Filed by Reliant Bancorp, Inc. Pursuant to Rule 425 under the Securities Act of 1933, as amended and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Tennessee Community Bank Holdings, Inc. (Commission File No. 001-37391) Hovde Group 2019 Community Bank Investor Conference November 4, 2019

Safe Harbor Statements FORWARD LOOKING STATEMENTS This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe,” “anticipate,” “expect,” “may,” “assume,” “should,” “predict,” “could,” “would,” “intend,” “targets,” “estimates,” “projects,” “plans,” and “potential,” and other similar words and expressions of similar meaning, and the negatives thereof, are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking, including statements about the expected timing and likelihood of completion of the proposed transaction (the “First Advantage Transaction”) between Reliant Bancorp, Inc. (“Reliant” or the “Company”) and First Advantage Bancorp (“First Advantage”), the benefits of the First Advantage Transaction to Reliant, First Advantage, and their respective shareholders, Reliant’s future financial and operating results (including the anticipated impact of the First Advantage Transaction, separately or together with Reliant’s previously-announced, pending acquisition of Tennessee Community Bank Holdings, Inc. (“TCB Holdings”) (the “TCB Holdings Transaction” and, together with the First Advantage Transaction, the “Transactions”), on Reliant’s earnings per share and tangible book value), and Reliant’s plans, objectives, and intentions. All forward-looking statements are subject to assumptions, risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from any results, performance, or achievements expressed or implied by such forward-looking statements. Such assumptions, risks, uncertainties, and factors include, among others, (1) the risk that expected cost savings and revenue synergies from the Transactions may not be realized or take longer than anticipated to be realized, (2) the ability to meet expectations regarding the timing and completion and accounting and tax treatment of the Transactions, (3) the effect of the announcement and pendency of the Transactions on customer, supplier, or employee relationships and operating results (including without limitation difficulties in maintaining relationships with employees and customers), as well as on the market price of Reliant’s common stock, (4) the risk that the businesses and operations of First Advantage and its subsidiaries and of TCB Holdings and its subsidiaries cannot be successfully integrated with the business and operations of Reliant and its subsidiaries or that integration will be more costly or difficult than expected, (5) the occurrence of any event, change, or other circumstances that could give rise to the termination of the merger agreement or the definitive merger agreement for the TCB Holdings Transaction, (6) the amount of costs, fees, expenses, and charges related to the Transactions, including those arising as a result of unexpected factors or events, (7) the ability to obtain the shareholder and governmental approvals required for the Transactions, (8) reputational risk associated with and the reaction of the parties’ customers, suppliers, employees, or other business partners to the Transactions, (9) the failure of any of the conditions to the closing of the Transactions to be satisfied, or any unexpected delay in closing the Transactions, (10) the dilution caused by Reliant’s issuance of additional shares of its common stock in the Transactions, (11) Reliant’s ability to simultaneously execute on two separate business combination transactions, (12) the risk associated with Reliant management’s attention being diverted away from the day-to-day business and operations of Reliant to the completion of the Transactions, and (13) general competitive, economic, political, and market conditions. Additional factors which could affect the forward-looking statements can be found in Reliant’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at http://www.sec.gov. Reliant believes the forward-looking statements contained herein are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. Reliant disclaims any obligation to update or revise any forward-looking statements, which speak only as of the date hereof, whether as a result of new information, future events, or otherwise. NON-GAAP FINANCIAL MEASURES This presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and, therefore, are considered non-GAAP financial measures. Members of the Company’s management use these non-GAAP financial measures in their analysis of the Company’s performance, financial condition, and efficiency of operations. Management of the Company believes that these non-GAAP financial measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods, and demonstrate the effects of significant gains and charges in the current period. Management of the Company also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding underlying operating performance and the analysis of ongoing operating trends. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the non-GAAP financial measures discussed herein are calculated may differ from that of other companies reporting measures with similar names. You should understand how such other companies calculate their financial measures similar to, or with names similar to, the non-GAAP financial measures we have discussed herein when comparing such non-GAAP financial measures. The non-GAAP financial measures contained in this presentation include, without limitation, pro forma return on average assets and pro forma return on average tangible common equity. 1

Safe Harbor Statements ADDITIONAL INFORMATION ABOUT THE TCB HOLDINGS TRANSACTION AND WHERE TO FIND IT In connection with TCB Holdings Transaction, Reliant intends to file a registration statement on Form S-4 with the SEC to register the shares of Reliant common stock that will be issued to TCB Holdings’ shareholders in connection with TCB Holdings Transaction. The registration statement will include a proxy statement of TCB Holding and prospectus of Reliant and other relevant materials pertaining to TCB Holdings Transaction. The proxy statement/prospectus will be sent to TCB Holdings’ shareholders in connection with seeking the required shareholder approval(s) for TCB Holdings Transaction). INVESTORS AND SECURITY HOLDERS OF RELIANT AND TCB HOLDINGS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT MATERIALS THAT MAY BE FILED WITH THE SEC IN CONNECTION WITH TCB HOLDINGS TRANSACTION (AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS) CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RELIANT, TCB HOLDINGS, AND TCB HOLDINGS TRANSACTION. Investors and security holders may obtain free copies of the registration statement and related proxy statement/prospectus, when filed, as well as other documents filed by Reliant with the SEC, through the website maintained by the SEC at www.sec.gov. Free copies of the documents filed by Reliant with the SEC (including the registration statement and related proxy statement/prospectus) also may be obtained by directing a request by mail or telephone to Reliant Bancorp, Inc., 6100 Tower Circle, Suite 120, Franklin, Tennessee 37067, Attention: J. Daniel Dellinger, Chief Financial Officer, (615) 221-2020. This communication is for informational purposes only and shall not constitute a solicitation of any proxy, vote, or approval or an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. PARTICIPANTS IN THE SOLICITATION Reliant, TCB Holdings, and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from TCB Holdings’ shareholders in connection with TCB Holdings Transaction. Certain information about the directors and executive officers of Reliant and TCB Holdings will be included in the proxy statement/prospectus included in the registration statement on Form S-4 to be filed by Reliant. Information about the directors and executive officers of Reliant can also be found in Reliant’s definitive proxy statement for its 2019 annual meeting of shareholders, filed with the SEC on April 22, 2019, and other documents subsequently filed by Reliant with the SEC. Additional information regarding the interests of these participants will also be included in the proxy statement/prospectus pertaining to TCB Holdings Transaction if and when it becomes available. These documents can be obtained free of charge in the manner described above. 2

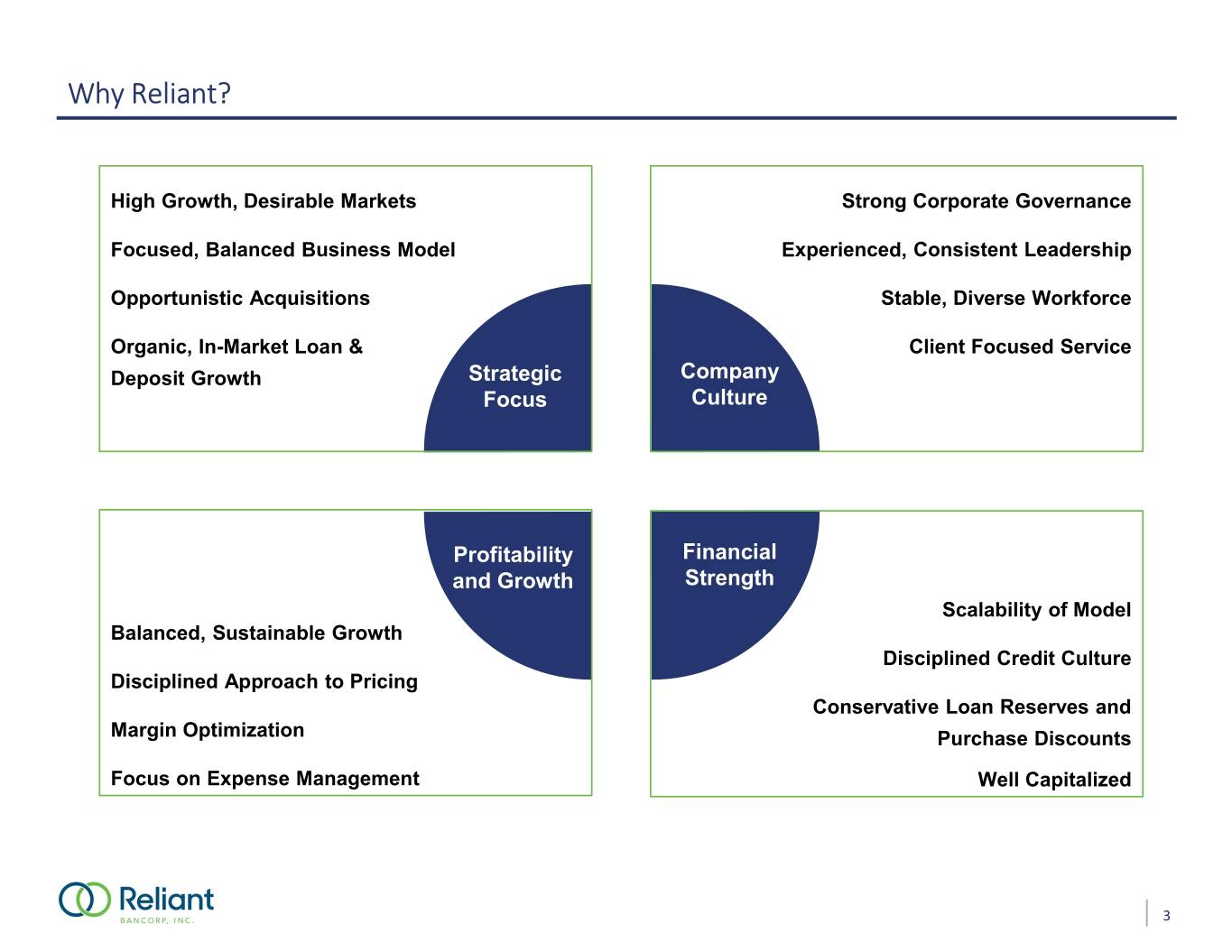

Why Reliant? High Growth, Desirable Markets Strong Corporate Governance Focused, Balanced Business Model Experienced, Consistent Leadership Opportunistic Acquisitions Stable, Diverse Workforce Organic, In-Market Loan & Client Focused Service Deposit Growth Strategic Company Focus Culture Profitability Financial and Growth Strength Scalability of Model Balanced, Sustainable Growth Disciplined Credit Culture Disciplined Approach to Pricing Conservative Loan Reserves and Margin Optimization Purchase Discounts Focus on Expense Management Well Capitalized 3

Reliant Bank Franchise Overview Pro Forma Branch Network Q3 ‘19 Financial Summary Market Information Price Per Share (10/24/19) $22.92 Market Cap. ($mm) $257 Price / Tang. Book 152 % Price / '19 EPS 15.5 x Price / '20 EPS 12.5 x Balance Sheet ($mm) Total Assets $1,852 Loans Held for Investment 1,351 Deposits 1,611 Tangible Common Equity 169 Loans Held for Investment / Deposits 83.9 % MRQ Profitability Reported ROAA 0.89 % ROATCE (1) 9.65 % Asset Quality NPAs / Loans + OREO 0.48 % Reserves / NPLs 273.1 Reserves / Loans Held for Investment 0.91 Capital Ratios - RBNC Tang. Com. Equity / Tang. Assets(1) 9.35 % Leverage Ratio 9.85 CET1 Ratio 10.85 Tier 1 Capital Ratio 11.64 Total Capital Ratio 12.51 Loan Concentration C&D Loans / Total Bank Capital 118 % Key Franchise Highlights CRE Loans / Total Bank Capital 323 Commercially oriented bank headquartered in Brentwood, Tennessee Focused on fast growing Middle Tennessee markets coupled with recent de novo expansion into Murfreesboro and Chattanooga, Tennessee, and the acquisitions of Tennessee Community Bank and First Advantage Bancorp(2) 10th largest bank by deposits in the Tennessee and 3rd largest community bank(3) by deposits headquartered in the Nashville MSA Concentrated on building in-market banking relationships; 80% of top 50 loan relationships have related deposits at the bank Experienced management team with extensive local market knowledge 10.0% insider ownership amongst management and the board of directors Source: S&P Global Market Intelligence Financial data as of or for the three months ended 3/31/19; ownership data as of 4/15/19; pricing data as of 4/24/19 (1) Refer to appendix for “reconciliation of non-GAAP financial measures” 4 (2) Announced on September 16, 2019 and October 23, 2019 respectively (3) Community bank defined as institutions with total assets less than $10 billion

