UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2018

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission file number 000-55642

LOVE INTERNATIONAL GROUP, INC. |

(Exact name of registrant as specified in charter) |

Nevada | | 80-0929366 |

(State or jurisdiction of Incorporation or organization) | | I.R.S Employer Identification No. |

Room 161, 2nd Floor, No. 12 Building, 1154 Kangqiao Road, Pu Dong New District, Shanghai, China | | 201315 |

(Address of principal executive offices) | | (Zip code) |

+86 021 23563330

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Name of Each Exchange on Which Registered |

None | | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001 Per Share

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10- K or any amendment to this Form 10- K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

| Emerging company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ¨ No x

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $0 based on a $0.00 average bid and asked price of such common equity (there were no bids or asks during the period from January 1, 2018 through June 30, 2018).

Number of shares of common stock outstanding as of March 25, 2019 was 1,000,000,000.

Documents Incorporated by Reference: None.

Table of Contents

EXPLANATORY NOTE

Following the completion of the fiscal year ended December 31, 2018 covered by this Annual Report on Form 10-K, on February 11, 2019, Love International Group, Inc., or the Company, completed a share exchange transaction pursuant to a share exchange agreement, or the Share Exchange Agreement with Lovego Holdings Limited, a corporation organized under the laws of the Cayman Islands (“Lovego Holdings”), Lovego Hong Kong Limited, a Hong Kong corporation (“Lovego Hong Kong”), Shanghai Lepan Business Information Consulting Co., Ltd., a PRC corporation (“WFOE”), Shenzhen Qianhai Lefu E-Commerce Co., Ltd., a PRC corporation (“Shenzhen Lefu”), Shanghai Lefu E-Commerce Co., Ltd., a PRC corporation (“Shanghai Lefu”), and the then shareholders of Lovego Holdings (the “Shareholders”). Pursuant to the Share Exchange Agreement, the Shareholders transferred all of the shares of the capital stock of Lovego Holdings held by them, constituting all of the issued and outstanding stock of Lovego Holdings, to the Company, in exchange for 710,666,640 newly issued shares of the Company’s common stock, par value $.0001 per share, that constituted approximately 71% of the Company’s issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement (the “Merger”). The Shareholders are Lejoy Holdings Limited and Leseng Holdings Limited, each a British Virgin Islands company.

Upon the completion of Merger, the business of Lovego Holdings Limited and its subsidiaries and consolidated affiliated entities became our business.

On February 1, 2016, the Financial Industry Regulatory Authority approved a 10-for-1 forward stock split of the issued and outstanding shares of common stock of the Company. Unless otherwise noted, all references to common stock share amounts and prices per share of common stock in this Annual Report on Form 10-K reflect the aforesaid forward stock split.

As used herein, the words the “Company,” “we,” “us,” and “our” refer to Love International Group, Inc. and its direct and indirect subsidiaries, as applicable.

Our reporting currency is the U.S. dollars. The Company uses RMB as its functional currency. This Report contains conversion of Renminbi (RMB) amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all conversions of Renminbi into U.S. dollars were made at RMB6.8632 to $1, which was the official base exchange rate published by the People’s Bank of China (PBOC) on December 31, 2018. Monetary assets and liabilities denominated in Renminbi are translated into U.S. dollars at the respective official base exchange rate published by the PBOC as of the balance sheet date. Equity accounts denominated in Renminbi are translated into U.S. dollars at the applicable historical exchange rate. Revenues, expenses, gains and losses denominated in Renminbi are translated into U.S. dollars at the official annual average exchange rate for the applicable year as published by the PBOC. We make no representation that the Renminbi or U.S. dollar amounts referred to in this Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may be identified by such forward-looking terminology as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. Our forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our company, are not guarantees of future results or performance and involve substantial risks and uncertainty. We may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements. Our business and our forward-looking statements involve substantial known and unknown risks and uncertainties, including the risks and uncertainties inherent in our statements regarding:

| ● | our planned online mobile platform’s ability to increase and expand the selection of products and services offering; |

| ● | our estimates of our expenses, ongoing losses, future revenue and capital requirements, including our expectations relating to the use of proceeds from our private placement offering and our needs for additional financing; |

| ● | our ability to obtain additional funds for our operations; |

| ● | our ability to obtain and maintain intellectual property protection for our technologies and our ability to operate our business without infringing the intellectual property rights of others; |

| ● | our ability to attract and retain qualified key management and technical personnel; |

| ● | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act, or Jobs Act; |

| ● | our financial performance; |

| ● | the impact of government regulation and developments relating to our competitors or our industry; and |

| ● | other risks and uncertainties, including those listed under the caption “Risk Factors.” |

All of our forward-looking statements are as of the date of this Annual Report on Form 10-K only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of, or any material adverse change in, one or more of the risk factors or risks and uncertainties referred to in this Annual Report on Form 10-K or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the U.S. Securities and Exchange Commission could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this Annual Report on Form 10-K, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. Any public statements or disclosures by us following this Annual Report on Form 10-K that modify or impact any of the forward-looking statements contained in this Annual Report on Form 10-K will be deemed to modify or supersede such statements in this Annual Report on Form 10-K.

This Annual Report on Form 10-K may include market data and certain industry data and forecasts, which we may obtain from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications, articles and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. While we believe that such studies and publications are reliable, we have not independently verified market and industry data from third-party sources.

PART I

ITEM 1. BUSINESS

Our Corporate History and Recent Developments

Love International Group, Inc. was incorporated in Nevada on May 23, 2013 under the name Quintec Corp. At formation, the Company was authorized to issue 100,000,000 shares of common stock, par value $0.001 per share.

The Company was originally formed to develop a way to make toy and trinket shopping more interactive and more fun. Prior to November 2015, when the Company underwent a change in control and a change in management, and the new management adopted a new business plan based on the development of an online, cross-border e-commerce platform for promotion and sales of foreign specialties and other discount branded products to worldwide customers, our primary mission was to develop and install 3D printing kiosks in shopping centers throughout Chile and eventually all of South America, which would allow customers to create 3D printed products on location, while they wait or shop for other items. The idea behind the technology was to allow customers to print toys and gifts at a low price, in a very interactive manner.

On August 13, 2013, we increased the number of authorized shares of common stock, par value $0.001 per share, from 100,000,000 to 150,000,000.

On November 11, 2015, a change in control of the Company occurred, whereby Walter Lee, the-then sole officer and director, sold 15,000,000 of his shares of common stock, representing 51.8% of the then voting power of the issued and outstanding capital stock of the Company, in a private transaction to Yong Qiang Yang (8,250,000 shares) and Wei Min Jin (6,750,000 shares), who subsequently became officers and directors of the Company. Mr. Lee sold the remainder of his shares (5,000,000 shares) to other individuals in separate transactions not involving a public sale or distribution. After the sale of stock, Walter Lee had no further ownership of any voting securities of the Company.

On November 30, 2015, the Company accepted the resignation of Walter Lee from his positions as President, Chief Executive Officer, Chief Financial Officer and member of the Board of Directors. The Board of Directors appointed Yong Qiang Yang as President of the Company and a member of the Board of Directors, and Wei Min Jin as Chief Financial Officer and Secretary of the Company and a member of the Board of Directors, effective November 30, 2015.

All references above to share and per share data have not been adjusted to give effect of the forward stock split (see below).

On January 20, 2016, the Board of Directors approved a change in the Company’s fiscal year end from January 31 to December 31.

