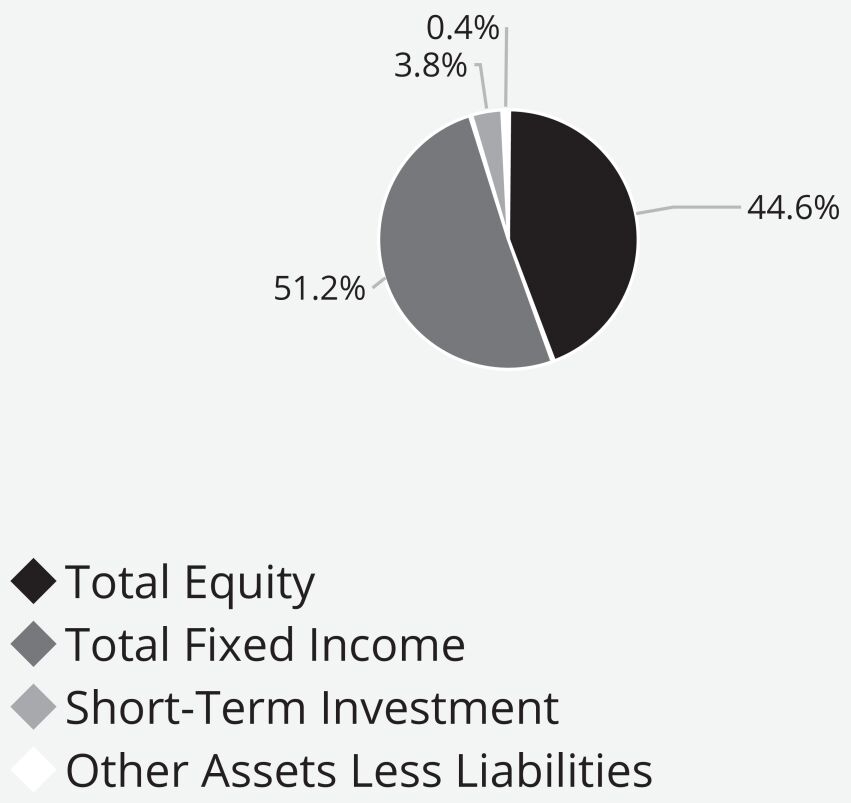

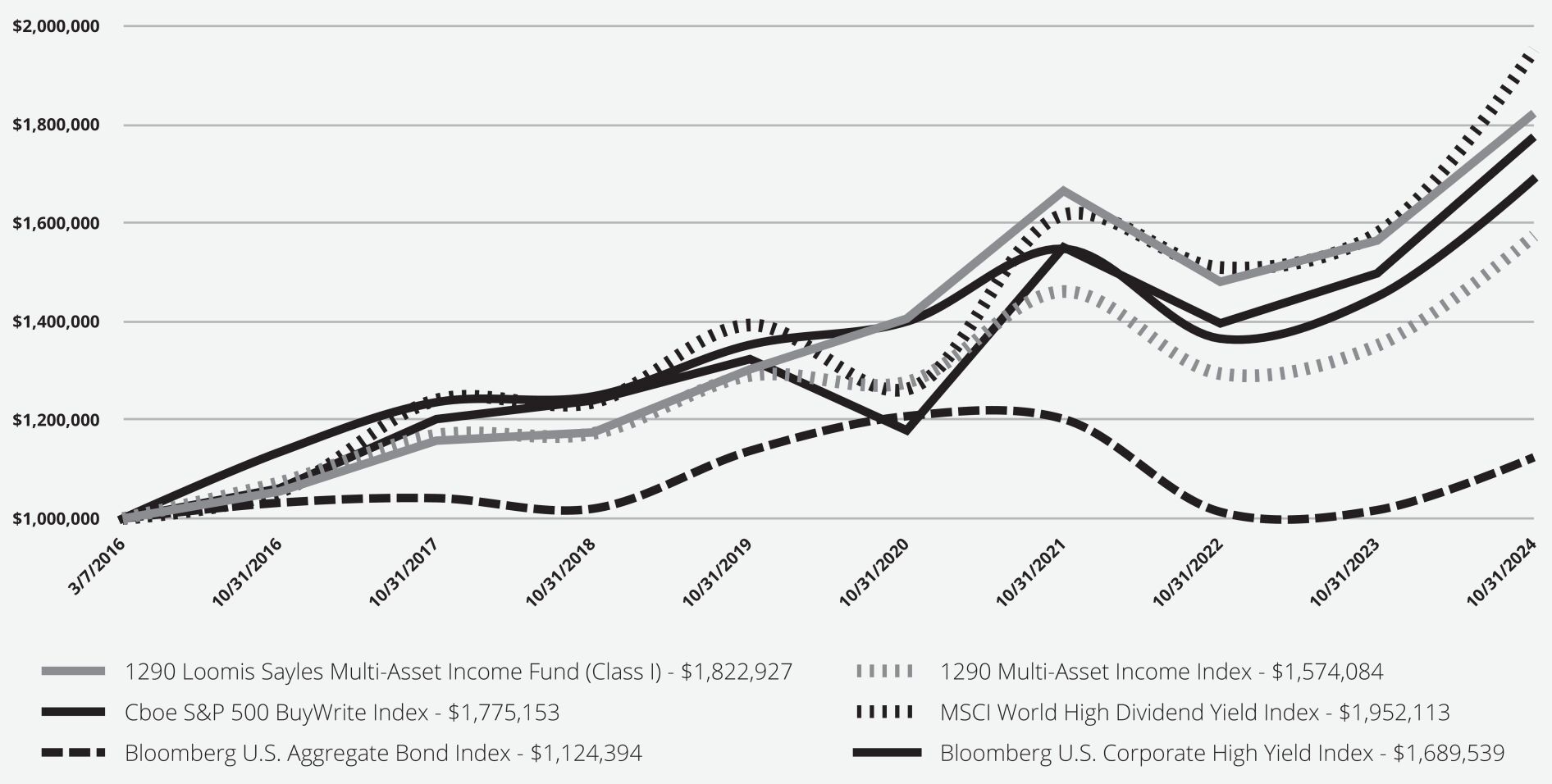

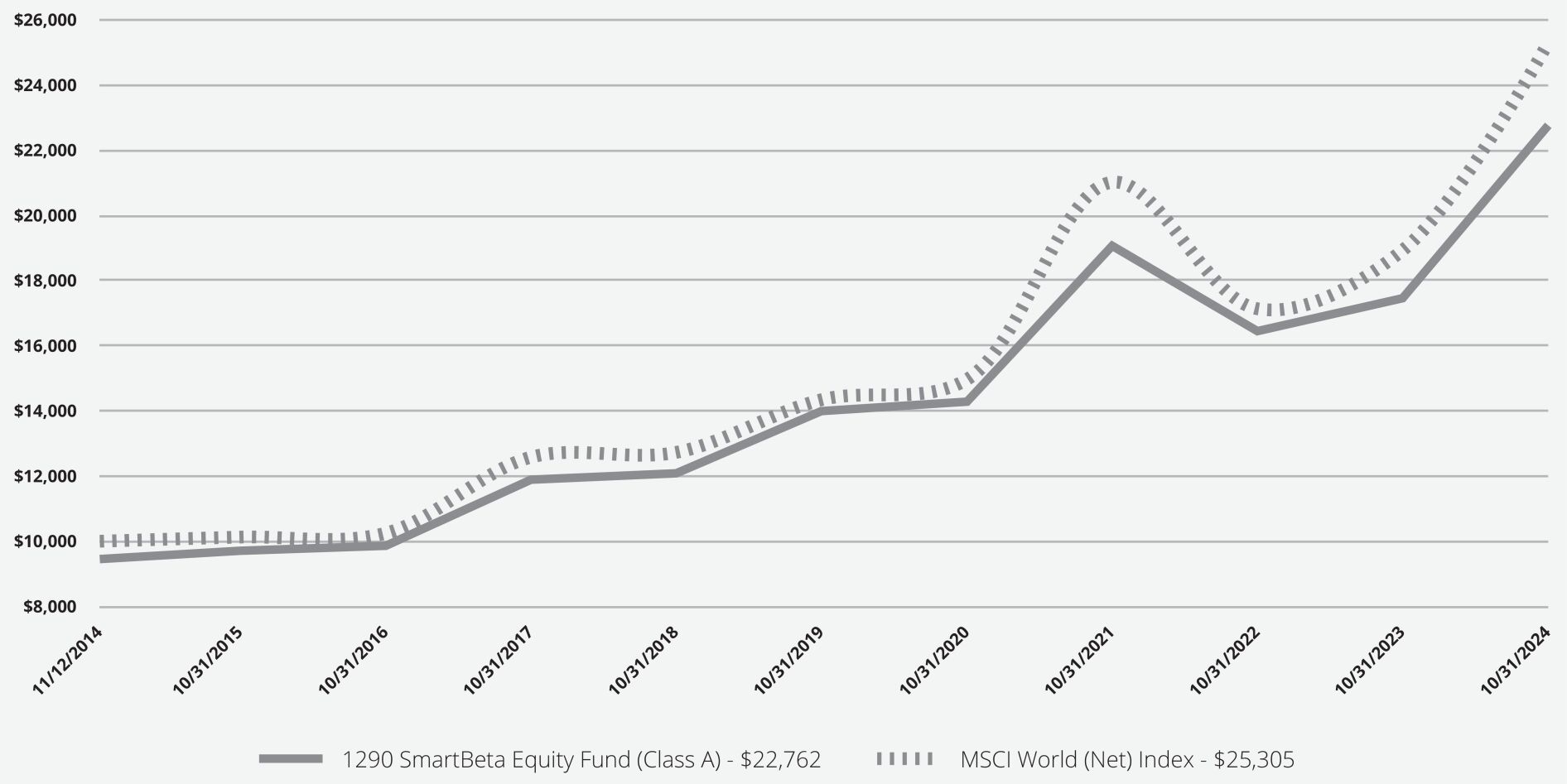

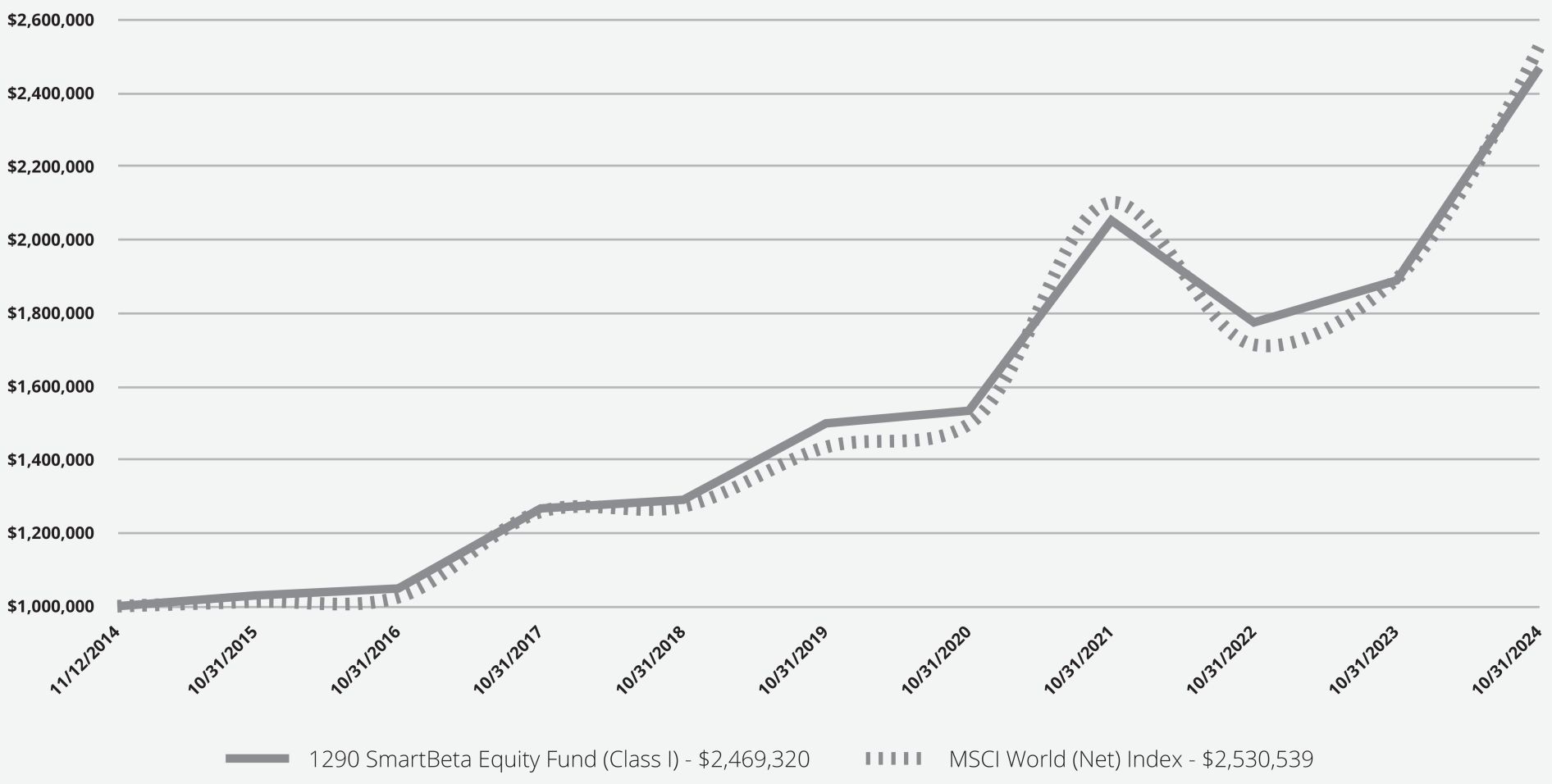

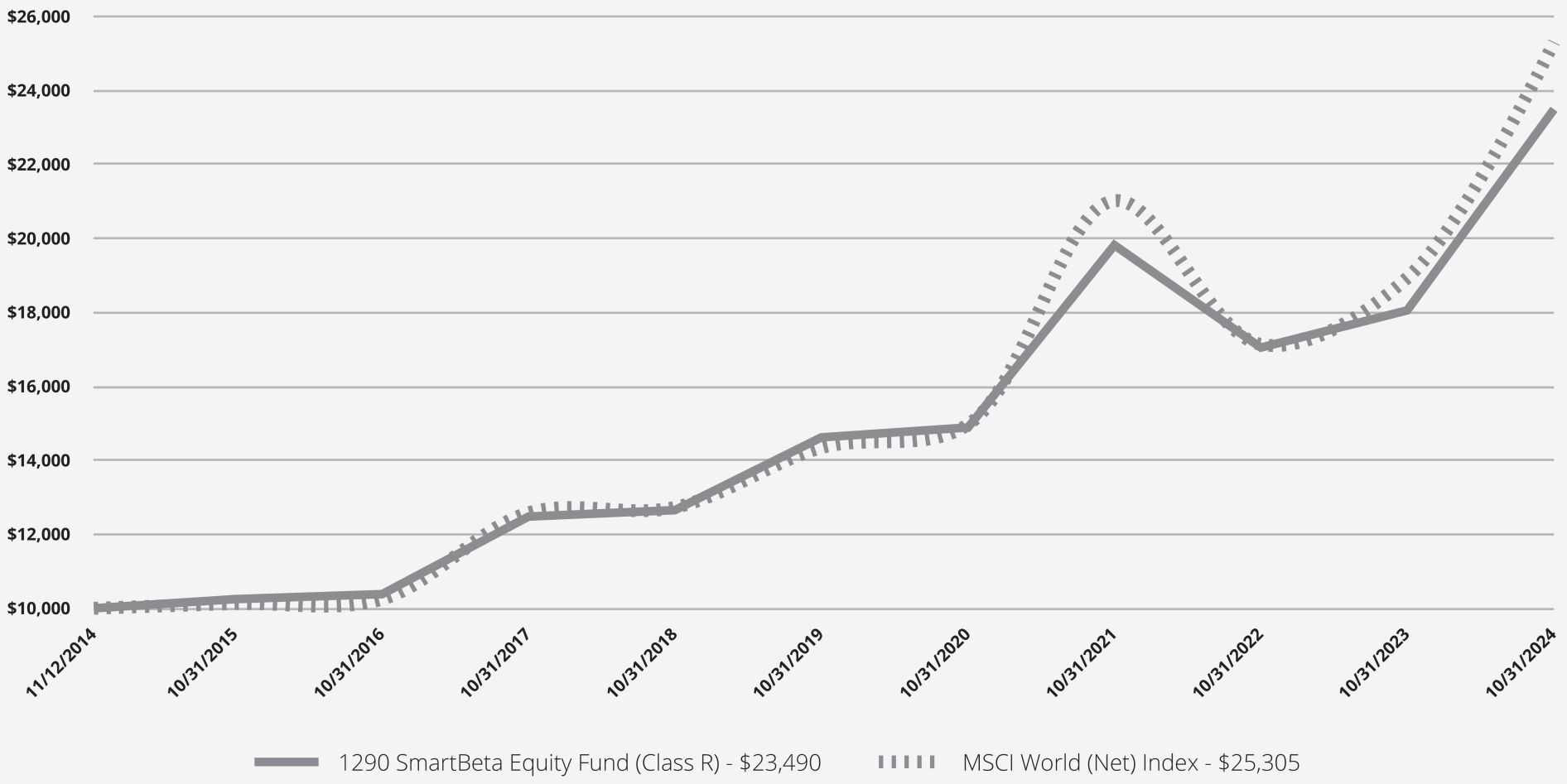

9463.1810040.8610003.4710042.110197.9110673.4110706.9810684.810647.6111131.0711145.1511128.2311699.2312249.5312394.4212213.0912176.6112698.4112967.9512680.692058475.351954427.92496989.321991923.421492544.871785128.122099181.431808491.591426554.82134763.572783933.772117945.81662019.351487520.331943967.071481972.621248372.1610000001000000.001000000100000011030001100675.821160384.781098719.9511260001181534.111284687.61175387.51288451.771350802.921504407.341341729.1811477.7111554.5310382.7210229.7010345.8710385.9712270.1413034.6412329.0912223.6811610.7211296.1410412.329989.3510630.6010135.4510094.399403.599551.101000010535.539722.371196639.041296451.841385282.061105722.671092080.241235839.331054948.211067671.661020901.14985143.56100000010000009839.8910140.2610549.5310371.1611702.5712611.6213423.7610658.9310481.711806.199451.8100001000010396.9810733.1410884.299971.6410143.2210743.4110813.810739.7511233.85966410883.9310712.0510775.7912090.812144.778447.6810993.249923.899987.0812796.0711735.1110063.113311.1712038.8311374.4414638.7813698.9411478.9715154.7413545.161221506.021209441.761069697.451060649.26896776.431143088.351024456.491146104.411056000110000010000008907.5310526.1710606.611973.912074.431000011000105401143110204.4611370.689451.8100009754.079805.3310054.2510567.7712740.8712677.9112506.9912712.4412792.9913487.3821109.1921129.9215956.716626.4716785.9216005.4718788.117979.9511892.711880.3210000001034347.231068879.581358484.031336806.421371123.921276856.961935354.91727500.61798441.352289842.1913371.7912394.2818701.6316603.7517205.3421792.761000010296.1610581.5613384.2113107.2813067.4614628.4211813.3812957.312321.1213721.5714279.9115992.159551.1100009874.4710802.8610782.8811790.2510875.1211891.9911632.8412881.6212182.2713209.299300.629806.041261371.881320482.851533978.771138482.261150945.791232883.091294306.541391787.341000000976147.421038985.8512622.0914592.8412558.7513438.6612131.93100009714.2810288.2211208.9711279.0612022.3515521.914609.6115508.4310541.281134910894.6211692.6112018.6112405.331236111024.1511727.7512398.4312362.111248212207.2712904.9413236.7213929.141352813140.4312768.7811789.5512626.551400016166.271547413759.9512940.9513962.8615096.181365514520.313510.6614977.5715789.961450616862.6515740.8417751.5319521.13168959451.8100001000010000100009952.7410727.3110611.92100000010550001158112.411174887.581302950.781405805.121665462.341480666.771564443.771822926.6913747.3716204.0914326.331052011482.1111589.4412801.271000017458.7615069.019610.5810272.869993.3110519.929792.3310616.3411187.119451.8100009168.2410000.589491.8510031.179756.0410103.5210622.289589.5410705.949731.6211220.3511057.1411828.1310000009710001007488.861038084.921025142.191068690.881049867.641202984.351033232.911050088.591197139.5210079.7410456.6810219.7711644.959968.7610078.6410000969010009.9110263.3611430.881200767.961117987.141000000100000010660001023612.481068594.531002594.611213120.511187158.421407112.61181482.391212297.8996195.911242865.77999744.051457971.021105179.691221910.021200532.041227614.281251718.101461446.491511161.891253928.731289566.781290769.371355231.681539332.631623325.471000000.001000000.001075000.001077785.421081435.291082087.981080000.001086540.261087526.691091884.611234998.901214935.791226546.591262380.211496130.351572500.941278913.141328886.511319855.431407913.011599343.211722921.611000000.001000000.001304435.051369676.291349009.751464805.481652805.181830580.731000000.001000000.001085000.001095097.691094561.991101129.581243513.181227973.961232750.181271399.401524963.431640409.281000000.001000000.001089000.001100708.641102713.681107591.431254767.661237077.881251752.291277911.301576189.981688617.841348337.041399899.551398184.821508839.141727234.471920632.561000000.001000000.001093000.001104100.781109731.321110636.631263388.411241566.451249706.311280218.331595011.541715508.951366941.201417655.281419688.081534592.511767031.551974817.741274120.041244813.221247999.651282833.511000000.001000000.001098000.001106845.491115848.451113730.581614587.281731683.401383489.231428568.611443205.601549165.941810469.362008190.702016928.381848482.481555169.911461287.921433558.241400272.341738015.761634709.011283322.691245290.961000000100000011020001108182.011122882.91115128.31283379.081246910.813994.1612726.1212083.9212580.4611889.3110246.789860.4710126.859707.44100009451.825305.3922761.5618930.0717458.0317134.1816447.921018.0719066.3614967.4914283.2114341.5310000001029402.871048316.361266866.391290401.331498992.971533464.232052816.211774471.11889085.692469320.461000010246.8312653.0312479.4810381.7414620.2214887.7119816.6817048.4818053.9423489.87false0001605941N-1A1290 Avantis® U.S. Large Cap Growth Fund (Class A) without Sales Charge1290 Avantis® U.S. Large Cap Growth Fund (Class A) with Sales Charge1290 Diversified Bond Fund (Class A) without Sales Charge1290 Diversified Bond Fund (Class A) with Sales Charge0.03800.05500.01400.02500.04800.34600.22500.24900.47400.47400.24900.22500.34600.04800.02500.01400.05500.03800.47400.24900.22500.34600.04800.02500.01400.05500.03801290 Avantis® U.S. Large Cap Growth Fund (Class A) without Sales Charge1290 Avantis® U.S. Large Cap Growth Fund (Class A) with Sales Charge0.27840.21470.39210.11480.27840.21470.39210.11480.11480.39210.21470.27841290 GAMCO® Small/Mid Cap Value Fund (Class A) without Sales Charge1290 GAMCO® Small/Mid Cap Value Fund (Class A) with Sales Charge1290 High Yield Bond Fund (Class A) without Sales Charge1290 High Yield Bond Fund (Class A) with Sales Charge0.04450.35200.38230.17140.00180.04800.04450.35200.38230.17140.00180.04800.04450.35200.38230.17140.00180.04801290 Loomis Sayles Multi-Asset Income Fund (Class A) without Sales Charge1290 Loomis Sayles Multi-Asset Income Fund (Class A) with Sales Charge0.4460.5120.0380.0040.4460.5120.0380.0040.4460.5120.0380.0041290 Multi-Alternative Strategies Fund (Class A) without Sales Charge1290 Multi-Alternative Strategies Fund (Class A) with Sales Charge0.1610.1620.1500.1280.1250.1070.1550.0120.1610.1620.1500.1280.1250.1070.1550.0120.1610.1620.1500.1280.1250.1070.1550.0121290 SmartBeta Equity Fund (Class A) without Sales Charge1290 SmartBeta Equity Fund (Class A) with Sales ChargeDate of inception: July 6, 2015Date of inception: November 30, 2023This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirementsLess than 0.05%Date of inception: July 11, 2022Date of inception: November 12, 2014Date of inception: February 27, 2017Date of inception: March 7, 2016The 1290 Multi-Asset Income Index is a hypothetical combination of unmanaged indexes composed of the Bloomberg U.S. Aggregate Bond Index (30%); the MSCI World High Dividend Yield Index (20%); the Cboe S&P 500 BuyWrite Index SM (20%); and the Bloomberg U.S. Corporate High Yield Index (30%).

