarterly distribution level to our unitholders by 22.1% over our minimum quarterly distribution. Purchasers of common units in this offering will not be entitled to receive the second quarter distribution.

Our relationship with Vitol

One of our principal strengths is our relationship with Vitol. Vitol, founded in 1966, formed VTTI in 2006, created a joint venture with MISC Berhad, a Malaysian company (“MISC”) at VTTI’s Malaysian terminal in 2008, and added MISC as an equal partner in VTTI in 2010. In November 2015, MISC sold its 50% interest in VTTI to VIP. Vitol is one of the world’s largest independent energy traders, trading over 5 million barrels of refined petroleum products and crude oil every day. Vitol has maintained a private, investment grade credit rating from at least one of the major credit rating agencies since 1994 and has rapidly expanded into a broad group of complementary businesses engaged in finding, extracting, refining, trading, storing and transporting resources. Vitol employs more than 5,400 people globally and has approximately 40 offices worldwide. Our relationship with Vitol also is the source of the majority of our revenues, representing 76%, 77% and 76% of our revenues for the years ended December 31, 2015, 2014 and 2013 respectively. Our relationship with Vitol provides us with unique market insights into global industry dynamics, product flows and customer demand.

S-11

Our business strategies

Our primary business objective is to generate stable cash flows that enable us to pay the minimum quarterly distribution to our unitholders and to increase our quarterly cash distributions over time. We intend to accomplish this objective by executing the following business strategies:

| • | | Procure long-term, fee-based, take-or-pay agreements. We are focused on generating stable and predictable cash flows by providing fee-based, take-or-pay terminaling services to our customers under long-term agreements. Contracts in our industry typically have a duration of two to four years. We do not have direct commodity price exposure because we do not own the underlying commodities being stored at our terminals and do not engage in the trading of any commodities. |

| • | | Pursue growth through strategic acquisitions of additional energy infrastructure assets from VTTI. We plan to pursue accretive acquisitions of additional energy infrastructure assets that VTTI may offer us in the future. We have entered into an omnibus agreement under which VTTI will offer us the right to acquire additional assets that it currently owns or will own in the future, including additional equity interests in VTTI Operating, before offering to sell any such assets to any third party. VTTI is currently in varying stages of evaluation and development of numerous additional terminaling projects, and we believe such projects may provide growth opportunities for us in the future. |

| • | | Capitalize on international terminaling market fragmentation through strategic acquisitions from third parties. We believe that the terminaling business outside the United States is highly fragmented and presents an attractive opportunity for large scale, well-capitalized companies to capture significant market share, achieve economies of scale and build brand equity. We will attempt to use our industry knowledge, network of customers and strategic asset base to identify and acquire third-party assets. We intend to pursue such acquisition opportunities both independently and jointly with VTTI or third parties, particularly when the third party partners have expertise in certain industries or geographies. We believe that our base of operations provides multiple platforms for strategic growth through acquisitions. If we acquire such assets, we will seek to operate the acquired assets or businesses more efficiently and competitively, thereby increasing our revenue and cash flow. |

| • | | Pursue organic development opportunities and greenfield construction projects. Our assets are generally located in the major international supply and demand centers for refined petroleum products and crude oil and have a high degree of interconnectivity and physical integration with major refinery complexes. We will continually evaluate organic development opportunities to expand the capacity of our existing assets, which can be accomplished at several of our terminals without purchasing additional property. Additionally, since 2006, VTTI has designed, constructed and contracted terminal storage of approximately 34.3 million barrels through greenfield and brownfield construction. We will continue to pursue development of new terminals independently of, or in partnership with, VTTI in order to meet increasing demand for our services. |

| • | | Continuous enhancement of customer service to retain our competitive position. Our terminals have been constructed with our customers’ business objectives in mind. Accordingly, we strive to maximize the utilization of our terminals by providing access to multiple modes of transportation, advanced blending and loading technology and high capacity throughput and storage equipment such as tanks, pumps and berths in order to provide our customers with maximum flexibility and optionality. Furthermore, we continually seek to identify and pursue opportunities to increase our utilization, improve our operating efficiency and expand our service offerings to our customers. |

| • | | Maintain sound financial practices and flexibility to ensure our long-term viability. We are committed to disciplined financial practices and a balanced capital structure, which we believe will serve the long-term |

S-12

| | interests of our unitholders. We believe our conservative capital structure, when combined with our stable, fee-based cash flows, should afford us efficient access to capital markets at a competitive cost of capital |

Principal executive offices

The Partnership was formed under the laws of the Republic of the Marshall Islands and we maintain our principal executive offices at 25-27 Buckingham Palace Road, London, SW1W 0PP, United Kingdom. The Partnership’s telephone number at that address is +44 20 3772 0110. The Partnership’s agent for service of process in the United States is Watson Farley & Williams LLP. The address of Watson Farley & Williams LLP is 250 West 55th Street, New York, New York 10019.

