NASDAQ: LMB An integrated building systems solutions firm Essential ● Diverse ● Evolving INVESTOR PRESENTATION • OCTOBER 2022

Forward Looking Statements We make forward-looking statements in this presentation within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations or forecasts for future events, including, without limitation, the execution of the Company’s long-term strategic roadmap. These statements may be preceded by, followed by or include the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,” “target, ” “scenario” or similar expressions. These forward-looking statements are based on information available to us as of the date they were made and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Some of these risks and uncertainties may in the future be amplified by the COVID-19 outbreak and there may be additional risks that we consider immaterial, or which are unknown. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Please refer to our most recent annual report on Form 10-K, as well as our subsequent filings on Form 10-Q and Form 8-K, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements in this presentation. 2

Limbach At-a-Glance 3 WHO WE ARE Limbach is an integrated building systems solutions firm. WHAT WE DO We provide mechanical, electrical, plumbing and building automation design, engineering, installation, maintenance and energy management services that protect our customers’ investments in commercial, institutional and industrial facility assets. HOW WE ARE DIFFERENT • Dedicated in-house engineering and design center allows us to deliver an end-to-end service suite, improving building owners’ ROI. • Industry-leading platform is oriented to delivering diverse, value- added and technically complex engineering and design-enhanced services. • Serve the full-lifecycle facility needs of a variety of prominent clients. KEY DATA Share Price $7.75 Shares Outstanding 10.4 M Market Cap $81 Total Revenues (TTM) $486.9 Total Revenues (2022E) $510 - 540 Adjusted EBITDA (TTM) 1 $27.7 Adjusted EBITDA (2022E)1 $25 - 29 Total Cash $19.7 Long-term Debt $34.9 Leverage Ratio 0.55x • Trading information as of 10/10/22; $ in millions other than per share amounts • Other historical financial information as of 6/30/22 1. See non-GAAP reconciliation on slide 23

Unique, Complete Portfolio of MEP Services 4 Off Site / Pre-fabrication MEP Construction Commissioning Virtual Design and ConstructionEngineering Energy Modeling Estimating and Takeoff Facility Analytics Building Automation Emergency 24/7 Response Operations and Maintenance Diverse and Essential Service Suite Allows Us to Drive Increased “Wallet Share” With Our Customers Value Creation Recurring Revenue

Our Two Operating Segments Hired by general contractors to provide: • Design services • Building construction • Commissioning Focus on maintaining operations in markets with demonstrated track records of successful execution. Target gross margin range of 12 – 13%. General Contractor Relationships (“GCR”) Hired by building owners to provide: • Design services • Pre-construction engineering • Energy efficiency analytics • Building construction • Commissioning • Ongoing service and maintenance Includes recurring revenue from service and maintenance contracts. Reduce risk by moving higher up cash flow hierarchy and lowering collection cycles from change order processing. Target gross margin range: 25 – 28%. Owner Direct Relationships (“ODR”) 5 Today 60% YTD Revenue 2025 Target 50% + Revenue 2025 Target 50% Revenue Today 40% YTD Revenue

Investment Highlights 6 1. See Balance Sheet on slide 21 2. See slide 24 for calculation of Enterprise Value and TTM EBITDA. The EV/TTM EBITDA calculations for our primary peers were calculated using comparable data obtained from their SEC filings. Strong sector tailwinds • Increased interest in “onshoring” of manufacturing by a variety of industries • Building owners increasingly focused on ROIC, including maintenance and retrofit of existing facilities, driving demand for facilities service capabilities Diverse geographical & end markets • 16 offices serving 30+ cities with wide range of industries and Fortune 100 customers • Uncorrelated end markets: healthcare, data centers, industrial, R&D, and education facilities Essential provider • Core expertise in mechanical, electrical and plumbing systems • Building owners placing an increasing emphasis on the indoor environment as a differentiating factor – the services we provide are mission critical for their business success Recurring revenues & margins on the rise • Growing base of recurring revenues through contracted building maintenance services • Expanding higher margin Owner-Direct segment; TTM segment revenues up 30.8% versus prior 12-month period Strong balance sheet; 0.46x leverage ratio • Net debt of $15.3M1 and Adjusted TTM EBITDA of $27.7M • Recently-announced share repurchase program for up to $2M while maintaining financial flexibility to pursue targeted M&A Attractive valuation vs. peers • Current valuation of 4.9x EV/TTM EBITDA2 • Primary peers have valuations of 15.5x (FIX) and 11.6x (EME)2

