Exhibit 1

As of May 2015 Macrocure Ltd. NASDAQ: MCUR Corporate Presentation

Safe harbor statement This presentation contains forward - looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, Section 21E of the U.S. Securities and Exchange Act of 1934, as amended, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Any and all statements concerning our business and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition. These forward - looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward - looking statements. In some cases, you can identify forward - looking statements by terms including ‘‘anticipates,’’ ‘‘believes,’’ ‘‘could,’’ ‘‘estimates,’’ ‘‘expects,’’ ‘‘intends,’’ ‘‘may,’’ ‘‘plans,’’ ‘‘potential,’’ ‘‘predicts,’’ ‘‘projects,’’ ‘‘should,’’ ‘‘will,’’ ‘‘ would,’’ and similar expressions intended to identify forward - looking statements. Forward - looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should not unduly rely on any forward - looking statements. Although we believe that the expectations reflected in the forward - looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward - looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward - looking statements for any reason after the date of this presentation, to conform these statements to actual results or to changes in our expectations. These forward - looking statements speak only as of the date of this presentation, and we assume no obligation to update or revise these forward - looking statements for any reason . The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company.

Macrocure − investment h ighlights ▪ Late - stage Phase 3 biotechnology company with novel, living cell therapy platform ▪ Lead BLA product candidate, CureXcell, is a once - monthly injectable, advanced wound care (AWC) treatment - Patented and proprietary liquid s uspension of living , human, activated white blood cells - 5,000 + patients treated to date in Israel - Largest BLA study to date in wound care; 500 + patient clinical program ▪ $ 5 billion market opportunity: diabetic foot ulcers (DFUs) and venous leg ulcers (VLUs) ▪ Substantial near - term milestones: - August 2015 : VLU Futility Analysis - October 2015 : DFU Phase 3 data readout - 1 H 2016 : VLU Phase 3 data readout ▪ Establishing commercial - scale manufacturing and pursuing drug - based reimbursement ▪ Attractive financial profile: 80 %+ gross - margins and low CAPEX requirements ▪ US - based management team experienced in developing and commercializing biologics

CureXcell could reshape chronic wound care therapy 4 Complex and challenging product preparation and application; not indicated for infected wounds or wounds post - amputation L imited by topical application – superficial covering and penetration of wound surface D aily, weekly or multi - monthly treatments H igh cost to overall healthcare system Average per patient treatment cost ~$10K Challenge for existing products Ready - to - use application (syringe draw) & Easy and quick to administer (~ 3 minutes; no debridement requirement) Administered directly into wound bed – direct contact with disturbed microenvironment to heal from the inside out Once a month injection enhances patient compliance, reduces number of patient visits a nd improves physician throughput Lower overall burden on the healthcare system Estimated per patient treatment cost ~$6K CureXcell advantages There is a large clinical need and commercial opportunity for our biologic solution over existing medical device therapies v s. v s. vs. v s.

CureXcell’s rigorous Phase 3 BLA clinical trial design MC - 102 DFU study MC - 105 VLU study Design Multicenter, Randomized, Double - blind, Parallel Group, Sham - controlled Inclusion criteria ▪ ABI: ≥ 0.65 ▪ Ulcer size: 1 - 20 cm 2 ▪ Includes infectious and post - amputation ▪ Wounds below the malleolus ▪ 4 weeks ulcer duration prior to screening ▪ No limit on ulcer duration ▪ ABI: ≥ 0.80 ▪ Ulcer size: 1 - 12 cm 2 ▪ Includes infectious ulcers ▪ Ulcer between the knee and malleolus ▪ 4 weeks ulcer duration prior to screening ▪ Ulcer duration 18 months Indication Lower extremity ulcers in diabetic patients Chronic venous leg ulcers of the lower extremity No. of patients ▪ 280 patients in up to 30 centers ▪ 252 patients in up to 30 centers Primary Endpoint Proportion of subjects with 100% closure at 16 weeks and sustained complete closure for 4 additional weeks (p - value ≤ 0.05) Proportion of subjects with superior time to 100% closure at 12 weeks and sustained complete closure for 4 additional weeks (p - value ≤ 0.05) Safety & efficacy trends 6 out of 6 positive DSMB meetings and positive futility outcome Positive safety outcome from first DSMB meeting in January 2015 ▪ Patient inclusion criteria supports broad label for the treatment of all chronic wounds below the knee