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number

811-22959

(Exact name of registrant as specified in charter)

1290 Avenue of the Americas

(Address of principal executive offices)

Executive Vice President, General Counsel and Secretary

Equitable Investment Management, LLC

1345 Avenue of the Americas

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (212)

554-1234

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| Item 1. | REPORTS TO STOCKHOLDERS. |

Item 1(a):

Copies of the reports transmitted to shareholders pursuant to Rule

30e-1

under the Investment Company Act of 1940 (the “1940 Act”) are filed herewith.

1290 AVANTIS

®

U.S. LARGE CAP GROWTH FUND CLASS A (TNRAX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Avantis

®

U.S. Large Cap Growth Fund (the “Fund”) for the period November 30, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

How did the Fund perform last period and what affected its

performance

?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class A | | $95 | | 0.90% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares returned 28.86% (without sales charge) for the year ended October 31, 2024, underperforming the Russell 1000

®

Index and the Russell 1000

®

Growth Index, which returned 38.07%, and 43.77% respectively, over the same period.

What helped performance during the period?

• The Fund’s overweight exposure to companies with the highest

and profitability characteristics, which outperformed, aided performance. Additionally, the Fund’s underweight to companies with the lowest

and profitability characteristics, which underperformed, also contributed to performance.

What hurt performance during the period?

• The Fund’s underweight to

mega-cap

stocks, which outperformed, and overweight exposure to large- and

mid-cap

stocks in the Russell 1000

®

Growth Index universe detracted from results.

1

1290 AVANTIS

®

U.S. LARGE CAP GROWTH FUND CLASS A (TNRAX)

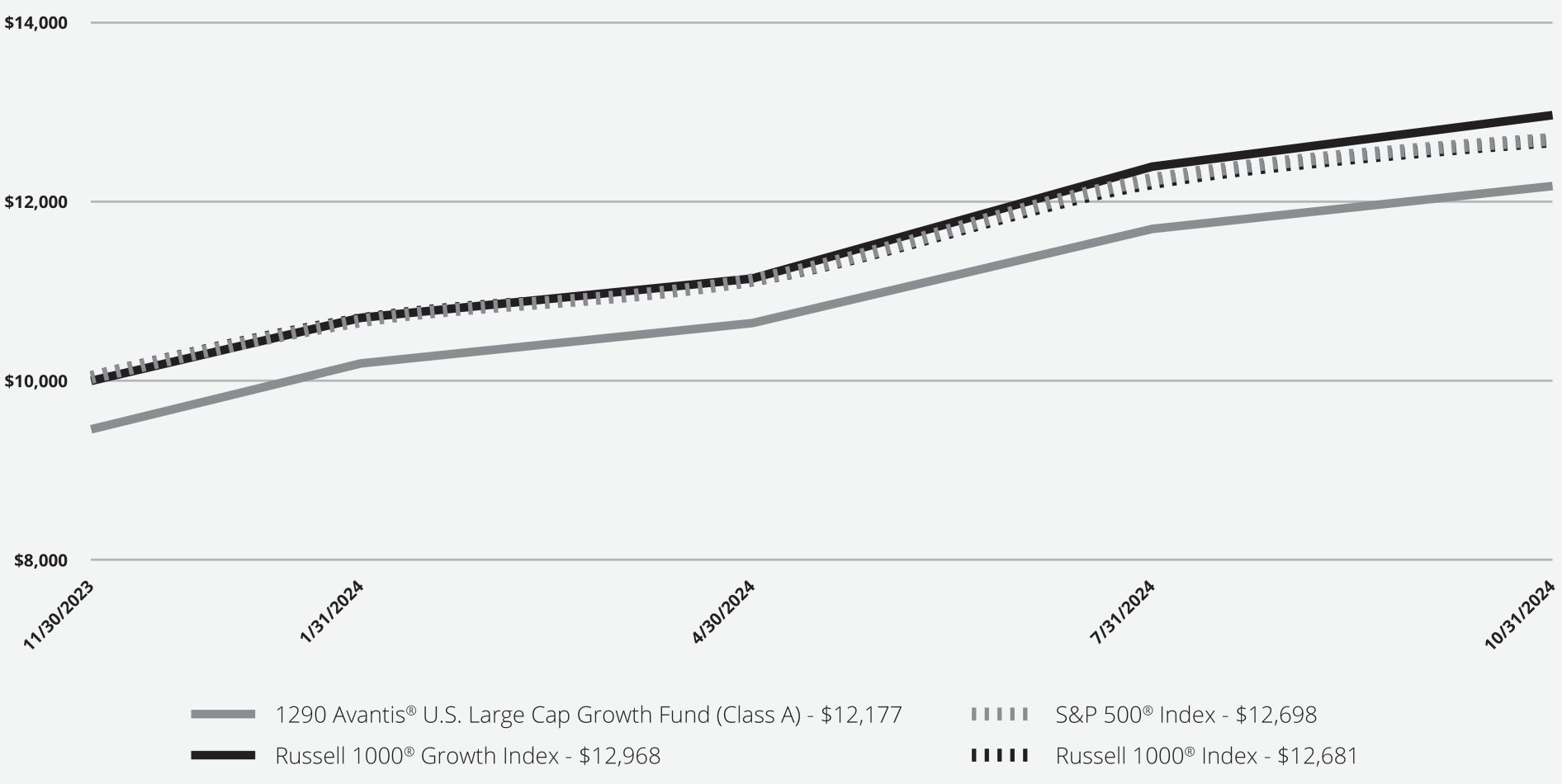

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund (reflecting the maximum applicable Class A sales charge) would have performed since inception, and how the S&P 500 Index, the Russell 1000

®

Index and the Russell 1000

®

Growth Index performed over the same period. This graph includes the deduction of the maximum sales charge, if any.

| | | | | | | | | | |

Average Annual Total Returns as of October 31, 2024 | | | | |

1290 Avantis ® U.S. Large Cap Growth Fund (Class A) | | | | | | | | | | |

| | | | 28.86% | | | | | | |

| | | | 21.77% | | | | | | |

| | | | 26.81% | | | | | | |

Russell 1000 ® Growth Index | | | | 29.68% | | | | | | |

| | | | 26.98% | | | | | | |

| | * | Date of inception: November 30, 2023 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 174,297,086 | | | | | |

| Total number of portfolio holdings | | | 197 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $189,209 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 22% | | | | | |

2

1290 AVANTIS

®

U.S. LARGE CAP GROWTH FUND CLASS A (TNRAX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Information Technology | | | 43.1 | % |

| | |

| | Consumer Discretionary | | | 15.9 | % |

| | |

| | Communication Services | | | 12.5 | % |

| | |

| | Industrials | | | 8.2 | % |

| | |

| | Financials | | | 6.7 | % |

| | |

| | Health Care | | | 5.7 | % |

| | |

| | Consumer Staples | | | 4.5 | % |

| | |

| | Energy | | | 2.1 | % |

| | |

| | Materials | | | 0.7 | % |

| | |

| | Utilities | | | 0.3 | % |

| | |

| | Short-Term Investments | | | 0.0 | % # |

| | |

| | Cash and Other Assets Less Liabilities | | | 0.3 | % |

| | | | | | |

| | | Top Ten Holdings (as a % of Net Assets) | |

| | |

| | Apple, Inc. | | | 12.0 | % |

| | |

| | NVIDIA Corp. | | | 9.5 | % |

| | |

| | Microsoft Corp. | | | 9.4 | % |

| | |

| | Amazon.com, Inc. | | | 6.1 | % |

| | |

| | Meta Platforms, Inc., Class A | | | 5.2 | % |

| | |

| | Alphabet, Inc., Class A | | | 3.4 | % |

| | |

| | Alphabet, Inc., Class C | | | 2.9 | % |

| | |

| | Broadcom, Inc. | | | 2.4 | % |

| | |

| | Costco Wholesale Corp. | | | 2.2 | % |

| | |

| | Mastercard, Inc., Class A | | | 1.5 | % |

# Less than 0.05%

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 AVANTIS

®

U.S. LARGE CAP GROWTH FUND CLASS I (TNXIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Avantis

®

U.S. Large Cap Growth Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

How did the Fund perform last year and what affected its performance?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class I | | $77 | | 0.65% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class I shares returned 37.92% for the year ended October 31, 2024, underperforming the Russell 1000

®

Index and the Russell 1000

®

Growth Index, which returned 38.07%, and 43.77% respectively, over the same period.

What helped performance during the year?

•

The Fund’s overweight exposure to companies with the highest

and profitability characteristics, which outperformed, aided performance. Additionally, the Fund’s underweight to companies with the lowest

and profitability characteristics, which underperformed, also contributed to performance.

What hurt performance during the year?

•

The Fund’s underweight to

mega-cap

stocks, which outperformed, and overweight exposure to large- and

mid-cap

stocks in the Russell 1000

®

Growth Index universe detracted from results.

1

1290 AVANTIS

®

U.S. LARGE CAP GROWTH FUND CLASS I (TNXIX)

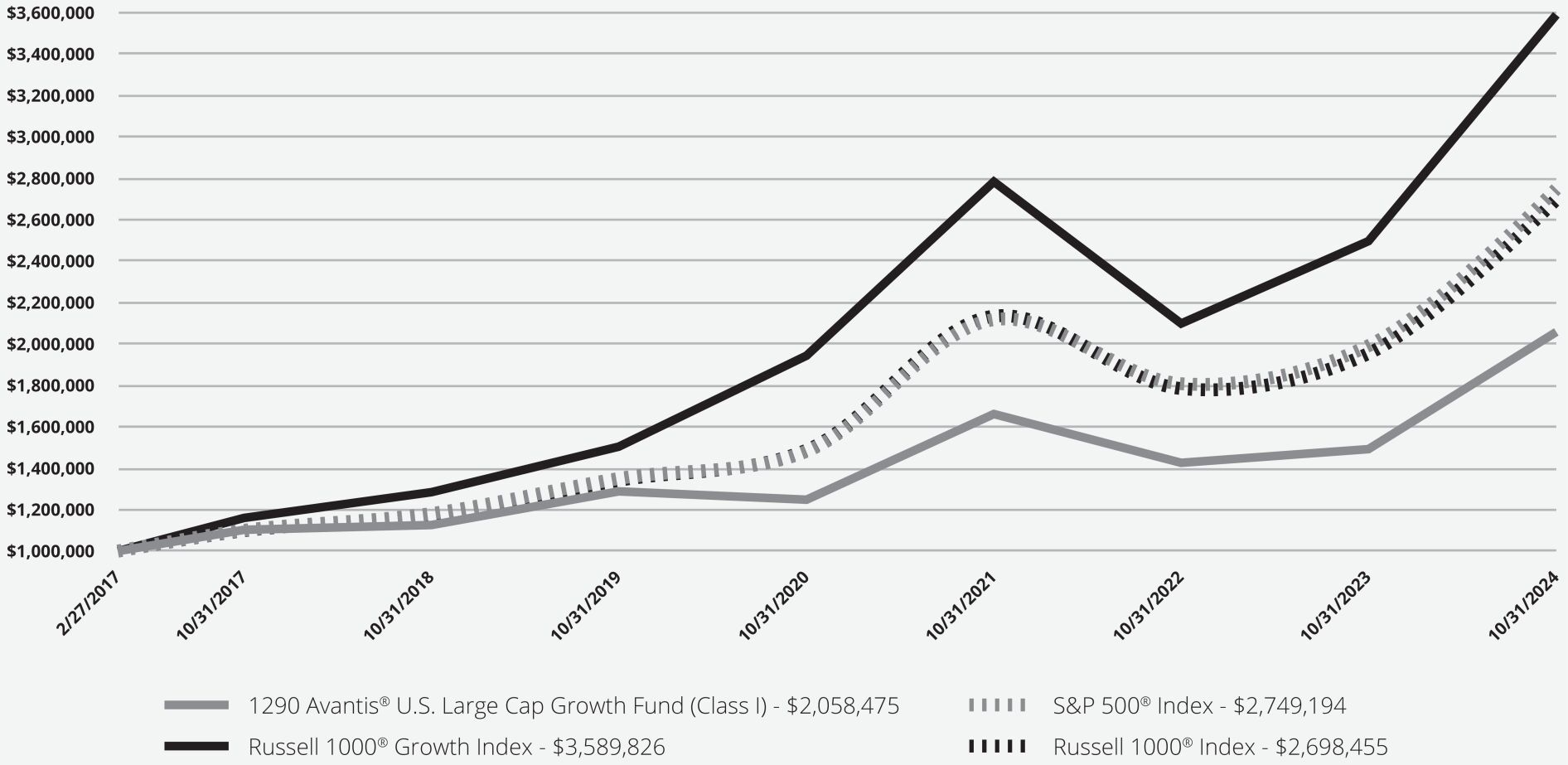

How did the Fund perform since inception?