On February 1, 2016, the Financial Industry Regulatory Authority approved: (a) changing the name of the Company to Love International Group, Inc. (the “Name Change”); (b) increasing the aggregate number of authorized shares of common stock of the Company from one hundred and fifty million (150,000,000) shares, par value $0.001, to one billion (1,000,000,000) shares, par value $0.0001 per share (the “Authorized Share Increase”); (c) a 10-for-1 forward stock split of the issued and outstanding shares of common stock of the Company (the “Forward Split”; together with the Name Change and Authorized Share Increase, the “Corporate Actions”); and (d) a new trading symbol of LOVV.

On February 5, 2016, the Corporate Actions became effective and the issued and outstanding shares of common stock of the Company became 289,333,360.

On March 7, 2016, the trading symbol changed to LOVV and a new CUSIP number (54714U107) was assigned to the Company’s common stock.

On May 18, 2016, the Company shifted its business focus from developing and launching an online, cross-border e-commerce platform to promote and market worldwide premium specialties and other well-known branded products with highly comparable discount pricing to developing and launching an online platform to promote cheap airline tickets and hotels as well as developing and launching a “Do-It-Yourself” (“DIY”) system for the Company’s customers to put together a trip with exotic activities such as hunting, flying a plane, or even piloting a submarine.

On February 11, 2019, we entered into the Share Exchange Agreement, pursuant to which, the Shareholders transferred all of the shares of the capital stock of Lovego Holdings held by them, constituting all of the issued and outstanding stock of Lovego Holdings, to the Company, in exchange for 710,666,640 newly issued shares of the our common stock, par value $.0001 per share, that constituted approximately 71% of our issued and outstanding capital stock on a fully-diluted basis as of and immediately after the consummation of the transactions contemplated by the Share Exchange Agreement (the “Merger”). The Shareholders are Lejoy Holdings Limited and Leseng Holdings Limited, each a British Virgin Islands company.

Our Corporate Structure

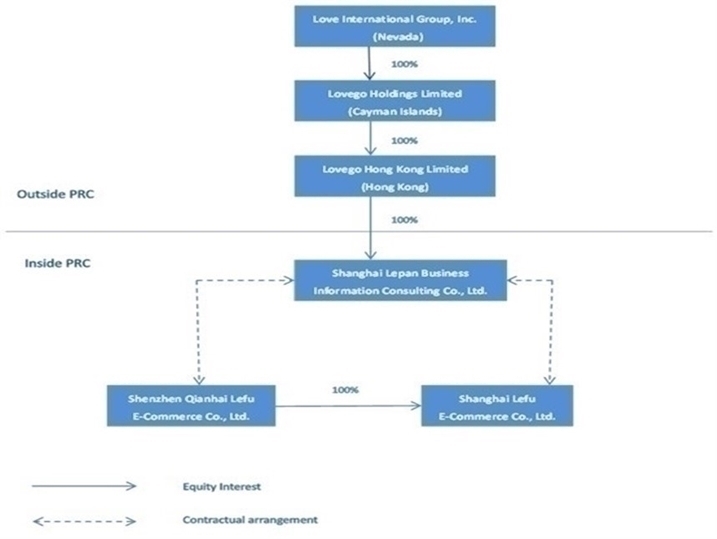

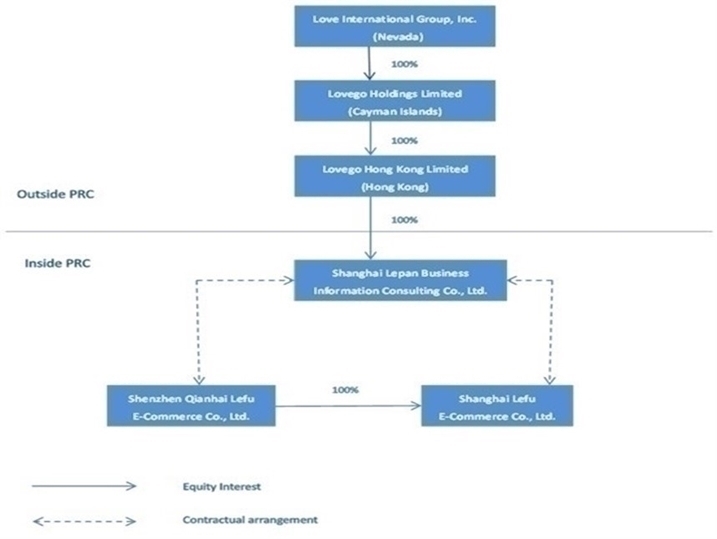

Following the completion of the Merger on February 11, 2019, we own all of the issued and outstanding capital stock of Lovego Holdings, which in turn owns 100% of the outstanding capital stock of Lovego Hong Kong. Lovego Hong Kong owns 100% of the outstanding equity interest of the WFOE, that in turn has signed a series of agreements with Shenzhen Lefu that grant it control of Shenzhen Lefu’s business and finances. Shenzhen Lefu owns 100% of the outstanding equity interest of Shanghai Lefu.

The following chart reflects our organizational structure as of the date of this Report.

Background and History of Lovego Holdings

Lovego Holdings was an exempted company incorporated in the Cayman Islands with limited liability on May 29, 2018. Lovego Holdings was wholly-owned by Leseng Holdings Limited, a British Virgin Islands company controlled by Yong Qiang Yang, our President, and Lejoy Holdings Limited, a British Virgin Islands company controlled by Wei Min Jin, our Chief Financial Officer, before the consummation of the Merger on February 11, 2019.

Lovego Hong Kong is a limited company incorporated in Hong Kong under the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) on June 20, 2018. Lovego Hong Kong has a wholly-owned subsidiary, the WFOE, which, in turn, has entered into a series of agreements with Shenzhen Lefu and/ or the shareholders of Shenzhen Lefu, as well as Shanghai Lefu, that grant it control of the business and finances of Shenzhen Lefu and Shanghai Lefu. Shenzhen Lefu owns 100% of the outstanding equity interest of Shanghai Lefu.

Shenzhen Lefu was incorporated in Shenzhen, China under the laws of the PRC on February 1, 2016. At the time of its incorporation, Shenzhen Lefu’s shareholder was Lefu Global (Hong Kong) Co., Ltd.. On September 12, 2017, Lefu Global (Hong Kong) Co., Ltd. transferred 100% of the registered capital of Shenzhen Lefu to Yong Qiang Yang. On October 10, 2017, Yong Qiang Yang transferred an aggregate of 87.78% of the registered capital of Shenzhen Lefu to Wei Min Jin and four (4) other entities. Subsequently on October 25, 2017, the aforesaid four (4) entities transferred the registered capital of Shenzhen Lefu held by them to Yong Qiang Yang and Wei Min Jin, so that since October 25, 2017 to date, Yong Qiang Yang has been the holder of 55% of the registered capital of Shenzhen Lefu and Wei Min Jin has been a holder of 45% of the registered capital of Shenzhen Lefu.

Shanghai Lefu was incorporated in Shanghai, China under the laws of the PRC on November 11, 2016. At the time of its incorporation, Shanghai Lefu had two (2) shareholders: Yong Qiang Yang held 55% of its registered capital and Wei Min Jin held 45% of its registered capital. On May 2, 2017, Yong Qiang Yang and Wei Min Jin transferred some of their equity in Shanghai Lefu to four (4) entities. On September 18, 2017, Yong Qiang Yang and Wei Min Jin and the aforesaid four (4) entities transferred the registered capital of Shanghai Lefu held by them to Shenzhen Lefu, as that since September 18, 2017 to date, Shenzhen Lefu has been the holder of 100% of the registered capital of Shanghai Lefu.