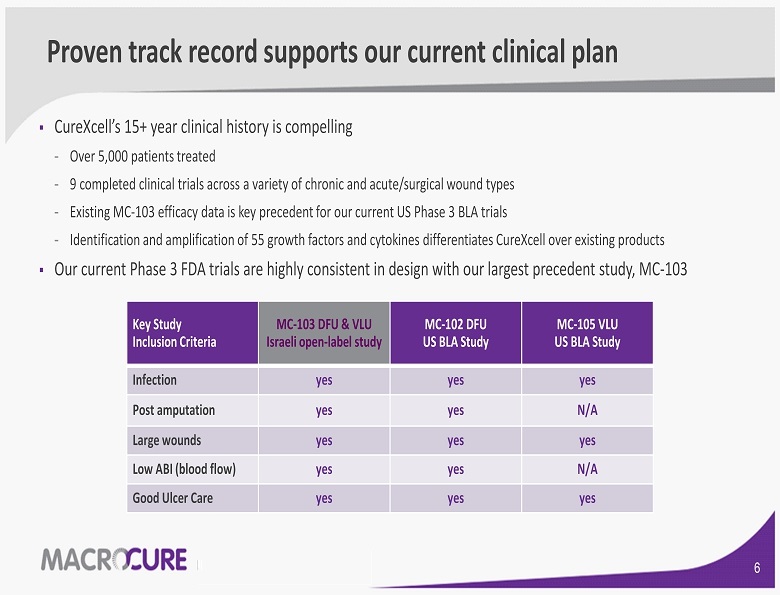

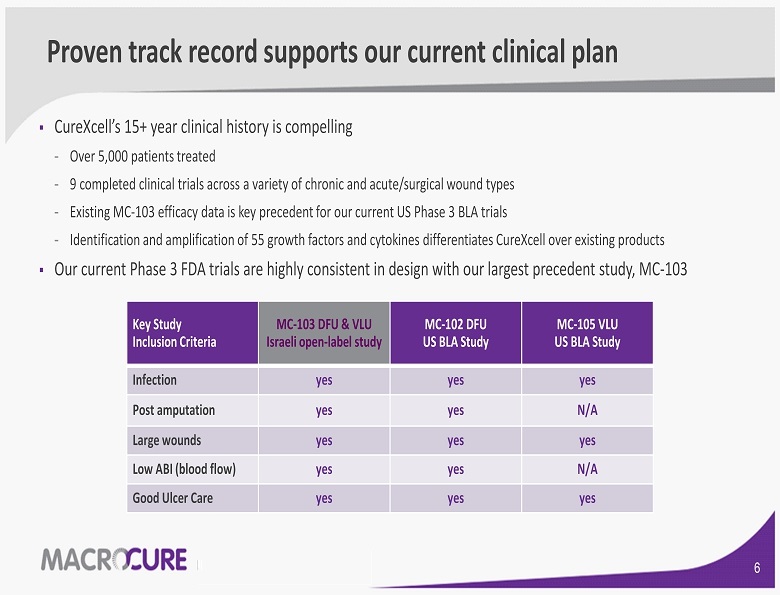

Proven track r ecord s upports our current clinical p lan ▪ CureXcell’s 15+ year clinical history is compelling - Over 5,000 patients treated - 9 completed clinical trials across a variety of chronic and acute/surgical wound types - Existing MC - 103 efficacy data is key precedent for our current US Phase 3 BLA trials - Identification and amplification of 55 growth factors and cytokines differentiates CureXcell over existing products ▪ Our current Phase 3 FDA trials are highly consistent in design with our largest precedent study, MC - 103 Key Study Inclusion Criteria MC - 103 DFU & VLU Israeli open - label study MC - 102 DFU US BLA Study MC - 105 VLU US BLA Study Infection yes yes yes Post amputation yes yes N/A Large wounds yes yes yes Low ABI (blood flow) yes yes N/A Good Ulcer Care yes yes yes

MC - 103 – strong real - world data 68.4% 81.4% 68.5 % Diabetic Foot Ulcers Venous Leg Ulcers All mITT Patients N = 58 N = 44 N = 131 MC - 103 achieved high closure rates in hard - to - heal DFU and VLU patients Percent of Patients with Complete Wound Closure at Week 24 by Wound Type (1) (1) 70.9% of patients had complete wound closure at study completion (2) mITT represents the modified intent - to - treat cohort ( 2 )

