Exhibit 1

As of March 2015 Macrocure Ltd. NASDAQ: MCUR Corporate Presentation

Safe harbor statement This presentation contains forward - looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, Section 21E of the U.S. Securities and Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Any and all statements concerning our business and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition. These forward - looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward - looking statements. In some cases, you can identify forward - looking statements by terms including ‘‘anticipates,’’ ‘‘believes,’’ ‘‘could,’’ ‘‘estimates,’’ ‘‘expects,’’ ‘‘intends,’’ ‘‘may,’’ ‘‘plans,’’ ‘‘potential,’’ ‘‘predicts,’’ ‘‘projects,’’ ‘‘should,’’ ‘‘will,’’ ‘‘ would,’’ and similar expressions intended to identify forward - looking statements. Forward - looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should not unduly rely on any forward - looking statements. Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward - looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward - looking statements for any reason after the date of this presentation, to conform these statements to actual results or to changes in our expectations. These forward - looking statements speak only as of the date of this presentation, and we assume no obligation to update or revise these forward - looking statements for any reason . The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company or this proposed offering .

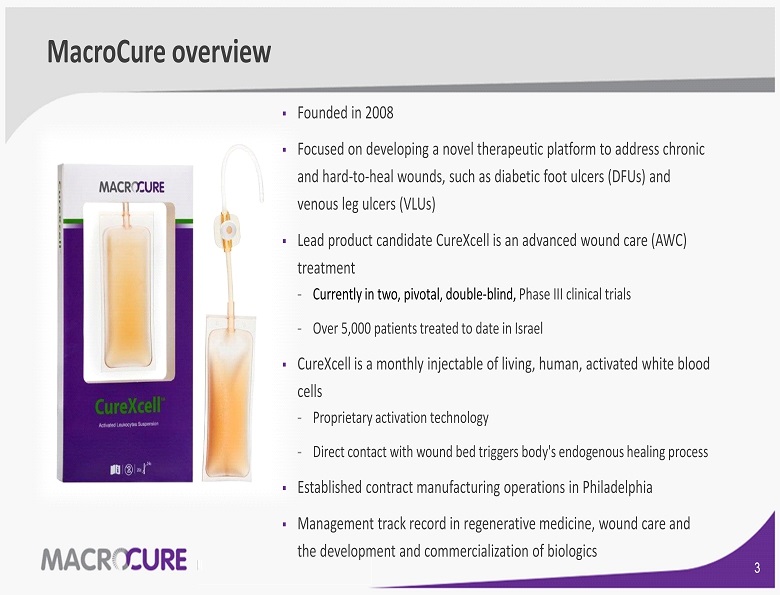

MacroCure overview ▪ Founded in 2008 ▪ Focused on developing a novel therapeutic platform to address chronic and hard - to - heal wounds, such as diabetic foot ulcers (DFUs) and venous leg ulcers (VLUs) ▪ Lead product candidate CureXcell is an advanced wound care (AWC) treatment - Currently in two, pivotal, double - blind, Phase III clinical trials - Over 5,000 patients treated to date in Israel ▪ CureXcell is a monthly injectable of living, human, activated white blood cells - Proprietary activation technology - Direct contact with wound bed triggers body's endogenous healing process ▪ Established contract manufacturing operations in Philadelphia ▪ Management track record in regenerative medicine, wound care and the development and commercialization of biologics

Investment highlights ~$5.3 billion advanced wound care market worldwide − ~ 800K (DFU) and ~1,300K (VLU) new patients each year (US, EU5, Japan ) − ~$25 billion burden on the US healthcare system Differentiated product with novel treatment mechanism and delivery method - CureXcell is in two pivotal, double - blind, US Phase 3 clinical studies Attractive value proposition - 5,000 + patients treated in Israel - Demonstrated safety and efficacy in clinical trials - Well positioned for current reimbursement environment Substantial proprietary technology, trade secrets and know - how - Significant barriers to entry - Issued patents valid until 2030 Multiple near - term milestones - VLU Futility Analysis in 3 Q 2015 - DFU Phase 3 data in October 2015 - VLU Phase 3 data in 1 H 2015 - Anticipated BLA filing in late 2016 Management team experienced in developing and commercializing biologics

Step 1 . Hypo - osmotic shock: A precisely timed event that enables the activation of WBC’s to allow for the production of cytokines and growth factors Our proprietary activation p rocess i nvolves two k ey s teps: 5 The rapid movement of water across the cell membrane results in the opening of ion channels. Step 2 . Incubation Period: Allows for the consistent and stable concentration of cytokines and growth factor production necessary for wound healing and tissue regeneration