S-13

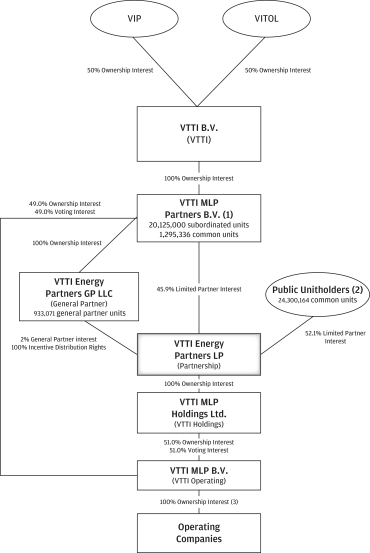

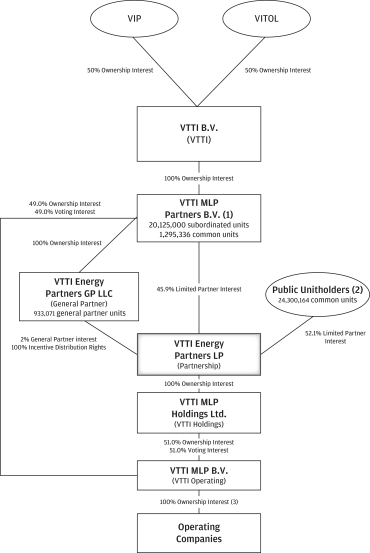

Organizational and ownership structure after this offering

At the closing of this offering, we will receive $2.1 million from our general partner for 107,142 general partner units to allow it to maintain its 2.0% general partner interest in us (or $2.4 million for 123,214 general partner units if the underwriters exercise in full their option to purchase additional common units). The sale of general partner units is not part of this offering. The following table and diagram depict our simplified organizational and ownership structure after giving effect to the offering, the sale of general partner units and the Acquisition, assuming no exercise of the underwriters’ option to purchase additional common units:

| (1) | | VTTI MLP Partners B.V., a wholly-owned subsidiary of VTTI B.V., our indirect parent, has agreed to purchase 1,295,336 common units from the underwriters at $19.30 per common unit, which is the price per common unit paid by the public in the initial distribution. The underwriters will not deduct any discounts or commissions from the price paid by VTTI MLP Partners B.V. and, as a result, we will receive the entire amount paid by VTTI MLP Partners B.V. for such units. |

| (2) | | Includes 220,500 common units held by Stichting Administratiekantoor, as set forth in the table below. |

| (3) | | VTTI Operating owns 100% of the operating companies, except for VTTI Fujairah Terminals Ltd, 10% of which is owned by Fujairah Petroleum Co., and Euro Tank Terminal B.V., ETT Pipeline Operations B.V. and ETT Jetty Operations B.V., of which 10% of each are owned by SK Terminal B.V. |

S-14

| | | | | | | | |

| | | Number of

units | | | Percentage

ownership | |

Public Common Units | | | 24,079,664 | | | | 51.6% | |

Stichting Administratiekantoor VTTI Common Units(1) | | | 220,500 | | | | 0.5% | |

VTTI MLP Partners B.V. Common Units | | | 1,295,336 | | | | 2.8% | |

VTTI MLP Partners B.V. Subordinated Units | | | 20,125,000 | | | | 43.1% | |

General Partner Units | | | 933,071 | | | | 2.0% | |

| | | | |

| | | 46,653,571 | | | | 100.0% | |

| |

| (1) | | On April 27, 2016, the Partnership entered into a Subscription Agreement (the “Subscription Agreement”) with Stichting Administratiekantoor VTTI, a foundation incorporated under the laws of the Netherlands (the “Foundation”) in connection with the VTTI Energy Partners 2014 Long-Term Incentive Plan (the “LTIP”). Pursuant to the Subscription Agreement, on May 2, 2016, the Partnership issued 220,500 common units to the Foundation in consideration for the Foundation’s promise to subsequently issue depositary receipts with respect to common units of the Partnership to be held in trust by the Foundation and distribution equivalent rights to certain employees, consultants and directors of the general partner of the Partnership and its affiliates (the “Participants”). The depositary receipts and distribution equivalent rights were issued pursuant to the LTIP. The Foundation will hold such common units on behalf of the Participants and will not transfer the common units to any other person until such time as the depositary receipts have vested. |

