Earnings Release Supplement August 2019

Notice to Investors We use market data and industry forecasts and projections throughout this presentation, including data from publicly available information and industry publications. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there can be no assurance that any of the forecasts or projections will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently investigated or verified this information. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements contained in this presentation. important presentation information

Forward-Looking Statements Some of the statements made in this presentation constitute forward-looking statements within the meaning of federal securities laws. Forward-looking statements reflect our current views with respect to future events and performance. In some cases you can identify forward-looking statements by terminology such as “may,” “might, “will,” “should,” “could” or the negative thereof. Generally, the words “anticipate,” “believe,” “continues,” “expect,” “intend,” “estimate,” “project,” “plan” and similar expressions identify forward-looking statements. In particular, statements about our pipeline, industry growth opportunities, disclosure of key performance indicators, business growth strategy and financial guidance in this presentation are forward-looking statements. We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, many of which are outside of our control, which could cause our actual results, performance or achievements to differ materially from any results, performance or achievements expressed or implied by such forward-looking statements. For additional discussion of risks, uncertainties and other factors, see the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our subsequent filings with the United States Securities and Exchange Commission (the “SEC"). Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These risks and uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. These forward-looking statements are made only as of the date of this presentation. We do not undertake and specifically decline any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments. The Company is in the process of finalizing its Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, including the process of reviewing the financial statements contained therein. Results reported in this presentation could change as result of this process. important presentation information