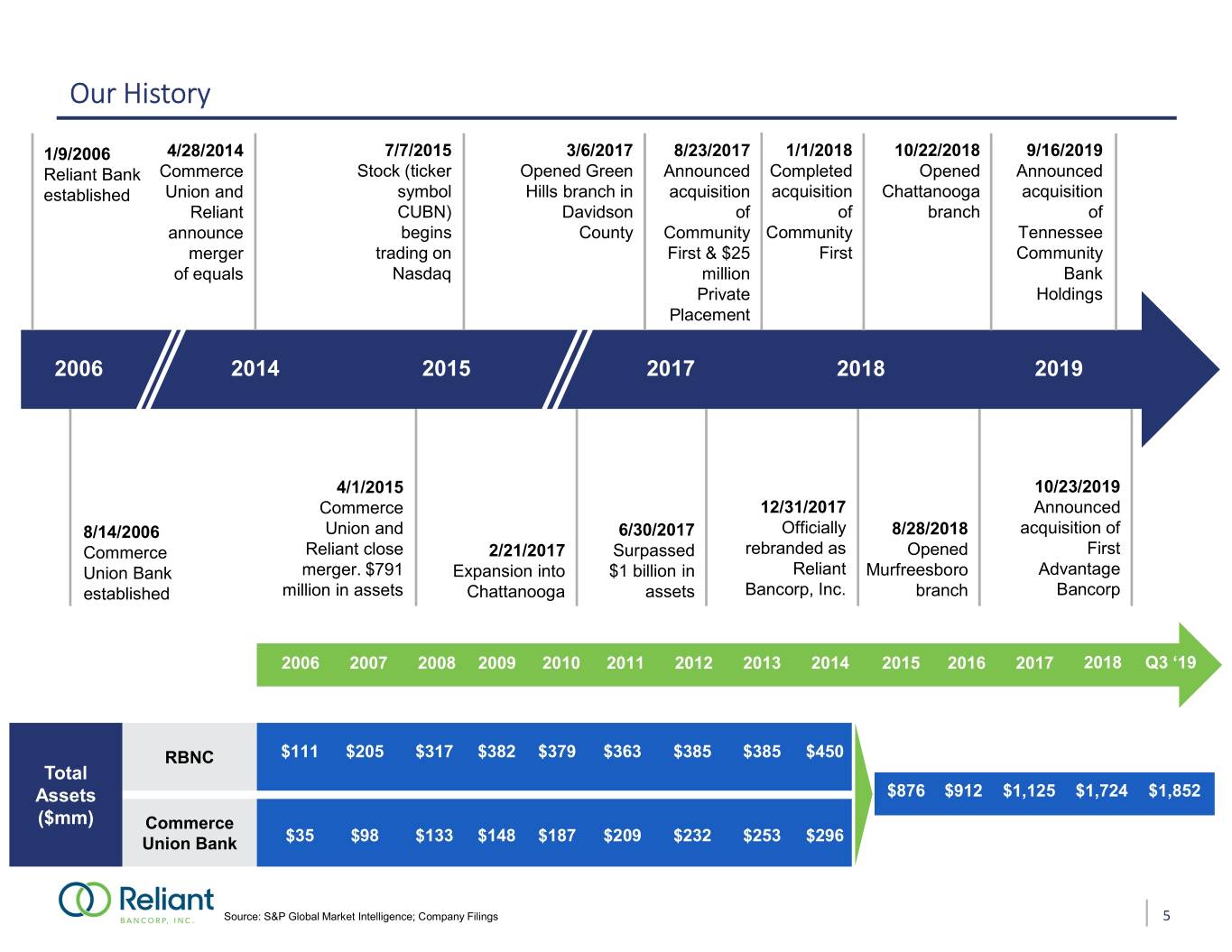

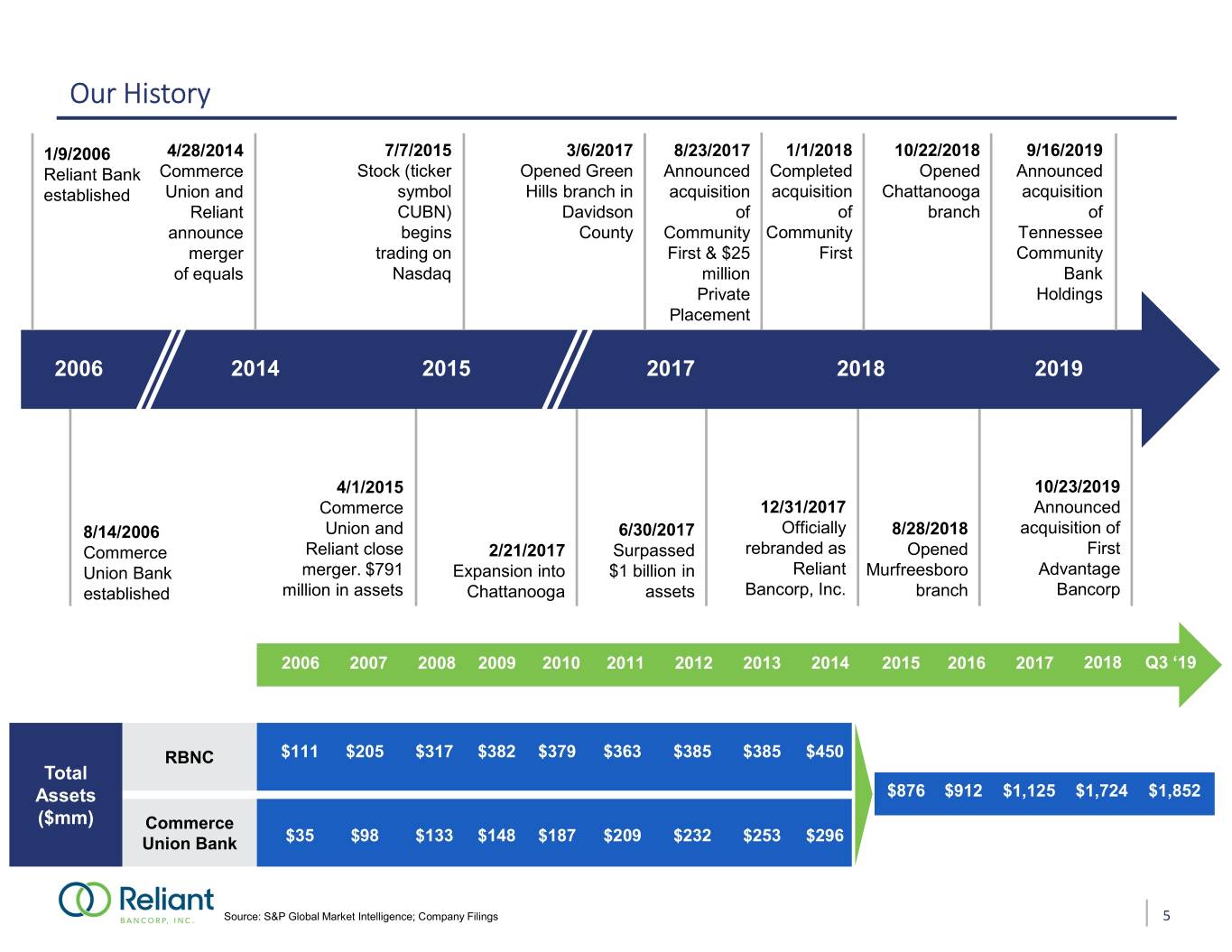

Our History 1/9/2006 4/28/2014 7/7/2015 3/6/2017 8/23/2017 1/1/2018 10/22/2018 9/16/2019 Reliant Bank Commerce Stock (ticker Opened Green Announced Completed Opened Announced established Union and symbol Hills branch in acquisition acquisition Chattanooga acquisition Reliant CUBN) Davidson of of branch of announce begins County Community Community Tennessee merger trading on First & $25 First Community of equals Nasdaq million Bank Private Holdings Placement 2006 2014 2015 2017 2018 2019 4/1/2015 10/23/2019 Commerce 12/31/2017 Announced 8/14/2006 Union and 6/30/2017 Officially 8/28/2018 acquisition of Commerce Reliant close 2/21/2017 Surpassed rebranded as Opened First Union Bank merger. $791 Expansion into $1 billion in Reliant Murfreesboro Advantage established million in assets Chattanooga assets Bancorp, Inc. branch Bancorp 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Q3 ‘19 RBNC $111 $205 $317 $382 $379 $363 $385 $385 $450 Total Assets $876 $912 $1,125 $1,724 $1,852 ($mm) Commerce Union Bank $35 $98 $133 $148 $187 $209 $232 $253 $296 Source: S&P Global Market Intelligence; Company Filings 5

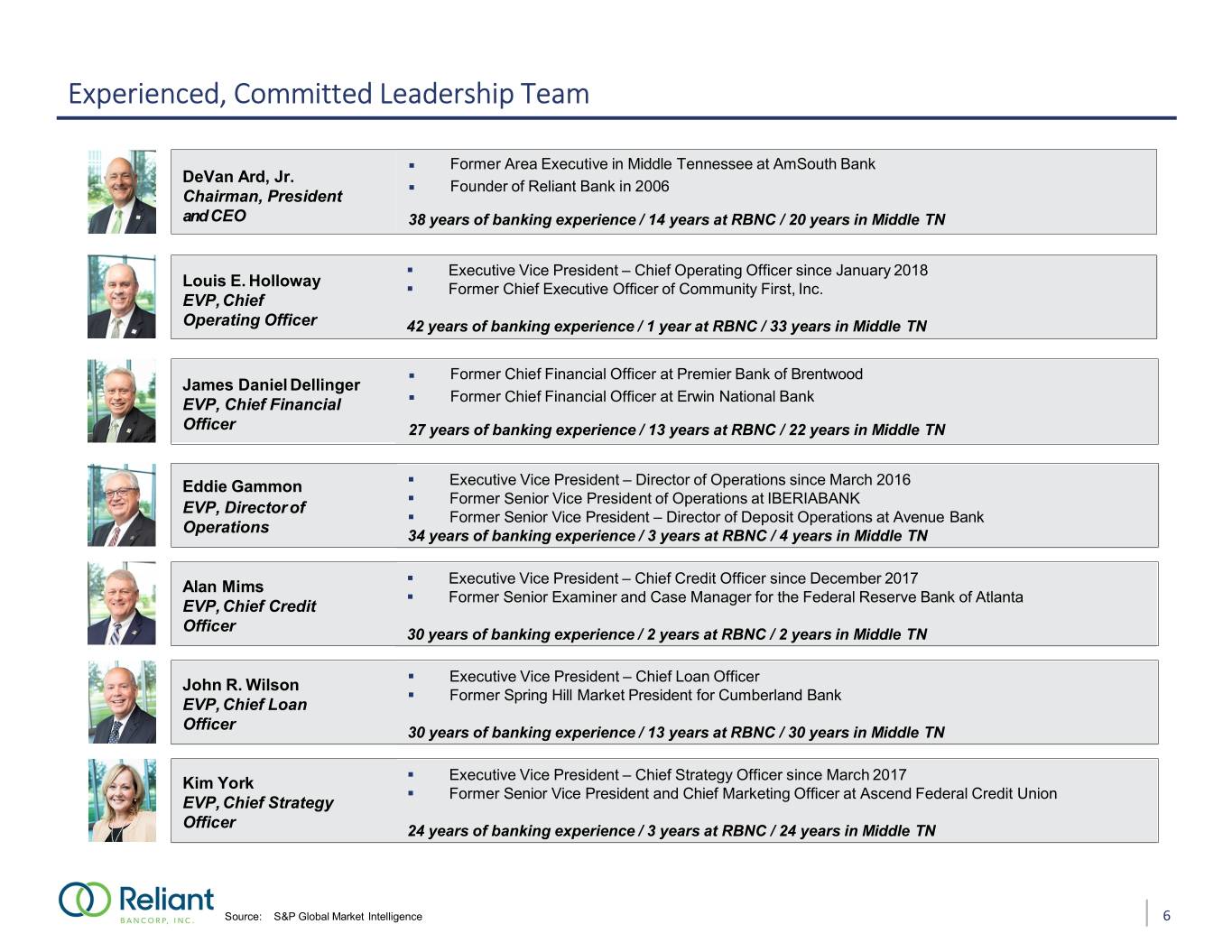

Experienced, Committed Leadership Team . Former Area Executive in Middle Tennessee at AmSouth Bank DeVan Ard, Jr. . Founder of Reliant Bank in 2006 Chairman, President and CEO 38 years of banking experience / 14 years at RBNC / 20 years in Middle TN . Executive Vice President – Chief Operating Officer since January 2018 Louis E. Holloway . Former Chief Executive Officer of Community First, Inc. EVP,Chief Operating Officer 42 years of banking experience / 1 year at RBNC / 33 years in Middle TN . Former Chief Financial Officer at Premier Bank of Brentwood James Daniel Dellinger . Former Chief Financial Officer at Erwin National Bank EVP, Chief Financial Officer 27 years of banking experience / 13 years at RBNC / 22 years in Middle TN . Eddie Gammon Executive Vice President – Director of Operations since March 2016 . Former Senior Vice President of Operations at IBERIABANK EVP, Directorof . Former Senior Vice President – Director of Deposit Operations at Avenue Bank Operations 34 years of banking experience / 3 years at RBNC / 4 years in Middle TN . Executive Vice President – Chief Credit Officer since December 2017 Alan Mims . Former Senior Examiner and Case Manager for the Federal Reserve Bank of Atlanta EVP, Chief Credit Officer 30 years of banking experience / 2 years at RBNC / 2 years in Middle TN . Executive Vice President – Chief Loan Officer John R. Wilson . Former Spring Hill Market President for Cumberland Bank EVP, Chief Loan Officer 30 years of banking experience / 13 years at RBNC / 30 years in Middle TN . Executive Vice President – Chief Strategy Officer since March 2017 Kim York . Former Senior Vice President and Chief Marketing Officer at Ascend Federal Credit Union EVP, Chief Strategy Officer 24 years of banking experience / 3 years at RBNC / 24 years in Middle TN Source: S&P Global Market Intelligence 6

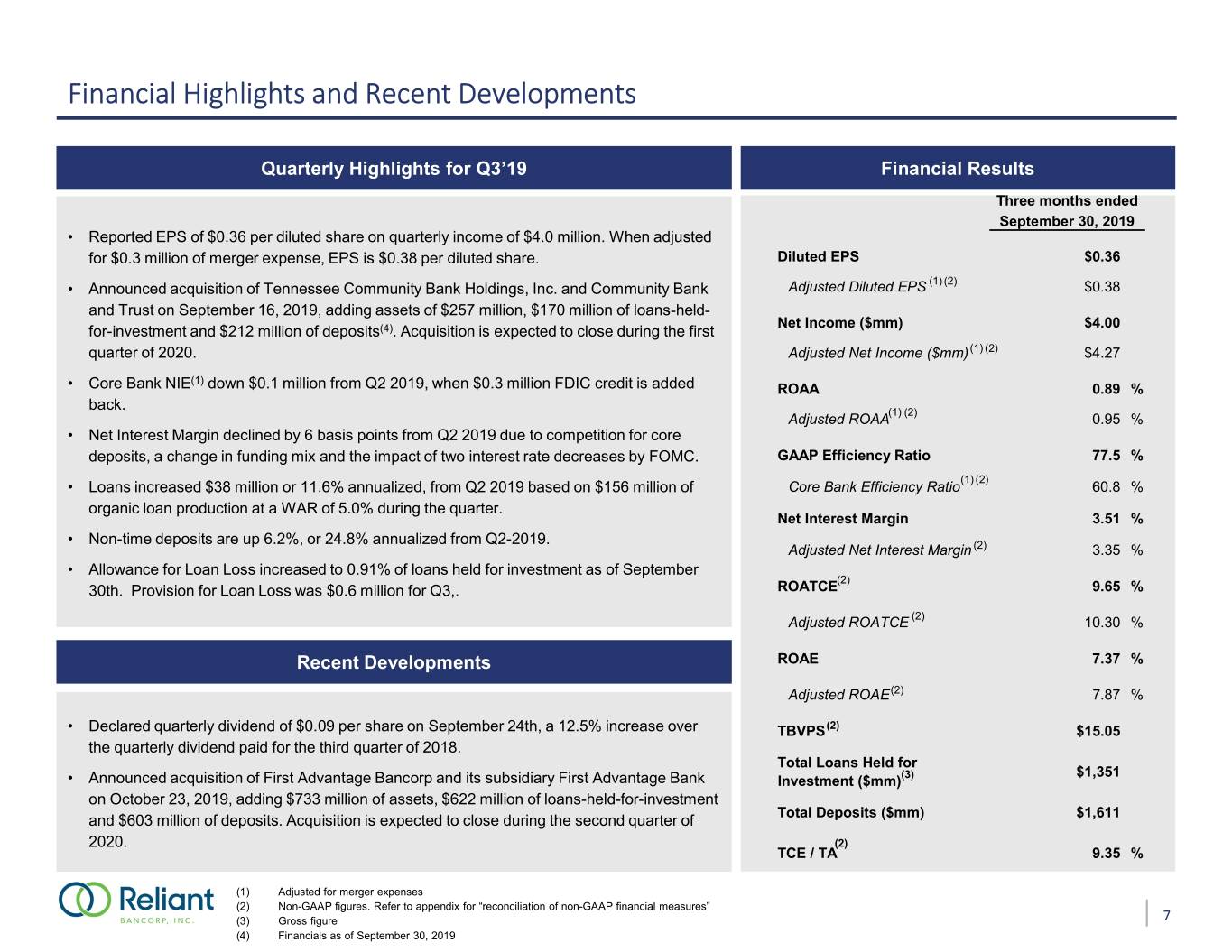

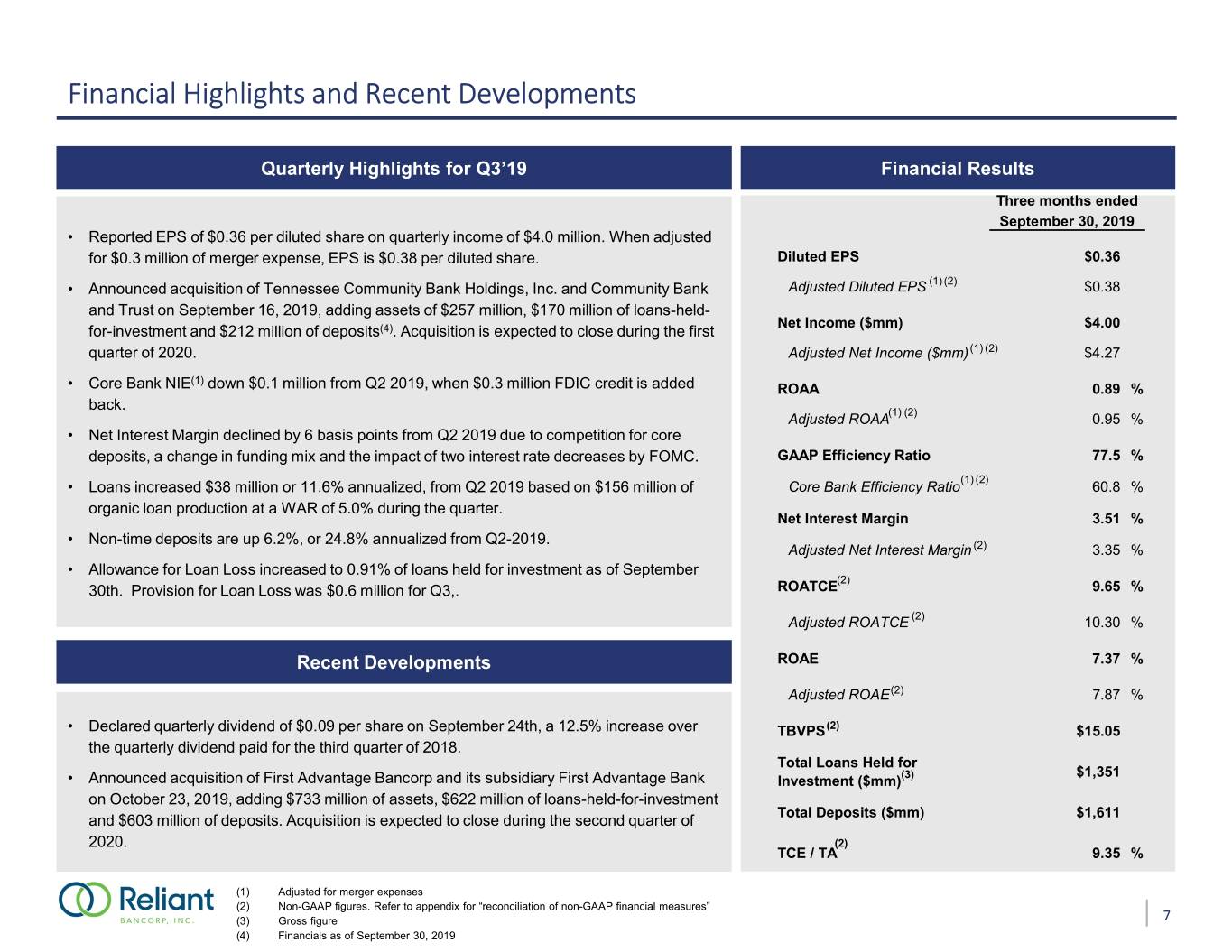

Financial Highlights and Recent Developments Quarterly Highlights for Q3’19 Financial Results Three months ended September 30, 2019 • Reported EPS of $0.36 per diluted share on quarterly income of $4.0 million. When adjusted for $0.3 million of merger expense, EPS is $0.38 per diluted share. Diluted EPS $0.36 (1) (2) • Announced acquisition of Tennessee Community Bank Holdings, Inc. and Community Bank Adjusted Diluted EPS $0.38 and Trust on September 16, 2019, adding assets of $257 million, $170 million of loans-held- Net Income ($mm) $4.00 for-investment and $212 million of deposits(4). Acquisition is expected to close during the first quarter of 2020. Adjusted Net Income ($mm) (1) (2) $4.27 (1) • Core Bank NIE down $0.1 million from Q2 2019, when $0.3 million FDIC credit is added ROAA 0.89 % back. (1) (2) Adjusted ROAA 0.95 % • Net Interest Margin declined by 6 basis points from Q2 2019 due to competition for core deposits, a change in funding mix and the impact of two interest rate decreases by FOMC. GAAP Efficiency Ratio 77.5 % (1) (2) • Loans increased $38 million or 11.6% annualized, from Q2 2019 based on $156 million of Core Bank Efficiency Ratio 60.8 % organic loan production at a WAR of 5.0% during the quarter. Net Interest Margin 3.51 % • Non-time deposits are up 6.2%, or 24.8% annualized from Q2-2019. Adjusted Net Interest Margin (2) 3.35 % • Allowance for Loan Loss increased to 0.91% of loans held for investment as of September (2) 30th. Provision for Loan Loss was $0.6 million for Q3,. ROATCE 9.65 % Adjusted ROATCE (2) 10.30 % Recent Developments ROAE 7.37 % Adjusted ROAE(2) 7.87 % • Declared quarterly dividend of $0.09 per share on September 24th, a 12.5% increase over TBVPS(2) $15.05 the quarterly dividend paid for the third quarter of 2018. Total Loans Held for (3) $1,351 • Announced acquisition of First Advantage Bancorp and its subsidiary First Advantage Bank Investment ($mm) on October 23, 2019, adding $733 million of assets, $622 million of loans-held-for-investment and $603 million of deposits. Acquisition is expected to close during the second quarter of Total Deposits ($mm) $1,611 2020. (2) TCE / TA 9.35 % (1) Adjusted for merger expenses (2) Non-GAAP figures. Refer to appendix for “reconciliation of non-GAAP financial measures” (3) Gross figure 7 (4) Financials as of September 30, 2019

