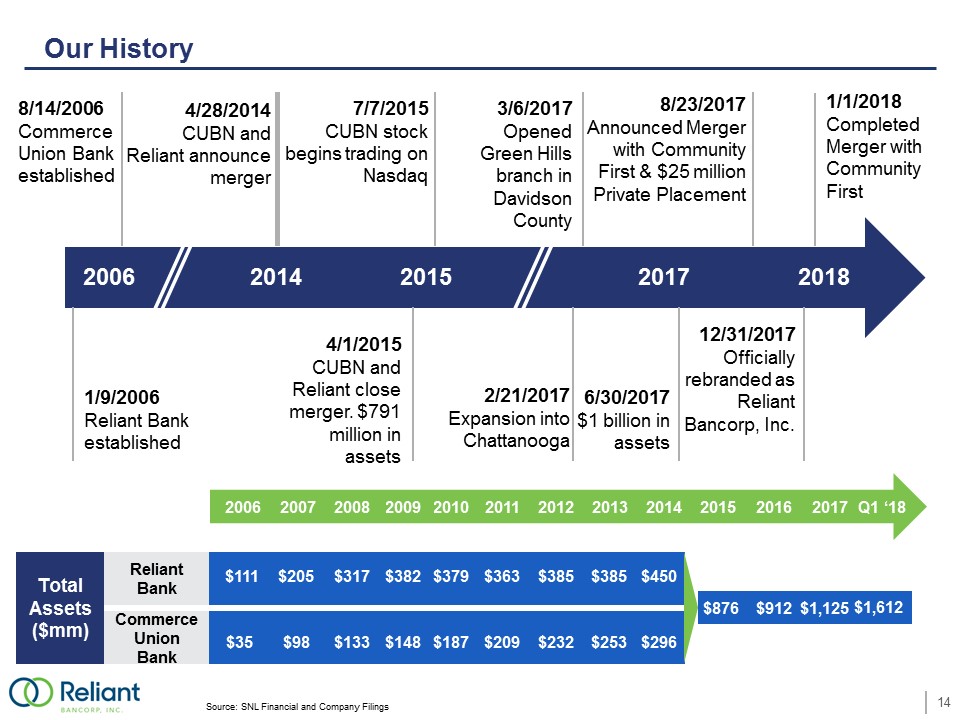

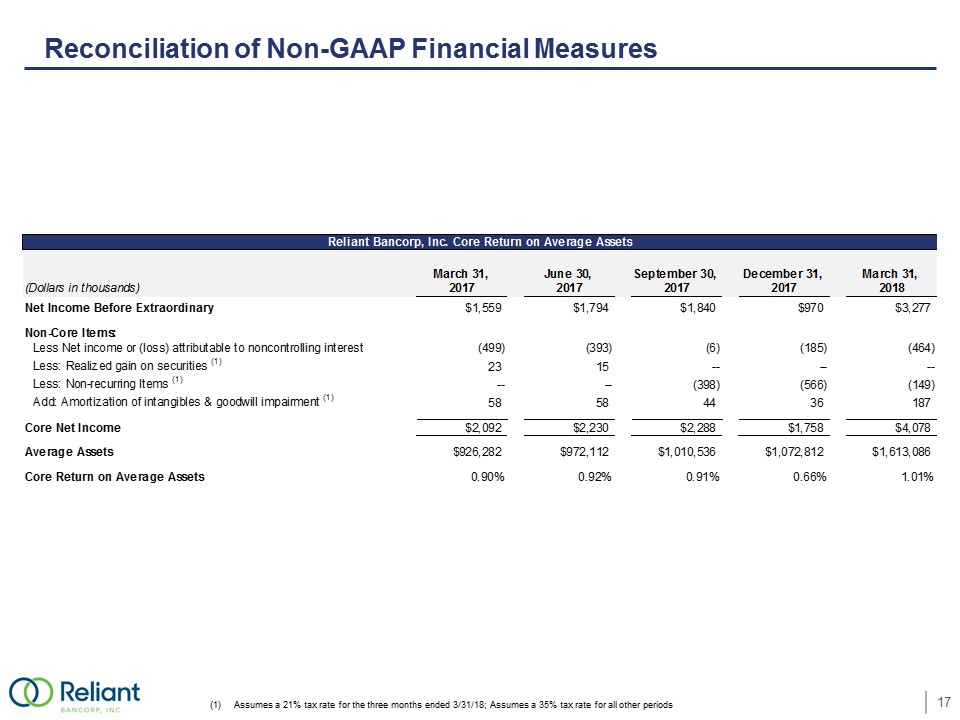

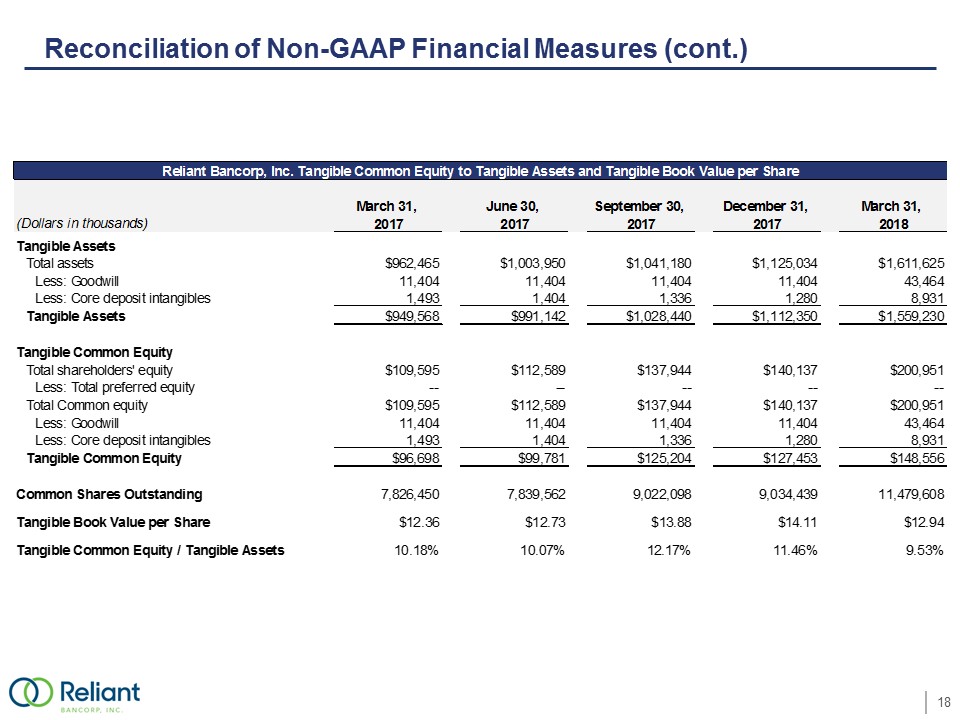

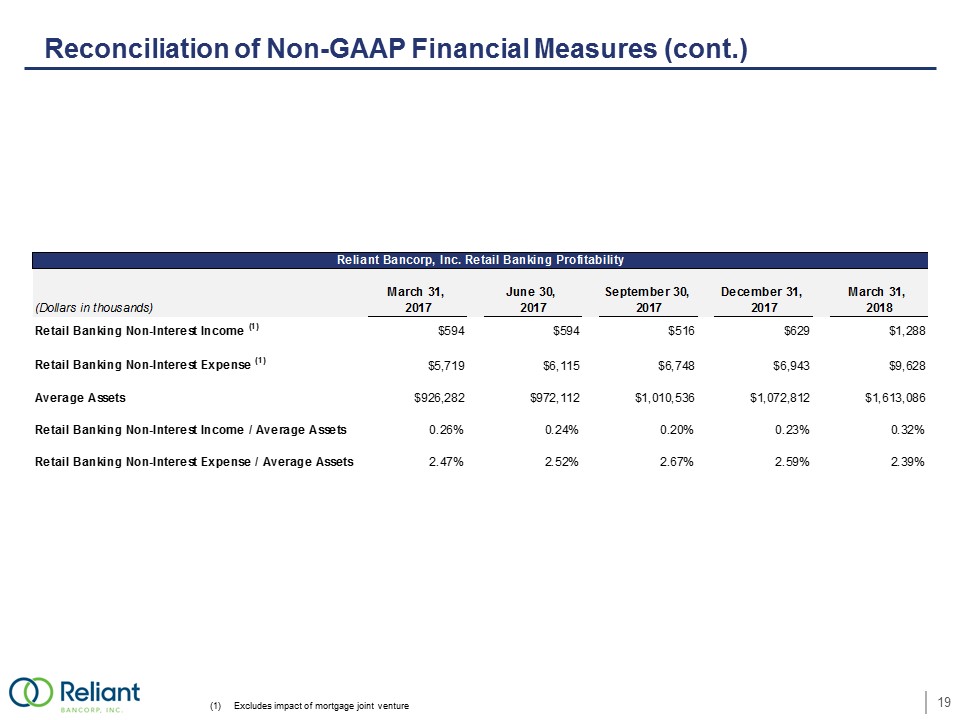

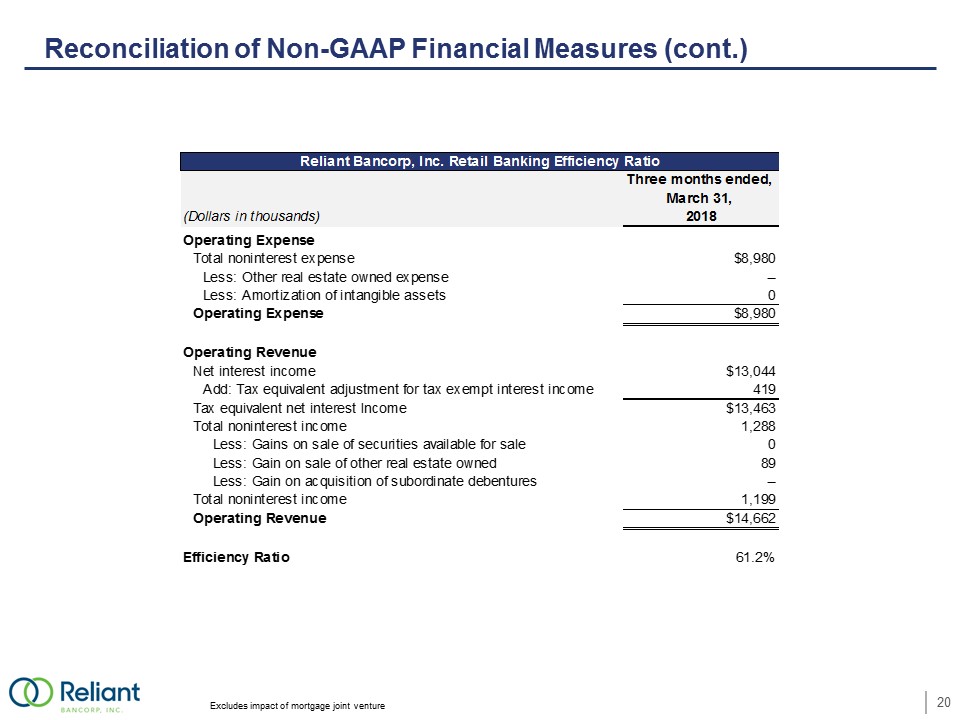

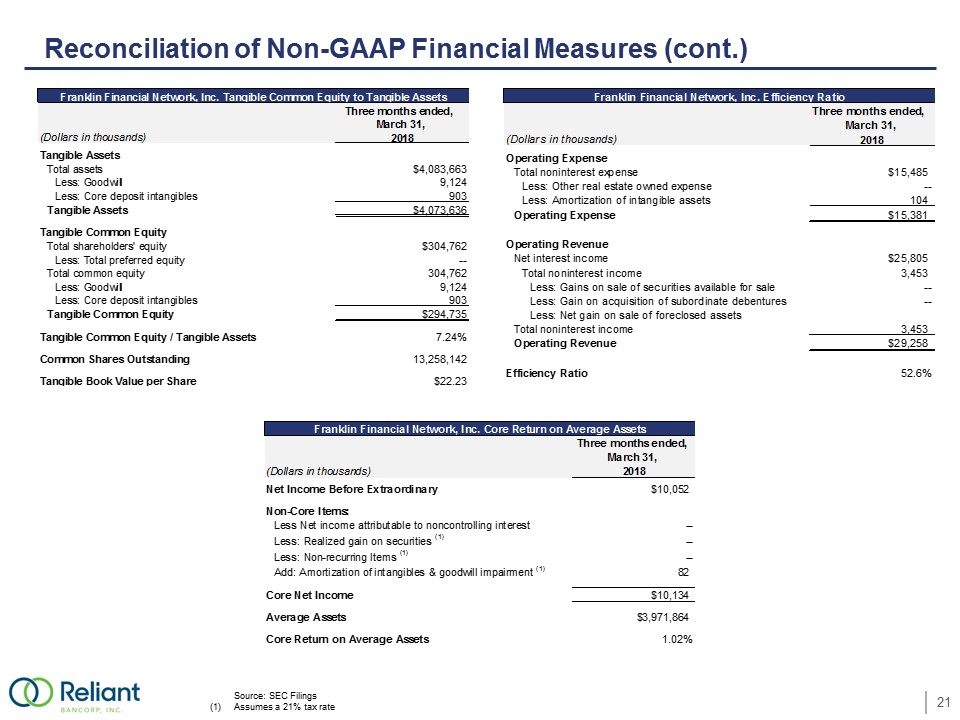

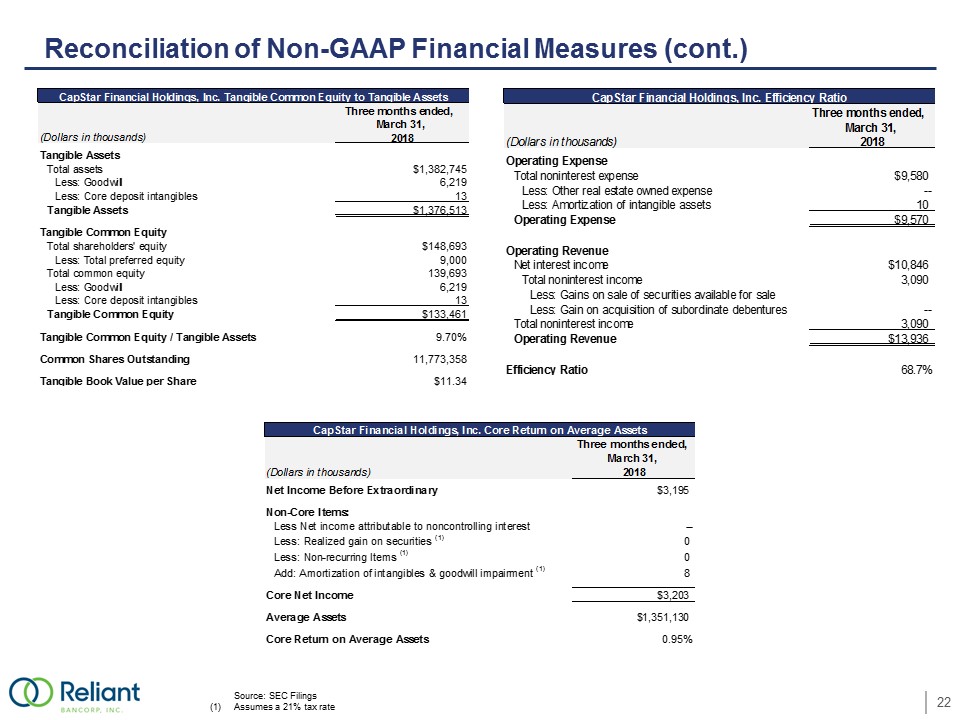

Safe Harbor Statements Forward Looking StatementsThis presentation includes forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward-looking statements and we undertake no obligation to update any such statements. The words “believe,” “anticipate,” “expect,” “may,” “will,” “assume,” “should,” “predict,” “could,” “would,” “intend,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Reliant Bancorp to differ materially from any results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others: (i) the possibility that our asset quality would decline or that we experience greater loan losses than anticipated; (ii) increased levels of other real estate, primarily as a result of foreclosures; (iii) the impact of liquidity needs on our results of operations and financial condition; (iv) competition from financial