Contractual Arrangements with Shenzhen Qianhai Lefu E-Commerce Co., Ltd.

The following is a summary of the currently effective contracts (the “Shenzhen Lefu Restructuring Agreements”) by and among our subsidiary, the WFOE, Shenzhen Lefu and/ or the shareholders of Shenzhen Lefu.

Under PRC laws, certain restrictions are placed on an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents. To comply with these restrictions, prior to the Merger, the WFOE entered into and consummated certain contractual arrangements with Shenzhen Lefu and its shareholders pursuant to which the WFOE will provide Shenzhen Lefu including its subsidiaries, branch offices and other investment funds) with commercial, technical and consulting services. Through these contractual arrangements, the WFOE has the ability to substantially influence Shenzhen Lefu’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result of these contractual arrangements, which enable our wholly-owned subsidiary, the WFOE, to control Shenzhen Lefu and operate our business in the PRC through Shenzhen Lefu, we are considered the primary beneficiary of Shenzhen Lefu.

Exclusive Business Cooperation Agreement

The Exclusive Business Cooperation Agreement between Shenzhen Lefu and WFOE provides that Shenzhen Lefu appoints WFOE as its exclusive service provider to provide Shenzhen Lefu including its subsidiaries, branch offices and other investment funds) with commercial, technical and consulting services, the scope of which is to be determined by WFOE from time to time. In exchange, Shenzhen Lefu will pay a service fee to WFOE equal to 100% of Shenzhen Lefu’s net profit. The service fee for each month is due in the next month. The agreement will remain effective until WFOE terminates it by 30 days’ advance written notice, while neither Shenzhen Lefu nor its shareholders are entitled to terminate the agreement. WFOE shall be the sole and exclusive owner of all intellectual property rights and interests arising from or in connection with the performance of this agreement.

The Exclusive Business Cooperation Agreement contains promises from Shenzhen Lefu that it will refrain from taking actions, such as declaring or paying any dividends, that could impair WFOE’s interests. These promises are substantially the same as those contained in the Loan Agreement described below, except that Shenzhen Lefu may sell or purchase assets or rights in an amount less than RMB 100,000 in its day-to-day operations, and may provide to or obtain any loan or guarantee from any third party in an amount less than RMB100,000 in its day-to-day operations.

Loan Agreement

The Loan Agreement among WFOE and all of the shareholders of Shenzhen Lefu provides that, WFOE will make a loan in the aggregate principal amount of RMB 10 million (approximately $1.45 million) to the shareholders of Shenzhen Lefu, each shareholder receiving a share of the loan proceeds proportional to his shareholding in Shenzhen Lefu, and in exchange each shareholder agreed (i) to contribute all of his proceeds from the loan to the registered capital of Shenzhen Lefu in order to fund or increase the registered capital of Shenzhen Lefu, and (ii) to pledge his equity in Shenzhen Lefu to WFOE under the Equity Pledge Agreement described below in order to guarantee the repayment of the loan.

The loan is repayable by the shareholders at the option of WFOE either by the transfer of Shenzhen Lefu’s equity to WFOE or a person designated by WFOE or through proceeds indirectly from the transfer of Shenzhen Lefu’s assets to WFOE. The loan does not bear interest, except that if (x) WFOE is able to purchase the equity of Shenzhen Lefu pursuant to the exclusive purchase option agreement described below, and (y) the lowest allowable purchase price for that equity is greater than the principal amount of the loan, then interest will be deemed to have accrued on the loan in an amount equal to the difference between the lowest allowable purchase price and the principal amount of the loan. The effect of this interest provision is that, if and when permitted under PRC law, WFOE may acquire all of the equity of Shenzhen Lefu by forgiving the loan, without making any further payment. If the principal amount of the loan is greater than the lowest allowable purchase price for the equity of Shenzhen Lefu, then WFOE would exempt the shareholders from paying the difference between the two amounts. The effect of this provision is that, if and when permitted under PRC law, the shareholders of Shenzhen Lefu may satisfy their repayment obligations under the loan by transferring all of Shenzhen Lefu’s equity to WFOE, without making any further payment.

The Loan Agreement also contains promises from the shareholders of Shenzhen Lefu that during the term of the agreement they will elect as the sole director of Shenzhen Lefu only the candidate nominated by WFOE, and they will use their best efforts to ensure that Shenzhen Lefu does not take certain actions without the prior written consent of WFOE, including (i) supplementing or amending the articles of association or rules of Shenzhen Lefu, or of any subsidiary wholly owned by it, (ii) increasing or decreasing its registered capital or shareholding structure, (iii) transferring, pledging or disposing of any interests in its assets or income, or encumbering its assets or income in a way that would affect WFOE’s security interest unless required for Shenzhen Lefu’s normal operational management, (iv) incurring or succeeding to any debts, (v) entering into any material contract except those executed in the course of ordinary business; (vi) acquiring or merging with any third party, or investing in any third party; and (vii) distributing any dividends to the shareholders in any manner. In addition, the Loan Agreement provides that at WFOE’s request, Shenzhen Lefu will promptly distribute all distributable dividends to its shareholders.

The funds that WFOE used to make the loan came from capital contribution of WFOE’s shareholder, i.e. Lovego Hong Kong.

Exclusive Purchase Option Agreement

The Exclusive Purchase Option Agreement among WFOE, Shenzhen Lefu, and all of the shareholders of Shenzhen Lefu, provides that Shenzhen Lefu shall grant WFOE or its designated third party an irrevocable and exclusive right to purchase all or part of Shenzhen Lefu’s assets, and the shareholders of Shenzhen Lefu shall grant WFOE or its designated third party an irrevocable and exclusive right to purchase all or part of their equity interests in Shenzhen Lefu. Either right may be exercised by WFOE in its sole discretion at any time that the exercise would be permissible under PRC law, and the purchase price for WFOE’s acquisition of equity or assets will be the lower of RMB 1 or the lowest price permissible under PRC law. Shenzhen Lefu and its shareholders are required to execute an equity transfer or asset transfer agreement and related documentation within 30 days of receiving notice from WFOE that it intends to exercise its right to purchase.

The Exclusive Purchase Option Agreement contains promises from Shenzhen Lefu and its shareholders that they will refrain from taking actions, such as distributing dividends, that could impair WFOE’s security interest in the equity of Shenzhen Lefu or reduce its value. These promises are substantially the same as those contained in the Loan Agreement described above, except that Shenzhen Lefu may sell or purchase assets or rights in an amount less than RMB 100,000 in the ordinary course of business, and may provide any loan or guarantee to any third party in an amount less than RMB100,000 in the ordinary course of business. The agreement has a term of 5 years, which shall be automatically extended for successive 1-year period, unless terminated by WFOE by 30 days’ advance written notice prior to the end of the term of this Agreement.

Powers of Attorney

Under the irrevocable powers of attorney executed by each shareholder of Shenzhen Lefu, each shareholder appointed WFOE as its attorney-in-fact to exercise such shareholders’ rights in Shenzhen Lefu, including without limitation, the power to vote on its behalf on all matters of Shenzhen Lefu requiring shareholder approval under PRC law and the articles of association of Shenzhen Lefu, including but not limited to transferring, pledging, or disposing of Shenzhen Lefu’s equity, and the right to nominate and appoint Shenzhen Lefu’s legal representative or director.

