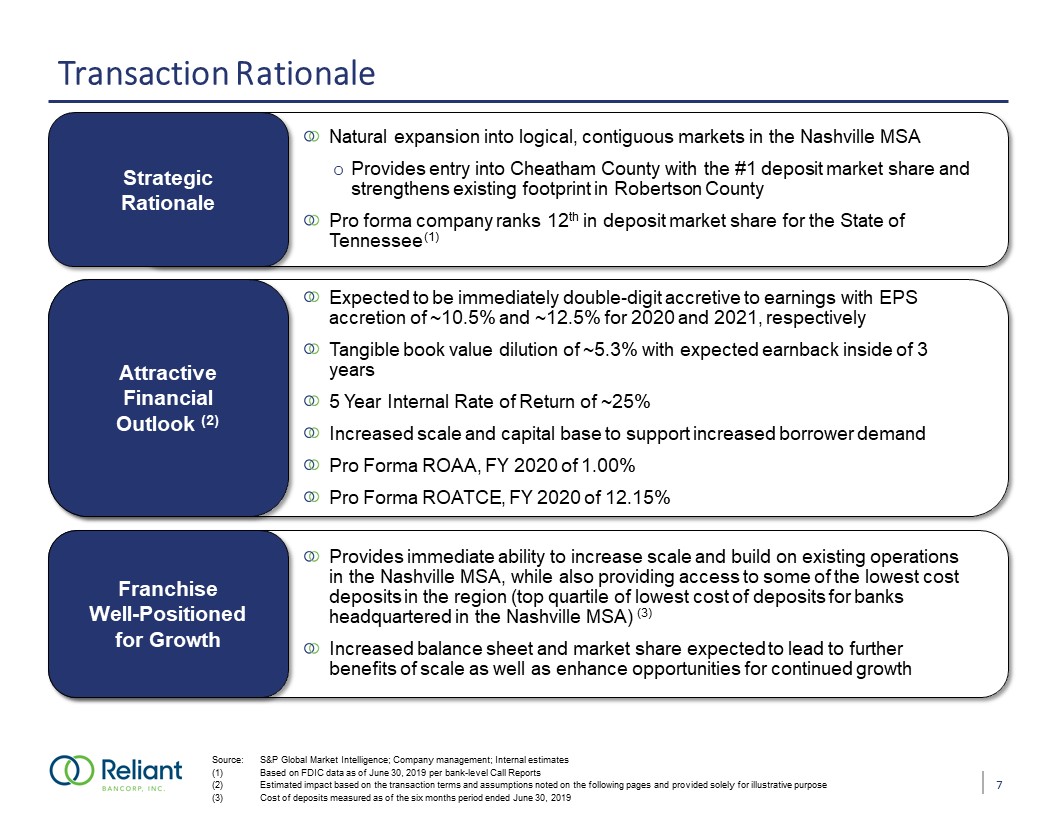

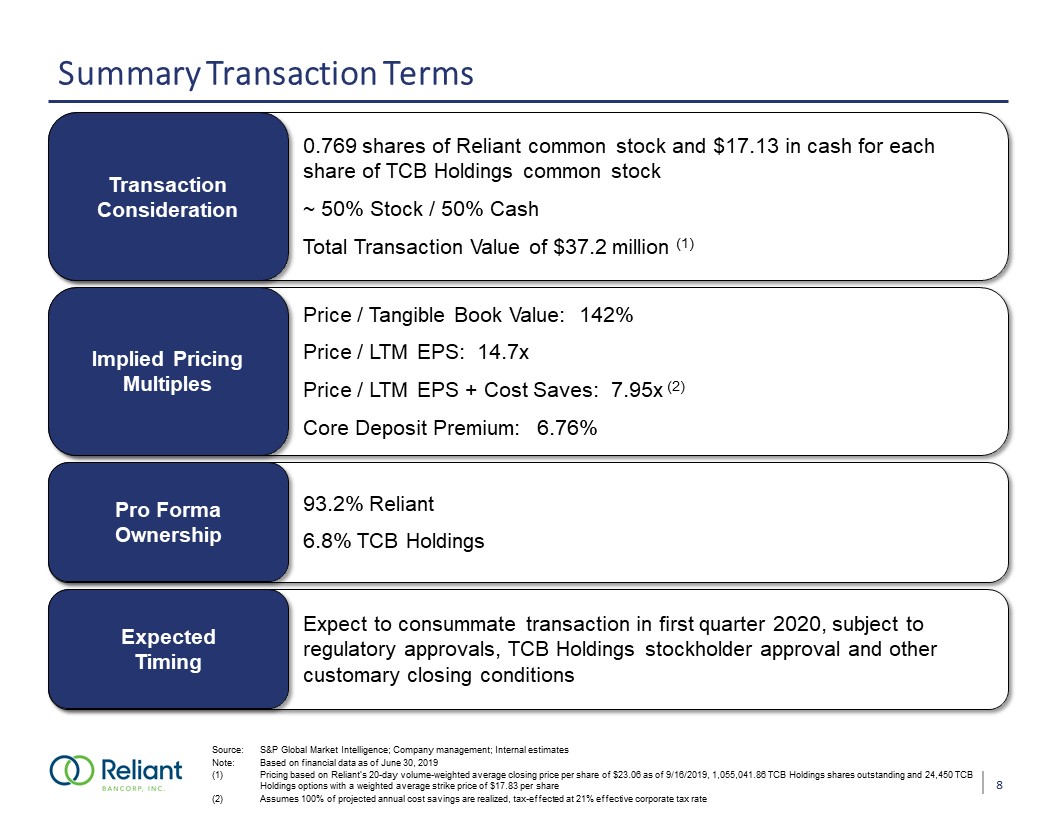

1 Safe Harbor Statements Forward Looking StatementsThis document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe,” “anticipate,” “expect,” “may,” “assume,” “should,” “predict,” “could,” “would,” “intend,” “targets,” “estimates,” “projects,” “plans,” and “potential,” and other similar words and expressions of similar meaning, and the negatives thereof, are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking, including statements about the expected timing and likelihood of completion of the proposed transaction (the “Transaction”), the benefits of the Transaction to Reliant Bancorp, Inc. (“Reliant” or the “Company”),Tennessee Community Bank Holdings, Inc. (“TCB Holdings”), and their respective shareholders, Reliant’s future financial and operating results (including the anticipated impact of the Transaction on Reliant’s earnings per share and tangible book value), and Reliant’s plans, objectives, and intentions. All forward-looking statements are subject to assumptions, risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. Such assumptions, risks, uncertainties, and factors include, among others, (1) the risk that expected cost savings and revenue synergies from the Transaction may not be realized or take longer than anticipated to be realized, (2) the parties’ ability to meet expectations regarding the timing and completion and accounting and tax treatment of the Transaction, (3) the effect of the announcement and pendency of the Transaction on customer, supplier, or employee relationships and operating results (including without limitation difficulties in maintaining relationships with employees and customers), as well as on the market price of Reliant’s common stock, (4) the risk that the parties’ businesses and operations cannot be successfully integrated or that integration will be more costly or difficult than expected, (5) the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement, (6) the amount of costs, fees, expenses, and charges related to the Transaction, including those arising as a result of unexpected factors or events, (7) the ability to obtain the shareholder and governmental approvals required for the