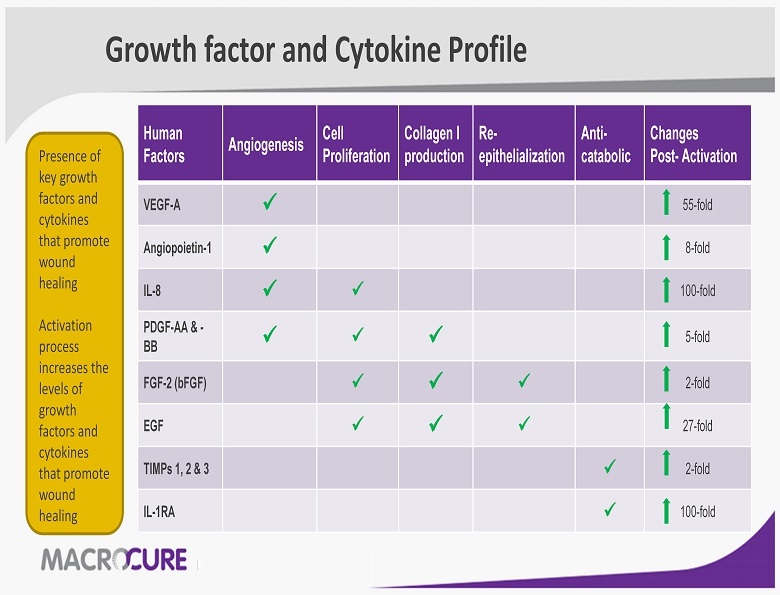

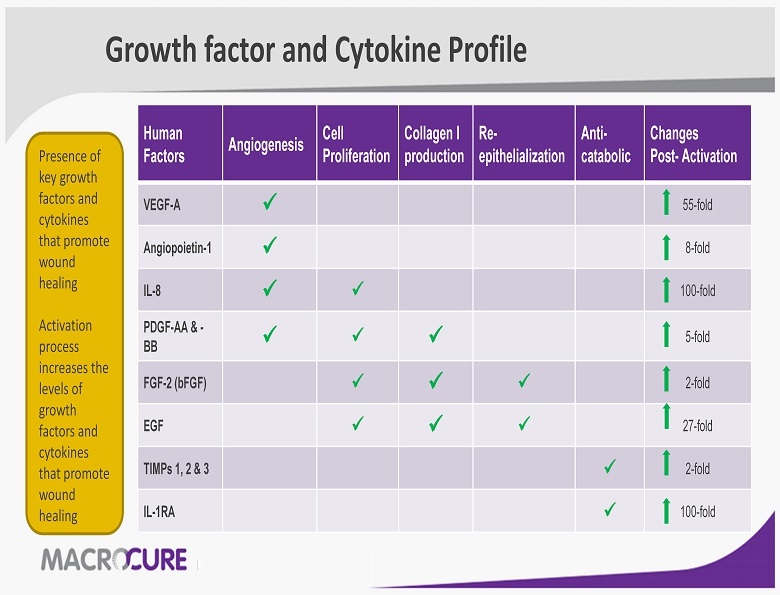

Growth factor and Cytokine Profile Human Factors Angiogenesis Cell Proliferation Collagen I production Re - epithelialization Anti - catabolic Changes Post - Activation VEGF - A x 55 - fold Angiopoietin - 1 x 8 - fold IL - 8 x x 100 - fold PDGF - AA & - BB x x x 5 - fold FGF - 2 (bFGF) x x x 2 - fold EGF x x x 27 - fold TIMPs 1, 2 & 3 x 2 - fold IL - 1RA x 100 - fold Presence of key growth factors and cytokines that promote wound healing Activation process increases the levels of growth factors and cytokines that promote wound healing

7 CureXcell addresses common challenges with many currently available products Complex and challenging product preparation and application Ready - to - use application Easy and quick to administer L imited by topical application and come in contact with contaminated environment Administered directly into wound bed to avoid contaminated environment and comes in direct contact with disturbed microenvironment M ultiple , cumbersome treatments Once a month injection enhances patient compliance and reduces number of patient visits H igh cost to overall healthcare system Average per patient treatment cost ~$ 10 K Lower overall burden on the healthcare system Estimated per patient treatment cost ~$6K Challenge for existing products CureXcell advantages