institutions and other financial service providers; (v) the risk that the cost savings and any revenue synergies from our merger with Community First, Inc. (“Community First”) may not be realized or take longer than anticipated to be realized; (vi) the effect of the announcement or completion of the Community First merger on employee and customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees and customers); (vii) the risk that integration of Community First’s operations with those of Reliant Bancorp will be materially delayed or will be more costly or difficult than expected; (viii) the amount of costs, fees, expenses, and charges related to the Community First merger; (ix) reputational risk and the reaction of the parties’ customers, suppliers, employees or other business partners to the Community First merger; (x) general competitive, economic, political and market conditions, including economic conditions in the local markets where we operate; (xi) the impact of negative developments in the financial industry and U.S. and global capital and credit markets; (xii) our ability to retain the services of key personnel; (xiii) our ability to adapt to technological changes; (xiv) risks associated with litigation, including the applicability of insurance coverage; (xv) the vulnerability of Reliant Bank’s digital network and online banking portals, and the systems of parties with whom Reliant Bancorp and Reliant Bank contract, to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and other security breaches; (xvi) changes in state and federal legislation, regulations or policies applicable to banks, including regulatory or legislative developments; (xvii) adverse results (including costs, fines, reputational harm and/or other negative effects) from current or future litigation, regulatory examinations or other legal and/or regulatory actions; (xviii) general competitive, economic, political and market conditions. Non-GAAP Financial MeasuresThis presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (GAAP) and, therefore, are considered non-GAAP financial measures. Members of Reliant’s management use these non-GAAP financial measures in their analysis of the Company’s performance, financial condition, and efficiency of operations. Management of Reliant believes that these non-GAAP financial measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods, and demonstrate the effects of significant gains and charges in the current period. Management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding underlying operating performance and the analysis of ongoing operating trends. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the non-GAAP financial measures discussed herein are calculated may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations calculate their financial measures similar to, or with names similar to, the non-GAAP financial measures we have discussed herein when comparing such non-GAAP financial measures.This presentation contains certain non-GAAP financial measures, including, without limitation, tangible assets, tangible book value, tangible common equity, tangible common equity to assets, efficiency ratio, and core income return on average assets. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures are provided in the appendix to this presentation. 2