The graph below shows how a hypothetical $1,000,000 investment in the Fund would have performed since inception, and how the S&P 500 Index, the Russell 1000

®

Index and the Russell 1000

®

Growth Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

1290 Avantis ® U.S. Large Cap Growth Fund (Class I) | | | | 37.92% | | | | | 9.82% | | | | | 9.86% | | | | | | |

| | | | 38.07% | | | | | 15.00% | | | | | 13.81% | | | | | | |

Russell 1000 ® Growth Index | | | | 43.77% | | | | | 19.00% | | | | | 18.12% | | | | | | |

| | | | 38.02% | | | | | 15.27% | | | | | 14.09% | | | | | | |

| | * | Date of inception: February 27, 2017 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 174,297,086 | | | | | |

| Total number of portfolio holdings | | | 197 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $189,209 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 22% | | | | | |

2

1290 AVANTIS

®

U.S. LARGE CAP GROWTH FUND CLASS I (TNXIX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Information Technology | | | 43.1% | |

| | |

| | Consumer Discretionary | | | 15.9% | |

| | |

| | Communication Services | | | 12.5% | |

| | |

| | Industrials | | | 8.2% | |

| | |

| | Financials | | | 6.7% | |

| | |

| | Health Care | | | 5.7% | |

| | |

| | Consumer Staples | | | 4.5% | |

| | |

| | Energy | | | 2.1% | |

| | |

| | Materials | | | 0.7% | |

| | |

| | Utilities | | | 0.3% | |

| | |

| | Short-Term Investments | | | 0.0% | # |

| | |

| | Cash and Other Assets Less Liabilities | | | 0.3% | |

| | | | | | |

| | | Top Ten Holdings (as a % of Net Assets) | |

| | |

| | Apple, Inc. | | | 12.0% | |

| | |

| | NVIDIA Corp. | | | 9.5% | |

| | |

| | Microsoft Corp. | | | 9.4% | |

| | |

| | Amazon.com, Inc. | | | 6.1% | |

| | |

| | Meta Platforms, Inc., Class A | | | 5.2% | |

| | |

| | Alphabet, Inc., Class A | | | 3.4% | |

| | |

| | Alphabet, Inc., Class C | | | 2.9% | |

| | |

| | Broadcom, Inc. | | | 2.4% | |

| | |

| | Costco Wholesale Corp. | | | 2.2% | |

| | |

| | Mastercard, Inc., Class A | | | 1.5% | |

|

Material Changes to the Fund |

Effective November 29, 2023, 1290 Retirement 2060 Fund was renamed 1290 Avantis ® U.S. Large Cap Growth Fund. Prior to November 29, 2023, the Fund was managed by the Adviser as a under the name “1290 Retirement 2060 Fund” and pursued its investment objective through investments in underlying exchanged-traded funds, which incurred their own operating costs and expenses, including management fees payable to their investment advisers. The Fund’s performance as a fund-of-funds reflected the impact of these operating costs and expenses. On November 29, 2023, the Fund repositioned its investments in connection with a change in its investment objective and principal investment strategy and policies. |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 DIVERSIFIED BOND FUND CLASS A (TNUAX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Diversified Bond Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

1-888-310-0416.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class A | | $80 | | 0.75% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares returned 12.95% (without sales charge) for the year ended October 31, 2024, outperforming the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% over the same period.

What helped performance during the year?

• The Fund’s overweight exposure to U.S. Treasury bonds added to performance over the year ended 10/31/24.

• The Fund’s overweight to Agency mortgage-backed securities (MBS) added to performance over the period.

• The Fund’s overweight to duration in South African bonds added to performance over the period.

• Long Swiss franc and long New Zealand dollar positions added to performance over the period.

What hurt performance during the year?

• The Fund’s overweight exposure to U.K. government bonds was the largest detractor from performance over the year ended 10/31/24.

• The Fund’s underweight to US Government Agency MBS detracted from performance over the period.

• The Fund’s overweight to Brazilian government bonds detracted from performance over the period.

• Long Brazilian real and Australian dollar positions detracted from performance over the period.

1

1290 DIVERSIFIED BOND FUND CLASS A (TNUAX)

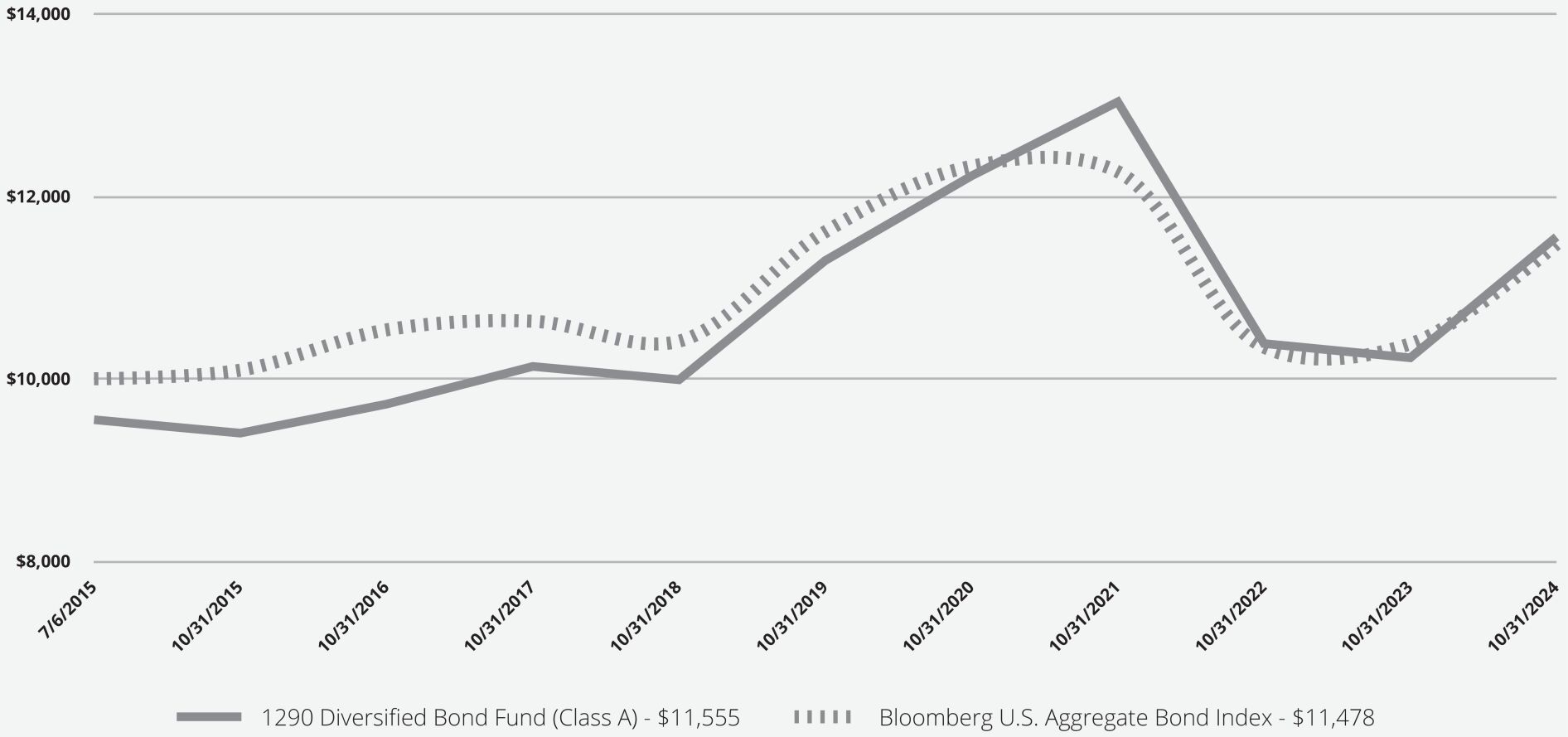

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund (reflecting the maximum applicable Class A sales charge) would have performed since inception, and how the Bloomberg U.S. Aggregate Bond Index performed over the same period. This graph includes the deduction of the maximum sales charge, if any.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of October 31, 2024 | | | | | | | | |

| 1290 Diversified Bond Fund (Class A) | | | | | | | | | | | | | | | | | | | | |

| | | | 12.95% | | | | | 0.45% | | | | | 2.06% | | | | | | |

| | | | 7.91% | | | | | (0.47%) | | | | | 1.56% | | | | | | |

| Bloomberg U.S. Aggregate Bond Index | | | | 10.55% | | | | | (0.23%) | | | | | 1.49% | | | | | | |

| | * | Date of inception: July 6, 2015 |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 632,633,526 | | | | | |

| Total number of portfolio holdings | | | 88 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $1,143,501 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 151% | | | | | |

2

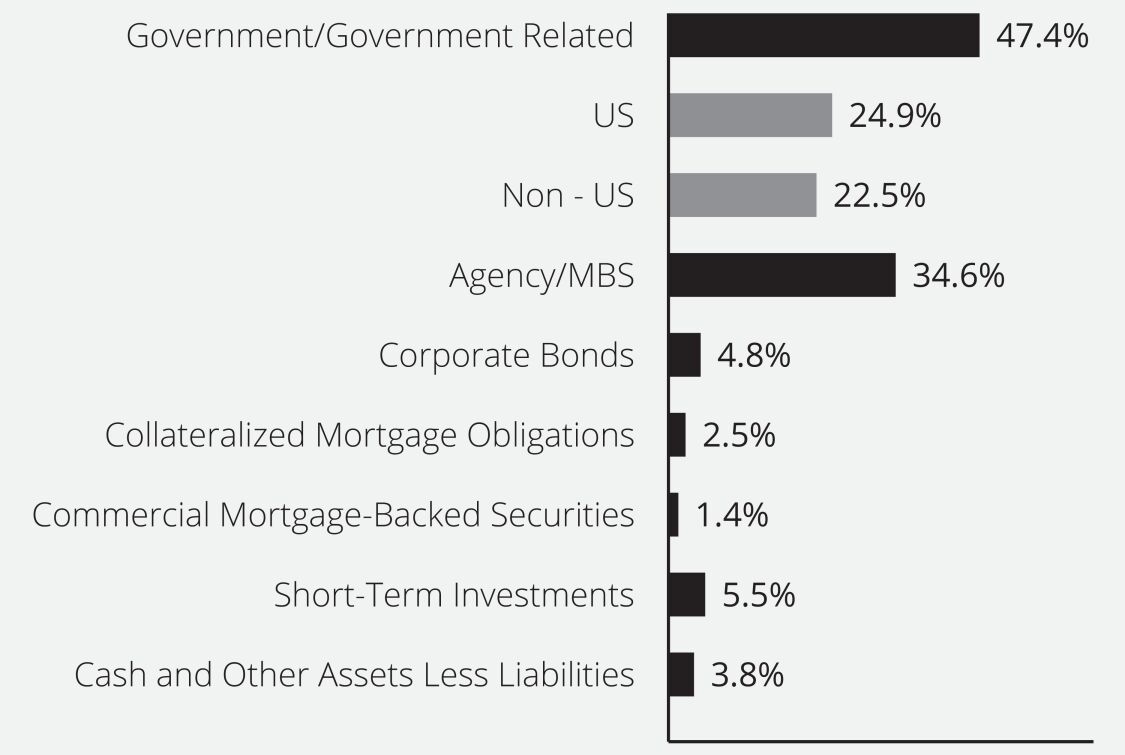

1290 DIVERSIFIED BOND FUND CLASS A (TNUAX)

What did the Fund invest in?

(as of October 31, 2024)

Sector Weightings (as a % of Net Assets)

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 DIVERSIFIED BOND FUND CLASS I (TNUIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Diversified Bond Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class I | | $53 | | 0.50% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class I shares returned 13.16% for the year ended October 31, 2024, outperforming the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% over the same period.

What helped performance during the year?

•

The Fund’s overweight exposure to U.S. Treasury bonds added to performance over the year ended 10/31/24.

•

The Fund’s overweight to Agency mortgage-backed securities (MBS) added to performance over the period.

•

The Fund’s overweight to duration in South African bonds added to performance over the period.

•

Long Swiss franc and long New Zealand dollar positions added to performance over the period.

What hurt performance during the year?

•

The Fund’s overweight exposure to U.K. government bonds was the largest detractor from performance over the year ended 10/31/24.

•

The Fund’s underweight to US Government Agency MBS detracted from performance over the period.

•

The Fund’s overweight to Brazilian government bonds detracted from performance over the period.

• Long Brazilian real and Australian dollar positions detracted from performance over the period.

1

1290 DIVERSIFIED BOND FUND CLASS I (TNUIX)

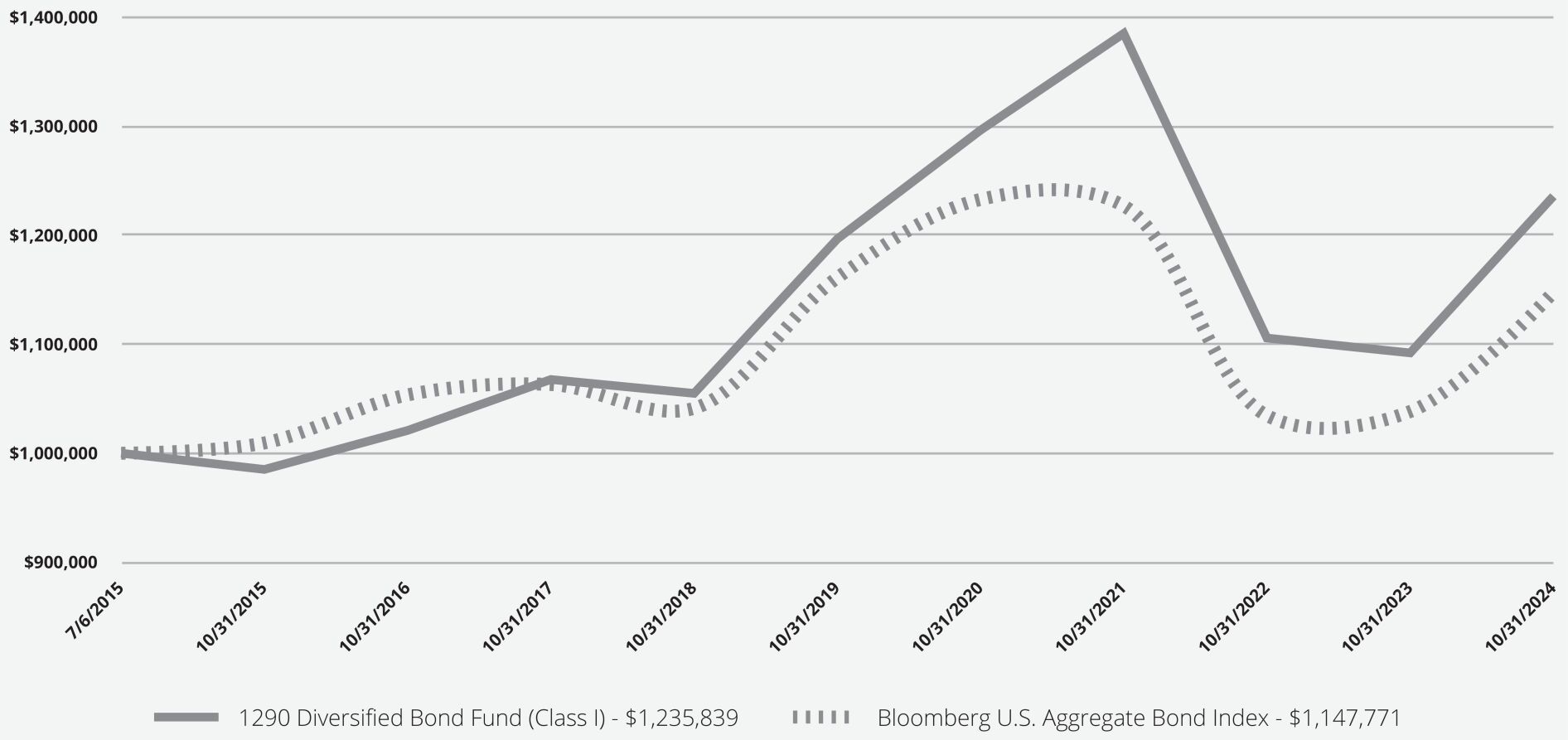

How did the Fund perform since inception?

The graph below shows how a hypothetical $1,000,000 investment in the Fund would have performed since inception, and how the Bloomberg U.S. Aggregate Bond Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

| 1290 Diversified Bond Fund (Class I) | | | | 13.16% | | | | | 0.65% | | | | | 2.30% | | | | | | |

| Bloomberg U.S. Aggregate Bond Index | | | | 10.55% | | | | | (0.23%) | | | | | 1.49% | | | | | | |

| | * | Date of inception: July 6, 2015 |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 632,633,526 | | | | | |

| Total number of portfolio holdings | | | 88 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $1,143,501 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 151% | | | | | |

2

1290 DIVERSIFIED BOND FUND CLASS I (TNUIX)

What did the Fund invest in?

(as of October 31, 2024)

Sector Weightings (as a % of Net Assets)

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 DIVERSIFIED BOND FUND CLASS R (TNURX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Diversified Bond Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class R | | $106 | | 1.00% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class R shares returned 12.64% for the year ended October 31, 2024, outperforming the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% over the same period.

What helped performance during the year?

•

The Fund’s overweight exposure to U.S. Treasury bonds added to performance over the year ended 10/31/24.

•

The Fund’s overweight to Agency mortgage-backed securities (MBS) added to performance over the period.

•

The Fund’s overweight to duration in South African bonds added to performance over the period.

•

Long Swiss franc and long New Zealand dollar positions added to performance over the period.

What hurt performance during the year?

•

The Fund’s overweight exposure to U.K. government bonds was the largest detractor from performance over the year ended 10/31/24.

•

The Fund’s underweight to US Government Agency MBS detracted from performance over the period.

•

The Fund’s overweight to Brazilian government bonds detracted from performance over the period.

• Long Brazilian real and Australian dollar positions detracted from performance over the period.