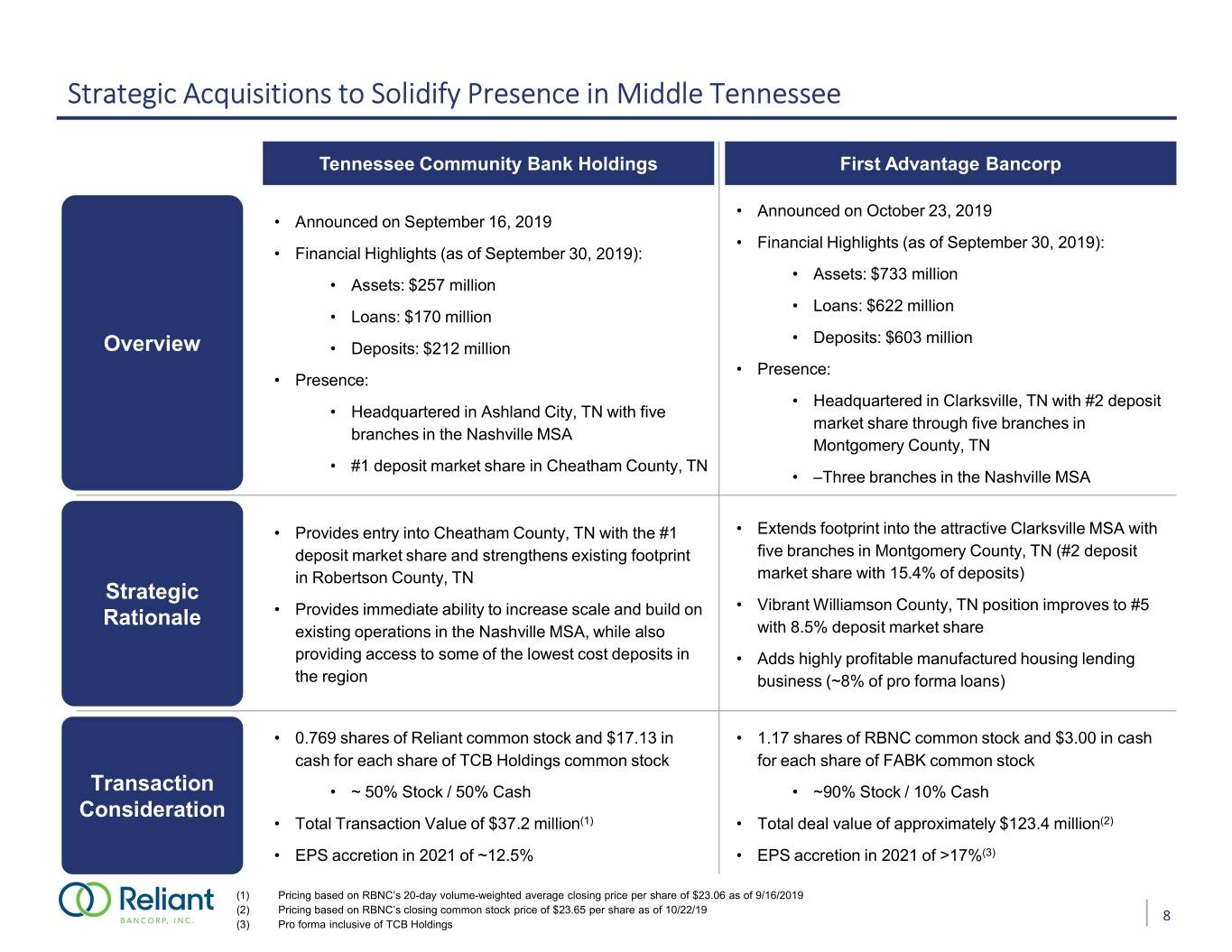

Strategic Acquisitions to Solidify Presence in Middle Tennessee Tennessee Community Bank Holdings First Advantage Bancorp • Announced on October 23, 2019 • Announced on September 16, 2019 • Financial Highlights (as of September 30, 2019): • Financial Highlights (as of September 30, 2019): • Assets: $733 million • Assets: $257 million • Loans: $622 million • Loans: $170 million • Deposits: $603 million Overview • Deposits: $212 million • Presence: • Presence: • Headquartered in Clarksville, TN with #2 deposit • Headquartered in Ashland City, TN with five market share through five branches in branches in the Nashville MSA Montgomery County, TN • #1 deposit market share in Cheatham County, TN • –Three branches in the Nashville MSA • Provides entry into Cheatham County, TN with the #1 • Extends footprint into the attractive Clarksville MSA with deposit market share and strengthens existing footprint five branches in Montgomery County, TN (#2 deposit in Robertson County, TN market share with 15.4% of deposits) Strategic • Vibrant Williamson County, TN position improves to #5 Rationale • Provides immediate ability to increase scale and build on existing operations in the Nashville MSA, while also with 8.5% deposit market share providing access to some of the lowest cost deposits in • Adds highly profitable manufactured housing lending the region business (~8% of pro forma loans) • 0.769 shares of Reliant common stock and $17.13 in • 1.17 shares of RBNC common stock and $3.00 in cash cash for each share of TCB Holdings common stock for each share of FABK common stock Transaction • ~ 50% Stock / 50% Cash • ~90% Stock / 10% Cash Consideration • Total Transaction Value of $37.2 million(1) • Total deal value of approximately $123.4 million(2) • EPS accretion in 2021 of ~12.5% • EPS accretion in 2021 of >17%(3) (1) Pricing based on RBNC’s 20-day volume-weighted average closing price per share of $23.06 as of 9/16/2019 (2) Pricing based on RBNC’s closing common stock price of $23.65 per share as of 10/22/19 8 (3) Pro forma inclusive of TCB Holdings

Nashville MSA Deposit Market Share Top 25 Deposit Market Share Community Deposits Market Rank Bank Rank (1) Institution ($mm) Share 1 -- Pinnacle Financial Partners Inc. $9,920 15.4 % 2 -- Bank of America Corp. $9,805 15.2 3 -- Regions Financial Corp. $7,767 12.1 4 -- SunTrust Banks Inc. $6,021 9.4 5 -- First Horizon National Corp. $5,332 8.3 6 1 Franklin Financial Network Inc. $3,148 4.9 7 -- U.S. Bancorp $2,330 3.6 8 -- Fifth Third Bancorp $2,216 3.4 9 2 Wilson Bank Holding Co. $2,087 3.2 10 3 Pro Forma Company(2) $1,877 2.9 10 3 Reliant Bancorp $1,521 2.4 11 4 CapStar Financial Holdings Inc. $1,320 2.1 12 5 FB Financial Corp. $1,312 2.0 13 -- Wells Fargo & Co. $1,281 2.0 14 6 First Farmers and Merchants Corp. $831 1.3 15 7 Volunteer State Bancshares Inc. $605 0.9 16 8 First Farmers Bancshares Inc. $573 0.9 17 -- Renasant Corp. $498 0.8 18 9 ServisFirst Bancshares Inc. $446 0.7 19 10 InsCorp Inc. $426 0.7 20 -- Royal Bank of Canada $410 0.6 21 11 Truxton Corp. $401 0.6 22 -- Simmons First National Corp. $396 0.6 23 -- Synovus Financial Corp. $366 0.6 24 12 Citizens Bancorp Investment Inc. $338 0.5 25 13 Southeastern Bancorp Inc. $337 0.5 32 19 Tennessee Community Bank Holdings Inc. $208 0.3 39 25 First Advantage Bancorp $148 0.2 Totals (1-25) $59,687 92.8 % Totals (Rest of the market) 4,645 7.2 Note: Dollars in millions; Deposit market share data as of 6/30/19 Source: S&P Global Market Intelligence (1) Community bank defined as an institution with less than $10 billion in total assets 9 (2) Reliant data shown pro forma for recently announced acquisitions of Tennessee Community Bank Holdings, Inc. and First Advantage Bancorp

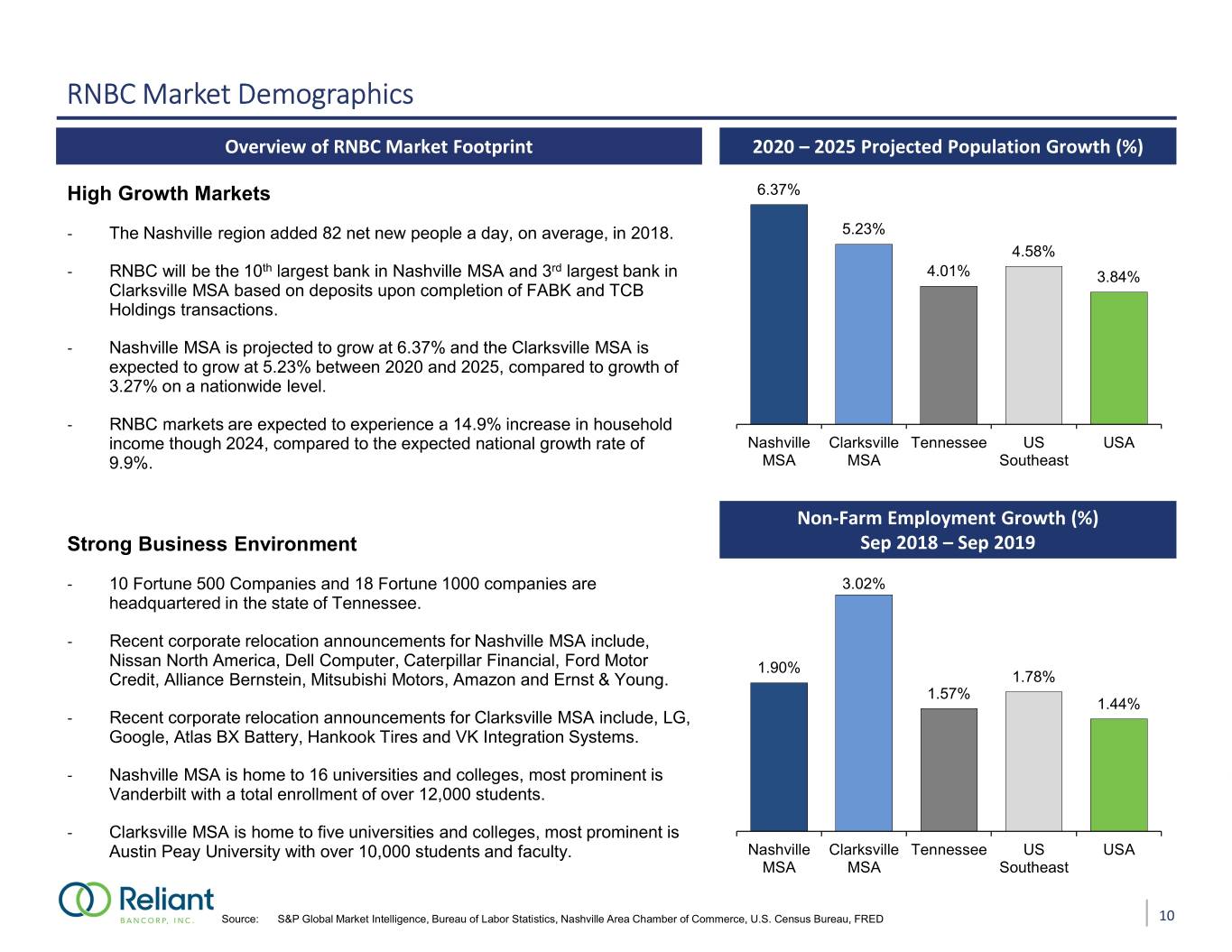

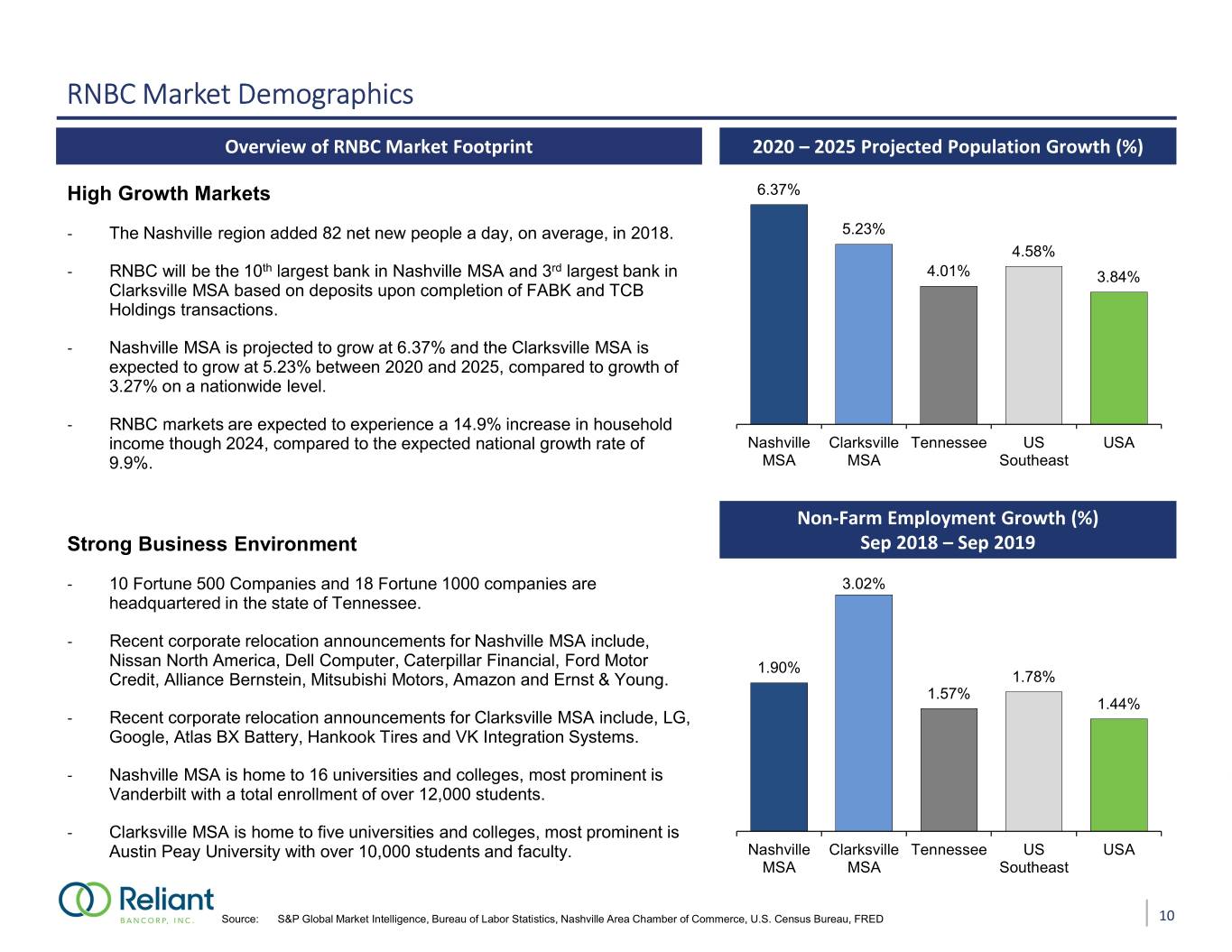

RNBC Market Demographics Overview of RNBC Market Footprint 2020 – 2025 Projected Population Growth (%) High Growth Markets 6.37% - The Nashville region added 82 net new people a day, on average, in 2018. 5.23% 4.58% th rd - RNBC will be the 10 largest bank in Nashville MSA and 3 largest bank in 4.01% 3.84% Clarksville MSA based on deposits upon completion of FABK and TCB Holdings transactions. - Nashville MSA is projected to grow at 6.37% and the Clarksville MSA is expected to grow at 5.23% between 2020 and 2025, compared to growth of 3.27% on a nationwide level. - RNBC markets are expected to experience a 14.9% increase in household income though 2024, compared to the expected national growth rate of Nashville Clarksville Tennessee US USA 9.9%. MSA MSA Southeast Non-Farm Employment Growth (%) Strong Business Environment Sep 2018 – Sep 2019 - 10 Fortune 500 Companies and 18 Fortune 1000 companies are 3.02% headquartered in the state of Tennessee. - Recent corporate relocation announcements for Nashville MSA include, Nissan North America, Dell Computer, Caterpillar Financial, Ford Motor 1.90% Credit, Alliance Bernstein, Mitsubishi Motors, Amazon and Ernst & Young. 1.78% 1.57% 1.44% - Recent corporate relocation announcements for Clarksville MSA include, LG, Google, Atlas BX Battery, Hankook Tires and VK Integration Systems. - Nashville MSA is home to 16 universities and colleges, most prominent is Vanderbilt with a total enrollment of over 12,000 students. - Clarksville MSA is home to five universities and colleges, most prominent is Austin Peay University with over 10,000 students and faculty. Nashville Clarksville Tennessee US USA MSA MSA Southeast Source: S&P Global Market Intelligence, Bureau of Labor Statistics, Nashville Area Chamber of Commerce, U.S. Census Bureau, FRED 10