MC - 103 – strong clinical data 68.4% 81.4 % 68.5 % Diabetic Foot Ulcers Venous Leg Ulcers All mITT Patients N = 58 N = 44 N = 131 MC - 103 achieved high closure rates in hard - to - heal DFU and VLU patients Percent of Patients with Complete Wound Closure at Week 24 by Wound Type (1) ( 1 ) 70.9 % of patients had complete wound closure at study completion ( 2 ) mITT represents the modified intent - to - treat cohort ( 2 ) Included : 1) hard - to - heal ulcers with infection 2) reduced blood flow 3) history of amputation

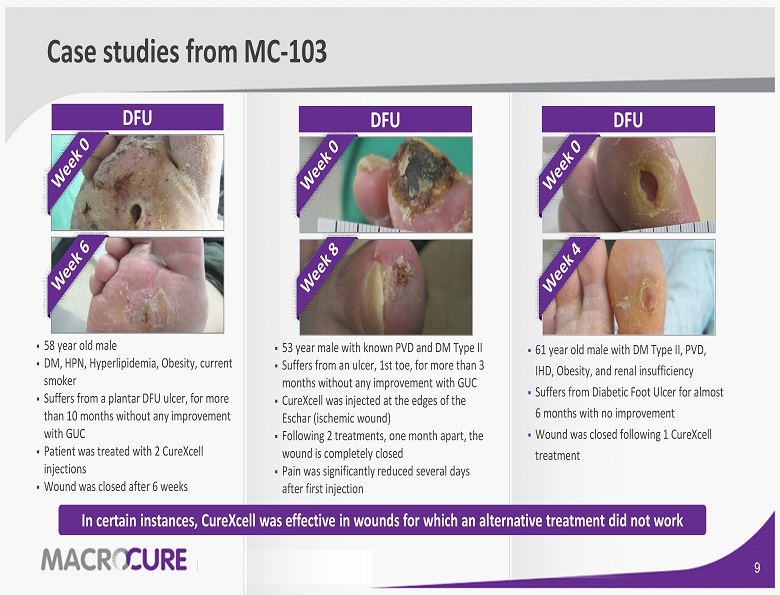

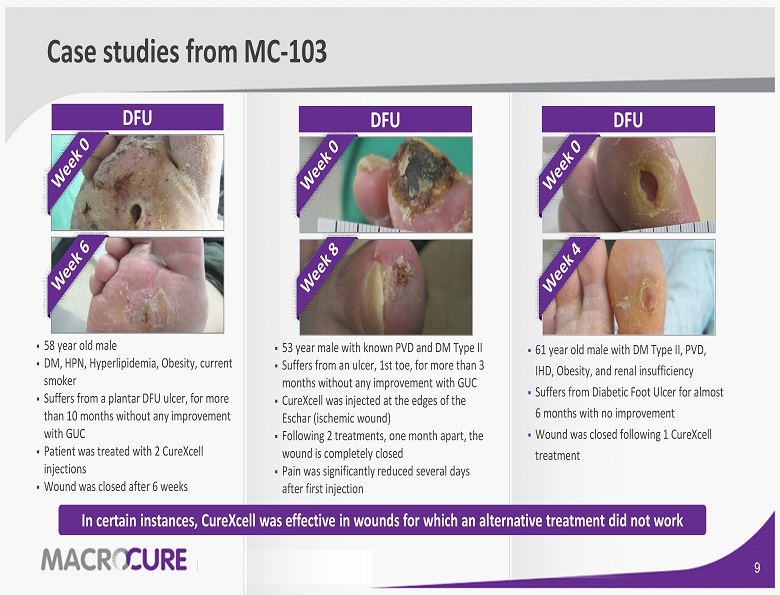

Case studies from MC - 103 ▪ 58 year old male ▪ DM , HPN, Hyperlipidemia, Obesity, current smoker ▪ Suffers from a plantar DFU ulcer, for more than 10 months without any improvement with GUC ▪ Patient was treated with 2 CureXcell injections ▪ Wound was closed after 6 weeks ▪ 53 year male with known PVD and DM Type II ▪ Suffers from an ulcer, 1st toe, for more than 3 months without any improvement with GUC ▪ CureXcell was injected at the edges of the Eschar (ischemic wound) ▪ Following 2 treatments, one month apart, the wound is completely closed ▪ Pain was significantly reduced several days after first injection ▪ 61 year old male with DM Type II, PVD, IHD, Obesity, and renal insufficiency ▪ Suffers from Diabetic Foot Ulcer for almost 6 months with no improvement ▪ Wound was closed following 1 CureXcell treatment DFU DFU DFU In certain instances, CureXcell was effective in wounds for which an alternative treatment did not work