1

1290 DIVERSIFIED BOND FUND CLASS R (TNURX)

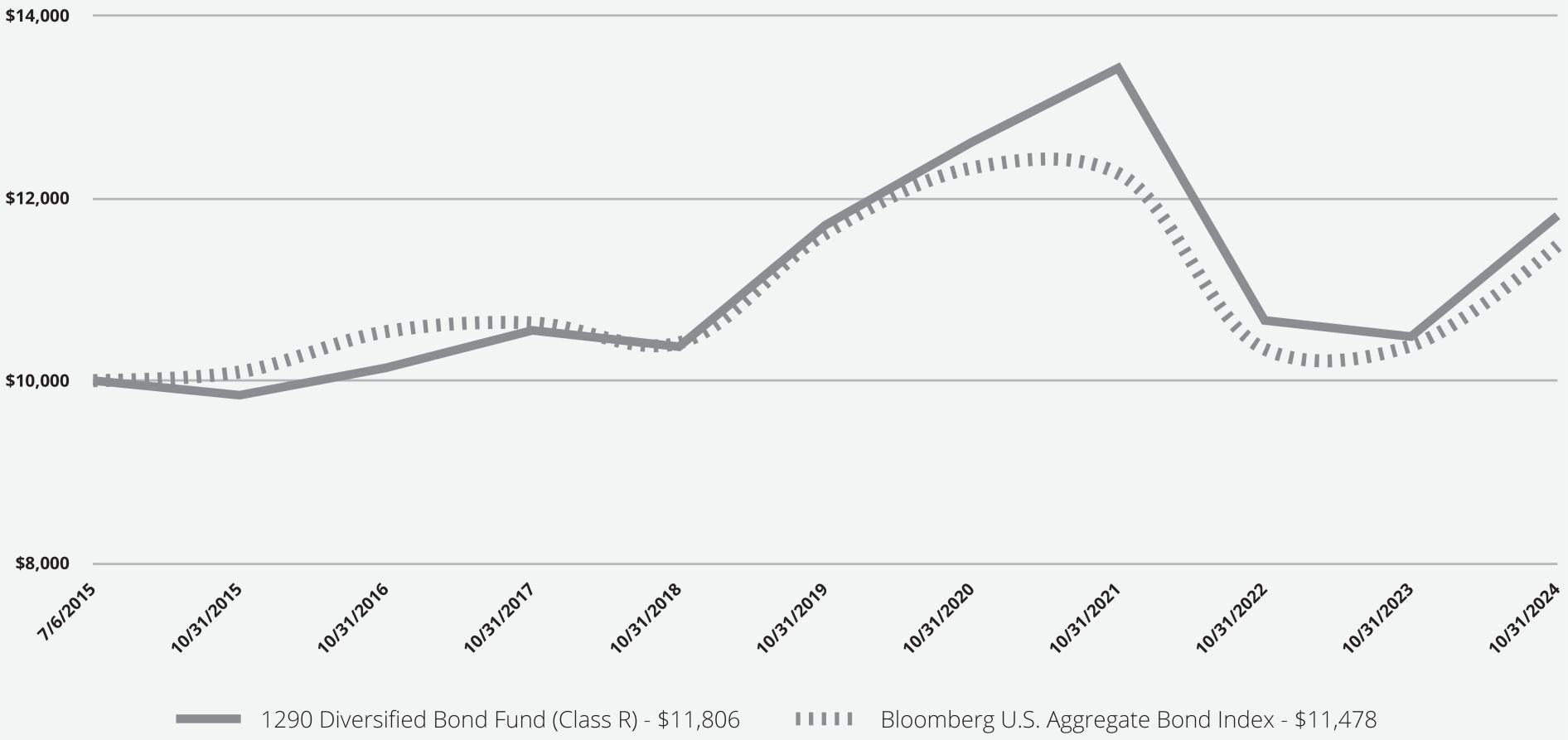

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund would have performed since inception, and how the Bloomberg U.S. Aggregate Bond Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

| 1290 Diversified Bond Fund (Class R) | | | | 12.64% | | | | | 0.18% | | | | | 1.80% | | | | | | |

| Bloomberg U.S. Aggregate Bond Index | | | | 10.55% | | | | | (0.23%) | | | | | 1.49% | | | | | | |

| | * | Date of inception: July 6, 2015 |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 632,633,526 | | | | | |

| Total number of portfolio holdings | | | 88 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $1,143,501 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 151% | | | | | |

2

1290 DIVERSIFIED BOND FUND CLASS R (TNURX)

What did the Fund invest in?

(as of October 31, 2024)

Sector Weightings (as a % of Net Assets)

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 ESSEX SMALL CAP GROWTH FUND CLASS A (ESCFX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Essex Small Cap Growth Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class A | | $133 | | 1.13% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares returned 35.88% (without sales charge) for the year ended October 31, 2024, underperforming the Russell 3000

®

Index but performing in line with the Russell 2000

®

Growth Index, which returned 37.86%, and 36.49% respectively, over the same period.

What helped performance during the year?

• Stock selection was particularly strong in the Healthcare sector led by small-cap specialty pharmaceuticals and medical devices with a strong focus on new technologies in cancer care, robotics, and treatments for eye disease.

• Overall stock selection drove performance for the year with strong contributions from Financials (financial payment processors, capital markets, and insurance), Consumer Discretionary (growth restaurants, home building related, workforce training), and Materials (energy transition) sectors.

What hurt performance during the year?

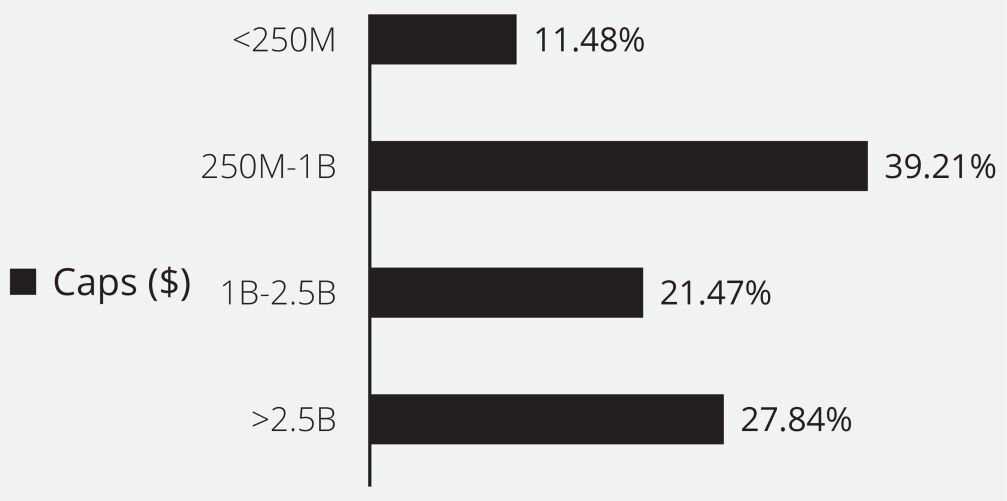

• Market-cap positioning detracted the most from performance, with our significant overweight position in stocks under $1B (50.3% in the fund versus less than 10% in the Russell 2000 Growth Index). Stock selection added value versus the index in all market-cap buckets, but the overall impact was negative due to the Fund’s smaller market-cap footprint.

1

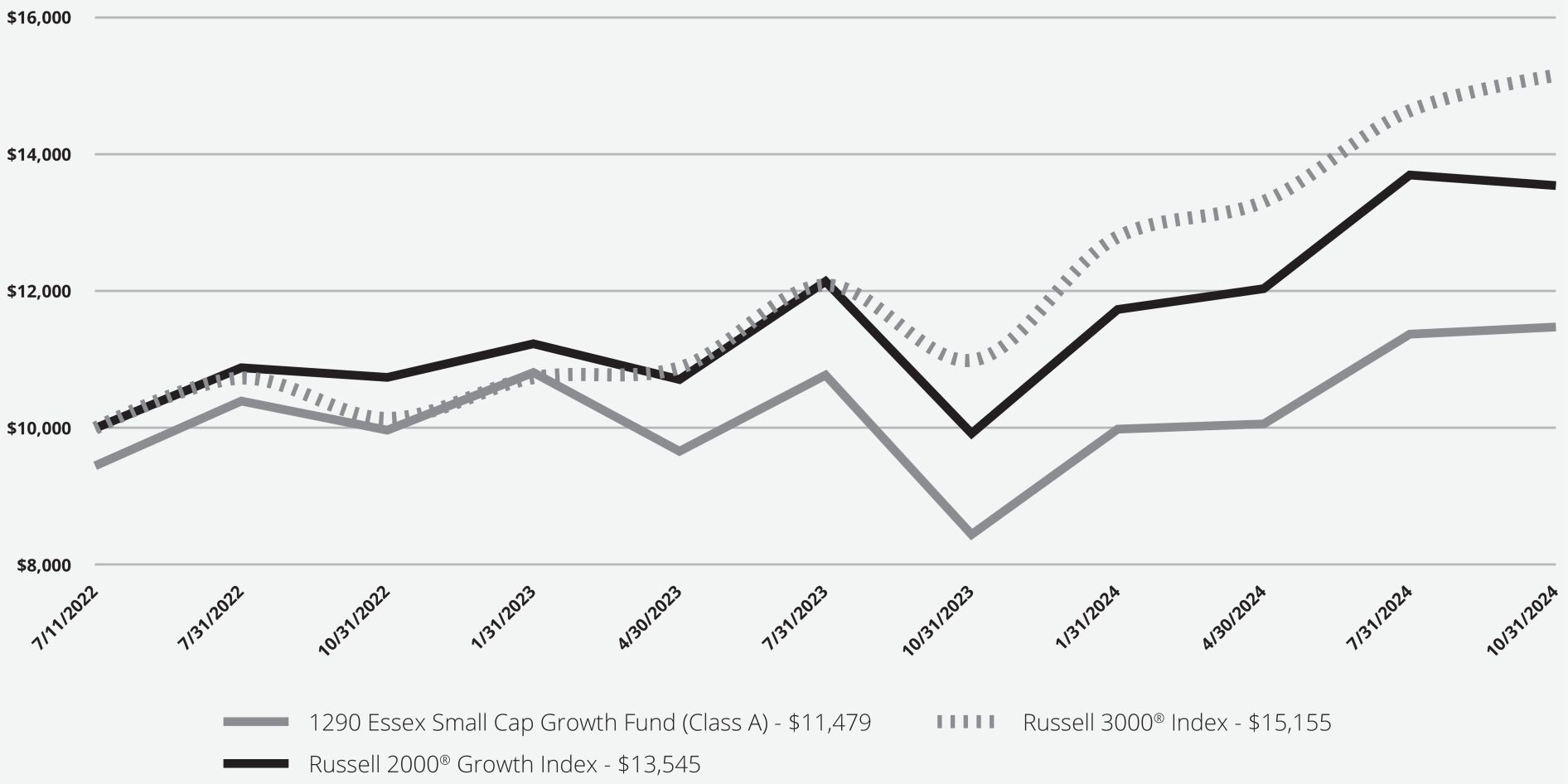

1290 ESSEX SMALL CAP GROWTH FUND CLASS A (ESCFX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund (reflecting the maximum applicable Class A sales charge) would have performed since inception, and how the Russell 3000

®

Index and the Russell 2000

®

Growth Index performed over the same period. This graph includes the deduction of the maximum sales charge, if any.

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of October 31, 2024 | | | | | | |

| 1290 Essex Small Cap Growth Fund (Class A) | | | | | | | | | | | | | | | |

| | | | 35.88% | | | | | 8.79% | | | | | | |

| | | | 28.37% | | | | | 6.16% | | | | | | |

| | | | 37.86% | | | | | 19.75% | | | | | | |

Russell 2000 ® Growth Index | | | | 36.49% | | | | | 14.06% | | | | | | |

| | * | Date of inception: July 11, 2022 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 64,532,475 | | | | | |

| Total number of portfolio holdings | | | 104 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $176,666 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 73% | | | | | |

2

1290 ESSEX SMALL CAP GROWTH FUND CLASS A (ESCFX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Industrials | | | 30.7 | % |

| | |

| | Health Care | | | 28.3 | % |

| | |

| | Information Technology | | | 21.6 | % |

| | |

| | Financials | | | 6.1 | % |

| | |

| | Consumer Discretionary | | | 5.6 | % |

| | |

| | Energy | | | 2.3 | % |

| | |

| | Communication Services | | | 1.2 | % |

| | |

| | Consumer Staples | | | 1.0 | % |

| | |

| | Materials | | | 0.8 | % |

| | |

| | Exchange Traded Fund | | | 0.7 | % |

| | |

| | Short-Term Investments | | | 4.5 | % |

| | |

| | Cash and Other Assets Less Liabilities | | | (2.8 | )% |

| | |

| | | Market Capitalization (as a % of Net Assets) |

| |

| | |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 ESSEX SMALL CAP GROWTH FUND CLASS I (ESCJX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Essex Small Cap Growth Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class I | | $104 | | 0.88% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class I shares returned 36.21% for the year ended October 31, 2024, underperforming the Russell 3000

®

Index but performing in line with the Russell 2000

®

Growth Index, which returned 37.86%, and 36.49% respectively, over the same period.

What helped performance during the year?

• Stock selection was particularly strong in the Healthcare sector led by small-cap specialty pharmaceuticals and medical devices with a strong focus on new technologies in cancer care, robotics, and treatments for eye disease.

• Overall stock selection drove performance for the year with strong contributions from Financials (financial payment processors, capital markets, and insurance), Consumer Discretionary (growth restaurants, home building related, workforce training), and Materials (energy transition) sectors.

What hurt performance during the year?

• Market-cap positioning detracted the most from performance, with our significant overweight position in stocks under $1B (50.3% in the fund versus less than 10% in the Russell 2000 Growth Index). Stock selection added value versus the index in all market-cap buckets, but the overall impact was negative due to the Fund’s smaller market-cap footprint.

1

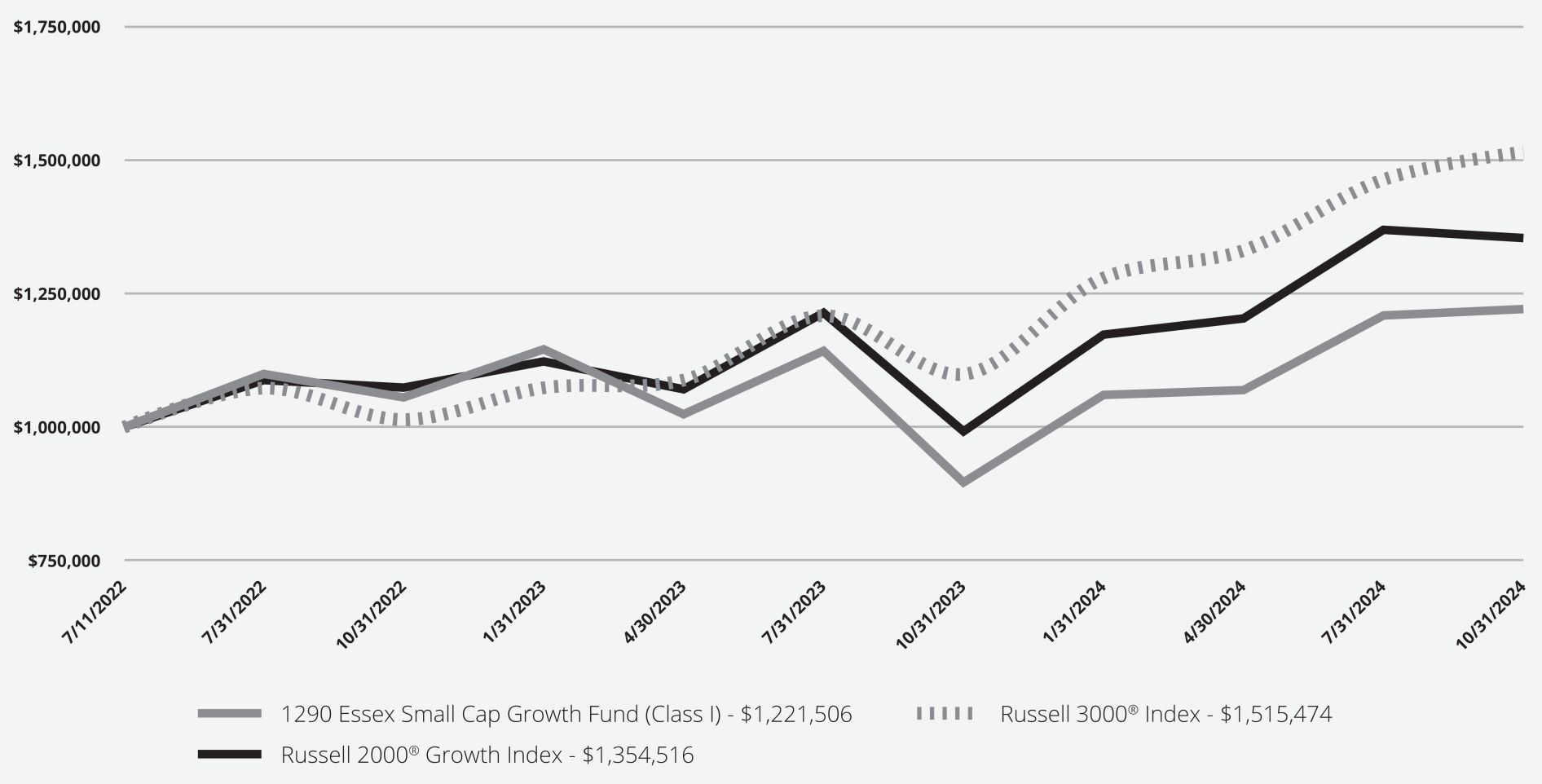

1290 ESSEX SMALL CAP GROWTH FUND CLASS I (ESCJX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $1,000,000 investment in the Fund would have performed since inception, and how the Russell 3000

®

Index and the Russell 2000

®

Growth Index performed over the same period.

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | |

| 1290 Essex Small Cap Growth Fund (Class I) | | | | 36.21% | | | | | 9.06% | | | | | | |

| | | | 37.86% | | | | | 19.75% | | | | | | |

Russell 2000 ® Growth Index | | | | 36.49% | | | | | 14.06% | | | | | | |

| | * | Date of inception: July 11, 2022 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 64,532,475 | | | | | |

| Total number of portfolio holdings | | | 104 | | | | | |

Total Investment advisory fees ( net of waiver) | | | $176,666 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 73% | | | | | |

2

1290 ESSEX SMALL CAP GROWTH FUND CLASS I (ESCJX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Industrials | | | 30.7 | % |

| | |

| | Health Care | | | 28.3 | % |

| | |

| | Information Technology | | | 21.6 | % |

| | |

| | Financials | | | 6.1 | % |

| | |

| | Consumer Discretionary | | | 5.6 | % |

| | |

| | Energy | | | 2.3 | % |

| | |

| | Communication Services | | | 1.2 | % |

| | |

| | Consumer Staples | | | 1.0 | % |

| | |

| | Materials | | | 0.8 | % |

| | |

| | Exchange Traded Fund | | | 0.7 | % |

| | |

| | Short-Term Investments | | | 4.5 | % |

| | |

| | Cash and Other Assets Less Liabilities | | | (2.8 | )% |

| | |

| | | Market Capitalization (as a % of Net Assets) |

| |

| | |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 ESSEX SMALL CAP GROWTH FUND CLASS R (ESCKX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Essex Small Cap Growth Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class R | | $163 | | 1.38% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class R shares returned 35.55% for the year ended October 31, 2024, underperforming the Russell 3000

®

Index but performing in line with the Russell 2000

®

Growth Index, which returned 37.86%, and 36.49% respectively, over the same period.

What helped performance during the year?

• Stock selection was particularly strong in the Healthcare sector led by small-cap specialty pharmaceuticals and medical devices with a strong focus on new technologies in cancer care, robotics, and treatments for eye disease.

• Overall stock selection drove performance for the year with strong contributions from Financials (financial payment processors, capital markets, and insurance), Consumer Discretionary (growth restaurants, home building related, workforce training), and Materials (energy transition) sectors.

What hurt performance during the year?

• Market-cap positioning detracted the most from performance, with our significant overweight position in stocks under $1B (50.3% in the fund versus less than 10% in the Russell 2000 Growth Index). Stock selection added value versus the index in all market-cap buckets, but the overall impact was negative due to the Fund’s smaller market-cap footprint.

