Investor Presentation February 2016

1 Safe Harbor Statement This presentation contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. These statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), can be identified by the use of forward-looking terminology including “guidance,” “may,” “should,” “likely,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “plan,” “intend,” “project,” or other similar words. All statements, other than statements of historical fact included in this presentation, regarding strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, objectives and beliefs of management are forward-looking statements. Forward-looking statements appear in a number of places in this presentation and may include statements about business strategy and prospects for growth, customer acquisition costs, ability to pay cash dividends, cash flow generation and liquidity, availability of terms of capital, competition and government regulation and general economic conditions. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot give any assurance that such expectations will prove correct. The forward-looking statements in this presentation are subject to risks and uncertainties. Important factors which could cause actual results to materially differ from those projected in the forward-looking statements include, but are not limited to: • changes in commodity prices, • finalization of Spark’s financial reporting for the fiscal year 2015, • extreme and unpredictable weather conditions, • the sufficiency of risk management and hedging policies, • customer concentration, • federal, state and local regulation, • key license retention, • increased regulatory scrutiny and compliance costs, • our ability to borrow funds and access credit markets, • restrictions in our debt agreements and collateral requirements, • credit risk with respect to suppliers and customers, • level of indebtedness, • changes in costs to acquire customers, • actual customer attrition rates, • actual bad debt expense in non-POR markets, • accuracy of internal billing systems, • ability to successfully navigate entry into new markets, • whether our majority shareholder or its affiliates offers us acquisition opportunities on terms that are commercially acceptable to us, • ability to successfully and efficiently integrate acquisitions into our operations, • changes in the assumptions we used to estimate our 2016 Adjusted EBITDA, including weather and customer acquisition costs, • competition, and • other factors discussed in “Risk Factors” in our Form 10-K for the year ended December 31, 2014, our Quarterly Reports on Form 10-Q for 2015 and in our other public filings and press releases. You should review the risk factors and other factors disclosed throughout our Report on Form 10-K for the year ended December 31, 2014 and the Quarterly Reports on Form 10-Q for 2015, all of which are filed with the Securities and Exchange Commission, which could cause our actual results to differ materially from those contained in any forward-looking statement. The estimate of Adjusted EBITDA for the year ended December 31, 2015 in this presentation is subject to change based on finalization of financial results for the year ended December 31, 2015. The Adjusted EBITDA guidance for 2016 is an estimate as of February 1, 2016. This estimate is based on assumptions believed to be reasonable as of that date. All forward-looking statements speak only as of the date of this presentation. Unless required by law, we disclaim any obligation to publicly update or revise these statements whether as a result of new information, future events or otherwise. It is not possible for us to predict all risks, nor can we assess the impact of all factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. In this presentation, we refer to EBITDA and Adjusted EBITDA, which are non-GAAP financials measures the Company believes are helpful in evaluating the performance of its business. Except as otherwise noted, reconciliation of such non-GAAP measures to the relevant GAAP measures can be found at the end of this presentation.

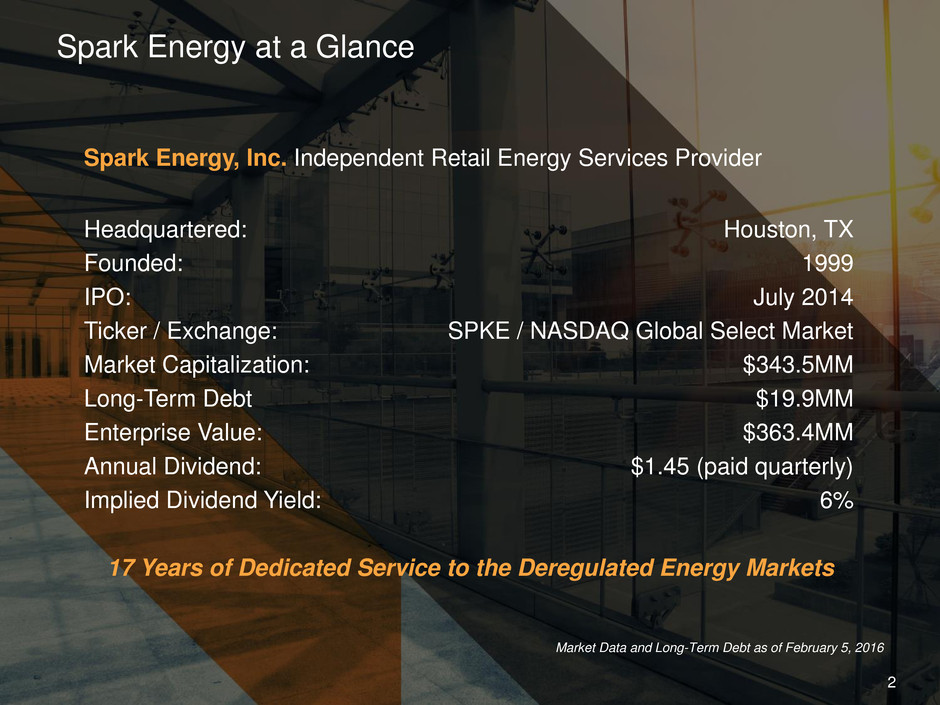

Spark Energy at a Glance Spark Energy, Inc. Independent Retail Energy Services Provider Headquartered: Houston, TX Founded: 1999 IPO: July 2014 Ticker / Exchange: SPKE / NASDAQ Global Select Market Market Capitalization: $343.5MM Long-Term Debt $19.9MM Enterprise Value: $363.4MM Annual Dividend: $1.45 (paid quarterly) Implied Dividend Yield: 6% 17 Years of Dedicated Service to the Deregulated Energy Markets Market Data and Long-Term Debt as of February 5, 2016 2

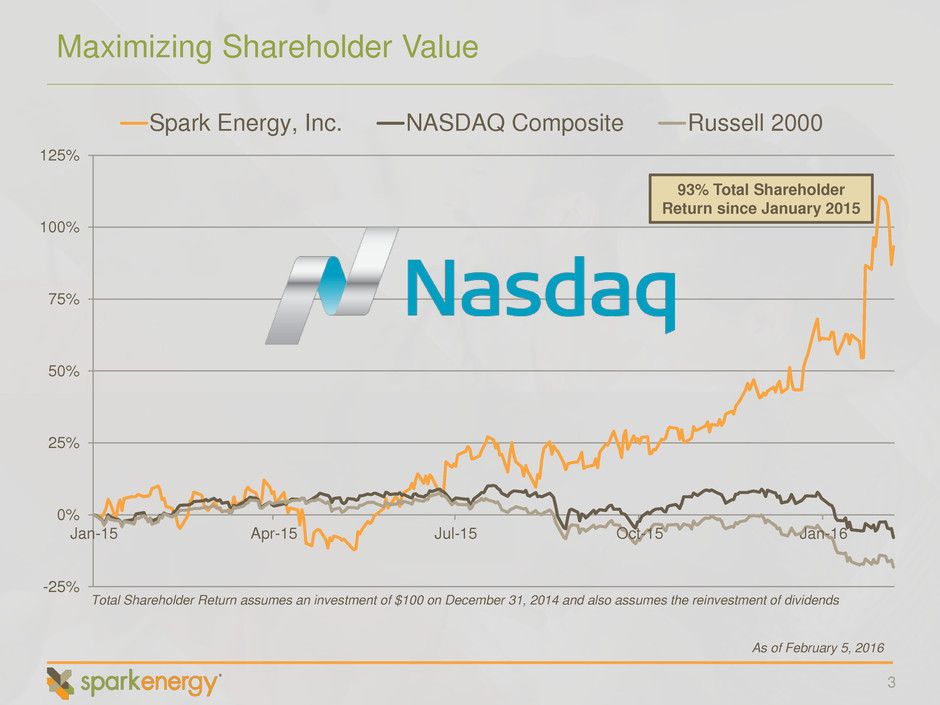

3 Maximizing Shareholder Value -25% 0% 25% 50% 75% 100% 125% Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Spark Energy, Inc. NASDAQ Composite Russell 2000 As of February 5, 2016 93% Total Shareholder Return since January 2015 Total Shareholder Return assumes an investment of $100 on December 31, 2014 and also assumes the reinvestment of dividends