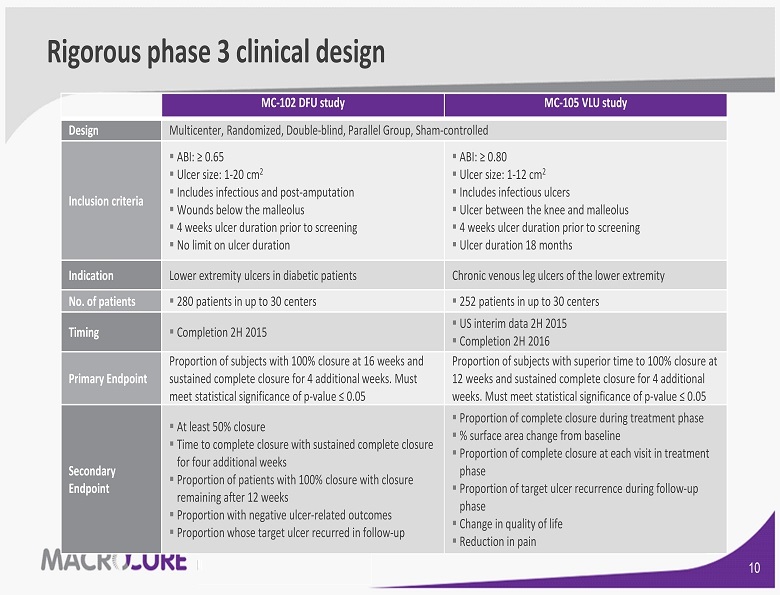

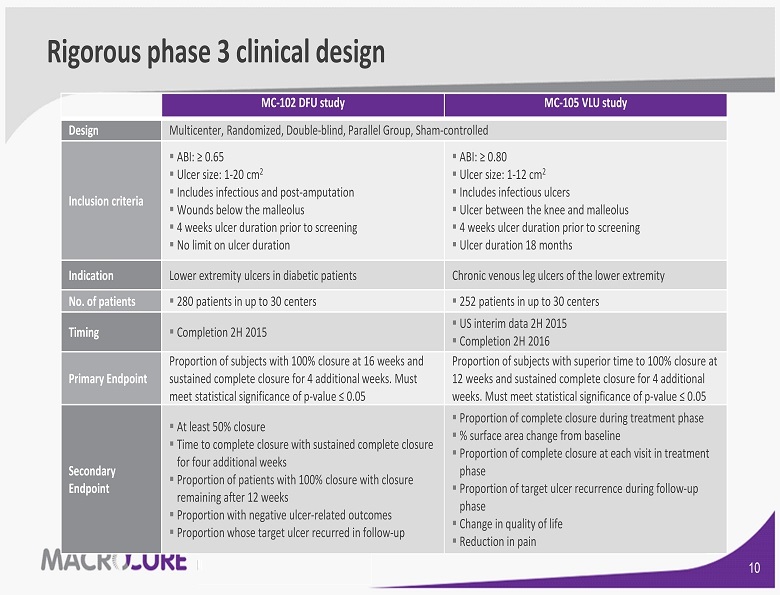

Rigorous phase 3 clinical design MC - 102 DFU study MC - 105 VLU study Design Multicenter, Randomized, Double - blind, Parallel Group, Sham - controlled Inclusion criteria ▪ ABI: ≥ 0.65 ▪ Ulcer size: 1 - 20 cm 2 ▪ Includes infectious and post - amputation ▪ Wounds below the malleolus ▪ 4 weeks ulcer duration prior to screening ▪ No limit on ulcer duration ▪ ABI: ≥ 0.80 ▪ Ulcer size: 1 - 12 cm 2 ▪ Includes infectious ulcers ▪ Ulcer between the knee and malleolus ▪ 4 weeks ulcer duration prior to screening ▪ Ulcer duration 18 months Indication Lower extremity ulcers in diabetic patients Chronic venous leg ulcers of the lower extremity No. of patients ▪ 280 patients in up to 30 centers ▪ 252 patients in up to 30 centers Timing ▪ Completion 2H 2015 ▪ US interim data 2H 2015 ▪ Completion 2H 2016 Primary Endpoint Proportion of subjects with 100% closure at 16 weeks and sustained complete closure for 4 additional weeks. Must meet statistical significance of p - value ≤ 0.05 Proportion of subjects with superior time to 100 % closure at 12 weeks and sustained complete closure for 4 additional weeks. Must meet statistical significance of p - value ≤ 0.05 Secondary Endpoint ▪ At least 50% closure ▪ Time to complete closure with sustained complete closure for four additional weeks ▪ Proportion of patients with 100% closure with closure remaining after 12 weeks ▪ Proportion with negative ulcer - related outcomes ▪ Proportion whose target ulcer recurred in follow - up ▪ Proportion of complete closure during treatment phase ▪ % surface area change from baseline ▪ Proportion of complete closure at each visit in treatment phase ▪ Proportion of target ulcer recurrence during follow - up phase ▪ Change in quality of life ▪ Reduction in pain