Transaction, (8) reputational risk associated with and the reaction of the parties’ customers, suppliers, employees, or other business partners to the Transaction, (9) the failure of any of the conditions to the closing of the Transaction to be satisfied, or any unexpected delay in closing the Transaction, (10) the dilution caused by Reliant’s issuance of additional shares of its common stock in the Transaction, and (11) general competitive, economic, political, and market conditions. Additional factors which could affect the forward-looking statements can be found in Reliant’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at www.sec.gov. Reliant believes the forward-looking statements contained herein are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. Reliant disclaims any obligation to update or revise any forward-looking statements, which speak only as of the date hereof, whether as a result of new information, future events, or otherwise. Non-GAAP Financial MeasuresThis presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and, therefore, are considered non-GAAP financial measures. Members of the Company’s management use these non-GAAP financial measures in their analysis of the Company’s performance, financial condition, and efficiency of operations. Management of the Company believes that these non-GAAP financial measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods, and demonstrate the effects of significant gains and charges in the current period. Management of the Company also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding underlying operating performance and the analysis of ongoing operating trends. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the non-GAAP financial measures discussed herein are calculated may differ from that of other companies reporting measures with similar names. You should understand how such other companies calculate their financial measures similar to, or with names similar to, the non-GAAP financial measures we have discussed herein when comparing such non-GAAP financial measures.The non-GAAP financial measures contained in this presentation include, without limitation, pro forma return on average assets and pro forma return on average tangible common equity.