4 Spark Energy Highlights 2016 annual Adjusted EBITDA guidance in the range of $44MM - $48MM, based upon projected 2016 customer acquisition costs of $13MM - $17MM Five recent M&A transactions successfully integrated and creating shareholder value Aligned sponsor supports growth strategy Dropped down Oasis transaction Financed 25% of our CenStar and Oasis transactions Implemented Retailco, a customer operations platform, to provide our back office functions at an expected 5-8% annual cost savings. Quarterly dividends of $0.3625 ($1.45 annualized) since IPO in July 2014 Management team includes experienced retail energy veteran specializing in organic sales, marketing, and customer retention Organic commission structure enhances customer quality and lifetime value Southern California operational issues are now behind us Total Shareholder Return of ~93% since January 2015

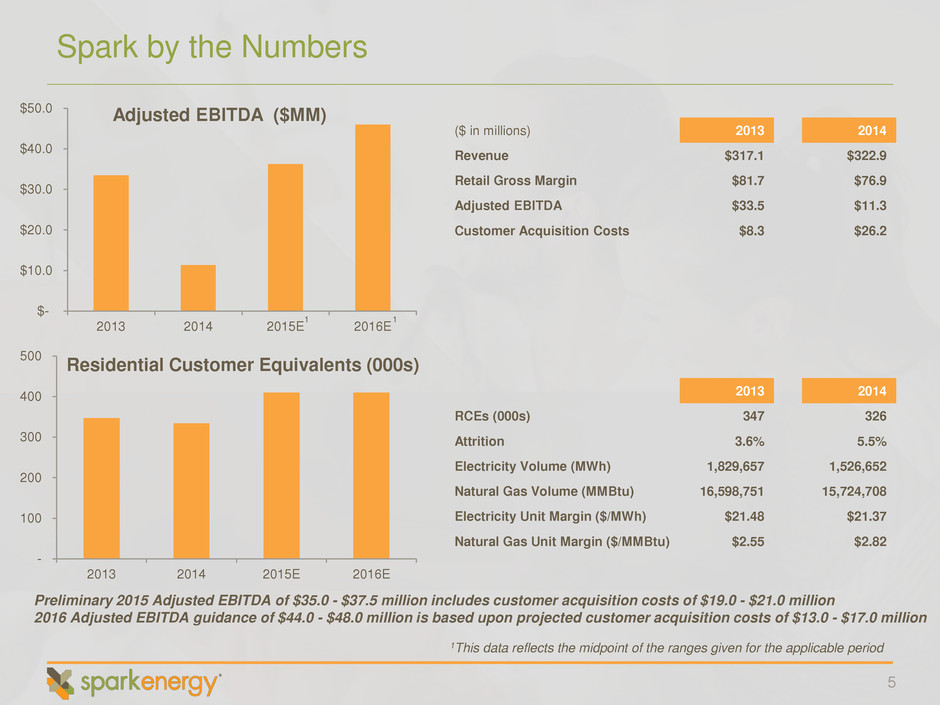

5 Spark by the Numbers $- $10.0 $20.0 $30.0 $40.0 $50.0 2013 2014 2015E 2016E Adjusted EBITDA ($MM) ($ in millions) 2013 2014 Revenue $317.1 $322.9 Retail Gross Margin $81.7 $76.9 Adjusted EBITDA $33.5 $11.3 Customer Acquisition Costs $8.3 $26.2 - 100 200 300 400 500 2013 2014 2015E 2016E 2013 2014 RCEs (000s) 347 326 Attrition 3.6% 5.5% Electricity Volume (MWh) 1,829,657 1,526,652 Natural Gas Volume (MMBtu) 16,598,751 15,724,708 Electricity Unit Margin ($/MWh) $21.48 $21.37 Natural Gas Unit Margin ($/MMBtu) $2.55 $2.82 Residential Customer Equivalents (000s) Preliminary 2015 Adjusted EBITDA of $35.0 - $37.5 million includes customer acquisition costs of $19.0 - $21.0 million 2016 Adjusted EBITDA guidance of $44.0 - $48.0 million is based upon projected customer acquisition costs of $13.0 - $17.0 million 1This data reflects the midpoint of the ranges given for the applicable period 1 1

6 How Spark Energy Serves its Customers Delivering Electricity Delivering Natural Gas POWER GENERATION SPARK ENERGY SPARK ENERGY DISTRIBUTION DISTRIBUTION PRODUCTION TRANSPORTATION TRANSMISSION Green and Renewable Products Stable and Predictable Energy Costs Potential Cost Savings Our Value Proposition to the Customer