Equity Pledge Agreement

The Equity Pledge Agreement, among WFOE, Shenzhen Lefu, and all of the shareholders of Shenzhen Lefu, provides that the shareholders of Shenzhen Lefu will pledge all of their equity interests in Shenzhen Lefu to WFOE as a guarantee of the performance of the shareholders’ obligations and Shenzhen Lefu’s obligations under each of the other Shenzhen Lefu Restructuring Agreements. Under the Equity Pledge Agreement, the shareholders of Shenzhen Lefu have also agreed (i) to cause Shenzhen Lefu to have the pledge recorded at the appropriate office of the PRC Bureau of Industry and Commerce when and if permitted under PRC laws, (ii) to deliver any dividends received from Shenzhen Lefu during the term of the agreement into a bank account designated by WFOE, and (iii) to deliver Shenzhen Lefu’s official shareholder register and certificate of capital contribution to WFOE or its designated third party.

The Equity Pledge Agreement contains promises from Shenzhen Lefu and its shareholders that they will refrain from taking actions, such as declaring or paying dividends, that could impair WFOE’s security interest in the equity of Shenzhen Lefu or reduce its value. These promises are substantially the same as those contained in the Loan Agreement described above, except that Shenzhen Lefu and its subsidiary may sell or purchase assets or rights in an amount less than RMB 100,000 in the ordinary course of business, and may provide to or obtain any loan or guarantee from any third party in an amount less than RMB100,000 in its day-to-day operations.

Completion of Shenzhen Lefu Restructuring

The Shenzhen Lefu Restructuring Agreements were executed on September 29, 2018. As of October 31, 2018, Yong Qiang Yang and Wei Min Jin have pledged their equity interests of Shenzhen Lefu to the WFOE pursuant to the Shenzhen Lefu Restructuring Agreements. The Shenzhen Lefu Restructuring Agreements require the registered capital of Shenzhen Lefu to be contributed in accordance with Shenzhen Lefu’s Articles of Association, which states that 100% of the registered capital of Shanghai Lefu is required to be contributed before February 1, 2036.

Contractual Arrangements with Shanghai Lefu E-Commerce Co., Ltd.

The following is a summary of the currently effective contracts (the “Shanghai Lefu Restructuring Agreement,” collectively with the Shenzhen Lefu Restructuring Agreement, the “PRC Restructuring Agreements”) by and among our subsidiary, the WFOE, Shanghai Lefu and/ or Shenzhen Lefu, which is the sole shareholder of Shanghai Lefu.

As previously stated, under PRC laws, certain restrictions are placed on an acquisition of a PRC entity by an offshore special purpose vehicle owned by one or more PRC residents. To comply with these restrictions, prior to the Merger, the WFOE entered into and consummated certain contractual arrangements with Shanghai Lefu and its shareholder, Shenzhen Lefu, pursuant to which the WFOE will provide Shanghai Lefu (including its subsidiaries, branch offices and other investment funds) with commercial, technical and consulting services. Through these contractual arrangements, the WFOE has the ability to substantially influence Shanghai Lefu’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring shareholder approval. As a result of these contractual arrangements, which enable our wholly-owned subsidiary, the WFOE, to control Shanghai Lefu, and to operate our business in the PRC through Shanghai Lefu, we are considered the primary beneficiary of Shanghai Lefu.

Exclusive Business Cooperation Agreement

The Exclusive Business Cooperation Agreement between Shanghai Lefu and WFOE provides that Shanghai Lefu appoints WFOE as its exclusive service provider to provide Shanghai Lefu (including its subsidiaries, branch offices and other investment funds) with commercial, technical and consulting services. the scope of which is to be determined by WFOE from time to time. In exchange, Shanghai Lefu will pay a service fee to WFOE equal to 100% of Shanghai Lefu’s net profit. The service fee for each month is due in the next month. The agreement will remain effective until WFOE terminates it by 30 days’ advance written notice, while neither Shanghai Lefu nor its shareholder are entitled to terminate the agreement. WFOE shall be the sole and exclusive owner of all intellectual property rights and interests arising from or in connection with the performance of this agreement.

The Exclusive Business Cooperation Agreement contains promises from Shanghai Lefu that it will refrain from taking actions, such as declaring or paying any dividends, that could impair WFOE’s interests. These promises are substantially the same as those contained in the Loan Agreement described below, except that Shanghai Lefu may sell or purchase assets or rights in an amount less than RMB 100,000 in its day-to-day operations, and may provide to or obtain any loan or guarantee from any third party in an amount less than RMB100,000 in its day-to-day operations.

Loan Agreement

The Loan Agreement among WFOE and Shenzhen Lefu, which is the sole shareholder of Shanghai Lefu, provides that, WFOE will make a loan in the aggregate principal amount of RMB 10 million (approximately $1.45 million) to Shenzhen Lefu, and in exchange Shenzhen Lefu agreed (i) to contribute all the proceeds from the loan to the registered capital of Shanghai Lefu in order to fund or increase the registered capital of Shanghai Lefu, and (ii) to pledge all of its equity interest in Shanghai Lefu to WFOE under the Equity Pledge Agreement described below in order to guarantee the repayment of the loan.

The loan is repayable by Shenzhen Lefu at the option of WFOE either by the transfer of Shanghai Lefu’s equity to WFOE or a person designated by WFOE or through proceeds indirectly from the transfer of Shanghai Lefu’s assets to WFOE. The loan does not bear interest, except that if (x) WFOE is able to purchase the equity of Shanghai Lefu pursuant to the exclusive purchase option agreement described below, and (y) the lowest allowable purchase price for that equity is greater than the principal amount of the loan, then interest will be deemed to have accrued on the loan in an amount equal to the difference between the lowest allowable purchase price and the principal amount of the loan. The effect of this interest provision is that, if and when permitted under PRC law, WFOE may acquire all of the equity of Shanghai Lefu by forgiving the loan, without making any further payment. If the principal amount of the loan is greater than the lowest allowable purchase price for the equity of Shanghai Lefu, then WFOE would exempt Shenzhen Lefu from paying the difference between the two amounts. The effect of this provision is that, if and when permitted under PRC law, Shenzhen Lefu may satisfy its repayment obligations under the loan by transferring all of Shanghai Lefu’s equity to WFOE, without making any further payment.

The Loan Agreement also contains promises from Shenzhen Lefu that during the term of the agreement it will elect as the sole director of Shanghai Lefu only the candidate nominated by WFOE, and it will use their best efforts to ensure that Shanghai Lefu does not take certain actions without the prior written consent of WFOE, including (i) supplementing or amending the articles of association or rules of Shanghai Lefu, or of any subsidiary wholly owned by it, (ii) increasing or decreasing its registered capital or shareholding structure, (iii) transferring, pledging or disposing of any interests in its assets or income, or encumbering its assets or income in a way that would affect WFOE’s security interest unless required for Shanghai Lefu’s normal operational management, (iv) incurring or succeeding to any debts, (v) entering into any material contract except those executed in the course of ordinary business; (vi) acquiring or consolidating with any third party, or investing in any third party; and (vii) distributing any dividends to the shareholders in any manner. In addition, the Loan Agreement provides that at WFOE’s request, Shanghai Lefu will promptly distribute all distributable dividends to its shareholder.

The funds that WFOE used to make the loan came from capital contribution of WFOE’s shareholder, i.e. Lovego Hong Kong.

Exclusive Purchase Option Agreement

The Exclusive Purchase Option Agreement among WFOE, Shenzhen Lefu, and Shanghai Lefu, provides that Shanghai Lefu shall grant WFOE or its designated third party an irrevocable and exclusive right to purchase all or part of Shanghai Lefu’s assets, and Shenzhen Lefu shall grant WFOE or its designated third party an irrevocable and exclusive right to purchase all or part of its equity interests in Shanghai Lefu. Either right may be exercised by WFOE in its sole discretion at any time that the exercise would be permissible under PRC law, and the purchase price for WFOE’s acquisition of equity or assets will be the lower of RMB 1 or the lowest price permissible under PRC law. Shanghai Lefu and Shenzhen Lefu are required to execute an equity transfer or asset transfer agreement and related documentation within 30 days of receiving notice from WFOE that it intends to exercise its right to purchase.