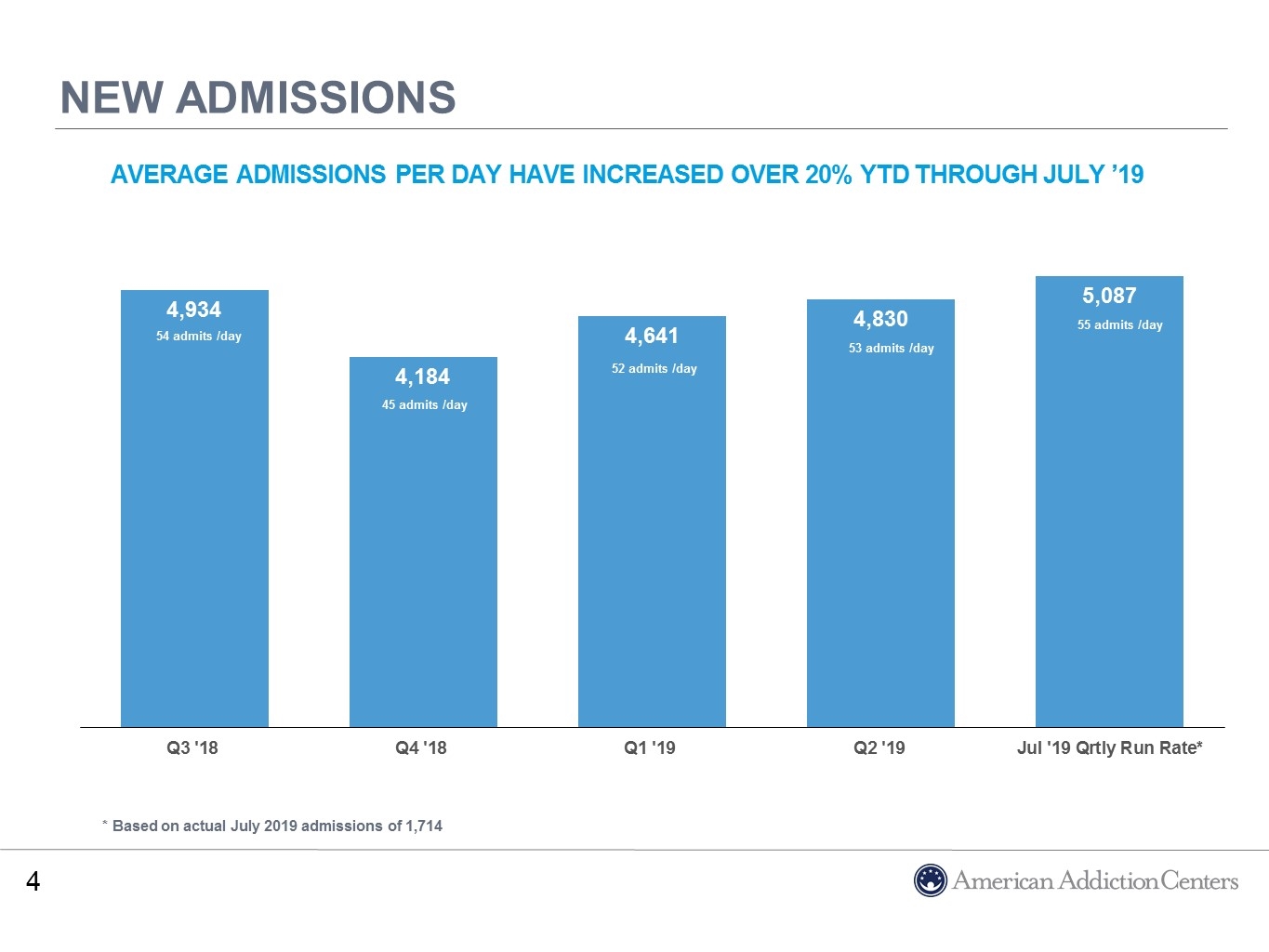

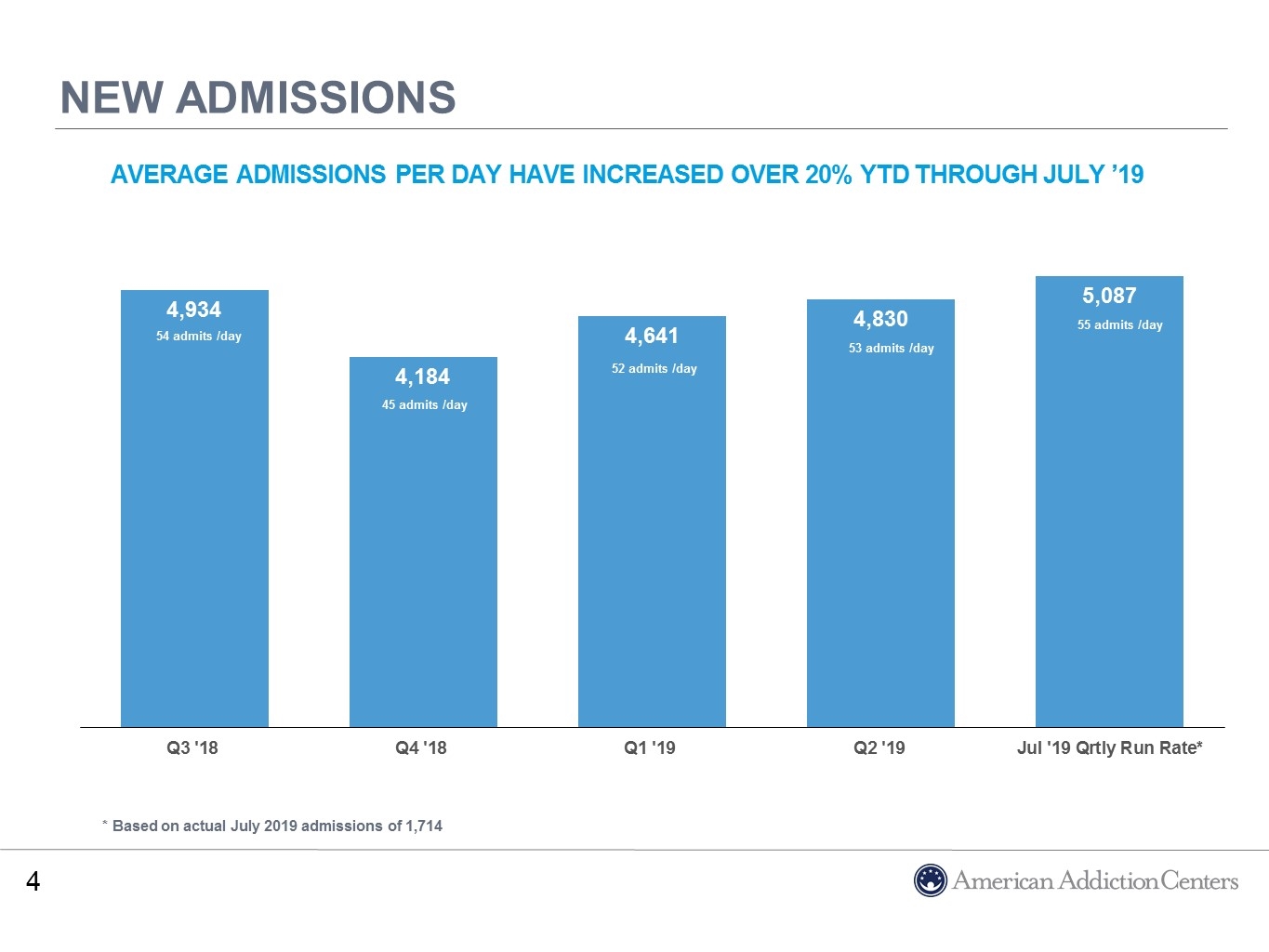

54 admits /day 45 admits /day 53 admits /day 55 admits /day New Admissions Average Admissions per Day have increased over 20% YTD through July ’19 52 admits /day 55 admits /day * Based on actual July 2019 admissions of 1,714