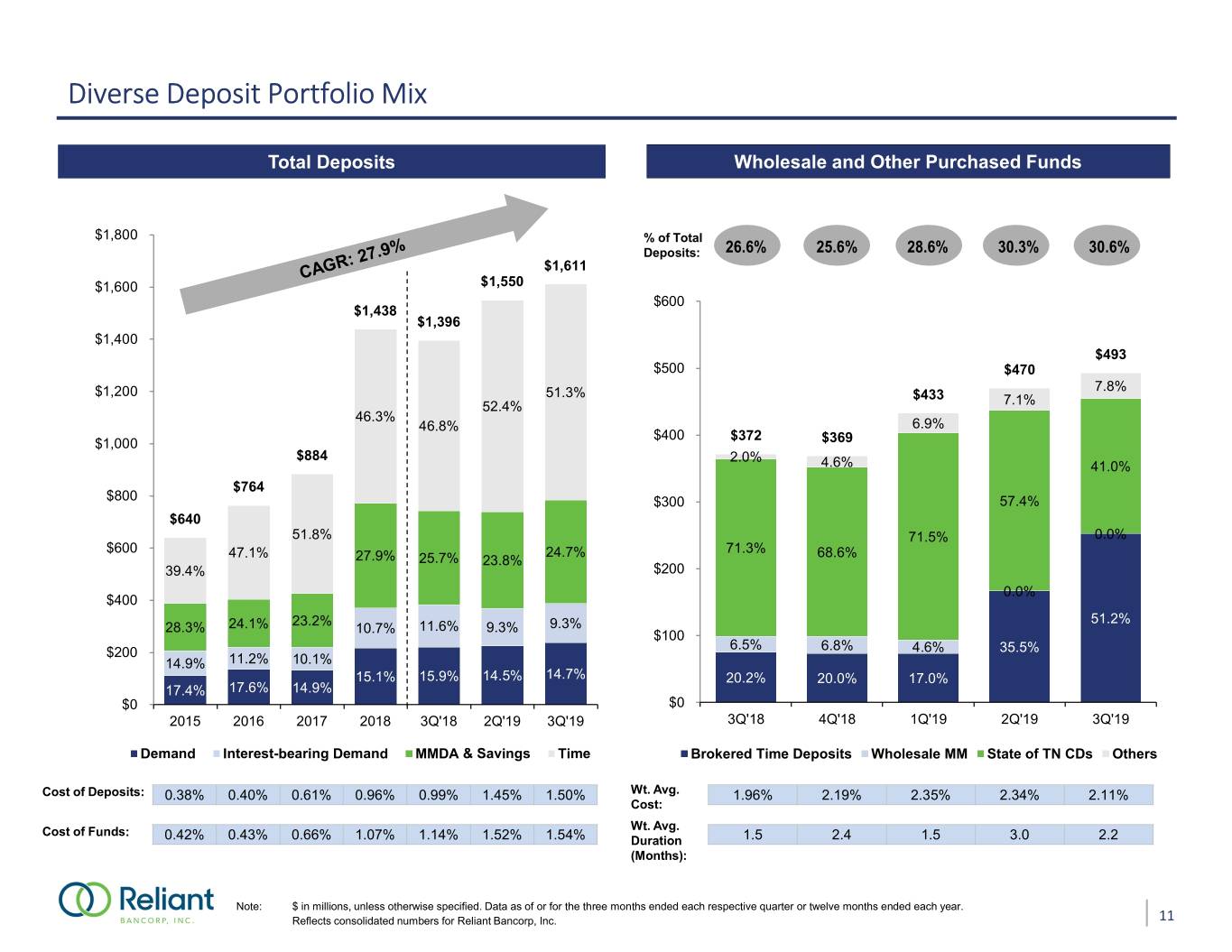

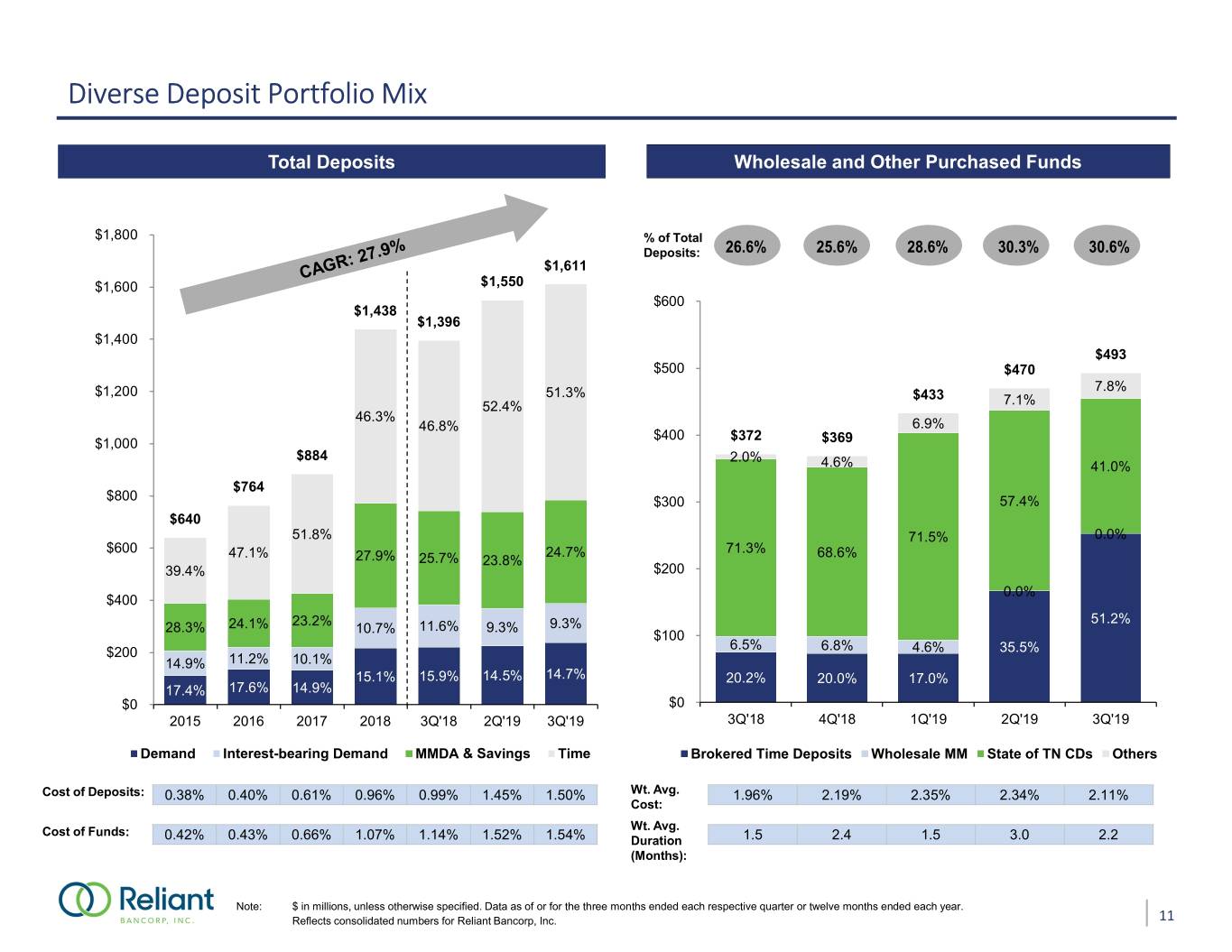

Diverse Deposit Portfolio Mix Total Deposits Wholesale and Other Purchased Funds $1,800 % of Total Deposits: 26.6% 25.6% 28.6% 30.3% 30.6% $1,611 $1,600 $1,550 $600 $1,438 $1,396 $1,400 $493 $500 $470 7.8% $1,200 51.3% $433 52.4% 7.1% 46.3% 46.8% 6.9% $400 $372 $1,000 $369 $884 2.0% 4.6% 41.0% $764 $800 $300 57.4% $640 51.8% 71.5% 0.0% $600 47.1% 24.7% 71.3% 68.6% 27.9% 25.7% 23.8% 39.4% $200 0.0% $400 23.2% 51.2% 28.3% 24.1% 10.7% 11.6% 9.3% 9.3% $100 6.5% $200 6.8% 4.6% 35.5% 14.9% 11.2% 10.1% 15.1% 15.9% 14.5% 14.7% 20.2% 20.0% 17.0% 17.4% 17.6% 14.9% $0 $0 2015 2016 2017 2018 3Q'18 2Q'19 3Q'19 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 Demand Interest-bearing Demand MMDA & Savings Time Brokered Time Deposits Wholesale MM State of TN CDs Others Cost of Deposits: 0.38% 0.40% 0.61% 0.96% 0.99% 1.45% 1.50% Wt. Avg. 1.96% 2.19% 2.35% 2.34% 2.11% Cost: Cost of Funds: Wt. Avg. 0.42% 0.43% 0.66% 1.07% 1.14% 1.52% 1.54% Duration 1.5 2.4 1.5 3.0 2.2 (Months): Note: $ in millions, unless otherwise specified. Data as of or for the three months ended each respective quarter or twelve months ended each year. Reflects consolidated numbers for Reliant Bancorp, Inc. 11