1

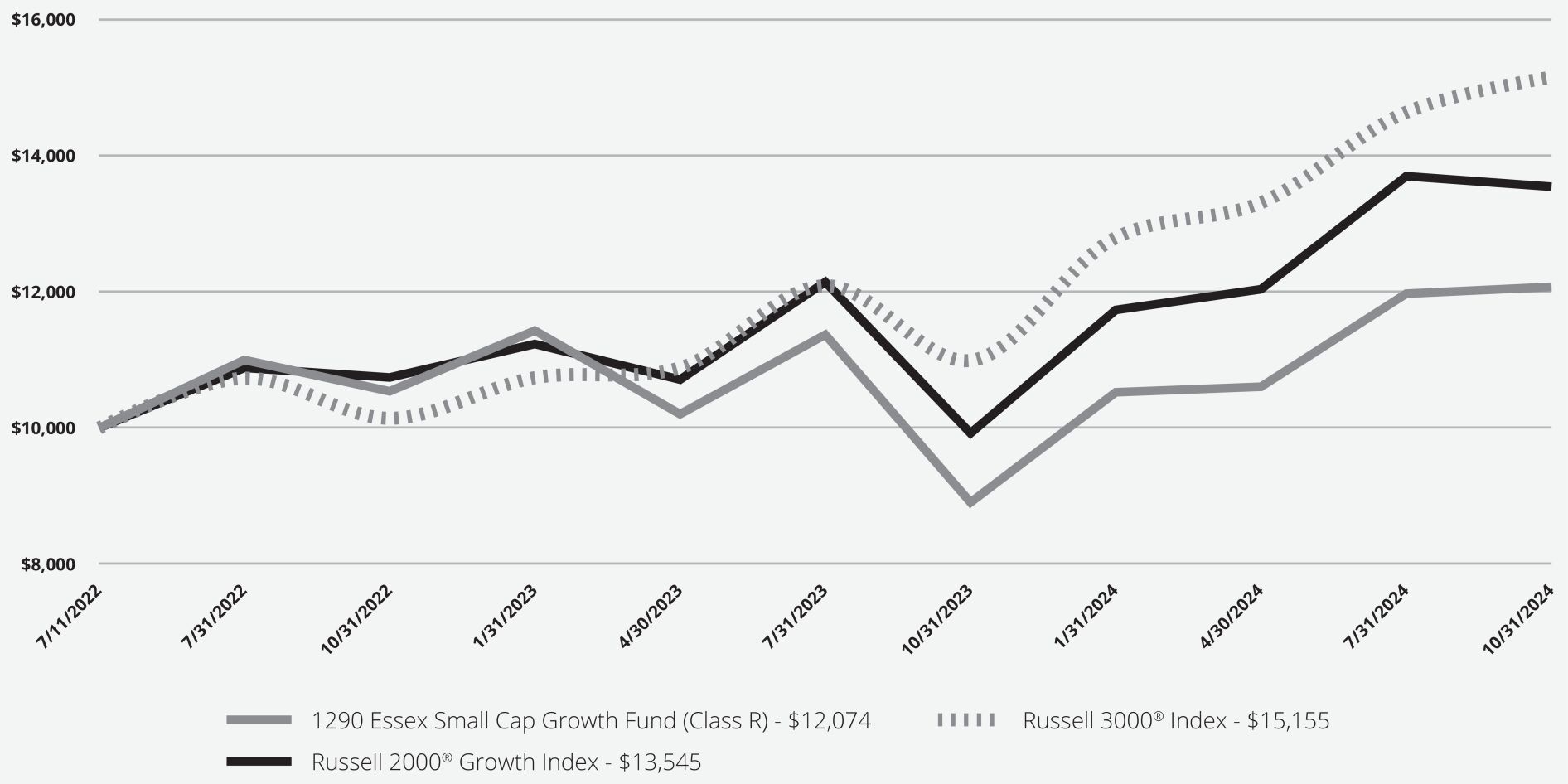

1290 ESSEX SMALL CAP GROWTH FUND CLASS R (ESCKX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund would have performed since inception, and how the Russell 3000

®

Index and the Russell 2000

®

Growth Index performed over the same period.

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | |

| 1290 Essex Small Cap Growth Fund (Class R) | | | | 35.55% | | | | | 8.51% | | | | | | |

| | | | 37.86% | | | | | 19.75% | | | | | | |

Russell 2000 ® Growth Index | | | | 36.49% | | | | | 14.06% | | | | | | |

| | * | Date of inception: July 11, 2022 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 64,532,475 | | | | | |

| Total number of portfolio holdings | | | 104 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $176,666 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 73% | | | | | |

2

1290 ESSEX SMALL CAP GROWTH FUND CLASS R (ESCKX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Industrials | | | 30.7 | % |

| | |

| | Health Care | | | 28.3 | % |

| | |

| | Information Technology | | | 21.6 | % |

| | |

| | Financials | | | 6.1 | % |

| | |

| | Consumer Discretionary | | | 5.6 | % |

| | |

| | Energy | | | 2.3 | % |

| | |

| | Communication Services | | | 1.2 | % |

| | |

| | Consumer Staples | | | 1.0 | % |

| | |

| | Materials | | | 0.8 | % |

| | |

| | Exchange Traded Fund | | | 0.7 | % |

| | |

| | Short-Term Investments | | | 4.5 | % |

| | |

| | Cash and Other Assets Less Liabilities | | | (2.8 | )% |

| | |

| | | Market Capitalization (as a % of Net Assets) |

| |

| | |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS A (TNVAX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 GAMCO Small/Mid Cap Value Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class A | | $136 | | 1.20% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares returned 26.96% (without sales charge) for the year ended October 31, 2024, underperforming the Russell 3000

®

Index and the Russell 2500

®

Value Index, which returned 37.86% and 32.42% respectively, over the same period.

What helped performance during the year?

• Industrial company exposure and performance was the largest contributor to absolute and relative returns during the period.

• The Fund’s Communication Services sector holdings were the second largest contributor to relative returns by sector for the period, with some tailwinds from election spending in this area over the period.

What hurt performance during the year?

• The Fund’s lower weighting in Financials was the largest detractor from relative performance for the period, mainly driven by the Fund’s much lower allocation to the sector.

• The Fund’s lower exposure to Information Technology companies hurt relative performance during the period.

Asset Class/Sector Overview

As interest rates continue to decline, the portfolio managers believe small to mid-sized companies are well-positioned to benefit from this trend throughout 2024 and into 2025. Lower interest rates generally act as a positive catalyst for equities by reducing borrowing costs, fostering robust corporate merger activity, increasing consumer spending, renewing investor risk appetite, and leading to higher valuation multiples.

1

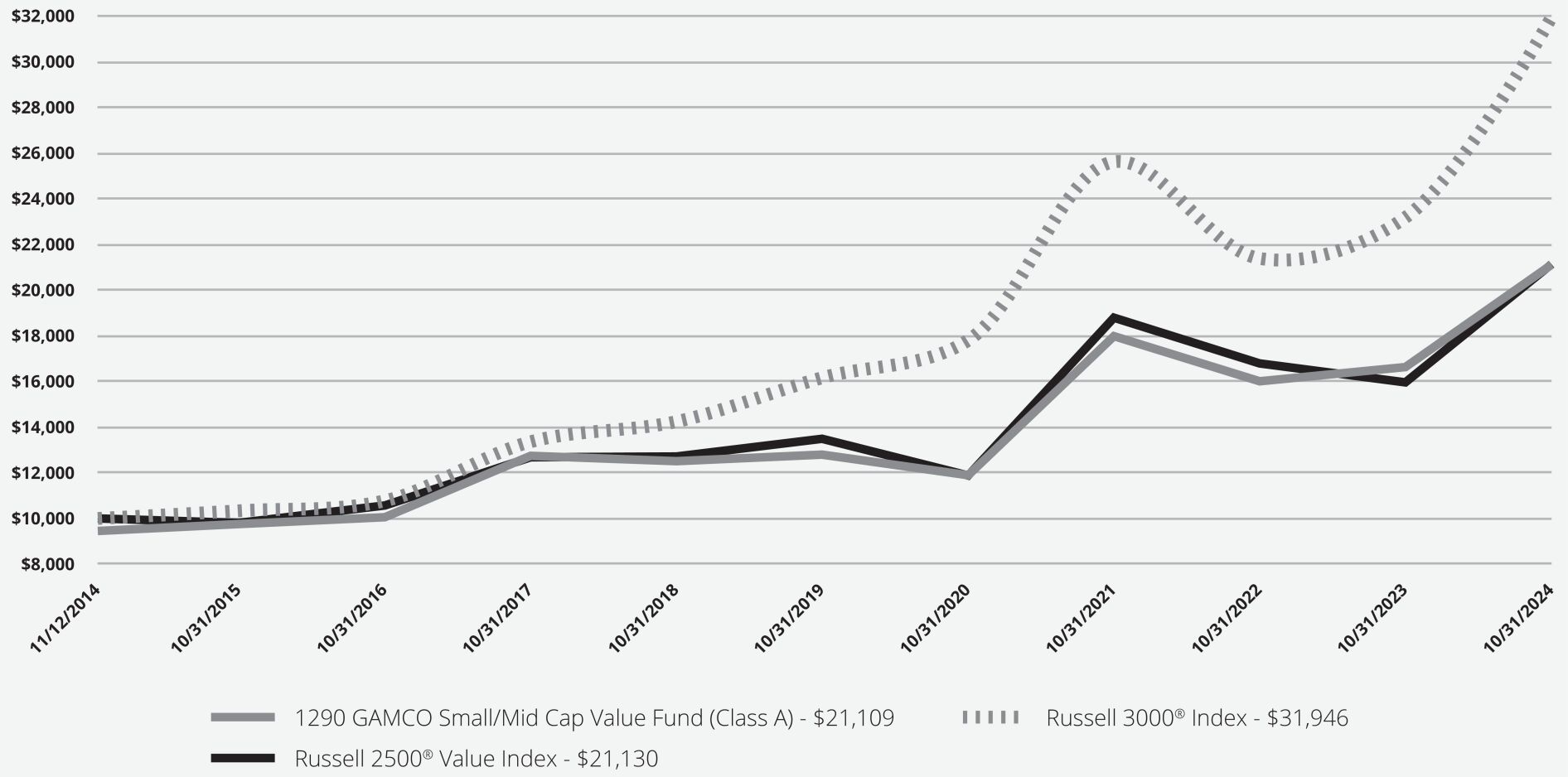

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS A (TNVAX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund (reflecting the maximum applicable Class A sales charge) would have performed since inception, and how the Russell 3000

®

Index and the Russell 2500

®

Value Index performed over the same period. This graph includes the deduction of the maximum sales charge, if any.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of October 31, 2024 | | | | | | | | |

| 1290 GAMCO Small/Mid Cap Value Fund (Class A) | | | | | | | | | | | | | | | | | | | | |

| | | | 26.96% | | | | | 10.54% | | | | | 8.40% | | | | | | |

| | | | 19.95% | | | | | 9.28% | | | | | 7.78% | | | | | | |

| | | | 37.86% | | | | | 14.60% | | | | | 12.36% | | | | | | |

| | | | 32.42% | | | | | 9.39% | | | | | 7.79% | | | | | | |

| | * | Date of inception: November 12, 2014 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 159,212,141 | | | | | |

| Total number of portfolio holdings | | | 180 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $707,215 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 11% | | | | | |

2

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS A (TNVAX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Industrials | | | 34.7 | % |

| | |

| | Communication Services | | | 17.8 | % |

| | |

| | Consumer Discretionary | | | 14.6 | % |

| | |

| | Consumer Staples | | | 7.9 | % |

| | |

| | Materials | | | 7.5 | % |

| | |

| | Utilities | | | 4.5 | % |

| | |

| | Health Care | | | 2.6 | % |

| | |

| | Financials | | | 2.5 | % |

| | |

| | Information Technology | | | 1.9 | % |

| | |

| | Energy | | | 0.9 | % |

| | |

| | Other | | | 0.6 | % |

| | |

| | Short-Term Investments | | | 5.2 | % |

| | |

| | Cash and Other Assets Less Liabilities | | | (0.7 | )% |

| | | | | | |

| | | Top Ten Holdings (as a % of Net Assets) | |

| | |

| | JPMorgan Prime Money Market Fund, IM Shares | | | 4.4 | % |

| | |

| | Mueller Industries, Inc. | | | 2.8 | % |

| | |

| | Herc Holdings, Inc. | | | 2.4 | % |

| | |

| | Scotts Miracle-Gro Co. (The) | | | 2.3 | % |

| | |

| | Modine Manufacturing Co. | | | 2.0 | % |

| | |

| | Madison Square Garden Sports Corp. | | | 1.9 | % |

| | |

| | Crane Co. | | | 1.8 | % |

| | |

| | Sinclair, Inc. | | | 1.8 | % |

| | |

| | Spectrum Brands Holdings, Inc. | | | 1.7 | % |

| | |

| | Paramount Global, Class A | | | 1.7 | % |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS I (TNVIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 GAMCO Small/Mid Cap Value Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class I | | $107 | | 0.95% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class I shares returned 27.32% for the year ended October 31, 2024, underperforming the Russell 3000

®

Index and the Russell 2500

®

Value Index, which returned 37.86% and 32.42% respectively, over the same period.

What helped performance during the year?

• Industrial company exposure and performance was the largest contributor to absolute and relative returns during the period.

• The Fund’s Communication Services sector holdings were the second largest contributor to relative returns by sector for the period, with some tailwinds from election spending in this area over the period.

What hurt performance during the year?

• The Fund’s lower weighting in Financials was the largest detractor from relative performance for the period, mainly driven by the Fund’s much lower allocation to the sector.

• The Fund’s lower exposure to Information Technology companies hurt relative performance during the period.

Asset Class/Sector Overview

As interest rates continue to decline, the portfolio managers believe small to mid-sized companies are well-positioned to benefit from this trend throughout 2024 and into 2025. Lower interest rates generally act as a positive catalyst for equities by reducing borrowing costs, fostering robust corporate merger activity, increasing consumer spending, renewing investor risk appetite, and leading to higher valuation multiples.

1

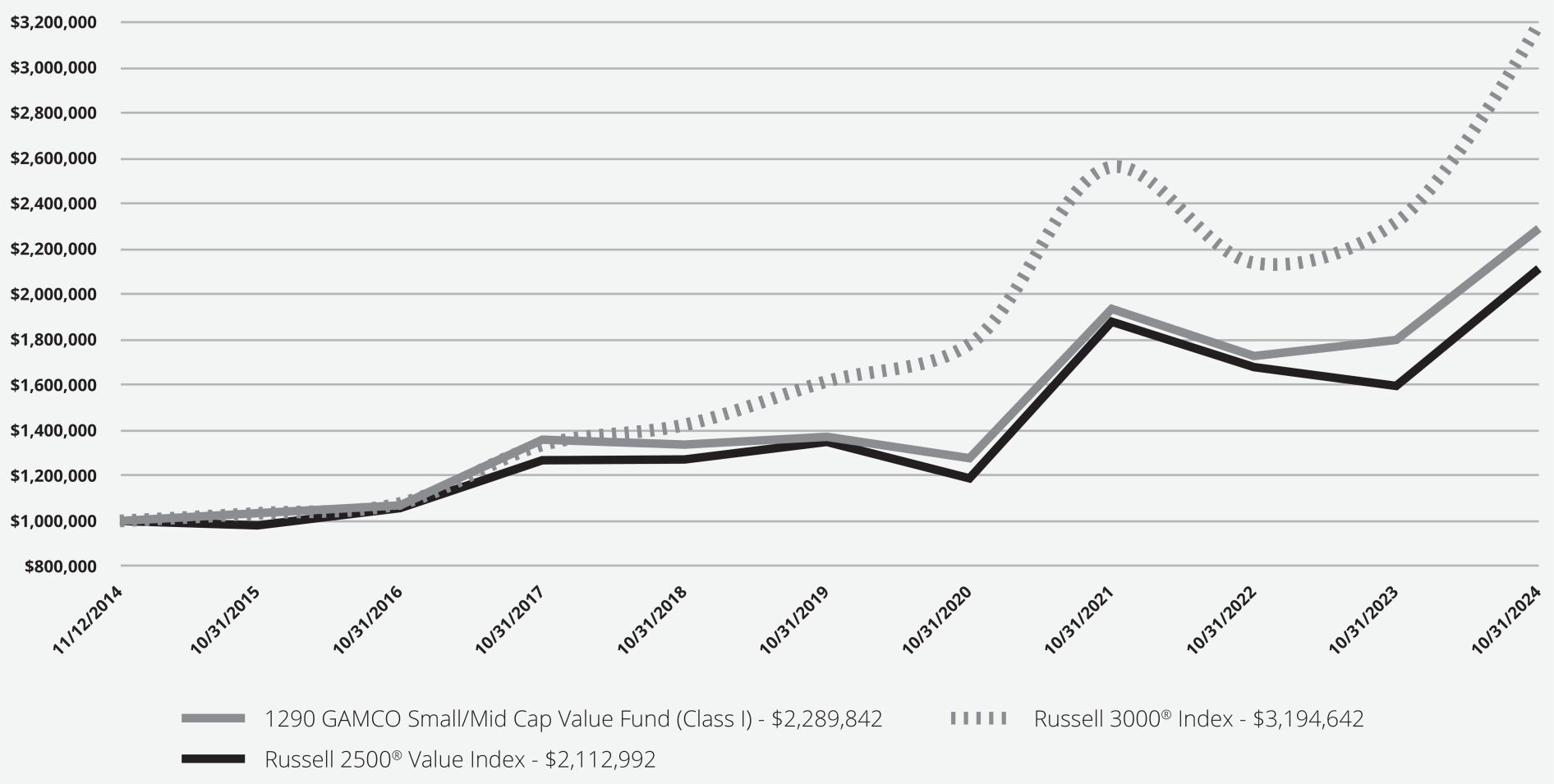

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS I (TNVIX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $1,000,000 investment in the Fund would have performed since inception, and how the Russell 3000

®

Index and the Russell 2500

®

Value Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

| 1290 GAMCO Small/Mid Cap Value Fund (Class I) | | | | 27.32% | | | | | 10.80% | | | | | 8.67% | | | | | | |

| | | | 37.86% | | | | | 14.60% | | | | | 12.36% | | | | | | |

| | | | 32.42% | | | | | 9.39% | | | | | 7.79% | | | | | | |

| | * | Date of inception: November 12, 2014 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 159,212,141 | | | | | |

| Total number of portfolio holdings | | | 180 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $707,215 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 11% | | | | | |

2

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS I (TNVIX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Industrials | | | 34.7 | % |

| | |

| | Communication Services | | | 17.8 | % |

| | |

| | Consumer Discretionary | | | 14.6 | % |

| | |

| | Consumer Staples | | | 7.9 | % |

| | |

| | Materials | | | 7.5 | % |

| | |

| | Utilities | | | 4.5 | % |

| | |

| | Health Care | | | 2.6 | % |

| | |

| | Financials | | | 2.5 | % |

| | |

| | Information Technology | | | 1.9 | % |

| | |

| | Energy | | | 0.9 | % |

| | |

| | Other | | | 0.6 | % |

| | |

| | Short-Term Investments | | | 5.2 | % |

| | |

| | Cash and Other Assets Less Liabilities | | | (0.7 | )% |

| | | | | | |

| | | Top Ten Holdings (as a % of Net Assets) | |

| | |

| | JPMorgan Prime Money Market Fund, IM Shares | | | 4.4 | % |

| | |

| | Mueller Industries, Inc. | | | 2.8 | % |

| | |

| | Herc Holdings, Inc. | | | 2.4 | % |

| | |

| | Scotts Miracle-Gro Co. (The) | | | 2.3 | % |

| | |

| | Modine Manufacturing Co. | | | 2.0 | % |

| | |

| | Madison Square Garden Sports Corp. | | | 1.9 | % |

| | |

| | Crane Co. | | | 1.8 | % |

| | |

| | Sinclair, Inc. | | | 1.8 | % |

| | |

| | Spectrum Brands Holdings, Inc. | | | 1.7 | % |

| | |

| | Paramount Global, Class A | | | 1.7 | % |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS R (TNVRX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 GAMCO Small/Mid Cap Value Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class R | | $164 | | 1.45% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class R shares returned 26.66% for the year ended October 31, 2024, underperforming the Russell 3000

®

Index and the Russell 2500

®

Value Index, which returned 37.86% and 32.42% respectively, over the same period.

