- RBNC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Reliant Bancorp (RBNC) 425Business combination disclosure

Filed: 21 Nov 14, 12:00am

Filed by Commerce Union Bancshares, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed file pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Reliant Bank

(Commission Filing No. 132-02783)

The following is a newsletter prepared by Commerce Union Bancshares, Inc. and distributed to its shareholders:

Commerce Union Bancshares, Inc.

Third Quarter 2014

Founders’ Club

Dear Shareholder:

Commerce Union Bancshares, Inc.’s proposed acquisition of Reliant Bank and the subsequent combination of Commerce Union Bank and Reliant Bank continues to be reviewed by our regulatory agencies. Our application is before the Federal Reserve Bank of Atlanta and the Tennessee Department of Financial Institutions and is progressing in the ordinary course. We anticipate a first quarter of 2015 closing, but regulatory delays could push that date. We have no control over our regulators’ review process. We will keep our shareholders informed of any unanticipated events associated with the timing of the transaction’s closing. Substantial dollars have been invested to date in the transaction, negatively impacting earnings through the third quarter of 2014.

Commerce Union Bancshares, Inc. reported net income of $1,327,053 for the first nine months of 2014 after incurring $604,241 in expenses related to the proposed acquisition. This compares to $1,468,520 of earnings for the same period in 2013, which did not include any unusual expenses.

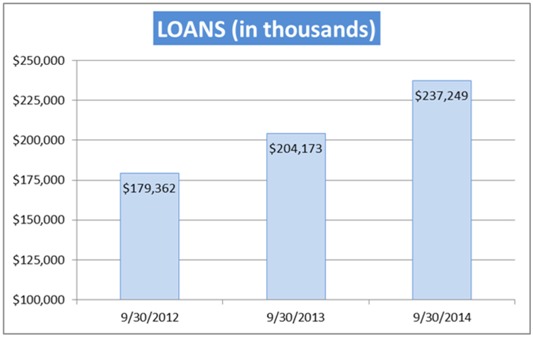

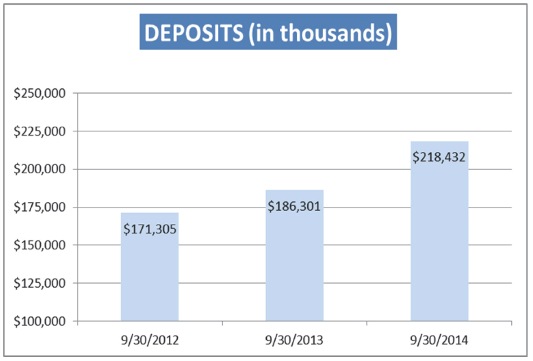

During the first nine months of 2014, loans increased to $237,249,000 from $204,173,000 for the same period in 2013, an increase of 16%. Total Assets increased to $278,689,000 from $239,531,000, resulting in an increase of 16% over the same period in 2013. Total Deposits increased to $218,432,000 from $186,301,000 for the same period in 2013, resulting in an increase of 17%. Net interest margin remains strong at 4.17%, and we have continued to improve our operating efficiency ending the quarter with an efficiency ratio of 59.9%. During the third quarter we sold our only piece of other real estate and continue to have $0 in charged-off loans in 2014. Credit quality remains strong.

As for Commerce Union Bank, we are experiencing a record year in earnings, ending the third quarter with year-to-date net income of $1,984,921, an increase of 29.7% over the third quarter year-to-date net income in 2013 of $1,530,656. For more detailed information on Commerce Union Bank please see our “Report of Condition and Income” that can be found at www.ffiec.gov. Your bank’s FDIC certificate number used to access this public information is 58366. Additionally, you can visit www.commerceunionbank.com to find this same information under the “Investor Relations” section of our website.

We appreciate your continued support of your company, Commerce Union Bancshares, Inc.

Best personal regards,

William R. DeBerry

Chairman and Chief Executive Officer

Additional Information

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed merger between Commerce Union and Reliant. In connection with the proposed merger, Commerce Union Bancshares, Inc. has filed a registration statement on Form S-4, containing a proxy statement/prospectus with the SEC.

SHAREHOLDERS OF COMMERCE UNION AND RELIANT ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain copies of the proxy statement/prospectus as well as other filings containing information about Commerce Union and Reliant, without charge, at the SEC’s website at http://www.sec.gov. Copies of documents filed with the SEC by Commerce Union will be made available free of charge on Commerce Union’s investor relations website at http://www.commerceunionbank.com/about-us/investor-relations.html.

Commerce Union and Reliant and their respective directors, executive officers, and members of management may be deemed to be participants in the solicitation of proxies from the shareholders of Commerce Union and Reliant in connection with the merger. Additional information regarding the interests of these participants may be obtained by reading the joint proxy/prospectus regarding the merger when it becomes available.