How We Are Essential 7 Rapid Response to Urgent Customer Needs Who was the client? What was the Challenge? Solution Offered Business Impact Hurricane Ian caused damage to facilities Program Management Expediting Design & Construction to Allow for Reopening of Facilities

GEOGRAPHY Focused on Eastern Half of the USA SECTORS Design – Build – Maintain SERVICES States with Branch Locations Potential Acquisition Target States CUSTOMERS HEALTHCARE MISSION CRITICAL INDUSTRIAL / MANUFACTURING INDOOR AGRICULTURE EDUCATION SPORTS & ENTERTAINMENT P R I M A R Y M A R K E T S S E C O N D A R Y M A R K E T S 8 Engineering Energy Modeling Facility Analytics MEP Construction Operations and Maintenance Emergency 24/7 Response INFRASTRUCTURE HOSPITALITY GOVERNMENT COMMERCIAL1,200+ Diversified Structure Allows Us to Allocate Human Capital to Busier Market Sectors, Geographies, Services and Customers

EVOLVING 9 Recession Resilient Over Our 120-Year History We Have Evolved to Meet the Dynamic Needs of Our Customers Strategic Goals for ODR / GCR Revenue Mix that Optimizes Returns Targeted Acquisition Strategy

Evolving ODR Strategy Provides Multiple Strategic Benefits Working directly for building owners enables us to… • Drive “Wallet Share” Expansion • Establish Recurring Revenue Streams • Earn Higher Margins • Reduce Risk Building Owner General Contractor 10 On Course to Achieve Strategic Goal of 50% / 50% Revenue Mix by 2025

Growth Strategy 11 Aggressive Sales Strategy Invest to broaden our Owner Direct customer base and to deliver an expanded array of conventional and technical MEP construction and facility services to capture additional “wallet share” Drive Profitability by Optimizing Return on Labor Maximize financial returns from accomplished and talented staff, both corporate and crafts level staff Organic Geographic Expansion Continue the geographic expansion of existing operating footprints based on customer needs Acquire Synergistic Companies Acquire strategically synergistic companies that supplement our current business model, address capability gaps, and enhance the breadth of our product and service offerings

ODR Growth is Accelerating – New Customers and Expansion of “Wallet Share” $127.23 $126.48 $130.71 $136.57 $140.34 $154.69 $171.00 10.50% 9.86% 12.15% 13.62% 10.30% 22.30% 30.83% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 $180.00 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Quarterly TTM ODR Revenue and Y/Y Growth Rate TTM ODR Revenue YOY Growth Rate 12 $ in millions

GCR Optimization – Reducing Risk, Improving Margins & Cash Flow Evaluating the optimal business mix on a bottom-up, branch-by-branch basis • Each of our local markets are unique • Right-sizing GCR is a function of a sharpened focus on higher margin work including; shifting resources from GCR to focus on ODR; and the closure of GCR services in some locations • Further GCR operations provide solid return on capital while also establishing a pathway to initiate new owner-direct relationships All $ in thousands On a trailing twelve-month basis, increase in gross profit dollars and gross margin, despite a planned reduction of GCR revenue 13 $0 $100,000 $200,000 $300,000 $400,000 $500,000 TTM at June 30, 2021 TTM at June 30, 2022 GCR Revenue $38,000 $39,000 $40,000 $41,000 $42,000 $43,000 $44,000 $45,000 TTM at June 30, 2021 TTM at June 30, 2022 GCR Gross Profit 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% TTM at June 30, 2021 TTM at June 30, 2022 GCR Gross Margin

Acquisition Strategy Legend: States with Branch Locations Potential Target Geographies for Acquisition → Geographic Proximity → Supports ODR Strategy → Attractive Business Model → Capability Expansion → Technology Focused Multi-Year Strategy Acquisition CriteriaTarget Geographies → Leverage Existing Operations and Resources → Accelerate Growth in High Margin Business Lines → Expand into Adjacent Geographic Markets → Expand into Growth Sectors 14