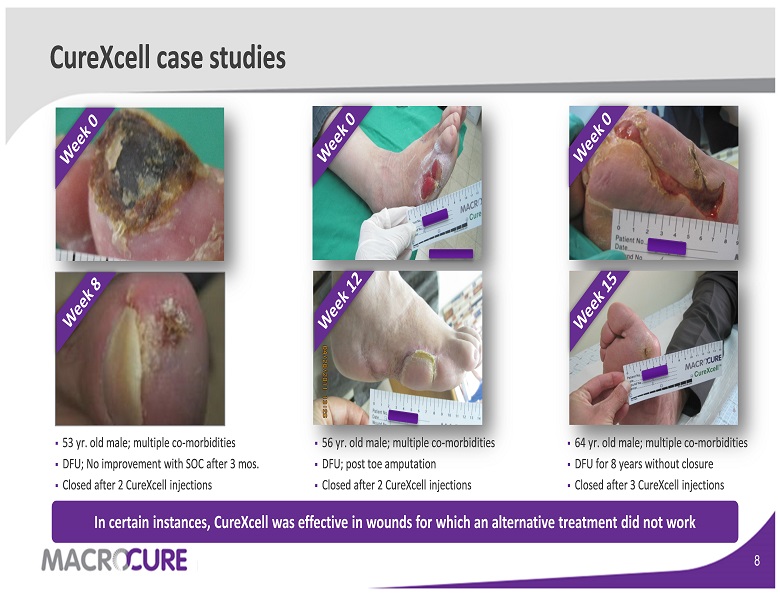

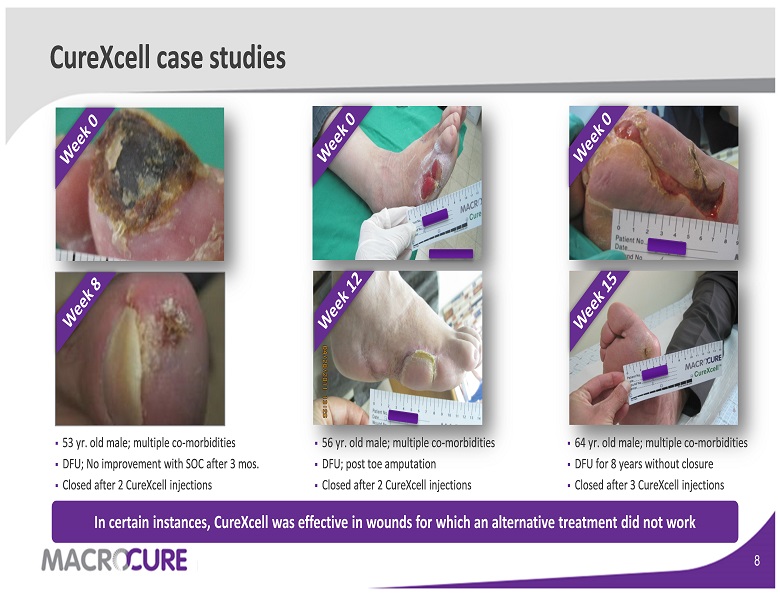

CureXcell case studies ▪ 53 yr. old male; multiple co - morbidities ▪ DFU; No improvement with SOC after 3 mos. ▪ Closed after 2 CureXcell injections In certain instances, CureXcell was effective in wounds for which an alternative treatment did not work ▪ 56 yr. old male; multiple co - morbidities ▪ DFU; post toe amputation ▪ Closed after 2 CureXcell injections ▪ 64 yr. old male; multiple co - morbidities ▪ DFU for 8 years without closure ▪ Closed after 3 CureXcell injections