S-15

The offering

Issuer | VTTI Energy Partners LP |

Common units offered by us | 5,250,000 common units (6,037,500 common units, if the underwriters exercise in full their option to purchase up to 787,500 additional common units). |

| | VTTI MLP Partners B.V., a wholly-owned subsidiary of VTTI B.V., our indirect parent, has agreed to purchase from the underwriters 1,295,336 of the common units offered hereby. The underwriters will not deduct any discounts or commissions from the price paid by VTTI MLP Partners B.V. and, as a result, we will receive the entire amount paid by VTTI MLP Partners B.V. for such units. |

Units outstanding after this offering | 25,595,500 common units (26,383,000 common units, if the underwriters exercise in full their option to purchase up to 787,500 additional common units), 20,125,000 subordinated units and 933,071 general partner units (949,143 general partner units, if the underwriters exercise in full their option to purchase up to 787,500 additional common units). |

Use of proceeds | We intend to use approximately $96.2 million of the net proceeds from this offering of common units and the related capital contribution to us by our general partner to fund the Purchase Price for the Acquisition. The remainder of the net proceeds will be used for general partnership purposes. The proceeds from any exercise of the underwriters’ option to purchase additional common units will be used for general partnership purposes. Until we apply the net proceeds for the purposes described above, we may invest them in short-term liquid investments. If the Acquisition does not close, we will use the net proceeds from this offering and the related capital contribution to us by our general partner for general partnership purposes. See “Use of Proceeds.” |

Exchange listing | Our common units are listed on the NYSE under the symbol “VTTI.” |

U.S. federal income tax considerations | Although we are organized as a partnership, we have elected to be treated as a corporation solely for U.S. federal income tax purposes. Consequently, all or a portion of the distributions you receive from us will constitute dividends for such purposes. The remaining portion of such distributions will be treated first as a non-taxable return of capital to the extent of your tax basis in your common units and, thereafter, as capital gain. For a discussion of other material U.S. federal income tax consequences that may be relevant to certain prospective unitholders who are citizens or residents of the United States, see “Certain United States Federal Income Tax Considerations” in this prospectus supplement and “Material United States Federal Income Tax Considerations” in the accompanying base prospectus. |

S-16

Non-U.S. tax considerations | We and our general partner have been organized under the laws of the Republic of the Marshall Islands and are managed and controlled in the United Kingdom. VTTI Operating has been organized under the laws of the Netherlands. |

| | For a discussion of material Marshall Islands, Dutch and U.K. income tax considerations that may be relevant to prospective unitholders, see “Non-United States Tax Considerations.” |

S-17

Risk factors

Any investment in our common units involves a high degree of risk. You should carefully consider the important factors set forth under the heading “Risk Factors” starting on page 5 of our 2015 Annual Report incorporated herein by reference before investing in our common units. For further details, see “Where You Can Find Additional Information” and “Incorporation by Reference.”

Any of the risk factors referred to above could significantly and negatively affect our business, results of operations or financial condition, which may reduce our ability to pay distributions and lower the trading price of our common units. The risks referred to above are not the only ones that may exist. Additional risks not currently known by us or that we deem immaterial may also impair our business operations. You may lose all or a part of your investment.

The pending acquisition may not close as anticipated or may close with adjusted terms.

We intend to use the net proceeds from this offering to fund the aggregate purchase price for the Acquisition, as described under “Summary—Recent Developments. We expect the Acquisition to close on September 1, 2016, subject to customary closing conditions. If these conditions are not satisfied or waived, we will not complete the Acquisition. Certain of the conditions that remain to be satisfied include, but are not limited to:

| • | | the continued accuracy of the representations and warranties contained in the Purchase and Sale Agreement; |

| • | | the performance by each party of its covenants under the Purchase and Sale Agreement; |

| • | | the absence of any investigation, inquiry, proceeding or claim relating to the validity, invalidity or legality of the Purchase and Sale Agreement and its consummation; |

| • | | the Conflicts Committee of our general partner’s board of directors shall not have withdrawn its approval of the Acquisition; |

| • | | the execution of certain agreements related to the consummation of the Acquisition. |

We cannot assure you that the Acquisition will close on our expected timeframe, or at all, or close without material adjustments. In addition, the closing of this offering is not conditioned on the consummation of the Acquisition. Therefore, upon the closing of this offering, you will become a holder of our common units regardless of whether either the Acquisition is consummated, delayed or terminated. If the Acquisition is not consummated, we will use the net proceeds from this offering for customary partnership purposes, over which our management will have broad discretion and could apply the proceeds in ways that you or other unitholders may not approve. Accordingly, if you decide to purchase common units in this offering, you should be willing to do so whether or not we complete the Acquisition.