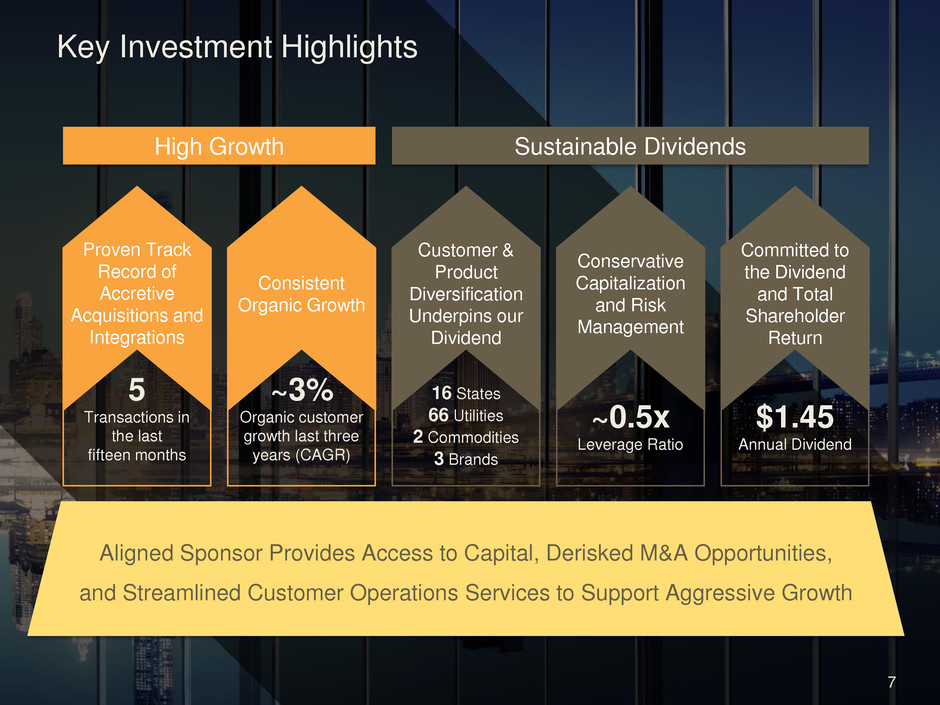

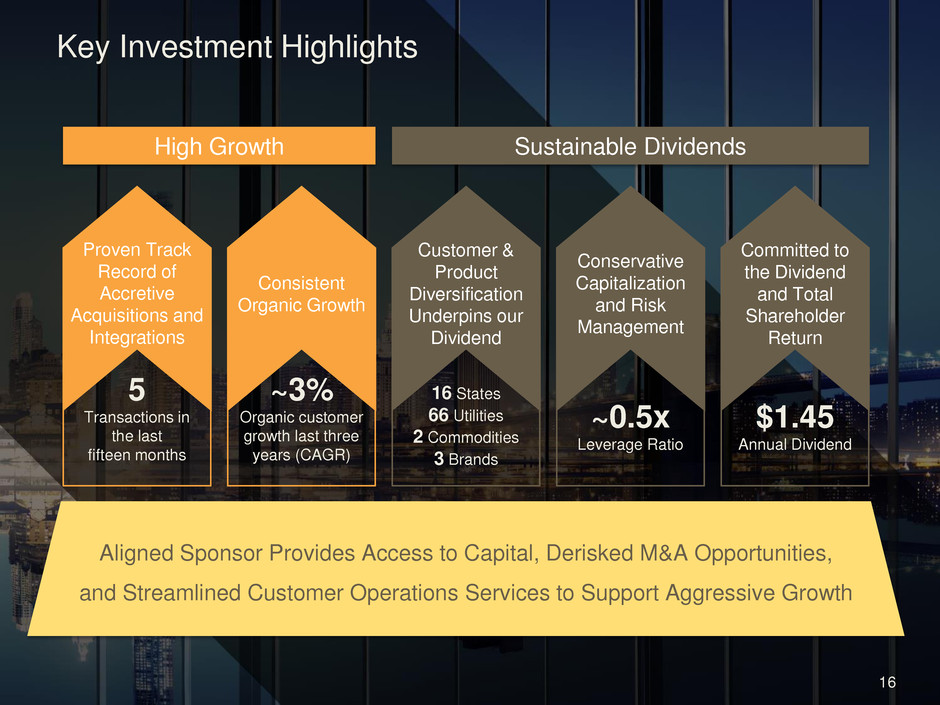

Key Investment Highlights Proven Track Record of Accretive Acquisitions and Integrations 5 Transactions in the last fifteen months Consistent Organic Growth ~3% Organic customer growth last three years (CAGR) Conservative Capitalization and Risk Management ~0.5x Leverage Ratio Committed to the Dividend and Total Shareholder Return $1.45 Annual Dividend Customer & Product Diversification Underpins our Dividend 16 States 66 Utilities 2 Commodities 3 Brands High Growth Sustainable Dividends 7 Aligned Sponsor Provides Access to Capital, Derisked M&A Opportunities, and Streamlined Customer Operations Services to Support Aggressive Growth

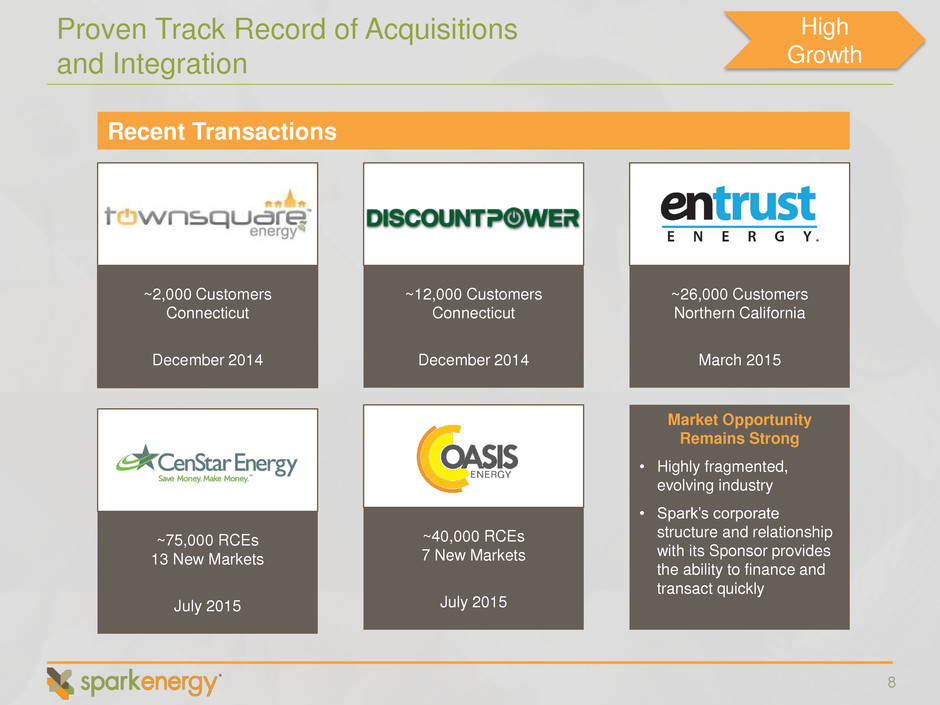

8 Proven Track Record of Acquisitions and Integration Recent Transactions ~75,000 RCEs 13 New Markets July 2015 ~40,000 RCEs 7 New Markets July 2015 ~2,000 Customers Connecticut December 2014 ~12,000 Customers Connecticut December 2014 ~26,000 Customers Northern California March 2015 Market Opportunity Remains Strong • Highly fragmented, evolving industry • Spark’s corporate structure and relationship with its Sponsor provides the ability to finance and transact quickly High Growth

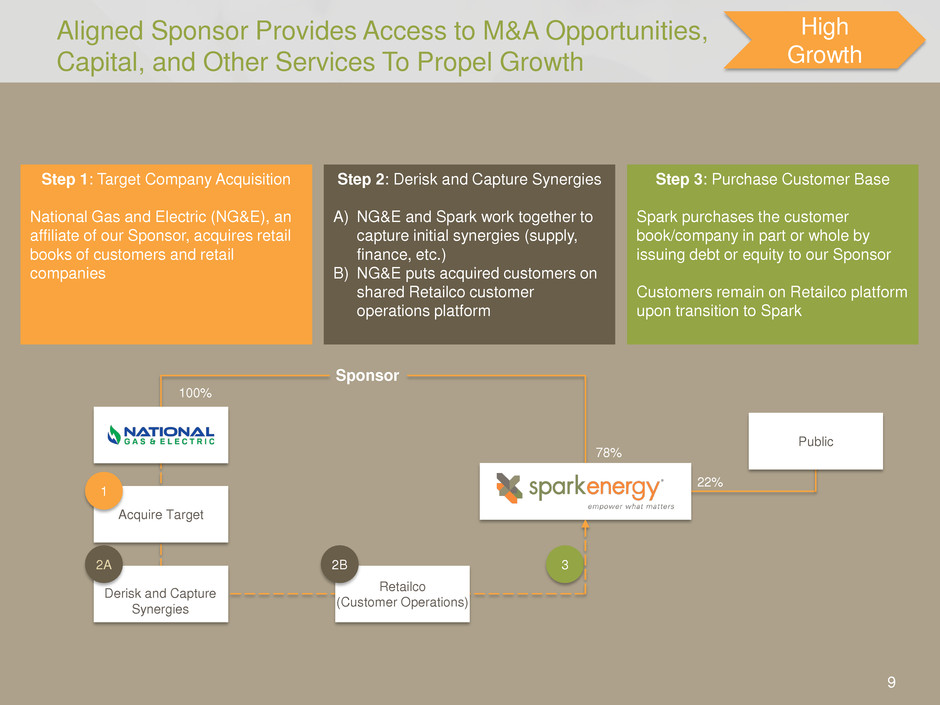

9 Aligned Sponsor Provides Access to M&A Opportunities, Capital, and Other Services To Propel Growth Step 2: Derisk and Capture Synergies A) NG&E and Spark work together to capture initial synergies (supply, finance, etc.) B) NG&E puts acquired customers on shared Retailco customer operations platform Step 1: Target Company Acquisition National Gas and Electric (NG&E), an affiliate of our Sponsor, acquires retail books of customers and retail companies 100% 78% 22% Sponsor Public Retailco (Customer Operations) Acquire Target Derisk and Capture Synergies 1 2A 3 2B Step 3: Purchase Customer Base Spark purchases the customer book/company in part or whole by issuing debt or equity to our Sponsor Customers remain on Retailco platform upon transition to Spark High Growth