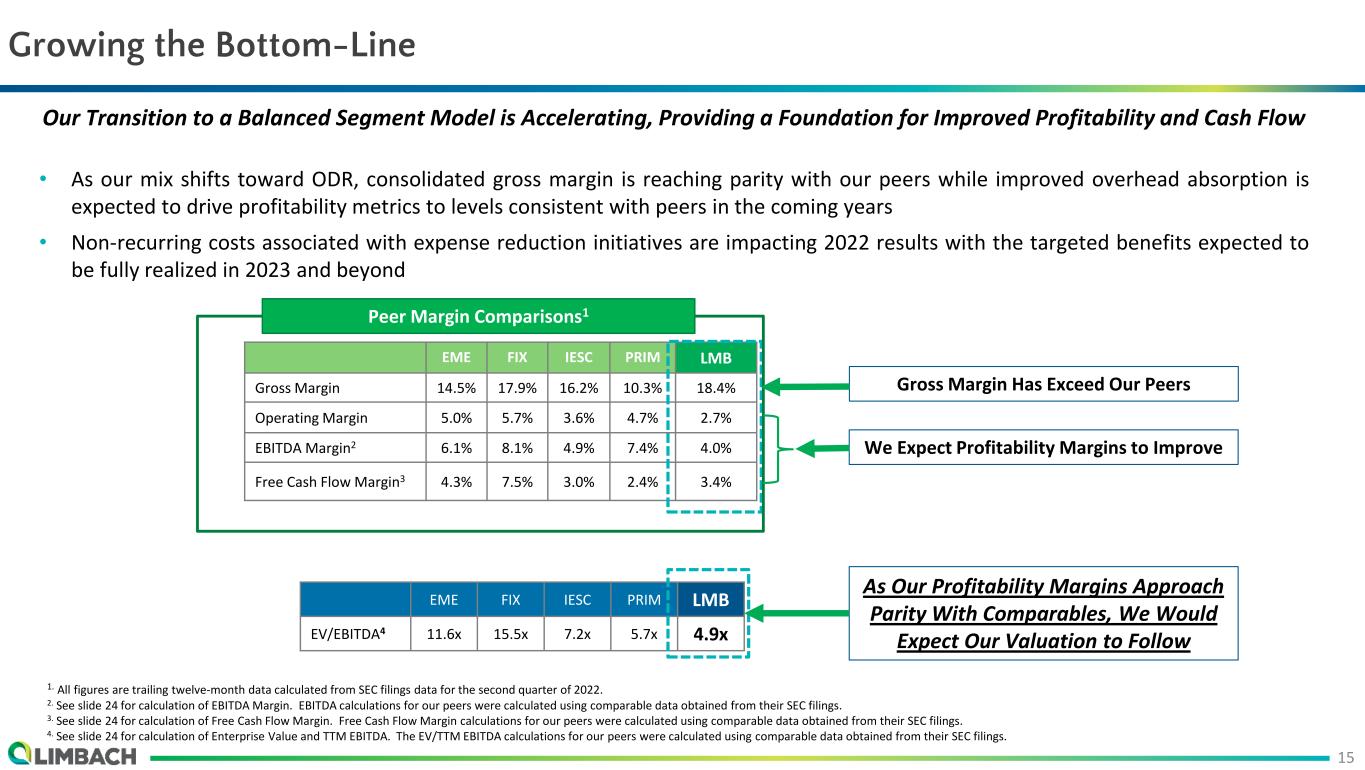

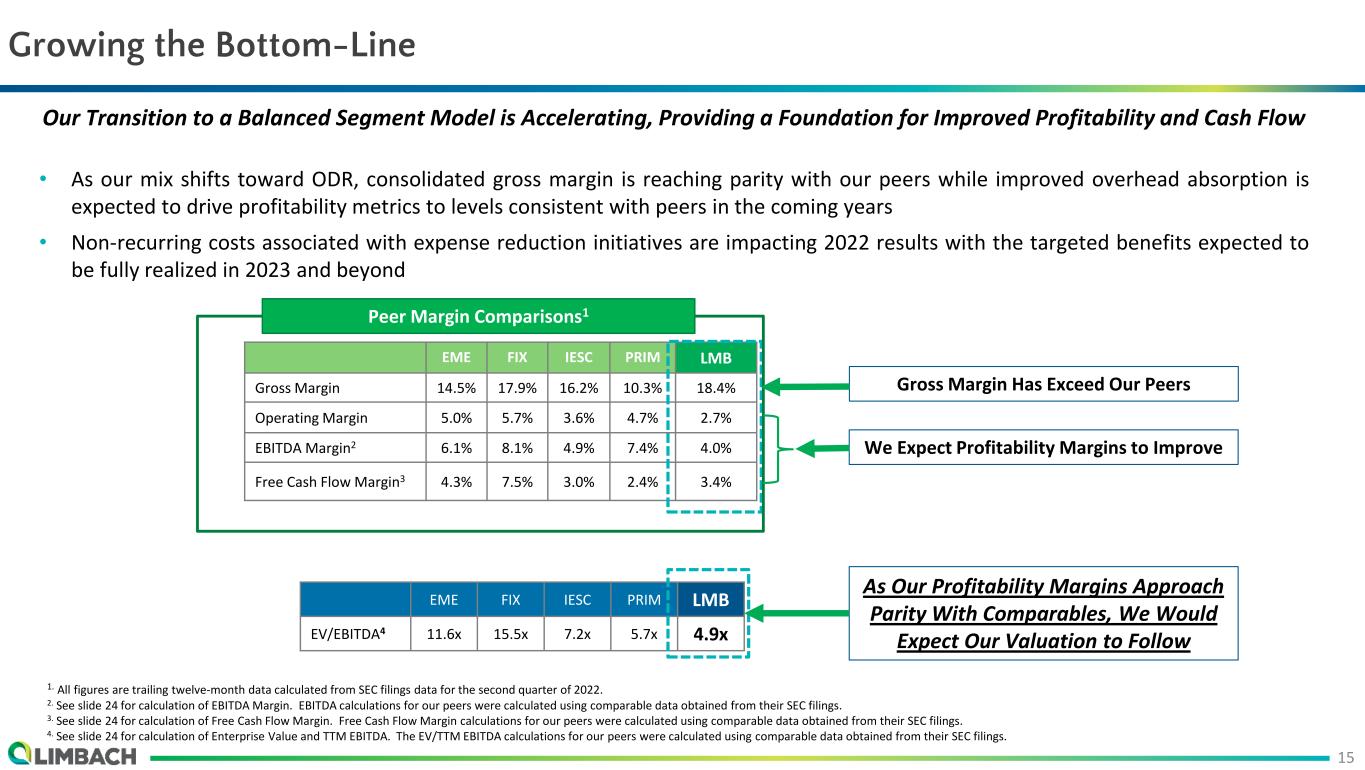

Growing the Bottom-Line Our Transition to a Balanced Segment Model is Accelerating, Providing a Foundation for Improved Profitability and Cash Flow • As our mix shifts toward ODR, consolidated gross margin is reaching parity with our peers while improved overhead absorption is expected to drive profitability metrics to levels consistent with peers in the coming years • Non-recurring costs associated with expense reduction initiatives are impacting 2022 results with the targeted benefits expected to be fully realized in 2023 and beyond EME FIX IESC PRIM LMB Gross Margin 14.5% 17.9% 16.2% 10.3% 18.4% Operating Margin 5.0% 5.7% 3.6% 4.7% 2.7% EBITDA Margin2 6.1% 8.1% 4.9% 7.4% 4.0% Free Cash Flow Margin3 4.3% 7.5% 3.0% 2.4% 3.4% Peer Margin Comparisons1 1. All figures are trailing twelve-month data calculated from SEC filings data for the second quarter of 2022. 2. See slide 24 for calculation of EBITDA Margin. EBITDA calculations for our peers were calculated using comparable data obtained from their SEC filings. 3. See slide 24 for calculation of Free Cash Flow Margin. Free Cash Flow Margin calculations for our peers were calculated using comparable data obtained from their SEC filings. 4. See slide 24 for calculation of Enterprise Value and TTM EBITDA. The EV/TTM EBITDA calculations for our peers were calculated using comparable data obtained from their SEC filings. 15 EME FIX IESC PRIM LMB EV/EBITDA4 11.6x 15.5x 7.2x 5.7x 4.9x As Our Profitability Margins Approach Parity With Comparables, We Would Expect Our Valuation to Follow Gross Margin Has Exceed Our Peers We Expect Profitability Margins to Improve

Investment Summary Limbach is well positioned in the current environment to capitalize on emerging trends in building infrastructure and system optimization, and to further increase earnings and enterprise value The unique combination and integration of professional services and field capabilities presents new opportunities for delivering value to an expanding customer base, and for revenue and profit growth across multiple strategies 121-year legacy of evolution and business model adaptation Geographic, end-market and customer diversification provides risk mitigation and a lack of correlation to national economic trends We expect improving field execution, SG&A leverage and new revenue streams will continue to drive margin expansion in coming quarters Gathering momentum in energy efficiency and improving indoor air quality support continued organic growth Growth Outlook Focus on debt pay down and claims recoveries which strengthens the balance sheet and reduces the cost of debt capital Balance Sheet Pursue accretive acquisition opportunities to support the owner-direct model, geographic expansion and market sector initiatives Acquisitions Brand Value Profit ExpansionDiversification 16