The results of the United Kingdom’s referendum on withdrawal from the European Union may have a negative effect on global economic conditions, financial markets and our business, which could reduce the price of our common units.

We are a multinational company with worldwide operations, including significant business operations in Europe. In June 2016, a majority of voters in the United Kingdom elected to withdraw from the European Union in a national referendum. The referendum was advisory, and the terms of any withdrawal are subject to a negotiation period that could last at least two years after the government of the United Kingdom formally initiates a withdrawal process. Nevertheless, the referendum has created significant uncertainty about the future relationship between the United Kingdom and the European Union, and has given rise to calls for the governments of other European Union member states to consider withdrawal.

S-18

These developments, or the perception that any of them could occur, have had and may continue to have a material adverse effect on global economic conditions and the stability of global financial markets, and could significantly reduce global market liquidity and restrict the ability of key market participants to operate in certain financial markets. Asset valuations, currency exchange rates and credit ratings may be especially subject to increased market volatility. Lack of clarity about future United Kingdom laws and regulations as the United Kingdom determines which European Union laws to replace or replicate in the event of a withdrawal, including financial laws and regulations, tax and free trade agreements, environmental, health and safety laws and regulations and employment laws, could depress economic activity and restrict our access to capital. If the United Kingdom and the European Union are unable to negotiate acceptable withdrawal terms or if other European Union member states pursue withdrawal, barrier-free access between the United Kingdom and other European Union member states or among the European economic area overall could be diminished or eliminated. Any of these factors could have a material adverse effect on our business, financial condition and results of operations and reduce the price of our common units.

S-19

Use of proceeds

We expect to receive net proceeds of approximately $100.0 million from the sale of common units we are offering (or $115.0 million if the underwriters exercise in full their option to purchase 787,500 additional common units), after deducting estimated offering expenses payable by us. We will also receive approximately $2.1 million of proceeds from the capital contribution to us by our general partner (or $2.4 million if the underwriters’ option to purchase additional common units is exercised in full) to maintain its 2% general partner interest in us.

We intend to use a portion of the net proceeds from this offering of common units and the related capital contribution to us by our general partner to fund the Purchase Price for the Acquisition. The remainder of the net proceeds will be used for general partnership purposes. Until we apply the net proceeds for the purposes described above, we may invest them in short-term liquid investments. If the Acquisition does not close, we will use the net proceeds from this offering and the related capital contribution to us by our general partner for general partnership purposes.

The proceeds from any exercise of the underwriters’ option to purchase additional common units will be used for general partnership purposes.

S-20

Capitalization

The following table sets forth our cash and cash equivalents and capitalization as of June 30, 2016:

| • | | on an actual basis; and |

| • | | as adjusted to give effect to (i) the issuance and sale of common units in this offering and the capital contribution by our general partner to maintain its 2.0% general partner interest in us, assuming no exercise of the underwriters’ option to purchase additional units, resulting in net proceeds of approximately $102.1 million (after deducting estimated offering expenses of $350,000) and (ii) the payment to VTTI MLP Partners B.V. of the Purchase Price. If the Acquisition does not close, we will use the net proceeds from this offering for general partnership purposes. |

| | | | | | | | |

| | | June 30, 2016 | |

| | | Actual | | | As

adjusted | |

| | | (dollars in millions) | |

| | |

CASH | | | | | | | | |

Cash and cash equivalents | | $ | 14.5 | | | $ | 20.4 | |

| | | | |

| | |

DEBT | | | | | | | | |

Current installments of long-term debt, affiliates | | | 7.4 | | | | 7.4 | |

Long-term debt(1)(2) | | | 546.7 | | | | 546.7 | |

Long-term debt, affiliates | | | 137.7 | | | | 137.7 | |

Total debt | | | 691.8 | | | | 691.8 | |

| | | | |

| | |

PARTNERS’ CAPITAL | | | | | | | | |

Common unitholders: 20,345,500 units issued and outstanding as of June 30, 2016; 25,595,500 units as adjusted | | | 109.2 | | | | 188.2 | |