The Exclusive Purchase Option Agreement contains promises from Shanghai Lefu and Shenzhen Lefu that they will refrain from taking actions, such as voting to dissolve or declaring dividends, that could impair WFOE’s security interest in the equity of Shanghai Lefu or reduce its value. These promises are substantially the same as those contained in the Loan Agreement described above, except that Shanghai Lefu may sell or purchase assets or rights in an amount less than RMB 100,000 in the ordinary course of business, and may provide any loan or guarantee to any third party in an amount less than RMB100,000 in the ordinary course of business. The agreement has a term of 5 years, which shall be automatically extended for successive 1-year period, unless terminated by WFOE by 30 days’ advance written notice prior to the end of the term of this Agreement.

Powers of Attorney

Under the irrevocable powers of attorney executed by Shenzhen Lefu, Shenzhen Lefu appointed WFOE as its attorney-in-fact to exercise its rights in Shanghai Lefu, including without limitation, the power to vote on its behalf on all matters of Shanghai Lefu requiring shareholder approval under PRC law and the articles of association of Shanghai Lefu, including but not limited to transferring, pledging, or disposing of Shanghai Lefu’s equity, and the right to nominate and appoint Shanghai Lefu’s legal representative or director.

Equity Pledge Agreement

The Equity Pledge Agreement, among WFOE, Shenzhen Lefu, and Shanghai Lefu, provides that Shenzhen Lefu will pledge its equity interests in Shanghai Lefu to WFOE as a guarantee of the performance of its obligations and Shanghai Lefu’s obligations under each of the other Shanghai Lefu Restructuring Agreements. Under the Equity Pledge Agreement, Shenzhen Lefu have also agreed (i) to cause Shanghai Lefu to have the pledge recorded at the appropriate office of the PRC Bureau of Industry and Commerce when and if permitted under PRC laws, (ii) to deliver any dividends received from Shanghai Lefu during the term of the agreement into a bank account designated by WFOE, and (iii) to deliver Shanghai Lefu’s official shareholder register and certificate of capital contribution to WFOE or its designated third party.

The Equity Pledge Agreement contains promises from Shanghai Lefu and Shenzhen Lefu that they will refrain from taking actions, such as declaring or paying dividends, that could impair WFOE’s security interest in the equity of Shanghai Lefu or reduce its value. These promises are substantially the same as those contained in the Loan Agreement described above, except that Shanghai Lefu and Shenzhen Lefu may sell or purchase assets or rights in an amount less than RMB 100,000 in the ordinary course of business, and may provide to or obtain any loan or guarantee from any third party in an amount less than RMB100,000 in its day-to-day operations.

Completion of Shanghai Lefu Restructuring

The Shanghai Lefu Restructuring Agreements were executed on September 29, 2018. As of December 28, 2018, Shenzhen Lefu has pledged its equity interests of Shanghai Lefu to the WFOE pursuant to the Shanghai Lefu Restructuring Agreements. The Shanghai Lefu Restructuring Agreements require the registered capital of Shanghai Lefu to be contributed in accordance with Shanghai Lefu’s Articles of Association, which states that 100% of the registered capital of Shanghai Lefu is required to be contributed before November, 2036.

Acquisition of Lovego Holdings

On February 11, 2019, pursuant to the Share Exchange Agreement, we completed a reverse acquisition transaction of Lovego Holdings whereby we issued to the Shareholders 710,666,640 shares of our common stock, constituting approximately 71% of our issued and outstanding capital stock on a fully-diluted basis, in exchange for all of the issued and outstanding capital stock of Lovego Holdings. Lovego Holdings thereby became our wholly owned subsidiary.

The combination of Shenzhen Lefu and Shanghai Lefu are considered under common control. The method used to present a common-control transaction that results in a change in the reporting entity is pooling of interests. A pooling of interests was a method of accounting for a merger of two businesses. The assets and liabilities and operations of the two businesses were combined at their historical carrying amounts, and all historical periods were adjusted as if the businesses had always been combined. Similarly, in a common-control transaction, the receiving entity retrospectively adjusts its financial statements to include the transferred net assets and any related operations for all periods for which the entities or net assets were under common control.

Business Overview

The Company was originally formed to develop a way to make toy and trinket shopping more interactive and more fun, with the primary mission to develop and install 3D printing kiosks in shopping centers throughout Chile and eventually all of South America, which would allow customers to create 3D printed products on location, while they wait or shop for other items. On November 2015, the Company underwent a change in control and a change in management, and the new management adopted a new business plan based on the development of an online, cross-border e-commerce platform for promotion and sales of foreign specialties and other discount branded products to worldwide customers. From May 18, 2016 to February 11, 2019, our business was to develop an online platform to promote cheap airline tickets and hotels as well as developing and launching a “Do-It-Yourself” (“DIY”) system for users to put together a trip with exotic activities such as hunting, flying a plane, or even piloting a submarine. On February 11, 2019, we completed the Merger pursuant the Share Exchange Agreement; upon the completion of Merger, the business of Lovego Holdings Limited and its subsidiaries and consolidated affiliated entities became our business.

We are a holding company that operates through our indirectly owned subsidiary Lovego Hong Kong Limited, or, Lovego Hong Kong, a Hong Kong corporation, an entrepreneurial technology-driven e-commerce company providing retail infrastructure service in China. We specialize in providing customers with diverse product lines and a user friendly shopping experience through our mobile application – Lovego App.

We believe that we provide a pleasant online retail experience for consumers. Through Lovego App, we provide customers with what we believe to be rich product lines and a user-friendly shopping experience, and we offer competitive prices for a wide selection of products to be delivered in a speedy and reliable manner. We also provide convenient different online payment options and comprehensive customer service. In order to better control performance and ensure customer satisfaction, we have established strategic co-operation with various express delivery companies to support our online direct sales. Lovego formed one major warehouse located in Jiaxing, Zhejiang province in order to provide faster delivery service for customers and further deepen and expand the business scope of the Company.

We have also established what we believe to be a strong relationship with suppliers in the process of developing online direct sales business.

In our online direct sales business, we acquire products from suppliers and sell them directly to customers. We also conduct supplier consignment sales, in which we transfer online orders received to our suppliers for them to fulfil and deliver directly, and we do not need to keep inventory of such products. In addition, we also cooperate with sales agents, including channel agents and commercial agents, to promote and sell our products. We started selling beauty and computer products online in 2016 and have introduced a wide variety of products since then. We significantly expanded our product offerings in 2018 with home appliances and a wide array of general merchandise product categories. We have been continually adding new products and categories since then.

To further expand our business, we made a strategic decision in September, 2018 to include services in our business, and we expect that this will help improve our profitability as well as contribute to our business development and expansion. In our services business, we initially plan to cooperate with a number of off-line stores that mainly focus on travel and beauty industries. We intend to promote their business on the Lovego App, and users can spend their Lefuyou (similar in function to membership points) earned by shopping on Lovego App on purchases made in these off-line stores. This business strategy will lead to a win-win situation where, we can use our customer base and online channel to boost these off-line stores’ revenue generation, and also attract more users to our own sales platform and further enhance our platform’s influence by being able to provide various off-line services to our customers.