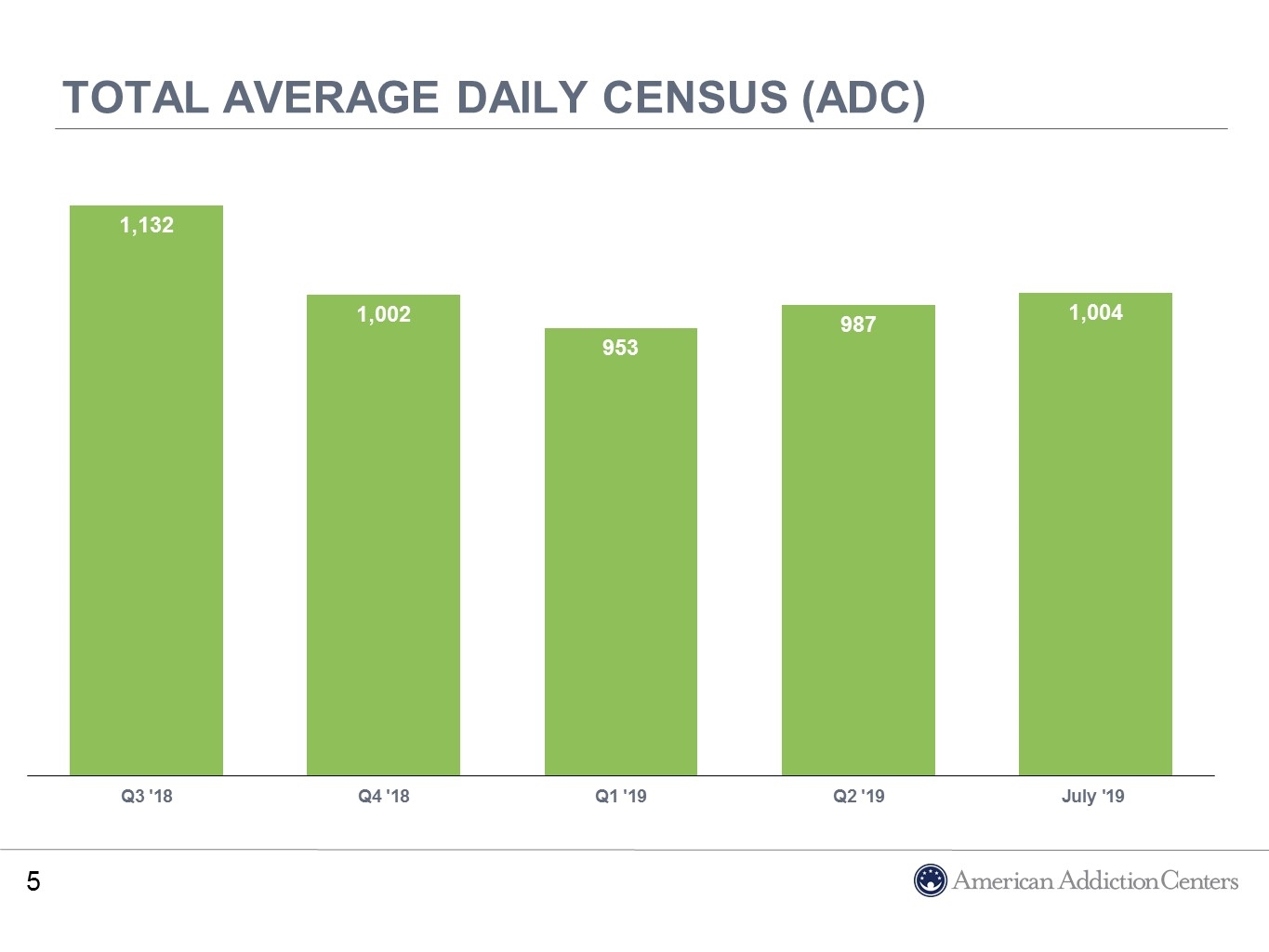

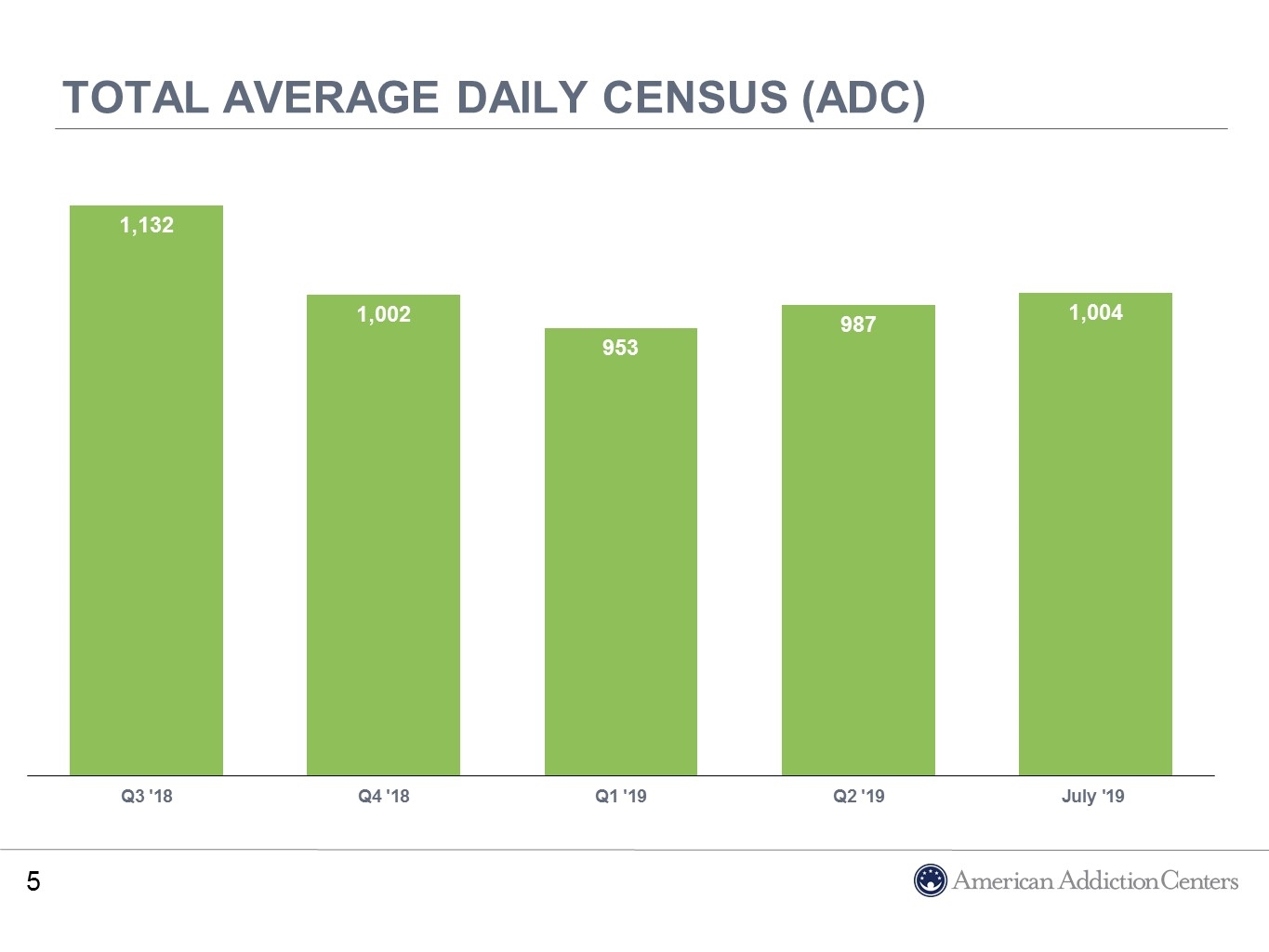

Total Average Daily Census (ADC)