Subordinated unitholders: 20,125,000 units issued and outstanding as of June 30, 2016 and as adjusted | | | 109.2 | | | | 92.7 | |

General partner: 825,929 units issued and outstanding as of June 30, 2016; 933,071 units as adjusted | | | 4.5 | | | | 5.9 | |

Total partners’ capital | | | 222.9 | | | | 286.8 | |

| | | | |

Accumulated other comprehensive loss | | | (9.4) | | | | (10.3 | ) |

Non-controlling interest | | | 429.3 | | | | 372.2 | |

| | | | |

Total equity | | | 642.8 | | | | 648.7 | |

Total capitalization | | | 1,334.6 | | | | 1,340.5 | |

| |

| (1) | | At June 30, 2016, VTTI Operating had a€300 million revolving credit facility. The amounts outstanding as of June 30, 2016, 2016 include€45 million of Euro borrowings and $55 million of US Dollar borrowings. |

| (2) | | Includes senior unsecured notes issued by VTTI Operating, with principal amounts of $245 million US Dollars and€180 million Euros. |

S-21

Price range of common units and distributions

As of August 5, 2016 there were 20,345,500 common units outstanding, 20,125,000 of which were held by the public and 220,500 of which were held by Stichting Administratiekantoor VTTI, a foundation incorporated under the laws of the Netherlands. As of August 5, 2016, there were three holders of record of our common units. Our common units were first offered on the NYSE on August 1, 2014 at an initial price of $21.00 per unit. Our common units are traded on the NYSE under the symbol “VTTI.”

The following table sets forth, for the periods indicated, the high and low sales prices for our common units, as reported on the NYSE, and quarterly cash distributions declared per common unit. The last reported sale price of our common units on the NYSE on August 8, 2016 was $20.71 per unit.

| | | | | | | | | | | | |

| | | Price range | | | Cash

distributions per

common unit(1) | |

| | | High | | | Low | | |

Year ended December 31, 2014(2) | | $ | 27.36 | | | $ | 21.46 | | | | | |

Year ended December 31, 2015 | | | 27.71 | | | | 17.26 | | | | | |

Quarter ended September 30, 2014(3) | | | 27.36 | | | | 22.10 | | | | 0.159783 | (4) |

Quarter ended December 31, 2014 | | | 26.11 | | | | 21.46 | | | | 0.2625 | |

Quarter ended March 31, 2015 | | | 25.86 | | | | 20.75 | | | | 0.2719 | |

Quarter ended June 30, 2015 | | | 27.71 | | | | 23.86 | | | | 0.2815 | |

Quarter ended September 30, 2015 | | | 25.20 | | | | 17.52 | | | | 0.2925 | |

Quarter ended December 31, 2015 | | | 27.01 | | | | 17.26 | | | | 0.3015 | |

Quarter ended March 31, 2016 | | | 20.71 | | | | 15.45 | | | | 0.31085 | |

Quarter ended June 30, 2016 | | | 21.74 | | | | 17.98 | | | | 0.3204 | (5) |

Month ended January 31, 2016 | | | 20.71 | | | | 15.61 | | | | | |

Month ended February 29, 2016 | | | 18.24 | | | | 15.45 | | | | | |

Month ended March 31, 2016 | | | 19.51 | | | | 17.87 | | | | | |

Month ended April 30, 2016 | | | 20.22 | | | | 18.28 | | | | | |

Month ended May 30, 2016 | | | 20.30 | | | | 18.94 | | | | | |

Month ended June 30, 2016 | | | 21.74 | | | | 17.98 | | | | | |

Month ended July 31, 2016 | | | 21.48 | | | | 19.12 | | | | | |

Month ended August 30, 2016(6) | | | 20.76 | | | | 19.36 | | | | | |

| |

| (1) | | Represents cash distributions attributable to the quarter. |

| (2) | | For the period from August 1, 2014 through December 31, 2014. |

| (3) | | For the period from August 1, 2014 through September 30, 2014. |

| (4) | | Represents a prorated cash distribution for the period from August 6, 2014 to September 30, 2014, equivalent to our minimum quarterly distribution of $0.2625 per unit per quarter. |

| (5) | | The distribution for the quarter ended March 31, 2016 will be paid on August 12, 2016 to all unitholders of record as of August 8, 2016. |

| (6) | | For the period from August 1, 2016 through August 8, 2016. |

S-22

Certain United States federal income tax considerations

The tax consequences to you of an investment in our common units will depend in part on your own tax circumstances. Please read the risk factors included under the caption “Tax Risks” in our Annual Report on Form 20-F for the year ended December 31, 2015 and the discussion of the principal United States federal income tax considerations associated with our operations and the purchase, ownership and disposition of our common units under the caption “Material United States Federal Income Tax Considerations” in the accompanying base prospectus. You are urged to consult with your own tax advisor about the federal, state, local and foreign tax consequences particular to your circumstances.