We believe that technology is the key to the success of our future business development and the evolution of our business ecosystem. We believe that our proprietary technology platform will have sufficient capacity to support our rapidly growing transaction needs, and will provide us with comprehensive, detailed and accurate operating data.

Our Industry

The industry we are in, China’s online retail industry, has been growing. China’s national total of online retail sales has reached RMB 7.17507 trillion in 2017, which represented a 32.0% growth rate, its national total of online retail sales in goods has reached RMB 5.48056 trillion in 2017, which represented a 28.0% growth rate, and its national total of retail sales of consumer goods has reached RMB 36.62616 trillion in 2017, which represented a 10.2% growth rate1. In addition, as of December 2017, the online shopping population in China reached 533 million, which represented an increase of 14.3% from the end of 2016, accounting for 69.1% of the total Internet users, and the number of users using mobile phone to do online shopping reached 506 million, which represented an increase of 14.7% from the end of 20162.

We believe that the following trends are driving the continued growth of China’s e-commerce industry and are reshaping its future form. First, mobile shopping has become the dominant form of online retail in China, as consumers increasingly use their fragmented time to browse and shop anywhere, anytime. Second, the extensive availability of logistics infrastructure and expansive adoption of mobile payment have made mobile shopping increasingly efficient and convenient. Third, historically less developed cities in China have become an increasingly important market for e-commerce due to the rising spending power and a desire for a better standard of living. Fourth, China has an increasing base of small and micro enterprises which could benefit from and hence help develop more direct access to consumers.

The industry we are in is online retail business. Same as any other industry, the recognition and reputation of the retailers among customers, supplier, brands, third party merchants and other service providers contribute significantly to the growth and success of the retailers. Moreover, the online retail industry is characterized by rapid technological evolution, frequent changes in customer requirements and preferences, constant emergence of new products and services embodying new technologies, with introduction to new industry standards and practice, any of which could render the existing technologies and system outdated. So to remain competitive in the industry, the retailers must continually conduct research and development with respect to their online platforms. It is anticipated that the industry will continually expand and evolve.

The PRC government extensively regulates the industry where we operate our business. The industry is subject to supervision and regulation by relevant PRC governmental authorities including China Food and Drug Administration and State Administration for Market Regulation (formerly “Administration for Industry and Commerce”). Also, online retailers are required to hold a number of licenses and permits in connection with the online platform operation.

Our Competitive Strengths

Product Quality and Selection

Our professional procurement team provides us with a diverse portfolio of products on a global scale. We make it easy for customers to buy high-end products around the world. Our list of product categories includes electronics, cosmetics & personal care, apparel, baby care, watch & jewelry, office supplies, food & snacks, home & lifestyle. We purchase products under certain strategic supplier agreements and impose strict control on the product sourcing channels and the qualification of suppliers. Especially for food products and cosmetics, we request the suppliers to provide corresponding certificates. We are receptive to feedback from our buyers and the general public.

_________

1 National Bureau of Statistics of China, China Statistical Yearbook 2018, http://www.stats.gov.cn/tjsj/ndsj/2018/indexeh.htm (assessed on March 21, 2019)

2 China Internet Network Information Center, The 41st Survey Report, p. 7, http://cnnic.com.cn/IDR/ReportDownloads/201807/P020180711391069195909.pdf (assessed on March 21, 2019)

Our Strategy

Increase Our Buyer Base and Engagement

We plan to increase our marketing efforts to attract more buyers to our platform and convert more existing buyers on our platform to active buyers. We will continue to introduce more interactive features on our platform to enhance buyer engagement and experience. We will also continue to improve the diversity of our buyers and penetrate a larger part of the population.

Expand Merchandise Choices and Offerings

We will further expand our merchandise choices to provide more diversified products to our buyers. We plan to leverage our large and active buyer base and our brand to attract new merchants and offer new merchandise choices as well as more product within each category on our platform. We also plan to cooperate existing and new merchants more closely to help them better understand and serve our customers.

Enhance Brand Recognition and Continue to Adhere to Strict Quality Control

We believe that building our brand and strengthening the reputation of our platform is crucial to our continued success. We plan to increase our marketing efforts across online and offline channels to enhance user awareness and recognition of our platform. In addition, we will continue to implement strict quality control measures to foster trust from buyers.

Further Improve Technology Capability

We seek to continuously strengthen our technologies to improve the efficiency of our platform. We will continue to develop proprietary software and systems to serve our buyers and merchants, such as streamlined merchant services SaaS systems, and standardized quality control systems. We aim to achieve, through these technology improvement initiatives, better buyer experience, deeper understanding by our merchants of their target buyers, and improved productivity and efficiency of both merchants and us.

Pursue Select Strategic Investment and Expansion Opportunities

We also plan to selectively pursue strategic investments, alliances and acquisition opportunities that are complementary to our business and operations. With the right opportunity, we may seek to expand into international markets and bring our products to more buyers.

Attract and Retain Talents

We intend to continue devoting substantial resources to seek top talents, in particular engineers having strong technology backgrounds and prior experience in large leading internet companies. We are dedicated to providing employees with diversified work environment and a wide range of career development opportunities. We will continue to invest significant resources in employee career development and training opportunities.

Our Competition

The online retail industry in China is intensely competitive. Our current or potential competitors include (1) major e-commerce companies in China that offer a wide range of general merchandise product categories, such as JD mall, VIPShop.com, Amazon China, Pinduoduo and (2) major traditional retailers in China that are moving into online retail space, such as Suning Appliance Company Limited, which operates suning.com, and Gome Electrical Appliances Holding Limited, which operates gome.com.cn. We also face competition from online retail companies in China focused on specific product categories and from traditional retail stores, including those aiming to offer a one-stop shopping experience to customers.

We anticipate that the online retail market will continually evolve and will continue to experience rapid technological change, evolving industry standards, shifting customer requirements, and frequent innovation. In addition, new and enhanced technologies may increase the competition in the online retail industry. New competitive business models may appear, for example based on new forms of social media or social commerce. We must continually innovate to remain competitive.

We also compete with companies making counterfeits of products sold on our platform at a lower prices. We may not be able to prevent others from unauthorized use which may adversely affect our sales amounts and harm our reputation eventually.

We believe we compete primarily on our ability to provide customers with a diverse portfolio of products, which helps to satisfy customers’ need. We believe we also compete on our ability to provide high-quality product offerings and customer services at competitive prices, which help generate more appeal for our products. We believe we also compete on our ability to provide efficient delivery services, which helps to provide convenience to customers.

Our Business Model

Since founding our Company, we have focused on developing the business of online direct sales, sales agent sales, supplier consignment sales, and offline stores sales, the operations of which are supported by our proprietary technology platform. The fact that our online direct sales and sales agent business have both grown substantially in size has proved to us, as we believe, that our online direct sales and technology platform will make us a strong player in China’s online retail industry in terms of providing superior customer experience.

Online Direct Sales

In our online direct sales business, we acquire products from suppliers and sell them directly to customers. We started selling beauty and computer products online in 2016, and significantly expanded our product offerings in 2018 with home appliances and a wide array of general merchandise product categories, and have been continually adding new products and categories since then.

Sales Agent Sales

Apart from direct sales, we also cooperate with sales agents including channel agents and commercial agents to promote and sell products.

Supplier Consignment Sales

Under supplier consignment sales, we transfer online orders received to our suppliers for them to fulfil and deliver directly, and we do not need to keep inventory of such products. Therefore the supplier consignment sales mode helps us reduce inventory risk while still providing us an avenue for considerable profits.