What helped performance during the year?

•

Industrial company exposure and performance was the largest contributor to absolute and relative returns during the period.

•

The Fund’s Communication Services sector holdings were the second largest contributor to relative returns by sector for the period, with some tailwinds from election spending in this area over the period.

What hurt performance during the year?

•

The Fund’s lower weighting in Financials was the largest detractor from relative performance for the period, mainly driven by the Fund’s much lower allocation to the sector.

•

The Fund’s lower exposure to Information Technology companies hurt relative performance during the period.

Asset Class/Sector Overview

As interest rates continue to decline, the portfolio managers believe small to

mid-sized

companies are well-positioned to benefit from this trend throughout 2024 and into 2025. Lower interest rates generally act as a positive catalyst for equities by reducing borrowing costs, fostering robust corporate merger activity, increasing consumer spending, renewing investor risk appetite, and leading to higher valuation multiples.

1

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS R (TNVRX)

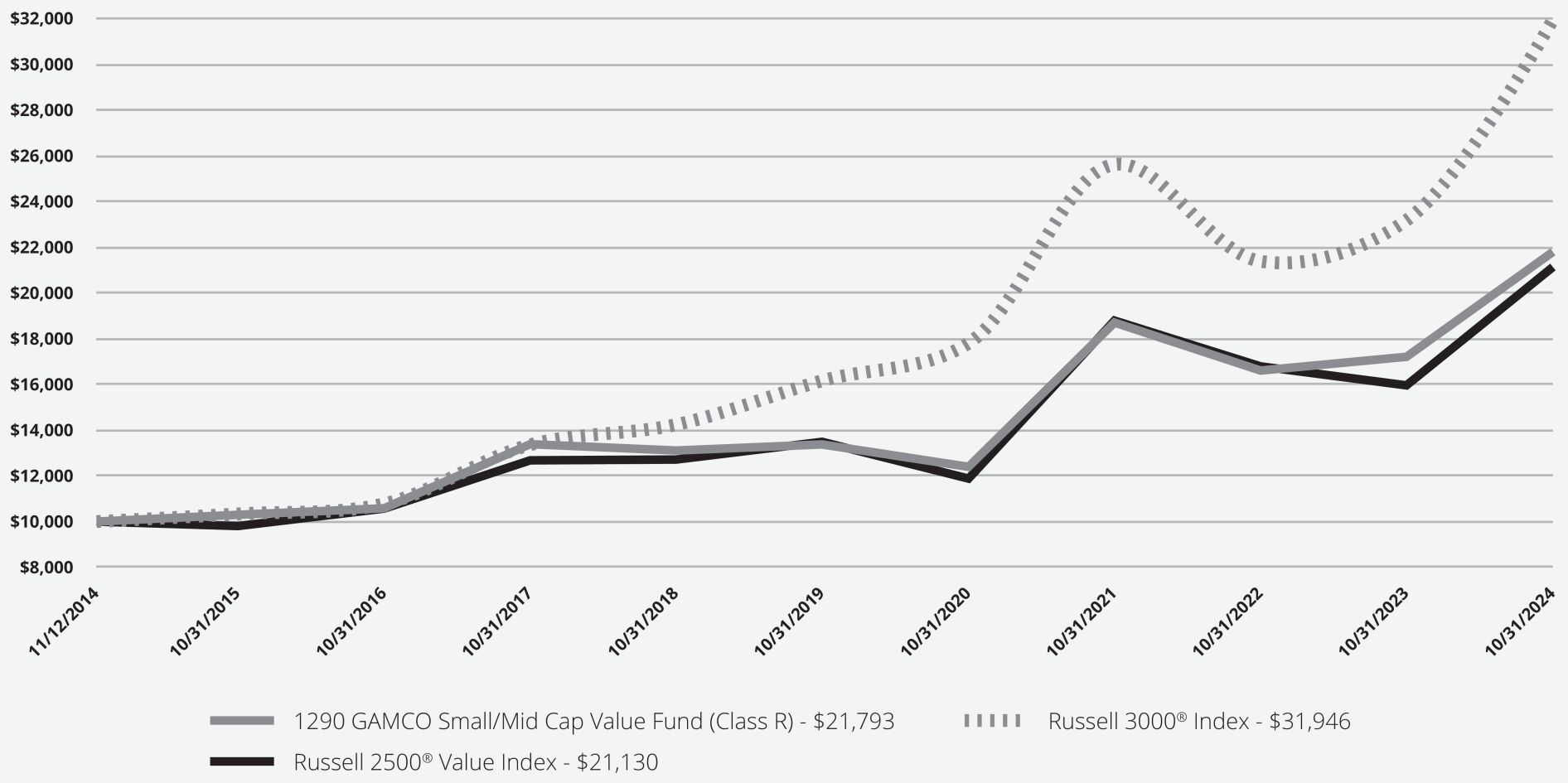

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund would have performed since inception, and how the Russell 3000

®

Index and the Russell 2500

®

Value Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

| 1290 GAMCO Small/Mid Cap Value Fund (Class R) | | | | 26.66% | | | | | 10.26% | | | | | 8.13% | | | | | | |

| | | | 37.86% | | | | | 14.60% | | | | | 12.36% | | | | | | |

| | | | 32.42% | | | | | 9.39% | | | | | 7.79% | | | | | | |

| | * | Date of inception: November 12, 2014 |

| | ** | This index replaced the prior broad-based securities market index in order to satisfy a change in regulatory requirements |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 159,212,141 | | | | | |

| Total number of portfolio holdings | | | 180 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $707,215 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 11% | | | | | |

2

1290 GAMCO SMALL/MID CAP VALUE FUND CLASS R (TNVRX)

What did the Fund invest in?

(as of October 31, 2024)

| | | | | | |

| | | Sector Weightings (as a % of Net Assets) | |

| | |

| | Industrials | | | 34.7 | % |

| | |

| | Communication Services | | | 17.8 | % |

| | |

| | Consumer Discretionary | | | 14.6 | % |

| | |

| | Consumer Staples | | | 7.9 | % |

| | |

| | Materials | | | 7.5 | % |

| | |

| | Utilities | | | 4.5 | % |

| | |

| | Health Care | | | 2.6 | % |

| | |

| | Financials | | | 2.5 | % |

| | |

| | Information Technology | | | 1.9 | % |

| | |

| | Energy | | | 0.9 | % |

| | |

| | Other | | | 0.6 | % |

| | |

| | Short-Term Investments | | | 5.2 | % |

| | |

| | Cash and Other Assets Less Liabilities | | | (0.7 | )% |

| | | | | | |

| | | Top Ten Holdings (as a % of Net Assets) | |

| | |

| | JPMorgan Prime Money Market Fund, IM Shares | | | 4.4 | % |

| | |

| | Mueller Industries, Inc. | | | 2.8 | % |

| | |

| | Herc Holdings, Inc. | | | 2.4 | % |

| | |

| | Scotts Miracle-Gro Co. (The) | | | 2.3 | % |

| | |

| | Modine Manufacturing Co. | | | 2.0 | % |

| | |

| | Madison Square Garden Sports Corp. | | | 1.9 | % |

| | |

| | Crane Co. | | | 1.8 | % |

| | |

| | Sinclair, Inc. | | | 1.8 | % |

| | |

| | Spectrum Brands Holdings, Inc. | | | 1.7 | % |

| | |

| | Paramount Global, Class A | | | 1.7 | % |

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call 0416, or scan the adjacent QR code. | |  | | |

3

1290 HIGH YIELD BOND FUND CLASS A (TNHAX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 High Yield Bond Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class A | | $108 | | 1.00% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares returned 15.90% (without sales charge) for the year ended October 31, 2024, performing similarly to the ICE BofA U.S. High Yield Index, which returned 16.55% over the same period.

What helped performance during the year?

•

Security selection in the highest yielding segment (lowest quality) of the market was a key positive contributor to the Fund’s relative performance.

•

Looking at performance by sector, security selection in the Telecommunications space was the top contributor to the Fund’s relative performance.

•

On an individual security basis, Mauser Packaging’s 9.25% note due 2027 was the top contributor to the Fund’s performance.

What hurt performance during the year?

•

From a macroeconomic risk-positioning perspective, a key detractor from the Fund’s relative performance was an underweight exposure to the highest-yielding (lowest-quality) segment of the market.

•

Looking at performance by sector, security selection in the Healthcare space was the top detractor from the Fund’s relative performance.

•

On an individual security basis, ARD Finance SA’s 6.5% note due 2027 was the top detractor from the Fund’s performance.

Asset Class/Sector Overview

The U.S. high-yield bond market has delivered solidly positive returns in 2024, due to moderating inflation data and the start of the Federal Reserve’s rate-cutting cycle. The default rate of the high-yield bond market remains below its long- term average as corporate earnings have held up well. Additionally, most companies have had little difficulty accessing the high-yield market as the supply/demand technical picture continues to be positive for issuers.

1

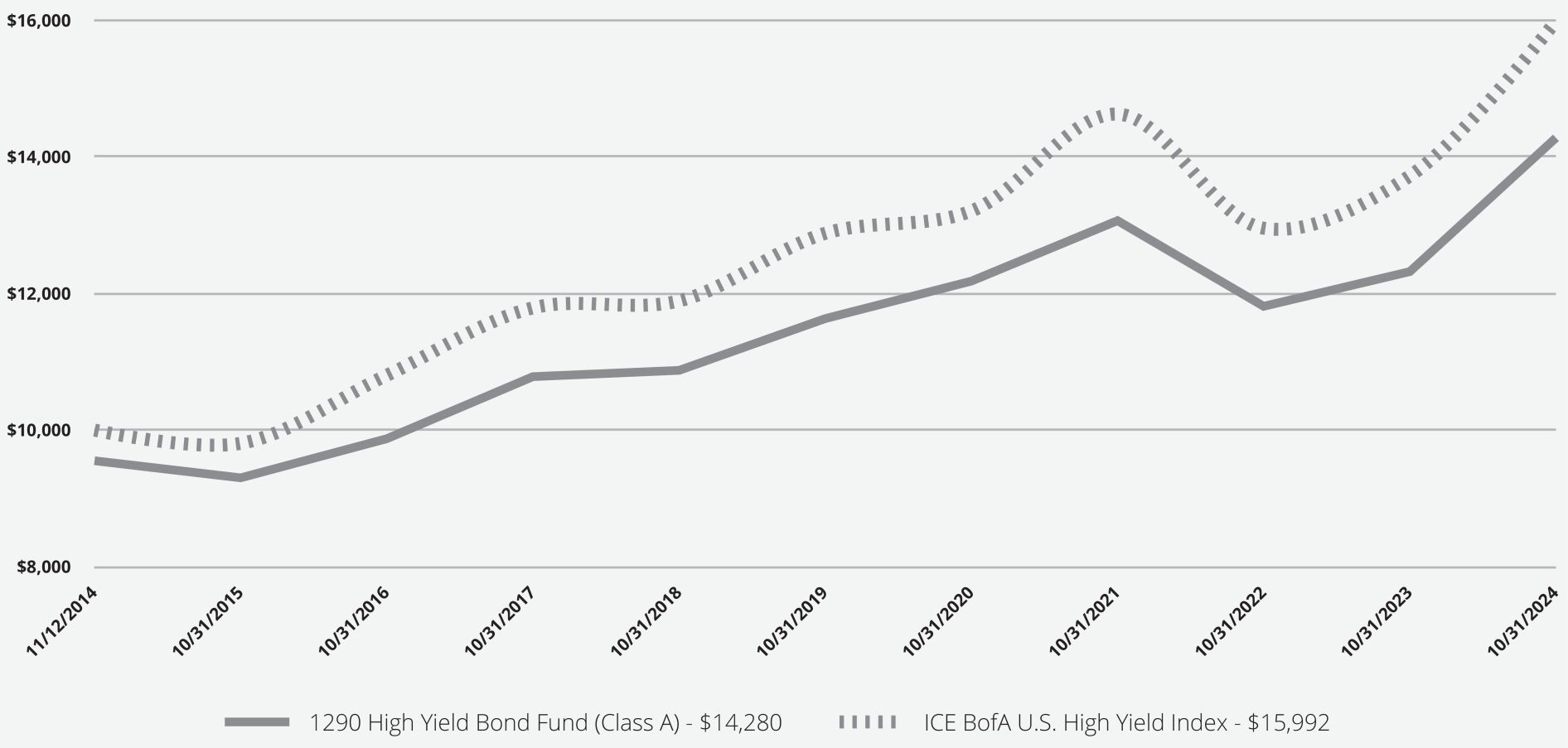

1290 HIGH YIELD BOND FUND CLASS A (TNHAX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund (reflecting the maximum applicable Class A sales charge) would have performed since inception, and how the ICE BofA U.S. High Yield Index performed over the same period. This graph includes the deduction of the maximum sales charge, if any.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of October 31, 2024 | | | | | | | | |

| 1290 High Yield Bond Fund (Class A) | | | | | | | | | | | | | | | | | | | | |

| without Sales Charge | | | | 15.90% | | | | | 4.19% | | | | | 4.12% | | | | | | |

| with Sales Charge | | | | 10.66% | | | | | 3.22% | | | | | 3.64% | | | | | | |

| ICE BofA U.S. High Yield Index | | | | 16.55% | | | | | 4.42% | | | | | 4.82% | | | | | | |

| | * | Date of inception: November 12, 2014 |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 74,442,835 | | | | | |

| Total number of portfolio holdings | | | 291 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $115,975 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 35% | | | | | |

2

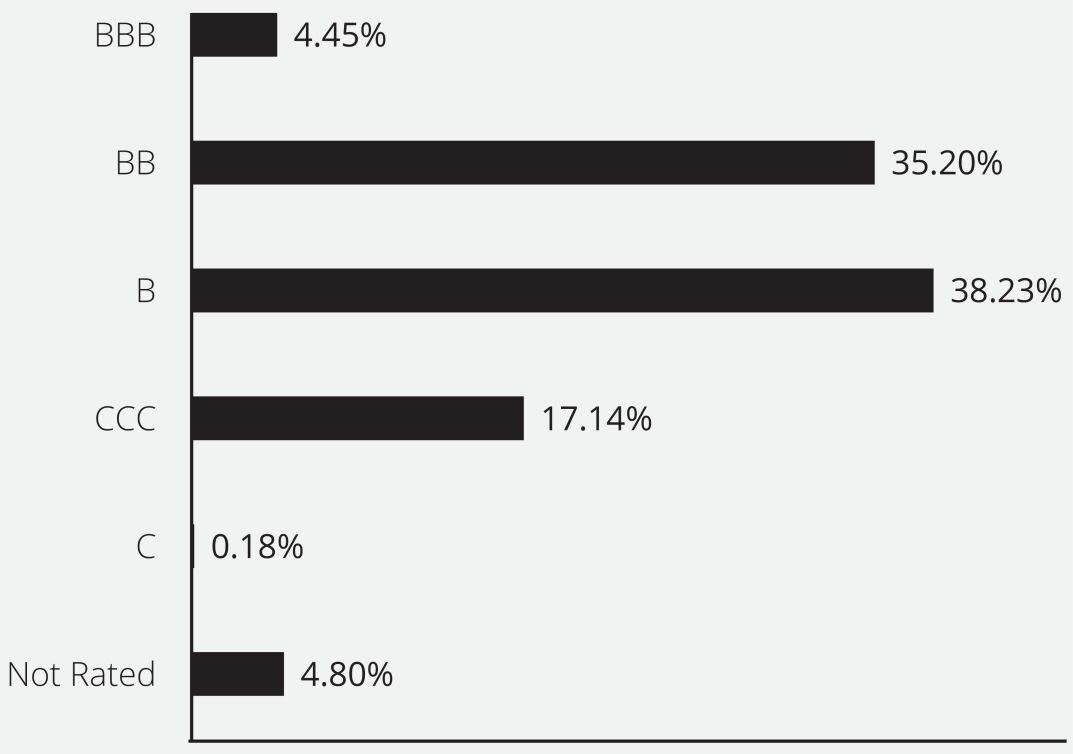

1290 HIGH YIELD BOND FUND CLASS A (TNHAX)

What did the Fund invest in?

(as of October 31, 2024)

Credit Quality Ratings (as a % of Net Assets)

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 HIGH YIELD BOND FUND CLASS I (TNHIX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 High Yield Bond Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class I | | $81 | | 0.75% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class I shares returned 16.17% for the year ended October 31, 2024, performing similarly to the ICE BofA U.S. High Yield Index, which returned 16.55% over the same period.

What helped performance during the year?

•

Security selection in the highest yielding segment (lowest quality) of the market was a key positive contributor to the Fund’s relative performance.

•

Looking at performance by sector, security selection in the Telecommunications space was the top contributor to the Fund’s relative performance.

•

On an individual security basis, Mauser Packaging’s 9.25% note due 2027 was the top contributor to the Fund’s performance.

What hurt performance during the year?

•

From a macroeconomic risk-positioning perspective, a key detractor from the Fund’s relative performance was an underweight exposure to the highest-yielding (lowest-quality) segment of the market.

•

Looking at performance by sector, security selection in the Healthcare space was the top detractor from the Fund’s relative performance.

•

On an individual security basis, ARD Finance SA’s 6.5% note due 2027 was the top detractor from the Fund’s performance.

Asset Class/Sector Overview

The U.S. high-yield bond market has delivered solidly positive returns in 2024, due to moderating inflation data and the start of the Federal Reserve’s rate-cutting cycle. The default rate of the high-yield bond market remains below its long- term average as corporate earnings have held up well. Additionally, most companies have had little difficulty accessing the high-yield market as the supply/demand technical picture continues to be positive for issuers.