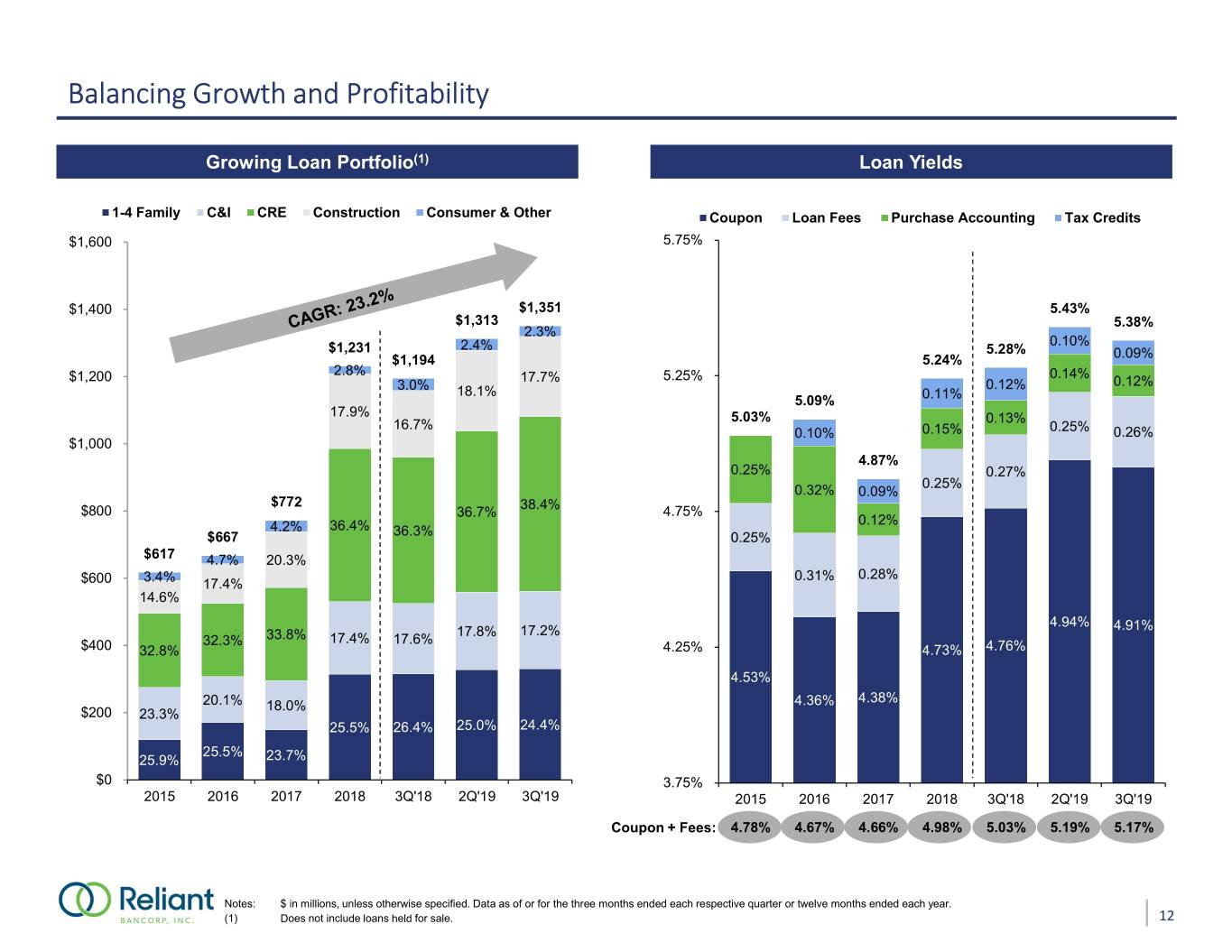

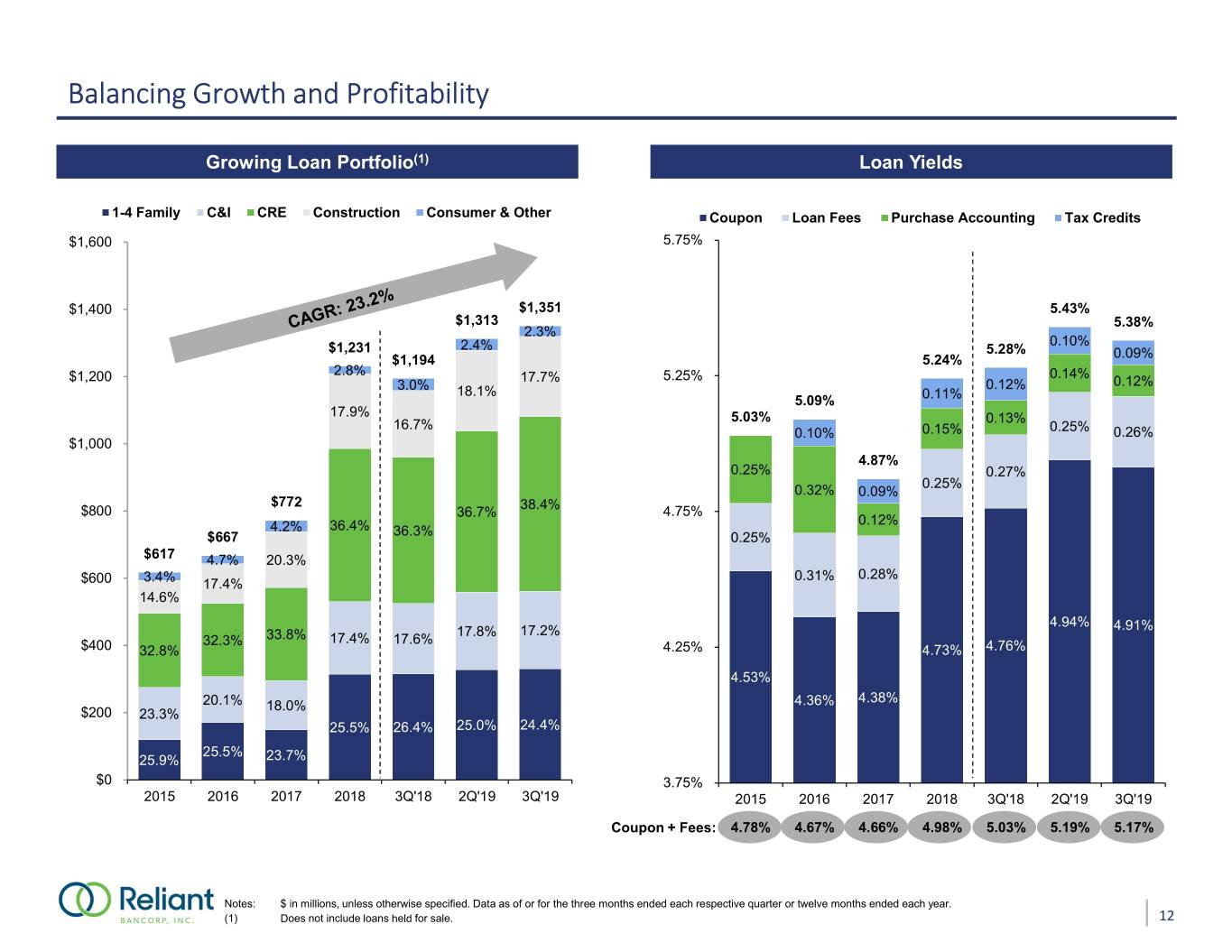

Balancing Growth and Profitability Growing Loan Portfolio(1) Loan Yields 1-4 Family C&I CRE Construction Consumer & Other Coupon Loan Fees Purchase Accounting Tax Credits $1,600 5.75% $1,400 $1,351 5.43% $1,313 5.38% 2.3% 2.4% 0.10% $1,231 5.28% 0.09% $1,194 5.24% $1,200 2.8% 17.7% 5.25% 0.14% 3.0% 0.12% 0.12% 18.1% 0.11% 5.09% 17.9% 16.7% 5.03% 0.13% 0.10% 0.15% 0.25% 0.26% $1,000 4.87% 0.25% 0.27% 0.25% 0.32% 0.09% $772 38.4% $800 36.7% 4.75% 4.2% 36.4% 0.12% $667 36.3% 0.25% $617 4.7% 20.3% 3.4% 0.31% 0.28% $600 17.4% 14.6% 4.94% 17.8% 17.2% 4.91% 32.3% 33.8% 17.4% 17.6% $400 32.8% 4.25% 4.73% 4.76% 4.53% 4.38% 20.1% 18.0% 4.36% $200 23.3% 25.5% 26.4% 25.0% 24.4% 25.5% 25.9% 23.7% $0 3.75% 2015 2016 2017 2018 3Q'18 2Q'19 3Q'19 2015 2016 2017 2018 3Q'18 2Q'19 3Q'19 Coupon + Fees: 4.78% 4.67% 4.66% 4.98% 5.03% 5.19% 5.17% Notes: $ in millions, unless otherwise specified. Data as of or for the three months ended each respective quarter or twelve months ended each year. (1) Does not include loans held for sale. 12

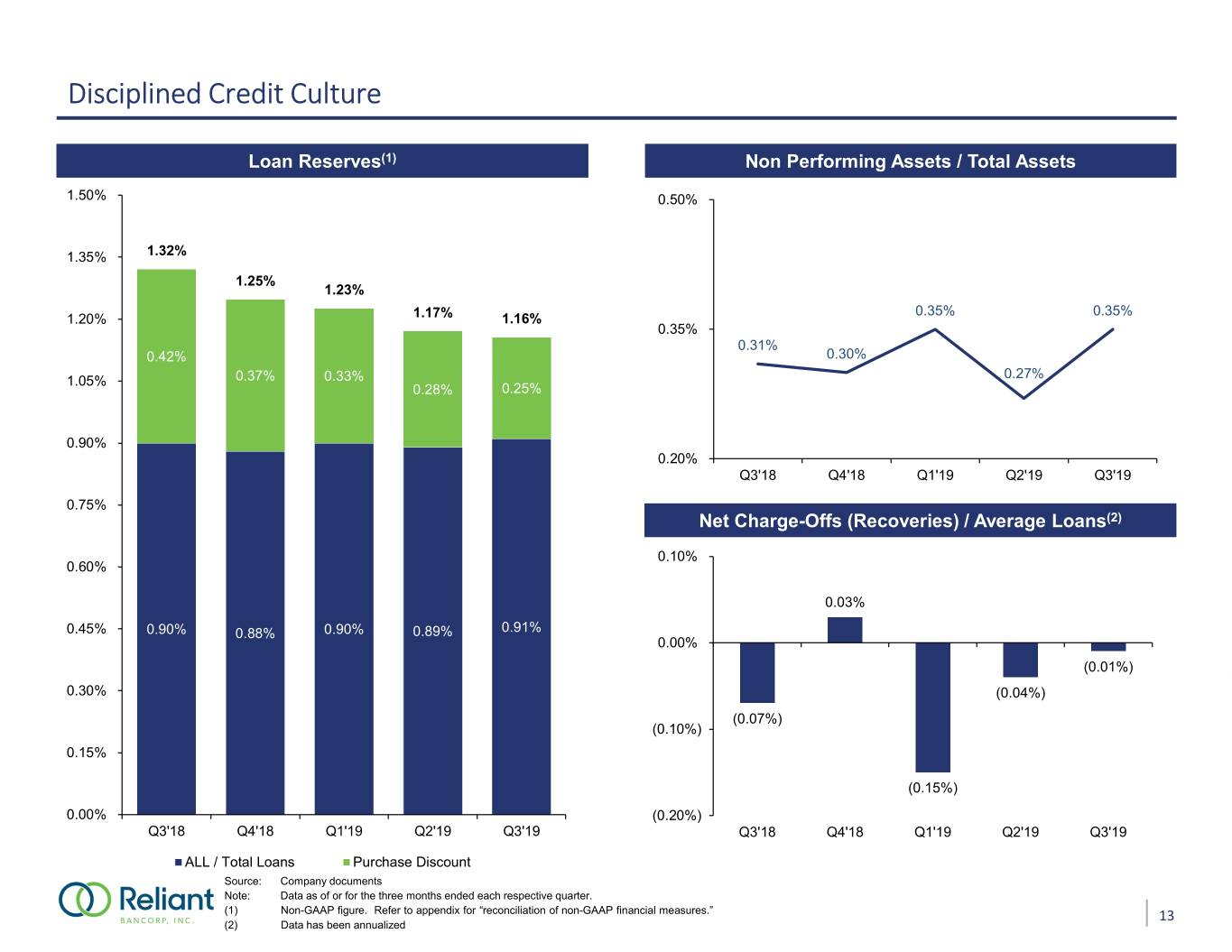

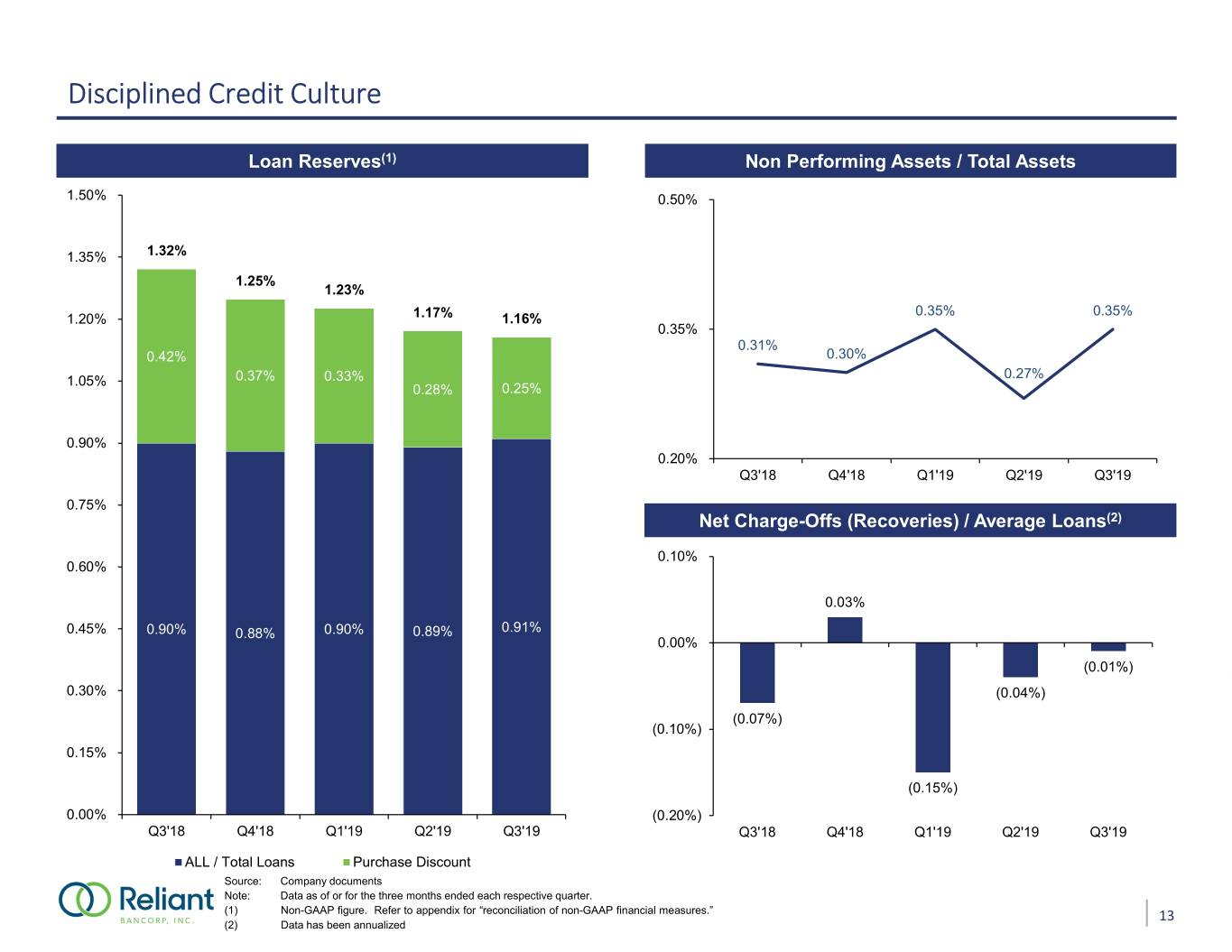

Disciplined Credit Culture Loan Reserves(1) Non Performing Assets / Total Assets 1.50% 0.50% 1.35% 1.32% 1.25% 1.23% 0.35% 0.35% 1.20% 1.17% 1.16% 0.35% 0.31% 0.42% 0.30% 0.27% 1.05% 0.37% 0.33% 0.28% 0.25% 0.90% 0.20% Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 0.75% Net Charge-Offs (Recoveries) / Average Loans(2) 0.10% 0.60% 0.03% 0.45% 0.90% 0.88% 0.90% 0.89% 0.91% 0.00% (0.01%) 0.30% (0.04%) (0.07%) (0.10%) 0.15% (0.15%) 0.00% (0.20%) Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 ALL / Total Loans Purchase Discount Source: Company documents Note: Data as of or for the three months ended each respective quarter. (1) Non-GAAP figure. Refer to appendix for “reconciliation of non-GAAP financial measures.” 13 (2) Data has been annualized