Full Year 2022 Financial Guidance Guidance Low High Revenue $510 million – $540 million Adjusted EBITDA1 $25 million – $29 million 17 Additional Modeling Considerations Metric Comment FY 2022 GCR Revenue Projected $275 to $310 million FY 2022 ODR Revenue Projected $220 to $240 million GCR Revenue Change (2023+) Targeted annual low single digit contraction ODR Revenue Change (2023+) Targeted growth in “low teens” GCR Gross Margin Targeted 12% to 13% ODR Gross Margin Targeted 25% to 28% SG&A Margin (Long Term) Targeted 13% to 13.5% Free Cash Flow Conversion (excluding working capital changes) Has historically converted at approximately 40% of Adjusted EBITDA Tax Rate Projected to be approximately 28% 1. With respect to projected 2022 Adjusted EBITDA, a quantitative reconciliation is not available without unreasonable effort due to the high variability, complexity and low visibility with respect to taxes and other items, which are excluded from Adjusted EBITDA. We expect the variability of this item to have a potentially unpredictable, and potentially significant, impact on future GAAP financial results.

OPERATING AND FINANCIAL UPDATE 18

Dollars in millions. Totals may not foot due to rounding. 1. See the Company’s quarterly report on Form 10-Q for the fiscal quarter ended June 30, 2022. 2. See slide 23 for Non-GAAP Reconciliation Table. Operating and Financial Update 2Q’22 Quarterly Performance $87.6 $66.3 $33.5 $49.8 2Q'21 2Q'22 GCR ODR Revenue1 Gross Profit and (Margin)1 $121.0 $3.6 $6.6 2Q'21 2Q'22 Adjusted EBITDA2 + 85.1%+ 14.1%- 4.0% Year-Over-Year Change Year-Over-Year Change Year-Over-Year Change $8.9 $8.7 $9.8 $12.6 2Q'21 2Q'22 GCR ODR $116.1 $18.7 (15.4%) $21.3 (18.4%) 19

20 Dollars in millions. Totals may not foot due to rounding. 1. See the Company’s quarterly report on Form 10-Q for the fiscal quarter ended June 30, 2022. 2. See p. 23 for Non-GAAP Reconciliation Table. $172.4 $138.3 $62.0 $92.7 1H'21 1H'22 GCR ODR Revenue1 Gross Profit and (Margin)1 $234.4 $5.6 $10.0 1H'21 1H'22 Adjusted EBITDA2 + 77.9%+ 10.4%- 1.5% Year-Over-Year Change Year-Over-Year Change Year-Over-Year Change $18.3 $17.1 $17.6 $22.6 1H'21 1H'22 GCR ODR $230.9 $35.9 (15.3%) $39.7 (17.2%) Operating and Financial Update Year to Date Performance

Operating and Financial Update Reduced Leverage from 2021 & Continuing Improvements in Capitalization Key Balance Sheet Items June 30, 20221 December 31, 20212 Cash and Cash Equivalents $19.6 $14.5 Current Assets $201.9 $192.9 Current Liabilities $142.1 $129.7 Working Capital $59.8 $63.2 Net (Over) / Under Billing3 $5.0 $21.2 Revolver $3.5 — Term Loans $25.7 $34.9 Finance Leases $5.7 $5.1 Total Debt $34.9 $40.0 Net Debt (Total Debt – Cash and Cash Equivalents) $15.3 $25.5 Equity $88.3 $87.8 Dollars in millions. 1. See the Company’s quarterly report on Form 10-Q for the fiscal quarter ended June 30, 2022. 2. See the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2021. 3. For the calculation of the Company’s net billing position, refer to Note 4 to the consolidated financial statements within the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2021, and Company’s quarterly report on Form 10-Q for the fiscal quarter ended June 30, 2022. 21