Activation Proprietary hypo - osmotic shock technology, alters gene expression/increases secretion of various growth and other biochemical factors Packaging Monthly injections Seven day shelf life Cell separation Centrifugation Collection Living white blood cells from fully - screened healthy volunteer blood donors Refined and validated production process 3 4 1 2 Plasma, white blood cell, red blood cell

Meeting the market demand Simple and efficient manufacturing process Use blood bank byproduct, which allows for cost - effective production and attractive margins Long term agreement with American Red Cross Secure raw materials Scalable infrastructure & low capital investment Establish multiple manufacturing facilities adjacent to blood banks to extend market reach

Regulatory strategy ▪ Comprehensive dossier for BLA regulatory review - Two independent Phase 3 randomized clinical trials - In - vitro and in - vivo mechanism of action studies - Long term safety study - Current FDA Phase 3 MC - 102 trial achieved highest possible recommendation by the Independent Data Safety Monitoring Board at each safety review cycle - 5 bi - annual DSMBs have been passed; most recently in June 2014 to review efficacy and safety ▪ Seeking broad label indication for DFU and VLU ▪ BLA submission targeted in late 2016

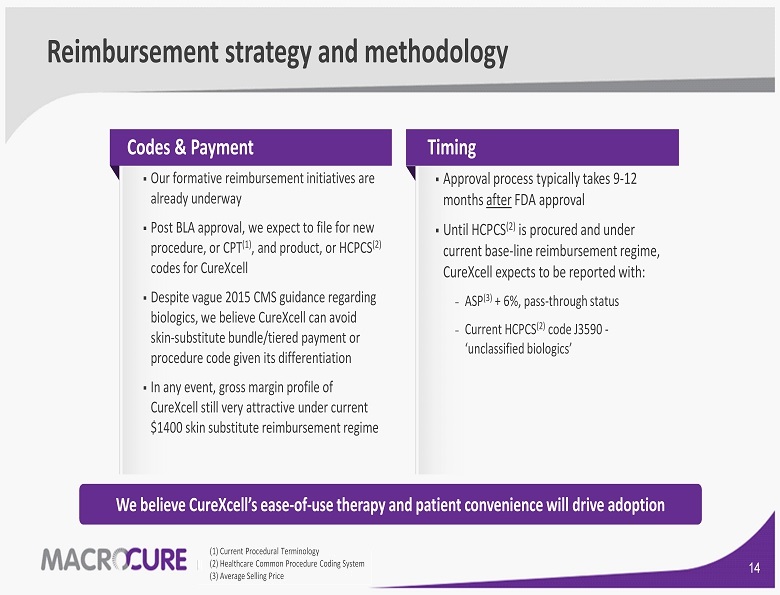

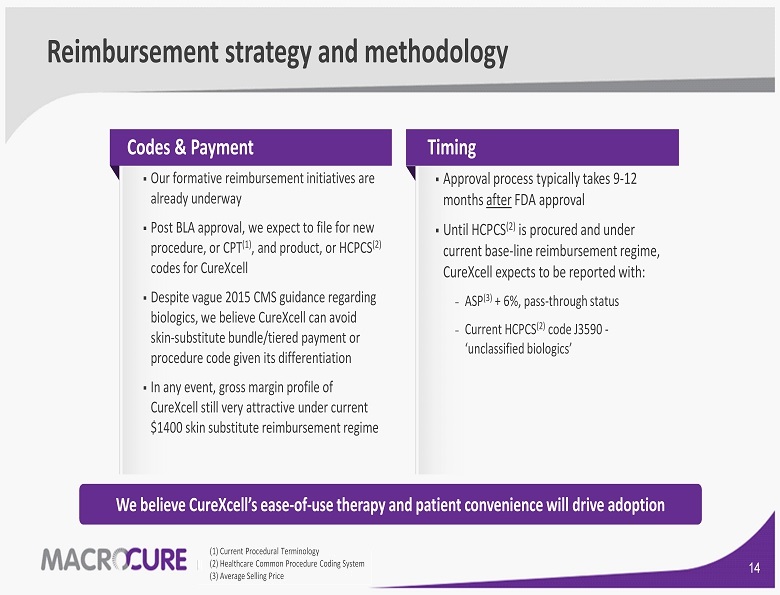

We believe CureXcell’s ease - of - use therapy and patient convenience will drive adoption Reimbursement strategy and methodology Codes & Payment ▪ Our formative reimbursement initiatives are already underway ▪ Post BLA approval, we expect to file for new procedure, or CPT ( 1 ) , and product , or HCPCS ( 2 ) codes for CureXcell ▪ Despite vague 2015 CMS guidance regarding biologics, we believe CureXcell can avoid skin - substitute bundle/tiered payment or procedure code given its differentiation ▪ In any event, gross margin profile of CureXcell still very attractive under current $ 1400 skin substitute reimbursement regime ▪ Approval process typically takes 9 - 12 months after FDA approval ▪ Until HCPCS ( 2 ) is procured and under current base - line reimbursement regime, CureXcell expects to be reported with: − ASP ( 3 ) + 6 %, pass - through status − Current HCPCS ( 2 ) code J 3590 - ‘unclassified biologics’ Timing ( 1 ) Current Procedural Terminology ( 2 ) Healthcare Common Procedure Coding System ( 3 ) Average Selling Price