S-23

Non-United States tax considerations

Marshall Islands tax considerations

The following discussion is based upon the opinion of Watson Farley & Williams LLP, our counsel as to matters of the laws of the Republic of the Marshall Islands, and the current laws of the Republic of the Marshall Islands and is applicable only to persons who are not citizens of, and do not reside in, maintain offices in or engage in business in the Republic of the Marshall Islands.

Because we and our subsidiaries do not, and we do not expect that we or our other subsidiaries will, maintain offices or conduct business, transactions or operations in the Republic of the Marshall Islands, and because all documentation related to this offering has been and will be executed outside of the Republic of the Marshall Islands, under current Marshall Islands law you will not be subject to Marshall Islands taxation or withholding on distributions, including upon a return of capital, we make to you as a unitholder. In addition, you will not be subject to Marshall Islands stamp, capital gains or other taxes on the purchase, ownership or disposition of our common units, and you will not be required by the Republic of the Marshall Islands to file a tax return relating to our common units.

It is the responsibility of each unitholder to investigate the legal and tax consequences, under the laws of pertinent jurisdictions, including the Marshall Islands, of its investment in us. Accordingly, each unitholder is urged to consult its tax counsel or other advisor with regard to those matters. Further, it is the responsibility of each unitholder to file all state, local and non-U.S., as well as U.S. federal, tax returns that may be required of such unitholder.

United Kingdom tax consequences

The following is a discussion of the material U.K. tax consequences that may be relevant to prospective unitholders who are not (and have not been) resident in the United Kingdom for U.K. tax purposes, or “non-U.K. Holders.”

Prospective unitholders who are (or have been) resident in the United Kingdom for U.K. tax purposes are urged to consult their own tax advisors regarding the potential U.K. tax consequences to them of an investment in our common units.

The discussion that follows is based upon existing U.K. legislation and current HM Revenue & Customs practice as of the date of this prospectus, both of which may change, possibly with retroactive effect. Changes in these authorities may cause the tax consequences to vary substantially from the consequences of unit ownership described below.

Taxation of income and disposals

We are not required to withhold U.K. tax when paying distributions to unitholders.

Under U.K. taxation legislation, non-U.K. holders will not be required to pay tax in the United Kingdom on income or profits, including chargeable (capital) gains, in respect of the acquisition, holding, disposition or redemption of the common units, provided that:

| • | | such holders do not use or hold and are not deemed or considered to use or hold their common units in the course of carrying on a trade, profession or vocation in the United Kingdom; and |

| • | | such holders do not have a branch or agency or permanent establishment in the United Kingdom to which such common units are used, held or acquired. |

S-24

We have obtained confirmation from HM Revenue & Customs that unitholders should not be regarded as carrying on a trade in the United Kingdom and should not be required to pay tax in the United Kingdom merely by virtue of ownership of our common units.

Stamp taxes

No liability for stamp duty reserve tax should arise in connection with the issuance of units to unitholders or the transfer of units by unitholders.

Provided that the instrument of transfer is not executed in any part of the United Kingdom and does not relate to any property situated or to any matter or thing done or to be done in any part of the United Kingdom, no liabilities to U.K. stamp duty should arise in connection with the issue of units to unitholders or the transfer of units in our partnership.

Netherlands tax consequences

The following is a discussion of the material Netherlands tax consequences that may be relevant to prospective unitholders who are not and have not been resident of the Netherlands for Netherlands tax purposes and who are not subject to any Netherlands tax for any source or reason other than by virtue of their ownership of our common units.

Prospective unitholders who are, or have been, resident of the Netherlands for Netherlands tax purposes and/or subject to Netherlands tax for any source or reason other than by virtue of their ownership of our common units are urged to consult their own tax advisors regarding the potential Netherlands tax consequences to them of an investment in our common units.

The discussion that follows is based upon existing Netherlands legislation, case law and current Netherlands tax authorities’ practice and policy as of the date of this prospectus, both of which may change, possibly with retroactive effect. Changes in legislation, case law and the practice and policy of Netherlands tax authorities may cause the tax consequences to vary substantially from the consequences of unit ownership described below.