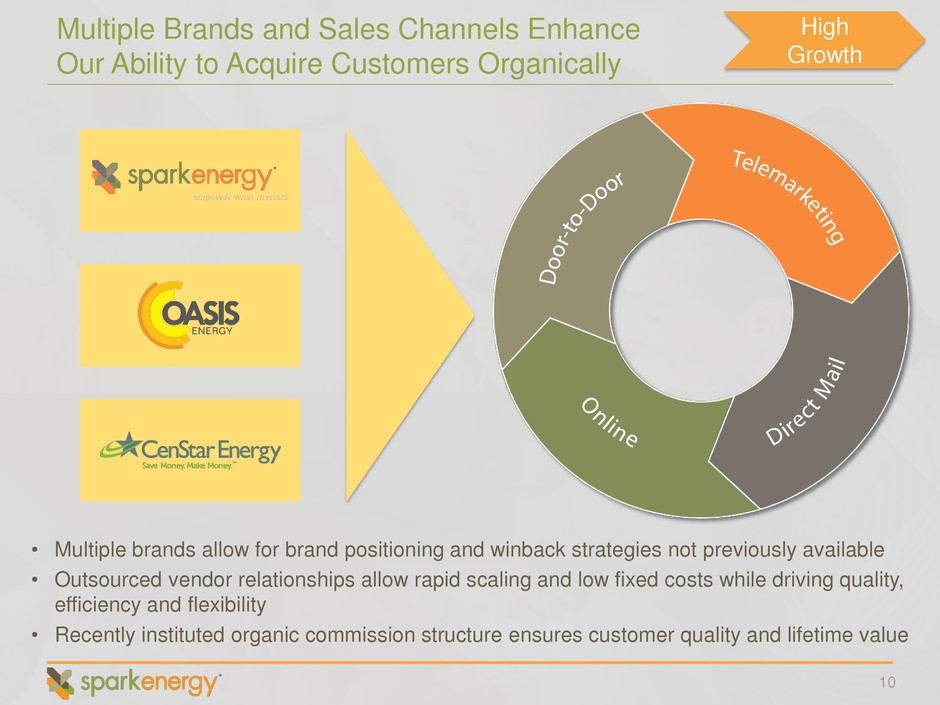

10 Multiple Brands and Sales Channels Enhance Our Ability to Acquire Customers Organically • Multiple brands allow for brand positioning and winback strategies not previously available • Outsourced vendor relationships allow rapid scaling and low fixed costs while driving quality, efficiency and flexibility • Recently instituted organic commission structure ensures customer quality and lifetime value High Growth

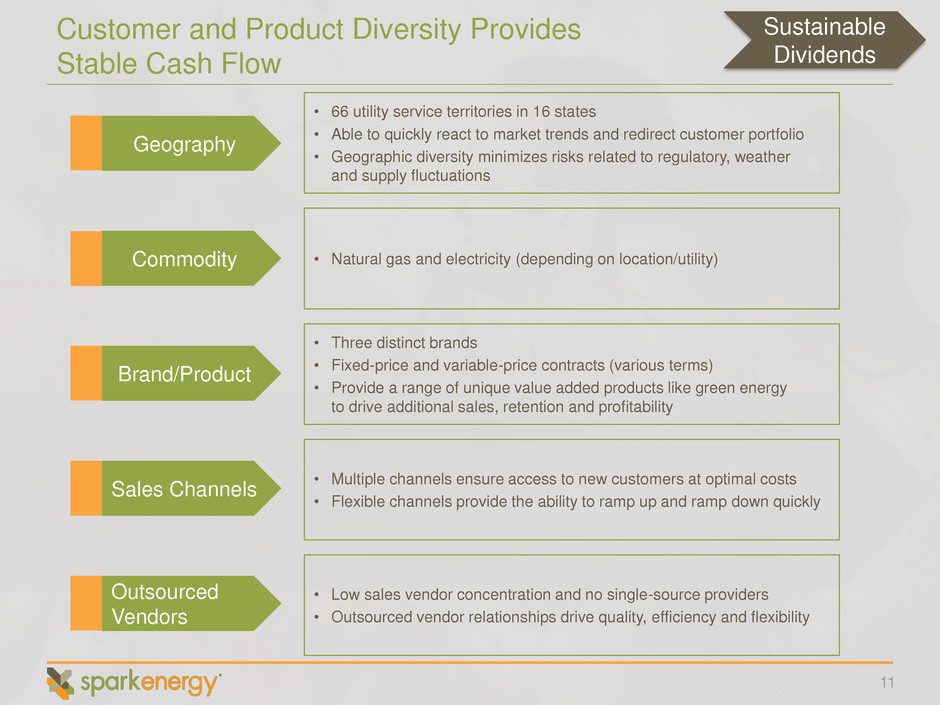

11 Customer and Product Diversity Provides Stable Cash Flow • 66 utility service territories in 16 states • Able to quickly react to market trends and redirect customer portfolio • Geographic diversity minimizes risks related to regulatory, weather and supply fluctuations • Natural gas and electricity (depending on location/utility) • Three distinct brands • Fixed-price and variable-price contracts (various terms) • Provide a range of unique value added products like green energy to drive additional sales, retention and profitability • Multiple channels ensure access to new customers at optimal costs • Flexible channels provide the ability to ramp up and ramp down quickly • Low sales vendor concentration and no single-source providers • Outsourced vendor relationships drive quality, efficiency and flexibility Sustainable Dividends Sales Channels Brand/Product Outsourced Vendors Commodity Geography

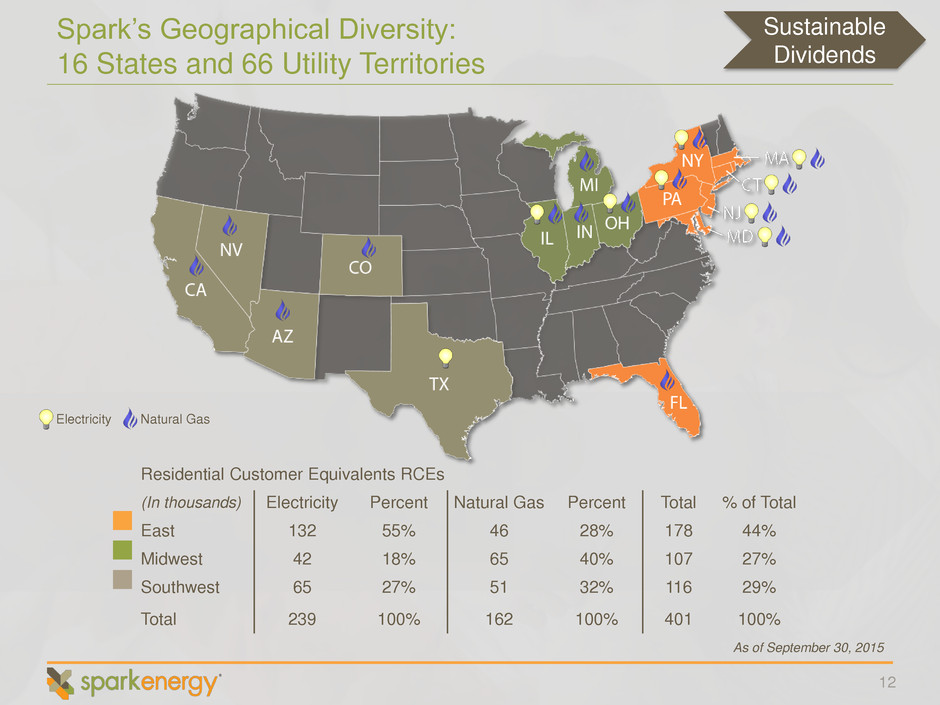

12 Spark’s Geographical Diversity: 16 States and 66 Utility Territories Residential Customer Equivalents RCEs (In thousands) Electricity Percent Natural Gas Percent Total % of Total East 132 55% 46 28% 178 44% Midwest 42 18% 65 40% 107 27% Southwest 65 27% 51 32% 116 29% Total 239 100% 162 100% 401 100% Sustainable Dividends As of September 30, 2015 Electricity Natural Gas