Forward-Looking Statements

This letter and its accompanying materials contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “should,” “seek,” “will,” “may,” and “estimate,” and similar expressions, are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking. All forward-looking statements are subject to risks, uncertainties and other factors that may cause actual results, performance or achievements of any of the parties to the merger to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation, the possibility that regulatory and other approvals and conditions to the transaction are not received or satisfied on a timely

basis or at all, or contain unanticipated terms and conditions; the possibility that modifications to the terms of the transactions may be required in order to obtain or satisfy such approvals or conditions; the receipt and timing of shareholder approvals; delays in closing the merger; difficulties, delays and unanticipated costs in integrating the merging banks’ businesses or realizing expected cost savings and other benefits; business disruptions as a result of the integration of the merging banks, including possible loss of customers; diversion of management time to address transaction-related issues; changes in asset quality and credit risk as a result of the merger; changes in customer borrowing, repayment, investment and deposit behaviors and practices; changes in interest rates, capital markets, and local economic and national economic conditions; the timing and success of new business initiatives; competitive conditions; and regulatory conditions.

Third Quarter 2014

Financials At-A-Glance

Commerce Union Bancshares, Inc.

Consolidated Balance Sheet*

| 09/30/14 | 09/30/13 | % Change | ||||||||||

ASSETS | ||||||||||||

Cash and Cash Equivalents | $ | 4,079 | $ | 5,614 | -27 | % | ||||||

Investments | $ | 27,142 | $ | 22,805 | 19 | % | ||||||

Loans | $ | 237,249 | $ | 204,173 | 16 | % | ||||||

Allowance for Loan Losses | ($ | 3,328 | ) | ($ | 2,784 | ) | 20 | % | ||||

Fixed Assets | $ | 4,651 | $ | 4,908 | -5 | % | ||||||

Foreclosed Property | $ | 0 | $ | 506 | -100 | % | ||||||

Other Assets | $ | 8,896 | $ | 4,309 | 106 | % | ||||||

|

|

|

|

|

| |||||||

Total Assets | $ | 278,689 | $ | 239,531 | 16 | % | ||||||

|

|

|

|

|

| |||||||

LIABILITIES AND SHAREHOLDER EQUITY | ||||||||||||

Deposits | $ | 218,432 | $ | 186,301 | 17 | % | ||||||

Repurchase Agreements and Other Borrowings | $ | 23,999 | $ | 18,367 | 31 | % | ||||||

Other Liabilities | $ | 519 | $ | 615 | -16 | % | ||||||

Shareholder Equity | $ | 35,739 | $ | 34,248 | 4 | % | ||||||

|

|

|

|

|

| |||||||

Total Liabilities & Shareholder Equity | $ | 278,689 | $ | 239,531 | 16 | % | ||||||

|

|

|

|

|

| |||||||

Consolidated Statement of Income*

| For Three Months Ending 09/30/14 | For Three Months Ending 09/30/13 | % Change | ||||||||||

Interest Income | $ | 3,245 | $ | 2,848 | 14 | % | ||||||

Interest Expense | $ | 444 | $ | 429 | 3 | % | ||||||

Net Interest Income | $ | 2,801 | $ | 2,419 | 16 | % | ||||||

Provision for Loan Losses | $ | 141 | $ | 63 | 124 | % | ||||||

Non-interest Income | $ | 376 | $ | 251 | 50 | % | ||||||

Non-interest expense | $ | 2,064 | $ | 1,726 | 20 | % | ||||||

Net Income before taxes | $ | 972 | $ | 881 | 10 | % | ||||||

Income Taxes | $ | 552 | $ | 314 | 76 | % | ||||||

Net Income | $ | 420 | $ | 567 | -26 | % | ||||||

| For Nine Months Ending 09/30/14 | For Nine Months Ending 09/30/13 | % Change | ||||||||||

Interest Income | $ | 9,130 | $ | 8,270 | 10 | % | ||||||

Interest Expense | $ | 1,301 | $ | 1,315 | -1 | % | ||||||

Net Interest Income | $ | 7,829 | $ | 6,955 | 13 | % | ||||||

Provision for Loan Losses | $ | 460 | $ | 294 | 56 | % | ||||||

Non-interest Income | $ | 961 | $ | 814 | 18 | % | ||||||

Non-interest expense | $ | 6,405 | $ | 5,209 | 16 | % | ||||||

Net Income before taxes | $ | 2,285 | $ | 2,266 | 1 | % | ||||||

Income Taxes | $ | 958 | $ | 797 | 20 | % | ||||||

Net Income | $ | 1,327 | $ | 1,469 | -10 | % | ||||||

Key Performance Ratios* (Annualized)

| 09/30/14 | 09/30/13 | % Change | ||||||||||

Return on Average Assets | 1.00 | % | 0.88 | % | 14 | % | ||||||

Return on Average Equity | 7.60 | % | 6.05 | % | 26 | % | ||||||

Net Interest Margin | 4.17 | % | 4.21 | % | -1 | % | ||||||

Efficiency Ratio | 59.90 | % | 64.89 | % | -8 | % | ||||||

Asset Quality Data | ||||||||||||

Nonperforming Assets | $ | 1,299 | $ | 1,838 | -29 | % | ||||||

Allowance for Loan Losses | $ | 3,328 | $ | 2,784 | 20 | % | ||||||

Nonperforming Assets to Period-End Loans | 0.55 | % | 0.90 | % | -39 | % | ||||||

Allowance for Loan Losses to Period-End Loans | 1.40 | % | 1.36 | % | 3 | % | ||||||

| * | Unaudited. All dollars in thousands. |