Distributions

We are not required to withhold Netherlands dividend withholding tax when making distributions to unitholders provided that the place of effective management of the following entities—VTTI Energy Partners GP LLC, VTTI Energy Partners LP and VTTI MLP Holdings Ltd—is not in the Netherlands for Netherlands tax purposes.

We have obtained an Advance Tax Ruling from the Netherlands tax authorities confirming that the place of effective management of these entities will be outside the Netherlands on the basis of our description of those entities’ envisaged organization, governance and management, as included in the ruling request. In addition, to comply with a condition of the Advance Tax Ruling we have informed the Netherlands tax authorities of relevant changes that have occurred since the receipt of the Advance Tax Ruling. Consequently, any distribution to unitholders should not be subject to Netherlands dividend withholding tax. Please read “—Advance Tax Ruling.”

Taxation of income and disposition of common units

Under Netherlands tax legislation, non-Netherlands resident unitholders will not be subject to tax in the Netherlands merely by virtue of their ownership of our common units. Consequently, under such circumstances, non-Netherlands resident unitholders will not be liable to any Netherlands taxation regarding the purchase, ownership or disposition of common units. Also, non-Netherlands resident unitholders are not required to file a Netherlands tax return in the Netherlands relating to their ownership of common units merely by virtue of their ownership of our common units. We have also obtained an Advance Tax Ruling from the Netherlands tax authorities confirming this tax treatment. Please read “—Advance Tax Ruling.”

S-25

Advance tax ruling

We concluded an Advance Tax Ruling with the Netherlands tax authorities with a term of five years starting from the day of the IPO and with an understanding to prolong the Advance Tax Ruling for another period of five years, unless the relevant facts and circumstances have changed or in case of a relevant amendment of the law.

The Advance Tax Ruling is a legally binding agreement between us and the Netherlands tax authorities. In the Advance Tax Ruling we obtained advance certainty from the Netherlands tax authorities that under the present Netherlands taxation legislation, and based on our description of the relevant facts and circumstances as included in the ruling request, non-Netherlands resident common unitholders will not be subject to Netherlands non-resident tax merely by virtue of their ownership of our common units. It has also been agreed that we are not required to withhold Netherlands dividend withholding tax on distributions made to unitholders provided that the place of effective management of the following entities—VTTI Energy Partners GP LLC, VTTI Energy Partners LP and VTTI MLP Holdings Ltd—is and will continue to be outside the Netherlands, which place of effective management has been confirmed to be outside the Netherlands on the basis of our description of those entities’ envisaged organization, governance and management as included in the ruling request.

In the Advance Tax Ruling, concluded on the basis of our description of the relevant facts and circumstances as included in the ruling request, we obtained advance certainty from the Netherlands tax authorities that under the present Netherlands taxation legislation dividend distributions and repayments of equity made by VTTI MLP B.V. to its shareholder VTTI MLP Holdings Ltd are exempt from Netherlands dividend withholding tax and that any benefit, including capital gains and dividend income, derived from our operating subsidiaries by VTTI MLP B.V. should be exempt from Netherlands taxation pursuant to the Netherlands participation exemption.

In the Advance Tax Ruling, concluded on the basis of our description of the envisaged organization, governance and management as included in the ruling request, we obtained advance certainty from the Netherlands tax authorities that we and our subsidiary VTTI MLP Holdings Ltd will not be regarded as Netherlands tax residents and, as a result, will not be subject to Netherlands corporate income tax.

In addition, to comply with a condition of the Advance Tax Ruling, we have informed the Netherlands tax authorities of relevant changes that have occurred since the receipt of the Advance Tax Ruling relating to our organization, governance and management.

S-26

Underwriting

J.P. Morgan Securities LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated are acting as underwriters of the offering. Subject to the terms and conditions set forth in an underwriting agreement between us and the underwriters, we have agreed to sell to the underwriters, and each of the underwriters has agreed, severally and not jointly, to purchase from us, the number of common units set forth opposite its name below:

| | | | |

| Underwriters | | Number of

common units | |

J.P. Morgan Securities LLC | | | 2,625,000 | |

Merrill Lynch, Pierce, Fenner & Smith

Incorporated | | | 2,625,000 | |

| | | | |

| Total | | | 5,250,000 | |

| |

Subject to the terms and conditions set forth in the underwriting agreement, the underwriters have agreed, severally and not jointly, to purchase all of the common units sold under the underwriting agreement if any of these common units are purchased.