Omni-channel Initiatives

To achieve a wider vision of our business, we are exploring a variety of omni-channel integration opportunities and innovative business models. Leveraging our well-established technology platform and infrastructures, we believe we are well-positioned to create enhanced shopping experience for consumers as well as improved efficiency for our business partners in the ecosystem.

We believe we are well-positioned to provide online-to-offline (O2O) solutions to customers and offline retailers in select locations in China by capitalizing on our strong online presence and leveraging delivery system, we have strategic cooperation with SF Express, ZTO Express and STO Express. SF Express is one of the largest express delivery companies in China, and provides the fastest delivery of products to all regions in China within 24 hours. We focus on the mobile commerce sector and also collaborates with convenience stores to provide consumers with speedy premium shopping experience.

To further expand and develop our business, we made a strategic decision in September 2018 provide certain services to other business companies and expect that such services would help increase profitability more significantly along with other business development and expansion. To provide such services, we plan to first cooperate with a number of other business companies off-line stores that mainly focus on travel and beauty industries. We will promote their business on Lovego App, and our users can spend their Lefuyou (a kind of incentive points) on purchases made in these off-line stores. We believe this business strategy will lead to a win-win situation where, we can use our customer base and online channel to boost these business companies’ revenue generation, and also attract more users to our own sales platform and further enhance our platform’s influence by being able to provide various off-line services to our customers.

Our Products and Services

Products

We continually seek to add more products that appeal to our target customers. The number of products we offer has grown rapidly. We offer eight categories of products including but not limited to: home appliances, mobile handsets, computers and other digital products, furniture and household goods; apparel, shoes, bags; cosmetics and other personal care items; mother and childcare products, toys and instruments; food, beverage and fresh produce; watches, jewelry and luxury goods and office supplies. Each of these categories is further divided into numerous subcategories to facilitate browsing.

In building up our product offerings, we focus on quality as well as quantity. Due to our nationwide reach and our efficient fulfillment system, suppliers often choose us as the preferred distributor for a period of a few days or weeks, when they launch new products that they expect will be in high demand.

To further expand and develop our business, we made a strategic decision in September, 2018 to provide certain services to other business companies, and we expect such services would increase the profitability of our business more significantly along with other business development and expansion. To provide such services, we plan to first cooperate with a number of other business companies that mainly focus on travel and beauty industries and enable our users to use Lefuyou on purchases made in such business companies.

Online Experience

We believe that providing a satisfactory online experience is critical to attracting and retaining customers. We make sales primarily through our content-rich and user-friendly mobile application – Lovego App. Our mobile application not only offers a broad selection of authentic products at competitive prices but also provides easy site navigation, basic and advanced search functions, comprehensive product information and a large volume of customer reviews and ratings. These features will likely increase customers’ desire to browse our product offerings, and enable customers to learn more about the products and compare products before making purchases. With the increasing popularity of mobile internet-enabled devices, we have also developed Lovego App that can function on iOS and Android platforms.

Order Fulfilment

Delivery

For our online direct sales, we are responsible for the delivery of products. For supplier consignment sales, suppliers are responsible for the delivery of products. We believe that timely and reliable delivery is critical to the continued success of our business.

Our nationwide delivery network has the following features:

Delivery Network

We can deliver products to customers in almost all counties and districts across China as of September 30, 2018. We deliver a majority of our orders through SF Express, which is allegedly the fastest and most reliable express delivery company in China. We believe using such reliable courier to deliver our orders fast is helpful to create satisfactory customer experience and can help us stand out from our competitors.

Flexible Delivery Arrangements

Customers can choose their preferred delivery period during the day when they place orders; in certain regions, customers can also choose evening delivery period at their choice. Customers also have the option to reschedule a delivery by logging into their respective Lovego App account to obtain the contact information of the delivery personnel and make arrangements with such personnel directly by themselves. We believe by offering our customers with flexible delivery arrangements that satisfy their needs is an essential part of customer satisfaction.

Payment

Various kinds of online payment methods are offered to customers at the time they place their orders, such as Weixin Pay, Alipay among others. Customers chose online payment approximately 90% of the time in 2018.

Marketing

We believe that the most effective form of marketing is to continually enhance our customer experience, as customer satisfaction engenders word-of-mouth referrals and repeat purchases. We have been able to build an extensive base of loyal customers primarily through providing superior customer experience and conducting marketing and brand promotion activities.

In addition to conducting marketing activities through traditional online and offline channels, we have also designed innovative programs and promotion activities to further enhance the brand awareness of both us and our partners, and to better reach our customers. For instance, we have offered “618 Mid-year Sales,” “Happy Fathers’ Day Selection,” and “6.1 Children’s Day Promotion.” In order to further improve customer experience and increase user engagement on mobile internet, we are exploring cooperation opportunities with many business partners on the mobile side.

Unique Business Model (Lefuyou)

We have developed a unique business model called Lefuyou (a kind of incentive points), under which we give our customers Lefuyou after they place orders with us, except some specific products. Lefuyou rules are as follows:

| · | A percentage of sales prices of some products is reserved as Lefuyou which are incentive points to be used in the future. |

| · | 100 Lefuyou can be used as RMB 1 Yuan. |

| · | Some products are not entitled to Lefuyou. |

| · | Lefuyou cannot be cashed. |

| · | Lefuyou can be used as payment for future purchases made with us. |

The time needed to process the giving back on an order depends on when we receive profits on an order. In other words, we would like to share our profit with our customers, Lefuyou mode is our comparative advantage to promote customer loyalty and increase our price competitiveness.

As part of our marketing strategy, we provide various incentives to our existing customers to increase their spending and loyalty. Our customers can earn reward points upon registration and for each purchase they make, and may exchange the reward points for coupons, gifts and lucky draw opportunities on our platform. Our customers may also earn reward points by introducing new members and customers to our platform. In addition, we encourage our customers to share their successful flash sales shopping experiences through social media and microblogging websites in China. We offer an “easy-to-share” function that enables our customers to easily share their shopping experiences with us on Internet social networking platforms and microblogging websites.

Pricing

We offer competitive pricing to attract and retain customers. We make continual efforts to maintain and improve an efficient cost structure and create incentives for our suppliers to provide us with competitive prices.

Pricing Policy

We are making continual efforts to set our prices to be competitive with those on other major online retail websites and in offline stores in China. We typically negotiate with our suppliers for prices that are comparable to or lower than those offered to retailers in other sales channels. If we reduce the price on our website before the product is delivered to the customer, then the customer generally has an opportunity to lock in the lower price.

Special Promotions

We offer a selection of discounted products on special occasions, such as the anniversary sales promotional event on June 18 and China’s new online shopping festival on November 11, and on important holidays such as Christmas and Chinese New Year. We also hold regular promotions for selected products for a limited period of time. Special promotions attract bargain hunters and give our customers an additional incentive to visit our website regularly.

Customer Service and Return and Exchange Policies

Providing satisfactory customer services is a high priority. Our commitment to customers is reflected in the high service levels provided by our customer service staff as well as in our product return and exchange policies.

13-7 Customer service centers

We operate three 13-7 customer service centers (providing online customer services 7 days a week and 13 hours per day) in Shanghai, handling all kinds of customer queries and complaints regarding our products and services. Customers can make queries and file complaints via various channels such as phone calls, online written instant messengers, and emails.