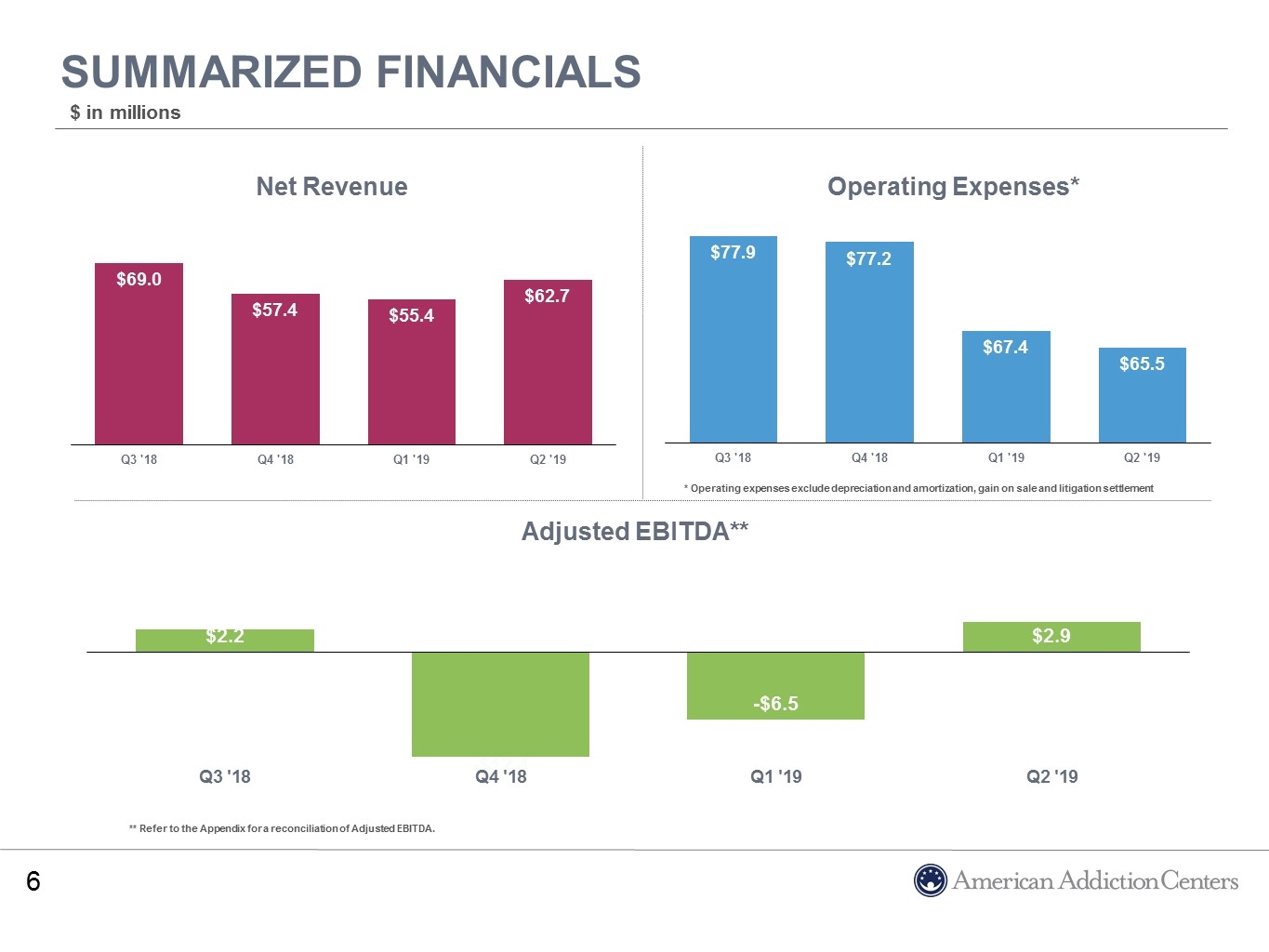

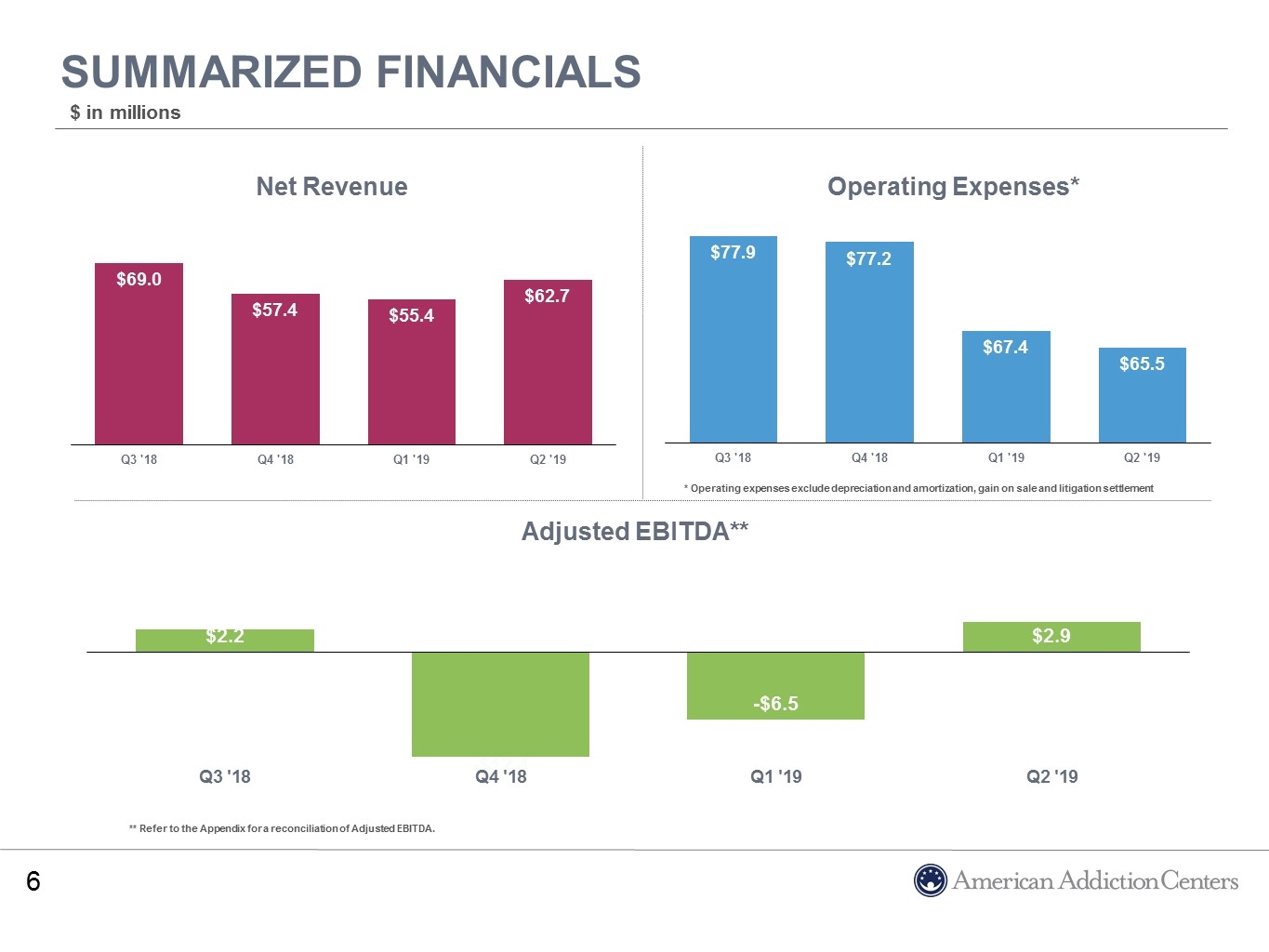

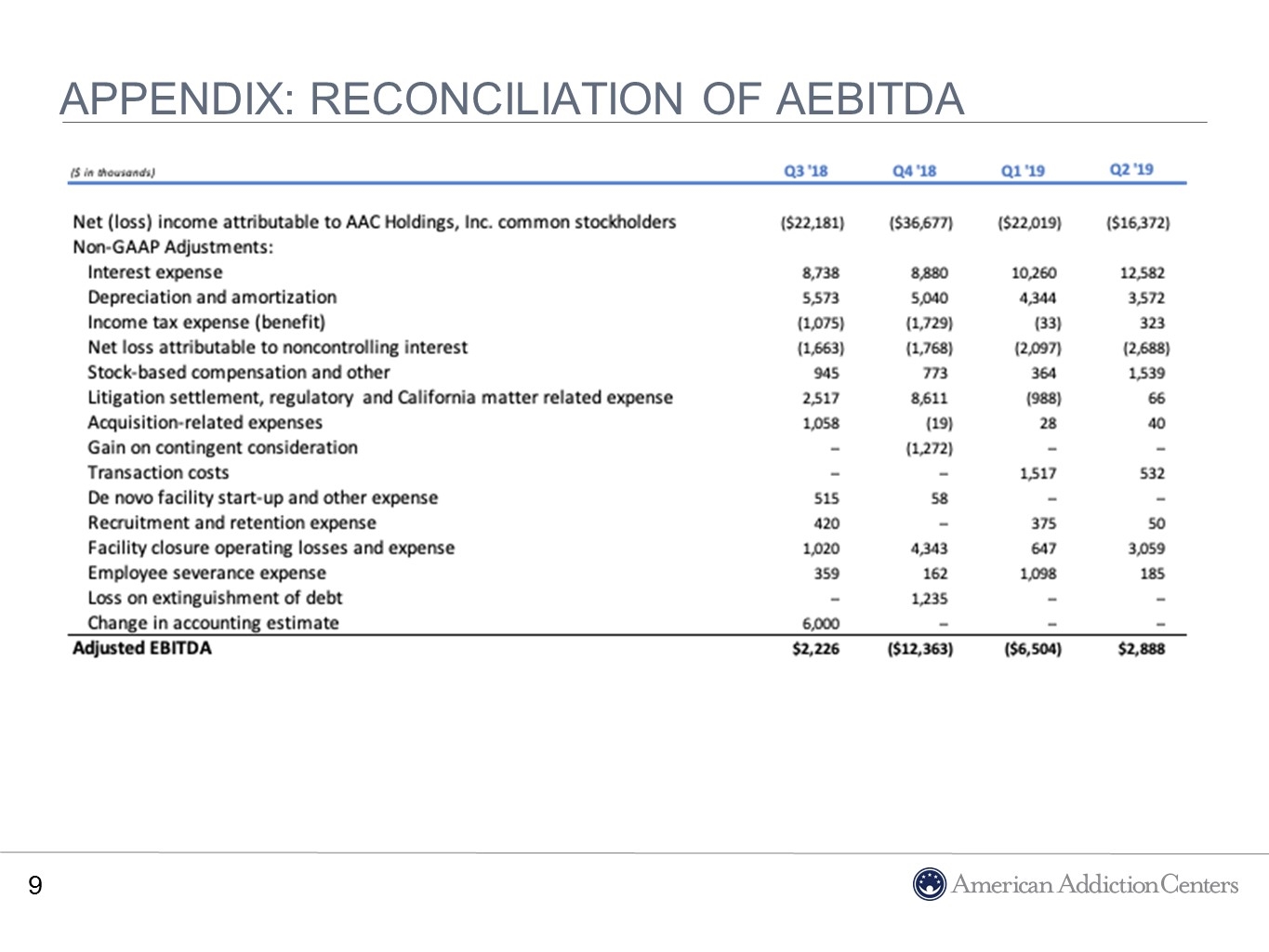

Net Revenue Operating Expenses* Adjusted EBITDA** Summarized Financials Summarized financials * Operating expenses exclude depreciation and amortization, gain on sale and litigation settlement $ in millions ** Refer to the Appendix for a reconciliation of Adjusted EBITDA.