1

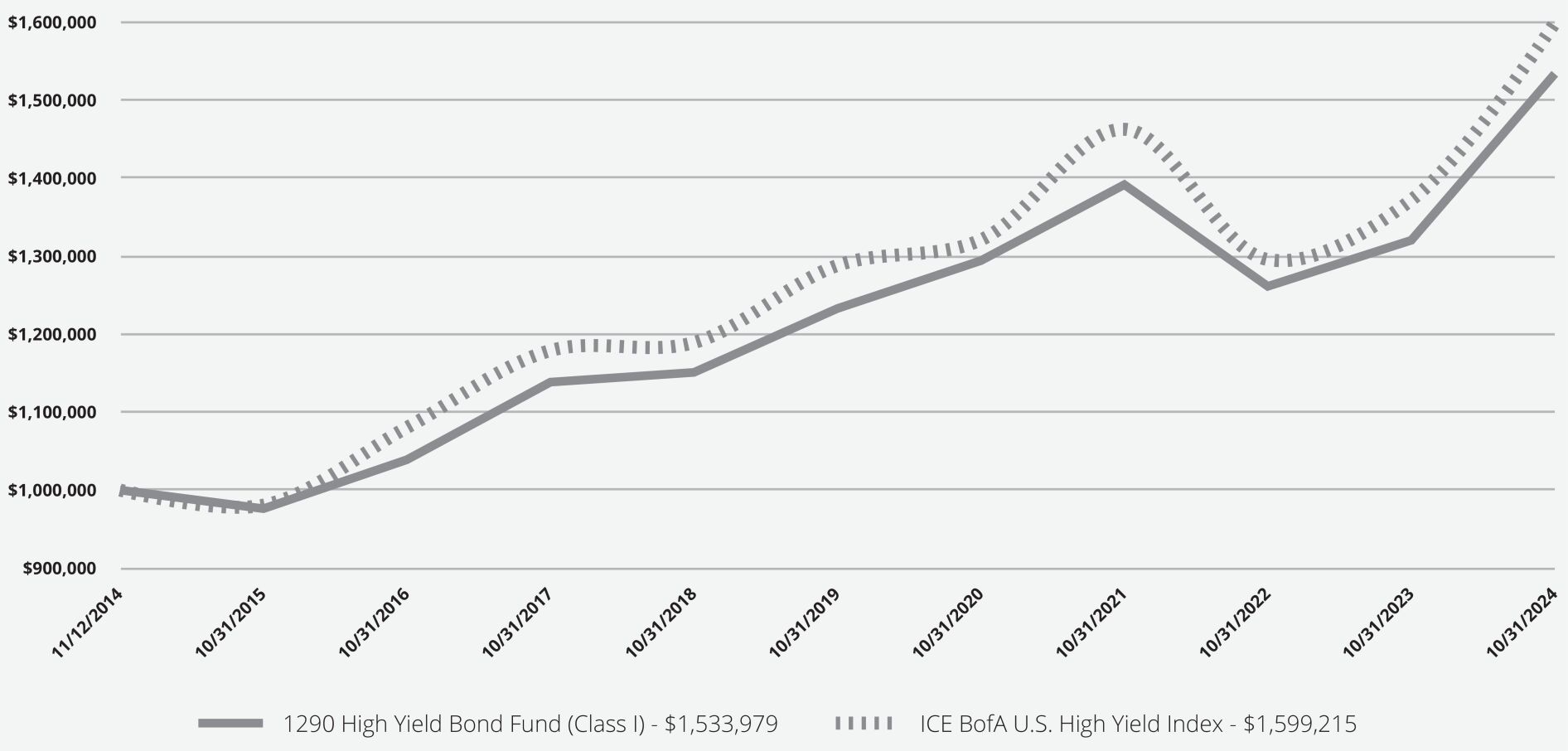

1290 HIGH YIELD BOND FUND CLASS I (TNHIX)

How did the Fund perform since inception?

The graph below shows how a hypothetical $1,000,000 investment in the Fund would have performed since inception, and how the ICE BofA U.S. High Yield Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

| 1290 High Yield Bond Fund (Class I) | | | | 16.17% | | | | | 4.47% | | | | | 4.39% | | | | | | |

| ICE BofA U.S. High Yield Index | | | | 16.55% | | | | | 4.42% | | | | | 4.82% | | | | | | |

| | * | Date of inception: November 12, 2014 |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 74,442,835 | | | | | |

| Total number of portfolio holdings | | | 291 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $115,975 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 35% | | | | | |

2

1290 HIGH YIELD BOND FUND CLASS I (TNHIX)

What did the Fund invest in?

(as of October 31, 2024)

Credit Quality Ratings (as a % of Net Assets)

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 HIGH YIELD BOND FUND CLASS R (TNHRX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 High Yield Bond Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class R | | $135 | | 1.25% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class R shares returned 15.61% for the year ended October 31, 2024, performing similarly to the ICE BofA U.S. High Yield Index, which returned 16.55% over the same period.

What helped performance during the year?

•

Security selection in the highest yielding segment (lowest quality) of the market was a key positive contributor to the Fund’s relative performance.

•

Looking at performance by sector, security selection in the Telecommunications space was the top contributor to the Fund’s relative performance.

•

On an individual security basis, Mauser Packaging’s 9.25% note due 2027 was the top contributor to the Fund’s performance.

What hurt performance during the year?

•

From a macroeconomic risk-positioning perspective, a key detractor from the Fund’s relative performance was an underweight exposure to the highest-yielding (lowest-quality) segment of the market.

•

Looking at performance by sector, security selection in the Healthcare space was the top detractor from the Fund’s relative performance.

•

On an individual security basis, ARD Finance SA’s 6.5% note due 2027 was the top detractor from the Fund’s performance.

Asset Class/Sector Overview

The U.S. high-yield bond market has delivered solidly positive returns in 2024, due to moderating inflation data and the start of the Federal Reserve’s rate-cutting cycle. The default rate of the high-yield bond market remains below its long- term average as corporate earnings have held up well. Additionally, most companies have had little difficulty accessing the high-yield market as the supply/demand technical picture continues to be positive for issuers.

1

1290 HIGH YIELD BOND FUND CLASS R (TNHRX)

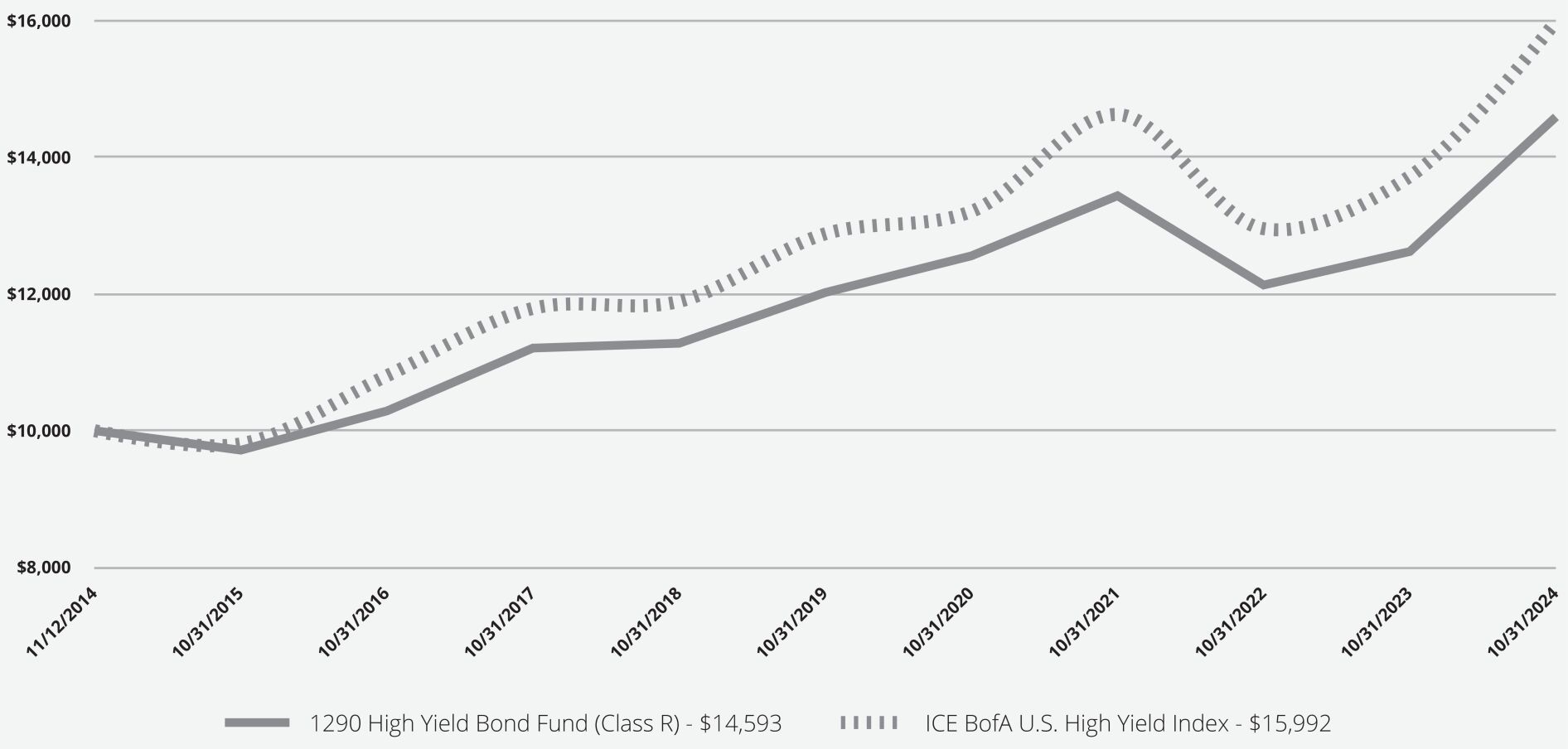

How did the Fund perform since inception?

The graph below shows how a hypothetical $10,000 investment in the Fund would have performed since inception, and how the ICE BofA U.S. High Yield Index performed over the same period.

| | | | | | | | | | | | | | | | | | | | |

Average Annual Total Returns as of 10/31/24 | | | | | | | | |

| 1290 High Yield Bond Fund (Class R) | | | | 15.61% | | | | | 3.95% | | | | | 3.86% | | | | | | |

| ICE BofA U.S. High Yield Index | | | | 16.55% | | | | | 4.42% | | | | | 4.82% | | | | | | |

| | * | Date of inception: November 12, 2014 |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit https://www.1290funds.com/resources/#shareholderReports for most recent performance information.

| | | | | | | | |

| | | | | | | | |

| (as of October 31, 2024) | | | | | | | | |

| Net Assets | | $ | 74,442,835 | | | | | |

| Total number of portfolio holdings | | | 291 | | | | | |

| Total Investment advisory fees (net of waiver) | | | $115,975 | | | | | |

| Portfolio turnover rate (for the year ended October 31, 2024) | | | 35% | | | | | |

2

1290 HIGH YIELD BOND FUND CLASS R (TNHRX)

What did the Fu

n

d invest in?

(as of October 31, 2024)

Credit Quality Ratings (as a % of Net Assets)

| | | | |

| | | | |

For additional information about the Fund, including its prospectus, financial statements, portfolio holdings, and proxy voting information, visit https://www.1290funds.com/resources/#shareholderReports, call or scan the adjacent QR code. | |  | | |

3

1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND CLASS A (TNXAX)

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about the 1290 Loomis Sayles Multi-Asset Income Fund (the “Fund”) for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.1290funds.com/resources/#shareholderReports. You can also request this information by contacting us at

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| | | | | | |

| Share Class | | Costs of a $10,000 investment | | Costs paid as a percentage of a $10,000 investment | | |

| Class A | | $113 | | 1.05% | | |

How did the Fund perform last year and what affected its performance?

The Fund’s Class A shares returned 16.13% (without sales charge) for the year ended October 31, 2024, outperforming the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% over the same period.

What helped performance during the year?

•

The Fund delivered positive relative performance led by equities, with BuyWrite strategies (covered calls on equities) and investment-grade corporate bond investments also contributing.

•

Issuer selection was strong throughout BuyWrite and investment-grade corporates with a bias toward banking and technology names.

What hurt performance during the year?

•

Relative to the Multi-Asset Income Index the Fund’s underweight allocation to high-yield corporates detracted on an overall basis, with issuer selection marginally bolstering the detraction.

•

Relative to the Multi-Asset Income Index the Funds’s underweight allocation to investment-grade corporates similarly detracted, but the effect was offset by selection.