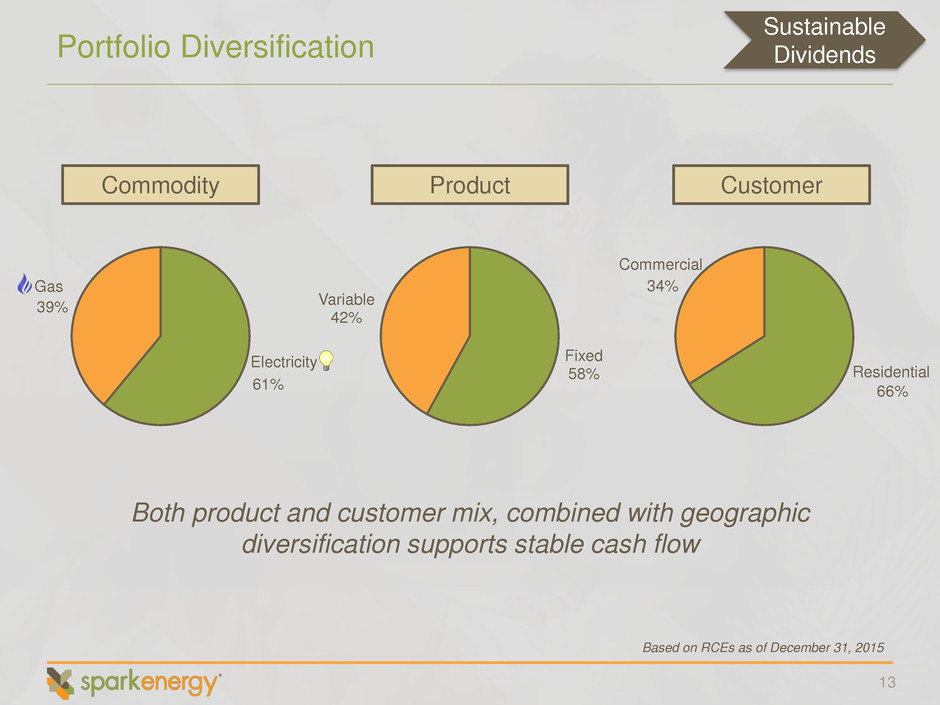

Electricity 13 Portfolio Diversification 66% 34% 61% 39% Fixed 58% Variable 42% Commercial Residential Both product and customer mix, combined with geographic diversification supports stable cash flow Commodity Product Customer Sustainable Dividends Based on RCEs as of December 31, 2015 Gas

14 Conservative Capitalization Minimizes Risk Leverage Ratio1 Debt2 $19.9MM Estimated 2015 Adjusted EBITDA $35.0 - $37.5MM Leverage Ratio 0.5x – 0.6x $85 million syndicated credit facility $60 million working capital line (eliminates need for costly credit sleeve) $19.9 million drawn on $25 million acquisition tranche1 Low cost of capital Anticipate near-term M&A transactions will be financed predominately using equity 1As of February 5, 2015 2Long-Term debt (attributable to the acquisitions) is amortized 25% annually Sustainable Dividends

15 Managing Commodity Price Risk Sustainable Dividends Proven hedging strategy that has been refined over Spark Energy’s 17 year history Demonstrated ability to “weather the storm” through up-and-down commodity markets, extreme weather events, and down economies Disciplined risk management supports aggressive growth plans Virtually all fixed price exposure is hedged Variable hedging policy based on individual market characteristics Hedging policy monitored closely by CFO and CRO Risk management policy approved by syndicate banks and Board of Directors Approximately $250MM in available credit with wholesale suppliers1 1As of February 5, 2016 Seasoned, in-house supply team provides a strong competitive advantage relative to our peers while ensuring risk mitigation

Key Investment Highlights Proven Track Record of Accretive Acquisitions and Integrations 5 Transactions in the last fifteen months Consistent Organic Growth ~3% Organic customer growth last three years (CAGR) Conservative Capitalization and Risk Management ~0.5x Leverage Ratio Committed to the Dividend and Total Shareholder Return $1.45 Annual Dividend Customer & Product Diversification Underpins our Dividend 16 States 66 Utilities 2 Commodities 3 Brands High Growth Sustainable Dividends 16 Aligned Sponsor Provides Access to Capital, Derisked M&A Opportunities, and Streamlined Customer Operations Services to Support Aggressive Growth

17 Spark in the Community Through our work with the Arbor Day Foundation, we are able to extend our environmental efforts far beyond green energy. We help Lemonade Day introduce youth to the concept of starting and operating their own lemonade stand businesses while teaching the real-world skills they need to achieve their dreams. 1.6 million people around the world lack proper access to electricity. Through our relationship with LuminAID, we are developing programs to distribute solar- powered inflatable lights to areas that need it the most. We are working with The Beer-Sheeba Project, which focuses on sustainable agro-forestry and holistic environmental education in Senegal. We started with a solar panel expansion plan that is now bringing additional energy to power the project’s feed mills, irrigation pumps and cooling systems. The Beer-Sheba Project Helping a Hero provides specially adapted homes — and other much-needed services and resources — for severely-injured military combat veterans. We’re proud to play our part in helping America’s heroes transition back to normal lives in their communities by donating electricity to these warriors for the first year they own their new homes. Empower What Matters Most We partner with organizations that: • Raise the quality of life for children and military veterans • Make communities better places to live and work • Drive America’s economic future through entrepreneurship education • Provide an avenue for our employees to get involved in our community and to support our green values

Investor Relations Contact Information Investor Relations Spark Energy, Inc. 12140 Wickchester Lane, Suite 100 Houston, TX 77079 http://ir.sparkenergy.com/ Contact: Andy Davis ir@sparkenergy.com 832-200-3727 18

Appendix

20 Proven Leadership Georganne Hodges • Chief Financial Officer • Former CFO of Direct Energy’s (LSE:CNA) retail energy services business • Experienced in M&A and integration of retail energy companies • Certified public accountant Jason Garrett • Executive Vice President • Served in leadership roles, including M&A, for various deregulated energy companies including SouthStar Energy, Just Energy, and Continuum • Proven success and expertise in sales leadership, call center management, operational improvements and cost reduction initiatives Gil Melman • Vice President, General Counsel and Corporate Secretary • Former general counsel to Madagascar Oil Limited (LSE:MOIL) and lawyer at Vinson & Elkins LLP • Proficient in representing public and private companies, investment funds and investment banking firms on M&A and capital markets transactions Nathan Kroeker • CEO and President • Veteran leader in sales strategy, global energy supply, and M&A across the upstream, downstream, and midstream energy sectors • Extensive international experience; board member of ESM (a Japanese retail energy company); previously worked for Macquarie and Centrica Extensive M&A Experience Across the Team Ensures Value Creation Senior Management has over 45 Years of Retail Energy Experience