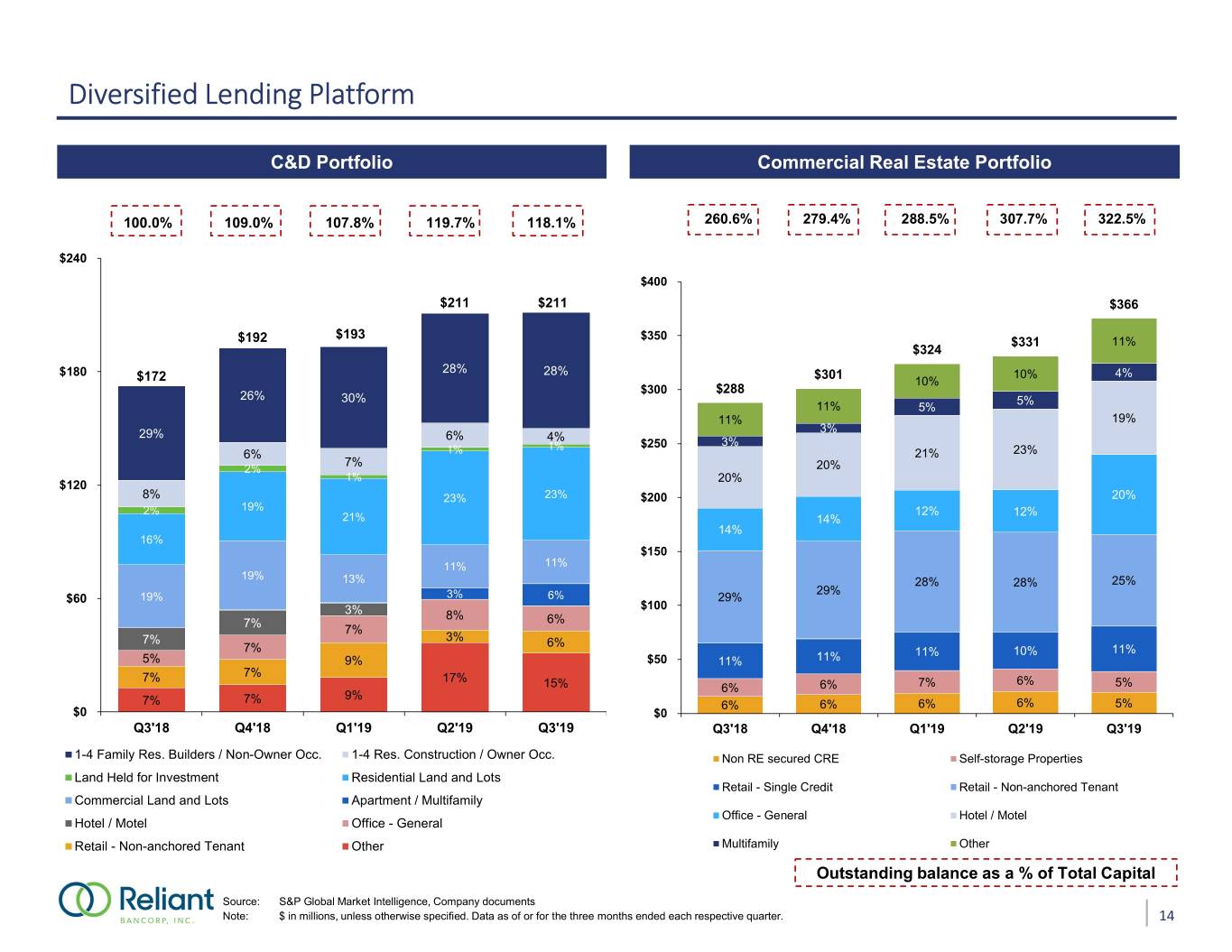

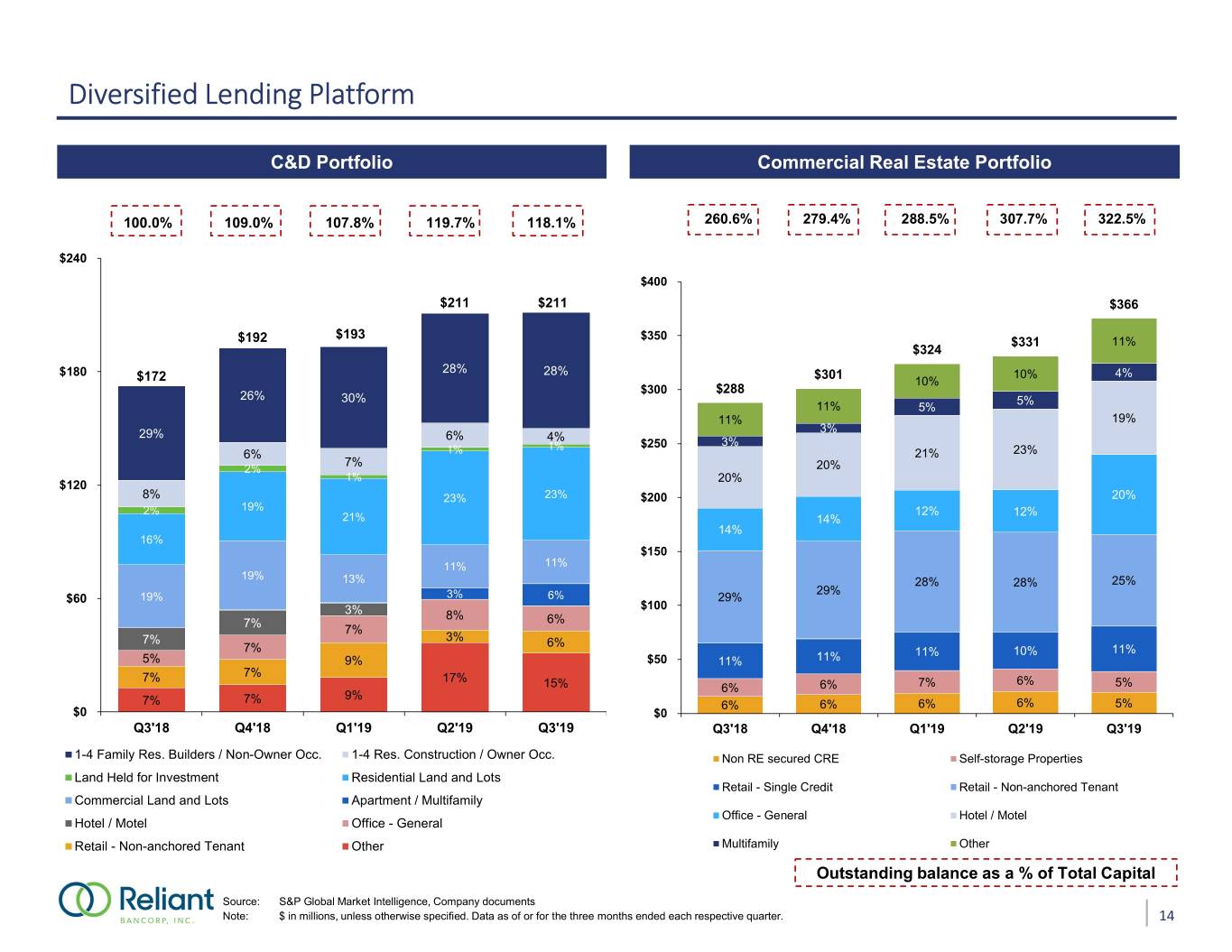

Diversified Lending Platform C&D Portfolio Commercial Real Estate Portfolio 100.0% 109.0% 107.8% 119.7% 118.1% 260.6% 279.4% 288.5% 307.7% 322.5% $240 $400 $211 $211 $366 $193 $350 $192 $331 11% $324 $180 28% 28% 10% 4% $172 $301 10% $300 $288 26% 30% 5% 11% 5% 11% 19% 3% 29% 6% 4% 1% $250 3% 6% 1% 21% 23% 7% 2% 20% 1% 20% $120 8% 23% 23% $200 20% 2% 19% 12% 12% 21% 14% 14% 16% $150 11% 11% 19% 13% 28% 28% 25% 29% $60 19% 3% 6% 29% $100 3% 8% 7% 6% 7% 7% 3% 6% 7% 11% 10% 11% 5% 9% $50 11% 11% 7% 7% 17% 6% 15% 6% 6% 7% 5% 7% 9% 7% 6% 6% 6% 6% 5% $0 $0 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 1-4 Family Res. Builders / Non-Owner Occ. 1-4 Res. Construction / Owner Occ. Non RE secured CRE Self-storage Properties Land Held for Investment Residential Land and Lots Retail - Single Credit Retail - Non-anchored Tenant Commercial Land and Lots Apartment / Multifamily Office - General Hotel / Motel Hotel / Motel Office - General Retail - Non-anchored Tenant Other Multifamily Other Outstanding balance as a % of Total Capital Source: S&P Global Market Intelligence, Company documents Note: $ in millions, unless otherwise specified. Data as of or for the three months ended each respective quarter. 14

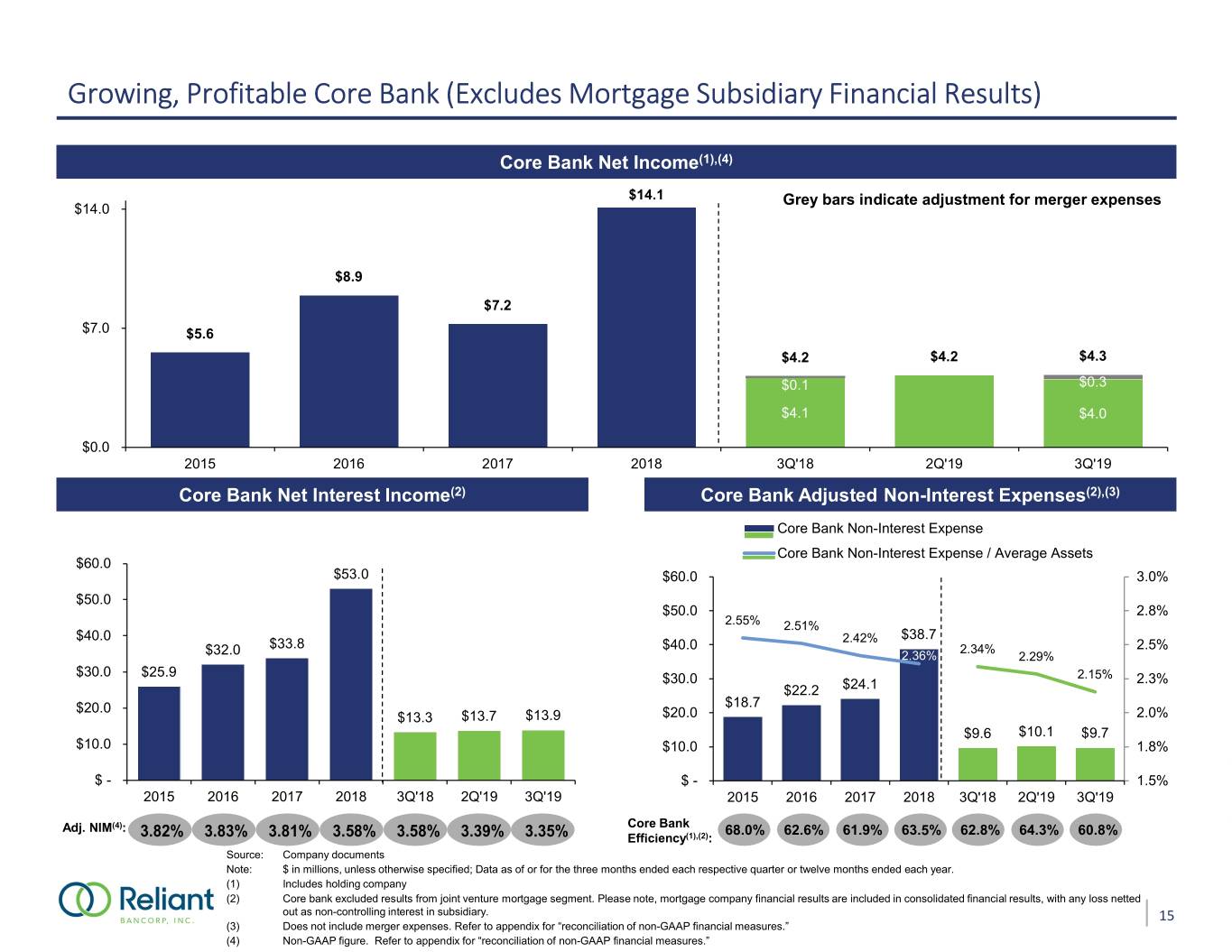

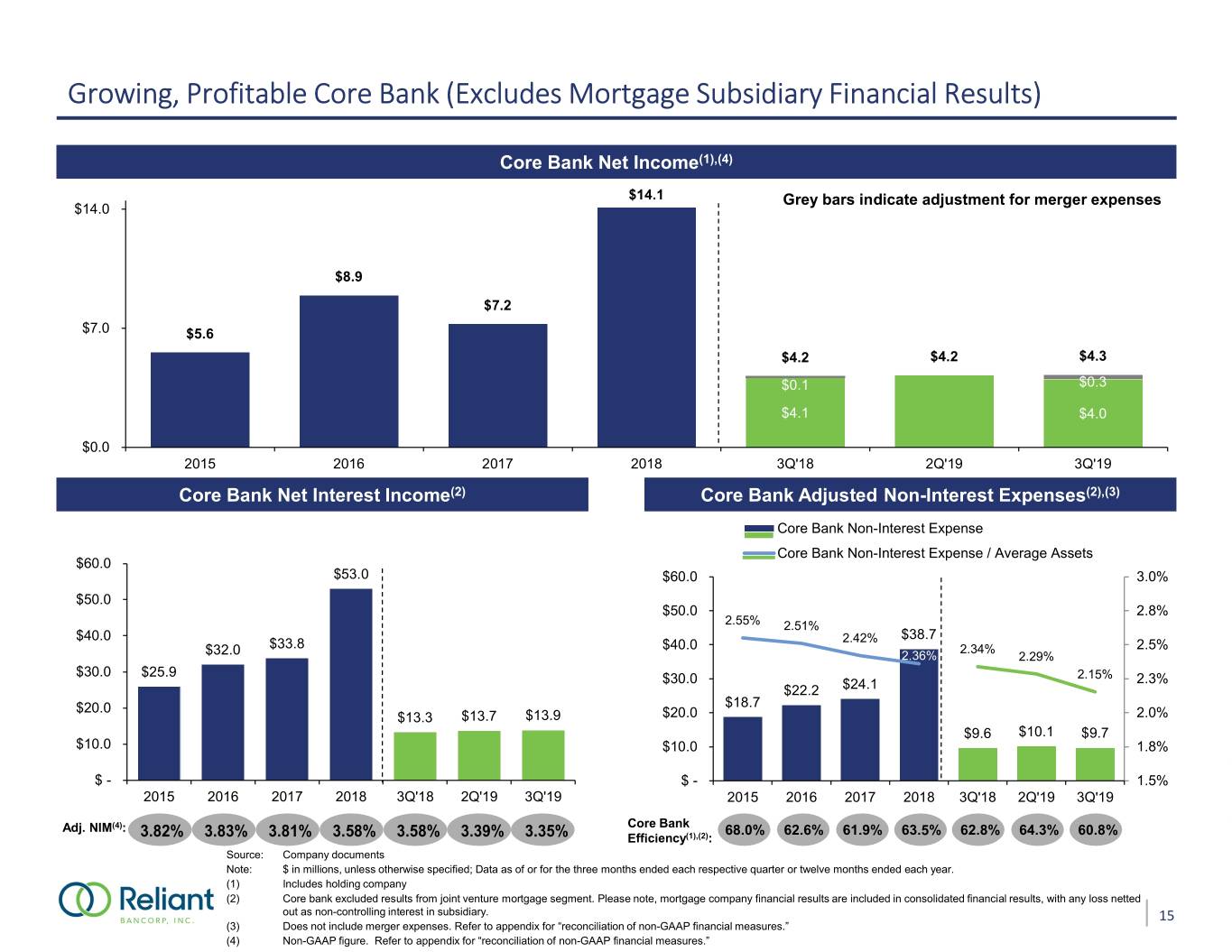

Growing, Profitable Core Bank (Excludes Mortgage Subsidiary Financial Results) Core Bank Net Income(1),(4) $14.1 Grey bars indicate adjustment for merger expenses $14.0 $8.9 $7.2 $7.0 $5.6 $4.2 $4.2 $4.3 $0.1 $0.3 $4.1 $4.0 $0.0 2015 2016 2017 2018 3Q'18 2Q'19 3Q'19 Core Bank Net Interest Income(2) Core Bank Adjusted Non-Interest Expenses(2),(3) Core Bank Non-Interest Expense Core Bank Non-Interest Expense / Average Assets $60.0 $53.0 $60.0 3.0% $50.0 $50.0 2.8% 2.55% 2.51% $40.0 2.42% $38.7 $33.8 $40.0 2.34% 2.5% $32.0 2.36% 2.29% $30.0 $25.9 $30.0 2.15% 2.3% $22.2 $24.1 $20.0 $18.7 $13.3 $13.7 $13.9 $20.0 2.0% $9.6 $10.1 $9.7 $10.0 $10.0 1.8% $ - $ - 1.5% 2015 2016 2017 2018 3Q'18 2Q'19 3Q'19 2015 2016 2017 2018 3Q'18 2Q'19 3Q'19 (4) Core Bank Adj. NIM : 68.0% 62.6% 61.9% 63.5% 62.8% 64.3% 60.8% 3.82% 3.83% 3.81% 3.58% 3.58% 3.39% 3.35% Efficiency(1),(2): Source: Company documents Note: $ in millions, unless otherwise specified; Data as of or for the three months ended each respective quarter or twelve months ended each year. (1) Includes holding company (2) Core bank excluded results from joint venture mortgage segment. Please note, mortgage company financial results are included in consolidated financial results, with any loss netted out as non-controlling interest in subsidiary. 15 (3) Does not include merger expenses. Refer to appendix for “reconciliation of non-GAAP financial measures.” (4) Non-GAAP figure. Refer to appendix for “reconciliation of non-GAAP financial measures.”