Returns and exchanges policies

We accept unconditional returns or exchanges within seven days of purchase. Merchandise with defects can be returned for exchange within 15 days of purchase. For customers with good credit, we provide “quick refund” service, that is, the customers are refunded as soon as they submit the return requests. If customers report defects more than 15 days after receipt but still within the warranty period, we will have defective goods repaired or take other appropriate action to compensate the customer, depending on the nature of the issue. We will generally pick up defective items for return or exchange at the customer’s address, provided that the return or exchange is requested within 15 days of receipt of the item and the address is within the area that is serviced by our employees or by one of the third-party couriers that have agreed to provide this service for us. Alternatively, customer can also mail the merchandise to one of our regional fulfillment centers or bring the product to the nearby pickup station. The same policies apply to products sold through our online marketplace.

Supply

In our online direct sales business, we sourced products from over [287] suppliers in 2018. Procuring products on such a massive scale requires considerable expertise. We negotiate with the manufacturer or a higher-level distributor where possible in order to obtain the most favorable terms, even if we sign a contract with a lower-level distributor for operational reasons.

As we increase in scale in particular product categories, we expect to increase our direct purchases from manufacturers and, where appropriate, to become an authorized reseller. We believe that our ability to establish direct relationships with manufacturers will provide improved product pricing and access to hard-to-get products.

We select suppliers on the basis of brand, reliability, volume and price. They must be able to meet our demands for timely supply of authentic products and also provide high quality post-sale customer service. We perform background checks on each supplier and the products it provides before we enter into any agreement. We examine their business licenses and the qualification certificates for their products, and check their brand recognition and make investigation about the market acceptance of their products among players in the same industry. We also conduct on-site visits to assess and verify their location, scale of business, production capacity, property and equipment, human resources, research and development capability, quality control system and fulfillment capability. Our standard form contract requires suppliers to represent that their goods are authentic and from lawful sources and do not infringe upon lawful rights of third parties and to pay us liquidated damages for any breach. We normally enter into one-year framework agreements with our suppliers and renew them annually.

Intellectual Property

As of March 25, 2019, we held 89 trademark registration certificates and our consolidated affiliated entity, Shenzhen Qianhai Lefu E-Commerce Co., Ltd., or Shenzhen Lefu, a PRC corporation, is the registrant of these trademarks and has the right to use these trademarks. We also hold 1 domain name registration certificate and another consolidated affiliated entity of ours, Shanghai Lefu E-Commerce Co., Ltd., or Shanghai Lefu, a PRC corporation is the registrant of the domain name. There is a Trademark Licensing Agreement between Shanghai Lefu and Shenzhen Lefu, under which Shanghai Lefu is the licensor and Shenzhen Lefu is the licensee of the trademark “Lovego.”

It is often difficult to register, maintain and enforce intellectual property rights in China. Statutory laws and regulations are subject to judicial interpretation and enforcement and may not be applied consistently due to the lack of clear guidance on statutory interpretation. Confidentiality, invention assignment and non-compete agreements may be breached by counterparties, and there may not be adequate remedies available to us for any such breach. Accordingly, we may not be able to effectively protect our intellectual property rights or to enforce our contractual rights in China. Policing any unauthorized use of our intellectual property is difficult and costly and the steps we take may be inadequate to prevent the infringement or misappropriation of our intellectual property. In the event that we resort to litigation to enforce our intellectual property rights, such litigation could result in substantial costs and a diversion of our managerial and financial resources, and could put our intellectual property at risk of being invalidated or narrowed in scope. We can provide no assurance that we will prevail in such litigation, and even if we do prevail, we may not obtain a meaningful recovery. Imitation or counterfeiting of our products or other infringement of our intellectual property rights, including our trademarks, could diminish the value of our various brands or otherwise adversely affect our net revenues. Any failure in maintaining, protecting or enforcing our intellectual property rights could have a material adverse effect on our business, financial condition and results of operations.

Technology

Technology is the key to the success of our future business development and the evolution of our ecosystem. Our proprietary technology platform supports our rapidly growing processing capacity requirements, and provides us with detailed and accurate visibility and information based on our comprehensive operating data from value chain.

As of March 25, 2019, we employed 9 research and development professionals to design, develop and operate our technology platform.

Key components of our technology platform include:

Support Different Business Models to Enhance Operating Efficiency

In addition to supporting traditional e-commerce mode, the platform can also achieve online payment and offline service mode, which is more flexible and more profitable than other traditional e-commerce systems.

Provide synchronous shopping App and web mall Lovego

The synchronous web mall and APP shopping mall can excavate the E-Commerce market potential, to create more chances for Lovego to achieve higher sales revenue further to make more profit.

Independent background, separate transaction

It takes the form of separate background of buyers and sellers and independent management, so that both buyers and sellers have their own independent login background and can conduct order, payment, settlement and other operations according to their own needs.

Our Lovego mobile apps contain the following information and features:

Browsing

All visitors to our platform can browse and view our promotion events, but a customer must register as a member for free in order to participate in the promotion events. Our platform features a variety of different brands and products for each regular promotion events. We sort our product offerings into different categories, such as “women,” “men,” “children,” “outdoors,” “lifestyle,” and “accessories” so that our customers can easily find the products they are interested in.

Comprehensive product information

Each product page contains pictures, descriptions, and sometimes short videos of the product, the price, a pull-down menu to show whether the product is in stock at the customer’s location, customer reviews and ratings, and whether the product will be delivered by us or by one of our third-party sellers. Depending on the type of product, there will be additional information to help the customer make a purchase decision or recommendations to steer the customer towards additional products.

Daily Sales Events

We launch new sales events regularly and typically last for several days. Each sale item is available in limited quantities and remains on sale only while supplies last.

Ordering

To order products on our platform, our customers simply click on a button to add an item to their virtual shopping cart. To execute orders, customers click on the “check-out” button and are prompted to supply shipping details and payment details in the case of first-time customers buying from our platform. Customers can always access our customer service representatives online or by phone for assistance during service time while they are shopping online or after the order is placed.

Real-time order tracking

Customers can log into their accounts to check the status of their orders. All packages in our system are given a unique identifier and their progress is updated each time they are handled by one of our warehouse or delivery personnel or one of our contracted third-party couriers.

Insurance

We provide social security insurance including medical insurance, maternity insurance, workplace injury insurance, unemployment insurance and pension benefits through a PRC government-mandated multi-employer defined contribution plan for our employees. We do not maintain business interruption insurance, nor do we maintain product liability insurance or key-man life insurance.

Corporate Social Responsibility

We recognize our responsibility to bring improvements to society in which we live and work, and we believe strongly that our core values, including commitment to brands, customers, our employees and broader society are the backbone that drives our decisions to build a healthy and vibrant ecosystem. Combined with an unrelenting focus on developing our technology capabilities to improve efficiency and service, we believe that we have laid the groundwork for many years of robust growth.

We are committed to leveraging our technology and relationships with consumers and suppliers to benefit society. We believe in putting our business assets to use to build not only the future of retail, but also a better future for all stakeholders. Our social responsibilities include environment sustainability, employee welfare and benefits, poverty alleviation and more.

Employee Welfare and Benefits

We have always striven to provide employees with full social benefits, diversified work environment and a wide range of career development opportunities. As of March 25, 2019, we had a total of 32 full-time employees, and we signed formal contracts with all of our employees and provided them with social benefits. We have invested significant resources in employee career development and training opportunities. For example, we established comprehensive training programs that cover topics such as corporate culture, employee rights and responsibilities, team-building, professional conduct, job performance, management skills, leadership and executive decision-making. We have a special training facility, Lefuhongde School of Chinese Classics, to further strengthen our internal training capabilities.

Regulation

Because our operating subsidiaries are located in the PRC, we are regulated by the national and local laws of the PRC.