APPENDIX 22

Non-GAAP Reconciliation Table For the Three and Six Months Ended June 30, 2022 and 2021 * Use of Non-GAAP Financial Measures In assessing the performance of our business, management utilizes a variety of financial and performance measures. The key measure is Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial measure. We define Adjusted EBITDA as net income plus depreciation and amortization expense, interest expense (net), and taxes, as further adjusted to eliminate the impact of, when applicable, other non-cash items or expenses that are unusual or non-recurring or that we believe do not reflect our core operating results. We believe that Adjusted EBITDA is meaningful to our investors to enhance their understanding of our financial performance for the current period and our ability to generate cash flows from operations that are available for taxes, capital expenditures and debt service. We understand that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties as a measure of financial performance and to compare our performance with the performance of other companies that report Adjusted EBITDA. Our calculation of Adjusted EBITDA, however, may not be comparable to similarly titled measures reported by other companies. When assessing our operating performance, investors and others should not consider this data in isolation or as a substitute for net income (loss) calculated in accordance with GAAP. Further, the results presented by Adjusted EBITDA cannot be achieved without incurring the costs that the measure excludes. 1. Dollars in thousands 2. Totals may not foot due to rounding. 3. Includes restructuring charges within our Southern California and Eastern Pennsylvania branches, as well as other cost savings initiatives throughout the Company. Reconciliation of Net Income (Loss) to Adjusted EBITDA(1),(2) Three Months Ended June 30, Six Months Ended June 30, (in thousands) 2022 2021 2022 2021 Net income (loss) $ 866 $ 732 $ (650) $ (1,550) Adjustments: Depreciation and amortization 2,086 1,469 4,148 2,964 Interest expense, net 478 452 964 1,716 Non-cash stock-based compensation expense 575 636 1,174 1,313 Loss on early debt extinguishment — — — 1,961 Change in fair value of warrants — — — (14) Loss on early termination of operating lease 32 — 849 — Income tax (benefit) provision (50) 264 (666) (771) Acquisition and other transaction costs 45 — 198 — Change in fair value of contingent consideration 237 — (379) — Restructuring costs(3) 1,491 — 2,926 — Adjusted EBITDA $ 6,575 $ 3,553 $ 9,995 $ 5,619 23

Non-GAAP Reconciliation Tables * Use of Non-GAAP Financial Measures In assessing the performance of our business, management utilizes a variety of financial and performance measures. The key measure is Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial measure. We define Adjusted EBITDA as net income plus depreciation and amortization expense, interest expense (net), and taxes, as further adjusted to eliminate the impact of, when applicable, other non-cash items or expenses that are unusual or non-recurring or that we believe do not reflect our core operating results. We believe that Adjusted EBITDA is meaningful to our investors to enhance their understanding of our financial performance for the current period and our ability to generate cash flows from operations that are available for taxes, capital expenditures and debt service. We understand that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties as a measure of financial performance and to compare our performance with the performance of other companies that report Adjusted EBITDA. Our calculation of Adjusted EBITDA, however, may not be comparable to similarly titled measures reported by other companies. When assessing our operating performance, investors and others should not consider this data in isolation or as a substitute for net income (loss) calculated in accordance with GAAP. Further, the results presented by Adjusted EBITDA cannot be achieved without incurring the costs that the measure excludes. 1. Amounts in thousands except market price data 2. Market price as of market close on 10/10/22 3. All figures are trailing twelve-month data calculated from SEC filings data 4. Includes restructuring charges within our Southern California and Eastern Pennsylvania branches, as well as other cost savings initiatives throughout the Company. 24 June 30, 2022 Shares outstanding 10,423 x Market price2 $ 7.75 Market capitalization $ 80,779 + Total outstanding debt 34,898 - Cash and cash equivalents (19,630) Enterprise value $ 96,047 Enterprise Value Calculation1 TTM June 30, 2022 Net income $ 7,614 Interest expense, net 1,816 Income tax provision 3,155 Depreciation and amortization 7,132 EBITDA $ 19,717 Non-cash stock-based compensation expense 2,462 Loss on early termination of operating lease 849 Acquisition and other transaction costs 933 Change in fair value of contingent consideration 765 Restructuring costs4 2,926 Adjusted EBITDA $ 27,652 Adjusted EBITDA Calculation1,3 Free Cash Flow Calculation1,3 TTM June 30, 2022 Net income $ 7,614 + Depreciation and amortization 7,132 + Non-cash stock-based compensation expense 2,462 - Capital expenditures (paid in cash) (763) Free cash flow $ 16,445

Diverse ● Essential ● Evolving 25