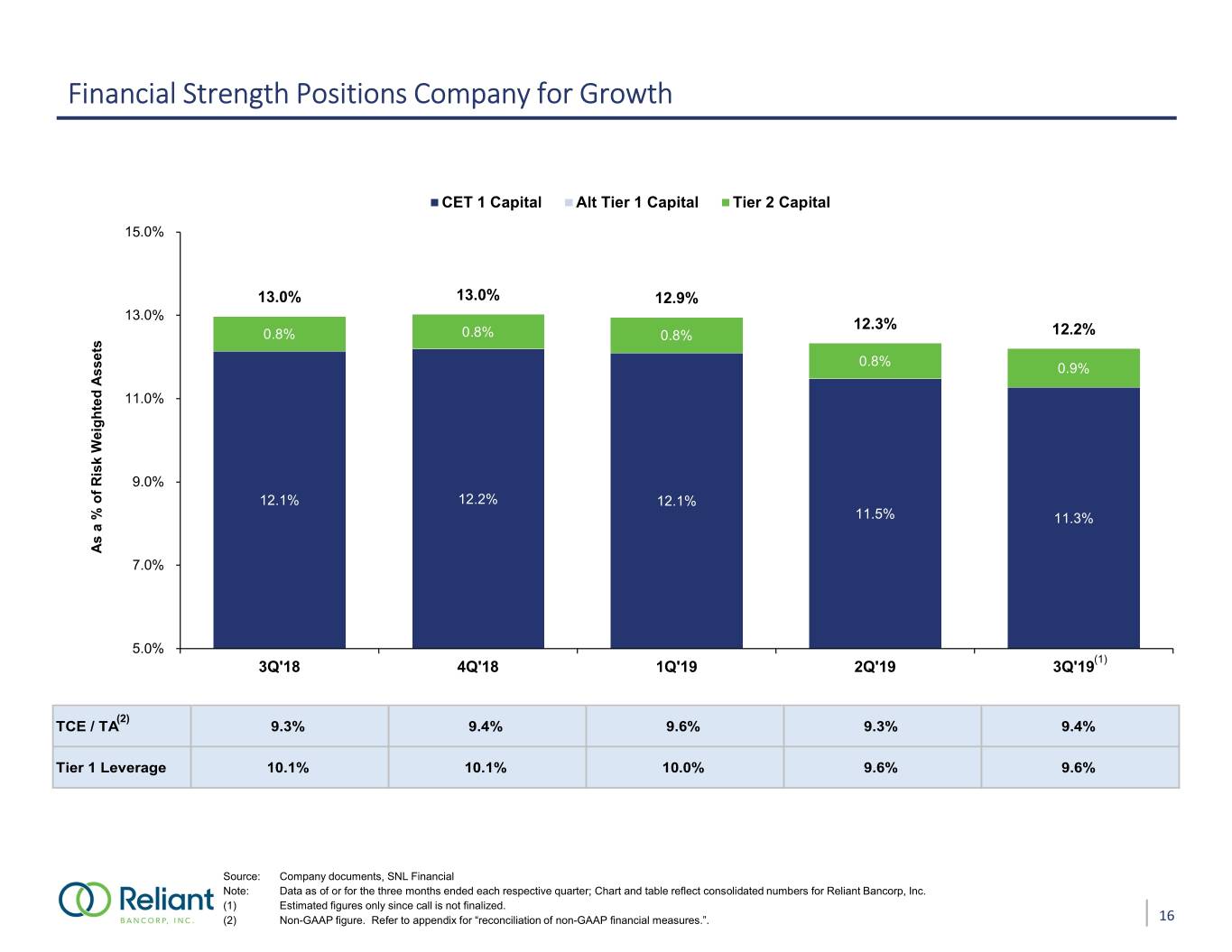

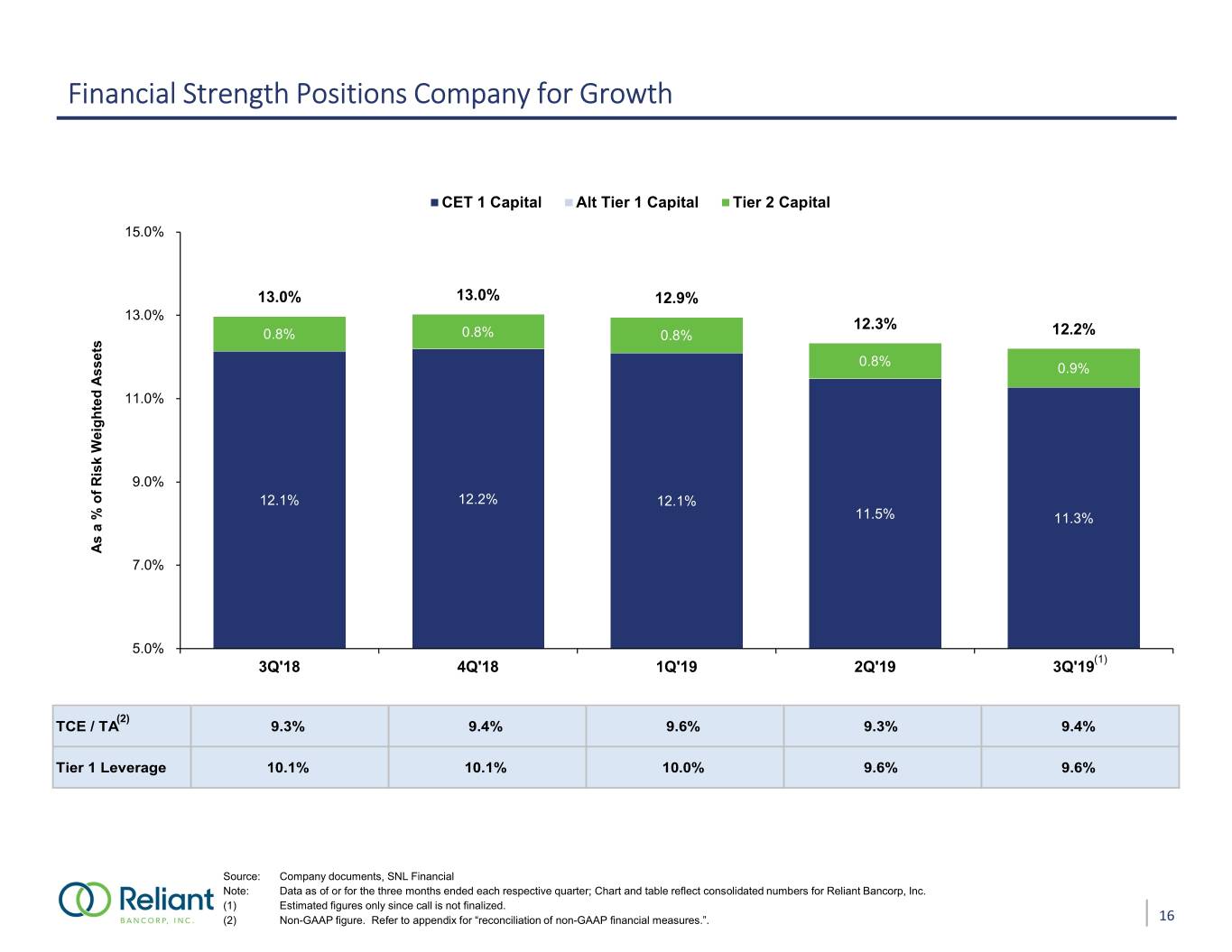

Financial Strength Positions Company for Growth CET 1 Capital Alt Tier 1 Capital Tier 2 Capital 15.0% 13.0% 13.0% 12.9% 13.0% 12.3% 0.8% 0.8% 0.8% 12.2% 0.8% 0.9% 11.0% 9.0% 12.1% 12.2% 12.1% 11.5% 11.3% As a % Assets As a % Risk Weighted of 7.0% 5.0% (1) 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 (2) TCE / TA 9.3% 9.4% 9.6% 9.3% 9.4% Tier 1 Leverage 10.1% 10.1% 10.0% 9.6% 9.6% Source: Company documents, SNL Financial Note: Data as of or for the three months ended each respective quarter; Chart and table reflect consolidated numbers for Reliant Bancorp, Inc. (1) Estimated figures only since call is not finalized. (2) Non-GAAP figure. Refer to appendix for “reconciliation of non-GAAP financial measures.”. 16

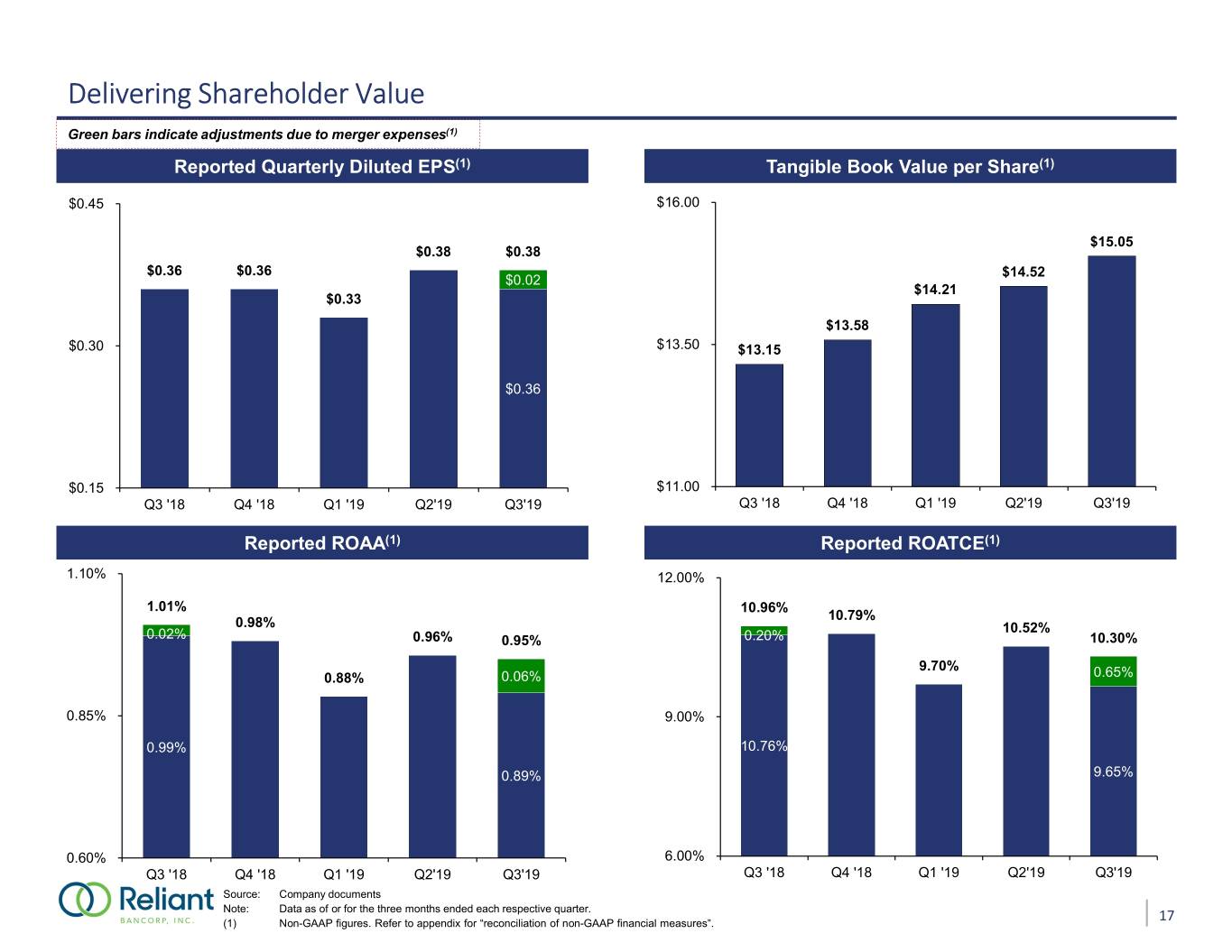

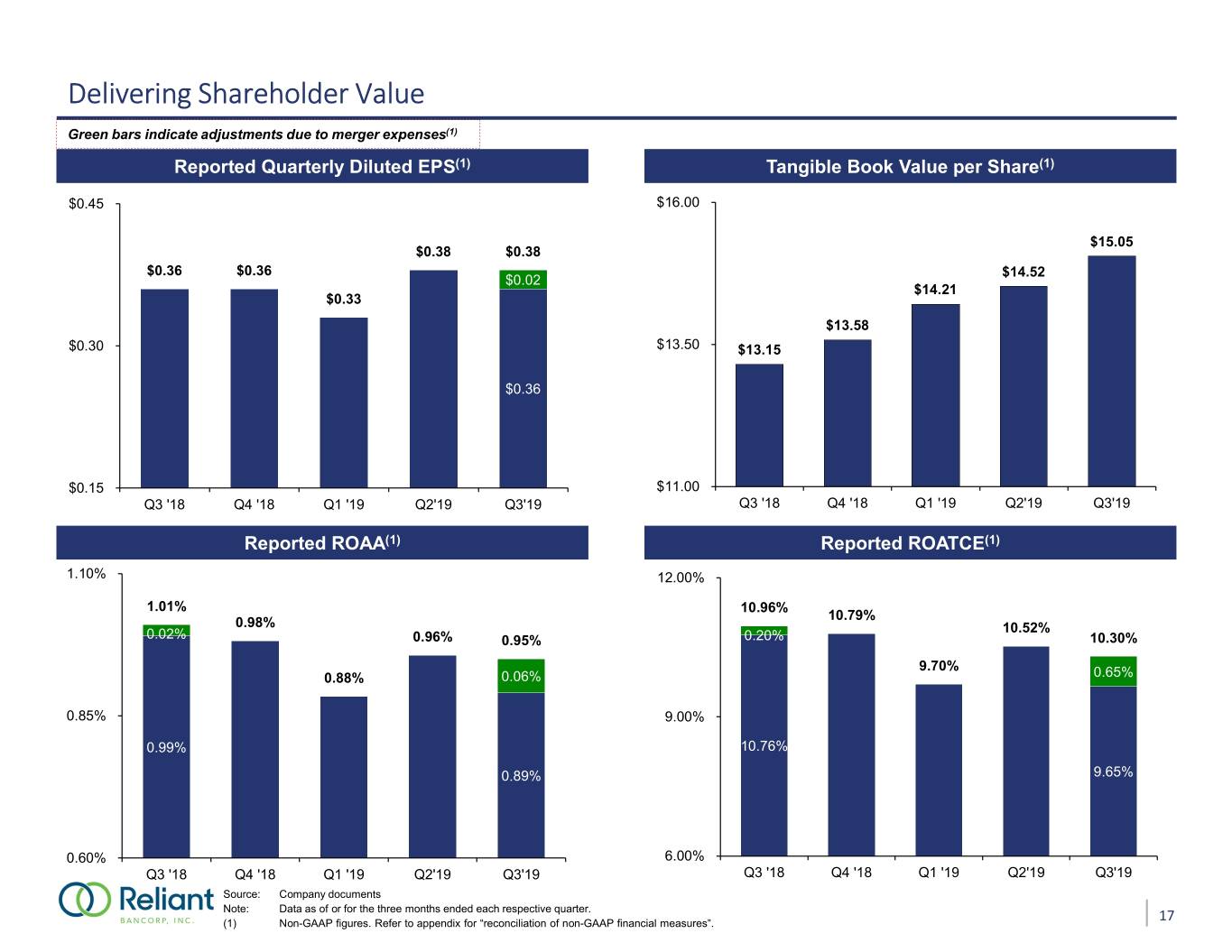

Delivering Shareholder Value Green bars indicate adjustments due to merger expenses(1) Reported Quarterly Diluted EPS(1) Tangible Book Value per Share(1) $0.45 $16.00 $15.05 $0.38 $0.38 $0.36 $0.36 $14.52 $0.02 $14.21 $0.33 $13.58 $0.30 $13.50 $13.15 $0.36 $0.15 $11.00 Q3 '18 Q4 '18 Q1 '19 Q2'19 Q3'19 Q3 '18 Q4 '18 Q1 '19 Q2'19 Q3'19 Reported ROAA(1) Reported ROATCE(1) 1.10% 12.00% 1.01% 10.96% 10.79% 0.98% 0.02% 10.52% 0.96% 0.95% 0.20% 10.30% 9.70% 0.88% 0.06% 0.65% 0.85% 9.00% 0.99% 10.76% 0.89% 9.65% 0.60% 6.00% Q3 '18 Q4 '18 Q1 '19 Q2'19 Q3'19 Q3 '18 Q4 '18 Q1 '19 Q2'19 Q3'19 Source: Company documents Note: Data as of or for the three months ended each respective quarter. (1) Non-GAAP figures. Refer to appendix for “reconciliation of non-GAAP financial measures”. 17

Our Strategy for Q4-2019 and 2020 Core deposit growth / deposit mix Low double-digit organic growth Seamless integration of recent acquisitions Leverage presence in new markets Add experienced lending talent in key growth markets Commitment to superior asset quality Expand digital channel Improve operating efficiency 18

Appendix

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Adjusted Return on Average Assets and Average Tangible Common Equity and Earnings Per Share September 30, December 31, March 31, June 30, September 30, (Dollars in thousands, except per share data) 2018 2018 2019 2019 2019 Net Income Attributable to Common Shareholders $4,082 $4,123 $3,824 $4,239 $4,000 Non-Core Items: Merger expenses 82 32 2 1 299 Tax effect of adjustments to net income (6) (8) - - (27) Adjusted net income attributable to common shareholders $4,158 $4,147 $3,826 $4,240 $4,272 Average Assets $1,644,396 $1,689,668 $1,731,177 $1,773,026 $1,806,455 Adjusted Return on Average Assets 1.01 % 0.98 % 0.88 % 0.96 % 0.95 % Average Tangible Common Equity $151,725 $153,681 $157,748 $161,172 $165,847 Adjusted Return on Average Tangible Common Equity 10.96 % 10.79 % 9.70 % 10.52 % 10.30 % Diluted Weighted Average Common Shares 11,498,179 11,501,758 11,487,145 11,286,627 11,177,367 Adjusted Quarterly Earnings Per Share $0.36 $0.36 $0.33 $0.38 $0.38 Average Stockholders Equity $203,901 $205,629 $209,461 $212,648 $217,087 Adjusted Return on Average Equity 8.16 % 8.07 % 7.31 % 7.98 % 7.87 % 19

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Adjusted Net Interest Margin Fiscal Year Ended December 31, September 30, June 30, September 30, (Dollars in thousands, except per share data) 2015 2016 2017 2018 2018 2019 2019 Tax Equivalent Net Interest Rate Spread $27,780 $34,702 $37,339 $56,898 $14,278 $14,556 $14,790 Non-Core Items: Purchase accounting adjustments (1,290) (2,033) (859) (1,665) (364) (448) (383) Tax credits - (650) (650) (1,268) (350) (300) (300) Adjusted Net Interest Rate Spread $26,490 $32,019 $35,830 $53,965 $13,564 $13,808 $14,107 Total Earning Assets (Average Balance) $694,135 $835,337 $939,947 $1,505,748 $1,504,424 $1,633,903 $1,669,481 Adjusted NIM 3.82 % 3.83 % 3.81 % 3.58 % 3.58 % 3.39 % 3.35 % 20

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Tangible Common Equity to Tangible Assets and Tangible Book Value per Share September 30, December 31, March 31, June 30, September 30, (Dollars in thousands, except per share data) 2018 2018 2019 2019 2019 Tangible Assets Total Assets $1,684,201 $1,724,338 $1,761,926 $1,794,248 $1,852,487 Less: Goodwill 43,642 43,642 43,642 43,642 43,642 Less: Core deposit intangibles 8,456 8,219 7,982 7,745 7,507 Tangible Assets $1,632,103 $1,672,477 $1,710,302 $1,742,861 $1,801,338 Tangible Common Equity Total Common equity $203,751 $208,414 $215,119 $213,943 $219,652 Less: Goodwill 43,642 43,642 43,642 43,642 43,642 Less: Core deposit intangibles 8,456 8,219 7,982 7,745 7,507 Tangible Common Equity $151,653 $156,553 $163,495 $162,556 $168,503 Average Tangible Common Equity Average stockholders' equity $203,901 $205,629 $209,461 $212,648 $217,087 Less: Average goodwill 43,632 43,642 43,642 43,642 43,642 Less: Average core deposit intangibles 8,544 8,306 8,071 7,834 7,598 Average Tangible Common Equity $151,725 $153,681 $157,748 $161,172 $165,847 Common Shares Outstanding 11,531,094 11,530,810 11,502,285 11,196,563 11,195,062 Tangible Book Value per Share $13.15 $13.58 $14.21 $14.52 $15.05 Tangible Common Equity / Tangible Assets 9.29 % 9.36 % 9.56 % 9.33 % 9.35 % Net Income Attributable to Common Shareholders $4,082 $4,123 $3,824 $4,239 $4,000 Return on Average Tangible Common Equity 10.76 % 10.73 % 9.70 % 10.52 % 9.65 % 21

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Core Bank Profitability Fiscal Year Ended December 31, September 30, June 30, September 30, (Dollars in thousands, except per share data) 2015 2016 2017 2018 2018 2019 2019 Core Bank Non-Interest Expense Non-interest expense $19,590 $22,327 $25,524 $41,512 $9,696 $10,130 $10,025 Less: Merger expenses (849) (82) (1,426) (2,774) (82) (1) (299) Core Bank Non-Interest Expense $18,741 $22,245 $24,098 $38,738 $9,614 $10,129 $9,726 Average Assets $733,651 $885,074 $995,436 $1,644,360 $1,644,396 $1,773,026 $1,806,455 Core Bank Non-Interest Expense / Average Assets 2.55 % 2.51 % 2.42 % 2.36 % 2.34 % 2.29 % 2.15 % Note: Core bank only, excluding mortgage segment. Includes Holding company. 22