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments the underwriters may be required to make in respect of those liabilities.

The underwriters are offering the common units, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel, including the validity of the common units, and other conditions contained in the underwriting agreement, such as the receipt by the underwriters of officer’s certificates and legal opinions. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

The underwriters are purchasing the common units from us at $19.05 per common unit (representing approximately $100.3 million aggregate proceeds to us, before we deduct our out-of-pocket expenses of approximately $350,000, or approximately $115.3 if the underwriters’ option to purchase additional common units described below is exercised in full). The underwriters may offer the common units from time to time for sale in one or more transactions on the New York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. In connection with the sale of the common units offered hereby, the underwriters may be deemed to have received compensation in the form of underwriting discounts. The underwriters may effect such transactions by selling common units to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or purchasers of common units for whom they may act as agents or to whom they may sell as principal.

VTTI MLP Partners B.V., a wholly-owned subsidiary of VTTI B.V., our indirect parent, has agreed to purchase 1,295,336 common units from the underwriters at $19.30 per common unit, which is the price per common unit paid by the public in the initial distribution. The underwriters will not deduct any discounts or commissions from the price paid by VTTI MLP Partners B.V. and, as a result, we will receive the entire amount paid by VTTI MLP Partners B.V. for such units.

Option to purchase additional common units

We have granted an option to the underwriters, exercisable for 30 days after the date of this prospectus, subject to the conditions contained in the underwriting agreement, to purchase up to 787,500 additional common units at the price per common unit set forth on the cover page of this prospectus supplement.

S-27

No sales of similar securities

We, our general partner, our general partner’s officers and directors and our affiliates have agreed, subject to certain exceptions, not to sell or transfer any common units or securities convertible into, exchangeable for, exercisable for, or repayable with common units, for 60 days after the date of this prospectus supplement without first obtaining the written consent of J.P. Morgan Securities LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated. Specifically, we and these other persons have agreed, with certain limited exceptions, not to directly or indirectly

| • | | offer, pledge, sell or contract to sell any common units, |

| • | | sell any option or contract to purchase any common units, |

| • | | purchase any option or contract to sell any common units, |

| • | | grant any option, right or warrant for the sale of any common units, |

| • | | lend or otherwise dispose of or transfer any common units, |

| • | | request or demand that we file a registration statement related to the common units, or |

| • | | enter into any swap or other agreement that transfers, in whole or in part, the economic consequence of ownership of any common units whether any such swap or transaction is to be settled by delivery of common units or other securities, in cash or otherwise. |

This lock-up provision applies to common units and to securities convertible into or exchangeable or exercisable for or repayable with common units. It also applies to common units owned now or acquired later by the person executing the agreement or for which the person executing the agreement later acquires the power of disposition.

New York stock exchange listing

The common units are listed on the New York Stock Exchange under the symbol “VTTI.”

Price stabilization, short positions

Until the distribution of the common units is completed, SEC rules may limit underwriter and selling group members from bidding for and purchasing our common units. However, the underwriters may engage in transactions that stabilize the price of the common units, such as bids or purchases to peg, fix or maintain that price in accordance with Regulation M under the Securities Exchange Act of 1934, as amended.

In connection with the offering, the underwriters may purchase and sell our common units in the open market. These transactions may include short sales, purchases on the open market to cover positions created by short sales and stabilizing transactions. Short sales involve the sale by the underwriters of a greater number of common units than it is required to purchase in the offering. “Covered” short sales are sales made in an amount not greater than the underwriters’ option to purchase additional common units described above. The underwriters may close out any covered short position by either exercising their option to purchase additional common units or purchasing common units in the open market. In determining the source of common units to close out the covered short position, the underwriters will consider, among other things, the price of common units available for purchase in the open market as compared to the price at which it may purchase common units through the option granted to them. “Naked” short sales are sales in excess of such option. The underwriters must close out any naked short position by purchasing common units in the open market. A naked

S-28

short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of our common units in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions consist of various bids for or purchases of common units made by the underwriters in the open market prior to the completion of the offering.

Similar to other purchase transactions, the underwriters’ purchases to cover the syndicate short sales may have the effect of raising or maintaining the market price of our common units or preventing or retarding a decline in the market price of our common units. As a result, the price of our common units may be higher than the price that might otherwise exist in the open market. The underwriters may conduct these transactions on the NYSE, in the over-the-counter market or otherwise.