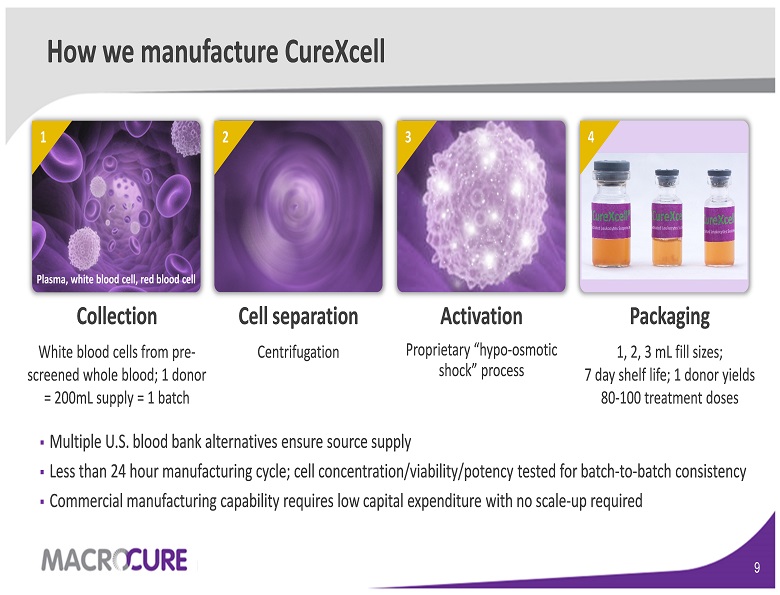

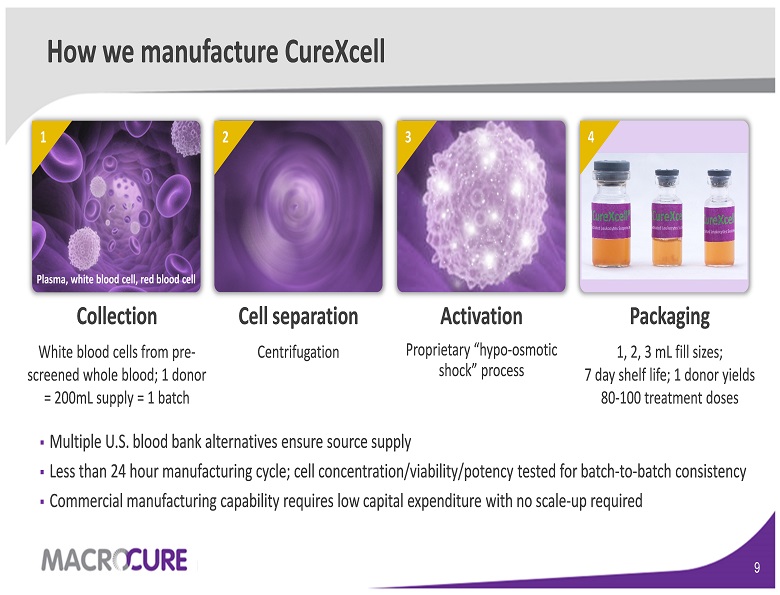

Activation Proprietary “hypo - osmotic shock” process Packaging 1, 2, 3 mL fill sizes; 7 day shelf life; 1 donor yields 80 - 100 treatment doses Cell separation Centrifugation Collection White blood cells from pre - screened whole blood; 1 donor = 200 mL supply = 1 batch How we manufacture CureXcell 3 1 2 Plasma, white blood cell, red blood cell ▪ Multiple U.S. blood bank alternatives ensure source supply ▪ Less than 24 hour manufacturing cycle; cell concentration/viability/potency tested for batch - to - batch consistency ▪ Commercial manufacturing capability requires low capital expenditure with no scale - up required 4

Our proprietary activation process is key 10 The rapid movement of water across the cell membrane results in the opening of ion channels Our proprietary activation process uses white blood cells as a biological factory for growth factor and cytokine production ▪ Step 1 . Hypo - osmotic shock: Precise timing enables WBC activation that allows the release of cytokines and growth factors ▪ Step 2 . Incubation Period: Achieves consistent and stable cytokines and growth factor concentration necessary for wound healing and tissue regeneration

MOA: 55 growth factors & cytokines differentiate CureXcell 11 ▪ Comprehensive Mechanism of Action data provides unique approach to address the common deficient pathways that exist in both DFU and VLU ▪ Demonstrated statistically significant amplification of growth factors and cytokines ▪ Measurable activation and potency throughout CureXcell’s shelf life Selected Human Factors Angiogenesis Cell Proliferation Collagen I production Re - epithelialization Anti - catabolic Changes Post - Activation IL - 1RA x 100 - fold IL - 8 x x 100 - fold VEGF - A x 55 - fold EGF x x x 27 - fold Angiopoietin - 1 x 8 - fold PDGF - AA & - BB x x x 5 - fold FGF - 2 (bFGF) x x x 2 - fold TIMPs 1, 2 & 3 x 2 - fold