21 Board of Directors W. Keith Maxwell III • Chairman of the Board of Directors Mr. Maxwell serves as non-executive Chairman of the Board of Directors, and was appointed to this position in connection with the IPO. Mr. Maxwell also serves as Chief Executive Officer of NuDevco Partners, LLC and National Gas & Electric, LLC, each of which is affiliated with us. Prior to founding the predecessor of Spark Energy in 1999, Mr. Maxwell was a founding partner in Wickford Energy, an oil and natural gas services company, in 1994. Wickford Energy was sold to Black Hills Utilities in 1997. Prior to Wickford Energy, Mr. Maxwell was a partner in Polaris Pipeline, a natural gas producer services and midstream company sold to TECO Pipeline in 1994. In 2010, Mr. Maxwell was named Ernst & Young Entrepreneur of the Year in the Energy, Chemicals and Mining category. A native of Houston, Texas, Mr. Maxwell earned a Bachelor’s Degree in Economics from the University of Texas at Austin in 1987. Mr. Maxwell has several philanthropic interests, including the Special Olympics, Child Advocates, Salvation Army, Star of Hope and Helping a Hero. We believe that Mr. Maxwell’s extensive energy industry background, leadership experience developed while serving in several executive positions and strategic planning and oversight brings important experience and skill to our board of directors. Nathan Kroeker • President and Chief Executive Officer Nathan Kroeker, appointed President of Spark Energy in April 2012, is responsible for overseeing the day-to-day operations and help shape the overall strategy of the company. Nathan is a 15-year industry veteran with diverse experience in public accounting, M&A, and both retail and wholesale energy. Nathan first joined the company in July 2010 as Executive Vice President and Chief Financial Officer of Spark Energy Ventures. Prior to Spark, Nathan held senior finance and leadership roles with Macquarie and Direct Energy. He began his career in public accounting, including both audit and M&A advisory functions. Nathan holds a Bachelor of Commerce (honors) degree from the University of Manitoba, and has both a CPA (Texas) as well as a CA (Canada). He is a board member for Young Life, a non-denominational community youth outreach program, and was formerly a board member for the Texas Diversity Council, where he received the Diversity First Award. James G. Jones II • Independent Director Mr. Jones has served on Spark Energy’s Board of Directors since our initial public offering in July 2014. Mr. Jones is a partner at Padgett Stratemann & Co, a regional CPA with over 230 professionals. Mr. Jones is the leader of the Houston office which opened in May 2014. Prior to Padgett Stratemann & Co, Mr. Jones worked at Ernst & Young LLP from 1998 to March 2014, where he was a tax partner. Mr. Jones holds a Doctor of Jurisprudence from Louisiana State University and a Bachelor of Science in Accounting from the University of Louisiana at Monroe. Mr. Jones was selected as a director because of his extensive tax and financial background as well as his management expertise. John Eads • Independent Director Mr. Eads has served on Spark Energy’s Board of Directors since our initial public offering in July 2014. Mr. Eads currently serves as President of Sierra Resources, LLC, a privately-held oil and gas company, a position he has held since 2002, where he directly supervises the negotiation and closing of all of Sierra Resources, LLC’s acquisitions and exploratory projects. Mr. Eads has been an independent producer in the oil and natural gas industry for over 37 years. Mr. Eads holds a Bachelor of Science in Mechanical Engineering from Southern Methodist University and a Masters of Business Administration from the University of Texas. Mr. Eads was selected as a director because of his substantial knowledge of the natural gas industry and his business, leadership and management expertise. Kenneth M. Hartwick • Independent Director Mr. Hartwick has served on Spark Energy’s Board of Directors since our initial public offering in July 2014. Mr. Hartwick served in various roles for Just Energy Group Inc., a retail natural gas and electricity provider, most recently serving as President and Chief Executive Officer from 2004 through 2014. Mr. Hartwick also served for Just Energy Group Inc. as President from 2006 to 2008, as Chief Financial Officer from 2004 to 2006 and as a director from 2008 to 2014. Mr. Hartwick also served as the Chief Financial Officer of Hydro One, Inc., an energy distribution company, from 2001 to 2004. Mr. Hartwick currently serves as a director of Atlantic Power Corporation, a power generation plant operator, a position he has held since 2004. Mr. Hartwick also serves as a director of MYR Group Inc., an electrical contractor specializing in transmission, distribution, and substation projects, a position he has held since 2015. Mr. Hartwick holds an Honours of Business Administration degree from Trent University. Mr. Hartwick was selected as a director because of his extensive knowledge of the retail natural gas and electricity business and his leadership and management expertise.

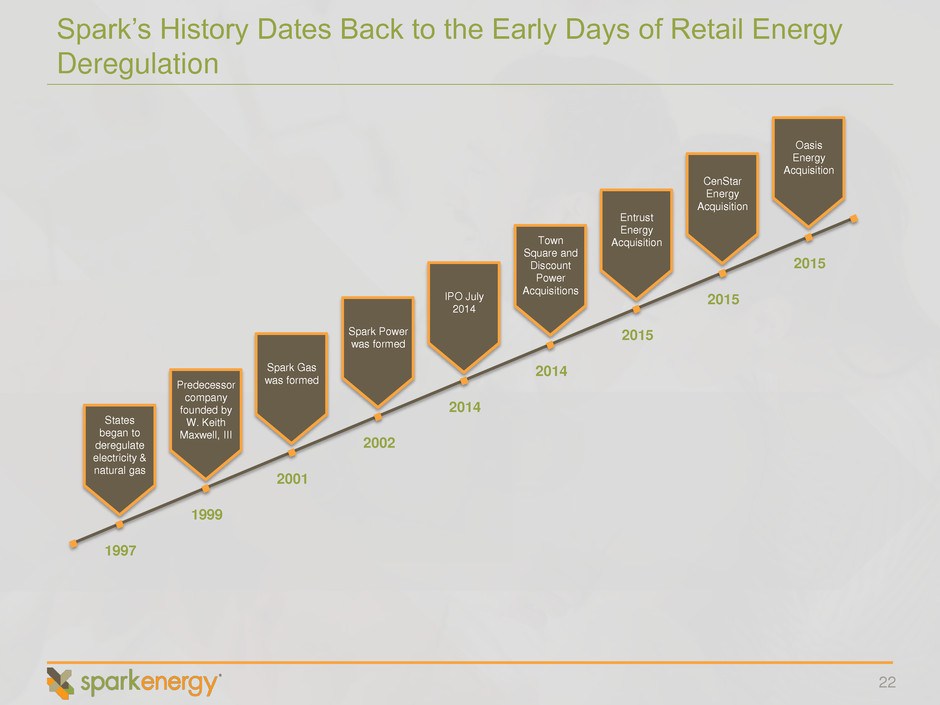

22 Spark’s History Dates Back to the Early Days of Retail Energy Deregulation Spark Gas was formed Spark Power was formed States began to deregulate electricity & natural gas Predecessor company founded by W. Keith Maxwell, III Town Square and Discount Power Acquisitions CenStar Energy Acquisition Oasis Energy Acquisition Entrust Energy Acquisition 1997 1999 2001 2002 2014 2014 2015 2015 2015 IPO July 2014