Broadening CureXcell’s potential market applications Aesthetics Regenerative Medicine Reconstruction CureXcell Potential Platform Technology Reprogrammed Cells : - Repair cells & damaged tissue - Growth factors - Shift to proliferation - Tissue - specific cell combinations Orthopedics

Expected corporate milestones Q 1 : Start Mechanism of Action study Q 2 : Start Phase 3 study for VLU Q 2 : Passed most recent DSMB Q 3 : Completed enrollment in DFU study Q 4 : Mechanism of Action study completion 2014 1 H: MOA results & analyst day (Feb. 12 th in NYC) 3 Q: Phase 3 futility analysis for VLU October: Phase 3 data readout for DFU 2015 1 H: Phase 3 data readout for VLU 2H: Submit BLA to the FDA 2016 A pproval of US BLA 2017

Financial snapshot Q 4 / 20 14 Unaudited Dec 31 , 2014 Audited ($ in millions) 5.7 15.5 Research and Develop, net 1.9 5.4 General and Administrative 7.6 20.9 Operating loss . 05 4.5 Finance, Tax (Income) expenses 7.6 25.5 Net loss Balance Sheet ▪ NASDAQ: MCUR ▪ Stock price: $ 9.61 (as of 03 / 23 / 15 ) ▪ Basic shares o utstanding: 16.7 M; 1.3 M penny warrants; 1.8 M options ▪ Total Cash Position: $ 47.4 M (as of 12 / 31 / 14 ); No debt ▪ Research coverage : Credit Suisse, Jefferies, Oppenheimer, Nomura Income Statement Dec 31 , 2014 Audited ($ in millions) 10.9 Cash and cash equivalents 35.3 Short term deposits 1.2 Long - term deposits 48.7 Total assets 2.5 Total current liabilities 46.2 Total shareholder’s equity ▪ Current c ash and cash equivalents s ufficient to: − Complete our ongoing Phase 3 trials − Seek FDA approval for CureXcell − Establish initial manufacturing capabilities to support CureXcell launch ▪ Burn rate for ongoing operating activities in 2015 : − $ 21 - $ 25 million ▪ Peak sales ~ $ 1 B+ in 2027 : − Assumes US m arket share of < 15 % ▪ Gross margin at scale over 80 % − Raw material advantage ( 1:30 ) − Relatively low capital investments − Efficient scalable process (*) Includes a one time non - cash expense of $ 4.4 million (*)

Investment highlights ~$ 5.3 billion advanced wound care market worldwide Attractive value proposition Differentiated product with novel treatment mechanism and delivery method Multiple near - term milestones Substantial proprietary technology, trade secrets and know - how Management team experienced in developing and commercializing biologics