1

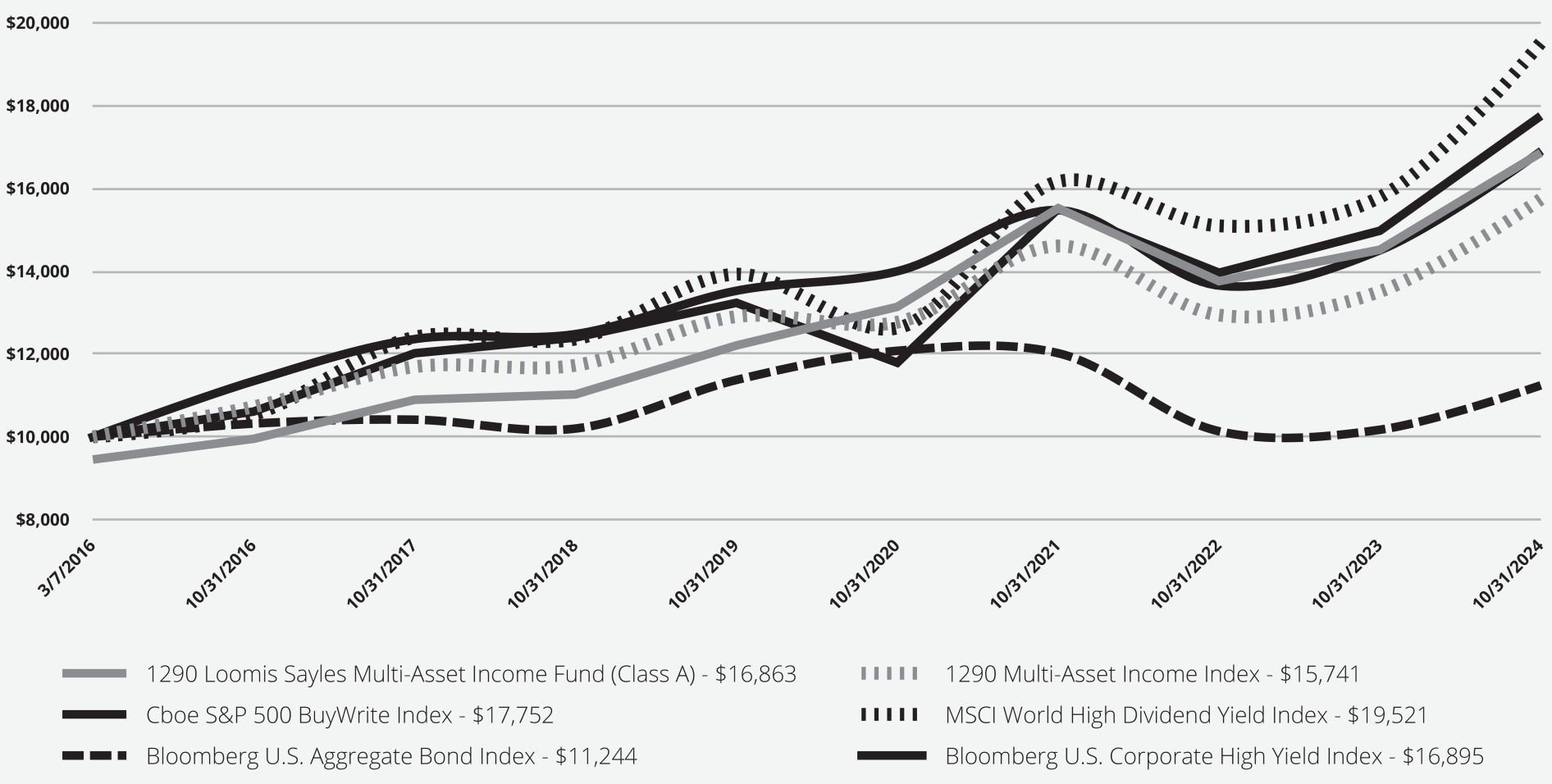

1290 LOOMIS SAYLES MULTI-ASSET INCOME FUND CLASS A (TNXAX)

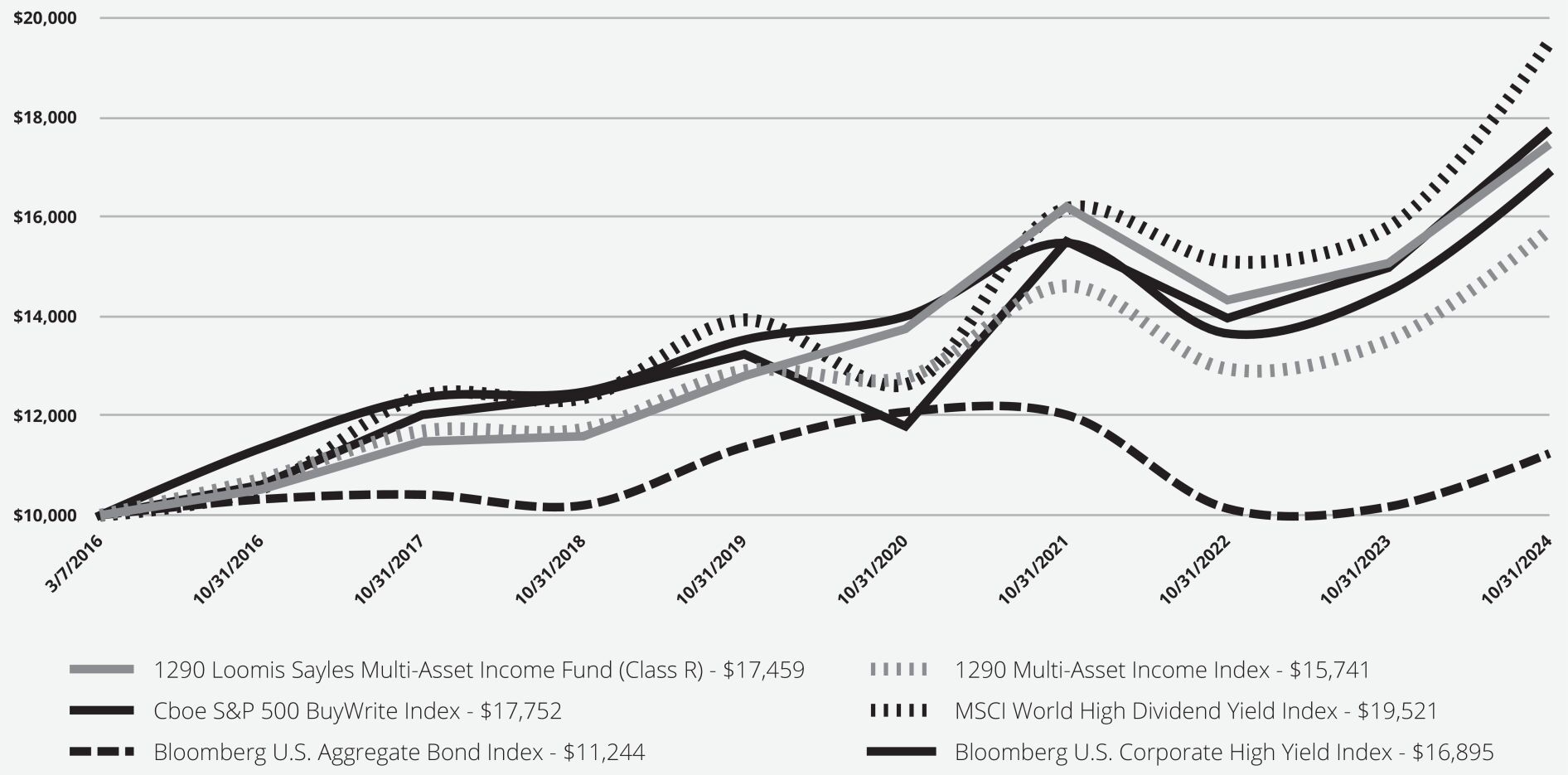

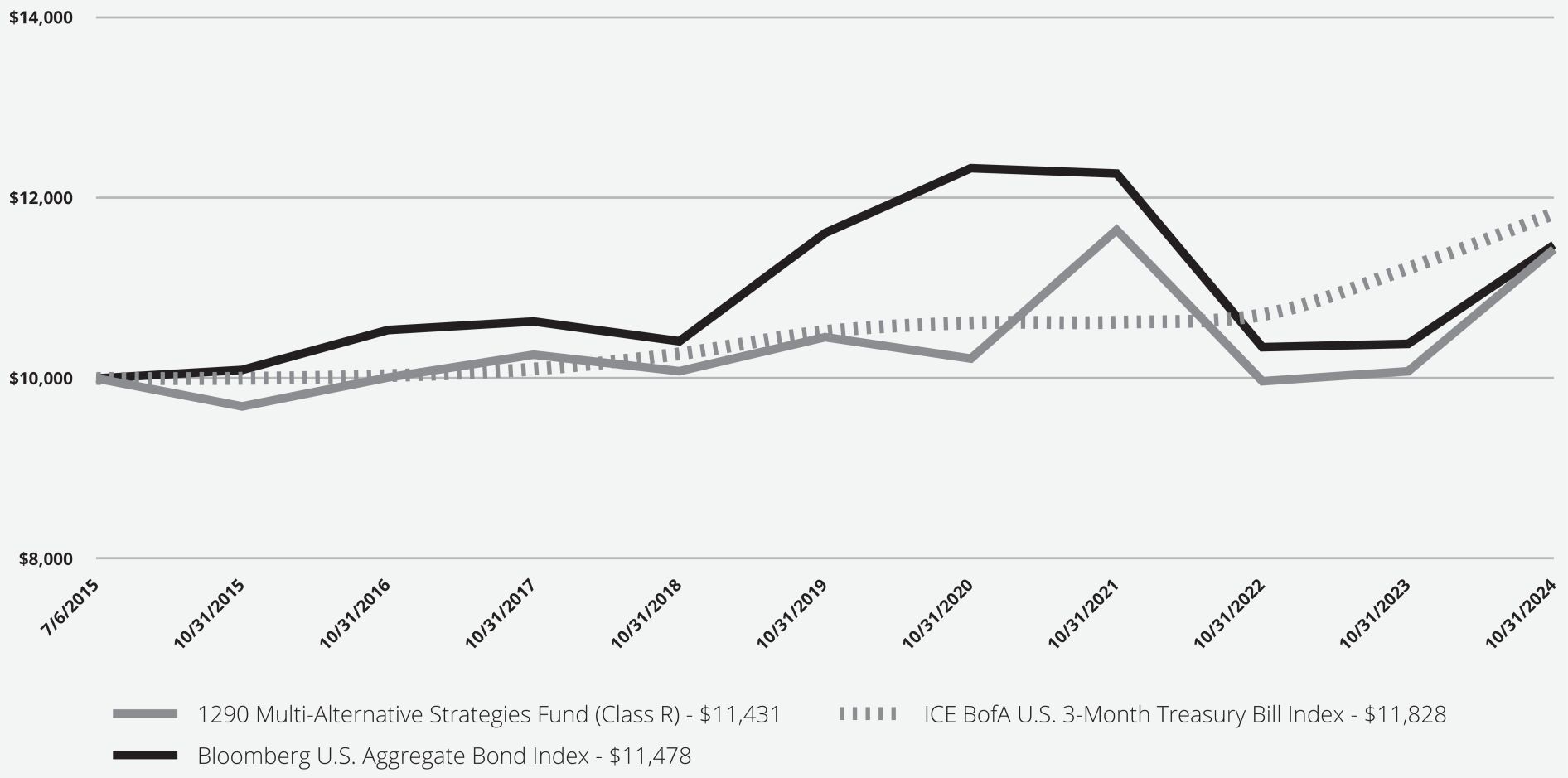

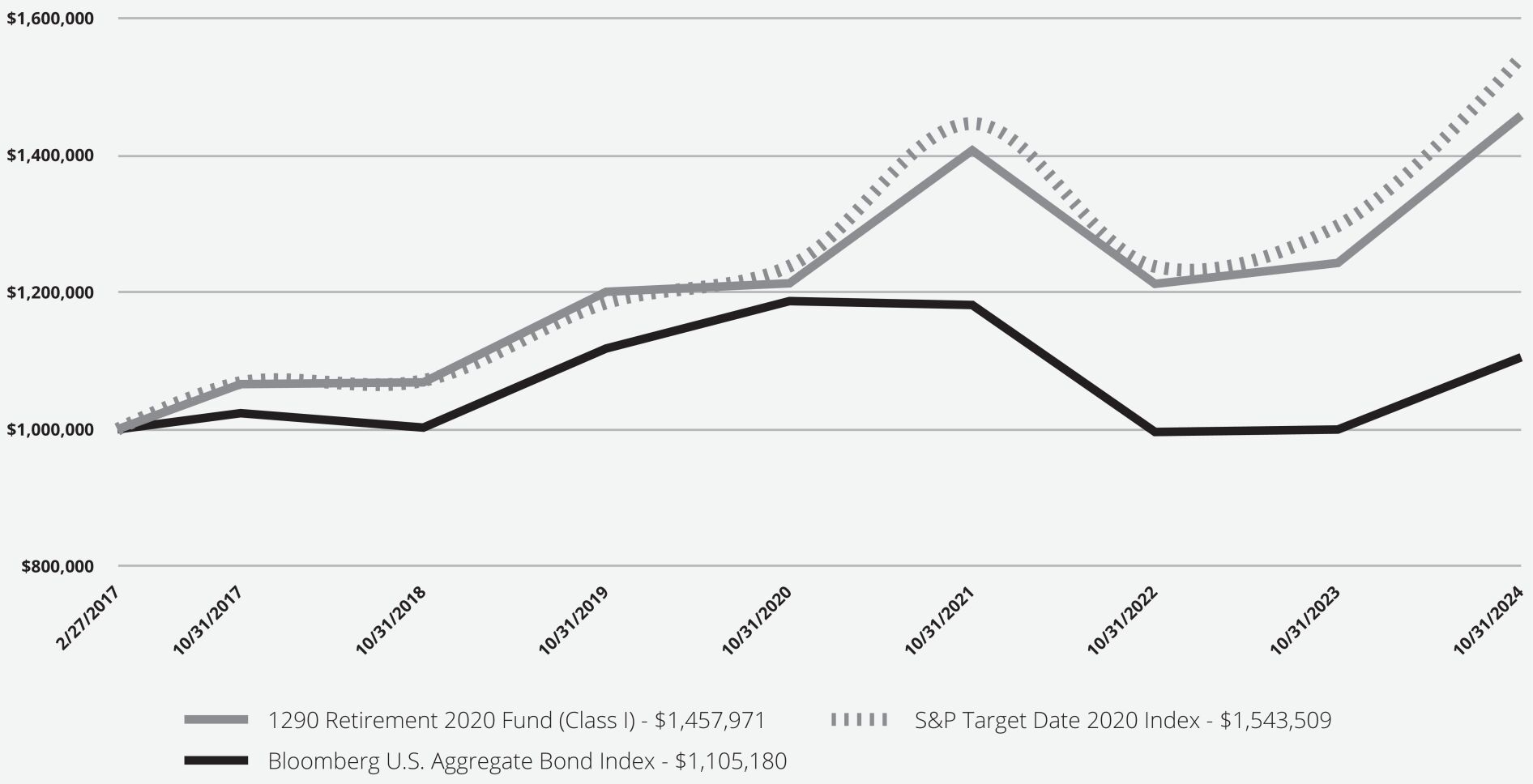

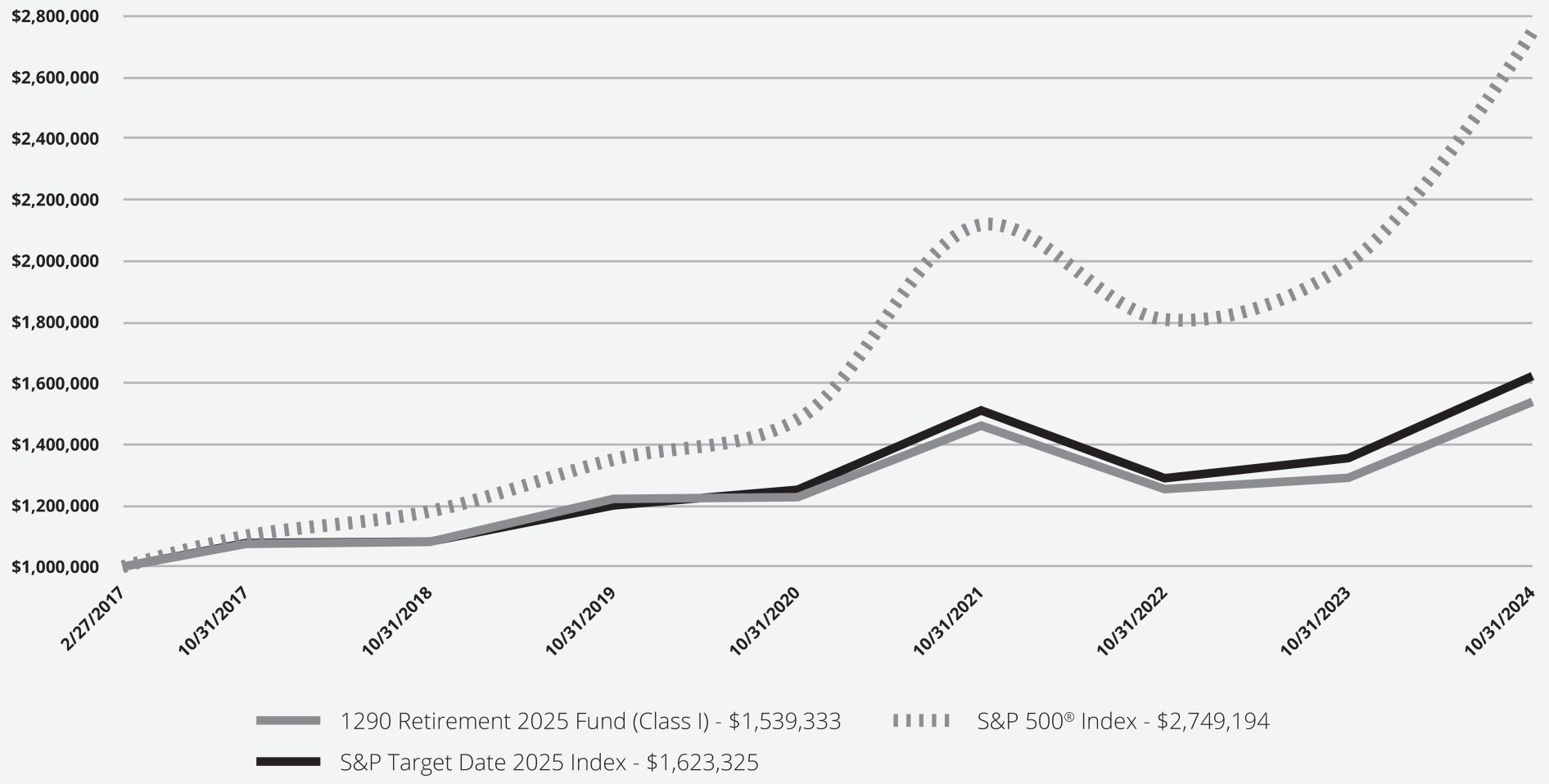

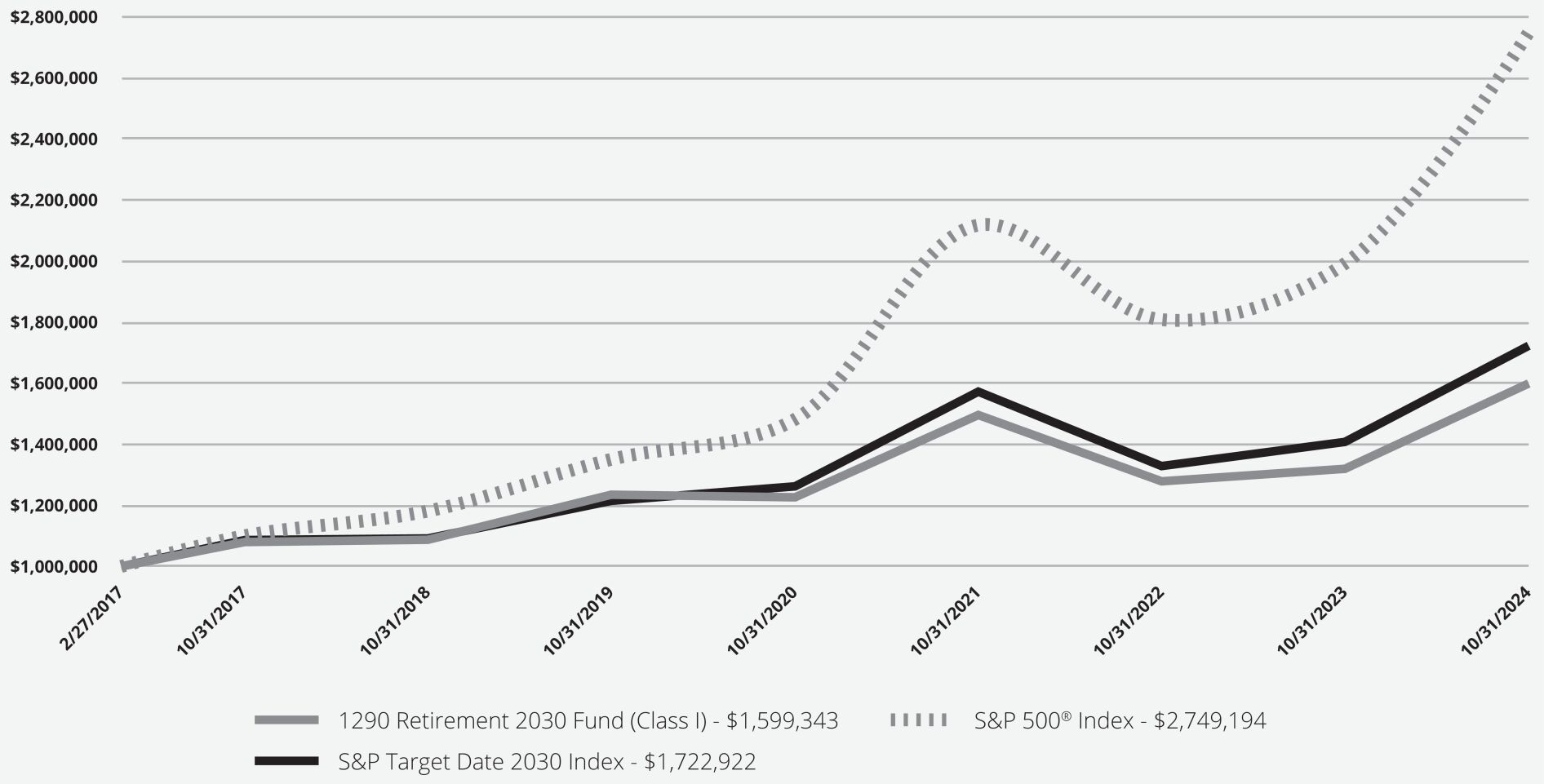

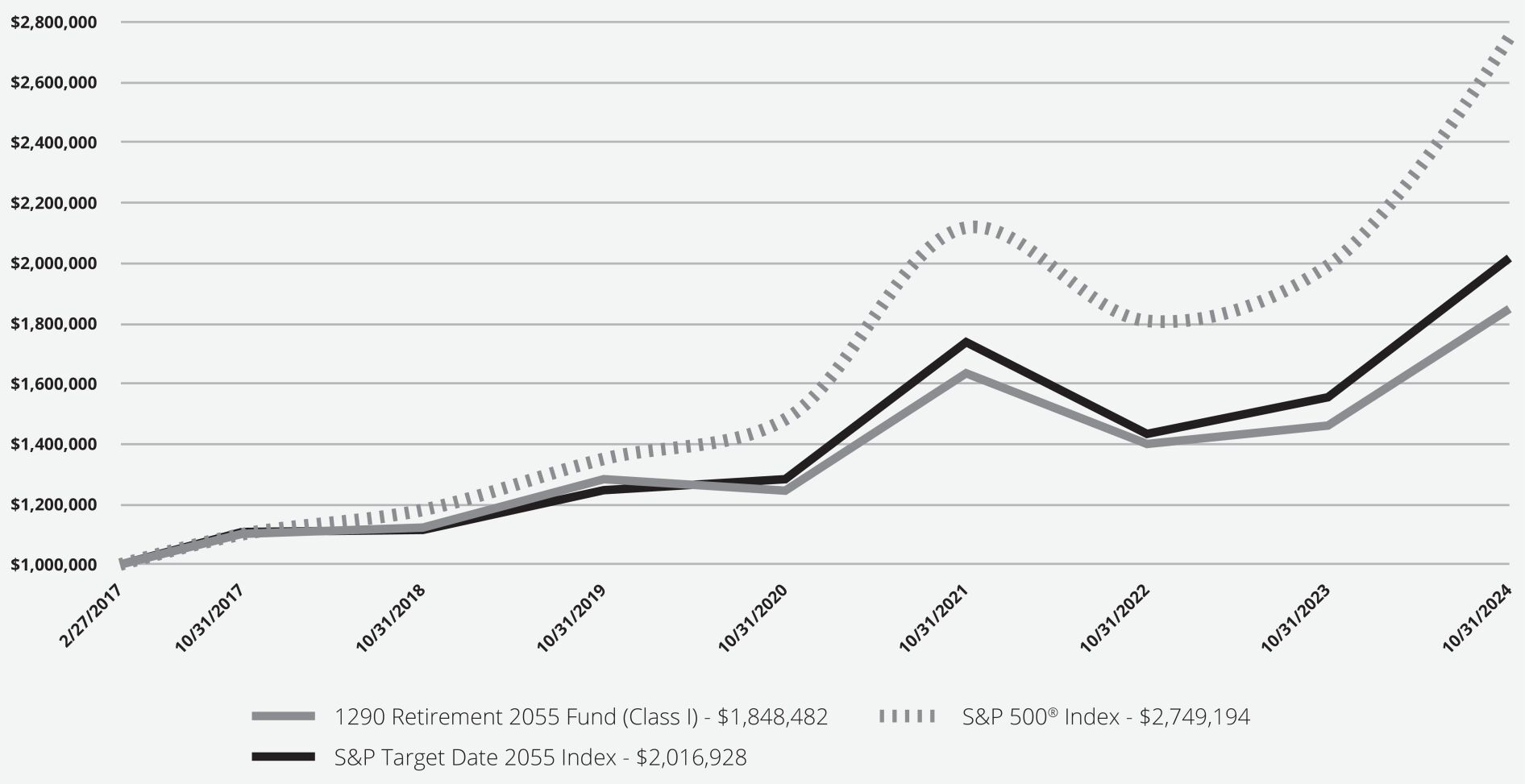

How did the Fund perform since inception?