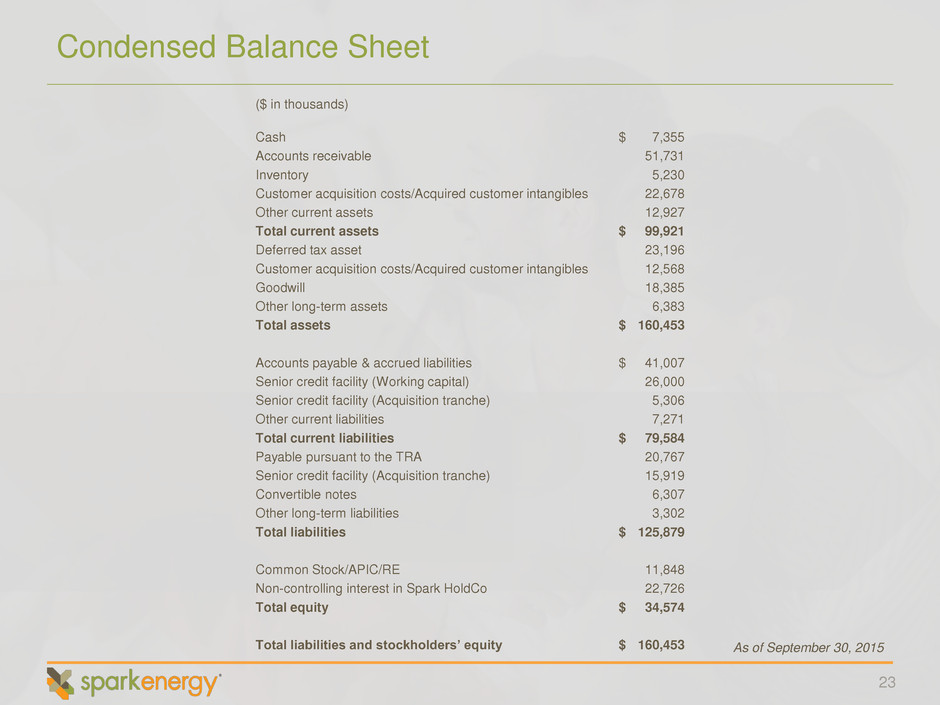

23 Condensed Balance Sheet ($ in thousands) Cash $ 7,355 Accounts receivable 51,731 Inventory 5,230 Customer acquisition costs/Acquired customer intangibles 22,678 Other current assets 12,927 Total current assets $ 99,921 Deferred tax asset 23,196 Customer acquisition costs/Acquired customer intangibles 12,568 Goodwill 18,385 Other long-term assets 6,383 Total assets $ 160,453 Accounts payable & accrued liabilities $ 41,007 Senior credit facility (Working capital) 26,000 Senior credit facility (Acquisition tranche) 5,306 Other current liabilities 7,271 Total current liabilities $ 79,584 Payable pursuant to the TRA 20,767 Senior credit facility (Acquisition tranche) 15,919 Convertible notes 6,307 Other long-term liabilities 3,302 Total liabilities $ 125,879 Common Stock/APIC/RE 11,848 Non-controlling interest in Spark HoldCo 22,726 Total equity $ 34,574 Total liabilities and stockholders’ equity $ 160,453 As of September 30, 2015

Appendix: Reg. G Schedules

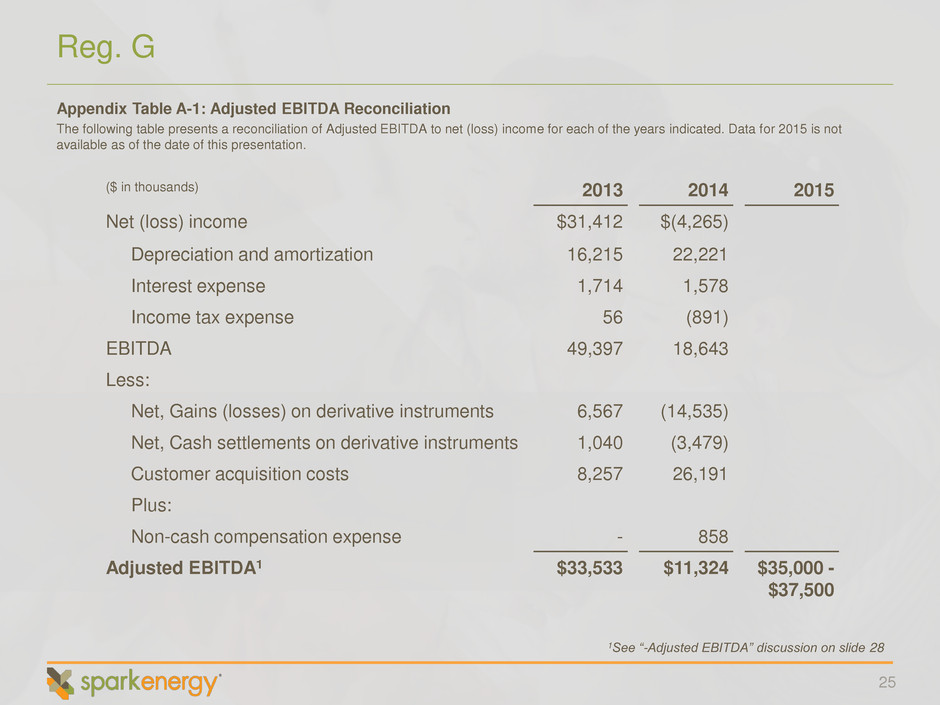

25 Reg. G ($ in thousands) 2013 2014 2015 Net (loss) income $31,412 $(4,265) Depreciation and amortization 16,215 22,221 Interest expense 1,714 1,578 Income tax expense 56 (891) EBITDA 49,397 18,643 Less: Net, Gains (losses) on derivative instruments 6,567 (14,535) Net, Cash settlements on derivative instruments 1,040 (3,479) Customer acquisition costs 8,257 26,191 Plus: Non-cash compensation expense - 858 Adjusted EBITDA1 $33,533 $11,324 $35,000 - $37,500 Appendix Table A-1: Adjusted EBITDA Reconciliation The following table presents a reconciliation of Adjusted EBITDA to net (loss) income for each of the years indicated. Data for 2015 is not available as of the date of this presentation. 1See “-Adjusted EBITDA” discussion on slide 28

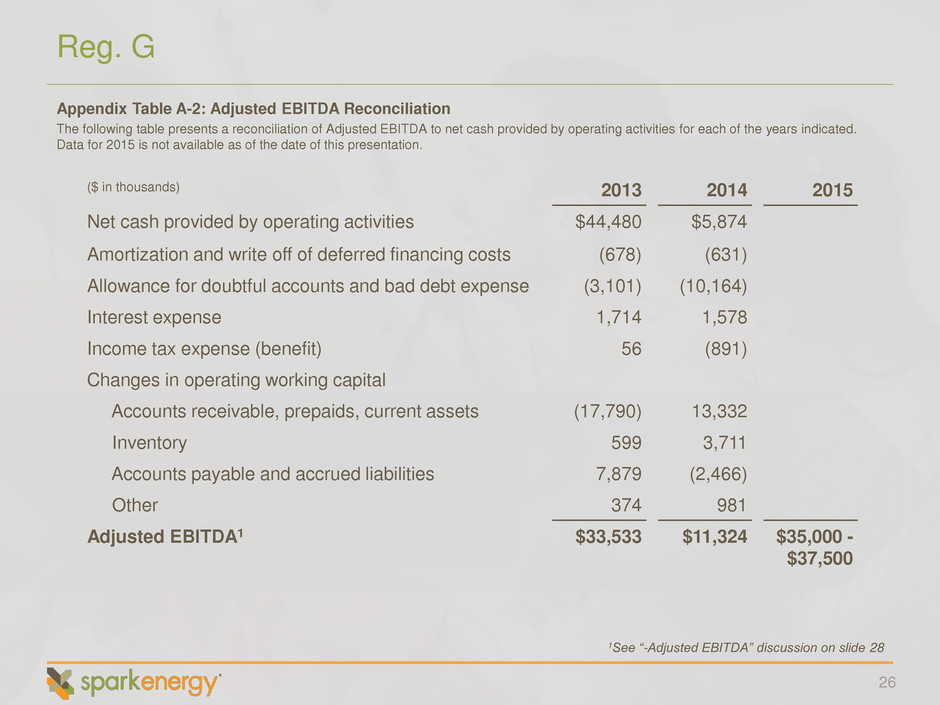

26 Reg. G ($ in thousands) 2013 2014 2015 Net cash provided by operating activities $44,480 $5,874 Amortization and write off of deferred financing costs (678) (631) Allowance for doubtful accounts and bad debt expense (3,101) (10,164) Interest expense 1,714 1,578 Income tax expense (benefit) 56 (891) Changes in operating working capital Accounts receivable, prepaids, current assets (17,790) 13,332 Inventory 599 3,711 Accounts payable and accrued liabilities 7,879 (2,466) Other 374 981 Adjusted EBITDA1 $33,533 $11,324 $35,000 - $37,500 Appendix Table A-2: Adjusted EBITDA Reconciliation The following table presents a reconciliation of Adjusted EBITDA to net cash provided by operating activities for each of the years indicated. Data for 2015 is not available as of the date of this presentation. 1See “-Adjusted EBITDA” discussion on slide 28