Executing our manufacturing strategy ▪ Existing US manufacturing capability with the American Red Cross in Philadelphia, PA ▪ New commercial manufacturing plans in place - Completion and validation for BLA submission in 2 H 2016 ▪ Commercial scale manufacturing requires low capital expenditure - Closed system, disposable bag technology - No scale - up required - Expansion capacity to accommodate future growth Over the longer - term, we believe 1 to 2 US facilities and 1 European facility sufficient to address the market

Executing our reimbursement strategy ▪ Our formative reimbursement initiatives are already underway ▪ Post BLA approval, we will file for new procedure (CPT) and product (HCPCS) codes for CureXcell ▪ CureXcell is a biologic drug and therefore we are pursuing drug - based reimbursement - Approval process typically takes 9 to 12 months post FDA approval - Current HCPCS code J 3590 – ‘unclassified biologics’ ▪ Currently, there is no expectation that CureXcell will be placed under the existing high or low cost skin substitute bundle We believe CureXcell’s product profile, efficacy, ease - of - use and patient convenience will help support our reimbursement strategy

Macrocure’s product platform potential Ophthalmology Aesthetics Orthopedics CureXcel Platform Technology ▪ CureXcell contains 55 growth factors & cytokines ▪ Our proprietary technology can up/down regulate specific growth factors ▪ This ‘tailor - made’ approach provides opportunities to target different tissues or disease states Selective Cytokine & Growth Factor Targeting A significant opportunity exists beyond wound care to leverage CureXcell’s underlying technology Tissue Repair

Mar 31 , 2015 Unaudited ($ in millions) 12.0 Cash and cash equivalents 29.7 1.0 Short term deposits Other assets 42.7 Total assets 2.8 Total current liabilities 39.9 Total shareholder’s equity Financial summary Mar 31 - 14 Unaudited Mar 31 - 15 Unaudited ($ in millions) 2.7 5.3 Research and Develop, net 0.7 1.6 General and Administrative 3.4 6.9 Operating loss * * Finance & Tax, net 3.4 6.9 Net loss Balance Sheet ▪ NASDAQ: MCUR ▪ Basic shares o utstanding: 16.7 M; 1.3 M penny warrants; 2.2 M options ▪ Total Cash Position: $ 41.7 M (as of 3 / 31 / 15 ); No debt ▪ Research coverage : Credit Suisse, Jefferies, Oppenheimer, Nomura Income Statement ▪ Current c ash and cash equivalents s ufficient to: − Complete our ongoing Phase 3 trials − Seek FDA approval for CureXcell − Establish initial manufacturing capabilities to support CureXcell launch ▪ Burn rate for ongoing operating activities in 2015 : − $ 21 - $ 25 million ▪ Gross margin at scale over 80 % − Raw material advantage − Relatively low capital investments − Efficient scalable process (*) Represent an amount lower than $ 0.1 M

Anticipated corporate milestones Q 1 : Start Mechanism of Action study Q 2 : Start Phase 3 study for VLU Q 2 : Successful DFU DSMB meeting Q 3 : Completed enrollment in DFU study Q 4 : Completed Mechanism of Action study 2014 1 H: MOA results & analyst day (Feb. 12 th in NYC) May: Completed enrollment in VLU study August: Phase 3 futility analysis for VLU October: Phase 3 data readout for DFU 2015 1 H: Phase 3 data readout for VLU 2 H: Submit BLA to the FDA 2016 A pproval of US BLA 2017

Macrocure − summary ▪ Late - stage Phase 3 biotechnology company with novel, cell therapy platform ▪ Lead BLA product candidate, CureXcell, is a once - monthly injectable therapy, with potential to transform conventional AWC category ▪ Initial focus on large $ 5 billion DFU and VLU market opportunity ▪ Substantial near - term milestones starting in August 2015 ▪ Commercial - scale manufacturing and reimbursement initiatives underway supporting attractive 80 %+ gross margin profile ▪ Proven management team experienced in developing and commercializing biologics