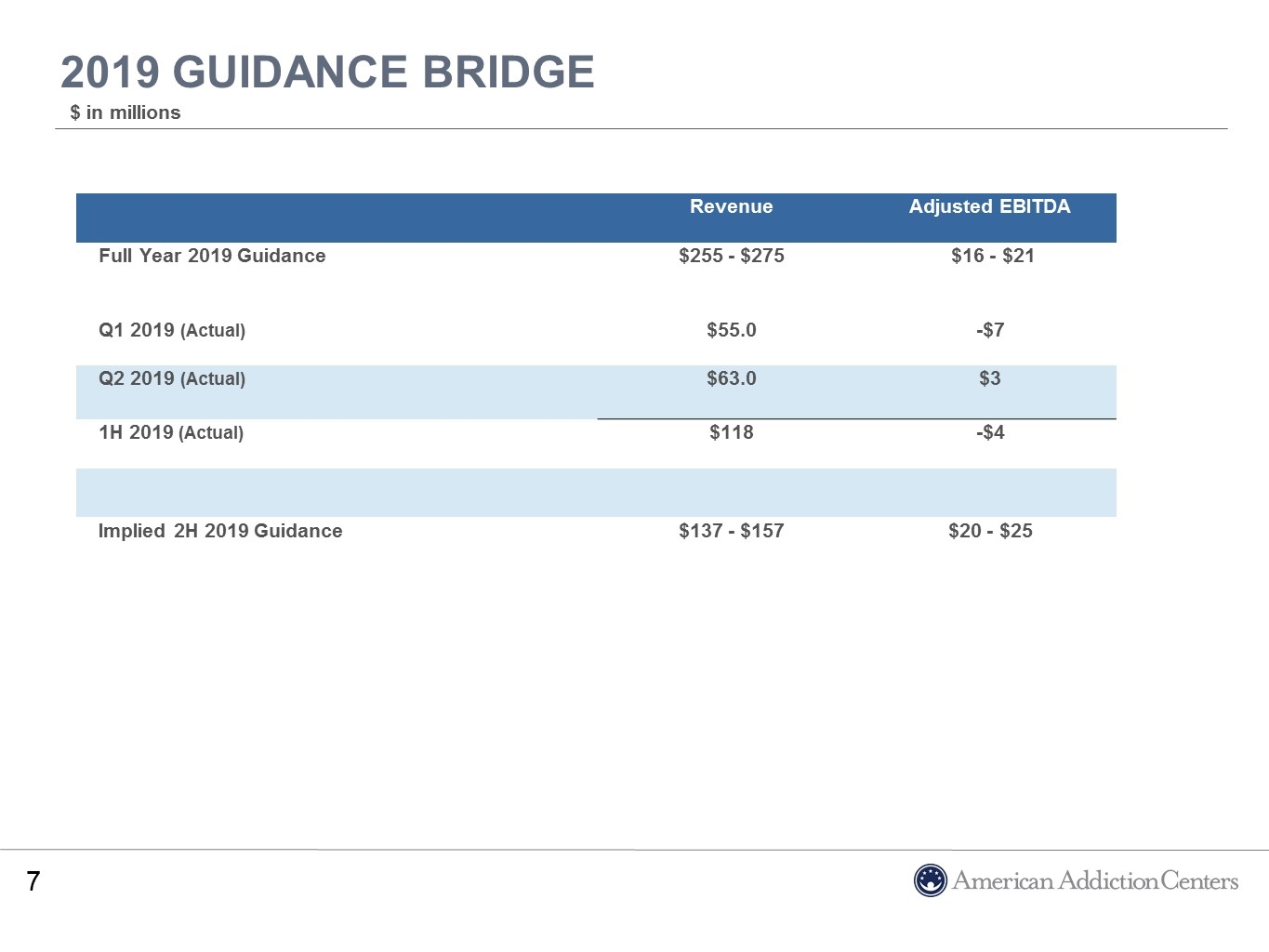

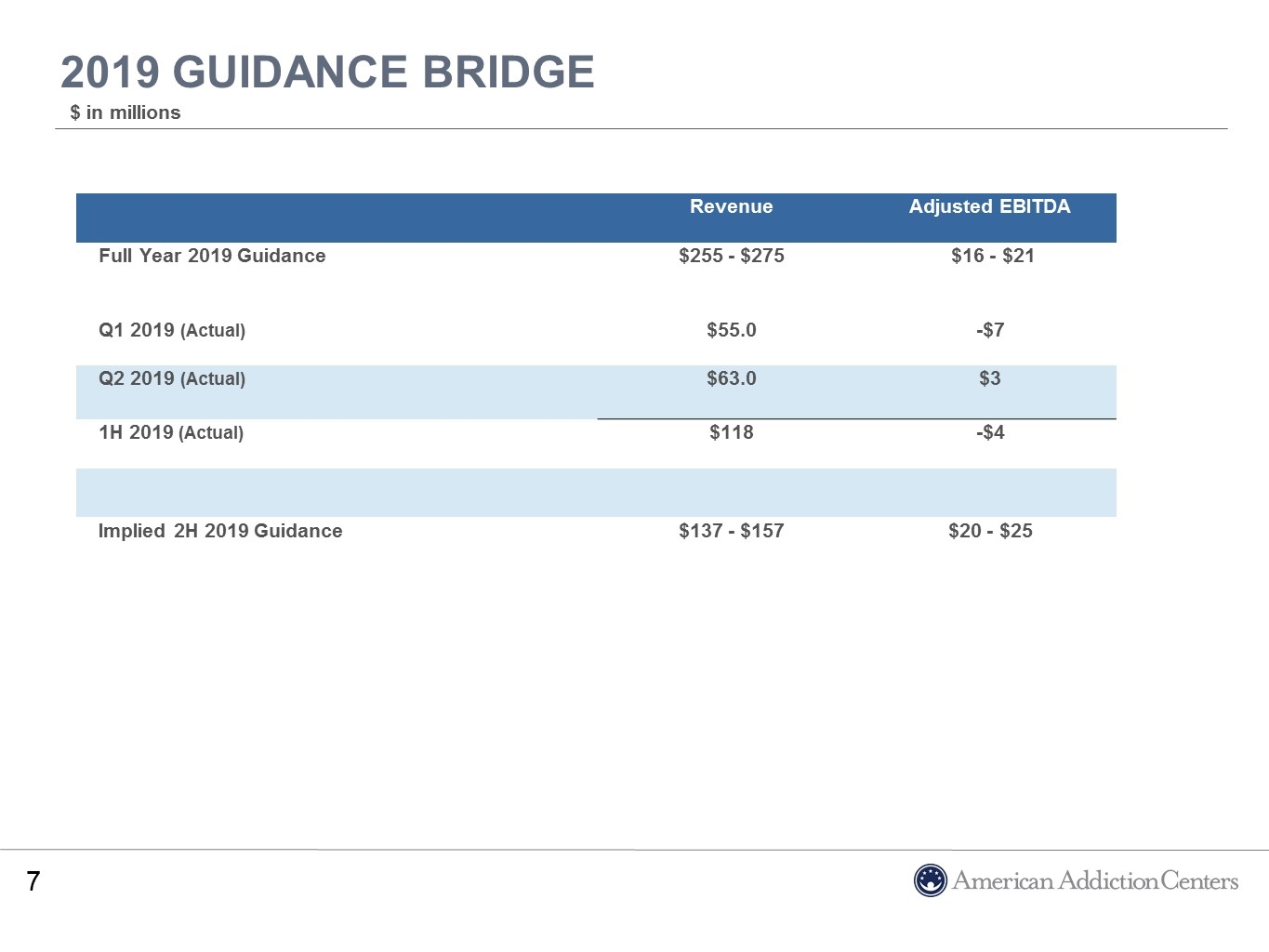

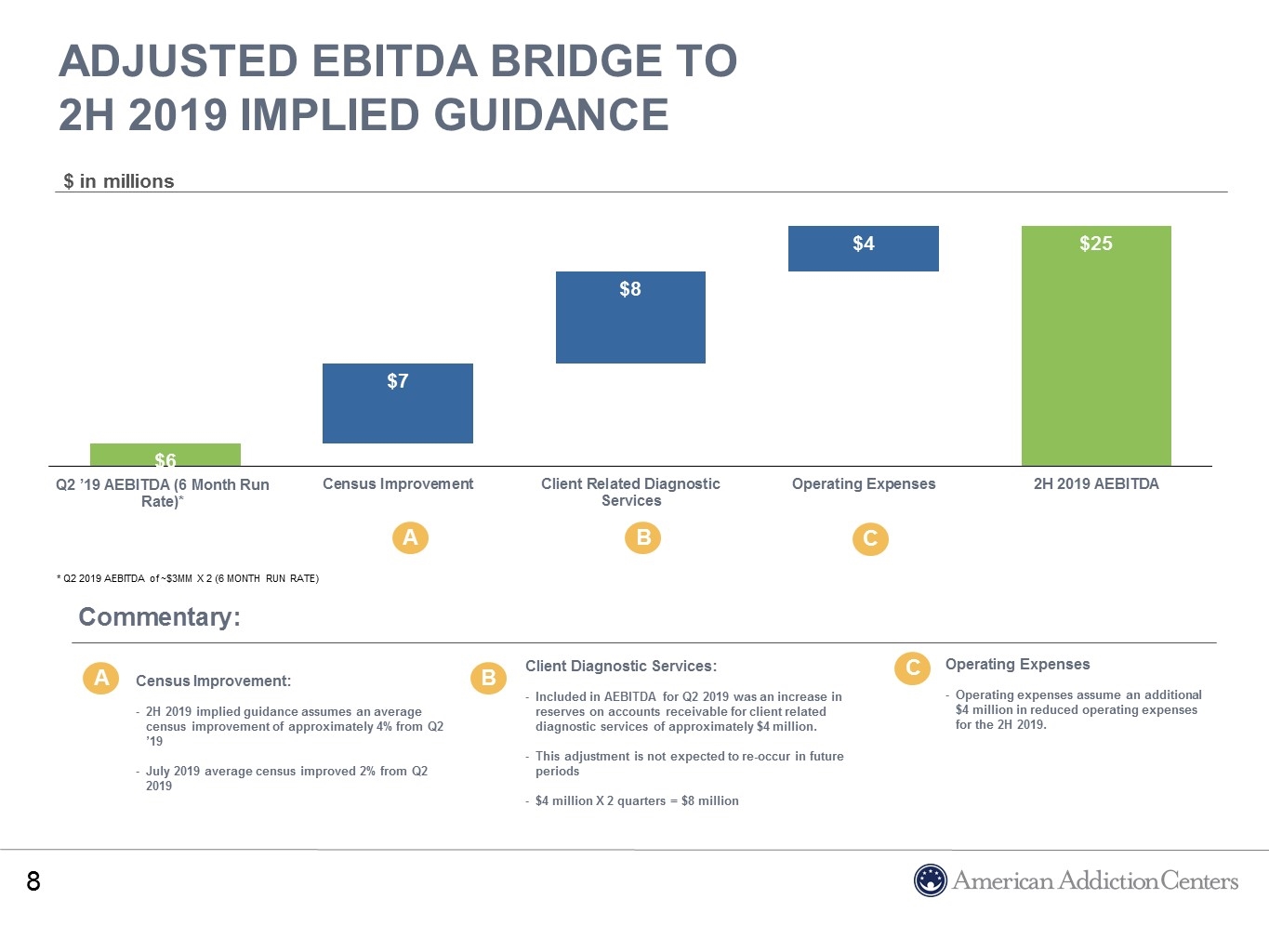

2019 Guidance Bridge 2019 Guidance Bridge $ in millions Revenue Adjusted EBITDA Full Year 2019 Guidance $255 - $275 $16 - $21 Q1 2019 (Actual) $55.0 -$7 Q2 2019 (Actual) $63.0 $3 1H 2019 (Actual) $118 -$4 Implied 2H 2019 Guidance $137 - $157 $20 - $25