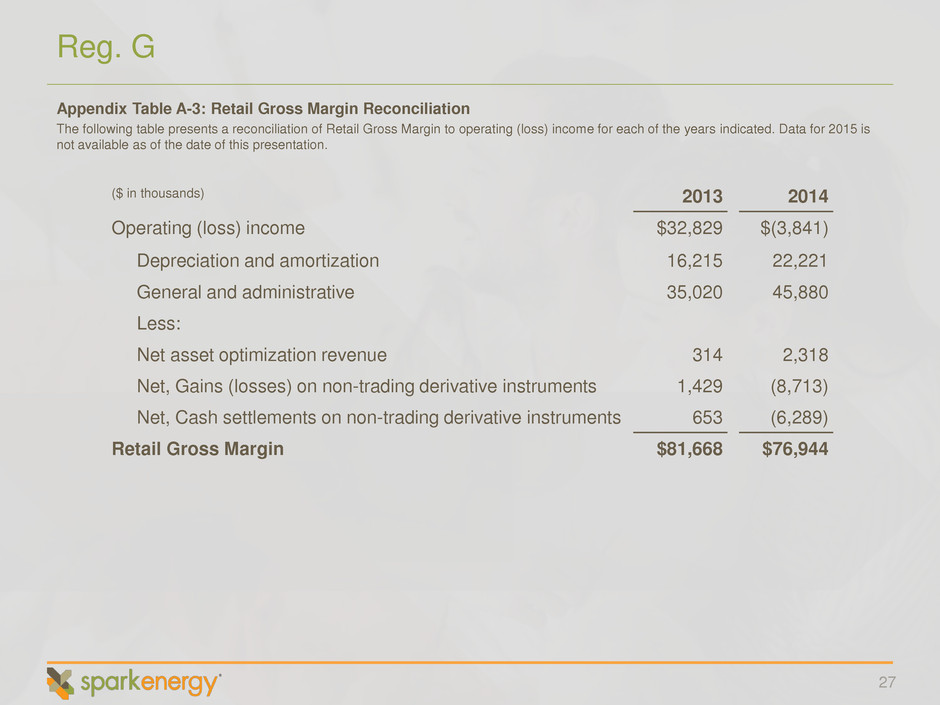

27 Reg. G ($ in thousands) 2013 2014 Operating (loss) income $32,829 $(3,841) Depreciation and amortization 16,215 22,221 General and administrative 35,020 45,880 Less: Net asset optimization revenue 314 2,318 Net, Gains (losses) on non-trading derivative instruments 1,429 (8,713) Net, Cash settlements on non-trading derivative instruments 653 (6,289) Retail Gross Margin $81,668 $76,944 Appendix Table A-3: Retail Gross Margin Reconciliation The following table presents a reconciliation of Retail Gross Margin to operating (loss) income for each of the years indicated. Data for 2015 is not available as of the date of this presentation.

28 Reg. G Adjusted EBITDA We define "Adjusted EBITDA" as EBITDA less (i) customer acquisition costs incurred in the current period, (ii) net gain (loss) on derivative instruments, and (iii) net current period cash settlements on derivative instruments, plus (iv) non-cash compensation expense and (v) other non-cash operating items. EBITDA is defined as net income before provision for income taxes, interest expense and depreciation and amortization. We deduct all current period customer acquisition costs in the Adjusted EBITDA calculation because such costs reflect a cash outlay in the year in which they are incurred, even though we capitalize such costs and amortize them over two years in accordance with our accounting policies. The deduction of current period customer acquisition costs is consistent with how we manage our business, but the comparability of Adjusted EBITDA between periods may be affected by varying levels of customer acquisition costs. We deduct our net gains (losses) on derivative instruments, excluding current period cash settlements, from the Adjusted EBITDA calculation in order to remove the non-cash impact of net gains and losses on derivative instruments. We also deduct non-cash compensation expense as a result of restricted stock units that were issued under our long-term incentive plan. We believe that the presentation of Adjusted EBITDA provides information useful to investors in assessing our liquidity and financial condition and results of operations and that Adjusted EBITDA is also useful to investors as a financial indicator of a company's ability to incur and service debt, pay dividends and fund capital expenditures. Adjusted EBITDA is a supplemental financial measure that management and external users of our condensed combined and consolidated financial statements, such as industry analysts, investors, commercial banks and rating agencies, use to assess the following, among other measures: • our operating performance as compared to other publicly traded companies in the retail energy industry, without regard to financing methods, capital structure or historical cost basis; • the ability of our assets to generate earnings sufficient to support our proposed cash dividends; and • our ability to fund capital expenditures (including customer acquisition costs) and incur and service debt. Reconciliation of Spark’s estimate of Adjusted EBITDA for the years ended December 31, 2015 and 2016 to the relevant GAAP line items is not being provided as Spark is not providing 2015 or 2016 guidance for net income (loss), net cash provided by operating activities, or the reconciling items between these GAAP financial measures and Adjusted EBITDA. Accordingly, a reconciliation to net income (loss) or net cash provided by operating activities is not available without unreasonable effort. Retail Gross Margin We define retail gross margin as operating income plus (i) depreciation and amortization expenses and (ii) general and administrative expenses, less (i) net asset optimization revenues, (ii) net gains (losses) on non-trading derivative instruments, and (iii) net current period cash settlements on non-trading derivative instruments. Retail gross margin is included as a supplemental disclosure because it is a primary performance measure used by our management to determine the performance of our retail natural gas and electricity business by removing the impacts of our asset optimization activities and net non-cash income (loss) impact of our economic hedging activities. As an indicator of our retail energy business' operating performance, retail gross margin should not be considered an alternative to, or more meaningful than, operating income, its most directly comparable financial measure calculated and presented in accordance with GAAP. The GAAP measures most directly comparable to Adjusted EBITDA are net income and net cash provided by operating activities. The GAAP measure most directly comparable to Retail Gross Margin is operating income. Our non-GAAP financial measures of Adjusted EBITDA and Retail Gross Margin should not be considered as alternatives to net income, net cash provided by operating activities, or operating income. Adjusted EBITDA and Retail Gross Margin are not presentations made in accordance with GAAP and have important limitations as analytical tools. You should not consider Adjusted EBITDA or Retail Gross Margin in isolation or as a substitute for analysis of our results as reported under GAAP. Because Adjusted EBITDA and Retail Gross Margin exclude some, but not all, items that affect net income and net cash provided by operating activities, and are defined differently by different companies in our industry, our definition of Adjusted EBITDA and Retail Gross Margin may not be comparable to similarly titled measures of other companies. Management compensates for the limitations of Adjusted EBITDA and Retail Gross Margin as analytical tools by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating these data points into management's decision-making process.