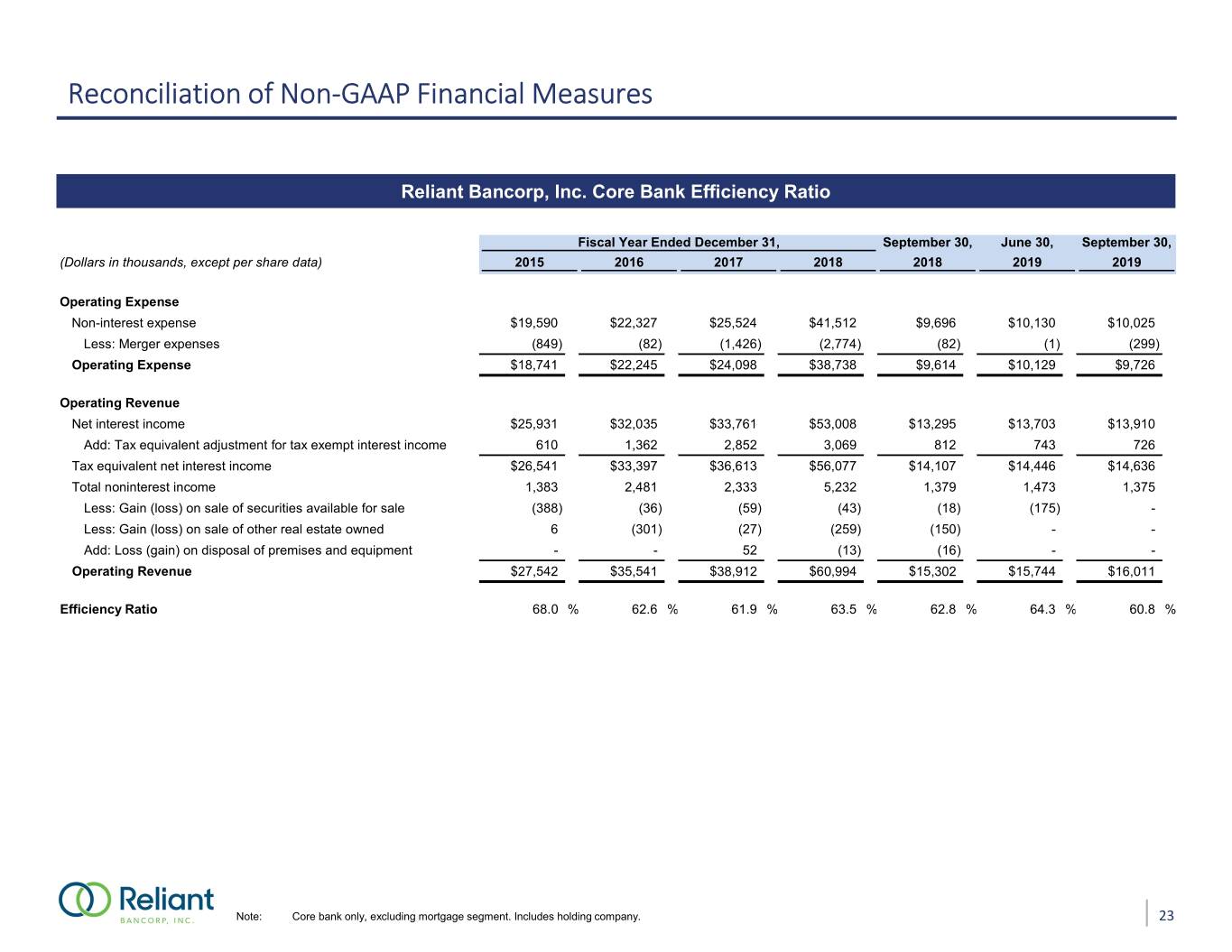

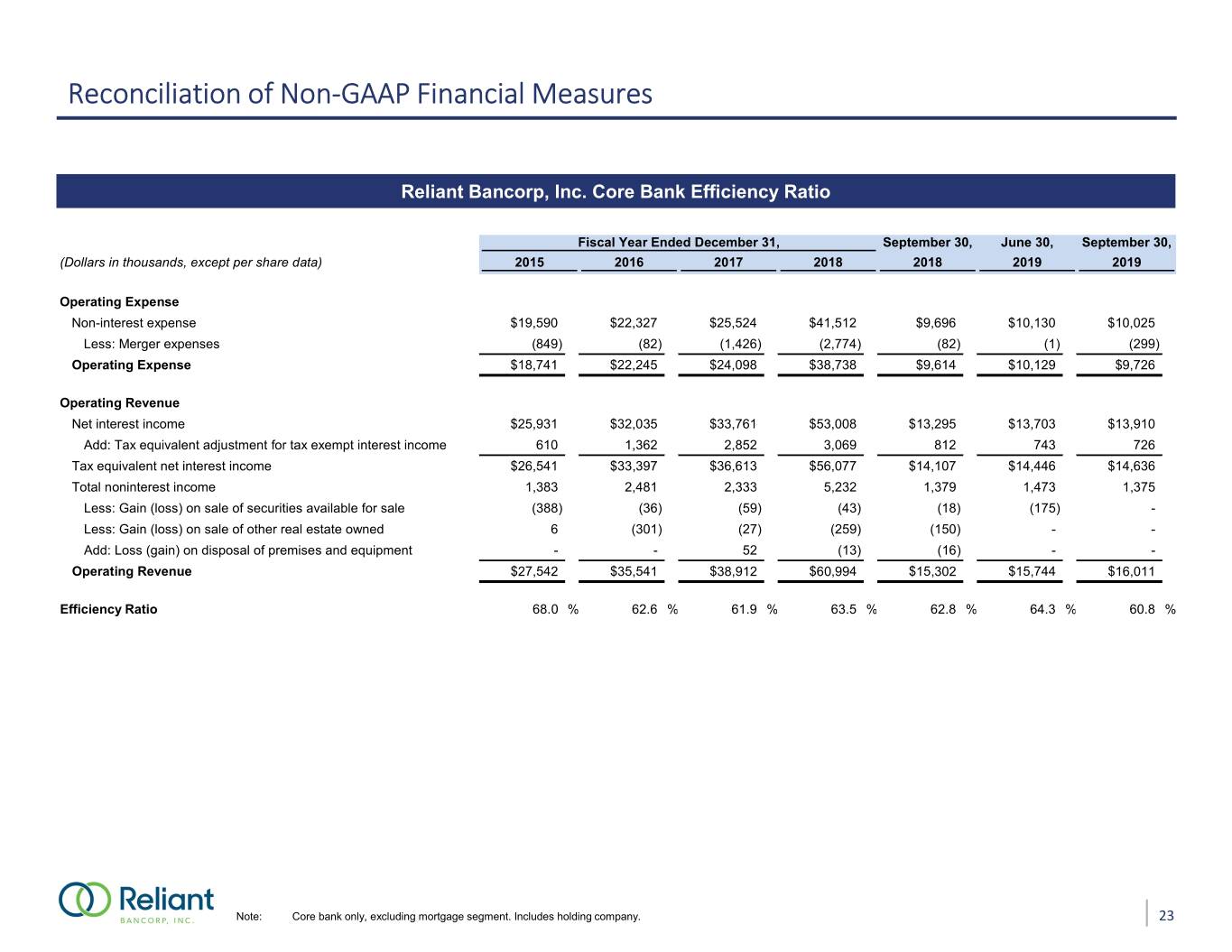

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Core Bank Efficiency Ratio Fiscal Year Ended December 31, September 30, June 30, September 30, (Dollars in thousands, except per share data) 2015 2016 2017 2018 2018 2019 2019 Operating Expense Non-interest expense $19,590 $22,327 $25,524 $41,512 $9,696 $10,130 $10,025 Less: Merger expenses (849) (82) (1,426) (2,774) (82) (1) (299) Operating Expense $18,741 $22,245 $24,098 $38,738 $9,614 $10,129 $9,726 Operating Revenue Net interest income $25,931 $32,035 $33,761 $53,008 $13,295 $13,703 $13,910 Add: Tax equivalent adjustment for tax exempt interest income 610 1,362 2,852 3,069 812 743 726 Tax equivalent net interest income $26,541 $33,397 $36,613 $56,077 $14,107 $14,446 $14,636 Total noninterest income 1,383 2,481 2,333 5,232 1,379 1,473 1,375 Less: Gain (loss) on sale of securities available for sale (388) (36) (59) (43) (18) (175) - Less: Gain (loss) on sale of other real estate owned 6 (301) (27) (259) (150) - - Add: Loss (gain) on disposal of premises and equipment - - 52 (13) (16) - - Operating Revenue $27,542 $35,541 $38,912 $60,994 $15,302 $15,744 $16,011 Efficiency Ratio 68.0 % 62.6 % 61.9 % 63.5 % 62.8 % 64.3 % 60.8 % Note: Core bank only, excluding mortgage segment. Includes holding company. 23

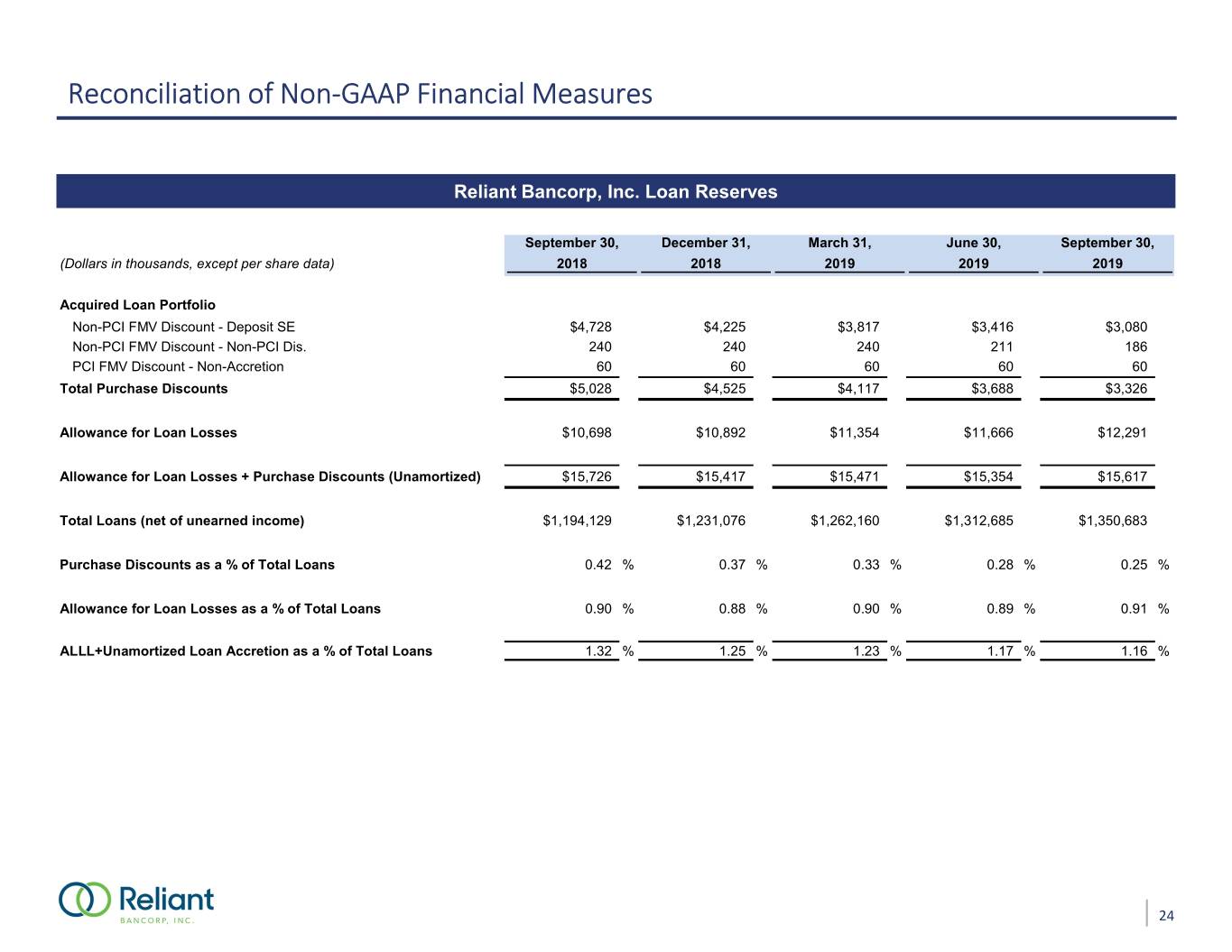

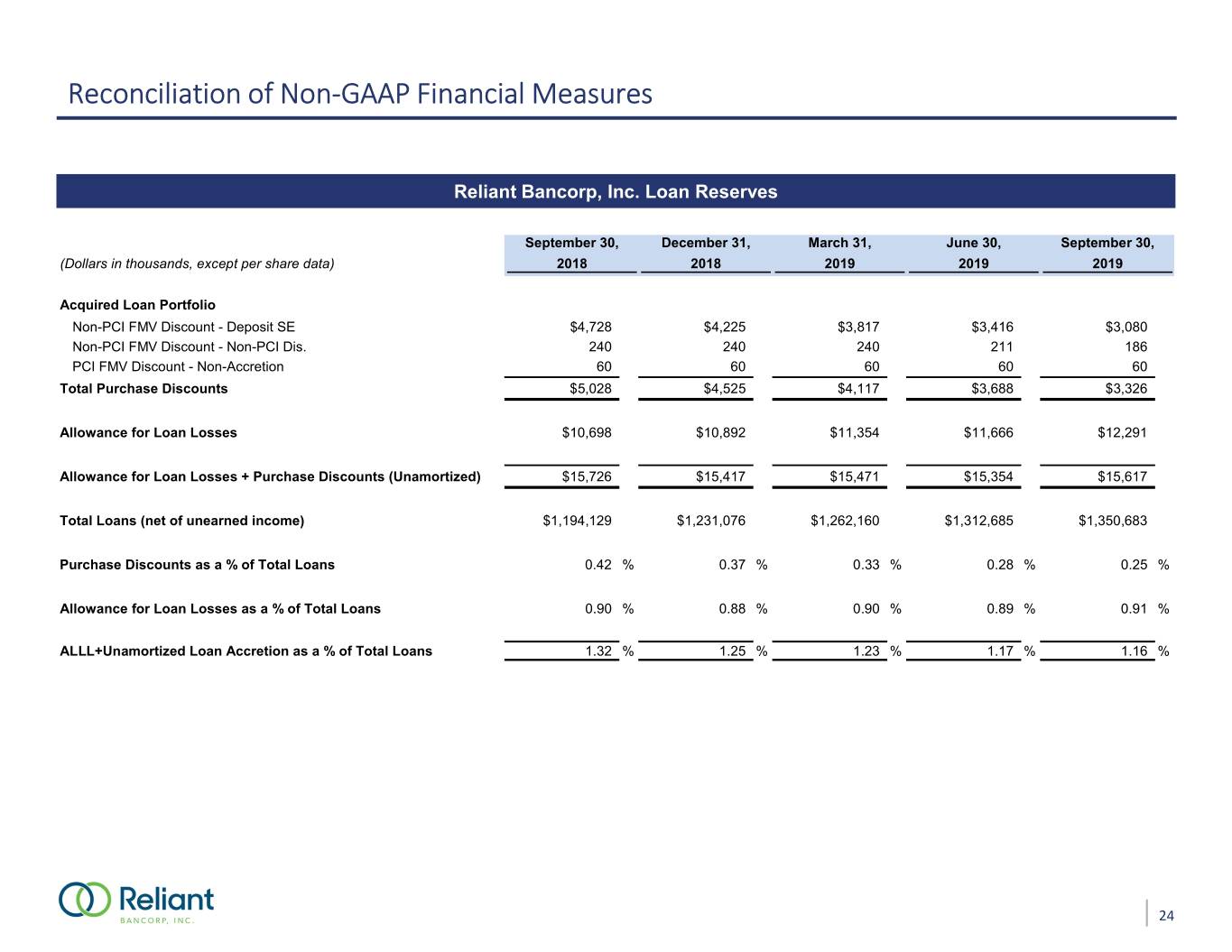

Reconciliation of Non-GAAP Financial Measures Reliant Bancorp, Inc. Loan Reserves September 30, December 31, March 31, June 30, September 30, (Dollars in thousands, except per share data) 2018 2018 2019 2019 2019 Acquired Loan Portfolio Non-PCI FMV Discount - Deposit SE $4,728 $4,225 $3,817 $3,416 $3,080 Non-PCI FMV Discount - Non-PCI Dis. 240 240 240 211 186 PCI FMV Discount - Non-Accretion 60 60 60 60 60 Total Purchase Discounts $5,028 $4,525 $4,117 $3,688 $3,326 Allowance for Loan Losses $10,698 $10,892 $11,354 $11,666 $12,291 Allowance for Loan Losses + Purchase Discounts (Unamortized) $15,726 $15,417 $15,471 $15,354 $15,617 Total Loans (net of unearned income) $1,194,129 $1,231,076 $1,262,160 $1,312,685 $1,350,683 Purchase Discounts as a % of Total Loans 0.42 % 0.37 % 0.33 % 0.28 % 0.25 % Allowance for Loan Losses as a % of Total Loans 0.90 % 0.88 % 0.90 % 0.89 % 0.91 % ALLL+Unamortized Loan Accretion as a % of Total Loans 1.32 % 1.25 % 1.23 % 1.17 % 1.16 % 24