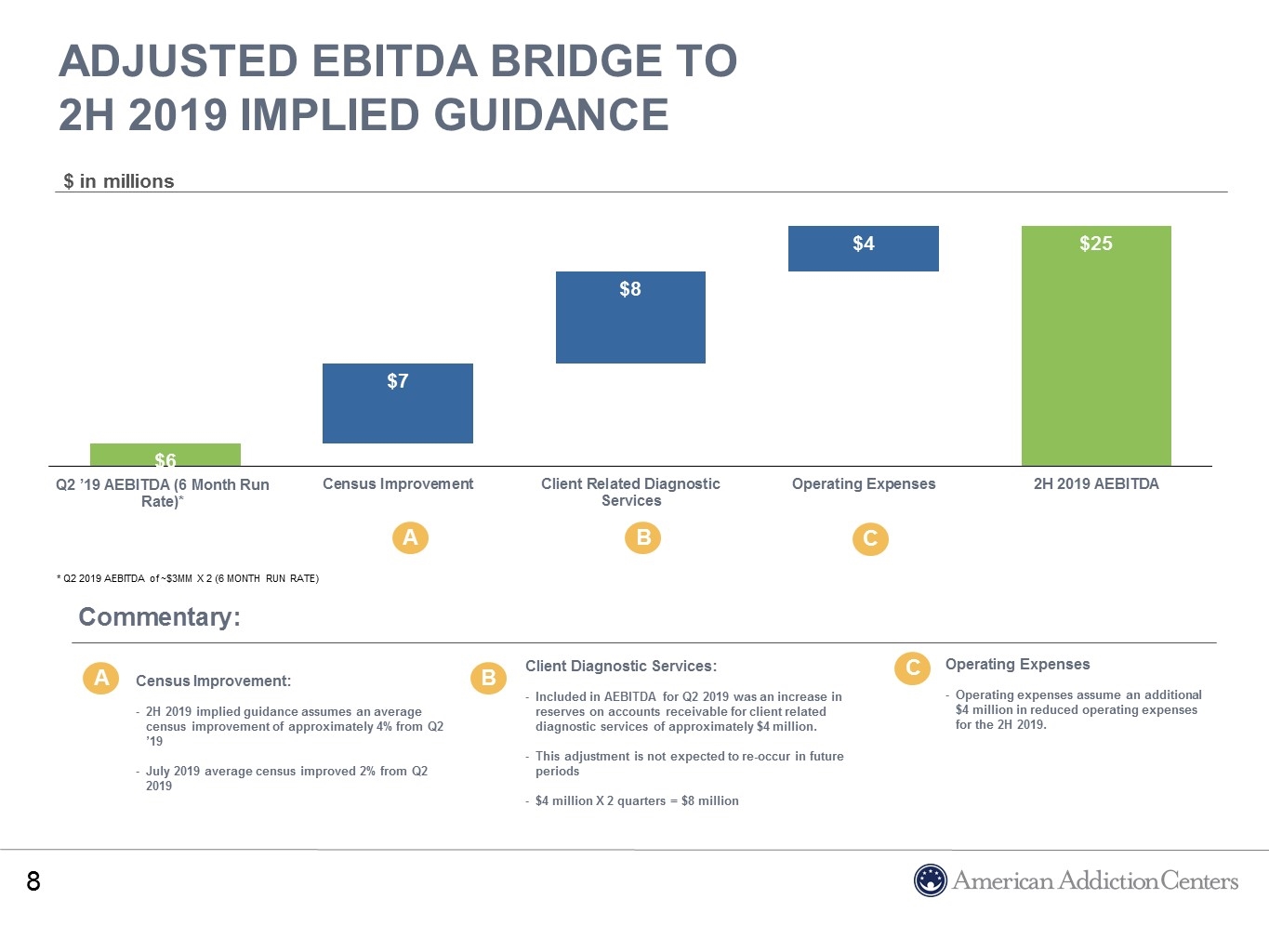

ADJUStED EBITDA Bridge to 2H 2019 Implied Guidance Adjusted EBITDA A Adjusted EBITDA Bridge to 2H 2019 Implied Guidance $ in millions Client Diagnostic Services: Included in AEBITDA for Q2 2019 was an increase in reserves on accounts receivable for client related diagnostic services of approximately $4 million. This adjustment is not expected to re-occur in future periods $4 million X 2 quarters = $8 million Census Improvement: 2H 2019 implied guidance assumes an average census improvement of approximately 4% from Q2 ’19 July 2019 average census improved 2% from Q2 2019 Operating Expenses Operating expenses assume an additional $4 million in reduced operating expenses for the 2H 2019. A B C A B C * Q2 2019 AEBITDA of ~$3MM X 2 (6 MONTH RUN RATE)

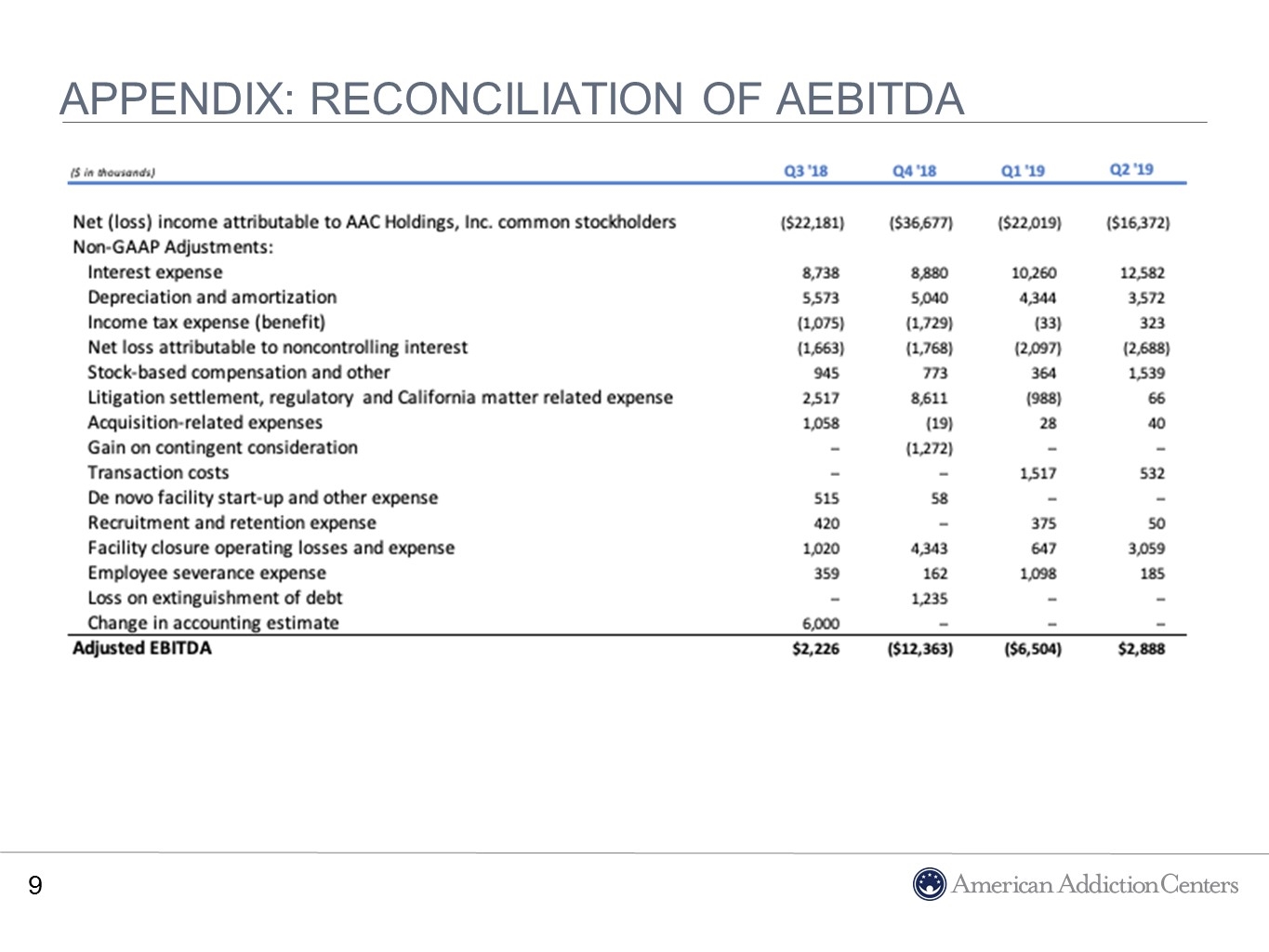

Appendix: Reconciliation of AEBITDA